Attached files

| file | filename |

|---|---|

| EX-23.2 - CONSENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM - Skylab USA, Inc. | skylab_s1a1-ex2302.htm |

| EX-23.1 - CONSENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM - Skylab USA, Inc. | skylab_s1a1-ex2301.htm |

| EX-10.1 - AMENDED SHARE EXCHANGE AGREEMENT - Skylab USA, Inc. | skylab_s1a-ex1001.htm |

| EX-3.2 - BY-LAWS - Skylab USA, Inc. | skylab_s1a1-ex0302.htm |

| EX-3.1 - AMENDED AND RESTATED ARTICLES OF INCORPORATION - Skylab USA, Inc. | skylab_s1a1-ex0301.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM S-1/A

AMENDMENT NO. 1

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

SKYLAB USA, INC.

(Exact name of Registrant as specified in its charter)

| FL | 7371 | 46-5560986 | ||

| (State or other jurisdiction of incorporation or organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification Number) |

|

10120 South Eastern Avenue, Suite 200 Henderson, Nevada, 89052 |

| (address of principal executive offices) |

|

Registrant's telephone number, including area code: 253.332.7362 |

| Dean Grey 5600 Avenida Encinas Carlsbad, CA 92008 |

| (Name and address of agent for service of process) |

COPIES OF COMMUNICATIONS TO:

W. Scott Lawler, Esq.

Booth Udall Fuller, PLC

1255 W. Rio Salado Parkway, Suite 215

Tempe, Arizona 85281

480.830.2700

WSL@BoothUdall.com

| Approximate date of commencement of proposed sale to the public: | As soon as practicable after the effective date of this Registration Statement. |

If any of the securities being registered on the Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box x

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If delivery of the prospectus is expected to be made pursuant to Rule 434, check the following box. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and "emerging growth company" in Rule 12b-2 of the Exchange Act.

| Large accelerated filer o | Accelerated filer o |

| Non-accelerated filer o | Smaller reporting company x |

| (Do not check if a smaller reporting company) | |

| Emerging Growth x |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided to Section 7(a)(2)(B) of the Securities Act. o

CALCULATION OF REGISTRATION FEE

| TITLE OF EACH CLASS OF SECURITIES TO BE REGISTRATION |

AMOUNT TO BE REGISTERED(1) |

PROPOSED MAXIMUM OFFERING PRICE PER SHARE | PROPOSED MAXIMUM AGGREGATE OFFERING PRICE(2) |

AMOUNT OF REGISTERED FEE | ||||||||||||

| Common Stock, par value $0.001 | 25,000,000 | $ | $ | 3,000,000 | $ | 373.50 (3) | ||||||||||

| (1) | This registration statement covers the sale by us of up to an aggregate of 25,000,000 shares of our common stock. Pursuant to Rule 416 under the Securities Act of 1933, this registration statement also covers any additional securities that may be offered or issued in connection with any stock dividend, stock split, recapitalization or other similar transaction effected without the receipt of consideration that results in an increase in the number of the outstanding shares of our common stock. |

| (2) | Estimated solely for the purpose of calculating the registration fee in accordance with Rule 457(a) under the Securities Act. |

| (3) | Previously paid. |

THE REGISTRANT HEREBY AMENDS THIS REGISTRATION STATEMENT ON SUCH DATE OR DATES AS MAY BE NECESSARY TO DELAY ITS EFFECTIVE DATE UNTIL THE REGISTRANT SHALL FILE A FURTHER AMENDMENT WHICH SPECIFICALLY STATES THAT THIS REGISTRATION STATEMENT SHALL THEREAFTER BECOME EFFECTIVE IN ACCORDANCE WITH SECTION 8(a) OF THE SECURITIES ACT OF 1933 OR UNTIL THE REGISTRATION STATEMENT SHALL BECOME EFFECTIVE ON SUCH DATE AS THE COMMISSION, ACTING PURSUANT TO SECTION 8(a), MAY DETERMINE.

The information contained in this prospectus is not complete and may be changed. No securities may be sold until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these shares, and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

SUBJECT TO COMPLETION

Dated September , 2018

PROSPECTUS

SKYLAB USA, INC.

25,000,000

SHARES OF COMMON STOCK

INITIAL PUBLIC OFFERING

___________________

This prospectus relates to our offering of 25,000,000 new shares of our common stock at a fixed offering price of $__ per share. There is no minimum number of shares that must be sold by us for the offering to proceed, and we will retain the proceeds from the sale of any of the offered shares. We have not made any arrangements to place funds raised in this offering in an escrow, trust or similar account. Any investor who purchases shares in this offering will have no assurance that other purchasers will invest in this offering. Accordingly, if we file for bankruptcy protection or a petition for insolvency bankruptcy is filed by creditors against us, your funds will become part of the bankruptcy estate and administered according to the bankruptcy laws.

The offering is being conducted on a self-underwritten, best efforts basis, which means our officers and directors will attempt to sell the shares with no commission or other remuneration payable to them for any shares they may sell.

There is no established public market for our common stock, and the offering price has been arbitrarily determined. Our common stock is not currently listed or quoted on any quotation service. Although we intend to apply for quotation on the OTCBB or OTCQB through a market maker, there can be no assurance that our common stock will ever be quoted on any quotation service or that any market for our stock will ever develop.

This offering will be open until the earlier of: (i) the maximum amount of shares have been sold; or (ii) twelve (12) months from the date of effectiveness of this registration statement of which this prospectus forms a part.

|

Offering Price |

Underwriting Discounts and Commissions (1) |

Proceeds to Company Assuming 100% Subscribed |

Proceeds to Company Assuming 75% Subscribed |

Proceeds to Company Assuming 50% Subscribed |

Proceeds to Company Assuming 25% Subscribed |

|||||||||||||||||||

| Per Share | $ | 0 | $ | $ | $ | $ | ||||||||||||||||||

| Gross/Net Proceeds(2) | 0 | $ | _________ | $ | _________ | $ | _________ | $ | _________ | |||||||||||||||

| (1) | There are no arrangements or plans to use underwriters or broker/dealers to offer our common stock. However, we reserve the right to utilize the services of licensed broker/dealers and compensate these broker/dealers with a commission not to exceed 10% of the proceeds raised. | |

| (2) | The Company has already paid all expenses associated with this offering and there will be no deduction from the Gross Proceeds. Therefore, the Gross Proceeds received will be the same at the Net Proceeds. |

We are an “emerging growth company” as defined under the federal securities laws and, as such, may elect to comply with certain reduced public company reporting requirements. The purchase of the securities offered through this prospectus involves a high degree of risk. See section entitled “Risk Factors” starting on page 24.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. The prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

The Date of This Prospectus is: September , 2018

| i |

This summary highlights information contained elsewhere in this prospectus. This summary does not contain all of the information you should consider before investing in our ordinary shares. You should read this entire prospectus carefully, especially “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our consolidated financial statements and related notes appearing elsewhere in this prospectus, before making an investment decision.

| 1 |

| 2 |

| 3 |

| 4 |

| 5 |

| 6 |

| 7 |

| 8 |

| 9 |

We were incorporated under the name of Pandora Venture Capital Corporation (“Pandora”) on May 9, 2014. Pandora was subsidiary of WRIT Media Group, a publicly traded company trading under the symbol WRIT. Pandora Venture Capital Corporation, a Florida Corporation, changed its name to Skylab USA, Inc. (the “Company”) on July 28, 2017. The Company acquired Skylab Apps Inc. (“SAI” or “Skylab”), via a Share Exchange Agreement dated April 26, 2017. The terms of the Share Exchange Agreement stipulated that the shareholders of SAI would sell all of their outstanding common shares, equal to 31,708,829 shares, to Pandora in exchange for 95% of the common shares of Pandora and 100% of the preferred shares of Pandora. The acquisition of SAI was completed on or about March 29, 2018. SAI is incorporated was incorporated in the State of Delaware on September 14, 2015 and is registered in the State of California as a foreign stock company.

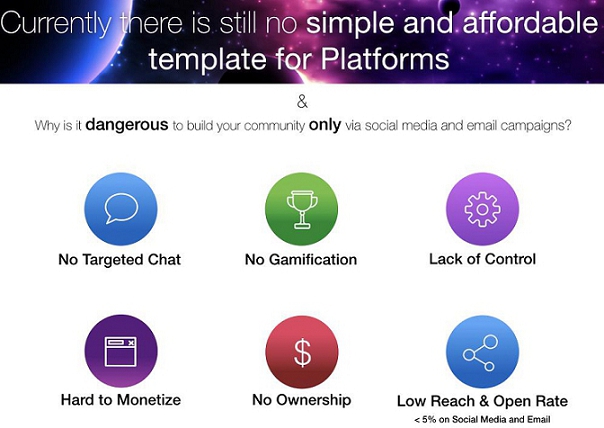

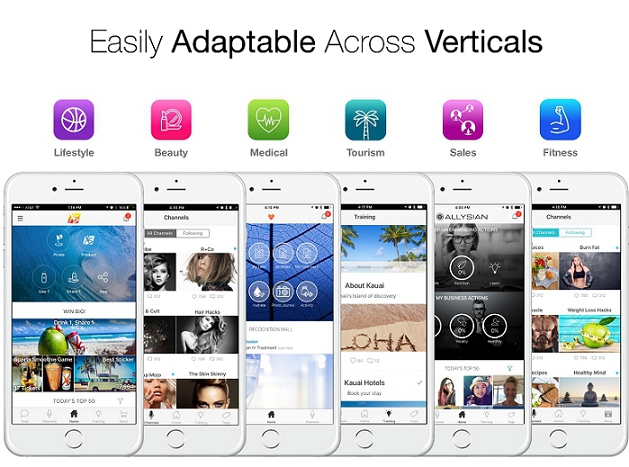

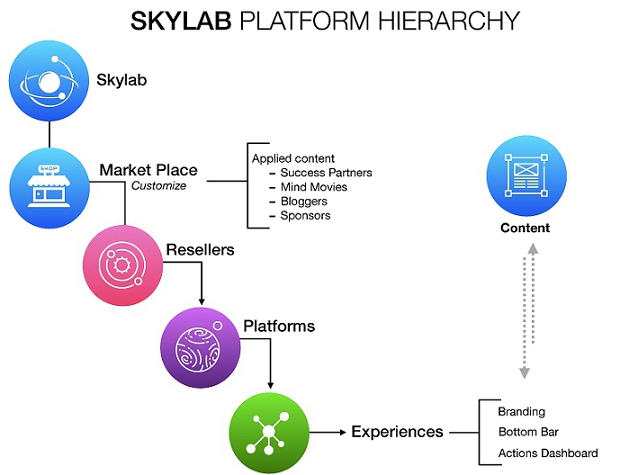

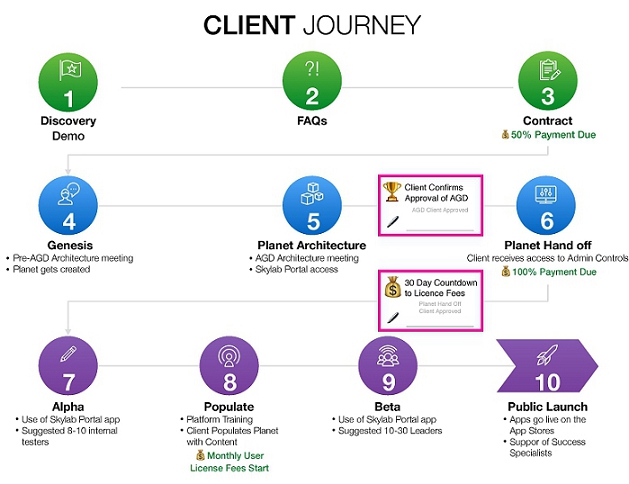

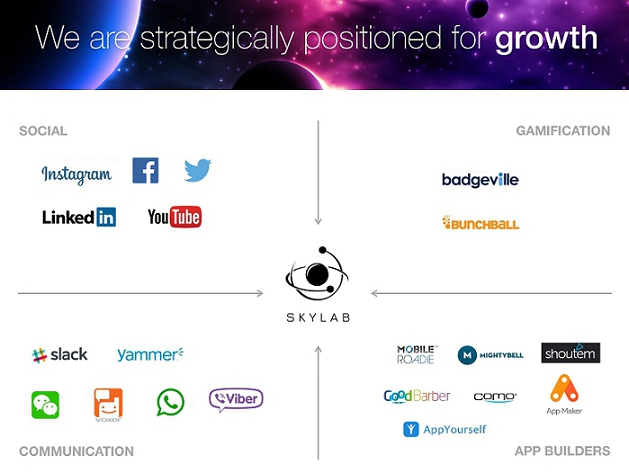

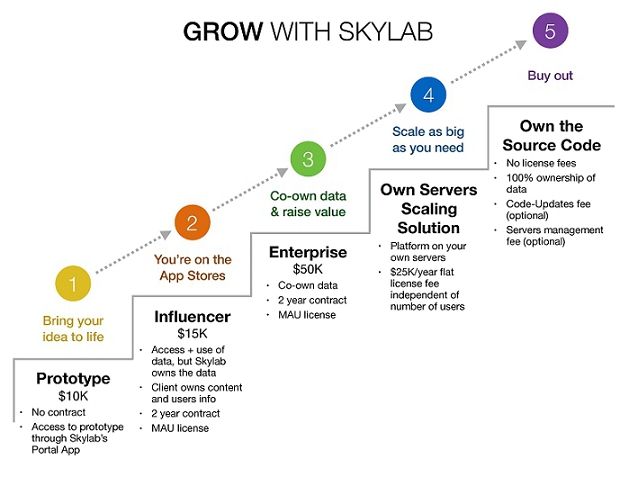

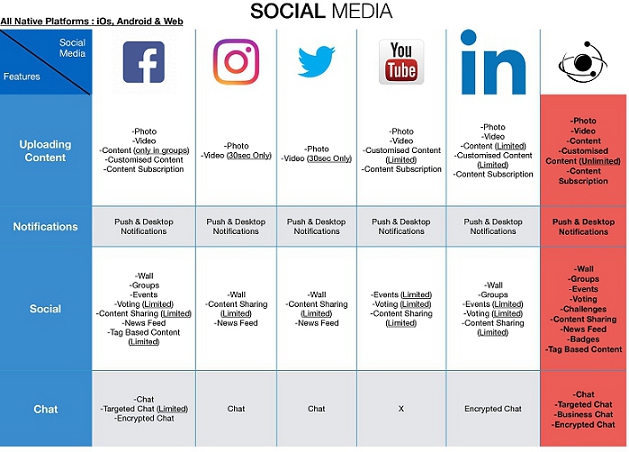

SAI was created for the purpose of developing a SASS white label platform for influencer and brands to train, track, reward and monetize their communities. The SASS model provides the platform licensing. The platform is driven by the Company’s proprietary Gamification Engine, which allows the client to customize the platform to fit the needs of its target community. The Gamification Engine/IP/technology is licensed to Skylab by Skynet Group, Inc., a Nevada corporation, which is a related party to Skylab due to the fact that Mr. Dean Grey is a member of the Board of Directors of each entity and Mr. Grey and Ms. Lorrie Edelblute are officers of each entity.

| 10 |

Through the platform’s Content Management System (CMS), the client can modify many features of the platform without the need to work with outside platform developers. We have a domestic and international client base, including Australia, Spain, and Brazil.

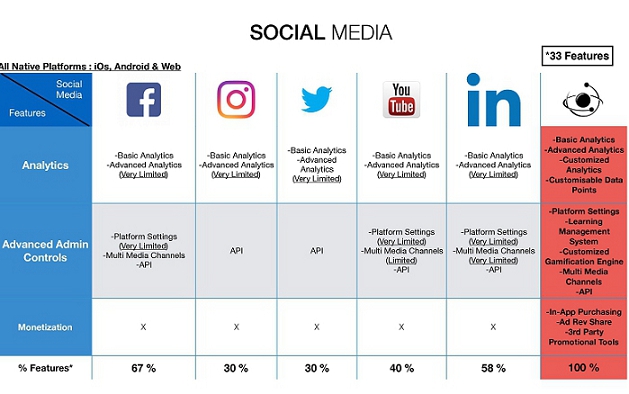

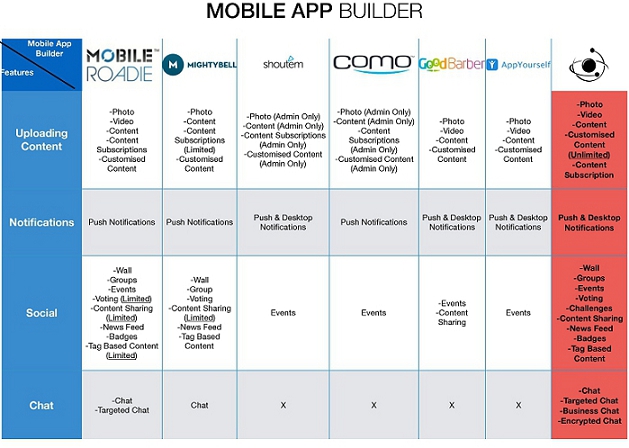

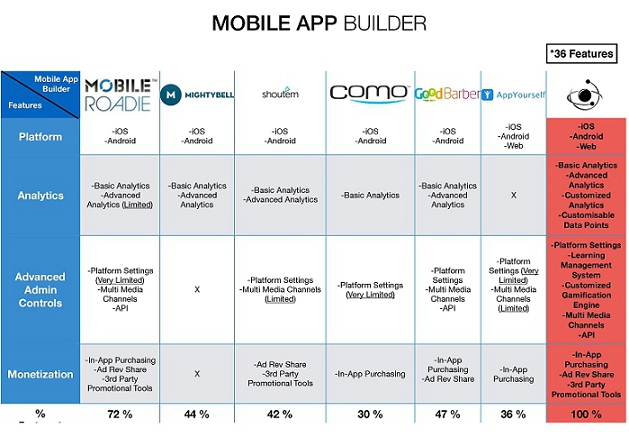

Social media engagement measures the public shares, likes and comments for an online business’ social media efforts. The public’s engagement, or interaction with the social media platform, has historically been a common metric for evaluating social media performance.

Skylab is focused on the trend that platforms are becoming the new websites for the world. Companies such as Wordpress, Squarespace and Wixs have made building websites easy. Skylab makes building social platforms easy.

Our focus is to provide a highly engaging, differentiated experience where the combination of challenge and progress drives our product. Our social media engagement platform is one of the fastest growing technologies that allow clients to customize and mold the platform to fit the needs of their target market or community. Our product allows the client to reach out to a target community and enhance the users experience by allowing the user to track use. This, in turn, trains the behavior of continued use of the platform and rewards the user with targeted information that is specific to the community.

Interactive social media platforms are large and growing quickly, driven by key technology and consumer trends. This demand creates the potential for leading applications to emerge from the category. The proliferation of mobile devices is dramatically expanding the social media audience and our platform is the leading competitor for targeted communities to connect, track, and be rewarded without the unwanted advertising and content that doesn’t fit within the community goals. What sets us apart from the larger social media groups is White Papers and Stats. This function demonstrates the impact and user engagement in the targeted community.

As of September 30, 2017, we had $220,221 in current assets and current liabilities in the amount of $1,405,986. Accordingly, we had a working capital deficit of $1,185,765. Our current working capital is not sufficient to enable us to implement our business plan as set forth in this prospectus. As such, our monthly burn rate for the next twelve months is estimated at $84,000. We will need to sell a minimum of 33.33% of the shares offered in this prospectus for net proceeds of $1,000,000 in order to meet our financial obligations. Our ability to remain in business with less than $1,000,000 in this offering is questionable

We are offering for sale to investors a maximum of 25,000,000 shares of our common stock at an offering price of $_______ per share. Our business plan is to use the proceeds of this offering for continued IT development, market expansion, and operating expenses. However, our management has retained discretion to use the proceeds of the offering for other uses. There is no minimum investment amount for a single investor. We are offering the shares on a “best efforts” basis and there can be no assurance that all or any of the shares offered will be subscribed. If less than the maximum proceeds are available to us, our development and prospects could be adversely affected. There is no minimum offering required for this offering to close. The proceeds of this offering will be immediately available to us for our general business purposes. The maximum offering amount is 25,000,000 shares for gross proceeds of $_________.

Our address is 10120 South Eastern Avenue, Suite 200, Henderson, Nevada, 89052. Our phone number is 253.332.7362. Our fiscal year end is December 31.

Industry Background and Our Opportunity

This industry develops and publishes Apps for smart phones, mobile devices and desktop computers. Apps are typically sold in a special "Platform Store" that can be accessed through the device. Platforms are created to make the users experience seamless on all devices. Our opportunity is to capture target communities and create a platform that allows each user to have a customized experience when using the Platform. We believe our clients are limitless and include every company looking to build a specialized community tailored to their industry. However, it doesn’t stop there. A target community can also include clubs, fitness, sports, hobbies, schools, and any organization that is looking to create a positive experience for its users.

| 11 |

MAJOR PRODUCTS

Lifestyle and social networking apps

Smartphone platform users spend the most time on social networking and messaging apps. The category includes popular apps such as Facebook, Twitter, Pinterest, WhatsApp and Viber. Over the past five years, this category has grown significantly and is expected to account for 34.4% of all time spent using smartphone apps. Social networking and messaging apps are popular because they allow for increased connectivity with friends and family. These apps also allow people to connect with friends and family that live far away, such as in other countries. Historically, connecting with people in other countries has been difficult due to the high cost of phone calls and possible additional costs for text messages. Since many social networking and messaging apps are free for consumers to download and use, the cost of connecting with people is significantly reduced. Social networking and messaging apps often generate revenue through advertisement, in-platform purchases and games.

Entertainment

Entertainment apps include television and film apps such as Netflix, YouTube and ringtones and wallpaper downloads. Additionally, this segment also includes music and video apps such as Pandora, Spotify, and other video creation applications. Entertainment apps have become more popular over the past five years, as consumers increasingly access the internet through mobile devices. Therefore, more television, film and other media are now consumed on the go. Despite increasing consumption of television, film and other media via smartphones, this segment faces heavy competition from online piracy. Rather than paying for a mobile application to watch videos or listen to music, consumers can download the content directly to their phones or stream the content from websites that do not require consumers to purchase a subscription to view videos. Despite these challenges, the entertainment apps segment is expected to account for 18.9% of all time users spend on smartphone applications.

Other

Other apps include those for shopping, news (2.2%), weather, health and fitness, travel and navigation, personal finance, business, security and sports. Over the period, time spent on retail applications has been increasing as more consumers use their smartphones to order goods such as food. Although shopping apps have increased as a percentage of time, other applications in this category have decreased as other segments have grown at a more rapid pace. Tools and productivity apps are generally organizational and administrative. This includes email, cloud storage, calendars, translators and notation tools. Many tools and productivity apps are provided as part of the smartphone operating system.

Games

Games account for 16.7% of time spent on mobile apps. Over the past five years, smartphone games have become increasingly popular, as they provide a convenient, casual and low-cost alternative to video game systems. Furthermore, rising smartphone penetration across the United States has allowed developers to market games to different demographics. This includes older generations and women, who typically represent a smaller proportion of the market for video games. According to research from Flurry, a mobile analytics company, games such as solitaire and social turn-based, brain and quiz games are most popular with women above the age of 20 while strategy, shooter, racing, poker and action role-playing games are most popular with men above the age of 20. Over the five years to 2016, games have declined a share of all time spent on smartphone apps due to fast growth in other categories. In addition to accounting for a significant portion of time, games also generate a large portion of revenue; however, the way consumers spend money on games has changed. Developers have created more freemium apps, in which consumers are provided basic functions for free but must pay to access advanced features or virtual goods. This allows developers to entice consumers before requesting they pay for additional features. Freemium games are expected to continue to grow over the next five years, as developers focus on encouraging consumers to download games and get a sample before requesting payments.

| 12 |

MAJOR MARKETS

Consumers aged 30 to 49

Consumers aged 30 to 49 are estimated to represent 32.4% of industry revenue. This segment has been growing over the past five years as consumers in this age category have become technologically aware and smartphone penetration has increased rapidly. More games, tools and productivity apps are being developed to cater to this market, as they typically have significantly higher incomes than consumers in the 18 to 29 age bracket. Additionally, consumers in this age bracket are most likely to make purchases for children. Over the past five years, this segment has expanded as a proportion of revenue and is expected to continue doing so over the next five years.

Consumers aged 18 to 29

Consumers aged 18 to 29 are estimated to account for 42.4% of industry revenue. These consumers exhibit the highest level of smartphone penetration and have become increasingly reliant on using apps as part of everyday life over the past five years.

Consumers in this age range also use social networking sites like Facebook the most, which is the industry's largest product offering. Over the past five years, consumers aged 18 to 29 have remained the largest segment; however, the segment has shrunk as a proportion of revenue as smartphones have been increasingly adopted by older consumers. Consumers aged 18 to 29 are expected to remain the single largest portion of revenue over the next five years; however, the development of more apps aimed at older demographics will slowly eat into its share of industry revenue.

Consumers aged 50 and older

Consumers aged 50 and over account for the smallest proportion of revenue, with an estimated 25.2% of industry revenue. Consumers in this age bracket are the least likely to own a smartphone and download paid apps. They are also least likely to use social networking sites, the industry's largest product offering. Despite historically low usage, over the past five years this category has grown as a percentage of revenue as consumers aged 50 and over become increasingly comfortable with technology and increase their use of social networking

| 13 |

| 14 |

| 15 |

| 16 |

| 17 |

| 18 |

| 19 |

| 20 |

| 21 |

| 22 |

| Securities Being Offered | Up to 25,000,000 shares of our common stock. | |

| Offering Price |

The offering price of the common stock is $____ per share. There is no public market for our common stock. We cannot give any assurance that the shares offered will have a market value, or that they can be resold at the offered price if and when an active secondary market might develop, or that a public market for our securities may be sustained even if developed. The absence of a public market for our stock will make it difficult to sell your shares in our stock.

Upon the effectiveness of the registration statement of which this prospectus is a part, we intend to apply to FINRA for quotation on the OTC Bulletin Board and OTCQB, through a market maker that is a licensed broker dealer, to allow the trading of our common stock upon our becoming a reporting entity under the Securities Exchange Act of 1934. There is no guarantee, however, that our common stock will ever be quoted on the OTC Bulletin Board or OTCQB. | |

| Minimum Number of Shares To Be Sold in This Offering | n/a | |

| Maximum Number of Shares To Be Sold in This Offering | 25,000,000 | |

| Securities Issued and to be Issued |

25,006,269 shares of our common stock are issued and outstanding as of the date of this prospectus. Our sole officer and director, Dean Grey owns an aggregate of 42.48% of the outstanding shares of our Company and therefore has substantial control. Upon the completion of this offering, Mr. Grey will own an aggregate of approximately 26.55% of the issued and outstanding shares of our common stock if the maximum number of shares is sold. | |

| Number of Shares Outstanding After the Offering If All the Shares Are Sold | 40,006,269 | |

| Use of Proceeds | If we are successful at selling all the shares we are offering, our net proceeds from this offering will be approximately $_________. We intend to use these proceeds to meet operational needs and invest in addition to technology and marketing. | |

| Offering Period | This offering will be open until the earlier of: (i) the maximum number of shares have been sold; (ii) twelve (12) months from the date of effectiveness of this registration statement of which this prospectus forms a part. |

Summary Financial Information

| Balance Sheet Data | As of June 30, 2018 (unaudited) | As of December 31, 2017 (audited) | As of December 31, 2016 (audited) | |||||||||

| Cash | $ | 75,249 | $ | 33,064 | $ | 134,930 | ||||||

| Total Current Assets | $ | 82,549 | $ | 44,764 | $ | 209,894 | ||||||

| Total Liabilities | $ | 1,775,347 | $ | 1,514,487 | $ | 1,251844 | ||||||

| Total Stockholders’ Equity (Deficit) | $ | – | $ | (1,074,468 | ) | $ | (496,355 | ) | ||||

| Statement of Operations | For the Year ended December 31, 2017 (audited) | For the Year ended December 31, 2016 (audited) | ||||||

| Revenue | $ | 562,368 | $ | 733,200 | ||||

| Net Profit (Loss) for Reporting Period | $ | (1,617,247 | ) | $ | (22,667 | ) | ||

| 23 |

| Statement of Operations | For the six months ended June 30, 2018 (unaudited) | For the six months ended June 30, 2017 (unaudited) | ||||||

| Revenue | $ | 219,615 | $ | 293,292 | ||||

| Net Profit (Loss) for Reporting Period | $ | 724,189 | $ | 601,475 | ||||

In addition to the other information in this prospectus, the following risk factors should be considered carefully in evaluating our business before purchasing any of our shares of common stock. A purchase of our common stock is speculative in nature and involves a lot of risks. No purchase of our common stock should be made by any person who is not in a position to lose the entire amount of his or her investment.

Risks Associated with Our Financial Condition

Because of our history of net losses, there is an increased risk associated with an investment in our Company.

We have earned limited revenue since our inception, which makes it difficult to evaluate whether we will operate profitably. Revenues generated were $562,368 for the year ended December 31, 2017 and $733,200 for the year ended December 31, 2016. Operating expenses were $2,035,432 and $731,762 for the years ended December 31, 2017 and 2016, respectively. We have incurred a net loss of $1,617,247 and $22,667 for the years ended December 31, 2017 and 2016, respectively.

Revenues generated were $219,615 for the six-month period ended June 30, 2018 and $293,292 for the same period from the prior year. Operating expenses were $914,468 for the six-month period ended June 30, 2018 and $847,769 for the same period from the prior year. We have incurred a net loss of $677,229 for the six-month period ended June 30, 2018 and $601,475 for the same period from the prior year.

We have not attained sustained profitable operations since inception and are dependent upon obtaining financing or generating revenue from operations to continue operations for the next twelve months. As of June 30, 2018, we had cash in the amount of $75,249. Our future is dependent upon our ability to obtain financing or upon future profitable operations. We reserve the right to seek additional funds through private placements of our common stock and/or through debt financing. Our ability to raise additional financing is unknown. We do not have any formal commitments or arrangements for the advancement or loan of funds. As a result, there is an increased risk that you could lose the entire amount of your investment in our company.

Because we have a limited operating history, it is difficult to evaluate your investment in our stock.

Evaluation of our business will be difficult because we have a limited operating history. To date, revenues are not substantial enough to maintain us without additional capital injection if we determine to pursue a growth strategy before significant revenues are generated. We face a number of risks encountered by early-stage companies, including our need to develop infrastructure to support growth and expansion; our need to obtain long-term sources of financing; our need to establish our marketing, sales and support organizations; and our need to manage expanding operations. Our business strategy may not be successful, and we may not successfully address these risks. If we are unable to sustain profitable operations, investors may lose their entire investment in us.

| 24 |

Because our offering will be conducted on a best efforts basis, there can be no assurance that we can raise the money we need.

The shares are being offered by us on a "best efforts" basis with no minimum and without benefit of a private placement agent. We can provide no assurance that this offering will be completely sold out. If less than the maximum proceeds are available, our business plans and prospects for the current fiscal year could be adversely affected.

In order to fund our operations for the next twelve months, we believe that we need approximately $1,000,000 in gross proceeds from this offering. We believe that $1,000,000 in gross proceeds will be sufficient to continue our current operations and business activities for the next twelve months. We believe that $3,000,000 from this offering would allow us to expand our business through additional technology, marketing and meeting our ongoing operational expenses. Our available funds combined with revenues will not fund our activities for the next twelve months. As of June 30, 2018, our current cash on hand is approximately $75,249. Our current monthly burn rate is approximately $40,000 per month. Based on our current burn rate, we will run out of funds in the next twelve months without additional capital and assuming revenues based on past performance during that period. If we fail to raise sufficient funds in this offering, investors may lose their entire cash investment.

Given that there is no minimum offering amount and we need to raise $1,000,000 to continue operations for the next twelve months, investors bear the complete risk of losing their entire investment if we are unable to raise enough proceeds from this offering to continue operations. If we are not able to raise more than $1,000,000, we will be limited in our ability to grow our business in technologies and reach additional clients. This will limit our ability to generate significant revenues and cause a delay becoming profitable. Moreover, the less money we are able to raise in this offering, the more the risk that you will lose your entire investment.

Our operation results may fluctuate from quarter to quarter, and therefore will be difficult to predict.

Our operating results fluctuate and will continue to fluctuate in the future. As a result, our past quarterly operating results are not necessarily indicators of future performance. Our quarterly operating results can, and will be, influenced by numerous factors. Many of these factors are unable to predict, and some are outside of our control, including:

| · | our ability to grow our user base and user engagement; |

| · | our ability to attract and retain these users; |

| · | the occurrence of unplanned significant events, such as natural disasters; |

| · | the pricing of our products and services; |

| · | the development and introduction of new products or services or changes in features of existing products or services; |

| · | the impact of our competitors or competitive products and services they produce; |

| · | our ability to maintain or increase revenue; |

| · | our ability to maintain or improve gross margins and operating margins; |

| · | increases in research and development, marketing and sales and other operating expenses that we may incur to grow and expand our operations and to remain competitive; |

| · | stock-based compensation expenses; |

| · | expenses relating to the acquisition of businesses, talent, technologies or intellectual property, including potentially significant amortization costs; |

| · | system failures resulting in the inability for our users to access our products and services; |

| · | breaches of security or privacy, and the costs associated with correcting such breaches; |

| · | adverse litigation judgments, settlements or other litigation-related costs, and the fees associated with investigating and defending claims; |

| · | changes in the legislative or regulatory environment, including with respect to security, privacy or enforcement by government regulators, including fines, orders or consent decrees; |

| · | fluctuations in currency exchange rates and changes in the proportion of our revenue and expenses denominated in foreign currencies; and |

| · | changes in global business conditions. |

| 25 |

We have a limited operating history and given the rapidly evolving markets in which we compete, our historical operating results may not be useful to you in predicting our future operating results. If our revenue growth rate slows in the future it will cause our operating results to fluctuate.

Risks Associated with Our Business Model

Because we may be unable fund the business, we could face significantly harm to our business plans, prospects, results of operations and financial condition.

Commercializing our platform depends on a number of factors, including but not limited to:

| · | development of an adequate sales force and sales channels to market our product; |

| · | demonstration of efficiencies that will make our product attractively priced; |

| · | further product development; and |

| · | overall demand for application intelligence solutions. |

We cannot assure investors that the strategies we intend to employ will enable us to support the development and distribution of our interactive platform. If we are unable to implement the necessary steps of our business plan, our prospects, results of operations and financial condition will suffer.

We will rely in part upon a sales team to distribute and sell our products, and we may be adversely affected if those parties do not actively promote our products or pursue customers who would have a potential demand for our products.

We estimate that a significant portion of our revenue will come from sales to partners including reps, distributors and resellers. These relationships may be subject to termination at any time.

We intend to continue to seek strategic relationships to distribute and sell our interactive software. We, however, may not be able to negotiate acceptable relationships in the future and cannot predict whether current or future relationships will be successful.

If the markets for interactive social media platforms do not experience significant growth or if our products do not achieve broad acceptance, we will not be able to achieve revenues.

We hope to achieve continued revenues from sales of websites and apps based on our platform and services. We cannot accurately predict, however, future growth rates or the size of the market for our industry in the United States and other markets we engage in. Demand for our applications may not occur as anticipated, or may decrease, either generally or in specific geographic markets, during particular time periods. The expansion of our interactive platform in the market depends on a number of factors, such as:

| · | the cost, performance and appearance of our products and products offered by our competitors; |

| · | public perceptions regarding our products and the effectiveness and value of our products; |

| · | customer satisfaction with our products; and |

| · | marketing efforts and publicity regarding the needs for our product and the public demand for our product |

Even if our product gains wide market acceptance, we may not adequately address market requirements and may not be able to expand market acceptance. If our products do not achieve wide market acceptance, we may not be able to achieve our anticipated level of growth, we may not achieve revenues and results of operations would suffer.

If we are unable to gauge trends and react to changing consumer preferences in a timely manner, our sales will decrease, and our business may fail.

We believe our success depends in substantial part on our ability to offer products that reflect current needs and anticipate, gauge and react to changing consumer demands in a timely manner. Our business is vulnerable to changes in consumer preferences. We will continue to modify and improve the function of our apps. However, if we misjudge consumer needs for our products, our ability to generate sales could be impaired resulting in the failure of our business. There are no assurances that our future products and will be successful, and in that regard, any unsuccessful products could also adversely affect our business.

| 26 |

In the event that we are unable to successfully compete in the Smartphone Platform Developer industry, we may not be able to achieve profitable operations.

We face substantial competition in the industry. Due to our small size, it can be assumed that many of our competitors have significantly greater financial, technical, marketing and other competitive resources. Accordingly, these competitors may have already begun to establish brand-recognition with consumers. We will attempt to compete against these competitors by developing features that exceed the features offered by competitors. However, we cannot assure you that our products will outperform competing products or those competitors will not develop new products that exceed what we provide. In addition, we may face competition based on price. If our competitors lower the prices on their products, then it may not be possible for us to market our products at prices that are economically viable. Increased competition could result in:

| · | Lower than projected revenues; |

| · | Price reductions and lower profit margins; and |

| · | The inability to develop and maintain our products with features and usability sought by potential customers. |

Any one of these results could adversely affect our business, financial condition and results of operations. In addition, our competitors may develop competing products that achieve greater market acceptance. It is also possible that new competitors may emerge and acquire significant market share. Our inability to achieve sales and revenue due to competition will have an adverse effect on our business, financial condition and results of operations.

Our apps may contain bugs and experience security breaches, which could adversely affect our reputation and cause us to incur significant costs.

Bugs and security breaches may be found in our products. Any such defects could cause us to incur significant repair costs and divert the attention of our personnel from product development efforts, and cause significant customer relations and business reputation problems. Any such defects could force us to undertake a research and repair program, which could cause us to incur significant expenses and could harm our reputation and that of our apps. If we deliver products with defects, our credibility and the market acceptance and sales of our products could be harmed.

If we do not effectively implement measures to sell our products, we may not achieve sustained revenues and you will lose your entire investment.

Over the past five years, revenue volatility in the Smartphone Platform Developers industry has been very high. This is due to rapidly evolving technology and competition. Marketing and sales is the driving force behind branding applications and is dominated by the larger companies such as Facebook and Twitter. We must implement and execute solid sales and marketing staff to maintain revenue share in the marketplace.

If we are unable to successfully manage growth, our operations could be adversely affected.

Our progress is expected to require the full utilization of our management, financial and other resources, which to date has occurred with limited working capital. Our ability to manage growth effectively will depend on our ability to improve and expand operations, including our financial and management information systems, and to recruit, train and manage sales personnel. There can be no absolute assurance that management will be able to manage growth effectively.

If we do not properly manage the growth of our business, we may experience significant strains on our management and operations and disruptions in our business. Various risks arise when companies and industries grow quickly. If our business or industry grows too quickly, our ability to meet customer demand in a timely and efficient manner could be challenged. We may also experience development delays as we seek to meet increased demand for our products. Our failure to properly manage the growth that we, or our industry, might experience could negatively impact our ability to execute on our operating plan and, accordingly, could have an adverse impact on our business, our cash flow and results of operations, and our reputation with our current or potential customers.

| 27 |

If we fail to grow our user base, or if user engagement on our platform decline, our revenue, business and operating results may be harmed.

Our financial performance will continue to be determined by our success in growing the number of users and increasing their overall level of engagement on our platform. If people do not perceive our products and services to be useful, engaging and reliable, we will not be able to attract new users or increase the frequency engagement with our platform. There is no guarantee that we will not experience an erosion of our user base or engagement levels. A number of factors could potentially negatively affect user growth and engagement, including if:

| · | users switch other products or services as an alternative to ours; |

| · | influential users, such as certain age demographics find that an alternative product or service is better suited for their needs; |

| · | we are unable to convince potential new users of the value and usefulness of our products and services; |

| · | there is a decrease in the perceived quality of the content generated by our users; |

| · | we fail to introduce new and improved products or services or if we introduce new products or services that are not favorably received; |

| · | Technical issues prevent us from delivering our products or services in a competent manner or otherwise affect the user experience; |

If we are unable to increase our user growth or engagement, or if they decline, this could result in our products and services being less attractive to potential new users which would have a material and adverse impact on our business, financial condition and operating results.

If we are unable to hire and retain key personnel, we may not be able to implement our business plan.

Due to the technical nature of our business, having certain key personnel is essential to the development and marketing of the products we plan to sell and thus to the entire business itself. Consequently, the loss of any of those individuals may have a substantial effect on our future success or failure. We may have to recruit qualified personnel with competitive compensation packages, equity participation, and other benefits that may affect the working capital available for our operations. Management may have to seek to obtain outside independent professionals to assist them in assessing the merits and risks of any business proposals as well as assisting in the development and operation of many company projects. No assurance can be given that we will be able to obtain such needed assistance on terms acceptable to us. Our failure to attract additional qualified employees or to retain the services of key personnel could have a material adverse effect on our operating results and financial condition.

Our officers have no experience in managing a public company, which increases the risk that we will be unable to establish and maintain all required disclosure controls and procedures and internal controls over financial reporting and meet the public reporting and the financial requirements for our business.

Our management has a legal and fiduciary duty to establish and maintain disclosure controls and control procedures in compliance with the securities laws, including the requirements mandated by the Sarbanes-Oxley Act of 2002. Although our officers have substantial business experience, they have no experience in managing a public company. The standards that must be met for management to assess the internal control over financial reporting as effective are new and complex, and require significant documentation, testing and possible remediation to meet the detailed standards. Because our officers have no prior experience with the management of a public company, we may encounter problems or delays in completing activities necessary to make an assessment of our internal control over financial reporting, and disclosure controls and procedures. If we cannot assess our internal control over financial reporting as effective or provide adequate disclosure controls or implement sufficient control procedures, investor confidence and share value may be negatively impacted.

We will incur increased costs and our management will face increased demands as a result of operating as a public company.

As a public company, we will incur significant legal, accounting and other expenses that we did not incur as a private company. We estimate that we will incur no less than $50,000 in these expenses on an annual basis to exist as a public company. Those expenses will be higher if our business volume and activity increases. Those obligations could diminish our ability to fund our operations and may prevent us from meeting our normal business obligations.

In addition, our administrative staff will be required to perform additional tasks. For example, in anticipation of becoming a public company, we will need to adopt additional internal controls and disclosure controls and procedures and bear all of the internal and external costs of preparing and distributing periodic public reports in compliance with our obligations under applicable securities laws.

| 28 |

In addition, changing laws, regulations and standards relating to corporate governance and public disclosure, including the Sarbanes-Oxley Act, the Dodd-Frank Act and related regulations implemented by the Securities and Exchange Commission are creating uncertainty for public companies, increasing legal and financial compliance costs and making some activities more time-consuming. We are currently evaluating and monitoring developments with respect to new and proposed rules and cannot predict or estimate the amount of additional costs we may incur or the timing of such costs. These laws, regulations and standards are subject to varying interpretations, in many cases due to their lack of specificity, and, as a result, their application in practice may evolve over time as regulatory and governing bodies provide new guidance. This could result in continuing uncertainty regarding compliance matters and higher costs necessitated by ongoing revisions to disclosure and governance practices. We intend to invest resources to comply with evolving laws, regulations and standards, and this investment may result in increased general and administrative expenses and a diversion of management's time and attention from revenue-generating activities to compliance activities. If our efforts to comply with new laws, regulations and standards differ from the activities intended by regulatory or governing bodies due to ambiguities related to practice, regulatory authorities may initiate legal proceedings against us and our business may be harmed. We also expect that being a public company and these new rules and regulations will make it more expensive for us to obtain director and officer liability insurance, and we may be required to accept reduced coverage or incur substantially higher costs to obtain coverage. These factors could also make it more difficult for us to attract and retain qualified members of our board of directors, particularly to serve on our audit committee and compensation committee, and attract and retain qualified executive officers.

The increased costs associated with operating as a public company may decrease our net income or increase our net loss, and may cause us to reduce costs in other areas of our business or increase the prices of our products or services to offset the effect of such increased costs. Additionally, if these requirements divert our management's attention from other business concerns, they could have a material adverse effect on our business, financial condition and results of operations.

Because we have two persons as our officers and directors that occupy all corporate positions, our internal controls may be inadequate and we may face negative consequences related to having them set their own salaries and making all of the decisions affecting our company.

Because we have only two officers, Dean Grey and Lorrie Edelblute, they might not be adequately able to administer our internal controls over disclosure or financial reporting. A control system, no matter how well conceived and operated, can provide only reasonable, not absolute, assurance that the objectives of the control system are met. Further, the design of a control system must reflect the fact that there are resource constraints, and the benefits of controls must be considered relative to their costs. Because of the inherent limitations in all control systems, no evaluation of controls can provide absolute assurance that all control issues and instances of fraud, if any, within the Company have been detected. These inherent limitations include the realities that judgments in decision-making can be faulty, and that breakdowns can occur because of a simple error or mistake. Since we have only two officers and directors, the controls can easily be circumvented by our officers and directors, which could result in adverse consequences to us.

In addition, they will have an overwhelming influence in determining the outcome of all corporate transactions or other matters, including setting their own salary and perquisites, using corporate assets and funds to the designs he feels best, and also the power to prevent or cause a change in control. As a result, our two officers and directors could establish a high salary in the future, which will drain our capital and prevent us from operating. You will not be able to control the decisions he makes and you may find them in conflict with your personal designs for this business.

Risks Related to Legal Uncertainty

Our inability to protect our brand name and proprietary rights in the United States and foreign countries could materially adversely affect our business prospects and competitive position.

Our success depends on our ability to obtain and maintain branding and other proprietary-right protection in the United States and other countries. If we are unable to obtain or maintain these protections, we may not be able to prevent third parties from using our proprietary rights.

If we are the subject of future state and federal level regulation imposed on companies that distribute apps, our business will likely be financially impacted.

In the course of our planned operations, we may become subject to state and federal regulation. Because of the sensitive nature of information consumers make available to apps and platform marketplaces, security and privacy issues related to third-party platform developers have become a central concern, spurring new regulation. As a result, policies that eliminate developers' access to private information have the potential to negatively affect industry revenue growth moving forward.

| 29 |

Our commercial success depends significantly on our ability to develop and commercialize our platform without infringing the intellectual property rights of third parties.

Our commercial success will depend, in part, on operating our business without infringing the trademarks or proprietary rights of third parties. Third parties that believe we are infringing on their rights could bring actions against us claiming damages and seeking to enjoin the development, marketing and distribution of our apps. If we become involved in any litigation, it could consume a substantial portion of our resources, regardless of the outcome of the litigation. If any of these actions are successful, we could be required to pay damages and/or to obtain a license to continue to develop or market our products, in which case we may be required to pay substantial royalties. However, any such license may not be available on terms acceptable to us or at all. Ultimately, we could be prevented from commercializing a product or forced to cease some aspect of our business operations as a result of patent infringement claims, which would harm our business.

RISKS RELATED TO AN EMERGING GROWTH COMPANY

We will face new challenges, increased costs and administrative responsibilities as a public company, particularly after we are no longer an “emerging growth company.”

Upon the effectiveness of this registration statement, we intend to file a Form 8-A registration statement, making us a fully reporting company and subject of the reporting requirements under Section 14 of the U.S. Securities Exchange Act of 1934. As a fully reporting company, we will need to comply with certain laws, regulations and requirements, including certain provisions of the Sarbanes-Oxley Act of 2002, or Sarbanes-Oxley, certain regulations of the Securities and Exchange Commission, or SEC, and certain of the OTCQB listing rules applicable to public companies, should we obtain a listing of our common stock on the OTCQB. Complying with these statutes, regulations and requirements will occupy a significant amount of the time of our board of directors and management and will significantly increase our costs and expenses.

We will need to:

institute a more comprehensive compliance framework;

update, evaluate and maintain a system of internal controls over financial reporting in compliance with the requirements of Section 404 of Sarbanes-Oxley and the related rules and regulations of the SEC;

prepare and distribute periodic public reports in compliance with our obligations under the federal securities laws;

revise our existing internal policies, such as those relating to disclosure controls and procedures and insider trading;

comply with SEC rules and guidelines including a requirement to provide our consolidated financial statements in interactive data format using eXtensible Business Reporting Language;

involve and retain to a greater degree outside counsel and independent accountants in the above activities; and

enhance our investor relations function.

However, for as long as we are an “emerging growth company” as defined in the Jumpstart Our Business Startups Act of 2012, or JOBS Act, we are permitted to, and intend to, take advantage of certain exemptions from various reporting requirements that are applicable to other public companies that are not emerging growth companies. We will remain an emerging growth company for up to five years, although we would cease to be an emerging growth company as of December 31 of a particular year (i) if we had gross revenue of $1 billion or more in such year, (ii) if the market value of our common stock that is held by non-affiliates exceeds $700 million as of June 30 in such year, (iii) if at any point in such year, we would have issued more than $1 billion of non-convertible debt during the three-year period prior thereto or (iv) on the date on which we are deemed a “large accelerated issuer” as defined under the federal securities laws. For so long as we remain an emerging growth company, we will not be required to:

have an auditor report on our internal control over financial reporting pursuant to Section 404(b) of Sarbanes-Oxley;

comply with any requirement that may be adopted by the Public Company Accounting Oversight Board, or PCAOB, regarding mandatory audit firm rotation or a supplement to the auditor’s report providing additional information about the audit and the financial statements (auditor discussion and analysis);

submit certain executive compensation matters to shareholder advisory votes pursuant to the “say on frequency” and “say on pay” provisions (requiring a non-binding shareholder vote to approve compensation of certain executive officers) and the “say on golden parachute” provisions (requiring a non-binding shareholder vote to approve golden parachute arrangements for certain executive officers in connection with mergers and certain other business combinations) of the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010; and

include detailed compensation discussion and analysis in our filings under the Securities Exchange Act of 1934, as amended, or Exchange Act, and instead may provide a reduced level of disclosure concerning executive compensation.

| 30 |

Although we intend to rely on the exemptions provided in the JOBS Act, the exact implications of the JOBS Act for us are still subject to interpretations and guidance by the SEC and other regulatory agencies. In addition, as our business grows, we may no longer satisfy the conditions of an emerging growth company. We are currently evaluating and monitoring developments with respect to these new rules, and we cannot assure you that we will be able to take advantage of all of the benefits from the JOBS Act. In addition, we also expect that being a public company subject to these rules and regulations will make it more expensive for us to acquire and maintain adequate director and officer liability insurance. These factors could also make it more difficult for us to attract and retain qualified executive officers and members of our board of directors.

Failure to establish and maintain effective internal controls in accordance with Section 404 of the Sarbanes-Oxley Act of 2002 could have a material adverse effect on our business and share price.

As a publicly traded company, we will be required to document and test our internal control procedures in order to satisfy the requirements of Section 404(a) of Sarbanes-Oxley, which will require, beginning with the filing of our second annual report with the SEC, annual management assessments of the effectiveness of our internal control over financial reporting. However, as an emerging growth company, our independent registered public accounting firm will not be required to formally attest to the effectiveness of our internal control over financial reporting pursuant to Section 404(b) until the later of the year following our first annual report required to be filed with the SEC or the date we are no longer an emerging growth company. During the course of our testing, we may identify material weaknesses that we may not be able to remediate in time to meet our deadline for compliance with Section 404.

Testing and maintaining internal control can divert our management’s attention from other matters that are important to the operation of our business. We also expect the regulations to increase our legal and financial compliance costs, make it more difficult to attract and retain qualified executive officers and members of our board of directors, particularly to serve on our audit committee, and make some activities more difficult, time-consuming and costly. We may not be able to conclude on an ongoing basis that we have effective internal control over financial reporting in accordance with Section 404 and, when applicable to us, our independent registered public accounting firm may not be able or willing to issue an unqualified report on the effectiveness of our internal control over financial reporting. If we conclude that our internal control over financial reporting is not effective, it could have a material adverse effect on our financial condition, results of operations and market for our common stock, and could subject us to regulatory scrutiny.

Risks Related to This Offering

If a market for our common stock does not develop, shareholders may be unable to sell their shares.

Prior to this offering, there has been no public market for our securities and there can be no assurance that an active trading market for the securities offered herein will develop after this offering, or, if developed, be sustained. We anticipate that, upon completion of this offering, the common stock will be eligible for quotation on the OTC Bulletin Board and OTCQB. If for any reason, however, our securities are not eligible for initial or continued quotation on the OTC Bulletin Board, OTCQB or a public trading market does not develop, purchasers of the common stock may have difficulty selling their securities should they desire to do so and purchasers of our common stock may lose their entire investment if they are unable to sell our securities.

Our common stock price may be volatile and could fluctuate widely in price, which could result in substantial losses for investors.

The market price of our common stock is likely to be highly volatile and could fluctuate widely in price in response to various factors, many of which are beyond our control, including:

| · | innovations or new products and services by us or our competitors; |

| · | government regulation of our products and services; |

| · | the establishment of partnerships with other companies; |

| · | intellectual property disputes; |

| · | additions or departures of key personnel; |

| · | sales of our common stock; |

| · | our ability to integrate operations, technology, products and services; |

| · | our ability to execute our business plan; |

| · | operating results below expectations; |

| · | loss of any strategic relationship; |

| · | industry developments; |

| · | economic and other external factors; and |

| · | period-to-period fluctuations in our financial results. |

| 31 |

You should consider any one of these factors to be material. Our stock price may fluctuate widely as a result of any of the above.

In addition, the securities markets have from time to time experienced significant price and volume fluctuations that are unrelated to the operating performance of particular companies. These market fluctuations may also materially and adversely affect the market price of our common stock.

Our management will have broad discretion over the use of the proceeds we receive in this offering and might not apply the proceeds in ways that increase the value of your investment.

The offering has no escrow, and investor funds may be used on receipt. There is no escrow of any funds received by us in this offering, and any funds received may be used by us for any corporate purpose as the funds are received.

We intend to use the money raised in this offering as detailed in “Use of Proceeds” section of this prospectus. However, our management has the discretion to use the money as it sees fit, and may diverge from using the proceeds of this offering as explained herein. The use of proceeds may not be used to increase the value of your investment.

Because FINRA sales practice requirements may limit a stockholder’s ability to buy and sell our stock, investors may not be able to sell their stock should they desire to do so.

In addition to the "penny stock" rules described below, FINRA has adopted rules that require that in recommending an investment to a customer, a broker-dealer must have reasonable grounds for believing that the investment is suitable for that customer. Prior to recommending speculative low priced securities to their non-institutional customers, broker-dealers must make reasonable efforts to obtain information about the customer's financial status, tax status, investment objectives and other information. Under interpretations of these rules, FINRA believes that there is a high probability that speculative low priced securities will not be suitable for at least some customers. The FINRA requirements make it more difficult for broker-dealers to recommend that their customers buy our common stock, which may have the effect of reducing the level of trading activity in our common stock. As a result, fewer broker-dealers may be willing to make a market in our common stock, reducing a stockholder's ability to resell shares of our common stock.

Because state securities laws may limit secondary trading, investors may be restricted as to the states in which they can sell the shares offered by this prospectus.

If you purchase shares of our common stock sold in this offering, you may not be able to resell the shares in any state unless and until the shares of our common stock are qualified for secondary trading under the applicable securities laws of such state or there is confirmation that an exemption, such as listing in certain recognized securities manuals, is available for secondary trading in such state. There can be no assurance that we will be successful in registering or qualifying our common stock for secondary trading, or identifying an available exemption for secondary trading in our common stock in every state. If we fail to register or qualify, or to obtain or verify an exemption for the secondary trading of, our common stock in any particular state, the shares of common stock could not be offered or sold to, or purchased by, a resident of that state. In the event that a significant number of states refuse to permit secondary trading in our common stock, the market for the common stock will be limited which could drive down the market price of our common stock and reduce the liquidity of the shares of our common stock and a stockholder's ability to resell shares of our common stock at all or at current market prices, which could increase a stockholder's risk of losing some or all of his investment.

Because we do not expect to pay dividends for the foreseeable future, investors seeking cash dividends should not purchase our common stock.

We have never declared or paid any cash dividends on our common stock. We currently intend to retain future earnings, if any, to finance the expansion of our business. As a result, we do not anticipate paying any cash dividends in the foreseeable future. Our payment of any future dividends will be at the discretion of our board of directors after taking into account various factors, including but not limited to our financial condition, operating results, cash needs, growth plans and the terms of any credit agreements that we may be a party to at the time. Accordingly, investors must rely on sales of their own common stock after price appreciation, which may never occur, as the only way to realize their investment. Investors seeking cash dividends should not purchase our common stock.

| 32 |

Because we will be subject to the “Penny Stock” rules, the level of trading activity in our stock may be reduced.

Broker-dealer practices in connection with transactions in “penny stocks” are regulated by penny stock rules adopted by the Securities and Exchange Commission. Penny stocks generally are equity securities with a price of less than $5.00 (other than securities registered on some national securities exchanges or quoted on Nasdaq). The penny stock rules require a broker-dealer, prior to a transaction in a penny stock not otherwise exempt from the rules, to deliver a standardized risk disclosure document that provides information about penny stocks and the nature and level of risks in the penny stock market. The broker-dealer also must provide the customer with current bid and offer quotations for the penny stock, the compensation of the broker-dealer and its salesperson in the transaction, and, if the broker-dealer is the sole market maker, the broker-dealer must disclose this fact and the broker-dealer’s presumed control over the market, and monthly account statements showing the market value of each penny stock held in the customer’s account. In addition, broker-dealers who sell these securities to persons other than established customers and “accredited investors” must make a special written determination that the penny stock is a suitable investment for the purchaser and receive the purchaser’s written agreement to the transaction. Consequently, these requirements may have the effect of reducing the level of trading activity, if any, in the secondary market for a security subject to the penny stock rules, and investors in our common stock may find it difficult to sell their shares.

If our shares are quoted on the OTC Bulletin Board or OTCQB, we will be required to remain current in our filings with the SEC and meet other obligations, the failure of which could risk us to removal from the quotation service.

There is no guarantee that our common stock will ever be quoted on the OTC Bulletin Board or OTCQB. However, in the event that our shares are quoted on the OTC Bulletin Board or OTCQB, we will be required to remain current in our filings with the SEC and, for eligibility on the OTCQB, we must maintain a stock price above $0.01 per share and pay annual dues. In the event that we become delinquent in these requirements, we may be relegated to an inferior quotation service or quotation of our common stock could be terminated. If our shares are not eligible for quotation on the OTC Bulletin Board or OTCQB, investors in our common stock may find it difficult to sell their shares.

Because purchasers in this offering will experience immediate and substantial dilution in the net tangible book value of their common stock, you may experience difficulty recovering the value of your investment.

Purchasers of our securities in this offering will experience immediate and substantial dilution in the net tangible book value of their common stock from the initial public offering price. Dilution in net tangible book value per share represents the difference between the amount per share paid by purchasers of shares of our common stock in this offering and the pro forma net tangible book value per share of our common stock immediately following this offering. The dilution experienced by investors in this offering will result in a net tangible book value per share that is less than the offering price of $________ per share. Such dilution may depress the value of the company’s common stock and make it more difficult to recover the value of your investment in a timely manner should you chose sell your shares.

If we undertake future offerings of our common stock, purchasers in this offering will experience dilution of their ownership percentage.

Generally, existing shareholders will experience dilution of their ownership percentage in the company if and when additional shares of common stock are offered and sold. In the future, we may be required to seek additional equity funding in the form of private or public offerings of our common stock. In the event that we undertake subsequent offerings of common stock, your ownership percentage, voting power as a common shareholder, and earnings per share, if any, will be proportionately diluted. This may, in turn, result in a substantial decrease in the per-share value of your common stock.

This prospectus contains forward-looking statements that involve risks and uncertainties. We use words such as anticipate, believe, plan, expect, future, intend and similar expressions to identify such forward-looking statements. The actual results could differ materially from our forward-looking statements. Our actual results are most likely to differ materially from those anticipated in these forward-looking statements for many reasons, including the risks faced by us described in this Risk Factors section and elsewhere in this prospectus.

| 33 |

The net proceeds to us from the sale of up to 25,000,000 shares of common stock offered at a public offering price of $_____ per share will vary depending upon the total number of shares sold. The following table summarizes, in order of priority the anticipated application of the proceeds we will receive from this offering if the maximum number of shares is sold:

| Amount Assuming Maximum Offering | Percent of Maximum | |||||||

| GROSS OFFERING | $ | – | 100% | |||||

| Commissions | $ | – | 0% | |||||

| Offering Expenses | $ | – | 0% | |||||

| Net Proceeds | $ | – | 100% | |||||

| USE OF NET PROCEEDS | – | |||||||

| IT Development | $ | – | 33.33% | |||||

| Market Expansion | $ | – | 33.33% | |||||

| Operations | $ | – | 33.33% | |||||

| TOTAL APPLICATION OF NET PROCEEDS | $ | – | 100.0% | |||||

Commissions: Shares will be offered and sold by us without special compensation or other remuneration for such efforts. We do not plan to enter into agreements with finders or securities broker-dealers whereby the finders or broker-dealers would be involved in the sale of the Shares to the investors. Shares will be sold directly by us, and no fee or commission will be paid. However, we reserve the right to utilize the services of licensed broker/dealers and compensate these broker/dealers with a commission not to exceed 10% of the proceeds raised.

IT Development: We intend to use approximately $_________, or one-third (1/3) of the net proceeds of this offering to further develop influencer software and add new features. In addition, we will increase the stability, speed, security and scalability of our software.

Market Expansion: We intend to use approximately $_________, or one-third (1/3) of the net proceeds of this offering to launch the influencer software and open a minimum of 3 new international markets. This will require the expansion of our sale and marketing team. We will hire additional sales personnel and increase the number of our marketing team.

Operations: We intend to use approximately $_________, or one-third (1/3) of the net proceeds of this offering to compensate C-Level staff who will act as the support system to our sales and marketing team in addition to performing administrative functions. A portion of the proceeds will also be used to legal/accounting fees and pay for patents needed to protect our proprietary products.

In the event that less than the maximum number of shares is sold we anticipate application of the proceeds we will receive from this offering, in order of priority, will be as follows:

| Amount Assuming 75% of Offering | Percent | Amount Assuming 50% of Offering | Percent | Amount Assuming 25% of Offering | Percent | |||||||||||||||||||

| GROSS OFFERING | $ | – | 100% | $ | – | 100% | $ | – | 100% | |||||||||||||||

| Commission | $ | – | – | $ | – | – | $ | – | - | |||||||||||||||

| Offering Expenses | $ | – | 0% | $ | – | 0% | $ | – | 0% | |||||||||||||||

| Net Proceeds | $ | – | 100% | $ | – | 100% | $ | – | 100% | |||||||||||||||

| USE OF NET PROCEEDS | ||||||||||||||||||||||||

| IT Development | $ | – | 33.33% | $ | – | 33.33% | $ | – | 33.33% | |||||||||||||||

| Market Expansion | $ | – | 33.33% | $ | – | 33.33% | $ | – | 33.33% | |||||||||||||||

| Operations | $ | – | 33.33% | $ | – | 33.33% | $ | – | 33.33% | |||||||||||||||

| TOTAL APPLICATION OF NET PROCEEDS | $ | – | 100.0% | $ | – | 100.0% | $ | – | 100.0% | |||||||||||||||

| 34 |

Determination of Offering Price

The $__ per share offering price of our common stock was arbitrarily chosen by management. There is no relationship between this price and our assets, earnings, book value or any other objective criteria of value.

Our net tangible book value as of June 30, 2018 was approximately $_________ or $_________ per share of common stock. Net tangible book value per share is determined by dividing our total tangible assets, less total liabilities, by the number of share of our common stock outstanding as of ______________ ______, 20______. Dilution with respect to net tangible book value per share represents the difference between the amount per share paid by purchasers of shares of common stock in this offering and the net tangible book value per share of our common stock immediately after this offering.

After giving effect to the assumed sale of shares of common stock in this offering at an assumed public offering price of $ per share of common stock our adjusted net tangible book value as of ______________ ______, 20______would have been approximately $______ or $_______ per share. This represents an immediate increase in net tangible book value of $ per share to existing stockholders and immediate dilution of $ per share to investors purchasing our securities in this offering at the public offering price. The following table illustrates this dilution on a per share basis:

| Assumed public offering price per share of common stock | $ | ||

| Net tangible book value per share as of ______________ ______, 20______ | $ | ||

| Increase in net tangible book value per share attributable to this offering | $ | ||

| As adjusted net tangible book value per share as of _______ __, 20__, after giving effect to this offer | $ | ||

| Dilution per share to new investors purchasing our common stock in this offering. | $ |

A $__________ increase or decrease in the assumed public offering price of $ per share of common stock would increase or decrease our adjusted net tangible book value per share after this offering by approximately $________ and decrease or increase dilution per share to new investors by approximately $ .

The information discussed above is illustrative only and will adjust based on the actual offering price and other terms of this offering determined at pricing.

The information above is based on 25,169,683 shares of our common stock outstanding as of August 31, 2018.

Plan of Distribution, Terms of The Offering

There Is No Current Market for Our Shares of Common Stock