Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - Amneal Pharmaceuticals, Inc. | amrxexhibit991pressrelease.htm |

| 8-K - 8-K - Amneal Pharmaceuticals, Inc. | amrxform8-k11x7x18.htm |

“We make healthy possible” Q3 2018 Financial Earnings Call Results and Business Update November 7, 2018

Safe Harbor Statement & Non-GAAP Financial Measures Safe Harbor Statement Certain statements contained herein, regarding matters that are not historical facts, may be forward-looking statements (as defined in the Private Securities Litigation Reform Act of 1995). Such forward-looking statements include statements regarding management’s intentions, plans, beliefs, expectations or forecasts for the future, including, among other things, future operating results and financial performance, product development and launches, integration strategies and resulting cost reduction, market position and business strategy. Words such as “may,” “will,” “could,” “expect,” “plan,” “anticipate,” “intend,” “believe,” “estimate,” “assume,” “continue,” and similar words are intended to identify estimates and forward-looking statements. The reader is cautioned not to rely on these forward-looking statements. These forward-looking statements are based on current expectations of future events. If the underlying assumptions prove inaccurate or known or unknown risks or uncertainties materialize, actual results could vary materially from the expectations and projections of Amneal Pharmaceuticals, Inc. (the “Company”). Such risks and uncertainties include, but are not limited to: the impact of global economic conditions; our ability to integrate the operations of Amneal Pharmaceuticals LLC and Impax Laboratories, LLC pursuant to the business combination completed on May 4, 2018, and our ability to realize the anticipated synergies and other benefits of the combination; our ability to successfully develop and commercialize new products; our ability to obtain exclusive marketing rights for our products and to introduce products on a timely basis; the competition we face in the pharmaceutical industry from brand and generic drug product companies, and the impact of that competition on our ability to set prices; our ability to manage our growth; the illegal distribution and sale by third parties of counterfeit versions of our products or of stolen products; market perceptions of us and the safety and quality of our products; our dependence on the sales of a limited number of products for a substantial portion of our total revenues; our ability to develop, license or acquire and introduce new products on a timely basis; the ability of our approved products to achieve expected levels of market acceptance; the risk that we may discontinue the manufacture and distribution of certain existing products; the impact of manufacturing or quality control problems; the risk of product liability and other claims against us by consumers and other third parties; risks related to changes in the regulatory environment, including United States federal and state laws related to healthcare fraud abuse and health information privacy and security and changes in such laws; changes to FDA product approval requirements; risks related to federal regulation of arrangements between manufacturers of branded and generic products; the impact of healthcare reform and changes in coverage and reimbursement levels by governmental authorities and other third-party payers; our dependence on a few locations that produce a majority of our products; relationships with our major customers; the continuing trend of consolidation of certain customer groups; our reliance on certain licenses to proprietary technologies from time to time; our dependence on third party suppliers and distributors for raw materials for our products and certain finished goods; the time necessary to develop generic and branded drug products; our dependence on third parties for testing required for regulatory approval of our products; our dependence on third party agreements for a portion of our product offerings; our ability to make acquisitions of or investments in complementary businesses and products on advantageous terms; regulatory oversight related to our international operations; our increased exposure to tax liabilities due to our international operations and the impact of recent U.S. tax legislation; payments required by our Tax Receivable Agreement; our involvement in various legal proceedings, including those brought by third parties alleging infringement of their intellectual property rights; legal, regulatory and legislative efforts by our brand competitors to deter competition from our generic alternatives; the significant amount of resources we expend on research and development; our substantial amount of indebtedness and our ability to generate sufficient cash to service our indebtedness in the future, and the impact of interest rate fluctuations on such indebtedness; risks inherent in conducting clinical trials; our reporting and payment obligations under the Medicaid rebate program and other government purchase and rebate programs; quarterly fluctuations in our operating results; adjustments to our reserves based on price adjustments and sales allowances; investigations and litigation concerning the calculation of average wholesale prices; the high concentration of ownership of our Class A Common Stock and the fact that we are controlled by a group of stockholders. A further list and descriptions of these risks, uncertainties and other factors can be found in the Company’s most recently filed Quarterly Report on Form 10-Q and in the Company’s subsequent filings with the Securities and Exchange Commission. Copies of these filings are available online at www.sec.gov, www.amneal.com or on request from the Company. Forward-looking statements included herein speak only as of the date hereof and we undertake no obligation to revise or update such statements to reflect the occurrence of events or circumstances after the date hereof. Non-GAAP Financial Measures This presentation includes certain non-GAAP financial measures as defined by SEC rules. Please see the Appendix to this presentation and our press release reporting our 2018 third quarter financial results, and our Quarterly Report on Form 10-Q for the quarter ended September 30, 2018, for a reconciliation of GAAP results to the non-GAAP financial measures. Management believes that using additional non-GAAP measures on a combined company basis will facilitate the evaluation of the financial performance of the Company and its ongoing operations. The Company does not provide forward-looking guidance metrics on a GAAP basis. Consequently, the Company cannot provide a reconciliation between non-GAAP expectations and corresponding GAAP measures without unreasonable efforts because it is unable to predict with reasonable certainty the ultimate outcome of certain significant items required for the reconciliation. The items include, but are not limited to, acquisition- related expenses, restructuring expenses, asset impairments and certain and other gains and losses. These items are uncertain, depend on various factors, and could have a material impact on U.S. GAAP reported results for the guidance period. 2

Q3 2018 Results and Business Update Robert Stewart President and CEO 3

Continued to Deliver Solid Financial and Operational Performance Double-digit adjusted EBITDA and earnings growth Generated strong cash flow of $62 million from operating activities The U.S. industry leader in ANDA approvals and launches Completed all actions related to merger; will deliver $200+ million in annual synergies Beginning to deploy capital to fuel growth 10-year agreement for Levothyroxine 5-year agreement for generic alternative to Makena® injection 4

Q3 2018 Financial Highlights Solid Financial Quarter with Double-Digit Adjusted Earnings Growth GAAP Adjusted Q3 2018 Compared to 1 1 ($ in millions, Q3 Q3 Q2 Q3 Q2 Q3 except EPS) 2018 2018 2018 2017 2018 2017 Net $476 $462 $475 3% 0% Revenue $476 Net $17 $70 $79 17% 4% Income $82 EBITDA --- $163 $139 $148 17% 10% Diluted $0.05 $0.24 N/A 17% N/A EPS $0.28 1 Assumes the combination of Amneal Pharmaceuticals LLC and Impax Laboratories, LLC occurred on the first day of the quarter presented. Refer to the GAAP to non-GAAP reconciliation tables in the 5 appendix for a reconciliation of non-GAAP results.

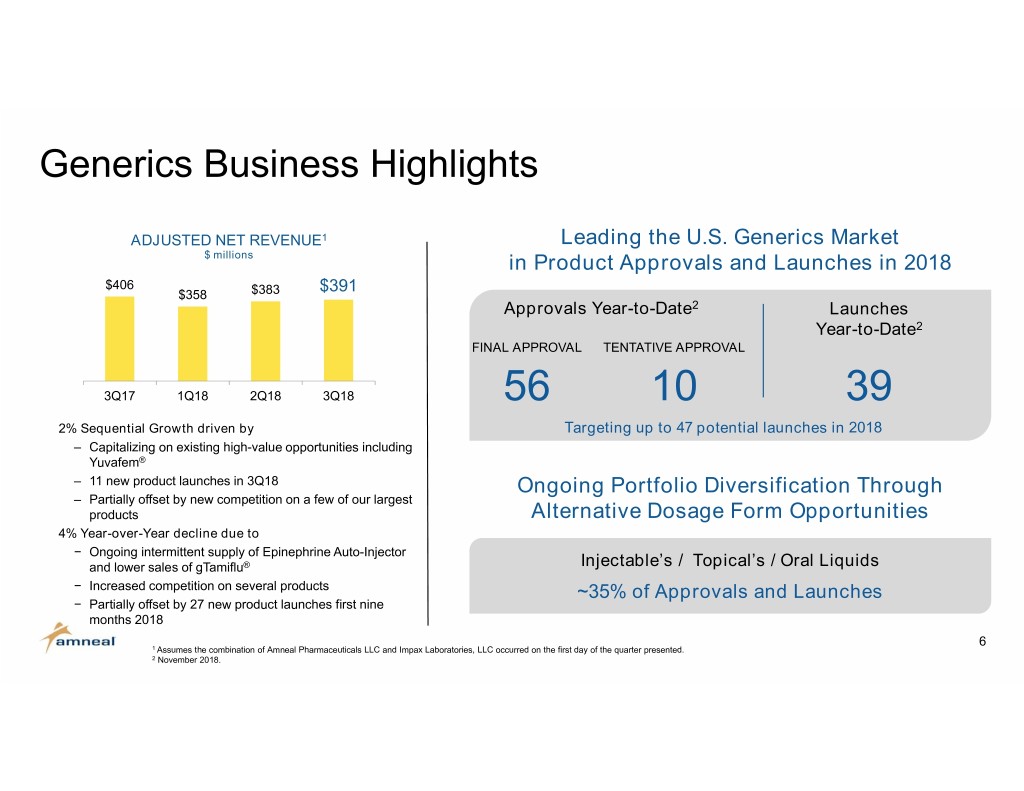

Generics Business Highlights ADJUSTED NET REVENUE1 Leading the U.S. Generics Market $ millions in Product Approvals and Launches in 2018 $406 $391 $358 $383 Approvals Year-to-Date2 Launches Year-to-Date2 FINAL APPROVAL TENTATIVE APPROVAL 3Q17 1Q18 2Q18 3Q18 56 10 39 2% Sequential Growth driven by Targeting up to 47 potential launches in 2018 ‒ Capitalizing on existing high-value opportunities including Yuvafem® ‒ 11 new product launches in 3Q18 Ongoing Portfolio Diversification Through ‒ Partially offset by new competition on a few of our largest products Alternative Dosage Form Opportunities 4% Year-over-Year decline due to − Ongoing intermittent supply of Epinephrine Auto-Injector and lower sales of gTamiflu® Injectable’s / Topical’s / Oral Liquids − Increased competition on several products ~35% of Approvals and Launches − Partially offset by 27 new product launches first nine months 2018 6 1 Assumes the combination of Amneal Pharmaceuticals LLC and Impax Laboratories, LLC occurred on the first day of the quarter presented. 2 November 2018.

Significant Opportunities to Drive Future Growth 238 total projects of which ~50% are potential high value opportunities1 Transmucosal 2% - $1.1B Nasal Spray Ophthalmic/Otic Nasal Spray 1% - $0.4B Inhalation 3% - $0.3B 4% - $2.2B 7% - $13.1B Transdermal IR Tablets 5% - $1.7B Diversified 16% - $5.2B Oral Liquid IR Tablets Ophthalmic/Otic 6% - $1.8B 31% - 31.7B Portfolio with an 12% - $1.6B Topical Expanding Focus 10% - $3.0B on Complex Transdermal 4% - $2.4B Injectables Products 24% - $7.1B Oral Liquid ER Tablets 10% - $0.5B 12% - $7.5B Topical Injectable 7% - $0.7B 16% - $31.7B ER Tablets Capsules/Soft Gels Capsule/Soft Gels 3% - $0.4B 14% - $7.0B 13% - $16.7B Filings: 121 ANDAs2 Development Pipeline: 117 projects2 U.S. Brand/Generic Sales ~$74 Billion3 U.S. Brand/Generic Sales ~$38 Billion3 Note: % numbers in pie charts above represent percentage of products within each dosage form; $ amounts represent respective sales data per IQVIA, as noted below. 1 High value opportunities are eFTF, FTF, FTM and other opportunities with 0 to 3 competitors. 7 2 Pipeline data as of November 5, 2018. 3 Sales data per IQVIA LTM August 2018

Specialty Pharma Business Highlights ADJUSTED NET REVENUE1 Focused on Growing Specialty Business $ millions $80 $85 $69 $69 3Q17 1Q18 2Q18 3Q18 6% Sequential Revenue Growth Rytary ‒ ‒ Rytary® TRx growth of 6% Expanding access; Humana Med D formulary coverage effective Feb. 1, 2019 ‒ Unithroid® TRx growth of 6% . 8.5 million lives covered ‒ Emverm® TRx growth of 9% Albenza ‒ 24% Year-Over-Year Revenue Growth Generic competition in September; launched authorized generic ‒ Rytary® TRx growth of 31% Emverm ‒ ‒ Unithroid® TRx growth of 31% Marketing focus expanding in 2019 ‒ Emverm® TRx growth of 6% 8 1 Assumes the combination of Amneal Pharmaceuticals LLC and Impax Laboratories, LLC occurred on the first day of the quarter presented.

Investing in Specialty Business to Drive Future Growth IPX203 - Potential treatment for the symptoms of advanced Parkinson’s disease. Patent issued; expires November 2034 Additional intellectual property protection expected First patient dosed in Phase 3 study Top line results expected in first half 2020 Committed to Investing in Organic and External Opportunities to Create Long-Term Growth 9

Rapid and Seamless Integration Activities Ahead of schedule on key deliverables Closure of Hayward facilities within one year of merger All actions required to deliver synergies are completed On Track to Achieve More Than $200 Million in cost Synergies Earlier Than Planned 10

Q3 2018 Financial Results Bryan Reasons SVP, Chief Financial Officer 11

Generic Division Results GAAP Adjusted Key Drivers: Adjusted Results Q3 2018 Compared to Sequentially: Revenue Up 2% ® Q3 Q3 Q21 Q31 Q2 Q3 • Higher sales of Yuvafem and Epinephrine Auto- ($ in millions) 2018 2018 2018 2017 2018 2017 injector (seasonality) • Lower sales of Aspirin Dipyridamole and Diclofenac Net Revenue $391 $391 $383 $406 2% (4%) 1% (gVoltaren® Gel) due to new competition Gross Margin 39% 50% 48% 47% 130bps 260bps Year-Over-Year: Revenue Down 4% • Lower sales of Oseltamivir and Diclofenac 3% ® Operating Profit $92 $132 $112 $132 17% 0% (gSolaraze ) due to competition; Epinephrine supply constraint • New product launches contributed $44MM Q3 2018 Top 5 Generic Products ® Revenue • Higher sales of Yuvafem ® ® Yuvafem Estradiol Vaginal Tablets (gVagifem ) $48 Gross Margin Epinephrine Auto-Injector (gAdrenaclick®) $30 • Sequential and year-over-year improvement driven by product sales mix Diclofenac Sodium Topical Gel 1% (gVoltaren® Gel) $26 Aspirin and ER Dipyridamole (gAggrenox®) $23 Operating Profit • Sequential improvement driven by higher gross profit Oxymorphone ER Tablets $19 and lower operating expenses as a result of synergy capture 12 1 Assuming the business combination of Amneal Pharmaceuticals LLC and Impax Laboratories, Inc. occurred on the first day of the quarter presented. Adjusted to exclude certain items. Refer to the GAAP to non-GAAP reconciliation tables in the appendix for a reconciliation of non-GAAP results.

Specialty Pharma Division Results GAAP Adjusted Key Drivers: Adjusted Results Q3 2018 Compared to Sequentially: Revenue Up 6% •Rytary®, Zomig® and anthelmintic franchise Q3 Q3 Q21 Q31 Q2 Q3 ($ in millions) 2018 2018 2018 2017 2018 2017 Year-Over-Year: Revenue Up 24% Net Revenue $85 $85 $80 $69 6% 24% •Rytary®, Zomig®, Unithroid® and anthelmintic franchise Gross Margin 55% 79% 79% 80% (30bps) (90bps) Operating Profit • Sequential and year-over-year improvement driven Operating Profit $23 $44 $38 $30 15% 43% by higher revenues 13 1 Assuming the business combination of Amneal Pharmaceuticals LLC and Impax Laboratories, Inc. occurred on the first day of the quarter presented. Adjusted to exclude certain items. Refer to the GAAP to non-GAAP reconciliation tables in the appendix for a reconciliation of non-GAAP results.

Generated Strong Operating Cash Flow in 3Q18 $62 million of cash flow from operating activities Major uses of cash ‒ $27 million for cap-ex ‒ $12 million purchase of remaining non-controlling interest in UK subsidiary ‒ $10 million earn-out payments related to prior-year product acquisition Expect Strong Cash Flow to Continue; Will Allow us to Support Additional Business Development Activities and Debt Reduction 14

Closing Remarks Robert Stewart President and CEO 15

2018 Financial Guidance1 Prior Updated Reasons for Adjusted Gross Margins 50% to 55% 51% to 53% tightening EBITDA/EPS ranges: Adjusted R&D Expense as a % of Total Revenues 10% to 15% 11% to 12% • Third-party manufacturer Adjusted SG&A Expense as a % of Total Revenues 13% to 16% 15% to 16% (Pfizer) continues to under perform on Epinephrine Adjusted EBITDA2 $580 to $620 million $580 to $585 million Auto-Injector supply • Earlier than expected Adjusted EPS $0.90 to $1.00 $0.90 to $0.92 competition on Yuvafem® and Aspirin Dipyridamole Adjusted Effective Tax Rate 20% to 22% ~21% • Additional competition on Oseltamivir (gTamiflu®) and slower start to flu season Capital Expenditures $80 to $100 million ~$90 million Diluted Shares Outstanding ~300 million ~300 million 16 1 See “Safe Harbor Statement” and “Non-GAAP Financial Measure” on page 2 of this presentation. 2 Includes cost synergies of ~ $30 - $35 million currently expected to be realized in 2018.

As We Look to 2019 and Beyond Continue Building Amneal From Our Position of Strength NEAR-TERM PRIORITIES OUR TARGET Capitalize on Organic Growth Continue to leverage industry leading Maintain double-digit approvals and on-time launch performance earnings growth Drive for Operational Excellence Maintain superior customer service and highest level of compliance Insulate business from Improve Earnings Potential quarterly fluctuations Completing synergy capture from the merger inherent in the Generics and maintain tight cost control business 17

As We Look to 2019 and Beyond Capital Deployment to Support Double-Digit Earnings Growth LONG-TERM INITIATIVES OUR PORTFOLIO FOCUS Continue to Drive Organic Growth Ongoing investment in Generic and Specialty R&D Generics Pursue Creative Business Development Tuck-in acquisitions as well as larger transactions to strengthen key portfolios Specialty Explore Additional Commercial Adjacencies Further diversify Amneal’s commercial footprint Biosimilars 18

Questions & Answers 19

Appendix & Non-GAAP Reconciliations 20

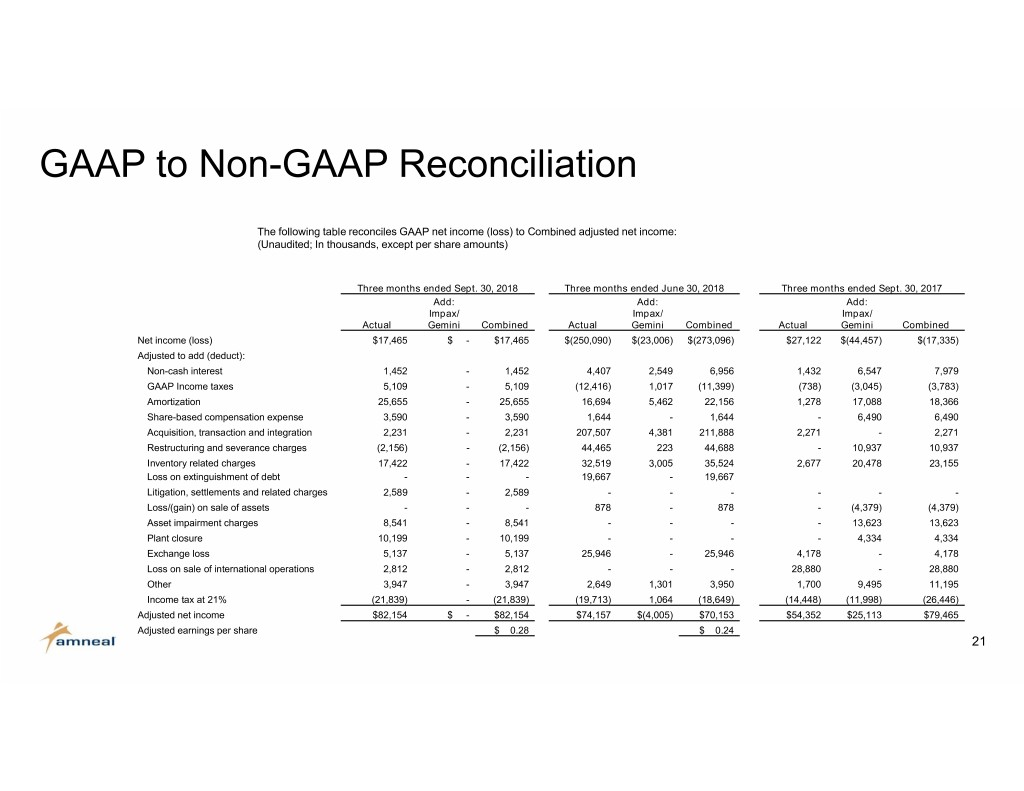

GAAP to Non-GAAP Reconciliation The following table reconciles GAAP net income (loss) to Combined adjusted net income: (Unaudited; In thousands, except per share amounts) Three months ended Sept. 30, 2018 Three months ended June 30, 2018 Three months ended Sept. 30, 2017 Add: Add: Add: Impax/ Impax/ Impax/ Actual Gemini Combined Actual Gemini Combined Actual Gemini Combined Net income (loss) $17,465 $ - $17,465 $(250,090) $(23,006) $(273,096) $27,122 $(44,457) $(17,335) Adjusted to add (deduct): Non-cash interest 1,452 - 1,452 4,407 2,549 6,956 1,432 6,547 7,979 GAAP Income taxes 5,109 - 5,109 (12,416) 1,017 (11,399) (738) (3,045) (3,783) Amortization 25,655 - 25,655 16,694 5,462 22,156 1,278 17,088 18,366 Share-based compensation expense 3,590 - 3,590 1,644 - 1,644 - 6,490 6,490 Acquisition, transaction and integration 2,231 - 2,231 207,507 4,381 211,888 2,271 - 2,271 Restructuring and severance charges (2,156) - (2,156) 44,465 223 44,688 - 10,937 10,937 Inventory related charges 17,422 - 17,422 32,519 3,005 35,524 2,677 20,478 23,155 Loss on extinguishment of debt - - - 19,667 - 19,667 Litigation, settlements and related charges 2,589 - 2,589 - - - - - - Loss/(gain) on sale of assets - - - 878 - 878 - (4,379) (4,379) Asset impairment charges 8,541 - 8,541 - - - - 13,623 13,623 Plant closure 10,199 - 10,199 - - - - 4,334 4,334 Exchange loss 5,137 - 5,137 25,946 - 25,946 4,178 - 4,178 Loss on sale of international operations 2,812 - 2,812 - - - 28,880 - 28,880 Other 3,947 - 3,947 2,649 1,301 3,950 1,700 9,495 11,195 Income tax at 21% (21,839) - (21,839) (19,713) 1,064 (18,649) (14,448) (11,998) (26,446) Adjusted net income $82,154 $ - $82,154 $74,157 $(4,005) $70,153 $54,352 $25,113 $79,465 Adjusted earnings per share $ 0.28 $ 0.24 21

GAAP to Non-GAAP Reconciliation The following table reconciles GAAP net loss to Combined EBITDA and Combined adjusted EBITDA: (Unaudited, In thousands) Three months ended Sept. 30, 2018 Three months ended June 30, 2018 Three months ended Sept. 30, 2017 Add: Add: Add: Impax/ Impax/ Impax/ Actual Gemini Combined GAAP Gemini Combined Actual Gemini Combined Net income (loss) $17,465 $ - $17,465 $(250,090) $(23,006) $(273,096) $27,122 $(44,457) $(17,335) Adjusted to add (deduct): Interest expense, net 43,018 - 43,018 36,622 4,753 41,375 19,218 13,300 32,518 Income taxes 5,109 - 5,109 (12,416) 1,017 (11,399) (738) (3,045) (3,783) Depreciation and amortization 43,013 - 43,013 32,147 6,925 39,072 11,958 23,781 35,739 EBITDA 108,605 - 108,605 (193,737) (10,311) (204,048) 57,560 (10,421) 47,139 Adjusted to add (deduct): Share-based compensation expense 3,590 - 3,590 1,644 - 1,644 - 6,490 6,490 Acquisition, transaction and integration 2,231 - 2,231 207,507 4,381 211,888 2,271 - 2,271 Restructuring and severance charges (2,156) - (2,156) 44,465 223 44,688 - 10,937 10,937 Inventory related charges 17,422 - 17,422 32,519 3,005 35,524 2,677 20,478 23,155 Loss on extinguishment of debt 19,667 - 19,667 Litigation, settlements and related charges 2,589 - 2,589 - - - - - - Loss/(gain) on sale of assets - - - 878 - 878 - (4,379) (4,379) Asset impairment charges 8,541 - 8,541 - - - - 13,623 13,623 Plant closure 10,199 - 10,199 - - - - 4,334 4,334 Exchange loss 5,137 - 5,137 25,946 - 25,946 4,178 - 4,178 Loss on sale of international operations 2,812 - 2,812 - - - 28,880 - 28,880 Other 3,947 - 3,947 2,649 - 2,649 1,700 9,495 11,195 Adjusted EBITDA $162,917 $ - $162,917 $141,538 $(2,702) $138,836 $97,266 $50,557 $147,823 22

GAAP to Non-GAAP Reconciliation The following table reconciles the Generics Business GAAP results to combined results and to adjusted combined operating profit: (Unaudited, In thousands) Three months ended Sept 30, 2018 Three months ended June 30, 2018 Three months ended Sept 30, 2017 Add: Add: Add: Actual Impax Combined Actual Impax Combined Actual Impax Combined Net revenue 391,175 $ - $391,175 361,770 $ 20,995 $382,765 254,733 151,098 405,831 Cost of goods sold 237,866 - 237,866 211,534 29,624 241,158 119,720 154,756 274,476 Gross profit 153,309 - 153,309 150,236 (8,629) 141,607 135,013 (3,658) 131,355 Selling, general, and administrative 21,030 - 21,030 16,621 4,340 20,961 15,030 5,570 20,600 Research and development 38,997 - 38,997 47,206 3,984 51,190 41,323 12,241 53,564 Intellectual property legal development expenses 3,929 - 3,929 4,004 - 4,004 6,693 28 6,721 Legal settlement gain - - - - - - (21,467) - (21,467) Acquisition, integration and transaction related expenses - - - 114,622 - 114,622 - - - Restructuring (2,885) - (2,885) 24,797 - 24,797 - - - Operating profit $ 92,238 $ - $ 92,238 $ (57,014) $(16,953) $ (73,967) $93,434 $(21,497) $ 71,937 Adjusted to add (deduct): Amortization 6,107 - 6,107 6,043 3,934 9,977 1,278 13,181 14,459 Plant Closure 10,199 - 10,199 5,036 5,036 - 4,334 4,334 Inventory related charges including inventory step-up 16,462 - 16,462 25,533 3,005 28,538 2,677 20,478 23,155 Asset impairment charges 8,541 - 8,541 - - - - 13,623 13,623 Acquisition, integration and transaction related expenses - - - 114,622 - 114,622 - - - Restructuring and severance charges (2,885) - (2,885) 24,797 - 24,797 - 4,601 4,601 Share-based compensation expense 1,201 - 1,201 221 - 221 - - - Other (314) - (314) 2,649 - 2,649 - 60 60 Adjusted operating profit $131,549 $ - $131,549 $ 121,887 $(10,014) $111,873 $97,390 $ 34,780 $132,169 23

GAAP to Non-GAAP Reconciliation The following table reconciles the Specialty Pharma Business GAAP results to combined results and to adjusted combined operating profit: (Unaudited, In thousands) Three months ended Sept. 30, 2018 Three months ended June. 30, 2018 Three months ended Sept. 30, 2017 Add: Add: Add: Actual Impax/Gemini Combined Actual Impax/Gemini Combined Actual Impax/Gemini Combined Rytary $ 33,073 $ - $ 33,073 $ 20,520 $ 8,578 $ 29,098 $ - $ 21,520 $ 21,520 Zomig 15,445 - 15,445 9,695 3,933 13,628 - 13,899 $ 13,899 All Other Specialty 36,794 - 36,794 21,802 15,035 36,837 - 33,348 $ 33,348 Net revenue 85,312 - 85,312 52,017 27,546 79,563 - 68,767 68,767 Cost of goods sold 38,516 - 38,516 23,958 6,711 30,669 - 23,026 23,026 Gross profit 46,796 - 46,796 28,059 20,835 48,894 - 45,741 45,741 Selling, general and administrative 19,716 - 19,716 13,549 7,707 21,256 - 19,213 19,213 Research and development 4,002 - 4,002 3,129 1,007 4,136 - 3,640 3,640 Intellectual property legal development expenses 472 - 472 43 - 43 - 1,612 1,612 Restructuring (27) - (27) 2,421 - 2,421 - - - Operating profit $ 22,633 $ - $ 22,633 $ 8,917 $ 12,121 $ 21,038 $ - $ 21,276 $ 21,276 Adjusted to add (deduct): - Amortization $ 19,548 $ - $ 19,548 $ 10,651 $ 1,535 $ 12,186 $ - $ 3,905 $ 3,905 Inventory step-up 960 - 960 1,950 - 1,950 - - - Restructuring (27) - (27) 2,421 - 2,421 - 5,257 5,257 Others 474 - 474 - - - - - Adjusted operating profit $ 43,588 $ - $ 43,588 $ 23,939 $ 13,656 $ 37,595 $ - $ 30,438 $ 30,438 24