Attached files

| file | filename |

|---|---|

| EX-32.1 - CERTIFICATIONS - ORANCO INC | f10k2018a2ex32-1_orancoinc.htm |

| EX-31.2 - CERTIFICATION - ORANCO INC | f10k2018a2ex31-2_orancoinc.htm |

| EX-31.1 - CERTIFICATION - ORANCO INC | f10k2018a2ex31-1_orancoinc.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Amendment No. 2)

þ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

FOR THE FISCAL YEAR ENDED JUNE 30, 2018

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from ___________ to ___________

COMMISSION FILE NO. 000-28181

ORANCO, INC.

(Exact name of registrant as specified in its charter)

Nevada

(State or Other Jurisdiction of Incorporation or Organization)

87-0574491

IRS Employer Identification Number

One Liberty Plaza, Suite 2310 PMB# 21

New York, NY 10006

Tel. (646) 759-3614

(Address and telephone number of principal executive offices)

Securities registered pursuant to Section 12(b) of the Act: None

Securities registered pursuant to Section 12(g) of the Act: Common Stock, par value $0.001

Indicate by check mark whether the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for shorter period that the registrant as required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Yes ☒ No ☐

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K(§ 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K.

☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ☐ | Accelerated filer ☐ |

| Non-accelerated filer ☐ (Do not check if a smaller reporting company) | Smaller reporting company ☒ |

| Emerging growth company ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act) Yes ☐ No ☒

The aggregate market value of the voting common stock held by non-affiliates of the registrant as of the last business day of the registrant’s most recently completed second fiscal quarter was approximately $4,231,791.

As of September 28, 2018, there were 98,191,480 shares of the registrant’s common stock issued and outstanding.

Explanatory Note

The purpose of this Amendment No. 2 (“Amendment No.2”) to the Annual Report on Form 10-K for the fiscal year ended June 30, 2018, as filed with the Securities and Exchange Commission (“the Commission”) on September 28, 2018 under Commission File No. 000-28181 (the “Original 10-K”) and as amended by Amendment No.1 to the Original 10-K filed with Commission on October 26, 2018 under Commission File No. 000-28181 (the “October 26, 2018 10-K/A”), is to file an amended report to reclassify the acquisition of additional interests in subsidiary Fenyang Jinqiang Wine Co. from investing activities to financing activities in the statement of cash flows. All other information disclosed in the Original 10-K remains the same.

This Amendment No.2 to the Original 10-K speaks as of the original filing date of the Original 10-K, does not reflect events that may have occurred subsequent to the original filing date, and does not modify or update in any way disclosures made in the Original 10-K, other than those described in the paragraph above.

TABLE OF CONTENTS

i

FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”) and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). These forward-looking statements are not historical facts but rather are based on current expectations, estimates and projections. We may use words such as “anticipate,” “expect,” “intend,” “plan,” “believe,” “foresee,” “estimate” and variations of these words and similar expressions to identify forward-looking statements. These statements are not guarantees of future performance and are subject to certain risks, uncertainties and other factors, some of which are beyond our control, are difficult to predict and could cause actual results to differ materially from those expressed or forecasted. These risks and uncertainties include the following:

| ● | The availability and adequacy of working capital to meet our requirements; |

| ● | Actions taken or omitted to be taken by legislative, regulatory, judicial and other governmental authorities; |

| ● | Changes in our business strategy or development plans; |

| ● | The availability of additional capital to support capital improvements and development; |

| ● | Other risks identified in this report and in our other filings with the Securities and Exchange Commission or the SEC; and |

| ● | The availability of new business opportunities. |

This Annual Report on Form 10-K should be read completely and with the understanding that actual future results may be materially different from what we expect. The forward-looking statements included in this Annual Report on Form 10-K are made as of the date of this Annual Report on Form 10-K and should be evaluated with consideration of any changes occurring after the date of this Annual Report on Form 10-K. We will not update forward-looking statements even though our situation may change in the future and we assume no obligation to update any forward-looking statements, whether as a result of new information, future events or otherwise.

Use of Term

Except as otherwise indicated by the context hereof, references in this report to “Company,” “ORNC,” “we,” “us” and “our” are references to Oranco, Inc. All references to “USD” or United States Dollars refer to the legal currency of the United States of America.

ii

ITEM 1. DESCRIPTION OF BUSINESS

Company Background

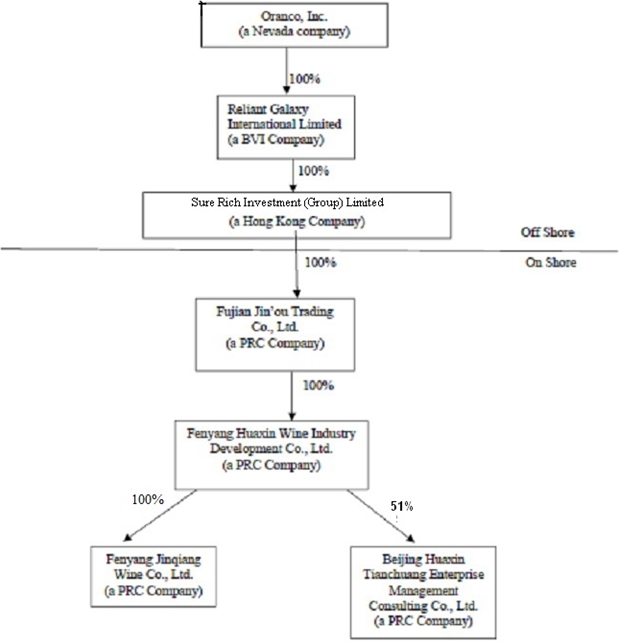

Oranco is engaged in alcohol wholesale in China through its operating subsidiary, Fenyang Huaxin Wine Industry Development Co., Ltd. (“Huaxin”), a People’s Republic of China company located in Shanxi Province, that is 100% held by Fujian Jin’ou Trading Co., Ltd. We maintain our principal executive offices at One Liberty Plaza, Suite 2310 PMB# 21, New York, NY 10006, United States. Our telephone number is (646) 759-3614.

| 1 |

We currently focus our business on the sale of Chinese Fenjiu liquor and imported wines. We run a growing alcoholic beverage business guided by a core purpose: to promote premium alcoholic beverages to China’s population. We aim to achieve this purpose by catering to the ever-evolving tastes in alcohols through our creative marketing strategies and innovative product designs that target different age groups of China’s population. To that end, we have hired marketing talents who have decades of experience in effective alcohol brand building. As a result, we have managed to respond to the demand for Chinese Fenjiu liquor and imported wines in the Chinese marketplace.

The popularity behind Chinese Fenjiu liquor is its unique combination of light alcohol fragrance and its soft and subtle sweetness. This combination has been one of the predominant taste preference amongst Chinese drinkers. Our Chinese Fenjiu liquor is a 53-proof clear spirit with a long lasting clean aftertaste. Our strategic partner, Shanxi Xinghuacun Fenjiu Group Alcohol Industry Development Zone Sales Co., Ltd. (“Fenjiu Group”), produces our Chinese Fenjiu product. Its brewing process is guided by the principle of “clean” and “pure”, and such standard is achieved by double fermentation and double distillation process in order to increase the yield of ethanol and expel any unfavorable flavors. The fermented grains, usually sorghum and barley, will be distilled; the distilled grains will be fermented once more; then the re-fermented grains will be distilled again.

Modern competition among different types of Chinese hard liquor is largely dependent on brand recognition that was built upon decades of customer goodwill and unique marketing strategies. Fenjiu liquor is recognized highly amongst Chinese consumers. It has long been a common liquor choice for traditional Chinese festivities, thus enjoying a deep cultural recognition amongst Chinese drinkers.

We believe that Fenjiu liquor presents great business opportunities for us to utilize creative product designs and marketing strategies to attract Chinese consumers. Collaborating with the Fenjiu Group, the sole producer of Fenjiu liquor in China, we have been focusing on product design to try to convey a modern feel to our Fenjiu products while maintaining Fenjiu liquor’s historical elegance. We believe our designer packaging stands out from our competitors’, symbolized by its bright coloring and prominently fat-bellied jars. With creative designs and stylized name, our registered trademarks, such as Dagangjiu (translated as “Big Jar Liquor”), are effective in capturing young and older Chinese populations’ attention.

|

|

| 2 |

|

|

Established in 2017, we believe our imported wine distribution business has a high growth potential as evidenced from the marked prices of the imported wines from Spain and New Zealand, countries from where we import our wine products, in the current Chinese market. A great majority of competitive players have priced their 750mL bottles of wine imported from Spain and New Zealand well above RMB 200. This price falls within the premium range in the general Chinese wine market. Within the general Chinese wine market, the premium range enjoyed the highest year-on-year growth compared to other price tiers of wine in 2017. This pricing trend for premium wines is applicable to imported wine from Spain and New Zealand, which we believe will benefit our growth in 2018. Accordingly, our strategy is to continue pricing our imported wine products within the premium range levels to generate higher margins. Though marketing and brand identity are still integral part of wine business in China, wine sales are highly driven by the origin of the wines. Since Spanish and New Zealand are considered prime origins for wine productions, our wine products will continue grab the attention of Chinese drinkers, ensuring the sustainable growth of our imported wine business.

We have strategically organized our wholesale and marketing channels. We sell directly to our six major distributors who then retail our products to over 300 storefronts and outlets. Even though we do not retail our products online, we believe the internet is a great way to market our products. Aside from promoting our products through traditional TV platforms, we have established our reputation on existing major Chinese e-commerce platforms such as Taobao.com and further enhanced our business goodwill through our marketing on online-to-offline (“O2O”), business-to-business (“B2B”) and business-to-consumer (“B2C”) platforms. We promote our Fenjiu liquors and imported wine through WeChat and other social media apps to strengthen our marketing efforts and to educate the general public on Chinese liquor tasting and history of Chinese Fenjiu liquors.

We believe that effective marketing strategies and creative product designs are two major contributing factors to our success. To improve and maintain the effectiveness of our marketing strategies, we have established integrated and collaborative processes to drive coordinated operations across our marketing efforts and sales. Our marketing strategies enable us to promote multiple sales concepts across two major alcohol categories, effectively attracting different age and cultural groups of Chinese populations. Our marketing plans are strategically designed to be efficiently executed and are tailored to meet unique taste and evolving demands of Chinese people. As a result, we believe that the Company’s innovative and highly-customized designs draw considerable public attention, which in turns is a factor in maximizing sales. As an example, in May 2015, we introduced a new line of product, “Qishierbian” (translated as “72 Earthly Transformations”), which brings modern visuals, ancient stories and new interpretations of Chinese culture to traditional Fenjiu liquor. This has helped creating acceptance of Fenjiu liquor from younger generations and its success reflects the changing needs and preferences of the Chinese populations. Over the past three years, we have generated approximately RMB 15,413,175 in revenue under “Qishierbian”. We believe it is essential to improve the overall business sustainability through focusing on marketing strategies and creative product designs to support our success.

For the year ended June 30, 2018, we generated revenue of approximately 84.9% from Fenjiu liquor wholesale and approximately 15.1% from imported wine wholesale. For the year ended June 30, 2017, we generated revenue of approximately 89.9% from Fenjiu liquor wholesale and approximately 10.1% from imported wine wholesale. We have not experienced any seasonality in our business.

| 3 |

Industry Overview

Chinese Fenjiu Liquor Market

We believe that the long-term demand for Chinese hard liquor, especially Fenjiu liquor, will continue to grow in China. The overall business environment has been optimistic, due to the continuous economic growth evidenced by the significant growth of Chinese nominal gross domestic product (“GDP”). This has led to an ever-increasing growth in China’s per capita expenditures on food, tobacco, and alcoholic beverages, indicating increased consumers’ disposable income and willingness to spend money on alcoholic beverages in general. According to the National Bureau of Statistics of China, the sales volumes of Chinese liquor in China has remained relatively flat between 2012 and 2016. Given the increasing purchasing power and improving living standards, the sales volume of Chinese liquor increased from 11,267.0 million liters in 2012 to 13,057.1 million liters in 2016, with a compound annual growth rate (“CAGR”) of 3.8%. Overall, we believe consumers are increasingly interested in drinking better quality liquor. We expect that with the Chinese consumers’ increasing purchasing power the consumption of Chinese liquor will shift to higher quality products and therefore the Chinese liquor market is expected to experience growth in the near future. According to the China Insights Consultancy (“CIC”) report, there are approximately 1,578 Chinese liquor producers in China with annual revenue above RMB 20 million in 2016. These producers are mainly located in the southwest, northeast and central China. Given the Chinese government’s implementation of policies designed to control and limit spending on “the three public consumptions”, namely overseas travel, receptions, and official cars, the high-end Chinese liquor market in China has undergone extensive restructuring since 2012.

Chinese government officials had a long history of using high-end liquors at reception events. However, in 2012, the Chinese governments implemented policies designed to control and limit spending on “the three public consumptions”, namely overseas travel, receptions, and use of government vehicles. Ripples of this anti-corruption campaign are felt beyond the high-end liquor industry, in sectors that heavily rely on China’s gifting culture and the lavish lifestyle of the privileged for growth. This extensive restructuring of Chinese liquor market caused by the anti-corruption campaign from Chinese government lasted for several years. As a result, the overall spending on high-end liquor market in China was limited and the sales volumes of Chinese high-end liquor has remained relatively flat till 2016. Nowadays, the structure of Chinese liquor market is stable again and has a steady growth supported by constant economic growth in China. Chinese consumers are expected to spend more on purchasing high-end liquors led by their increasing purchasing power.

Fenjiu Group and its subsidiaries are the sole suppliers of Fenjiu liquor in China. Fenjiu liquor has a relatively long history and is one of the world-famous Chinese liquor brands. Due to the Chinese government’s implementation of policies meant to control and limit spending on “the three public consumptions”, sales revenue in the Fenjiu liquor market have followed a downward trend since 2012. However, with increasing per capita incomes and rising demand for mid- to high-range products, the Fenjiu liquor market started to rebound in 2015, the market has expanded in terms of sales revenue to reach RMB5,117.9 million in 2016. Shanxi Province is the main market of Fenjiu liquor. Approximately 55% of Fenjiu liquor sales revenue was achieved in Shanxi in 2016. It is expected that the sales revenue of Fenjiu liquor will reach a further RMB10,532.0 million in China by 2022, increasing at a CAGR of 12.8% between 2016 and 2022.

According to the CIC report, at the end of 2016, the total number of Fenjiu liquor distributors reached 987 in China. The Fenjiu liquor distribution market is highly competitive with no single distributor occupying a major share of the market.

There are relatively high entry barriers for new competitors in the Fenjiu liquor distribution market. Firstly, it is important for new entrants to get an authorization from Fenjiu Group, which is the sole provider of Fenjiu liquor products in China, to distribute Fenjiu Group’s products. Fenjiu Group started placing stricter requirements on its distributors, including, for example, new sales target, rich experience in the industry, good past performance in cooperation with the Group, etc. Thus, it has become increasingly difficult for new players to enter the market. Fenjiu liquor enjoys widespread popularity in and around Shanxi Province, with markets in other parts of China being significantly smaller. It is therefore important for new entrants to have a pre-existing distribution network in certain regions of China in order to be successful. It remains risky for new entrants to enter into new areas where Fenjiu liquor is not yet fully established and where the distribution market is already saturated. Distributors range from mom-and-pop stores in Shanxi Province to larger companies with years of experience in the Fenjiu liquor industry, each competing for a fair share of the market. Intense competition arises between distributors within the same region, selling the same or different Fenjiu brands. Fenjiu liquor includes a variety of products, differing in terms of ABV, vintage, recipe, etc. Although there are no dominant varieties in the market, some are preferred by end consumers more than others. However, almost all of these popular varieties have already been taken up by exclusive distributors. Thus, new entrants might find it difficult to source popular products directly from Fenjiu Group or will be left to source them from existing distributors, which entails lower profit margins.

| 4 |

Chinese Wine Market

According to the International Organization of Vine and Wine, or OIV, the per capita wine consumption in China is much lower than the US average level between 2012 and 2016. After the reduction of “three public consumptions” in 2013, China’s per capita consumption showed a further decrease. However, the consumption pattern has changed and the wine consumption has grown into a mass consumption accompanied by a decrease in wine price. Compared with the world average consumption, China’s per capita wine consumption has been around one-third of the world’s average since 2010. The relatively low per capita wine consumption in China indicates great growth potential for China’s wine market in the future.

According to the CIC report, Chinese consumers should, between 2017 and 2022, develop the habit of drinking wine rather than other alcoholic beverages, wine consumption is considered a healthier option. In addition, the development of O2O platforms selling wine will most certainly facilitate the purchase of wine in China.

There are three market drivers for China’s wine market. Firstly, China’s per capita disposable income has been increasing rapidly mainly due to increasing wages. Rising disposable income translates into increasing purchasing power for Chinese people; it also means that Chinese people tend to focus more on their quality of life. As wine is considered in China as a premium product with some beneficial health effect, we believe that increasing purchasing power will stimulate the further growth of wine consumption. In addition, the characteristics associated with drinking wine, such as beautification and antioxidation, play an important role in contributing to its consumption, especially for female customers. Secondly, China’s urbanization rate has been improving greatly during the past decades and the Chinese government sets up the goal that the urbanization rate of China is set to reach 60% by 2020. With the further improvement of the urbanization rate in China, the retail sales market is experiencing a rapid growth in urban regions in China. Thirdly, there are favorable national and international policies for imported wine. According to bilateral trade agreements signed by the PRC government with New Zealand, Chile and Australia, imported goods from the three countries will benefit from low tariff rates, effective from 2019. According to those agreements, by 2019, these tariffs will be totally eliminated. This favorable policy should reduce the wine retailing price and hence contribute to a growth in sales.

Our Strengths

Our Company has a high brand recognition in the Chinese Fenjiu liquor market

Our “Dagangjiu” brand Fenjiu liquor is one of the Chinese Fenjiu liquor market’s popular brands. We believe that we have built a reputation among Chinese drinkers as a reliable Fenjiu liquor brand. Our customers choose our Fenjiu products for personal enjoyment, gifts for loved ones or superior quality alcohol for special occasions such as weddings and other traditional Chinese festivities. We have also leveraged the strength of the Fenjiu Group to become one of the leading Fenjiu brands in international alcohol festivals such as the World Wine Culture Expo held in Shanxi, China in 2017. We believe our high brand recognition anchors our packaging and distribution business with strong customer goodwill in Shanxi province and beyond, providing us with a competitive advantage.

Our Marketing Experts’ Extensive Experience and Superior Reputation in our Industry

We believe that our competitors’ marketing team cannot match our marketing experts’ extensive industry experience and their superior reputation. We believe our commercial campaigns build strong credibility with consumers and potential liquor distribution partners and shape the market trends of consumer preferences and business evolutions in the industry.

Additionally, we believe our marketing expertise and design proficiency required to successfully attract new customers combined with our ability to generate a range of business concepts and capability to customize each sales opportunity according to customers’ need are advantages when competing in the Chinese Fenjiu market. Our expertise also allows us to successfully manage the numerous regional and cultural complexities involved in operating a traditional liquor business in China.

| 5 |

A Flexible Business Model

Our current business model is flexible. It can be diversified in terms of the product flavors we serve and producers we sign commissions with. While operating a mix of marketing campaigns and business concepts under our own registered trademarks “Dagangjiu” and “Dagang Jiufang”, we entrust the liquor production to reputed large-scale producers. Currently, we are in a strategic partnership with Fenjiu Group.

Although our current business strategy emphasizes on the marketing, packaging and distribution of Fenjiu liquor and imported wines, should we want to change our business strategy to cater to more popular product types such as Luzhou-flavor liquor and Maotai-flavor liquor, we can quickly adjust our marketing concepts and product packaging to meet customers’ evolving needs and preferences. Since our bard is well recognized and the intellectual property used for our brand is owned by us, we can change our strategic partnerships to address new product preferences while maintaining our accumulated goodwill. This approach enables us to update marketing concepts and product mix any time and allows us to be flexible in our marketing approach.

This reliable and flexible business model has contributed to the marketing resilience of our business performance.

Service-driven and Cohesive Management Team

Our talented and dedicated senior management team has guided our organization through its expansion and, we believe, positioned us for continued growth. Each member of our team has an average of 20 years of expertise. Additionally, our management team possesses extensive experience across a broad range of disciplines, including Chinese liquor marketing, sales, E-Commerce, finance, franchising and business management. Our management team embraces our core purpose to “promote premium alcoholic beverages to the Chinese population of all ages” and exemplifies our passionate and customer-oriented culture, which is shared by our employees throughout our company. We believe this results in a service-driven and cohesive management team focused on long-term business growth.

Principal Products and Services

For the year ended June 30, 2018, we generated revenue of approximately 84.9% from Fenjiu liquor wholesale and approximately 15.1% from imported wine wholesale. For the year ended June 30, 2017, we generated revenue of approximately 89.9% from Fenjiu liquor wholesale and approximately 10.1% from imported wine wholesale. We have not experienced any seasonality in our business.

Fenjiu Liquor Wholesale

For our Fenjiu liquor wholesale business, we secure a strategic partnership with dealers based on our market survey data, market positioning data, sales channels data, sales capabilities data and sales potential evaluation. We further evaluate dealers according to their geographical and administrative area and categorize them into provincial, municipal and county agents. We establish cooperative relationships and strategic sales partnership amongst them to further facilitate the sales of our products. We wholesale our Fenjiu liquor products directly to these dealers.

In addition, we target dealers with sales access to retail stores and outlets. We sell our Fenjiu products with simple and bulk packaging to these dealers. The main idea is to achieve profit margins through the reduction of high-end designs and packaging while maintaining a relatively low price of our Fenjiu liquor products. Through this approach, we believe we can reach a greater number of Chinese customers who are attracted by the cost-effectiveness of our products. We sell our products to our dealers who then resell these products to retail stores and outlets.

Revenue generated from our Fenjiu liquor wholesale business accounted for 89.9% and 84.9%, respectively, of the total revenue derived from our general business in 2017 and 2018.

Imported Wine Wholesale

For our imported wine wholesale business, we secure strategic partnerships with dealers based on our market survey data, market positioning data, sales channels data, sales capabilities data and sales potential evaluation. We further evaluate dealers according to their geographical and administrative area and categorize them into provincial, municipal and county agents. We establish cooperative relationships and strategic sales partnership amongst them to further facilitate the sales of our products. We wholesale our imported wines directly to these dealers.

Revenue generated from our imported wine wholesale business accounted for 10.1% of the total revenue derived from our general business in 2017.

| 6 |

Competition

There is intense competition in the Chinese liquor market. As a result, customers face a tremendous number of choices when deciding which brand or product to choose from.

Fenjiu Group has nearly 1,000 multi-layered distributors as of the beginning of 2018, with these distributors often serving as Fenjiu brand co-builders. Although the Fenjiu Group is now widely known as the only producer of Fenjiu throughout the market, intense competition in the wholesale market remains since Fenjiu liquor distributors will continue working to co-build and enhance their respective brand image alongside Fenjiu Group to capture additional market share from competitors. By the end of 2016, there were nearly 1,000 distributors of Fenjiu liquor in China. Distributors range from mom-and-pop stores in Shanxi Province to larger companies with years of experience in the Fenjiu liquor industry, each competing for a fair share of the market. Competition is even more intense amongst the distributors within the same region.

The wine industry in China is also very competitive. Competitors conduct various marketing activities and pricing strategies in an effort to keep their market shares, which directly impact our sales, revenues and profitability. We follow the market trend constantly and adjust our own advertising, promotion, pricing and sourcing strategies accordingly. In addition, competitors in the Chinese wine market compete against us for regaining highly qualified marketing personnel and staff members.

In response to the intense competition in the Chinese liquor and wine markets, we have implemented a number of initiatives designed to expand revenues. Our revenue enhancement initiatives include expanding our marketing efforts, developing new products and working with start-up and bulk-sale customers to decrease our marketing costs.

Regulations

Huaxin is in the alcohol wholesale business, including Fenjiu liquor wholesale and imported wine wholesale, in China. Huaxin is subject to various existing and probable governmental regulations on its alcohol wholesale business.

According to the Regulations on Administration of Liquor of Shanxi Province which came into effect on January 1, 2000, entities or individuals who engage in liquor wholesale in Shanxi Province shall apply for a License for Liquor Wholesale. Huaxin has obtained the License for Liquor Wholesale and such license will expire on December 31, 2018. Also, Huaxin is required to obtain the Food Operation License pursuant to the Administrative Measures for Food Operation Licensing which came into effect on November 17, 2017. Huaxin has obtained Food Operation License and such license will expire on August 31, 2022. Nevertheless, Huaxin may be subject to penalties by PRC regulatory authorities if the wholesale license and food operation license is not timely renewed after expiration.

Currently, license for liquor wholesale is no longer required in nationwide level, but it is still required in some particular Provinces, such as Shanxi Province and Shanghai. In addition to Shanxi Province, the Company also sell liquor to other Provinces, namely Fujian, Ningxia, Gansu, Xinjiang, Beijing, Shanghai and Hebei Province. Liquor wholesale business of the Company is operated by its subsidiaries, Huaxin and Fenyang Jinqiang Wine Co., Ltd. (“Jinqiang”), both of which were established in Shanxi Province and have obtained wholesale licenses in Shanxi Province. According to our telephone consultation with the competent authorities in Beijing, Shanghai, Ningxia, Gansu and Hebei, no wholesale license is required for Huaxin or Jinqiang in such Provinces since Huaxin and Jinqiang were established in Shanxi Province and have already obtained wholesale licenses in Shanxi Province. In conclusion, no further wholesale license is required in other Provinces where the Company operates its business, unless the Company newly establish operating entity in such Provinces and license is still required for liquor wholesale business in such Provinces.

Regarding the imported wine business, pursuant to the Foreign Trade Law of the People’s Republic of China (Revised in 2016), a foreign trade operator engaged in import and export of goods shall register with competent local regulatory authorities in Shanxi Province that in charge of foreign trades; and pursuant to the Administrative Provisions of the Customs of the People’s Republic of China on the Registration of Customs Declaration Entities, consignors and consignees of imported and exported goods shall go through customs declaration entity registration formalities with their local Customs in accordance with the applicable provisions. Huaxin has completed the registration for a record as a foreign trade operator and has obtained Certificate of the Customs of the People’s Republic of China on the Registration of Customs Declaration Entities. The registration for a record as a foreign trade operator has no time limit; while the validity period for Certificate of the Customs of the PRC on the Registration of Customs Declaration Entities is two years and such certificate can be renewed before the expiration date. Nevertheless, Huaxin may be subject to penalties by PRC regulatory authorities if Huaxin fails to go through the modification formalities in the event of a change to any of its details registered with the competent governmental authorities including its name, nature, domicile and legal representative.

| 7 |

Customers

Our customers are downstream distributors. We rely upon several of our large customers from whom we generated substantial revenue each year, and the composition of our largest customers has changed from year to year. For the year ended June 30, 2018, five of our customers, Beijing Huaxin Rongfa Trading Co., Ltd., Fuqing Jing Hong Trading Co., Ltd., Shanghai Baiwang Trading Co., Ltd., New Venus Trade (Fujian) Group Co., Ltd. and Shanxi Moneng Trading Co., Ltd. represented approximately 16.3%, 16.2%, 11.5%, 11.2% and 10.6% of Huaxin’s revenue, respectively. For the year ended June 30, 2017, four of our customers, Fuqing Jing Hong Trading Co., Ltd., Beijing Huaxin Rongfa Trading Co., Ltd., New Venus Trade (Fujian) Group Co., Ltd. and Shanghai Baiwang Trading Co., Ltd. represented approximately 27%, 30%, 11% and 15% of Huaxin’s revenue, respectively. Huaxin currently engages its major customers with purchase agreements negotiated on an arm’s length basis. These purchase agreements customarily cover a one-year period and contain material subsections such as targeted customers’ selling goals, representation and warranties of the customers, rights and responsibility of the customers, pricing adjustment, logistics and shipping, payment methods, downstream management and dispute resolutions. While we believe that one or more of our major customers could account for a significant portion of our sales for at least the year 2019, we anticipate that our customer’s base will continue to expand and that in the future we will be less dependent on major customers.

Suppliers

We primarily rely upon five main suppliers from whom we purchase materials each year. For the year ended June 30, 2018, five of our suppliers, Shanxi Xinghuacun Liquor Group Wine Industry Development Zone Sales Co., Ltd., Fuzhou Tongshunda Trading Co., Ltd., Fenyang Xinghua Haokoufu Wine Industry Flagship Store, Shanxi Yuanquan Drinking Co., Ltd. and Shanxi Xinjin Merchants Wine Group Co., Ltd., accounted for 41%, 17%, 10%, 8% and 8% of our total supply purchases. For the year ended June 30, 2017, five of our suppliers, Shanxi Yuanquan Drinking Co., Ltd., Shanxi Wanli Wine Industry Sales Co., Ltd., Fuyang City Xinghua Haokoufu Wine Industry Flagship Store, Shanxi Xinjin Merchants Wine Group Co., Ltd. and Fuzhou Tongshunda Trading Co., Ltd. represented for 45%, 21%, 13%, 11% and 8% of the total supply purchases. All supplier contracts with large suppliers were entered from year to year on an arm’s length basis.

In general, we enter into procurement agreements in the ordinary course of business with our suppliers, pursuant to a form of supply order typically on a “deal by deal” basis. However, we have a strategic partnership with Fenjiu Group. We entered into a partnership agreement with Fenjiu Group on June 30, 2017, pursuant to which Fenjiu Group has agreed to supply us $4,379,850 worth of Fenjiu liquor during a three-year period. We are committed to buy and sell $4,379,850 worth of Fenjiu liquor pursuant to the strategic partnership agreement.

Intellectual Property

Protection of our intellectual property is a strategic priority for our business. We rely on a combination of patent, copyright, trademark and trade secret laws, as well as confidentiality agreements, to establish and protect our proprietary rights. We do not rely on third-party licenses of intellectual property for use in our business.

As of the date of this Annual Report on Form 10-K, we had obtained two patents for liquor-making devices that can change proofs of various liquors, both of which were registered in 2015. Our issued PRC patents will expire in 2025. As of the date of this Annual Report on Form 10-K, we had registered 10 trademarks and had submitted 11 additional trademark applications. Our registered PRC trademarks will expire between 2024 and 2028 but can be renewed before the trademarks’ respective expiration date. As of the date of this Annual Report on Form 10-K, we had obtained two registered domain names.

In addition to the foregoing protections, we generally control access to and use of our proprietary and other confidential information through the use of internal and external controls, such as the use of confidentiality agreement with our employees.

Employees

As of the date of this report, we had 54 employees throughout our operations in 4 offices and 3 warehouses. None of our employees are covered by a collective bargaining agreement. We have not experienced any work stoppages and we consider our relations with our employees to be good.

| 8 |

WHERE YOU CAN FIND MORE INFORMATION

The registrant is subject to the requirements of the Exchange Act, and files reports, proxy statements and other information with the SEC. You may read and copy these reports, proxy statements and other information at the public reference room maintained by the SEC at its Public Reference Room, located at 100 F Street, N.E. Washington, D.C. 20549. You may obtain information on the operation of the public reference room by calling the SEC at (800) SEC-0330. In addition, we are required to file electronic versions of those materials with the SEC through the SEC’s EDGAR system. The SEC also maintains a website at http://www.sec.gov, which contains reports, proxy statements and other information regarding registrants that file electronically with the SEC.

Our business operations are subject to various risks related to doing business in the People’s Republic of China (“PRC”).

First, we conduct all of our operations and all of our revenue is generated in the PRC. Accordingly, economic, political and legal developments in the PRC will significantly affect our business, financial condition, results of operations and prospects. Our ability to operate profitably in the PRC may be adversely affected by changes in policies by the PRC government, including changes in laws, regulations or their interpretation, particularly those dealing with the Internet, including censorship and other restriction on material which can be transmitted over the Internet, security, intellectual property, money laundering, taxation and other laws that affect our ability to operate our business through mobile APP.

Second, since our business is dependent upon government policies that encourage a market-based economy, change in the political or economic climate in the PRC may impair our ability to operate profitably, if at all. The PRC government continues to exercise significant control over economic growth in the PRC and we are dependent upon the PRC government pursuing policies that encourage private ownership of businesses. Restrictions on private ownership of businesses would affect the e-commerce and lodging services in general.

Third, PRC laws and regulations governing our current business operations are sometimes vague and uncertain and any changes in such laws and regulations may impair our ability to operate profitably. The Laws and regulations regarding the interpretation and application of PRC laws that govern our business and the enforcement and performance of our arrangements with customers in certain circumstances are sometimes vague and may be subject to future changes, and their official interpretation and enforcement may involve substantial uncertainty. New laws and regulations that affect existing and proposed future businesses may also be applied retroactively, which may have an adverse effect on our business.

In addition, because our business is conducted in RMB and the price of our Common Stock is quoted in United States dollars, changes in currency conversion rates may affect the value of your investments. Fluctuation in the exchange rate between the RMB and dollar resulting from economic conditions and others affect the value of our assets and the results of our operations in United States dollars. Any significant revaluation of the RMB may materially and adversely affect our cash flows, revenue and financial condition.

Further, the Enterprise Income Tax Law (“EIT Law”) and its implementing rules provide that enterprises established outside of China whose “de facto management bodies” are located in China are considered “resident enterprises” under PRC tax laws. However, there are no detailed rules or precedents governing the procedures and specific criteria for determining “de facto management body.” If we are deemed as a PRC “resident enterprise,” we will be subject to PRC enterprise income tax on our worldwide income at a uniform tax rate of 25%, although dividends distributed to us from our existing PRC subsidiary and any other PRC subsidiaries which we may establish from time to time could be exempt from the PRC dividend withholding tax due to our PRC “resident recipient” status. In addition, any dividends we pay to our non-PRC investors, and the gains realized from the transfer of our Common Stocks may be considered income derived from sources within the PRC and be subject to PRC tax, at a rate of 10% in the case of non-PRC enterprises or 20% in the case of non-PRC individuals (in each case, subject to the provisions of any applicable tax treaty). This could have a material and adverse effect on our overall effective tax rate, our income tax expenses, our net income and our dividends paid to our shareholders.

Finally, there are significant uncertainties under the EIT Law relating to the withholding tax liabilities of our PRC subsidiary, and dividends payable by our PRC subsidiary to our offshore subsidiaries may not qualify to enjoy certain treaty benefits. Under the PRC EIT Law and its implementation rules, the profits of a foreign-invested enterprise generated through operations, which are distributed to its immediate holding company outside the PRC, will be subject to a withholding tax rate of 10%. Pursuant to a special arrangement between Hong Kong and the PRC, such rate may be reduced to 5% if a Hong Kong resident enterprise owns more than 25% of the equity interest in the PRC company. Our PRC subsidiary is wholly-owned by our Hong Kong subsidiary. In current practice, a Hong Kong enterprise must obtain a tax resident certificate from the relevant Hong Kong tax authority to apply for the 5% lower PRC withholding tax rate. As the Hong Kong tax authority will issue such a tax resident certificate on a case-by-case basis, we cannot assure you that we will be able to obtain the tax resident certificate from the relevant Hong Kong tax authority. Additionally, even after we obtain the Hong Kong tax resident certificate, we are required by applicable tax laws and regulations to file required forms and materials with relevant PRC tax authorities to prove that we can enjoy 5% lower PRC withholding tax rate. There is no assurance that the PRC tax authorities will approve the 5% withholding tax rate on dividends received from our Hong Kong business entity.

| 9 |

ITEM 1B. UNRESOLVED STAFF COMMENTS

Not applicable to a smaller reporting company.

The Company’s office is located at One Liberty Plaza, Suite 2310 PMB# 21, New York, NY 10006.

Huaxin’s headquarters are located at Building 22, Baihui Shoufu, Xinghuacun Town, Fenyang City, Shanxi Province, China, where we own the property with an aggregate floor area of approximately 1561.6 square meters. This includes Huaxin’s sales and marketing office, communication and business development office and our management and operations facilities.

Huaxin also currently leases the following properties for its operations:

| ● | from Fenyang Baihui Real Estate Co., Ltd. on an arm’s length basis, approximately 50 square meters of office space at No.2, 1st Floor, Block A4, Baihui Shoufu, Xinghuacun Town, Fenyang City, Shanxi Province, China under a lease that expires on September 6, 2018 and can be renewed subject to mutual agreements by both parties; |

| ● | from Taiyuan Xiangyu Enterprise Management Consulting Co. Ltd. on an arm’s length basis, approximately 100 square meters of office space at No.5, Unit 1, Building 2, No. 343, Fenyang Road, Xiaodian District, Taiyuan City, Shanxi Province, China under a lease that expires on November 9, 2018 and can be renewed subject to mutual agreements by both parties; |

| ● | from Shanxi Zhanpeng Metal Products Co., Ltd. on an arm’s length basis, approximately 1000 square meters of office space at No. 2, South Hero Road, Fenyang City, Shanxi Province, China under a lease that expires on March 9, 2021 and can be renewed subject to mutual agreements by both parties; |

| ● | from Ms. Jiangmei Guo on an arm’s length basis, approximately 140 square meters of office space at No. 1011, Unit 2, Unit 1, Wenxingyuan, Xiaodian District, Fenyang City, Shanxi Province, China under a lease that expires on December 8, 2018 and can be renewed subject to mutual agreements by both parties; |

| ● | from Mr. Genshan Zhao on an arm’s length basis, approximately 60 square meters of office space at Room 915, Wufeng International, No. 11 Zhenxing Street, High-Tech Zone, Taiyuan City, Shanxi Province, China under a lease that expires on September 30, 2018 and can be renewed subject to mutual agreements by both parties; |

| ● | from Mr. Jianhong Zhang on an arm’s length basis, approximately 50 square meters of office space at Room 903, 9th Floor, Wufeng International Building, High-tech Development Zone, Taiyuan City, Shanxi Province, China under a lease that expires on September 20, 2018 and can be renewed subject to mutual agreements by both parties; and |

| ● | from Fenyang City Jiudu Xinhua Liquor Trading Center Co., Ltd. on an arm’s length basis, approximately 1200 square meters of warehouse space at South District if Shudao Avenue, High-Speed Exit, Xinghua Village, Fenyang City, Shanxi Province, China under a lease that expires on January 11, 2019 and can be renewed subject to mutual agreements by both parties. |

We believe that our current facilities are adequate and suitable for our operations.

From time to time, we may become involved in various lawsuits and legal proceedings which arise in the ordinary course of business. Litigation is subject to inherent uncertainties, and an adverse result in these or other matters may arise from time to time that may harm our business. To the knowledge of management, no federal, state or local governmental agency is presently contemplating any proceeding against the Company. No director, executive officer or affiliate of the Company or owner of record or beneficially of more than five percent of the Company’s common stock is a party adverse to the Company or has a material interest adverse to the Company in any proceeding.

ITEM 4. MINE SAFETY DISCLOSURES

Not applicable.

| 10 |

ITEM 5. MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES (U.S. Dollars)

Market Information

There is a limited public market for our common stock. Our common stock trades on the OTC Pink marketplace under the symbol “ORNC”. The OTC Pink marketplace is a quotation service that displays real-time quotes, last-sale prices, and volume information in over-the-counter (“OTC”) equity securities. An OTC Pink equity security generally is any equity that is not listed or traded on a national securities exchange.

OTC Pink securities are not listed or traded on the floor of an organized national or regional stock exchange. Instead, OTC Pink securities transactions are conducted through a telephone and computer network connecting dealers in stocks. OTC Pink issuers are traditionally smaller companies that do not meet the financial and other listing requirements of a regional or national stock exchange.

Price Range of Common Stock

The following table shows, for the periods indicated, the high and low bid prices per share of our common stock as reported by the OTC Pink quotation service. These bid prices represent prices quoted by broker-dealers on the OTC Pink quotation service. The quotations reflect inter-dealer prices, without retail mark-up, mark-down or commissions, and may not represent actual transactions.

| High | Low | |||||||

| Fiscal Year 2018 | Bid | Bid | ||||||

| First Quarter | $ | 0.4 | $ | 0.2 | ||||

| Second Quarter | $ | 0.55 | $ | 0.1 | ||||

| Fiscal Year 2017 | Bid | Bid | ||||||

| First Quarter | $ | 0.21 | $ | 0.21 | ||||

| Second Quarter | $ | 0.21 | $ | 0.21 | ||||

| Third Quarter | $ | 1 | $ | 1 | ||||

| Fourth Quarter | $ | 0.25 | $ | 0.25 | ||||

| Fiscal Year 2016 | Bid | Bid | ||||||

| First Quarter | $ | 0.6015 | $ | 0.6015 | ||||

| Second Quarter | $ | 0.425 | $ | 0.425 | ||||

| Third Quarter | $ | 0.425 | $ | 0.425 | ||||

| Fourth Quarter | $ | 0.3 | $ | 0.3 | ||||

There is no “public market” for shares of common stock of the Company. Although the Company’s shares are quoted on the OTC Pink marketplace, the Company is aware of only a few transactions that have taken place in the previous ten years. In any event, no assurance can be given that any market for the Company’s common stock will develop or be maintained.

Stockholders of Record

As of September 28, 2018 there were approximately 50 stockholders of record of our common stock.

Dividends

The Company has not declared any cash dividends with respect to its common stock and does not intend to declare dividends in the foreseeable future. There are no material restrictions limiting, or that are likely to limit, the Company’s ability to pay dividends on its common stock.

| 11 |

Securities authorized for issuance under equity compensation plans.

None.

Recent Sales of Unregistered Securities

None.

Purchase of Equity Securities By the Issuer and Affiliated Purchasers.

None.

ITEM 6. SELECTED FINANCIAL DATA

Not applicable to a smaller reporting company.

ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS (Chinese Renminbi)

| Years Ended June 30, | Variance | |||||||||||||||

| 2018 | 2017 | Amount | % | |||||||||||||

| Revenue | 101,759,660 | 91,144,666 | 10,614,994 | 11.6 | % | |||||||||||

| Cost of sales | 27,800,667 | 24,065,113 | 3,735,554 | 15.5 | % | |||||||||||

| Gross profit | 73,958,993 | 67,079,553 | 6,879,440 | 10.3 | % | |||||||||||

| Selling and distribution expenses | 5,477,457 | 2,521,950 | 2,955,507 | 117.2 | % | |||||||||||

| Administrative expenses | 7,109,937 | 5,505,952 | 1,603,985 | 29.1 | % | |||||||||||

| Income from operations | 61,371,599 | 59,051,651 | 2,319,948 | 3.9 | % | |||||||||||

| Other income | 155,700 | 227,552 | 71,852 | -31.6 | % | |||||||||||

| Interest and other financial charges | 1,759,325 | 3,431,027 | 1,671,702 | -48.7 | % | |||||||||||

| Income before income taxes | 59,767,974 | 55,848,176 | 3,919,798 | 7.0 | % | |||||||||||

| Income taxes | 15,095,681 | 14,121,343 | 974,338 | 6.9 | % | |||||||||||

| Net income | 44,672,293 | 41,726,833 | 2,945,460 | 7.1 | % | |||||||||||

Revenue

| Year Ended June 30, | Variance | |||||||||||||||||||||||

| 2018 | % | 2017 | % | Amount | % | |||||||||||||||||||

| Sales of Fenjiu liquor products | 86,358,407 | 84.9 | % | 81,973,982 | 89.9 | % | 4,384,425 | 5.3 | % | |||||||||||||||

| Sales of imported wine products | 15,401,253 | 15.1 | % | 9,170,684 | 10.1 | % | 6,230,369 | 67.9 | % | |||||||||||||||

| Total Amount | 101,759,660 | 100.0 | % | 91,144,666 | 100.0 | % | 10,614,994 | 11.6 | % | |||||||||||||||

For the year ended June 30, 2018 and 2017, revenue generated from our Fenjiu liquor wholesale business was RMB86,358,407 and RMB81,973,982, respectively, which represented an increase of RMB4,384,425 or 5.3%. The increase in revenue generated from our Fenjiu liquor wholesale business was mainly due to the increased sales volume of our Fenjiu liquor products.

For the years ended June 30, 2018 and 2017, revenue generated from our imported wine wholesale business was RMB15,401,253 and RMB9,170,684, respectively, which represented an increase of RMB6,230,369 or 67.9%. The increase in revenue generated from our imported wine wholesale business was mainly due to the increased sales volume of our imported wine products.

| 12 |

Cost of Sales

| Years Ended June 30, | Variance | |||||||||||||||||||||||

| 2018 | % | 2017 | % | Amount | % | |||||||||||||||||||

| Sales of Fenjiu liquor products | 23,250,121 | 83.6 | % | 21,645,410 | 89.9 | % | 1,604,711 | 7.4 | % | |||||||||||||||

| Sales of imported wine products | 4,550,546 | 16.4 | % | 2,419,703 | 10.1 | % | 2,130,843 | 88.1 | % | |||||||||||||||

| Total Amount | 27,800,667 | 100.0 | % | 24,065,113 | 100.0 | % | 3,735,554 | 15.5 | % | |||||||||||||||

For the years ended June 30, 2018 and 2017, the cost of sales from our Fenjiu liquor wholesale business was RMB23,250,121 and RMB21,645,410, respectively, which represented an increase of RMB1,604,711 or 7.4%. The increase of cost of sales from our Fenjiu liquor wholesale business was mainly due to the increased sales volume of our Fenjiu liquor products.

For the years ended June 30, 2018 and 2017, the cost of sales from our imported wine wholesale business was RMB4,550,546 and RMB2,419,703, respectively, which represented an increase of RMB2,130,843 or 88.1%. The increase of cost of sales from our imported wine wholesale business was mainly due to the increased sales volume of our imported wine products.

Gross Profit

| Years Ended June 30, | Variance | |||||||||||||||||||||||

| 2018 | % | 2017 | % | Amount | % | |||||||||||||||||||

| Sales of Fenjiu liquor products | 63,108,286 | 85.3 | % | 60,328,572 | 89.9 | % | 2,779,714 | 4.6 | % | |||||||||||||||

| Sales of imported wine products | 10,850,707 | 14.7 | % | 6,750,981 | 10.1 | % | 4,099,726 | 60.7 | % | |||||||||||||||

| Total Amount | 73,958,993 | 100.0 | % | 67,079,553 | 100.0 | % | 6,879,440 | 10.3 | % | |||||||||||||||

Gross profit from our Fenjiu liquor wholesale business increased by RMB2,779,714 or 4.6% for the year ended June 30, 2018, as compared to the same period of 2017. The Company adopted its strategy to sell products with fairly stable profit margins that gross profit contribution percentage was 73.1% for the year ended June 30, 2018, as compared to 73.6% for the same period of 2017.

Gross profit from our imported wine wholesale business increased by RMB4,099,726 or 60.7% for the year ended June 30, 2018, as compared to the same period of 2017. The gross profit contribution percentage was 70.5% for the year ended June 30, 2018, as compared to 73.6% for the same period of 2017. The decrease in gross profit contribution percentage represented different product mix.

Selling and Distribution Expenses

For the year ended June 30, 2018, our selling and distribution expenses were RMB5,477,457, representing an increase of RMB2,955,507, or 117.2%, as compared to the same period of 2017. The increase was primarily due to increased advertising expenses, packaging expenses and salaries during the year ended June 30, 2018, as compared to the same period of 2017.

Administrative Expense

For the year ended June 30, 2018, our administrative expenses were RMB7,109,937, representing an increase of RMB1,603,985 or 29.1%, as compared to the same period of 2017. The increase was primarily due to professional fees in connection with share exchange with Reliant Galaxy International Limited.

Other Income

For the year ended June 30, 2018, our other income was RMB155,700, representing a decrease of RMB71,852 or 31.6%, as compared to the same period of 2017. The decrease was primarily due to the decreased interest income.

| 13 |

Interest and Other Financial Charges

For the year ended June 30, 2018, our interest and other financial charges were RMB 1,759,325 as compared to interest and other financial charges of RMB3,420,272 in the same period of 2017. The decrease in interest and other financial charges was primarily due to repayment of bank borrowings.

Income Taxes

For the years ended June 30, 2018 and 2017, the Company’s income taxes increased by RMB974,338 or 6.9% to RMB15,095,681 for the year ended June 30, 2018 from RMB14,121,343 for the year ended June 30, 2017. The increase in the Company’s income taxes was primarily due to increased taxable income of the Company for the year indicated.

Liquidity and Capital Resources

A summary of our changes in cash flows for the years ended June 30, 2018, 2017 and 2016 is provided below:

| As of June 30 | As of June 30 | As of June 30 | ||||||||||

| 2018 | 2017 | 2016 | ||||||||||

| RMB | RMB | RMB | ||||||||||

| Net cash flows provided by (used in): | ||||||||||||

| Cash generated from operating activities | 47,292,147 | 18,910,609 | (33,525,505 | ) | ||||||||

| Cash used in investing activities | 5,408 | (30,893 | ) | (143,781 | ) | |||||||

| Cash used in financing activities | (27,400,000 | ) | (12,700,000 | ) | 32,950,000 | |||||||

| Net increase (decrease) in cash and restricted cash | 19,897,555 | 6,179,716 | (719,286 | ) | ||||||||

| Cash and cash equivalents, beginning of the year | 6,607,407 | 427,691 | 1,146,977 | |||||||||

| Cash and restricted cash, end of period | 26,504,962 | 6,607,407 | 427,691 | |||||||||

We use our operating cash flows to meet our cash requirements and liquidity needs.

Operating Activities

Net cash flows provided by or used in operating activities consist of net loss adjusted for non-cash expenses such as depreciation and amortization, bad debt expense, amortizations of debt issuance costs and beneficial conversion features, stock-based compensation, and accrued interest expense. Our operating assets and liabilities primarily consist of balances related to inventory purchases and accounts receivables. Operating assets and liabilities that arise from the inventory purchases and accounts receivables may fluctuate significantly from time to time depending on our inventory purchases and market behaviors.

Cash flows generated from operating activities were RMB 47.29 million as of June 30, 2018, RMB 18.91 million as of June 30, 2017, and negative RMB 33.53 million as of June 30, 2016. There has been an increase in cash flow of RMB 28.38 million from 2017 to 2018. There has been a significant increase in cash flow of RMB 52.44 million from 2016 to 2017. The primary reason for the increases in cash flows was increases in net income—there has been increases in net income of RMB 44.67 million in 2018, RMB 41.63 million in 2017 and RMB 9.59 million in 2016. There were many factors contributing to our increases in net income, however increased sales, increased gross margins, and increased ability to turn our inventory into cash are the primary factors that contributed to our increase in net income.

Investing Activities

Net cash generated from investing activities was RMB 5,408 as of June 30, 2018. Net cash used in investing activities was (RMB 30,893) as of June 30, 2017 and (RMB 143,781) as of June 30, 2016. For fiscal year 2018, the Company invested (RMB 401,305) in purchasing office spaces. The Company purchased computers and equipment of (RMB 30,893) in 2017 and (RMB 143,781) in 2016 for operational purposes. Net cash by investing activities was RMB 406,713 in 2018, consisted primarily of cash received in connection with the share exchange with Reliant Galaxy International Limited. No net cash generated from investing activities in 2017 and 2016.

Financing Activities

Net cash for investing activities in the fiscal year 2018 and 2017 consists of acquiring Jinqiang. We spent (RMB 0.4 million) in 2018 and (RMB 2.1 million) in 2017 on acquiring Jingqiang’s shares, and we eventually gained 100% control of Jinqiang on May 7, 2018. We were able to generate significant cash flows from our sales, which lowered our need for external financing. We were able to pay back bank loans of (RMB 27 million) in 2018 and (RMB 10.65 million) in 2017. We had financing activities of RMB 32.95 million that contributed to our net cash flows as of June 30, 2016.

Liquidity

Our net income was RMB 44.67 million as of June 30, 2018, RMB 41.63 million as of June 30, 2017 and RMB 9.59 million as of June 30, 2016. Our cash flow from business operations was RMB 47.29 million as of June 30, 2018, RMB 18.91 million as of June 30, 2017 and negative RMB 33.53 million as of June 30, 2018. Management believes that our increased sales caused the decreases in net loss and increases in cash flows.

Management is of the opinion that we have funds available to continue developing our products and capturing more market shares. Based on the Company’s current revenues and cash flows, management believes that we will be able to fund our development efforts through cash flow or external financing for the fiscal year 2019. However, there can be no assurances that the Company will be successful in developing new products or capturing larger market shares and the Company may need additional share capital issued over the next 12 months.

| 14 |

ITEM 7A. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK

Not applicable to a smaller reporting company.

ITEM 8. FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA

The consolidated financial statements of the Company are included in this Annual Report on Form 10-K beginning on page F-1, which are incorporated herein by reference.

ITEM 9. CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURE

None.

ITEM 9A. CONTROLS AND PROCEDURES

Evaluation of disclosure controls and procedures

We are required to maintain disclosure controls and procedures that are designed to ensure that information required to be disclosed in our reports filed under the Securities Exchange Act of 1934, as amended, is recorded, processed, summarized and reported within the time periods specified in the Securities and Exchange Commission’s rules and forms, and that such information is accumulated and communicated to our management, including our chief executive officer (also our principal executive officer) and our chief financial officer (also our principal financial and accounting officer) to allow for timely decisions regarding required disclosure.

Pursuant to Rule 13a-15(b) under the Securities Exchange Act of 1934 (“Exchange Act”), the Company’s management, including the Company’s Chief Executive Officer (“CEO”) (the Company’s principal executive officer) and Chief Financial Officer (“CFO”) (the Company’s principal financial and accounting officer), has evaluated the effectiveness of the Company’s disclosure controls and procedures (as defined under Rule 13a-15(e) under the Exchange Act) as of the end of the period covered by this report. Based upon that evaluation the Company’s CEO and CFO concluded that the Company’s disclosure controls and procedures were not effective as of June 30, 2018 to ensure that information required to be disclosed by the Company in the reports that the Company files or submits under the Exchange Act, is recorded, processed, summarized and reported, within the time periods specified in the SEC’s rules and forms, and that such information is accumulated and communicated to the Company’s management, including the Company’s CEO and CFO, as appropriate, to allow timely decisions regarding required disclosure. The principal basis for this conclusion is the lack of segregation of duties within our financial function and the lack of an operating Audit Committee.

Management’s Report on Internal Control over Financial Reporting

Our management is responsible for establishing and maintaining adequate internal control over financial reporting. Internal control over financial reporting is defined in Rule 13a-15(f) or 15d-15(f) promulgated under the Securities Exchange Act of 1934 as a process designed by, or under the supervision of, the company’s principal executive and principal financial officers and effected by the company’s board of directors, management and other personnel, to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with accounting principles generally accepted in the United States of America and includes those policies and procedures that:

| ● | Apply to the maintenance of records that in reasonable detail accurately and fairly reflect the transactions and dispositions of the assets of the company; |

| ● | Provide reasonable assurance that transactions are recorded as necessary to permit preparation of financial statements in accordance with accounting principles generally accepted in the United States of America and that receipts and expenditures of the company are being made only in accordance with authorizations of management and directors of the company; and |

| ● | Provide reasonable assurance regarding prevention or timely detection of unauthorized acquisition, use or disposition of the company’s assets that could have a material effect on the financial statements. |

| 15 |

Because of its inherent limitations, internal control over financial reporting may not prevent or detect misstatements. Projections of any evaluation of effectiveness to future periods are subject to the risk that controls may become inadequate because of changes in conditions, or that the degree of compliance with the policies or procedures may deteriorate. All internal control systems, no matter how well designed, have inherent limitations. Therefore, even those systems determined to be effective can provide only reasonable assurance with respect to financial statement preparation and presentation. Because of the inherent limitations of internal control, there is a risk that material misstatements may not be prevented or detected on a timely basis by internal control over financial reporting. However, these inherent limitations are known features of the financial reporting process. Therefore, it is possible to design into the process safeguards to reduce, though not eliminate, this risk.

We carried out an assessment, under the supervision and with the participation of our management, including our CEO and CFO, of the effectiveness of the design and operation of our internal controls over financial reporting, as defined in Rules 13a-15(e) and 15d-15(e) of the Securities Exchange Act of 1934, as of June 30, 2018. Integrated Framework (2013) . Based on that assessment and on those criteria, our CEO and CFO concluded that our internal control over financial reporting was not effective as of June 30, 2018. The principal basis for this conclusion is failure to engage sufficient resources in regards to our accounting and reporting obligations.

Remediation

Our management has dedicated resources to correct the control deficiencies and to ensure that we take proper steps to improve our internal control over financial reporting in the area of financial statement preparation and disclosure.

We have taken a number of remediation actions that we believe will improve the effectiveness of our internal control over financial reporting, including the following:

| ● | Required all of the accounting personnel in the accounting department to take a minimum of 24 CPE credits annually with a focus on US GAAP and financial reporting standards. We also required the Chief Financial Officer to take a minimum of 40 CPE credits annually with a focus on US GAAP and financial reporting standards. |

| ● | Implemented an internal review process over financial reporting to continue to improve our ongoing review and supervision of our internal control over financial reporting; |

| ● | Implemented an ongoing initiative and training in the Company to ensure the importance of internal controls and compliance with the established policies and procedures are fully understood throughout the organization, and we plan to provide continuous U.S. GAAP knowledge training to relevant employees involved to ensure the performance of and the compliance with those procedures and policies. |

In addition to the above executed remediation plans, we have appointed a full-time CFO on April 16, 2018, who has expertise in U.S. GAAP financial reporting and accounting.

This annual report does not include an attestation report of our registered public accounting firm regarding internal control over financial reporting. Management’s report was not subject to attestation by our registered public accounting firm pursuant to temporary rules of the SEC that permit us to provide only the management’s report in this annual report.

Changes in Internal Control over Financial Reporting

We plan to enhance our internal controls over financial reporting related to this new adoption to ensure all related accounting policy and disclosures reflect this change.

Except for the aforementioned remediation plans, there have not been any other changes in the Company’s internal control over financial reporting (as such term is defined in Rules 13a-15(f) under the Exchange Act) during the current quarter ended June 30, 2018, to have materially affected the Company’s internal control over financial reporting.

| 16 |

Attestation Report of Registered Public Accounting Firm

This Annual Report on Form 10-K does not include an attestation report of our independent registered public accounting firm, regarding internal controls over financial reporting. Our internal control over financial reporting was not subject to such attestation as we are a smaller reporting company.

Changes in internal controls

As reported on the Form 8-K filed by the Company with the SEC on January 5, 2018, the Company’s president, secretary, treasurer and director, Claudio Gianascio, resigned and on the same date the Company appointed Peng Yang to serve as president, secretary, treasurer and director.

As reported on the Form 8-K filed by the Company with the SEC on July 6, 2018, the Company appointed Ronald Zhang to serve as the Chief Financial Officer on April 16, 2018.

Other than the foregoing, there was no change in our internal controls over financial reporting that occurred during the period covered by this report, which has materially affected or is reasonably likely to materially affect, our internal controls over financial reporting.

None.

| 17 |

ITEM 10. DIRECTORS, EXECUTIVE OFFICERS AND CORPORATE GOVERNANCE

DIRECTORS AND EXECUTIVE OFFICERS

The name, age and titles of our executive officer and director is as follows:

| NAME | AGE | POSITION(S) | DATE ELECTED OR APPOINTED | |||||

| Claudio Gianascio (1) | 59 | Director, President, Secretary, and Treasurer | Resigned 01/05/2018 | |||||

| Peng Yang (2) | 26 | Director, President and Secretary | Appointed 01/05/2018 | |||||

| Ronald Zhang (3) | 46 | Chief Financial Officer | Appointed 04/16/2018 | |||||

| (1) | Mr. Gianascio resigned from his positions as Director, President, Secretary, and Treasurer on January 5, 2018 as a result of a share purchase transaction entered into on December 26, 2017. |

| (2) | Mr. Peng Yang took office on January 5, 2018. |

| (3) | Mr. Ronald Zhang took office on September 16, 2018. |

Mr. Gianascio, age 59, is a Swiss citizen and private investor. From 1999 until March 2011, he was President, Secretary, Treasurer and Director of Oranco. Mr. Gianascio holds a Masters Degree in Economics which he received from the University of Geneva, Switzerland and was a Fiduciario Finanziario within the state of Ticino, Switzerland.

Mr. Yang, age 26, has international business and management experience from his positions working with Huaxin, a company engaged in wine trading and Reliant Investment (Group) Limited, an investment company. He has served as the general manager assistant and overseas affairs manager of Huaxin since 2015 and as limited director of Reliant Investment (Group) Limited since 2016. Mr. Yang is a leading member of our sophisticated and long-serving management team who has experience in alcohol marketing and has led us through multiple business breakthroughs. Mr. Yang holds a bachelors of engineering degree, with honors, from the University of Auckland in New Zealand in 2016.

Mr. Zhang, age 46, has substantial experience in corporate finance, financial planning, financial risks and financial reporting. He has served as the executive director of Guangzhou Double 3D Technology Limited since June 2017. From January 2010 to April 2017, Mr. Zhang served as the executive director of Moon Treasure Limited. Mr. Zhang received his GAAP Certificate from the American Institute of Certified Public Accountants in June, 2018. He received his Bachelor of Arts in Accounting from Edinburgh Napier University in 1999 and his Master of Laws from the University of Wolverhampton in 2014.

Director Independence

We are not currently subject to listing requirements of any national securities exchange or inter-dealer quotation system which has requirements that a majority of the board of directors be “independent” and, as a result, we are not at this time required to have our Board of Directors comprised of a majority of “independent directors.” None of our directors are independent directors under the applicable standards.

Family Relationships

There are no family relationships among our directors or executive officers.

| 18 |

Involvement in Certain Legal Proceedings

None of our directors or executive officers has been involved in any of the following events during the past ten years:

| ● | any bankruptcy petition filed by or against any business of which such person was a general partner or executive officer either at the time of the bankruptcy or within two years prior to that time; | |

| ● | any conviction in a criminal proceeding or being subject to a pending criminal proceeding (excluding traffic violations and other minor offenses); | |

| ● | being subject to any order, judgment, or decree, not subsequently reversed, suspended or vacated, of any court of competent jurisdiction, permanently or temporarily enjoining, barring, suspending or otherwise limiting his or her involvement in any type of business, securities or banking activities; or | |

| ● | being found by a court of competent jurisdiction (in a civil action), the Commission or the Commodity Futures Trading Commission to have violated a federal or state securities or commodities law, and the judgment has not been reversed, suspended, or vacated. |

Board Committees

The Company currently has not established any committees of the Board of Directors. Our Board of Directors may designate from among its members an executive committee and one or more other committees in the future. We do not have a nominating committee or a nominating committee charter. Further, we do not have a policy with regard to the consideration of any director candidates recommended by security holders. To date, other than as described above, no security holders have made any such recommendations. The entire Board of Directors performs all functions that would otherwise be performed by committees. Given the present size of our board, it is not practical for us to have committees. If we are able to grow our business and increase our operations, we intend to expand the size of our board and allocate responsibilities accordingly.

Audit Committee Financial Expert

We have no separate audit committee at this time. The entire Board of Directors oversees our audits and auditing procedures. Neither of our directors is an “audit committee financial expert” within the meaning of Item 407(d)(5) of SEC Regulation S-K.

Compensation Committee