Attached files

| file | filename |

|---|---|

| 8-K - 8-K - US BANCORP \DE\ | d637560d8k.htm |

Bank of America Merrill Lynch Future of Financials Conference 2018 November 5, 2018 Jason Witty EVP, Chief Information Security Officer Exhibit 99.1

The following information appears in accordance with the Private Securities Litigation Reform Act of 1995: Today’s presentation contains forward-looking statements about U.S. Bancorp. Statements that are not historical or current facts, including statements about beliefs and expectations, are forward-looking statements and are based on the information available to, and assumptions and estimates made by, management as of the date hereof. These forward-looking statements cover, among other things, anticipated future revenue and expenses and the future plans and prospects of U.S. Bancorp. Forward-looking statements involve inherent risks and uncertainties, and important factors could cause actual results to differ materially from those anticipated. Deterioration in general business and economic conditions or turbulence in domestic or global financial markets could adversely affect U.S. Bancorp’s revenues and the values of its assets and liabilities, reduce the availability of funding to certain financial institutions, lead to a tightening of credit, and increase stock price volatility. Stress in the commercial real estate markets, as well as a downturn in the residential real estate markets, could cause credit losses and deterioration in asset values. In addition, changes to statutes, regulations, or regulatory policies or practices could affect U.S. Bancorp in substantial and unpredictable ways. U.S. Bancorp’s results could also be adversely affected by changes in interest rates; deterioration in the credit quality of its loan portfolios or in the value of the collateral securing those loans; deterioration in the value of securities held in its investment securities portfolio; legal and regulatory developments; litigation; increased competition from both banks and non-banks; changes in the level of tariffs and other trade policies of the United States and its global trading partners; changes in customer behavior and preferences; breaches in data security; effects of mergers and acquisitions and related integration; effects of critical accounting policies and judgments; and management’s ability to effectively manage credit risk, market risk, operational risk, compliance risk, strategic risk, interest rate risk, liquidity risk and reputational risk. For discussion of these and other risks that may cause actual results to differ from expectations, refer to U.S. Bancorp’s Annual Report on Form 10-K for the year ended December 31, 2017, on file with the Securities and Exchange Commission, including the sections entitled “Risk Factors” and “Corporate Risk Profile” contained in Exhibit 13, and all subsequent filings with the Securities and Exchange Commission under Sections 13(a), 13(c), 14 or 15(d) of the Securities Exchange Act of 1934. However, factors other than these also could adversely affect U.S. Bancorp’s results, and the reader should not consider these factors to be a complete set of all potential risks or uncertainties. Forward-looking statements speak only as of the date hereof, and U.S. Bancorp undertakes no obligation to update them in light of new information or future events. This presentation includes non-GAAP financial measures to describe U.S. Bancorp’s performance. The calculations of these measures are provided in the Appendix. These disclosures should not be viewed as a substitute for operating results determined in accordance with GAAP, nor are they necessarily comparable to non-GAAP performance measures that may be presented by other companies. Forward-looking Statements and Additional Information

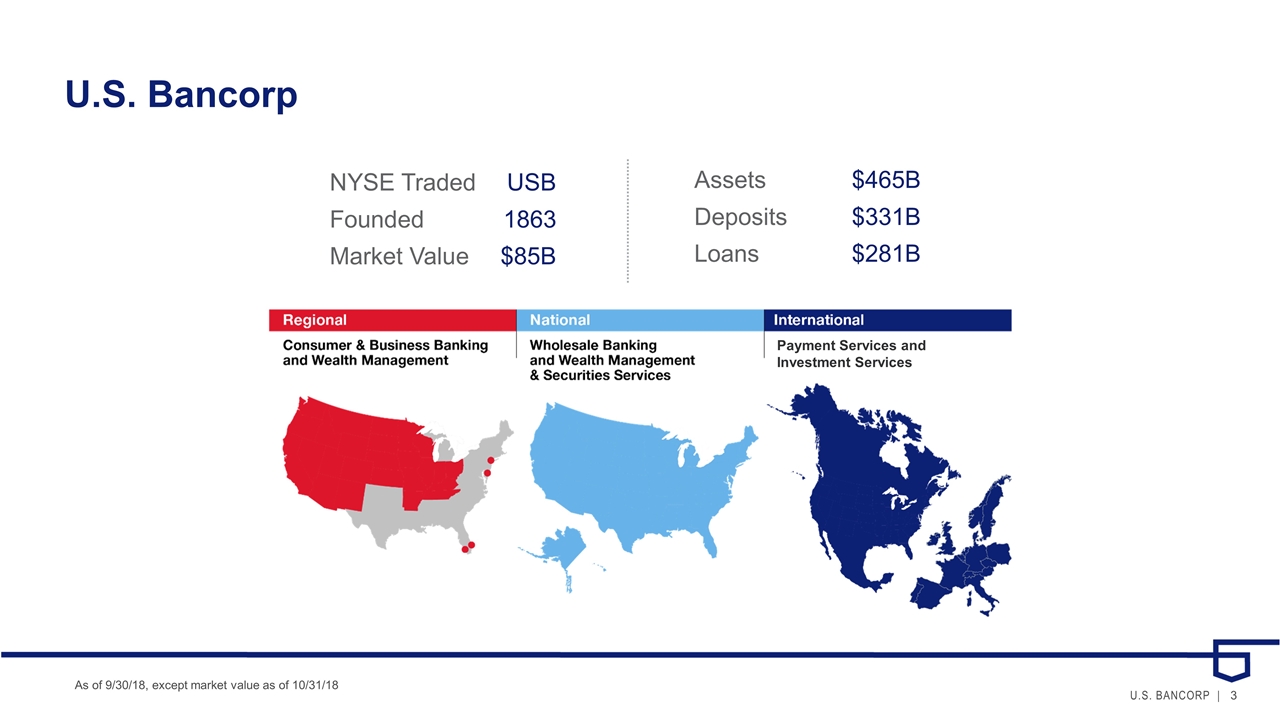

U.S. Bancorp As of 9/30/18, except market value as of 10/31/18 NYSE TradedUSB Founded 1863 Market Value $85B Assets $465B Deposits $331B Loans $281B Payment Services and Investment Services

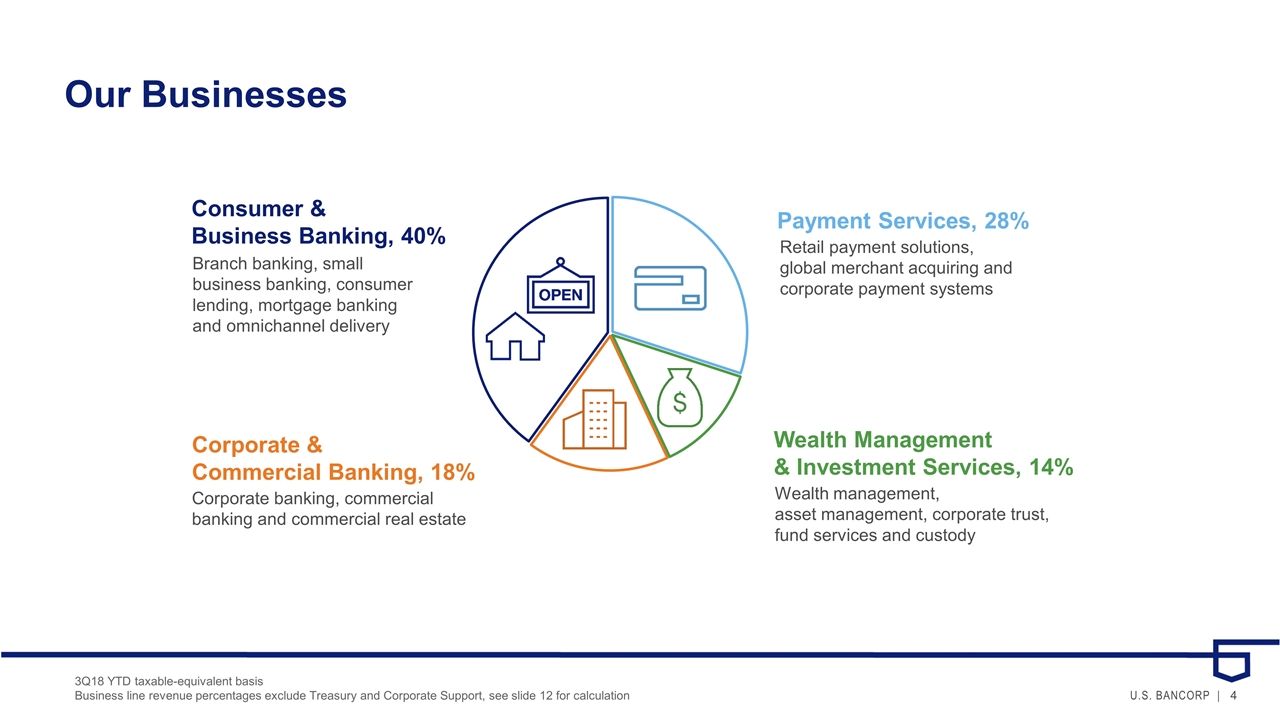

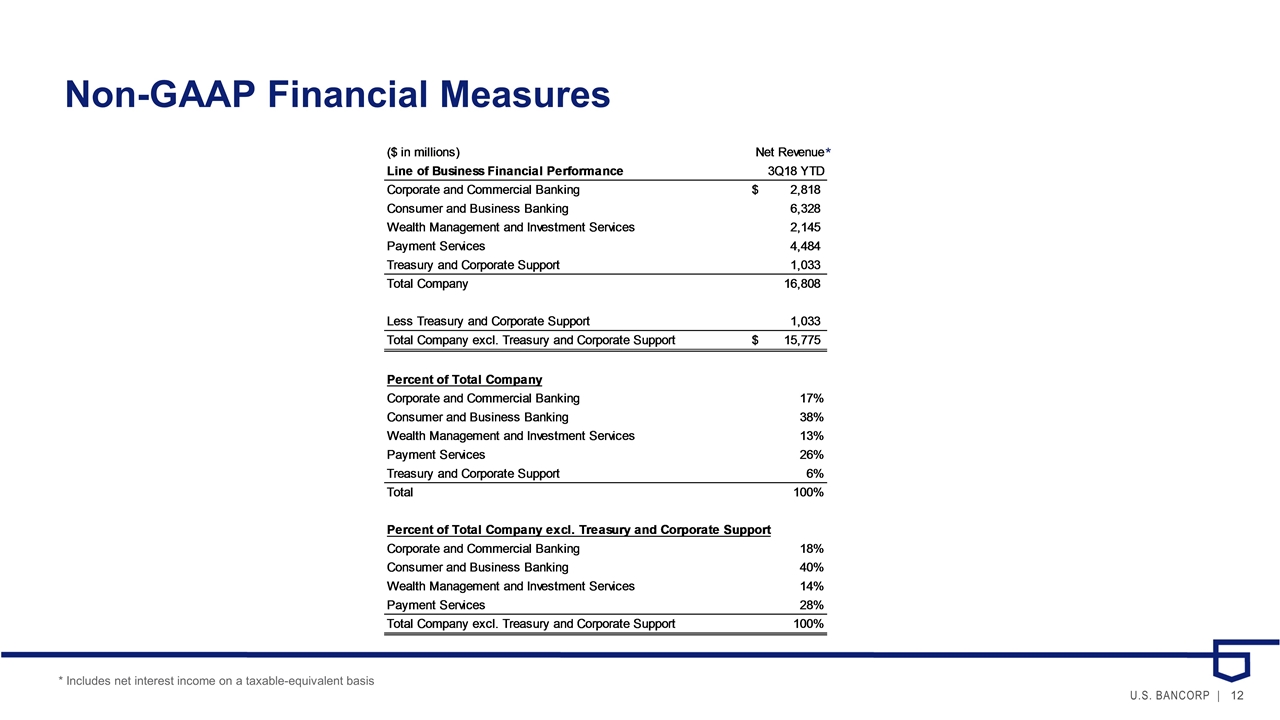

Our Businesses Consumer & Business Banking, 40% Branch banking, small business banking, consumer lending, mortgage banking and omnichannel delivery Payment Services, 28% Retail payment solutions, global merchant acquiring and corporate payment systems Corporate & Commercial Banking, 18% Corporate banking, commercial banking and commercial real estate Wealth Management & Investment Services, 14% Wealth management, asset management, corporate trust, fund services and custody 3Q18 YTD taxable-equivalent basis Business line revenue percentages exclude Treasury and Corporate Support, see slide 12 for calculation

Our Strategy Our robust information security program supports our reputation as a trusted financial partner. Anticipate emerging threats and risks Enable business growth while protecting existing revenue Safeguard U.S. Bank information and assets

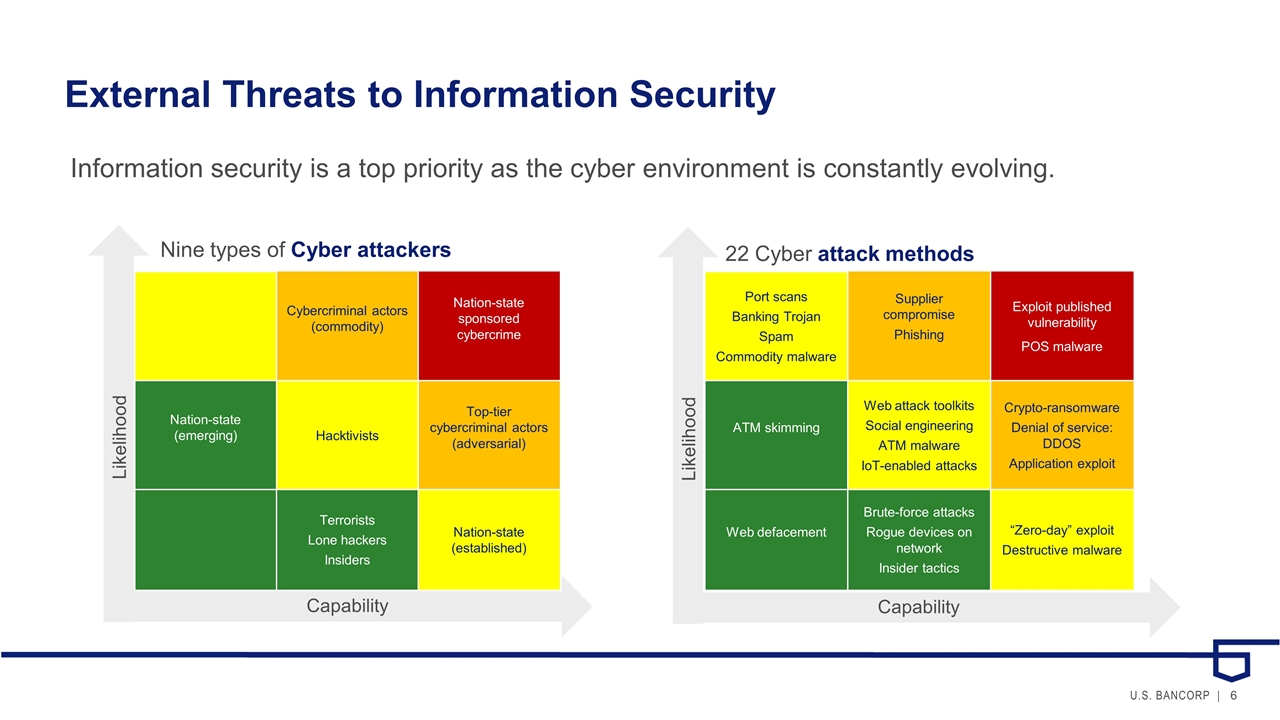

External Threats to Information Security Information security is a top priority as the cyber environment is constantly evolving. 22 Cyber attack methods Port scans Banking Trojan Spam Commodity malware Supplier compromise Phishing Exploit published vulnerability POS malware ATM skimming Web attack toolkits Social engineering ATM malware IoT-enabled attacks Crypto-ransomware Denial of service: DDOS Application exploit Web defacement Brute-force attacks Rogue devices on network Insider tactics “Zero-day” exploit Destructive malware Capability Likelihood Cybercriminal actors (commodity) Nation-state sponsored cybercrime Nation-state (emerging) Hacktivists Top-tier cybercriminal actors (adversarial) Terrorists Lone hackers Insiders Nation-state (established) Nine types of Cyber attackers Capability Likelihood

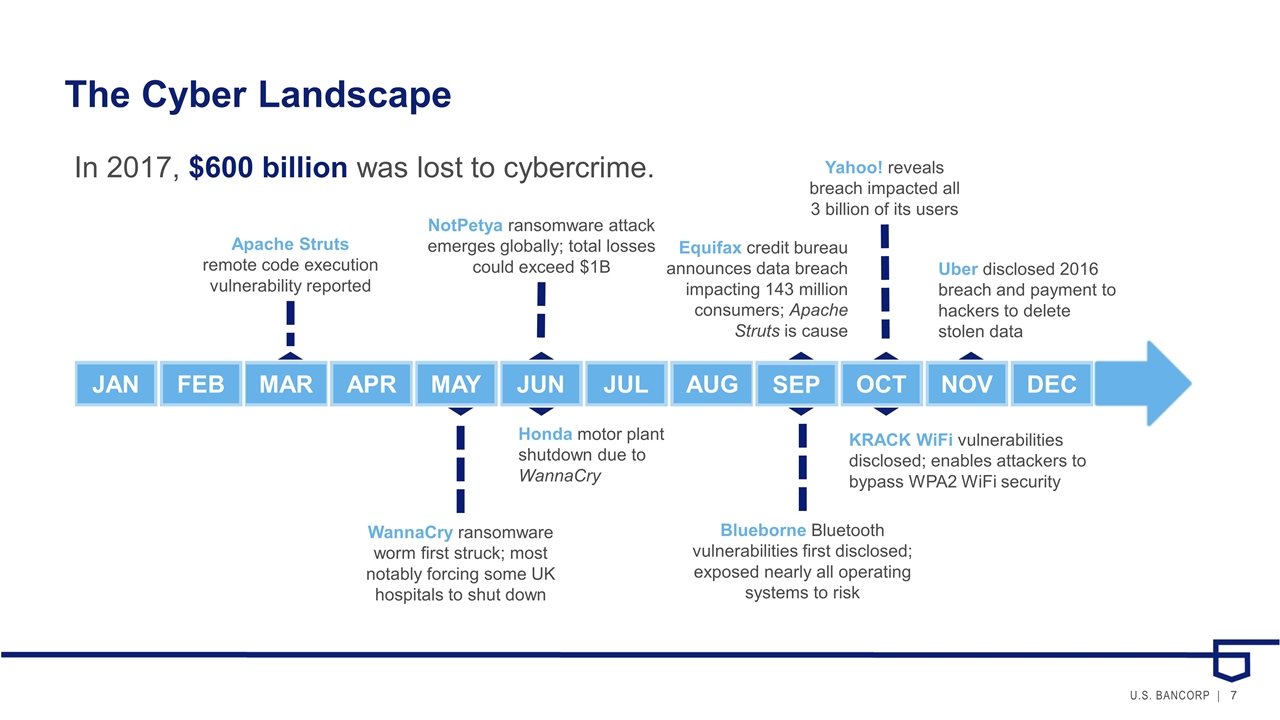

The Cyber Landscape In 2017, $600 billion was lost to cybercrime. Uber disclosed 2016 breach and payment to hackers to delete stolen data Honda motor plant shutdown due to WannaCry JAN FEB MAR APR MAY JUN JUL AUG SEP OCT NOV DEC Apache Struts remote code execution vulnerability reported WannaCry ransomware worm first struck; most notably forcing some UK hospitals to shut down Blueborne Bluetooth vulnerabilities first disclosed; exposed nearly all operating systems to risk NotPetya ransomware attack emerges globally; total losses could exceed $1B Equifax credit bureau announces data breach impacting 143 million consumers; Apache Struts is cause KRACK WiFi vulnerabilities disclosed; enables attackers to bypass WPA2 WiFi security Yahoo! reveals breach impacted all 3 billion of its users

Information Security at U.S. Bank Cyber adversaries are becoming more sophisticated all the time. We stay a step ahead of external threats by: Investing in the right people, technology and leading-edge capabilities Partnering with industry peers Conducting outreach and coordination with the government and other resources and suppliers Constantly upgrading our defenses

Our Leadership Team Information Security Services: Corporate Innovation Award – Cyber Security Startup Accelerator Plug and Play Tech Center, 2018 Patent Grant – Access Control and Mobile Security App U.S. Department of Commerce, 2018 Return on Investment Award RSA, 2017 1st Place – Cyberdefense Contest Mastercard, 2017 Project of the Year – Enterprise Tokenization ISE® North America, 2016 Our highly experienced, award-winning Information Security Services executive leadership team is recognized throughout the industry. U.S. Bancorp: Most Trusted Company for Retail Banking Ponemon Institute, 2018 (11 years running) A World’s Most Ethical Company® Ethisphere, 2018 (Four years running) “World’s Most Ethical Companies” and “Ethisphere” names and marks are registered trademarks of Ethisphere LLC

Securely Enabling USB’s Digital-first Strategy As cybersecurity and fraud intelligence converge, we continue to innovate and leverage our investments in intelligence-driven, machine-speed information security techniques. 24/7 monitoring, dedicated data science, hunting and threat intelligence 4.9 billion security events reviewed daily Threat automation actions reduced from days to milliseconds 6 petabytes of information security data Artificial intelligence and machine learning Secure cloud enablement Robotic process automation and orchestration Strong customer authentication choices $15 billion in money movement reviewed daily

Appendix

Non-GAAP Financial Measures * Includes net interest income on a taxable-equivalent basis *