Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - Oblong, Inc. | glowpressreleasefinal115181.htm |

| 8-K - 8-K - Oblong, Inc. | a8kpressrelease-sharedlabs.htm |

October 24, 2018

SharedLabs, Inc.

118 West Adams Street, Suite 200

Jacksonville, Florida 32202

Attn: Mr. Jason Cory

President & CEO

Dear Jason:

This letter of intent confirms our mutual present intenton to pursue a transaction in which, subject to the terms and conditions set forth in the Term Sheet attached as Annex A hereto (the “Term Sheet”), Glowpoint, Inc., a Delaware corporation (“GLOW”), would acquire 100% of the issued outstanding equity securities of SharedLabs, Inc., a Delaware corporation (“SHLB” and, together with GLOW, the “Parties”), in a transaction the Parties expect to effect by means of a reverse triangular merger in which a newly-formed subsidiary of GLOW will be merged into SHLB (the “Transaction”). The terms of the Transaction will be more particularly set forth in a merger agreement (together with any other agreements related thereto, the “Definitive Agreements”) to be mutually agreed upon by the Parties. Except as specifically set forth below, this letter of intent and the Term Sheet are not intended to be binding on the Parties.

We will need to complete legal, business and other due diligence to our satisfaction and our Board of Directors will need to receive a fairness opinion from our financial advisor and consider and approve the Transaction, in each case before we submit any binding offer or execute any Definitive Agreements. Our due diligence will involve a more in-depth review of technical, legal, tax, accounting, and commercial subject areas. We would expect to gain access to an expanded data room of key documents and engage in more detailed discussions with SHLB management. Accordingly, except as set forth in Sections 8 and 10 of the Term Sheet, this letter of intent and the Term Sheet are not intended to be binding or enforceable and neither Party hereto will have any obligation to consummate a transaction of any kind until such time as the Parties have entered into mutually agreeable Definitive Agreements with respect thereto, and then only subject to the terms and conditions thereof.

Any amendments or extensions to this letter of intent must be signed by each of the Parties hereto. This letter of intent shall be governed by the laws of the State of Delaware, without giving effect to any conflict of law principles, and may be signed in one or more counterparts, each of which shall be deemed to be an original, but all of which together shall constitute one agreement.

This letter of intent is confidential to the Parties and their representatives and is subject to the Mutual Non-Disclosure and Confidentiality Agreement, dated July 26, 2018, by and between the Parties, as amended to date, which continues in full force and effect in accordance with its terms.

Except as specifically set forth or referred to herein, nothing herein is intended or shall be construed to confer upon any person or entity other than the Parties and their successors or assigns, any rights or remedies under or by reason of this letter of intent.

Upon execution of this letter of intent, GLOW will prepare a press release regarding the terms of this letter of intent and the Term Sheet for joint issuance by the Parties. Any other announcement, circular or other material relating to the existence or the subject matter of this letter of intent or the Term Sheet, including any material to be disseminated by SHLB in connection with any issuance of securities or borrowing of funds by SHLB, or the pursuit thereof, shall first be approved by both Parties as to its content, form and manner of publication or dissemination, prior to any publication or dissemination thereof.

This letter of intent will automatically terminate and be of no further force and effect upon the earlier to occur of (a) execution of a Definitive Agreement by the Parties, (b) mutual agreement of the Parties, and (c) 5:00 PM MT on November 8, 2018. Notwithstanding anything in the previous sentence, Sections 8 and 10 of the Term Sheet and the NDA, as amended, shall each survive the termination of this letter of intent and the termination of this letter of intent shall not affect any rights any Party has with respect to the breach of this letter of intent by another Party prior to such termination.

If you are in agreement with the foregoing, please sign in the space provided below and return a signed copy to us. If not previously executed and returned, this letter of intent expires at 5:00 PM MT on October 26, 2018.

Best regards,

GLOWPOINT, INC.,

a Delaware corporation

/s/ Peter J. Holst

Name: Peter J. Holst

Title: President & CEO

Accepted and Agreed to as of the date first written above:

SHAREDLABS, INC.,

a Delaware corporation

/s/ Jason M. Cory

Name: Jason M. Cory

Title: President & CEO

ANNEX A

Term Sheet

1. | Parties: | • Glowpoint, Inc., a Delaware corporation (“GLOW”); and | |

• SharedLabs, Inc., a Delaware corporation ("SHLB" and, together with GLOW, the "Parties".) | |||

2. | Structure: | At the closing of the Transaction (“Closing”) (i) each option, restricted stock unit or restricted stock award outstanding under the Glowpoint 2014 Equity Incentive Plan, Glowpoint 2007 Equity Incentive Plan or Glowpoint 2000 Equity Incentive Plan will be vested or exercised, as the case may be; and (ii) GLOW will acquire 100% of the issued and outstanding equity securities of SHLB (including each outstanding option, warrant, share equivalent or other right to purchase or acquire, convert into, or contingently receive capital stock of SHLB), in exchange for the consideration described in Section 3, by means of a reverse triangular merger in which a newly-formed subsidiary of GLOW will be merged into SHLB (the “Transaction”). As a result of the Transaction, SHLB will become a wholly-owned subsidiary of GLOW. | |

It is expected that the Transaction will constitute a tax-free reorganization for U.S. Federal income tax purposes. | |||

The directors and executive officers of each Party will enter into agreements to vote their shares of voting capital stock in favor of the Transaction and any related matters on which such stockholders may be called to vote. Each Party will use commercially reasonable efforts to cause its 5% or greater stockholders to enter into support agreements to vote their shares of voting capital stock in favor of the Transaction and any related matters on which such stockholders may be called to vote. | |||

The Parties will, from the time of signing the letter of intent governing this Term Sheet until the termination of such letter of intent, use their commercially reasonable efforts and work jointly, and in good faith, to facilitate the transactions described in Sections 4(I)(B) and (C). | |||

3. | Consideration: | Assuming GLOW has approximately 58,531,426 shares of its Common Stock, par value $0.0001 per share (“Common Stock”), outstanding at Closing, GLOW will issue at Closing an aggregate of 112,802,326 shares (the “Shares”) of its Common Stock, in exchange for 100% of the issued and outstanding equity securities of SHLB (including each outstanding option, warrant, share equivalent or other right to purchase or acquire, convert into, or contingently receive capital stock of SHLB), subject to the terms outlined herein. | |

The Shares to be issued in the Transaction will be registered with the Securities and Exchange Commission (the “SEC”) pursuant to a Form S-4 Registration Statement to be filed with the SEC by GLOW. | |||

4. | Conditions to Closing: | I. In addition to the other terms and conditions set forth in this Term Sheet, any obligation of GLOW to close a Transaction is conditional upon: | |

A. The receipt of all required approvals of the stockholders of SHLB and GLOW (including but not limited to stockholder approval of any required amendments to GLOW’s Certificate of Incorporation, a reverse stock split of GLOW’s issued and outstanding Common Stock, a new equity incentive plan for existing and future award recipients (the “New Incentive Plan”) and any stockholder approval required by NYSE American rules applicable to GLOW), third-party consents, and regulatory clearances, including from the NYSE American, the SEC and under applicable merger regulations, which, in each case, may be necessary to effect the Transaction or the consideration to be provided therein; | |||

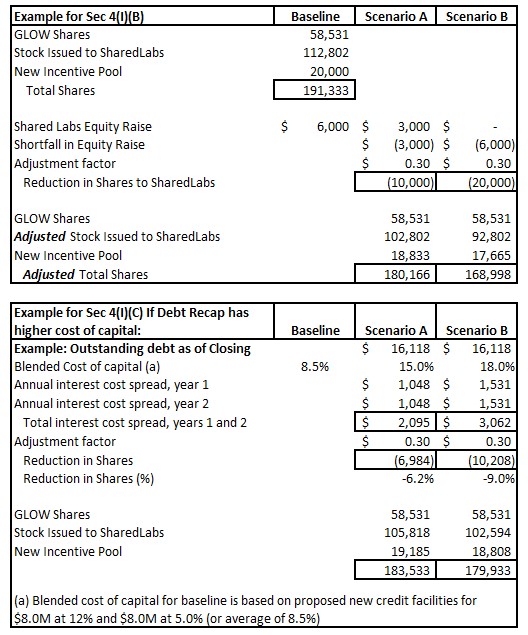

B. The completion, prior to Closing, with funds to be released from escrow no later than the date of Closing, by SHLB of a private placement of SHLB common stock for at least $6,000,000 of cash proceeds, net of expenses for the raise itself; | |||

C. Delivery by SHLB to GLOW of a signed loan term sheet(s) from a lending institution(s) on or before ten days following execution of a Definitive Agreement providing for a credit facility or credit facilities (collectively, the “Loans”) totaling at least $16,000,000, including a maximum of $8,000,000 on a subordinated term loan with an annual interest rate not to exceed 12% and $8,000,000 on an Accounts Receivable Line with an annual interest rate not to exceed 5%, and including all other material terms and conditions of the Loans, with a closing date for the Loans of no later than ninety days after Closing, and providing that the Loans will be available to be fully drawn immediately following the Closing of such Loans; | |||

D. SHLB will provide to GLOW a calculation of its Net Working Capital (as defined below) as of Closing, within 15 days following Closing, which calculation will be prepared by an outside independent accounting firm. The Definitive Agreement will include a “make whole” clause to adjust the Shares in the event: (i) SHLB's actual Net Working Capital deficit as of Closing is worse than SHLB’s Net Working Capital deficit as of June 30, 2018, (ii) the balance on SHLB’s existing Seller’s Note as of Closing exceeds $1,000,000, (iii) the balance on SHLB’s existing financing line as of Closing exceeds $10,000,000 (which will be refinanced by the Loan referenced in Section 4(I)(C) above at the closing of the Loans), and/or (iv) the balance of SHLB’s long-term debt as of Closing is greater than the balance as of June 30, 2018. The “make whole” clause will reduce the number of Shares to be issued in the Transaction consistent with the methodology set forth in Exhibit A attached hereto for Section (4)(I)(B) above (with such terms to be set forth in the Definitive Agreement); | |||

E. All contracts or other agreements to which SHLB is a party that provide a counterparty with redeemable or contingent common stock or a guaranteed return (including pursuant to the iTech and ExoiS acquisitions and all agreements with the investor in SHLB’s January 2018 Financing (as defined in the S-1 (as defined below))) shall be fully satisfied and terminated on or prior to Closing; and | |||

F. Other customary conditions such as the absence of any injunction prohibiting the Transaction, the truth of all representations and warranties, compliance with covenants and absence of any material adverse event. | |||

II. In addition to the other terms and conditions set forth in this Term Sheet, any obligation of SHLB to close a Transaction is conditional upon: | |||

A. The receipt of all required approvals of the stockholders of SHLB and GLOW (including but not limited to stockholder approval of any required amendments to GLOW’s Certificate of Incorporation, a reverse stock split of GLOW’s issued and outstanding Common Stock, the New Incentive Plan and any stockholder approval required by NYSE American rules applicable to GLOW), third-party consents, and regulatory clearances, including from the NYSE American, the SEC and under applicable merger regulations, which, in each case, may be necessary to effect the Transaction or the consideration to be provided therein; | |||

B. GLOW will provide to SHLB a calculation of its Net Working Capital, as of Closing, within 15 days following Closing, which calculation will be prepared by an outside independent accounting firm. The Definitive Agreement will include a “make whole” clause to adjust the Shares in the event that GLOW’s actual Net Working Capital as of Closing is below $1,500,000. The “make whole” clause will increase the number of Shares to be issued in the Transaction consistent with the methodology set forth in Exhibit A attached hereto for Section (4)(I)(B) above (with such terms to be set forth in the Definitive Agreement); and | |||

C. Other customary conditions such as the absence of any injunction prohibiting the Transaction, the truth of all representations and warranties, compliance with covenants and absence of any material adverse event. | |||

For purposes of this Section 4, subject to finalization of financial due diligence, “Net Working Capital” is defined as the sum of (i) cash, (ii) accounts receivable, (iii) pre-paid expenses, (iv) inventory and (v) other current assets, less the sum of (i) accounts payable, (ii) accrued expenses, (iii) current debt and (iv) other current liabilities. | |||

5. | Representations, Warranties, Indemnities, and Other Provisions; Post-Signing Market Check: | In the Definitive Agreement, GLOW and SHLB will each make customary representations and warranties (which will survive the Closing). The Definitive Agreement will also contain customary covenants, closing conditions and other provisions. | |

In addition, in order to ensure that the GLOW Board fulfills its fiduciary duty under Delaware law to maximize the value of GLOW for its stockholders’ benefit, the Definitive Agreement will include a “go-shop” provision entitling GLOW, for a 45-day period immediately following the execution of a definitive merger agreement, to conduct a post-signing market check process. | |||

6. | Corporate Governance and Board Composition: | A. The Board of Directors of GLOW following Closing will include at least one Board member to be designated by the Board of GLOW existing prior to Closing. | |

B. GLOW, after obtaining the agreement of SHLB to the terms of the New Incentive Plan, will seek shareholder approval for the establishment of the New Incentive Plan with 20,000,000 shares of Common Stock (the “Plan Shares”) initially available for issuance pursuant to awards under the New Incentive Plan, with the final number of Plan Shares under the New Incentive Plan to be subject to adjustment, including as a result of the “Amendment to Exchange Ratio” provisions of Section 7, in order to, at Closing, be equal to 10.453% of the sum of (i) the shares of GLOW Common Stock outstanding at Closing (not including any Shares issued in the Transaction) plus (ii) the Shares issued in the Transaction plus (iii) the number of Plan Shares. | |||

7. | Amendment to Exchange Ratio Upon Failure of Certain Conditions: | A. (1) If SHLB fails to fully satisfy the condition precedent set forth in Section 4(I)(B) above, GLOW may, at its option, upon approval by the GLOW Board of Directors, proceed to consummate the Transaction upon the terms set forth herein with the exception that the Shares to be issued to SHLB in the Transaction shall be reduced proportionally consistent with the methodology set forth in Exhibit A attached hereto (with such terms to be set forth in a Definitive Agreement). | |

(2) Alternatively, and without limitation on the foregoing sentence, if SHLB fails to complete a private placement of SHLB common stock for cash proceeds, net of all expenses, discounts, fees and commissions associated with such private placement, of at least $5,000,000, prior to Closing, with funds to be released from escrow no later than the date of Closing, GLOW may, at its option, elect to not proceed to consummate the Transaction and, in such event, GLOW will be entitled to receive reimbursement for its actual expenses associated with the Transaction on the terms set forth in Section 10(C) below. | |||

B. If SHLB fails to fully satisfy the condition precedent set forth in Section 4(I)(C) above, GLOW may, at its option and upon approval by the GLOW Board of Directors, proceed to consummate the Transaction upon the terms set forth herein with the exception that the Shares to be issued to SHLB in the Transaction shall be reduced by 7.5% (or 8,460,174 shares). These shares will be held in escrow until the condition precedent set forth in Section (4)(I)(C) is satisfied. Alternatively, and not in limitation of the foregoing sentence, if SHLB secures the Loans but at higher interest rates than set forth in Section (4)(I)(C), GLOW may, at its option and upon approval by the GLOW Board of Directors, proceed to consummate the Transaction upon the terms set forth herein with the exception that the Shares to be issued to SHLB in the Transaction shall be reduced proportionally consistent with the methodology set forth in Exhibit A attached hereto, with such dollar amount based on the difference in per annum cost of capital over a period of two years (with such terms to be set forth in a Definitive Agreement, including that cost of capital will factor in the issuance of stock derivatives (such as warrants) and that such derivatives will be valued using Black-Scholes). | |||

C. If SHLB fails to fully satisfy the condition precedents set forth in each of Sections 4(I)(B) and 4(I)(C) above, GLOW may, at its option and upon approval by the GLOW Board of Directors, proceed to consummate the Transaction upon the terms set forth herein with the exception that the Shares to be issued in the Transaction shall be reduced proportionally based on a mutually agreed valuation to be determined in a Definitive Agreement. | |||

D. In each of the cases set forth in Sections 7(A) - (C) above, the decision of GLOW or the GLOW Board of Directors will be in its sole, unfettered discretion with no fiduciary or similar obligation to SHLB or its stockholders, officers, directors or affiliates. | |||

8. | Due Diligence: | Each Party will have the right to conduct such due diligence with respect to the other Party as it shall desire, including, without limitation, technical, legal, tax, accounting, commercial, and other due diligence, as well as reviews of all books, records, financial statements, models, forecasts, budgets, contracts, agreements, filings, permits, approvals, and all other documentation pertaining to such Party and its business. Each Party will cooperate with the other Party and its agents and representatives in connection with such due diligence, including by (i) providing copies of all such documentation reasonably promptly following their request by the other Party or their agents or other representatives and (ii) making available its facilities, records, key employees and key members of such Party’s senior management. | |

Further, prior to the Parties’ agreement upon this Term Sheet, SHLB shall provide to GLOW all correspondence between SHLB and the SEC regarding the S-1 and all related matters in complete and full format together with all exhibits, schedules and other attachments (if any) thereto. | |||

9. | Definitive Agreement; Closing: | The Parties will negotiate in good faith to execute a Definitive Agreement no later than November 8, 2018. The Definitive Agreement and all other such agreements must be satisfactory to the parties to such agreements. | |

10. | Binding Provisions (Fees and Expenses; S-1; Public Announcements): | A. Except as otherwise set forth in this Section 10, each Party shall bear and pay, without any right of reimbursement from the other Party, all costs, fees, and expenses, including attorney fees, incurred by it or on its behalf in connection with the preparation, execution, and delivery of the letter of intent and this Term Sheet and the transactions contemplated thereby and hereby; provided, however, that, notwithstanding anything to the contrary set forth therein or herein, if, at any time prior to Closing, either Party (such Party, the “Terminating Party”) ceases to pursue, or informs the other Party (such Party, the “Terminated Party”) that it no longer wishes to pursue, the Transaction pursuant to the terms set forth in this Term Sheet or otherwise (a “Termination”), the Parties agree that the Terminating Party shall pay to the Terminated Party fifty percent (50%) of all reasonable and customary third-party expenses of the Terminated Party, including but not limited to all legal, accounting, financial and other professional fees and expenses, actually incurred by the Terminated Party in connection with the Terminated Party’s pursuit of the Transaction (the “Reimbursable Expenses”). Any such Reimbursable Expenses shall be payable by the Terminating Party to the Terminated Party in immediately available funds by wire transfer no later than ten (10) days after receipt by the Terminating Party of written notice from the Terminated Party pursuant to this Section 10(A). Notwithstanding the foregoing, (i) if GLOW ceases to pursue, or informs SHLB that it no longer wishes to pursue, the Transaction, pursuant to the terms of Section 7 or 10(C) of this Term Sheet, or (ii) if any Party ceases to pursue, or informs the other Party that it no longer wishes to pursue, the Transaction, as a result of a Material Adverse Condition (as defined below) in the other Party’s business, such event shall not be deemed to be a “Termination” for purposes of this Section 10(A). For purposes of this Section 10(A), “Material Adverse Condition” shall include any event, occurrence, fact, condition or change that is materially adverse to (a) the business, results of operations, condition (financial or otherwise) or assets of a Party, or (b) the ability of a Party to consummate the transactions contemplated hereby; provided, however, that “Material Adverse Condition” shall not include any event, occurrence, fact, condition or change, directly or indirectly, arising out of or attributable to: (i) general economic or political conditions; (ii) conditions generally affecting the industries in which the Party operates; (iii) any changes in financial or securities markets in general; (iv) acts of war (whether or not declared), armed hostilities or terrorism, or the escalation or worsening thereof; (v) any changes in applicable laws or accounting rules, including GAAP; or (vi) the public announcement, pendency or completion of the transactions contemplated by this Term Sheet; provided, further, however, that any event, occurrence, fact, condition or change referred to in clauses (i) through (iv) immediately above shall be taken into account in determining whether a Material Adverse Condition has occurred or could reasonably be expected to occur to the extent that such event, occurrence, fact, condition or change has a disproportionate effect on a Party compared to other participants in the industries in which the Party operates. | |

B. The definitive merger agreement will require SHLB to withdraw its Registration Statement on Form S-1, File No. 333-224954 (the “S-1”), and will include break-fee provisions (the “Break Fee”) applicable in the event that the Transaction is not consummated as a result of (i) a breach of SHLB, (ii) termination of the Transaction by SHLB for a reason other than the breach of SHLB or the failure of SHLB to satisfy a condition precedent to the consummation of the Transaction, (iii) a breach of GLOW or (iv) termination of the Transaction by GLOW for a reason other than the breach of GLOW or the failure of GLOW to satisfy a condition precedent to the consummation of the Transaction, in each case following the Parties’ agreement upon this Term Sheet. | |||

C. Notwithstanding any other provision of this Term Sheet, and separate and apart from the provisions of Sections 10(A) and (B), if SHLB fails to complete a private placement of SHLB common stock for cash proceeds, net of all expenses, discounts, fees and commissions associated with such private placement, of at least $5,000,000, prior to Closing, with funds to be released from escrow no later than the date of Closing, GLOW may elect, in its sole and absolute discretion, to not proceed to consummate the Transaction and, in such event, GLOW will be entitled to receive reimbursement from SHLB for 100% of its actual expenses associated with this Transaction up to $750,000. In no event shall GLOW be entitled to receive more than 100% of its actual expenses associated with this Transaction as a result of Sections 10(A) and (C) of this Term Sheet. | |||

D. Upon execution of the letter of intent governing this Term Sheet, GLOW will prepare a press release regarding the terms of the letter of intent and this Term Sheet for joint issuance by the Parties. Any other announcement, circular or other material relating to the existence or the subject matter of the letter of intent or this Term Sheet, including any material to be disseminated by SHLB in connection with any issuance of securities or borrowing of funds by SHLB, or the pursuit thereof, shall first be approved by both Parties as to its content, form and manner of publication or dissemination, prior to any publication or dissemination thereof. | |||

11. | Conduct of Business: | Subject to the other provisions of this Term Sheet, from the date hereof through the earlier of execution of a Definitive Agreement or termination of the negotiations of a Transaction (as referenced in writing), each Party will (i) conduct its business in the ordinary course in a manner substantially consistent with past custom and practice, (ii) pay all accounts payable, and collect all accounts receivable in the ordinary course of business and consistent with past and customary practice, (iii) not sell, transfer or otherwise dispose of any of the material tangible or intangible assets of such Party (other than in the ordinary course of business), (iv) maintain its properties and other assets in good working condition (normal wear and tear excepted), and (v) use its best efforts to maintain its business and employees, customers, assets and operations as an ongoing concern in accordance with past custom and practice. Each Party acknowledges that any material changes in such Party following execution of this Term Sheet may affect valuation and ability to proceed with a Transaction. | |

Exhibit A to Term Sheet