Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Atlas Financial Holdings, Inc. | a8-kreq32018earningsrelease.htm |

| EX-99.1 - EXHIBIT 99.1 - Atlas Financial Holdings, Inc. | q32018pressrelease.htm |

NASDAQ: AFH Third Quarter 2018 Conference Call November 6, 2018

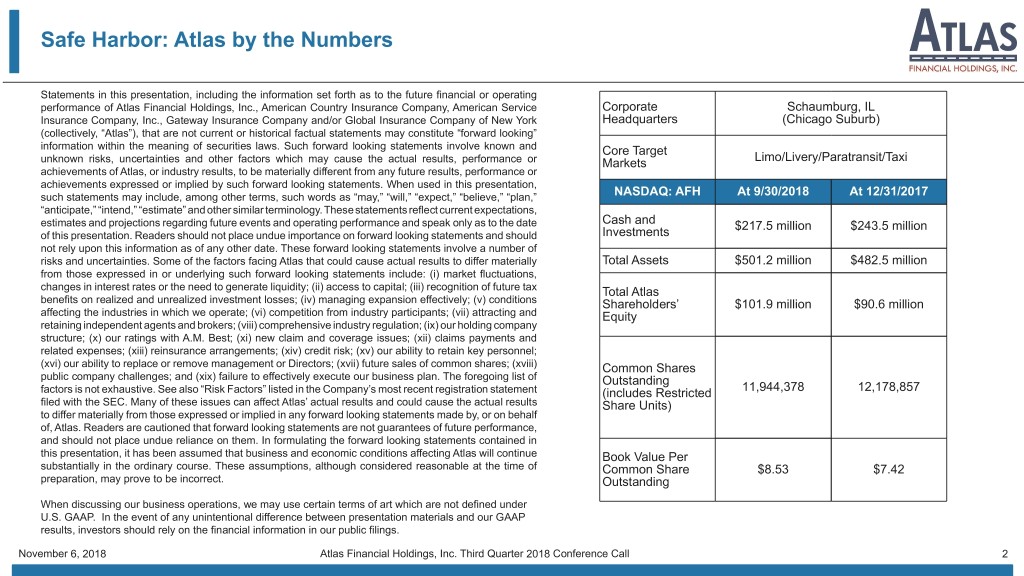

Safe Harbor: Atlas by the Numbers Statements in this presentation, including the information set forth as to the future financial or operating performance of Atlas Financial Holdings, Inc., American Country Insurance Company, American Service Corporate Schaumburg, IL Insurance Company, Inc., Gateway Insurance Company and/or Global Insurance Company of New York Headquarters (Chicago Suburb) (collectively, “Atlas”), that are not current or historical factual statements may constitute “forward looking” information within the meaning of securities laws. Such forward looking statements involve known and Core Target unknown risks, uncertainties and other factors which may cause the actual results, performance or Markets Limo/Livery/Paratransit/Taxi achievements of Atlas, or industry results, to be materially different from any future results, performance or achievements expressed or implied by such forward looking statements. When used in this presentation, such statements may include, among other terms, such words as “may,” “will,” “expect,” “believe,” “plan,” NASDAQ: AFH At 9/30/2018 At 12/31/2017 “anticipate,” “intend,” “estimate” and other similar terminology. These statements reflect current expectations, estimates and projections regarding future events and operating performance and speak only as to the date Cash and $217.5 million $243.5 million of this presentation. Readers should not place undue importance on forward looking statements and should Investments not rely upon this information as of any other date. These forward looking statements involve a number of risks and uncertainties. Some of the factors facing Atlas that could cause actual results to differ materially Total Assets $501.2 million $482.5 million from those expressed in or underlying such forward looking statements include: (i) market fluctuations, changes in interest rates or the need to generate liquidity; (ii) access to capital; (iii) recognition of future tax Total Atlas benefits on realized and unrealized investment losses; (iv) managing expansion effectively; (v) conditions Shareholders’ $101.9 million $90.6 million affecting the industries in which we operate; (vi) competition from industry participants; (vii) attracting and Equity retaining independent agents and brokers; (viii) comprehensive industry regulation; (ix) our holding company structure; (x) our ratings with A.M. Best; (xi) new claim and coverage issues; (xii) claims payments and related expenses; (xiii) reinsurance arrangements; (xiv) credit risk; (xv) our ability to retain key personnel; (xvi) our ability to replace or remove management or Directors; (xvii) future sales of common shares; (xviii) Common Shares public company challenges; and (xix) failure to effectively execute our business plan. The foregoing list of Outstanding factors is not exhaustive. See also “Risk Factors” listed in the Company’s most recent registration statement (includes Restricted 11,944,378 12,178,857 filed with the SEC. Many of these issues can affect Atlas’ actual results and could cause the actual results Share Units) to differ materially from those expressed or implied in any forward looking statements made by, or on behalf of, Atlas. Readers are cautioned that forward looking statements are not guarantees of future performance, and should not place undue reliance on them. In formulating the forward looking statements contained in this presentation, it has been assumed that business and economic conditions affecting Atlas will continue Book Value Per substantially in the ordinary course. These assumptions, although considered reasonable at the time of Common Share $8.53 $7.42 preparation, may prove to be incorrect. Outstanding When discussing our business operations, we may use certain terms of art which are not defined under U.S. GAAP. In the event of any unintentional difference between presentation materials and our GAAP results, investors should rely on the financial information in our public filings. November 6, 2018 Atlas Financial Holdings, Inc. Third Quarter 2018 Conference Call 2

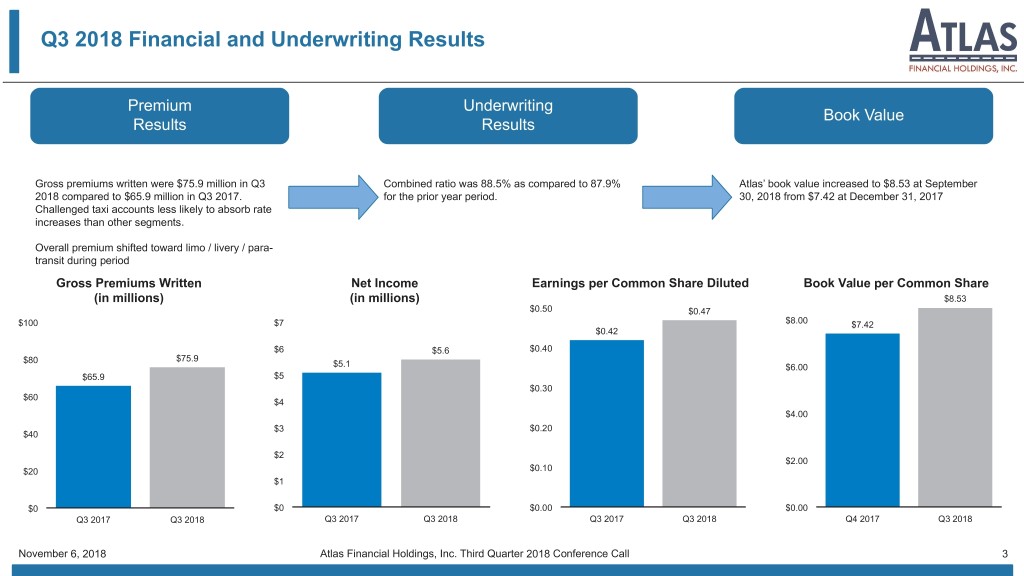

Q3 2018 Financial and Underwriting Results Premium Underwriting Book Value Results Results Gross premiums written were $75.9 million in Q3 Combined ratio was 88.5% as compared to 87.9% Atlas’ book value increased to $8.53 at September 2018 compared to $65.9 million in Q3 2017. for the prior year period. 30, 2018 from $7.42 at December 31, 2017 Challenged taxi accounts less likely to absorb rate increases than other segments. Overall premium shifted toward limo / livery / para- transit during period Gross Premiums Written Net Income Earnings per Common Share Diluted Book Value per Common Share (in millions) (in millions) $8.53 $0.50 $0.47 $100 $7 $8.00 $7.42 $0.42 $6 $5.6 $0.40 $80 $75.9 $5.1 $6.00 $65.9 $5 $0.30 $60 $4 $4.00 $3 $0.20 $40 $2 $2.00 $20 $0.10 $1 $0 $0 $0.00 $0.00 Q3 2017 Q3 2018 Q3 2017 Q3 2018 Q3 2017 Q3 2018 Q4 2017 Q3 2018 November 6, 2018 Atlas Financial Holdings, Inc. Third Quarter 2018 Conference Call 3

Atlas Business Mix 2016 Full Year 2017 Full Year YTD Q3 2018 Taxi Limo/Livery/TNC Taxi Limo/Livery/TNC Taxi Limo/Livery Para-transit Para-transit Para-transit Average Vehicles Average Vehicles Average Vehicles Per Policy Per Policy Per Policy Taxi 2.0 Taxi 2.0 Taxi 2.4 Limo/Livery 1.7 Limo/Livery 2.1 Limo/Livery 1.7 Para-transit 3.1 Para-transit 3.3 Para-transit 3.2 November 6, 2018 Atlas Financial Holdings, Inc. Third Quarter 2018 Conference Call 4

Geographic Diversification Gross premiums written by state (in $000) Three months ended September 30, 2018 2017 Nationwide market share is estimated at approximately New York $ 36,082 47.5% $ 23,136 35.1% California 10,805 14.2% 9,446 14.3% 12% to 13%, with proportionate share forecast at 20% New Jersey 2,572 3.4% 2,327 3.5% Virginia 2,473 3.3% 2,265 3.4% Missouri 1,933 2.5% 2,296 3.5% Ohio 1,799 2.4% 2,028 3.1% Georgia 1,567 2.1% 1,360 2.1% Louisiana 1,483 2.0% 1,211 1.8% Texas 1,448 1.9% 2,271 3.4% Illinois 1,248 1.6% 1,476 2.2% Other 14,507 19.1% 18,082 27.6% Total $ 75,917 100.0% $ 65,898 100.0% IL: 1.6% TX: 1.9% Other: 19.1% Other: 27.6% LA: 2.0% GA: 2.1% OH: 2.4% MO: 2.5% IL: 2.2% VA: 3.3% TX: 3.4% NJ: 3.4% LA: 1.8% GA: 2.1% NY: 35.1% OH: 3.1% MO: 3.5% CA: 14.2% VA: 3.4% NY: 47.5% NJ: 3.5% CA: 14.3% Limited volume of business in-force in FL to evaluate market conditions November 6, 2018 Atlas Financial Holdings, Inc. Third Quarter 2018 Conference Call 5

Premiums Written: Rate Activity Pricing Relative to ISO 40 30 20 10 0 -10 -20 12 12 12 12 13 13 13 13 14 14 14 14 15 15 15 15 16 16 16 16 17 17 17 17 18 18 18 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Atlas Rate Change (Ave) Average ISO Recommendation (for period) Predictive Model Policy Counts 6/1/2016 - 9/30/2018 10,000 t 8,000 n u o 6,000 C y c i 4,000 l o P 2,000 0 0 - 100 101 - 200 201 - 300 301 - 400 401 - 500 501 - 600 601 - 700 701 - 800 801 - 900 901+ Score Group Policy Quote November 6, 2018 Atlas Financial Holdings, Inc. Third Quarter 2018 Conference Call 6

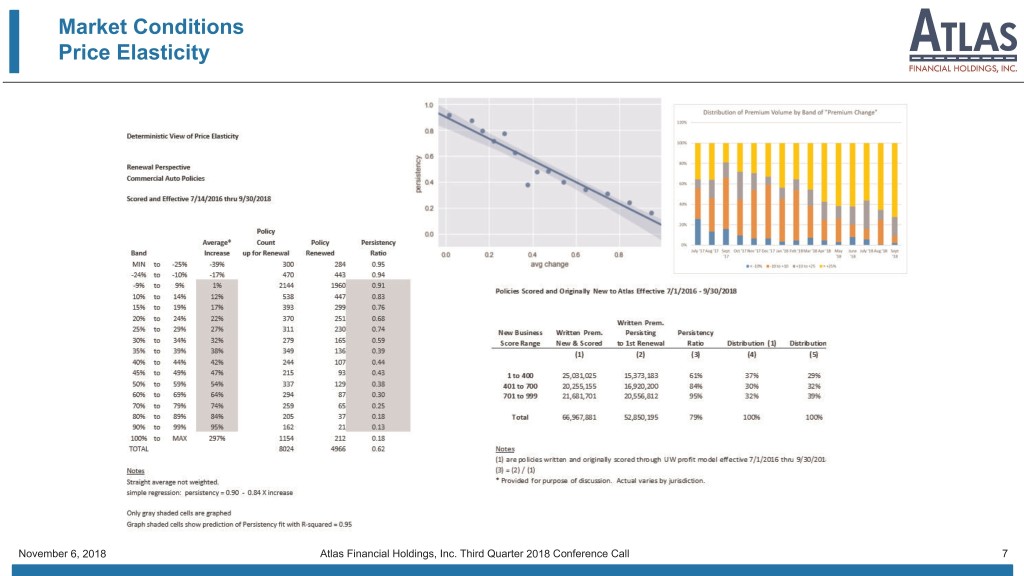

Market Conditions Price Elasticity November 6, 2018 Atlas Financial Holdings, Inc. Third Quarter 2018 Conference Call 7

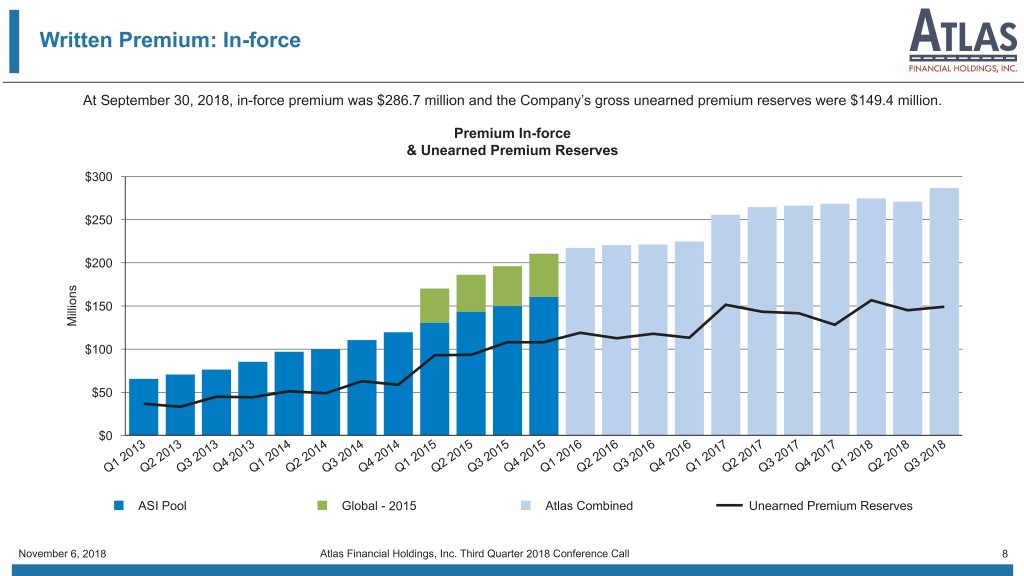

Written Premium: In-force At September 30, 2018, in-force premium was $286.7 million and the Company’s gross unearned premium reserves were $149.4 million. Premium In-force & Unearned Premium Reserves $300 $250 $200 s n o i l $150 l i M $100 $50 $0 13 13 13 13 14 14 14 14 15 15 15 15 16 16 16 16 17 17 17 17 18 18 18 20 20 20 20 20 20 20 20 20 20 20 20 20 20 20 20 20 20 20 20 20 20 20 1 2 3 4 1 2 3 4 1 2 3 4 1 2 3 4 1 2 3 4 1 2 3 Q Q Q Q Q Q Q Q Q Q Q Q Q Q Q Q Q Q Q Q Q Q Q ASI Pool Global - 2015 Atlas Combined Unearned Premium Reserves November 6, 2018 Atlas Financial Holdings, Inc. Third Quarter 2018 Conference Call 8

Financial Highlights

Third Quarter 2018 Financial Highlights Third Quarter 2018 Financial and Operating Information Quarterly Premiums Affected by Rate Underwriting Book Value / Return on Equity Decisions / Shift in Market Dynamics Performance • Gross premiums written generated by • Underwriting income for the third • Book value per common share of the Company were $75.9 million at quarter of 2018 was $6.3 million, $8.53 (increased $1.11 compared to September 30, 2018 compared to compared to underwriting income of prior year end) $65.9 million at September 30, 2017 $6.8 million in the prior year period • Return on equity was 22.6% in the • In-force premium at September 30, • Atlas’ underwriting expense ratio(1)(2) third quarter of 2018 compared to 2018 increased 6.8% to $286.7 for the quarter ended September 30, 14.5% in the prior year period million, compared to $268.5 million at 2018 was 26.4% December 31, 2017 (1) 2018 Financial Expectations • Combined Ratio (“CR”) was 88.5% ü • Underwriting profit always takes Relative stability regarding target market with continued growth precedent over top line growth • Net income was $5.6 million or $0.47 ü Emphasis remains on underwriting profit as earnings per common share diluted priority • Expected continued market hardening ü Expense ratio at or below current levels (1) Ratios are computed as a percentage of net premiums earned ü (2) Excluding the impact of share-based compensation expenses Exceed P&C industry Return on Equity (“ROE”) by 500 - 1,000 bps No indicators of new market entry and Company continues to expect price leadership to optimize return on deployed capital via underwriting November 6, 2018 Atlas Financial Holdings, Inc. Third Quarter 2018 Conference Call 10

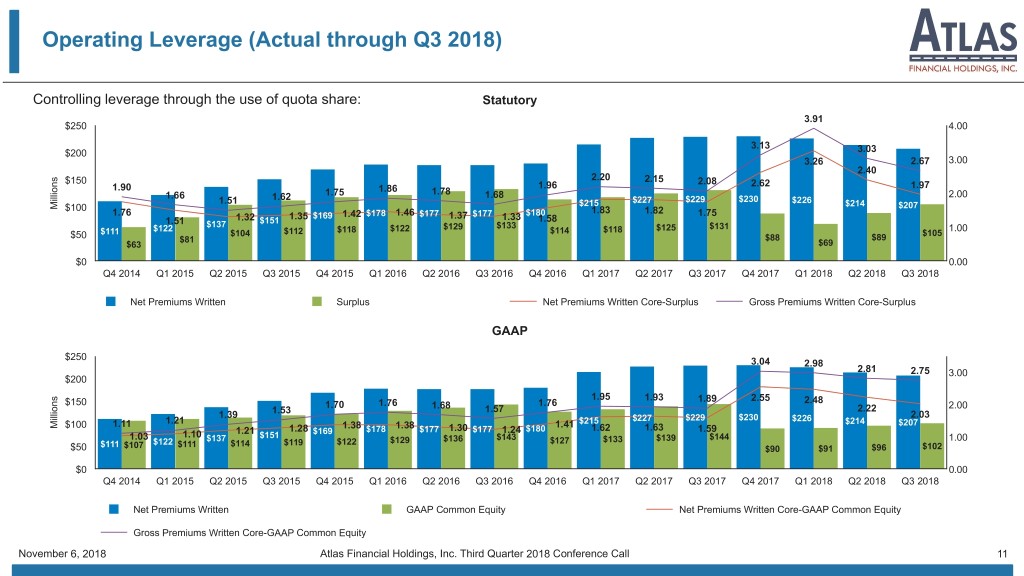

Operating Leverage (Actual through Q3 2018) Controlling leverage through the use of quota share: Statutory 3.91 $250 4.00 3.13 $200 3.03 3.26 2.67 3.00 2.40 s $150 2.20 2.15 2.08 n 1.90 1.96 2.62 1.97 o 1.86 i 1.78 l 1.75 l 1.66 1.68 2.00 i 1.62 1.51 $215 $227 $229 $230 $226 $214 M $207 $100 1.83 1.82 1.76 $169 1.42 $178 1.46 $177 1.37 $177 $180 1.75 1.51 1.32 $151 1.35 1.33 1.58 $122 $137 $122 $129 $133 $125 $131 1.00 $111 $104 $112 $118 $114 $118 $105 $50 $81 $88 $89 $63 $69 $0 0.00 Q4 2014 Q1 2015 Q2 2015 Q3 2015 Q4 2015 Q1 2016 Q2 2016 Q3 2016 Q4 2016 Q1 2017 Q2 2017 Q3 2017 Q4 2017 Q1 2018 Q2 2018 Q3 2018 Net Premiums Written Surplus Net Premiums Written Core-Surplus Gross Premiums Written Core-Surplus GAAP $250 3.04 2.98 2.81 2.75 3.00 $200 s 1.95 1.93 1.89 2.55 2.48 n $150 1.70 1.76 1.68 1.76 2.00 o 2.22 i 1.53 1.57 l l 1.39 2.03 i $227 $229 $230 1.21 $215 $226 $214 $207 M 1.11 1.41 $100 1.28 1.38 $178 1.38 $177 1.30 $177 $180 1.62 1.63 1.59 1.10 1.21 $169 1.24 1.03 $137 $151 $136 $143 $133 $139 $144 1.00 $111 $122 $111 $114 $119 $122 $129 $127 $50 $107 $90 $91 $96 $102 $0 0.00 Q4 2014 Q1 2015 Q2 2015 Q3 2015 Q4 2015 Q1 2016 Q2 2016 Q3 2016 Q4 2016 Q1 2017 Q2 2017 Q3 2017 Q4 2017 Q1 2018 Q2 2018 Q3 2018 Net Premiums Written GAAP Common Equity Net Premiums Written Core-GAAP Common Equity Gross Premiums Written Core-GAAP Common Equity November 6, 2018 Atlas Financial Holdings, Inc. Third Quarter 2018 Conference Call 11

Combined Ratio Analysis The table below details the comparisons of each component of the Company’s combined ratio for the periods indicated (after accounting for the effect of quota share reinsurance): Three months ended Nine months ended September 30, September 30, 2018 2017 2018 2017 Loss Ratio: Current accident year 61.7 % 59.3% 61.0 % 59.6% Prior accident years (0.1)% 0.2% 0.8 % 0.4% Loss Ratio 61.6 % 59.5% 61.8 % 60.0% Underwriting Expense Ratio: Acquisition cost ratio 10.5 % 14.0% 11.1 % 12.4% Other underwriting expense ratio 16.0 % 13.3% 16.0 % 13.7% Deferred policy acquisition costs amortization ratio (0.1)% 0.6% (0.2)% 0.3% Underwriting expense ratio before expenses related to stock purchase agreements and share-based compensation expenses 26.4 % 27.9% 26.9 % 26.4% Expenses recovered related to stock purchase agreement ratio — % —% (0.3)% —% Share-based compensation expense ratio 0.5 % 0.5% 0.5 % 0.6% Underwriting expense ratio 26.9 % 28.4% 27.1 % 27.0% Total combined ratio 88.5 % 87.9% 88.9 % 87.0% November 6, 2018 Atlas Financial Holdings, Inc. Third Quarter 2018 Conference Call 12

Combined Ratio Combined Ratio by Quarter Combined Ratio 250% 140% 200% * 130.3% and 120% 72.9% impact in Q4 2017 & 2016, 28.0% respectively, 100% 150% related to claims reserve 24.1% strengthening on 80% 100% prior accident 30.3% 29.1% years 29.0% 27.1% 50% 60% 94.5% 0% 40% 78.8% Q1 Q2 Q3 Q4* 63.9% 62.3% 59.2% 61.8% 20% 2013 2014 2015 2016 2017 2018 0% (1) (2) Three months ended September 30, 2013 2014 2015 2016 2017 2018 Q3 YTD 2018 2017 Loss & LAE Ratio Underwriting Expense Ratio Loss ratio 61.6% 59.5% Underwriting expense ratio 26.9% 28.4% (1) 2016 includes 19.1% impact for the full year related to claims reserves strengthening related to Combined Ratio 88.5% 87.9% prior accident years (2) 2017 includes 35.0% impact for the full year related to claims reserves strengthening related to prior accident years November 6, 2018 Atlas Financial Holdings, Inc. Third Quarter 2018 Conference Call 13

Healthy Balance Sheet with Availability of Capital & Reinsurance to Support Growth • Attractive investment leverage, Company has $25 million outstanding of Senior Unsecured Notes at September 30, 2018 ($ in millions) September 30, 2018 December 31, 2017 Cash and Investments $217.5 $243.5 Total Assets $501.2 $482.5 Claims Liabilities (gross of Reinsurance Recoverable) $187.0 $211.6 Unearned Premium Reserves $149.4 $128.0 Atlas Shareholders’ Equity $101.9 $90.6 November 6, 2018 Atlas Financial Holdings, Inc. Third Quarter 2018 Conference Call 14

Investment Portfolio Conservative Investment Approach • Emphasize preservation of capital, market liquidity to support Investment Portfolio (9/30/2018) payment of liabilities and diversification of risk • Investment duration re-positioned to match core commercial auto reserve liabilities (3.8 years) Investment Portfolio Other Investments: Government: 17% 18% • As of September 30, 2018, total cash and invested assets were $217.5 million, of which fixed income consisted of 58.8% • Predominantly corporate and government bonds Short-term Investments: 3% • Average S&P rating of AA Equity Securities: 4% • 27.6% AAA Other Asset Backed: • 83.3% A or better 5% Corporate: 26% September 30, 2018 December 31, 2017 Amount % of Total Amount % of Total AAA/Aaa $ 35,286 27.6% $ 42,978 27.2% Mortgage Backed: AA/Aa 49,278 38.5 58,173 36.8 27% A/A 21,994 17.2 27,384 17.3 BBB/Baa 20,591 16.1 28,348 18.0 BB 569 0.4 875 0.6 Other than fixed income securities will be reduced as B 219 0.2 226 0.1 a percentage of overall investments during 2018 Total Fixed Income Securities $ 127,937 100.0% $ 157,984 100.0% November 6, 2018 Atlas Financial Holdings, Inc. Third Quarter 2018 Conference Call 15

Detailed Impact of Changes to Book Value per Common Share Book value per common share of $8.53 increased by $1.11 relative to December 31, 2017 as follows: 9.0 $0.03 $(0.01) $(0.25) $0.06 $8.53 8.5 $(0.09) $1.37 8.0 ) s n o i l l i M ( $ 7.5 $7.42 7.0 6.5 12/31/17 Net Income* Fair Value of Equity Securities* Net Realized Investment Gains* Unrealized Gains/Losses* Stock Repurchases* Share-Based Compensation* 09/30/18 *after-tax November 6, 2018 Atlas Financial Holdings, Inc. Third Quarter 2018 Conference Call 16

Operating Conclusions

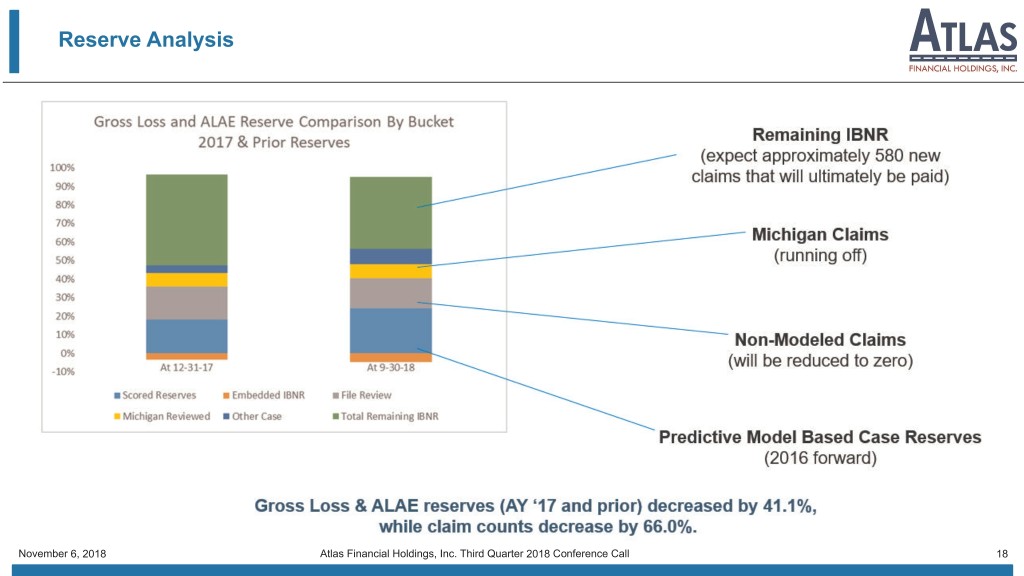

Reserve Analysis November 6, 2018 Atlas Financial Holdings, Inc. Third Quarter 2018 Conference Call 18

Incremental Benefit of Predictive Analytics Claim Activity - ASI POOL Reserves November 6, 2018 Atlas Financial Holdings, Inc. Third Quarter 2018 Conference Call 19

Reserve Analysis Predictive Model Based Case November 6, 2018 Atlas Financial Holdings, Inc. Third Quarter 2018 Conference Call 20

Reserve Analysis Older Non-Modelled Claims November 6, 2018 Atlas Financial Holdings, Inc. Third Quarter 2018 Conference Call 21

Reserve Analysis Michigan Claims November 6, 2018 Atlas Financial Holdings, Inc. Third Quarter 2018 Conference Call 22

Reserve Analysis Remaining IBNR November 6, 2018 Atlas Financial Holdings, Inc. Third Quarter 2018 Conference Call 23

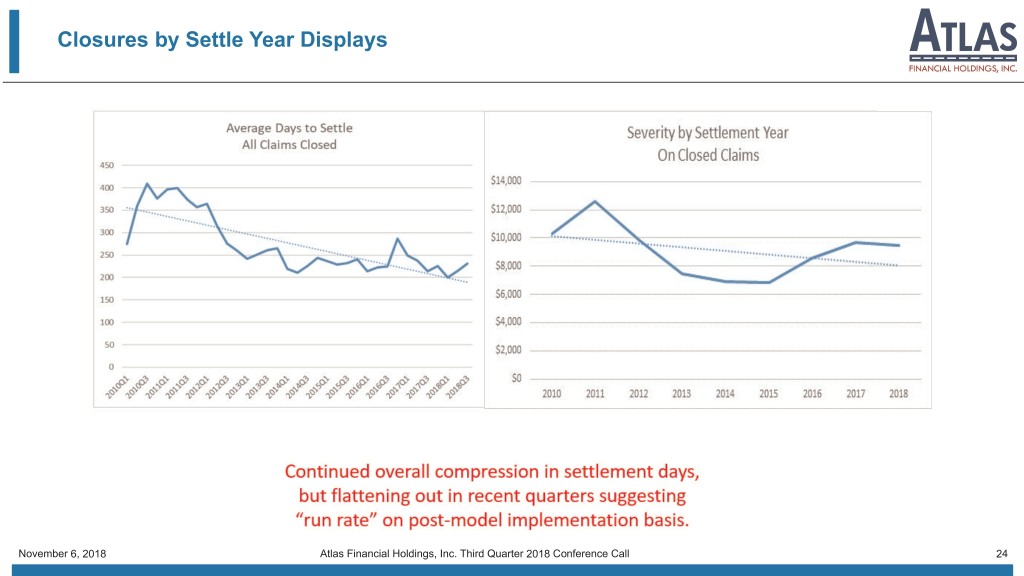

Closures by Settle Year Displays November 6, 2018 Atlas Financial Holdings, Inc. Third Quarter 2018 Conference Call 24

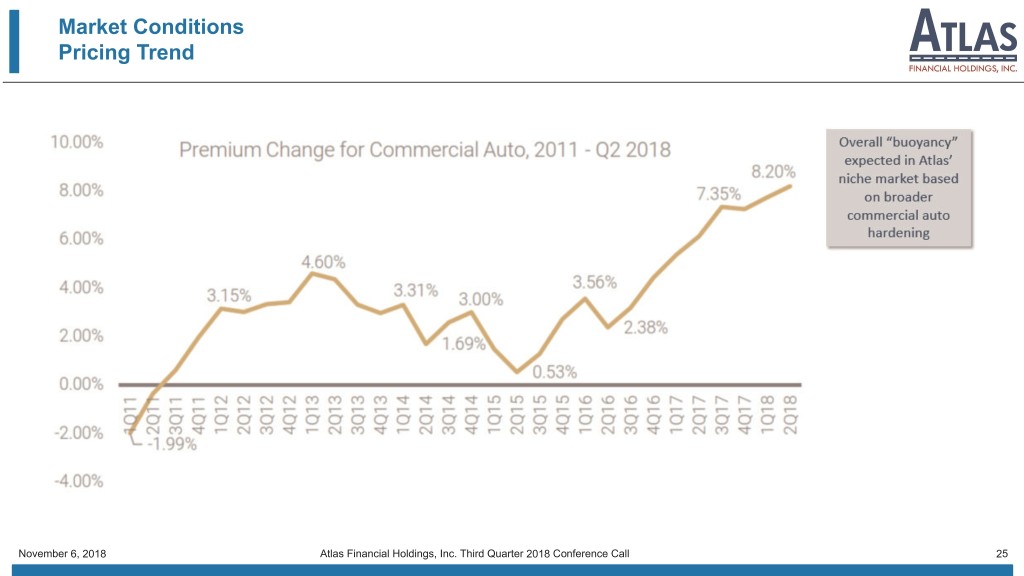

Market Conditions Pricing Trend November 6, 2018 Atlas Financial Holdings, Inc. Third Quarter 2018 Conference Call 25

Market Conditions Pricing Trend November 6, 2018 Atlas Financial Holdings, Inc. Third Quarter 2018 Conference Call 26

Operating Activities: Underwriting (ASI Pool Companies, commercial business) New and Renewal Business Submissions Vehicles In-Force (Monthly Vehicles Submitted) 52,000 10,000 50,000 9,000 48,000 8,000 46,000 44,000 7,000 42,000 6,000 40,000 5,000 38,000 Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec Number of Vehicles (incls Expiring) Prior Year Actual Prior Year November 6, 2018 Atlas Financial Holdings, Inc. Third Quarter 2018 Conference Call 27

Incremental Benefit of Predictive Analytics Claim Activity New Claims Presented versus Vehicles In Force 30,000 70,000 60,000 25,000 50,000 20,000 40,000 6 7 8 6 6 7 7 8 8 6 7 6 7 8 6 6 6 6 7 7 7 7 8 8 6 7 8 15,000 6 6 7 7 8 38 0,000 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - l l l t t r r r r r r y y y v c v c b b b n n n n n n g p g p g p c c u u u p p p a a a o e o e a a a a u a u a u e e e u e u e u e J J J O O A A A J J J J J J M M M F F F N D N D A S A S A S M M M Vehicles In-force Rolling Twelve Claims Presented November 6, 2018 Atlas Financial Holdings, Inc. Third Quarter 2018 Conference Call 28

Usage Based Insurance Innovative Fintech Initiative focusing on “Part Time” TNC drivers https://www.getopton.com/ November 6, 2018 Atlas Financial Holdings, Inc. Third Quarter 2018 Conference Call 29

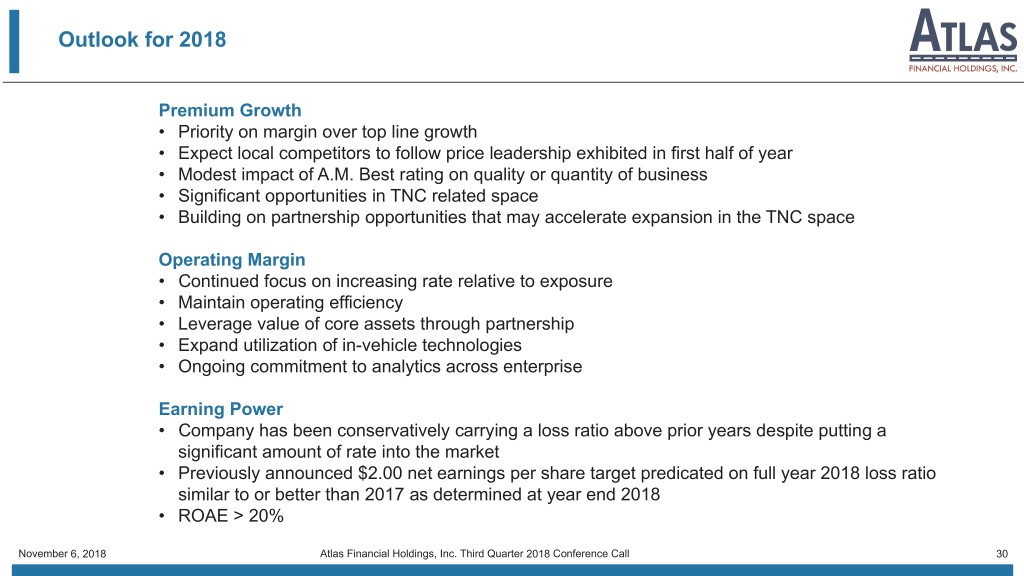

Outlook for 2018 Premium Growth • Priority on margin over top line growth • Expect local competitors to follow price leadership exhibited in first half of year • Modest impact of A.M. Best rating on quality or quantity of business • Significant opportunities in TNC related space • Building on partnership opportunities that may accelerate expansion in the TNC space Operating Margin • Continued focus on increasing rate relative to exposure • Maintain operating efficiency • Leverage value of core assets through partnership • Expand utilization of in-vehicle technologies • Ongoing commitment to analytics across enterprise Earning Power • Company has been conservatively carrying a loss ratio above prior years despite putting a significant amount of rate into the market • Previously announced $2.00 net earnings per share target predicated on full year 2018 loss ratio similar to or better than 2017 as determined at year end 2018 • ROAE > 20% November 6, 2018 Atlas Financial Holdings, Inc. Third Quarter 2018 Conference Call 30

For Additional Information At the Company: Scott Wollney Chief Executive Officer swollney@atlas-fin.com 847-700-8600 NASDAQ: AFH Investor Relations: The Equity Group Inc. Adam Prior Senior Vice President APrior@equityny.com A reconciliation of Non-GAAP financial measures can be found on the next slide 212-836-9606

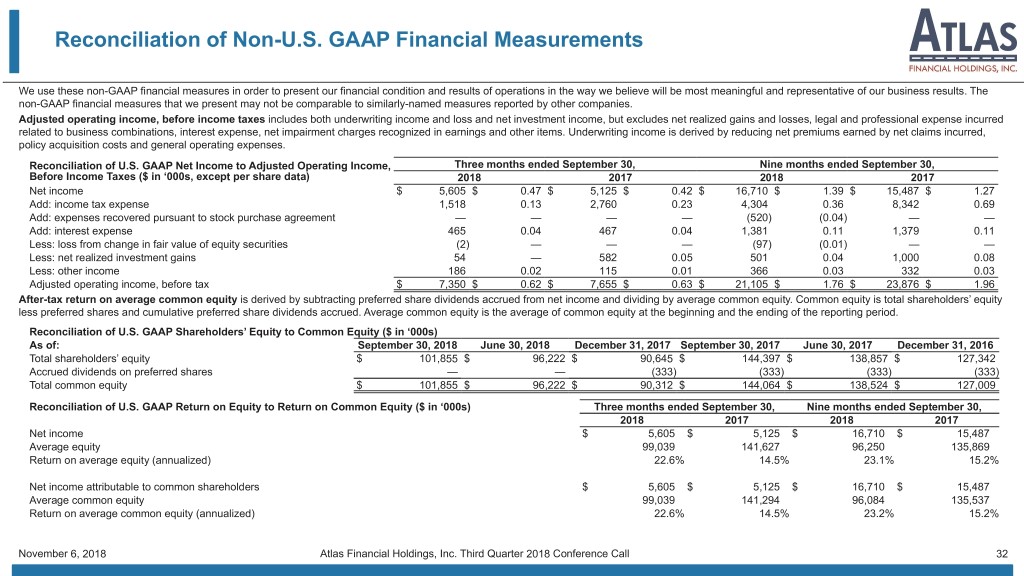

Reconciliation of Non-U.S. GAAP Financial Measurements We use these non-GAAP financial measures in order to present our financial condition and results of operations in the way we believe will be most meaningful and representative of our business results. The non-GAAP financial measures that we present may not be comparable to similarly-named measures reported by other companies. Adjusted operating income, before income taxes includes both underwriting income and loss and net investment income, but excludes net realized gains and losses, legal and professional expense incurred related to business combinations, interest expense, net impairment charges recognized in earnings and other items. Underwriting income is derived by reducing net premiums earned by net claims incurred, policy acquisition costs and general operating expenses. Reconciliation of U.S. GAAP Net Income to Adjusted Operating Income, Three months ended September 30, Nine months ended September 30, Before Income Taxes ($ in ‘000s, except per share data) 2018 2017 2018 2017 Net income $ 5,605 $ 0.47 $ 5,125 $ 0.42 $ 16,710 $ 1.39 $ 15,487 $ 1.27 Add: income tax expense 1,518 0.13 2,760 0.23 4,304 0.36 8,342 0.69 Add: expenses recovered pursuant to stock purchase agreement — — — — (520) (0.04) — — Add: interest expense 465 0.04 467 0.04 1,381 0.11 1,379 0.11 Less: loss from change in fair value of equity securities (2) — — — (97) (0.01) — — Less: net realized investment gains 54 — 582 0.05 501 0.04 1,000 0.08 Less: other income 186 0.02 115 0.01 366 0.03 332 0.03 Adjusted operating income, before tax $ 7,350 $ 0.62 $ 7,655 $ 0.63 $ 21,105 $ 1.76 $ 23,876 $ 1.96 After-tax return on average common equity is derived by subtracting preferred share dividends accrued from net income and dividing by average common equity. Common equity is total shareholders’ equity less preferred shares and cumulative preferred share dividends accrued. Average common equity is the average of common equity at the beginning and the ending of the reporting period. Reconciliation of U.S. GAAP Shareholders’ Equity to Common Equity ($ in ‘000s) As of: September 30, 2018 June 30, 2018 December 31, 2017 September 30, 2017 June 30, 2017 December 31, 2016 Total shareholders’ equity $ 101,855 $ 96,222 $ 90,645 $ 144,397 $ 138,857 $ 127,342 Accrued dividends on preferred shares — — (333) (333) (333) (333) Total common equity $ 101,855 $ 96,222 $ 90,312 $ 144,064 $ 138,524 $ 127,009 Reconciliation of U.S. GAAP Return on Equity to Return on Common Equity ($ in ‘000s) Three months ended September 30, Nine months ended September 30, 2018 2017 2018 2017 Net income $ 5,605 $ 5,125 $ 16,710 $ 15,487 Average equity 99,039 141,627 96,250 135,869 Return on average equity (annualized) 22.6% 14.5% 23.1% 15.2% Net income attributable to common shareholders $ 5,605 $ 5,125 $ 16,710 $ 15,487 Average common equity 99,039 141,294 96,084 135,537 Return on average common equity (annualized) 22.6% 14.5% 23.2% 15.2% November 6, 2018 Atlas Financial Holdings, Inc. Third Quarter 2018 Conference Call 32