Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Braemar Hotels & Resorts Inc. | bhrinvestorpresentation8-k.htm |

November 2018

Forward Looking Statements and Non-GAAP Measures In keeping with the SEC's "Safe Harbor" guidelines, certain statements made during this presentation could be considered forward- looking and subject to certain risks and uncertainties that could cause results to differ materially from those projected. When we use the words "will likely result," "may," "anticipate," "estimate," "should," "expect," "believe," "intend," or similar expressions, we intend to identify forward-looking statements. Such forward-looking statements include, but are not limited to, our business and investment strategy, our understanding of our competition, current market trends and opportunities, projected operating results, and projected capital expenditures. These forward-looking statements are subject to known and unknown risks and uncertainties, which could cause actual results to differ materially from those anticipated including, without limitation: general volatility of the capital markets and the market price of our common stock; changes in our business or investment strategy; availability, terms and deployment of capital; availability of qualified personnel; changes in our industry and the market in which we operate, interest rates or the general economy, and the degree and nature of our competition. These and other risk factors are more fully discussed in the company's filings with the Securities and Exchange Commission. EBITDA is defined as net income before interest, taxes, depreciation and amortization. EBITDA yield is defined as trailing twelve month EBITDA divided by the purchase price or debt amount. A capitalization rate is determined by dividing the property's net operating income by the purchase price. Net operating income is the property's funds from operations minus a capital expense reserve of either 4% or 5% of gross revenues. Hotel EBITDA flow-through is the change in Hotel EBITDA divided by the change in total revenues. EBITDA, FFO, AFFO, CAD and other terms are non-GAAP measures, reconciliations of which have been provided in prior earnings releases and filings with the SEC or in the appendix to this presentation. The calculation of implied equity value is derived from an estimated blended capitalization rate (“Cap Rate”) for the entire portfolio using the capitalization rate method. The estimated Cap Rate is based on recent Cap Rates of publically traded peers involving a similar blend of asset types found in the portfolio, which is then applied to Net Operating Income (“NOI”) of the company’s assets to calculate a Total Enterprise Value (“TEV”) of the company. From the TEV, we deduct debt and preferred equity and then add back working capital and the company’s investment in Ashford Inc. to derive an equity value. The capitalization rate method is one of several valuation methods for estimating asset value and implied equity value. Among the limitations of using the capitalization rate method for determining an implied equity value are that it does not take into account the potential change or variability in future cash flows, potential significant future capital expenditures, the intended hold period of the asset, or a change in the future risk profile of an asset. This overview is for informational purposes only and is not an offer to sell, or a solicitation of an offer to buy or sell, any securities of Braemar Hotels & Resorts, Inc. or any of its respective affiliates, and may not be relied upon in connection with the purchase or sale of any such security. Company Presentation // November 2018 2

Management Team RICHARD J. STOCKTON Chief Executive Officer & DERIC S. EUBANKS, CFA JEREMY J. WELTER President Chief Financial Officer Chief Operating Officer . . 20 years of hospitality . 18 years of hospitality 13 years of hospitality experience experience experience . . 2 years with the Company . 15 years with the Company 8 years with the Company (5 years with the Company’s . 15 years with Morgan Stanley . 3 years with ClubCorp predecessor) . Cornell School of Hotel . CFA charterholder . 5 years with Stephens Administration, BS . Southern Methodist University . Investment Bank University of Pennsylvania BBA . Oklahoma State University BS MBA Company Presentation // November 2018 3

Strategic Overview Focused strategy of investing in luxury hotels and resorts Bardessono Hotel & Spa Grow organically through strong revenue and cost Yountville, CA control initiatives Grow externally through accretive acquisitions of high quality assets Pier House Resort Key West, FL Targets conservative leverage of Net Debt / Gross Assets of 45% with non-recourse property debt The Ritz-Carlton St. Thomas St. Thomas, USVI Highly-aligned management team and advisory structure Company Presentation // November 2018 4

2018 Q3 Hotel Operating Results Comparable Hotel Operating Results(1) 2018 Q3 2017 Q3 % Variance ADR $ 272.57 $ 271.43 0.42% Occupancy 85.86% 84.68% 1.39% RevPAR $ 234.04 $ 229.86 1.82% RevPAR (not under renovation) $ 240.05 $ 232.30 3.34% Total Hotel Revenue(2) $ 108,466 $ 107,592 0.81% Hotel EBITDA(2) $ 33,210 $ 30,111 10.29% Hotel EBITDA Margin 30.62% 27.99% 2.63% COMPARABLE REVPAR(3) COMPARABLE HOTEL EBITDA(3) $235 $140 $138.7 $224 $225 $219 $135 $215 $130 $207 $126.9 $205 $199 $125 $123.3 (In millions) (In $195 $121.1 $120 $185 $115 $175 2015 2016 2017 2018 Q3 2015 2016 2017 2018 Q3 TTM TTM (1) Includes: Bardessono, Hotel Yountville, Ritz-Carlton St. Thomas, Pier House, Marriott Seattle Waterfront, Capital Hilton, Sofitel Chicago, Hilton Torrey Pines, Courtyard San Francisco, Courtyard Philadelphia, Park Hyatt Beaver Creek, and Ritz-Carlton Sarasota (2) In thousands. (3) As reported in Earnings Releases: 2015, as reported on 2/25/2016; 2016 as reported on 2/22/2017; 2017 as reported on 2/28/2018; Q3 2018 as reported on 10/31/2018 Company Presentation // November 2018 5

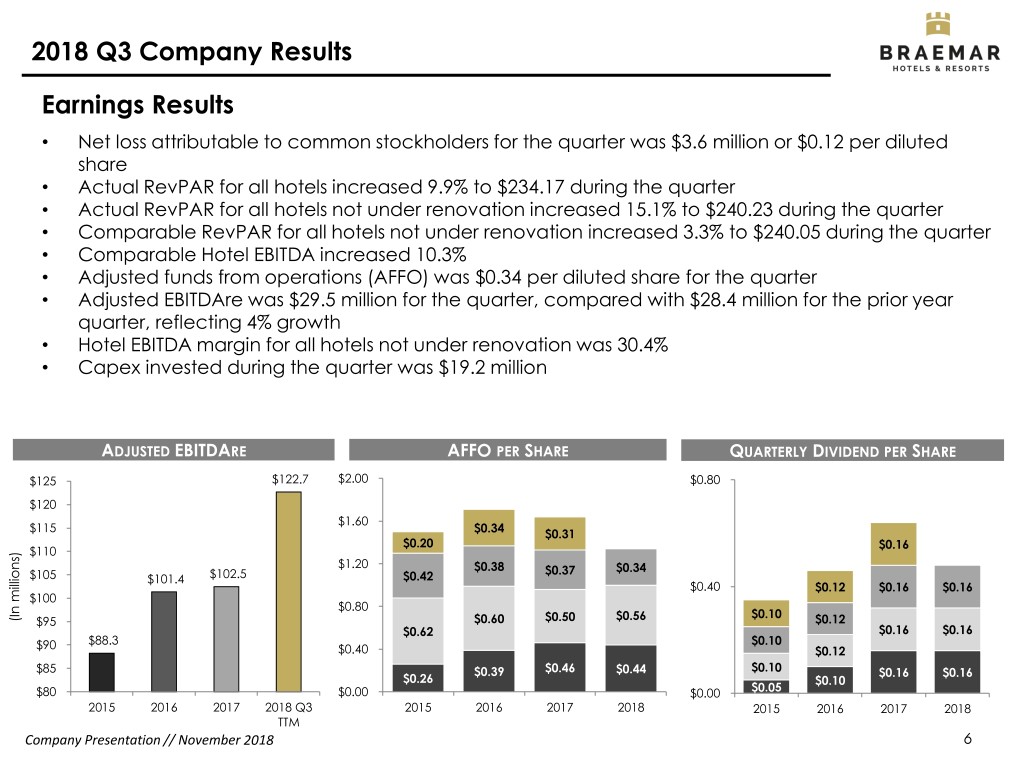

2018 Q3 Company Results Earnings Results • Net loss attributable to common stockholders for the quarter was $3.6 million or $0.12 per diluted share • Actual RevPAR for all hotels increased 9.9% to $234.17 during the quarter • Actual RevPAR for all hotels not under renovation increased 15.1% to $240.23 during the quarter • Comparable RevPAR for all hotels not under renovation increased 3.3% to $240.05 during the quarter • Comparable Hotel EBITDA increased 10.3% • Adjusted funds from operations (AFFO) was $0.34 per diluted share for the quarter • Adjusted EBITDAre was $29.5 million for the quarter, compared with $28.4 million for the prior year quarter, reflecting 4% growth • Hotel EBITDA margin for all hotels not under renovation was 30.4% • Capex invested during the quarter was $19.2 million ADJUSTED EBITDARE AFFO PER SHARE QUARTERLY DIVIDEND PER SHARE $125 $122.7 $2.00 $0.80 $120 $1.60 $115 $0.34 $0.31 $0.20 $0.16 $110 $1.20 $0.38 $0.37 $0.34 $105 $101.4 $102.5 $0.42 $0.40 $0.12 $0.16 $0.16 $100 $0.80 $0.10 (In millions) (In $95 $0.60 $0.50 $0.56 $0.12 $0.62 $0.16 $0.16 $90 $88.3 $0.10 $0.40 $0.12 $85 $0.39 $0.46 $0.44 $0.10 $0.16 $0.16 $0.26 $0.10 $80 $0.00 $0.00 $0.05 2015 2016 2017 2018 Q3 2015 2016 2017 2018 2015 2016 2017 2018 TTM Company Presentation // November 2018 6

Recent Developments May 2018 April 2018 We recently completed the sale of the 293-room We recently completed the acquisition of the 266- Renaissance Tampa in Tampa, Florida for $68 million room Ritz-Carlton Sarasota in Sarasota, Florida for $171 million Meets Defined Strategy . Luxury chain scale segment TTM Cap Rate: 6% . Increases portfolio RevPAR by $5 . Replaces EBITDA . Attractive financial returns Stabilized Yield(2): 8% . No need to raise equity Property Financial Overview RevPAR(1): $284 . Hotel Net Operating Income of $10.2 million . Hotel EBITDA $13.3 million(1) RENAISSANCE TAMPA . 12.8x Hotel EBITDA multiple IRR(3): 10% RevPAR(1): $158 Price per Key: $232,000 Meets Defined Strategy . Sale of non-core hotel increases overall portfolio RevPAR . Reduces the Company’s leverage and interest expense Property Financial Overview . Hotel Net Operating Income of $5.6 million . 8.2% TTM NOI Cap Rate . Hotel EBITDA $6.8 million . 10.0x Hotel EBITDA multiple RITZ-CARLTON SARASOTA (1) TTM at time of announcement Company Presentation // November 2018 (2) Expected unlevered stabilized yield 7 (3) Underwritten unlevered IRR

High-Quality Hotels in Leading Urban & Resort Markets Courtyard Philadelphia Philadelphia, PA Capital Hilton Marriott Seattle Washington D.C. Hotel Yountville Sofitel Chicago Magnificent Mile Seattle, WA Yountville, CA Chicago, IL Capital Hilton Washington D.C. Renaissance Tampa Tampa, FL Bardessono Hotel & Spa Yountville, CA The Ritz-Carlton, Courtyard San Francisco Sarasota, FL San Francisco, CA Hilton Torrey Pines Pier House Resort Park Hyatt Beaver Creek Pier House Resort The Ritz-Carlton St. Thomas La Jolla, CA Key West, FL Beaver Creek, CO Key West, FL St. Thomas, USVI Company Presentation // November 2018 Core Assets Non-Core Assets 8

Portfolio Detail • Core portfolio quality unparalleled in the $234 $224 public lodging REIT sector • Geographically diversified portfolio CORE REVPAR(1) OVERALL REVPAR(1) located in strong markets Number of TTM TTM TTM TTM Hotel % of (1) (1) (1) (1) Core Location Rooms ADR OCC RevPAR EBITDA Total Bardessono Napa Valley, CA 62 $780 73% $572 $5,413 3.9% Hotel Yountville Napa Valley, CA 80 $546 71% $388 $5,537 4.0% Ritz-Carlton St. Thomas St. Thomas, USVI 180 $285 77% $221 $13,150 9.5% Pier House Key West, FL 142 $428 79% $337 $11,629 8.4% Park Hyatt Beaver Creek Beaver Creek, CO 190 $442 61% $268 $9,404 6.8% Marriott Seattle Waterfront Seattle, WA 361 $282 86% $243 $16,400 11.8% Capital Hilton Washington D.C. 550 $234 85% $198 $14,886 10.7% Sofitel Chicago Magnificent Mile Chicago, IL 415 $213 80% $170 $6,659 4.8% Hilton Torrey Pines La Jolla, CA 394 $210 85% $178 $14,733 10.6% Ritz-Carlton Sarasota Sarasota, FL 266 $369 75% $277 $12,729 9.2% Total Core 2,640 $292 80% $234 $110,540 79.7% Non-Core Courtyard San Francisco Downtown (2) San Francisco, CA 410 $283 86% $243 $13,783 10.0% Courtyard Philadelphia Downtown (2) Philadelphia, PA 499 $186 85% $159 $14,338 10.3% Total Non-Core 909 $230 86% $197 $28,121 20.3% Total Portfolio 3,549 $275 82% $224 $138,661 100.0% (1) Pro Forma TTM as of 9/30/2018 Company Presentation // November 2018 (2) Announced repositioning to Autograph Collection by Marriott 9 Note: TTM Hotel EBITDA in thousands

Near Term Potential Performance Catalysts Year Over Year RevPAR Potential Comparisons(1) 2018 Q4 2019 Q1 2019 Q2 2019 Q3 2019 Q4 Bardessono Wildfires Rebound Hotel Yountville Wildfires Rebound Park Hyatt Beaver Creek Low Snowfall Rebound Sofitel Chicago New Rooms/New Mgmt. Pier House Irma Rebound Ritz-Carlton St. Thomas Irma Rebound Soft Opening Grand Opening Autograph Courtyard San Francisco New Rooms online/Moscone Open Grand Opening Courtyard Philadelphia Autograph Grand Opening Ritz-Carlton Sarasota Red Tide Rebound (1) The timing, certainty, and degree of any potential RevPAR increase is subject to a number of Company Presentation // November 2018 variables and may not occur in this timeline or to the degree described or may not occur at 10 all.

Upbranding Status Update – Autograph Conversions Courtyard San Francisco • Investment cost: $28.9 million • Expected RevPAR uplift: $50 • Estimated unlevered IRR: 22% Construction Timing (Completion) Guestrooms 9/18 - 12/18 Restaurant 2/19 - 10/19 Lobby 2/19 - 10/19 Exterior 4/19 - 11/19 SAN FRANCISCO Courtyard Philadelphia • Investment cost: $19.8 million • Expected RevPAR uplift: $25 • Estimated unlevered IRR: 19% Construction Timing (Completion) Guestrooms 10/18 - 6/19 Restaurant 1/19 - 6/19 PHILADELPHIA Lobby 12/18 - 4/19 Company Presentation // November 2018 11

Ritz-Carlton St. Thomas Update • Launched central reservations on June 29 as St. Thomas Great Bay Resort to allow transient room nights to be booked directly on Marriott.com and OTA channels • Permanent roof work is underway • Guestroom model rooms were completed and reviewed with brand on Jul 10 NEW FACADE • Guestroom building work started Sep. 2018 • Contemplating soft opening as Ritz‐Carlton in Jul. 2019, at which point 4 of 6 guestroom buildings would be available • Current construction timeline has completion at the end of Oct. 2019 NEW POOL Company Presentation // November 2018 12

EBITDA Contribution by Brand and Class Q3 2018 TTM Hotel EBITDA by Brand Q3 2018 TTM EBITDA by Class 5% 7% 20% 16% 47% 51% 21% 33% Marriott Hilton Independent Hyatt Accor Luxury Upper Upscale Upscale Company Presentation // November 2018 13

Why We Focus on Luxury LUXURY UPPER UPSCALE Greatest long-term Second greatest long- RevPAR growth of term RevPAR growth of 4.0%(1) 3.1%(1) 350 300 250 200 150 RevPAR(Indexed) 100 50 Jul-95 Jul-89 Jul-92 Jul-98 Jul-01 Jul-04 Jul-07 Jul-10 Jul-13 Jul-16 Apr-17 Apr-90 Apr-93 Apr-96 Apr-99 Apr-02 Apr-05 Apr-08 Apr-11 Apr-14 Jan-88 Jan-91 Jan-94 Jan-97 Jan-00 Jan-03 Jan-06 Jan-09 Jan-12 Jan-15 Jan-18 Oct-88 Oct-91 Oct-94 Oct-97 Oct-00 Oct-03 Oct-06 Oct-09 Oct-12 Oct-15 Luxury Class Upper Upscale Class Upscale Class Upper Midscale Class Midscale Class Economy Class (1) CAGR from 12/31/1987 to 9/30/2018 Company Presentation // November 2018 Source: STR 14

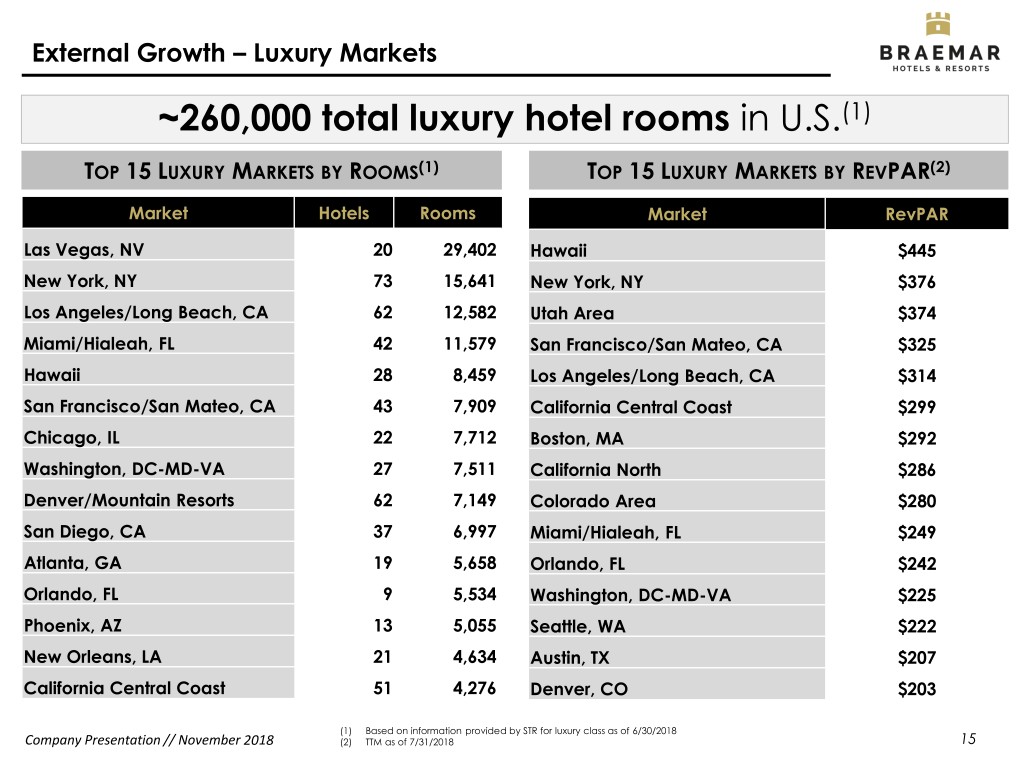

External Growth – Luxury Markets ~260,000 total luxury hotel rooms in U.S.(1) TOP 15 LUXURY MARKETS BY ROOMS(1) TOP 15 LUXURY MARKETS BY REVPAR(2) Market Hotels Rooms Market RevPAR Las Vegas, NV 20 29,402 Hawaii $445 New York, NY 73 15,641 New York, NY $376 Los Angeles/Long Beach, CA 62 12,582 Utah Area $374 Miami/Hialeah, FL 42 11,579 San Francisco/San Mateo, CA $325 Hawaii 28 8,459 Los Angeles/Long Beach, CA $314 San Francisco/San Mateo, CA 43 7,909 California Central Coast $299 Chicago, IL 22 7,712 Boston, MA $292 Washington, DC-MD-VA 27 7,511 California North $286 Denver/Mountain Resorts 62 7,149 Colorado Area $280 San Diego, CA 37 6,997 Miami/Hialeah, FL $249 Atlanta, GA 19 5,658 Orlando, FL $242 Orlando, FL 9 5,534 Washington, DC-MD-VA $225 Phoenix, AZ 13 5,055 Seattle, WA $222 New Orleans, LA 21 4,634 Austin, TX $207 California Central Coast 51 4,276 Denver, CO $203 (1) Based on information provided by STR for luxury class as of 6/30/2018 Company Presentation // November 2018 (2) TTM as of 7/31/2018 15

Target Market Analysis(1) Market Size Fundamentals Pricing Desirability 60 50 40 30 20 10 0 Fundamentals Market Size Pricing Company Presentation // November 2018 16 (1) Based on internal analysis as of 6/30/2018

Long-Term Trading Premium(1) The top quartile of lodging REITs (by RevPAR) have consistently had higher quality assets and 2.4 traded at a premium relative to other peers over PREMIUM EBITDA TRADING MULTIPLE a long-term 10 year period (TURNS) 25.0x 23.0x 21.0x 19.0x 17.0x 15.0x 13.0x 11.0x 9.0x 7.0x 5.0x 1/3/2006 1/3/2007 1/3/2008 1/3/2009 1/3/2010 1/3/2011 1/3/2012 1/3/2013 1/3/2014 1/3/2015 1/3/2016 1/3/2017 1/3/2018 Top Quartile Avg NTM EBITDA Multiple Peer Avg NTM EBITDA Multiple (1) Data is from 1/1/2006 to 9/30/2018 Company Presentation // November 2018 Source: STR, SNL 17 Top Quartile: BEE, PEB, LHO Peers: AHT, CLDT, CHSP, DRH, FCH, HT, HPT, HST, INN, RLJ, SHO

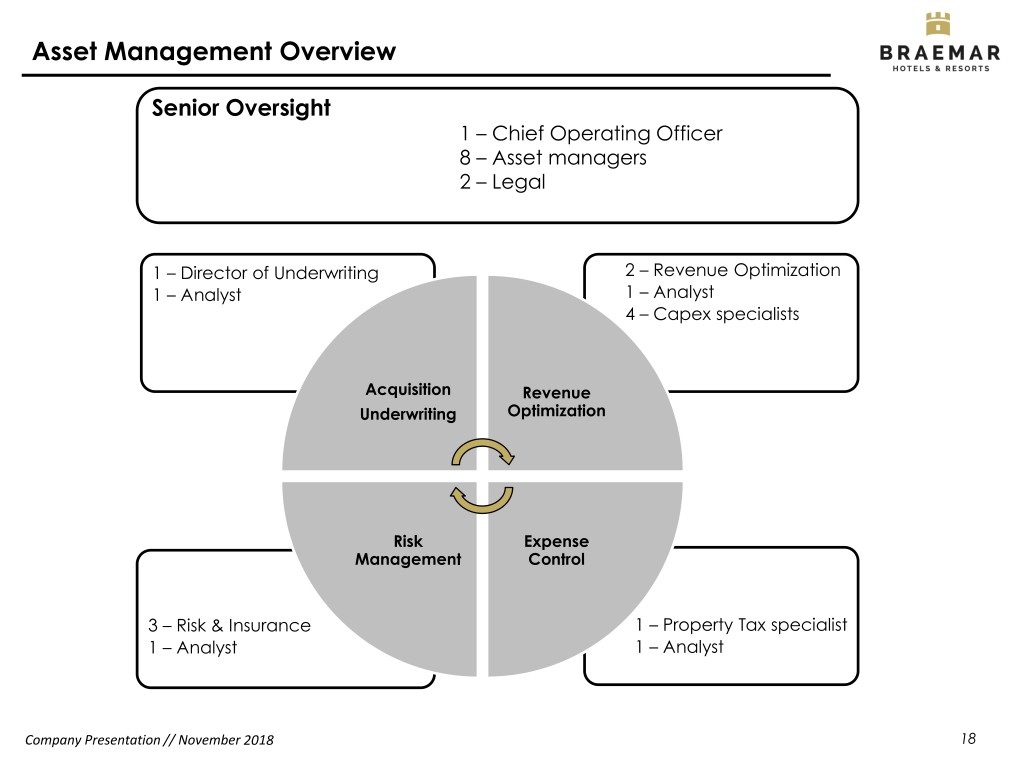

Asset Management Overview Senior Oversight 1 – Chief Operating Officer 8 – Asset managers 2 – Legal 1 – Director of Underwriting 2 – Revenue Optimization 1 – Analyst 1 – Analyst 4 – Capex specialists Acquisition Revenue Underwriting Optimization Risk Expense Management Control 3 – Risk & Insurance 1 – Property Tax specialist 1 – Analyst 1 – Analyst Company Presentation // November 2018 18

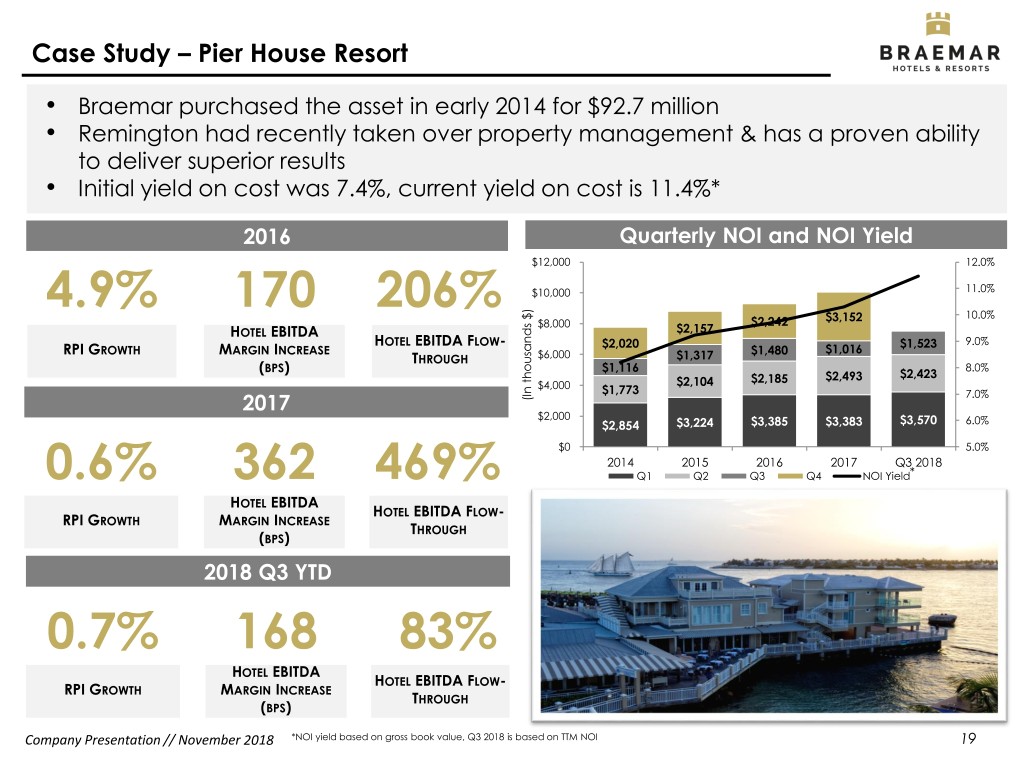

Case Study – Pier House Resort • Braemar purchased the asset in early 2014 for $92.7 million • Remington had recently taken over property management & has a proven ability to deliver superior results • Initial yield on cost was 7.4%, current yield on cost is 11.4%* 2016 Quarterly NOI and NOI Yield $12,000 12.0% 4.9% 170 206% $10,000 11.0% $3,152 10.0% $8,000 $2,242 HOTEL EBITDA $2,157 HOTEL EBITDA FLOW- $2,020 $1,523 9.0% RPI GROWTH MARGIN INCREASE $1,480 $1,016 THROUGH $6,000 $1,317 (BPS) $1,116 8.0% $2,185 $2,493 $2,423 $4,000 $2,104 $1,773 7.0% 2017 $) thousands (In $2,000 $2,854 $3,224 $3,385 $3,383 $3,570 6.0% $0 5.0% 2014 2015 2016 2017 Q3 2018 0.6% 362 469% Q1 Q2 Q3 Q4 NOI Yield* HOTEL EBITDA HOTEL EBITDA FLOW- RPI GROWTH MARGIN INCREASE THROUGH (BPS) 2018 Q3 YTD 0.7% 168 83% HOTEL EBITDA HOTEL EBITDA FLOW- RPI GROWTH MARGIN INCREASE THROUGH (BPS) Company Presentation // November 2018 *NOI yield based on gross book value, Q3 2018 is based on TTM NOI 19

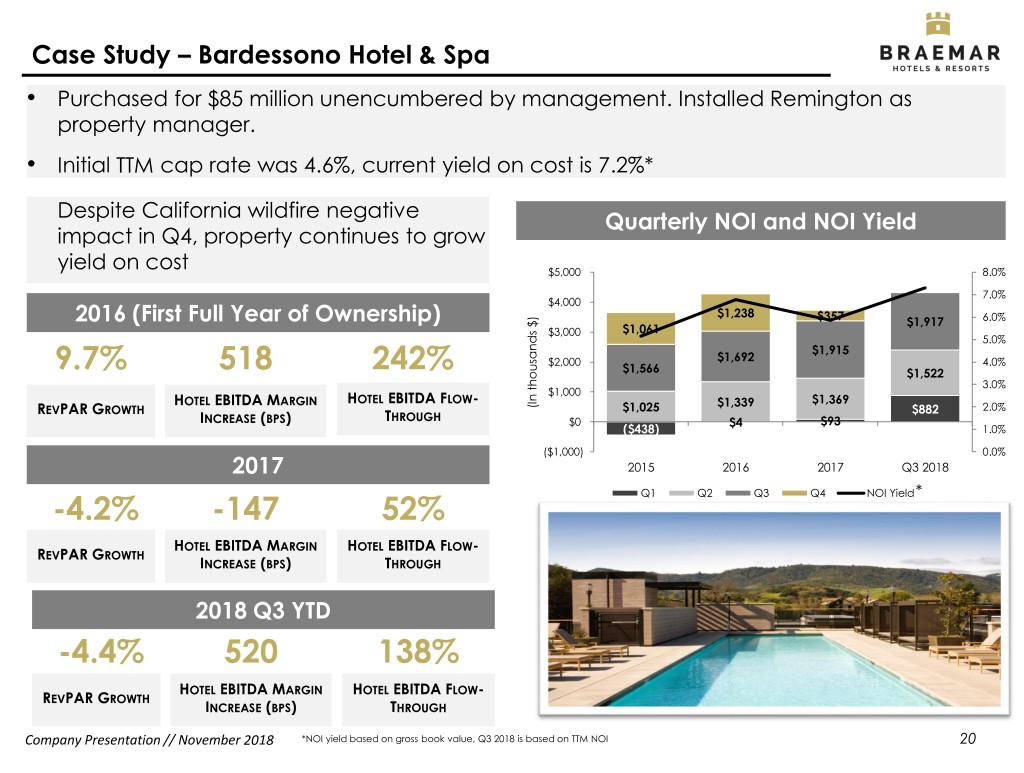

Case Study – Bardessono Hotel & Spa • Purchased for $85 million unencumbered by management. Installed Remington as property manager. • Initial TTM cap rate was 4.6%, current yield on cost is 7.2%* Despite California wildfire negative Quarterly NOI and NOI Yield impact in Q4, property continues to grow yield on cost $5,000 8.0% 7.0% $4,000 $1,238 2016 (First Full Year of Ownership) $357 $1,917 6.0% $3,000 $1,061 5.0% $1,915 $2,000 $1,692 4.0% 9.7% 518 242% $1,566 $1,522 3.0% $1,000 HOTEL EBITDA MARGIN HOTEL EBITDA FLOW- $1,369 (In thousands $) thousands (In $1,339 REVPAR GROWTH $1,025 $882 2.0% INCREASE (BPS) THROUGH $0 $4 $93 ($438) 1.0% ($1,000) 0.0% 2017 2015 2016 2017 Q3 2018 Q1 Q2 Q3 Q4 NOI Yield* -4.2% -147 52% HOTEL EBITDA MARGIN HOTEL EBITDA FLOW- REVPAR GROWTH INCREASE (BPS) THROUGH 2018 Q3 YTD -4.4% 520 138% HOTEL EBITDA MARGIN HOTEL EBITDA FLOW- REVPAR GROWTH INCREASE (BPS) THROUGH Company Presentation // November 2018 *NOI yield based on gross book value, Q3 2018 is based on TTM NOI 20

Conservative Capital Structure TARGET LEVERAGE OVERVIEW Floating-rate debt Non-recourse debt provides a natural 45% lowers risk profile of hedge to hotel cash the platform flows Gross Assets Maximizes flexibility Long-standing lender in all economic relationships Net Debt environments Company Presentation // November 2018 21

Cash Management Strategy NET WORKING CAPITAL(1) Cash & Cash Equivalents $158.5 10-15% 17% $5.05 Restricted Cash $73.6 Accounts Receivable, net $22.5 CASH TO GROSS Prepaid Expenses $5.7 CASH TO GROSS DEBT TARGET NWC / SHARE (2) DEBT(1) Investment in Ashford Inc. $12.8 Total Current Assets $273.1 Accounts Payable, net & Accrued Expenses $70.5 Dividends Payable 8.8 $48.4M 6.2% 50% 36% Due to Affiliates, net 3.2 Due to third-party hotel managers,net 0.4 (1),(3),(4) DIVIDEND CAD AFFO CAD Total Current Liabilities $82.9 YIELD(2) PAYOUT RATIO(1) PAYOUT RATIO(1) Net Working Capital $190.2 BENEFITS Defend our assets at financing maturity Hilton Torrey Pines La Jolla, CA Opportunistic investments in severe economic downturn (1) As of 9/30/2018 (4) GAAP reconciliation in appendix (2) At market value as of 10/26/2018 Company Presentation // November 2018 (3) Deducts preferred dividends and actual FF&E reserve payments which are between 4% and 5% of hotel 22 revenue and adds back amortization of loan costs

Debt Maturities Courtyard Philadelphia OVERVIEW Philadelphia, PA 2020 2.1x 4.8% NEXT HARD DEBT FCCR(1) WEIGHTED AVG. MATURITY INTEREST RATE(1) Laddered debt maturities(1) $600 $500 $400 $300 $535.0 (In millions)(In $200 $100 $187.8 $158.5 $112.0 $0 2018 2019 2020 2021 2022 Thereafter Fixed-Rate Floating-Rate 23 Company Presentation // November 2018 (1) As of 9/30/2018

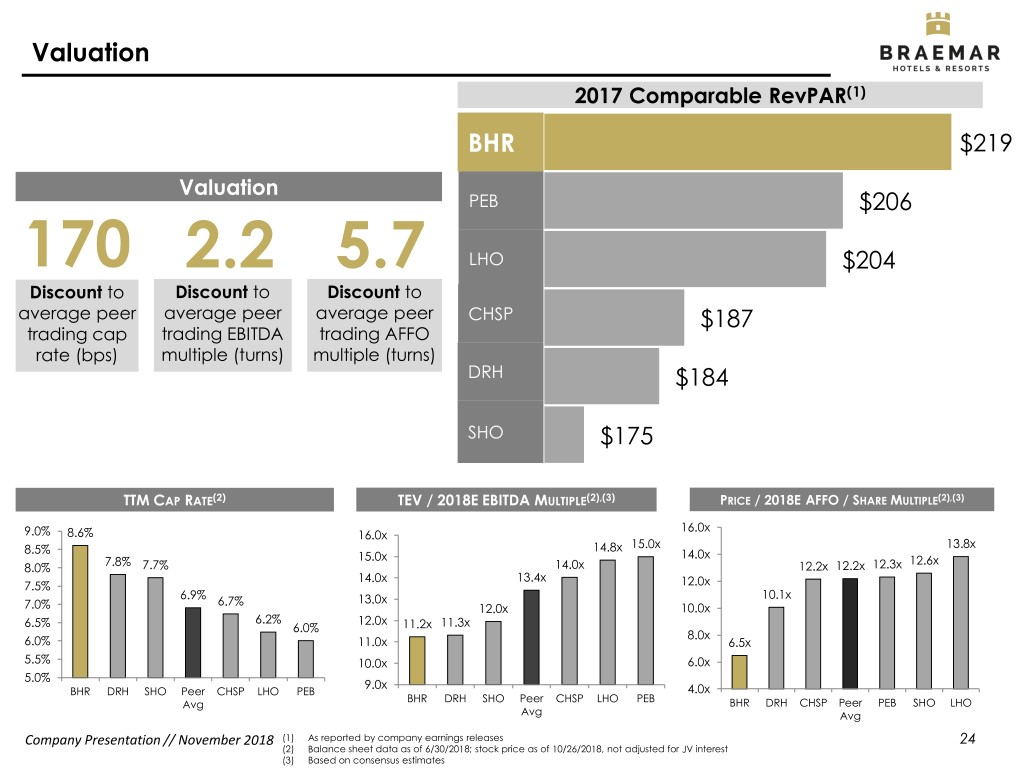

Valuation 2017 Comparable RevPAR(1) BHR $219 Valuation PEB $206 170 2.2 5.7 LHO $204 Discount to Discount to Discount to average peer average peer average peer CHSP $187 trading cap trading EBITDA trading AFFO rate (bps) multiple (turns) multiple (turns) DRH $184 SHO $175 TTM CAP RATE(2) TEV / 2018E EBITDA MULTIPLE(2),(3) PRICE / 2018E AFFO / SHARE MULTIPLE(2),(3) 16.0x 9.0% 8.6% 16.0x 14.8x 15.0x 13.8x 8.5% 14.0x 7.8% 15.0x 12.6x 8.0% 7.7% 14.0x 12.2x 12.2x 12.3x 14.0x 13.4x 7.5% 12.0x 6.9% 10.1x 6.7% 13.0x 7.0% 12.0x 10.0x 6.2% 12.0x 6.5% 6.0% 11.2x 11.3x 8.0x 6.0% 11.0x 6.5x 5.5% 10.0x 6.0x 5.0% 9.0x BHR DRH SHO Peer CHSP LHO PEB 4.0x BHR DRH SHO Peer CHSP LHO PEB Avg BHR DRH CHSP Peer PEB SHO LHO Avg Avg Company Presentation // November 2018 (1) As reported by company earnings releases 24 (2) Balance sheet data as of 6/30/2018; stock price as of 10/26/2018, not adjusted for JV interest (3) Based on consensus estimates

Intrinsic Value(1),(2) Current Equity Implied Equity Implied Equity Valuation Market Cap(3) Market Cap(4) Value Upside Disconnect $388M $851M $463M BRAEMAR PORTFOLIO 119% Increase $985 (In millions $) Low-End High-End $851 TTM NOI(5),(7) $111.9 $111.9 $718 Cap Rate(6) 7.0% 6.0% Implied Value 1,598.6 $1,865.0 $388 NWC(7),(8) $190.2 $190.2 Preferred Equity(7) ($124.1) ($124.1) Debt(7) ($946.4) ($946.4) Current Market Low End - Avg - Implied High End - Cap Implied Equity Equity Market Implied Equity Implied Equity Mkt Cap $718.3 -- $984.7 Market Cap Cap Market Cap (1) See valuation methodology disclaimer (5) See GAAP reconciliation in appendix (2) Excludes termination fee (6) Based on current implied cap rates of publicly traded peers Company Presentation // November 2018 (3) As of 10/26/2018 (7) As of 9/30/2018; Adjusted for Hilton JV as applicable 25 (4) Based on average of estimated cap rates (8) Investment in Ashford Inc. at market value as of 10/26/2018

Highly Aligned Management Team 14% Management has significant personal wealth invested in the Company 4.0x Insider ownership 4.0x higher than REIT industry average $56M Total dollar value of insider ownership (as of 10/26/2018) 20.0% 18.0% 17.3% 16.0% 14.4% Highly-aligned management team is among 14.0% highest insider equity ownership of publicly- traded Hotel REITs 12.0% 10.0% 9.4% 8.0% 6.3% 6.0% 4.0% 3.6% 3.4% 2.6% 2.2% 2.1% 1.9% 2.0% 1.6% 1.2% 0.9% 0.9% 0.4% 0.4% 0.0% AHT BHR HT APLE Peer CLDT CHSP PEB INN HST RLJ DRH SHO XHR LHO PK Avg. REIT Avg includes: AHT, HT, APLE, CLDT, CHSP, RLJ, PEB, INN, HST, DRH, SHO, XHR, LHO, PK Company Presentation // November 2018 Source: Proxy and Company filings 26 Note insider equity ownership for BHR includes direct interests and interests of related parties

Key Takeaways Highest Quality Portfolio Amongst All Lodging REITs…In The Segment With Greatest Growth Trajectory Bardessono Hotel & Spa Growing Organically: Rigorous Asset Management Yountville, CA While Mining Portfolio for Investment Opportunities Growing Externally: Redeploying Capital into Accretive Acquisitions Pier House Resort Key West, FL Shares Are Significantly Undervalued vs Peers The Ritz-Carlton St. Thomas St. Thomas, USVI Highly Aligned Mgmt. Team That Is a Major Shareholder Company Presentation // November 2018 27

Appendix

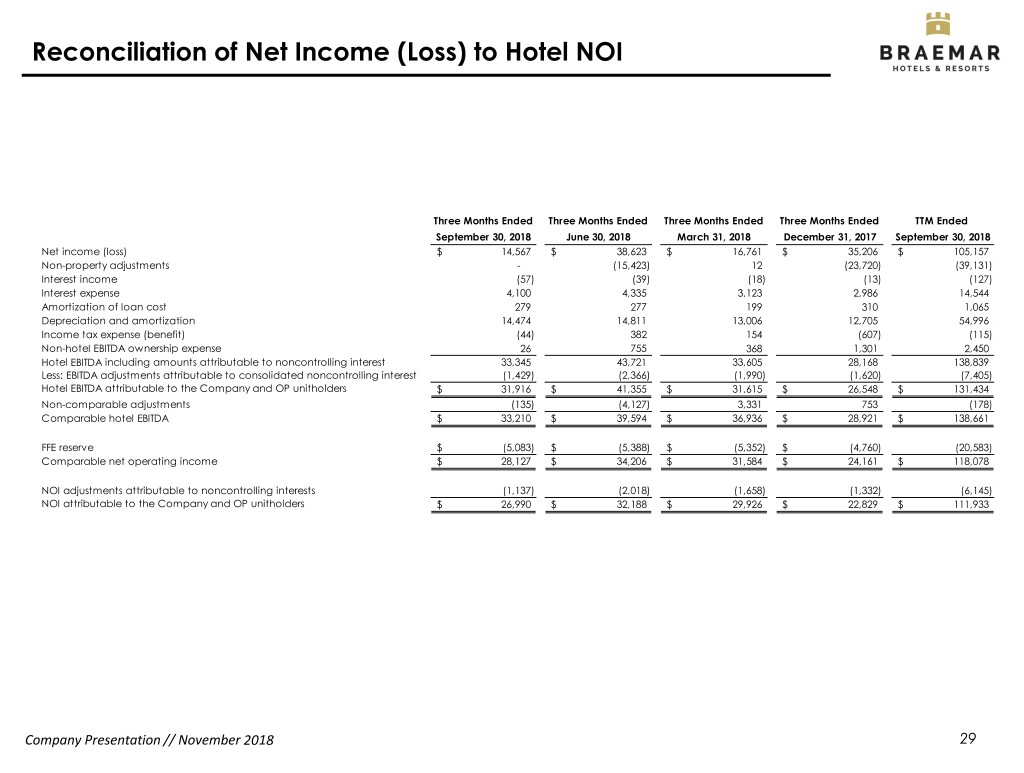

Reconciliation of Net Income (Loss) to Hotel NOI Three Months Ended Three Months Ended Three Months Ended Three Months Ended TTM Ended September 30, 2018 June 30, 2018 March 31, 2018 December 31, 2017 September 30, 2018 Net income (loss) $ 14,567 $ 38,623 $ 16,761 $ 35,206 $ 105,157 Non-property adjustments - (15,423) 12 (23,720) (39,131) Interest income (57) (39) (18) (13) (127) Interest expense 4,100 4,335 3,123 2,986 14,544 Amortization of loan cost 279 277 199 310 1,065 Depreciation and amortization 14,474 14,811 13,006 12,705 54,996 Income tax expense (benefit) (44) 382 154 (607) (115) Non-hotel EBITDA ownership expense 26 755 368 1,301 2,450 Hotel EBITDA including amounts attributable to noncontrolling interest 33,345 43,721 33,605 28,168 138,839 Less: EBITDA adjustments attributable to consolidated noncontrolling interest (1,429) (2,366) (1,990) (1,620) (7,405) Hotel EBITDA attributable to the Company and OP unitholders $ 31,916 $ 41,355 $ 31,615 $ 26,548 $ 131,434 Non-comparable adjustments (135) (4,127) 3,331 753 (178) Comparable hotel EBITDA $ 33,210 $ 39,594 $ 36,936 $ 28,921 $ 138,661 FFE reserve $ (5,083) $ (5,388) $ (5,352) $ (4,760) (20,583) Comparable net operating income $ 28,127 $ 34,206 $ 31,584 $ 24,161 $ 118,078 NOI adjustments attributable to noncontrolling interests (1,137) (2,018) (1,658) (1,332) (6,145) NOI attributable to the Company and OP unitholders $ 26,990 $ 32,188 $ 29,926 $ 22,829 $ 111,933 Company Presentation // November 2018 29

Reconciliation of Net Income (Loss) to Cash Available for Distribution Three Months Ended Three Months Ended Three Months Ended Three Months Ended TTM Ended September 30, 2018 June 30, 2018 March 31, 2018 December 31, 2017 September 30, 2018 Net income (loss) $ (626) $ 12,854 $ 4,270 $ 28,444 $ 44,942 (Income) loss from consolidated entities attributable to noncontrolling interest (1,695) (89) 42 (528) (2,270) Net (income) loss attributable to redeemable noncontrolling interests in operating partnership 452 (1,235) (292) (2,996) (4,071) Preferred dividends (1,707) (1,708) (1,707) (1,708) (6,830) Net income (loss) attributable to common stockholders (3,576) 9,822 2,313 23,212 31,771 Depreciation and amortization on real estate 13,720 14,052 12,258 11,952 51,982 Impairment charges on real estate - 59 12 60 131 Net income (loss) attributable to redeemable noncontrolling interests in operating partnership (452) 1,235 292 2,996 4,071 (Gain) loss on sale of hotel property - (15,711) - (23,797) (39,508) Equity in (earnings) loss of unconsolidated entities 81 62 3 - 146 Company's portion of FFO of OpenKey (81) (63) (2) - (146) FFO available to common stockholders and OP unitholders 9,692 9,456 14,876 14,423 48,447 Preferred dividends 1,707 1,708 1,707 1,708 6,830 Transaction and management conversion costs - 462 503 74 1,039 Other (income) expense 64 63 63 85 275 Interest expense accretion on refundable membership club deposits 226 150 - - 376 Write-off of loan costs and exit fees - 4,176 2 1,531 5,709 Amortization of loan costs 1,070 1,075 988 1,149 4,282 Unrealized (gain) loss on investments (2,158) 6,024 (528) (6,314) (2,976) Unrealized (gain) loss on derivatives 578 298 (73) 524 1,327 Non-cash stock/unit-based compensation 1,674 1,442 2,593 665 6,374 Legal, advisory and settlement costs 277 197 (1,141) 203 (464) Advisory services incentive fee 1,380 691 170 2,241 Contract modification cost - - - - - Software implementation costs - - - - - Uninsured hurricane and wildfire related costs - (55) 467 248 660 Tax reform 2 2 - (161) (157) Adjusted FFO available to the Company and OP unitholders $ 14,512 $ 25,689 $ 19,627 $ 14,135 $ 73,963 FFE reserve (net of noncontrolling interest) (4,790) (5,400) (4,415) (4,110) (18,715) Preferred dividends (1,707) (1,708) (1,707) (1,708) (6,830) Cash available for distribution to the Company and OP unitholders $ 8,015 $ 18,581 $ 13,505 $ 8,317 $ 48,418 Company Presentation // November 2018 30