Attached files

| file | filename |

|---|---|

| 8-K - 8-K - ESSEX PROPERTY TRUST, INC. | form8k.htm |

Exhibit 99.1

Essex Announces Third Quarter 2018 Results

San Mateo, California—October 29, 2018—Essex Property Trust, Inc. (NYSE: ESS) (the

“Company”) announced today its third quarter 2018 earnings results and related business activities.

Net Income, Funds from Operations (“FFO”) and Core FFO per diluted share for the quarter ended September 30, 2018 are detailed below.

|

Three Months Ended

September 30,

|

%

|

Nine Months Ended

September 30,

|

%

|

||||

|

2018

|

2017

|

Change

|

2018

|

2017

|

Change

|

||

|

Per Diluted Share

|

|||||||

|

Net Income

|

$1.22

|

$1.21

|

0.8%

|

$4.12

|

$5.00

|

-17.6%

|

|

|

Total FFO

|

$3.22

|

$2.97

|

8.4%

|

$9.74

|

$8.90

|

9.4%

|

|

|

Core FFO

|

$3.15

|

$2.98

|

5.7%

|

$9.38

|

$8.90

|

5.4%

|

|

Third Quarter 2018 Highlights:

| · |

Reported Net Income per diluted share for the third quarter of 2018 of $1.22, compared to $1.21 in the third quarter of 2017.

|

| · |

Grew Core FFO per diluted share by 5.7% compared to the third quarter of 2017, exceeding the midpoint of the guidance range.

|

| · |

Achieved same-property gross revenue and net operating income (“NOI”) growth of 2.2% and 2.4%, respectively,

compared to the third quarter of 2017.

|

| · |

Realized a sequential quarterly increase in same-property revenue growth of 0.9%.

|

| · |

Revised full-year 2018 Net Income per diluted share guidance range to $5.18 to $5.28. Provided Net Income guidance range for the fourth quarter of 2018 of $1.06 to $1.16

per diluted share.

|

| · |

Revised full-year 2018 Total FFO per diluted share guidance range to $12.80 to $12.90, raising the midpoint by $0.05 per share. Provided Total FFO guidance range for the

fourth quarter of 2018 of $3.07 to $3.17 per diluted share.

|

| · |

Increased full-year 2018 Core FFO per diluted share guidance by $0.03 per share at the midpoint to a range of $12.51 to $12.61. Provided Core FFO guidance range for the

fourth quarter of 2018 of $3.13 to $3.23 per diluted share.

|

1100 Park Place Suite 200 San Mateo California 94403 telephone 650 655 7800 facsimile 650 655 7810

www.essex.com

“We are pleased to report another quarter of healthy growth, driven by strong apartment

fundamentals in the major coastal metros of California and Washington. Job growth continues to outpace national averages, contributing to ongoing shortages of rental housing and pushing personal income higher amid tight labor market conditions.

We expect these conditions to continue into 2019, with market rents continuing to grow near long-term averages” commented Michael Schall, President and CEO of the company.

Same-Property Operations

Same-property operating results exclude any properties that are not comparable for the periods presented. The table below illustrates the percentage change in

same-property gross revenues for the quarter ended September 30, 2018 compared to the quarter ended September 30, 2017, and the sequential percentage change for the quarter ended September 30, 2018 versus the quarter ended June 30, 2018, by

submarket for the Company:

|

Q3 2018 vs.

Q3 2017

|

Q3 2018 vs.

Q2 2018

|

% of Total

Revenues

|

|

|

Gross Revenues

|

Gross Revenues

|

Q3 2018 Revenues

|

|

|

Southern California

|

|||

|

Los Angeles County

|

2.2%

|

1.0%

|

20.4%

|

|

Orange County

|

1.8%

|

1.0%

|

11.2%

|

|

San Diego County

|

3.1%

|

1.2%

|

8.8%

|

|

Ventura County

|

3.2%

|

0.5%

|

4.5%

|

|

Other Southern California

|

5.2%

|

2.3%

|

0.5%

|

|

Total Southern California

|

2.4%

|

1.0%

|

45.4%

|

|

Northern California

|

|||

|

Santa Clara County

|

2.4%

|

0.8%

|

15.6%

|

|

Alameda County

|

2.0%

|

1.0%

|

7.1%

|

|

San Mateo County

|

3.4%

|

1.7%

|

5.1%

|

|

Contra Costa County

|

2.0%

|

0.6%

|

5.0%

|

|

San Francisco

|

0.3%

|

1.1%

|

3.3%

|

|

Other Northern California

|

-0.5%

|

-4.3%

|

0.2%

|

|

Total Northern California

|

2.2%

|

0.9%

|

36.3%

|

|

Seattle Metro

|

1.6%

|

0.7%

|

18.3%

|

|

Same-Property Portfolio

|

2.2%

|

0.9%

|

100.0%

|

|

Year-Over-Year Growth

|

Year-Over-Year Growth

|

||||||

|

Q3 2018 compared to Q3 2017

|

YTD 2018 compared to YTD 2017

|

||||||

|

Gross

Revenues

|

Operating

Expenses

|

NOI

|

Gross

Revenues

|

Operating

Expenses

|

NOI

|

||

|

Southern California

|

2.4%

|

2.5%

|

2.4%

|

3.0%

|

2.2%

|

3.4%

|

|

|

Northern California

|

2.2%

|

-1.7%

|

3.6%

|

2.3%

|

0.2%

|

3.0%

|

|

|

Seattle Metro

|

1.6%

|

6.1%

|

-0.2%

|

3.0%

|

5.5%

|

2.0%

|

|

|

Same-Property Portfolio

|

2.2%

|

1.8%

|

2.4%

|

2.8%

|

2.1%

|

3.0%

|

|

- 2 -

|

Sequential Growth

|

|||

|

Q3 2018 compared to Q2 2018

|

|||

|

Gross

Revenues

|

Operating

Expenses

|

NOI

|

|

|

Southern California

|

1.0%

|

6.0%

|

-0.9%

|

|

Northern California

|

0.9%

|

2.8%

|

0.3%

|

|

Seattle Metro

|

0.7%

|

-0.6%

|

1.3%

|

|

Same-Property Portfolio

|

0.9%

|

3.6%

|

-0.1%

|

|

Financial Occupancies

|

|||

|

Quarter Ended

|

|||

|

9/30/2018

|

6/30/2018

|

9/30/2017

|

|

|

Southern California

|

96.5%

|

96.8%

|

96.8%

|

|

Northern California

|

96.3%

|

96.7%

|

97.0%

|

|

Seattle Metro

|

96.1%

|

96.3%

|

96.2%

|

|

Same-Property Portfolio

|

96.4%

|

96.7%

|

96.7%

|

Investment Activity

In October 2018, Wesco V, LLC (“Wesco V”), one of the Company’s joint ventures, acquired

Meridian at Midtown in San Jose, CA for a total contract price of $104.0 million. As part of the transaction, Wesco V assumed a $69.9 million loan with an effective interest rate of 4.5% and a maturity date in 2026. Meridian was built in 2015 and comprises 218 apartment homes

near downtown San Jose.

Other Investments

In October 2018, the Company originated an $18.6 million preferred equity investment in a multifamily development, located in Burlingame, CA. The investment

has an initial preferred return of 12.0% and matures in 2024.

Liquidity and Balance Sheet

Common Stock

The Company did not issue any shares of common stock through its equity distribution program in the third quarter of 2018.

The Company did not repurchase any shares of common stock in the third quarter of 2018.

Balance Sheet

As of October 22, 2018, the Company had $1.2 billion in undrawn capacity on its unsecured credit facilities.

Guidance

For the third quarter of 2018, the Company exceeded the midpoint of the guidance range

provided in its second quarter 2018 earnings release for Core FFO by $0.03 per share.

- 3 -

The following table provides a reconciliation of third quarter 2018 Core FFO per share to the midpoint of the guidance provided in the second quarter 2018

earnings release, which was dated August 1, 2018.

|

Per Diluted

Share

|

||||

|

Projected midpoint of Core FFO per share for Q3 2018

|

$

|

3.12

|

||

|

NOI from consolidated communities

|

0.01

|

|||

|

Interest expense and other

|

0.02

|

|||

|

Core FFO per share for Q3 2018 reported

|

$

|

3.15

|

||

The following table provides key changes to the 2018 full-year assumptions for Net Income,

Total FFO, Core FFO per diluted share, and same-property growth. For additional details regarding the Company’s 2018 assumptions, please see page S-14 of the accompanying supplemental financial information. For the fourth quarter of 2018,

the Company has established a range for Core FFO per diluted share of $3.13 to $3.23.

2018 Full-Year Guidance

|

Previous

Range

|

Previous

Midpoint

|

Revised

Range

|

Revised

Midpoint

|

|||||||||||||

|

Per Diluted Share

|

||||||||||||||||

|

Net Income

|

$

|

5.15 - $5.31

|

$

|

5.23

|

$

|

5.18 - $5.28

|

$

|

5.23

|

||||||||

|

Total FFO

|

$

|

12.72 - $12.88

|

$

|

12.80

|

$

|

12.80 - $12.90

|

$

|

12.85

|

||||||||

|

Core FFO

|

$

|

12.44 - $12.62

|

$

|

12.53

|

$

|

12.51 - $12.61

|

$

|

12.56

|

||||||||

|

Same-Property Growth

|

||||||||||||||||

|

Gross Revenues

|

2.6% to 3.0%

|

2.8

|

%

|

2.7% to 2.9%

|

2.8

|

%

|

||||||||||

|

Operating Expenses

|

2.4% to 2.8%

|

2.6

|

%

|

2.5% to 2.7%

|

2.6

|

%

|

||||||||||

|

NOI

|

2.5% to 3.2%

|

2.9

|

%

|

2.7% to 3.0%

|

2.9

|

%

|

||||||||||

Conference Call with Management

The Company will host an earnings conference call with management to discuss its quarterly results on Monday, October 29, 2018 at 12 p.m. PT (3 p.m. ET),

which will be broadcast live via the Internet at www.essex.com, and accessible via phone by dialing toll-free, (877) 407-0784, or toll/international, (201) 689-8560. No

passcode is necessary.

A rebroadcast of the live call will be available online for 30 days and digitally for seven days. To access the replay online, go to www.essex.com and select Investors and the third quarter earnings webcast. To access the replay digitally, dial (844) 512-2921 using the Replay Pin Number – 13683691. If you are unable to access the information via the

Company’s website, please contact the Investor Relations Department at investors@essex.com or by calling (650) 655-7800.

- 4 -

Corporate Profile

Essex Property Trust, Inc., an S&P 500 company, is a fully integrated real estate investment trust (REIT) that acquires, develops, redevelops, and manages

multifamily residential properties in selected West Coast markets. The Company currently has ownership interests in 248 apartment communities comprising approximately 60,000 apartment homes, excluding six properties in various stages of active development, one commercial building, preferred equity co-investments, and loan investments. Additional information about Essex can be found on the Company’s website at www.essex.com.

This press release and accompanying supplemental financial information has been furnished to the Securities and Exchange Commission (“SEC”) electronically on

Form 8-K and can be accessed from the Company’s website at www.essex.com. If you are unable to obtain the information via the Internet, please contact the Investor

Relations Department at (650) 655-7800.

FFO Reconciliation

FFO, as defined by the National Association of Real Estate Investment Trusts (“NAREIT”), is generally considered by industry analysts as an appropriate

measure of performance of an equity REIT. Generally, FFO adjusts the net income of equity REITs for non-cash charges such as depreciation and amortization of rental properties, impairment charges, gains on sales of real estate and extraordinary

items. Management considers FFO and FFO which excludes non-core items, which is referred to as “Core FFO,” to be useful supplemental operating performance measures of an equity REIT because, together with net income and cash flows, FFO and Core FFO

provide investors with additional bases to evaluate the operating performance and ability of a REIT to incur and service debt and to fund acquisitions and other capital expenditures and to pay dividends. By excluding gains or losses related to

sales of depreciated operating properties and excluding real estate depreciation (which can vary among owners of identical assets in similar condition based on historical cost accounting and useful life estimates), FFO can help investors compare

the operating performance of a real estate company between periods or as compared to different companies. By further adjusting for items that are not considered part of the Company’s core business operations, Core FFO allows investors to compare

the core operating performance of the Company to its performance in prior reporting periods and to the operating performance of other real estate companies without the effect of items that by their nature are not comparable from period to period

and tend to obscure the Company’s actual operating results.

FFO and Core FFO do not represent net income or cash flows from operations as defined by U.S. generally accepted accounting principles (“GAAP”) and are not

intended to indicate whether cash flows will be sufficient to fund cash needs. These measures should not be considered as alternatives to net income as an indicator of the REIT’s operating performance or to cash flows as a measure of liquidity. FFO

and Core FFO do not measure whether cash flow is sufficient to fund all cash needs including principal amortization, capital improvements and distributions to stockholders. FFO and Core FFO also do not represent cash flows generated from operating,

investing or financing activities as defined under GAAP. Management has consistently applied the NAREIT definition of FFO to all periods presented. However, there is judgment involved and other REITs’ calculation of FFO may vary from the NAREIT

definition for this measure, and thus their disclosures of FFO may not be comparable to the Company’s calculation.

- 5 -

The following table sets forth the Company’s calculation of diluted FFO and Core FFO for the three and nine months ended September 30, 2018 and 2017 (in

thousands, except for share and per share amounts):

|

Three Months Ended

September 30,

|

Nine Months Ended

September 30,

|

|||||||||||||||

|

Funds from Operations attributable to common stockholders and unitholders

|

2018

|

2017

|

2018

|

2017

|

||||||||||||

|

Net income available to common stockholders

|

$

|

80,975

|

$

|

79,723

|

$

|

272,333

|

$

|

329,446

|

||||||||

|

Adjustments:

|

||||||||||||||||

|

Depreciation and amortization

|

120,852

|

117,451

|

359,287

|

350,893

|

||||||||||||

|

Gains not included in FFO

|

-

|

(10,307

|

)

|

(22,244

|

)

|

(125,122

|

)

|

|||||||||

|

Depreciation and amortization from unconsolidated co-investments

|

15,766

|

13,854

|

47,345

|

40,335

|

||||||||||||

|

Noncontrolling interest related to Operating Partnership units

|

2,789

|

2,721

|

9,381

|

11,289

|

||||||||||||

|

Depreciation attributable to third party ownership and other

|

(234

|

)

|

(23

|

)

|

(699

|

)

|

(74

|

)

|

||||||||

|

Funds from Operations attributable to common stockholders and unitholders

|

$

|

220,148

|

$

|

203,419

|

$

|

665,403

|

$

|

606,767

|

||||||||

|

FFO per share – diluted

|

$

|

3.22

|

$

|

2.97

|

$

|

9.74

|

$

|

8.90

|

||||||||

|

Expensed acquisition and investment related costs

|

$

|

31

|

$

|

324

|

$

|

156

|

$

|

1,154

|

||||||||

|

Gain on sale of marketable securities

|

(120

|

)

|

(32

|

)

|

(669

|

)

|

(1,650

|

)

|

||||||||

|

Unrealized gains on marketable securities

|

(1,180

|

)

|

-

|

(426

|

)

|

-

|

||||||||||

|

Interest rate hedge ineffectiveness (1)

|

(35

|

)

|

1

|

61

|

(19

|

)

|

||||||||||

|

Gain on early retirement of debt from unconsolidated co-investment

|

(3,662

|

)

|

-

|

(3,662

|

)

|

-

|

||||||||||

|

Co-investment promote income

|

-

|

-

|

(20,541

|

)

|

-

|

|||||||||||

|

Income from early redemption of preferred equity investments

|

-

|

(8

|

)

|

(1,602

|

)

|

(256

|

)

|

|||||||||

|

Insurance reimbursements, legal settlements, and other, net

|

30

|

335

|

2,013

|

310

|

||||||||||||

|

Core Funds from Operations attributable to common stockholders and unitholders

|

$

|

215,212

|

$

|

204,039

|

$

|

640,733

|

$

|

606,306

|

||||||||

|

Core FFO per share – diluted

|

$

|

3.15

|

$

|

2.98

|

$

|

9.38

|

$

|

8.90

|

||||||||

|

Weighted average number of shares outstanding diluted (2)

|

68,339,057

|

68,392,419

|

68,328,370

|

68,159,766

|

||||||||||||

| (1) |

Interest rate swaps are generally adjusted to fair value through other comprehensive income (loss). However, because certain of our interest rate swaps do not have a 0%

LIBOR floor, while related hedged debt in these cases is subject to a 0% LIBOR floor, the portion of the change in fair value of these interest rate swaps attributable to this mismatch is recorded as noncash interest rate hedge

ineffectiveness through interest expense.

|

| (2) |

Assumes conversion of all outstanding limited partnership units in Essex Portfolio, L.P. (the “Operating Partnership”) into shares of the Company’s common stock and

excludes all DownREIT limited partnership units for which the Operating Partnership has the ability and intention to redeem the units for cash and does not consider them to be common stock equivalents.

|

- 6 -

NOI and Same-Property NOI Reconciliations

NOI and Same-Property NOI are considered by management to be important supplemental performance measures to earnings from operations included in the Company’s

condensed consolidated statements of income. The presentation of same-property NOI assists with the presentation of the Company’s operations prior to the allocation of depreciation and any corporate-level or financing-related costs. NOI reflects

the operating performance of a community and allows for an easy comparison of the operating performance of individual communities or groups of communities. In addition, because prospective buyers of real estate have different financing and overhead

structures, with varying marginal impacts to overhead by acquiring real estate, NOI is considered by many in the real estate industry to be a useful measure for determining the value of a real estate asset or group of assets. The Company defines

same-property NOI as same-property revenue less same-property operating expenses, including property taxes. Please see the reconciliation of earnings from operations to NOI and same-property NOI, which in the table below is the NOI for stabilized

properties consolidated by the Company for the periods presented (dollars in thousands):

|

Three Months Ended

September 30,

|

Nine Months Ended

September 30,

|

|||||||||||||||

|

2018

|

2017

|

2018

|

2017

|

|||||||||||||

|

Earnings from operations

|

$

|

113,897

|

$

|

112,669

|

$

|

340,716

|

$

|

334,147

|

||||||||

|

Adjustments:

|

||||||||||||||||

|

Corporate-level property management expenses

|

7,761

|

7,573

|

23,313

|

22,604

|

||||||||||||

|

Depreciation and amortization

|

120,852

|

117,451

|

359,287

|

350,893

|

||||||||||||

|

Management and other fees from affiliates

|

(2,307

|

)

|

(2,395

|

)

|

(6,812

|

)

|

(6,927

|

)

|

||||||||

|

General and administrative

|

10,601

|

9,788

|

36,539

|

30,726

|

||||||||||||

|

Expensed acquisition and investment related costs

|

31

|

324

|

156

|

1,154

|

||||||||||||

|

NOI

|

250,835

|

245,410

|

753,199

|

732,597

|

||||||||||||

|

Less: Non-same property NOI

|

(18,274

|

)

|

(18,214

|

)

|

(56,611

|

)

|

(56,273

|

)

|

||||||||

|

Same-Property NOI

|

$

|

232,561

|

$

|

227,196

|

$

|

696,588

|

$

|

676,324

|

||||||||

Safe Harbor Statement Under The Private Litigation Reform Act of 1995:

This press release includes “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the

Securities Exchange Act of 1934, as amended. Forward-looking statements are statements which are not historical facts, including statements regarding the Company’s expectations, estimates, assumptions, hopes, intentions, beliefs and strategies

regarding the future. Words such as “expects,” “assumes,” “anticipates,” “may,” “will,” “intends,” “plans,” “believes,” “seeks,” “estimates,” and variations of such words and similar expressions are intended to identify such forward-looking

statements. Such forward-looking statements include, among other things, statements regarding the Company’s intent, beliefs or expectations with respect to the timing of completion of current development and redevelopment projects and the

stabilization of such projects, the timing of lease-up and occupancy of its apartment communities, the anticipated operating performance of its apartment communities, the total projected costs of development and redevelopment projects,

co-investment activities, qualification as a REIT under the Internal Revenue Code, the real estate markets in the geographies in which the Company’s properties are located and in the United States in general, the adequacy of future cash flows to

meet anticipated cash needs, its financing activities and the use of proceeds from such activities, the availability of debt and equity financing, general economic conditions including the potential impacts from the economic conditions, trends

affecting the Company’s financial condition or results of operations, changes to U.S. tax laws and regulations in general or specifically related to REITs or real estate, changes to laws and regulations in jurisdictions in which communities the

Company owns are located, and other information that is not historical information.

- 7 -

While the Company’s management believes the assumptions underlying its forward-looking statements are reasonable, such forward-looking statements involve

known and unknown risks, uncertainties and other factors, many of which are beyond the Company’s control, which could cause the actual results, performance or achievements of the Company to be materially different from any future results,

performance or achievements expressed or implied by such forward-looking statements. The Company cannot assure the future results or outcome of the matters described in these statements; rather, these statements merely reflect the Company’s current

expectations of the approximate outcomes of the matters discussed. Factors that might cause the Company’s actual results, performance or achievements to differ materially from those expressed or implied by these forward-looking statements include,

but are not limited to, the following: the Company may fail to achieve its business objectives; the actual completion of development and redevelopment projects may be subject to delays; the stabilization dates of such projects may be delayed; the

Company may abandon or defer development projects for a number of reasons, including changes in local market conditions which make development less desirable, increases in costs of development, increases in the cost of capital or lack of capital

availability, resulting in losses; the total projected costs of current development and redevelopment projects may exceed expectations; such development and redevelopment projects may not be completed; development and redevelopment projects and

acquisitions may fail to meet expectations; estimates of future income from an acquired property may prove to be inaccurate; occupancy rates and rental demand may be adversely affected by competition and local economic and market conditions; there

may be increased interest rates and operating costs; the Company may be unsuccessful in the management of its relationships with its co-investment partners; future cash flows may be inadequate to meet operating requirements and/or may be

insufficient to provide for dividend payments in accordance with REIT requirements; there may be a downturn in general economic conditions, the real estate industry, and the markets in which the Company’s communities are located; changes in laws or

regulations; the terms of any refinancing may not be as favorable as the terms of existing indebtedness; and those risks, special considerations, and other factors referred to in the Company’s quarterly reports on Form 10-Q, in the Company’s annual

report on Form 10-K for the year ended December 31, 2017, and in the Company’s other filings with the SEC. All forward-looking statements are made as of the date hereof, the Company assumes no obligation to update or supplement this information for

any reason, and therefore, they may not represent the Company’s estimates and assumptions after the date of this press release.

Definitions and Reconciliations

Non-GAAP financial measures and certain other capitalized terms, as used in this earnings release, are defined and further explained on pages S-17.1 through

S-17.4, “Reconciliations of Non-GAAP Financial Measures and Other Terms,” of the accompanying supplemental financial information. The supplemental financial information is available on the Company’s website at www.essex.com.

Contact Information

Barb Pak

Group Vice President of Finance & Investor Relations

(650) 655-7800

bpak@essex.com

- 8 -

Q3 2018 Supplemental

Table of Contents

|

Page(s)

|

|

|

Consolidated Operating Results

|

S-1 – S-2

|

|

Consolidated Funds From Operations

|

S-3

|

|

Consolidated Balance Sheets

|

S-4

|

|

Debt Summary – September 30, 2018

|

S-5

|

|

Capitalization Data, Public Bond Covenants, Credit Ratings, and Selected Credit Ratios – September 30, 2018

|

S-6

|

|

Portfolio Summary by County – September 30, 2018

|

S-7

|

|

Operating Income by Quarter – September 30, 2018

|

S-8

|

|

Same-Property Revenue Results by County – Quarters ended September 30, 2018

and 2017, and June 30, 2018

|

S-9

|

|

Same-Property Revenue Results by County – Nine months ended September 30,

2018 and 2017 S-9.1

|

S-9.1 |

|

Same-Property Operating Expenses – Quarter and Year to Date as of September

30, 2018 and 2017

|

S-10

|

|

Development Pipeline – September 30, 2018

|

S-11

|

|

Redevelopment Pipeline – September 30, 2018

|

S-12

|

|

Capital Expenditures – September 30, 2018

|

S-12.1

|

|

Co-investments and Preferred Equity Investments – September 30, 2018

|

S-13

|

|

Assumptions for 2018 FFO Guidance Range

|

S-14

|

|

Reconciliation of Projected EPS, FFO and Core FFO per diluted share

|

S-14.1

|

|

Summary of Apartment Community Acquisitions and Dispositions Activity

|

S-15

|

|

Preliminary 2019 MSA Level Forecast: Supply, Jobs and Apartment Market Conditions

|

S-16

|

|

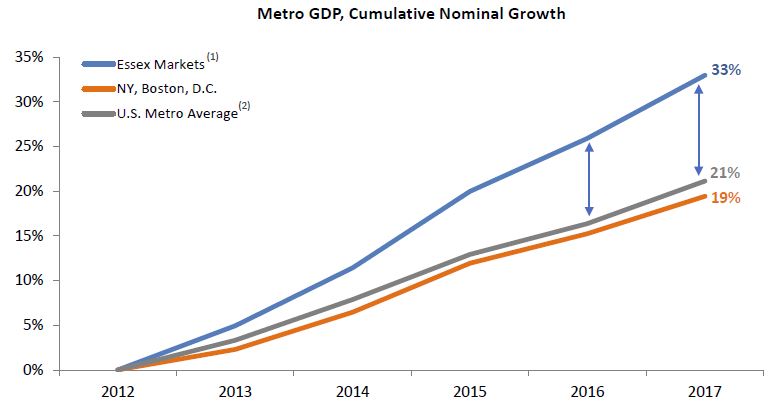

GDP Growth in Essex Metros Consistently Exceeds U.S. and Supports Stronger Household Earnings Growth

|

S-16.1

|

|

Reconciliations of Non-GAAP Financial Measures and Other Terms

|

S-17.1 – S-17.4

|

E S S E X P R O P E R T Y T R U S T, I N C.

|

Consolidated Operating Results

(Dollars in thousands, except share and per share amounts)

|

Three Months Ended

September 30, |

Nine Months Ended

September 30, |

||||||||||||||

|

2018

|

2017

|

2018

|

2017

|

|||||||||||||

|

Revenues:

|

||||||||||||||||

|

Rental and other property

|

$

|

348,610

|

$

|

341,974

|

$

|

1,040,083

|

$

|

1,011,908

|

||||||||

|

Management and other fees from affiliates

|

2,307

|

2,395

|

6,812

|

6,927

|

||||||||||||

|

350,917

|

344,369

|

1,046,895

|

1,018,835

|

|||||||||||||

|

Expenses:

|

||||||||||||||||

|

Property operating

|

97,775

|

96,564

|

286,884

|

279,311

|

||||||||||||

|

Corporate-level property management expenses

|

7,761

|

7,573

|

23,313

|

22,604

|

||||||||||||

|

Depreciation and amortization

|

120,852

|

117,451

|

359,287

|

350,893

|

||||||||||||

|

General and administrative

|

10,601

|

9,788

|

36,539

|

30,726

|

||||||||||||

|

Expensed acquisition and investment related costs

|

31

|

324

|

156

|

1,154

|

||||||||||||

|

237,020

|

231,700

|

706,179

|

684,688

|

|||||||||||||

|

Earnings from operations

|

113,897

|

112,669

|

340,716

|

334,147

|

||||||||||||

|

Interest expense, net (1)

|

(53,012

|

)

|

(53,400

|

)

|

(159,653

|

)

|

(159,680

|

)

|

||||||||

|

Interest and other income

|

8,437

|

5,790

|

21,241

|

17,916

|

||||||||||||

|

Equity income from co-investments

|

16,788

|

19,727

|

64,611

|

40,934

|

||||||||||||

|

Gain on sale of real estate and land

|

-

|

249

|

22,244

|

26,423

|

||||||||||||

|

Gain on remeasurement of co-investment

|

-

|

-

|

-

|

88,641

|

||||||||||||

|

Net income

|

86,110

|

85,035

|

289,159

|

348,381

|

||||||||||||

|

Net income attributable to noncontrolling interest

|

(5,135

|

)

|

(5,312

|

)

|

(16,826

|

)

|

(18,935

|

)

|

||||||||

|

Net income available to common stockholders

|

$

|

80,975

|

$

|

79,723

|

$

|

272,333

|

$

|

329,446

|

||||||||

|

Net income per share - basic

|

$

|

1.23

|

$

|

1.21

|

$

|

4.12

|

$

|

5.01

|

||||||||

|

Shares used in income per share - basic

|

66,052,108

|

65,994,896

|

66,047,990

|

65,759,450

|

||||||||||||

|

Net income per share - diluted

|

$

|

1.22

|

$

|

1.21

|

$

|

4.12

|

$

|

5.00

|

||||||||

|

Shares used in income per share - diluted

|

66,103,812

|

66,078,283

|

66,093,004

|

65,836,965

|

||||||||||||

| (1) |

Refer to page S-17.2, the section titled “Interest Expense, Net” for additional information.

|

See Company’s Form 10-K and Form 10-Qs filed with the SEC for additional information

S-1

E S S E X P R O P E R T Y T R U S T, I N C.

|

Consolidated Operating Results

Selected Line Item Detail |

Three Months Ended

September 30, |

Nine Months Ended

September 30, |

||||||||||||||

|

(Dollars in thousands)

|

2018

|

2017

|

2018

|

2017

|

||||||||||||

|

Rental and other property

|

||||||||||||||||

|

Rental

|

$

|

324,780

|

$

|

319,308

|

$

|

969,461

|

$

|

943,976

|

||||||||

|

Other property

|

23,830

|

22,666

|

70,622

|

67,932

|

||||||||||||

|

Rental and other property

|

$

|

348,610

|

$

|

341,974

|

$

|

1,040,083

|

$

|

1,011,908

|

||||||||

|

Property operating expenses

|

||||||||||||||||

|

Real estate taxes

|

$

|

38,675

|

$

|

37,531

|

$

|

112,378

|

$

|

108,283

|

||||||||

|

Administrative

|

19,500

|

20,431

|

61,211

|

61,119

|

||||||||||||

|

Maintenance and repairs

|

20,132

|

20,323

|

59,742

|

58,409

|

||||||||||||

|

Utilities

|

19,468

|

18,279

|

53,553

|

51,500

|

||||||||||||

|

Property operating expenses

|

$

|

97,775

|

$

|

96,564

|

$

|

286,884

|

$

|

279,311

|

||||||||

|

Interest and other income

|

||||||||||||||||

|

Marketable securities and other interest income

|

$

|

6,772

|

$

|

5,504

|

$

|

18,824

|

$

|

15,428

|

||||||||

|

Gain on sale of marketable securities

|

120

|

32

|

669

|

1,650

|

||||||||||||

|

Unrealized gains on marketable securities (1)

|

1,180

|

-

|

426

|

-

|

||||||||||||

|

Insurance reimbursements, legal settlements, and other, net

|

365

|

254

|

1,322

|

838

|

||||||||||||

|

Interest and other income

|

$

|

8,437

|

$

|

5,790

|

$

|

21,241

|

$

|

17,916

|

||||||||

|

Equity income from co-investments

|

||||||||||||||||

|

Equity income from co-investments

|

$

|

4,097

|

$

|

3,688

|

$

|

12,878

|

$

|

13,336

|

||||||||

|

Income from preferred equity investments

|

9,029

|

5,973

|

25,928

|

17,284

|

||||||||||||

|

Gain on sale of co-investment communities

|

-

|

10,058

|

-

|

10,058

|

||||||||||||

|

Gain on early retirement of debt from unconsolidated co-investment

|

3,662

|

-

|

3,662

|

-

|

||||||||||||

|

Co-investment promote income

|

-

|

-

|

20,541

|

-

|

||||||||||||

|

Income from early redemption of preferred equity investments

|

-

|

8

|

1,602

|

256

|

||||||||||||

|

Equity income from co-investments

|

$

|

16,788

|

$

|

19,727

|

$

|

64,611

|

$

|

40,934

|

||||||||

|

Noncontrolling interest

|

||||||||||||||||

|

Limited partners of Essex Portfolio, L.P.

|

$

|

2,789

|

$

|

2,721

|

$

|

9,381

|

$

|

11,289

|

||||||||

|

DownREIT limited partners’ distributions

|

1,590

|

1,692

|

4,770

|

4,937

|

||||||||||||

|

Third-party ownership interest

|

756

|

899

|

2,675

|

2,709

|

||||||||||||

|

Noncontrolling interest

|

$

|

5,135

|

$

|

5,312

|

$

|

16,826

|

$

|

18,935

|

||||||||

| (1) |

The Company adopted ASU No. 2016-01 “Recognition and Measurement of Financial Assets and Financial Liabilities”, as of January 1, 2018 using the modified-retrospective method.

As a result of this adoption, the Company recognizes mark to market adjustments on equity securities through its income statement on a prospective basis. Prior period results have not been adjusted.

|

See Company’s Form 10-K and Form 10-Qs filed with the SEC for additional information

S-2

E S S E X P R O P E R T Y T R U S T, I N C.

|

Consolidated Funds From Operations (1)

(Dollars in thousands, except share and per share amounts and in footnotes) |

Three Months Ended

September 30, |

Nine Months Ended

September 30, |

||||||||||||||||

|

2018

|

2017

|

% Change |

2018

|

2017

|

% Change | |||||||||||||

|

Funds from operations attributable to common stockholders and unitholders (FFO)

|

||||||||||||||||||

|

Net income available to common stockholders

|

$

|

80,975

|

$

|

79,723

|

$

|

272,333

|

$

|

329,446

|

||||||||||

|

Adjustments:

|

||||||||||||||||||

|

Depreciation and amortization

|

120,852

|

117,451

|

359,287

|

350,893

|

||||||||||||||

|

Gains not included in FFO

|

-

|

(10,307

|

)

|

(22,244

|

)

|

(125,122

|

)

|

|||||||||||

|

Depreciation and amortization from unconsolidated co-investments

|

15,766

|

13,854

|

47,345

|

40,335

|

||||||||||||||

|

Noncontrolling interest related to Operating Partnership units

|

2,789

|

2,721

|

9,381

|

11,289

|

||||||||||||||

|

Depreciation attributable

to third party ownership and other (2)

|

(234

|

)

|

(23

|

)

|

(699

|

)

|

(74

|

)

|

||||||||||

|

Funds from operations attributable to common stockholders and unitholders

|

$

|

220,148

|

$

|

203,419

|

$

|

665,403

|

$

|

606,767

|

||||||||||

|

FFO per share-diluted

|

$

|

3.22

|

$

|

2.97

|

8.4%

|

$

|

9.74

|

$

|

8.90

|

9.4%

|

||||||||

|

Components of the change in FFO

|

||||||||||||||||||

|

Non-core items:

|

||||||||||||||||||

|

Expensed acquisition and investment related costs

|

$

|

31

|

$

|

324

|

$

|

156

|

$

|

1,154

|

||||||||||

|

Gain on sale of marketable securities

|

(120

|

)

|

(32

|

)

|

(669

|

)

|

(1,650

|

)

|

||||||||||

|

Unrealized gains on marketable securities

|

(1,180

|

)

|

-

|

(426

|

)

|

-

|

||||||||||||

|

Interest rate hedge

ineffectiveness (3)

|

(35

|

)

|

1

|

61

|

(19

|

)

|

||||||||||||

|

Gain on early retirement of debt from unconsolidated co-investment

|

(3,662

|

)

|

-

|

(3,662

|

)

|

-

|

||||||||||||

|

Co-investment promote income

|

-

|

-

|

(20,541

|

)

|

-

|

|||||||||||||

|

Income from early redemption of preferred equity investments

|

-

|

(8

|

)

|

(1,602

|

)

|

(256

|

)

|

|||||||||||

|

Insurance reimbursements, legal settlements, and other, net

|

30

|

335

|

2,013

|

310

|

||||||||||||||

|

Core funds from operations attributable to common stockholders and unitholders

|

$

|

215,212

|

$

|

204,039

|

$

|

640,733

|

$

|

606,306

|

||||||||||

|

Core FFO per share-diluted

|

$

|

3.15

|

$

|

2.98

|

5.7%

|

$

|

9.38

|

$

|

8.90

|

5.4%

|

||||||||

|

Changes in core items:

|

||||||||||||||||||

|

Same-property NOI

|

$

|

5,365

|

$

|

20,349

|

||||||||||||||

|

Non-same property NOI

|

60

|

253

|

||||||||||||||||

|

Management and other fees, net

|

(88

|

)

|

(115

|

)

|

||||||||||||||

|

FFO from co-investments

|

5,377

|

15,196

|

||||||||||||||||

|

Interest and other income

|

933

|

3,009

|

||||||||||||||||

|

Interest expense

|

424

|

(53

|

)

|

|||||||||||||||

|

General and administrative

|

(672

|

)

|

(3,239

|

)

|

||||||||||||||

|

Corporate-level property management expenses

|

(188

|

)

|

(709

|

)

|

||||||||||||||

|

Other items, net

|

(38

|

)

|

(264

|

)

|

||||||||||||||

|

$

|

11,173

|

$

|

34,427

|

|||||||||||||||

|

Weighted average number of

shares outstanding diluted (4)

|

68,339,057

|

68,392,419

|

68,328,370

|

68,159,766

|

||||||||||||||

| (1) |

Refer to page S-17.2, the section titled “Funds from Operations (“FFO”) for additional information on the Company’s definition and use of FFO and Core FFO.

|

| (2) |

The Company consolidates certain co-investments. The noncontrolling interest’s share of net operating income in these investments for the three and nine months ended

September 30, 2018 was $1.3 million and $3.8 million, respectively.

|

| (3) |

Interest rate swaps are generally adjusted to fair value through other comprehensive income (loss). However, because certain of our interest rate swaps do not have a 0%

LIBOR floor, while related hedged debt in these cases is subject to a 0% LIBOR floor, the portion of the change in fair value of these interest rate swaps attributable to this mismatch, if any, is recorded as noncash interest rate

hedge ineffectiveness through interest expense.

|

| (4) |

Assumes conversion of all outstanding limited partnership units in the Operating Partnership into shares of the Company’s common stock and excludes all DownREIT limited

partnership units for which the Operating Partnership has the ability and intention to redeem the units for cash and does not consider them to be common stock equivalents.

|

See Company’s Form 10-K and Form 10-Qs filed with the SEC for additional information

S-3

E S S E X P R O P E R T Y T R U S T, I N C.

|

Consolidated Balance Sheets

(Dollars in thousands)

|

||||||||

|

September 30, 2018

|

December 31, 2017

|

|||||||

|

Real Estate:

|

||||||||

|

Land and land improvements

|

$

|

2,710,139

|

$

|

2,719,064

|

||||

|

Buildings and improvements

|

10,744,841

|

10,643,009

|

||||||

|

13,454,980

|

13,362,073

|

|||||||

|

Less: accumulated depreciation

|

(3,113,386

|

)

|

(2,769,297

|

)

|

||||

|

10,341,594

|

10,592,776

|

|||||||

|

Real estate under development

|

403,644

|

355,735

|

||||||

|

Co-investments

|

1,267,593

|

1,155,984

|

||||||

|

12,012,831

|

12,104,495

|

|||||||

|

Cash and cash equivalents, including restricted cash

|

174,626

|

61,126

|

||||||

|

Marketable securities

|

210,596

|

190,004

|

||||||

|

Notes and other receivables

|

69,166

|

100,926

|

||||||

|

Prepaid expenses and other assets

|

50,924

|

39,155

|

||||||

|

Total assets

|

$

|

12,518,143

|

$

|

12,495,706

|

||||

|

Unsecured debt, net

|

$

|

3,798,705

|

$

|

3,501,709

|

||||

|

Mortgage notes payable, net

|

1,834,967

|

2,008,417

|

||||||

|

Lines of credit

|

-

|

179,000

|

||||||

|

Distributions in excess of investments in co-investments

|

-

|

36,726

|

||||||

|

Other liabilities

|

411,778

|

333,823

|

||||||

|

Total liabilities

|

6,045,450

|

6,059,675

|

||||||

|

Redeemable noncontrolling interest

|

36,665

|

39,206

|

||||||

|

Equity:

|

||||||||

|

Common stock

|

7

|

7

|

||||||

|

Additional paid-in capital

|

7,133,587

|

7,129,571

|

||||||

|

Distributions in excess of accumulated earnings

|

(808,085

|

)

|

(833,726

|

)

|

||||

|

Accumulated other comprehensive loss, net

|

(8,548

|

)

|

(18,446

|

)

|

||||

|

Total stockholders’ equity

|

6,316,961

|

6,277,406

|

||||||

|

Noncontrolling interest

|

119,067

|

119,419

|

||||||

|

Total equity

|

6,436,028

|

6,396,825

|

||||||

|

Total liabilities and equity

|

$

|

12,518,143

|

$

|

12,495,706

|

||||

See Company’s Form 10-K and Form 10-Qs filed with the SEC for additional information

S-4

E S S E X P R O P E R T Y T R U S T, I N C.

|

Debt Summary - September 30, 2018

(Dollars in thousands, except in footnotes) |

|||||||||||||||||||||||||||

|

Scheduled principal payments, unamortized premiums (discounts) and (debt issuance costs) are as follows - excludes lines of credit:

|

|||||||||||||||||||||||||||

| |

|||||||||||||||||||||||||||

|

Balance

Outstanding

|

Weighted Average

|

Unsecured

|

Secured

|

Total

|

Weighted

Average

Interest

Rate

|

Percentage

of

Total

Debt

|

|||||||||||||||||||||

|

Interest

Rate

|

Maturity

in Years

|

||||||||||||||||||||||||||

|

Unsecured Debt, net

|

|||||||||||||||||||||||||||

|

Bonds private - fixed rate

|

$

|

275,000

|

4.5

|

%

|

2.3

|

2018

|

$

|

-

|

$

|

68,054

|

$

|

68,054

|

5.8

|

%

|

1.2

|

%

|

|||||||||||

|

Bonds public - fixed rate

|

3,200,000

|

3.9

|

%

|

7.9

|

2019

|

75,000

|

530,688

|

605,688

|

4.4

|

%

|

10.7

|

%

|

|||||||||||||||

|

Term loan (1)

|

350,000

|

2.8

|

%

|

3.4

|

2020

|

-

|

693,723

|

693,723

|

5.0

|

%

|

12.3

|

%

|

|||||||||||||||

|

Unamortized net discounts and debt issuance costs

|

(26,295

|

)

|

-

|

-

|

2021

|

500,000

|

43,604

|

543,604

|

4.5

|

%

|

9.6

|

%

|

|||||||||||||||

|

3,798,705

|

3.8

|

%

|

7.1

|

2022

|

650,000

|

41,178

|

691,178

|

3.3

|

%

|

12.3

|

%

|

||||||||||||||||

|

Mortgage Notes Payable, net

|

2023

|

600,000

|

852

|

600,852

|

3.7

|

%

|

10.7

|

%

|

|||||||||||||||||||

|

Fixed rate - secured

|

1,548,409

|

4.7

|

%

|

2.2

|

2024

|

400,000

|

932

|

400,932

|

4.0

|

%

|

7.1

|

%

|

|||||||||||||||

|

Variable rate - secured (2)

|

269,766

|

2.3

|

%

|

17.9

|

2025

|

500,000

|

14,619

|

514,619

|

3.6

|

%

|

9.1

|

%

|

|||||||||||||||

|

Unamortized premiums and debt issuance costs, net

|

16,792

|

-

|

-

|

2026

|

450,000

|

53,601

|

503,601

|

3.5

|

%

|

8.9

|

%

|

||||||||||||||||

|

Total mortgage notes payable

|

1,834,967

|

4.4

|

%

|

4.5

|

2027

|

350,000

|

153,955

|

503,955

|

3.6

|

%

|

8.9

|

%

|

|||||||||||||||

|

2028

|

-

|

53,332

|

53,332

|

4.0

|

%

|

1.0

|

%

|

||||||||||||||||||||

|

Unsecured Lines of Credit

|

Thereafter

|

300,000

|

163,637

|

463,637

|

3.8

|

%

|

8.2

|

%

|

|||||||||||||||||||

|

Line of credit (3)

|

-

|

3.0

|

%

|

Subtotal

|

3,825,000

|

1,818,175

|

5,643,175

|

4.0

|

%

|

100.0

|

%

|

||||||||||||||||

|

Line of credit (4)

|

-

|

3.0

|

%

|

Debt Issuance Costs

|

(19,334

|

)

|

(4,418

|

)

|

(23,752

|

)

|

NA

|

NA

|

|||||||||||||||

|

Total lines of credit

|

-

|

3.0

|

%

|

(Discounts)/Premiums

|

(6,961

|

)

|

21,210

|

14,249

|

NA

|

NA

|

|||||||||||||||||

|

Total

|

$

|

3,798,705

|

$

|

1,834,967

|

$

|

5,633,672

|

4.0

|

%

|

100.0

|

%

|

|||||||||||||||||

|

Total debt, net

|

$

|

5,633,672

|

4.0

|

%

|

|||||||||||||||||||||||

Capitalized interest for the three and nine months ended September 30, 2018 was approximately $4.9 million and $13.3 million, respectively.

| (1) |

The unsecured term loan has a variable interest rate of LIBOR plus 0.95%. The Company has interest rate swap contracts with an aggregate notional amount of $175 million,

which effectively converts the interest rate on $175 million of the term loan to a fixed rate of 2.3%.

|

| (2) |

$269.8 million of variable rate debt is tax exempt to the note holders. $9.9 million is subject to interest rate cap protection agreements.

|

| (3) |

This unsecured line of credit facility has a capacity of $1.2 billion. The line matures in December 2021 with one 18-month extension, exercisable at the Company’s option.

The underlying interest rate on this line is based on a tiered rate structure tied to the Company’s corporate ratings and is currently at LIBOR plus 0.875%.

|

| (4) |

This unsecured line of credit facility has a capacity $35.0 million and is scheduled to mature in January 2020. The underlying interest rate on this line is based on a

tiered rate structure tied to the Company’s corporate ratings and is currently at LIBOR plus 0.875%.

|

See Company’s Form 10-K and Form 10-Qs filed with the SEC for additional information

S-5

E S S E X P R O P E R T Y T R U S T, I N C.

Capitalization Data, Public Bond Covenants, Credit Ratings and Selected Credit Ratios - September 30, 2018

(Dollars and shares in thousands, except per share amounts)

|

Capitalization

Data

|

Public Bond Covenants (1)

|

Actual

|

Requirement

|

||||||||||||

|

Total debt, net

|

$

|

5,633,672

|

|||||||||||||

|

Adjusted Debt to Adjusted Total Assets:

|

36%

|

|

< 65%

|

|

|||||||||||

|

Common stock and potentially dilutive securities

|

|||||||||||||||

|

Common stock outstanding

|

66,055

|

||||||||||||||

|

Limited partnership units (1)

|

2,235

|

||||||||||||||

|

Options-treasury method

|

59

|

Secured Debt to Adjusted Total Assets:

|

12%

|

|

< 40%

|

||||||||||

|

Total shares of common stock and potentially dilutive securities

|

68,349

|

||||||||||||||

|

Common stock price per share as of September 30, 2018

|

$

|

246.71

|

|||||||||||||

|

Interest Coverage:

|

433%

|

|

> 150%

|

||||||||||||

|

Total equity capitalization

|

$

|

16,862,382

|

|||||||||||||

|

Total market capitalization

|

$

|

22,496,054

|

Unsecured Debt Ratio (2):

|

287%

|

|

> 150%

|

|||||||||

|

Ratio of debt to total market capitalization

|

25.0

|

%

|

|

||||||||||||

|

Selected

Credit Ratios (3)

|

Actual

|

||||||||||||||

|

Credit

Ratings

|

|||||||||||||||

|

Rating Agency

|

Rating

|

Outlook

|

Net Indebtedness Divided by Adjusted EBITDAre, normalized and annualized:

|

5.5

|

|||||||||||

|

Fitch

|

BBB+

|

Positive

|

|||||||||||||

|

Moody’s

|

Baa1

|

Stable

|

Unencumbered NOI to Adjusted Total NOI:

|

73%

|

|

||||||||||

|

Standard & Poor’s

|

BBB+

|

Stable

|

|||||||||||||

| |

|

|

|||||||||||||

|

(1) Assumes conversion of all outstanding limited partnership units in the

Operating Partnership into shares of the Company’s common stock.

|

(1) Refer to page S-17.4 for additional information on the Company’s Public Bond

Covenants.

|

||||||||||||||

|

(2) Unsecured Debt Ratio is unsecured assets (excluding investments in

co-investments) divided by unsecured indebtedness.

|

|||||||||||||||

|

(3) Refer to pages S-17.1 to S-17.4, the section titled “Reconciliations of Non-GAAP

Financial Measures and Other Terms” for additional information on the Company’s Selected Credit Ratios.

|

|||||||||||||||

See Company’s Form 10-K and Form 10-Qs filed with the SEC for additional information

S-6

E S S E X P R O P E R T Y T R U S T, I N C.

Portfolio Summary by County as of September 30, 2018

Region - County

|

Apartment Homes

|

Average Monthly Rental Rate (1)

|

Percent of NOI (2)

|

|||||||||||||||||||||||||||||||||||||

|

Consolidated(3)

|

Unconsolidated

Co-investments(3)

|

Apartment

Homes in

Development(4)

|

Total

|

Consolidated

|

Unconsolidated

Co-investments(5)

|

Total(6)

|

Consolidated

|

Unconsolidated

Co-investments(5)

|

Total(6)

|

|||||||||||||||||||||||||||||||

|

Southern California

|

||||||||||||||||||||||||||||||||||||||||

|

Los Angeles County

|

9,387

|

1,563

|

200

|

11,150

|

$

|

2,436

|

$

|

2,095

|

$

|

2,409

|

19.7

|

%

|

12.4

|

%

|

19.0

|

%

|

||||||||||||||||||||||||

|

Orange County

|

5,553

|

1,149

|

-

|

6,702

|

2,170

|

1,882

|

2,143

|

10.4

|

%

|

8.3

|

%

|

10.2

|

%

|

|||||||||||||||||||||||||||

|

San Diego County

|

4,824

|

616

|

-

|

5,440

|

1,924

|

1,789

|

1,916

|

8.2

|

%

|

4.2

|

%

|

7.8

|

%

|

|||||||||||||||||||||||||||

|

Ventura County

|

2,577

|

693

|

-

|

3,270

|

1,806

|

2,131

|

1,847

|

4.4

|

%

|

6.2

|

%

|

4.6

|

%

|

|||||||||||||||||||||||||||

|

Other Southern CA

|

623

|

249

|

-

|

872

|

1,634

|

1,619

|

1,631

|

0.9

|

%

|

1.5

|

%

|

0.9

|

%

|

|||||||||||||||||||||||||||

|

Total Southern California

|

22,964

|

4,270

|

200

|

27,434

|

2,172

|

1,975

|

2,155

|

43.6

|

%

|

32.6

|

%

|

42.5

|

%

|

|||||||||||||||||||||||||||

|

Northern California

|

||||||||||||||||||||||||||||||||||||||||

|

Santa Clara County

|

7,356

|

2,266

|

745

|

10,367

|

2,745

|

2,866

|

2,762

|

18.9

|

%

|

27.1

|

%

|

19.7

|

%

|

|||||||||||||||||||||||||||

|

Alameda County

|

2,954

|

1,983

|

-

|

4,937

|

2,543

|

2,350

|

2,492

|

6.9

|

%

|

19.4

|

%

|

8.1

|

%

|

|||||||||||||||||||||||||||

|

San Mateo County

|

1,951

|

197

|

371

|

2,519

|

2,958

|

2,962

|

2,958

|

5.2

|

%

|

2.4

|

%

|

4.9

|

%

|

|||||||||||||||||||||||||||

|

Contra Costa County

|

2,270

|

49

|

-

|

2,319

|

2,320

|

4,644

|

2,345

|

4.8

|

%

|

0.7

|

%

|

4.4

|

%

|

|||||||||||||||||||||||||||

|

San Francisco

|

1,343

|

463

|

545

|

2,351

|

3,132

|

3,262

|

3,153

|

3.7

|

%

|

5.6

|

%

|

3.9

|

%

|

|||||||||||||||||||||||||||

|

Other Northern CA

|

96

|

-

|

-

|

96

|

2,993

|

-

|

2,993

|

0.2

|

%

|

-

|

0.2

|

%

|

||||||||||||||||||||||||||||

|

Total Northern California

|

15,970

|

4,958

|

1,661

|

22,589

|

2,707

|

2,717

|

2,709

|

39.7

|

%

|

55.2

|

%

|

41.2

|

%

|

|||||||||||||||||||||||||||

|

Seattle Metro

|

10,238

|

1,582

|

-

|

11,820

|

1,838

|

1,836

|

1,838

|

16.7

|

%

|

12.2

|

%

|

16.3

|

%

|

|||||||||||||||||||||||||||

|

Total

|

49,172

|

10,810

|

1,861

|

61,843

|

$

|

2,276

|

$

|

2,299

|

$

|

2,279

|

100.0

|

%

|

100.0

|

%

|

100.0

|

%

|

||||||||||||||||||||||||

| (1) |

Average monthly rental rate is defined as the total potential monthly rental revenue (actual rent for occupied apartment homes plus market rent for vacant apartment homes)

divided by the number of apartment homes.

|

| (2) |

Actual NOI for the quarter ended September 30, 2018. See the section titled “Net Operating Income (“NOI”) and Same-Property NOI Reconciliations” on page S-17.3.

|

| (3) |

Includes all apartment communities with rents.

|

| (4) |

Includes development communities with no rental income.

|

| (5) |

Co-investment amounts weighted for Company’s pro rata share.

|

| (6) |

At Company’s pro rata share.

|

|

|

See Company’s Form 10-K and Form 10-Qs filed with the SEC for additional information

S-7

E S S E X P R O P E R T Y T R U S T, I N C.

Operating Income by Quarter (1)

(Dollars in thousands, except in footnotes)

|

Apartment

Homes

|

Q3 ‘18

|

Q2 ‘18

|

Q1 ‘18

|

Q4 ‘17

|

Q3 ‘17

|

|||||||||||||||||||

|

Rental and other property revenues:

|

||||||||||||||||||||||||

|

Same-property

|

46,863

|

$

|

324,271

|

$

|

321,283

|

$

|

320,095

|

$

|

317,738

|

$

|

317,302

|

|||||||||||||

|

Acquisitions (2)

|

1,328

|

10,695

|

10,501

|

10,383

|

10,435

|

10,498

|

||||||||||||||||||

|

Development (3)

|

121

|

1,091

|

450

|

19

|

-

|

-

|

||||||||||||||||||

|

Redevelopment

|

621

|

5,125

|

5,036

|

5,024

|

5,005

|

4,913

|

||||||||||||||||||

|

Non-residential/other, net (4)

|

239

|

7,428

|

9,256

|

9,426

|

9,239

|

9,261

|

||||||||||||||||||

|

Total rental and other property revenues

|

49,172

|

348,610

|

346,526

|

344,947

|

342,417

|

341,974

|

||||||||||||||||||

|

Property operating expenses:

|

||||||||||||||||||||||||

|

Same-property

|

91,710

|

88,519

|

88,832

|

89,425

|

90,106

|

|||||||||||||||||||

|

Acquisitions (2)

|

2,842

|

2,116

|

3,074

|

3,116

|

3,220

|

|||||||||||||||||||

|

Development (3)

|

638

|

498

|

64

|

-

|

-

|

|||||||||||||||||||

|

Redevelopment

|

1,647

|

1,468

|

1,469

|

1,528

|

1,529

|

|||||||||||||||||||

|

Non-residential/other, net (4) (5)

|

938

|

1,545

|

1,524

|

2,005

|

1,709

|

|||||||||||||||||||

|

Total property operating expenses

|

97,775

|

94,146

|

94,963

|

96,074

|

96,564

|

|||||||||||||||||||

|

Net operating income (NOI):

|

||||||||||||||||||||||||

|

Same-property

|

232,561

|

232,764

|

231,263

|

228,313

|

227,196

|

|||||||||||||||||||

|

Acquisitions (2)

|

7,853

|

8,385

|

7,309

|

7,319

|

7,278

|

|||||||||||||||||||

|

Development (3)

|

453

|

(48

|

)

|

(45

|

)

|

-

|

-

|

|||||||||||||||||

|

Redevelopment

|

3,478

|

3,568

|

3,555

|

3,477

|

3,384

|

|||||||||||||||||||

|

Non-residential/other, net (4)

|

6,490

|

7,711

|

7,902

|

7,234

|

7,552

|

|||||||||||||||||||

|

Total NOI

|

$

|

250,835

|

$

|

252,380

|

$

|

249,984

|

$

|

246,343

|

$

|

245,410

|

||||||||||||||

|

Same-property metrics

|

||||||||||||||||||||||||

|

Operating margin

|

72

|

%

|

72

|

%

|

72

|

%

|

72

|

%

|

72

|

%

|

||||||||||||||

|

Annualized turnover (6)

|

56

|

%

|

53

|

%

|

40

|

%

|

46

|

%

|

61

|

%

|

||||||||||||||

|

Financial occupancy (7)

|

96.4

|

%

|

96.7

|

%

|

97.1

|

%

|

96.8

|

%

|

96.7

|

%

|

||||||||||||||

| (1) |

Includes consolidated communities only.

|

| (2) |

Acquisitions include properties acquired which did not have comparable stabilized results as of January 1, 2017.

|

| (3) |

Development includes properties developed which did not have comparable stabilized results as of January 1, 2017.

|

| (4) |

Other real estate assets consists mainly of retail space, commercial properties, boat slips, held for sale properties, disposition properties, and student housing.

|

| (5) |

Includes other expenses and intercompany eliminations pertaining to self-insurance.

|

| (6) |

Annualized turnover is defined as the number of apartment homes turned over during the quarter, annualized, divided by the total number of apartment homes.

|

| (7) |