Attached files

| file | filename |

|---|---|

| 10-Q - 10-Q - GOODYEAR TIRE & RUBBER CO /OH/ | gt-q3201810q.htm |

| EX-32 - EX-32.1 - GOODYEAR TIRE & RUBBER CO /OH/ | gt-q32018xex_321.htm |

| EX-31 - EX-31.2 - GOODYEAR TIRE & RUBBER CO /OH/ | gt-q32018xex_312.htm |

| EX-31 - EX-31.1 - GOODYEAR TIRE & RUBBER CO /OH/ | gt-q32018xex_311.htm |

| EX-12 - EX-12.1 - GOODYEAR TIRE & RUBBER CO /OH/ | gt-q32018xratioofearningse.htm |

| EX-10 - EX-10.1 - GOODYEAR TIRE & RUBBER CO /OH/ | d635065dex101.htm |

Exhibit 10.2

| Execution version

GOODYEAR PROGRAM |

|

GENERAL MASTER PURCHASE AGREEMENT

IN RELATION TO THE SECURITISATION OF TRADE RECEIVABLES OF CERTAIN

EUROPEAN SUBSIDIARIES OF THE GOODYEAR GROUP

dated 10 December 2004, as last amended and restated on 26 September 2018

between

ESTER FINANCE TITRISATION

as Purchaser

CREDIT AGRICOLE LEASING & FACTORING

as Agent

CREDIT AGRICOLE CORPORATE AND INVESTMENT BANK

as Joint Lead Arranger and as Calculation Agent

NATIXIS

as Joint Lead Arranger

DUNLOP TYRES LTD

as Centralising Unit

THE SELLERS

Listed in SCHEDULE 8

CMS Francis Lefebvre Avocats

Avocats au Barreau des Hauts de Seine

2 rue Ancelle, 92522 Neuilly-sur-Seine Cedex, France

cms.law/fl

SOMMAIRE

| CLAUSE | PAGE | |||||

| CHAPTER I INTERPRETATION |

9 | |||||

| 1. |

DEFINITIONS | 9 | ||||

| 2. |

INTERPRETATION | 9 | ||||

| CHAPTER II PURPOSE - TERM - CONDITIONS PRECEDENT |

10 | |||||

| 3. |

PURPOSE OF THIS AGREEMENT | 10 | ||||

| 4. |

TERM OF THIS AGREEMENT | 13 | ||||

| 5. |

[RESERVED] | 14 | ||||

| CHAPTER III CURRENT ACCOUNT - DEPOSITS |

14 | |||||

| 6. |

CURRENT ACCOUNT | 14 | ||||

| 7. |

AMOUNT OF THE PURCHASER’S FUNDING | 17 | ||||

| 8. |

SUBORDINATED DEPOSIT | 20 | ||||

| 9. |

COMPLEMENTARY DEPOSIT | 21 | ||||

| CHAPTER IV FEES |

21 | |||||

| 10. |

FEES | 21 | ||||

| CHAPTER V REPRESENTATIONS AND WARRANTIES - GENERAL COVENANTS |

23 | |||||

| 11. |

REPRESENTATIONS AND WARRANTIES | 23 | ||||

| 12. |

GENERAL COVENANTS | 26 | ||||

| CHAPTER VI EARLY AMORTISATION |

38 | |||||

| 13. |

EARLY AMORTISATION | 38 | ||||

| CHAPTER VII TAXES - CHANGES IN CIRCUMSTANCES |

43 | |||||

| 14. |

TAXES | 43 | ||||

| 15. |

CHANGES IN CIRCUMSTANCES | 46 | ||||

| CHAPTER VIII ORDER OF PRIORITY - PAYMENTS |

47 | |||||

| 16. |

ORDER OF PRIORITY DURING THE AMORTISATION PERIOD | 47 | ||||

| 17. |

PAYMENTS | 49 | ||||

| CHAPTER IX PURCHASE OF ONGOING PURCHASABLE RECEIVABLES AND REMAINING |

50 | |||||

| PURCHASABLE RECEIVABLES | ||||||

| 18. |

CONDITIONS IN RELATION TO ANY PURCHASE OF ONGOING PURCHASABLE RECEIVABLES AND REMAINING PURCHASABLE RECEIVABLES | 50 | ||||

| 19. |

CONFORMITY WARRANTIES FOR ONGOING PURCHASABLE RECEIVABLES AND REMAINING PURCHASABLE RECEIVABLES | 52 | ||||

| 20. |

IDENTIFICATION OF THE CONTRACTUAL DOCUMENTATION FOR THE SOLD RECEIVABLES - ACCESS TO DOCUMENTS | 53 | ||||

| CHAPTER X COLLECTION OF SOLD RECEIVABLES |

54 | |||||

| 21. |

COLLECTION OF SOLD RECEIVABLES | 54 | ||||

| 22. |

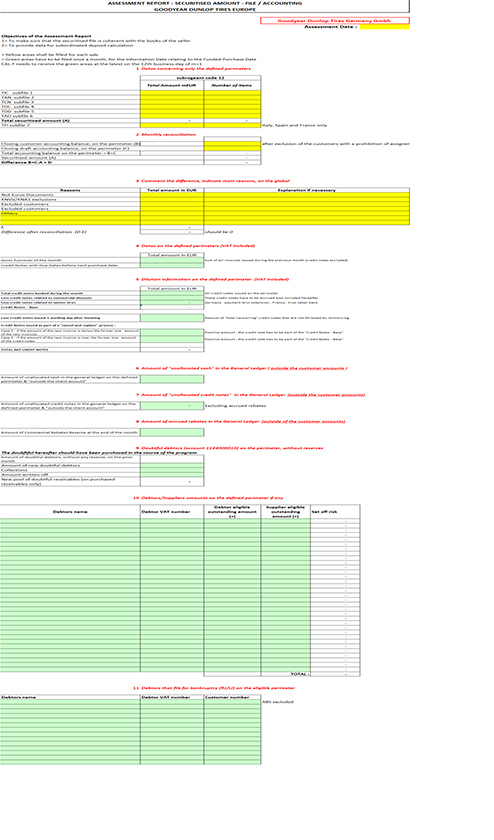

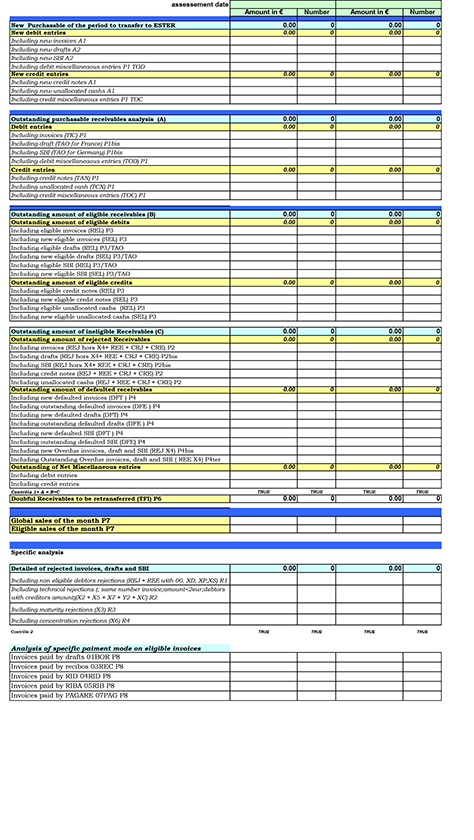

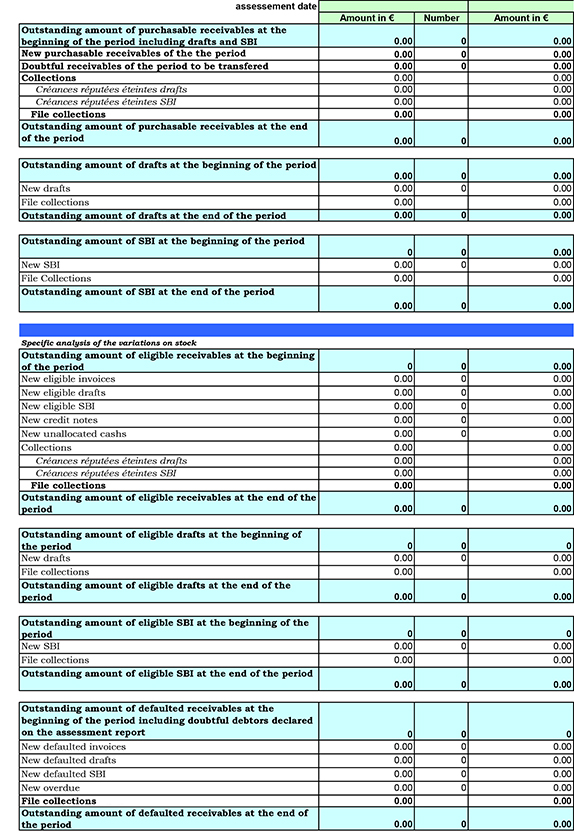

ASSESSMENT REPORT AND BACK-UP SERVICER REPORT | 59 | ||||

| 23. |

APPLICATION OF PAYMENTS AND PAYMENTS OF COLLECTIONS | 59 | ||||

| 24. |

RENEGOTIATION | 61 | ||||

2

| 25. |

REPRESENTATION MANDATE |

61 | ||||

| 26. |

OBLIGATIONS OF CARE |

62 | ||||

| 27. |

COMMISSION FOR AND COSTS OF COLLECTION |

63 | ||||

| CHAPTER XI DEEMED COLLECTIONS |

65 | |||||

| 28. |

DEEMED COLLECTIONS |

65 | ||||

| CHAPTER XII MISCELLANEOUS |

66 | |||||

| 29. |

FEES AND EXPENSES |

66 | ||||

| 30. |

SUBSTITUTION AND AGENCY |

66 | ||||

| 31. |

CONFIDENTIALITY |

67 | ||||

| 32. |

NOTICES |

68 | ||||

| 33. |

EXERCISE OF RIGHTS – RECOURSE – NO PETITION |

69 | ||||

| 34. |

TRANSFERABILITY OF THIS AGREEMENT |

69 | ||||

| 35. |

AMENDMENT TO THE TRANSACTION DOCUMENTS |

70 | ||||

| 36. |

INDEMNITIES |

71 | ||||

| 37. |

INDIVISIBILITY |

73 | ||||

| 38. |

EXECUTION AND EVIDENCE |

73 | ||||

| 39. |

WITHDRAWAL OF SELLERS |

74 | ||||

| 40. |

ACCESSION OF NEW SELLERS |

75 | ||||

| 41. |

NO HARDSHIP |

76 | ||||

| 42. |

SANCTIONS |

76 | ||||

| CHAPTER XIII GOVERNING LAW - JURISDICTION |

76 | |||||

| 43. |

GOVERNING LAW - JURISDICTION |

76 | ||||

| SCHEDULE | PAGE | |||

| SCHEDULE 1 MASTER DEFINITIONS SCHEDULE | 77 | |||

| SCHEDULE 2 RESERVED | 112 | |||

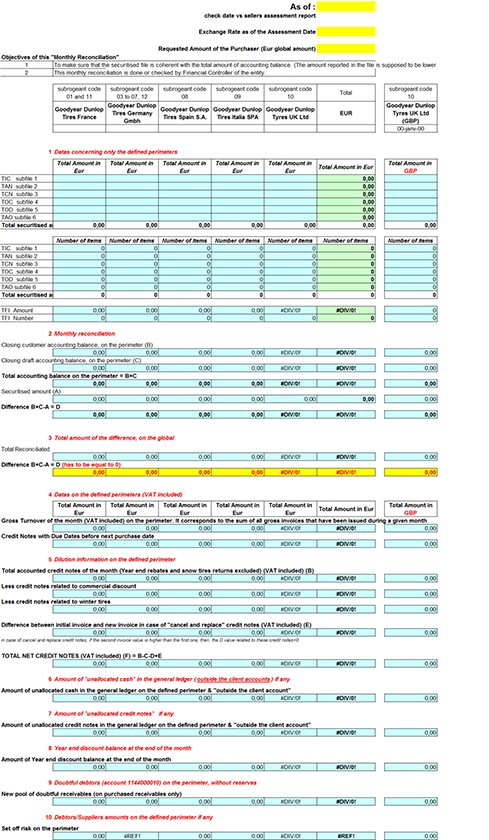

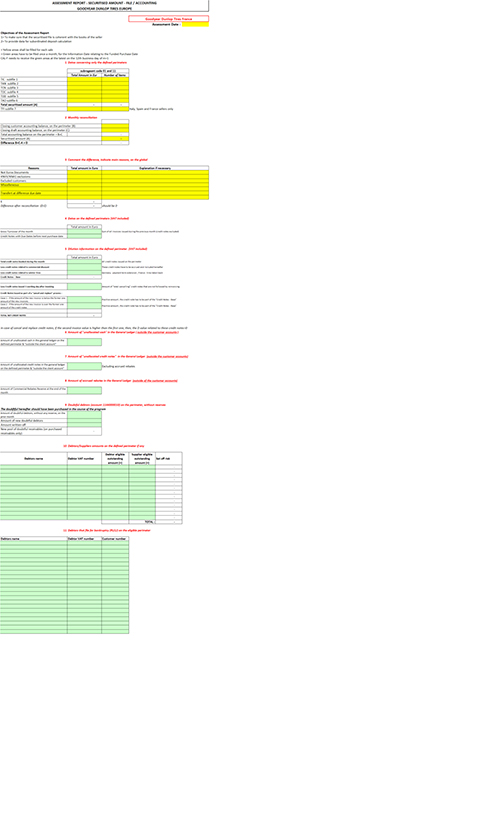

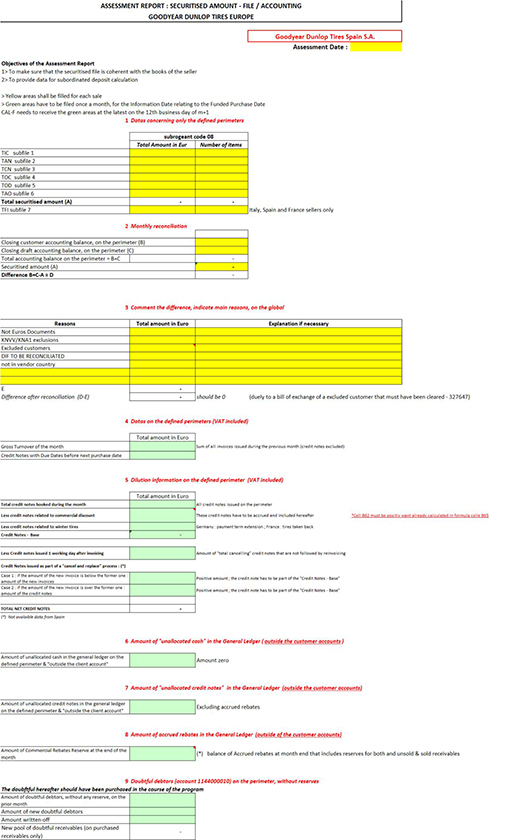

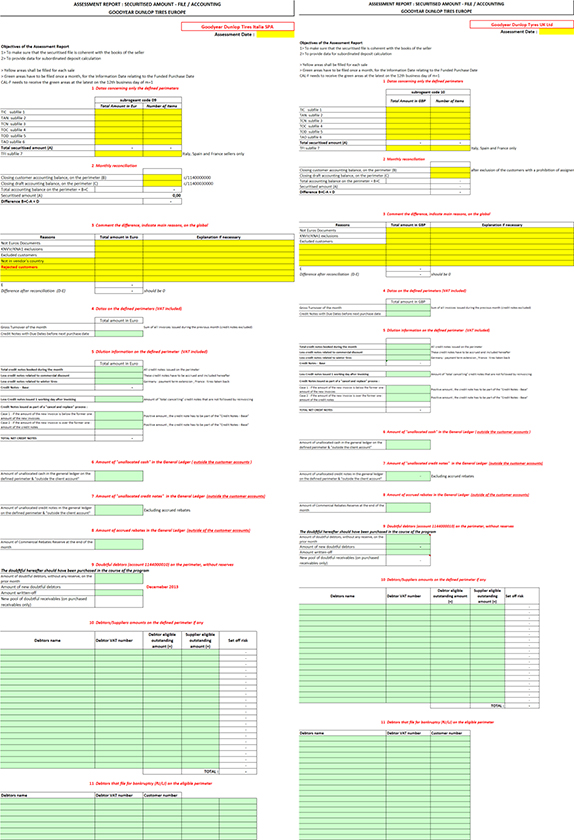

| SCHEDULE 3 FORM OF ASSESSMENT REPORT | 113 | |||

| SCHEDULE 4 FORM OF SELLER’S AUDITORS CERTIFICATE | 122 | |||

| SCHEDULE 5 FORM OF SELLER’S AND CENTRALISING UNIT’S SOLVENCY CERTIFICATE | 136 | |||

| SCHEDULE 6 LIST OF ADDRESSEES | 147 | |||

| SCHEDULE 7 FORMS OF NOTIFICATION OF WITHDRAWAL OR ACCESSION OF ONE OR MORE SELLER(S) | 149 | |||

| SCHEDULE 8 LIST OF SELLERS | 152 | |||

| SCHEDULE 9 LIST OF CALENDAR DATES OF THE TRANSACTION | 153 | |||

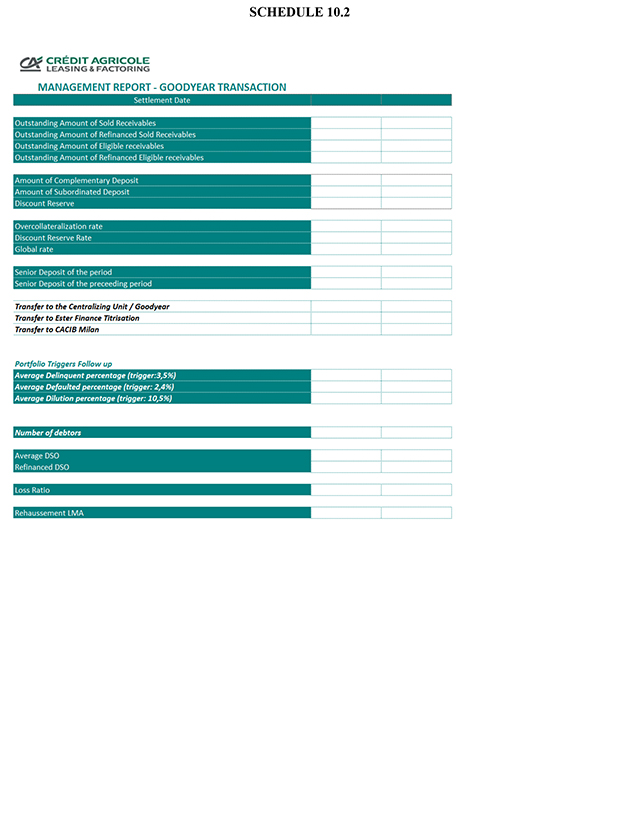

| SCHEDULE 10 REPORTING DOCUMENT RELATING TO THE SOLD RECEIVABLES (ARTICLE 12.3.3) | 157 | |||

| SCHEDULE 11 CONFORMITY WARRANTIES FOR REMAINING PURCHASABLE RECEIVABLES | 161 | |||

| SCHEDULE 12 LIST OF EXCLUDED DEBTORS | 171 | |||

| SCHEDULE 13 FORM OF CALCULATION LETTER | 174 | |||

| SCHEDULE 14 FINANCIAL COVENANTS DEFINITIONS | 176 | |||

| SCHEDULE 15 [RESERVED] | 188 | |||

3

| SCHEDULE 16 CALCULATION FORMULAE OF THE DISCOUNT RESERVE AND OF THE ASSIGNMENT COSTS | 189 | |||

| SCHEDULE 17 FORM OF NOTICE FOR MAXIMUM AMOUNT OF THE PURCHASER’S FUNDING | 195 | |||

| SCHEDULE 18 LIST OF THE COLLECTION ACCOUNTS (AS OF THE 2018 AMENDMENT DATE) | 196 | |||

| SCHEDULE 19 DATA PROCESSING | 197 |

4

BETWEEN:

| (1) | ESTER FINANCE TITRISATION, a company incorporated under French law and authorised as a specialized credit institution (établissement de crédit spécialisé), having its registered office at 12 place des Etats-Unis, CS 70052, 92547 Montrouge Cedex, France, registered with the trade and companies registry (registre du commerce et des sociétés) of Nanterre under the number 414 886 226, whose representative is duly authorised for the purpose of this Agreement (the “Purchaser”); |

| (2) | CREDIT AGRICOLE LEASING & FACTORING, a company incorporated under French law and authorised as a financing company (société de financement), having its registered office at 12, place des Etats-Unis – CS 20001, 92548 Montrouge Cedex, France, registered with the trade and companies registry (registre du commerce et des sociétés) of Nanterre under the number 692 029 457, whose representative is duly authorised for the purpose of this Agreement (the “Agent”) (succeeding to Eurofactor as a consequence of the merger by absorption of Eurofactor into Crédit Agricole Leasing & Factoring on 31 December 2013); |

| (3) | CREDIT AGRICOLE CORPORATE AND INVESTMENT BANK, a company incorporated under French law and authorised as a credit institution (établissement de crédit), having its registered office at 12 place des Etats-Unis, CS 70052, 92547 Montrouge Cedex, France, registered with the trade and companies registry (registre du commerce et des sociétés) of Nanterre under the number 304 187 701, whose representatives are duly authorised for the purpose of this Agreement (“CREDIT AGRICOLE CORPORATE AND INVESTMENT BANK”, “Joint Lead Arranger” or the “Calculation Agent”); |

| (4) | NATIXIS, a limited company (société anonyme) incorporated under French law and duly authorised as a credit institution (établissement de crédit), having its registered office at 30, avenue Pierre Mendès France 75013 Paris, registered with the trade and companies registry (registre du commerce et des sociétés) of Paris under the number 542 044 524, whose representatives are duly authorised for the purpose of this Agreement (“NATIXIS” or “Joint Lead Arranger”); |

| (5) | DUNLOP TYRES LTD, a company incorporated under the laws of England and Wales with company number 1792065 whose registered office is situated at 2920 Trident Court Solihull Parkway, Birmingham Business Park, Birmingham, England, B37 7YN, whose representative is duly authorised for the purpose of this Agreement (the “Centralising Unit”); and |

| (6) | The companies listed in SCHEDULE 8 (each of them as a “Seller” and collectively the “Sellers”). |

WHEREAS:

| (A) | GOODYEAR DUNLOP TIRES FRANCE S.A.S. (the “French Seller”), GOODYEAR DUNLOP TIRES GERMANY GmbH (the “German Seller”), GOODYEAR DUNLOP TIRES ITALIA SPA (the “Italian Seller”), GOODYEAR DUNLOP TIRES ESPAÑA, S.A. (the “Spanish Seller”) and GOODYEAR DUNLOP TYRES UK Ltd (the “UK Seller”) are in the business of |

5

| manufacturing and/or supplying tyres and activities relating thereto, and hold receivables over certain customers. |

| (B) | In order to provide financing to certain European subsidiaries of GOODYEAR, CREDIT AGRICOLE CORPORATE AND INVESTMENT BANK and NATIXIS have proposed to set up a securitisation transaction by way of the sale, on an ongoing basis, of trade receivables resulting from the ordinary business of the Sellers in Belgium, the United Kingdom, France, Germany, Italy and Spain (the “Securitisation Transaction”). |

| (C) | Pursuant to the Securitisation Transaction and with respect to (i) the French Seller, the Spanish Seller and the UK Seller, existing and future domestic trade receivables will be purchased by the Purchaser from those Sellers on an ongoing basis and in accordance with receivables purchase agreements governed by French law, in respect of the French Seller and the Spanish Seller, and English law, in respect of the UK Seller, and (ii) the German Seller, existing and future domestic and cross-border trade receivables will be purchased by the Purchaser from the German Seller on an ongoing basis and in accordance with, and subject to, the laws governing such receivables as set forth in a receivables purchase agreement (entered into, inter alios, between the German Seller, the Centralising Unit and the Purchaser) (the receivables purchase agreements under (i) and (ii) above together, the “Receivables Purchase Agreements”). |

| (D) | The Purchaser has agreed to acquire certain existing trade receivables (the “Remaining Purchasable Receivables”) and future trade receivables (the “Ongoing Purchasable Receivables”) held and to be held by the Sellers subject to the terms and conditions contained in this Agreement and in the Receivables Purchase Agreements. Furthermore, the Purchaser shall refinance the purchase of Refinanced Ongoing Purchasable Receivables and the Refinanced Remaining Purchasable Receivables by ITALASSET FINANCE S.R.L. through the subscription and funding of Italian Notes. |

| (E) | The Purchaser shall fund the acquisition of Ongoing Purchasable Receivables, Remaining Purchasable Receivables and Italian Notes: |

| (i) | partly out of a senior deposit (the “Senior Deposit”) effected by the Depositor with the Purchaser in accordance with a master senior deposit agreement (the “Master Senior Deposit Agreement”); and |

| (ii) | partly by way of set-off against any amount due and payable by the Centralising Unit to the Purchaser in connection with (a) a subordinated deposit (the “Subordinated Deposit”) to be effected by the Centralising Unit with the Purchaser in accordance with the terms and conditions of a master subordinated deposit agreement (the “Master Subordinated Deposit Agreement”) and (b) a complementary deposit (the “Complementary Deposit”) to be effected by the Centralising Unit with the Purchaser in accordance with the terms and conditions of a master complementary deposit agreement (the “Master Complementary Deposit Agreement”). |

6

| (F) | The receivable held by the Depositor over the Purchaser in connection with the repayment of the Senior Deposit shall be assigned to a French fonds commun de titrisation (the “Fund”) set up in accordance with articles L. 214-167 to L. 214-175, L. 214-175-1 and L. 214-180 to L. 214-186, and R. 214-217 to R. 214-235 of the French Monetary and Financial Code (code monétaire et financier) which shall issue related units. Such units may be subscribed by any Issuer (as defined in SCHEDULE 1 (Master Definition Schedule)) or any Fund Subscriber (as defined in SCHEDULE 1 (Master Definition Schedule)), pursuant to the terms and conditions of subscription agreements to be entered into between the Fund and each Issuer and Fund Subscriber (the “Subscription Agreements”), in the following conditions: |

| (i) | unless the corresponding Fund Subscriber has exercised its Fund Subscriber Option (as defined below) and until rescission thereof by such Fund Subscriber, each Issuer shall fund the subscription of units, by either (x) issuing commercial paper (the “Notes”), or (y) in the event that the Issuer is not capable to issue Notes in the commercial paper market, exercising its rights under a liquidity agreement (a “Liquidity Agreement”) entered into with credit institutions (the “Liquidity Banks”), pursuant to which the Liquidity Banks have undertaken to either acquire from such Issuer all or part of the units which cannot be funded through the issuance of Notes or grant a facility to finance or refinance the susbscription of such units; |

| (iii) | upon notice given by any Fund Subscriber to, among others, the Centralising Unit, the Calculation Agent and the Fund, of its intention to exercise such option, such Fund Subscriber shall directly subscribe to units issued by the Funds (the “Fund Subscriber Option”). Upon the exercise of such Fund Subscriber Option and until rescission thereof by such Fund Subscriber, the obligation of the corresponding Issuer to subscribe to units issued by the Fund under the Subscription Agreement to which such Issuer is a party shall be suspended. |

| (G) | Pursuant to a financial guarantee agreement entered into between, inter alios, the Purchaser, the Depositor and the Fund, the Purchaser will indirectly pledge the Sold Receivables of the French Seller to the benefit of the Fund to guarantee its financial obligations under the Senior Deposit assigned to the Fund in accordance with article L. 211-38 of the French Monetary and Financial Code (code monétaire et financier). |

| (H) | The Centralising Unit shall be appointed by the Sellers to act as their agent (mandataire) for the purposes of carrying out certain activities, in accordance with the provisions of this general master purchase agreement, including the execution of certain amendments hereto (the “General Master Purchase Agreement” or the “Agreement”). |

| (I) | For the purposes of the General Master Purchase Agreement and the relevant Receivables Purchase Agreement, the Purchaser shall appoint the Sellers for the recovery of collections in accordance with a Collection Mandate (the “Collection Mandate”). |

| (J) | Due to the number of Sellers and the different Receivables Purchase Agreements under which Ongoing Purchasable Receivables and Remaining Purchasable Receivables will be purchased by |

7

| the Purchaser, the Parties have agreed to enter into this General Master Purchase Agreement in order to set out a Master Definitions Schedule, common terms, representations and warranties, general covenants and all other provisions provided for by this General Master Purchase Agreement that will apply in respect of the Receivables Purchase Agreements. |

8

NOW IT IS HEREBY AGREED AS FOLLOWS:

CHAPTER I

INTERPRETATION

| 1. | DEFINITIONS |

Capitalised terms and expressions used in this Agreement shall have the same meaning as ascribed to such terms and expressions in the Master Definitions Schedule set out in SCHEDULE 1 hereto. The schedules hereto shall form an integral part of this Agreement.

| 2. | INTERPRETATION |

The titles of the Chapters, the Schedules and the Articles (including their paragraphs) used herein and the table of contents are for convenience of reference only, and shall not be used to interpret this Agreement.

In this Agreement, except if the context calls for another interpretation:

| (i) | references to “Chapters”, “Articles” and “Schedules” shall be construed as references to the chapters, articles and schedules of this Agreement and references to this Agreement include its recitals and schedules; |

| (ii) | headings are for convenience of reference only and shall not affect the interpretation of this Agreement; |

| (iii) | words in the plural shall cover the singular and vice versa; |

| (iv) | references to the time of the day shall refer to Paris time, unless otherwise stipulated; |

| (v) | words appearing in this Agreement in a language other than English shall have the meaning ascribed to them under the law of the corresponding jurisdiction and such meaning shall prevail over their translation into English, if any; |

| (vi) | references to a “person” shall include (i) any natural person, corporation, limited liability company, trust, joint venture, association, company, partnership, governmental authority or other entity and (ii) its permitted assignees, transferees and successors or any person deriving title under or through it; in particular, any reference to GOODYEAR DUNLOP TIRES EUROPE BV shall include any successor thereof as a result of any internal corporate reorganisation (without prejudice to Articles 13.3(iii) and 21.3.1(v) hereof); |

| (vii) | references to a document shall mean such document, as amended, replaced by novation or varied from time to time; |

9

| (viii) | references to any Securitisation Document shall be construed to mean such securitisation document, as amended and restated until the date hereof and as may be amended and supplemented from time to time thereafter; and |

| (ix) | references to “Parties” shall be construed as references to the parties to this Agreement, and a “Party” shall mean any of the Parties. |

CHAPTER II

PURPOSE - TERM - CONDITIONS PRECEDENT

| 3. | PURPOSE OF THIS AGREEMENT |

| 3.1 | Pursuant to the terms and conditions of this Agreement, the relevant Receivables Purchase Agreements and, where applicable, the relevant Transfer Deeds, the Sellers shall sell Ongoing Purchasable Receivables and Remaining Purchasable Receivables to the Purchaser and the Purchaser shall purchase Ongoing Purchasable Receivables and Remaining Purchasable Receivables from the Sellers on each Funded Settlement Date during the Replenishment Period. |

| 3.2 | The Parties agree that the Purchaser shall fund the acquisition of Ongoing Purchasable Receivables, Remaining Purchasable Receivables and Italian Notes as follows: |

| (i) | partly out of a Senior Deposit effected by the Depositor with the Purchaser in accordance with the Master Senior Deposit Agreement, for an amount which shall not exceed the Maximum Amount of the Program, as determined in accordance with Article 7 (Amount of the Purchaser’s Funding); |

| (ii) | partly by way of set-off against any amount due and payable by the Centralising Unit to the Purchaser in connection with (a) a Subordinated Deposit to be effected by the Centralising Unit with the Purchaser in accordance with the provisions of the Master Subordinated Deposit Agreement and (b) a Complementary Deposit to be effected by the Centralising Unit with the Purchaser in accordance with the provisions of the Master Complementary Deposit Agreement, for an amount which shall not exceed the Maximum Amount of the Complementary Deposit. |

| 3.3 | The Parties hereby acknowledge that the Centralising Unit is acting for the purposes of this Agreement, in its own name and behalf, but also in the name and on behalf of the Sellers, pursuant to the terms of a mandate (mandat) expressly granted by each of the Sellers to the Centralising Unit and which the Centralising Unit hereby accepts. By virtue of this mandate, the Sellers appoint the Centralising Unit to act in their name and on their behalf and to perform the following obligations in accordance with the provisions of the Transaction Documents: (i) receive all Payments due by the Purchaser to the Sellers in respect of the Sold Receivables, (ii) make any payment due by the Sellers to the Purchaser and the Agent pursuant to the Transaction Documents, such payments covering inter alia the amount due in respect of Actual Collections or Adjusted Collections, (iii) enter into the Current Account relationship set forth in Article 6, (iv) |

10

| negotiate with the Purchaser, in particular upon the occurrence of any of the events set out in Articles 13, 14 and 15, such negotiation to be conducted outside the UK (v) deliver to the Purchaser on each Funded Settlement Date during the Replenishment Period, the Transfer Deeds received from the Sellers or executed by the Centralising Unit and, on each Information Date, the List of Purchasable Receivables, (vi) receive or give any notices, mails, or documents provided pursuant to the Transaction Documents, (vii) exercise any rights arising in respect of the Transaction Documents (with the exception of the Master Subordinated Deposit Agreement and the Master Complementary Deposit Agreement, in respect of which the Centralising Unit acts in its own name and on its own behalf), (viii) deliver to the Purchaser the Assessment Reports substantially in the form set out in SCHEDULE 3 and (ix) carry out any powers it has as agent of the Seller as set out in Articles 35 and 40, including the negotiation and execution of any amendments provided for under Articles 35 and 40, provided that nothing in this Agreement shall give the Centralising Unit authority to act on behalf of the Purchaser and in particular it will not perform the obligations of the Sellers under Articles 24 and 25. |

The Sellers and the Centralising Unit have entered into the Intercompany Arrangements, which provide, among other things, for the allocation of all sums due and/or received in connection with the Transaction Documents to which each Seller and the Centralising Unit is a party. Such Intercompany Arrangements shall provide inter alia that each Seller has an effective recourse against the defaulting Seller, the other Sellers and GOODYEAR DUNLOP TIRES EUROPE BV for any payment that any Seller or the Centralising Unit may be required to make under the joint and several liability provisions provided for under Article 3.6. The Sellers and the Centralising Unit hereby irrevocably and unconditionally undertake to refrain from exercising any rights of recourse against the Purchaser, the Agent, CREDIT AGRICOLE CORPORATE AND INVESTMENT BANK and/or NATIXIS in connection with such allocation.

| 3.4 | The Parties agree that the Purchaser shall appoint the Sellers to act as collection agents for the servicing of the Sold Receivables, in accordance with the provisions of Article 21. |

| 3.5 | This Agreement shall apply automatically to any Transfer Deed delivered by the Centralising Unit, acting in the name and on behalf of a Seller to the Purchaser or any other similar document agreed between a Seller and the Purchaser, pursuant to the relevant Receivables Purchase Agreement. |

| 3.6 | Joint and several liability |

| 3.6.1 | The Parties agree that the obligations of each Seller under this Agreement shall be several but not joint and shall be construed as if each Seller had entered into a separate agreement with the Purchaser. |

| 3.6.2 | By way of exception to the foregoing, each Seller and the Centralising Unit shall be jointly and severally liable to the Purchaser for the payment by a Seller, GOODYEAR DUNLOP TIRES EUROPE BV and/or the Centralising Unit of (i) any sums due under the Transaction Documents and notably (without limitation) for the transfer of Adjusted Collections on the due date to the Purchaser, in accordance with the provisions of Article 23, and (ii) any claim for damages against |

11

| a Seller for breach of its representations and warranties or for failure to perform its obligations under this Agreement and the other Transaction Documents to which it is a party. |

Each Seller hereby acknowledges and accepts that the benefit of any joint and several liability between Sellers party to the Transaction Documents shall be extended to any New Seller, without any need for additional written consent under this Agreement (other than by the Centralising Unit as contemplated by Articles 35 and 40).

| 3.6.3 | Notwithstanding any other provision of this Agreement, the Parties agree that any claim enforceable under Article 3.6.2 above against the German Seller shall on any date on which payment is requested pursuant to Article 3.6.2 be limited to the amount of its Net Assets less its Registered Share Capital as of such date (the “Free Equity Amount”). |

For the purpose of this Article 3.6, “Net Assets” means, in respect of any entity as of any date, the result of (a) the sum of the amounts shown under the balance sheet positions pursuant to § 266 (2) (A), (B), (C), (D) and (E) of the German Commercial Code (Handelsgesetzbuch), with the exception of (i) any loan repayment claims against any of such entity’s affiliates (other than such entity’s subsidiaries) (or other, economically equivalent claims, including recourse claims against a defaulting Seller under the Intercompany Arrangements) and (ii) the value of any assets which is not available for distribution to shareholders pursuant to §268 (8) of the German commercial code, less (b) the sum of the amounts of liabilities shown under the balance sheet positions pursuant to § 266 (3) (B), (C), (D) and (E) of the German Commercial Code, in each case as determined as of such date; and “Registered Share Capital” means, in respect of any entity as of any date, the amount shown under the balance sheet position pursuant to § 266 (3) (A) I of the German Commercial Code as determined as of such date.

| 3.6.4 | If, upon a payment request to the German Seller under Article 3.6.2 above, the German Seller is of the reasonable opinion that the amount requested exceeds the Free Equity Amount at the time of such request, the German Seller shall provide evidence to the Purchaser that the payment in full of the amount requested would result: in the case of a GmbH Party, in the amount of its Net Assets falling below the amount of its Registered Share Capital, including, without limitation, plausible calculations made by the German Seller and all supporting documents reasonably requested by the Purchaser, and a written statement from the statutory auditors of the German Seller (in case of Article 3.6.3) to the Purchaser to the effect that the amount of the payment requested exceeds the Free Equity Amount of the German Seller (in case of Article 3.6.3). |

| 3.6.5 | For the purposes of calculating the Free Equity Amount, loans and other contractual liabilities incurred in negligent or wilful violation of the provisions of this Agreement shall be disregarded. |

In the event that a payment is requested under Article 3.6.2 above, the German Seller shall realise, to the extent (i) the Free Equity Amount falls short of the amount so requested, (ii) required to enable the German Seller to make the requested payment, and (iii) legally permitted, assets that are shown in the balance sheet with a book value (Buchwert) that is significantly lower than the market value of the assets at the time of such request if such assets are not necessary for the business of the German Seller (betriebsnotwendig).

12

| 3.6.6 | None of the above restrictions on enforcement shall apply if and to the extent such enforcement relates to any obligations of the German Seller other than under Article 3.6.2. |

| 3.6.7 | The Parties expressly agree that the Sellers and the Centralising Unit shall not have any responsibility for any non-payment by any Debtor of any sums due in respect of the Sold Receivables, except to the extent that the Purchaser may exercise recourse for such non-payment against the Subordinated Deposit and, as the case may be, the Complementary Deposit, as provided herein and, for the avoidance of any doubt, to the extent of any Deemed Collections in accordance with the provisions of Article 28. |

| 4. | TERM OF THIS AGREEMENT |

| 4.1 | This Agreement shall commence on the Closing Date and end on the Program Expiry Date. For the purposes of this Agreement and the Receivables Purchase Agreements, the Parties agree that there shall be two (2) periods: |

| (i) | the Replenishment Period, which commences on the Closing Date and ends on the Commitment Expiry Date (excluded); and |

| (ii) | the Amortisation Period, which commences on the Commitment Expiry Date and ends on the Program Expiry Date. |

| 4.2 | The Parties expressly agree that, in the event that there are any Sold Receivables outstanding on the Program Expiry Date: |

| (a) | until such time as (i) any sums due under the Master Senior Deposit Agreement have been paid, or (ii) the Centralising Unit, acting in the name and on behalf of the Sellers, has repurchased all such Sold Receivables from the Purchaser: |

| (i) | the Centralising Unit shall make a payment to the Purchaser for an amount equal to any collections actually received by the Sellers arising in relation to those Sold Receivables which are outstanding; and |

| (ii) | the Conformity Warranties set out in Article 19 (Conformity Warranties for Ongoing Purchasable Receivable and Remaining Purchasable Receivables) and the relevant Seller’s covenants in relation to the Sold Receivables as set out in Articles 12 (General Covenants), 16 (Order of Priority during the Amortisation Period), 21 (Collection of Sold Receivables), 23 (Application of Payments and Payments of collections), 24 (Renegotiation), and 25 (Representation Mandate) shall remain in force ; |

| (b) | thereafter, up to an amount equal to any portion of the Complementary Deposit and/or the Subordinated Deposit that was not reimbursed on the Program Expiry Date plus any Deferred Purchase Price that remained outstanding on such date, any Adjusted Collections shall be refunded to the Centralising Unit. |

13

In any event, the Parties expressly agree that, even after the Program Expiry Date, the provisions set out in Articles 14 (Taxes), 15 (Changes in Circumstances), 29 (Fees and expenses), 31 (Confidentiality), 33 (Exercise of Rights – Recourse- Non Petition), 36 (Indemnities), 43 (Governing law – Jurisdiction) shall remain in force.

| 4.3 | The Centralising Unit, acting in the name and on behalf of the Sellers, may, upon written notice given to the Purchaser at least nine (9) Business Days before a Funded Settlement Date during the Amortisation Period or at any time after the Program Expiry Date, offer to repurchase all outstanding Sold Receivables from the Purchaser, at a price equal to the nominal value of such Sold Receivables or such other price as the Parties may agree. Such purchase price shall be applied towards the payments and in the order specified in Article 16 and, to the extent applicable, shall be set off against any amounts due to the Centralising Unit in accordance with said Article 16. |

| 5. | [RESERVED] |

CHAPTER III

CURRENT ACCOUNT - DEPOSITS

| 6. | CURRENT ACCOUNT |

| 6.1 | Current Account agreement |

| 6.1.1 | The Purchaser and the Centralising Unit hereby agree to enter into a current account relationship (relation de compte courant) (the “Current Account”). |

| 6.1.2 | Subject to the daily set-off or netting mechanism for the payment of the Initial Purchase Price of Originated Ongoing Purchasable Receivables provided for under the Receivables Purchase Agreements, any sum due either by (i) the Purchaser to the Centralising Unit, acting in its own name or in the name of the Sellers pursuant to the Transaction Documents and/or by (ii) the Sellers or the Centralising Unit, acting in its own name or in the name of the Sellers, to the Purchaser pursuant to the Transaction Documents shall be recorded respectively as credit or debit on the Current Account. Any mutual debit or credit that does not arise from the Transaction Documents shall be excluded from the Current Account. |

| 6.2 | Automatic Set-off |

The Parties hereby agree that any debit and credit recorded on the Current Account shall be automatically set-off (compensés).

| 6.3 | Balance |

| 6.3.1 | On each Calculation Date, the Agent shall calculate the balance of the Current Account, in accordance with the provisions of Article 12.3.1, on the basis of information it has received |

14

| pursuant to such Article 12.3.1, and shall forthwith provide the Centralising Unit and the Purchaser with such calculation. |

| 6.3.2 | In the case of a debit balance of the Current Account on a Calculation Date, as stated in the Current Account statement communicated in accordance with the provisions of Article 6.3.1, the Centralising Unit shall pay to the Purchaser’s Account in immediately available funds an amount equal to such debit balance, on the Funded Settlement Date or on the Intermediary Settlement Date in relation to which the Current Account statement is drawn up, in accordance with the provisions of Article 17.5. |

| 6.3.3 | In the case of a credit balance of the Current Account on a Calculation Date, as stated in the Current Account statement communicated in accordance with the provisions of Article 6.3.1, the Purchaser shall pay to the Centralising Unit’s Account in immediately available funds an amount equal to such credit balance on the Funded Settlement Date or on the Intermediary Settlement Date in relation to which the Current Account statement has been drawn up, in accordance with the provisions of Article 17.5. |

| 6.3.4 | Once the payment referred to in Article 6.3.2 or in Article 6.3.3 has been made, the Current Account shall be balanced at zero (0). |

| 6.4 | Entry on Current Account |

| 6.4.1 | On the Initial Settlement Date, the Purchaser shall record: |

| (i) | on the debit of the Current Account, an amount equal to the Subordinated Deposit calculated as of the Initial Settlement Date in accordance with Article 8 (Subordinated Deposit); |

| (ii) | on the debit of the Current Account, an amount equal to the Complementary Deposit calculated as of the Initial Settlement Date in accordance with Article 9 (Complementary Deposit); |

| (iii) | on the debit of the Current Account, the amount of the Adjusted Collections calculated in respect of such Initial Settlement Date; and |

| (iv) | on the credit of the Current Account an amount equal to the Initial Purchase Price of the Sold Receivables sold on the Initial Settlement Date within the limits provided for by Article 12.3.1(i). |

| 6.4.2 | On each Intermediary Settlement Date during the Replenishment Period, the Purchaser shall enter: |

| (i) | on the debit of the Current Account, |

| (a) | an amount equal to any Increase in the Subordinated Deposit on such date, |

| (b) | an amount equal to any Increase in the Complementary Deposit on such date, |

15

| (c) | the amount of the Adjusted Collections calculated in respect of such date, less the amount of Collections for Set-off which has been set-off during the last Intermediary Settlement Date Reference Period in accordance with the Receivables Purchase Agreements, |

| (d) | the amount of any payment due with respect to the repurchase of Doubtful Receivables on such date, and |

| (e) | any other sums due by the Centralising Unit acting on its own behalf or on behalf of the Sellers, to the Purchaser pursuant to the Transaction Documents, and not paid otherwise; |

| (ii) | on the credit of the Current Account, |

| (a) | an amount equal to the part of the Initial Purchase Price of the Sold Receivables due and payable on such date in accordance with the Receivables Purchase Agreements and within the limits set out in Article 12.3.1(i), |

| (b) | an amount equal to any Reduction of the Subordinated Deposit on such date, |

| (c) | an amount equal to any Reduction of the Complementary Deposit on such date, and |

| (d) | any other sums due by the Purchaser to the Centralising Unit acting on its own behalf or on behalf of the Sellers pursuant to the Transaction Documents, and not paid otherwise. |

| 6.4.3 | On each Funded Settlement Date during the Replenishment Period, the Purchaser shall enter: |

| (i) | on the debit of the Current Account, |

| (a) | an amount equal to any Increase in the Subordinated Deposit on such date, |

| (b) | an amount equal to any Increase in the Complementary Deposit on such date, |

| (c) | the amount of the Adjusted Collections calculated in respect of such date, less the amount of Collections for Set-off which has been set-off during the last Monthly Reference Period (or, during the last Funded Settlement Date Reference Period in the event Collections for Set-off have been set-off pursuant to Article 6.4.2(i)(c) on the date identified as “Intermediary Settlement Date” under SCHEDULE 9 (List of Calendar Dates of the Transaction) that immediately precedes such Funded Settlement Date), in each case in accordance with the Receivables Purchase Agreements, |

16

| (d) | the amount of any payment due with respect to the repurchase of Doubtful Receivables on such date, |

| (e) | the amount of any payment due with respect to the rescission, on such Funded Settlement Date, of the transfer of Originated Ongoing Purchasable Receivables, pursuant to the relevant provisions of the French Receivables Purchase Agreement, the Spanish Receivables Purchase Agreement and the German Receivables Purchase Agreement (in that latter case only if the transfer of said Originated Ongoing Purchasable Receivables was governed by French law), and |

| (f) | any other sums due by the Centralising Unit acting on its own behalf or on behalf of the Sellers, to the Purchaser pursuant to the Transaction Documents, and not paid otherwise. |

| (ii) | on the credit of the Current Account, |

| (a) | an amount equal to the part of the Initial Purchase Price of the Sold Receivables due and payable on such date in accordance with the Receivables Purchase Agreements and within the limits set out in Article 12.3.1(i), |

| (b) | an amount equal to any Deferred Purchase Price payable on such date, |

| (c) | an amount equal to any Reduction of the Subordinated Deposit on such date; |

| (d) | an amount equal to any Reduction of the Complementary Deposit on such date, |

| (e) | any sum due and payable on such date as Complementary Deposit Fee and Subordinated Deposit Fee, and |

| (f) | any other sums due by the Purchaser to the Centralising Unit acting on its own behalf or on behalf of the Sellers pursuant to the Transaction Documents, and not paid otherwise. |

The Parties hereby agree that all entries on the Current Account are calculated, for any Settlement Date during the Replenishment Period, on the Calculation Date preceding such Settlement Date, and that, once entered in the Current Account, such entries shall constitute payments for the purposes of the Transaction Documents.

| 6.5 | Termination of the Current Account |

The current account relationship shall terminate, and the Current Account shall be closed, on the Commitment Expiry Date.

| 7. | AMOUNT OF THE PURCHASER’S FUNDING |

| 7.1 | Maximum Amount of the Purchaser’s Funding |

| 7.1.1 | The Purchaser shall fund Payments: |

17

| (a) | first, out of the applicable Refinanced Received Net Amount, if any; |

| (b) | second, out of a Senior Deposit (the “Purchaser’s Funding”), up to the then applicable Maximum Amount of the Purchaser’s Funding. |

The Senior Deposit shall create an indebtedness of the Purchaser to the Depositor in relation to the repayment of such Senior Deposit.

| 7.1.2 | The Maximum Amount of the Purchaser’s Funding shall be communicated by the Centralising Unit, acting in the name and on behalf the Sellers, to the Purchaser and to the Agent at the latest sixty (60) calendar days before the expiration date of the Liquidity Agreements and the Fund Subscription Agreements (as amended from time to time). For such purpose, the Centralising Unit, acting in the name and on behalf the Sellers, shall send to the Purchaser and the Agent a notice (in the form of SCHEDULE 17) indicating the new amount of the Maximum Amount of the Purchaser’s Funding (such new amount, for the avoidance of doubt, being not lower than the Minimum Amount of the Program and not greater than the Maximum Amount of the Program) that shall apply from the date of renewal of the Liquidity Agreements and the Fund Subscription Agreements through and including the new expiration date of the Liquidity Agreements and the Fund Subscription Agreements (as renewed) (the “Notice for Maximum Amount of the Purchaser’s Funding”). |

| 7.1.3 | The Maximum Amount of the Purchaser’s Funding for the period starting on the Funded Settlement Date of October 2018 (included) and ending on the Funded Settlement Date of October 2019 (excluded) shall be equal to EUR320,000,000. |

| 7.1.4 | In the event that any Liquidity Agreement is not renewed as a result of a Liquidity Commitment Non-Renewal, the Maximum Amount of the Program shall be partially and automatically reduced by an amount equal to the commitment of the Liquidity Bank party to such Liquidity Agreement (except in circumstances where such Liquidity Bank would have renewed the Fund Subscription Agreement to which it is a party). Similarly, in the event that any Fund Subscription Agreement is not renewed as a result of a Subscription Commitment Non-Renewal, the Maximum Amount of the Program shall be partially and automatically reduced by an amount equal to the commitment of the Fund Subscriber party to such Fund Subscription Agreement (except in circumstances where such Fund Subscriber would have renewed the Liquidity Agreement to which it is a party). |

Such reduction of the Maximum Amount of the Program shall take effect on the Funded Settlement Date following the date upon which an event described above has occurred and shall be definitive and irrevocable.

| 7.2 | Amount of the Purchaser’s Funding on the Initial Settlement Date |

On the Initial Settlement Date, the amount of the Purchaser’s Funding shall be equal to the lower of the following amounts:

| (a) | the Outstanding Amount of Eligible Receivables to be purchased by the Purchaser on such date, multiplied by the excess of: |

18

- one (1) less;

- the sum of the Overcollateralisation Rate and the Discount Reserve Rate; and

| (b) | the Requested Amount of the Purchaser’s Funding. |

| 7.3 | Change in the Purchaser’s Funding |

On each Funded Settlement Date during the Replenishment Period other than the Initial Settlement Date, the Purchaser’s Funding shall be adjusted as follows:

| (a) | if: |

| (i) | the lower of the following amounts: |

| (x) | the sum of (a) the Outstanding Amount of Eligible Receivables on such date and (ß) the Outstanding Amount of Refinanced Eligible Receivables on such date, multiplied by the positive difference between: |

| - | one (1) less; |

| - | the sum of the Overcollateralisation Rate and the Discount Reserve Rate; and |

| (y) | the Requested Amount of the Purchaser’s Funding; |

exceeds

| (ii) | the amount of the Purchaser’s Funding outstanding on the preceding Funded Settlement Date; |

then the Purchaser’s Funding shall be increased by an amount equal to such excess (the “Increase in the Purchaser’s Funding”); and

| (b) | if: |

| (i) | the lower of the following amounts: |

| (x) | the sum of (a) the Outstanding Amount of Eligible Receivables on such date and (ß) the Outstanding Amount of Refinanced Eligible Receivables on such date, multiplied by the positive difference between: |

| - | one (1) less; |

| - | the sum of the Overcollateralisation Rate and the Discount Reserve Rate; and |

| (y) | the Requested Amount of the Purchaser’s Funding; |

is lower than

19

| (ii) | the amount of the Purchaser’s Funding outstanding on the preceding Funded Settlement Date; |

then the Purchaser’s Funding shall be reduced by the amount of such difference (the “Reduction in the Purchaser’s Funding”).

| 7.4 | Amount of the Purchaser’s Funding in the event of a Potential Early Amortisation Event |

In the event that a Potential Early Amortisation Event occurs, and as long as such Potential Early Amortisation Event is continuing, the amount of the Purchaser’s Funding shall be limited to the amount of the Purchaser’s Funding on the Funded Settlement Date before such Potential Early Amortisation Event has occurred.

| 8. | SUBORDINATED DEPOSIT |

| 8.1 | Subordinated Deposit |

On the first Settlement Date following the 2008 Amendment Date, the Subordinated Depositor shall make a Subordinated Deposit in Euro with the Purchaser and on each following Settlement Date during the Replenishment Period, the amount of the Subordinated Deposit shall be increased or decreased in accordance with the calculations made by the Agent on each Calculation Date in accordance with the provisions of schedules 1 and 2 of the Master Subordinated Deposit Agreement.

On each Calculation Date during the Replenishment Period, the Agent shall calculate the difference between (i) the amount of the Subordinated Deposit to be made on the following Settlement Date and (ii) the amount of the Subordinated Deposit made on the preceding Settlement Date.

| 8.2 | Pledge of the Subordinated Deposit |

The Subordinated Deposit shall be pledged as cash collateral (affecté à titre de gage-espèces) by the Centralising Unit in favour of the Purchaser, to secure the payment of (i) any sum due by the Debtors to the Purchaser in respect of the Sold Receivables and (ii) any sum due to the Purchaser by any Seller, the Centralising Unit or the Italian Issuer pursuant to the Transaction Documents; provided that, in respect of sums due by the Italian Issuer, such sums shall be limited to those remaining due under the Italian Notes (notwithstanding any limited recourse provision applicable thereto) as a result of any payment default from a Debtor under a Refinanced Sold Receivable or from the Italian Seller under the Italian Receivables Purchase Agreement and provided, further, that no party shall be entitled to receive, as a result of such pledge, any amounts in addition to those that it is entitled to receive pursuant to Article 16.

20

| 8.3 | Repayment of the Subordinated Deposit |

The repayment of the Subordinated Deposit shall be carried out in accordance with the terms and conditions set forth in the Master Subordinated Deposit Agreement and Article 16 (Order of Priority during the Amortisation Period).

| 9. | COMPLEMENTARY DEPOSIT |

| 9.1 | Complementary Deposit |

The Centralising Unit shall make a Complementary Deposit with the Purchaser in accordance with the terms and conditions of the Master Complementary Deposit Agreement.

On each Calculation Date during the Replenishment Period, the amount of the Complementary Deposit shall be calculated by the Agent in accordance with the provisions of schedule 1 of the Master Complementary Deposit Agreement.

| 9.2 | Pledge of the Complementary Deposit |

The Complementary Deposit shall be pledged as cash collateral (affecté à titre de gage-espèces) by the Centralising Unit in favour of the Purchaser, to secure the payment of (i) any sum due by the Debtors to the Purchaser in respect of the Sold Receivables and (ii) any sum due to the Purchaser by any Seller, the Centralising Unit or the Italian Issuer pursuant to the Transaction Documents, provided that in respect of sums due by the Italian Issuer, such sums shall be limited to those remaining due under the Italian Notes (notwithstanding any limited recourse provision applicable thereto) as a result of any payment default from a Debtor under a Refinanced Sold Receivable or from the Italian Seller under the Italian Receivables Purchase Agreement and provided, further, that no party shall be entitled to receive, as a result of such pledge, any amounts in addition to those that it is entitled to receive pursuant to Article 16.

| 9.3 | Repayment of the Complementary Deposit |

The repayment of the Complementary Deposit shall be carried out in accordance with the terms and conditions set forth in the Master Complementary Deposit Agreement and Article 16 (Order of Priority during the Amortisation Period).

CHAPTER IV

FEES

| 10. | FEES |

| 10.1 | On each Funded Settlement Date (except the Initial Settlement Date), the Centralising Unit shall pay to the Agent, the Management Fee which is due to compensate the Agent for its services under this Agreement. |

21

| 10.2 | Such Management Fee shall be equal to €10,041.66 per month to be increased to €12,791.66 per month during any Bi-monthly Management Period (VAT excluded), increased by the applicable VAT. In the event that the Centralising Unit decides to terminate the Securitisation Transaction and repurchases the Sold Receivables upon such termination (other than a termination after (i) the occurrence of an Early Amortisation Event, (ii) a drawing under a Liquidity Agreement or (iii) the exercise of the rights stated in a Bank Commitment Letter) and does not inform the Agent at the latest three (3) months beforehand, the Centralising Unit undertakes to pay an amount upon such termination equal to the lesser of (i) the Management Fee for three (3) months (i.e. €30,124.98) (VAT excluded), increased by the applicable VAT, from the date on which the notice of termination is delivered minus any Management Fee otherwise paid after notice of termination is delivered and (ii) the Management Fee that would otherwise have been payable from such termination until the expiration date of the Liquidity Agreements and the Fund Subscription Agreements. |

| 10.3 | The Agent shall notify the amount of the Management Fee to the Centralising Unit, at the latest before 5.00 pm on the Calculation Date immediately preceding any Funded Settlement Date. |

| 10.4 | On each Funded Settlement Date, the Centralising Unit shall pay the Management Fee by crediting the Agent’s Account before 12.00 (noon), for an amount equal to the Management Fee, as determined in accordance with Article 10.2. The Parties acknowledge that the payment of such Management Fee by the Centralising Unit to the Agent shall be expressly excluded from the Current Account mechanism. |

| 10.5 | In the event that the Centralising Unit fails to pay such Management Fee on a Funded Settlement Date, the Purchaser shall proceed forthwith with the payment of such Management Fee, on the Centralising Unit’s behalf to the extent of the Adjusted Collections received. As such, the Purchaser shall be, upon delivery of a subrogation notice by the Agent, subrogated in the rights of the Agent against the Centralising Unit to the extent of the sums paid to the Agent in respect of the Management Fee. |

| 10.6 | For the purposes of carrying out any of the audits referred to in Article 12.1.1(vi), the Agent shall be entitled to receive a fee equal to €8,000 (VAT excluded) per audit plus the amount of expenses relating to the German, French, Spanish and UK audits (which shall be based on an on-site audit for a duration of two (2) days). Such fee and expenses shall be paid by the Centralising Unit acting in the name and on behalf of the Sellers on the Funded Settlement Date immediately following the relevant annual audit(s). |

22

CHAPTER V

REPRESENTATIONS AND WARRANTIES - GENERAL COVENANTS

| 11. | REPRESENTATIONS AND WARRANTIES |

| 11.1 | Each Seller and the Centralising Unit represents and warrants to the Purchaser that, as at the 2018 Amendment Date: |

| (i) |

| - | in the case of the French Seller, it is a joint stock company (société par actions simplifiée) duly incorporated and validly existing under French law, or |

| - | in the case of the German Seller, it is a limited liability company (Gesellschaft mit beschränkter Haftung) duly established and validly existing under German law, or |

| - | in the case of the Spanish Seller, it is a corporation (sociedad anónima) duly incorporated and validly existing under Spanish law, or |

| - | in the case of the UK Seller, it is a limited liability company duly incorporated and validly existing under the laws of England and Wales, or |

| - | in the case of the Centralising Unit, it is a limited liability company duly incorporated and validly existing under the laws of England and Wales; |

| (ii) | it has the capacity (a) to carry on its business, as currently conducted, and to own all of the assets appearing on its balance sheet, except where failure of such capacity would not be reasonably likely to result in a Material Adverse Effect, and (b) to enter into and perform its obligations under the Transaction Documents to which it is a party; |

| (iii) | it does not require any power or authorisation to execute the Transaction Documents to which it is a party or to perform its obligations under the Transaction Documents, that it has not already obtained, unless, in the case of any Governmental Authorisation, the failure to obtain such authorisation would not be reasonably likely to result in a Material Adverse Effect; |

| (iv) |

| - | except to the extent that no Material Adverse Effect would be reasonably likely to result, the execution of the Transaction Documents to which it is a party and the performance of its obligations under the Transaction Documents will not contravene (a) any of the provisions of its articles of association or of any other of its constitutional or organisational documents, (b) any laws or regulations applicable to it, or (c) any contractual obligations, negative pledges, agreements or undertakings to which it is a party or by which it is bound; |

| - | the execution of the Transaction Documents to which it is a party and the performance of its obligations under the Transaction Documents will not contravene (x) if such concept is applicable in the relevant jurisdiction, the corporate interest (intérêt social) of the Centralising Unit or the relevant Seller and (y) in the case of the German Seller, § 30 and seq. of the German Limited Liability Companies Act (Gesetz betreffend die Gesellschaften mit beschränkter Haftung); |

23

| (v) | the Transaction Documents to which it is a party constitute its legal, valid and binding obligations and are enforceable against it in accordance with their terms, subject to applicable bankruptcy, insolvency, moratorium and other laws affecting creditors’ right generally; |

| (vi) | all of the documents that it has provided to the Purchaser pursuant to the Transaction Documents are accurate and correct in all material respects as of their respective dates and as of the date of their delivery, and the audited, certified annual accounts were prepared in accordance with the relevant Accounting Principles and give, in all material respects, a true, accurate and fair view (comptes réguliers, sincères et qui donnent une image fidèle) of its results for the relevant fiscal year; |

| (vii) | it carries on its business in compliance with all of the relevant laws and regulations applicable to it, except where failure to do so would not be reasonably likely to have a Material Adverse Effect; |

| (viii) | there are no actions, suits or proceedings pending or, to its knowledge, threatened to be raised or brought against it, which are reasonably likely to result in a Material Adverse Effect, or any material litigation that challenges or seeks to prevent the Securitisation Transaction; |

| (ix) | except as specifically disclosed in writing to the Purchaser before the 2018 Amendment Date, no event has occurred since the closing date of its last fiscal year that is reasonably likely to adversely and materially affect, impede or prohibit the execution or the performance of its obligations under the Transaction Documents to which it is a party or that is otherwise reasonably likely to have a Material Adverse Effect; |

| (x) | no Early Amortisation Event of the type described in Article 13.3 has occurred and is continuing; |

| (xi) | GOODYEAR DUNLOP TIRES EUROPE BV holds directly or indirectly 100% in the Centralising Unit’s share capital and voting rights and more than 50% in each Seller’s share capital and voting rights and as such exercises effective control over the Centralising Unit and the Sellers within the meaning of article L.511-7.3 of the French Monetary and Financial Code (code monétaire et financier); |

| (xii) | it has received a certified true copy of the Transaction Documents and has full knowledge of the same; |

| (xiii) | it has carried out its own legal, tax and accounting analysis as to the consequences of the execution and performance of its obligations under the Transaction Documents, and agrees that the Purchaser, the Joint Lead Arrangers, the Issuers, the Liquidity Banks and the Fund Subscribers shall have no liability to any of the Sellers or the Centralising Unit in that respect; |

| (xiv) | it has entered into intercompany arrangements with the Centralising Unit and the other Sellers, pursuant to which it has undertaken (a) to reimburse the Centralising Unit for certain fees, including any amount paid on its behalf and any losses arising under the |

24

| Transaction Documents, (b) to pay the Centralising Unit a direct and sufficient consideration for the making of the Subordinated Deposit and the Complementary Deposit and compensate the Centralising Unit as is appropriate in respect of all losses incurred by the latter arising from the making of the Subordinated Deposit and the Complementary Deposit, and (c) to ensure that fees and expenses or any other sums due by the Sellers under the Transaction Documents are allocated among the Sellers in accordance with their respective corporate interest, if such concept is applicable in the relevant jurisdiction (the “Intercompany Arrangements”), it being provided that the Intercompany Arrangements shall not provide or otherwise authorise any recourse against a German Seller with respect to the inability of a Debtor to pay the relevant Sold Receivables (keine Bonitätshaftung); |

| (xv) | it has entered into intercompany arrangements which shall, inter alia, if complied with, ensure due compliance by each of the German Seller, GOODYEAR DUNLOP TIRES EUROPE BV, GOODYEAR and/or any other shareholder or affiliate of the German Seller with the relevant applicable corporate capital maintenance provisions, including, without limitation, § 30 of the German Limited Liability Companies Act (Gesetz betreffend die Gesellschaften mit beschränkter Haftung); |

| (xvi) | no Lien exists (other than any Lien contemplated by the Transaction Documents) (a) in relation to any Sold Receivables (and related rights) assigned by it prior to their respective assignment to the Purchaser or in respect of the Collection Accounts, with the exception of those Liens which arise by operation of applicable laws and regulations, or (b) over the Subordinated Deposit and/or the Complementary Deposit; |

| (xvii) | its obligations under the Transaction Documents rank and will rank at least pari passu with all other present and future unsecured and unsubordinated obligations (with the exception of those preferred by law generally); |

| (xviii) | it is not entitled to claim immunity from suit, execution, attachment or other legal process in any proceeding taken in the jurisdiction of its incorporation in relation to any Transaction Documents; |

| (xix) | it is not subject to Insolvency Proceedings and is not insolvent within the meaning of applicable laws; |

| (xx) | in the case of the German Seller, (a) such German Seller has, to the extent permissible, opted for payment on a monthly basis of self-assessed or assessed VAT, (b) such German Seller having applied for a permanent extension for the filing of monthly returns (Dauerfristverlängerung) has posted a special advance estimated tax payment to the relevant tax office and (c) any such self-assessed or assessed VAT owed by such German Seller in accordance with applicable German VAT laws and regulations, has been paid to the relevant German tax administration when due; |

| (xxi) | in the case of the German Seller, there is no dispute, action, suit or proceeding pending or, to its knowledge, threatened to be raised or brought against it, except for disputes, actions, |

25

| suits or proceedings that such German Seller disputes in good faith, by any German tax administration in relation to any VAT tax payment or the calculation of such VAT; |

| (xxii) | in the case of the German Seller, (a) all commercial contracts in relation to the Sold Receivables, whether they are master agreements, general conditions of sale or other documents have been either executed between such German Seller and the relevant Debtors, or executed between another Seller and the relevant Debtors and transferred to such German Seller, and the relevant Debtors are situated in Belgium, England, France, Germany, Italy or Spain, (b) each commercial contract is concluded with either a single Debtor or Debtors that are Affiliates of each other, and (c) each commercial contract is governed by an Eligible Law, and (d) the jurisdiction clause, if any, of each commercial contract attributes jurisdiction to the competent courts of the jurisdiction whose laws are one of the Eligible Laws; |

| (xxiii) | the communication by it to any other Party of any information or data and the delivery by it of any records or reports relating to (i) any Debtor, (ii) any person having granted a related right in connection with the Sold Receivables (if applicable), (iii) the Sold Receivables and/or (iv) the rights related to the Sold Receivables, in connection with the Securitisation Transaction, does not violate any provisions of applicable Data Protection Laws (as defined in SCHEDULE 19); and |

| (xxiv) | it has implemented and maintains in effect policies and procedures reasonably designed to promote compliance by itself, its Subsidiaries and their respective directors, officers, employees and agents with applicable Sanctions. Any Seller and the Centralising Unit and their Subsidiaries are not knowingly engaged in any activity that would reasonably be expected to result in any of them being listed on any Sanctions-related list referred to in point (a) of the definition of “Sanctioned Person”. None of the Sellers, the Centralising Unit or any of their Subsidiaries or, to their knowledge, any of their respective directors, officers or employees that will act for them or any of their Subsidiaries in any capacity in connection with this Agreement, is listed on any Sanctions-related list referred to in point (a) of the definition of “Sanctioned Person”. |

| 11.2 | The above representations and warranties shall be deemed to be repeated by each Seller and the Centralising Unit, as applicable, on each Settlement Date during the Replenishment Period. Such representations and warranties shall remain in force until the Program Expiry Date. |

| 12. | GENERAL COVENANTS |

The following general covenants shall remain in force from the Signing Date until the Program Expiry Date.

| 12.1 | Sellers |

| 12.1.1 | Affirmative covenants: |

Each Seller undertakes:

26

| (i) | to provide the Purchaser without undue delay, on a non-consolidated basis, with: |

| (a) | its annual accounts (balance sheet, profit and loss accounts and annexes), as published and certified by its statutory auditors, report of the board of directors (or, as regards the French Seller, of the president of the French Seller) and statutory auditors relating thereto and an extract of the minutes of the shareholders’ annual general meeting approving the said accounts, no later than sixty (60) calendar days following the holding of its shareholders’ annual general meeting; |

| (b) | all published interim financial information; |

| (c) | all other information, reports or statements as the Purchaser may at any time reasonably request in so far as is permitted by applicable laws and regulations, and depending on the type of information requested, in accordance with the different procedures applicable to the communication of information under this Agreement; |

| (ii) | to request promptly any authorisation as may become necessary for the performance of its obligations under this Agreement; |

| (iii) | to do or cause to be done all things necessary to preserve, renew and keep in full force and effect its legal existence and the rights, licenses, permits, privileges and franchises material to the conduct of its business, except to the extent that failures to keep in effect such rights, licenses, permits, privileges and franchises would not be reasonably likely to result in a Material Adverse Effect; |

| (iv) | upon knowledge by the relevant Seller that (a) an Early Amortisation Event defined in Article 13.3 has occurred, to notify or cause to be notified forthwith the Purchaser and provide a copy of the same to the Joint Lead Arrangers and (b) a Potential Early Amortisation Event has occurred, to notify or cause the Purchaser to be notified forthwith and provide a copy of the same to the Joint Lead Arrangers and, where applicable, of actions which the Seller has taken and/or proposes to take with respect thereto in order to prevent such Potential Early Amortisation Event from becoming an Early Amortisation Event; |

| (v) | to carry on its business in all material aspects in accordance with all applicable laws and regulations, except where failure to do so would not be reasonably likely to have a Material Adverse Effect; |

| (vi) | upon the Purchaser’s request, which shall be subject to a reasonable prior notice, to arrange forthwith for audit(s) to be carried out by the Purchaser or by any other entity appointed by the Purchaser for such purposes, of its receivables and collection procedures. The audits shall be conducted at the expense of and paid by the Centralising Unit, acting in the name and on behalf of the Sellers, within the limits set forth in Article 10.6, it being understood that: |

27

| - | the annual audit shall be carried out at the latest two (2) months before the anniversary date of the 2018 Amendment Date (with the exception of a New Seller acceding to the Securitisation Transaction in accordance with the provisions of Article 40, in relation to which the first audit carried out before the entry into the Securitisation Transaction of the New Seller shall be sufficient to satisfy the annual requirement referred to above for the first anniversary date of the 2018 Amendment Date falling after its accession); |

| - | further, upon unanimous written request from each of the Purchaser, the Liquidity Banks and the Fund Subscribers, the Agent shall carry out a second audit during that same year; |

| (vii) | with respect to any Seller, to deliver to the Purchaser an Auditors Certificate within twelve (12) calendar months after the date of delivery of the previous Auditors Certificate in the form set out in SCHEDULE 4; |

| (viii) | to notify forthwith the Purchaser, promptly upon becoming aware, of any material adverse change in relation to any Sold Receivable, and to promptly respond to any reasonable written request of the Purchaser, the Agent, any Back-Up Servicer (if and when appointed) concerning any event in relation to any Sold Receivable which is reasonably likely to endanger the payment of a sum under such Sold Receivable; |

| (ix) | to keep the Purchaser fully informed of the existence and progress of (a) any material litigation relating to a Sold Receivable, (b) any claim or litigation relating to the Sold Receivables before the courts or in arbitration for the purposes of recovering material sums due under such Sold Receivables, (c) any claim or litigation relating to the Sold Receivables before the courts or in arbitration for the purposes of recovering sums due under such Sold Receivable, upon written request of the Purchaser, the Agent or any Back-Up Servicer (if and when appointed), and (d) any action, suit or proceeding described in Article 11.1(viii); |

| (x) | to submit to the Purchaser, as soon as practicable, on the Purchaser’s reasonable request and subject to the provisions of Article 20 (Identification of the contractual documentation for the Sold Receivables - Access to documents) and Article 31 (Confidentiality), all documents which enable the latter to verify that the Seller has properly fulfilled its contractual obligations concerning the collection of sums due under the Sold Receivables, to the extent permitted by applicable laws or regulations and in particular, in the case of the Protected Debtors, by the provisions of the Data Protection Laws (as defined in SCHEDULE 19) and the Data Escrow Agreement; |

| (xi) | to transfer or cause to be transferred to the Purchaser all Adjusted Collections in accordance with the provisions of Article 23 (Application of payments and payments of collections); |

| (xii) | with respect to any Seller, to deliver to the Purchaser a Solvency Certificate (on a date which shall be a Funded Settlement Date during the Replenishment Period) on a semi-annual basis in accordance with the form set out in SCHEDULE 5; |

28

| (xiii) | to execute any and all further documents, agreements and instruments, and take all such further actions, as may be reasonably requested by the Purchaser in order to ensure that the sales of Ongoing Purchasable Receivables and Remaining Purchasable Receivables to the Purchaser under the Receivables Purchase Agreements constitute valid and perfected sales of such Ongoing Purchasable Receivables and Remaining Purchasable Receivables and the Liens created over the Collection Accounts for the benefit of the Purchaser constitute valid and perfected Liens; |

| (xiv) | to inform the Purchaser, as soon as possible and in so far permitted by applicable laws and regulations, of its intention to restructure such Seller leading to GOODYEAR DUNLOP TIRES EUROPE BV ceasing to hold directly or indirectly more than 50% in the voting rights of such Seller; |

| (xv) | to ensure that steps are taken to maintain the performance of the billing and recovery procedures and accountancy methods in relation to the customer account (compte client) of such Seller, with the same degree of skill and care as evidenced during the audits carried out on behalf of the Purchaser or any of their agents during the structuring phase of the Securitisation Transaction; |

| (xvi) | to ensure that any information transmitted by the Centralising Unit or such Seller during the term of this Agreement and pursuant to the Transaction Documents is true and accurate in all material respects; |

| (xvii) | to maintain effective and in full force at all times the Intercompany Arrangements with the Centralising Unit and the other Sellers, and not to change such Intercompany Arrangements in any way that may adversely affect the rights of the Purchaser under the Securitisation Transaction; |

| (xviii) | to maintain effective and in full force at all times, such internal arrangements between the German Seller, GOODYEAR DUNLOP TIRES EUROPE BV, GOODYEAR and/or any other shareholder or affiliate of the German Seller which are necessary to, if complied with, ensure due compliance of each of the German Seller, GOODYEAR DUNLOP TIRES EUROPE BV, GOODYEAR and/or any other shareholder or affiliate of the German Seller with the relevant applicable corporate capital maintenance provisions, including, without limitation, § 30 of the German Limited Liability Companies Act (Gesetz betreffend die Gesellschaften mit beschränkter Haftung); |

| (xix) | to keep any Bill of Exchange relating to a Sold Receivable as custodian of the Purchaser for collection purposes unless the Sellers’ Collection Mandate has been terminated and it has received notification from the Purchaser to deliver such Bill of Exchange to the Purchaser or any third party appointed by the Purchaser; |

| (xx) | in the case of the Spanish Seller, to take such steps and do all things as to notarise before a Spanish Notary Public, on each Funded Settlement Date during the Replenishment Period, any Transfer Deed executed and delivered pursuant to the French law governed Receivables Purchase Agreement executed by the Spanish Seller (specifying in such |

29

| Transfer Deeds any promissory notes (pagarés) which must be transferred in accordance with this Agreement and such Receivables Purchase Agreement), it being understood that the costs of such notarisation shall, at all times, be borne by the Spanish Seller; |

| (xxi) | in the case of the German Seller, to take such steps and do all things as to notarise before a Spanish Notary Public on each Funded Settlement Date during the Replenishment Period, any Transfer Deed relating to Spanish law governed receivables and/or Spanish Debtors that has to be executed and delivered pursuant to the Receivables Purchase Agreement executed by the German Seller, it being understood that the costs of such notarisation shall, at all times, be borne by the German Seller; |

| (xxii) | (a) to instruct any Debtor, which has not been already informed, to pay any sum due under a Sold Receivable to the relevant Collection Account(s), (b) from the Signing Date, to collect any sums due under a Sold Receivable exclusively on the relevant Collection Account(s) and (c) to promptly transfer to the relevant Collection Account(s) any sums paid by a Debtor in a different manner than to the relevant Collection Account(s); |

| (xxiii) | to maintain in effect policies and procedures reasonably designed to promote compliance by them and their Subsidiaries, and their respective directors, officers and employees, with applicable Sanctions; |

| (xxiv) | in the case of the German Seller, |

| (a) | (w) to opt or continue to opt at all times for payment of self-assessed or assessed VAT on a monthly basis, (x) having applied for a permanent extension for the filing of monthly returns (Dauerfristverlängerung) post and maintain posted a special advance estimated tax payment to the relevant tax office, (y) to calculate and self-assess VAT on a monthly basis in accordance with German VAT laws and regulations and (z) to pay any VAT when due to the relevant German tax administration on a monthly basis; |

| (b) | promptly upon request of the Purchaser to provide the Purchaser with (x) a report for the time period specified in the Purchaser’s request detailing the calculation of VAT due in the specified calendar month(s) in accordance with German VAT laws and regulations, and (y) evidence of the payment of any amounts of VAT when due to the relevant German tax administration, as described in such report; |

| (c) | to submit promptly upon request of the Purchaser a statement and/or evidence in respect of any VAT payment; and |

| (d) | promptly upon request of the Purchaser to ensure that (x) its auditors or any qualified accountants carry out an audit in relation to its VAT assessment procedures and VAT payment in accordance with applicable law and regulations, detailing the calculation and the payment of VAT during the period since the previous audit or such shorter period as the Purchaser may request and (y) the results of such audit are forthwith communicated to the Purchaser, whereby the costs of such audit shall be borne by such German Seller; |

30

| (xxv) | to use all commercially reasonable efforts to enter into an amendment to, or a replacement of, the Data Escrow Agreement no later than the Funded Settlement Date of November 2018 in order to, among other things, make each Seller a party to the Data Escrow Agreement. |

| 12.1.2 | Negative covenants |

Each Seller undertakes:

| (i) | (a) not to sell, lease, transfer or dispose of, the whole or a substantial part of its business or assets whether in a single transaction or by a number of transactions. Such prohibitions do not however apply to: (w) disposals in the ordinary course of the business of the Centralising Unit or of any Seller; (x) disposals between the Centralising Unit and any Seller(s) or between any Sellers or within the GOODYEAR Group; (y) disposals for arm’s length consideration on normal commercial terms; or (z) other disposals which are not reasonably likely to materially prejudice the rights of the Purchaser hereunder or adversely and materially affect the collectibility of the Sold Receivables; and |

(b) except for any intra-group mergers or reorganisations within the GOODYEAR Group, not to purchase all or part of the assets of any individual, undertaking or company, and not to enter into any merger (fusion), demerger (scission) or proceeding of a similar nature, which is reasonably likely to materially prejudice the rights of the Purchaser hereunder or adversely affects such Seller’s ability to collect the Sold Receivables;

| (ii) | not to vary any of its collection procedures currently in operation on the date it becomes a Seller under the Transaction Documents, without the prior written consent of the Purchaser if such a variation is reasonably likely to adversely affect the quality of such collection procedures; |

| (iii) | not to deliver to the Purchaser any document containing information concerning the Sold Receivables which it knows to be inaccurate or incomplete; |

| (iv) | not to deliver to the Purchaser any document containing information concerning the Sold Receivables which it, in the exercise of reasonable diligence, should reasonably have known to be inaccurate or incomplete, in any material respect; |