Attached files

| file | filename |

|---|---|

| 8-K - 8-K - UNITED STATES STEEL CORP | form8-kq32018earningscalls.htm |

United States Steel Corporation Third Quarter 2018 Earnings Presentation & Remarks November 1, 2018 United States Steel Corporation 1

Forward-looking Statements These slides and remarks are being provided to assist readers in understanding the results of operations, financial condition and cash flows of United States Steel Corporation for the third quarter of 2018. They should be read in conjunction with the consolidated financial statements and Notes to Consolidated Financial Statements contained in our Annual Report on Form 10-K and Quarterly Reports on Form 10-Q filed with the Securities and Exchange Commission. This presentation contains information that may constitute “forward-looking statements” within the meaning of Section 27 of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. We intend the forward-looking statements to be covered by the safe harbor provisions for forward-looking statements in those sections. Generally, we have identified such forward-looking statements by using the words “believe,” “expect,” “intend,” “estimate,” “anticipate,” “project,” “target,” “forecast,” “aim,” “should,” “will” and similar expressions or by using future dates in connection with any discussion of, among other things, operating performance, trends, events or developments that we expect or anticipate will occur in the future, statements relating to volume growth, share of sales and earnings per share growth, and statements expressing general views about future operating results. However, the absence of these words or similar expressions does not mean that a statement is not forward-looking. Forward-looking statements are not historical facts, but instead represent only the Company’s beliefs regarding future events, many of which, by their nature, are inherently uncertain and outside of the Company’s control. It is possible that the Company’s actual results and financial condition may differ, possibly materially, from the anticipated results and financial condition indicated in these forward-looking statements. Management believes that these forward-looking statements are reasonable as of the time made. However, caution should be taken not to place undue reliance on any such forward-looking statements because such statements speak only as of the date when made. Our Company undertakes no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law. In addition, forward-looking statements are subject to certain risks and uncertainties that could cause actual results to differ materially from our Company's historical experience and our present expectations or projections. These risks and uncertainties include, but are not limited to the risks and uncertainties described in “Item 1A. Risk Factors” in our Annual Report on Form 10-K for the year ended December 31, 2017, in our Quarterly Report on Form 10-Q for the quarter ended June 30, 2018, and those described from time to time in our future reports filed with the Securities and Exchange Commission. References to "we," "us," "our," the "Company," and "U. S. Steel," refer to United States Steel Corporation and its consolidated subsidiaries. United States Steel Corporation Explanation of Use of Non-GAAP Measures We present adjusted net earnings (loss), adjusted net earnings (loss) per diluted share, earnings (loss) before interest, income taxes, depreciation and amortization (EBITDA), adjusted EBITDA, segment EBITDA, and net debt, which are all non-GAAP measures, as additional measurements to enhance the understanding of our performance. We believe that EBITDA and segment EBITDA, considered along with net earnings (loss) and segment earnings (loss) before interest and income taxes, are relevant indicators of trends relating to our operating performance and provide management and investors with additional information for comparison of our operating results to the operating results of other companies. Net debt is a non-GAAP measure calculated as total debt less cash and cash equivalents. We believe net debt is a useful measure in calculating enterprise value. Both EBITDA and net debt are used by analysts to refine and improve the accuracy of their financial models which utilize enterprise value. We believe the cash conversion cycle is a useful measure in providing investors with information regarding our cash management performance and is a widely accepted measure of working capital management efficiency. The cash conversion cycle should not be considered in isolation or as an alternative to other GAAP metrics as an indicator of performance. Adjusted net earnings (loss) and adjusted net earnings (loss) per diluted share are non-GAAP measures that exclude the effects of gains (losses) associated with our retained interest in U. S. Steel Canada Inc., gains on the sale of ownership interests in equity investees, facility restart costs, restructuring charges, significant temporary idling charges, and debt extinguishment and other related costs that are not part of the Company’s core operations. Adjusted EBITDA is also a non-GAAP measure that excludes the effects of gains (losses) associated with our retained interest in U. S. Steel Canada Inc., gains on the sale of ownership interests in equity investees, facility restart costs, restructuring charges, and significant temporary idling charges. We present adjusted net earnings (loss), adjusted net earnings (loss) per diluted share and adjusted EBITDA to enhance the understanding of our ongoing operating performance and established trends affecting our core operations by excluding the effects of gains (losses) associated with our retained interest in U. S. Steel Canada Inc. gains on the sale of ownership interests in equity investees, facility restart costs, restructuring charges, significant temporary idling charges, and debt extinguishment and other related costs that can obscure underlying trends. U. S. Steel’s management considers adjusted net earnings (loss), adjusted net earnings (loss) per diluted share and adjusted EBITDA as alternative measures of operating performance and not alternative measures of the Company’s liquidity. U. S. Steel’s management considers adjusted net earnings (loss), adjusted net earnings (loss) per diluted share and adjusted EBITDA useful to investors by facilitating a comparison of our operating performance to the operating performance of our competitors, many of which use adjusted net earnings (loss), adjusted net earnings (loss) per diluted share and adjusted EBITDA as alternative measures of operating performance. Additionally, the presentation of adjusted net earnings (loss), adjusted net earnings (loss) per diluted share and adjusted EBITDA provides insight into management’s view and assessment of the Company’s ongoing operating performance, because management does not consider the adjusting items when evaluating the Company’s financial performance or in preparing the Company’s annual financial Guidance. Adjusted net earnings (loss), adjusted net earnings (loss) per diluted share and adjusted EBITDA should not be considered a substitute for net earnings (loss), earnings (loss) per diluted share or other financial measures as computed in accordance with U.S. GAAP and is not necessarily comparable to similarly titled measures used by other companies. United States Steel Corporation 2

Third Quarter 2018 Financial Highlights Reported Net Earnings Adjusted Net Earnings $ Millions $ Millions $321 $291 $161 $147 Third quarter reported net earnings of $291 million 3Q 2017 3Q 2018 3Q 2017 3Q 2018 Third quarter adjusted net earnings of $321 million Segment EBIT1 Adjusted EBITDA2 $ Millions $ Millions Third quarter adjusted EBITDA of $526 $526 million $400 $357 $239 3Q 2017 3Q 2018 3Q 2017 3Q 2018 1 Earnings before interest and income taxes 2 Earnings before interest, income taxes, depreciation and amortization United States Steel Corporation Note: For reconciliation of non-GAAP amounts see Appendix. The third quarter was another strong quarter in which we generated adjusted EBITDA of $526 million, a $169 million improvement compared to the third quarter of 2017. In the third quarter, we continued executing investments in our people and our assets as we work towards our objective of achieving operational excellence through a focus on safety, quality, delivery, and cost. We believe that executing well in these areas is the foundation for long term success and value creation. We are focused on the pillars of operational excellence – safety, quality, delivery, and cost, and are confident that improving our performance in these key areas will help us: Create value for our stockholders, as well as all other U. S. Steel stakeholders, including employees, customers, suppliers, and the communities in which we operate Develop distinct competitive advantages and solutions for our customers Achieve success through business cycles Drive predictable, sustainable and increased profitability in the future, including reinvestment in our business that provides returns in excess of our cost of capital 3

Third Quarter Segment Results Flat-Rolled U. S. Steel Europe Tubular Adjusted EBIT1 Adjusted EBITDA2 Adjusted EBIT1 Adjusted EBITDA2 Adjusted EBIT1 Adjusted EBITDA2 $ Millions $ Millions $ Millions $ Millions $ Millions $ Millions $392 $93 $95 $18 $305 $73 $72 $7 $244 $161 $4 ($7) 3Q 2017 3Q 2018 3Q 2017 3Q 2018 3Q 2017 3Q 2018 3Q 2017 3Q 2018 3Q 2017 3Q 2018 3Q 2017 3Q 2018 Flat-rolled Adjusted EBITDA Bridge U. S. Steel Europe Adjusted EBITDA Bridge Tubular Adjusted EBITDA Bridge 3Q 2017 vs. 3Q 2018 ($ Millions) 3Q 2017 vs. 3Q 2018 ($ Millions) 3Q 2017 vs. 3Q 2018 ($ Millions) ($75) ($29) ($11) ($92) ($41) $47 ($5) $95 $356 $392 $93 ($18) $18 $244 $25 ($3) $10 $4 3Q 2017 Commercial Raw Maintenance Other 3Q 2018 3Q 2017 CommercialRaw Maintenance Other 3Q 2018 3Q 2017 Commercial Raw Maintenance Other 3Q 2018 Materials & Outage Materials & Outage Materials & Outage 1 Earnings before interest and income taxes 2 Earnings before interest, income taxes, depreciation and amortization United States Steel Corporation Note: For reconciliation of non-GAAP amounts see Appendix. Flat-Rolled 3Q 2017 vs. 3Q 2018 Adjusted EBITDA Bridge: Commercial – The favorable impact is primarily the result of higher average realized prices. Raw Materials – The unfavorable impact is primarily the result of higher raw material costs across all raw material categories. Maintenance and Outage – The unfavorable impact is primarily the result of higher outage spending, including the major planned blast furnace outage at Great Lakes Works. Other – The unfavorable impact is primarily the result of higher variable compensation, partially offset by higher earnings from Joint Ventures and lower energy costs. U. S. Steel Europe 3Q 2017 vs. 3Q 2018 Adjusted EBITDA Bridge: Commercial – The favorable impact is primarily the result of higher average realized prices. Raw Materials – The unfavorable impact is primarily the result of higher iron ore and coal costs. Maintenance and Outage – The unfavorable impact is primarily the result of higher planned outages taken to coincide with the normal seasonal decrease in customer demand. Other – The unfavorable impact is primarily due to higher variable compensation. Tubular 3Q 2017 vs. 3Q 2018 Adjusted EBITDA Bridge: Commercial – The favorable impact is primarily the result of higher average realized prices. Raw Materials – The unfavorable impact is primarily the result of higher prices for steel substrate, primarily hot rolled bands from our Flat-Rolled segment. Maintenance and Outage – The change is not material. Other – The favorable impact is primarily the result of lower variable compensation and increased earnings from joint ventures. 4

Year to Date Segment Results Flat-Rolled U. S. Steel Europe Tubular Adjusted EBIT1 Adjusted EBITDA2 Adjusted EBIT1 Adjusted EBITDA2 Adjusted EBIT1 Adjusted EBITDA2 $ Millions $ Millions $ Millions $ Millions $ Millions $ Millions $831 $361 $562 $297 $271 $556 $215 $293 ($19) ($55) ($93) ($54) YTD 2017 YTD 2018 YTD 2017 YTD 2018 YTD 2017 YTD 2018 YTD 2017 YTD 2018 YTD 2017 YTD 2018 YTD 2017 YTD 2018 Flat-rolled Adjusted EBITDA Bridge U. S. Steel Europe Adjusted EBITDA Bridge Tubular Adjusted EBITDA Bridge YTD 2017 vs. YTD 2018 ($ Millions) YTD 2017 vs. YTD 2018 ($ Millions) YTD 2017 vs. YTD 2018 ($ Millions) ($49) $40 $361 ($241) ($21) ($122) $120 ($50) $688 $831 $271 ($59) $101 $556 $10 ($17) ($19) ($54) YTD 2017Commercial Raw Maintenance Other YTD 2018 YTD 2017 Commercial Raw Maintenance Other YTD 2018 YTD 2017Commercial Raw Maintenance Other YTD 2018 Materials & Outage Materials & Outage Materials & Outage 1 Earnings before interest and income taxes 2 Earnings before interest, income taxes, depreciation and amortization United States Steel Corporation Note: For reconciliation of non-GAAP amounts see Appendix. Flat-Rolled YTD 2017 vs. YTD 2018 Adjusted EBITDA Bridge: Commercial – The favorable impact is primarily the result of higher average realized prices and increased volumes, including higher shipment of hot rolled bands to our Tubular segment. Raw Materials – The unfavorable impact is primarily the result of higher raw material costs across all raw material categories. Maintenance and Outage – The unfavorable impact is primarily the result of higher planned outage spending, including the major planned blast furnace outage at Great Lakes Works. Other – The unfavorable impact is primarily the result of higher variable compensation, partially offset by higher earnings from Joint Ventures and lower energy costs. U. S. Steel Europe YTD 2017 vs. YTD 2018 Adjusted EBITDA Bridge: Commercial – The favorable impact is primarily the result of higher average realized prices. Raw Materials – The unfavorable impact is primarily the result of higher raw materials costs, primarily for iron ore and scrap. Maintenance and Outage – The unfavorable impact is primarily the result of higher planned outage spending. Other – The favorable impact is primarily due to the change in the U.S. Dollar / Euro exchange rate. Tubular YTD 2017 vs. YTD 2018 Adjusted EBITDA Bridge: Commercial – The favorable impact is primarily the result of higher average realized prices and increased volumes. Raw Materials – The unfavorable impact is primarily the result of higher prices for steel substrate, primarily hot rolled bands from our Flat-Rolled segment. Maintenance and Outage – The unfavorable impact is primarily the result of a higher planned outages. Other – The favorable impact is primarily due to lower variable compensation and increased earnings from joint ventures. 5

2018 4Q and Full Year Guidance Guidance: • 4Q 2018 Adjusted EBITDA of approximately $575 million • Full Year 2018 Adjusted EBITDA of approximately $1.8 billion Note: For reconciliation of non-GAAP amounts see Appendix United States Steel Corporation Market conditions remain solid, with stable end-user steel consumption. We experienced lower customer order rates for an extended period, driven by falling spot and index prices. Based on this pattern of order rates, we currently expect Flat-rolled shipments of approximately 10.6 million tons for 2018. However, we expect continued strength in steel demand will support favorable market conditions as we enter 2019. We currently expect fourth quarter 2018 adjusted EBITDA will be approximately $575 million. We expect our Flat-rolled segment results to continue to improve primarily due to increased shipments and lower maintenance and outage costs, partially offset by lower average realized prices. We currently expect our Flat-rolled segment raw steel capability utilization rate will be approximately 80% in the fourth quarter to support the increase in shipments. We expect results for our Tubular segment to continue to improve primarily due to increased shipments, partially offset by lower average realized prices. We expect results for our European segment to decrease primarily due to inventory revaluation adjustments related to raw material price volatility. We currently expect full-year 2018 adjusted EBITDA to be approximately $1.8 billion. See the Appendix for the reconciliation of Guidance net earnings to consolidated Guidance adjusted EBITDA. 6

Financial Flexibility Strong cash and liquidity positions Cash from Operations1 Cash and Cash Equivalents $ Millions $ Millions +$798 Improved cash +$465 +$176 $1,515 $1,553 conversion cycle $825 $1,344 $754 $722 to 26 days $546 $755 $360 YE 2015 YE 2016 YE 2017 YTD 2017 YTD 2018 YE 2015 YE 2016YE 2017 3Q 2018 Total Estimated Liquidity Net Debt Our liquidity $ Millions $ Millions +$975 provides support -$1,233 for our asset $3,350 $3,410 $2,383 $2,899 revitalization $2,375 $1,516 program, as well $1,150 $1,158 as investments that will increase our earnings YE 2015 YE 2016 YE 2017 3Q 2018 YE 2015 YE 2016 YE 2017 3Q 2018 power 1 2016 and 2017 Cash from Operations amounts have been adjusted due to the retrospective application of accounting standards update 2016-15, “Statement of Cash Flows: Classification of Certain Cash Receipts and Payments” that was effective January 1, 2018. There was no impact to 2015 Cash from Operations. Note: For reconciliation of non-GAAP amounts see Appendix United States Steel Corporation Cash from operations was $722 million through the third quarter of 2018, primarily due to increased earnings, partially offset by a $283 million change in working capital. Cash and cash equivalents decreased by $209 million through the third quarter of 2018, primarily due to capital spending of $646 million and a net repayment of long-term debt of $282 million. The increase in total estimated liquidity reflects the decrease in cash and cash equivalents offset by a new five-year €460 million revolving credit facility which replaced the existing €200 million credit facility. Our cash and liquidity position continues to provide support for our investment in asset revitalization at our Flat-rolled facilities, as well as future investments that will increase our earnings power. 7

Appendix © 2011 United States Steel Corporation United States Steel Corporation Operating Update Iron ore mining facilities At our iron ore mining operations, we are operating both our Minntac and Keetac facilities to meet our current domestic steel making needs and support our third party pellet sales. Flat-Rolled steel making and finishing facilities We continue to operate the steel making and finishing facilities at our Gary, Great Lakes, and Mon Valley Works. We began shipping steel from the restarted “B” blast furnace and steel making facilities at Granite City Works on June 13 and resumed production from the “A” blast furnace on October 3. We continue to operate the hot strip mill and finishing facilities at our Granite City Works and continue to operate the finishing facilities at our Fairfield, Midwest, East Chicago, and Fairless Hills locations. U. S. Steel Europe Our European operations are seeing stable market conditions and are running at high levels. Tubular facilities We are currently operating our seamless mills in Fairfield, AL and Lorain, OH. Our seamless mill in Fairfield produces mid-range diameter pipe, while our Lorain #3 mill produces large diameter pipe that is historically used for off-shore drilling. We are currently purchasing rounds from third parties to feed our seamless mills. We restarted our Lone Star #2 welded pipe mill in late April 2017. United States Steel Corporation 8

Flat-Rolled Segment asset revitalization program Performance Scorecard EBITDA improvement Capital Spending $ Millions $ Millions $275- $1.5B $325M $75-$100M $275-$325M $200 - $250M $249M $21M 2017 2017 2018 2020 2017 2017 2018 Total Target Actual Target Exit_Rate Target Actual Target Program Quality Reliability (including Unplanned Maintenance Downtime) % Improvement vs. 2016 Base % Improvement vs. 2016 Base 12% 8% 7% 9% +25% +16% 7% 3% 2017 2017 2018 2020 2017 2017 2018 2020 End of End of End of End of End of End of End of End of Year Year Year Year Year Year Year Year Target Actual Target Target Target Actual Target Target Total Asset Revitalization program is $2.0 billion, comprised of $1.5 billion of capital and $0.5 billion of expense United States Steel Corporation Other Items Capital Spending 2017 actual: $505 million 2018 estimate: $1,000 million Depreciation, Depletion and Amortization 2017 actual: $501 million 2018 estimate: $520 million Pension and Other Benefits Costs 2017 actual: $187 million 2018 estimate: $203 million Pension and Other Benefits Cash Payments (excluding voluntary pension contributions) 2017 actual: $131 million 2018 estimate: $138 million United States Steel Corporation 9

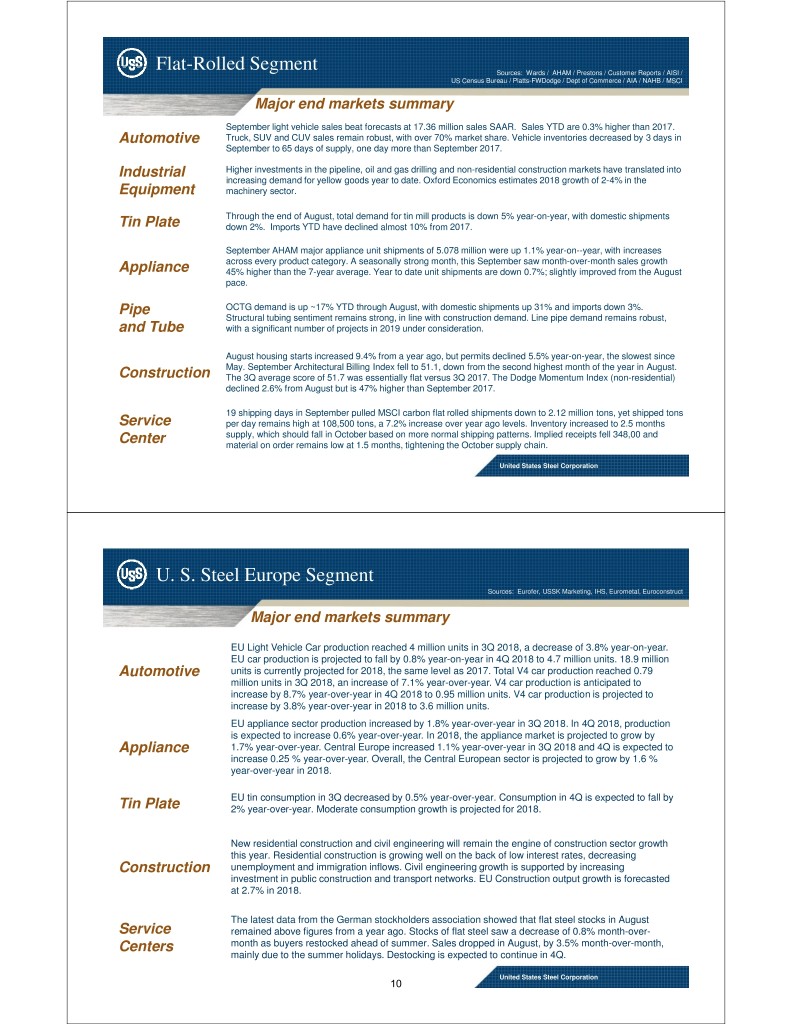

Flat-Rolled Segment Sources: Wards / AHAM / Prestons / Customer Reports / AISI / US Census Bureau / Platts-FWDodge / Dept of Commerce / AIA / NAHB / MSCI Major end markets summary September light vehicle sales beat forecasts at 17.36 million sales SAAR. Sales YTD are 0.3% higher than 2017. Automotive Truck, SUV and CUV sales remain robust, with over 70% market share. Vehicle inventories decreased by 3 days in September to 65 days of supply, one day more than September 2017. Industrial Higher investments in the pipeline, oil and gas drilling and non-residential construction markets have translated into increasing demand for yellow goods year to date. Oxford Economics estimates 2018 growth of 2-4% in the Equipment machinery sector. Through the end of August, total demand for tin mill products is down 5% year-on-year, with domestic shipments Tin Plate down 2%. Imports YTD have declined almost 10% from 2017. September AHAM major appliance unit shipments of 5.078 million were up 1.1% year-on--year, with increases across every product category. A seasonally strong month, this September saw month-over-month sales growth Appliance 45% higher than the 7-year average. Year to date unit shipments are down 0.7%; slightly improved from the August pace. Pipe OCTG demand is up ~17% YTD through August, with domestic shipments up 31% and imports down 3%. Structural tubing sentiment remains strong, in line with construction demand. Line pipe demand remains robust, and Tube with a significant number of projects in 2019 under consideration. August housing starts increased 9.4% from a year ago, but permits declined 5.5% year-on-year, the slowest since May. September Architectural Billing Index fell to 51.1, down from the second highest month of the year in August. Construction The 3Q average score of 51.7 was essentially flat versus 3Q 2017. The Dodge Momentum Index (non-residential) declined 2.6% from August but is 47% higher than September 2017. 19 shipping days in September pulled MSCI carbon flat rolled shipments down to 2.12 million tons, yet shipped tons Service per day remains high at 108,500 tons, a 7.2% increase over year ago levels. Inventory increased to 2.5 months supply, which should fall in October based on more normal shipping patterns. Implied receipts fell 348,00 and Center material on order remains low at 1.5 months, tightening the October supply chain. United States Steel Corporation U. S. Steel Europe Segment Sources: Eurofer, USSK Marketing, IHS, Eurometal, Euroconstruct Major end markets summary EU Light Vehicle Car production reached 4 million units in 3Q 2018, a decrease of 3.8% year-on-year. EU car production is projected to fall by 0.8% year-on-year in 4Q 2018 to 4.7 million units. 18.9 million Automotive units is currently projected for 2018, the same level as 2017. Total V4 car production reached 0.79 million units in 3Q 2018, an increase of 7.1% year-over-year. V4 car production is anticipated to increase by 8.7% year-over-year in 4Q 2018 to 0.95 million units. V4 car production is projected to increase by 3.8% year-over-year in 2018 to 3.6 million units. EU appliance sector production increased by 1.8% year-over-year in 3Q 2018. In 4Q 2018, production is expected to increase 0.6% year-over-year. In 2018, the appliance market is projected to grow by Appliance 1.7% year-over-year. Central Europe increased 1.1% year-over-year in 3Q 2018 and 4Q is expected to increase 0.25 % year-over-year. Overall, the Central European sector is projected to grow by 1.6 % year-over-year in 2018. EU tin consumption in 3Q decreased by 0.5% year-over-year. Consumption in 4Q is expected to fall by Tin Plate 2% year-over-year. Moderate consumption growth is projected for 2018. New residential construction and civil engineering will remain the engine of construction sector growth this year. Residential construction is growing well on the back of low interest rates, decreasing Construction unemployment and immigration inflows. Civil engineering growth is supported by increasing investment in public construction and transport networks. EU Construction output growth is forecasted at 2.7% in 2018. The latest data from the German stockholders association showed that flat steel stocks in August Service remained above figures from a year ago. Stocks of flat steel saw a decrease of 0.8% month-over- Centers month as buyers restocked ahead of summer. Sales dropped in August, by 3.5% month-over-month, mainly due to the summer holidays. Destocking is expected to continue in 4Q. United States Steel Corporation 10

Tubular Segment Sources: Baker Hughes, US Energy Information Administration, Preston Publishing, Internal Market industry summary The oil rig count averaged 863 during 3Q, an increase of 2% quarter-over-quarter. As of Oil Rig Count October 5, 2018, there were 861 active oil rigs. The natural gas rig count averaged 186 during 3Q, a decrease of 5% quarter-over-quarter. Gas Rig Count As of October 5, 2018, there were 189 active natural gas rigs. Natural Gas As of September 28, 2018, there was 2.9 Tcf of natural gas in storage, down 18% year-over- Storage Level year. The West Texas Intermediate oil price averaged $70 per barrel during 3Q, up 2% quarter- Oil Price over-quarter. The Henry Hub natural gas price averaged $2.93 per million btu during 3Q, up 3% quarter- Natural Gas Price over-quarter. Imports of OCTG remain high. During 3Q, import share of OCTG apparent market demand Imports is projected to be approximately 45%. OCTG Inventory Overall, OCTG supply chain inventory remains near 3 months. United States Steel Corporation U. S. Steel Commercial – Contract vs. Spot Contract vs. spot mix – twelve months ended September 30, 2018 Flat-Rolled Tubular U. S. Steel Europe Contract: 79% Program: 30% Contract: 70% Spot: 21% Spot: 70% Spot: 30% 1% 8% 16% 5% 32% 30% 43% 23% 30% 7% 70% 21% 14% Firm Market Based Quarterly* Program Spot Firm Market Based Quarterly* Cost Based Market Based Monthly* Cost Based Market Based Monthly* Spot Market Based Semi Annual* Spot * Annual contract volume commitments with price adjustments in stated time frame United States Steel Corporation 11

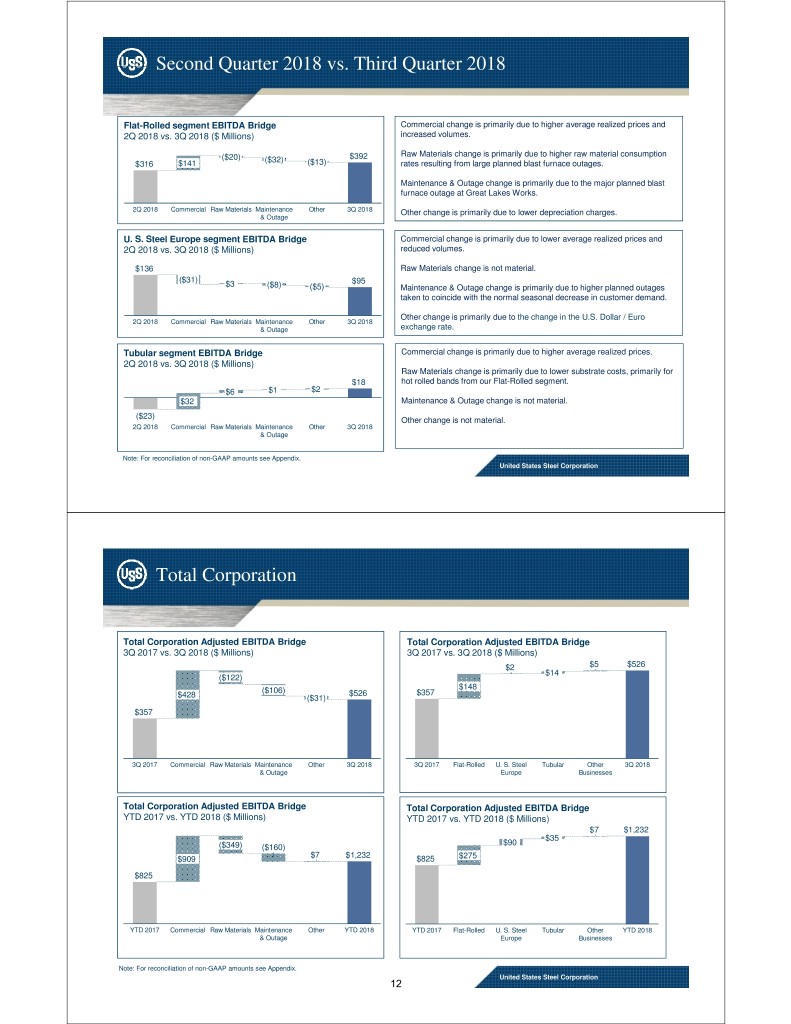

Second Quarter 2018 vs. Third Quarter 2018 Flat-Rolled segment EBITDA Bridge Commercial change is primarily due to higher average realized prices and 2Q 2018 vs. 3Q 2018 ($ Millions) increased volumes. Raw Materials change is primarily due to higher raw material consumption ($20) ($32) $392 $316 $141 ($13) rates resulting from large planned blast furnace outages. Maintenance & Outage change is primarily due to the major planned blast furnace outage at Great Lakes Works. 2Q 2018 Commercial Raw Materials Maintenance Other 3Q 2018 Other change is primarily due to lower depreciation charges. & Outage U. S. Steel Europe segment EBITDA Bridge Commercial change is primarily due to lower average realized prices and 2Q 2018 vs. 3Q 2018 ($ Millions) reduced volumes. $136 Raw Materials change is not material. ($31) $95 $3 ($8) ($5) Maintenance & Outage change is primarily due to higher planned outages taken to coincide with the normal seasonal decrease in customer demand. Other change is primarily due to the change in the U.S. Dollar / Euro 2Q 2018 CommercialRaw Materials Maintenance Other 3Q 2018 & Outage exchange rate. Tubular segment EBITDA Bridge Commercial change is primarily due to higher average realized prices. 2Q 2018 vs. 3Q 2018 ($ Millions) Raw Materials change is primarily due to lower substrate costs, primarily for $18 hot rolled bands from our Flat-Rolled segment. $6 $1 $2 $32 Maintenance & Outage change is not material. ($23) Other change is not material. 2Q 2018 Commercial Raw Materials Maintenance Other 3Q 2018 & Outage Note: For reconciliation of non-GAAP amounts see Appendix. United States Steel Corporation Total Corporation Total Corporation Adjusted EBITDA Bridge Total Corporation Adjusted EBITDA Bridge 3Q 2017 vs. 3Q 2018 ($ Millions) 3Q 2017 vs. 3Q 2018 ($ Millions) $2 $5 $526 $14 ($122) $148 ($106) $526 $357 $428 ($31) $357 3Q 2017Commercial Raw Materials Maintenance Other 3Q 2018 3Q 2017 Flat-Rolled U. S. Steel Tubular Other 3Q 2018 & Outage Europe Businesses Total Corporation Adjusted EBITDA Bridge Total Corporation Adjusted EBITDA Bridge YTD 2017 vs. YTD 2018 ($ Millions) YTD 2017 vs. YTD 2018 ($ Millions) $7 $1,232 $35 $90 ($349) ($160) $7 $1,232 $909 $825 $275 $825 YTD 2017 Commercial Raw Materials Maintenance Other YTD 2018 YTD 2017 Flat-Rolled U. S. Steel Tubular Other YTD 2018 & Outage Europe Businesses Note: For reconciliation of non-GAAP amounts see Appendix. United States Steel Corporation 12

Reconciliation of segment EBITDA Segment EBITDA – Flat-Rolled 3Q 2017 2Q 2018 3Q 2018 YTD 2017 YTD 2018 ($ millions) Segment earnings before interest and income taxes $161 $224 $305 $293 $562 Depreciation 83 92 87 263 269 Segment EBITDA $244 $316 $392 $556 $831 Segment EBITDA – U. S. Steel Europe 3Q 2017 2Q 2018 3Q 2018 YTD 2017 YTD 2018 ($ millions) Segment earnings before interest and income taxes $73 $115 $72 $215 $297 Depreciation 20 21 23 56 64 Segment EBITDA $93 $136 $95 $271 $361 Segment EBITDA – Tubular 3Q 2017 Q 2018 3Q 2018 YTD 2017 YTD 2018 ($ millions) Segment loss before interest and income taxes ($7) ($35) $7 ($93) ($55) Depreciation 11 12 11 39 36 Segment EBITDA $4 ($23) $18 ($54) ($19) United States Steel Corporation Reconciliation to Consolidated 4Q and Full Year Adjusted EBITDA Included in Guidance ($ millions) 4Q 2018 FY 2018 Projected net earnings attributable to United States Steel Corporation $349 $872 included in Guidance Estimated income tax expense 30 66 Estimated net interest and other financial costs 75 327 Estimated depreciation, depletion and amortization 136 520 Projected EBITDA included in Guidance $590 $1,785 Gain on equity investee transactions (20) (38) Granite City Works restart costs 5 68 Granite City Works adjustment to temporary idling charges - (8) Projected adjusted EBITDA included in Guidance $575 $1,807 Note: Projected adjusted EBITDA included in Guidance excludes one-time costs resulting from the future ratification of a new collective bargaining agreement United States Steel Corporation 13

Reconciliation of net debt Net Debt YE 2015 YE 2016 YE 2017 YTD 2018 ($ millions) Short-term debt and current maturities of long-term $45 $50 $3 $4 debt Long-term debt, less unamortized discount and debt 3,093 2,981 2,700 2,498 issuance costs Total Debt $3,138 $3,031 $2,703 $2,502 Less: Cash and cash equivalents 755 1,515 1,553 1,344 Net Debt $2,383 $1,516 $1,150 $1,158 United States Steel Corporation Cash conversion cycle Cash Conversion Cycle 2Q 2018 3Q 2018 $ $ millions Days millions Days Accounts Receivable, net $1,656 41 $1,673 41 + Inventories $1,848 53 $1,950 55 − Accounts Payable and Other Accrued $2,318 65 $2,523 70 Liabilities = Cash Conversion Cycle 29 26 Accounts Receivable Days is calculated as Average Accounts Receivable, net divided by total Net Sales multiplied by the number of days in the quarter. Inventory Days is calculated as Average Inventory divided by total Cost of Sales multiplied by the number of days in the quarter. Accounts Payable Days is calculated as Average Accounts Payable and Other Accrued Liabilities less bank checks outstanding and other current liabilities divided by total Cost of Sales multiplied by the number of days in the quarter. Cash Conversion Cycle is calculated as Accounts Receivable Days plus Inventory Days less Accounts Payable Days. United States Steel Corporation 14

Reconciliation of reported and adjusted net earnings ($ millions) 3Q 2017 3Q 2018 Reported net earnings attributable to U. S. Steel $147 $291 Gain on equity investee transactions (21) ─ Granite City restart costs ─ 27 Loss on debt extinguishment and other related costs 35 3 Adjusted net earnings attributable to U. S. Steel $161 $321 Note: The adjustments included in the table have been tax effected at a 0% rate due to the recognition of a full valuation allowance. United States Steel Corporation Reconciliation of adjusted EBITDA 3Q 2017 2Q 2018 3Q 2018 YTD 2017 YTD 2018 ($ millions) Reported net earnings attributable to U. S. Steel $147 $214 $291 $228 $523 Income tax provision (benefit) ─ 12 23 3 36 Net interest and other financial costs1 113 75 59 276 252 Reported earnings before interest and income taxes $260 $301 $373 $507 $811 Depreciation, depletion and amortization expense 118 130 126 376 384 EBITDA $378 $431 $499 $883 $1,195 Gain associated with retained interest in ─ ─ ─ (72) ─ U. S. Steel Canada Inc. Gain on equity investee transactions (21) (18) ─ (21) (18) Granite City Works restart costs ─ 36 27 ─ 63 Loss on shutdown of certain tubular assets ─ ─ ─ 35 ─ Granite City Works temporary idling charges ─ 2 ─ ─ (8) Adjusted EBITDA $357 $451 $526 $825 $1,232 1Net interest and other financial costs amounts were adjusted due to the retrospective application of accounting standards update 2017-07, “Compensation-Retirement Benefits” that was effective January 1, 2018. United States Steel Corporation 15