Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - GENTHERM Inc | thrm-ex991_77.htm |

| 8-K - 8-K - GENTHERM Inc | thrm-8k_20181025.htm |

2018 Third Quarter Results Gentherm, Inc. October 25, 2018 Exhibit 99.2

Forward-Looking Statement Except for historical information contained herein, statements in this presentation are forward-looking statements that are made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. These forward-looking statements represent Gentherm Incorporated's goals, beliefs, plans and expectations about its prospects for the future and other future events. The forward-looking statements included in this presentation are made as of the date hereof or as of the date specified and are based on management's current expectations and beliefs. Such statements are subject to a number of important assumptions, risks, uncertainties and other factors that may cause the Company's actual performance to differ materially from that described in or indicated by the forward-looking statements. Those risks include, but are not limited to, risks that new products may not be feasible, sales may not increase, additional financing requirements may not be available, new competitors may arise or customers may develop their own products to replace the Company’s products, customer preferences for end products may shift, the Company may lose suppliers or customers, market acceptance of the Company’s existing or new products may decrease, currency exchange rates may change unfavorably, pricing pressures from customers may increase, the Company’s workforce and operations could be disrupted by civil or political unrest in the countries in which the Company operates, free trade agreements may be altered in a manner adverse to the Company, our customers may not accept pass-through of new tariff costs, additional tariffs may be implemented, cost-savings measures may not be achievable or may need to be reversed, assets held for sale may not be sold quickly or at all, the Company may be unable to repurchase its shares of common stock at favorable prices or at all, due to market conditions, applicable legal requirements, debt covenants or other restrictions, compliance with covenants and other restrictions under the Company’s credit facility, medical device regulations could change in an unfavorable manner, oil and gas prices could fluctuate causing adverse consequences, and other adverse conditions in the industries in which the Company operates may negatively affect its results. You should review the Company's filings with the Securities and Exchange Commission (the “SEC”), including “Risk Factors”, in its most recent Annual Report on Form 10-K and subsequent quarterly reports, for a discussion of these and other risks and uncertainties. The business outlook discussed in this presentation does not include the potential impact of any business combinations, acquisitions, divestitures, strategic investments and other significant transactions that may be completed after the date hereof. Except as required by law, the Company expressly disclaims any obligation or undertaking to update any forward-looking statements to reflect any change in its expectations with regard thereto or any change in events, conditions or circumstances on which any such statement is based.

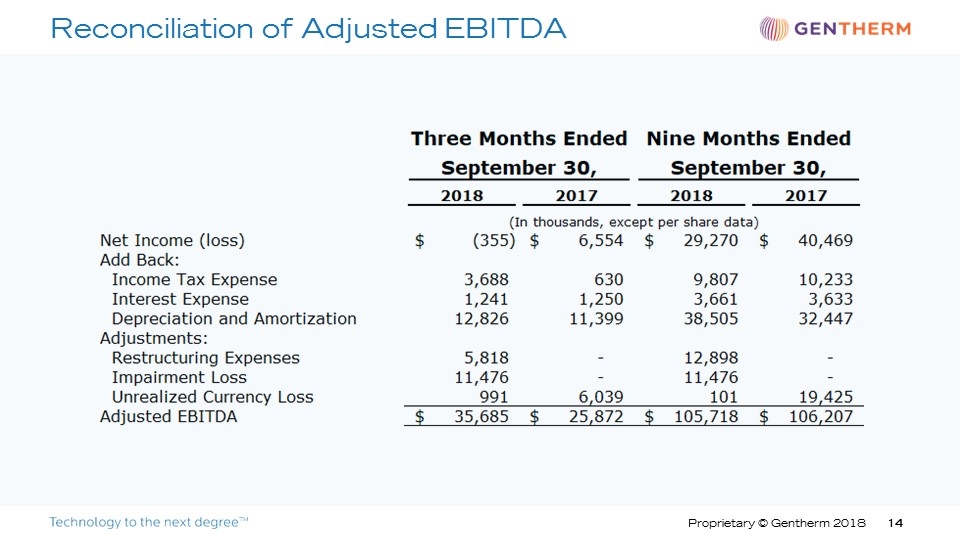

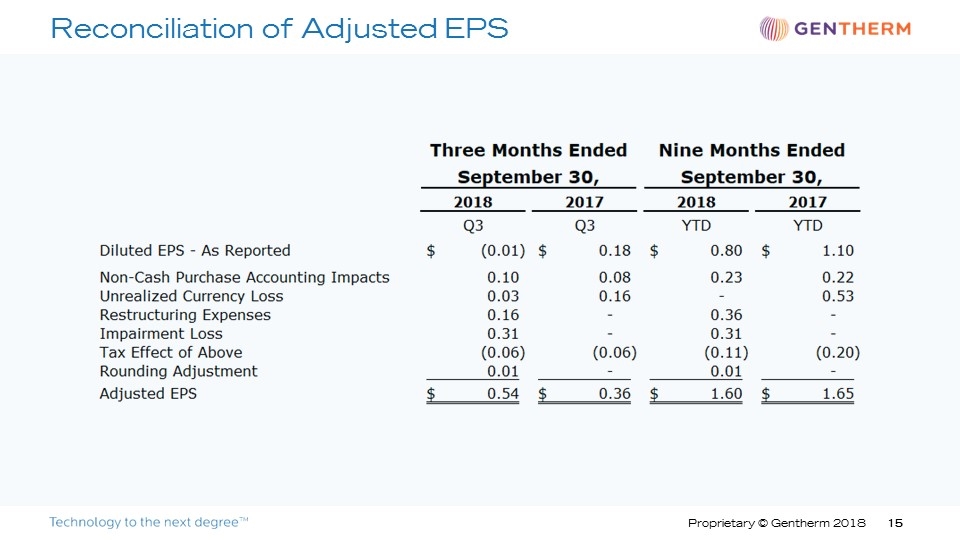

In addition to the results reported in accordance with GAAP throughout this presentation, the Company has provided information regarding “earnings before interest, taxes, depreciation and amortization, deferred financing cost amortization, transaction expenses, debt retirement expenses, impairment loss, restructuring expenses, unrealized currency gain or loss and unrealized revaluation of derivatives” (Adjusted EBITDA) and “Return on Invested Capital (ROIC)” (each, a non-GAAP financial measure). We define ROIC as tax-affected operating income, prior to the effect of extraordinary or unusual items, divided by Invested Capital. Invested Capital is defined as shareholders’ equity and total debt, less cash and cash equivalents. In evaluating its business, the Company considers and uses Adjusted EBITDA as a supplemental measure of its operating performance. Management provides an Adjusted EBITDA measure so that investors will have the same financial information that management uses with the belief that it will assist investors in properly assessing the Company's performance on a period-over-period basis. Additionally, management believes that ROIC provides a useful measure of how effectively the Company uses capital to generate profits. Other companies in our industry may calculate these non-GAAP financial measures differently than we do and those calculations may not be comparable to our metrics. These non-GAAP measures have limitations as analytical tools, and when assessing the Company's operating performance, investors should not consider Adjusted EBITDA or ROIC in isolation, or as a substitute for net income or other consolidated income statement data prepared in accordance with GAAP. Non-GAAP measures referenced in this presentation may include estimates of future Adjusted EBITDA and ROIC. Such forward-looking non-GAAP measures may differ significantly from the corresponding GAAP measures, due to depreciation and amortization, tax expense, and/or interest expense, some or all of which management has not quantified for the future periods. Use of Non-GAAP Financial Measures

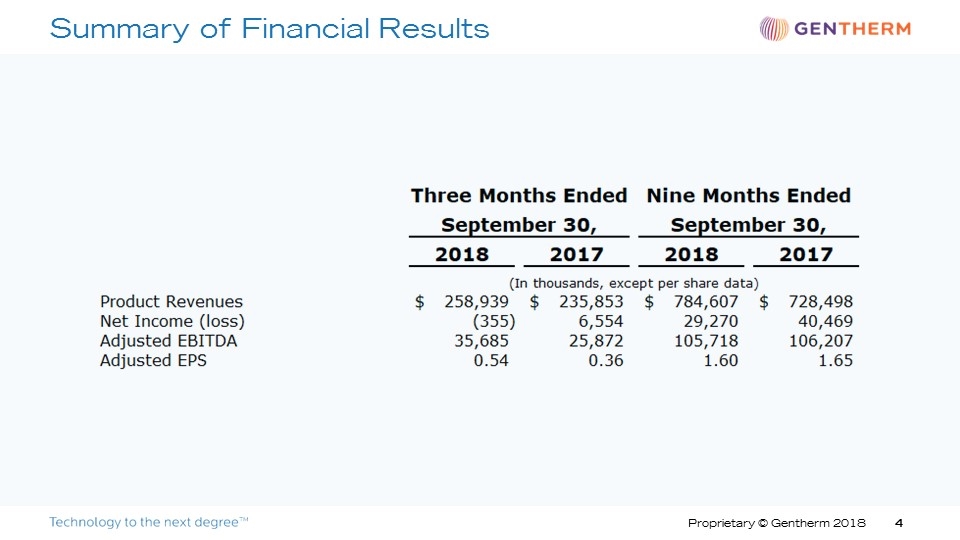

Summary of Financial Results

Significantly outperformed the automotive market 3Q 2018 Highlights Organic automotive revenue growth Record automotive awards Sequential and year-over-year Climate Control Seat (CCS®) revenue growth Strong double-digit revenue growth in Medical Continued progress on Focused Growth and Margin Expansion activities $44M of share repurchases in the quarter

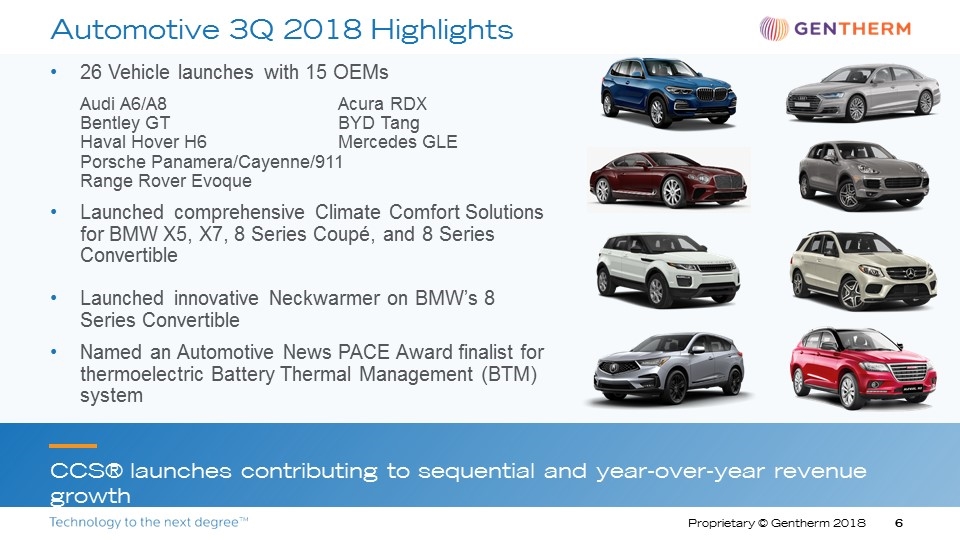

26 Vehicle launches with 15 OEMs Audi A6/A8 Acura RDX Bentley GTBYD Tang Haval Hover H6Mercedes GLE Porsche Panamera/Cayenne/911 Range Rover Evoque Launched comprehensive Climate Comfort Solutions for BMW X5, X7, 8 Series Coupé, and 8 Series Convertible Launched innovative Neckwarmer on BMW’s 8 Series Convertible Named an Automotive News PACE Award finalist for thermoelectric Battery Thermal Management (BTM) system CCS® launches contributing to sequential and year-over-year revenue growth Automotive 3Q 2018 Highlights

Record quarter with $470M in new awards across 17 OEMs Multiple CCS® awards JLR multiple platforms: Land Rover Velar, Defender Jaguar XF, XE, F-Pace Hyundai Genesis JX/JK BYD Multiple Heated Steering Wheel awards Acura Audi A6/A8 DongfengVW Group various Air Cooling Battery Thermal Management (BTM) award with Hyundai for Genesis JX/JK Automotive 3Q 2018 Awards Secured nearly $1.3B of new awards from global OEMs year to date

Delivered strong double digit revenue growth in Medical Over 60% growth in Blanketrol®III equipment Over 25% growth in FilteredFlo® patient warming disposables Launched innovative cardiovascular heat/cool system with integrated automatic disinfection technology Won Industrial business awards from 32 new accounts Large awards from SF Motors and Delta Taiwan for automotive testing Achieved continued growth in China with orders from 27 customers and over 70 chambers YTD CSZ 3Q 2018 Highlights Strong growth momentum in the Medical business

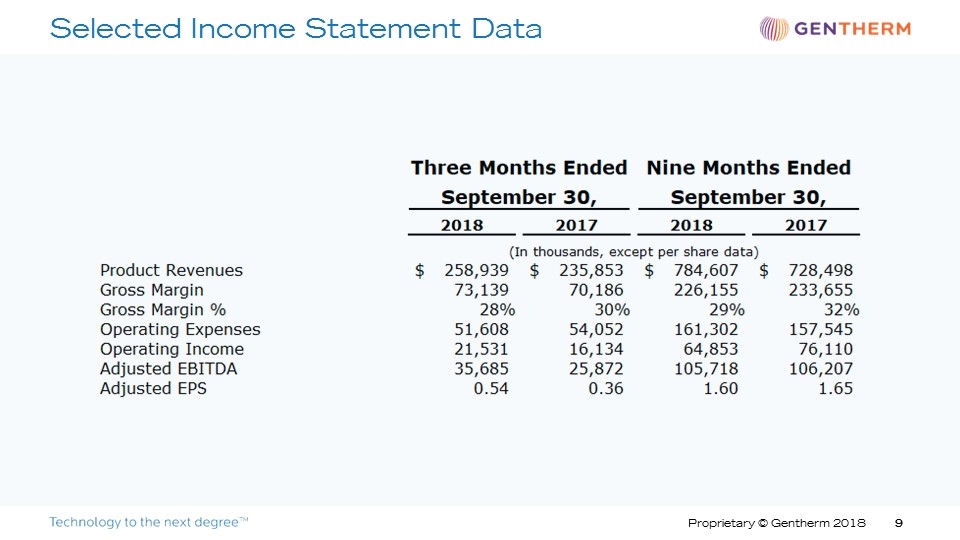

Selected Income Statement Data

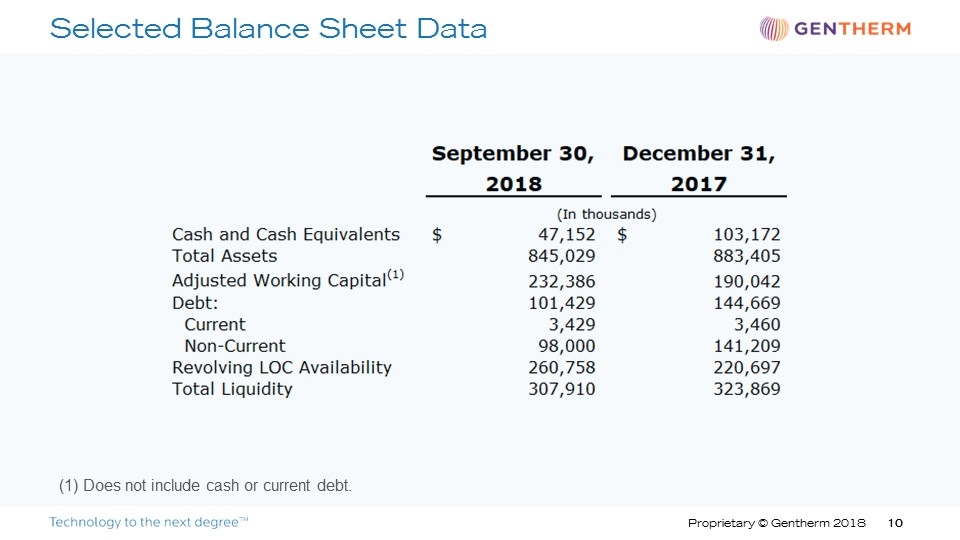

Selected Balance Sheet Data (1) Does not include cash or current debt.

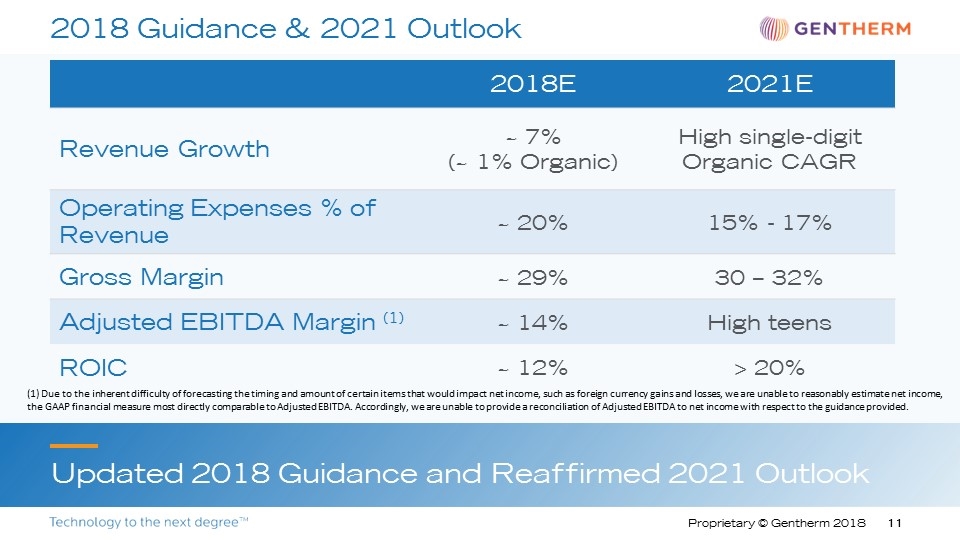

2018 Guidance & 2021 Outlook 2018E 2021E Revenue Growth ~ 7% (~ 1% Organic) High single-digit Organic CAGR Operating Expenses % of Revenue ~ 20% 15% - 17% Gross Margin ~ 29% 30 – 32% Adjusted EBITDA Margin (1) ~ 14% High teens ROIC ~ 12% > 20% Updated 2018 Guidance and Reaffirmed 2021 Outlook (1) Due to the inherent difficulty of forecasting the timing and amount of certain items that would impact net income, such as foreign currency gains and losses, we are unable to reasonably estimate net income, the GAAP financial measure most directly comparable to Adjusted EBITDA. Accordingly, we are unable to provide a reconciliation of Adjusted EBITDA to net income with respect to the guidance provided.

Appendix

Reconciliation of Adjusted EBITDA

Reconciliation of Adjusted EPS