Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Axalta Coating Systems Ltd. | a201810318-k.htm |

Exhibit 99.1 Axalta Coating Systems Ltd. Investor Presentation Fourth Quarter 2018 Sensitivity: Business Internal

Legal Notices Forward-Looking Statements This presentation and the oral remarks made in connection herewith may contain “forward-looking statements” within the meaning of the U.S. Private Securities Litigation Reform Act of 1995, including those relating to our 2018 goals and financial projections, which include net sales, net sales excluding FX, Adjusted EBITDA, interest expense, tax rate, as adjusted, free cash flow, capital expenditures, depreciation and amortization, diluted shares outstanding, capital expenditures, cost savings, pricing actions, contributions from acquisitions, raw material cost increases, currency effects, product launches and related assumptions. Any forward-looking statements involve risks, uncertainties and assumptions. These statements often include words such as “believe,” “expect,” “anticipate,” “intend,” “plan,” “estimate,” “target,” “project,” “forecast,” “seek,” “will,” “may,” “should,” “could,” “would,” or similar expressions. These statements are based on certain assumptions that we have made in light of our experience in the industry and our perceptions of historical trends, current conditions, expected future developments and other factors we believe are appropriate under the circumstances as of the date hereof. Although we believe that the assumptions and analysis underlying these statements are reasonable as of the date hereof, investors are cautioned not to place undue reliance on these statements. We do not have any obligation to and do not intend to update any forward-looking statements included herein, which speak only as of the date hereof. You should understand that these statements are not guarantees of future performance or results. Actual results could differ materially from those described in any forward-looking statements contained herein or the oral remarks made in connection herewith as a result of a variety of factors, including known and unknown risks and uncertainties, many of which are beyond our control including, but not limited to, the risks and uncertainties described in "Non-GAAP Financial Measures," and "Forward-Looking Statements" as well as "Risk Factors" in our Annual Report on Form 10-K for the year ended December 31, 2017 and in our Quarterly Reports on Form 10-Q for the quarters ended March 31, 2018, June 30, 2018, and September 30, 2018. Non-GAAP Financial Measures The historical financial information included in this presentation includes financial information that is not presented in accordance with generally accepted accounting principles in the United States (“GAAP”), including net sales excluding FX, EBITDA, Adjusted EBITDA, Free Cash Flow, tax rate, as adjusted, and Net Debt. Management uses these non-GAAP financial measures in the analysis of our financial and operating performance because they assist in the evaluation of underlying trends in our business. Adjusted EBITDA consists of EBITDA adjusted for (i) non-cash items included within net income, (ii) items Axalta does not believe are indicative of ongoing operating performance or (iii) nonrecurring, unusual or infrequent items that have not occurred within the last two years or Axalta believes are not reasonably likely to recur within the next two years. We believe that making such adjustments provides investors meaningful information to understand our operating results and ability to analyze financial and business trends on a period-to-period basis. Our use of the terms net sales excluding FX, EBITDA, Adjusted EBITDA, Free Cash Flow, tax rate, as adjusted, and Net Debt may differ from that of others in our industry. Net sales excluding FX, EBITDA, Adjusted EBITDA and Free Cash Flow should not be considered as alternatives to net sales, net income, operating income or any other performance measures derived in accordance with GAAP as measures of operating performance or operating cash flows or as measures of liquidity. Net sales excluding FX, EBITDA, Adjusted EBITDA, Free Cash Flow, tax rate, as adjusted, and Net Debt have important limitations as analytical tools and should be considered in conjunction with, and not as substitutes for, our results as reported under GAAP. This presentation includes a reconciliation of certain non-GAAP financial measures with the most directly comparable financial measures calculated in accordance with GAAP. Axalta does not provide a reconciliation for non-GAAP estimates for net sales excluding FX, EBITDA, Adjusted EBITDA, Free Cash Flow or tax rate, as adjusted, as-reported on a forward-looking basis because the information necessary to calculate a meaningful or accurate estimation of reconciling items is not available without unreasonable effort. For example, such reconciling items include the impact of foreign currency exchange gains or losses, gains or losses that are unusual or nonrecurring in nature, as well as discrete taxable events. We cannot estimate or project those items and they may have a substantial and unpredictable impact on our US GAAP results. Segment Financial Measures The primary measure of segment operating performance is Adjusted EBITDA, which is a key metric that is used by management to evaluate business performance in comparison to budgets, forecasts and prior year financial results, providing a measure that management believes reflects Axalta’s core operating performance. As we do not measure segment operating performance based on Net Income, a reconciliation of this non-GAAP financial measure with the most directly comparable financial measure calculated in accordance with GAAP is not available. Defined Terms All capitalized terms contained within this presentation have been previously defined in our filings with the United States Securities and Exchange Commission. Rounding Due to rounding the tables presented may not foot. P RO P RIE TARY Sensitivity: Business Internal 2

Axalta’s Customer Focused Organization PERFORMANCE COATINGS TRANSPORTATION COATINGS SEGMENTS $2.7 Billion, 62% of Sales $1.7 Billion, 38% of Sales SALES BY END MARKET ▪ General industrial powders ▪ Automotive OEMs ▪ Heavy duty truck, utility trucks ▪ Independent body shops ▪ Wood coatings END ▪ Coatings for plastic and ▪ Rail, bus, machinery ▪ Multi-shop operators (MSOs) ▪ Electrical insulation composite materials ▪ Recreational vehicles MARKETS ▪ Auto dealership groups ▪ Architectural and decorative ▪ Automotive interiors ▪ Marine ▪ Coil and extruded metals ______________________________________________ 1. Financials for FY 2017, all sales data refers to Net Sales P RO P RIE TARY Sensitivity: Business Internal 3

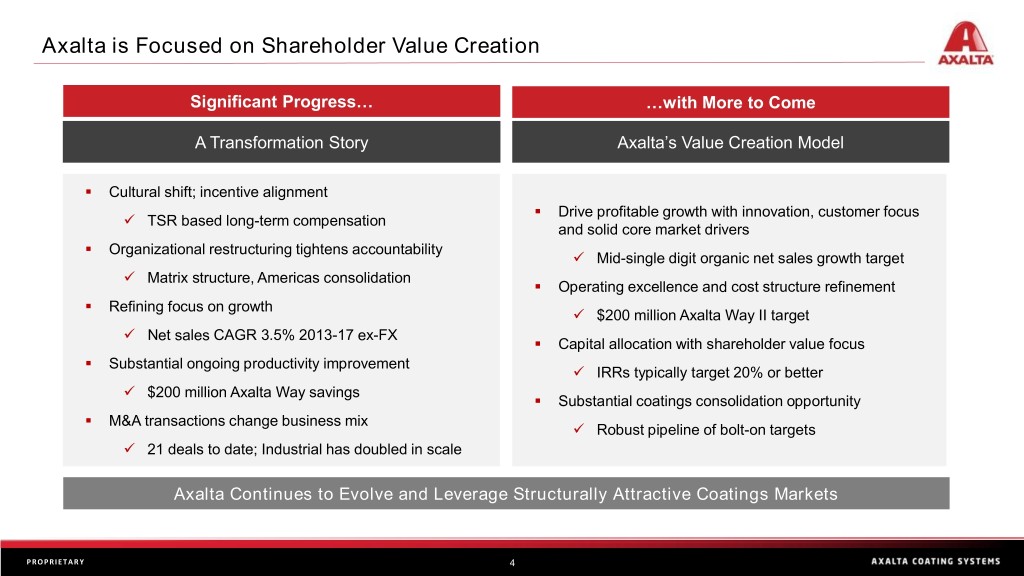

Axalta is Focused on Shareholder Value Creation Significant Progress… …with More to Come A Transformation Story Axalta’s Value Creation Model ▪ Cultural shift; incentive alignment ▪ Drive profitable growth with innovation, customer focus ✓ TSR based long-term compensation and solid core market drivers ▪ Organizational restructuring tightens accountability ✓ Mid-single digit organic net sales growth target ✓ Matrix structure, Americas consolidation ▪ Operating excellence and cost structure refinement ▪ Refining focus on growth ✓ $200 million Axalta Way II target ✓ Net sales CAGR 3.5% 2013-17 ex-FX ▪ Capital allocation with shareholder value focus ▪ Substantial ongoing productivity improvement ✓ IRRs typically target 20% or better ✓ $200 million Axalta Way savings ▪ Substantial coatings consolidation opportunity ▪ M&A transactions change business mix ✓ Robust pipeline of bolt-on targets ✓ 21 deals to date; Industrial has doubled in scale Axalta Continues to Evolve and Leverage Structurally Attractive Coatings Markets P RO P RIE TARY Sensitivity: Business Internal 4

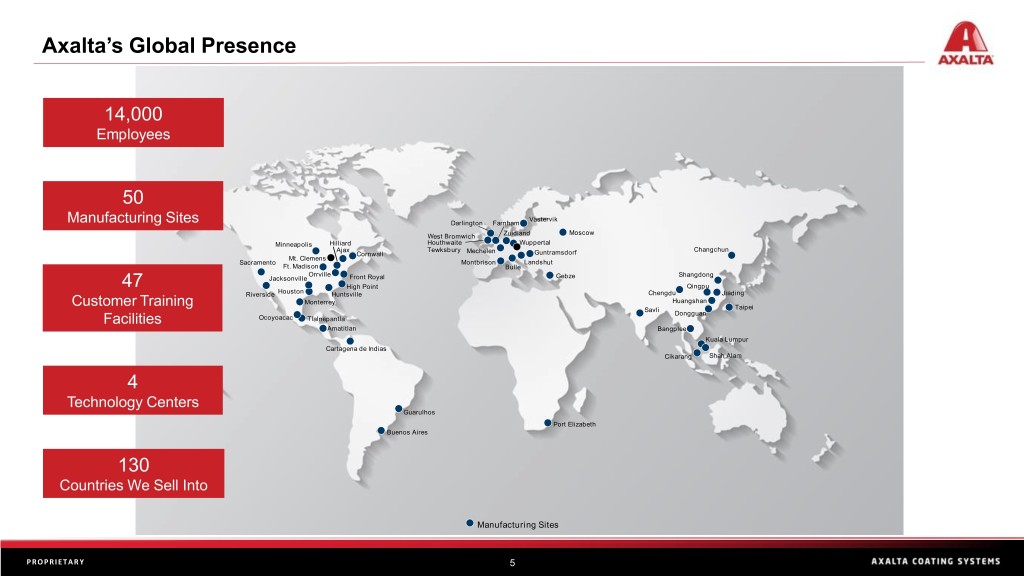

Axalta’s Global Presence 14,000 Employees 50 Västervik Manufacturing Sites Darlington Farnham Moscow West Bromwich Zuidland Minneapolis Hilliard Houthwaite Wuppertal Ajax Tewksbury Changchun Cornwall Mechelen Guntramsdorf Mt. Clemens Sacramento Montbrison Landshut Ft. Madison Bulle Orrville Shangdong Jacksonville Front Royal Gebze 47 High Point Qingpu Riverside Houston Huntsville Chengdu Jiading Customer Training Monterrey Huangshan Savli Taipei Dongguan Facilities Ocoyoacac Tlalnepantla Amatitlan Bangplee Kuala Lumpur Cartagena de Indias Cikarang Shah Alam 4 Technology Centers Guarulhos Port Elizabeth Buenos Aires 130 Countries We Sell Into Manufacturing Sites P RO P RIE TARY 5 Sensitivity: Business Internal 5

Why Invest in Axalta Today? Strong Free Focused End- Consolidation ROIC Growth Significant Axalta Way Cash Markets, Opportunity Focus, China Growth Driving Generation and Structural with Proven Shareholder Opportunity Productivity Allocation Volume Growth M&A Strategy Value Alignment Process P RO P RIE TARY Sensitivity: Business Internal 6

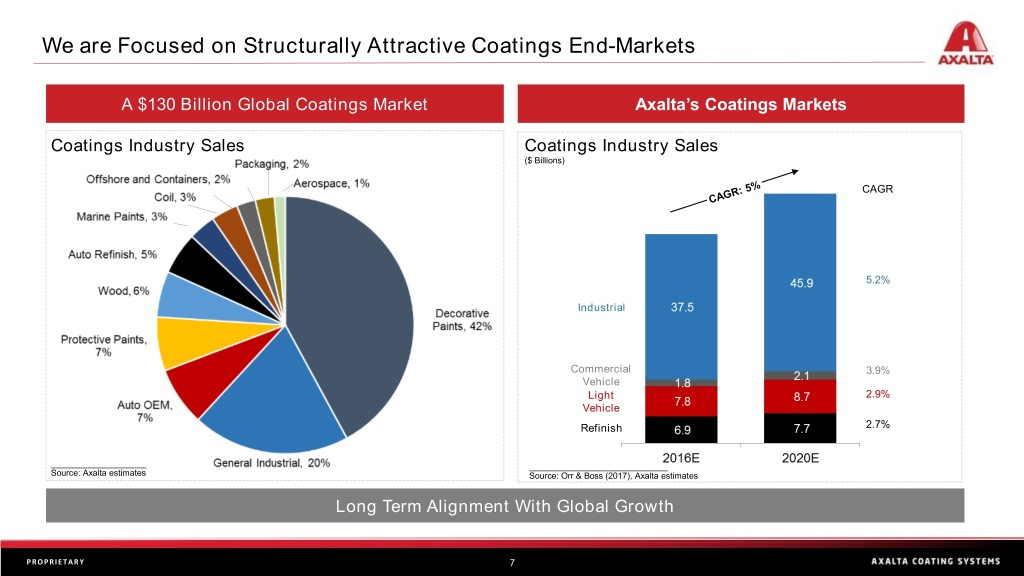

We are Focused on Structurally Attractive Coatings End-Markets A $130 Billion Global Coatings Market Axalta’s Coatings Markets Coatings Industry Sales Coatings Industry Sales ($ Billions) CAGR 5.2% Industrial Commercial 3.9% Vehicle Light 2.9% Vehicle Refinish 2.7% ____________________ _____________________________ Source: Axalta estimates Source: Orr & Boss (2017), Axalta estimates Long Term Alignment With Global Growth P RO P RIE TARY Sensitivity: Business Internal 7

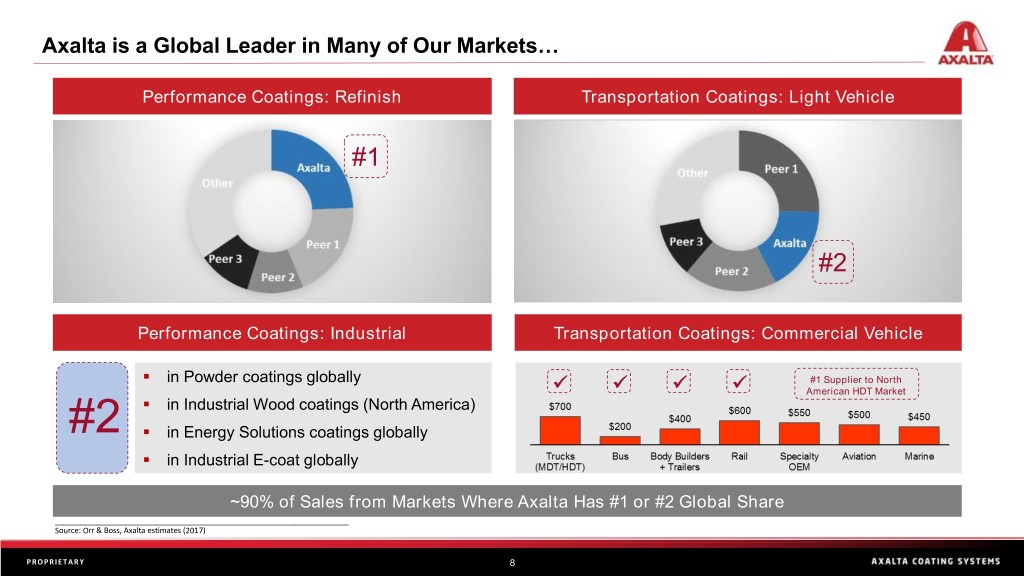

Axalta is a Global Leader in Many of Our Markets… Performance Coatings: Refinish Transportation Coatings: Light Vehicle #1 #2 Performance Coatings: Industrial Transportation Coatings: Commercial Vehicle ▪ in Powder coatings globally ✓ ✓ ✓ ✓ #1 Supplier to North American HDT Market ▪ in Industrial Wood coatings (North America) #2 ▪ in Energy Solutions coatings globally ▪ in Industrial E-coat globally ~90% of Sales from Markets Where Axalta Has #1 or #2 Global Share _____________________________________________________________________ Source: Orr & Boss, Axalta estimates (2017) P RO P RIE TARY Sensitivity: Business Internal 8

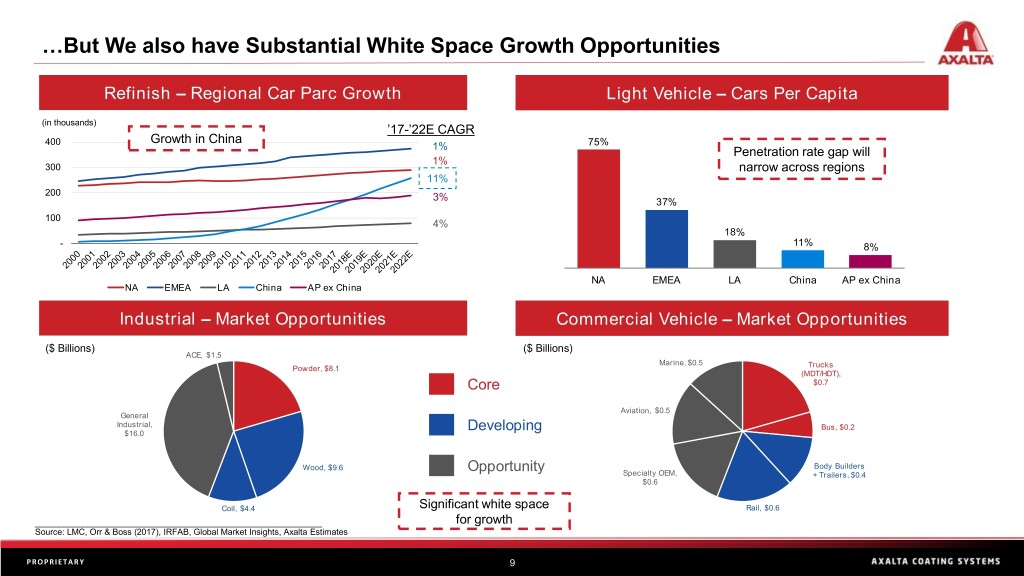

…But We also have Substantial White Space Growth Opportunities Refinish – Regional Car Parc Growth Light Vehicle – Cars Per Capita (in thousands) ’17-’22E CAGR 400 Growth in China 75% 1% Penetration rate gap will 1% 300 narrow across regions 11% 200 3% 37% 100 4% 18% - 11% 8% NA EMEA LA China AP ex China NA EMEA LA China AP ex China Industrial – Market Opportunities Commercial Vehicle – Market Opportunities ($ Billions) ($ Billions) ACE, $1.5 Marine, $0.5 Powder, $8.1 Trucks (MDT/HDT), Core $0.7 Aviation, $0.5 General Industrial, Developing Bus, $0.2 $16.0 Wood, $9.6 Opportunity Body Builders Specialty OEM, + Trailers, $0.4 $0.6 Coil, $4.4 Significant white space Rail, $0.6 ____________________________________________________________ for growth Source: LMC, Orr & Boss (2017), IRFAB, Global Market Insights, Axalta Estimates P RO P RIE TARY Sensitivity: Business Internal 9

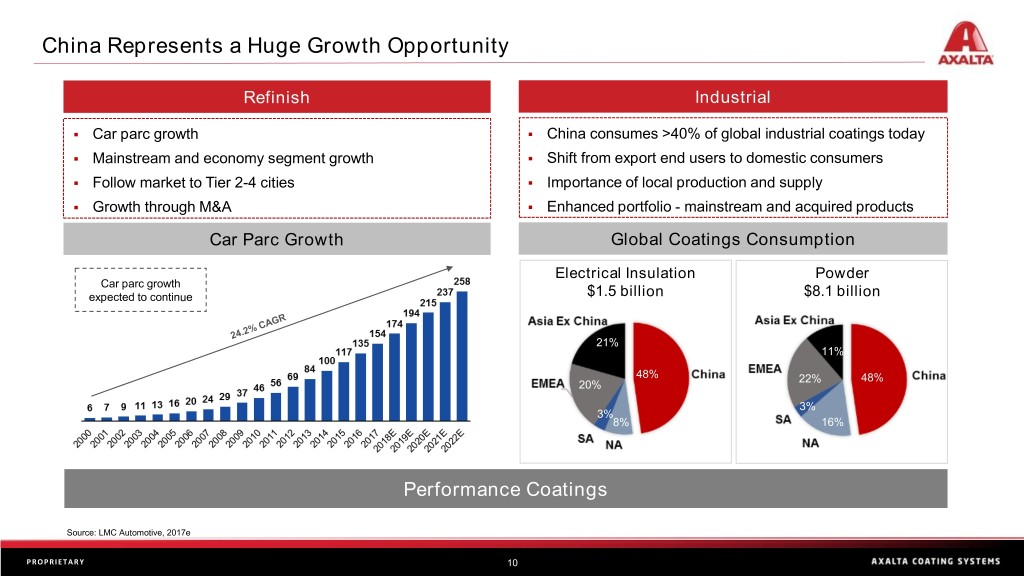

China Represents a Huge Growth Opportunity Refinish Industrial ▪ Car parc growth ▪ China consumes >40% of global industrial coatings today ▪ Mainstream and economy segment growth ▪ Shift from export end users to domestic consumers ▪ Follow market to Tier 2-4 cities ▪ Importance of local production and supply ▪ Growth through M&A ▪ Enhanced portfolio - mainstream and acquired products Car Parc Growth Global Coatings Consumption Electrical Insulation Powder Car parc growth expected to continue $1.5 billion $8.1 billion 21% 11% 48% 22% 48% 20% 3% 3% 8% 16% Performance Coatings Source: LMC Automotive, 2017e P RO P RIE TARY Sensitivity: Business Internal 10

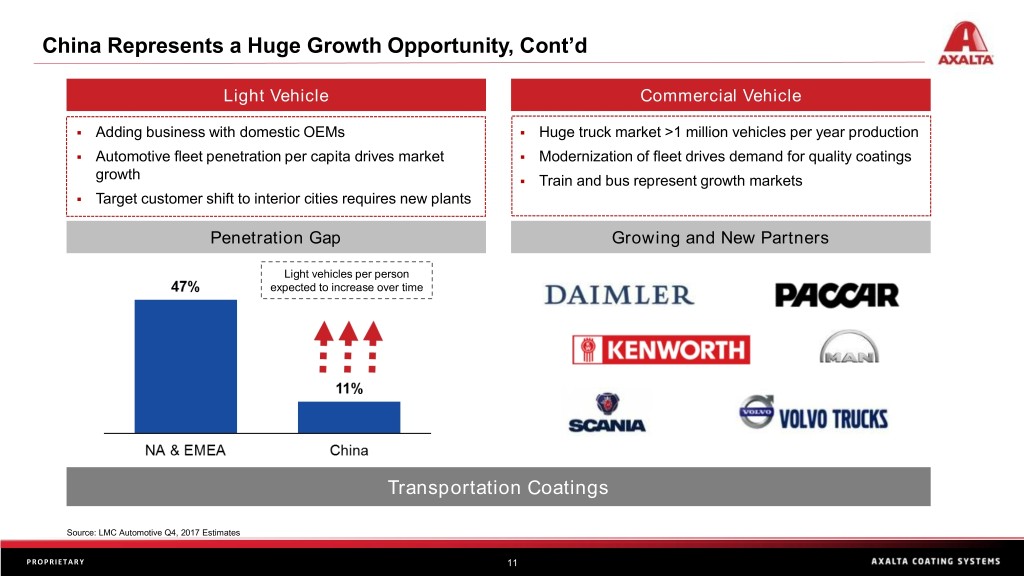

China Represents a Huge Growth Opportunity, Cont’d Light Vehicle Commercial Vehicle ▪ Adding business with domestic OEMs ▪ Huge truck market >1 million vehicles per year production ▪ Automotive fleet penetration per capita drives market ▪ Modernization of fleet drives demand for quality coatings growth ▪ Train and bus represent growth markets ▪ Target customer shift to interior cities requires new plants Penetration Gap Growing and New Partners Light vehicles per person expected to increase over time Transportation Coatings Source: LMC Automotive Q4, 2017 Estimates P RO P RIE TARY Sensitivity: Business Internal 11

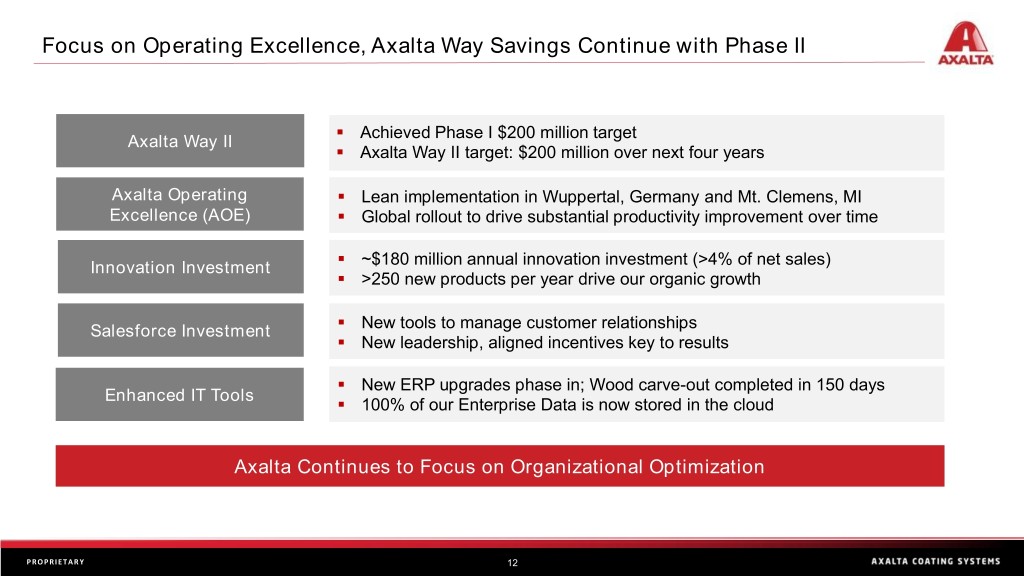

Focus on Operating Excellence, Axalta Way Savings Continue with Phase II ▪ Achieved Phase I $200 million target Axalta Way II ▪ Axalta Way II target: $200 million over next four years Axalta Operating ▪ Lean implementation in Wuppertal, Germany and Mt. Clemens, MI Excellence (AOE) ▪ Global rollout to drive substantial productivity improvement over time ▪ ~$180 million annual innovation investment (>4% of net sales) Innovation Investment ▪ >250 new products per year drive our organic growth ▪ Salesforce Investment New tools to manage customer relationships ▪ New leadership, aligned incentives key to results ▪ New ERP upgrades phase in; Wood carve-out completed in 150 days Enhanced IT Tools ▪ 100% of our Enterprise Data is now stored in the cloud Axalta Continues to Focus on Organizational Optimization P RO P RIE TARY Sensitivity: Business Internal 12

M&A: Leveraging a Consolidating Coatings Sector 2017 Key Acquisitions Benefits ▪ Provide access to new technologies, products, customers, and markets ▪ Leverage combined supply chains and distribution channels ▪ Develop process and marketing efficiencies Ellis Paint Century Industrial Coatings Spencer Coatings and globalize products North America North America EMEA – U.K. Refinish • Industrial Industrial Industrial Key Data ▪ 8 total transactions in 2017 ▪ $564 million capital deployed ▪ Valspar Wood Coatings (N.A.) Plascoat Annual run-rate of ~$370 million in sales North America EMEA Industrial Industrial We Have a Robust Pipeline and Will Continue to Leverage Market Consolidation P RO P RIE TARY Sensitivity: Business Internal 13

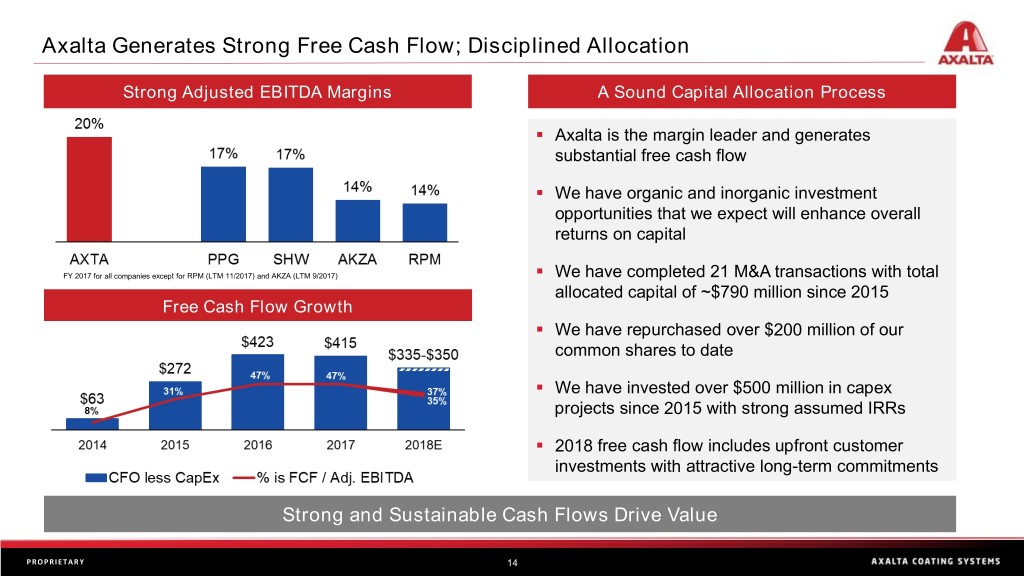

Axalta Generates Strong Free Cash Flow; Disciplined Allocation Strong Adjusted EBITDA Margins A Sound Capital Allocation Process ▪ Axalta is the margin leader and generates substantial free cash flow ▪ We have organic and inorganic investment opportunities that we expect will enhance overall returns on capital ▪ FY 2017 for all companies except for RPM (LTM 11/2017) and AKZA (LTM 9/2017) We have completed 21 M&A transactions with total allocated capital of ~$790 million since 2015 Free Cash Flow Growth ▪ We have repurchased over $200 million of our common shares to date ▪ We have invested over $500 million in capex projects since 2015 with strong assumed IRRs ▪ 2018 free cash flow includes upfront customer investments with attractive long-term commitments Strong and Sustainable Cash Flows Drive Value P RO P RIE TARY Sensitivity: Business Internal 14

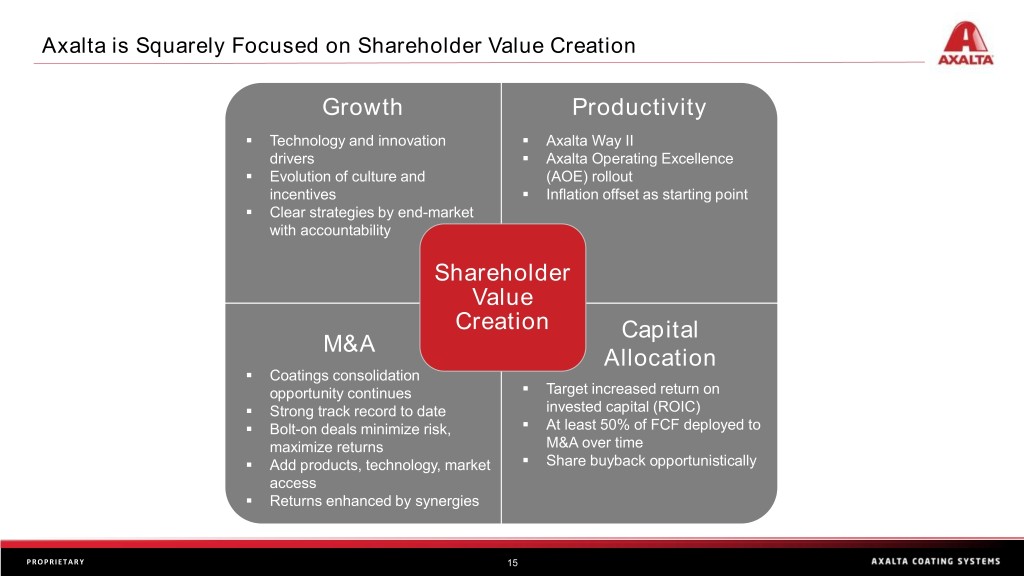

Axalta is Squarely Focused on Shareholder Value Creation Growth Productivity ▪ Technology and innovation ▪ Axalta Way II drivers ▪ Axalta Operating Excellence ▪ Evolution of culture and (AOE) rollout incentives ▪ Inflation offset as starting point ▪ Clear strategies by end-market with accountability Shareholder Value Creation Capital M&A ▪ Allocation Coatings consolidation ▪ opportunity continues Target increased return on ▪ invested capital (ROIC) Strong track record to date ▪ ▪ Bolt-on deals minimize risk, At least 50% of FCF deployed to M&A over time maximize returns ▪ ▪ Add products, technology, market Share buyback opportunistically access ▪ Returns enhanced by synergies P RO P RIE TARY Sensitivity: Business Internal 15

Sustainability at Axalta Environment Social Governance ▪ Environment, Health & Safety policies well defined ▪ Supply chain initiatives including Supplier Code of ▪ Environment, Health, Safety & Sustainability Conduct and Supplier Sustainability Risk Management ▪ Committee of the Board Responsible Care® RC (ISO) 14001 certification Program ▪ Created sustainability function and team ▪ Next generation health & safety training introduced ▪ Enhancing product stewardship systems ▪ Material issues and goal setting ▪ Production localization strategy reduces risk, cost ▪ Employee engagement and environmental impact ▪ Ethics & integrity compliance program ✓ Development and recruitment programs ▪ Targeting reduced environmental impact across ✓ Communications with Inside Axalta intranet ▪ Cybersecurity initiatives multiple categories with specific goals in place ✓ Volunteerism supported ▪ Bi-annual sustainability reporting cycle ▪ ✓ Employee diversity supported with Axalta Product sustainability benefits from low-to-no VOC or ▪ HAPs formulations and from new application Women’s Network Engage OEM procurement sustainability teams technologies ▪ Corporate social responsibility programs ✓ STEM education ✓ Environmental stewardship P RO P RIE TARY Sensitivity: Business Internal 16

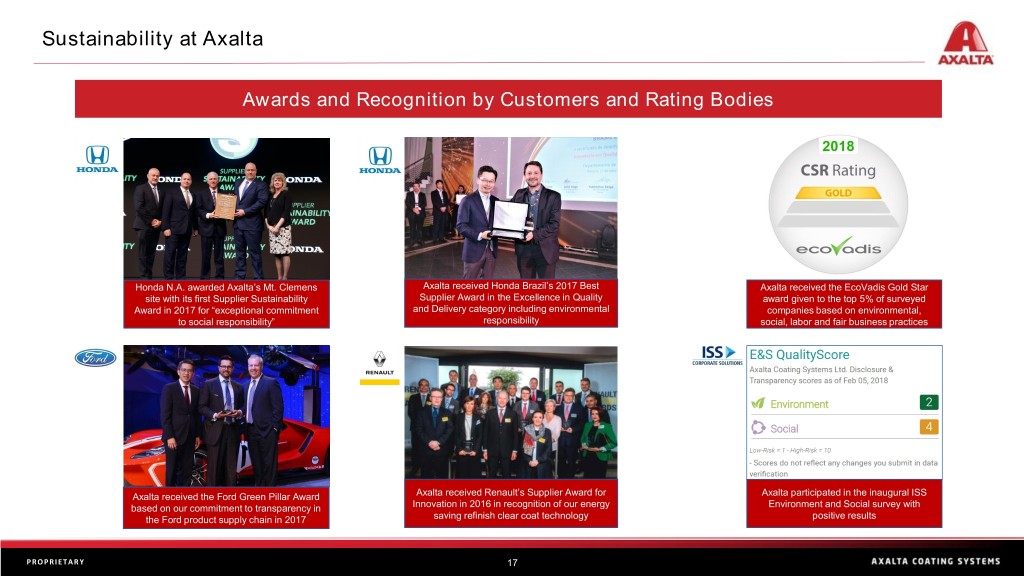

Sustainability at Axalta Awards and Recognition by Customers and Rating Bodies Honda N.A. awarded Axalta’s Mt. Clemens Axalta received Honda Brazil’s 2017 Best Axalta received the EcoVadis Gold Star site with its first Supplier Sustainability Supplier Award in the Excellence in Quality award given to the top 5% of surveyed Award in 2017 for “exceptional commitment and Delivery category including environmental companies based on environmental, to social responsibility” responsibility social, labor and fair business practices Axalta received the Ford Green Pillar Award Axalta received Renault’s Supplier Award for Axalta participated in the inaugural ISS based on our commitment to transparency in Innovation in 2016 in recognition of our energy Environment and Social survey with the Ford product supply chain in 2017 saving refinish clear coat technology positive results P RO P RIE TARY Sensitivity: Business Internal 17

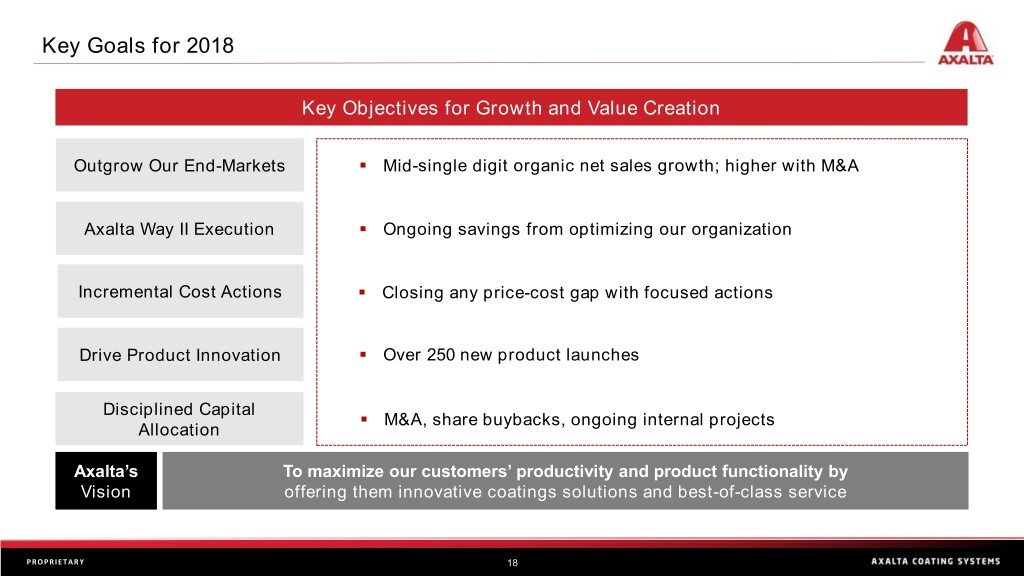

Key Goals for 2018 Key Objectives for Growth and Value Creation Outgrow Our End-Markets ▪ Mid-single digit organic net sales growth; higher with M&A Axalta Way II Execution ▪ Ongoing savings from optimizing our organization Incremental Cost Actions ▪ Closing any price-cost gap with focused actions Drive Product Innovation ▪ Over 250 new product launches Disciplined Capital ▪ M&A, share buybacks, ongoing internal projects Allocation Axalta’s To maximize our customers’ productivity and product functionality by Vision offering them innovative coatings solutions and best-of-class service P RO P RIE TARY Sensitivity: Business Internal 18

Financial Overview Sensitivity: Business Internal

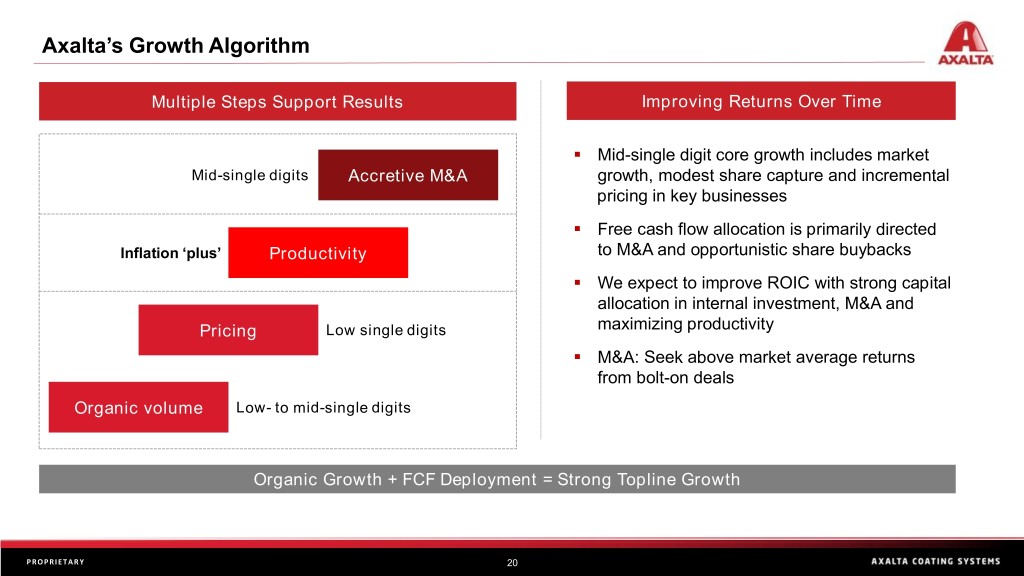

Axalta’s Growth Algorithm Multiple Steps Support Results Improving Returns Over Time ▪ Mid-single digit core growth includes market Mid-single digits Accretive M&A growth, modest share capture and incremental pricing in key businesses ▪ Free cash flow allocation is primarily directed Inflation ‘plus’ Productivity to M&A and opportunistic share buybacks ▪ We expect to improve ROIC with strong capital allocation in internal investment, M&A and Pricing Low single digits maximizing productivity ▪ M&A: Seek above market average returns from bolt-on deals Organic volume Low- to mid-single digits Organic Growth + FCF Deployment = Strong Topline Growth P RO P RIE TARY Sensitivity: Business Internal 20

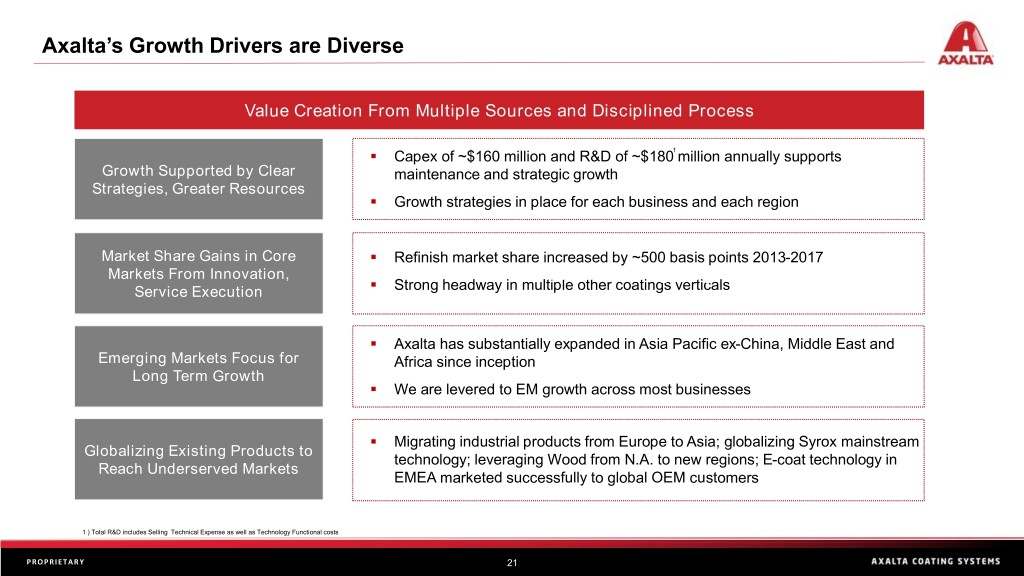

Axalta’s Growth Drivers are Diverse Value Creation From Multiple Sources and Disciplined Process ▪ Capex of ~$160 million and R&D of ~$1801 million annually supports Growth Supported by Clear maintenance and strategic growth Strategies, Greater Resources ▪ Growth strategies in place for each business and each region Market Share Gains in Core ▪ Refinish market share increased by ~500 basis points 2013-2017 Markets From Innovation, ▪ I think we are go to go. Service Execution Strong headway in multiple other coatings verticals ▪ Axalta has substantially expanded in Asia Pacific ex-China, Middle East and Emerging Markets Focus for Africa since inception Long Term Growth I think we are go to go. ▪ We are levered to EM growth across most businesses ▪ Migrating industrial products from Europe to Asia; globalizing Syrox mainstream Globalizing Existing Products to technology; leveraging Wood from N.A. to new regions; E-coat technology in Reach Underserved Markets EMEA marketed successfully to global OEM customers 1 ) Total R&D includes Selling Technical Expense as well as Technology Functional costs P RO P RIE TARY Sensitivity: Business Internal 21

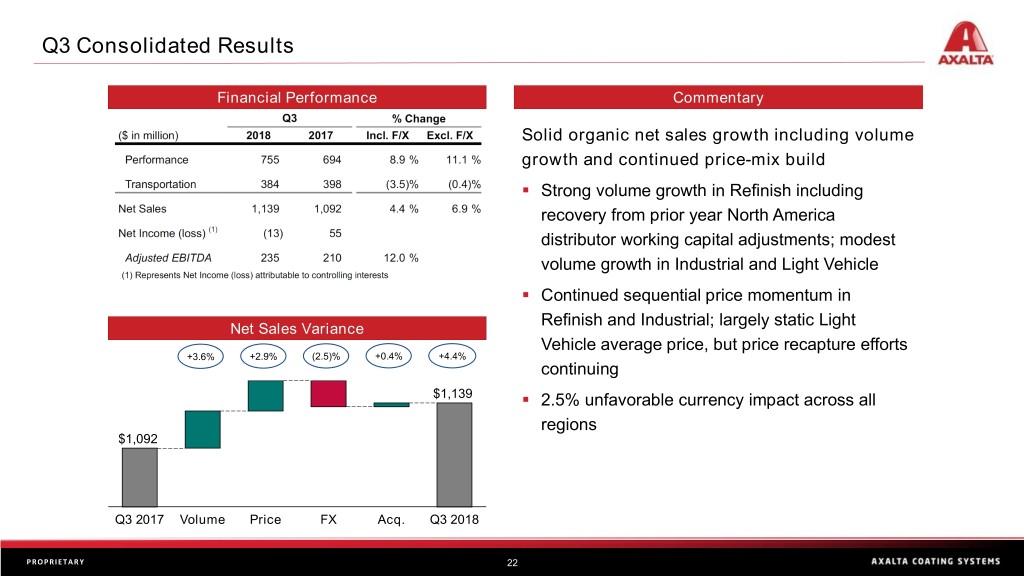

Q3 Consolidated Results Financial Performance Commentary Solid organic net sales growth including volume growth and continued price-mix build ▪ Strong volume growth in Refinish including recovery from prior year North America distributor working capital adjustments; modest volume growth in Industrial and Light Vehicle ▪ Continued sequential price momentum in Refinish and Industrial; largely static Light Net Sales Variance Vehicle average price, but price recapture efforts +3.6% +2.9% (2.5)% +0.4% +4.4% continuing $1,139 ▪ 2.5% unfavorable currency impact across all regions $1,092 Q3 2017 Volume Price FX Acq. Q3 2018 P RO P RIE TARY Sensitivity: Business Internal 22

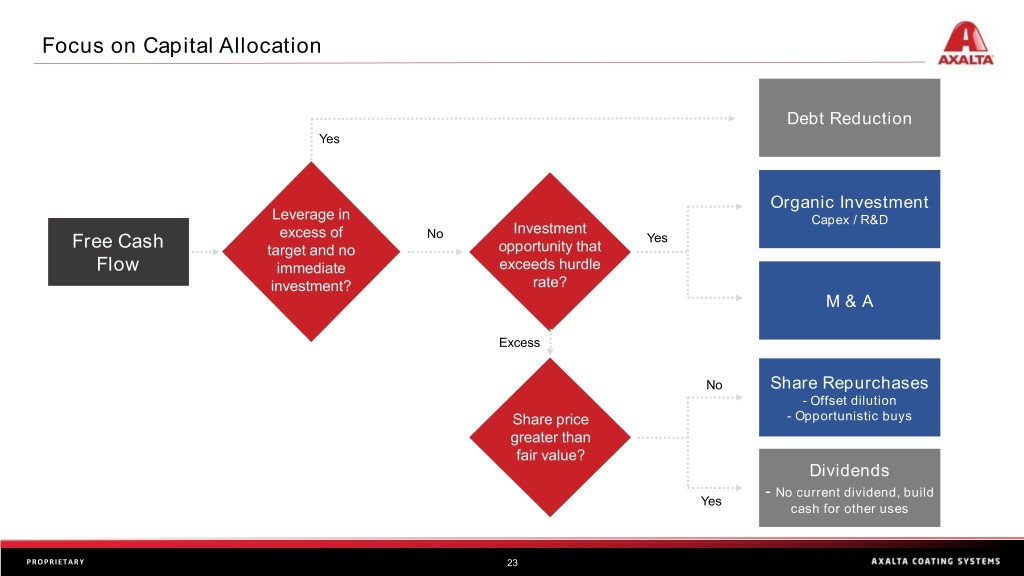

Focus on Capital Allocation Debt Reduction Yes Organic Investment Leverage in Capex / R&D Investment excess of No Yes Free Cash target and no opportunity that Flow immediate exceeds hurdle investment? rate? M & A Excess No Share Repurchases - Offset dilution Share price - Opportunistic buys greater than fair value? Dividends - No current dividend, build Yes cash for other uses P RO P RIE TARY Sensitivity: Business Internal 23

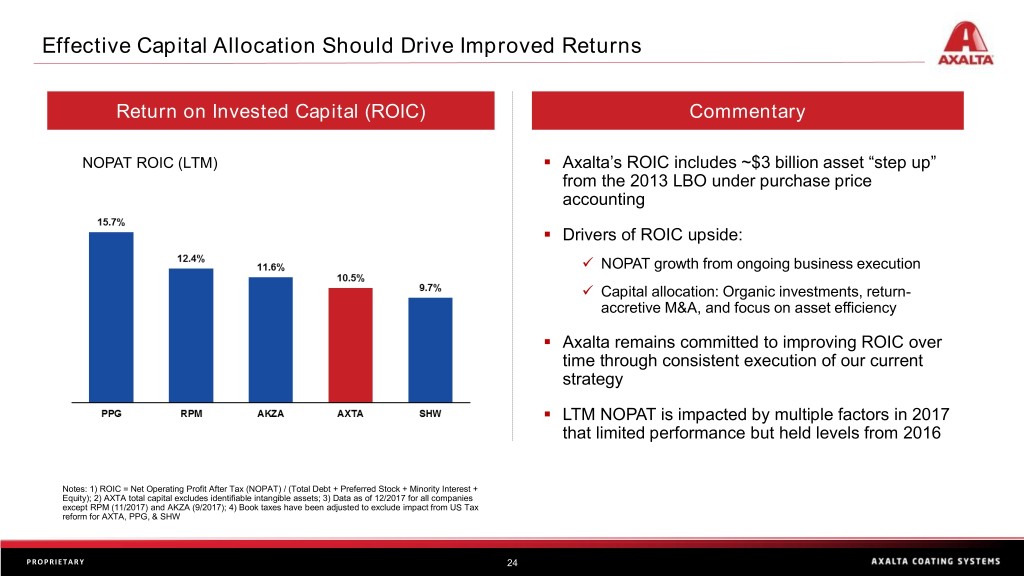

Effective Capital Allocation Should Drive Improved Returns Return on Invested Capital (ROIC) Commentary NOPAT ROIC (LTM) ▪ Axalta’s ROIC includes ~$3 billion asset “step up” from the 2013 LBO under purchase price accounting ▪ Drivers of ROIC upside: ✓ NOPAT growth from ongoing business execution ✓ Capital allocation: Organic investments, return- accretive M&A, and focus on asset efficiency ▪ Axalta remains committed to improving ROIC over time through consistent execution of our current strategy ▪ LTM NOPAT is impacted by multiple factors in 2017 that limited performance but held levels from 2016 Notes: 1) ROIC = Net Operating Profit After Tax (NOPAT) / (Total Debt + Preferred Stock + Minority Interest + Equity); 2) AXTA total capital excludes identifiable intangible assets; 3) Data as of 12/2017 for all companies except RPM (11/2017) and AKZA (9/2017); 4) Book taxes have been adjusted to exclude impact from US Tax reform for AXTA, PPG, & SHW P RO P RIE TARY Sensitivity: Business Internal 24

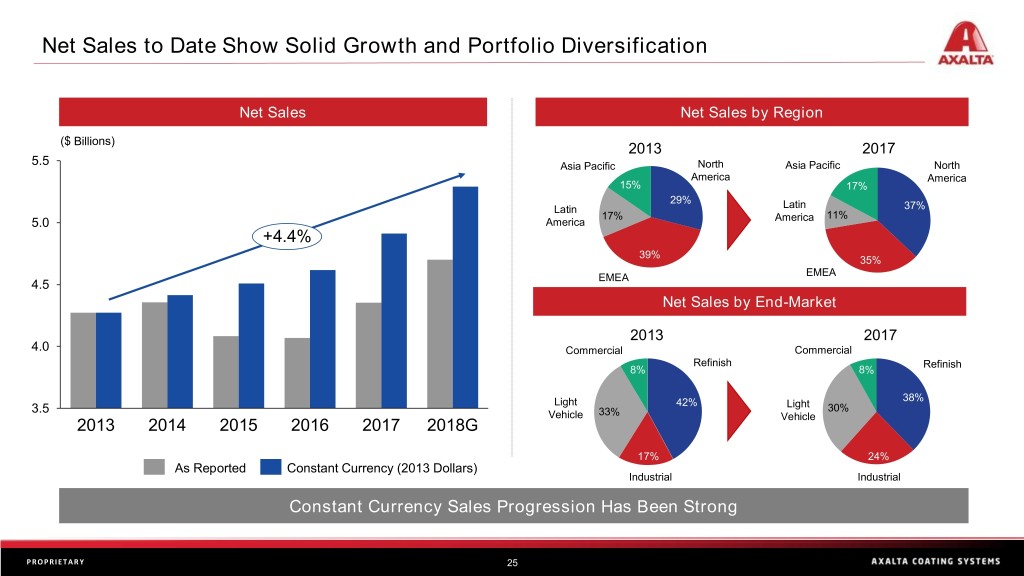

Net Sales to Date Show Solid Growth and Portfolio Diversification Net Sales Net Sales by Region ($ Billions) 2013 2017 5.5 Asia Pacific North Asia Pacific North America America 15% 17% 29% Latin Latin 37% 17% 11% 5.0 America America +4.4% 39% 35% EMEA EMEA 4.5 Net Sales by End-Market 2013 2017 4.0 Commercial Commercial Refinish Refinish 8% 8% Light 42% 38% 3.5 Light 30% Vehicle 33% Vehicle 2013 2014 2015 2016 2017 2018G 17% 24% As Reported Constant Currency (2013 Dollars) Industrial Industrial Constant Currency Sales Progression Has Been Strong P RO P RIE TARY Sensitivity: Business Internal 25

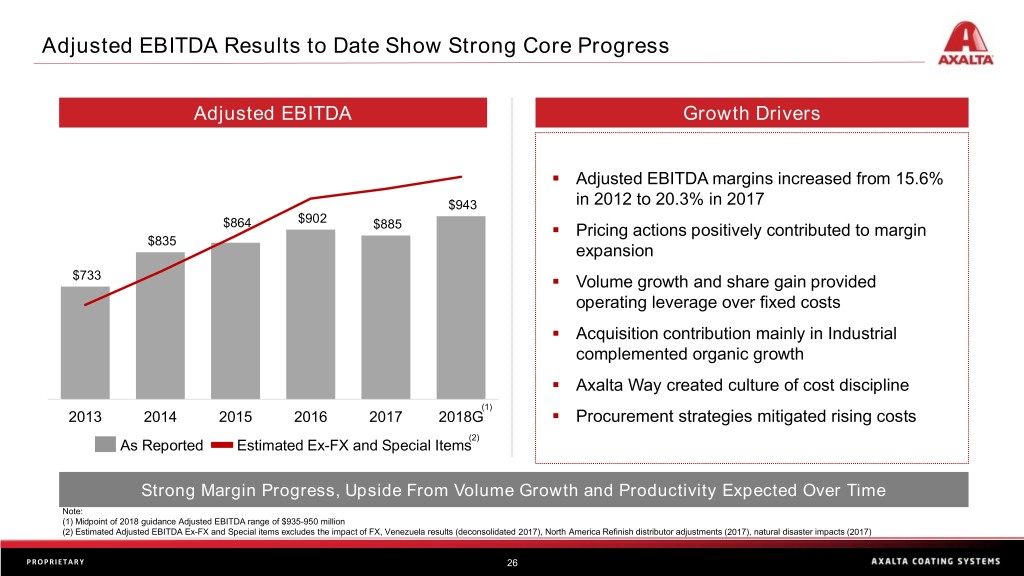

Adjusted EBITDA Results to Date Show Strong Core Progress Adjusted EBITDA Growth Drivers ▪ Adjusted EBITDA margins increased from 15.6% $943 in 2012 to 20.3% in 2017 $902 $864 $885 ▪ Pricing actions positively contributed to margin $835 expansion $733 ▪ Volume growth and share gain provided operating leverage over. fixed costs ▪ Acquisition contribution mainly in Industrial complemented organic growth ▪ Axalta Way created culture of cost discipline (1) 2013 2014 2015 2016 2017 2018G ▪ Procurement strategies mitigated rising costs (2) As Reported Estimated Ex-FX and Special Items Strong Margin Progress, Upside From Volume Growth and Productivity Expected Over Time Note: (1) Midpoint of 2018 guidance Adjusted EBITDA range of $935-950 million (2) Estimated Adjusted EBITDA Ex-FX and Special items excludes the impact of FX, Venezuela results (deconsolidated 2017), North America Refinish distributor adjustments (2017), natural disaster impacts (2017) P RO P RIE TARY Sensitivity: Business Internal 26

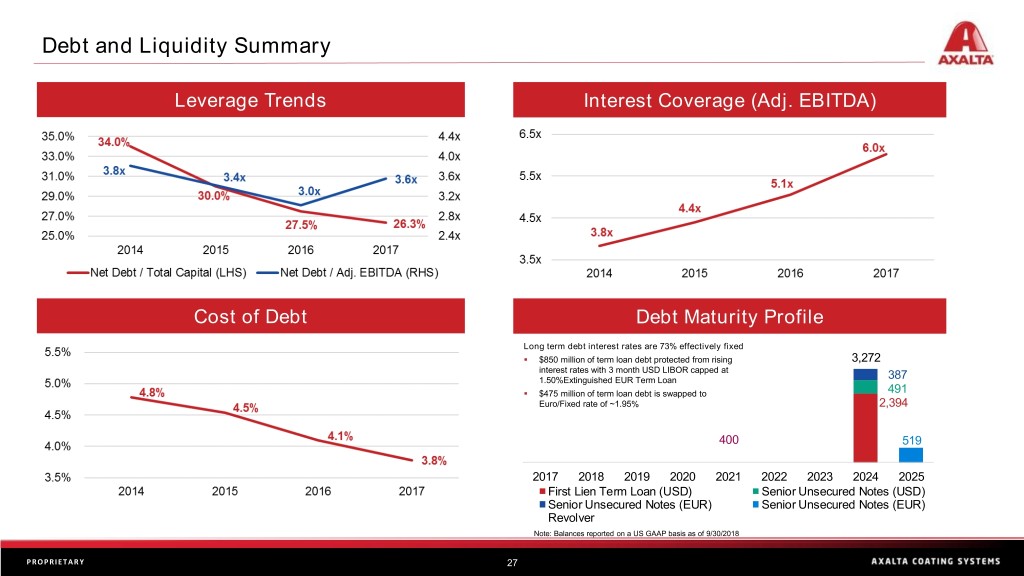

Debt and Liquidity Summary Leverage Trends Interest Coverage (Adj. EBITDA) Cost of Debt Debt Maturity Profile Long term debt interest rates are 73% effectively fixed ▪ $850 million of term loan debt protected from rising 3,272 interest rates with 3 month USD LIBOR capped at 1.50%Extinguished EUR Term Loan 387 ▪ $475 million of term loan debt is swapped to 491 Euro/Fixed rate of ~1.95% 2,394 400 519 2017 2018 2019 2020 2021 2022 2023 2024 2025 First Lien Term Loan (USD) Senior Unsecured Notes (USD) Senior Unsecured Notes (EUR) Senior Unsecured Notes (EUR) Revolver Note: Balances reported on a US GAAP basis as of 9/30/2018 P RO P RIE TARY Sensitivity: Business Internal 27

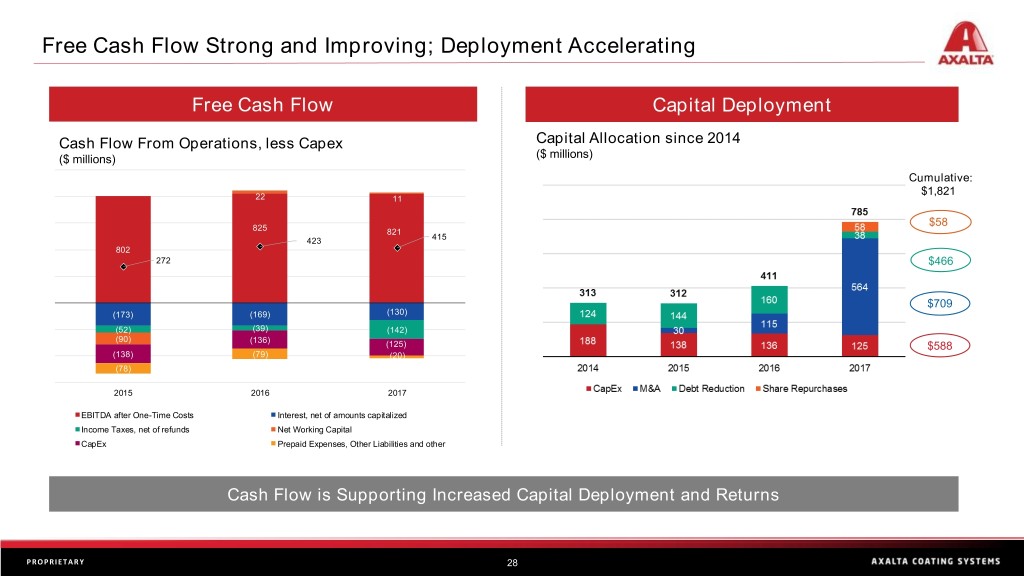

Free Cash Flow Strong and Improving; Deployment Accelerating Free Cash Flow Capital Deployment Cash Flow From Operations, less Capex Capital Allocation since 2014 ($ millions) ($ millions) Cumulative: $1,821 22 11 $58 825 821 423 415 802 272 $466 $709 (173) (169) (130) (52) (39) (142) (90) (136) (125) $588 (138) (79) (20) (78) 2015 2016 2017 EBITDA after One-Time Costs Interest, net of amounts capitalized Income Taxes, net of refunds Net Working Capital CapEx Prepaid Expenses, Other Liabilities and other Cash Flow is Supporting Increased Capital Deployment and Returns P RO P RIE TARY Sensitivity: Business Internal 28

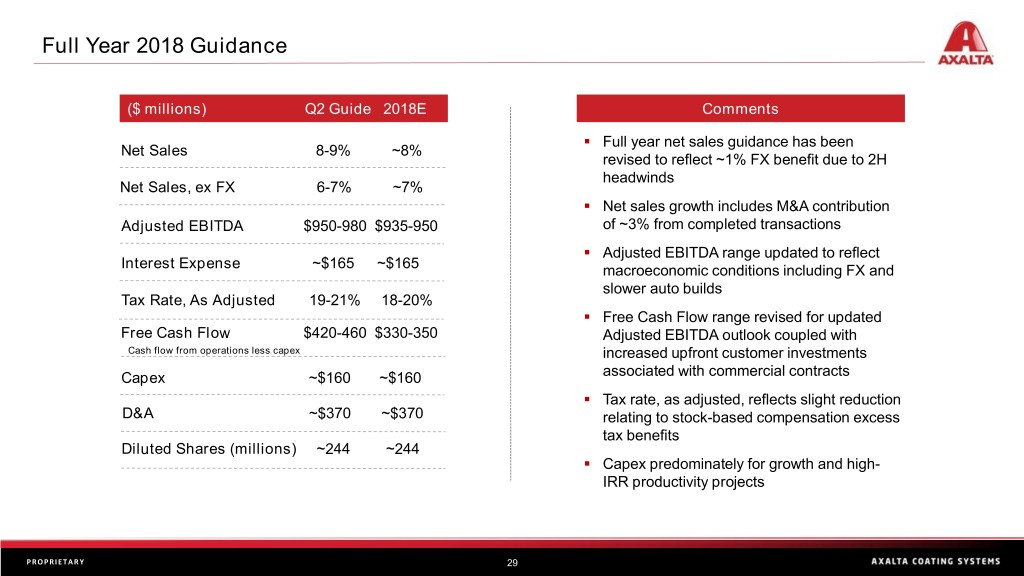

Full Year 2018 Guidance ($ millions) Q2 Guide 2018E Comments ▪ Full year net sales guidance has been Net Sales 8-9% ~8% revised to reflect ~1% FX benefit due to 2H headwinds Net Sales, ex FX 6-7% ~7% ▪ Net sales growth includes M&A contribution Adjusted EBITDA $950-980 $935-950 of ~3% from completed transactions ▪ Adjusted EBITDA range updated to reflect Interest Expense ~$165 ~$165 macroeconomic conditions including FX and slower auto builds Tax Rate, As Adjusted 19-21% 18-20% ▪ Free Cash Flow range revised for updated Free Cash Flow $420-460 $330-350 Adjusted EBITDA outlook coupled with Cash flow from operations less capex increased upfront customer investments Capex ~$160 ~$160 associated with commercial contracts ▪ Tax rate, as adjusted, reflects slight reduction D&A ~$370 ~$370 relating to stock-based compensation excess tax benefits Diluted Shares (millions) ~244 ~244 ▪ Capex predominately for growth and high- IRR productivity projects P RO P RIE TARY Sensitivity: Business Internal 29

Performance Coatings: Refinish Sensitivity: Business Internal

Axalta Refinish Investment Thesis ▪ The global automotive refinish market is stable, consolidated and growing ✓ Refinish is highly stable, linked to global miles driven and accident rates ✓ The top four Refinish players hold two-thirds of the global market ✓ End-market growth ~3-4% per year expected ▪ Axalta leads with the broadest and deepest technology and market reach ✓ We lead the global market with 25% share; higher share in developed regions ✓ Our deep portfolio of next-generation technology addresses wide-ranging customer needs ✓ Axalta has broad market reach across product and customer types globally ▪ Axalta continues to grow through an aggressive and disciplined strategy ✓ Organic and inorganic product introductions to increase reach and competitiveness ✓ Benefiting from consolidation and professionalization of body shop market ✓ Tailwind from growing car parc, especially in emerging markets ✓ Adding technology and services to solidify competitive moat and customer relationships P RO P RIE TARY Sensitivity: Business Internal 31

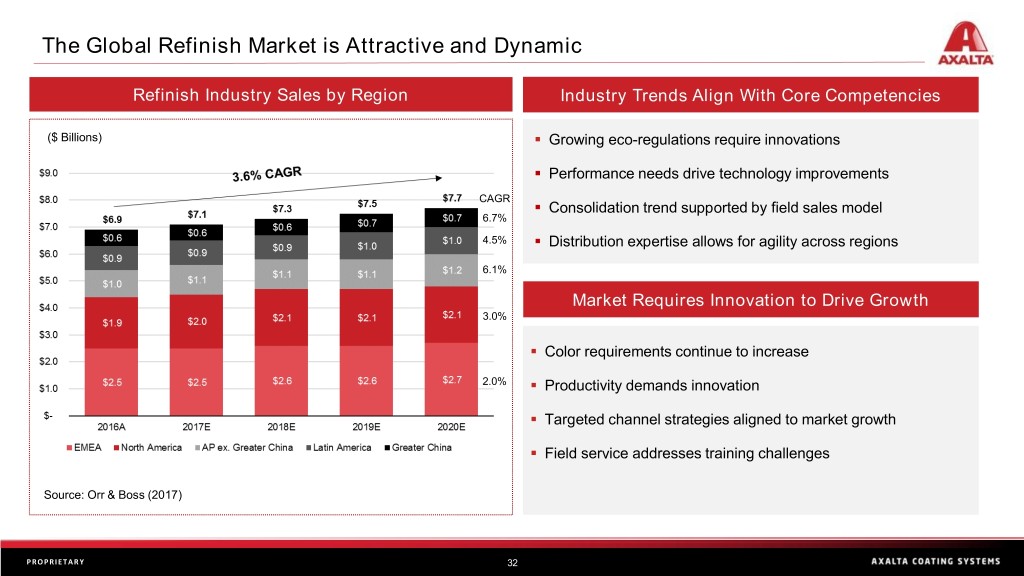

The Global Refinish Market is Attractive and Dynamic Refinish Industry Sales by Region Industry Trends Align With Core Competencies ($ Billions) ▪ Growing eco-regulations require innovations ▪ Performance needs drive technology improvements CAGR ▪ Consolidation trend supported by field sales model 6.7% 4.5% ▪ Distribution expertise allows for agility across regions 6.1% Market Requires Innovation to Drive Growth 3.0% ▪ Color requirements continue to increase 2.0% ▪ Productivity demands innovation ▪ Targeted channel strategies aligned to market growth ▪ Field service addresses training challenges Source: Orr & Boss (2017) P RO P RIE TARY Sensitivity: Business Internal 32

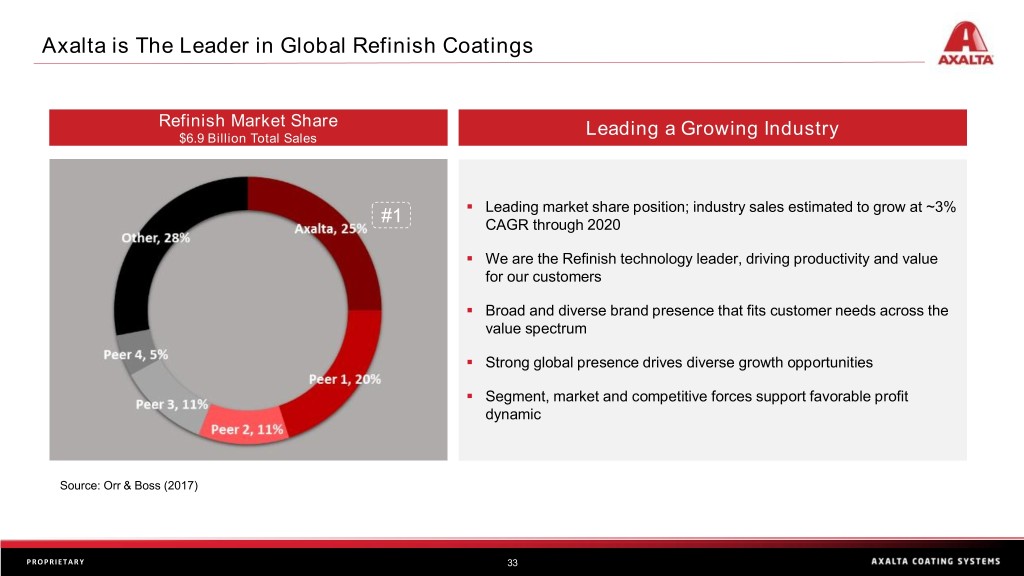

Axalta is The Leader in Global Refinish Coatings Refinish Market Share Leading a Growing Industry $6.9 Billion Total Sales ▪ Leading market share position; industry sales estimated to grow at ~3% #1 CAGR through 2020 ▪ We are the Refinish technology leader, driving productivity and value for our customers ▪ Broad and diverse brand presence that fits customer needs across the value spectrum ▪ Strong global presence drives diverse growth opportunities ▪ Segment, market and competitive forces support favorable profit dynamic Source: Orr & Boss (2017) P RO P RIE TARY Sensitivity: Business Internal 33

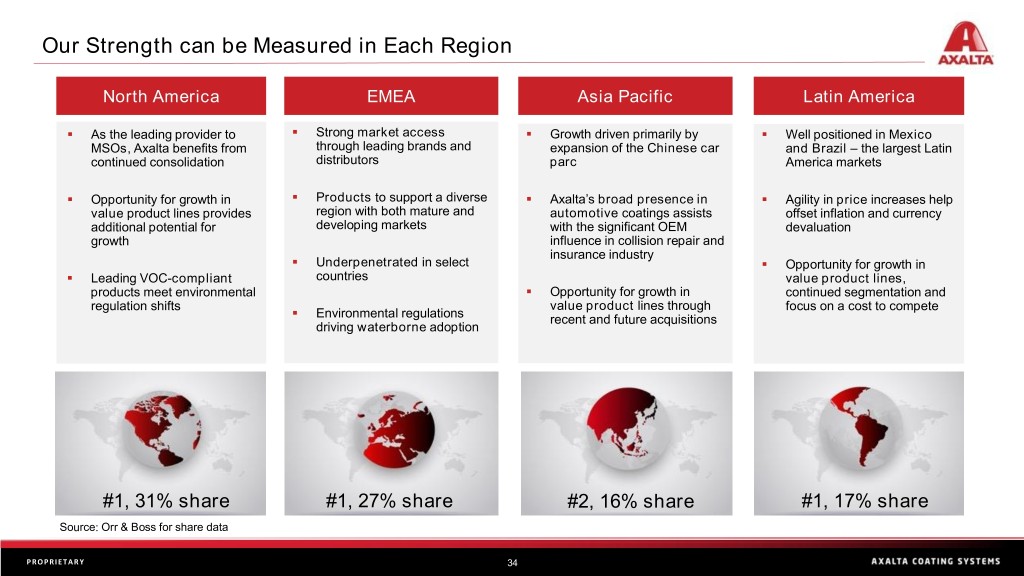

Our Strength can be Measured in Each Region North America EMEA Asia Pacific Latin America ▪ ▪ As the leading provider to Strong market access ▪ Growth driven primarily by ▪ Well positioned in Mexico MSOs, Axalta benefits from through leading brands and expansion of the Chinese car and Brazil – the largest Latin continued consolidation distributors parc America markets ▪ ▪ Opportunity for growth in Products to support a diverse ▪ Axalta’s broad presence in ▪ Agility in price increases help value product lines provides region with both mature and automotive coatings assists offset inflation and currency additional potential for developing markets with the significant OEM devaluation growth influence in collision repair and ▪ insurance industry Underpenetrated in select ▪ Opportunity for growth in ▪ Leading VOC-compliant countries value product lines, products meet environmental ▪ Opportunity for growth in continued segmentation and regulation shifts ▪ value product lines through focus on a cost to compete Environmental regulations recent and future acquisitions driving waterborne adoption #1, 31% share #1, 27% share #2, 16% share #1, 17% share Source: Orr & Boss for share data P RO P RIE TARY Sensitivity: Business Internal 34

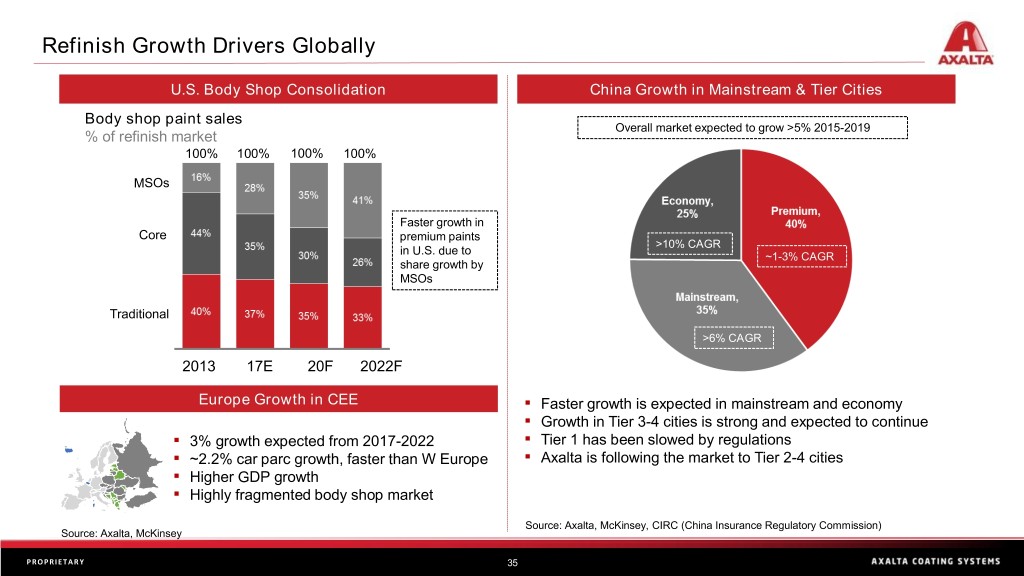

Refinish Growth Drivers Globally U.S. Body Shop Consolidation China Growth in Mainstream & Tier Cities Body shop paint sales Overall market expected to grow >5% 2015-2019 % of refinish market 100% 100% 100% 100% MSOs Faster growth in Core premium paints >10% CAGR in U.S. due to ~1-3% CAGR share growth by MSOs Traditional >6% CAGR 2013 17E 20F 2022F Europe Growth in CEE ▪ Faster growth is expected in mainstream and economy ▪ Growth in Tier 3-4 cities is strong and expected to continue ▪ 3% growth expected from 2017-2022 ▪ Tier 1 has been slowed by regulations ▪ ~2.2% car parc growth, faster than W Europe ▪ Axalta is following the market to Tier 2-4 cities ▪ Higher GDP growth ▪ Highly fragmented body shop market Source: Axalta, McKinsey, CIRC (China Insurance Regulatory Commission) Source: Axalta, McKinsey P RO P RIE TARY Sensitivity: Business Internal 35

Performance Coatings: Industrial Sensitivity: Business Internal

Axalta Industrial: Where We Have Come From 2013 2016 - 2018 Industrial sales 2x since 2013 1960 - 2013 2014 - 2018 P RO P RIE TARY Sensitivity: Business Internal 37

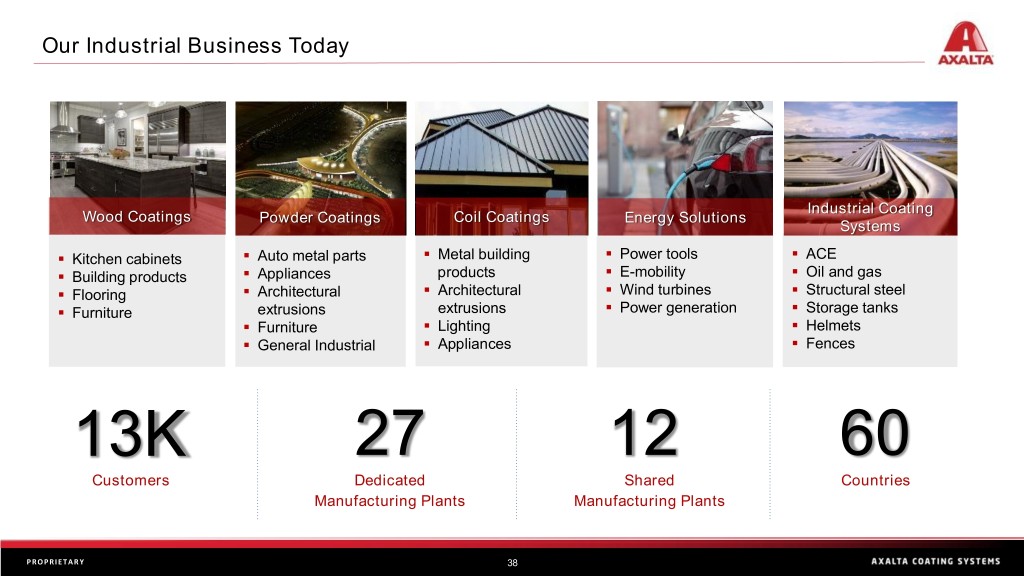

Our Industrial Business Today Industrial Coating Wood Coatings Powder Coatings Coil Coatings Energy Solutions Systems ▪ ▪ ▪ ▪ ▪ Auto metal parts Metal building Power tools ACE Kitchen cabinets ▪ ▪ ▪ ▪ Appliances products E-mobility Oil and gas Building products ▪ ▪ ▪ ▪ ▪ Architectural Architectural Wind turbines Structural steel Flooring ▪ ▪ ▪ extrusions extrusions Power generation Storage tanks Furniture ▪ ▪ ▪ Furniture Lighting Helmets ▪ ▪ ▪ General Industrial Appliances Fences 13K 27 12 60 Customers Dedicated Shared Countries Manufacturing Plants Manufacturing Plants P RO P RIE TARY Sensitivity: Business Internal 38

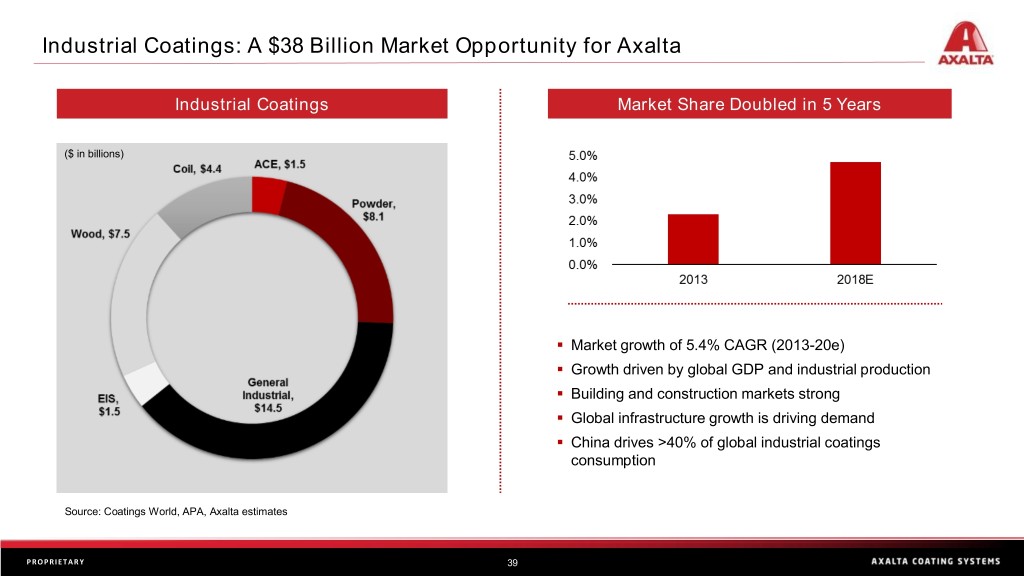

Industrial Coatings: A $38 Billion Market Opportunity for Axalta Industrial Coatings Market Share Doubled in 5 Years ($ in billions) ▪ Market growth of 5.4% CAGR (2013-20e) ▪ Growth driven by global GDP and industrial production ▪ Building and construction markets strong ▪ Global infrastructure growth is driving demand ▪ China drives >40% of global industrial coatings consumption Source: Coatings World, APA, Axalta estimates P RO P RIE TARY Sensitivity: Business Internal 39

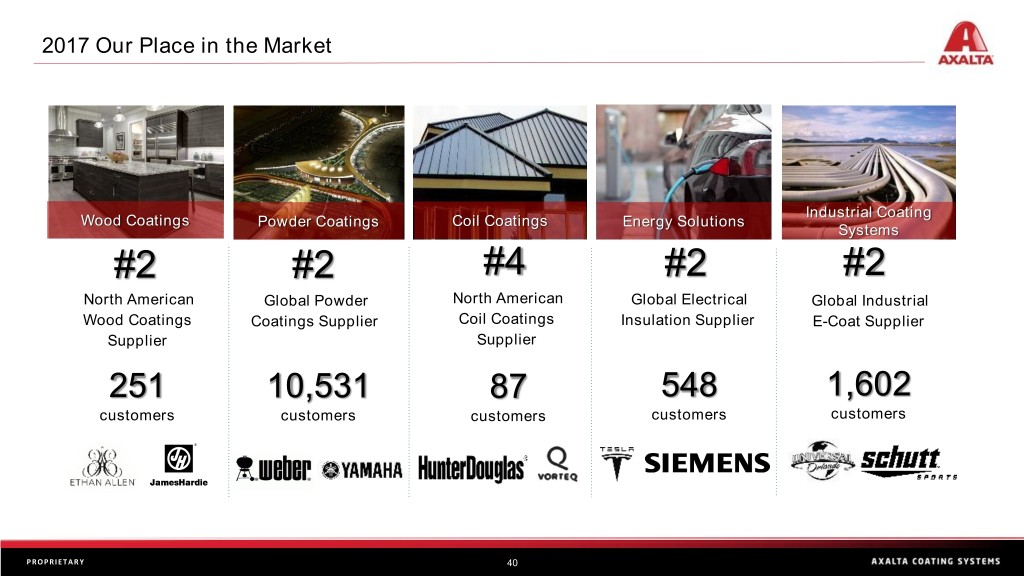

2017 Our Place in the Market Industrial Coating Wood Coatings Powder Coatings Coil Coatings Energy Solutions Systems #2 #2 #4 #2 #2 North American Global Powder North American Global Electrical Global Industrial Wood Coatings Coatings Supplier Coil Coatings Insulation Supplier E-Coat Supplier Supplier Supplier 251 10,531 87 548 1,602 customers customers customers customers customers P RO P RIE TARY Sensitivity: Business Internal 40

Transportation Coatings Sensitivity: Business Internal

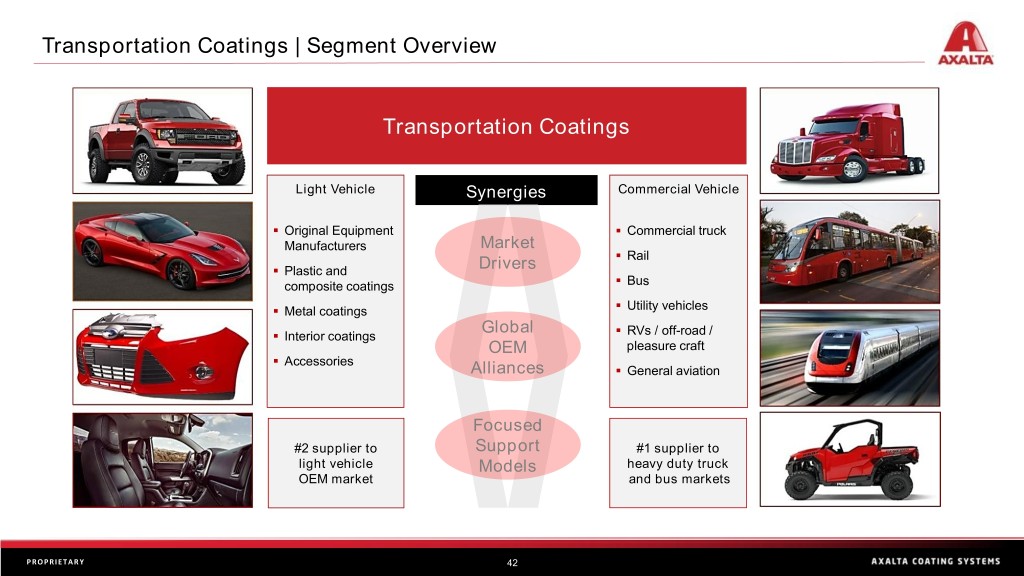

Transportation Coatings | Segment Overview Transportation Coatings Light Vehicle Synergies Commercial Vehicle ▪ Original Equipment ▪ Commercial truck Manufacturers Market ▪ Rail ▪ Drivers Plastic and ▪ composite coatings Bus ▪ ▪ Metal coatings Utility vehicles Global ▪ ▪ Interior coatings RVs / off-road / OEM pleasure craft ▪ Accessories Alliances ▪ General aviation Focused #2 supplier to Support #1 supplier to light vehicle Models heavy duty truck OEM market and bus markets P RO P RIE TARY Sensitivity: Business Internal 42

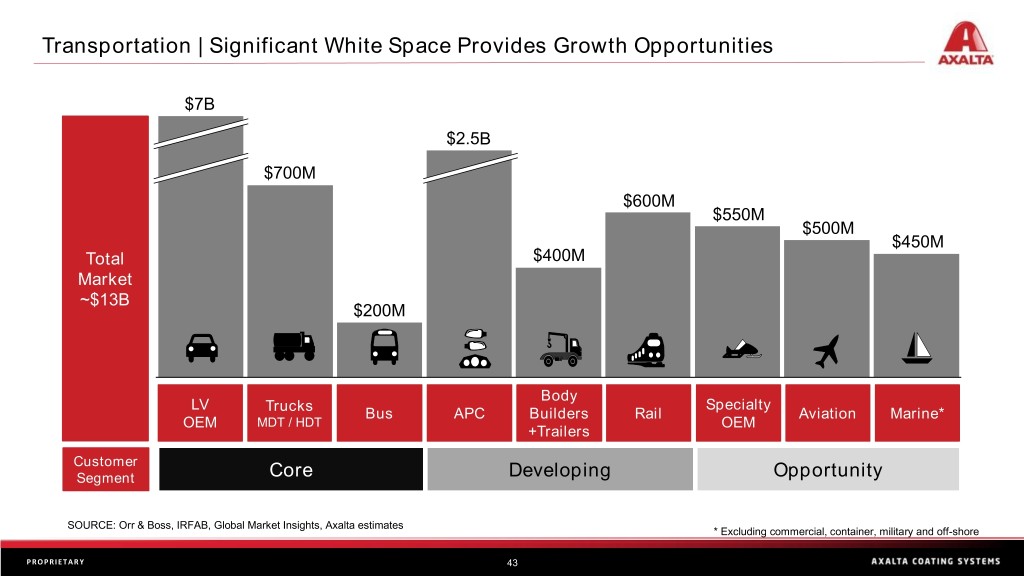

Transportation | Significant White Space Provides Growth Opportunities $7B ~ $2.5B $700M $600M $550M $500M $450M Total $400M Market ~$13B $200M Body LV Trucks Specialty Bus APC Builders Rail Aviation Marine* OEM MDT / HDT OEM +Trailers Customer Segment Core Developing Opportunity SOURCE: Orr & Boss, IRFAB, Global Market Insights, Axalta estimates * Excluding commercial, container, military and off-shore P RO P RIE TARY Sensitivity: Business Internal 43

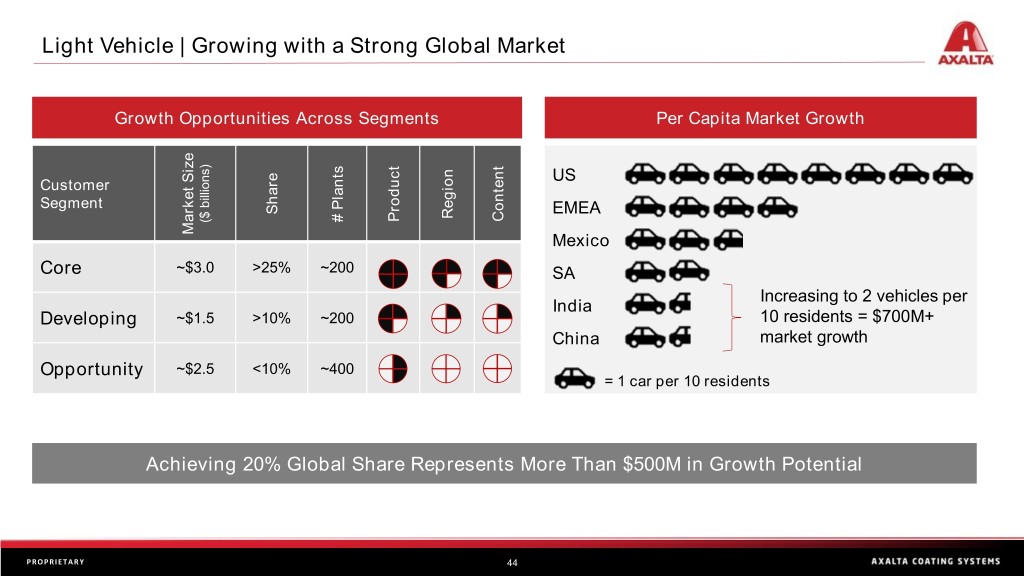

Light Vehicle | Growing with a Strong Global Market Growth Opportunities Across Segments Per Capita Market Growth US Customer Segment Share EMEA Region Content Product # Plants # ($ billions) ($ Market Size Market Mexico Core ~$3.0 >25% ~200 SA Increasing to 2 vehicles per India Developing ~$1.5 >10% ~200 10 residents = $700M+ China market growth Opportunity ~$2.5 <10% ~400 = 1 car per 10 residents Achieving 20% Global Share Represents More Than $500M in Growth Potential P RO P RIE TARY Sensitivity: Business Internal 44

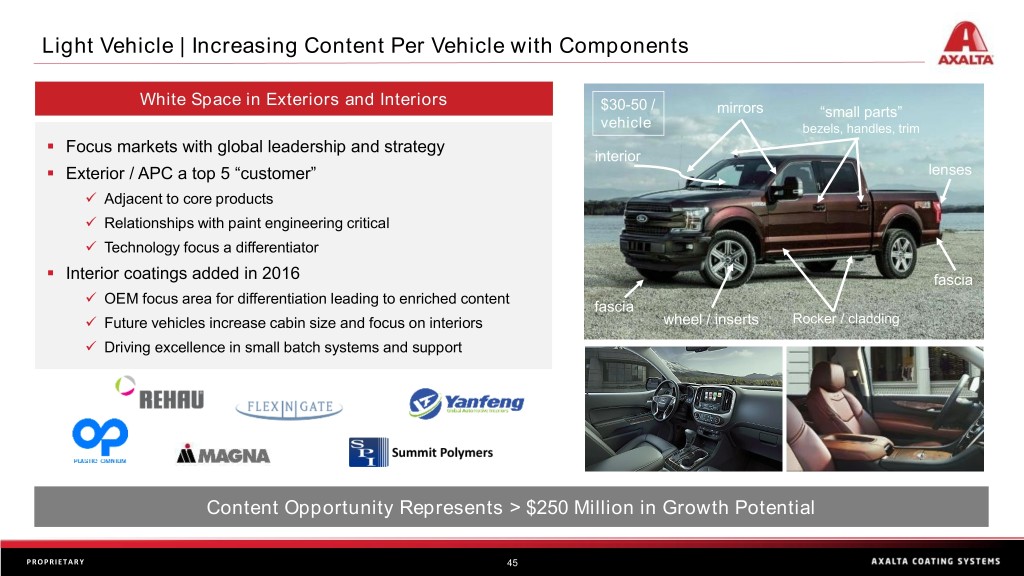

Light Vehicle | Increasing Content Per Vehicle with Components White Space in Exteriors and Interiors $30-50 / mirrors “small parts” vehicle bezels, handles, trim ▪ Focus markets with global leadership and strategy interior ▪ Exterior / APC a top 5 “customer” lenses ✓ Adjacent to core products ✓ Relationships with paint engineering critical ✓ Technology focus a differentiator ▪ Interior coatings added in 2016 fascia ✓ OEM focus area for differentiation leading to enriched content fascia ✓ Future vehicles increase cabin size and focus on interiors wheel / inserts Rocker / cladding ✓ Driving excellence in small batch systems and support Content Opportunity Represents > $250 Million in Growth Potential P RO P RIE TARY Sensitivity: Business Internal 45

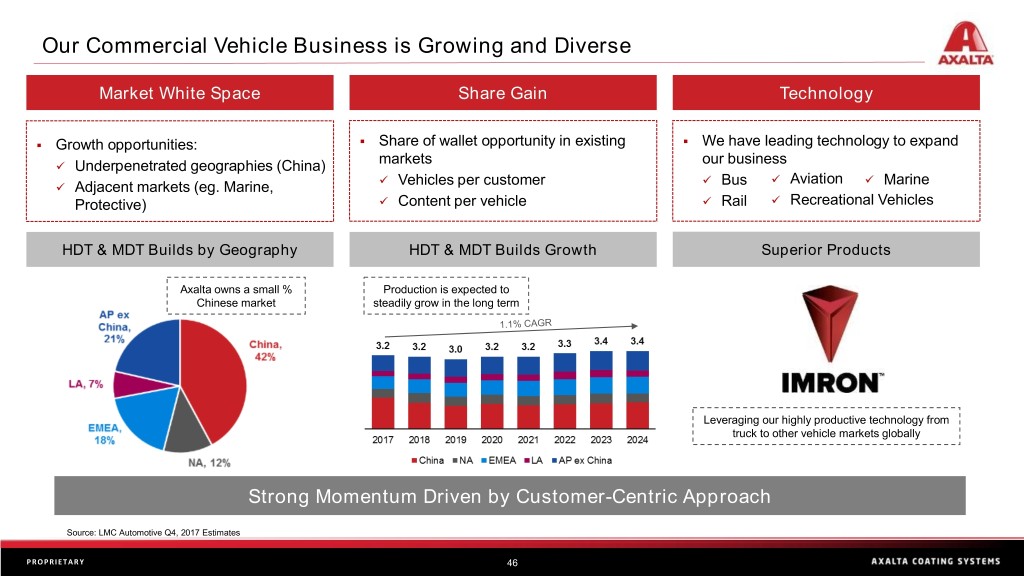

Our Commercial Vehicle Business is Growing and Diverse Market White Space Share Gain Technology ▪ ▪ ▪ Growth opportunities: Share of wallet opportunity in existing We have leading technology to expand ✓ Underpenetrated geographies (China) markets our business ✓ ✓ ✓ Aviation ✓ Marine ✓ Adjacent markets (eg. Marine, Vehicles per customer Bus ✓ ✓ ✓ Protective) Content per vehicle Rail Recreational Vehicles HDT & MDT Builds by Geography HDT & MDT Builds Growth Superior Products Axalta owns a small % Production is expected to Chinese market steadily grow in the long term Leveraging our highly productive technology from truck to other vehicle markets globally Strong Momentum Driven by Customer-Centric Approach Source: LMC Automotive Q4, 2017 Estimates P RO P RIE TARY Sensitivity: Business Internal 46

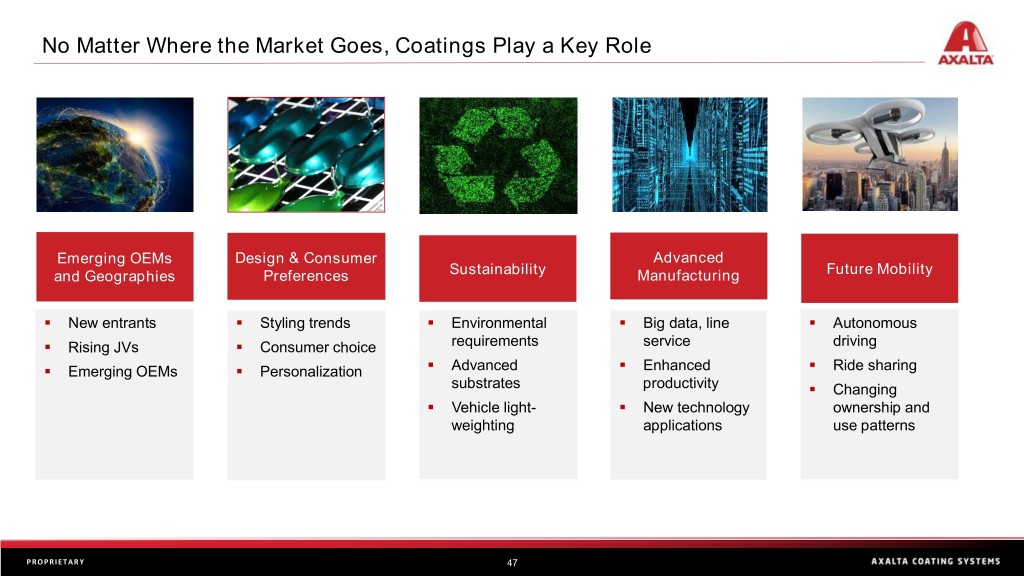

No Matter Where the Market Goes, Coatings Play a Key Role Emerging OEMs Design & Consumer Advanced and Geographies Preferences Sustainability Manufacturing Future Mobility ▪ New entrants ▪ Styling trends ▪ Environmental ▪ Big data, line ▪ Autonomous ▪ Rising JVs ▪ Consumer choice requirements service driving ▪ ▪ ▪ ▪ Emerging OEMs ▪ Personalization Advanced Enhanced Ride sharing substrates productivity ▪ Changing ▪ Vehicle light- ▪ New technology ownership and weighting applications use patterns P RO P RIE TARY Sensitivity: Business Internal 47

Investor Contact: Chris Mecray, VP, Strategy and IR christopher.mecray@axalta.com 215-255-7970 Sensitivity: Business Internal

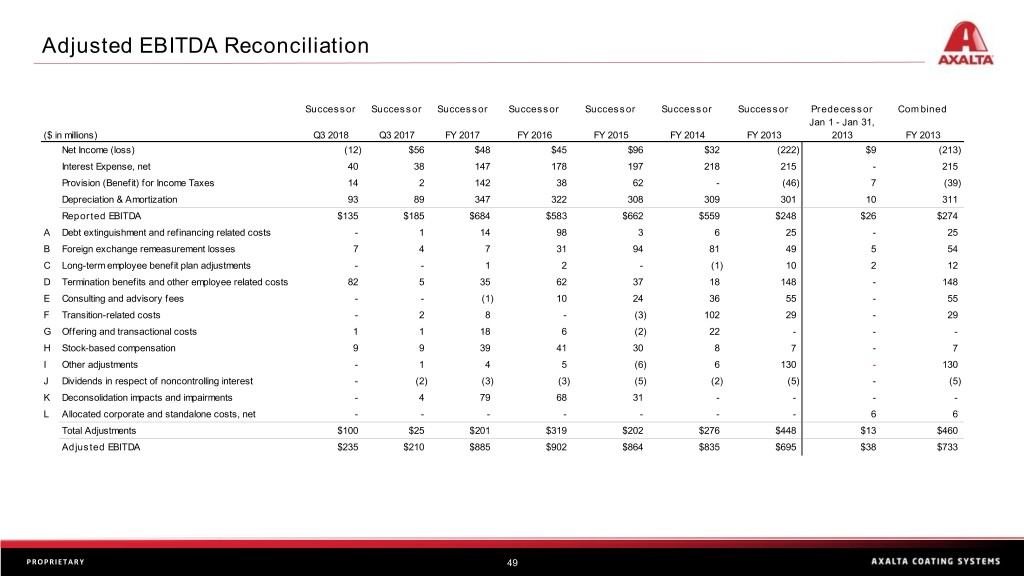

Adjusted EBITDA Reconciliation Successor Successor Successor Successor Successor Successor Successor Predecessor Combined Jan 1 - Jan 31, ($ in millions) Q3 2018 Q3 2017 FY 2017 FY 2016 FY 2015 FY 2014 FY 2013 2013 FY 2013 Net Income (loss) (12) $56 $48 $45 $96 $32 (222) $9 (213) Interest Expense, net 40 38 147 178 197 218 215 - 215 Provision (Benefit) for Income Taxes 14 2 142 38 62 - (46) 7 (39) Depreciation & Amortization 93 89 347 322 308 309 301 10 311 Reported EBITDA $135 $185 $684 $583 $662 $559 $248 $26 $274 A Debt extinguishment and refinancing related costs - 1 14 98 3 6 25 - 25 B Foreign exchange remeasurement losses 7 4 7 31 94 81 49 5 54 C Long-term employee benefit plan adjustments - - 1 2 - (1) 10 2 12 D Termination benefits and other employee related costs 82 5 35 62 37 18 148 - 148 E Consulting and advisory fees - - (1) 10 24 36 55 - 55 F Transition-related costs - 2 8 - (3) 102 29 - 29 G Offering and transactional costs 1 1 18 6 (2) 22 - - - H Stock-based compensation 9 9 39 41 30 8 7 - 7 I Other adjustments - 1 4 5 (6) 6 130 - 130 J Dividends in respect of noncontrolling interest - (2) (3) (3) (5) (2) (5) - (5) K Deconsolidation impacts and impairments - 4 79 68 31 - - - - L Allocated corporate and standalone costs, net - - - - - - - 6 6 Total Adjustments $100 $25 $201 $319 $202 $276 $448 $13 $460 Adjusted EBITDA $235 $210 $885 $902 $864 $835 $695 $38 $733 P RO P RIE TARY Sensitivity: Business Internal 49

Adjusted EBITDA Reconciliation (cont’d) A. During 2017, 2016 and 2014 we refinanced our indebtedness, resulting in losses of $13 million, $88 million and $3 million respectively. During 2017, 2016, 2015 and 2014 we prepaid outstanding principal on our term loans, resulting in non-cash extinguishment losses of $1 million, $10 million, $3 million and $3 million, respectively. Also during 2013, upon the issuance of the Senior Notes and the entry into the Senior Secured Credit Facilities, we expensed commitment fees related to a terminated Bridge Facility of $25 million. We do not consider these items to be indicative of our ongoing operative performance. B. Eliminates foreign exchange gains and losses resulting from the remeasurement of assets and liabilities denominated in foreign currencies, net of impacts of our foreign currency instruments used to hedge our balance sheet exposures. Exchange effects included the remeasurement of our Venezuelan subsidiary prior to deconsolidation in 2017 as well as a $19 million loss related to the acquisition date settlement by Axalta of the DuPont Performance Coatings business ("the Acquisition") of a foreign currency contract used to hedge the variability of Euro-based financing. C. Eliminates the non-cash, non-service components of long-term employee benefit costs including the elimination of a pension curtailment gain of $7 million during 2014. D. Represents expenses and associated adjustments to estimates primarily related to employee termination benefits and other employee-related costs associated with our Axalta Way and Fit for Growth cost- saving initiatives and additional Axalta CEO recruitment fees, which are not considered indicative of our ongoing operating performance. E. Represents expenses and associated changes to estimates for professional services primarily related to our Axalta Way and Fit for Growth initiatives, which are not considered indicative of our ongoing operating performance. Amounts incurred during 2013 and 2014 relate to services rendered in conjunction with our transition from DuPont to a standalone entity. F. During 2013, 2014 and 2015 we recorded charges associated with the transition from DuPont to a standalone entity, including branding and marketing, information technology related costs, and facility transition costs. Charges and associated changes to estimates during 2017 and 2018 represent integration costs related to the acquisition of the Industrial Wood business that was a carve-out business from Valspar. All charges are not considered indicative of our ongoing operating performance. G. Represents acquisition-related expenses, including changes in the fair value of contingent consideration, as well as $10 million of costs associated with contemplated merger activities during 2017 and costs associated with the IPO and secondary offerings of our common shares by Carlyle. Included in the 2014 charges was a $13 million pre-tax charge associated with the termination of the management agreement with Carlyle Investment Management, L.L.C., an affiliate of Carlyle, upon the completion of the IPO. All amounts discussed are not considered indicative of our ongoing operating performance. H. Represents non-cash costs associated with stock-based compensation, including $8 million of expense during 2015 attributable to the accelerated vesting of all issued and outstanding stock options issued under the Axalta Coating Systems Bermuda Co., Ltd 2013 Equity Incentive Plan (the "2013 Plan") as a result of Carlyle's interest falling below 50% and triggering a liquidity event. I. Represents costs for certain non-operational or non-cash (gains) and losses unrelated to our core business and which we do not consider indicative of ongoing operations, including equity investee dividends, indemnity losses (gains) associated with the Acquisition, losses (gains) on sale and disposal of property, plant and equipment, losses (gains) on the remaining foreign currency derivative instruments and non-cash fair value inventory adjustments associated with our business combinations. During 2013 we recorded non-cash fair value inventory adjustments and merger and acquisition charges associated with the Acquisition from DuPont for $104 million and $28 million, respectively. J. Represents the payment of dividends to our joint venture partners by our consolidated entities that are not 100% owned, which are reflected to show cash operating performance of these entities on Axalta’s financial statements. K. During 2017, we recorded a loss in conjunction with the deconsolidation of our Venezuelan subsidiary of $71 million. During 2016, we recorded non-cash impairments at our Venezuela subsidiary of $68 million associated with our operational long-lived assets and a real estate investment. Additionally, during 2017, we recorded non-cash impairment charges related to certain manufacturing facilities previously announced for closure of $8 million. We do not consider these to be indicative of our ongoing operating performance. L. Represents (1) the add-back of corporate allocations from DuPont to DPC for the usage of DuPont’s facilities, functions and services; costs for administrative functions and services performed on behalf of DPC by centralized staff groups within DuPont; a portion of DuPont’s general corporate expenses; and certain pension and other long-term employee benefit costs, in each case because we believe these costs are not indicative of costs we would have incurred as a standalone company net, of (2) estimated standalone costs based on a corporate function resource analysis that included a standalone executive office, the costs associated with supporting a standalone information technology infrastructure, corporate functions such as legal, finance, treasury, procurement and human resources and certain costs related to facilities management. This resource analysis included anticipated headcount and the associated overhead costs of running these functions effectively as a standalone company of our size and complexity. This estimate is provided for additional information and analysis only, as we believe that it facilitates enhanced comparability between Predecessor and Successor periods. It represents the difference between the costs that were allocated to our predecessor by its parent and the costs that we believe would be incurred if it operated as a standalone entity. P RO P RIE TARY Sensitivity: Business Internal 50