Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Cornerstone Building Brands, Inc. | tv506207_8k.htm |

Exhibit 99.1

VAL r th E UATION These materials may not be used or relied upon for any purpose othe an as specifically contemplated by a 1 NCI / Ply Gem Merger Update November 2018

FORWARD - LOOKING STATEMENTS Certain statements and information in this filing may constitute forward - looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 . The words “believe,” “anticipate,” “plan,” “intend,” “foresee,” “guidance,” “potential,” “expect,” “should,” “will,” “continue,” “could,” “estimate,” “forecast,” “goal,” “may,” “objective,” “predict,” “projection,” or similar expressions are intended to identify forward - looking statements (including those contained in certain visual depictions) in this filing . These forward - looking statements reflect the Company’s current expectations and/or beliefs concerning future events . The Company believes the information, estimates, forecasts and assumptions on which these statements are based are current, reasonable and complete . Our expectations with respect to the first quarter of fiscal 2018 and the full year fiscal 2018 that are contained in this filing are forward - looking statements based on management’s best estimates, as of the date of this filing . These estimates are unaudited, and reflect management’s current views with respect to future results . However, the forward - looking statements in this filing are subject to a number of risks and uncertainties that may cause the Company’s actual performance to differ materially from that projected in such statements . Among the factors that could cause actual results to differ materially include, but are not limited to, industry cyclicality and seasonality and adverse weather conditions ; challenging economic conditions affecting the nonresidential construction industry ; volatility in the U . S . economy and abroad, generally, and in the credit markets ; substantial indebtedness and our ability to incur substantially more indebtedness ; our ability to generate significant cash flow required to service or refinance our existing debt, including our secured term loan facility, and obtain future financing ; our ability to comply with the financial tests and covenants in our existing and future debt obligations ; operational limitations or restrictions in connection with our debt ; increases in interest rates ; recognition of asset impairment charges ; commodity price increases and/or limited availability of raw materials, including steel ; costs relative to maintenance or replacement of our enterprise resource planning technologies ; our ability to make strategic acquisitions accretive to earnings ; retention and replacement of key personnel ; our ability to carry out our restructuring plans and to fully realize the expected cost savings ; enforcement and obsolescence of intellectual property rights ; fluctuations in customer demand ; costs related to environmental clean - ups and liabilities ; competitive activity and pricing pressure ; increases in energy prices ; volatility of the Company's stock price ; potential future sales of the Company's common stock held by our sponsor ; substantial governance and other rights held by our sponsor ; breaches of our information system security measures and damage to our major information management systems ; hazards that may cause personal injury or property damage, thereby subjecting us to liabilities and possible losses, which may not be covered by insurance ; changes in laws or regulations, including the Dodd – Frank Act ; and costs and other effects of legal and administrative proceedings, settlements, investigations, claims and other matters ; timing and amount of any future stock repurchases . In addition to these factors, we encourage you to review the “Risk Factors” set forth in the Company’s Annual Report on Form 10 - K for the fiscal year ended October 29 , 2017 , and the other risks and uncertainties described in documents we file from time to time with the SEC, which identify other important factors, though not necessarily all such factors, that could cause future outcomes to differ materially from those set forth in the forward - looking statements contained in this filing . The Company expressly disclaims any obligation to release publicly any updates or revisions to these forward - looking statements, whether as a result of new information, future events, or otherwise . Disclaimer

WHERE YOU CAN FIND MORE INFORMATION In connection with the proposed transaction, the Company has filed a proxy statement of the Company with respect to the obtaining of stockholder approval for the transaction . STOCKHOLDERS OF THE COMPANY ARE URGED TO READ CAREFULLY AND IN THEIR ENTIRETY THE PROXY STATEMENT (INCLUDING ALL AMENDMENTS AND SUPPLEMENTS THERETO) AND OTHER DOCUMENTS RELATING TO THE PROPOSED MERGER THAT HAVE BEEN FILED WITH THE SEC BECAUSE THEY CONTAIN IMPORTANT INFORMATION ABOUT THE COMPANY, PLY GEM AND THE PROPOSED MERGER . Stockholders are able to obtain free copies of the proxy statement and other documents containing important information about the Company and Ply Gem through the website maintained by the SEC at http : //www . sec . gov . Copies of the documents filed with the SEC by the Company are available free of charge on the Company’s internet website at www . ncibuildingsystems . com under the tab “Investors” and then under the tab “SEC Filings” or by contacting the Company’s Investor Relations department at ( 281 ) 897 - 7785 . PARTICIPANTS IN THE SOLICITATION The Company and its respective directors and executive officers may be deemed to be participants in the solicitation of proxies from the Company’s stockholders in connection with the proposed merger . Information about the persons who may be deemed to be participants in the solicitation of the Company’s stockholders in connection with the proposed merger, including a description of their direct and indirect interests, by security holdings or otherwise, will be set forth in the Company’s definitive proxy statement and other filings with the SEC when they are filed with the SEC . Information about the directors and executive officers of the Company and their ownership of the Common Stock is set forth in the definitive proxy statement for the Company’s 2018 annual meeting of stockholders, as previously filed with the SEC on January 26 , 2018 . Free copies of these documents can be obtained as described in the preceding paragraph . NON - SOLICITATION This communication shall not constitute an offer to sell or the solicitation of an offer to sell or the solicitation of an offer to buy any securities, nor shall there by any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to the registration or qualification under the securities laws of any such jurisdiction . NON - GAAP FINANCIAL MEASURES This document includes certain non - GAAP measures, including Adjusted EBITDA and free cash flow (collectively, the “Non - GAAP Measures”) . These Non - GAAP Measures are performance measures that provide supplemental information that NCI and Ply Gem believe are useful to analysts and investors to evaluate ongoing results of operations, when considered alongside other GAAP measures such as net income, operating income and gross profit . Such measures are not prepared in accordance with U . S . GAAP and should not be construed as an alternative to reported results determined in accordance with U . S . GAAP . These Non - GAAP Measures exclude the financial impact of items management does not consider in assessing the ongoing operating performance of NCI, Ply Gem or the combined company, and thereby facilitate review of its operating performance on a period - to - period basis . Additional information regarding these Non - GAAP measures are available in previously disclosed SEC filings of NCI . The appearance of Non - GAAP Measures in this presentation should not be construed as an inference that its future results will be unaffected by unusual or non - recurring items . Disclaimer

Best Long - Term Alternative for NCI and Its Shareholders 1 Superior value proposition vs. standalone plan x Substantially expands addressable market and transforms NCI from a narrowly - focused metal products player to a broad - based building products manufacturer x Significantly accelerated earnings growth (~24% combined EBITDA growth from 2018 to 2019 vs. ~15% for NCI), with additional upside beyond 2019 x Ongoing cost initiatives and synergies conservatively estimated to generate ~$180+ million by 2020 x Strong free cash flow growth will enable aggressive de - leveraging as well as value - enhancing M&A x Strengthened #1 position in vinyl windows with the acquisition of Andersen’s Silver Line business x Experienced , complementary leadership teams driving integration plans that have already identified significant additional upside over originally announced synergy targets

Combination Enhances Key Performance Metrics End Market Growth Low single digit Mid single digit Mid single digit 2018E Revenue $2.0bn $3.0bn $5.0bn Medium - Term R evenue Growth Mid single digit High single digit High single digit Medium - Term EBITDA Growth Mid teens High teens High teens 2018E PF Adj . EBITDA Margin 12% (2) 14% (2) 14% 2018E Free Cash Flow Conversion (3) 78% 85% 84% Pro Forma (incl. Atrium and Silver Line) Note: Growth reflects projected estimates. (1) IMP = Insulated Metal Panels. (2) Excludes unrealized Merger synergies from combination of NCI and Ply Gem; includes other pro forma adjustments. (3) Conversion defined as (PF Adjusted EBITDA – Capex) / PF Adjusted EBITDA. 2 Incremental Value for NCI x x x x x x

Experienced Leadership Team Already Driving Business Plan x Management in place with integration teams operating across all key functional areas x Integration teams have increased internal synergy targets significantly above originally announced estimates x Operating teams confident in increasing revenues through cross - selling (e.g., stone facades through NCI distribution and steel roofing through Ply Gem distribution) x Meetings with customers who are positive about expanded offerings and capabilities of new NCI Management Team Accomplishments Pre - Closing Pro Forma Organizational Structure 3 Jim Metcalf Chairman and CEO Shawn Poe CFO Don Riley CEO NCI Division Supply Chain & Tech Art Steinhafel President U.S. Windows John Buckley President Siding Todd Moore EVP GC Katy Theroux EVP CHRO Susan Selle CMO John Wallace SVP Integration Mgmt. Office Lee Clark - Sellers Chief Innovation Officer Alan Strassner SVP Corp. Strategy and Bus. Dev. Ron Cauchi President Canada From NCI From Ply Gem x Highly complementary leadership teams and competencies

Robust and Enhanced Growth Driven by Cost Initiatives and Synergies ~ $5 50 ~$200 ~ $230 ~ $ 350 ~ $ 435 ~$15 2 0 1 8E Pro Forma Adjusted EBITDA ($ in millions) ~$ 695 – $ 715 4 NCI Realized NCI + Ply Gem Synergies Total unrealized cost initiatives + synergies Ply Gem ~$7 5 5 – $ 7 7 5 Pro Forma Pro Forma Combined Combined ~ $ 680 $180+ of cost savings 2 0 1 9 E Pro Forma Adjusted EBITDA

10.7x 9.4x 8.8x 8.0x 7.6x 7.2x 7.2x 6.8x 6.5x 6.2x 6.1x 5.9x 5.9x 5.7x ~24% 19% 15% 14% 14% 14% 12% 11% 11% 10% 10% 8% 7% 3% Source: Financial data and broker consensus estimates per FactSet as of 10 / 26 /18. Interface, JHX and OC pro forma for acquisitions. (1) Includes incremental run - rate cost savings and synergies of $ 85 m in 2019E. Stock Price Does Not Reflect Expected Growth and Value Potential 5 Current (1) + Peer Valuation Multiples (EV / CY2019E EBITDA) Peer EBITDA Growth (CY2018E – CY2019E) Current (1) + Median: 7 . 2 x Median: 11%

Short - Term Stock Reaction Does Not Reflect Long - Term Value 6 65 66 20 40 60 80 100 120 140 160 Jan-18 Feb-18 Apr-18 May-18 Jul-18 Sep-18 Oct-18 NCI Building Products Peers Median (35%) (34%) % Dec. YTD Indexed Stock Performance Source: Financial data per FactSet as of 10/26/18. (1) Building Product Peers comprised of companies from previous page Big change in investment thesis and technical trading factors resulted in price pressure following announcement − Shift from short - term, pure - play commercial construction momentum thesis to long - term investment in diversified end - markets − Substantial increase in scale − Greater financial leverage − Limited investor visibility to Ply Gem business plan and value of merger with Atrium Resulting selling pressure was magnified by NCI’s limited free float Key Factors Impacting Stock Price Momentum in commercial cycle and strong NCI earnings Merger announcement changes investment thesis Market and sector decline due to economic uncertainty (1)

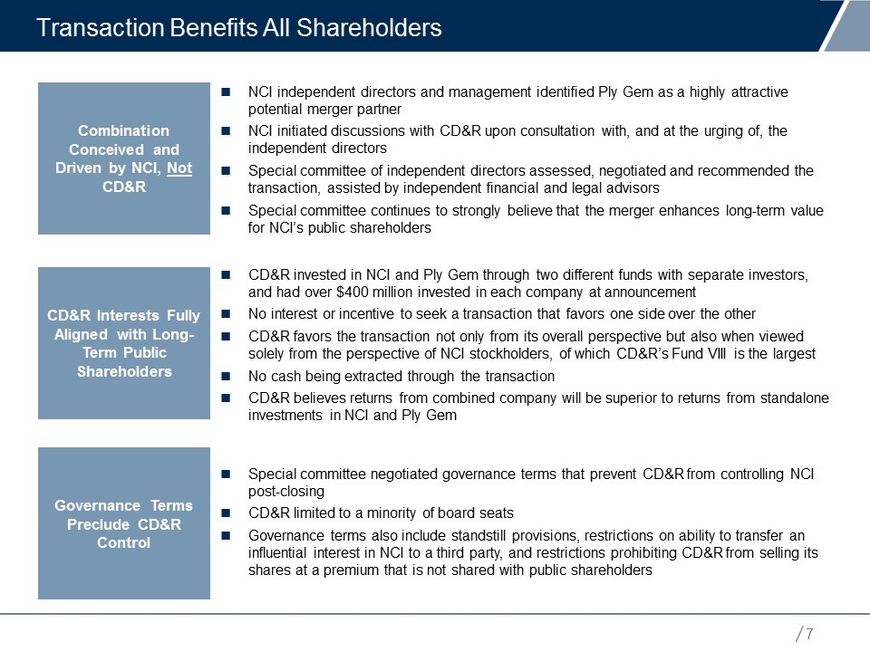

Transaction Benefits All Shareholders 7 Combination Conceived and Driven by NCI, Not CD&R CD&R Interests Fully Aligned with Long - Term Public Shareholders Governance Terms Preclude CD&R Control CD&R invested in NCI and Ply Gem through two different funds with separate investors, and had over $400 million invested in each company at announcement N o interest or incentive to seek a transaction that favors one side over the other CD&R favors the transaction not only from its overall perspective but also when viewed solely from the perspective of NCI stockholders, of which CD&R’s Fund VIII is the largest No cash being extracted through the transaction CD&R believes returns from combined company will be superior to returns from standalone investments in NCI and Ply Gem NCI independent directors and management identified Ply Gem as a highly attractive potential merger partner NCI initiated discussions with CD&R upon consultation with, and at the urging of, the independent directors Special committee of independent directors assessed, negotiated and recommended the transaction, assisted by independent financial and legal advisors Special committee continues to strongly believe that the merger enhances long - term value for NCI’s public shareholders Special committee negotiated governance terms that prevent CD&R from controlling NCI post - closing CD&R limited to a minority of board seats Governance terms also include standstill provisions, restrictions on ability to transfer an influential interest in NCI to a third party, and restrictions prohibiting CD&R from selling its shares at a premium that is not shared with public shareholders

Key Investment Highlights Market leading North American exterior building products company with scale 1 ƀ Value creation through ongoing cost initiatives and synergies 4 6 Strong projected earnings growth and free cash flow generation Expansive advantaged platform with complementary strengths 5 Comprehensive product offering with enhanced growth opportunity 2 Proven platform for industry consolidation 3 8

$6.1 $6.0 $4.9 $4.6 $4.5 $3.2 $2.8 $2.2 $1.8 $1.7 $1.6 $1.3 $1.3 $1.0 $1.0 $0.8 $0.6 $0.5 $0.5 $0.5 MAS MHK FBHS Ply Gem + NCI OC USG Ply Gem JELD NCI DOOR JHX APOG AMWD ROCK AWI SSD TREX TILE PGTI CBPX North American Revenue of Selected Building Products Players ($ in Billions) U.S. Market Leadership in Numerous Categories Increased Scale Benefits #1 in U.S. & Canada Vinyl Siding #1 in U.S. Vinyl Windows #1 in Metal Accessories x One - stop - shop solution for exterior building products x Deepened product development capabilities x Cost and operating efficiencies x Greater ability to attract and retain top talent x Broadened universe of acquisition targets Market Leading N. A. Exterior Building Products Company with Scale + + Note: Latest fiscal year revenue in North America. (1) Assumes exterior component of Owens Corning includes Roofing segment (~40%). (2) Pro forma for Silver Line. x Market leader in exterior building products x Top 4 of the broader building products peer group Exterior B uilding Products Companies (1) (2) #1 in Insulated Metal Panels #1 in Metal Roof and Wall Systems 9 1

Comprehensive Product Offering with Enhanced Growth Opportunity Metal Roofing Commercial Windows IMP Single Skin Metal Panels Overhead Doors Building Systems Windows Vinyl Siding Trim / Gutters Fencing / Railing Stone Shutters Steel Siding Other Intermediate Steel Products Commercial Residential Metal Roofing Current Offerings Stone / Fencing Growth and Potential M&A Opportunities Garage / Overhead Doors Skylights Residential Entry Doors Punched Windows Curtain Wall Exterior / Entry Doors Immediate Cross - Selling Medium to Long - Term Adjacency Expansion Roofing Insulation Insulation Composite, Asphalt and Other Roofing Storefront / Commercial Windows PVC Drainpipe Storefront Systems Building Wrap / Weather Barrier 10 2

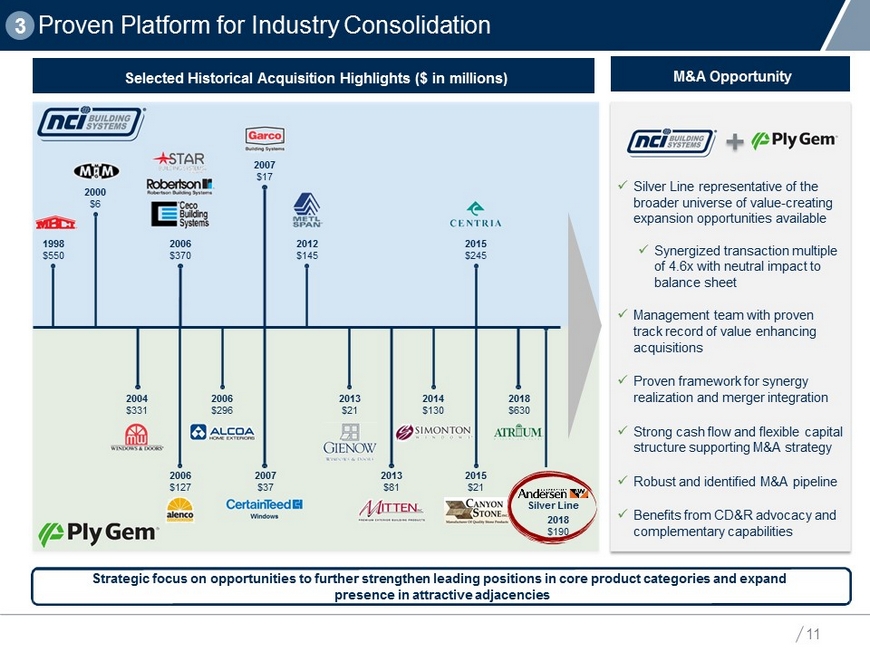

3 Strategic focus on opportunities to further strengthen leading positions in core product categories and expand presence in attractive adjacencies x Silver Line representative of the broader universe of value - creating expansion opportunities available x Synergized transaction multiple of 4.6x with neutral impact to balance sheet x Management team with proven track record of value enhancing acquisitions x Proven framework for synergy realization and merger integration x Strong cash flow and flexible capital structure supporting M&A strategy x Robust and identified M&A pipeline x Benefits from CD&R advocacy and complementary capabilities Proven Platform for Industry Consolidation 2006 $127 2007 $37 2013 $81 2015 $21 2004 2006 2013 2014 2018 $331 $296 $21 $130 $630 2006 $370 2007 $17 2012 $145 2015 $245 2000 $6 1998 $550 Selected H istorical A cquisition H ighlights ($ in millions) M&A O pportunity 2018 $ 190 Silver Line 11

Value Creation Through Ongoing Cost Initiatives And Projected Synergies G&A − Headcount rationalization Manufacturing efficiencies − Consolidating vendor spend − Plant consolidation Procurement − Aluminum and paint purchases Advanced manufacturing − Process automation and labor savings − Improved yield and product quality Continuous improvement and procurement − Waste elimination − Six sigma implementation Engineering & Drafting − North America consolidation and off - shoring Atrium and Silver Line synergies − Manufacturing, procurement, logistics and G&A Manufacturing efficiencies − U.S. Windows footprint consolidation − Labor and variable overhead reduction − Raw material efficiencies Procurement savings − Improved raw material sourcing − Centralized supply chain functions Streamlined organization, functions and processes − Back office consolidation Ply Gem NCI Merger Synergies ~$45 ~$90 ~$45 ~$25 ~$100 ~$ 180+ 2018E 2019E Run Rate Cost Initiatives and Cost Synergies ($ in millions) Ply Gem Cost Initiatives + Synergies NCI Cost Initiatives Merger Synergies Cost and revenue synergies will expand as businesses continue to be integrated Realization of Cost Initiatives and Cost Synergies 12 4

63% 37% x Serve both commercial and residential markets x Capability across both new construction and repair & remodel (“R&R”) x Ability to cross - sell across residential and commercial end markets (e.g., commercial windows, metal roofing and stone) x World class lean manufacturing operation x Vertically integrated x Best - in - class automation capabilities and high ROI initiatives x Lean manufacturing culture and commitment to continuous improvement x Vertically integrated x Foundation Labs advancing product innovation x Dedicated R&D resources and design center x Vast builder, distributor, architect and big box network x Long - standing relationships x National footprint x Legacy brands with strong customer support Broader Customer and Go - to - Market Platform Enhanced Reach to All Segments of the Construction Market Best - in - Class Manufacturing and Innovation Vertically Integrated Manufacturing Model with Best - in - Class Operations Delivering a Broad Exterior Building Product Portfolio to Serve All Channels of the Construction Market Residential (1) Commercial Expansive Advantaged Platform With Complementary Strengths (1) Pro Forma for Silver Line acquisition. 13 5

Strong Projected Earnings Growth ~$ 1 45 – $ 1 65 ~ $5 50 Combined x Both NCI and Ply Gem expecting strong growth through 2019 x Continued momentum in commercial and residential construction x Growth initiatives x Cost savings programs x Combination synergies start to be realized x Conservatively expect ~$15 million in 2019 x 2018 - 2019 Adj. EBITDA growth expands from 15% to 24% due to combination x Forecasting combined revenue and EBITDA growth of mid - single digits and high - teens, respectively, over the next several years x Additional upside from revenue synergies not factored into forecast x Cross - selling x Adjacencies ~$200 ~$20 ~$10 ~ $230 ~ $ 350 ~$ 45 ~$ 40 ~ $ 435 ~$15 ~$15 ~$ 65 ~$ 6 5 2 0 1 8E G rowth Realized Cost Savings 2 0 1 9E NCI Ply Gem Realized NCI + Ply Gem Synergies ($ in millions) Total unrealized cost initiatives + synergies Ply Gem cost initiatives + Atrium and Silver Line synergies NCI cost initiatives Transaction synergies ~$ 695 – $ 715 Pro forma ~$ 7 5 5 – $ 7 7 5 Pro forma ~$ 75 – $ 95 ~$ 680 Combined Pro Forma Adjusted EBITDA Commentary 6 Note: Based on projected figures presented to potential lenders on October 17, 2018 14

Strong Free Cash Flow Will Enable Rapid De - leveraging 7 /3 1 /2018 2020E / 2021E x Target net leverage of 2.0 – 3.0x Adj. EBITDA x No leverage covenants & no significant maturities until 2025 x Significant excess cash flow generation after investment in organic growth initiatives enables prudent capital allocation x Debt paydown – a clear priority x Strategically compelling M&A will be considered if leverage neutral or better Pro Forma Projected Net Leverage (1) Commentary Source: Management. (1) Includes run - rate cost saving initiatives and synergies. 4. 5 x ~2.0x – 3.0x 15 6

Appendix

NCI 8% Other NCI 48% #2 45% Other NCI 22% Other NCI 40% Other NCI Overview Source: NCI management. Note: Based on October fiscal year end. (1) Represents unrealized cost efficiencies from standalone NCI cost savings initiatives. Highlights PF Adjusted EBITDA and Margin $199 $231 $76 $130 $166 $167 $235 $252 6% 8% 10% 9% 12% 13% 2014A 2015A 2016A 2017A 2018E 2019E Adj. EBITDA Unrealized Cost Initiatives % Margin Market Share (1) North America’s largest integrated manufacturer of metal building products for the commercial construction industry Four vertically integrated market segments − Metal Coil Coatings − Insulated Metal Panels (“IMP”) − Metal Components − Engineered Building Systems Leading market positions across the portfolio Large end - markets provide broad customer diversification Manufacturing footprint strategically located to serve key markets ($ in millions) #1 Insulated Metal Panels #1 Heavy Gauged Hot Rolled Steel Coating #1 Metal Components #2 Engineered Building Systems 16

Ply Gem 40% #2 #3 #4 Other $350 $435 $184 $239 $294 $310 $ 424 $469 10% 11% 13% 13% 14% 14% 2014A 2015A 2016A 2017A 2018PF 2019PF Ply Gem (Incl. Atrium) Unrealized Cost Savings & Synergies % Margin Ply Gem 18% Atrium 4% Silver Line 8% #2 #3 #4 Other Ply Gem Overview Source: Vinyl Siding Institute, Ply Gem management. Note: Based on calendar year end . Silver Line included in 2018PF and 2019PF (1) Represent unrealized Ply Gem standalone cost initiatives and unrealized cost synergies related to Atrium and Silver Line tra nsactions. Highlights Leader in exterior residential building products, with #1 positions in U.S. & Canada vinyl siding , U.S. vinyl windows and metal accessories Balanced exposure across end markets, channels and geographies Favorable tailwinds from continued residential recovery and outsized growth in entry - level housing where vinyl is most prevalent Attractive cash flow profile given limited capex and modest net working capital requirements Track record of driving operational improvements, integrating M&A and outperforming cost synergy targets #1 U.S. Vinyl Siding Market Share Adjusted EBITDA and Margin #1 U.S. Vinyl Windows Market Share (Units) Kaycan 4% Other 3% Market Share (1) ($ in millions) 17 Combined 30%

Our Mission & Vision Attractive Transaction Multiple for Ply Gem + Atrium 18 Source: Management and public filings. Note: CD&R transaction multiples shown include fees. Current Ply Gem transaction multiples shown include fees and present value of NOLs. (1) LTM (2017) excludes $30mm of run - rate Atrium synergies, NTM (2018) excludes $25mm of unrealized run - rate Atrium synergies. (2) Includes fees. (3) Price and est. EBITDA as of 10/26/18 . (4) Excludes incremental cost savings and synergies of $100 million in 2018E and $65m in 2019E. (5) Multiple based on FY 2018E EBITDA (mid - point) as announced in press release dated 7/24/18. (6) Implied LTM EBITDA calculated using target leverage at close, per 8/2/16 press release. (7) LTM EBITDA assumes 38% tax ra te, per go - forward tax rate disclosed in 10/10/14 acquisition conference call. (8) Multiple based on FY 2014E EBITDA as announced in FBHS acquisition related press release dated 9/22/14 . (9) Multiple based on FY 2009A adj. EBITDA. Selected Precedent Exterior Building Products Transactions (EV / LTM EBITDA) 10.2x 9.3x LTM NTM 8.5x 7.6x 7.6x 6.8x At Announcement At Current Price 2018PF 2019PF 10.9x 11.4x 11.0x 10.0x 11.9x 11.8x 11.6x 11.8x 11.6x 11.9x At Announcement Hellman & Friedman / AMI Ares / OTPP / CPG Ply Gem / Simonton PGT / CGI PGT / WinDoor Headwaters / Krestmark Boral / Headwaters Knauf / USG PGT / Western Window Systems (1) CD&R / Ply Gem & Atrium Transaction (EV / EBITDA) Current Implied Ply Gem Valuation (EV / EBITDA) (3) (8) 10.9x 9.1x 10.0x 7.9x Median: 11.6x Excluding synergies (4) (5) TEV (2) : ~$3.2B (1) (9) (6) (7) TEV: ~$ 3.7B TEV: ~$ 3.2B