UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

October 30, 2018

Date of Report

MARKER THERAPEUTICS, INC.

(Exact name of registrant as specified in its charter)

| Delaware | 001-37939 | 45-4497941 |

| (State or other jurisdiction of incorporation) |

(Commission File Number) | (IRS Employer Identification No.) |

|

5 West Forsyth Street Suite 200 Jacksonville, FL |

32202 | |

| (Address of principal executive offices) | (Zip Code) |

(904) 516-5436

Registrant’s telephone number, including area code

N/A

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). Emerging growth company ¨

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Introductory Note

On October 17, 2018, Marker Therapeutics, Inc., formerly known as TapImmune Inc. (“Marker” or the “Company”, and prior to the merger described below, “TapImmune”), completed its business combination with Marker Cell Therapy, Inc. (formerly Marker Therapeutics, Inc.), a privately-held Delaware corporation (“Marker Cell”) dedicated to the development of non-gene modified T cell therapies for the treatment of hematologic malignancies and solid tumors, in accordance with the terms of an Agreement and Plan of Merger and Reorganization, dated as of May 15, 2018 (the “Merger Agreement”), by and among the Company, Timberwolf Merger Sub, Inc., a Delaware corporation and wholly-owned subsidiary of the Company (“Merger Sub”), and Marker Cell. On October 17, 2018, pursuant to the Merger Agreement, Merger Sub was merged with and into Marker Cell (the “Merger”), with Marker Cell being the surviving corporation and becoming a wholly-owned subsidiary of the Company. In connection with the Merger, the Company reincorporated to a Delaware corporation and changed its name to Marker Therapeutics, Inc., and Marker Cell changed its name to Marker Cell Therapy, Inc. The Company is filing this Current Report on Form 8-K to update the description of the Company’s business and risk factors after giving effect to the Merger.

Item 8.01. Other Events.

Cautionary Note Regarding Forward-Looking Statements

This Current Report on Form 8-K includes forward-looking statements within the meaning of Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) and Section 27A of the Securities Act of 1933, as amended (the “Securities Act”). For this purpose, any statements contained herein, other than statements of historical fact, including future financial and operating results, targeted product milestones and potential revenues; future opportunities of the Company; the progress and timing of product development programs and related trials; the potential efficacy of products and product candidates; and the strategy, projected costs, prospects, plans and objectives of management of the Company, may be forward-looking statements under the provisions of The Private Securities Litigation Reform Act of 1995. Words such as “anticipate,” “believe,” “could,” “estimate,” “expect,” “intend,” “may,” “plan,” “project,” “should,” “target,” “will,” “would” or other words that convey uncertainty of future events or outcomes are used to identify these forward-looking statements. Actual results may differ materially from those indicated by such forward-looking statements as a result of various important factors, including “critical accounting estimates” and risks relating to: the ability to maintain compliance with NASDAQ listing standards; the liquidity and trading market for the Company’s common stock; clinical trials, including difficulties or delays in the completion of patient enrollment, data collection or data analysis; uncertainties in obtaining successful pre-clinical and clinical results for product candidates and unexpected costs that may result therefrom; ability to manufacture sufficient product to conduct clinical trials; ability to manage potential conflicts of interest concerning manufacturing and licensing matters; ability to obtain required regulatory approvals for product candidates; costs, timing and regulatory review of the Company’s studies and clinical trials; failure to realize any value of certain product candidates being developed, in light of inherent risks and difficulties involved in successfully bringing product candidates to market; the ability to develop new product candidates; the ability to commercialize and launch any product candidate that receives regulatory approval; the ability to attain market acceptance among physicians, patients, patient advocacy groups, health care payors and the medical community for future products of the Company; the ability to market any approved drug successfully or at all once it is on the market in light of challenges relating to regulatory compliance, pricing, market acceptance and competition; the ability to obtain the substantial additional funding required to conduct development and commercialization activities; and the ability to obtain, maintain and enforce patent and other intellectual property protection for currently marketed products and product candidates. Many of these factors that will determine actual results are beyond the Company’s ability to control or predict. If one or more of these factors materialize, or if any underlying assumptions prove incorrect, actual results, performance or achievements may vary materially from any future results, performance or achievements expressed or implied by these forward-looking statements. In addition, any forward-looking statements in this Current Report on Form 8-K represent the Company’s views only as of the date of this Current Report on Form 8-K and should not be relied upon as representing the Company’s views as of any subsequent date. The Company anticipates that subsequent events and developments will cause its views to change. However, while the Company may elect to update these forward-looking statements publicly at some point in the future, the Company specifically disclaims any obligation to do so, except as may be required by law, whether as a result of new information, future events or otherwise. The Company’s forward-looking statements generally do not reflect the potential impact of any future acquisitions, mergers, dispositions, joint ventures or investments it may make.

DESCRIPTION OF THE COMPANY’S BUSINESS

See the Glossary at the end of this Form 8-K for definitions of certain technical terms frequently used herein.

Overview

The Company is a clinical-stage immuno-oncology company specializing in the development and commercialization of innovative cell-based immunotherapies for the treatment of hematological malignancies and solid tumor indications and novel peptide-based vaccines for the treatment of breast and ovarian cancers. The Company’s cell-based immunotherapy technology is based on the selective expansion of non-engineered, tumor-specific T cells that recognize tumor associated antigens (i.e. tumor targets) and kill tumor cells expressing those targets. Once infused into patients, this population of T cells recognizes multiple tumor targets to produce broad spectrum anti-tumor activity. Because the Company does not genetically engineer its T cells, when compared to current engineered CAR-T and TCR-based approaches, its products (i) are significantly less expensive and easier to manufacture, (ii) appear to be markedly less toxic, and (iii) are associated with meaningful clinical benefit. As a result, the Company believes its portfolio of T cell therapies has a compelling therapeutic product profile, as compared to current gene-modified CAR-T and TCR-based therapies. In addition, the Company’s legacy TapImmune Folate Receptor Alpha program (TPIV200) for breast and ovarian cancers and its HER2/neu program (TPIV100/110) are in Phase II clinical trials. In parallel, the Company has been working on a proprietary nucleic acid-based antigen expression technology named PolyStart™ to improve the ability of the immune system to recognize and destroy diseased cells.

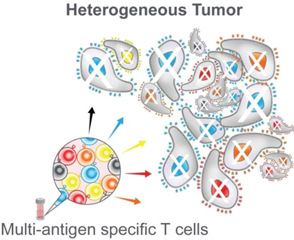

Immuno-oncology, which utilizes a patient’s own immune system to combat cancer, is one of the most actively pursued areas of research by biotechnology and pharmaceutical companies today. Interest and excitement about immunotherapy is driven by compelling efficacy data in cancers with historically bleak outcomes, and the potential to achieve a cure or functional cure for some patients. Harnessing the power of the immune system is an important component of fighting cancerous cells in the body. The Company’s MultiTAA T cell therapy platform identifies and selects for effectively all T cells that are specific for any peptide from the antigens that the Company targets (e.g., WT1, MAGE-A4, PRAME, Survivin, NY-ESO-1, and SSX2). The Company’s in-vitro manufacturing process promotes proliferation of very rare cancer-killing T cells to augment their anti-tumor properties and provide benefit to patients following their infusion. By using the multi-antigen targeted approach, the Company’s proprietary technology can kill heterogeneous tumor cell populations more effectively than single-antigen targeted approaches, thereby reducing the likelihood of tumor escape and potentially increasing the durability of a patient’s response to therapy.

The Company believes that its therapy presents a promising innovation in immuno-oncology. The Company’s therapy has been developed through its collaboration with the Cell and Gene Therapy Center at the Baylor College of Medicine (“BCM”) founded by Malcolm K. Brenner, M.D., Ph.D., a recognized pioneer in immuno-oncology. Marker Cell’s founders include Drs. Malcolm Brenner M.D., PhD, Ann Leen, PhD., Juan Vera, M.D., Helen Heslop, M.D., DSc (Hon) and Cliona Rooney, PhD, who have significant experience in this field.

The Company’s Strategy

The goal of the Company is to be the leader in the development and commercialization of transformative and best-in-class immunotherapies for the treatment of hematological malignancies and solid tumors. The Company will be developing a portfolio of highly-differentiated T cell therapies utilizing its MultiTAA platform that has the potential to significantly disrupt the current cell therapy landscape, while substantially improving survival and quality of life for patients with cancers.

| 2 |

Key elements of the Company’s strategy include:

• Expedite clinical development, regulatory approval, and commercialization of the Company’s lead product candidates.

Based on results in the Phase I clinical trials conducted at BCM, the Company plans to advance its lead product candidates into Phase II clinical trials and facilitate the initiation of Company-sponsored clinical trials in post-transplant AML and in lymphoma. The Company expects to finalize its clinical trial protocols by the end of 2018.

The Company plans to initiate a Phase II clinical trial in post-transplant AML in the second quarter of 2019 and a Phase II clinical trial in relapsed/refractory (“r/r”) Non-Hodgkin’s Lymphoma (“NHL”) in 2020. The Company anticipates that product manufacturing in support of those clinical trials will be conducted at BCM within its GMP cell manufacturing facility.

In 2019, the Company expects to begin the technology transfer process and begin the planning and implementation of additional GMP manufacturing capacity that would be capable of supporting the Company’s manufacturing needs with respect to pivotal trials. If the results of its Phase II studies are positive, the Company will explore potential avenues to achieve regulatory approval for the use of its products in these indications, including any potential avenues for accelerated approval. The U.S. Food and Drug Administration (“FDA”) may grant accelerated approval for product candidates for serious conditions that fill an unmet medical need based on a surrogate or intermediate endpoint. The Company believes that an accelerated approval strategy may be warranted given the limited options available for patients with post-transplant AML. However, if the FDA grants accelerated approval, confirmatory trials will be required by the FDA.

• Continue collaboration with the Company’s partners, and increase the Company’s internal research and development activities, to improve and develop adoptive cell therapy technologies.

The Company intends to finalize a strategic alliance with BCM, in which the Company would sponsor selected research at the institution in support of the Company’s technology. In conjunction with this strategic alliance, BCM will conduct selected Phase I/II clinical trials using the Company’s technology. If data from these early clinical trials appear positive, the Company will consider the therapeutic and commercial potential for such therapies to be advanced as new products for the Company.

In addition, the Company plans to use BCM facilities to enable the process development and manufacturing required to support the Phase II clinical trials of the Company’s product candidates. Outside of its relationship with BCM, the Company will invest in its research and development and CMC capabilities to enhance its ability to conduct process development to optimize its manufacturing process, product quality and commercial scalability.

The Company believes that its G-Rex® based manufacturing process is highly robust and scalable, and it will continue to invest resources in further refining the manufacturing process to create a product with highly attractive commercial attributes. The Company plans to engage Wilson Wolf Manufacturing Corporation (a company controlled by John Wilson, who is a director of the Company) in discussions to further customize the G-Rex® to optimally match the Company’s manufacturing requirements, as well as to develop a scalability plan to drive efficiencies for a commercial product.

• Invest in the Company’s platform to maximize the beneficial outcomes for cancer patients.

The Company plans to explore new product opportunities by expanding and/or customizing the antigens the Company targets, in order to expand the indications in which the Company’s products may be used, including solid tumors or other hematologic malignancies. Additionally, the Company’s research and development efforts may include the exploration of dosing and/or frequency of product administration and the relationship of these factors with potential therapeutic benefit.

| 3 |

• Leverage the Company’s relationships with its founding institutions, scientific founders and other scientific advisors.

The Company’s world renowned scientific founders and scientific advisors have made seminal contributions to major discoveries in the field of immuno-oncology, and have significant experience in oncology, immunology and cell therapy. The Company intends to be a science-driven company in its strategic decision-making and thus it intends to significantly leverage the knowledge, experience and advice of its scientific founders and advisors, as well as the institutional expertise of BCM, the Mayo Clinic and our other major institutional partners, to advance its therapies through the clinic and into commercialization.

The Company is in the process of evaluating the legacy therapeutic products and programs of the Company to determine the future strategy and the proper allocation of resources to best maximize stockholder value in the Company. In conjunction with this strategic review, the reconstituted board of directors and management of the Company may de-emphasize or terminate therapeutic products or programs, as appropriate. The Company’s board and management plan to make this strategic review a high priority now that the Merger has been completed, and expect to continue this strategic review on an ongoing basis.

Legacy Marker Cell Products

Multi Tumor-Associated Antigen (MultiTAA) Approach

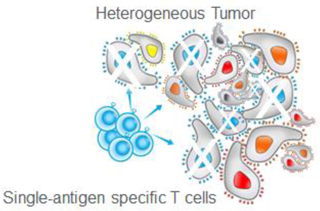

By their nature, cancers are heterogeneous in their expression of antigens, meaning that a tumor generally consists of individual cancer cells that express different antigens, and each of those antigens can be present at a different level that can change over time. If a therapy targets only a single antigen, it is vulnerable to evolutionary escape mechanisms.

Even if the single-antigen specific therapy can eliminate all the tumor cells expressing the targeted antigen, the residual tumor cells that do not express that antigen may survive and expand. In addition, tumor cells may also downregulate or mutate the targeted antigen, thus becoming invisible to the T cell therapy. Both phenomena create a transformed tumor that is impervious to that therapy. This process is referred to as antigen-negative tumor immune escape. The Company’s solution to the problem of tumor heterogeneity was to develop T cell products that simultaneously attack multiple tumor-expressed antigens and thereby enable more complete initial tumor targeting, thus minimizing the subsequent opportunity for the cancer to engage escape mechanisms. Of note, data suggest this strategy may be responsible for recruitment and activation of unique cancer-killing cells from the patient’s own immune repertoire to participate in cancer eradication, further minimizing the possibility for tumor cell escape.

| 4 |

The Company’s proprietary MultiTAA T cell platform may have meaningful advantages over current CAR-T and TCR cell therapy approaches. Compared to current gene-modified T cell therapies, the Company’s programs are characterized by the following:

•Demonstrated clinical benefit, without the need for lymphodepletion before infusion: In its Phase I lymphoma study, the Company saw complete responses (“CRs”) in 50 – 60% of its evaluable patients. The Company believes it is significant that no patient with a CR has subsequently relapsed with disease, whereas typically 30% or more of patients with CR in reported CAR-T studies relapse within one year. In patient results to date, observed therapeutic responses appear to be highly durable, with some patients being relapse-free beyond two years.

•Non-gene-modified: Unlike CAR-T and TCR approaches, the Company’s therapy requires no genetic modification of T cells, a costly and complex process that significantly complicates the manufacturing of a patient product. The Company believes its therapy can be manufactured at a fraction of the cost of a gene-modified T cell product, with substantially reduced complexity of manufacturing.

•Low incidence rate of adverse events: In approximately 60 patients treated to date, the Company has seen only one grade III adverse reaction possibly related to its therapy. This appears to compare favorably with published CD19 CAR-T studies, wherein up to 95% of patients had associated grade III or higher adverse events during treatment. The Company believes that it is notable that there have been no cases of cytokine-release syndrome (“CRS”), or related serious adverse events (“SAEs”) in patients treated with its therapy to date.

•Capable of addressing a broad repertoire of cancer cells: While CAR-T and TCR therapies generally target a single epitope, the Company’s manufacturing process selects for T cells that are specific for multiple peptides derived from several targeted antigens. Deep gene sequencing of the Company products shows that a typical patient dose usually consists of approximately 4,000 unique T cell clonotypes targeting up to five different tumor-associated antigens. In layman’s terms, the five antigen targets can be recognized by a very wide range of T cells, facilitating robust killing of targeted cancer cells.

•Appears to drive endogenous immune responses: The Company sees evidence of “epitope spreading” in its patients, meaning that the Company’s therapy is potentially inducing an enhanced response by the patient’s own T cells (specific for an expanded set of tumor-associated antigens beyond those targeted by the Company’s infused product). The Company’s correlative analyses show expansion of endogenous T cells, other than those present in the Company product, in the months following the infusion of the Company’s product. This phenomenon, also known as “antigen spreading,” is potentially important in generating a durable response for a patient, because it enables the killing of tumors that do not express any of the antigens initially targeted by the Company’s product.

| 5 |

Legacy TapImmune Products

In contrast to standard therapies for cancer treatment including surgery, radiation therapy and chemotherapy that target both cancer cells and normal cells, the Company has been developing vaccines that precisely target breast, colorectal, ovarian and non-small cell lung cancers. The Company is currently developing three core technology platforms:

1) an exclusively licensed peptide-based vaccine (composition and methods of use) for the treatment of HER2/neu+ breast cancer that overexpresses Human Epidermal Growth Factor Receptor 2 (HER2/neu+) (TPIV100/110),

(2) an exclusively licensed peptide-based vaccine (composition and methods of use) for treating breast and ovarian cancers that overexpress Folate Receptor Alpha (TPIV200), and

(3) a wholly-owned nucleic acid-based vaccine (composition and methods of use) technology (PolyStart™) for treatment of various cancers or infectious disease.

The Company’s peptide vaccines derived from naturally processed T cell antigens discovered using cancer patient samples and the Company’s PolyStart™ expression technology, which improves antigen presentation to T cells, are not just effective therapies on their own, but can also to enhance the efficacy of other immunotherapy approaches such as CAR-T and PD-1 inhibitors, for example.

Products and Technology in Development

| Product/Candidate | Description | Application | Status | |||||||

| TPIV100/110 HER2/neu Breast Cancer Vaccine | Peptide Vaccine | Treatment of HER2/neu+ Breast Cancer | Phase I trial completed Phase I(b) trial to start in 2018 Phase I/II to start in 2018 (TPIV110) |

|||||||

| TPIV200 Folate Receptor Alpha Vaccine | Peptide Vaccine | Treatment of Folate Receptor Alpha+/Triple-Negative Breast and Ovarian Cancer | Phase I trial completed Multiple Phase II trials started in 2016 and 2017 | |||||||

| PolyStart™ | Nucleic acid expression technology | Broad Application to “Prime”- and- “Boost” | Preclinical |

Background and History of Cancer Immunotherapies

Despite advances in options for treatment, cancer continues to be one of the main causes of death in developed countries. Historically, cancer therapy has been constrained to surgery, radiation, and chemotherapy. More recently, advances in the understanding of the immune system’s role in cancer immune surveillance have led to immunotherapy becoming an important treatment approach. Cancer immunotherapy began with treatments that nonspecifically activated the immune system and had limited efficacy and/or significant toxicity. In contrast, newer immunotherapy treatments can activate specific, potent immune cells, leading to improved efficacy and safety. Within the immunotherapy category, treatments have included vaccines, cytokine therapies, antibody therapies, and adoptive cell therapies.

In 1996, Leach, Krummel and Allison reported that monoclonal antibodies (“mAbs”) blocking CTLA-4 could treat tumors in animal models. Subsequently, mAbs that targeted CTLA-4 and PD-1 became known as “immune checkpoint inhibitors” (“ICIs”). Immune checkpoints are a means by which cancer cells are able to inhibit or turn down the body’s immune response to cancer. By interfering with these cloaking mechanisms, ICIs have shown an ability to activate T cells, shrink tumors, and improve patient survival. Recent clinical data from checkpoint inhibitors such as ipilimumab, nivolumab and pembrolizumab have confirmed both the validity of this approach and the importance of T cells as promising tools for the treatment of cancer.

| 6 |

Despite these many advances, there persists a significant unmet need in cancer therapeutics. We believe that the use of human cells as a therapeutic modality to re-engage the immune system will be the next significant advancement in the treatment of cancer. These cellular therapies may avoid the long-term side effects associated with current treatments and have the potential to be effective regardless of the type of previous treatments patients have experienced.

T Cell Therapy Overview

The field of adoptive cell transfer (“ACT”) is currently comprised primarily of CAR and TCR engineered T cells and has emerged from principles of basic immunology to become a paradigm-shifting clinical immunotherapy. T cell therapy has evolved as one of the most promising branches of immunotherapy. T cell immunotherapy involves the infusion of immune cells into a patient. Immune cells used for immunotherapy treatments can either be collected from the patient (autologous) or harvested from a donor (allogenic). The cells are retrieved and mixed with specific antigens, then cultured to proliferate to reach a sufficient number before infusion into the patient. Upon infusion, the cells are capable of targeting and eliminating cancerous cells. Unlike chemotherapy, which is unable to distinguish between healthy and malignant cells, T cells produced for immunotherapy are able to selectively attack cancer cells that express the target antigen(s). This leads to a more effective treatment platform with fewer side effects. In addition, because of immunological memory, these infused T cells remain in the body for long periods of time, thus leading to longer and more durable responses.

TCRs and CARs have distinct signaling properties and antigen sensitivities. TCRs recognize peptide fragments from proteins expressed either inside the cell or on the cell surface. CARs are programmed to recognize a specific cell surface protein. Because CARs are specific for a single antigen, or more precisely a single epitope within the single antigen, they are very narrowly focused and come with limitations. While it is true that they may eliminate the tumor cells that express the target antigen, when applying a CAR-T cell product to a specific antigen of a heterogeneous disease, CAR-T cells may leave behind tumor cells that do not express the target antigen, which can lead to tumor relapse due to immune escape.

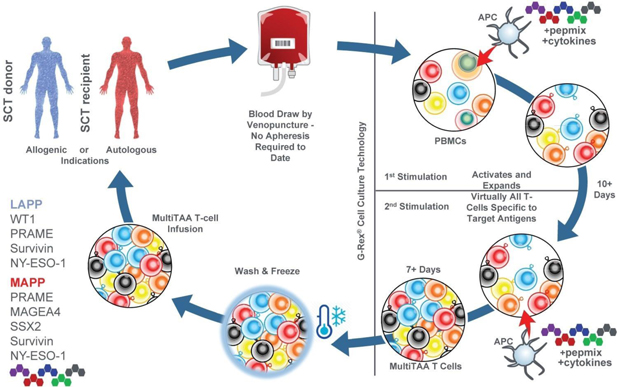

The Company’s approach is to avoid genetic engineering by relying upon the native T cell receptor, which has evolved over millions of years to provide T cells with an exquisite capacity to recognize and kill cancer cells. Use of the native T cell receptor is the bedrock of the Company’s versatile immunotherapy, which is intended to provide a cost-effective and non-toxic strategy to target multiple tumor antigens and lead to durable responses. The process entails expanding tumor-specific T cells from patients, or a patient’s hematopoietic stem cell donor. This is achieved by in vitro manipulation consisting of co-culturing antigen presenting cells with patient (or donor) peripheral blood mononuclear cells (“PBMCs”). As a source of antigen, the Company uses overlapping peptide libraries spanning each of several immunogenic target antigens that are typically associated with certain types of cancer. These peptides are 15 amino acids in length, overlapping by 11 amino acids and span the entire length of each of the target antigens. This typical footprint of peptides allows the Company to induce both CD4 (helper) and CD8 (cytotoxic) T cells. Following manufacture, these cells are frozen and stored for later infusion. Once infused, the natural characteristics of T cells take over and the T cells multiply in quantity, when they encounter the targeted antigens expressed by cancer cells, forming an army of T cells that kill the targeted cancer cells.

Process Development and Manufacturing

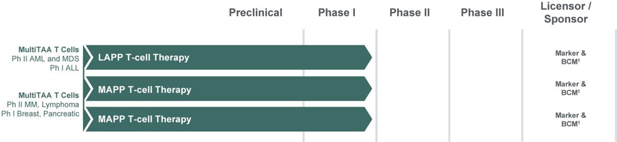

The Company is advancing two legacy Marker Cell products through clinical development. Mixed Antigen Peptide Pool (“MAPP”) T cells, which are currently used for patients with lymphoma, multiple myeloma and selected solid tumors, is an autologous product that targets the NY-ESO-1, PRAME, MAGE-A4, Survivin and SSX2 antigens. Leukemia Antigen Peptide Pool (“LAPP”) T cells, which are used for patients with AML, is an allogeneic product targeting the WT1, NY-ESO-1, PRAME, and Survivin antigens using the blood of the stem cell donor as a source of the cells used for therapy. While the blood source and the antigens for stimulation differ between the LAPP and the MAPP products, the manufacturing process for each product is otherwise identical.

| 7 |

In the manufacturing process, blood is drawn from either the individual patient (in the case of the autologous MAPP T cells) or from the allogeneic stem cell transplant donor (in the case of the allogeneic LAPP T cells). Although the T cells that are selected and expanded by the Company process exist in a patient’s circulating blood, these T cells are often present at very low frequencies. More importantly, researchers at BCM believe that these T cells are adversely affected by the suppressive tumor microenvironment. It is a well-accepted concept that cancers not only evade immune detection but often actively suppress the function of the human immune system. The Company’s manufacturing and culturing process is intended to (i) identify the T cells specific for the antigens that the Company intends to target, (ii) restore these T cells to functionality with respect to their anti-tumor capability and (iii) expand the population of those T cells specific for the Company’s targets to achieve the required patient dose.

After blood is drawn, the required component cells, including monocytes and PBMCs, are extracted from the blood, isolated and cryopreserved. Sufficient numbers of cryopreserved monocytes and PBMCs are taken to be used to manufacture a patient-specific product. These cells are placed inside a G-Rex® manufacturing device and combined with an experimentally optimized cocktail of GMP-grade cytokines that is used to restore and enhance the functional capability of the cultured T cells.

In addition, libraries of overlapping peptides (pepmix) spanning the target antigens are combined and added to the cell culture. Each peptide within the pepmix represents a small segment of a target antigen, which a T cell might recognize. Each library represents the entire protein sequence of a target antigen, with each peptide in the pepmix overlapping significantly with the peptides adjacent to it within the antigen’s protein sequence. This overlapping structure ensures that the Company can isolate, activate and expand any T cell that is specific for any segment of every antigen it targets in the unique genetic background of every patient.

The G-Rex® is a cell culture device manufactured by Wilson Wolf used by many cell therapy developers, both in commercial and academic settings. The device allows a user to introduce cells, media and other reagents into a cell culture chamber, which has a gas-permeable membrane at its bottom. The cells settle on this gas-permeable membrane through which oxygen and carbon dioxide are exchanged (i.e. the cells are allowed to breathe), while nutrients required for cell expansion are obtained from the medium above the cells. This system allows for the highly robust growth of cells in culture, by providing them with superior access to oxygen and nutrients. Cells manufactured in the device grow efficiently without need for further manipulation or agitation by a technician, scientist or automated system.

Inside the G-Rex®, PBMCs are co-cultured with dendritic cells that have been exposed to the stimulating pepmixes. This results in the selective expansion of T cells that specifically recognize the target antigens and the loss of other non-specific T cell populations. At the end of the manufacturing process, the resulting product is a mix of helper (CD4) and cytotoxic (CD8) T cells that recognize the antigens that the Company is targeting.

Once cell manufacturing is complete, the product is tested for identity, sterility, phenotype and safety before it is released for infusion into a patient. Sampling of product indicates that, on average, approximately 4,000 different T cell clonotypes are present in a typical 5-antigen-specific patient product.

Upon release of the final patient product, the cells are frozen and transported to the site where the cells will be administered. The standard dose for patients with lymphoma, AML or myeloma ranges from 5 – 20 million cells per meter squared (typically 10 – 40 million cells per adult patient). These cell doses represent a significantly smaller dose of cells, when compared to CAR-T or TCR therapies. As a result, the Company’s therapy requires only a very small infusion volume (less than 10 ml) that can be administered within minutes at an outpatient center. Because the Company’s therapies have generated only one grade 3 adverse event that was considered to be possibly related to the infused T cells out of approximately 60 patients dosed, patients do not need to be hospitalized and monitored overnight. Instead, the Company’s patients are evaluated for any immediate infusion-related reactions and can then usually be discharged within two hours.

| 8 |

Clinical-stage MultiTAA T Cell Therapy

(1) Baylor College of Medicine

The Company’s MAPP and LAPP product candidates identify and select for substantially all T cells that are specific for any peptide derived from the targeted antigens, thereby recognizing and killing heterogeneous tumors more effectively than single-antigen targeted approaches. These product candidates are currently in Phase I clinical trials for lymphoma, AML/myelodysplastic syndromes (MDS), and MM at BCM and each of these programs is ready for initiation of Phase II. BCM has also initiated Phase I trials in acute lymphocytic leukemia, breast and pancreatic cancers.

In lymphoma, MAPP T cell therapy is currently in a Phase I trial that has treated 13 patients with active disease (“lymphoma active group”), of which 11 patients had follow-up date beyond 3 months post-infusion, and 17 patients in remission (“lymphoma adjuvant group”). No SAEs or CRS have been observed in any of these patients.

| 9 |

Of the 11 patients in the lymphoma active group, 6 patients demonstrated a complete response, 1 patient had durable stable disease and 4 patients had transient disease stabilization (range 5 – 9 months). None of the complete responders has subsequently progressed after receiving MAPP T cells. The duration of response for the complete responders ranged from 5 months to over 2 years (ongoing). Of the 17 patients in the lymphoma adjuvant group, 15 patients were in a continuing complete response, as of the date of data cutoff. The duration of response for these patients ranged from 3 to 37 months.

In post-transplant AML, a setting where currently the only available alternative therapy is a donor lymphocyte infusion (DLI), the Company has seen significant therapeutic benefit for patients, without causing graft-versus-host disease (GVHD) — a frequent side effect of DLIs. LAPP T cell therapy is currently in a Phase I trial that has treated 5 patients with active disease (“AML/MDS active group”) after allogeneic hematopoietic stem cell transplant (HSCT), and 8 patients in remission after HSCT (“AML/MDS adjuvant group”), of which 7 patients were evaluable. One patient had a transient elevation in liver enzymes. Otherwise there were no possibly/probably related SAEs, nor episodes of CRS.

Of the 5 evaluable patients in the AML/MDS active group, 1 patient demonstrated a complete response, 1 patient demonstrated a partial response, and 1 patient demonstrated ongoing stable disease. The duration of response for the complete or partial response patients ranged from 7 to 11 months. Of the 7 evaluable patients in the AML/MDS adjuvant group, 5 patients demonstrated a continued complete response. The duration of response for these patients ranged from 8 to 20 months.

MAPP T cell therapy is also being evaluated in a Phase I/II trial for patients with MM. One arm of this trial assessed patients who received MAPP T cells more than 90 days after an autologous stem cell transplant (“ASCT”), while a second arm assessed patients who received MAPP T cells within 90 days of ASCT. The Company has not seen a meaningful difference in response rates or durability between the two arms and intends to standardize future trials based upon a protocol wherein patients will receive MAPP T cells immediately post ASCT.

Of the patients evaluated in the MM trial, there were 7 patients with residual active disease, 6 of whom were evaluable with greater than 3 months of available follow-up date. Of these evaluable patients, 2 patients demonstrated complete responses and 2 patients demonstrated partial responses. The duration of response ranged from 4 to 22 months. Additionally, there were 7 patients treated in remission after ASCT and all were evaluable. All patients remain in continuing complete response and none have subsequently progressed. The duration of response for these patients ranged from 4 to 22 months.

Intellectual Property

The Company’s commercial success will depend in part on its ability to obtain and maintain patent and other proprietary protection for its technology, inventions, improvements, and know-how related to the business; to defend and enforce proprietary rights, including any patents that the Company may own in the future; to preserve the confidentiality of its trade secrets and other intellectual property; to obtain and maintain licenses to use intellectual property owned by third parties; and to operate without infringing the valid and enforceable patents and other proprietary rights of third parties. The Company’s ability to stop third parties from making, using, selling, offering to sell, or importing its products may depend on the extent to which it has rights under valid and enforceable patents or trade secrets that cover these activities — in other words, the rights obtained under exclusive license arrangements such as those pursuant to the BCM license agreement. With respect to both licensed and Company-owned intellectual property, the Company cannot be sure that patents will be granted with respect to any of its pending patent applications or with respect to any patent applications filed in the future, nor can the Company be sure that any of its existing patents or any patents that may be granted in the future will be commercially useful in protecting its commercial products and methods of manufacturing the same.

The Company also relies on trade secrets and know-how relating to its proprietary technology and product candidates, continuing innovation, and in-licensing opportunities to develop, strengthen and maintain its proprietary position in the field of immuno-oncology. However, trade secrets can be difficult to protect. The Company also plans to rely on regulatory protection afforded through orphan drug designations, data exclusivity, market exclusivity and patent term extensions when available, as well as contractual agreements with our academic and commercial partners.

| 10 |

The Company requires each of its employees, consultants and advisors to execute a confidentiality agreement upon the commencement of any employment, consulting or advisory relationship with the Company. Each agreement provides that all confidential information developed or made known to the individual during the course of the relationship will be kept confidential and not be disclosed to third parties except in specified circumstances. In the case of employees, the agreements provide that all inventions conceived of by an employee shall be the Company’s exclusive property.

There can be no assurance that the Company’s patents, and any patents that may be issued or licensed to it in the future, will afford protection against competitors with similar technology. In addition, no assurances can be given that the patents issued or licensed to the Company will not be infringed upon or designed around by others or that others will not obtain patents that we would need to license or design around. If the courts uphold existing or future patents containing broad claims over technology used by the Company, the holders of such patents could require the Company to obtain licenses to use such technology. Patent coverage may also vary from country to country based on the scope of available patent protection. There are also opportunities to obtain an extension of patent coverage for a product in certain countries, which adds further complexity to the determination of patent life.

To achieve this objective, a strategic focus for the Company has been to identify and license key patents and patent applications that serve to enhance the Company’s intellectual property and technology position. The Company’s intellectual property portfolio currently includes patent applications having: (1) claims directed to methods of generating multi-antigen specific T cell products; and (2) claims directed to therapeutic uses of such multi-antigen specific T cell products. The Company believes its patent portfolio, together with its efforts to develop and patent next generation technologies, provides it with a substantial intellectual property position. However, the area of patent and other intellectual property rights in biotechnology is an evolving one with many risks and uncertainties. Currently, all of the Company’s MultiTAA intellectual property rights are licensed from BCM.

Legacy Marker Cell Intellectual Property

BCM Exclusive License Agreement

On March 16, 2018, the Company entered into an Exclusive License Agreement (the “BCM license agreement”) with BCM, under which the Company received a worldwide, exclusive license to BCM’s rights in and to three patent families to develop and commercialize MultiTAA product candidates in exchange for partial ownership, royalties and milestone payments.

The following is a list of patents and patent applications that the Company has licensed from BCM under the BCM license agreement:

Exclusive license to BCM’s Patent Applications and Patents:

| Title | Country | Application No. | Filing/Issue Date | Patent Number (if issued) |

|||||||||

| PEPMIXES TO GENERATE MULTIVIRAL CTLS WITH BROAD SPECIFICITY | US | 15/905,176 | Filed: 26-Feb-2018 | ||||||||||

| PEPMIXES TO GENERATE MULTIVIRAL CTLS WITH BROAD SPECIFICITY | EP | EP 13746524.1 | Filed: 08-Feb-2013 | ||||||||||

| IMMUNOGENIC ANTIGEN IDENTIFICATION FROM A PATHOGEN AND CORRELATION TO CLINICAL EFFICACY | US | 62/220,884 | Filed: 18-Sep-2015 | N/A | |||||||||

| IMMUNOGENIC ANTIGEN IDENTIFICATION FROM A PATHOGEN AND CORRELATION TO CLINICAL EFFICACY | PCT | PCT/US2016/052487 | Filed: 19-Sep-2016 | N/A | |||||||||

| IMMUNOGENIC ANTIGEN IDENTIFICATION FROM A PATHOGEN AND CORRELATION TO CLINICAL EFFICACY | US | 15/759,501 | Filed: 12-Mar-2018 | ||||||||||

| IMMUNOGENIC ANTIGEN IDENTIFICATION FROM A PATHOGEN AND CORRELATION TO CLINICAL EFFICACY | AU | 2016324479 | Filed: 19-Sep-2016 | ||||||||||

| IMMUNOGENIC ANTIGEN IDENTIFICATION FROM A PATHOGEN AND CORRELATION TO CLINICAL EFFICACY | EP | 16847545.7 | Filed: 19-Sep-2016 | ||||||||||

| IMMUNOGENIC ANTIGEN IDENTIFICATION FROM A PATHOGEN AND CORRELATION TO CLINICAL EFFICACY | IL | 258090 | Filed: 19-Sep-2016 | ||||||||||

| IMMUNOGENIC ANTIGEN IDENTIFICATION FROM A PATHOGEN AND CORRELATION TO CLINICAL EFFICACY | SG | 11201802204S | Filed: 19-Sep-2016 |

| 11 |

Exclusive license to BCM’s Subject Technology:

1. “Generation of CTL Lines with Specificity Against Multiple Tumor Antigens or Multiple Viruses”

2. “Pepmixes to Generate Multiviral CTLs with Broad Specificity”

3. “Immunogenic Antigen Identification from a Pathogen and Correlation to Clinical Efficacy”

In partial consideration for the exclusive rights granted under the BCM license agreement, prior to the Merger, Marker Cell issued shares of Marker Cell common stock to BCM valued at approximately $5.0 million at the time of issuance. Additional consideration includes a royalty paid on net sales by the Company to BCM according to the royalty schedule in the BCM license agreement. The royalty fee schedule is based on aggregate net sales in four different ranges: (1) less than $500M, (2) $500M to $1.0B, (3) $1.0B and over, and (4) $2.0B and over. The corresponding royalty percentages range from 0.65% to 5.0% - increasing in proportion to the aggregate net sales. The royalty fee may be reduced in the event that the Company must pay additional royalties with respect to third-party owned patent rights or technology necessary for the use, manufacture or sale of a licensed product. The Company also agreed to pay BCM one-time milestone payments upon the occurrence of nine particular milestones relating to completion of the first dosing in clinical trials for a first and second distinct product, receipt of approval from the FDA, and hitting certain net sales goals. Under the agreement, the Company may be obligated to make aggregate milestone payments of up to $64.85 million. The Company is also responsible for sublicensing fees. In addition, under the BCM license agreement the Company is responsible for reimbursing BCM for patent-related expenses incurred prior to the execution of the license agreement of approximately $82,000. The Company will be responsible for filing, prosecuting and maintaining all patent applications and patents included in the licensed patent rights and all such related legal costs incurred after the date of the BCM license agreement, except such legal costs shall be reduced on a pro-rata basis on a patent or patent application basis should BCM license such patent or patent application in additional fields of use to any third party.

In addition, upon a liquidity event (as defined in the BCM license agreement) of the Company , BCM will receive a liquidity incentive payment of 0.5% of the liquidity event proceeds (as defined in the BCM license agreement) received by the Company or its stockholders in the liquidity event.

| 12 |

The Company has agreed to indemnify BCM and certain persons affiliated with BCM against claims and liabilities directly or indirectly related to or arising out of the design, process, manufacture or use by any third party of the licensed products, even though such claims and liabilities result in whole or in part from the negligence of the BCM indemnified parties or are based upon doctrines of strict liability or product liability, but not claims or liabilities arising from the gross negligence or intentional misconduct of any such BCM indemnified parties.

Unless terminated sooner, the license will expire on a licensed product-by-product basis and country by country basis, on the later of (i) the date of expiration of the last valid claim of patent rights to expire that covers the sale of such licensed product in such country, or (ii) the first date following the tenth anniversary of the first commercial sale of first licensed product by the Company in such country. After such expiration, but not termination, the licenses granted to the Company shall survive and become a perpetual, paid-in-full license in such country with respect to such licensed product.

The Company has the right in its sole discretion to terminate the BCM license agreement upon 60 days’ written notice to BCM. BCM has the right to terminate the agreement upon material default or failure of the Company of its overall obligation to perform any of the terms, covenants or provisions of the license agreement, including failure to make timely payment, taken as a whole, and which default or failure remains uncured thirty days after written notice from BCM of such material default or failure to correct such default or failure. Notwithstanding the foregoing, if a material default or failure is not susceptible to cure within the 30-day cure period, BCM’s right to terminate shall be suspended if, and for so long as, (i) the Company has provided BCM with a written plan that is reasonably calculated to effect a cure, (ii) such plan is reasonably acceptable to BCM, in its sole but reasonable discretion, and (iii) the Company commits to and does carry out such plan; provided, however, that, unless mutually agreed to by the parties in such plan, such suspension of BCM’s right to terminate shall not extend beyond 60 days after the original cure period. In addition, either party’s right to terminate the license agreement shall be tolled for so long as dispute resolution procedures are being pursued by the allegedly breaching party in good faith, and if it is finally and conclusively determined that the allegedly breaching party is in material breach, then the breaching party shall have the right to cure within 30 days after such determination. BCM also has the right to terminate the agreement if the Company shall (i) become involved in insolvency, dissolution, bankruptcy or receivership proceedings affecting the operation of its business, (ii) make an assignment of all or substantially all of its assets for the benefit of creditors, or (iii) if a receiver or trustee is appointed for the Company and the Company shall, after the expiration of 30 days following any of the enumerated events, have been unable to secure a dismissal, stay or other suspension of such proceedings.

In the event of termination of the BCM license agreement, but not expiration, all rights to the subject technology and patent rights thereunder shall revert to BCM, except to the extent necessary to exercise any surviving right or license thereunder. The Company may sell any licensed products actually in its possession at the effective date of termination, provided that the Company continues to pay to BCM royalties on all such sales in accordance with the license agreement and otherwise complies with the terms of the license agreement and sells all such licensed products within six months after the effective date of the termination.

Other Marker Cell Patent Applications and Patents:

| Title | Country | Application No. | Filing/Issue Date | Patent Number (if issued) |

|||||||||

| GENERATION OF CTL LINES WITH SPECIFICITY AGAINST MULTIPLE TUMOR ANTIGENS | US | 61/236,261 | Filed: 24-Aug-2009 | N/A | |||||||||

| GENERATION OF CTL LINES WITH SPECIFICITY AGAINST MULTIPLE TUMOR ANTIGENS OR MULTIPLE VIRUSES | US | 15/246,241 | Filed: 24-Aug-2016 |

| 13 |

| Title | Country | Application No. | Filing/Issue Date | Patent Number (if issued) |

|||||||||

| GENERATION OF CTL LINES WITH SPECIFICITY AGAINST MULTIPLE TUMOR ANTIGENS OR MULTIPLE VIRUSES | PCT | PCT/US2010/046505 | Filed: 24-Aug-2010 | N/A | |||||||||

| GENERATION OF CTL LINES WITH SPECIFICITY AGAINST MULTIPLE TUMOR ANTIGENS OR MULTIPLE VIRUSES | EP | EP 10814245.6 | Filed: 24-Aug-2010 Issued: 21-Sep-2016 |

EP Patent No. 2470644 |

|||||||||

| GENERATION OF CTL LINES WITH SPECIFICITY AGAINST MULTIPLE TUMOR ANTIGENS OR MULTIPLE VIRUSES | CH | 10814245.6 | Filed: 24-Aug-2010 | EP Patent No. 2470644 |

|||||||||

| GENERATION OF CTL LINES WITH SPECIFICITY AGAINST MULTIPLE TUMOR ANTIGENS OR MULTIPLE VIRUSES | DE | 10814245.6 | Filed: 24-Aug-2010 | EP Patent No. 2470644 |

|||||||||

| GENERATION OF CTL LINES WITH SPECIFICITY AGAINST MULTIPLE TUMOR ANTIGENS OR MULTIPLE VIRUSES | DK | 10814245.6 | Filed: 24-Aug-2010 | EP Patent No. 2470644 |

|||||||||

| GENERATION OF CTL LINES WITH SPECIFICITY AGAINST MULTIPLE TUMOR ANTIGENS OR MULTIPLE VIRUSES | FR | 10814245.6 | Filed: 24-Aug-2010 | EP Patent No. 2470644 |

|||||||||

| GENERATION OF CTL LINES WITH SPECIFICITY AGAINST MULTIPLE TUMOR ANTIGENS OR MULTIPLE VIRUSES | GB | 10814245.6 | Filed: 24-Aug-2010 | EP Patent No. 2470644 |

|||||||||

| GENERATION OF CTL LINES WITH SPECIFICITY AGAINST MULTIPLE TUMOR ANTIGENS OR MULTIPLE VIRUSES | IE | 10814245.6 | Filed: 24-Aug-2010 | EP Patent No. 2470644 |

|||||||||

| GENERATION OF CTL LINES WITH SPECIFICITY AGAINST MULTIPLE TUMOR ANTIGENS OR MULTIPLE VIRUSES | NL | 10814245.6 | Filed: 24-Aug-2010 | EP Patent No. 2470644 |

|||||||||

| GENERATION OF CTL LINES WITH SPECIFICITY AGAINST MULTIPLE TUMOR ANTIGENS OR MULTIPLE VIRUSES | NO | 10814245.6 | Filed: 24-Aug-2010 | EP Patent No. 2470644 |

|||||||||

| GENERATION OF CTL LINES WITH SPECIFICITY AGAINST MULTIPLE TUMOR ANTIGENS OR MULTIPLE VIRUSES | SE | 10814245.6 | Filed: 24-Aug-2010 | EP Patent No. 2470644 |

| 14 |

| Title | Country | Application No. | Filing/Issue Date | Patent Number (if issued) |

|||||||||

| GENERATION OF CTL LINES WITH SPECIFICITY AGAINST MULTIPLE TUMOR ANTIGENS OR MULTIPLE VIRUSES | EP | EP 16180607.0 | Filed: 24-Aug-2010 | ||||||||||

| PEPMIXES TO GENERATE MULTIVIRAL CTLS WITH BROAD SPECIFICITY | US | 61/596,875 | Filed: 09-Feb-2012 | N/A | |||||||||

| PEPMIXES TO GENERATE MULTIVIRAL CTLS WITH BROAD SPECIFICITY | PCT | PCT/US2013/025342 | Filed: 08-Feb-2013 | N/A |

Legacy TapImmune Intellectual Property

Patents

| Applicantion / Publication / Patent No. | Title | Ownership | Jurisdiction Where Granted/Filed |

||||||||||

| Peptide Based Vaccine (Folate Receptor Alpha, Breast and Ovarian Cancer) | |||||||||||||

| Patent No. 8,486,412 | Immunity to Folate Receptors | Exclusive License | USA | ||||||||||

| Patent No. 9,243,033 | Immunity to Folate Receptors | Exclusive License | USA | ||||||||||

| Patent No. 9,915,646 | Immunity to Folate Receptors | Exclusive License | USA | ||||||||||

| Patent No. 2,685,300 | Immunity to Folate Receptors | Exclusive License | Canada | ||||||||||

| Peptide Based Vaccine (HER2/neu+ Breast Cancer) | |||||||||||||

| Patent No. 8,858,952 | Methods and Materials for Generating T Cells | Exclusive License | USA | ||||||||||

| Patent No. 2013221309 | Methods and Materials for Generating CD8+ T Cells Having the Ability to Recognize Cancer Cells Expressing a HER2/neu+ Polypeptide | Exclusive License | Australia | ||||||||||

| 15 |

| Applicantion / Publication / Patent No. | Title | Ownership | Jurisdiction Where Granted/Filed |

||||||||||

| Patent No. ZL2013380019913.1 | Same as above | Exclusive License | China | ||||||||||

| Patent No. 2,814,836 | Same as above | Exclusive License | Europe | ||||||||||

| Patent No. 6,170,076 | Same as above | Exclusive License | Japan | ||||||||||

| Patent No. 9,814,767 | Same as above | Exclusive License | USA | ||||||||||

| Patent No. ZL200890124030.6 | HLA-DR Binding Peptides and Their Uses | Exclusive License | China | ||||||||||

| Patent No. 2,704,397 | Same as above | Exclusive License | Canada | ||||||||||

| Nucleic Acid Based Vaccine (PolyStart™; infectious disease, breast and ovarian Cancer) | |||||||||||||

| Patent No. 9,364,523 | Chimeric Nucleic Acid Molecule with Non-AUG Translation Initiation Sequences | Owned | USA | ||||||||||

| Patent No. 9,655,956 | Chimeric Nucleic Acid Molecules with Non-AUG Translation Initiation Sequences and Uses Thereof | Owned | USA | ||||||||||

| Patent No. 9,988,643 | Chimeric Nucleic Acid Molecules with Non-AUG Translation Initiation Sequences and Uses Thereof | Owned | USA | ||||||||||

| Patent No. 10,030,252 | Chimeric Nucleic Acid Molecules with Non-AUG Translation Initiation Sequences and Uses Thereof | Owned | USA | ||||||||||

| 16 |

| Applicantion / Publication / Patent No. | Title | Ownership | Jurisdiction Where Granted/Filed |

||||||||||

| HLA DR Peptide Vaccines | |||||||||||||

| Patent No. 6,006,265 | HLA-DR Binding Peptides And Their Uses | Exclusive License | Japan | ||||||||||

| Patent No. 2,215,111 | HLA-DR Binding Peptides And Their Uses | Exclusive License | Europe (DE, FR, GB, IE) |

We have exclusively licensed the intellectual property for our TPIV100/110 HER2/neu breast cancer vaccine and TPIV200 folate receptor alpha vaccine product candidates from the Mayo Foundation for Medical Education and Research (the “Mayo Foundation”).

The effect of the issued patents is that they provide us with patent protection for the claims covered by the patents. While the expiration of a product patent normally results in a loss of market exclusivity for the covered product or product candidate, commercial benefits may continue to be derived from: (i) later-granted patents on processes and intermediates related to the most economical method of manufacture of the active ingredient of such product; (ii) patents relating to the use of such product; (iii) patents relating to novel compositions and formulations; and (iv) in the United States and certain other countries, market exclusivity that may be available under relevant law. The effect of patent expiration on our product candidates also depends upon many other factors such as the nature of the market and the position of the product in it, the growth of the market, the complexities and economics of the process for manufacture of the active ingredient of the product and the requirements of new drug provisions of the Federal Food, Drug and Cosmetic Act or similar laws and regulations in other countries.

Our pending patent applications cover a range of technologies, including specific embodiments and applications for treatment of various medical indications, improved application methods and adjunctive utilization with other therapeutic modalities. The coverage claimed in a patent application can be significantly reduced before the patent is issued. Accordingly, we do not know whether any of the applications we acquire or license will result in the issuance of patents, or, if any patents are issued, whether they will provide significant proprietary protection or will be challenged, circumvented or invalidated. Because unissued U.S. patent applications are maintained in secrecy for a period of eighteen months and U.S. patent applications filed prior to November 29, 2000 are not disclosed until such patents are issued, and since publication of discoveries in the scientific or patent literature often lags behind actual discoveries, we cannot be certain of the priority of inventions covered by pending patent applications. Moreover, we may have to participate in opposition proceedings in a foreign patent office, or for United States patent applications filed before March 16, 2013, in interference proceedings declared by the United States Patent and Trademark Office “USPTO”) to determine priority of invention, or in United States inter partes review or post-grant review procedures, any of which could result in substantial cost to us, even if the eventual outcome is favorable to us. There can be no assurance that the patents, if issued, would be held valid by a court of competent jurisdiction. An adverse outcome could subject us to significant liabilities to third parties, require disputed rights to be licensed from third parties or require us to cease using such technology.

We have patents and patent applications in other countries, as well as in the European Patent Office that we believe provide equivalent or comparable protection for our product candidates in jurisdictions internationally that we consider to be key markets. Because of the differences in patent laws and laws concerning proprietary rights, the extent of protection provided by U.S. patents or proprietary rights owned by us may differ from that of their foreign counterparts.

| 17 |

We believe that our patents, the protection of discoveries in connection with our development activities, our proprietary products, technologies, processes and know-how and all of our intellectual property are important to our business. To achieve a competitive position, we rely on trade secrets, non-patented proprietary know-how and continuing technological innovation, where patent protection is not believed to be appropriate or attainable. In addition, as outlined above, we have a number of patent licenses from third parties, some of which are important to our business. There can be no assurance that any of our patents, licenses or other intellectual property rights will afford us any protection from competition.

Trademarks

We currently have pending with the USPTO applications for registration of the marks POLYSTART™ and “Marker Therapeutics.” We currently have the mark “TapImmune” registered with the USPTO. We also have rights to use other names essential to our business. Federally registered trademarks have a perpetual life, as long as they are maintained and renewed on a timely basis and used properly as trademarks, subject to the rights of third parties to seek cancellation of the trademarks if they claim priority or confusion of usage. We regard our trademarks and other proprietary rights as valuable assets and believe they have significant value to us.

| 18 |

RISK FACTORS

See the Glossary at the end of this Form 8-K for definitions of certain technical terms frequently used herein.

An investment in the Company’s common stock involves a high degree of risk. You should carefully consider the risks described below before making an investment decision in the Company’s securities. These risk factors are effective as of the date of this Current Report on Form 8-K and shall be deemed to be modified or superseded to the extent that a statement contained in the Company’s future filings modifies or replaces such statement. All of these risks may impair the Company’s business operations. The forward-looking statements in this Current Report on Form 8-K involve risks and uncertainties and actual results may differ materially from the results we discuss in the forward-looking statements. If any of the following risks actually occur, the Company’s business, financial condition or results of operations could be materially adversely affected. In that case, the trading price of the Company’s common stock could decline, and you may lose all or part of your investment.

Risks Related to the Company’s Business and Intellectual Property

The Company is a development stage company with a history of operating losses.

The Company is a clinical-stage immunotherapy company with a history of losses, and it may always operate at a loss. The Company expects that it will continue to operate at a loss throughout its development stage, and as a result, it may exhaust its financial resources and be unable to complete the development of its products. The Company anticipates that its ongoing operational costs will increase significantly as it continues conducting its clinical development program. The deficit of the Company will continue to grow during its drug development period. The Company has no sources of revenue to provide incoming cash flows to sustain its future operations. As outlined above, the ability of the Company to pursue its planned business activities depends upon its successful efforts to raise additional financing.

The Company has sustained losses from operations in each fiscal year since its inception, and it expects losses to continue for the indefinite future due to the substantial investment in research and development. As of December 31, 2017, the Company had an accumulated deficit of approximately $157 million since inception. The Company expects to spend substantial additional sums on the continued administration and research and development of licensed and proprietary products and technologies with no certainty that its approach and associated technologies will become commercially viable or profitable as a result of these expenditures. If the Company fails to raise a significant amount of capital, it may need to significantly curtail operations or cease operations in the near future. If any of the product candidates of the Company fails in clinical trials or does not gain regulatory approval, the Company may never generate revenue. Even if the Company generates revenue in the future, it may not be able to become profitable or sustain profitability in subsequent periods.

The Company’s future success is highly dependent upon its key personnel, and its ability to attract, retain, and motivate additional qualified personnel.

The Company’s ability to compete in the highly competitive biotechnology and pharmaceutical industries depends upon its ability to attract and retain highly qualified managerial, scientific, and medical personnel. The Company is highly dependent on its management, scientific, and medical personnel, including Peter Hoang, its President and Chief Executive Officer, Ann Leen, Ph.D., its Chief Scientific Officer, Juan Vera, M.D., its Chief Development Officer, and Dr. Richard Kenney, its Acting Chief Medical Officer, as well as the services of several key consultants. The loss of the services of any of the Company’s executive officers, other key employees, and other scientific and medical advisors, and the Company’s inability to find suitable replacements could result in delays in product development and harm to the Company’s business. In particular, Dr. Leen is the key person who has produced the Company’s MultiTAA T cell therapy-based product. A priority of the Company is to quickly train additional qualified scientific and medical personnel in the Company to ensure the ability to maintain business continuity following the Merger. Any delays in training such personnel could delay the development, manufacture, and clinical trials of the Company’s product candidates.

| 19 |

The Company’s ability to attract and retain highly skilled personnel is critical to its operations and expansion. The Company faces competition for these types of personnel from other biotechnology companies and more established organizations, many of which have significantly larger operations and greater financial, technical, human and other resources than the Company. The Company may not be successful in attracting and retaining qualified personnel on a timely basis, on competitive terms, or at all. If the Company is not successful in attracting and retaining these personnel, or integrating them into its operations, its business, prospects, financial condition and results of operations will be materially adversely affected. In such circumstances the Company may be unable to conduct certain research and development programs, unable to adequately manage its clinical trials and other products, and unable to adequately address its management needs.

The Company’s strategic relationship with Baylor College of Medicine, or BCM, is dependent, in part, upon its relationship with key medical and scientific personnel and advisors.

The legacy Marker Cell therapy has been developed through its collaboration with the Center for Cell and Gene Therapy at BCM, founded by Malcom K. Brenner, M.D., Ph.D., a recognized pioneer in immuno-oncology. In addition to Dr. Brenner, Marker Cell’s founders include Ann Leen, Ph.D., Juan Vera, M.D., Helen Heslop, M.D., DSc (Hon) and Cliona Rooney, Ph.D., who have significant experience in this field and are all affiliated with the Center for Cell and Gene Therapy at BCM. Dr. Leen and Dr. Vera are the Company’s Chief Scientific Officer and Chief Development Officer, respectively. In addition, Dr. Brenner, Dr. Heslop and Dr. Rooney have joined the Company’s newly formed Scientific Advisory Board.

The Company’s strategic relationship with BCM is dependent, in part, on its relationship with these key employees and advisors, and in particular Dr. Leen and Dr. Vera, who are also employed with the Center for Cell and Gene Therapy at BCM. If the Company loses Dr. Leen or Dr. Vera, or if either leaves their position at BCM, the Company’s relationship with BCM may deteriorate, and its business could be harmed.

The Company, and certain of its key medical and scientific personnel, will need additional agreements in place with BCM to expand its development, manufacture, and clinical trial efforts.

Although the Company has an exclusive license agreement with BCM under which the Company received a worldwide, exclusive license to BCM’s rights in and to three patent families to develop and commercialize the MultiTAA product candidates, the Company will need to enter into additional agreements with BCM with respect to (i) a strategic alliance to advance pre-clinical research, early stage clinical trials, and Phase II clinical trials with respect to the Company’s product candidates, as well as continued access to its clinical data, (ii) sponsored research for investigators within the Center for Cell and Gene Therapy at BCM, and (iii) product manufacturing and support, including personnel and space at the institution for the foreseeable future. Any delays in entering into new strategic agreements with BCM related to the Company’s product candidates could delay the development, manufacture, and clinical trials of its product candidates.

The multiple roles of certain of the Company’s officers and directors could limit their time and availability to the Company, and create, or appear to create, conflicts of interest.

Dr. Leen and Dr. Vera are employees of BCM and are contractually obligated to spend a significant portion of their time for BCM. In addition, Dr. Leen and Dr. Vera are co-founders and members of ViraCyte, and perform services from time to time for ViraCyte LLC (“ViraCyte”). ViraCyte is owned by the same principal stockholder group as Marker Cell prior to the Merger, and has technology which is being developed under a license agreement with BCM by the same research group at BCM. More specifically, ViraCyte is a clinical stage biopharmaceutical company, which is investigating and developing virus-specific T cell therapy technology for the prevention and/or treatment of viral infections. Accordingly, Dr. Leen and Dr. Vera may have other commitments that would, at times, limit their availability to the Company, and other research being conducted by Dr. Leen and Dr. Vera may, at times, receive higher priority than research on the Company’s programs, which may, in turn, delay the development or commercialization of the Company’s product candidates.

| 20 |

In addition, John Wilson is a member, director and officer of ViraCyte and is a director of the Company. Dr. Leen and Dr. Vera are also co-founders and members of ViraCyte, and perform services for ViraCyte from time to time, and Dr. Vera is a director of the Company. All of these individuals have certain fiduciary or other obligations to the Company and certain fiduciary or other obligations to ViraCyte and, in the case of Dr. Leen and Dr. Vera, to BCM. Such multiple obligations may in the future result in a conflict of interest with respect to presenting other potential business opportunities to the Company or to ViraCyte. A conflict of interest also may arise concerning the timing of the parties’ planned and ongoing clinical trials, investigational new drug application filings and the parties’ opportunities for marketing their respective product candidates. In addition, they may be faced with decisions that could have different implications for the Company than for ViraCyte. Consequently, there is no assurance that these members of the Company’s board and management will always act in the Company’s best interests in all situations should a conflict arise.

The Company has not yet sold any products or received regulatory approval to sell its products.

The Company has no approved products or products pending approval. As a result, the Company has not derived any revenue from the sales of products and has not yet demonstrated ability to obtain regulatory approval, formulate and manufacture commercial-scale products, or conduct sales and marketing activities necessary for successful product commercialization. Without revenue, the Company can only finance its operations through debt and equity financings.

Product development involves a lengthy and expensive process with an uncertain outcome, and results of earlier pre-clinical and clinical trials may not be predictive of future clinical trial results.

Clinical testing is expensive and generally takes many years to complete, and the outcome is inherently uncertain. Failure can occur at any time during the clinical trial process. The results of pre-clinical testing and early clinical trials of the Company’s product candidates may not be predictive of the results of larger, later-stage controlled clinical trials. Product candidates that have shown promising results in early-stage clinical trials may still suffer significant setbacks in subsequent clinical trials. The Company’s clinical trials to date have been conducted on a small number of patients in a single clinical site for a limited number of indications. The Company will have to conduct larger, well-controlled trials in its proposed indications at multiple sites to verify the results obtained to date and to support any regulatory submissions for further clinical development of the Company’s product candidates. The Company’s assumptions related to the Company’s products, such as with respect to lack of toxicity and manufacturing cost estimates, are based on early limited clinical trials and current manufacturing process at BCM and may prove to be incorrect. In addition, the initial estimates of the clinical cost of development may prove to be inadequate, particularly if clinical trial timing or outcome is different than predicted or regulatory agencies require further testing before approval. A number of companies in the biopharmaceutical industry have suffered significant setbacks in advanced clinical trials due to lack of efficacy or adverse safety profiles despite promising results in earlier, smaller clinical trials. Moreover, clinical data are often susceptible to varying interpretations and analyses. The Company does not know whether any Phase II, Phase III, or other clinical trials it may conduct will demonstrate consistent or adequate efficacy and safety with respect to the proposed indication for use sufficient to receive regulatory approval or market its product candidates.

The biotechnology and immunotherapy industries are characterized by rapid technological developments and a high degree of competition. The Company may be unable to compete with more substantial enterprises.

The biotechnology and biopharmaceutical industries are characterized by rapid technological developments and a high degree of competition. As a result, the Company’s actual or proposed immunotherapies could become obsolete before it recoups any portion of its related research and development and commercialization expenses. Competition in the biopharmaceutical industry is based significantly on scientific and technological factors. These factors include the availability of patent and other protection for technology and products, the ability to commercialize technological developments and the ability to obtain governmental approval for testing, manufacturing and marketing. The Company competes with specialized biopharmaceutical firms in the United States, Europe and elsewhere, as well as a growing number of large pharmaceutical companies that are applying biotechnology to their operations. Many biopharmaceutical companies have focused their development efforts in the human therapeutics area, including cancer. Many major pharmaceutical companies have developed or acquired internal biotechnology capabilities or made commercial arrangements with other biopharmaceutical companies. These companies, as well as academic institutions, governmental agencies and private research organizations, also compete with the Company in recruiting and retaining highly qualified scientific personnel and consultants. The Company’s ability to compete successfully with other companies in the pharmaceutical field will also depend to a considerable degree on the continuing availability of capital to it.

| 21 |

The Company is aware of certain investigational new drugs under development or approved products by competitors that are used for the prevention, diagnosis, or treatment of certain diseases we have targeted for drug development. Various companies are developing biopharmaceutical products that have the potential to directly compete with the Company’s immunotherapies even though their approach may be different. The biotechnology and biopharmaceutical industries are highly competitive, and this competition comes from both biotechnology firms and from major pharmaceutical companies. Many of these companies have substantially greater financial, marketing, and human resources than the Company. The Company also experiences competition in the development of its immunotherapies from universities, other research institutions and others in acquiring technology from such universities and institutions.

In addition, certain of the Company’s immunotherapies may be subject to competition from investigational new drugs and/or products developed using other technologies, some of which have completed numerous clinical trials.

The Company is subject to numerous risks inherent in conducting clinical trials.