Attached files

| file | filename |

|---|---|

| EX-99.2 - EX-99.2 - OCEANFIRST FINANCIAL CORP | d642636dex992.htm |

| 8-K - FORM 8-K - OCEANFIRST FINANCIAL CORP | d642636d8k.htm |

Exhibit 99.1 . . . OceanFirst Financial Corp. Agreement to Acquire Capital Bank of New Jersey October 25, 2018Exhibit 99.1 . . . OceanFirst Financial Corp. Agreement to Acquire Capital Bank of New Jersey October 25, 2018

INVESTOR PRESENTATION . . . Forward Looking Statements This communication contains “forward-looking statements” within the meaning of the federal securities laws, including Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. These forward-looking statements may include: management plans relating to the proposed transaction; the expected timing of the completion of the proposed transaction; the ability to complete the proposed transaction; the ability to obtain any required regulatory, stockholder or other approvals; any statements of the plans and objectives of management for future operations, products or services, including the execution of integration plans relating to the proposed transaction; any statements of expectation or belief; projections related to certain financial metrics; and any statements of assumptions underlying any of the foregoing. Forward-looking statements are typically identified by words such as “believe,” “expect,” “anticipate,” “intend,” “seek”, “plan”, “will”, “would”, “target,” “outlook,” “estimate,” “forecast,” “project” and other similar words and expressions or negatives of these words. Forward-looking statements are subject to numerous assumptions, risks and uncertainties, which change over time and are beyond our control. Forward-looking statements speak only as of the date they are made. Neither OceanFirst nor Capital Bank assumes any duty and does not undertake to update any forward-looking statements. Because forward-looking statements are by their nature, to different degrees, uncertain and subject to assumptions, actual results or future events could differ, possibly materially, from those that OceanFirst or Capital Bank anticipated in its forward-looking statements, and future results could differ materially from historical performance. Factors that could cause or contribute to such differences include, but are not limited to, those included under Item 1A “Risk Factors” in OceanFirst’s Annual Report on Form 10-K, those disclosed in OceanFirst’s other periodic reports filed with the Securities and Exchange Commission (the “SEC”), as well as the possibility that expected benefits of the proposed transaction and the recently completed acquisition of Sun Bancorp, Inc. by OceanFirst (the “Sun acquisition”) may not materialize in the timeframe expected or at all, or may be more costly to achieve; that the proposed transaction may not be timely completed, if at all; that prior to the completion of the proposed transaction or thereafter, OceanFirst’s and Capital Bank’s respective businesses may not perform as expected due to transaction-related uncertainty or other factors; that the parties are unable to successfully implement integration strategies related to the proposed transaction and the Sun acquisition; that required regulatory, stockholder or other approvals are not obtained or other customary closing conditions are not satisfied in a timely manner or at all; reputational risks and the reaction of the companies’ stockholders, customers, employees and other constituents to the proposed transaction; and diversion of management time on merger-related matters. These risks, as well as other risks associated with the proposed transaction, will be more fully discussed in the prospectus of OceanFirst and proxy statement of Capital Bank that will be included in the registration statement on Form S-4 that will be filed with the SEC in connection with the proposed transaction. While the list of factors presented here is, and the list of factors to be presented in the registration statement on Form S-4 will be, considered representative, no such list should be considered to be a complete statement of all potential risks and uncertainties. Unlisted factors may present significant additional obstacles to the realization of forward looking statements. For any forward-looking statements made in this communication or in any documents, OceanFirst and Capital Bank claim the protection of the safe harbor for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995. Annualized, pro forma, projected and estimated numbers are used for illustrative purposes only, are not forecasts and may not reflect actual results. 2INVESTOR PRESENTATION . . . Forward Looking Statements This communication contains “forward-looking statements” within the meaning of the federal securities laws, including Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. These forward-looking statements may include: management plans relating to the proposed transaction; the expected timing of the completion of the proposed transaction; the ability to complete the proposed transaction; the ability to obtain any required regulatory, stockholder or other approvals; any statements of the plans and objectives of management for future operations, products or services, including the execution of integration plans relating to the proposed transaction; any statements of expectation or belief; projections related to certain financial metrics; and any statements of assumptions underlying any of the foregoing. Forward-looking statements are typically identified by words such as “believe,” “expect,” “anticipate,” “intend,” “seek”, “plan”, “will”, “would”, “target,” “outlook,” “estimate,” “forecast,” “project” and other similar words and expressions or negatives of these words. Forward-looking statements are subject to numerous assumptions, risks and uncertainties, which change over time and are beyond our control. Forward-looking statements speak only as of the date they are made. Neither OceanFirst nor Capital Bank assumes any duty and does not undertake to update any forward-looking statements. Because forward-looking statements are by their nature, to different degrees, uncertain and subject to assumptions, actual results or future events could differ, possibly materially, from those that OceanFirst or Capital Bank anticipated in its forward-looking statements, and future results could differ materially from historical performance. Factors that could cause or contribute to such differences include, but are not limited to, those included under Item 1A “Risk Factors” in OceanFirst’s Annual Report on Form 10-K, those disclosed in OceanFirst’s other periodic reports filed with the Securities and Exchange Commission (the “SEC”), as well as the possibility that expected benefits of the proposed transaction and the recently completed acquisition of Sun Bancorp, Inc. by OceanFirst (the “Sun acquisition”) may not materialize in the timeframe expected or at all, or may be more costly to achieve; that the proposed transaction may not be timely completed, if at all; that prior to the completion of the proposed transaction or thereafter, OceanFirst’s and Capital Bank’s respective businesses may not perform as expected due to transaction-related uncertainty or other factors; that the parties are unable to successfully implement integration strategies related to the proposed transaction and the Sun acquisition; that required regulatory, stockholder or other approvals are not obtained or other customary closing conditions are not satisfied in a timely manner or at all; reputational risks and the reaction of the companies’ stockholders, customers, employees and other constituents to the proposed transaction; and diversion of management time on merger-related matters. These risks, as well as other risks associated with the proposed transaction, will be more fully discussed in the prospectus of OceanFirst and proxy statement of Capital Bank that will be included in the registration statement on Form S-4 that will be filed with the SEC in connection with the proposed transaction. While the list of factors presented here is, and the list of factors to be presented in the registration statement on Form S-4 will be, considered representative, no such list should be considered to be a complete statement of all potential risks and uncertainties. Unlisted factors may present significant additional obstacles to the realization of forward looking statements. For any forward-looking statements made in this communication or in any documents, OceanFirst and Capital Bank claim the protection of the safe harbor for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995. Annualized, pro forma, projected and estimated numbers are used for illustrative purposes only, are not forecasts and may not reflect actual results. 2

INVESTOR PRESENTATION . . . Important Additional Information ADDITIONAL INFORMATION ABOUT THE PROPOSED TRANSACTION This communication is being made in respect of the proposed transaction involving OceanFirst and Capital Bank. In connection with the proposed transaction, OceanFirst intends to file a registration statement on Form S-4 containing a prospectus of OceanFirst and proxy statement of Capital Bank and other documents regarding the proposed transaction with the SEC. Before making any voting or investment decision, the investors and stockholders of Capital Bank are urged to carefully read the entire prospectus of OceanFirst and proxy statement of Capital Bank when it becomes available and any other relevant documents filed by OceanFirst with the SEC, as well as any amendments or supplements to those documents, because they will contain important information about OceanFirst, Capital Bank and the proposed transaction. Investors and security holders are also urged to carefully review and consider each of OceanFirst’s public filings with the SEC, including but not limited to its Annual Report on Form 10-K, its proxy statement, its Current Reports on Form 8-K and its Quarterly Reports on Form 10-Q. When available, copies of the prospectus of OceanFirst and proxy statement of Capital Bank will be mailed to the stockholders of Capital Bank. When available, copies of the prospectus of OceanFirst and proxy statement of Capital Bank also may be obtained free of charge at the SEC’s web site at http://www.sec.gov. You may also obtain these documents, free of charge, from OceanFirst by accessing OceanFirst’s website at www.oceanfirstonline.com under the tab “Investor Relations” and then under the heading “SEC Filings.” For more information, please contact OceanFirst Financial Corp., 110 West Front Street Red Bank, New Jersey 07701, Attn: Jill Hewitt or Capital Bank, 175 South Main Road, Vineland, NJ 08360, Attn: David J. Hanrahan. NO OFFER OR SOLICITATION This communication is not intended to and shall not constitute an offer to sell or the solicitation of an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote of approval, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended. 3INVESTOR PRESENTATION . . . Important Additional Information ADDITIONAL INFORMATION ABOUT THE PROPOSED TRANSACTION This communication is being made in respect of the proposed transaction involving OceanFirst and Capital Bank. In connection with the proposed transaction, OceanFirst intends to file a registration statement on Form S-4 containing a prospectus of OceanFirst and proxy statement of Capital Bank and other documents regarding the proposed transaction with the SEC. Before making any voting or investment decision, the investors and stockholders of Capital Bank are urged to carefully read the entire prospectus of OceanFirst and proxy statement of Capital Bank when it becomes available and any other relevant documents filed by OceanFirst with the SEC, as well as any amendments or supplements to those documents, because they will contain important information about OceanFirst, Capital Bank and the proposed transaction. Investors and security holders are also urged to carefully review and consider each of OceanFirst’s public filings with the SEC, including but not limited to its Annual Report on Form 10-K, its proxy statement, its Current Reports on Form 8-K and its Quarterly Reports on Form 10-Q. When available, copies of the prospectus of OceanFirst and proxy statement of Capital Bank will be mailed to the stockholders of Capital Bank. When available, copies of the prospectus of OceanFirst and proxy statement of Capital Bank also may be obtained free of charge at the SEC’s web site at http://www.sec.gov. You may also obtain these documents, free of charge, from OceanFirst by accessing OceanFirst’s website at www.oceanfirstonline.com under the tab “Investor Relations” and then under the heading “SEC Filings.” For more information, please contact OceanFirst Financial Corp., 110 West Front Street Red Bank, New Jersey 07701, Attn: Jill Hewitt or Capital Bank, 175 South Main Road, Vineland, NJ 08360, Attn: David J. Hanrahan. NO OFFER OR SOLICITATION This communication is not intended to and shall not constitute an offer to sell or the solicitation of an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote of approval, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended. 3

INVESTOR PRESENTATION . . . Transaction Rationale Compelling • Acquisition of a high-performing, in-market franchise in Capital Bank Acquisition • Enhances OceanFirst’s presence in Cumberland, Atlantic and Gloucester counties and deepens ties to the Opportunity Philadelphia metropolitan area • Commercially-focused balance sheet • 91% core deposit funding 1 • Low average cost of deposits (0.46%) 1 • High liquidity (loan-to-deposit ratio of 70%) • Potential for significant efficiencies through infrastructure optimization and branch consolidation • All Capital Bank branches within 5 miles of an OceanFirst branch Financially • Attractive pro forma financial impact metrics Attractive • Approximately 2.0% accretive to 2020 estimated earnings (first full year of combined operations and fully phased-in synergies) • Tangible book value per common share dilution of 1.4% at closing with an earnback of approximately 3 years 2 using the cross-over method • IRR over 20% • Manageable acquisition at 7% of current OceanFirst asset base Low Risk Transaction • Conservative credit mark of 2.5% on a historically well-performing loan portfolio • Leverages OceanFirst’s significant integration expertise • Since 2015, OceanFirst has successfully integrated and met expected cost savings reductions for all 4 of its acquisitions during that period 1 4 As of and for the quarter ended September 30, 2018. 2 Calculated as time period at which the OceanFirst pro forma tangible book value per share equals OceanFirst’s projected stand-alone tangible book value per share.INVESTOR PRESENTATION . . . Transaction Rationale Compelling • Acquisition of a high-performing, in-market franchise in Capital Bank Acquisition • Enhances OceanFirst’s presence in Cumberland, Atlantic and Gloucester counties and deepens ties to the Opportunity Philadelphia metropolitan area • Commercially-focused balance sheet • 91% core deposit funding 1 • Low average cost of deposits (0.46%) 1 • High liquidity (loan-to-deposit ratio of 70%) • Potential for significant efficiencies through infrastructure optimization and branch consolidation • All Capital Bank branches within 5 miles of an OceanFirst branch Financially • Attractive pro forma financial impact metrics Attractive • Approximately 2.0% accretive to 2020 estimated earnings (first full year of combined operations and fully phased-in synergies) • Tangible book value per common share dilution of 1.4% at closing with an earnback of approximately 3 years 2 using the cross-over method • IRR over 20% • Manageable acquisition at 7% of current OceanFirst asset base Low Risk Transaction • Conservative credit mark of 2.5% on a historically well-performing loan portfolio • Leverages OceanFirst’s significant integration expertise • Since 2015, OceanFirst has successfully integrated and met expected cost savings reductions for all 4 of its acquisitions during that period 1 4 As of and for the quarter ended September 30, 2018. 2 Calculated as time period at which the OceanFirst pro forma tangible book value per share equals OceanFirst’s projected stand-alone tangible book value per share.

INVESTOR PRESENTATION . . . Transaction Summary • 100% of the consideration paid in OceanFirst common stock Consideration • Capital Bank shareholders to receive OceanFirst shares based on a fixed exchange ratio of 1.25 shares of OceanFirst common stock per share of Capital Bank common stock; Capital Bank stock options to be cashed out 1 2 • Represents $31.33 per Capital Bank common share , or approximately $80.0 million in the aggregate Capital Bank Acquisition Comparable Transactions Pricing Pricing Metric 3 Multiple Median Multiple Metrics Price / Sept. 30, 2018 Tangible Book Value 172% 190% (4) Core Deposit Premium8.1% 13.3% (5) Price / LTM Core Earnings 13.7x 16.2x (5)(6) Price / LTM Core Earnings w/ Cost Saves8.0x - • One-time after-tax transaction and integration expenses of $7.6 million Key • Cost savings estimated at 50% of Capital Bank’s non-interest expense base Transaction • Phased-in 56% in 2019 and 100% in 2020 and thereafter Assumptions • Core deposit intangible (CDI) of 2.00% of Capital Bank’s non-time deposits. Amortization to occur over a 10 year period and sum of years digit method • Gross credit mark of 2.5% of loan portfolio • Estimated net fair value of all purchase accounting marks (including the net credit mark and excluding CDI) of ($2.5 million) • Minimal impact to capital Capital • First quarter of 2019 Closing • Subject to required regulatory approvals, approval by Capital Bank shareholders and other customary closing conditions 1 Based on OceanFirst common stock price of $25.06 as of October 25, 2018. 2 Based on 2,533,779 shares of Capital Bank common stock outstanding and 33,075 Capital Bank options with a weighted average per share exercise price of $10.97. 3 Mid-Atlantic and New England B&T M&A transactions announced since 2014 where target at announcement had assets between $250M - $1.0B, LTM ROAA greater than 0.75%, and TCE/ TA less than 12.0%. 4 Core deposits defined as total deposits less time deposits over $100,000. 5 Core earnings excludes impact of Tax Cuts and Jobs Act incurred during the quarter ended December 31, 2017, along with credit to loan provision and gain from sale of OREO recognized during the quarter 5 ended September 30, 2018. 6 Cost savings of 50% as if applied historically.INVESTOR PRESENTATION . . . Transaction Summary • 100% of the consideration paid in OceanFirst common stock Consideration • Capital Bank shareholders to receive OceanFirst shares based on a fixed exchange ratio of 1.25 shares of OceanFirst common stock per share of Capital Bank common stock; Capital Bank stock options to be cashed out 1 2 • Represents $31.33 per Capital Bank common share , or approximately $80.0 million in the aggregate Capital Bank Acquisition Comparable Transactions Pricing Pricing Metric 3 Multiple Median Multiple Metrics Price / Sept. 30, 2018 Tangible Book Value 172% 190% (4) Core Deposit Premium8.1% 13.3% (5) Price / LTM Core Earnings 13.7x 16.2x (5)(6) Price / LTM Core Earnings w/ Cost Saves8.0x - • One-time after-tax transaction and integration expenses of $7.6 million Key • Cost savings estimated at 50% of Capital Bank’s non-interest expense base Transaction • Phased-in 56% in 2019 and 100% in 2020 and thereafter Assumptions • Core deposit intangible (CDI) of 2.00% of Capital Bank’s non-time deposits. Amortization to occur over a 10 year period and sum of years digit method • Gross credit mark of 2.5% of loan portfolio • Estimated net fair value of all purchase accounting marks (including the net credit mark and excluding CDI) of ($2.5 million) • Minimal impact to capital Capital • First quarter of 2019 Closing • Subject to required regulatory approvals, approval by Capital Bank shareholders and other customary closing conditions 1 Based on OceanFirst common stock price of $25.06 as of October 25, 2018. 2 Based on 2,533,779 shares of Capital Bank common stock outstanding and 33,075 Capital Bank options with a weighted average per share exercise price of $10.97. 3 Mid-Atlantic and New England B&T M&A transactions announced since 2014 where target at announcement had assets between $250M - $1.0B, LTM ROAA greater than 0.75%, and TCE/ TA less than 12.0%. 4 Core deposits defined as total deposits less time deposits over $100,000. 5 Core earnings excludes impact of Tax Cuts and Jobs Act incurred during the quarter ended December 31, 2017, along with credit to loan provision and gain from sale of OREO recognized during the quarter 5 ended September 30, 2018. 6 Cost savings of 50% as if applied historically.

INVESTOR PRESENTATION . . . Capital Bank Acquisition Aligns with OceanFirst’s Strategic Priorities Objective OceanFirst Capital Bank Pro Forma • Operates in Cumberland, • Improve operating scale with • Premier community bank • Deepens OceanFirst’s market Atlantic, and Gloucester organic growth and serving New Jersey, position in Southern NJ and counties with a loan Philadelphia, and New York the greater Philadelphia acquisitions focused on core production office in markets metro area markets Burlington county 1 2 • ROAA: 1.35% • ROAA: 1.32% • Proj. ROAA: 1.43% • Demonstrate consistent and 1 2 broad top quality performance • ROATCE: 15.4% • ROATCE: 14.3% • Proj. ROATCE: 14.4% • Maintain risk management and • CRE concentration: 266% • CRE concentration: 162% • CRE concentration: 259% regulatory compliance • Investing in corporate cash • Leverage cash management • Often participate out larger management and interest services with Capital’s • Continue to invest in loans due to smaller size rate swap products commercial client base commercial banking • C&I / Total Loans: 32.5% • C&I / Total Loans: 6.2% • C&I / Total Loans: 7.6% 1 2 • Efficiency ratio: 54% • Efficiency ratio: 55% • Proj. Eff. ratio: 50% • Improve operating efficiency 3 • Deposits / branch: $99M • Deposits / branch: $112M • Deposits / branch: $107M • Cost of deposits: 0.39% • Cost of deposits: 0.46% • Cost of deposits: 0.39% • Maintain strong funding base • Loans / deposits ratio: 95% • Loans / deposits ratio: 70% • Loans / deposits ratio: 93% Note: Financials as of or for the quarter ended September 30, 2018 unless otherwise noted. 1 Shown on a core basis which excludes merger related and branch consolidation expenses. 2 Projected pro forma profitability metrics shown for the year ending 2020 (first year of fully phased-in operations). 6 3 Assumes four branch consolidations as part of the transaction.INVESTOR PRESENTATION . . . Capital Bank Acquisition Aligns with OceanFirst’s Strategic Priorities Objective OceanFirst Capital Bank Pro Forma • Operates in Cumberland, • Improve operating scale with • Premier community bank • Deepens OceanFirst’s market Atlantic, and Gloucester organic growth and serving New Jersey, position in Southern NJ and counties with a loan Philadelphia, and New York the greater Philadelphia acquisitions focused on core production office in markets metro area markets Burlington county 1 2 • ROAA: 1.35% • ROAA: 1.32% • Proj. ROAA: 1.43% • Demonstrate consistent and 1 2 broad top quality performance • ROATCE: 15.4% • ROATCE: 14.3% • Proj. ROATCE: 14.4% • Maintain risk management and • CRE concentration: 266% • CRE concentration: 162% • CRE concentration: 259% regulatory compliance • Investing in corporate cash • Leverage cash management • Often participate out larger management and interest services with Capital’s • Continue to invest in loans due to smaller size rate swap products commercial client base commercial banking • C&I / Total Loans: 32.5% • C&I / Total Loans: 6.2% • C&I / Total Loans: 7.6% 1 2 • Efficiency ratio: 54% • Efficiency ratio: 55% • Proj. Eff. ratio: 50% • Improve operating efficiency 3 • Deposits / branch: $99M • Deposits / branch: $112M • Deposits / branch: $107M • Cost of deposits: 0.39% • Cost of deposits: 0.46% • Cost of deposits: 0.39% • Maintain strong funding base • Loans / deposits ratio: 95% • Loans / deposits ratio: 70% • Loans / deposits ratio: 93% Note: Financials as of or for the quarter ended September 30, 2018 unless otherwise noted. 1 Shown on a core basis which excludes merger related and branch consolidation expenses. 2 Projected pro forma profitability metrics shown for the year ending 2020 (first year of fully phased-in operations). 6 3 Assumes four branch consolidations as part of the transaction.

INVESTOR PRESENTATION . . . Overview of Capital Bank of New Jersey • Founded in 2007 by 27 South Jersey businesspeople, Capital Bank of New Jersey has 10+ years of operating history primarily in the southern counties of New Jersey • Operates 4 branches in the counties of Cumberland, Gloucester and Atlantic with a loan production office in Burlington County • Niche market focus consisting of Southern New Jersey’s small and mid-sized businesses with an emphasis on - OCFC Branches customer service to drive business - CANJ Branches • Strong core funding along with a low loan / deposit ratio of 1 1 70% Capital Bank Financial Highlights Market Cap ($M) $62.1 Shares 2,533,779 • Attractive interest rate risk well-positioned for rising rates Total Assets ($M) $495.3 ROAA 1.32% Gross Loans ($M) $313.4 ROAE 14.3% • Each year since 2015, Capital Bank has been named among Total Deposits ($M) $446.2 Reported NIM 3.45% American Banker’s Top 200 Community Banks in the United TCE / TA 9.23% Yield on Loans 4.96% States 2 NPAs / Assets 0.08% Cost of Deposits 0.46% CRE Concentration 162% Loans / Deposits 70.2% 7 Source: SNL Financial. 1 As of or for the quarter ended September 30, 2018. 2 As of or for the quarter ended June 30, 2018.INVESTOR PRESENTATION . . . Overview of Capital Bank of New Jersey • Founded in 2007 by 27 South Jersey businesspeople, Capital Bank of New Jersey has 10+ years of operating history primarily in the southern counties of New Jersey • Operates 4 branches in the counties of Cumberland, Gloucester and Atlantic with a loan production office in Burlington County • Niche market focus consisting of Southern New Jersey’s small and mid-sized businesses with an emphasis on - OCFC Branches customer service to drive business - CANJ Branches • Strong core funding along with a low loan / deposit ratio of 1 1 70% Capital Bank Financial Highlights Market Cap ($M) $62.1 Shares 2,533,779 • Attractive interest rate risk well-positioned for rising rates Total Assets ($M) $495.3 ROAA 1.32% Gross Loans ($M) $313.4 ROAE 14.3% • Each year since 2015, Capital Bank has been named among Total Deposits ($M) $446.2 Reported NIM 3.45% American Banker’s Top 200 Community Banks in the United TCE / TA 9.23% Yield on Loans 4.96% States 2 NPAs / Assets 0.08% Cost of Deposits 0.46% CRE Concentration 162% Loans / Deposits 70.2% 7 Source: SNL Financial. 1 As of or for the quarter ended September 30, 2018. 2 As of or for the quarter ended June 30, 2018.

INVESTOR PRESENTATION . . . Enhanced Pro Forma Market Share 1 New Jersey Deposit Market Share Select County Deposit Market Share Atlantic, NJ 2018 2018 2018 2018 $14.9 4.48% Investors Bancorp, Inc. Rank Deposits ($M) Branches DMS Pro Forma 1 1,298 12 24.1% Company $12.7 Valley National Bancorp 3.82% OCFC 2 1,220 11 22.7% Provident Financial CANJ 10 78 1 1.4% $6.5 1.94% Services, Inc. Cumberland, NJ Pro Forma Pro Forma Company $6.3 1.88% 1 875 7 33.5% Company OCFC 1 632 5 24.2% $5.9 1.76% CANJ 6 243 2 9.3% Lakeland Bancorp, Inc. $4.8 Gloucester, NJ 1.43% Pro Forma 9 253 3 4.2% Company $0.4 0.12% OCFC 11 160 2 2.6% Headquarters OceanFirst Bank Branches CANJ 14 93 1 1.5% Deposits ($B) $0.0 $10.0 $20.0 OceanFirst Bank Loan Offices Capital Bank Branches Capital Bank Loan Office Source: SNL Financial Note: Deposit data as of June 30, 2018 1 Banks headquartered in New JerseyINVESTOR PRESENTATION . . . Enhanced Pro Forma Market Share 1 New Jersey Deposit Market Share Select County Deposit Market Share Atlantic, NJ 2018 2018 2018 2018 $14.9 4.48% Investors Bancorp, Inc. Rank Deposits ($M) Branches DMS Pro Forma 1 1,298 12 24.1% Company $12.7 Valley National Bancorp 3.82% OCFC 2 1,220 11 22.7% Provident Financial CANJ 10 78 1 1.4% $6.5 1.94% Services, Inc. Cumberland, NJ Pro Forma Pro Forma Company $6.3 1.88% 1 875 7 33.5% Company OCFC 1 632 5 24.2% $5.9 1.76% CANJ 6 243 2 9.3% Lakeland Bancorp, Inc. $4.8 Gloucester, NJ 1.43% Pro Forma 9 253 3 4.2% Company $0.4 0.12% OCFC 11 160 2 2.6% Headquarters OceanFirst Bank Branches CANJ 14 93 1 1.5% Deposits ($B) $0.0 $10.0 $20.0 OceanFirst Bank Loan Offices Capital Bank Branches Capital Bank Loan Office Source: SNL Financial Note: Deposit data as of June 30, 2018 1 Banks headquartered in New Jersey

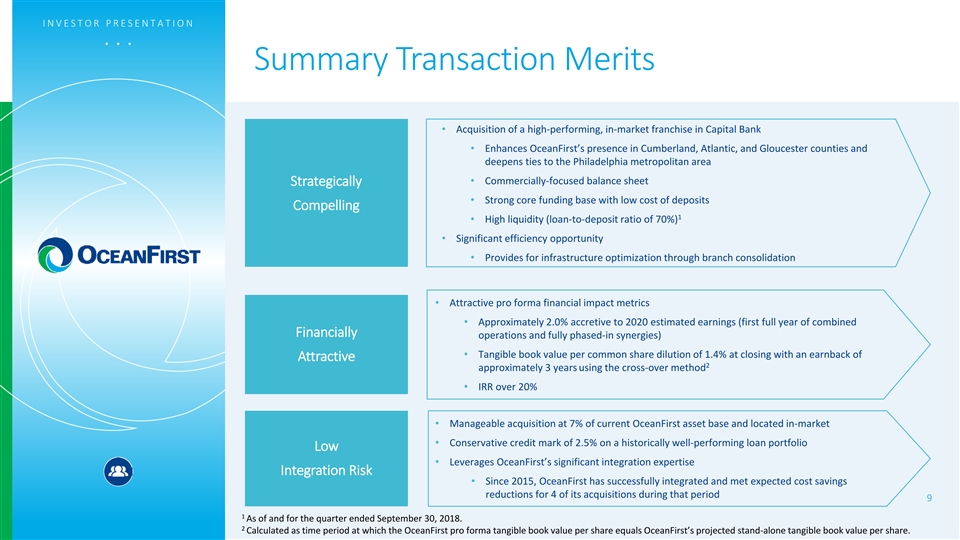

INVESTOR PRESENTATION . . . Summary Transaction Merits • Acquisition of a high-performing, in-market franchise in Capital Bank • Enhances OceanFirst’s presence in Cumberland, Atlantic, and Gloucester counties and deepens ties to the Philadelphia metropolitan area • Commercially-focused balance sheet Strategically • Strong core funding base with low cost of deposits Compelling 1 • High liquidity (loan-to-deposit ratio of 70%) • Significant efficiency opportunity • Provides for infrastructure optimization through branch consolidation • Attractive pro forma financial impact metrics • Approximately 2.0% accretive to 2020 estimated earnings (first full year of combined Financially operations and fully phased-in synergies) • Tangible book value per common share dilution of 1.4% at closing with an earnback of Attractive 2 approximately 3 years using the cross-over method • IRR over 20% • Manageable acquisition at 7% of current OceanFirst asset base and located in-market • Conservative credit mark of 2.5% on a historically well-performing loan portfolio Low • Leverages OceanFirst’s significant integration expertise Integration Risk • Since 2015, OceanFirst has successfully integrated and met expected cost savings reductions for 4 of its acquisitions during that period 9 1 As of and for the quarter ended September 30, 2018. 2 Calculated as time period at which the OceanFirst pro forma tangible book value per share equals OceanFirst’s projected stand-alone tangible book value per share.INVESTOR PRESENTATION . . . Summary Transaction Merits • Acquisition of a high-performing, in-market franchise in Capital Bank • Enhances OceanFirst’s presence in Cumberland, Atlantic, and Gloucester counties and deepens ties to the Philadelphia metropolitan area • Commercially-focused balance sheet Strategically • Strong core funding base with low cost of deposits Compelling 1 • High liquidity (loan-to-deposit ratio of 70%) • Significant efficiency opportunity • Provides for infrastructure optimization through branch consolidation • Attractive pro forma financial impact metrics • Approximately 2.0% accretive to 2020 estimated earnings (first full year of combined Financially operations and fully phased-in synergies) • Tangible book value per common share dilution of 1.4% at closing with an earnback of Attractive 2 approximately 3 years using the cross-over method • IRR over 20% • Manageable acquisition at 7% of current OceanFirst asset base and located in-market • Conservative credit mark of 2.5% on a historically well-performing loan portfolio Low • Leverages OceanFirst’s significant integration expertise Integration Risk • Since 2015, OceanFirst has successfully integrated and met expected cost savings reductions for 4 of its acquisitions during that period 9 1 As of and for the quarter ended September 30, 2018. 2 Calculated as time period at which the OceanFirst pro forma tangible book value per share equals OceanFirst’s projected stand-alone tangible book value per share.