Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - SunCoke Energy, Inc. | d643743dex991.htm |

| 8-K - 8-K - SunCoke Energy, Inc. | d643743d8k.htm |

SunCoke Energy, Inc. Q3 2018 Earnings Conference Call October 25, 2018 Exhibit 99.2

Forward-Looking Statements This slide presentation should be reviewed in conjunction with the Third Quarter 2018 earnings release of SunCoke Energy, Inc. (SXC) and conference call held on October 25, 2018 at 10:00 a.m. ET. Except for statements of historical fact, information contained in this presentation constitutes “forward-looking statements” as defined in Section 27A of the Securities Act of 1933, as amended and Section 21E of the Securities Exchange Act of 1934, as amended. Such forward-looking statements are based upon information currently available, and express management’s opinions, expectations, beliefs, plans, objectives, assumptions or projections with respect to anticipated future performance of SXC or SunCoke Energy Partners, L.P. (SXCP). These statements are not guarantees of future performance and undue reliance should not be placed on them. Although management believes that its plans, intentions and expectations reflected in, or suggested by, the forward-looking statements made in this presentation are reasonable, no assurance can be given that these plans, intentions or expectations will be achieved when anticipated or at all. Forward-looking statements often may be identified by the use of forward-looking terminology such as the words “believe,” “expect,” “plan,” “intend,” “anticipate,” “contemplate,” “estimate,” “predict,” “guidance,” “forecast,” “potential,” “continue,” “may,” “will,” “could,” “should,” or the negative of these terms or similar expressions. Such statements are subject to a number of known and unknown risks, and uncertainties, many of which are beyond the control of SXC and SXCP, or are difficult to predict, and may cause actual results to differ materially from those implied or expressed by the forward-looking statements. Each of SXC and SXCP has included in its filings with the Securities and Exchange Commission (SEC) cautionary language identifying important factors (but not necessarily all the important factors) that could cause actual results to differ materially from those expressed in any forward-looking statement. Such factors include, but are not limited to: changes in industry conditions; the ability to renew current customer, supplier and other material agreements; future liquidity, working capital and capital requirements; the ability to successfully implement business strategies and potential growth opportunities; the impact of indebtedness and financing plans, including sources and availability of third-party financing; possible or assumed future results of operations; the outcome of pending and future litigation; potential operating performance improvements and the ability to achieve anticipated cost savings from strategic revenue and efficiency initiatives. For more information concerning these factors, see the SEC filings of SXC and SXCP. All forward-looking statements included in this presentation are expressly qualified in their entirety by the cautionary statements contained in such SEC filings. The forward-looking statements in this presentation speak only as of the date hereof. Except as required by applicable law, SXC and SXCP do not have any intention or obligation to revise or update publicly any forward-looking statement (or associated cautionary language) made herein, whether as a result of new information, future events, or otherwise after the date of this presentation. This presentation includes certain non-GAAP financial measures intended to supplement, not substitute for, comparable GAAP measures. Furthermore, the non-GAAP financial measures presented herein may not be consistent with similar measures provided by other companies. Reconciliations of non-GAAP financial measures to GAAP financial measures are provided in the Appendix at the end of the presentation. Investors are urged to consider carefully the comparable GAAP measures and the reconciliations to those measures provided in the Appendix. These data should be read in conjunction with the periodic reports of SXC and SXCP previously filed with the SEC. Due to rounding, numbers presented throughout this presentation may not add up precisely to the totals indicated and percentages may not precisely reflect the absolute figures for the same reason. Industry and market data used in this presentation have been obtained from industry publications and sources as well as from research reports prepared for other purposes. SXC and SXCP have not independently verified the data obtained from these sources and cannot assure investors of either the accuracy or completeness of such data. SXC Q3 2018 Earnings Call

Q3 2018 Highlights Operating performance of coke and logistics segments in line with expectations Delivered strong Q3 ‘18 Adj. EBITDA of $66.0M and generated significant cash flow; ended quarter with ample liquidity of >$420M Completed majority of 2018 IHO oven rebuild campaign; Increasing 2018 IHO Adj. EBITDA guidance to $10M - $15M from approximately breakeven CMT handled approximately 3.2Mt; on pace to achieve 11.5Mt of total throughput volume in 2018 SXCP reduced debt by $25M during the quarter Well positioned to achieve top-end FY 2018 Consolidated Adjusted EBITDA guidance range of $240M to $255M SXC Q3 2018 Earnings Call

IHO 2018 Performance 45 of 67 ovens from 2018 campaign have been completed, 39 of which have returned to full production by the end of Q3 2018 Pleased with performance of rebuilt A-battery ovens; improved efficiencies from rebuilt ovens significantly increasing production Rebuilt C/D battery continues to perform as expected; 300Kt annual run-rate per battery Remaining 22 ovens from 2018 campaign expected to be completed by end of November Anticipate FY 2018 rebuild spending total approximately ~$600k/oven or ~$40M, which includes $8M O&M expense and $32M CapEx for FY 2018 Once 2018 campaign completed, ~80% of facility rebuilt (211 total ovens) Increasing FY 2018 IHO Adj. EBITDA guidance to be $10M - $15M versus ~$0M; FY 2018 production of ~950Kt from 870Kt – 900Kt 2018 oven rebuild campaign remains on track for November completion; Increasing 2018 IHO Adj. EBITDA to $10M - $15M on production of ~950Kt SXC Q3 2018 Earnings Call

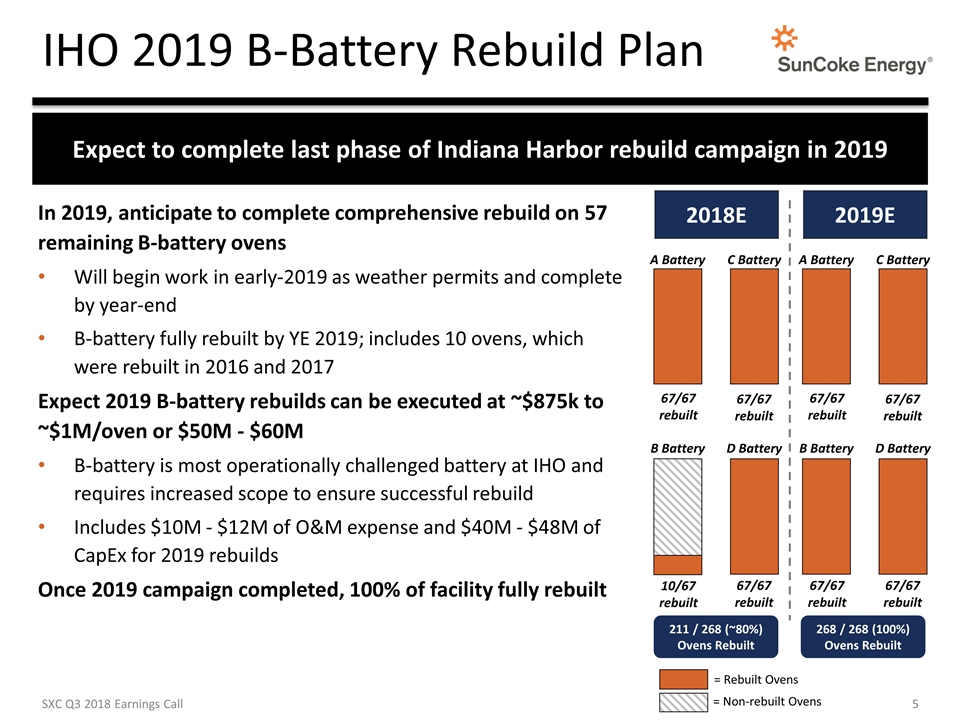

IHO 2019 B-Battery Rebuild Plan In 2019, anticipate to complete comprehensive rebuild on 57 remaining B-battery ovens Will begin work in early-2019 as weather permits and complete by year-end B-battery fully rebuilt by YE 2019; includes 10 ovens, which were rebuilt in 2016 and 2017 Expect 2019 B-battery rebuilds can be executed at ~$875k to ~$1M/oven or $50M - $60M B-battery is most operationally challenged battery at IHO and requires increased scope to ensure successful rebuild Includes $10M - $12M of O&M expense and $40M - $48M of CapEx for 2019 rebuilds Once 2019 campaign completed, 100% of facility fully rebuilt SXC Q3 2018 Earnings Call Expect to complete last phase of Indiana Harbor rebuild campaign in 2019 2018E A Battery B Battery C Battery D Battery 67/67 rebuilt 67/67 rebuilt 67/67 rebuilt 10/67 rebuilt 2019E A Battery B Battery C Battery D Battery 67/67 rebuilt 67/67 rebuilt 67/67 rebuilt 67/67 rebuilt = Rebuilt Ovens = Non-rebuilt Ovens 211 / 268 (~80%) Ovens Rebuilt 268 / 268 (100%) Ovens Rebuilt

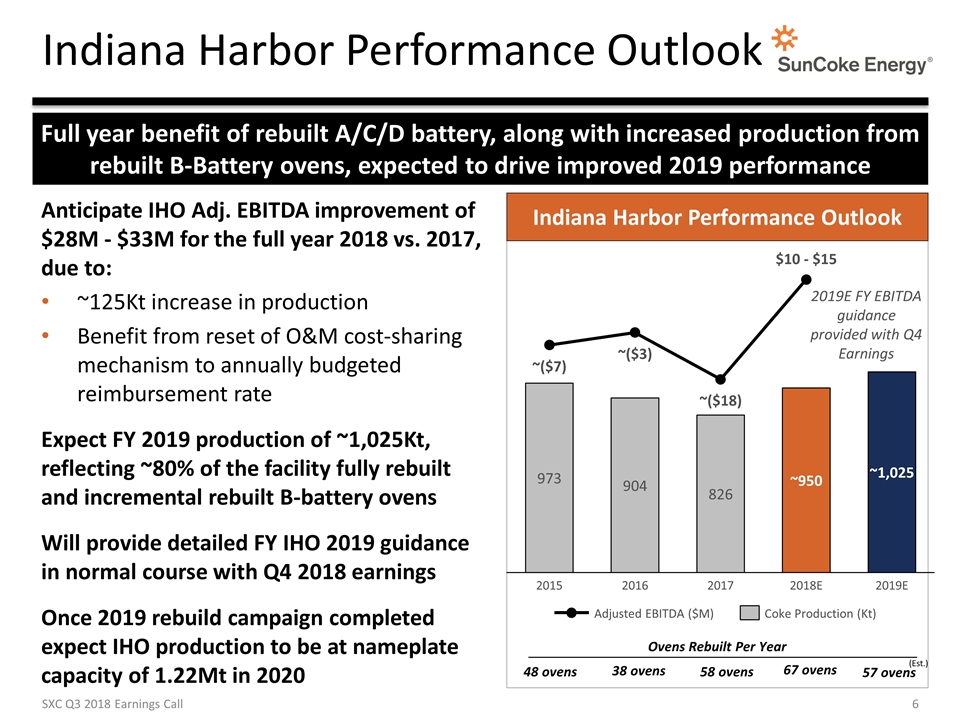

Indiana Harbor Performance Outlook ~ ~950 ~ ~ $10 - $15 ~ Indiana Harbor Performance Outlook Anticipate IHO Adj. EBITDA improvement of $28M - $33M for the full year 2018 vs. 2017, due to: ~125Kt increase in production Benefit from reset of O&M cost-sharing mechanism to annually budgeted reimbursement rate Expect FY 2019 production of ~1,025Kt, reflecting ~80% of the facility fully rebuilt and incremental rebuilt B-battery ovens Will provide detailed FY IHO 2019 guidance in normal course with Q4 2018 earnings Once 2019 rebuild campaign completed expect IHO production to be at nameplate capacity of 1.22Mt in 2020 Ovens Rebuilt Per Year 48 ovens 38 ovens 58 ovens 67 ovens 57 ovens Full year benefit of rebuilt A/C/D battery, along with increased production from rebuilt B-Battery ovens, expected to drive improved 2019 performance 2019E FY EBITDA guidance provided with Q4 Earnings SXC Q3 2018 Earnings Call (Est.)

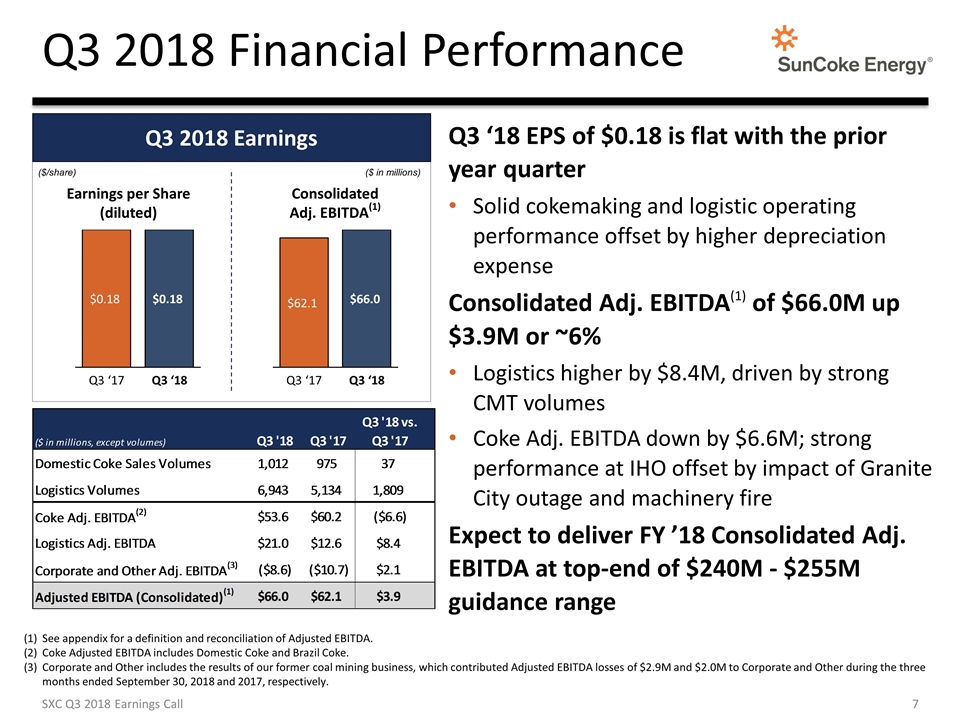

Q3 2018 Financial Performance See appendix for a definition and reconciliation of Adjusted EBITDA. Coke Adjusted EBITDA includes Domestic Coke and Brazil Coke. Corporate and Other includes the results of our former coal mining business, which contributed Adjusted EBITDA losses of $2.9M and $2.0M to Corporate and Other during the three months ended September 30, 2018 and 2017, respectively. Q3 ‘18 EPS of $0.18 is flat with the prior year quarter Solid cokemaking and logistic operating performance offset by higher depreciation expense Consolidated Adj. EBITDA(1) of $66.0M up $3.9M or ~6% Logistics higher by $8.4M, driven by strong CMT volumes Coke Adj. EBITDA down by $6.6M; strong performance at IHO offset by impact of Granite City outage and machinery fire Expect to deliver FY ’18 Consolidated Adj. EBITDA at top-end of $240M - $255M guidance range SXC Q3 2018 Earnings Call ($/share) ($ in millions) Earnings per Share (diluted) Consolidated Adj. EBITDA(1) Q3 2018 Earnings

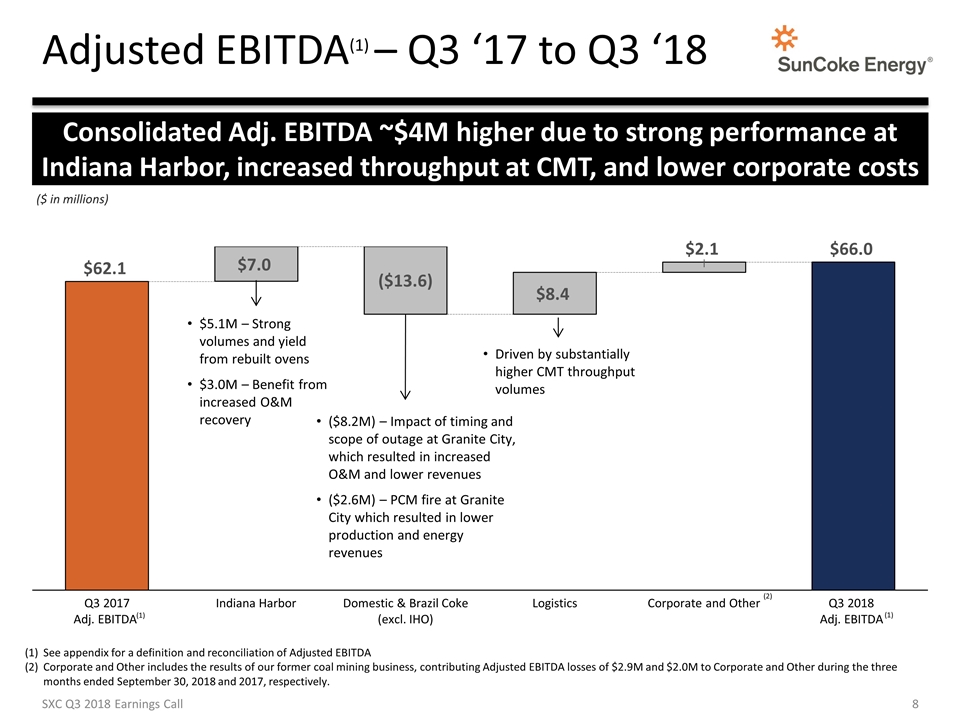

Adjusted EBITDA(1) – Q3 ‘17 to Q3 ‘18 Consolidated Adj. EBITDA ~$4M higher due to strong performance at Indiana Harbor, increased throughput at CMT, and lower corporate costs See appendix for a definition and reconciliation of Adjusted EBITDA Corporate and Other includes the results of our former coal mining business, contributing Adjusted EBITDA losses of $2.9M and $2.0M to Corporate and Other during the three months ended September 30, 2018 and 2017, respectively. (1) (1) SXC Q3 2018 Earnings Call $5.1M – Strong volumes and yield from rebuilt ovens $3.0M – Benefit from increased O&M recovery Driven by substantially higher CMT throughput volumes ($8.2M) – Impact of timing and scope of outage at Granite City, which resulted in increased O&M and lower revenues ($2.6M) – PCM fire at Granite City which resulted in lower production and energy revenues ($ in millions) (2)

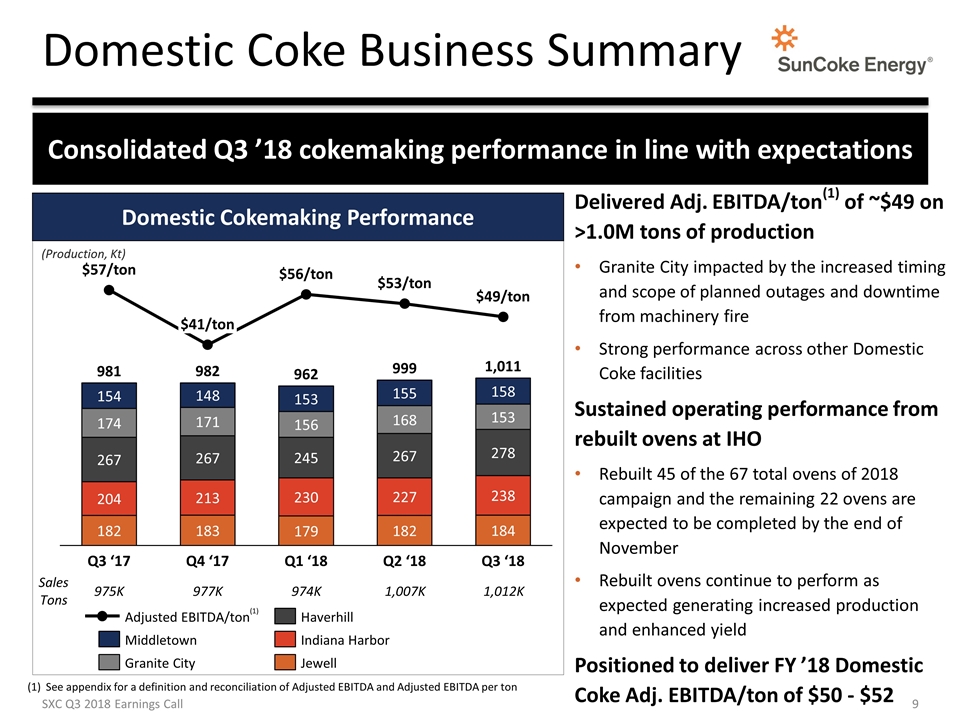

Domestic Coke Business Summary Consolidated Q3 ’18 cokemaking performance in line with expectations Domestic Cokemaking Performance /ton /ton /ton /ton /ton 975K 977K 974K 1,007K Sales Tons (Production, Kt) 1,012K Delivered Adj. EBITDA/ton(1) of ~$49 on >1.0M tons of production Granite City impacted by the increased timing and scope of planned outages and downtime from machinery fire Strong performance across other Domestic Coke facilities Sustained operating performance from rebuilt ovens at IHO Rebuilt 45 of the 67 total ovens of 2018 campaign and the remaining 22 ovens are expected to be completed by the end of November Rebuilt ovens continue to perform as expected generating increased production and enhanced yield Positioned to deliver FY ’18 Domestic Coke Adj. EBITDA/ton of $50 - $52 See appendix for a definition and reconciliation of Adjusted EBITDA and Adjusted EBITDA per ton SXC Q3 2018 Earnings Call (1)

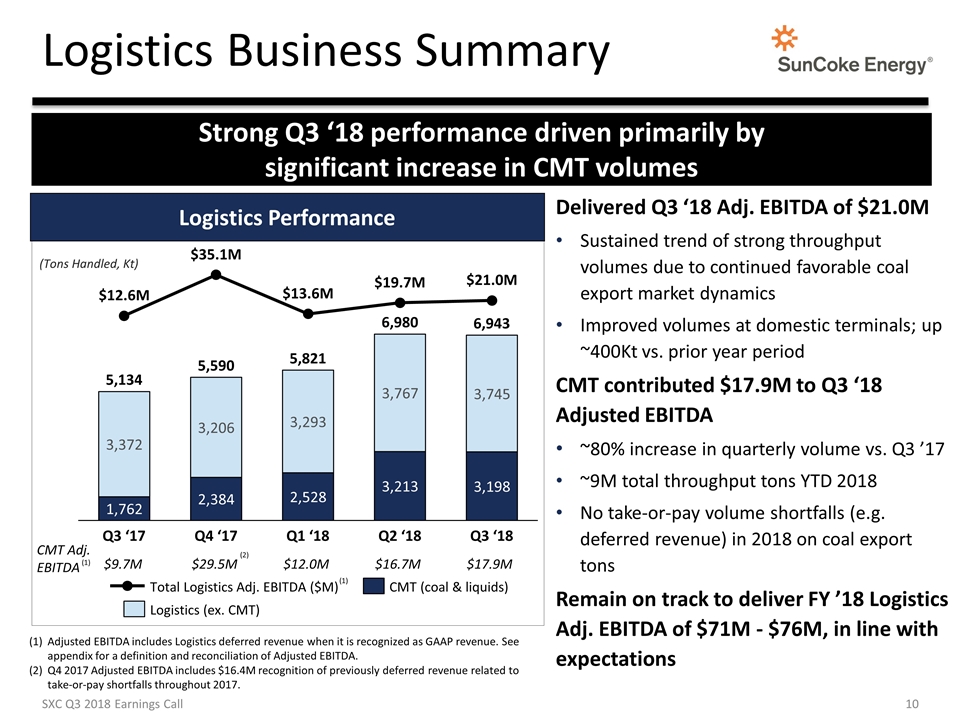

Logistics Business Summary Strong Q3 ‘18 performance driven primarily by significant increase in CMT volumes M M M M M (Tons Handled, Kt) Logistics Performance $9.7M $29.5M $12.0M $16.7M CMT Adj. EBITDA $17.9M (1) (1) SXC Q3 2018 Earnings Call Adjusted EBITDA includes Logistics deferred revenue when it is recognized as GAAP revenue. See appendix for a definition and reconciliation of Adjusted EBITDA. Q4 2017 Adjusted EBITDA includes $16.4M recognition of previously deferred revenue related to take-or-pay shortfalls throughout 2017. (2) Delivered Q3 ‘18 Adj. EBITDA of $21.0M Sustained trend of strong throughput volumes due to continued favorable coal export market dynamics Improved volumes at domestic terminals; up ~400Kt vs. prior year period CMT contributed $17.9M to Q3 ‘18 Adjusted EBITDA ~80% increase in quarterly volume vs. Q3 ’17 ~9M total throughput tons YTD 2018 No take-or-pay volume shortfalls (e.g. deferred revenue) in 2018 on coal export tons Remain on track to deliver FY ’18 Logistics Adj. EBITDA of $71M - $76M, in line with expectations

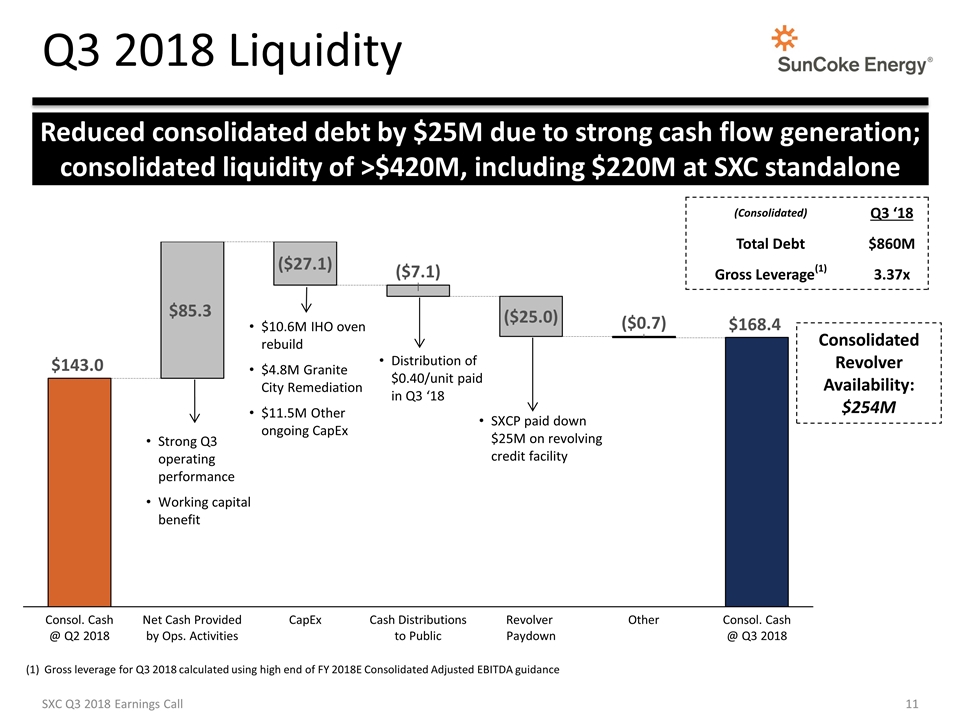

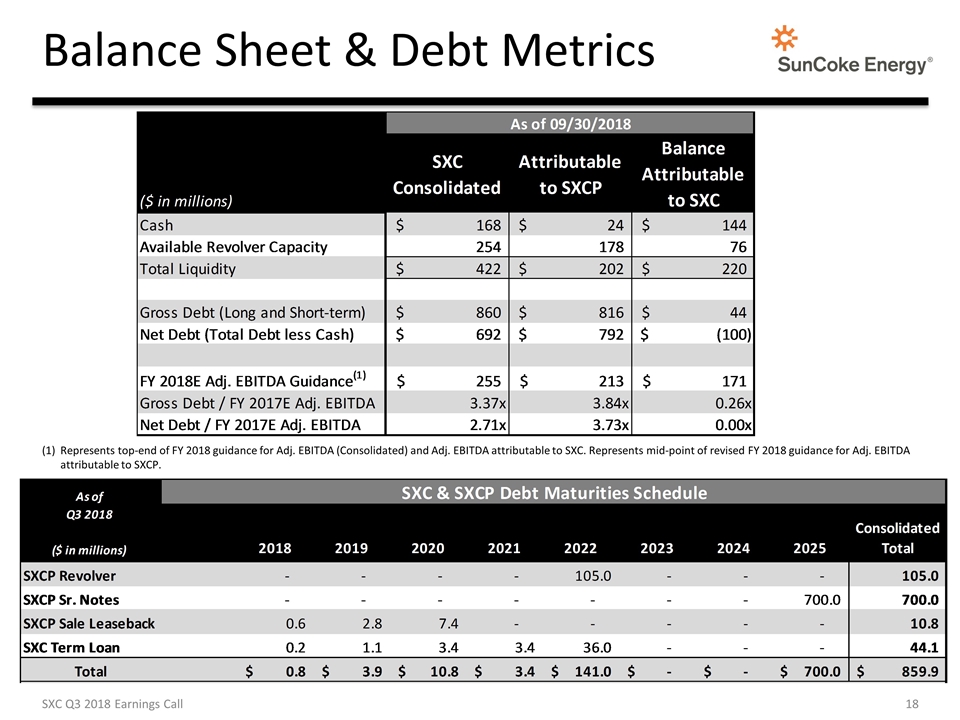

Q3 2018 Liquidity Reduced consolidated debt by $25M due to strong cash flow generation; consolidated liquidity of >$420M, including $220M at SXC standalone SXC Q3 2018 Earnings Call Distribution of $0.40/unit paid in Q3 ‘18 Consolidated Revolver Availability: $254M (Consolidated) Q3 ‘18 Total Debt $860M Gross Leverage(1) 3.37x Gross leverage for Q3 2018 calculated using high end of FY 2018E Consolidated Adjusted EBITDA guidance Strong Q3 operating performance Working capital benefit $10.6M IHO oven rebuild $4.8M Granite City Remediation $11.5M Other ongoing CapEx SXCP paid down $25M on revolving credit facility

Questions

Investor Relations 630-824-1907 www.suncoke.com

Appendix

Definitions Adjusted EBITDA represents earnings before interest, taxes, depreciation and amortization (“EBITDA”), adjusted for any impairments, loss (gain) on extinguishment of debt, changes to our contingent consideration liability related to our acquisition of CMT and/or loss on the disposal of our interest in VISA SunCoke Limited. EBITDA and Adjusted EBITDA do not represent and should not be considered alternatives to net income or operating income under GAAP and may not be comparable to other similarly titled measures in other businesses. Management believes Adjusted EBITDA is an important measure of the operating performance and liquidity of the Company's net assets and its ability to incur and service debt, fund capital expenditures and make distributions. Adjusted EBITDA provides useful information to investors because it highlights trends in our business that may not otherwise be apparent when relying solely on GAAP measures and because it eliminates items that have less bearing on our operating performance and liquidity. EBITDA and Adjusted EBITDA are not measures calculated in accordance with GAAP, and they should not be considered a substitute for net income, operating cash flow or any other measure of financial performance presented in accordance with GAAP. EBITDA represents earnings before interest, taxes, depreciation and amortization. Adjusted EBITDA attributable to SXC/SXCP represents Adjusted EBITDA less Adjusted EBITDA attributable to noncontrolling interests. Adjusted EBITDA/Ton represents Adjusted EBITDA divided by tons sold/handled. SXC Q3 2018 Earnings Call

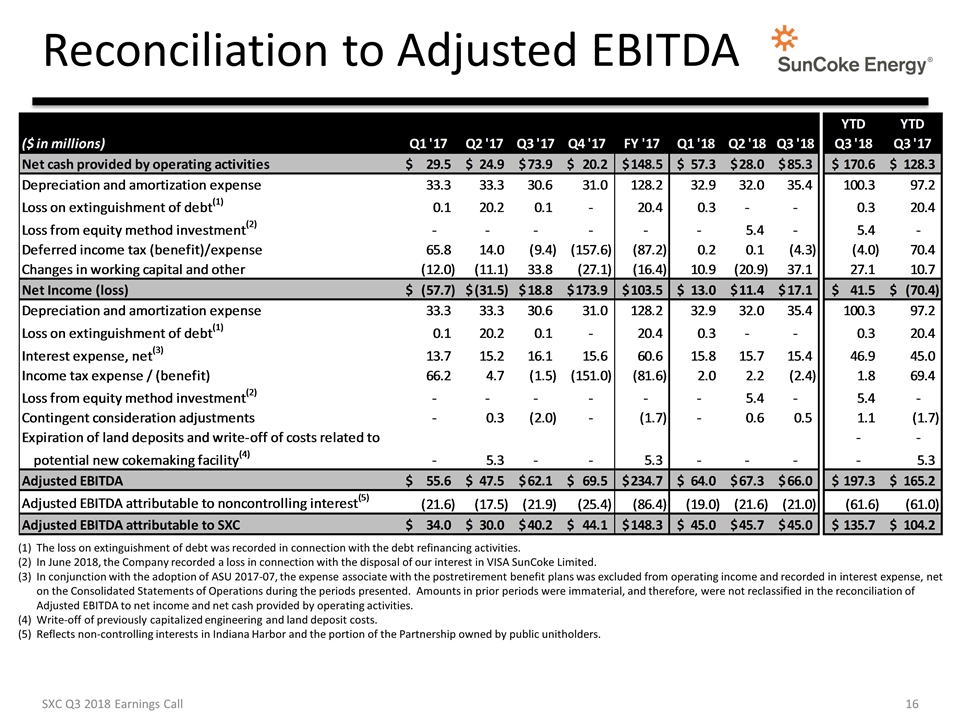

Reconciliation to Adjusted EBITDA The loss on extinguishment of debt was recorded in connection with the debt refinancing activities. In June 2018, the Company recorded a loss in connection with the disposal of our interest in VISA SunCoke Limited. In conjunction with the adoption of ASU 2017-07, the expense associate with the postretirement benefit plans was excluded from operating income and recorded in interest expense, net on the Consolidated Statements of Operations during the periods presented. Amounts in prior periods were immaterial, and therefore, were not reclassified in the reconciliation of Adjusted EBITDA to net income and net cash provided by operating activities. Write-off of previously capitalized engineering and land deposit costs. Reflects non-controlling interests in Indiana Harbor and the portion of the Partnership owned by public unitholders. SXC Q3 2018 Earnings Call

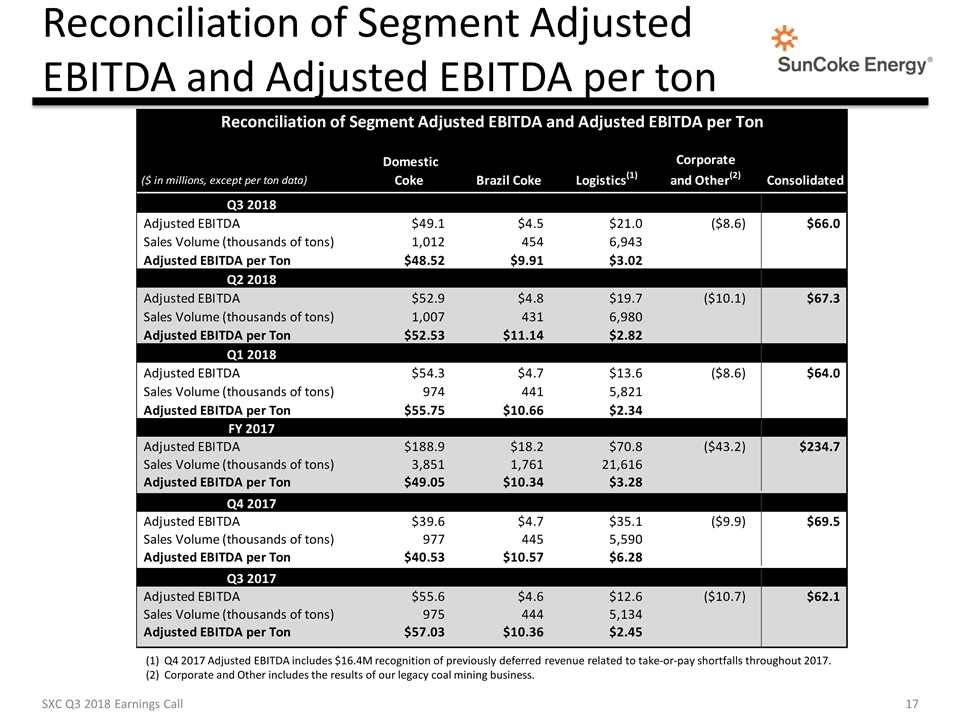

Reconciliation of Segment Adjusted EBITDA and Adjusted EBITDA per ton Q4 2017 Adjusted EBITDA includes $16.4M recognition of previously deferred revenue related to take-or-pay shortfalls throughout 2017. Corporate and Other includes the results of our legacy coal mining business. SXC Q3 2018 Earnings Call

Balance Sheet & Debt Metrics Represents top-end of FY 2018 guidance for Adj. EBITDA (Consolidated) and Adj. EBITDA attributable to SXC. Represents mid-point of revised FY 2018 guidance for Adj. EBITDA attributable to SXCP. SXC Q3 2018 Earnings Call

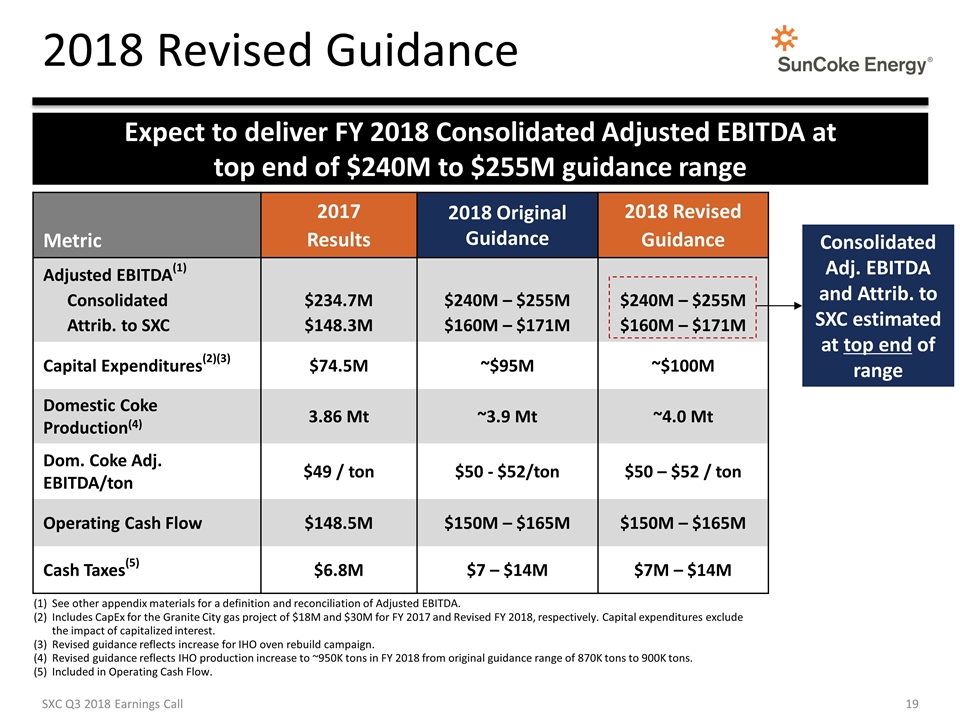

2018 Revised Guidance SXC Q3 2018 Earnings Call Expect to deliver FY 2018 Consolidated Adjusted EBITDA at top end of $240M to $255M guidance range Metric 2017 Results 2018 Original Guidance 2018 Revised Guidance Adjusted EBITDA(1) Consolidated Attrib. to SXC $234.7M $148.3M $240M – $255M $160M – $171M $240M – $255M $160M – $171M Capital Expenditures(2)(3) $74.5M ~$95M ~$100M Domestic Coke Production(4) 3.86 Mt ~3.9 Mt ~4.0 Mt Dom. Coke Adj. EBITDA/ton $49 / ton $50 - $52/ton $50 – $52 / ton Operating Cash Flow $148.5M $150M – $165M $150M – $165M Cash Taxes(5) $6.8M $7 – $14M $7M – $14M See other appendix materials for a definition and reconciliation of Adjusted EBITDA. Includes CapEx for the Granite City gas project of $18M and $30M for FY 2017 and Revised FY 2018, respectively. Capital expenditures exclude the impact of capitalized interest. Revised guidance reflects increase for IHO oven rebuild campaign. Revised guidance reflects IHO production increase to ~950K tons in FY 2018 from original guidance range of 870K tons to 900K tons. Included in Operating Cash Flow. Consolidated Adj. EBITDA and Attrib. to SXC estimated at top end of range

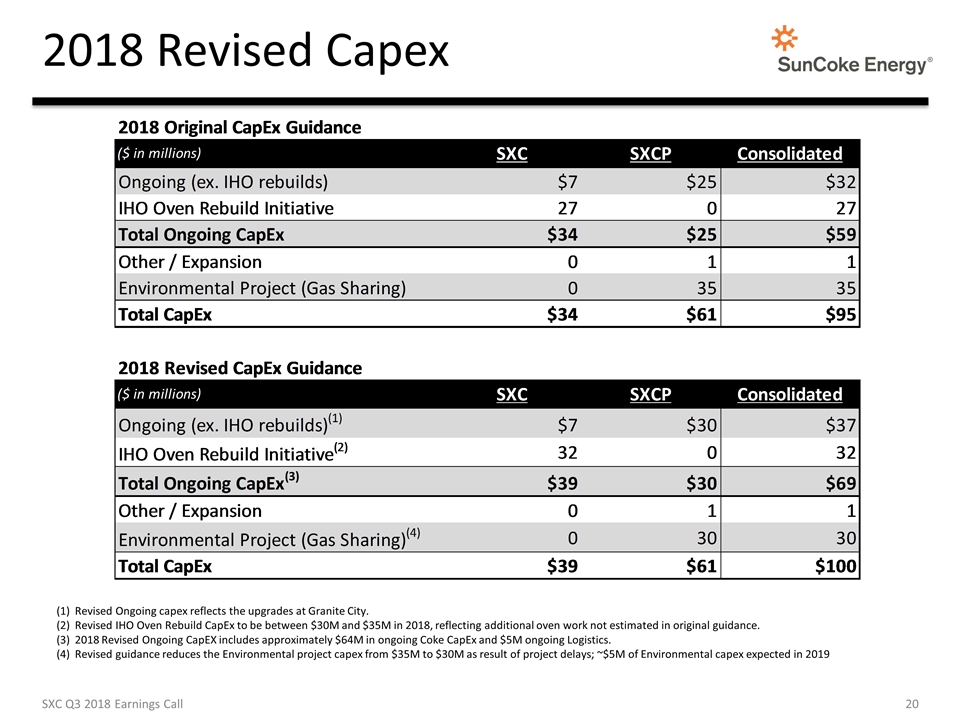

2018 Revised Capex SXC Q3 2018 Earnings Call Revised Ongoing capex reflects the upgrades at Granite City. Revised IHO Oven Rebuild CapEx to be between $30M and $35M in 2018, reflecting additional oven work not estimated in original guidance. 2018 Revised Ongoing CapEX includes approximately $64M in ongoing Coke CapEx and $5M ongoing Logistics. Revised guidance reduces the Environmental project capex from $35M to $30M as result of project delays; ~$5M of Environmental capex expected in 2019

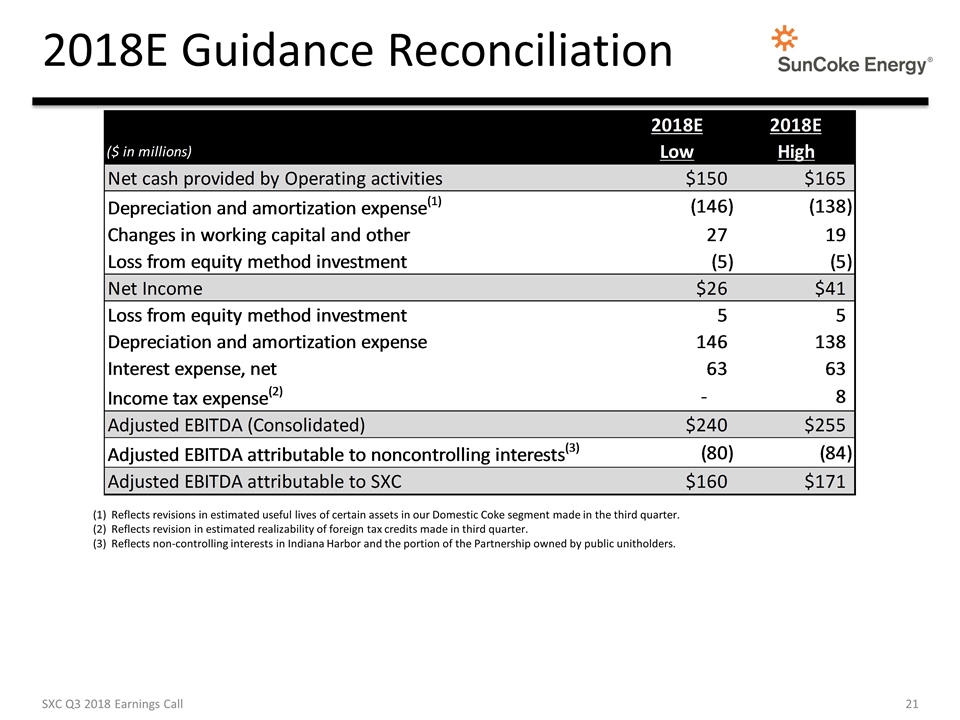

2018E Guidance Reconciliation Reflects revisions in estimated useful lives of certain assets in our Domestic Coke segment made in the third quarter. Reflects revision in estimated realizability of foreign tax credits made in third quarter. Reflects non-controlling interests in Indiana Harbor and the portion of the Partnership owned by public unitholders. SXC Q3 2018 Earnings Call

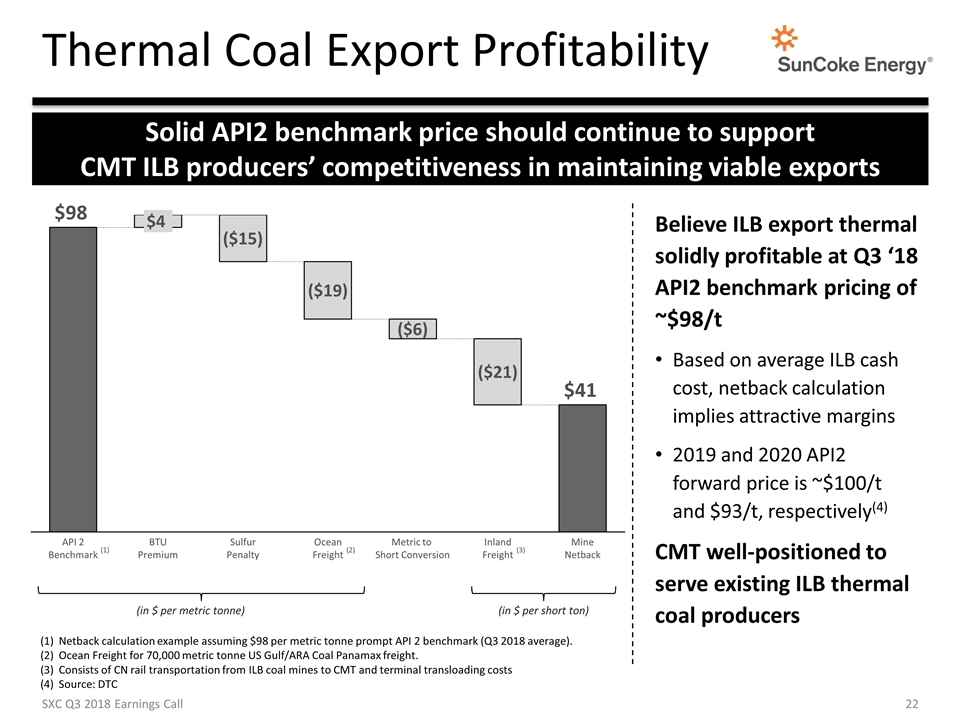

Thermal Coal Export Profitability (in $ per metric tonne) Solid API2 benchmark price should continue to support CMT ILB producers’ competitiveness in maintaining viable exports Netback calculation example assuming $98 per metric tonne prompt API 2 benchmark (Q3 2018 average). Ocean Freight for 70,000 metric tonne US Gulf/ARA Coal Panamax freight. Consists of CN rail transportation from ILB coal mines to CMT and terminal transloading costs Source: DTC (1) (2) Believe ILB export thermal solidly profitable at Q3 ‘18 API2 benchmark pricing of ~$98/t Based on average ILB cash cost, netback calculation implies attractive margins 2019 and 2020 API2 forward price is ~$100/t and $93/t, respectively(4) CMT well-positioned to serve existing ILB thermal coal producers (in $ per short ton) (3) SXC Q3 2018 Earnings Call