Attached files

| file | filename |

|---|---|

| EX-99.3 - EXHIBIT 99.3 - CHESAPEAKE ENERGY CORP | chkex993wildhorseacquisi.htm |

| EX-99.2 - EXHIBIT 99.2 - CHESAPEAKE ENERGY CORP | chk-ex_992x20180930x8kxjoi.htm |

| EX-99.1 - EXHIBIT 99.1 - CHESAPEAKE ENERGY CORP | chk-ex_991x20180930x8kxpr.htm |

| 8-K - 8-K - CHESAPEAKE ENERGY CORP | chk-20180930_8kxpr.htm |

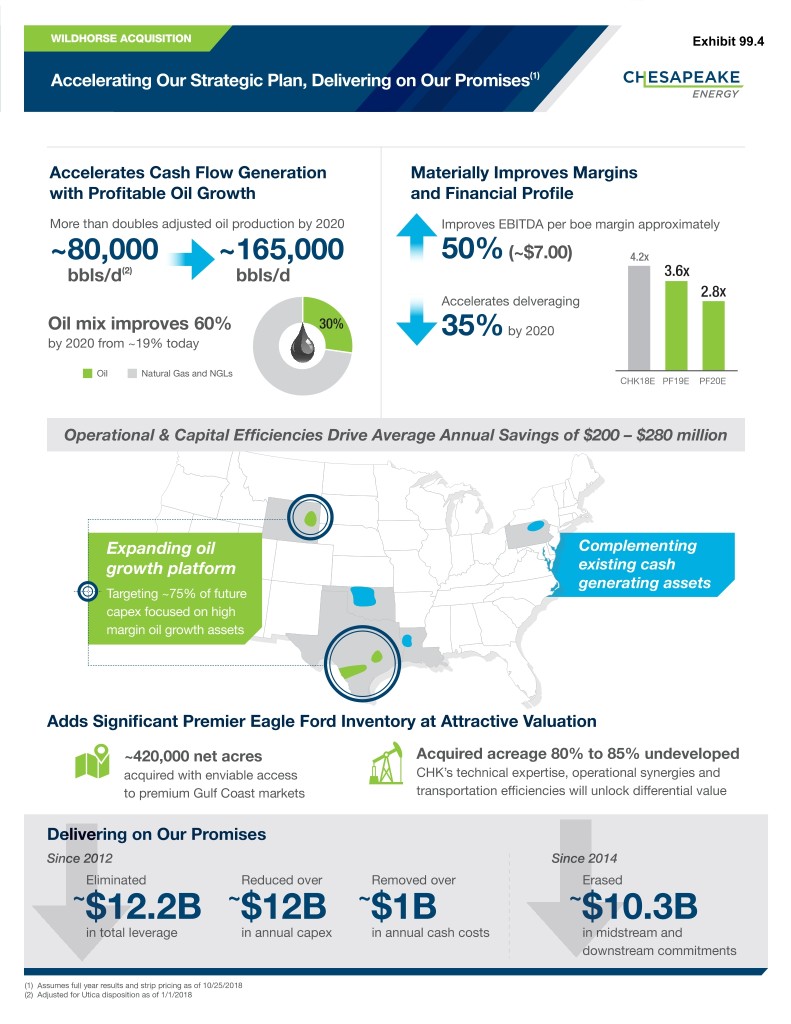

WILDHORSE ACQUISITION Exhibit 99.4 Accelerating Our Strategic Plan, Delivering on Our Promises(1) Accelerates Cash Flow Generation Materially Improves Margins with Profitable Oil Growth and Financial Profile More than doubles adjusted oil production by 2020 Improves EBITDA per boe margin approximately ~80,000 ~165,000 50% (~$7.00) 4.2x bbls/d(2) bbls/d 3.6x 2.8x Accelerates delveraging 30% Oil mix improves 60% 35% by 2020 by 2020 from ~19% today Oil Natural Gas and NGLs CHK18E PF19E PF20E Operational & Capital Efficiencies Drive Average Annual Savings of $200 – $280 million Expanding oil Complementing growth platform existing cash generating assets Targeting ~75% of future capex focused on high margin oil growth assets Adds Significant Premier Eagle Ford Inventory at Attractive Valuation ~420,000 net acres Acquired acreage 80% to 85% undeveloped acquired with enviable access CHK’s technical expertise, operational synergies and to premium Gulf Coast markets transportation efficiencies will unlock differential value Delivering on Our Promises Since 2012 Since 2014 Eliminated Reduced over Removed over Erased ~$12.2B ~$12B ~$1B ~$10.3B in total leverage in annual capex in annual cash costs in midstream and downstream commitments (1) Assumes full year results and strip pricing as of 10/25/2018 (2) Adjusted for Utica disposition as of 1/1/2018

Cautionary Statement Regarding Forward-Looking Information This communication may contain certain forward-looking statements, including certain plans, expectations, goals, projections, and statements about the benefits of the proposed transaction, WildHorse’s and Chesapeake’s plans, objectives, expectations and intentions, the expected timing of completion of the transaction, and other statements that are not historical facts. Such statements are subject to numerous assumptions, risks, and uncertainties. Statements that do not describe historical or current facts, including statements about beliefs and expectations, are forward-looking statements. Forward-looking statements may be identified by words such as expect, anticipate, believe, intend, estimate, plan, target, goal, or similar expressions, or future or conditional verbs such as will, may, might, should, would, could, or similar variations. The forward-looking statements are intended to be subject to the safe harbor provided by Section 27A of the Securities Act of 1933, Section 21E of the Securities Exchange Act of 1934, and the Private Securities Litigation Reform Act of 1995. While there is no assurance that any list of risks and uncertainties or risk factors is complete, below are certain factors which could cause actual results to differ materially from those contained or implied in the forward-looking statements: the possibility that the proposed transaction does not close when expected or at all because required regulatory, shareholder or other approvals are not received or other conditions to the closing are not satisfied on a timely basis or at all; the risk that regulatory approvals required for the proposed merger are not obtained or are obtained subject to conditions that are not anticipated; potential adverse reactions or changes to business or employee relationships, including those resulting from the announcement or completion of the transaction; uncertainties as to the timing of the transaction; competitive responses to the transaction; the possibility that the anticipated benefits of the transaction are not realized when expected or at all, including as a result of the impact of, or problems arising from, the integration of the two companies; the possibility that the transaction may be more expensive to complete than anticipated, including as a result of unexpected factors or events; diversion of management’s attention from ongoing business operations and opportunities; the ability of Chesapeake to complete the acquisition and integration of WildHorse successfully; litigation relating to the transaction; and other factors that may affect future results of WildHorse and Chesapeake. Additional factors that could cause results to differ materially from those described above can be found in WildHorse’s Annual Report on Form 10-K for the year ended December 31, 2017 and in its subsequent Quarterly Reports on Form 10-Q for the quarters ended March 31, 2018 and June 30, 2018, each of which is on file with the SEC and available in the “Investor Relations” section of WildHorse’s website, http://www.wildhorserd.com/, under the subsection “SEC Filings” and in other documents WildHorse files with the SEC, and in Chesapeake’s Annual Report on Form 10-K for the year ended December 31, 2017 and in its subsequent Quarterly Reports on Form 10-Q for the quarters ended March 31, 2018 and June 30, 2018, each of which is on file with the SEC and available in the “Investors” section of Chesapeake’s website, https://www.chk.com/, under the heading “SEC Filings” and in other documents Chesapeake files with the SEC. All forward-looking statements speak only as of the date they are made and are based on information available at that time. Neither WildHorse nor Chesapeake assumes any obligation to update forward-looking statements to reflect circumstances or events that occur after the date the forward-looking statements were made or to reflect the occurrence of unanticipated events except as required by federal securities laws. As forward-looking statements involve significant risks and uncertainties, caution should be exercised against placing undue reliance on such statements. Important Additional Information This communication relates to a proposed business combination transaction (the “Transaction”) between WildHorse Resource Development Corporation (“WildHorse”) and Chesapeake Energy Corporation (“Chesapeake”). This communication is for informational purposes only and does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval, in any jurisdiction, pursuant to the Transaction or otherwise, nor shall there be any sale, issuance, exchange or transfer of the securities referred to in this document in any jurisdiction in contravention of applicable law. In connection with the Transaction, Chesapeake will file with the SEC a registration statement on Form S-4 that will include a joint proxy statement of Chesapeake and WildHorse and a prospectus of Chesapeake, as well as other relevant documents concerning the Transaction. The Transaction involving WildHorse and Chesapeake will be submitted to WildHorse’s stockholders and Chesapeake’s shareholders for their consideration. STOCKHOLDERS OF WILDHORSE AND SHAREHOLDERS OF CHESAPEAKE ARE URGED TO READ THE REGISTRATION STATEMENT AND THE JOINT PROXY STATEMENT/PROSPECTUS REGARDING THE TRANSACTION WHEN IT BECOMES AVAILABLE AND ANY OTHER RELEVANT DOCUMENTS FILED WITH THE SEC, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THOSE DOCUMENTS, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION. Investors will be able to obtain a free copy of the registration statement and the joint proxy statement/prospectus, as well as other filings containing information about WildHorse and Chesapeake, without charge, at the SEC’s website (http://www.sec.gov). Copies of the documents filed with the SEC can also be obtained, without charge, by directing a request to

Investor Relations, WildHorse, P.O. Box 79588, Houston, Texas 77279, Tel. No. (713) 255-9327 or to Investor Relations, Chesapeake, 6100 North Western Avenue, Oklahoma City, Oklahoma, 73118, Tel. No. (405) 848-8000. Participants in the Solicitation WildHorse, Chesapeake and certain of their respective directors, executive officers and employees may be deemed to be participants in the solicitation of proxies in respect of the Transaction. Information regarding WildHorse’s directors and executive officers is available in its definitive proxy statement, which was filed with the SEC on April 2, 2018, and certain of its Current Reports on Form 8-K. Information regarding Chesapeake’s directors and executive officers is available in its definitive proxy statement, which was filed with the SEC on April 6, 2018, and certain of its Current Reports on Form 8-K. Other information regarding the participants in the proxy solicitation and a description of their direct and indirect interests, by security holdings or otherwise, will be contained in the joint proxy statement/prospectus and other relevant materials filed with the SEC. Free copies of this document may be obtained as described in the preceding paragraph.