Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - AMICUS THERAPEUTICS, INC. | exhibit991.htm |

| 8-K - 8-K - AMICUS THERAPEUTICS, INC. | form8-kx3qx2018earningspre.htm |

Exhibit 99.2 3Q18 Financial Results & Corporate Highlights November 5, 2018

2 Forward Looking Statements This presentation contains "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995 relating to preclinical and clinical development of our product candidates, the timing and reporting of results from preclinical studies and clinical trials, the prospects and timing of the potential regulatory approval of our product candidates, commercialization plans, manufacturing and supply plans, financing plans, and the projected revenues and cash position for the Company. The inclusion of forward-looking statements should not be regarded as a representation by us that any of our plans will be achieved. Any or all of the forward-looking statements in this press release may turn out to be wrong and can be affected by inaccurate assumptions we might make or by known or unknown risks and uncertainties. For example, with respect to statements regarding the goals, progress, timing, and outcomes of discussions with regulatory authorities, and in particular the potential goals, progress, timing, and results of preclinical studies and clinical trials, actual results may differ materially from those set forth in this release due to the risks and uncertainties inherent in our business, including, without limitation: the potential that results of clinical or preclinical studies indicate that the product candidates are unsafe or ineffective; the potential that it may be difficult to enroll patients in our clinical trials; the potential that regulatory authorities, including the FDA, EMA, and PMDA, may not grant or may delay approval for our product candidates; the potential that we may not be successful in commercializing Galafold in Europe and other geographies or our other product candidates if and when approved; the potential that preclinical and clinical studies could be delayed because we identify serious side effects or other safety issues; the potential that we may not be able to manufacture or supply sufficient clinical or commercial products; and the potential that we will need additional funding to complete all of our studies and manufacturing. Further, the results of earlier preclinical studies and/or clinical trials may not be predictive of future results. With respect to statements regarding projections of the Company's revenue and cash position, actual results may differ based on market factors and the Company's ability to execute its operational and budget plans. In addition, all forward-looking statements are subject to other risks detailed in our Annual Report on Form 10-K for the year ended December 31, 2017 as well as our Quarterly Report on Form 10-Q for the quarter September 30, 2018 to be filed November 6, 2018 with the Securities and Exchange Commission. You are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date hereof. All forward-looking statements are qualified in their entirety by this cautionary statement, and we undertake no obligation to revise or update this news release to reflect events or circumstances after the date hereof.

Introduction 3 Amicus Today PORTFOLIO 500+ of 15 programs for rare EMPLOYEES metabolic diseases globally BIOLOGICS AT-GAA* PLATFORM Investigational Leading Expertise in Protein Engineering Therapy for Lysosomal & Glycobiology Pompe Entering Phase 3 Storage GLOBAL Disorders ~$564M Gene Therapy FOOTPRINT Cash in 27 countries (9/30/18) Platforms * AT-GAA, also known as ATB200/AT2221

Introduction 4 Corporate Highlights: 3Q18 and Early 4Q18 » Well Capitalized to Advance Toward 2023 Vision: 5,000+ Patients & $1B+ in Revenue » Current Cash Position is Sufficient to Fund Operations into at least 2021 » Galafold: International Growth and Strong U.S. Launch Momentum o U.S. launch exceeding expectations following August 2018 approval; now reimbursed in 22 countries o 3Q18 revenue of $20.6M – on track to meet $80M-90M FY18 guidance range o $500M+ peak revenue potential; $1B+ cumulative revenue from 2019E-2023E to drive R&D engine » AT-GAA: Positive 18-month Data Presented World Muscle Society (October 2018) o Highly differentiated ERT with potential to be the future standard of care o On track to initiate pivotal study by YE18 o $1B+ peak revenue potential » NEW Gene Therapy Portfolio for 14 Rare Metabolic Diseases o Industry leading Batten disease portfolio: Two clinical stage programs (CLN6 and CLN3); One preclinical (CLN8) o Preclinical AAV (intrathecal) gene therapy programs for 7 additional neurologic LSDs o Next-generation preclinical gene therapies for Fabry, Pompe, CDKL5 and one other indication o $1B+ peak revenue potential

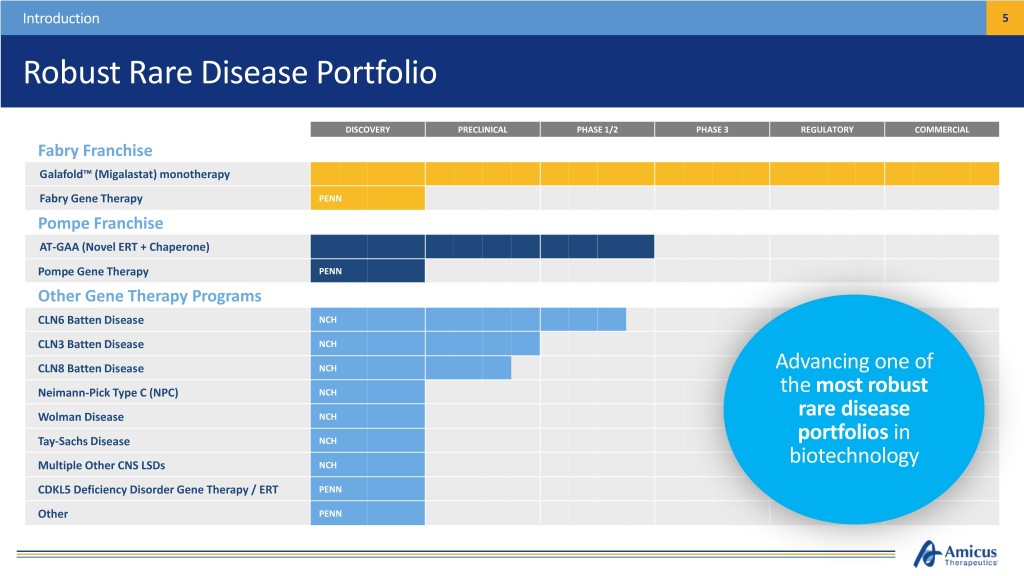

Introduction 5 Robust Rare Disease Portfolio DISCOVERY PRECLINICAL PHASE 1/2 PHASE 3 REGULATORY COMMERCIAL Fabry Franchise Galafold™ (Migalastat) monotherapy Fabry Gene Therapy PENN Pompe Franchise AT-GAA (Novel ERT + Chaperone) Pompe Gene Therapy PENN Other Gene Therapy Programs CLN6 Batten Disease NCH CLN3 Batten Disease NCH CLN8 Batten Disease NCH Advancing one of Neimann-Pick Type C (NPC) NCH the most robust Wolman Disease NCH rare disease Tay-Sachs Disease NCH portfolios in Multiple Other CNS LSDs NCH biotechnology CDKL5 Deficiency Disorder Gene Therapy / ERT PENN Other PENN

Galafold® (Migalastat) Precision Medicine for Fabry Disease

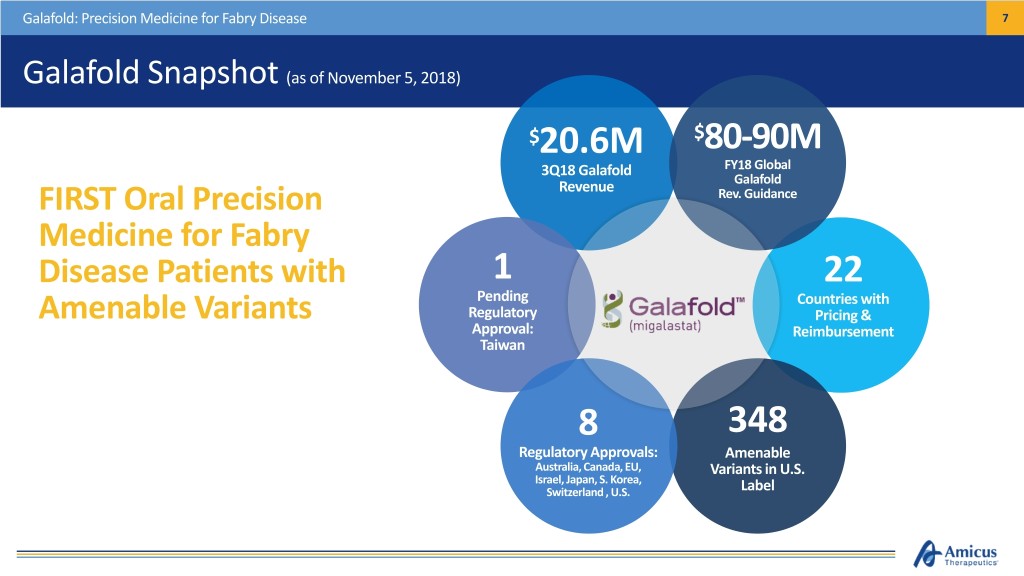

Galafold: Precision Medicine for Fabry Disease 7 Galafold Snapshot (as of November 5, 2018) $20.6M $80-90M 3Q18 Galafold FY18 Global Galafold FIRST Oral Precision Revenue Rev. Guidance Medicine for Fabry Disease Patients with 1 22 Pending Countries with Amenable Variants Regulatory Pricing & Approval: Reimbursement Taiwan 8 348 Regulatory Approvals: Amenable Australia, Canada, EU, Variants in U.S. Israel, Japan, S. Korea, Switzerland , U.S. Label

Galafold: Precision Medicine for Fabry Disease 8 International Update (as of October 31, 2018) Continuing to Execute on Our Strategy with High Compliance and Adherence Among 500+ International Patients on Galafold Current estimated MARKET DYNAMICS mkt share in EU5* of treated amenable patients • Continued strong uptake and growth in ERT-switch patients; increasing number of previously untreated patients • Very high rates of adherence and compliance (>90%) Galafold ERT • Balanced mix of males and females, ~50% ~50% classic and late-onset patients • Oral ROA allows for new ordering patterns • Continued high interest from physician community • 145 HCPs attended inaugural Amicus Fabry Connections meeting in Madrid, Spain *Market share assumptions based on estimated number of treated amenable patients in EU5 as of October 2018

Galafold: Precision Medicine for Fabry Disease 9 Key U.S. Launch Metric – Individual Prescriptions (Patient Referral Forms) 103 Individual Prescriptions (10/31/18) Significantly Exceeds Internal Forecast and Provides Strong Foundation for 2019 Individual Prescriptions Actual PRFs 103 Market Dynamics • Strong patient and physician demand 75 • High conversion of study patients 64 Forecast • Growing prescriber base of 40+ physicians 66 • Patient demographics in line with launch strategy 54 • ~60 day average PRF to shipment 24 43 limits FY18 impact 32 • Solid foundation for 2019 20 August 30 September 30 October 31 November 30 December 31

Galafold: Precision Medicine for Fabry Disease 10 Galafold Success and FY18 Galafold Revenue Guidance On Track to Achieve Higher End of FY2018 Revenue Guidance of $80-$90M $80-$90M Q3* $20.6M $36.9M Q2 $21.3M $10.9M $14.6M $7.2M $4.2M Q1 $16.7M 1Q17 2Q17 3Q17 4Q17 FY17 FY18E *QoQ revenue reflects new ordering patterns

Financial Summary

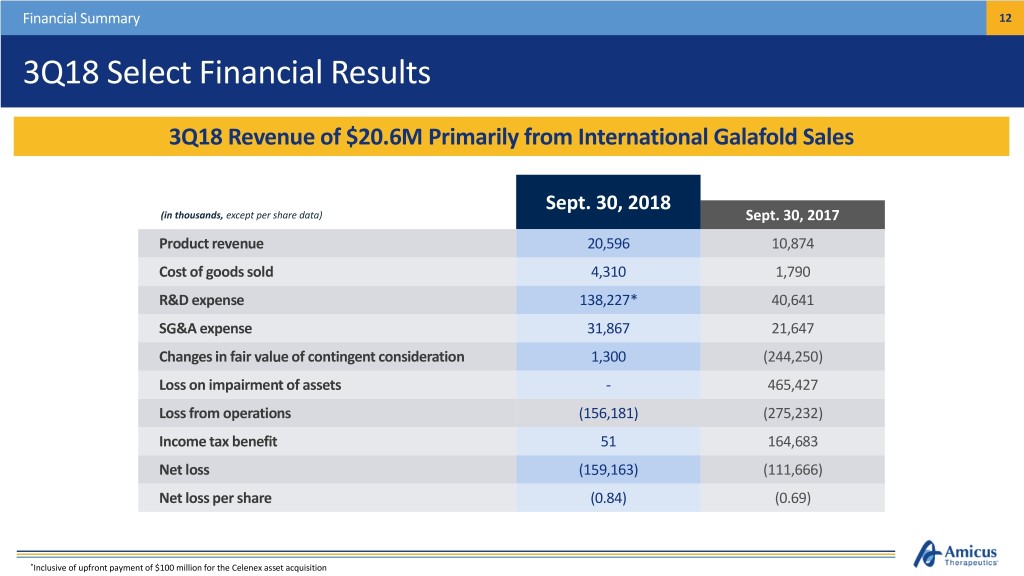

Financial Summary 12 3Q18 Select Financial Results 3Q18 Revenue of $20.6M Primarily from International Galafold Sales Sept. 30, 2018 (in thousands, except per share data) Sept. 30, 2017 Product revenue 20,596 10,874 Cost of goods sold 4,310 1,790 R&D expense 138,227* 40,641 SG&A expense 31,867 21,647 Changes in fair value of contingent consideration 1,300 (244,250) Loss on impairment of assets - 465,427 Loss from operations (156,181) (275,232) Income tax benefit 51 164,683 Net loss (159,163) (111,666) Net loss per share (0.84) (0.69) *Inclusive of upfront payment of $100 million for the Celenex asset acquisition

Financial Summary 13 Financial Summary & Guidance Strong Balance Sheet with $564M Cash at 9/30/18 - Cash Runway into at Least 2021 FINANCIAL POSITION September 30, 2018 Cash $564M Debt $319M Cash Runway1 Into at least 2021 CAPITALIZATION Shares Outstanding2 189,254,341 FINANCIAL GUIDANCE FY18 Net Cash Spend Guidance $190M-$210M Galafold Revenue Guidance $80-$90M 1Based on existing operating plan. 2Includes shares from the February 2018 equity offering

AT-GAA Novel ERT for Pompe Disease

Pompe 18 Month Data: ATB200-02 Phase 1/2 Clinical Study of AT-GAA (ATB200/AT2221) 15 AT-GAA 18-Month Clinical Data Summary (ATB200-02 Study) Consistent and Durable Responses Across Key Measures of Safety, Functional Outcomes and Biomarkers in both ERT-Switch and ERT-Naïve Pompe Patients out to Month 18 • 6-minute walk test (6MWT) showed continued benefit in ERT-naïve and ERT-switch patients • Timed motor function tests generally consistent with 6MWT results in both ambulatory cohorts • Muscle strength increased in all cohorts, including nonambulatory ERT-switch patients • Pulmonary function – Forced vital capacity (FVC), maximal inspiratory pressure (MIP), and maximal expiratory pressure (MEP) generally increased in ERT-naive patients – FVC, MIP, and MEP were generally stable in ERT-switch patients • Fatigue severity scale – Improvement in fatigue score was observed in all cohorts • Biomarkers and safety – Creatine kinase (CK) and urine hexose tetrasaccharide (Hex4) levels decreased in all cohorts – AT-GAA (ATB200/AT2221) was generally well tolerated – Adverse Events Generally Mild and Transient • Very low rates of IARs (<1%) after 890+ total infusions across all cohorts

AT-GAA Novel ERT + Chaperone for Pompe Disease 16 Key Activities in 2018 Significant Progress in Clinical, Regulatory, and GMP Manufacturing Activities in 2018 Year-to-Date Progress CLINICAL MANUFACTURING Addt’l. Phase 1/2 ATB200-02 extension data presented at WORLDSymposium Final FDA agreement on comparability between Addt’l. patients in Phase 1/2 ATB200-02 clinical study 1,000L and 250L GMP scale Initiation of retrospective natural history of ERT-treated patients German regulatory authorities (BfArM) agreement on strategy to demonstrate comparability between 18-month data from ATB200-02 clinical study (4Q18) 1,000L and 250L GMP scale Initiation of larger registration-directed study Release for clinic of 1,000L GMP commercial scale Completion of a retrospective natural history study (4Q18) material Announce plan for long-term commercial REGULATORY manufacturing EMA: Received Scientific Advice Working Party Guidance U.S. FDA type C meeting and U.S. update

Gene Therapy Pipeline

Amicus Gene Therapy Programs 18 Leading Gene Therapy Portfolio in Lysosomal Storage Disorders License Through Nationwide Children’s Hospital and Collaboration with Penn Combine with Successful Amicus Development and Commercial Track Record in LSDs Amicus Gene Therapy Portfolio Ground-Breaking, Clinically Validated Science DISCOVERY PRECLINICAL PHASE 1/2 PHASE 3 CLN6 Batten Disease NCH 14 Gene Therapy Programs CLN3 Batten Disease NCH CLN8 Batten Disease NCH Fabry Gene Therapy PENN Expertise and Relationships in Gene Therapy Pompe Gene Therapy PENN Neimann-Pick C NCH Compelling Data in Three Lead Batten Disease Wolman Disease NCH Programs; Earlier-Stage Fabry and Pompe Programs Tay-Sachs NCH Multiple Other CNS LSDs NCH CDKL5 Gene Therapy / ERT PENN Leading Gene Therapy Portfolio in Lysosomal Storage Disorders Other PENN

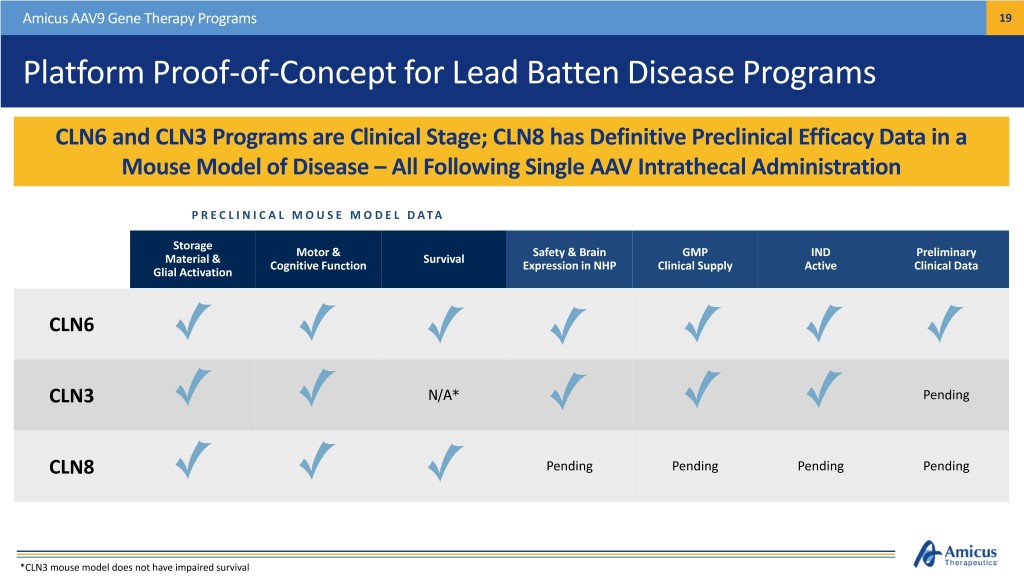

Amicus AAV9 Gene Therapy Programs 19 Platform Proof-of-Concept for Lead Batten Disease Programs CLN6 and CLN3 Programs are Clinical Stage; CLN8 has Definitive Preclinical Efficacy Data in a Mouse Model of Disease – All Following Single AAV Intrathecal Administration P R E C L I N I C A L M O U S E M O D E L D A T A Storage Motor & Safety & Brain GMP IND Preliminary Material & Survival Cognitive Function Expression in NHP Clinical Supply Active Clinical Data Glial Activation CLN6 CLN3 N/A* Pending CLN8 Pending Pending Pending Pending *CLN3 mouse model does not have impaired survival

Amicus-Penn Collaboration 20 Amicus Protein Engineering Expertise & Technologies for Gene Therapy Collaboration with Penn to Enable Greater Protein Expression and Delivery at Lower Gene Therapy Doses for Fabry, Pompe, CDKL5 Deficiency Disorder and 1 Additional Indication Increased Protein Increased Protein Improved Protein Expression Secretion Targeting and Stabilization Novel untranslated Effective signal sequences to Targeting moieties sequences to avoid inhibition increase protein expression of initiation and drive & secretion Protein design efficient protein synthesis

Closing Remarks John F. Crowley

Closing Remarks 22 2018 Key Strategic Priorities On Track to Achieve All FIVE Key Strategic 2018 Priorities Outlined in January 1 Double Galafold (migalastat) revenue to $80-$90M 2 Secure approvals for migalastat in Japan and the U.S. Achieve clinical, manufacturing and regulatory milestones to advance 3 AT-GAA toward global regulatory submissions and approvals 4 Develop and expand preclinical pipeline to ensure at least one new clinical program in 2019 5 Maintain financial strength

Closing Remarks 23 Amicus Vision: Delivering for Patients and Shareholders To build a top-tier, fully integrated, global biotechnology company whose medicines treat 5,000+ patients with $1B+ in worldwide sales revenue by 2023 >350 Patients* | $36.9M Global Sales 5,000 Patients* | $1B Global Sales YE17 2023 *Clinical & commercial, all figures approximate

Thank You