Attached files

| file | filename |

|---|---|

| EX-99.1 - PRESS RELEASE - Shake Shack Inc. | shak-20181101_exhibit991.htm |

| 8-K - FORM 8-K - Shake Shack Inc. | shak-20181101_8k.htm |

Q3 2018 Supplemental Earnings Slides November 1, 2018 1

Cautionary Note on Forward-Looking Statements Third Quarter 2018 This presentation contains forward-looking statements, within the meaning of the Private Securities Litigation Reform Act of 1995 ("PSLRA"), which are subject to known and unknown risks, uncertainties and other important factors that may cause actual results to be materially different. All statements other than statements of historical fact included in this presentation are forward-looking statements, including, but not limited to, expected financial outlook for fiscal 2018, preliminary financial outlook for 2019, expected Shack openings, expected same-Shack sales growth and trends in the Company’s operations. Forward-looking statements discuss the Company's current expectations and projections relating to their financial position, results of operations, plans, objectives, future performance and business. You can identify forward-looking statements by the fact that they do not relate strictly to historical or current facts. These statements may include words such as "aim," "anticipate," "believe," "estimate," "expect," "forecast," "outlook," "potential," "project," "projection," "plan," "intend," "seek," "may," "could," "would," "will," "should," "can," "can have," "likely," the negatives thereof and other similar expressions. All forward-looking statements are expressly qualified in their entirety by these cautionary statements. You should evaluate all forward-looking statements made in this presentation in the context of the risks and uncertainties disclosed in the Company’s Annual Report on Form 10-K for the fiscal year ended December 27, 2017 and subsequent Quarterly Reports on Form 10-Q filed with the Securities and Exchange Commission ("SEC"). All of the Company's SEC filings are available online at www.sec.gov, investor.shakeshack.com or upon request from Shake Shack Inc. The forward-looking statements included in this presentation are made only as of the date hereof. The Company undertakes no obligation to publicly update or revise any forward-looking statement as a result of new information, future events or otherwise, except as otherwise required by law. 2

Earnings Highlights Third Quarter 2018 Total Revenue ($M) Seven domestic, company-operated Shacks and two licensed Shacks opened in the Third Quarter +27% Entered new markets of Birmingham and Nashville, and expanded footprint in New York City, Washington D.C. area and Kansas City $120 $95 Entry to Latin America with new licensing contract in Mexico for 30 Shacks over 10 years, first to open in Q3 '17 Q3 '18 2019 Adjusted EBITDA1 ($M) Expansion of existing SPC partnership in Asia, with new licensing contract in Singapore for 10 Shacks over 5 years, first to open in 2019 +18% Opened first Innovation Kitchen, to be led by new Executive Chef, John Karangis; Chick’n Bites first test item $21 $18 Expanded digital ordering capabilities with launch of browser-based ordering for mobile and desktop Q3 '17 Q3 '18 1. Adjusted EBITDA is a non-GAAP measure. Definitions and reconciliations of Adjusted EBITDA to net income, the most directly comparable financial measures presented in accordance with GAAP, are included in the appendix of this presentation. 3

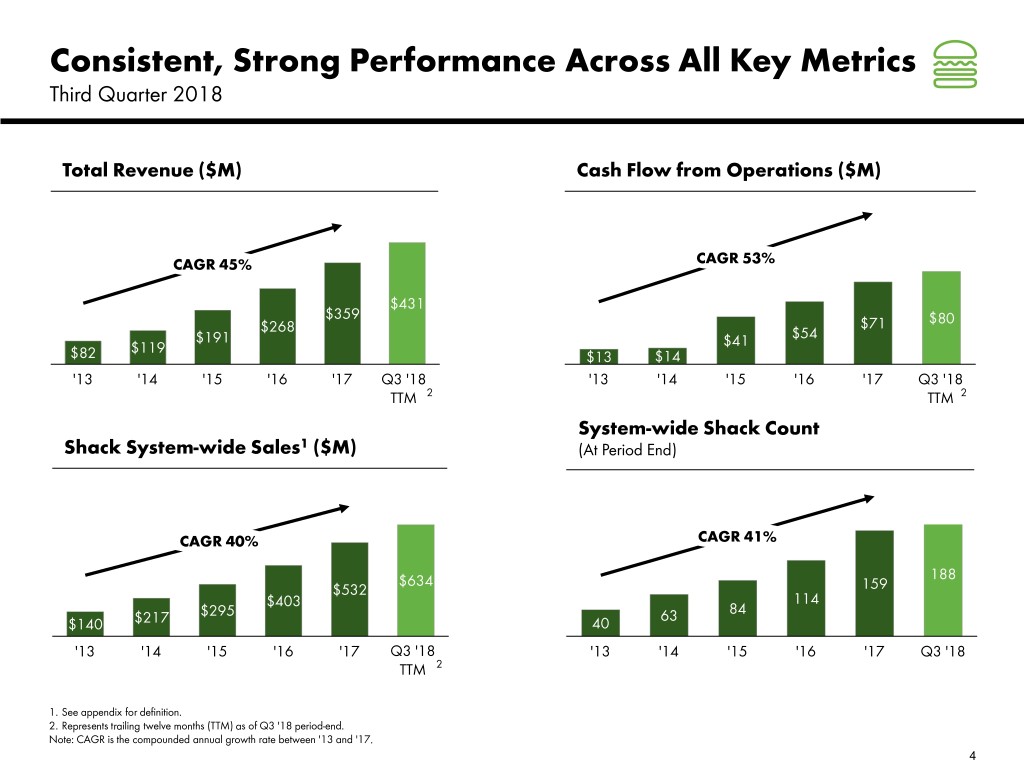

Consistent, Strong Performance Across All Key Metrics Third Quarter 2018 Total Revenue ($M) Cash Flow from Operations ($M) CAGR 45% CAGR 53% $431 $359 $80 $268 $71 $191 $54 $119 $41 $82 $13 $14 '13 '14 '15 '16 '17 Q3 '18 '13 '14 '15 '16 '17 Q3 '18 TTM 2 TTM 2 System-wide Shack Count Shack System-wide Sales1 ($M) (At Period End) CAGR 40% CAGR 41% $634 188 $532 159 $403 114 $295 63 84 $140 $217 40 '13 '14 '15 '16 '17 Q3 '18 '13 '14 '15 '16 '17 Q3 '18 TTM 2 1. See appendix for definition. 2. Represents trailing twelve months (TTM) as of Q3 '18 period-end. Note: CAGR is the compounded annual growth rate between '13 and '17. 4

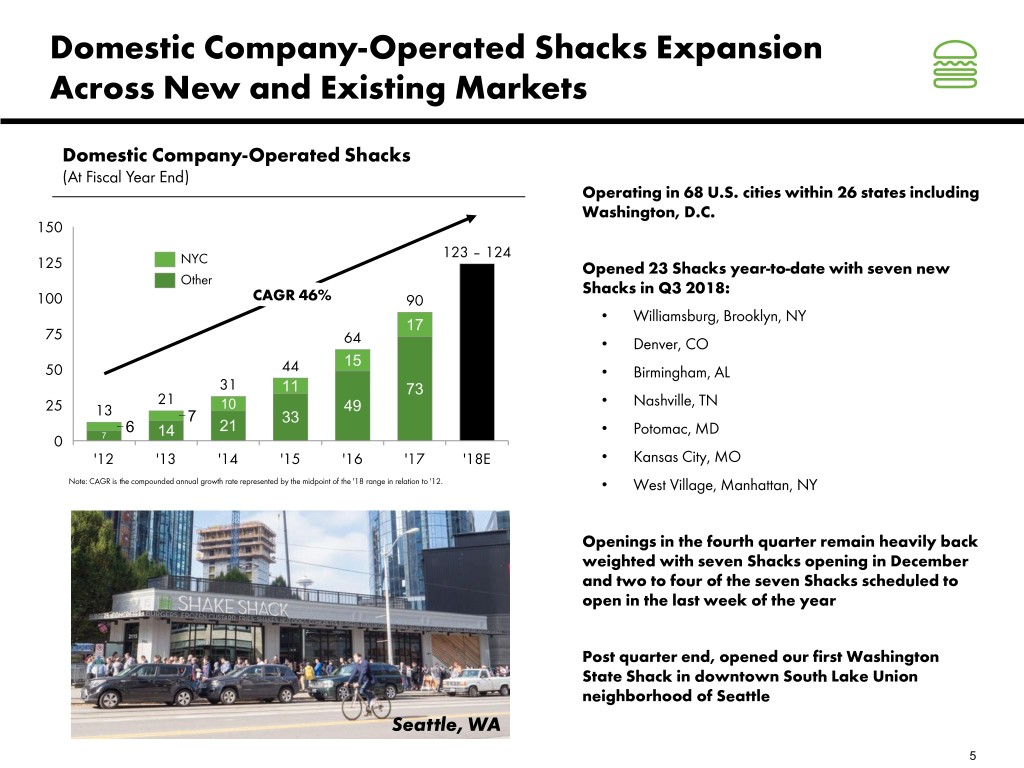

Domestic Company-Operated Shacks Expansion Across New and Existing Markets Domestic Company-Operated Shacks (At Fiscal Year End) Operating in 68 U.S. cities within 26 states including Washington, D.C. 150 NYC 123 – 124 125 Opened 23 Shacks year-to-date with seven new Other Shacks in Q3 2018: 100 CAGR 46% 90 • Williamsburg, Brooklyn, NY 17 75 64 • Denver, CO 15 50 44 • Birmingham, AL 31 11 73 21 • Nashville, TN 25 13 10 49 7 33 6 14 21 • Potomac, MD 0 7 '12 '13 '14 '15 '16 '17 '18E • Kansas City, MO Note: CAGR is the compounded annual growth rate represented by the midpoint of the '18 range in relation to '12. • West Village, Manhattan, NY Openings in the fourth quarter remain heavily back weighted with seven Shacks opening in December and two to four of the seven Shacks scheduled to open in the last week of the year Post quarter end, opened our first Washington State Shack in downtown South Lake Union neighborhood of Seattle Seattle, WA 5

Licensing Growth Consistently Strong Licensed Shacks (At Period End) Opened 12 Licensed Shacks year-to-date and opened 100 10th Shack in the United Kingdom and Hartsfield- US 95 Jackson Atlanta Airport in the Third Quarter Middle East, Turkey, Russia 90 UK 83 – 85 Airport growth planned to continue with new contracts 85 Japan, Korea for Shacks at Cleveland Hopkins, Denver International, 80 and Dallas/Fort Worth International Airports 75 Remain strategically focused on Asia as primary 70 69 growth driver with licensed agreements in place in 65 8 Japan, South Korea, Hong Kong, Shanghai, Philippines 60 CAGR 48% and Singapore 55 10 50 50 First international office to open in 2019 in Hong Kong 5 to support ongoing growth and existing partnerships 45 11 40 5 40 1 4 7 35 32 1 5 30 5 25 19 20 1 40 15 4 30 33 26 10 8 14 5 3 5 0 '12 '13 '14 '15 '16 '17 '18E City of London, UK Note: CAGR is the compounded annual growth rate represent an estimated range from ’18 in relation to '12. 6

Strong Shack-level Volumes & Margins Across All Regions Domestic Company-Operated Shacks by Region1, Q3 ’18 TTM2 NYC Northeast Southeast Midwest West Q3 '18 TTM Total Shack Count 20 37 21 12 17 107 Unit Growth 4 5 7 5 7 28 Revenue Growth 14% 19% 43% 60% 61% 29% AUV3 $6.9M $3.7M $3.5M $3.8M $4.7M $4.4M SLOP%4 25% 25% 26% 28% 27% 26% 1. The regions of domestic company-operated Shacks are defined as: NYC, which represents 5 boroughs; Northeast, which represents non-NYC NY, CT, DC, DE, MA, MD, NJ, PA, VA; Southeast, which represents AL, FL, GA, NC, TN, TX; Midwest, which represents IL, KY, MI, MN, MO, OH, WI; and West, which represents AZ, CA, CO, NV. 2. Represents the results for the trailing twelve months (TTM) for all Shacks open as of the Q3’ 18 period-end. 3. See appendix for definition of Average Unit Volumes (AUV). 4. Shack-Level operating profit (SLOP) is a non-GAAP measure. A definition and reconciliation of Shack-level operating profit to operating income, the most directly comparable financial measures presented in accordance with GAAP, is included in the appendix of this presentation. 7

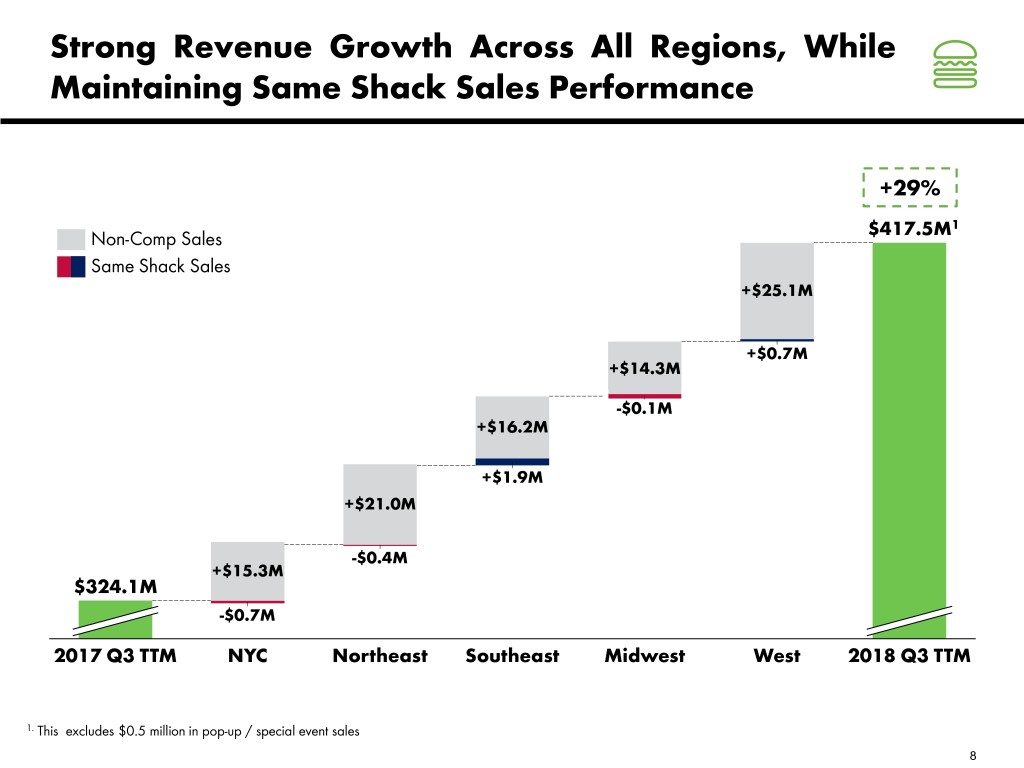

Strong Revenue Growth Across All Regions, While Maintaining Same Shack Sales Performance +29% 1 Non-Comp Sales $417.5M Same Shack Sales +$25.1M +$0.7M +$14.3M -$0.1M +$16.2M +$1.9M +$21.0M -$0.4M +$15.3M $324.1M -$0.7M 2017 Q3 TTM NYC Northeast Southeast Midwest West 2018 Q3 TTM 1. This excludes $0.5 million in pop-up / special event sales 8

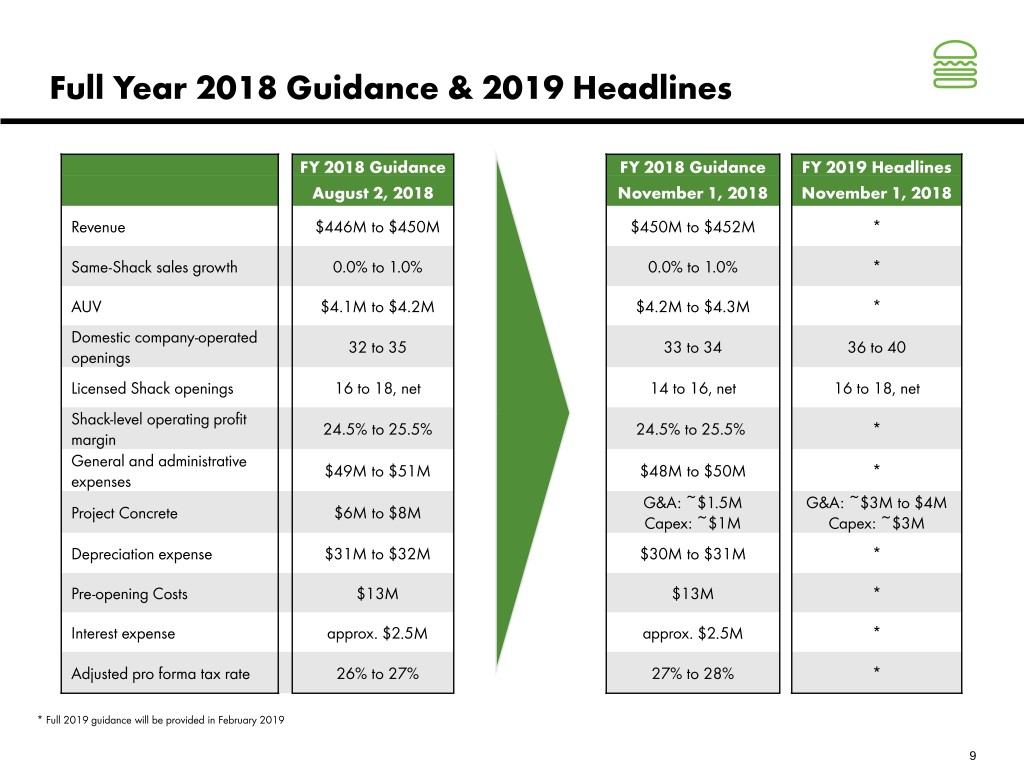

Full Year 2018 Guidance & 2019 Headlines FY 2018 Guidance FY 2018 Guidance FY 2019 Headlines August 2, 2018 November 1, 2018 November 1, 2018 Revenue $446M to $450M $450M to $452M * Same-Shack sales growth 0.0% to 1.0% 0.0% to 1.0% * AUV $4.1M to $4.2M $4.2M to $4.3M * Domestic company-operated 32 to 35 33 to 34 36 to 40 openings Licensed Shack openings 16 to 18, net 14 to 16, net 16 to 18, net Shack-level operating profit 24.5% to 25.5% 24.5% to 25.5% * margin General and administrative $49M to $51M $48M to $50M * expenses G&A: ~$1.5M G&A: ~$3M to $4M Project Concrete $6M to $8M Capex: ~$1M Capex: ~$3M Depreciation expense $31M to $32M $30M to $31M * Pre-opening Costs $13M $13M * Interest expense approx. $2.5M approx. $2.5M * Adjusted pro forma tax rate 26% to 27% 27% to 28% * * Full 2019 guidance will be provided in February 2019 9

West Village, NYC – Innovation Kitchen and Leadership Center The Innovation Kitchen, located on the lower level of the West Village Shack will be the hub of all menu development. This dedicated space will allow our culinary team to get even more creative, improve our core menu, work on throughput initiatives and increase our quality assurance practices. The Leadership Center, dedicated to the training and development of our Shack and home office teams is where we’ll host New Leader Orientation for new managers as well as ongoing training and development classes for our people. 10

Appendix INCLUDING GAAP AND NON-GAAP MEASURES 11

Income Statement Third Quarter 2018 Thirteen Weeks Ended Thirty-Nine Weeks Ended September 26, 2018 September 27, 2017 September 26, 2018 September 27, 2017 Shack sales $ 115,882 96.9% $ 91,100 96.3% $ 324,869 97.0% $ 253,258 96.4% Licensing revenue 3,765 3.1% 3,509 3.7% 10,176 3.0% 9,416 3.6% TOTAL REVENUE 119,647 100.0% 94,609 100.0% 335,045 100.0% 262,674 100.0% Shack-level operating expenses(1): Food and paper costs 32,703 28.2% 25,760 28.3% 91,336 28.1% 71,646 28.3% Labor and related expenses 31,232 27.0% 23,806 26.1% 87,651 27.0% 66,692 26.3% Other operating expenses 13,496 11.6% 9,229 10.1% 36,536 11.2% 25,380 10.0% Occupancy and related expenses 8,545 7.4% 7,522 8.3% 23,621 7.3% 20,741 8.2% General and administrative expenses 13,151 11.0% 9,204 9.7% 37,547 11.2% 27,352 10.4% Depreciation expense 7,439 6.2% 5,604 5.9% 20,905 6.2% 15,610 5.9% Pre-opening costs 3,581 3.0% 2,670 2.8% 8,031 2.4% 6,961 2.7% Loss on disposal of property and equipment 157 0.1% 204 0.2% 543 0.2% 317 0.1% TOTAL EXPENSES 110,304 92.2% 83,999 88.8% 306,170 91.4% 234,699 89.3% OPERATING INCOME 9,343 7.8% 10,610 11.2% 28,875 8.6% 27,975 10.7% Other income, net 436 0.4% 229 0.2% 1,070 0.3% 622 0.2% Interest expense (592) -0.5% (475) -0.5% (1,770) -0.5% (1,144) -0.4% INCOME BEFORE INCOME TAXES 9,187 7.7% 10,364 11.0% 28,175 8.4% 27,453 10.5% Income tax expense 2,241 1.9% 2,494 2.6% 5,679 1.7% 7,537 2.9% NET INCOME 6,946 5.8% 7,870 8.3% 22,496 6.7% 19,916 7.6% Less: net income attributable to non-controlling interests 1,921 1.6% 2,873 3.0% 6,359 1.9% 7,773 3.0% NET INCOME ATTRIBUTABLE TO SHAKE SHACK INC. $ 5,025 4.2% $ 4,997 5.3% $ 16,137 4.8% $ 12,143 4.6% Earnings per share of Class A common stock: Basic $0.17 $0.19 $0.58 $0.47 Diluted $0.17 $0.19 $0.56 $0.46 Weighted-average shares of Class A common stock outstanding: Basic 28,954 26,024 27,930 25,733 Diluted 29,883 26,477 28,820 26,248 (1) As a percentage of Shack sales. 12

Definitions Third Quarter 2018 “Adjusted EBITDA,” a non-GAAP measure, is defined as EBITDA excluding equity-based compensation expense, deferred rent expense, losses on the disposal of property and equipment, as well as certain non-recurring items that the Company does not believe directly reflect its core operations and may not be indicative of the Company's recurring business operations. “Adjusted EBITDA margin,” a non-GAAP measure, is defined as net income before net interest, taxes, depreciation and amortization, which also excludes equity-based compensation expense, deferred rent expense, losses on the disposal of property and equipment, as well as certain non-recurring items that the Company does not believe directly reflect its core operations, as a percentage of revenue. "Average unit volumes" or "AUVs" for any 12-month period consist of the average annualized sales of all domestic company-operated Shacks over that period. AUVs are calculated by dividing total Shack sales from domestic company-operated Shacks by the number of domestic company-operated Shacks open during that period. For Shacks that are not open for the entire period, fractional adjustments are made to the number of Shacks open such that it corresponds to the period of associated sales. "Same-Shack Sales" represents Shack sales for the comparable Shack base, which is defined as the number of domestic company-operated Shacks open for 24 full fiscal months or longer. “EBITDA,” a non-GAAP measure, is defined as net income before interest expense (net of interest income), income tax expense, and depreciation and amortization expense. "Shack-level operating profit," a non-GAAP measure, is defined as Shack sales less Shack-level operating expenses including food and paper costs, labor and related expenses, other operating expenses and occupancy and related expenses. "Shack-level operating profit margin," a non-GAAP measure, is defined as Shack sales less Shack-level operating expenses, including food and paper costs, labor and related expenses, other operating expenses and occupancy and related expenses as a percentage of Shack sales. "Shack sales" is defined as the aggregate sales of food, beverages and Shake Shack-branded merchandise at domestic company-operated Shacks and excludes sales from licensed Shacks. “Shack system-wide sales” is an operating measure and consists of sales from domestic company-operated Shacks, domestic licensed Shacks and international licensed Shacks. The Company does not recognize the sales from licensed Shacks as revenue. Of these amounts, revenue is limited to Shack sales from domestic company- operated Shacks and licensing revenue based on a percentage of sales from domestic and international licensed Shacks, as well as certain up-front fees such as territory fees and opening fees. 13

Shack-Level Operating Profit Definition Third Quarter 2018 Shack-Level Operating Profit Shack-level operating profit is defined as Shack sales less Shack-level operating expenses, including food and paper costs, labor and related expenses, other operating expenses and occupancy and related expenses. How This Measure Is Useful When used in conjunction with GAAP financial measures, Shack-level operating profit and Shack-level operating profit margin are supplemental measures of operating performance that the Company believes are useful measures to evaluate the performance and profitability of its Shacks. Additionally, Shack- level operating profit and Shack-level operating profit margin are key metrics used internally by management to develop internal budgets and forecasts, as well as assess the performance of its Shacks relative to budget and against prior periods. It is also used to evaluate employee compensation as it serves as a metric in certain performance-based employee bonus arrangements. The Company believes presentation of Shack-level operating profit and Shack-level operating profit margin provides investors with a supplemental view of its operating performance that can provide meaningful insights to the underlying operating performance of the Shacks, as these measures depict the operating results that are directly impacted by the Shacks and exclude items that may not be indicative of, or are unrelated to, the ongoing operations of the Shacks. It may also assist investors to evaluate the Company's performance relative to peers of various sizes and maturities and provides greater transparency with respect to how management evaluates the business, as well as the financial and operational decision-making. Limitations of the Usefulness of this Measure Shack-level operating profit and Shack-level operating profit margin may differ from similarly titled measures used by other companies due to different methods of calculation. Presentation of Shack-level operating profit and Shack-level operating profit margin is not intended to be considered in isolation or as a substitute for, or superior to, the financial information prepared and presented in accordance with GAAP. Shack-level operating profit excludes certain costs, such as general and administrative expenses and pre-opening costs, which are considered normal, recurring cash operating expenses and are essential to support the operation and development of the Company's Shacks. Therefore, this measure may not provide a complete understanding of the Company's operating results as a whole and Shack-level operating profit and Shack-level operating profit margin should be reviewed in conjunction with the Company’s GAAP financial results. A reconciliation of Shack-level operating profit to operating income, the most directly comparable GAAP financial measure, is set forth below. 14

Shack-Level Operating Profit Third Quarter 2018 Thirteen Weeks Ended Thirty-Nine Weeks Ended (dollar amounts in thousands) September 26, 2018 September 27, 2017 September 26, 2018 September 27, 2017 Operating income $ 9,343 $ 10,610 $ 28,875 $ 27,975 Less: Licensing revenue 3,765 3,509 10,176 9,416 Add: General and administrative expenses 13,151 9,204 37,547 27,352 Depreciation expense 7,439 5,604 20,905 15,610 Pre-opening costs 3,581 2,670 8,031 6,961 Loss on disposal of property and equipment 157 204 543 317 Shack-level operating profit $ 29,906 $ 24,783 $ 85,725 $ 68,799 Total revenue $ 119,647 $ 94,609 $ 335,045 $ 262,674 Less: licensing revenue 3,765 3,509 10,176 9,416 Shack sales $ 115,882 $ 91,100 $ 324,869 $ 253,258 Shack-level operating profit margin 25.8% 27.2% 26.4% 27.2% 15

Shack-Level Operating Profit Region Third Quarter 2018 Total Company Domestic Company-operated Shacks By Region(1), Q3 '18 TTM Trailing Twelve Corporate / (dollar amounts in thousands) Q4 2017 Q1 2018 Q2 2018 Q3 2018 Months NYC Northeast Southeast Midwest West Other (2) Domestic Company-operated Shacks (Opened During Q3 '18 TTM Period) 28 4 5 7 5 7 0 Domestic Company-operated Shacks (as of Q3 '18) 107 20 37 21 12 17 0 Operating income $ 5,838 $ 6,514 $ 13,018 $ 9,343 $ 34,713 $ 23,788 $ 22,622 $ 9,321 $ 7,103 $ 12,312 $ (40,433) Less: Licensing revenue 3,006 3,027 3,384 3,765 13,182 13,182 Add: General and administrative expenses 11,651 11,809 12,587 13,151 49,198 49,198 Depreciation expense 6,094 6,498 6,968 7,439 26,999 4,980 9,216 4,122 2,358 4,686 1,637 Pre-opening costs 2,642 2,029 2,421 3,581 10,673 1,429 917 2,071 1,294 1,682 3,280 Loss on disposal of property and equipment 291 190 196 157 834 351 327 61 36 59 – Shack-level operating profit $ 23,510 $ 24,013 $ 31,806 $ 29,906 $ 109,235 $ 30,548 $ 33,082 $ 15,575 $ 10,791 $ 18,739 $ 500 Total revenue $ 96,136 $ 99,116 116,282$ 119,647$ $ 431,181 121,320 130,152 59,731 38,050 68,258 13,670 Less: Licensing revenue 3,006 3,027 3,384 3,765 13,182 13,182 Shack sales $ 93,130 $ 96,089 112,898$ 115,882$ $ 417,999 $ 121,320 $ 130,152 $ 59,731 $ 38,050 $ 68,258 $ 488 Shack-level operating profit margin 25% 25% 28% 26% 26% 25% 25% 26% 28% 27% NA (1)The regions of domestic company-operated Shacks are defined as: NYC, which represents 5 boroughs; Northeast, which represents non-NYC NY, CT, DC, DE, MA, MD, NJ, PA, VA; Southeast, which represents AL, FL, GA, NC, TN, TX; Midwest, which represents IL, KY, MI, MN, MO, OH, WI; and West, which represents AZ, CA, CO, NV. (2)Corporate/Other includes any amounts not attributable to a specific Shack or any shack not open during the TTM Q3 2018 period and primarily relates to our corporate functions and other centralized operations. 16

Adjusted EBITDA Definition Third Quarter 2018 EBITDA and Adjusted EBITDA EBITDA is defined as net income before interest expense (net of interest income), income tax expense and depreciation and amortization expense. Adjusted EBITDA is defined as EBITDA (as defined above) excluding equity-based compensation expense, deferred rent expense, losses on the disposal of property and equipment, as well as certain non-recurring items that the Company does not believe directly reflect its core operations and may not be indicative of the Company's recurring business operations. How These Measures Are Useful When used in conjunction with GAAP financial measures, EBITDA and adjusted EBITDA are supplemental measures of operating performance that the Company believes are useful measures to facilitate comparisons to historical performance and competitors' operating results. Adjusted EBITDA is a key metric used internally by management to develop internal budgets and forecasts and also serves as a metric in its performance-based equity incentive programs and certain bonus arrangements. The Company believes presentation of EBITDA and adjusted EBITDA provides investors with a supplemental view of the Company's operating performance that facilitates analysis and comparisons of its ongoing business operations because they exclude items that may not be indicative of the Company's ongoing operating performance. Limitations of the Usefulness of These Measures EBITDA and adjusted EBITDA may differ from similarly titled measures used by other companies due to different methods of calculation. Presentation of EBITDA and adjusted EBITDA is not intended to be considered in isolation or as a substitute for, or superior to, the financial information prepared and presented in accordance with GAAP. EBITDA and adjusted EBITDA exclude certain normal recurring expenses. Therefore, these measures may not provide a complete understanding of the Company's performance and should be reviewed in conjunction with the GAAP financial measures. A reconciliation of EBITDA and adjusted EBITDA to net income, the most directly comparable GAAP measure, is set forth below. 17

Adjusted EBITDA Third Quarter 2018 Thirteen Weeks Ended Thirty-Nine Weeks Ended (in thousands) September 26, 2018 September 27, 2017 September 26, 2018 September 27, 2017 Net income $ 6,946 $ 7,870 $ 22,496 $ 19,916 Depreciation expense 7,439 5,604 20,905 15,610 Interest expense, net 591 456 1,762 1,086 Income tax expense 2,241 2,494 5,679 7,537 EBITDA 17,217 16,424 50,842 44,149 Equity-based compensation 1,636 1,289 4,376 3,823 Deferred rent 813 240 521 767 Loss on disposal of property and equipment 157 204 543 317 Legal Settlement(1) 1,200 — 1,200 — Executive and management transition costs(2) 32 13 280 664 Project Concrete(3) 292 — 608 — Costs related to relocation of Home Office(4) 2 — 1,019 — Adjusted EBITDA $ 21,349 $ 18,170 $ 59,389 $ 49,720 Adjusted EBITDA margin 17.8% 19.2% 17.7% 18.9% 18

Investor Contact: Melissa Calandruccio, ICR Michelle Michalski, ICR (844) SHACK-04 (844-742-2504) investor@shakeshack.com Media Contact: Kristyn Clark, Shake Shack 646-747-8776 kclark@shakeshack.com 19