Attached files

| file | filename |

|---|---|

| 8-K - 8-K - HomeTrust Bancshares, Inc. | htbi-20181105x8k.htm |

Sandler O’Neill East Coast Financial Services Conference November 6 – 7, 2018 Positionedgrowth for

Forward-Looking Statements This presentation includes “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Such statements often include words such as “believe,” “expect,” “anticipate,” “estimate,” and “intend” or future or conditional verbs such as “will,” “would,” “should,” “could,” or “may.” Forward-looking statements are not historical facts but instead represent management’s current expectations and forecasts regarding future events many of which are inherently uncertain and outside of our control. Actual results may differ, possibly materially, from those currently expected or projected in these forward-looking statements. Factors that could cause our actual results to differ materially from those described in the forward-looking statements, include expected cost savings, synergies and other financial benefits from acquisitions might not be realized within the expected time frames or at all, and costs or difficulties relating to integration matters might be greater than expected; increased competitive pressures; changes in the interest rate environment; changes in general economic conditions and conditions within the securities markets; legislative and regulatory changes; and other factors described in HomeTrust’s latest annual Report on Form 10-K and Quarterly Reports on Form 10-Q and other filings with the Securities and Exchange Commission- which are available on our website at www.hometrustbanking.com and on the SEC’s website at www.sec.gov. Any of the forward-looking statements that we make in this presentation or our SEC filings are based upon management’s beliefs and assumptions at the time they are made and may turn out to be wrong because of inaccurate assumptions we might make, because of the factors illustrated above or because of other factors that we cannot foresee. We do not undertake and specifically disclaim any obligation to revise any forward-looking statements to reflect the occurrence of anticipated or unanticipated events or circumstances after the date of such statements. These risks could cause our actual results for fiscal 2019 and beyond to differ materially from those expressed in any forward-looking statements by, or on behalf of, us and could negatively affect our operating and stock performance. Positioned for growth 2

HomeTrust Bancshares, Inc. Overview Headquarters: Asheville, NC Exchange/Ticker: NASDAQ: HTBI Number of Founded: 1926 525 Employees: Locations: 43 (NC, SC, VA, TN) Stock Price: $27.33 Total Assets: $3.4 billion Price to TBV: 133% Total Loans: $2.6 billion Market Cap: $511.2 million Average Daily Total Deposits: $2.2 billion 40,456 Volume: Outstanding Shares: 5,728,765 18,705,880 Shares Repurchased (since Feb 19, 2013) or approx. 26% Financial data as of September 30, 2018 Market data as of November 1, 2018 Positioned for growth 3

Foundation for Growth and Performance • Converted to stock in July 2012 raising $211.6MM • Added 7 larger growing markets in NC, SC, VA and East TN since conversion • 4 whole bank acquisitions • 3 new Commercial Loan Production Offices from “lift-outs” of existing commercial lending teams • Purchased 10 Bank of America branches • Added new metro markets with populations of more than 5.4 million to legacy markets of 900,000 • Hired key experienced team members to buildout infrastructure to transition from rural thrift to commercial bank in metro markets • Chief Credit Officer – Create strong credit culture and processes • Chief Risk Officer – Oversee enterprise risk management • Director of Mortgage Lending – Reinvent line of business and expand into metro markets • Consumer Banking Executive – Focus on improving retail and consumer lines of business • Commercial Banking Executive – Driving a relationship banking model • Director of Treasury Management – Develop products and enhance fees to drive noninterest income • Hired 36 new Commercial Market Presidents / Commercial Relationship Managers / Line of Business Executives to grow commercial lending Positioned for growth 4

Foundation for Growth and Performance (cont.) • Reinvented business lines • Mortgage – streamlined origination process and increased rates to enhance gain on loan sales • Home Equity Lines of Credit – new origination platform focusing on retail branch originations • Retail Offices – consolidated 10 offices and optimized staffing to better address customer trends • Municipal Finance – acquired municipal leasing company for future growth • Added new lines of business and experienced leaders • Indirect Auto Finance - grown portfolio to over $170 million over past four years • Treasury Management – growth of deposits and fee income • SBA 7(a) Loan Program – noninterest income from sales • Equipment Finance – future loan growth at higher yields • Added 23 new locations and $1.7 billion in assets • Grown to the 2nd largest community bank headquartered in NC • Only remaining bank headquartered in Asheville, NC – Top 10 City in America (Source: Travel and Leisure) Positioned for growth 5

Current Focus pFoundation for growth and performance Value Creation for Shareholders • EPS growth • Increasing franchise value • Investing in the future with enhanced/new lines of business • Core deposit growth • Noninterest income growth • Opportunistic acquisition strategy • Reinitiating stock buyback program – July 2018 • Initiated quarterly cash dividends – November 2018 Positioned for growth 6

Improving Earnings Performance Dollars in thousands $35,000 $1.70 $1.64 $31,160 $1.50 $30,000 $1.38 4-Year EPS CAGR of 33% $1.30 $25,000 $1.10 $20,000 $0.94 $23,370 $0.90 $0.61 $17,111 $0.70 $15,000 $0.70 $25,886 $0.44 $0.50 $12,228 $11,784 $10,000 $0.30 $8,256 $7,790 $5,000 Net Income $0.10 $- $(0.10) 2014 2015 2016 2017 2018 Q1 FY19 Net Income - Annualized Net Income - Adjusted See Non-GAAP Disclosure Appendix Diluted EPS - Adjusted Positioned for growth 7

ROA Trajectory – Adjusted Return on Assets1 1.00% 0.94% Normalized EPS Growth with Upward Momentum 0.90% . EPS increased 185.2% from FY14 0.80% 0.80% 0.70% 0.60% 0.58% 0.49% 0.50% 0.47% 0.45% 0.40% 0.30% 0.20% 0.10% 0.00% 2014 2015 2016 2017 2018 Q1 FY19 (2) (1) See Non-GAAP Disclosure Appendix (2) Unadjusted ROA for Q1 FY19 Positioned for growth 8

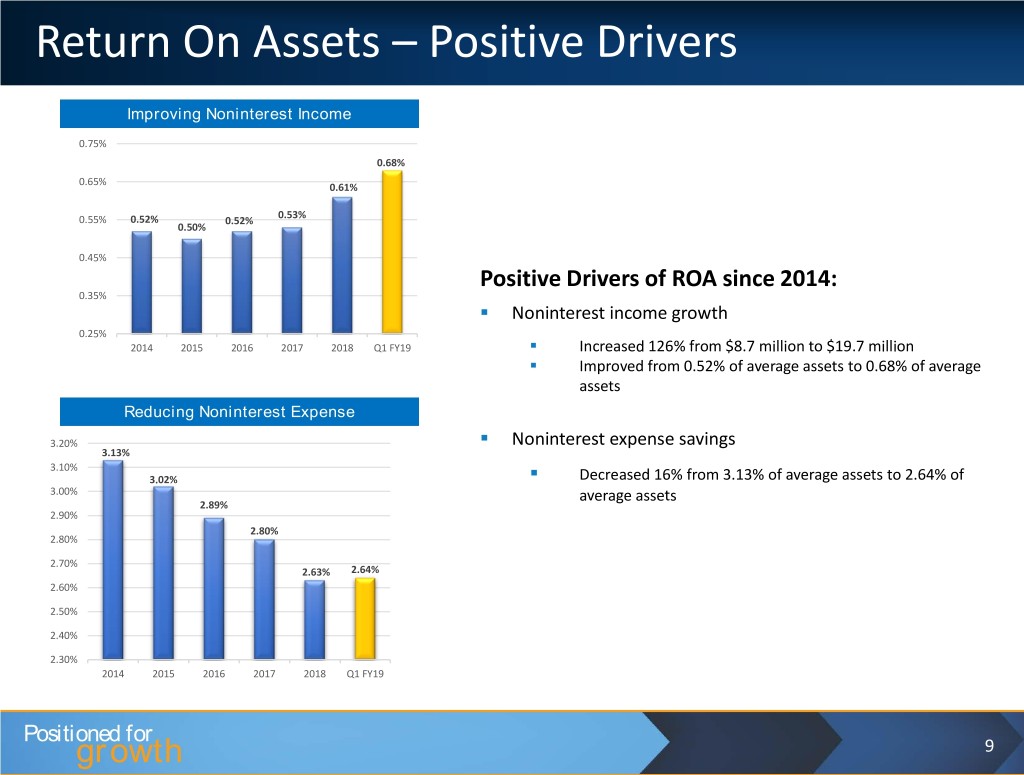

Return On Assets – Positive Drivers Improving Noninterest Income 0.75% 0.68% 0.65% 0.61% 0.53% 0.55% 0.52% 0.52% 0.50% 0.45% Positive Drivers of ROA since 2014: 0.35% . Noninterest income growth 0.25% . 2014 2015 2016 2017 2018 Q1 FY19 Increased 126% from $8.7 million to $19.7 million . Improved from 0.52% of average assets to 0.68% of average assets Reducing Noninterest Expense . 3.20% Noninterest expense savings 3.13% 3.10% . 3.02% Decreased 16% from 3.13% of average assets to 2.64% of 3.00% average assets 2.89% 2.90% 2.80% 2.80% 2.70% 2.63% 2.64% 2.60% 2.50% 2.40% 2.30% 2014 2015 2016 2017 2018 Q1 FY19 Positioned for growth 9

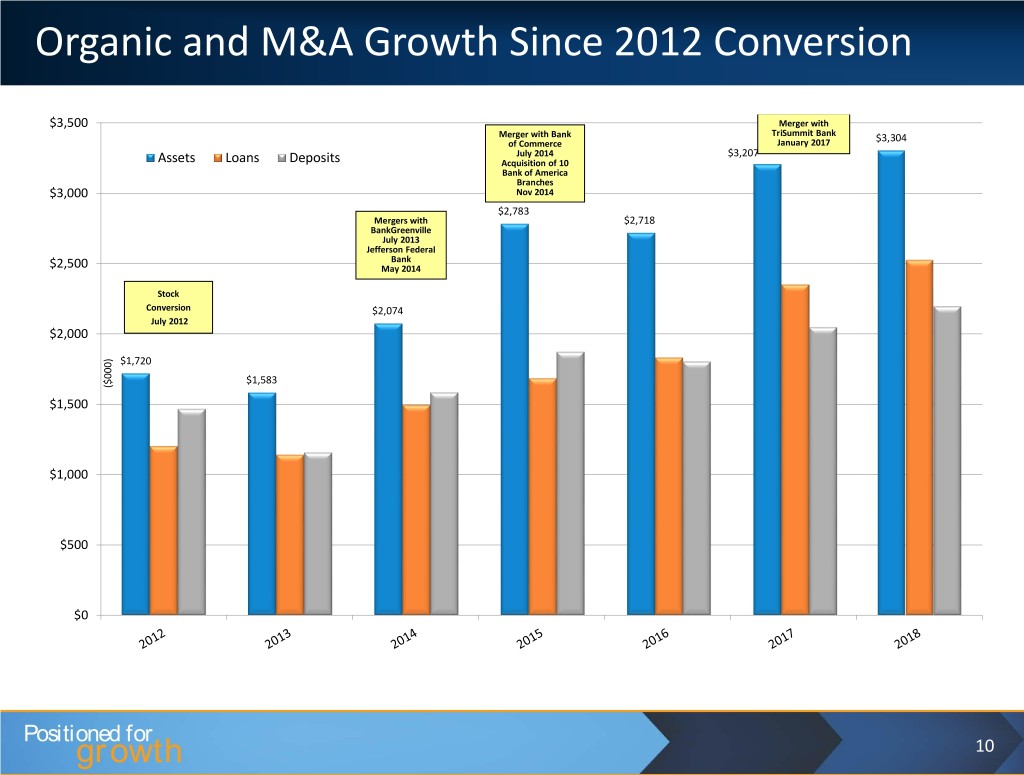

Organic and M&A Growth Since 2012 Conversion $3,500 Merger with Merger with Bank TriSummit Bank $3,304 of Commerce January 2017 July 2014 $3,207 Assets Loans Deposits Acquisition of 10 Bank of America Branches $3,000 Nov 2014 $2,783 Mergers with $2,718 BankGreenville July 2013 Jefferson Federal Bank $2,500 May 2014 Stock Conversion $2,074 July 2012 $2,000 $1,720 $1,583 ($000) $1,500 $1,000 $500 $0 Positioned for growth 10

Strong Footprint for Growth 613% Increase in Market Population since 2012 Positioned for growth 11

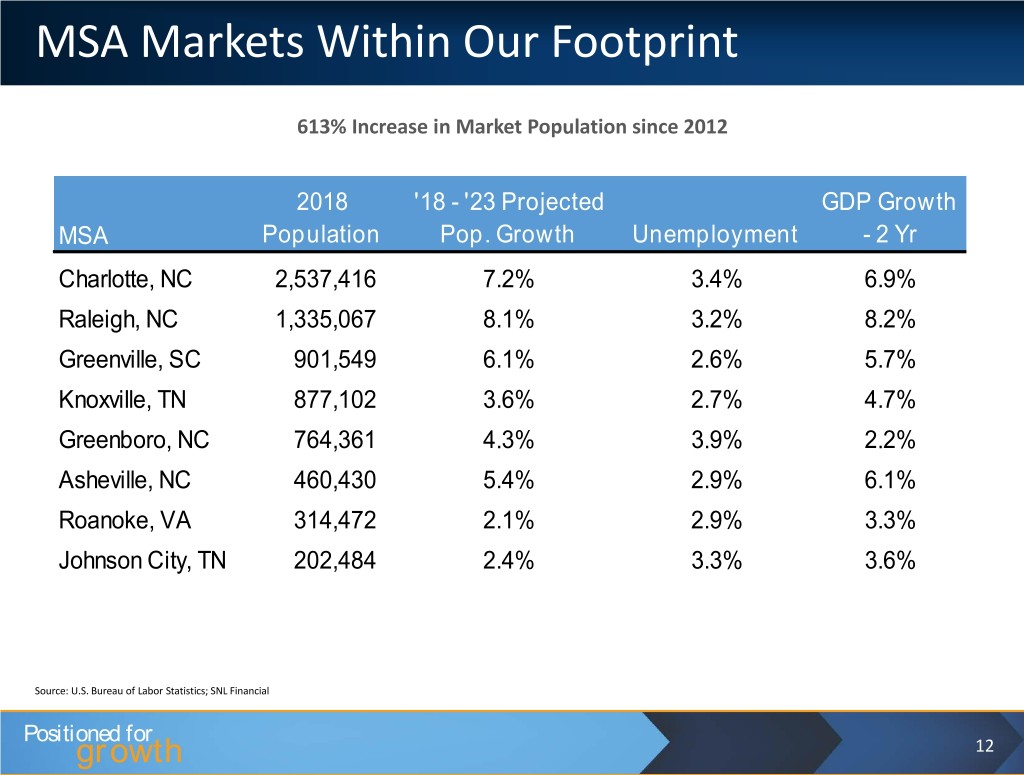

MSA Markets Within Our Footprint 613% Increase in Market Population since 2012 2018 '18 - '23 Projected GDP Growth MSA Population Pop. Growth Unemployment - 2 Yr Charlotte, NC 2,537,416 7.2% 3.4% 6.9% Raleigh, NC 1,335,067 8.1% 3.2% 8.2% Greenville, SC 901,549 6.1% 2.6% 5.7% Knoxville, TN 877,102 3.6% 2.7% 4.7% Greenboro, NC 764,361 4.3% 3.9% 2.2% Asheville, NC 460,430 5.4% 2.9% 6.1% Roanoke, VA 314,472 2.1% 2.9% 3.3% Johnson City, TN 202,484 2.4% 3.3% 3.6% Source: U.S. Bureau of Labor Statistics; SNL Financial Positioned for growth 12

Building a High-Performing Commercial Lending Team Changes in the past 6 years Commercial lenders in legacy markets – June 2012 6 Attrition in legacy markets (5) Hired/replaced in legacy markets 5 Acquired through bank acquisitions 21 Attrition after bank acquisitions (19) Hired/replaced in acquired markets 9 “Lift-outs” of commercial teams in 3 new metro markets 9 _____ Current Market Presidents/Commercial Relationship Managers 26 New lines of business: SBA 4 Equipment Finance 5 Business Banking 4 ____ High Performing Commercial Lending Team – October 2018 39 Positioned for growth 13

Adding Talent for Growth Commercial and Line of Business Leaders Hunter Positioned for growth 14

Loan Highlights – Fiscal 2018 Loan Portfolio Growth: . Organic loan growth of 8% ($171MM) in FY 2018 . 24% growth in C&I loans ($28MM) . 17% growth in CRE ($127MM) . 23% growth in indirect auto loans ($32MM) Recent Highlights/Enhancements: . Hired 13 new Commercial Market Presidents/Relationship Managers in last 12 months . Hired/replaced 36 Commercial Market Presidents/Relationship Managers in last 5 years . Began new SBA 7(a) loan program which produced over $1MM in noninterest income in FY 2018 . SBA team of 4 now in place since January 2018 . Developed new Equipment Finance line of business which produced over $33MM in originations in first quarter of fiscal 2019 . Equipment Finance team of 5 now in place since May 2018 . New Greensboro Commercial Loan Production Office with focus on C&I lending . Team of 5 in Greensboro . Added 12 new mortgage loan officers in the last 12 months in 5 new metro markets Positioned for growth 15

New SBA Line of Business Strategy . Originate SBA 7(a) and USDA B&I loan facilities to provide additional lending products for deeper customer service and have a more robust basket of tools from which to compete. . SBA 7(a) and USDA B&I allows the Bank to offer non-traditional clients financing options while the Bank obtains a government guaranty, typically at 75% of the gross loan amount. . This lending can be a means to continue to serve client’s needs when the Bank is nearing concentration limits. . The originations can drive high levels of noninterest income through the sale of the guaranteed portion of the loan. The Bank then retains the unguaranteed portion, typically on an adjustable rate structure at a spread over the Prime Rate. Dollars in thousands $30,000 Total Originations Net Gain on Sale $1,200 $25,000 $1,000 $20,000 $800 $4,714 $15,000 $600 $3,206 $10,000 $898 $400 $14,141 1 $5,000 $1,447 $867 $9,618 $500 $86 $200 $4,342 $310 $258 $2,600 1 $244 $0 $18 $0 Q1 FY18 Q2 FY18 Q3 FY18 Q4 FY18 Q1 FY19 1 Q1 FY18 Q2 FY18 Q3 FY18 Q4 FY18 Q1 FY19 Guaranteed Balance Residual Balance Positioned for growth 16

New Equipment Finance Strategy . Offers a variety of solutions including leases, loans, and commercial finance agreements. . Target industries and equipment types include: manufacturing, machine tools, material handling, construction, transportation, and other essential use commercial equipment . Typical transaction size ranges from $25,000 to $1 million, with an average size of $300,000 . Short duration product with financing terms range from 24 to 84 months, with an average of 60 months Portfolio Analysis Industry and Equipment Type $90,000 5.24% 5.30% Dollars in thousands $80,000 5.20% 5.17% $10,001 $70,000 5.03% 5.10% $15,650 $60,000 5.00% $50,000 4.81% 4.90% $40,000 $80,349 $16,750 4.80% $30,000 $7,780 $49,349 4.70% $20,000 $3,111 $10,000 $22,508 4.60% $2,388 $5,145 $0 4.50% $1,732 Jan-Mar 2018 Apr-Jun 2018 Jul-Sep 2018 Oct-Dec 2018 (1) Construction Transportation Manufacturing Avg Gross Receivable Avg Yield Material Handling Medical/Office/Other Municipal Trailers (1) Projections are based on current receivables and current pipeline Positioned for growth 17

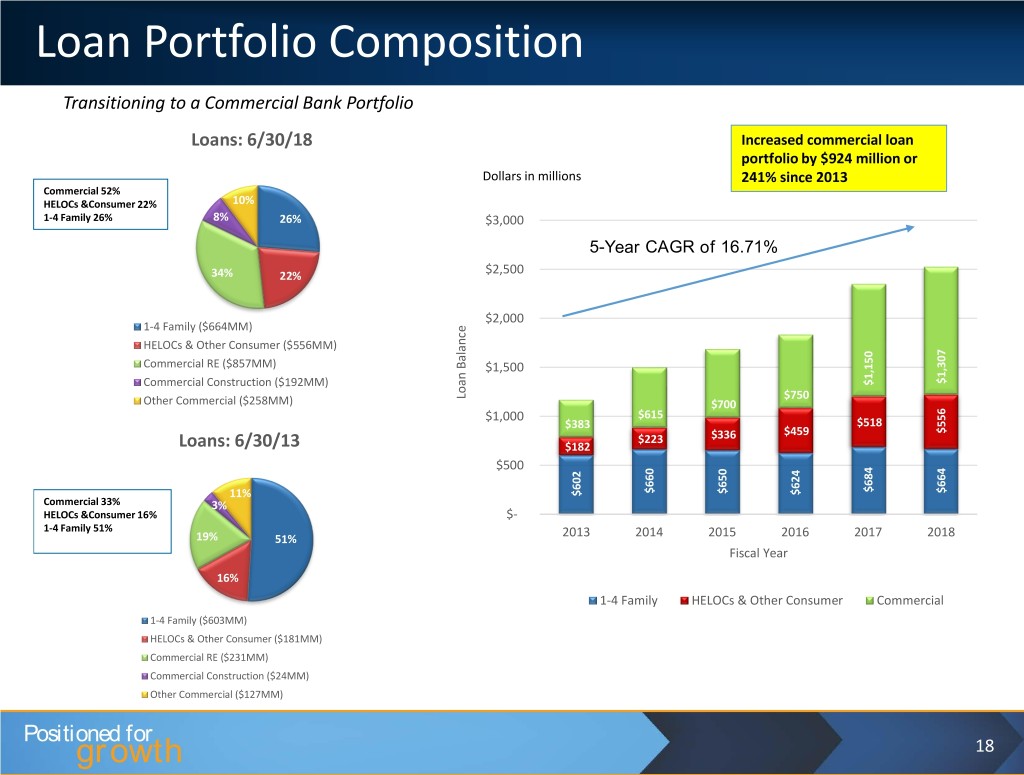

Loan Portfolio Composition Transitioning to a Commercial Bank Portfolio Loans: 6/30/18 Increased commercial loan portfolio by $924 million or Dollars in millions 241% since 2013 Commercial 52% HELOCs &Consumer 22% 10% 1-4 Family 26% 8% 26% $3,000 5-Year CAGR of 16.71% 34% 22% $2,500 $2,000 1-4 Family ($664MM) HELOCs & Other Consumer ($556MM) Commercial RE ($857MM) $1,500 $1,307 $1,307 Commercial Construction ($192MM) $1,150 LoanBalance $750 Other Commercial ($258MM) $700 $1,000 $615 $383 $518 $459 $556 $223 $336 Loans: 6/30/13 $182 $500 $684 $684 $664 $664 $660 $660 $650 $650 $624 $624 11% $602 Commercial 33% 3% HELOCs &Consumer 16% $- 1-4 Family 51% 2013 2014 2015 2016 2017 2018 19% 51% Fiscal Year 16% 1-4 Family HELOCs & Other Consumer Commercial 1-4 Family ($603MM) HELOCs & Other Consumer ($181MM) Commercial RE ($231MM) Commercial Construction ($24MM) Other Commercial ($127MM) Positioned for growth 18

Commercial Real Estate Composition ($857MM) As of 6/30/18 13% 12% 4% 5% 27% 9% 10% 11% 9% Multifamily Owner Occupied Office Retail Hospitality Shopping Centers Industrial Healthcare Other Positioned for growth 19

Total Loan Production Total Loan Dollars in thousands Total Loan Production: Production: $1,042,182 $983,186 $20,228 1,000,000 $17,251 $28,453 $21,038 $84,707 $99,558 $49,794 Total Loan $60,118 Production: 800,000 $697,146 $11,118 Total Loan $305,153 Production: $289,983 $87,844 $528,376 600,000 $54,598 $15,282 Total Loan $53,010 Originations Production: $49,841 $216,033 400,000 $320,071 $15,814 $213,341 $33,324 $9,598 $524,264 $520,786 200,000 $191,199 $325,537 $194,887 $68,122 0 2014 2015 2016 2017 2018 Fiscal Year Commercial 1-4 Family HELOC/Consumer Indirect Auto Municipal Finance SBA Equipment Finance Positioned for growth 20

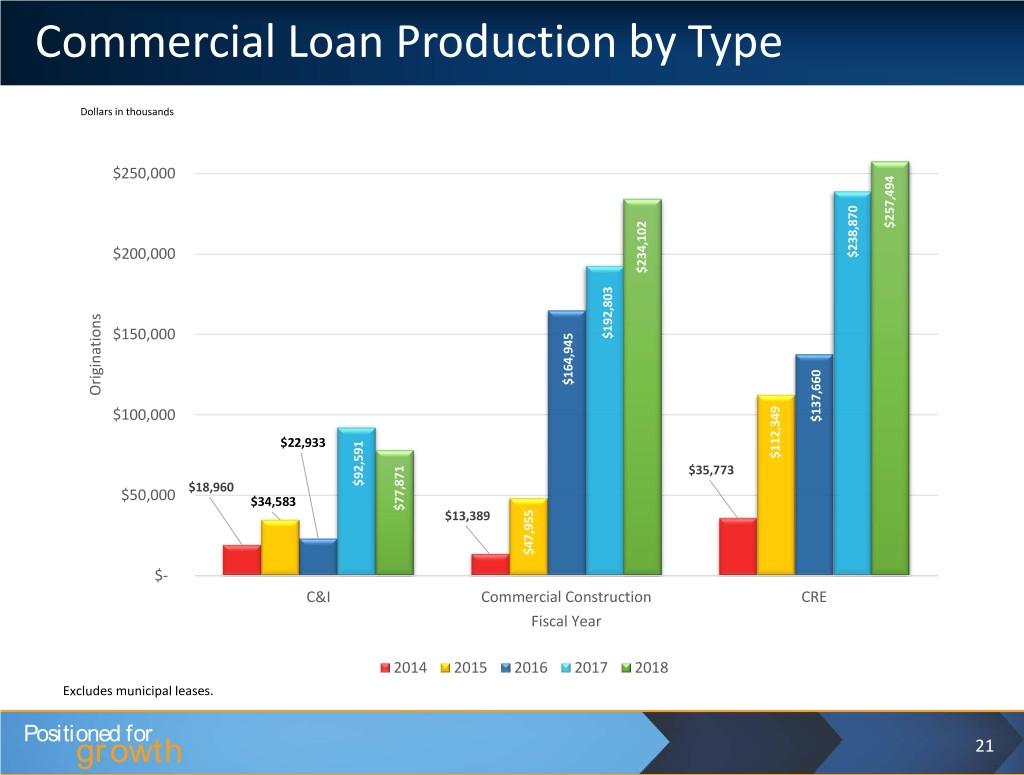

Commercial Loan Production by Type Dollars in thousands $250,000 $257,494 $257,494 $200,000 $238,870 $234,102 $234,102 $150,000 $192,803 $164,945 $164,945 Originations $100,000 $137,660 $22,933 $112,349 $112,349 $35,773 $18,960 $92,591 $50,000 $34,583 $77,871 $77,871 $13,389 $47,955 $47,955 $- C&I Commercial Construction CRE Fiscal Year 2014 2015 2016 2017 2018 Excludes municipal leases. Positioned for growth 21

Consumer Loan Production Dollars in thousands $120,000 Since 2014, Indirect Auto has provided 14,000 additional in-market retail customers for cross-sale opportunities. $100,000 $80,000 $99,558 $84,707 $84,707 $87,844 $87,844 $60,000 Originations $60,118 $60,118 $40,000 $53,010 $53,010 $49,794 $49,794 $54,598 $54,598 $20,000 $49,841 $49,841 $9,598 $0 $33,324 $33,324 $- HELOC-originated/Consumer Indirect auto Fiscal Year 2014 2015 2016 2017 2018 Positioned for growth 22

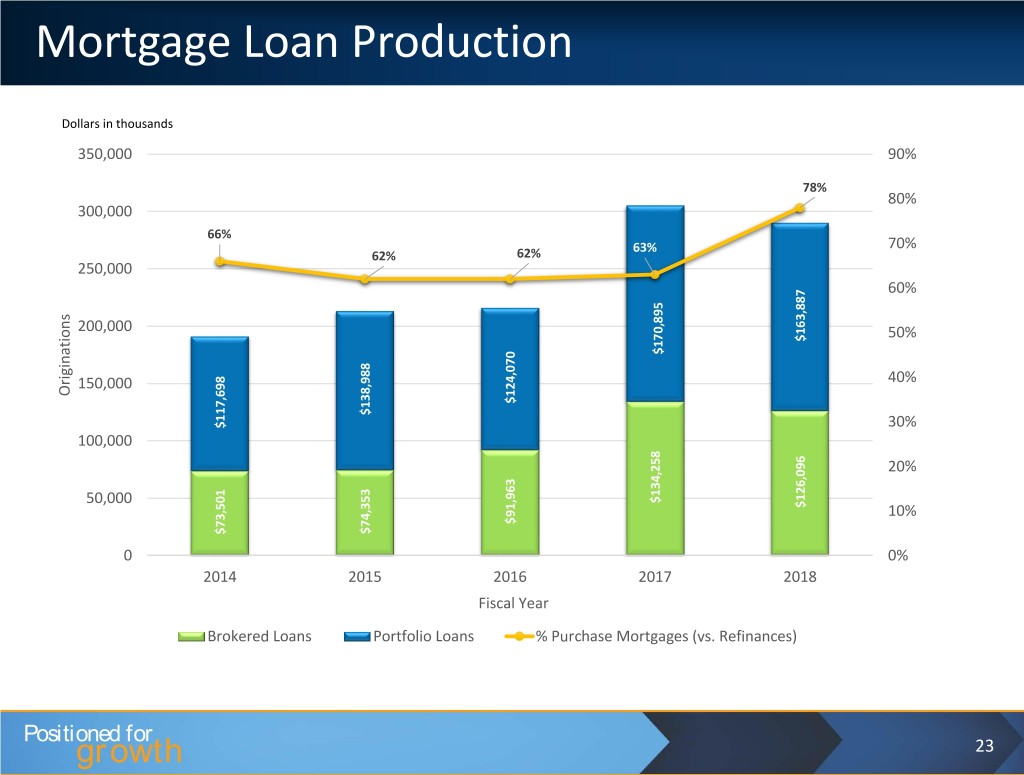

Mortgage Loan Production Dollars in thousands 350,000 90% 78% 80% 300,000 66% 63% 70% 62% 62% 250,000 60% 200,000 50% $163,887 $163,887 $170,895 $170,895 150,000 40% Originations $124,070 $124,070 $138,988 $138,988 $117,698 $117,698 30% 100,000 20% 50,000 $134,258 $126,096 $126,096 10% $91,963 $91,963 $74,353 $74,353 $73,501 $73,501 0 0% 2014 2015 2016 2017 2018 Fiscal Year Brokered Loans Portfolio Loans % Purchase Mortgages (vs. Refinances) Positioned for growth 23

Drivers of Organic Loan Growth 2013 Dollars in thousands Began Buildout of Commercial Banking $3,000,000 $300,000 Infrastructure Restructured Mortgage Loan Origination $242,501 Process $250,000 $2,500,000 2014 Added Indirect Auto LOB $200,000 Hired New Chief Credit Officer $2,527,000 $2,527,000 $2,000,000 $170,513 $2,352,000 $2,352,000 $150,000 2015 Opened Two Commercial LPOs $1,500,000 $100,000 $1,833,000 $1,833,000 2017 $74,757 $1,686,000 $1,686,000 Expanded Mortgage LOB in Metro Markets $50,000 $1,498,000 $1,498,000 Opened New Commercial LPO $1,000,000 $28,154 Meridian – HELOC Originations $- Began developing new equipment finance $1,167,000 $1,167,000 $- line of business $500,000 $(36,627) $(50,000) 2018 2015 Added SBA 7(a) Loan Program FY2017 FY2018 FY 2013 FY 2014 FY FY FY2016 Began equipment finance originations $- $(100,000) 201 Loan Portfolio Looking Forward Organic Loan Growth • Equipment Finance • Business Banking • Consumer Lending Through Branches Positioned for growth 24

Deposit/Retail Highlights – Fiscal 2018 Deposit Growth: . 6% core deposit* growth in fiscal 2018 ($94MM) . 19% growth in money market accounts . Core deposits* make up 77% of total deposits . Average cost of total deposits at .37% for fiscal 2018 Customer/Household Trends in fiscal 2018: . 5% growth in total retail loan households . 5.2% increase in the number of ‘sweet spot’ relationships – those households with checking, savings, and credit accounts (all 3) – and 1.3% increase in engaged checking Product/Process Improvements: . Implemented new loan decisioning platform and overhauled HELOC origination process, resulting in 75% increase in branch originations and 68% reduction in average time to close . Selected new broker-dealer to expand our investment services capabilities . Continually refining staffing models to achieve/maintain optimum FT/PT balance . Opened de novo branch in Cary, NC in March 2018 *Core deposits exclude all time deposits/certificates of deposit. Positioned for growth 25

Loan to Deposit Ratio Higher ratio of 115% at 6/30/18 due to investment alternatives included in loan portfolio: . $166 million in purchased HELOCs . These loan types are often included in the 26% of loan portfolio ($664 million) in 1-4 family loans investment portfolio at other commercial banks . $109 million in tax-free municipal leases . Adjusted loan to deposit ratio of 87% (excluding purchased HELOCS, ½ of 1-4 family portfolio, and tax-free municipal leases above) Options for right-sizing loans to deposit ratio: . More aggressive deposit pricing in select markets . Focusing on newer markets with less deposits to avoid repricing in deposit-heavy legacy markets . Better management of deposit runoff . Better customer conversations . Improved reporting . Runoff of 1-4 family & purchased HELOCs . Branch acquisition opportunities . Bulk loan sales . M&A with deposit heavy commercial bank Positioned for growth 26

Deposit Portfolio Mix Dollars in $1,000,000 Total Total Total Total Total Total 90% thousands Deposits: Deposits: Deposits: Deposits: Deposits: Deposits: $1,154,749 $1,583,046 $1,872,126 $1,802,696 $2,048,451 $2,196,253 $900,000 80% 77.44% 76.50% $800,000 75.45% 70% 69.18% $700,000 60% 59.94% $600,000 53.20% 50% $500,000 40% $400,000 30% $300,000 20% $200,000 $100,000 10% $- 0% 2013 2014 2015 2016 2017 2018 Time Deposits $540,387 $634,154 $577,075 $442,649 $462,146 $516,152 Money Market/Savings $357,876 $530,221 $703,622 $731,137 $806,756 $890,915 Checking Accounts $256,486 $418,671 $591,429 $628,910 $779,549 $789,186 Core Deposits % 53.20% 59.94% 69.18% 75.45% 77.44% 76.50% (excludes time deposits) Positioned for growth 27

Deposit Composition Deposit Migration Deposit Composition 100% 6/30/18 19.1% Time Deposits 90% 22.2% 26.4% 31.6% $516,152 34.9% 80% 38.1% 35.9% $789,186 Money Market/Savings 70% Checking Accounts 28.8% $890,915 31.0% 60% 33.5% 50% 37.6% Dollars in thousands 40.6% 40.6% 39.4% 40% Cost of Funds 0.90% 0.85% 30% 0.80% 52.1% 0.70% 0.63% 46.8% 20% 40.1% 0.60% 0.46% 30.8% 0.50% 24.6% 0.37% 10% 22.6% 23.5% 0.40% 0.30% 0.28% 0.28% 0.30% 0% 0.20% 2012 2013 2014 2015 2016 2017 2018 0.10% 0.00% 2012 2013 2014 2015 2016 2017 2018 Time Deposits Money Market/Savings Checking Accounts Deposit balances as of fiscal year end; Cost of funds are averages for the fiscal year Positioned for growth 28

Growing Noninterest Income . New SBA Line of Business in FY 2018 . Gains from loan sales - $1MM in start-up year . Third party servicer to keep overhead low . Mortgage Banking . Expanded into 5 of our new metro markets . Added 12 new mortgage loan officers in the last 12 months . Increasing rates to enhance gain on loan sales . Average gain increased to 2.55% in FY 2018 from 1.99% in FY 2017 . Moved to a “mortgage banking” model and process and away from the “traditional thrift” model . Treasury Management . Focus on increasing fees and appropriate pricing . Increased fees from new merchant services program . Core deposit growth with treasury management products Positioned for growth 29

Asset Quality Dollars in thousands Net Charge-Offs and NCO / Average Loans Allowance for Loan Losses and ALL / Total Loans 2,500 2,343 0.20% 24,000 2.00% 23,500 2,000 0.15% 23,000 1.50% 22,500 1,500 1,205 22,000 1,082 0.10% 1.00% 1,000 21,500 0.05% 21,000 500 20,500 0.50% 141 91 20,000 - 0.00% 2014 2015 2016 2017 2018 19,500 0.00% 2014 2015 2016 2017 2018 Net Charge-Offs NCO/Avg. Loans ALL ALL/Tot. Loans Nonperforming Assets / Total Assets Allowance for Loan Losses / Nonperforming Loans (Coverage Ratio) 3.00% 250.00% 2.50% 200.00% 2.00% 1.50% 150.00% 1.00% 100.00% 0.50% 50.00% 0.00% 2014 2015 2016 2017 2018 0.00% 2014 2015 2016 2017 2018 All data is as of or for the year ended June 30 Positioned for growth 30

Investment Portfolio Composition Investments: 6/30/18 ($451 MM) US Gov't Agency ($48 MM) MBS-Gov't Agcy/GSE ($70 MM) Munis ($28 MM) - 90% Taxable Corporate Bonds ($9 MM) FDIC Insured CDs in Other Banks ($67 MM) Commercial Paper ($229 MM) - 30-Day Avg Life 2% 6% 15% 15% Yield: 2.25% 11% Avg Repricing Term: 12 months 51% Positioned for growth 31

Opportunistic Acquisition Strategy Goal – Leverage infrastructure and lines of business to accelerate earnings growth and value creation for shareholders . Earnings accretion of 10% or more . Strong core deposit base . Asset size – Target of $300 million to $1.5 billion . Geographic footprint – within or adjacent to our current market footprint . Attractive, growing market . Minimum dilution to current tangible book value . Earnback period of 5 years or less . Significant but realistic cost savings . Reasonable price with a currency mix of cash and stock . No major credit issues . Cultural fit Positioned for growth 32

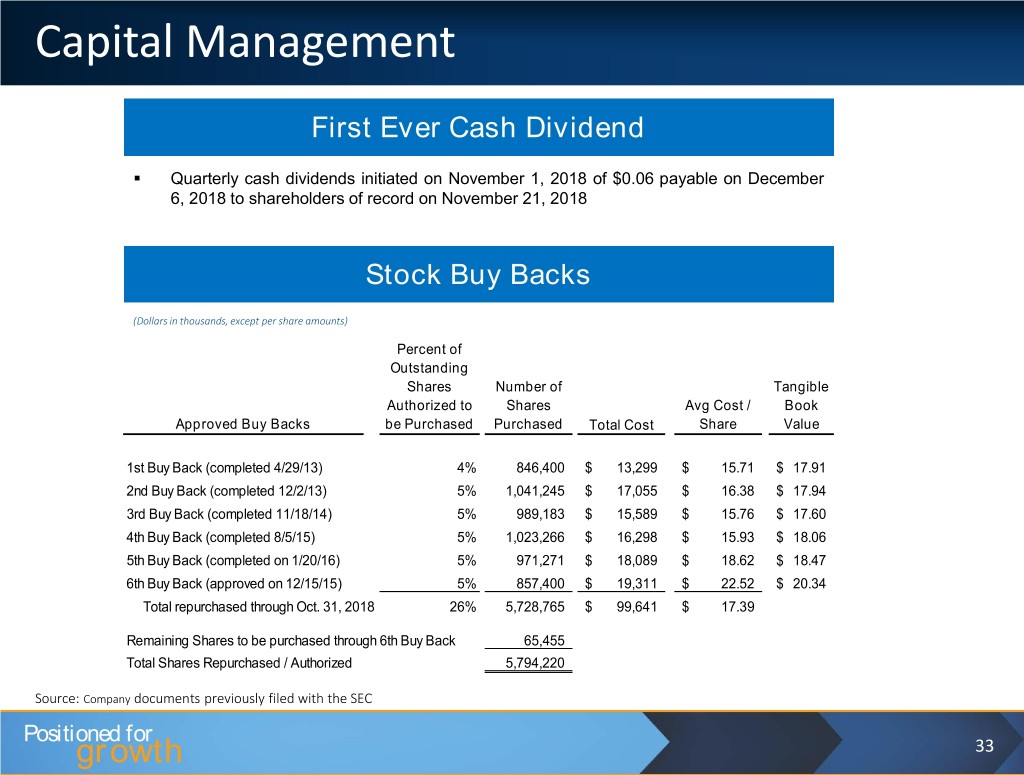

Capital Management First Ever Cash Dividend . Quarterly cash dividends initiated on November 1, 2018 of $0.06 payable on December 6, 2018 to shareholders of record on November 21, 2018 Stock Buy Backs (Dollars in thousands, except per share amounts) Percent of Outstanding Shares Number of Tangible Authorized to Shares Avg Cost / Book Approved Buy Backs be Purchased Purchased Total Cost Share Value 1st Buy Back (completed 4/29/13) 4% 846,400 $ 13,299 $ 15.71 $ 17.91 2nd Buy Back (completed 12/2/13) 5% 1,041,245 $ 17,055 $ 16.38 $ 17.94 3rd Buy Back (completed 11/18/14) 5% 989,183 $ 15,589 $ 15.76 $ 17.60 4th Buy Back (completed 8/5/15) 5% 1,023,266 $ 16,298 $ 15.93 $ 18.06 5th Buy Back (completed on 1/20/16) 5% 971,271 $ 18,089 $ 18.62 $ 18.47 6th Buy Back (approved on 12/15/15) 5% 857,400 $ 19,311 $ 22.52 $ 20.34 Total repurchased through Oct. 31, 2018 26% 5,728,765 $ 99,641 $ 17.39 Remaining Shares to be purchased through 6th Buy Back 65,455 Total Shares Repurchased / Authorized 5,794,220 Source: Company documents previously filed with the SEC Positioned for growth 33

Quarter Ended September 30, 2018 Highlights (Dollars in thousands, except per share amounts) Quarter Ended Change As Reported 09/30/2018 09/30/2017 Amount Percent Net Income $ 7,790 $ 5,567 $ 2,223 40% EPS - diluted $ 0.41 $ 0.30 $ 0.11 37% ROA 0.94% 0.70% 0.24% 34% Net interest margin (tax equivalent) 3.45% 3.44% 0.01% 0% Noninterest income $ 5,613 $ 4,262 $ 1,351 32% Efficiency Ratio 68.03% 71.46% (3.43%) (5%) Organic Loan Growth $ Growth $ 76,797 $ 43,175 $ 33,622 78% % Growth (annualized) 13.02% 7.89% 5.13% 65% Loan originations: Commercial portfolio $ 157,370 $ 164,054 $ (6,684) (4%) Retail portfolio 75,068 80,439 (5,371) (7%) 1-4 family originated for sale 30,310 32,424 (2,114) (7%) Total loan originations $ 262,748 $ 276,917 $ (14,169) (5%) Source: Company documents previously filed with the SEC Positioned for growth 34

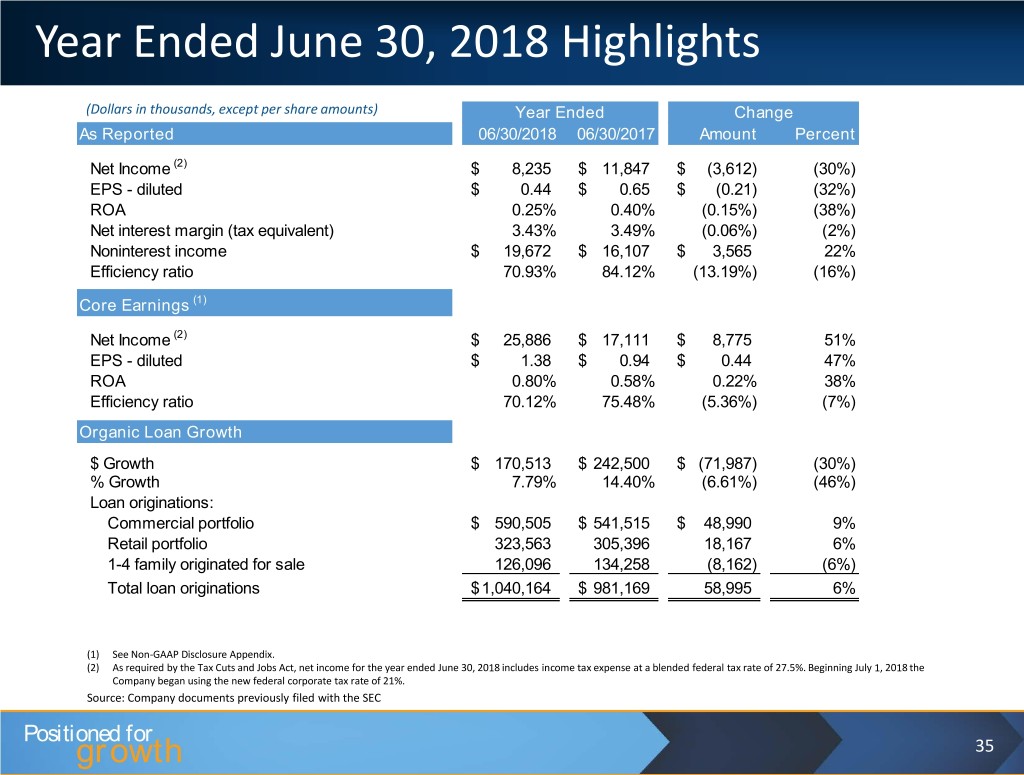

Year Ended June 30, 2018 Highlights (Dollars in thousands, except per share amounts) Year Ended Change As Reported 06/30/2018 06/30/2017 Amount Percent Net Income (2) $ 8,235 $ 11,847 $ (3,612) (30%) EPS - diluted $ 0.44 $ 0.65 $ (0.21) (32%) ROA 0.25% 0.40% (0.15%) (38%) Net interest margin (tax equivalent) 3.43% 3.49% (0.06%) (2%) Noninterest income $ 19,672 $ 16,107 $ 3,565 22% Efficiency ratio 70.93% 84.12% (13.19%) (16%) Core Earnings (1) Net Income (2) $ 25,886 $ 17,111 $ 8,775 51% EPS - diluted $ 1.38 $ 0.94 $ 0.44 47% ROA 0.80% 0.58% 0.22% 38% Efficiency ratio 70.12% 75.48% (5.36%) (7%) Organic Loan Growth $ Growth $ 170,513 $ 242,500 $ (71,987) (30%) % Growth 7.79% 14.40% (6.61%) (46%) Loan originations: Commercial portfolio $ 590,505 $ 541,515 $ 48,990 9% Retail portfolio 323,563 305,396 18,167 6% 1-4 family originated for sale 126,096 134,258 (8,162) (6%) Total loan originations $ 1,040,164 $ 981,169 58,995 6% (1) See Non-GAAP Disclosure Appendix. (2) As required by the Tax Cuts and Jobs Act, net income for the year ended June 30, 2018 includes income tax expense at a blended federal tax rate of 27.5%. Beginning July 1, 2018 the Company began using the new federal corporate tax rate of 21%. Source: Company documents previously filed with the SEC Positioned for growth 35

Balance Sheet Highlights (Dollars in thousands, except per share amounts) At 09/30/2018 vs. 06/30/18 06/30/2018 vs. 06/30/17 09/30/2018 06/30/2018 06/30/2017 Amount Percent Amount Percent Total assets $ 3,353,959 $ 3,304,169 $ 3,206,533 $ 49,790 2% $ 97,636 3% Total loans 2,587,106 2,525,852 2,351,470 61,254 2% 174,382 7% Core deposits 1,666,323 1,680,101 1,586,305 (13,778) (1%) 93,796 6% Total deposits 2,203,044 2,196,253 2,048,451 6,791 0% 147,802 7% Stockholders' equity 414,195 409,242 397,647 4,953 1% 11,595 3% Nonperforming loans / total loans 0.39% 0.43% 0.58% (0.04%) (9%) (0.15%) (26%) Classified assets / total assets 0.93% 1.00% 1.57% (0.07%) (7%) (0.57%) (36%) Book value per share $ 21.87 $ 21.49 $ 20.96 $ 0.38 2% $ 0.53 3% Tangible book value per share (1) $ 20.35 $ 19.96 $ 19.37 $ 0.39 2% $ 0.59 3% HomeTrust Bancshares, Inc. share price $ 29.15 $ 28.15 $ 24.40 $ 1.00 4% $ 3.75 15% Price to tangible book value (1) 143% 141% 126% 2% 1% 15% 12% (1) See Non-GAAP Disclosure Appendix. Source: Company documents previously filed with the SEC Positioned for growth 36

Market Price and Price to Tangible Book $35.0 150.0% 143% 4-Year CAGR of 16% 141% 130.0% $30.0 126% $29.15 $28.15 110.0% 97% $25.0 89% 93% $24.40 90.0% $20.0 $28.15 70.0% $16.76 $15.0 $15.77 50.0% $10.0 30.0% $5.0 10.0% $- -10.0% 06/30/2014 06/30/2015 06/30/2016 06/30/2017 06/30/2018 09/30/2018 Market Price per Share See Non-GAAP Disclosure Appendix Price to Tangible Book Positioned for growth 37

Total Shareholder Return Total Return Performance 300.0 280.0 260.0 240.0 220.0 200.0 180.0 160.0 140.0 120.0 100.0 07/11/12 06/30/13 06/30/14 06/30/15 06/30/2016 06/30/2017 06/30/2018 09/30/2018 HomeTrust Bancshares, Inc. NASDAQ Bank NASDAQ Composite Positioned for growth 38

Value Drivers for HTBI Proven ability to grow organically Proven ability to grow through M&A Footprint in attractive metro markets with strong growth Strong experienced team of revenue producers Diversified loan portfolio including equipment finance/C&I lending Strong asset quality and credit discipline Attractive core deposit mix and cost Ability to generate additional noninterest income with mortgage banking and SBA lending Capital, credit, compliance strength for continued growth Second largest community bank headquartered in North Carolina Strong culture of alignment and teamwork, built on foundation of outstanding character and competence of team members Positioned for growth 39

Investor Contacts Dana Stonestreet Chairman, President and CEO dana.stonestreet@htb.com Hunter Westbrook SEVP/Chief Operating Officer hunter.westbrook@htb.com Tony VunCannon EVP/Chief Financial Officer/Corporate Secretary/Treasurer tony.vuncannon@htb.com 10 Woodfin Street Asheville, NC 28801 (828) 259-3939 www.hometrustbanking.com Positioned for growth 40

Non-GAAP Disclosure Appendix Positionedgrowth for

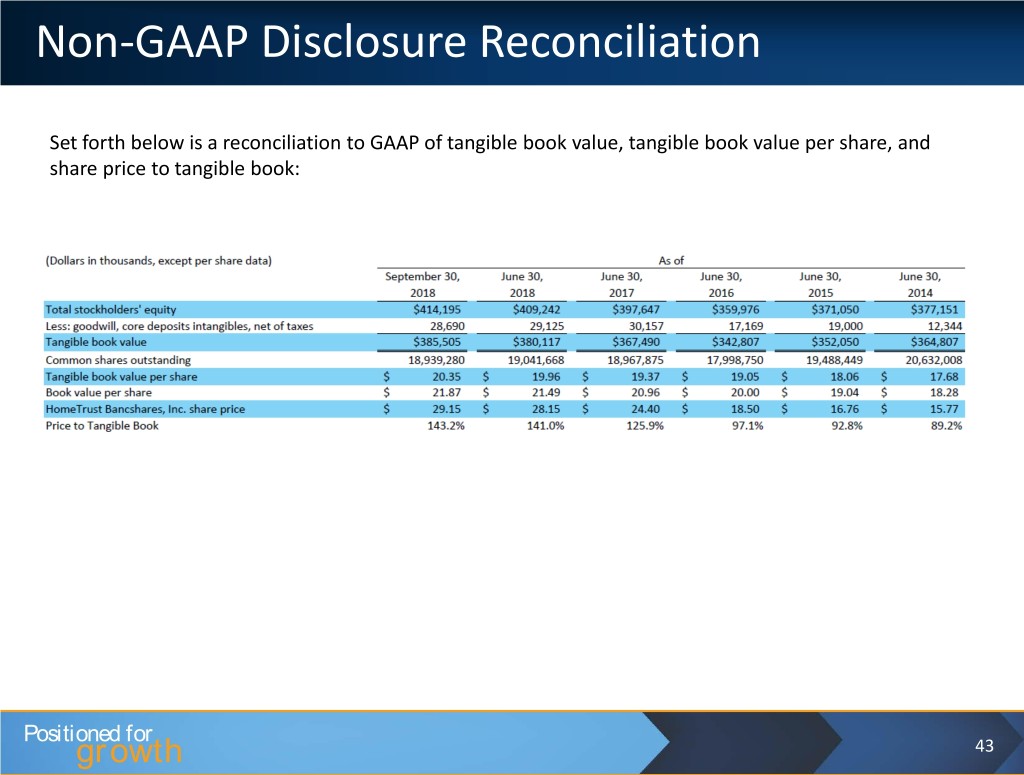

Non-GAAP Disclosure Reconciliation In addition to results presented in accordance with generally accepted accounting principles utilized in the United States ("GAAP"), this presentation contains certain non-GAAP financial measures, which include: the efficiency ratio; tangible book value; tangible book value per share; tangible equity to tangible assets ratio; net income excluding merger-related expenses, certain state income tax expense, adjustments for the change in federal tax law, and gain from the sale of premises and equipment; and earnings per share ("EPS"), return on assets ("ROA"), and return on equity ("ROE") excluding merger-related expenses, certain state income tax expense, adjustments for the change in federal tax law, and gain from the sale of premises and equipment. The Company believes these non-GAAP financial measures and ratios as presented are useful for both investors and management to understand the effects of certain items and provides an alternative view of the Company's performance over time and in comparison to the Company's competitors. The Company believes these measures facilitate comparison of the quality and composition of the Company's capital and earnings ability over time and in comparison to its competitors. These non-GAAP measures have inherent limitations, are not required to be uniformly applied and are not audited. They should not be considered in isolation or as a substitute for total stockholders' equity or operating results determined in accordance with GAAP. These non- GAAP measures may not be comparable to similarly titled measures reported by other companies. Positioned for growth 42

Non-GAAP Disclosure Reconciliation Set forth below is a reconciliation to GAAP of tangible book value, tangible book value per share, and share price to tangible book: Positioned for growth 43

Non-GAAP Disclosure Reconciliation Set forth to the right is a reconciliation to GAAP net income, EPS, ROE, and ROA as adjusted to exclude merger-related expenses, certain state tax expense, adjustments for the change in federal tax law, gain on sale of premises and equipment, impairment charges for branch consolidation, and recovery of loan losses: Positioned for growth 44