Attached files

| file | filename |

|---|---|

| EX-99.2 - EXHIBIT 99.2 - Bloom Energy Corp | ex992pressreleasedatednove.htm |

| 8-K - 8-K - Bloom Energy Corp | a2018q3earningsrelease8-k.htm |

Q3 FISCAL 2018 Letter to Shareholders November 5, 2018 1

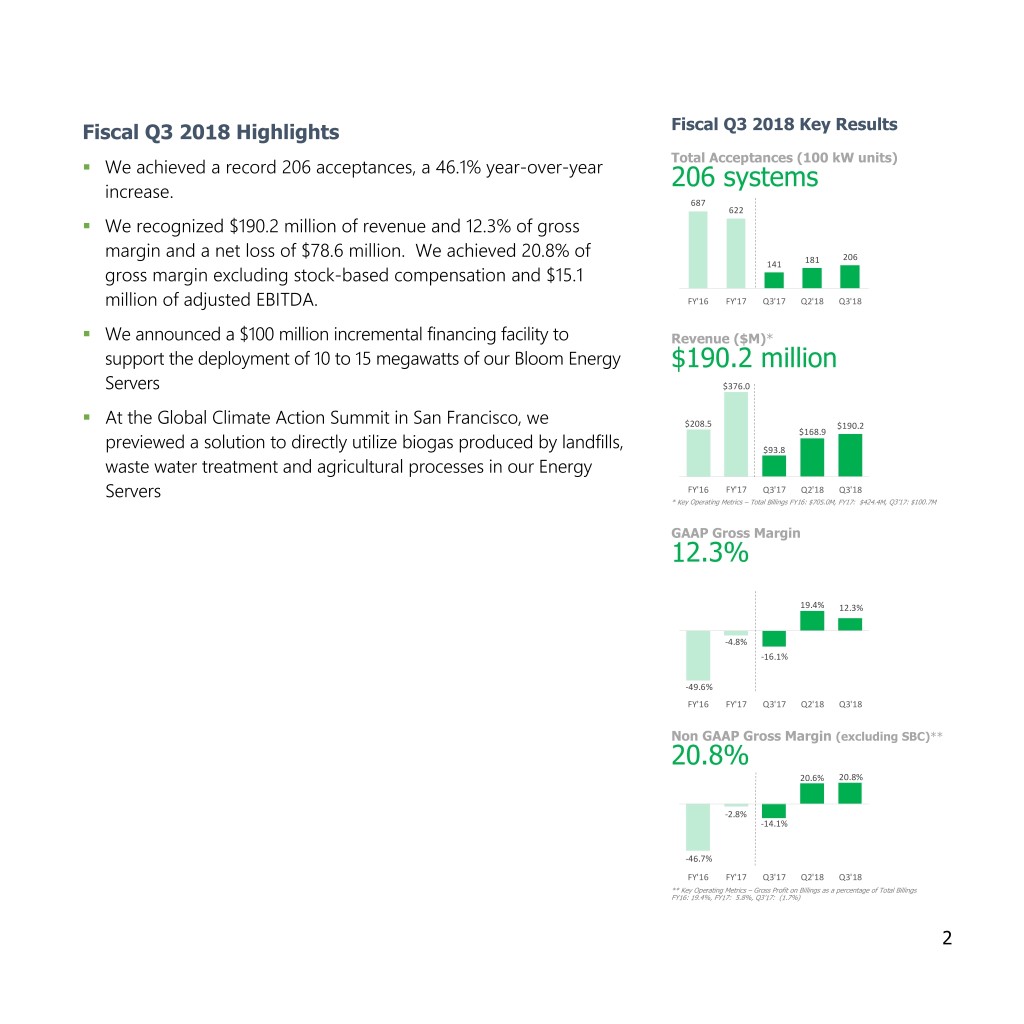

Fiscal Q3 2018 Highlights Fiscal Q3 2018 Key Results . Total Acceptances (100 kW units) We achieved a record 206 acceptances, a 46.1% year-over-year 206 systems increase. 687 622 . We recognized $190.2 million of revenue and 12.3% of gross margin and a net loss of $78.6 million. We achieved 20.8% of 206 141 181 gross margin excluding stock-based compensation and $15.1 million of adjusted EBITDA. FY'16 FY'17 Q3'17 Q2'18 Q3'18 . We announced a $100 million incremental financing facility to Revenue ($M)* support the deployment of 10 to 15 megawatts of our Bloom Energy $190.2 million Servers $376.0 . At the Global Climate Action Summit in San Francisco, we $208.5 $190.2 $168.9 previewed a solution to directly utilize biogas produced by landfills, $93.8 waste water treatment and agricultural processes in our Energy Servers FY'16 FY'17 Q3'17 Q2'18 Q3'18 * Key Operating Metrics – Total Billings FY16: $705.0M, FY17: $424.4M, Q3’17: $100.7M GAAP Gross Margin 12.3% 19.4% 12.3% -4.8% -16.1% -49.6% FY'16 FY'17 Q3'17 Q2'18 Q3'18 Non GAAP Gross Margin (excluding SBC)** 20.8% 20.6% 20.8% -2.8% -14.1% -46.7% FY'16 FY'17 Q3'17 Q2'18 Q3'18 ** Key Operating Metrics – Gross Profit on Billings as a percentage of Total Billings FY16: 19.4%, FY17: 5.8%, Q3’17: (1.7%) 2

Dear Shareholder, Today, we are pleased to share our Q3 FY18 results with you. We completed our initial public offering on July 24. While we did communicate our Q2 results in August, this was our first quarter operating as a public company. As we have transitioned from a private to a public company, we have been grateful for the investor response. We believe investors see the strength in Bloom’s value proposition and our potential to disrupt the global market for electricity with a unique, differentiated technology, as evidenced by our customer roster of industry leading companies. In our third fiscal quarter, which ended September 30, 2018, we delivered revenue of $190.2 million yielding a net loss of $78.6 million and adjusted EBITDA of $15.1 million. Bloom Energy at a data center We look forward to continuing to execute on our key theme of relentless strategic cost reduction to allow us to expand into new markets both domestically and internationally and achieve our mission of making clean, reliable power affordable to everyone in the world. Q3 Fiscal 2018 Business Highlights High Tech, Data Center and Healthcare Sectors Drive Q3 Revenue Growth We saw the strongest growth in the quarter in the high tech, data center and healthcare sectors, driven by a major new hospital deployment on the east coast, and the expansion of our business with existing data center customers. No single customer accounted for more than 25% of total acceptances. 3

Bloom Energy Servers Emerge as Vital Building Blocks for Microgrids Microgrids - power sources that can operate independently of the centralized electricity grid - are one of the fastest growing segments of the distributed generation market. Research firm Technavio estimates the market will reach $23.1 billion by 2022, growing at a CAGR of 9.7%. Bloom Energy Servers are emerging as an increasingly popular choice for microgrids because of the always-on primary power they provide. Our Servers are well suited to the demands of grid-independent power either combined with intermittent renewables and battery storage, or as the sole source of power. For example, during Q3, we announced a new microgrid deployment Bloom Energy at a Brookyln medical facility for JSR Micro of Silicon Valley. JSR Micro is a subsidiary of JSR Corporation, a multinational company employing more than 7,500 people worldwide, and a leading materials supplier in a variety of technology-driven markets. JSR’s story is one we often hear from companies operating in high tech industries. Faced with escalating power outages and an increased risk of interruptions to its precision manufacturing operations, JSR selected Bloom Energy to deploy a microgrid for primary power. Bloom will enable the company’s manufacturing, test, measurement, and other facilities to operate independently when disruption to the electric grid occurs. In addition to improving the resiliency of its business operations, Bloom also expects to significantly reduce JSR’s electricity costs and its carbon footprint over the lifetime of the deployment. 4

Bloom Systems Power through Hurricane Florence, Typhoon Jebi Extreme weather once again exacted terrible damage on human lives, property and infrastructure, including the electrical grid, during the past quarter. In the US, Hurricane Florence knocked out power to more than one million customers and has caused between $17 billion and $22 billion of damage according to Moody’s Analytics. Meanwhile in Japan, Typhoon Jebi, the worst such storm in a quarter century, left approximately 1.5 million people without power, and caused the cancellation of over 600 flights and suspension of bullet train operations. Bloom Energy Server systems located in the path of Hurricane Florence and Typhoon Jebi powered through both events without Bloom Energy at a market in Japan disruption, providing powerful proof of the resiliency and reliability of our solution. Our systems generate power on-site, avoiding one of the key vulnerabilities of the centralized grid: exposed transmission and distribution lines, which are often impacted by extreme weather events. The 1.2MW Bloom solution supporting the 3.5 million square foot Osaka Fish Market in Japan exemplifies the resiliency of our solution. The market’s Bloom-powered business continuity solutions was deployed in Kansai Electric Power’s area in 2015. It not only rode unscathed through Typhoon Jebi, but also protected the market from another typhoon in 2018 and the recent Osaka earthquake whose epicenter was just 1km away. In North Carolina, a Bloom Energy- powered data center also continued normal operations through Hurricane Florence. 5

New Shorter-Term Leasing Options Extend Our Market Opportunity During the quarter, we introduced new, shorter-term lease financing structures with five-year terms that we believe will further expand our market opportunity. To date, our financing options have tended towards longer-term contracts of 10 years or more. These options are attractive to customers seeking to lock-in long-term predictable electricity costs over long periods. However, they have not met the needs of customers who are constrained from signing long-term contracts for reasons ranging from business planning timeframes to incompatible length of terms on property leases. We believe the $100 million in new financing provided by Key Equipment Finance, an affiliate of KeyCorp, will enable us to provide these new short-term financing options. Biogas-powered Energy Server Demonstration Shows a Path to a Zero Carbon Future The U.S. has reduced energy-related carbon emissions by 14 percent since 2005. According to the Energy Information Administration, 61% of this decline can be attributed to the shift from fossil fuels to natural gas. Bloom Energy Servers convert natural gas to electricity with the highest electrical efficiency of any device, further reducing CO2 emissions. Today, our platform produces 60% less CO2 emissions than the power that they offset from the US grid. We believe that increasing the efficiency and decreasing the cost of our natural gas-based systems will continue to provide compelling California generates sufficient biogas from benefits to customers and to the environment for many years to come. However, we are simultaneously pursuing multiple paths to offering human activity to power two cities the size of zero carbon solutions. San Francisco for a year. 6

One such path lies in using biogas as a fuel for our Energy Servers. Today, approximately 9% of our deployed fleet of Energy Servers, by megawatts deployed, utilize directed biogas. We see a very significant opportunity to directly use biogas from landfills, waste water treatment and agriculture to power our systems. For example, California generates 80 million MMBtu of economically viable biogas from human activity per year. This amount of biogas could generate approximately 1.26GW of electricity using our Servers, sufficient to power two cities the size of San Francisco. We are very interested in this market opportunity and previewed a highly-efficient solution for generating clean electricity from biogas at the Global Climate Action Summit in San Francisco in September. We demonstrated how a standard Bloom Energy Server integrated with a new biogas clean-up module can generate clean electricity from biogas produced by landfills, waste water treatment and agricultural processes. The prototype clean-up module cleans biogas of moisture and contaminants, enabling its use in fuel cells while dramatically reducing methane emissions in the process. Biogas is rich in methane, which has a 25 times greater impact on climate change than carbon dioxide emissions. The biogas-powered Bloom Energy Solution would allow this methane to be used to generate electricity rather than being emitted to the environment or flared. According to the Environmental Protection Agency’s “Overview of Greehouse Gas Emissions,” in 2016, methane accounted for about 10 percent of all U.S. greenhouse gas emissions from human activities. We expect to share more about our biogas solution in the quarters ahead, including an update on the first biogas solution which we deployed with a customer in late Q3 2018. 7

Q3 Fiscal 2018 Financial Highlights Q3’17 Q2’18 Q3’18 Acceptances (100 kW) 141 181 206 Revenue ($M) $93.8 $168.9 $190.2 GAAP Gross Margin (%) (16.1%) 19.4% 12.3% 20.6% Gross Margin Excluding SBC (%) (14.1%) 20.8% GAAP Net Loss ($M) ($71.8) ($45.7) ($78.6) Adjusted EBITDA ($M) ($28.4) $12.5 $15.1 GAAP Net Loss per Share ($) ($6.97) ($4.34) ($0.97) Adjusted Net Loss per Share ($) ($0.78) ($0.27) ($0.13) Total Acceptances We achieved 206 acceptances in Q3 of FY18, or 20.6 megawatts, a 46.1% increase in acceptances year-over-year driven by the growth in our backlog. Generally, an acceptance occurs when the system is turned on and producing full power. Upon acceptance, the customer order is moved from backlog and is recognized as revenue. We continued to see good diversity of acceptances in the quarter, with the 206 acceptances spread across multiple customers and no one customer accounting for more than 25% of the acceptances. Note that Q3 revenue related to many of these acceptances will once again show as concentrated with Southern Company, the financing partner behind most of our current PPA agreements with customers. However, revenue attributed to Southern Company is comprised of multiple individual customers financed by, but not related to, Southern Company. 100% of our acceptances were recognized upfront in Q3 of FY18, compared to 86% in Q3 of FY17. In FY17, we worked with our financing partners to structure our customer financing options in 8

order to achieve upfront revenue recognition on our product and install revenue, so that our revenue could generally be in line with the timing of cash receipts and correlate with our acceptance volume. Revenue Our revenue for Q3 is at approximately the mid-point of our Q3 estimates. We generated $190.2 million of GAAP revenue in Q3 of FY18 compared to $93.8 million of GAAP revenue in Q3 of FY17, an increase of 102.8% year-over-year and up 12.6% sequentially from Q2 of FY18. It is difficult to draw meaningful comparisons when evaluating P&L metrics between FY18 and FY17, because in FY17, a portion of our acceptances were recognized ratably and we did not have the benefit of the federal investment tax credit (ITC). There were three principal drivers of this revenue increase relative to Q3 of FY17: . an increase in volume (acceptances) by 65 systems from 141 to 206 acceptances . a higher mix of upfront versus ratable revenue recognition acceptances (100% in Q3 of FY18 versus 86% in Q3 of FY17) as mentioned above; and . ITC was reinstated on February 9, 2018. ITC was not available to the fuel cell industry in 2017, so our revenue in 2018 now includes the benefit of ITC. Billings is a key operating metric that reflects all invoices issued in the quarter and it more closely represents 100% upfront revenue recognition for the product and install portion of our customer contracts. When compared to the $100.7 million of total billings for Q3 of FY17, the GAAP revenue for Q3 of FY18 represents year-over- year growth of approximately 88.9%, with most of that growth driven by volume and the reinstatement of ITC in 2018. 9

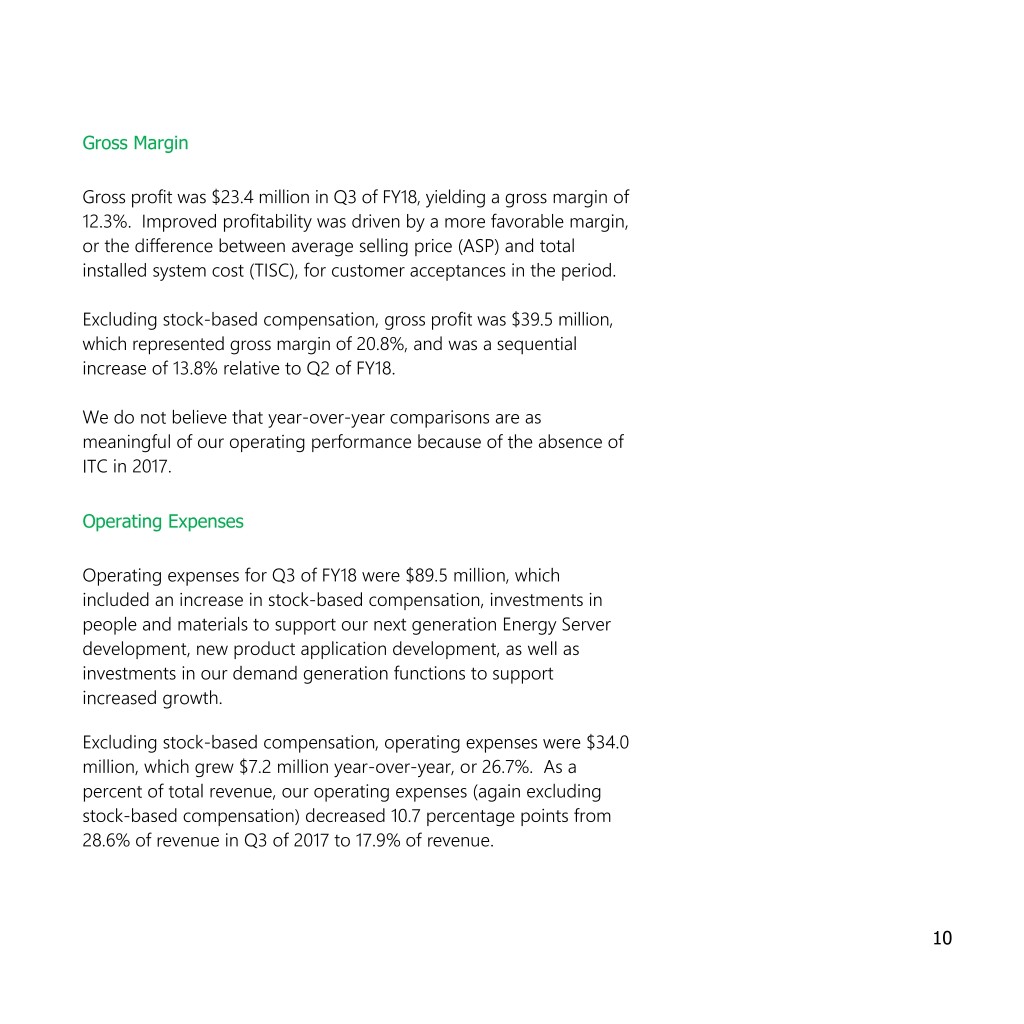

Gross Margin Gross profit was $23.4 million in Q3 of FY18, yielding a gross margin of 12.3%. Improved profitability was driven by a more favorable margin, or the difference between average selling price (ASP) and total installed system cost (TISC), for customer acceptances in the period. Excluding stock-based compensation, gross profit was $39.5 million, which represented gross margin of 20.8%, and was a sequential increase of 13.8% relative to Q2 of FY18. We do not believe that year-over-year comparisons are as meaningful of our operating performance because of the absence of ITC in 2017. Operating Expenses Operating expenses for Q3 of FY18 were $89.5 million, which included an increase in stock-based compensation, investments in people and materials to support our next generation Energy Server development, new product application development, as well as investments in our demand generation functions to support increased growth. Excluding stock-based compensation, operating expenses were $34.0 million, which grew $7.2 million year-over-year, or 26.7%. As a percent of total revenue, our operating expenses (again excluding stock-based compensation) decreased 10.7 percentage points from 28.6% of revenue in Q3 of 2017 to 17.9% of revenue. 10

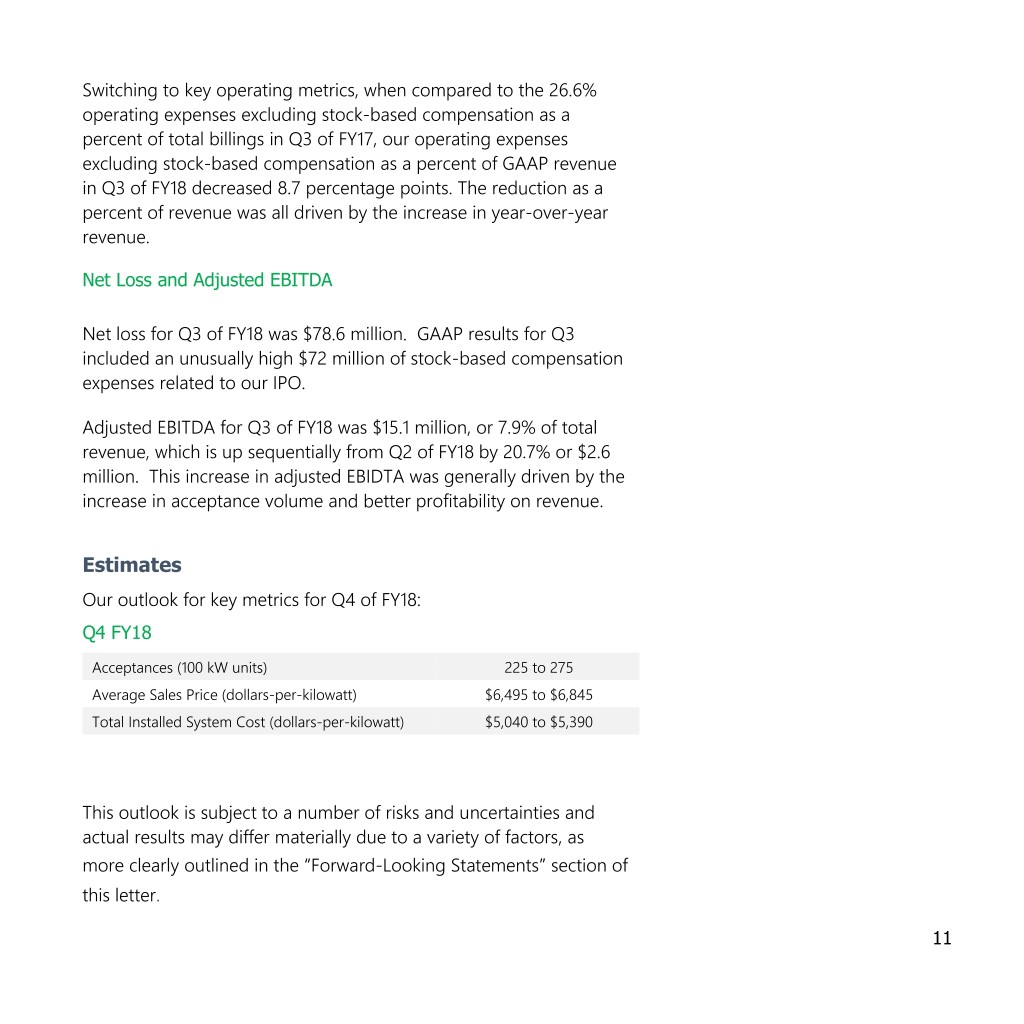

Switching to key operating metrics, when compared to the 26.6% operating expenses excluding stock-based compensation as a percent of total billings in Q3 of FY17, our operating expenses excluding stock-based compensation as a percent of GAAP revenue in Q3 of FY18 decreased 8.7 percentage points. The reduction as a percent of revenue was all driven by the increase in year-over-year revenue. Net Loss and Adjusted EBITDA Net loss for Q3 of FY18 was $78.6 million. GAAP results for Q3 included an unusually high $72 million of stock-based compensation expenses related to our IPO. Adjusted EBITDA for Q3 of FY18 was $15.1 million, or 7.9% of total revenue, which is up sequentially from Q2 of FY18 by 20.7% or $2.6 million. This increase in adjusted EBIDTA was generally driven by the increase in acceptance volume and better profitability on revenue. Estimates Our outlook for key metrics for Q4 of FY18: Q4 FY18 Acceptances (100 kW units) 225 to 275 Average Sales Price (dollars-per-kilowatt) $6,495 to $6,845 Total Installed System Cost (dollars-per-kilowatt) $5,040 to $5,390 This outlook is subject to a number of risks and uncertainties and actual results may differ materially due to a variety of factors, as more clearly outlined in the “Forward-Looking Statements” section of this letter. 11

Summary Our third quarter of 2018 marked a major milestone for Bloom Energy, given our initial public offering in July, and we look forward to the opportunities that creates for us and our investors. The results reflect our team’s broad execution across all aspects of our business. We are excited to share the results of our first quarter operating as a public company with you, as we continue our mission to deliver clean, reliable and affordable energy to everyone in the world. Sincerely, KR Sridhar, Founder, Chairman and Chief Executive Officer Randy Furr, Chief Financial Officer 12

Bloom Energy Summary GAAP Profit and Loss Statements, 3 Months Ended ($000) Q3’FY17 Q2’FY18 Q3’FY18 Revenue 93,765 168,881 190,190 Cost of Goods Sold (COGS) 108,855 136,110 166,805 Gross Profit (Loss) (15,090) 32,771 23,385 Gross Margin (16.1%) 19.4% 12.3% Operating Expenses 32,587 38,026 89,496 Operating Income (47,677) (5,256) (66,111) Operating Margin (50.8%) (3.1%) (34.8%) Non-operating Expenses 24,154 40,422 12,468 Net Loss (71,831) (45,676) (78,579) Bloom Energy Summary Non-GAAP Profit and Loss Statements, 3 Months Ended Excluding Stock Based Compensation Q3’FY17 Q2’FY18 Q3’FY18 ($000) Revenue 93,765 168,881 190,190 Cost of Goods Sold (COGS) 106,949 134,139 150,649 Gross Profit (Loss) (13,184) 34,742 39,541 Gross Margin (14.1%) 20.6% 20.8% Operating Expenses 26,807 32,179 33,975 Operating Income (39,991) 2,563 5,566 Operating Margin (42.7%) 1.5% 2.9% Non-operating Expenses 24,154 40,422 12,468 Net Income (Loss) (64,145) (37,859) (6,902) Adjusted EBITDA (28,350) 12,468 15,050 Stock-Based Compensation ($000) Q3’FY17 Q2’FY18 Q3’FY18 Gross Profit (Loss) (15,090) 32,771 23,385 Stock-based compensation-COGS 1,906 1,971 16,156 Gross Profit (Loss)-excluding SBC (13,184) 34,742 39,541 Operating Expenses 32,587 38,026 89,496 Stock-based compensation-Opex 5,780 5,847 55,521 Operating Expenses (excluding SBC) 26,807 32,179 33,975 13

Upfront Ongoing Total Q3’18 Non Product + Product Total Service Electricity Q3’18 GAAP P&L Install + Install Ongoing $’000 Acceptances (100kW) 206 206 Revenue 148,595 20,751 6,785 14,059 41,595 190,190 COGS 116,075 21,009 4,886 8,679 34,574 150,649 Gross Profit 32,520 (258) 1,899 5,380 7,021 39,541 Opex 33,975 Operating Income 5,566 Key Operating Metrics ($000) Q3’FY17 Q2’FY18 Q3’FY18 Billings 100,671 152,516 167,603 Gross Profit on Billings (1,682) 32,026 36,222 Gross Profit as a % of Total Billings (1.7%) 21.0% 21.6% Operating Expenses (excluding SBC) 26,807 32,179 33,975 Operating Income on Billings (28,489) (153) 2,247 Operating Margin on Billings (28.3%) (0.1%) 1.3% Product & Install Unit Economics Q3’FY17 Q2’FY18 Q3’FY18 ($/kW)1 ASP 5,479 7,093 7,231 TISC2 5,158 5,607 5,648 Profit (Loss) 321 1,486 1,583 1. Q3’17 calculated based on Operating Metrics and Q3’18 based on GAAP Financials 2. Total installed system cost is a cost metric to approximate the product and install cost of goods sold on a per kilowatt basis Working Capital Metrics1 Q3’FY17 Q2’FY18 Q3’FY18 Days of Sales 35 26 19 Days of Inventory 82 85 87 Days of Payables 30 35 34 1. Q3’17 calculated based on Operating Metrics; Q2’18 and Q3’18 based on GAAP Financials 14

Today, our customer base includes 25 of the Fortune 100 companies and 42 of the Fortune 500. 15

Bloom Energy Consolidated Balance Sheet (Unaudited) September 30 (in thousands) 2018 Assets Current assets Cash and cash equivalents $395,516 Restricted cash 17,931 Short term investments 4,494 Accounts receivable 41,485 Inventories, net 134,725 Deferred cost of revenue 66,009 Customer financing receivable 5,496 Prepaid expenses and other current assets 32,876 Total current assets 698,532 Property, plant and equipment, net 471,074 Customer financing receivable, non-current 68,535 Restricted cash 30,779 Deferred cost of revenue, non-current 139,217 Other long-term assets 37,008 Total assets 1,445,145 Liabilities, Convertible Redeemable Preferred Stock and Stockholders’ Deficit Current liabilities Accounts payable $59,818 Accrued warranty 17,975 Accrued other current liabilities 66,873 Deferred revenue and customer deposits 105,265 Current portion of debt 21,922 Total current liabilities 271,853 Preferred stock warrant liabilities - Derivative liabilities 9,441 Deferred revenue and customer deposits 290,481 Long-term portion of debt 718,889 Other long-term liabilities 48,161 Total liabilities 1,338,825 Commitments and contingencies Redeemable noncontrolling interest 56,466 Convertible redeemable preferred stock: 80,461,552 shares authorized at September 30, 2018; no shares outstanding at September 30, 2018 - Stockholders’ deficit Common stock: $0.0001 par value; Class A shares, 400,000,000 shares authorized at September 30, 2018, and 20,865,308 shares issued and outstanding at September 30, 2018, Class B shares, 400,000,000 shares authorized at September 30, 2018, and 88,534,989 shares 11 issued and outstanding at September 30, 2018 Additional paid-in capital 2,387,361 Accumulated other comprehensive loss 272 Accumulated deficit -2,472,619 Total stockholders’ deficit -84,975 Non-controlling interest 134,849 Total deficit 106,320 Total liabilities, convertible redeemable preferred stock and deficit $1,445,145 16

Bloom Energy Consolidated Statement of Operations (Unaudited) Three Months Ended September 30 (in thousands, except for per share data) 2017 2018 Revenue Product $45,255 $125,690 Install 14,978 29,690 Service 19,511 20,751 Electricity 14,021 14,059 Total Revenue 93,765 190,190 Cost of goods sold Product 53,923 95,357 Install 14,696 40,118 Service 30,058 22,651 Electricity 10,178 8,679 Cost of goods sold 108,855 166,805 Gross profit (loss) (15,090) 23,385 Total operating expenses 32,587 89,496 Operating income (loss) (47,677) (66,111) Interest expense (28,899) (18,819) Other income (expense), net (40) 762 Loss on revaluation of warrant liabilities and embedded derivatives 572 1,655 Net loss before income taxes (76,044) (82,513) Income tax provision (benefit) 314 (3) Net loss (76,358) (82,510) Net loss per share attributable to non-controlling interests and redeemable non-controlling interests (4,527) (3,931) Net loss attributable to common stockholders (71,831) (78,579) Net loss per share attributable to common stockholders, basic and diluted ($6.97) ($0.97) Weighted average shares used to compute net loss per share attributable to common stockholders, basic 10,305 81,321 and diluted 17

Bloom Energy Consolidated Statement of Cash Flows (Unaudited) Nine Months Ended September 30 (in thousands) 2017 2018 Cash flows from operating activities: Net Loss ($209,344) ($155,046) Adjustments to reconcile net loss to net cash used in operating activities: Depreciation 34,968 32,141 Write off of property, plant and equipment, net 6 901 Revaluation of derivative contracts (2,764) 26,761 Stock-based compensation 22,349 87,451 Loss on long-term REC purchase contract 60 150 Revaluation of preferred stock warrants 94 (8,943) Common stock warrant valuation 230 (166) Amortization of interest expense from preferred stock warrants 797 776 Amortization of debt issuance cost 2,294 2,906 Amortization of debt discount from embedded derivatives 31,578 16,597 Changes in operating assets and liabilities: Accounts receivable (2,093) (11,168) Inventories, net 31 (44,466) Deferred cost of revenue (64,786) 47,945 Customer financing receivable and others 4,392 3,736 Prepaid expenses and other current assets (4,789) (6,514) Other long-term assets 2,948 1,052 Accounts payable (2,311) 11,236 Accrued warranty (1,766) 1,163 Accrued other current liabilities 2,030 1,886 Deferred revenue and customer deposits 87,551 (32,202) Other long-term liabilities 34,453 10,156 Net cash used in operating activities (64,072) (13,648) Cash flows from investing activities: Purchase of property, plant and equipment (4,063) (4,333) Payments for acquisition of intangible assets (240) (2,762) Purchase of marketable securities (26,825) (15,732) Maturities of marketable securities - 38,250 Net cash provided by (used in) investing activities (31,128) 15,423 Cash flows from financing activities: Borrowings from issuance of debt 100,000 - Repayment of debt (16,263) (14,036) Repayment of debt to related parties (644) (990) Debt issuance cost (6,108) - Proceeds from non-controlling and redeemable non-controlling interests 13,652 - Distributions to non-controlling and redeemable non-controlling interests (20,725) (14,192) Proceeds from issuance of common stock 336 1,456 Proceeds from public offerings, net of underwriting costs - 292,529 Payments of initial public offering issuance costs (1,027) (2,928) Net cash provided by financing activities 69,221 261,839 Net (decrease) increase in cash, cash equivalents, and restricted cash (25,979) 263,614 Cash, cash equivalents, and restricted cash: Beginning of period $217,915 $180,612 End of period $191,936 $444,226 18

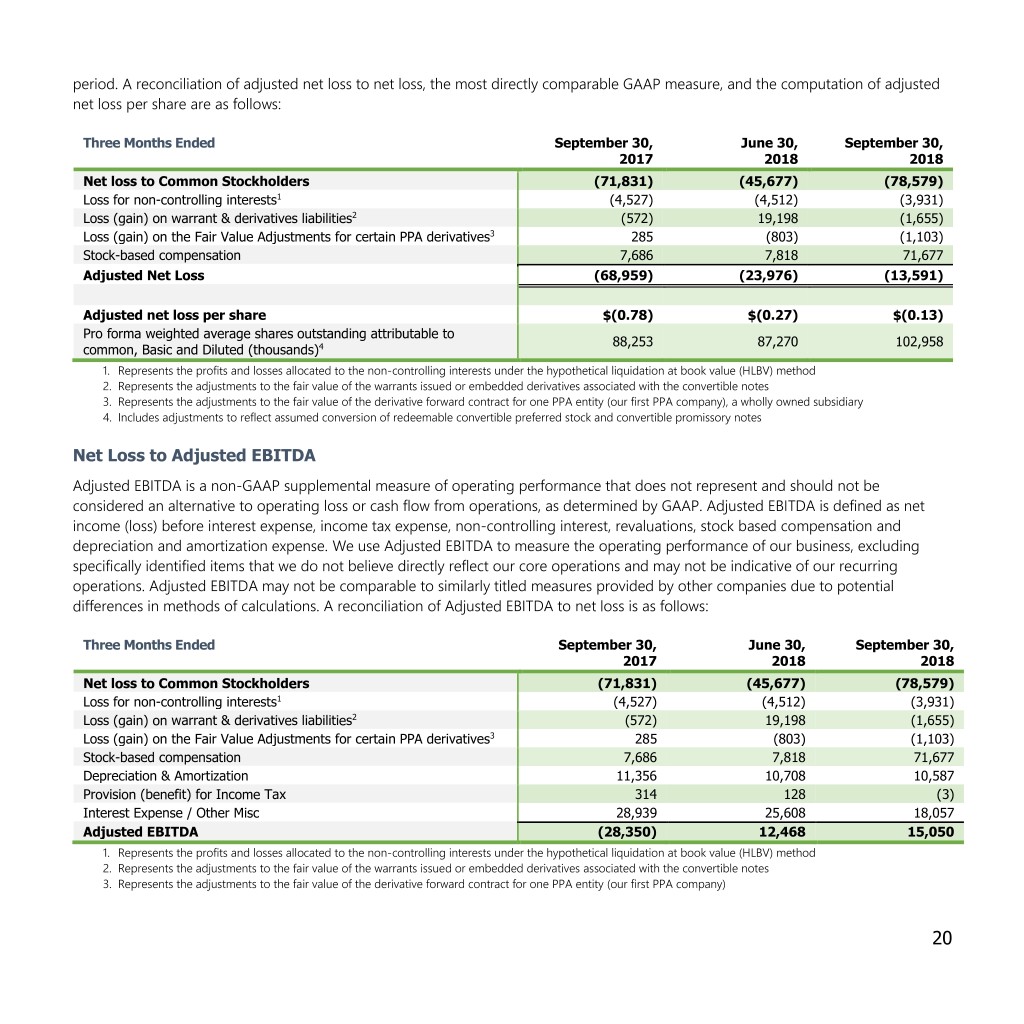

Bloom Energy Reconciliation of GAAP to Non-GAAP Financial Measures (Unaudited) (In Thousands) Gross Margin to Gross Margin Excluding Stock Based Compensation Gross margin excluding stock based compensation (SBC) is a supplemental measure of operating performance that does not represent and should not be considered an alternative to gross margin, as determined under GAAP. This measure removes the impact of stock based compensation. We believe that gross margin excluding stock based compensation supplements the GAAP measure and enables us to more effectively evaluate our performance period-over-period. A reconciliation of gross margin excluding stock based compensation to gross margin, the most directly comparable GAAP measure, and the computation of gross margin excluding stock based compensation are as follows: Three Months Ended September 30, 2017 June 30, 2018 September 30, 2018 Revenue 93,765 168,881 190,190 Gross Profit (Loss) (15,090) 32,771 23,385 Gross Margin % (16.1%) 19.4% 12.3% Stock-based compensation (COGS) 1,906 1,971 16,156 Gross Profit (Loss) excluding SBC (13,184) 34,742 39,541 Gross Margin excluding SBC % (14.1%) 20.6% 20.8% Operating Income to Operating Income Excluding Stock Based Compensation Operating income excluding stock based compensation is a supplemental measure of operating performance that does not represent and should not be considered an alternative to operating income, as determined under GAAP. This measure removes the impact of stock based compensation. We believe that operating income excluding stock based compensation supplement the GAAP measure and enable us to more effectively evaluate our performance period-over-period. A reconciliation of operating income excluding stock based compensation to operating income, the most directly comparable GAAP measure, and the computation of operating income excluding stock based compensation are as follows: Three Months Ended September 30, 2017 June 30, 2018 September 30, 2018 Operating Income (47,677) (5,255) (66,111) Stock-based compensation 7,686 7,818 71,677 Operating Income excluding SBC (39,991) 2,563 5,566 Net Loss to Adjusted Net Loss and Computation of Adjusted Net Loss per Share Adjusted net loss and adjusted net loss per share are supplemental measures of operating performance that do not represent and should not be considered alternatives to net loss and net loss per share, as determined under GAAP. This measure removes the impact of the non-controlling interests associated with our legacy PPA entities, the revaluation of warrants and derivatives, fair market value adjustment for the PPA derivatives, and stock based compensation, all of which are non-cash charges. We believe that adjusted net loss and adjusted net loss per share supplement GAAP measures and enable us to more effectively evaluate our performance period-over- 19

period. A reconciliation of adjusted net loss to net loss, the most directly comparable GAAP measure, and the computation of adjusted net loss per share are as follows: Three Months Ended September 30, June 30, September 30, 2017 2018 2018 Net loss to Common Stockholders (71,831) (45,677) (78,579) Loss for non-controlling interests1 (4,527) (4,512) (3,931) Loss (gain) on warrant & derivatives liabilities2 (572) 19,198 (1,655) Loss (gain) on the Fair Value Adjustments for certain PPA derivatives3 285 (803) (1,103) Stock-based compensation 7,686 7,818 71,677 Adjusted Net Loss (68,959) (23,976) (13,591) Adjusted net loss per share $(0.78) $(0.27) $(0.13) Pro forma weighted average shares outstanding attributable to 88,253 87,270 102,958 common, Basic and Diluted (thousands)4 1. Represents the profits and losses allocated to the non-controlling interests under the hypothetical liquidation at book value (HLBV) method 2. Represents the adjustments to the fair value of the warrants issued or embedded derivatives associated with the convertible notes 3. Represents the adjustments to the fair value of the derivative forward contract for one PPA entity (our first PPA company), a wholly owned subsidiary 4. Includes adjustments to reflect assumed conversion of redeemable convertible preferred stock and convertible promissory notes Net Loss to Adjusted EBITDA Adjusted EBITDA is a non-GAAP supplemental measure of operating performance that does not represent and should not be considered an alternative to operating loss or cash flow from operations, as determined by GAAP. Adjusted EBITDA is defined as net income (loss) before interest expense, income tax expense, non-controlling interest, revaluations, stock based compensation and depreciation and amortization expense. We use Adjusted EBITDA to measure the operating performance of our business, excluding specifically identified items that we do not believe directly reflect our core operations and may not be indicative of our recurring operations. Adjusted EBITDA may not be comparable to similarly titled measures provided by other companies due to potential differences in methods of calculations. A reconciliation of Adjusted EBITDA to net loss is as follows: Three Months Ended September 30, June 30, September 30, 2017 2018 2018 Net loss to Common Stockholders (71,831) (45,677) (78,579) Loss for non-controlling interests1 (4,527) (4,512) (3,931) Loss (gain) on warrant & derivatives liabilities2 (572) 19,198 (1,655) Loss (gain) on the Fair Value Adjustments for certain PPA derivatives3 285 (803) (1,103) Stock-based compensation 7,686 7,818 71,677 Depreciation & Amortization 11,356 10,708 10,587 Provision (benefit) for Income Tax 314 128 (3) Interest Expense / Other Misc 28,939 25,608 18,057 Adjusted EBITDA (28,350) 12,468 15,050 1. Represents the profits and losses allocated to the non-controlling interests under the hypothetical liquidation at book value (HLBV) method 2. Represents the adjustments to the fair value of the warrants issued or embedded derivatives associated with the convertible notes 3. Represents the adjustments to the fair value of the derivative forward contract for one PPA entity (our first PPA company) 20

Forward-Looking Statements This letter may be deemed to contain forward-looking statements, which are subject to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. These forward-looking statements include, among other things, statements regarding our strategies, trends and expected expansion and estimates of future acceptances, Average Sales Price and Total Installed System Costs. Readers are cautioned that these forward-looking statements are only predictions and may differ materially from actual future events or results due to a variety of factors, including: our limited operating history, the emerging nature of the distributed generation market, the significant losses we have incurred in the past, the significant upfront costs of our Energy Servers, the risk of manufacturing defects, the accuracy of our estimates regarding the useful life of our Energy Servers, the availability of rebates, tax credits and other tax benefits, our reliance on tax equity financing arrangements, our reliance upon a limited number of customers, our lengthy sales and installation cycle, construction, utility interconnection and other delays and cost overruns related to the installation of our Energy Servers, business and economic conditions and growth trends in commercial and industrial energy markets, global economic conditions and uncertainties in the geopolitical environment; overall electricity generation market and other risks and uncertainties. These statements were made as of November 5, 2018, and reflect management’s views and expectations at that time. We disclaim any obligation to update or revise any forward-looking statements in this letter to reflet subsequent events, actual results or changes in our expectations. 21