Attached files

| file | filename |

|---|---|

| 8-K - 8-K - HUNTINGTON BANCSHARES INC /MD/ | hban-2018x11x05x8k.htm |

Exhibit 99.1 Welcome Huntington Bancshares Incorporated Bank of America Merrill Lynch Future of Financials 2018 Conference November 5, 2018 ©2018 Huntington Bancshares Incorporated. All rights reserved. (Nasdaq: HBAN)

Disclaimer CAUTION REGARDING FORWARD-LOOKING STATEMENTS This communication contains certain forward-looking statements, including, but not limited to, certain plans, expectations, goals, projections, and statements, which are not historical facts and are subject to numerous assumptions, risks, and uncertainties. Statements that do not describe historical or current facts, including statements about beliefs and expectations, are forward-looking statements. Forward-looking statements may be identified by words such as expect, anticipate, believe, intend, estimate, plan, target, goal, or similar expressions, or future or conditional verbs such as will, may, might, should, would, could, or similar variations. The forward-looking statements are intended to be subject to the safe harbor provided by Section 27A of the Securities Act of 1933, Section 21E of the Securities Exchange Act of 1934, and the Private Securities Litigation Reform Act of 1995. While there is no assurance that any list of risks and uncertainties or risk factors is complete, below are certain factors which could cause actual results to differ materially from those contained or implied in the forward-looking statements: changes in general economic, political, or industry conditions; uncertainty in U.S. fiscal and monetary policy, including the interest rate policies of the Federal Reserve Board; volatility and disruptions in global capital and credit markets; movements in interest rates; competitive pressures on product pricing and services; success, impact, and timing of our business strategies, including market acceptance of any new products or services implementing our “Fair Play” banking philosophy; the nature, extent, timing, and results of governmental actions, examinations, reviews, reforms, regulations, and interpretations, including those related to the Dodd-Frank Wall Street Reform and Consumer Protection Act and the Basel III regulatory capital reforms, as well as those involving the OCC, Federal Reserve, FDIC, and CFPB; and other factors that may affect our future results. Additional factors that could cause results to differ materially from those described above can be found in our 2017 Annual Report on Form 10-K, as well as our subsequent Securities and Exchange Commission (“SEC”) filings, which are on file with the SEC and available in the “Investor Relations” section of our website, http://www.huntington.com, under the heading “Publications and Filings.” All forward-looking statements speak only as of the date they are made and are based on information available at that time. We do not assume any obligation to update forward-looking statements to reflect circumstances or events that occur after the date the forward- looking statements were made or to reflect the occurrence of unanticipated events except as required by federal securities laws. As forward-looking statements involve significant risks and uncertainties, caution should be exercised against placing undue reliance on such statements. 2

Important Messages Building long-term shareholder value Consistent organic growth Maintain aggregate moderate-to-low risk appetite Minimize earnings volatility through the cycle Disciplined capital allocation Focus on top quartile financial performance relative to peers Strategic focus on Customer Experience High level of colleague and shareholder alignment Board, management, and colleague ownership represent the seventh largest shareholder 3

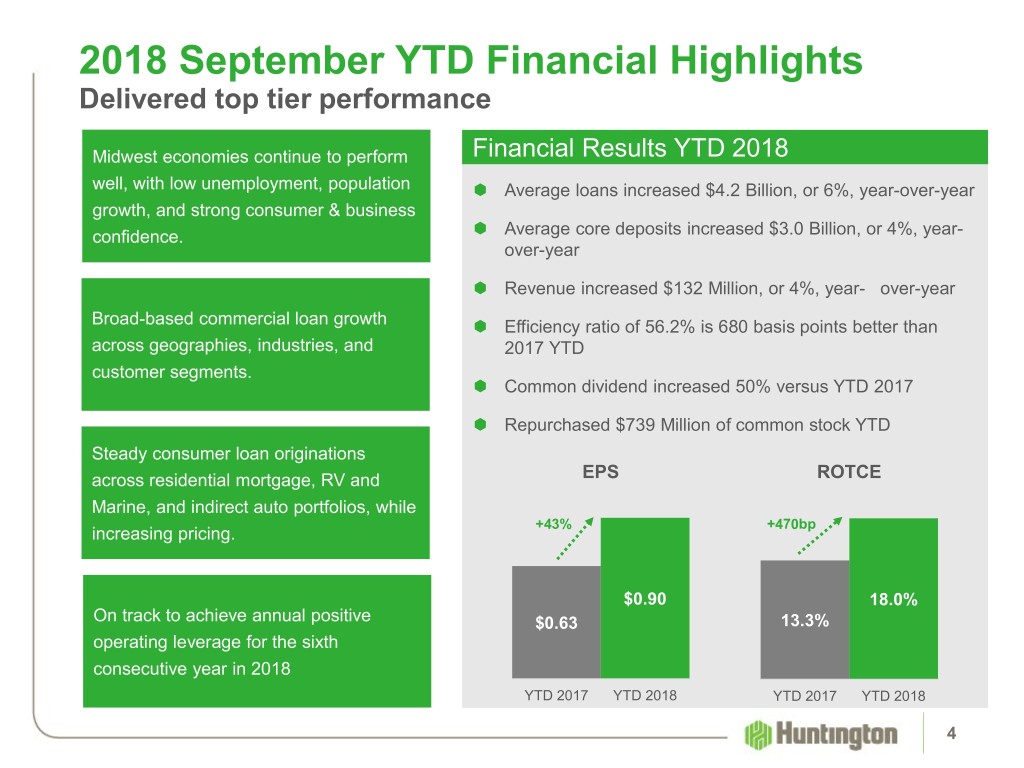

2018 September YTD Financial Highlights Delivered top tier performance Midwest economies continue to perform Financial Results YTD 2018 well, with low unemployment, population Average loans increased $4.2 Billion, or 6%, year-over-year growth, and strong consumer & business confidence. Average core deposits increased $3.0 Billion, or 4%, year- over-year Revenue increased $132 Million, or 4%, year- over-year Broad-based commercial loan growth Efficiency ratio of 56.2% is 680 basis points better than across geographies, industries, and 2017 YTD customer segments. Common dividend increased 50% versus YTD 2017 Repurchased $739 Million of common stock YTD Steady consumer loan originations across residential mortgage, RV and EPS ROTCE Marine, and indirect auto portfolios, while +43% +470bp increasing pricing. $0.90 18.0% On track to achieve annual positive $0.63 13.3% operating leverage for the sixth consecutive year in 2018 YTD 2017 YTD 2018 YTD 2017 YTD 2018 4

Industry-leading Profitability Metrics 2018 YTD Efficiency Ratio 2018 YTD ROTCE Peer 1 53.1% Peer 4 19.6% Peer 2 54.1% Peer 3 18.1% Peer 3 55.9% HBAN 18.0% HBAN 56.2% Peer 5 17.8% Peer 4 57.3% Peer 7 17.6% Peer 5 58.5% Peer 11 17.1% Peer 6 58.6% Peer 9 16.2% Peer 7 59.7% Peer 2 15.6% Peer 8 60.0% Peer 10 14.0% Peer 9 60.1% Peer 6 12.6% Peer 10 60.3% Peer 8 11.8% Peer 11 60.6% Peer 1 8.0% 5 Source: S&P Global Market Intelligence

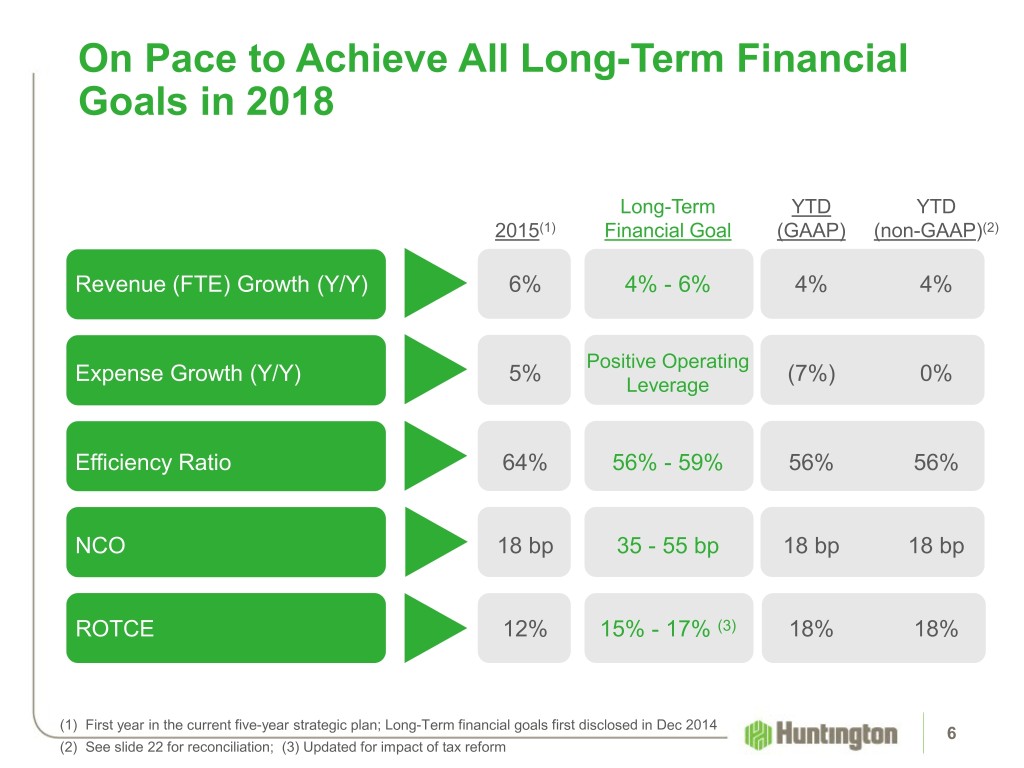

On Pace to Achieve All Long-Term Financial Goals in 2018 Long-Term YTD YTD 2015(1) Financial Goal (GAAP) (non-GAAP)(2) Revenue (FTE) Growth (Y/Y) 6% 4% - 6% 4% 4% Positive Operating Expense Growth (Y/Y) 5% (7%) 0% Leverage Efficiency Ratio 64% 56% - 59% 56% 56% NCO 18 bp 35 - 55 bp 18 bp 18 bp ROTCE 12% 15% - 17% (3) 18% 18% (1) First year in the current five-year strategic plan; Long-Term financial goals first disclosed in Dec 2014 6 (2) See slide 22 for reconciliation; (3) Updated for impact of tax reform

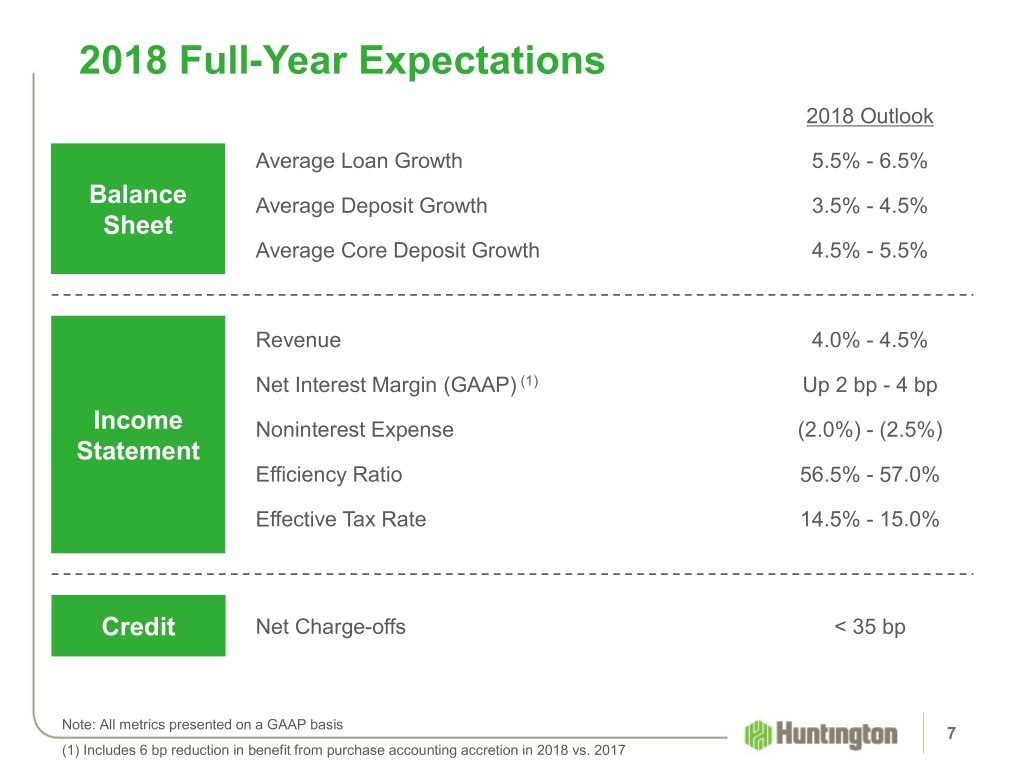

2018 Full-Year Expectations 2018 Outlook Average Loan Growth 5.5% - 6.5% Balance Average Deposit Growth 3.5% - 4.5% Sheet Average Core Deposit Growth 4.5% - 5.5% Revenue 4.0% - 4.5% Net Interest Margin (GAAP) (1) Up 2 bp - 4 bp Income Noninterest Expense (2.0%) - (2.5%) Statement Efficiency Ratio 56.5% - 57.0% Effective Tax Rate 14.5% - 15.0% Credit Net Charge-offs < 35 bp Note: All metrics presented on a GAAP basis 7 (1) Includes 6 bp reduction in benefit from purchase accounting accretion in 2018 vs. 2017

Strategic Plan History - 2009 Execution of strategic plans delivered results Themes Outcomes Disciplined risk management ✔ Industry-leading customer acquisition Fair Play consumer strategy ✔ Focus on deepening Optimal Customer relationships Relationship (OCR) strategy ✔ Customer-centric products Huntington brand evolution ✔ Leading client satisfaction New commercial verticals and scores SBA targeted growth ✔ Expanded commercial offerings ✔ In-store strategy build-out 8

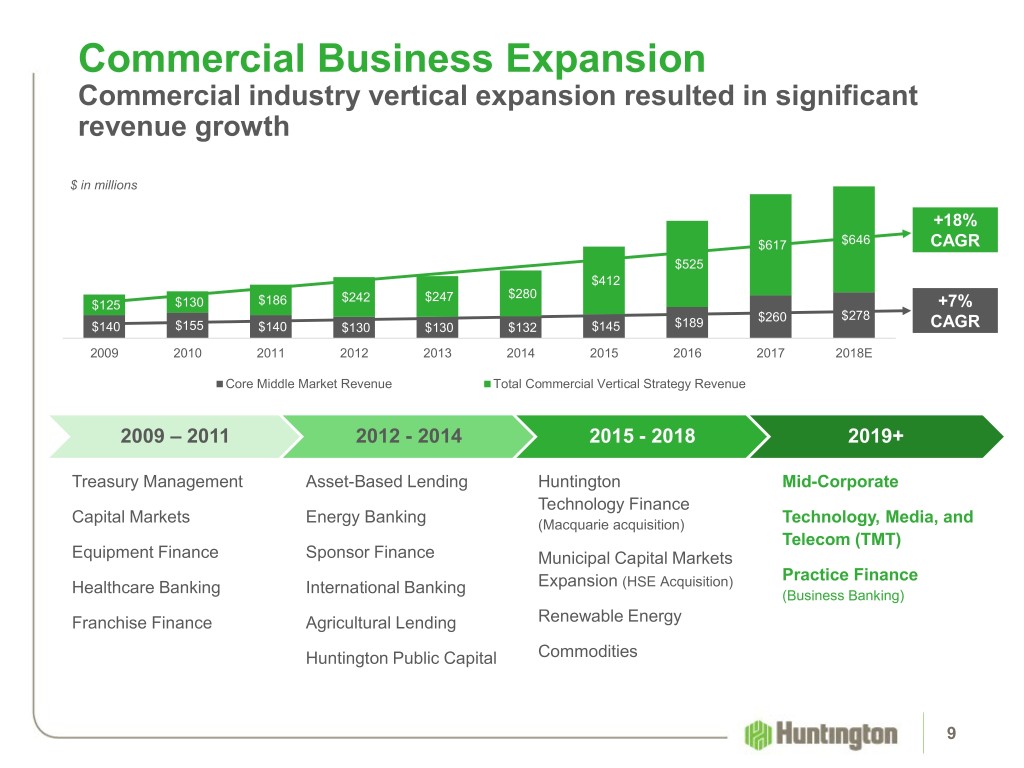

Commercial Business Expansion Commercial industry vertical expansion resulted in significant revenue growth $ in millions +18% $617 $646 CAGR $525 $412 $242 $247 $280 $125 $130 $186 +7% $260 $278 $140 $155 $140 $130 $130 $132 $145 $189 CAGR 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018E Core Middle Market Revenue Total Commercial Vertical Strategy Revenue 2009 – 2011 2012 - 2014 2015 - 2018 2019+ Treasury Management Asset-Based Lending Huntington Mid-Corporate Technology Finance Capital Markets Energy Banking (Macquarie acquisition) Technology, Media, and Telecom (TMT) Equipment Finance Sponsor Finance Municipal Capital Markets Expansion (HSE Acquisition) Practice Finance Healthcare Banking International Banking (Business Banking) Franchise Finance Agricultural Lending Renewable Energy Huntington Public Capital Commodities 9

Strategic Plan History - 2014 Execution of strategic plans delivered results Themes Outcomes Build scale ✔ Improved scale through organic growth and acquisition Strategic acquisition (FMER & Macquarie) Technology platform ✔ Accelerated achievement of investment long-term financial goals Data & Analytics launch ✔ #1 branch share in OH & MI ✔ Expansion: Chicago & Marine & RV (FMER) ✔ Best-in-class return profile 10

FirstMerit Acquisition Deal economics driven by scale, density, and efficiency Achieved 42% FMER Cost Savings Deposit Market Share Rankings Illustrate (10% of Pro Forma Expenses) Franchise Density(1) % of Company MSAs Company Top 3 Ranking #1 Ranking Wells Fargo & Co. 65.5% 21.4% Bank of America Corp. 58.7 11.9 10% Capital One Financial Corp. 43.3 16.7 76% 24% Huntington Bancshares Inc. 41.1 13.3 14% JPMorgan Chase & Co. 38.7 6.9 BB&T Corp. 37.5 15.8 SunTrust Banks Inc. 35.9 9.8 BMO Financial Corp. 35.7 11.9 Toronto-Dominion Bank 32.9 8.2 M&T Bank Corp. 32.3 12.3 HBAN FMER FMER ongoing Cost Savings U.S. Bancorp 31.1 5.5 Transaction exceeded profitability improvement expectations Efficiency Ratio ROA ROTCE 67.9% 64.9% 1.4% 18.0% 15.7% 60.9% 1.2% a 1.0% 12.4% 56.2% 0.8% 10.2% 2015 2016(2) 2017 2018 YTD 2015 2016 (2) 2017 2018 YTD (3) 2015 2016(2) 2017 2018 YTD(3) (1) Source: S&P Global Market Intelligence; (2) FMER acquisition closed in August 2016; 2016 and 2017 results 11 included acquisition-related expense; 2017 results included benefit from implementation of federal tax reform; (3) 2018 YTD ROA and ROTCE benefitted from 12 bp and 167 bp respective increases related to federal tax reform

2018 Strategic Plan Overview Driving towards sustained top quartile performance Top-Line Revenue Growth Business Model Capital Evolution & Optimization Disruption Themes Continue to differentiate based on superior Customer Experience Deepen customer relationships Extend local advantage Drive digital acceleration and branch transformation Improve execution (Process, Speed, and Simplicity) 12

Technology Enables Our Strategy 35% increase in technology development in 2018, 40% increase planned in 2019 Flexible Scale & Security ✔ Next generation data center and cyber – secure, flexible, and scalable cloud-based infrastructure Efficient Deployment ✔ Automation and DevOps – efficient delivery of new capabilities Digitization ✔ Imaging, workflow, robotics and process automation (RPA) – driving efficiency Agile Solution Development ✔ Innovation and delivery transformation – development, learning, and testing Architecture ✔ Core bank modernization – maintain technology currency and accelerate new product delivery ✔ Service-oriented architecture providing API-based access through enterprise middleware Consistent Channel Experience ✔ Consistent customer and colleague access to data and services Technology investments enable Customer Experience strategy by driving process improvement, speed, and simplicity 13

Leveraging Data & Analytics Deep customer insights inform Customer Experience improvements Leveraging customer behaviors and perceptions: ✔ Enhance customer experience ✔ Segmentation-driven tailored experiences ✔ Focused product development ✔ Optimize staffing for customer service, expense, and colleague stability Real-time insights / predictions: ✔ Real-time sales opportunities ✔ Targeted marketing offers to customers and prospects likely to respond Campaign effectiveness: ✔ Pricing optimization for volume, risk, and yield ✔ Customer Acquisition Geographic information sciences: ✔ Optimize Branch and ATM networks Delivering machine learning, statistics, and operations research to improve customer insights, personalize experiences, manage risk, and drive incremental revenue 14

End-to-End Digital Transformation Technology enhancements driving modernized delivery model Improving and Simplifying Sales and Service Strategically Positioned Transforming Branch Next Gen Acquisition for Digital Future Efficiency and Deepening Reducing time to open Improved, real-time an account by 40% sales leads Paperless origination New sales process PEOPLE led, Continued migration of Acquisition enabled online branch deposits to TECHNOLOGY self service AI / Machine Learning enabled Customized Segment Chatbot Portals Mobile and Digital Initiatives to Enhance Customer Experience Introduced “the Hub” portal (digital and mobile tools, alerts, and insights) Introduced digital card lock for credit and debit cards Partnered with third-party fintech on spend categorization Partnered with third-party firm on updated leads generation capability Launching AI on Huntington Heads Up (push notification service) Robotic Process Automation – 11 RPAs currently in use or in development 15

New Long-Term Financial Goals Prior Long-Term New Long-Term Financial Goal Financial Goal Revenue (FTE) Growth (Y/Y) 4% - 6% 4% - 6% Positive Operating Positive Operating Expense Growth (Y/Y) Leverage Leverage Efficiency Ratio 56% - 59% 53% - 56% NCO 35 - 55 bp 35 - 55 bp ROTCE 15% - 17% (1) 17% - 20% 16 (1) Updated for impact of tax reform

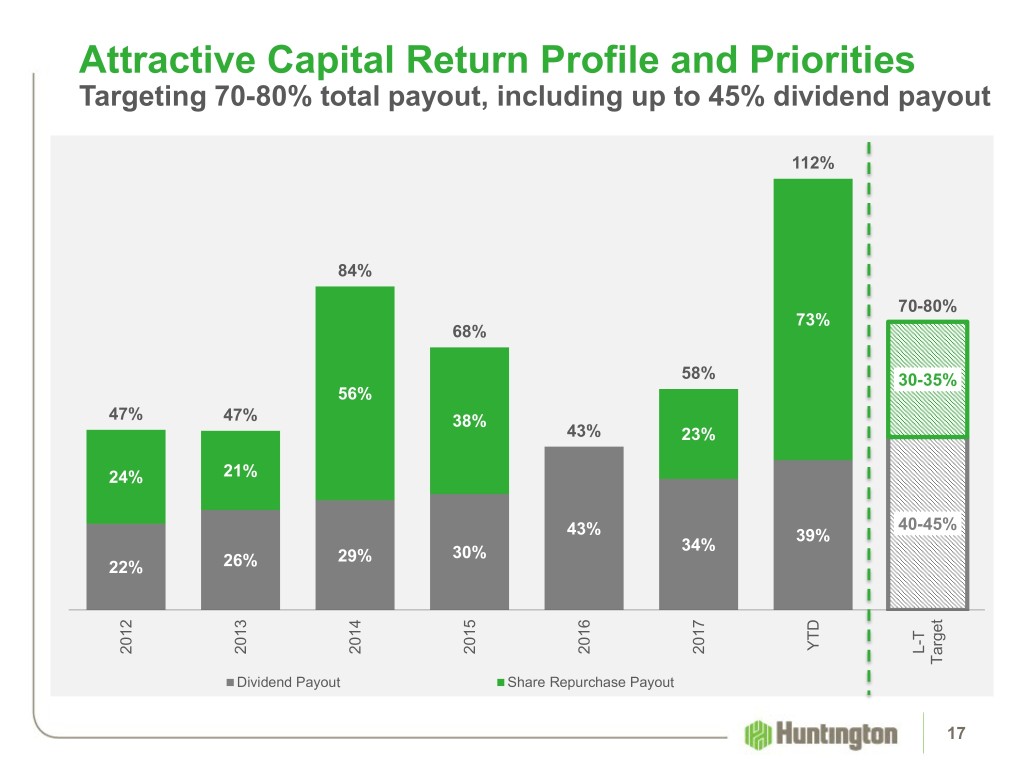

Attractive Capital Return Profile and Priorities Targeting 70-80% total payout, including up to 45% dividend payout 112% 84% 70-80% 73% 68% 58% 30-35% 56% 47% 47% 38% 43% 23% 24% 21% 40-45% 43% 39% 34% 29% 30% 22% 26% YTD L-T 2012 2013 2014 2015 2016 2017 Target Dividend Payout Share Repurchase Payout 17

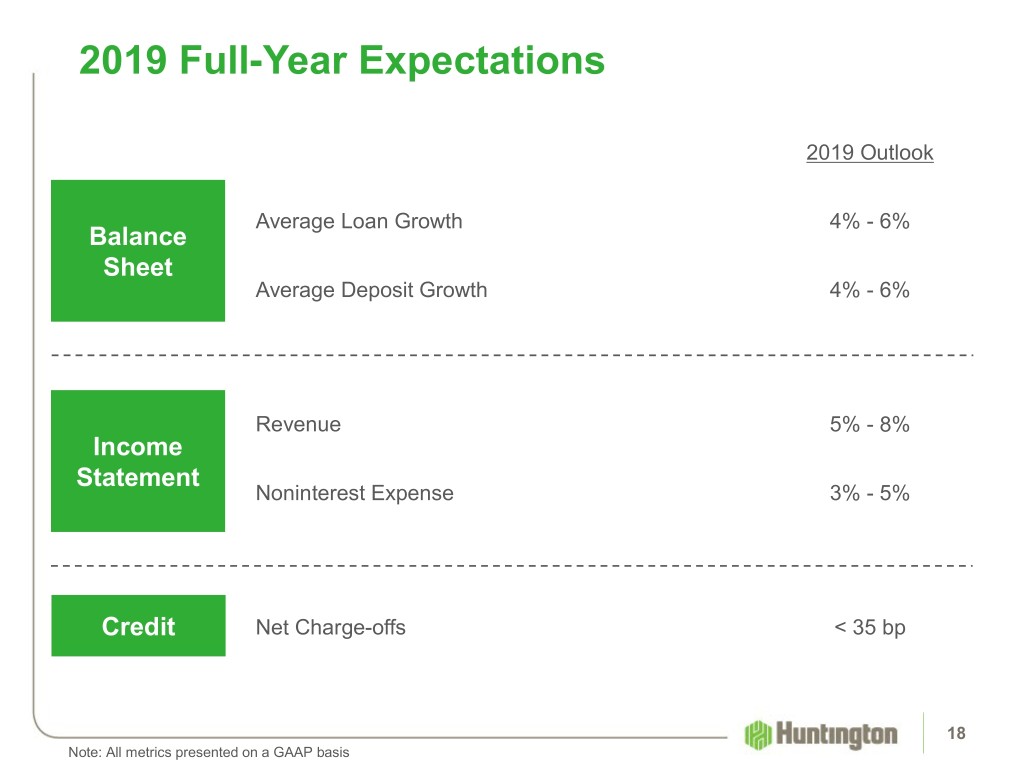

2019 Full-Year Expectations 2019 Outlook Average Loan Growth 4% - 6% Balance Sheet Average Deposit Growth 4% - 6% Revenue 5% - 8% Income Statement Noninterest Expense 3% - 5% Credit Net Charge-offs < 35 bp 18 Note: All metrics presented on a GAAP basis

Important Messages Building long-term shareholder value Consistent organic growth Maintain aggregate moderate-to-low risk appetite Minimize earnings volatility through the cycle Disciplined capital allocation Focus on top quartile financial performance relative to peers Strategic focus on Customer Experience High level of colleague and shareholder alignment Board, management, and colleague ownership represent the seventh largest shareholder 19

Appendix 20

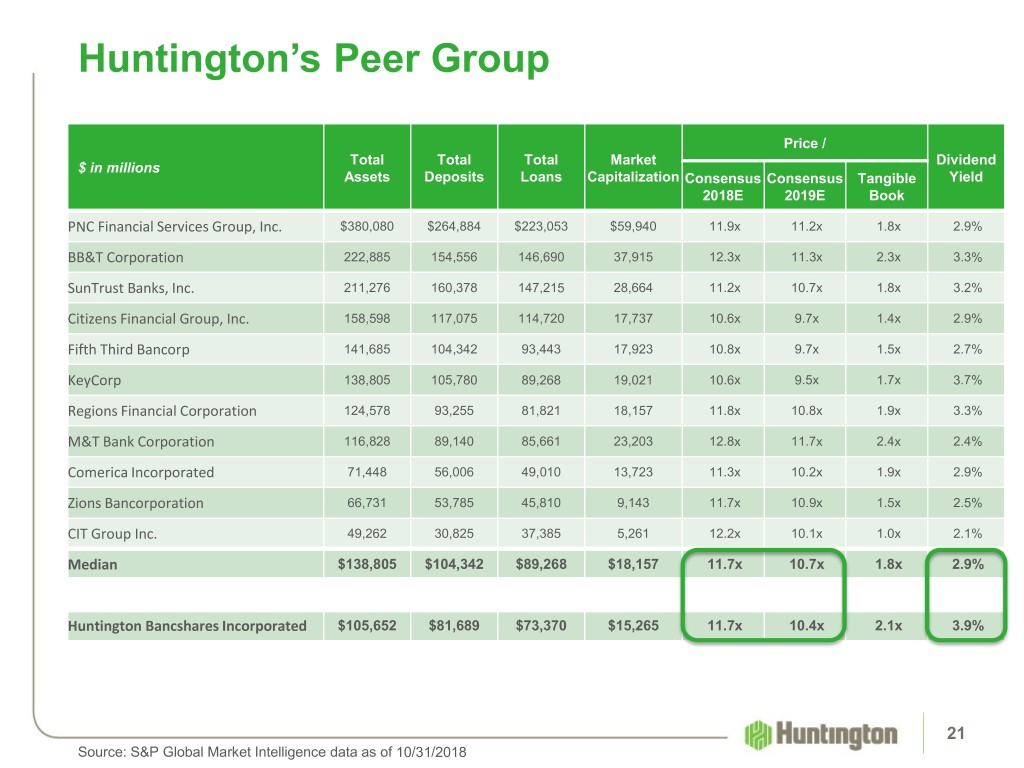

Huntington’s Peer Group Price / Total Total Total Market Dividend $ in millions Assets Deposits Loans Capitalization Consensus Consensus Tangible Yield 2018E 2019E Book PNC Financial Services Group, Inc. $380,080 $264,884 $223,053 $59,940 11.9x 11.2x 1.8x 2.9% BB&T Corporation 222,885 154,556 146,690 37,915 12.3x 11.3x 2.3x 3.3% SunTrust Banks, Inc. 211,276 160,378 147,215 28,664 11.2x 10.7x 1.8x 3.2% Citizens Financial Group, Inc. 158,598 117,075 114,720 17,737 10.6x 9.7x 1.4x 2.9% Fifth Third Bancorp 141,685 104,342 93,443 17,923 10.8x 9.7x 1.5x 2.7% KeyCorp 138,805 105,780 89,268 19,021 10.6x 9.5x 1.7x 3.7% Regions Financial Corporation 124,578 93,255 81,821 18,157 11.8x 10.8x 1.9x 3.3% M&T Bank Corporation 116,828 89,140 85,661 23,203 12.8x 11.7x 2.4x 2.4% Comerica Incorporated 71,448 56,006 49,010 13,723 11.3x 10.2x 1.9x 2.9% Zions Bancorporation 66,731 53,785 45,810 9,143 11.7x 10.9x 1.5x 2.5% CIT Group Inc. 49,262 30,825 37,385 5,261 12.2x 10.1x 1.0x 2.1% Median $138,805 $104,342 $89,268 $18,157 11.7x 10.7x 1.8x 2.9% Huntington Bancshares Incorporated $105,652 $81,689 $73,370 $15,265 11.7x 10.4x 2.1x 3.9% 21 Source: S&P Global Market Intelligence data as of 10/31/2018

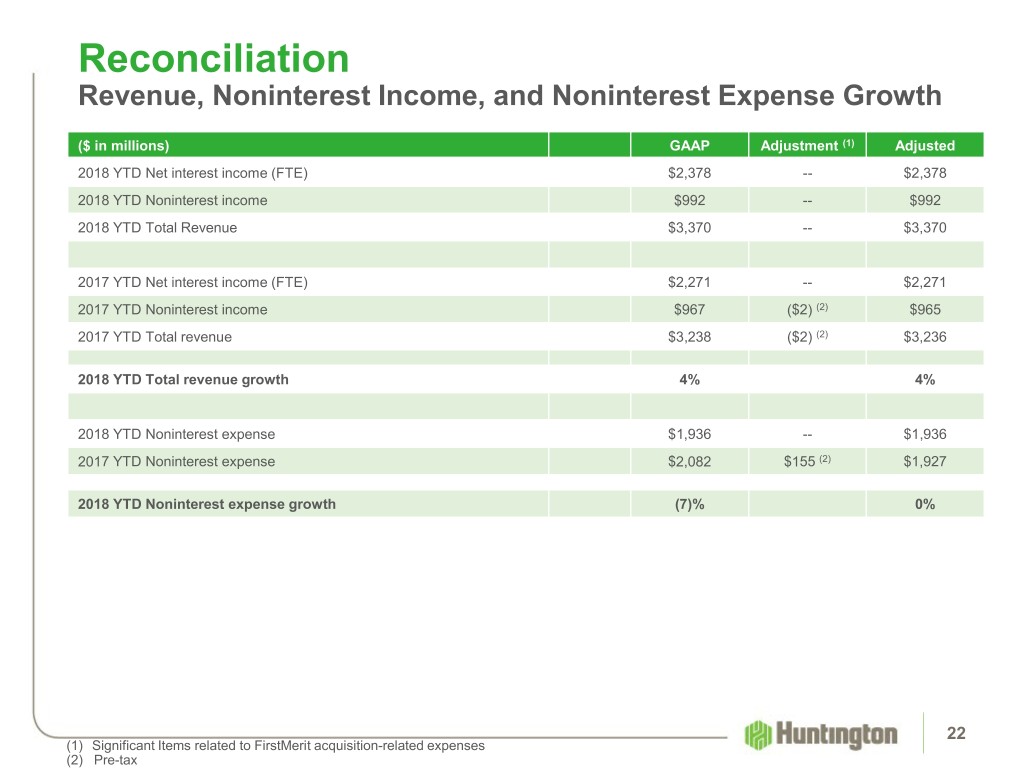

Reconciliation Revenue, Noninterest Income, and Noninterest Expense Growth ($ in millions) GAAP Adjustment (1) Adjusted 2018 YTD Net interest income (FTE) $2,378 -- $2,378 2018 YTD Noninterest income $992 -- $992 2018 YTD Total Revenue $3,370 -- $3,370 2017 YTD Net interest income (FTE) $2,271 -- $2,271 2017 YTD Noninterest income $967 ($2) (2) $965 2017 YTD Total revenue $3,238 ($2) (2) $3,236 2018 YTD Total revenue growth 4% 4% 2018 YTD Noninterest expense $1,936 -- $1,936 2017 YTD Noninterest expense $2,082 $155 (2) $1,927 2018 YTD Noninterest expense growth (7)% 0% 22 (1) Significant Items related to FirstMerit acquisition-related expenses (2) Pre-tax

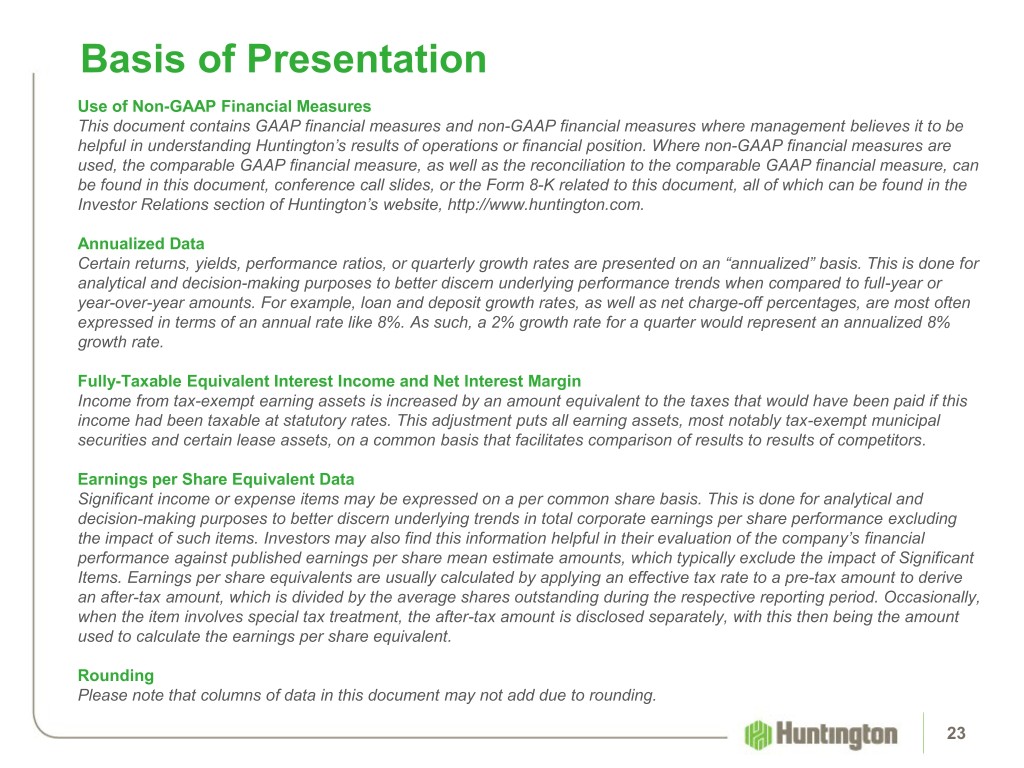

Do we consolidate this and Basis of Presentation next slide? Use of Non-GAAP Financial Measures This document contains GAAP financial measures and non-GAAP financial measures where management believes it to be helpful in understanding Huntington’s results of operations or financial position. Where non-GAAP financial measures are used, the comparable GAAP financial measure, as well as the reconciliation to the comparable GAAP financial measure, can be found in this document, conference call slides, or the Form 8-K related to this document, all of which can be found in the Investor Relations section of Huntington’s website, http://www.huntington.com. Annualized Data Certain returns, yields, performance ratios, or quarterly growth rates are presented on an “annualized” basis. This is done for analytical and decision-making purposes to better discern underlying performance trends when compared to full-year or year-over-year amounts. For example, loan and deposit growth rates, as well as net charge-off percentages, are most often expressed in terms of an annual rate like 8%. As such, a 2% growth rate for a quarter would represent an annualized 8% growth rate. Fully-Taxable Equivalent Interest Income and Net Interest Margin Income from tax-exempt earning assets is increased by an amount equivalent to the taxes that would have been paid if this income had been taxable at statutory rates. This adjustment puts all earning assets, most notably tax-exempt municipal securities and certain lease assets, on a common basis that facilitates comparison of results to results of competitors. Earnings per Share Equivalent Data Significant income or expense items may be expressed on a per common share basis. This is done for analytical and decision-making purposes to better discern underlying trends in total corporate earnings per share performance excluding the impact of such items. Investors may also find this information helpful in their evaluation of the company’s financial performance against published earnings per share mean estimate amounts, which typically exclude the impact of Significant Items. Earnings per share equivalents are usually calculated by applying an effective tax rate to a pre-tax amount to derive an after-tax amount, which is divided by the average shares outstanding during the respective reporting period. Occasionally, when the item involves special tax treatment, the after-tax amount is disclosed separately, with this then being the amount used to calculate the earnings per share equivalent. Rounding Please note that columns of data in this document may not add due to rounding. 23

Basis of Presentation Significant Items From time to time, revenue, expenses, or taxes are impacted by items judged by management to be outside of ordinary banking activities and/or by items that, while they may be associated with ordinary banking activities, are so unusually large that their outsized impact is believed by management at that time to be infrequent or short term in nature. We refer to such items as “Significant Items”. Most often, these Significant Items result from factors originating outside the company – e.g., regulatory actions/assessments, windfall gains, changes in accounting principles, one-time tax assessments/refunds, and litigation actions. In other cases they may result from management decisions associated with significant corporate actions out of the ordinary course of business – e.g., merger/restructuring charges, recapitalization actions, and goodwill impairment. Even though certain revenue and expense items are naturally subject to more volatility than others due to changes in market and economic environment conditions, as a general rule volatility alone does not define a Significant Item. For example, changes in the provision for credit losses, gains/losses from investment activities, and asset valuation write- downs reflect ordinary banking activities and are, therefore, typically excluded from consideration as a Significant Item. Management believes the disclosure of “Significant Items”, when appropriate, aids analysts/investors in better understanding corporate performance and trends so that they can ascertain which of such items, if any, they may wish to include/exclude from their analysis of the company’s performance - i.e., within the context of determining how that performance differed from their expectations, as well as how, if at all, to adjust their estimates of future performance accordingly. To this end, Management has adopted a practice of listing “Significant Items” in its external disclosure documents (e.g., earnings press releases, quarterly performance discussions, investor presentations, Forms 10-Q and 10-K). “Significant Items” for any particular period are not intended to be a complete list of items that may materially impact current or future period performance. A number of items could materially impact these periods, including those described in Huntington’s 2017 Annual Report on Form 10-K and other factors described from time to time in Huntington’s other filings with the Securities and Exchange Commission. 24