Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - ENERGY FUELS INC | exhibit99-1.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C.

20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): October 25, 2018

ENERGY FUELS INC.

(Exact

name of registrant as specified in its charter)

Ontario |

001-36204 |

98-1067994 |

(State or other jurisdiction of incorporation) |

(Commission File Number) |

(I.R.S. Employer |

Identification No.) |

225 Union Blvd., Suite 600 |

|

Lakewood, Colorado |

80228 |

(Address of principal executive offices) |

(Zip Code) |

(303) 974-2140

(Registrant’s telephone number,

including area code)

N/A

(Former name or former address, if changed

since last report)

Check the appropriate box below if the Form 8-K is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

[ ] Written communications pursuant to Rule 425

under the Securities Act (17 CFR 230.425)

[ ] Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a -12)

[ ] Pre-commencement communications pursuant to Rule 14d-2(b)

under the Exchange Act (17 CFR 240.14d -2(b))

[ ]

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act

(17 CFR 240.13e -4(c))

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b -2 of this chapter).

Emerging growth company [X]

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. [ ]

Item 8.01 Other Events.

Initial Results of Test-Mining Program Targeting Vanadium at La Sal Complex

Energy Fuels Inc. (the “Company” or “Energy Fuels”) announced on October 25, 2018 that it has commenced a limited conventional vanadium test mining program at its 100% owned and fully permitted and constructed La Sal Complex of uranium/vanadium mines in Utah. The purpose of the test-mining program is to evaluate different approaches that selectively target high-grade vanadium zones, thereby potentially increasing productivity and mined grades for vanadium and decreasing mining costs per pound of V2O5 and U3O8 recovered. After three weeks of test mining and evaluation, the Company is discovering areas of high-grade vanadium mineralization that were not previously mined due to the relatively lower uranium grades in the material.

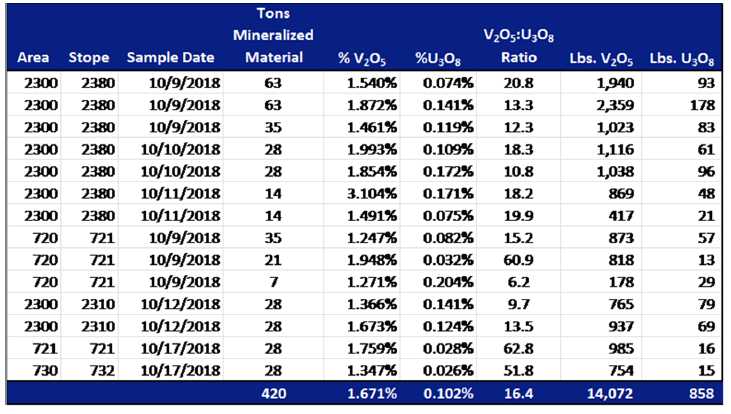

While the test mining campaign is still in its early stages, the Company is pleased to provide the following assay results from the initial 420 tons of material mined and sampled to date:

- All data presented in the table above are the result of the following mining, evaluation, and laboratory QA/QC procedures. Company personnel blast and remove the mineralized material from the mine, and transport it to an ore pad on the mine surface using a seven-ton truck. After the material is dumped on the stockpile pad, representative samples from various locations in each seven-ton pile are sampled randomly. The Company believes that blasting, mucking, transporting, and dumping adequately mixes the material in each pile, allowing for representative sampling. Approximately, ten pounds of sample material is collected from each seven-ton pile. All samples are analyzed at the Company’s White Mesa Mill using titration chemical analysis for vanadium and spectrophotometric analysis for uranium, in each case following the Mill’s standard quality assurance program and quality control measures.

Historically, when uranium was targeted for production at the La Sal Complex, the recovered vanadium-to-uranium ratio was approximately 5-to-1. By targeting vanadium, the samples in the above table show a ratio of over 16-to-1 vanadium-to-uranium, including an average vanadium grade of 1.675% and an average uranium grade of 0.102% U3O8. Assuming average historic recoveries at the Company’s White Mesa uranium/vanadium mill of approximately 95% uranium and 70% vanadium, using these results, the Company would expect to recover approximately 23.5 pounds of V2O5, and 1.9 pounds of U3O8, per ton of the mineralized material that has been mined to date under this program. On October 25, 2018, the uranium spot price was $27.75 per pound (TradeTech), and the vanadium price was $24.80 per pound (Metal Bulletin).

2

While not intended to represent a resource or reserve estimate or economic evaluation, this test mining program is demonstrating two key points to the Company. First, high-grade vanadium associated with lower grade uranium exists in the La Sal mine complex. This mineralized material was either not detected in the past or not mined due to its relatively lower uranium grade. Second, the Company now has the technology to identify this mineralization, which was not available historically. This material is attractive at current vanadium prices, and would have been attractive during previous mining campaigns had the vanadium grades been identified at those times. These two key points confirm the Company’s belief that further study is required to determine the extent of this additional mineralized material at the La Sal Complex and other uranium/vanadium mines owned or controlled by the Company, and the impacts such additional mineralized material may have on the mining costs per pound of V2O5 and U3O8 recovered from these mines.

The Company plans to continue the test-mining program and recover, sample, and evaluate a minimum of 5,000 tons of mineralized material. The Company also plans to conduct additional surface exploration drilling that targets high-grade vanadium mineralization at the La Sal Complex. Furthermore, the Company expects to commence vanadium production from tailings pond solutions, which result from past mineral processing operations, at its White Mesa Mill in November 2018, at an expected rate of approximately 200,000 to 225,000 pounds of V2O5 per month, up to a total of approximately 4 million pounds of V2O5, subject to market conditions, costs, and recoveries.

Final Federal Approval for La Sal Complex Expansion Plan of Operations

The Company is also pleased to announce that the Manti-La Sal National Forest has issued their final approval for the La Sal Complex Plan of Operations Amendment. The Company is now fully authorized by the U.S. Forest Service and Bureau of Land Management to move forward with the expansion of mining operations, exploration drilling, and vent shaft construction at the La Sal Complex. This follows the February 2018 issuance of the Environmental Assessment, Decision Record/Notice, and Finding of No Significant Impact approving the expansion of a large portion of the La Sal Complex, pending certain conditions including having the required reclamation bond in place. All of those conditions have now been fully met.

Mark S. Chalmers, P.E.,is a Qualified Person as defined by Canadian National Instrument 43-101 and has reviewed and approved the technical disclosure, including sampling, analytical, and test data underlying the information, contained in this Current Report on Form 8-K.

Cautionary Note Regarding Forward-Looking Statements:Certain information contained in this Form 8-K, including any information relating to any expectations relating to potential increases in productivity and mined grades for vanadium and decreases in mining costs at the La Sal Complex or any other mines; any expectations about uranium and vanadium recovery rates and expected pounds of uranium and vanadium that may be recovered at the White Mesa Mill; any expectation that the Company plans to continue the test mining program and the tons of mineralized material that may be recovered, sampled and evaluated under the program; any expectation that the Company plans to conduct additional surface exploration drilling that targets high-grade vanadium at the La Sal Complex; any expectation that the Company plans to commence vanadium production from existing pond solutions at the Mill and any expected vanadium recoveries from such solutions; any expectations that high-grade vanadium associated with lower grade uranium exists in the La Sal mine complex or in any other mines, and the extent to which it may exist; any expectation that the Company now has the technology to identify higher-grade vanadium mineralization; any expectation about the attractiveness of higher-grade vanadium mineralized material at current vanadium prices or during previous mining campaigns; any expectation that the Company may be able to mine its mines in a manner that targets vanadium during periods of elevated vanadium prices even during periods of lower uranium prices; and any other statements regarding Energy Fuels’ future expectations, beliefs, goals or prospects; constitute forward-looking information within the meaning of applicable securities legislation (collectively, “forward-looking statements”). All statements in this news release that are not statements of historical fact (including statements containing the words “expects”, “does not expect”, “plans”, “anticipates”, “does not anticipate”, “believes”, “intends”, “estimates”, “projects”, “potential”, “scheduled”, “forecast”, “budget” and similar expressions) should be considered forward-looking statements. All such forward-looking statements are subject to important risk factors and uncertainties, many of which are beyond Energy Fuels’ ability to control or predict. A number of important factors could cause actual results or events to differ materially from those indicated or implied by such forward-looking statements, including without limitation factors relating to: any expectations to commence vanadium production at the Mill; any expectations relating to expected vanadium recoveries from the Mill pond and cash flows; any expectations relating to potential increases in productivity and mined grades for vanadium and decreases in mining costs at the La Sal Complex or any other mines; any expectations about uranium and vanadium recovery rates and expected pounds of uranium and vanadium that may be recovered at the White Mesa Mill; any expectation that the Company plans to continue the test mining program and the tons of mineralized material that may be recovered, sampled and evaluated under the program; any expectation that the Company plans to conduct additional surface exploration drilling that targets high-grade vanadium at the La Sal Complex; any expectation that the Company plans to commence vanadium production from existing pond solutions at the Mill and any expected vanadium recoveries from such solutions; any expectations that high-grade vanadium associated with lower grade uranium exists in the La Sal mine complex or in any other mines, and the extent to which it may exist; any expectation that the Company now has the technology to identify higher-grade vanadium mineralization; any expectation about the attractiveness of higher-grade vanadium mineralized material at current vanadium prices or during previous mining campaigns; any expectation that the Company may be able to mine its mines in a manner that targets vanadium during periods of elevated vanadium prices even during periods of lower uranium prices; and other risk factors as described in Energy Fuels’ most recent annual report on Form 10-K and quarterly financial reports. Energy Fuels assumes no obligation to update the information in this communication, except as otherwise required by law. Additional information identifying risks and uncertainties is contained in Energy Fuels’ filings with the various securities commissions which are available online at www.sec.gov and www.sedar.com. Forward-looking statements are provided for the purpose of providing information about the current expectations, beliefs and plans of the management of Energy Fuels relating to the future. Readers are cautioned that such statements may not be appropriate for other purposes. Readers are also cautioned not to place undue reliance on these forward-looking statements, that speak only as of the date hereof.

3

Item 9.01 - Financial Statements and Exhibits

| Exhibit | Description |

| 99.1 | Consent of Mark S. Chalmers |

4

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Company has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| ENERGY FUELS INC. | |

| (Registrant) | |

| Dated: October 31, 2018 | By: /s/ David C. Frydenlund |

| David C. Frydenlund | |

| Chief Financial Officer, General Counsel | |

| and Corporate Secretary |

5