Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 GREEN BRICK PARTNERS, INC. EARNINGS RELEASE 09.30.2018 - Green Brick Partners, Inc. | exhibit991earningsrelease9.htm |

| 8-K - FORM 8-K 9.30.2018 - Green Brick Partners, Inc. | a9302018form8-k.htm |

Exhibit 99.2 GREEN BRICK PARTNERS Q3 2018 INVESTOR CALL PRESENTATION November 5, 2018 1

FORWARD LOOKING STATEMENTS This presentation and the oral statements made by representatives of the Company during the course of this presentation that are not historical facts are forward-looking statements. These statements are often, but not always, made through the use of words or phrases such as “may,” “will,” “should,” “could,” “would,” “predicts,” “potential,” “continue,” “expects,” “anticipates,” “future,” “outlook,” “strategy,” “positioned,” “intends,” “plans,” “believes,” “projects,” “estimates” and similar expressions, as well as statements in the future tense. Although the Company believes that the assumptions underlying these statements are reasonable, individuals considering such statements for any purpose are cautioned that such forward- looking statements are inherently uncertain and necessarily involve risks that may affect the Company’s business prospects and performance, causing actual results to differ from those discussed during the presentation, and any such difference may be material. Factors that could cause actual results to differ from those anticipated are discussed in the Company’s annual and quarterly reports filed with the SEC. Any forward-looking statements made are subject to risks and uncertainties, many of which are beyond management’s control. These risks include the risks described in the Company’s filings with the SEC. Should one or more of these risks or uncertainties occur, or should underlying assumptions prove incorrect, the Company’s actual results and plans could differ materially from those expressed in any forward-looking statements. Given these risks and uncertainties, you are cautioned not to place undue reliance on such forward-looking statements. These forward-looking statements are made only as of the date hereof. The Company undertakes no obligation to publicly update any forward-looking statements, whether as a result of new information or future events. The Company presents Basic Adjusted EPS, Diluted Adjusted EPS, Basic and Diluted Adjusted weighted-average number of shares outstanding, GRBK Pre-tax Income and Adjusted Homebuilding Gross Margin. The Company believes these and similar measures are useful to management and investors in evaluating its operating performance and financing structure. The Company also believes these measures facilitate the comparison of their operating performance and financing structure with other companies in the industry. Because these measures are not calculated in accordance with Generally Accepted Accounting Principles (“GAAP”), they may not be comparable to other similarly titled measures of other companies and should not be considered in isolation or as a substitute for, or superior to, financial measures prepared in accordance with GAAP. 2

MANAGEMENT PRESENTERS Jim Brickman Rick Costello Chief Executive Officer Chief Financial Officer • Over 40 years in real estate development and • Over 26 years of financial and operating experience in homebuilding. all aspects of real estate management. • Co-founded JBGL with Greenlight Capital in 2008. JBGL • Previously served as CFO and COO of GL Homes, as was merged into Green Brick in 2014. AVP of finance of Paragon Group and as an auditor for • Previously served as Chairman and CEO of Princeton KPMG. Homes and Princeton Realty Corp. • Received his M.B.A from Northwestern University’s Kellogg School. Jed Dolson Summer Loveland President of Texas Region Chief Accounting Officer • Over 15 years of land development and property • Over 20 years of experience in the accounting and acquisition. financial reporting services industry. • Head of GRBK land acquisitions since 2010. • Previously served as Chief Financial Officer of the Dallas • Masters Degree in Engineering, Stanford University, and Police and Fire Pension System. Registered Engineer, State of Texas. • Certified Public Accountant licensed in the states of Texas and California. 3

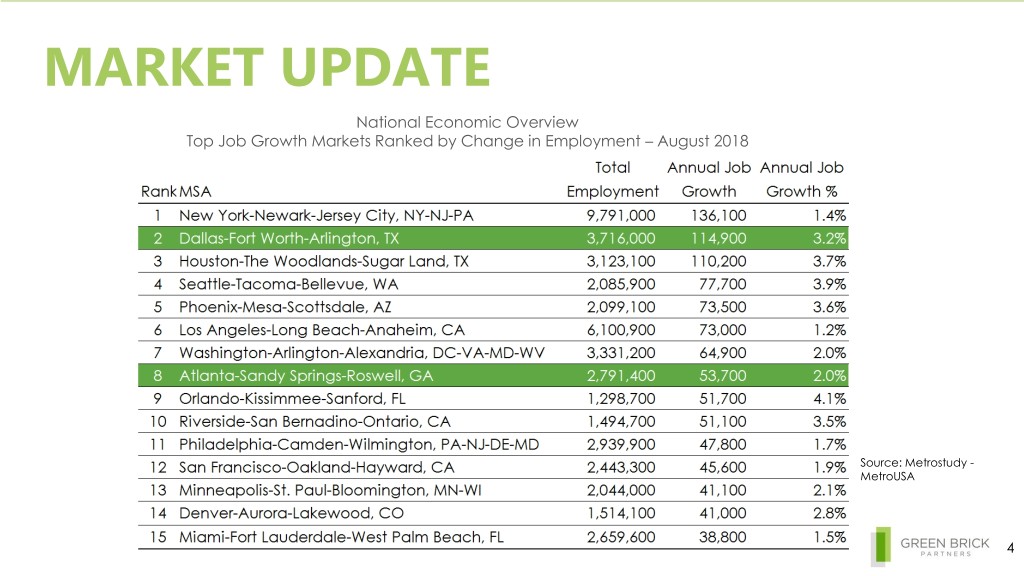

MARKET UPDATE National Economic Overview Top Job Growth Markets Ranked by Change in Employment – August 2018 Source: Metrostudy - MetroUSA 4

MARKET UPDATE We are 2% to 3% of the starts in two of the largest housing markets, giving us significant opportunity for growth National Housing Market Annual Starts by Market – August 2018 GRBK has also entered the Colorado Springs market through our investment in Challenger Homes. Source: Metrostudy - MetroUSA 5

MARKET UPDATE Dallas market continues 7-year expansion but is still well below the 2006 peak of more than 50,000 starts (not shown) Dallas/Fort Worth Market SFD-TH – Starts and closings Source: Metrostudy - MetroUSA 6

MARKET UPDATE GRBK has over 5,000 lots in Dallas where the market continues its 7-year trend of constrained supply Dallas/Fort Worth Market Lot Inventory Source: Metrostudy - MetroUSA 7

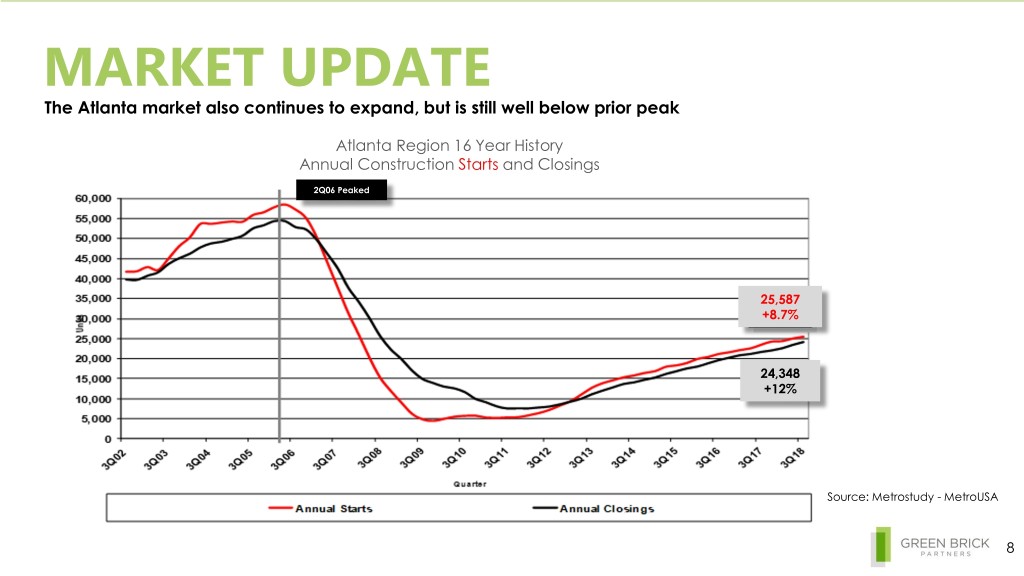

MARKET UPDATE The Atlanta market also continues to expand, but is still well below prior peak Atlanta Region 16 Year History Annual Construction Starts and Closings 2Q06 Peaked 25,587 +8.7% 24,348 +12% Source: Metrostudy - MetroUSA 8

LIMITED SUPPLY Our markets exhibit limited supply Resale Months Supply in Major U.S. Cities(1) Source: Metrostudy – MetroUSA 9 (1) Metrostudy – MetroUSA (Atlanta Housing Market Third Quarter 2018 published November 2, 2018)

LAND POSITION Land is well positioned in attractive submarkets Atlanta Metro Area Dallas Metro Area Submarket Submarket Grades Grades A A B B C C D D E E GRBK GRBK Locations Locations Source: John Burns Real Estate Consulting (Regional Analysis and Forecast Published May 2018) 10 Note: GRBK Locations are approximate

CORPORATE STRUCTURE • Control positions in six separate homebuilders and 49.9% position with a pathway to control in one homebuilder • Acquire and develop land and provide land and construction financing to our Dallas and Atlanta Team BuildersTM • Participate in the profits of all of our Team BuildersTM Team Builders Voting Market Products Offered Price Range Control Townhomes $310k - $650k 51%(1) Atlanta, GA Single Family $440k - $1,100k Townhomes $250k - $430k 51%(1) Dallas, TX / Single Family $320k - $700k Dallas, TX Townhomes 51%(1) $320k - $1,500k Single Family Dallas, TX 51%(1) Luxury Homes $550k - $1,300k Single Family 80% Vero Beach, FL $200k - $600k Financial Services Platform Patio Homes Townhomes 49.9%(2) Colorado Springs, CO $250k - $600k Single Family 100% control 49% ownership 100% Dallas, TX Single Family $200k - $450k (1) GRBK receives lot sale profits and lending profits before these builders receive any income on their non-controlling interest 11 (2) With pathway to control.

BUILDER SPOTLIGHT Green Brick introduces Trophy Signature Homes, our first entry into lower price point housing. • Launched Trophy Signature Homes October 2018. • Wholly-owned by Green Brick Partners. • Under the direction of Stewart Parker, President of Trophy Signature Homes. • Purchased or optioned land for over 1,100 lots in Dallas-Fort Worth. • First homes expected to be delivered Q4 2019. • Single family homes priced between $200,000 - $450,000. • Expected to work closely with Green Brick Mortgage and Green Brick Title. 12

BUILDER MARKETS Trophy Signature Homes will target the $254k and under market • First time buyer segment at $254K and below experiences relatively flat start pace. • Demand remains high, but supply is difficult to replenish given increasing development and construction costs. • Supply of vacant lots for homes priced $254K and below at a tight 18.6 month supply. • DR Horton and Express Homes by DR Horton account for 31% of starts in this price category. AnnualStarts • Additional builders with top performing positions at this price point include LGI, Lennar, Centex, Impression and Camden Homes. • Top submarkets for the first time buyer: Princeton, City of Ft. Worth- Southwest and Northwest, Kaufman County, and the 287 corridor. • On average, builders close 71.4 homes per year, per model home in Annual Start Rate this price range. 13 Source: RSI

BUILDER MARKETS Trophy Signature Homes will also target $255-305k & $305-350k markets • The two quintiles spanning $255K to$350K account for 88% of the increase in starts in DFW during the last year (+2,889 starts this year vs. year prior). • Builders producing strong 34.6 closings per year, per model in $254-304K price range. • $305-350K segment is more competitive with average annual closings per model of 32.2 units. AnnualStarts • $255-304K top submarkets include: Fort Worth 287 Corridor, Fate, Denton Co Uninc – East, and Kaufman Co Uninc. • $305-350K top submarkets include: Denton Co Uninc – East, Wylie, McKinney-West, and Celina Annual Start Rate 14 Source: RSI

GRBK: A TRUE GROWTH STORY We have the strong balance sheet and operational excellence for continued growth Annual Revenue Growth for Green Brick Partners and Predecessor 15

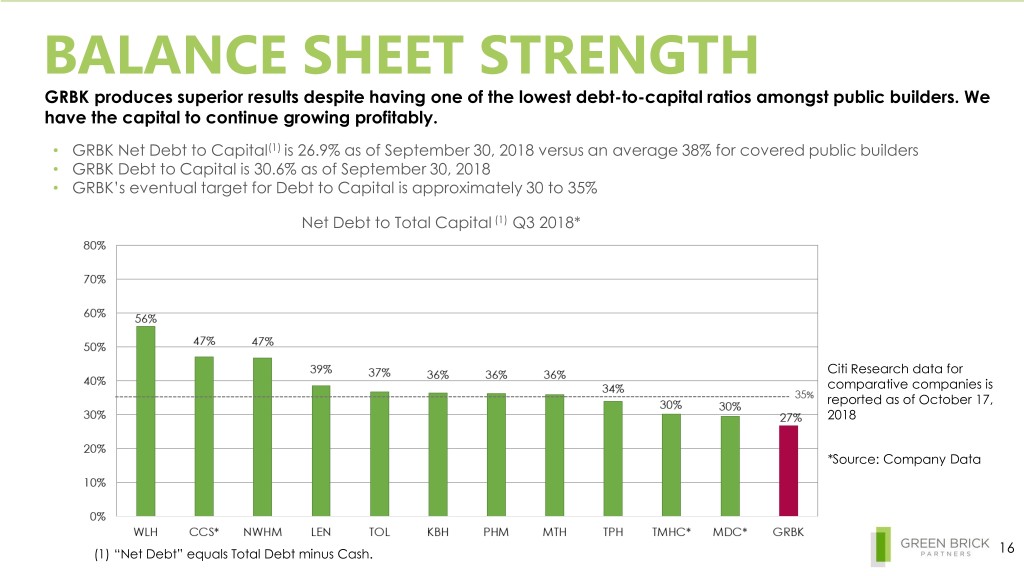

BALANCE SHEET STRENGTH GRBK produces superior results despite having one of the lowest debt-to-capital ratios amongst public builders. We have the capital to continue growing profitably. • GRBK Net Debt to Capital(1) is 26.9% as of September 30, 2018 versus an average 38% for covered public builders • GRBK Debt to Capital is 30.6% as of September 30, 2018 • GRBK’s eventual target for Debt to Capital is approximately 30 to 35% Net Debt to Total Capital (1) Q3 2018* Citi Research data for comparative companies is reported as of October 17, 2018 *Source: Company Data (1) “Net Debt” equals Total Debt minus Cash. 16

FINANCIAL HIGHLIGHTS Unaudited Q3 2017 Q3 2018 17 vs 18 Increase YTD 2017 YTD 2018 YTD Increase Home Closings - Units 235 312 32.8% 698 905 29.7% Net New Orders 241 297 23.2% 798 1,118 40.1% Homebuilding Revenues ($'s in thousands) $108,437 $137,399 26.7% $302,179 $401,643 32.9% 3rd Party Lot Closings ($'s in thousands) $ 5,269 $ 12,593 139.0% $ 15,815 $ 31,624 100.0% Total Revenues ($'s in thousands) $113,706 $149,992 31.9% $317,994 $433,267 36.3% GRBK Portion of Pre-Tax Income ($'s in thousands) $14,616 $16,943 15.9% $36,705 $52,326 42.6% GAAP EPS $0.19 $0.24 26.3% $0.47 $0.76 61.7% Backlog $164,632 $308,974 87.7% Homebuilding Gross Margin 21.8% 20.8% 21.5% 21.4% Adjusted Gross Margin 22.4% 21.5% 22.2% 22.1% NCI as % of Building Revenues 2.4% 2.3% 2.1% 2.3% GRBK Pre-Tax / Homebuilding Revenues 13.5% 12.3% 12.1% 13.0% EBITDA Return on Average Equity 14.9% 16.7% 13.0% 17.5% Total Lots Owned & Controlled 5,697 8,101 42.2% Units Under Construction 715 1,113 55.7% 17 Last 12 Months Starts 1,023 1,441 40.9%

OPERATIONAL HIGHLIGHTS LTM Adjusted Gross Margins LTM GRBK Pre-Tax Income to Homebuilding Revenues 18

INDUSTRY-LEADING MARGINS LTM Pretax Margin%* (LTM – Q3 2018 for GRBK / FYE 18 Estimates for Peers) Median: 8.7% Source: Citi Research data for comparative companies is reported as of August 24, 2018 *Source: Company Data 19

APPENDIX 20

NON-GAAP RECONCILIATION Adjusted Homebuilding Gross Margin Reconciliation 12 Months 12 Months 12 Months 12 Months 12 Months Ended Ended Ended Ended Ended (Unaudited, in thousands) Sep 30, 2017 Dec 31, 2017 Mar 31, 2018 Jun 30, 2018 Sep 30, 2018 Sale of Residential Units $419,156 $435,644 $462,613 $506,146 $535,108 Homebuilding gross margin $93,637 $93,579 $99,800 $109,570 $114,503 Add back: Capitalized Interest charged to cost $2,639 $2,630 $2,784 $2,938 $3,319 of sales Adjusted homebuilding gross margin $96,276 $96,209 $102,584 $112,508 $117,822 Adjusted gross margin percentage 23.0% 22.1% 22.2% 22.2% 22.0% 21

NON-GAAP RECONCILIATION GRBK Pre-tax Income as a Percentage of Homebuilding Revenues 12 Months 12 Months 12 Months 12 Months 12 Months Ended Ended Ended Ended Ended (Unaudited, in thousands) Sep 30, 2017 Dec 31, 2017 Mar 31, 2018 Jun 30, 2018 Sep 30, 2018 LTM net income attributable to Green Brick $30,842 $14,970 $19,976 $27,156 $30,074 LTM income tax provision attributable to Green Brick $19,541 $38,896 $38,376 $39,176 $38,586 LTM transaction expenses $ - $ - $ 122 $ 827 $ 827 LTM GRBK pre-tax income $50,383 $53,866 $58,474 $67,159 $69,487 LTM Sale of Residential Units $419,156 $435,644 $462,613 $506,146 $535,108 LTM GRBK pre-tax income as a % of 12.0% 12.4% 12.6% 13.3% 13.0% Homebuilding Revenues 22

NON-GAAP RECONCILIATION Return on Invested Capital 3 Months Ended 3 Months Ended 9 Months Ended 9 Months Ended (Unaudited, in thousands) Sep 30, 2017 Sep 30, 2018 Sep 30, 2017 Sep 30, 2018 GRBK Pre-tax Income $14,616 $16,943 $36,705 $52,326 Add back: Capitalized interest charged to cost of sales $716 $1,114 $2,486 $3,079 Add back: Depreciation expense $66 $766 $238 $1,804 EBITDA $15,398 $18,823 $39,429 $57,209 Divided by: GRBK Beginning Equity $399,944 $443,324 $384,572 $416,347 GRBK Ending Equity $424,214 $455,686 $424,214 $455,686 GRBK Average Equity $412,079 $449,505 $404,393 $436,017 Multiplied by: Annualization Multiple 4x 4x 1.33x 1.33x EBITDA Return on Average Equity 14.9% 16.7% 13.0% 17.5% 23

2805 Dallas Parkway, Suite 400 Plano, TX 75093 www.greenbrickpartners.com 24