Attached files

| file | filename |

|---|---|

| EX-99.3 - PRESS RELEASE - FRANKLIN RESOURCES INC | exhibit993q4fy18.htm |

| EX-99.1 - PRESS RELEASE - FRANKLIN RESOURCES INC | exhibit991q4fy18.htm |

| 8-K - FORM 8-K - FRANKLIN RESOURCES INC | form8kq4fy18.htm |

FRANKLIN RESOURCES, INC. Executive Commentary Preliminary Fourth Quarter and Fiscal Year Results October 25, 2018 Exhibit 99.2 Highlights • Relative investment performance improved across nearly all asset classes for the 1- and 3-year periods. Greg Johnson • Long-term redemptions decreased 6% overall this quarter and Chairman of the Board U.S. sales improved driven by continued demand for several Chief Executive Officer growth strategies. • Operating income for the fiscal year was $2.1 billion, reflecting modestly lower revenue and investments in a number of growth initiatives throughout the year. • Returned over $3.5 billion to shareholders through dividends and Kenneth A. Lewis Executive Vice President stock repurchases, an increase of 191% versus the prior year. Chief Financial Officer • Launched Franklin Templeton Private Equity, LLC, a new joint venture with Asia private equity fund-of-funds specialist Asia Alternatives Management LLC to provide bespoke global private equity solutions. Contents Page(s) • Earlier today we announced that we reached agreement to acquire Benefit Street Partners, LLC (“BSP”), a leading Benefit Street Partners, LLC 2-4 alternative credit asset manager. Investment Performance 5 Assets Under Management 6-8 Conference Call Details: and Flows Johnson and Lewis will lead a live teleconference today at 11:00 a.m. Flows by Investment Eastern Time to answer questions of a material nature. Access to the 9-11 Objective teleconference will be available via investors.franklinresources.com or by dialing (877) 407-8293 in the U.S. and Canada or (201) 689-8349 Financial Results 12-13 internationally. A replay of the teleconference can also be accessed by calling (877) 660-6853 in the U.S. and Canada or (201) 612-7415 Operating Revenues and internationally using access code 13683834, after 2:00 p.m. Eastern 13-14 Expenses Time on October 25, 2018 through November 25, 2018. Analysts and investors are encouraged to review the Company’s recent Other Income and Taxes 15 filings with the U.S. Securities and Exchange Commission and to contact Investor Relations at (650) 312-4091 before the live teleconference for Capital Management 15-16 any clarifications or questions related to the earnings release or written Appendix 17-18 commentary.

Fourth Quarter and Fiscal Year Executive Commentary Greg Johnson, Chairman and CEO Unaudited Benefit Street Partners, LLC At $26.2 billion of assets under management, as of September 30, 2018, BSP provides us with new investment capabilities in private credit that complement our existing alternatives and fixed income platforms to meet the evolving needs of our clients. KEY STRATEGIC BENEFITS • Adds expertise in the attractive and growing alternative credit asset class • Diverse product offerings across the credit spectrum with a differentiated approach • Seasoned credit team with a strong reputation in the market • A 10-year track record with consistent market outperformance • The ability to construct more comprehensive credit portfolios for clients with compelling risk- adjusted returns Unlike large companies that are able to access the high U.S. Middle Market Lending1 yield market, middle market companies have more limited access to public markets. Alternative credit as an asset class has expanded over the past 10 years as 31.0% traditional lenders have retreated from the space as a result of additional regulatory constraints. 91.5% Concurrently, alternative credit has emerged as an attractive asset class for investors seeking higher yields 69.0% with lower volatility relative to traditional fixed income. That demand resulted in a huge expansion of private 8.5% alternative credit as an asset class. In fact, aggregate 2002 2017 capital raised for private credit funds grew at a 23% Banks (US and Non-US) Non-Banks CAGR from 2009 – 2017. Historical Private Capital AUM Benefit Street Partners Historical AUM Assets under Management ($Bn) CAGR (%): $Bn 26.2 5,000 14.7 229 23.3 230 418 15.4 173 194 386 186 324 811 7.1 296 141 276 780 18.1 114 803 221 706 749 638 12.0 102 210 604 85 162 593 551 2,500 77 559 472 58 125 447 474 100 118 393 400 11.5 408 332 371 398 281 205 246 9.2 2,582 2,829 6.7 2,189 2,242 2,388 6.3 1,807 1,947 1,477 1,586 1,733 4.5 1,430 3.3 3.7 2.0 2.7 0 '08 '09 '10 '11 '12 '13 '14 '15 '16 '17 9/30/2018 Private Equity Private Debt Real Estate Infrastructure Natural Resources Sources: Preqin Online Products 1. Source: S&P LCD, September 2018. Middle market defined as issuers with EBITDA of $50 million or less 2

Fourth Quarter and Fiscal Year Executive Commentary Greg Johnson, Chairman and CEO Unaudited Despite rapid growth over the past 10 years, demand for alternative credit is expected to continue to increase with the asset class expected to double to an estimated $1.4 Investor Allocation Plans Over Longer Term trillion by 2023. Future growth in the asset class is expected to be strong Proportion of Investors Proportion of Investors Planning to Decrease Planning to Increase as a number of trends drive demand, such as: Allocation ▼ Allocation ▲ • 54% of institutional investors are under allocated or plan to increase their allocation to private credit over 4% PRIVATE EQUITY 53% the long term. 2% PRIVATE DEBT 54% • Pensions and insurance companies struggling to 11% REAL ESTATE 32% achieve targeted returns with lower volatility while under allocated to the asset class 4% INFRASTRUCTURE 55% 18% NATURAL RESOURCES 10% • Today only 37% of institutional investors invest in private credit vs. 58% in private equity and 59% in Source: Preqin Investor Interviews, December 2017 real estate • Structural changes in the bond market such as decreased liquidity and rising asset correlations Established in 2008, BSP offers a broad range of investment capabilities across the spectrum of alternative credit investment opportunities. BSP also brings a talented and focused credit team, led by CEO Tom Gahan, who have multiple decades of experience working together in private credit origination and underwriting, along with a deep bench of strategy leaders with significant experience building institutional-quality businesses that have delivered strong results through multiple market cycles. $26.2 Bn 188 $ AUM1 Employees2 6 Offices NEW YORK, NY 106 PROVIDENCE, RI Investment HOUSTON, TX RALEIGH, NC Professionals CHARLOTTE, NC SAN FRANCISCO, CA $26.2 Billion AUM1 $166 Million Run-Rate Management Fees1 188 Employees2 Private Debt / Special Long-Only Long-Short Commercial Opportunistic Situations Liquid Credit Liquid Credit Real Estate Credit Debt $12.1 $0.8 $9.4 $1.4 $2.5 Billion AUM1 Billion AUM1 Billion AUM1 Billion AUM1 Billion AUM1 1. BSP AUM amounts are preliminary as of September 30, 2018. 2. As of October 19, 2018. 3

Fourth Quarter and Fiscal Year Executive Commentary Greg Johnson, Chairman and CEO Unaudited BSP’s success in alternative credit is a result of: • Seasoned team with long track record of working together dating back to pre BSP • Differentiated approach to sourcing and origination and consistent, repeatable investment process • Flexible investment style with ability to diligence and underwrite instruments across capital structure • Intense focus on capital conservation, downside protection and risk adjusted returns across a market cycle • Deep bench of restructuring expertise across the platform Under the terms of the agreement, Franklin Templeton will acquire 100% of BSP’s operations and management fee earnings for initial cash consideration of $683 million ($130 million of which will be used to retire BSP debt), plus service-contingent, deferred consideration, with staggered vesting over the next several years. Key investment team members will continue to accrue the majority of performance fees and participate in retention programs that are contingent on employment with vesting staggered over the next several years. A portion of both the deferred consideration and retention pool will be delivered in the form of Franklin Resources, Inc. stock to be priced at closing. Employees will continue to co-invest in BSP products, along with seed capital for new products to be provided by Franklin. All current BSP employees will be offered continued employment and we see tremendous opportunity to grow the platform over time, working with Franklin Templeton global credit teams, and expanding into new markets, such as Europe. This transaction is subject to customary closing conditions and we anticipate the transaction will close in the second quarter of fiscal 2019. Net of anticipated, non-cash amortization of certain intangible assets, deferred consideration, and retention programs, we expect the transaction to be neutral to GAAP EPS in FY 2019 and accretive thereafter. 4

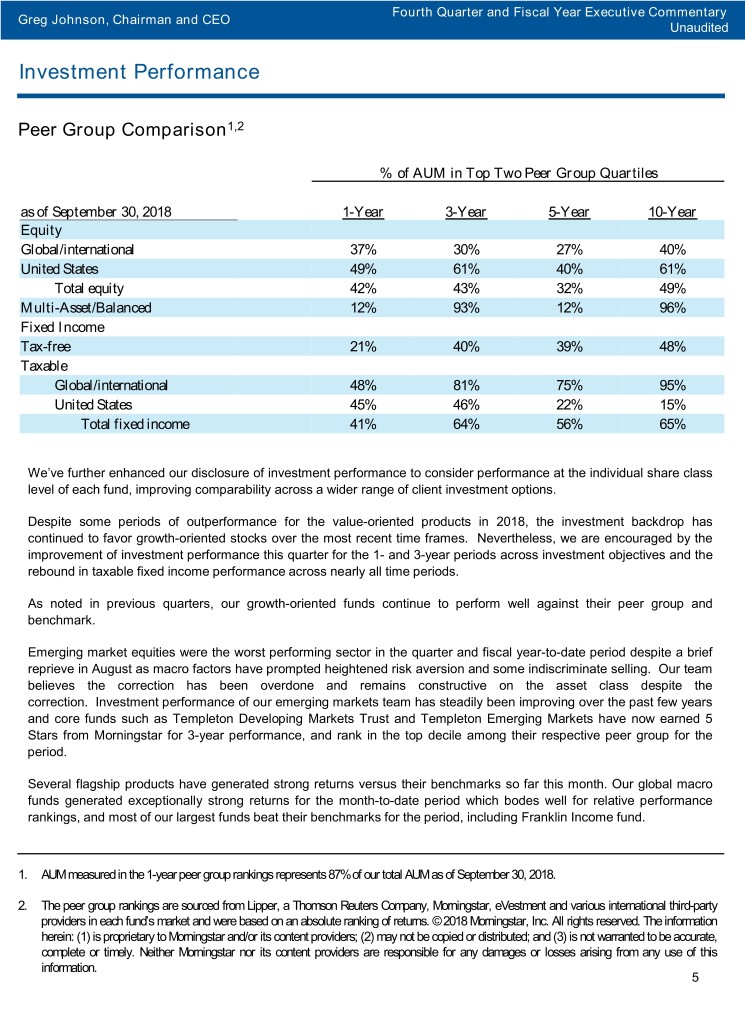

Fourth Quarter and Fiscal Year Executive Commentary Greg Johnson, Chairman and CEO Unaudited Investment Performance Peer Group Comparison1,2 % of AUM in Top Two Peer Group Quartiles as of September 30, 2018 1-Year 3-Year 5-Year 10-Year Equity Global/international 37% 30% 27% 40% United States 49% 61% 40% 61% Total equity 42% 43% 32% 49% Multi-Asset/Balanced 12% 93% 12% 96% Fixed Income Tax-free 21% 40% 39% 48% Taxable Global/international 48% 81% 75% 95% United States 45% 46% 22% 15% Total fixed income 41% 64% 56% 65% We’ve further enhanced our disclosure of investment performance to consider performance at the individual share class level of each fund, improving comparability across a wider range of client investment options. Despite some periods of outperformance for the value-oriented products in 2018, the investment backdrop has continued to favor growth-oriented stocks over the most recent time frames. Nevertheless, we are encouraged by the improvement of investment performance this quarter for the 1- and 3-year periods across investment objectives and the rebound in taxable fixed income performance across nearly all time periods. As noted in previous quarters, our growth-oriented funds continue to perform well against their peer group and benchmark. Emerging market equities were the worst performing sector in the quarter and fiscal year-to-date period despite a brief reprieve in August as macro factors have prompted heightened risk aversion and some indiscriminate selling. Our team believes the correction has been overdone and remains constructive on the asset class despite the correction. Investment performance of our emerging markets team has steadily been improving over the past few years and core funds such as Templeton Developing Markets Trust and Templeton Emerging Markets have now earned 5 Stars from Morningstar for 3-year performance, and rank in the top decile among their respective peer group for the period. Several flagship products have generated strong returns versus their benchmarks so far this month. Our global macro funds generated exceptionally strong returns for the month-to-date period which bodes well for relative performance rankings, and most of our largest funds beat their benchmarks for the period, including Franklin Income fund. 1. AUM measured in the 1-year peer group rankings represents 87% of our total AUM as of September 30, 2018. 2. The peer group rankings are sourced from Lipper, a Thomson Reuters Company, Morningstar, eVestment and various international third-party providers in each fund’s market and were based on an absolute ranking of returns. © 2018 Morningstar, Inc. All rights reserved. The information herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information. 5

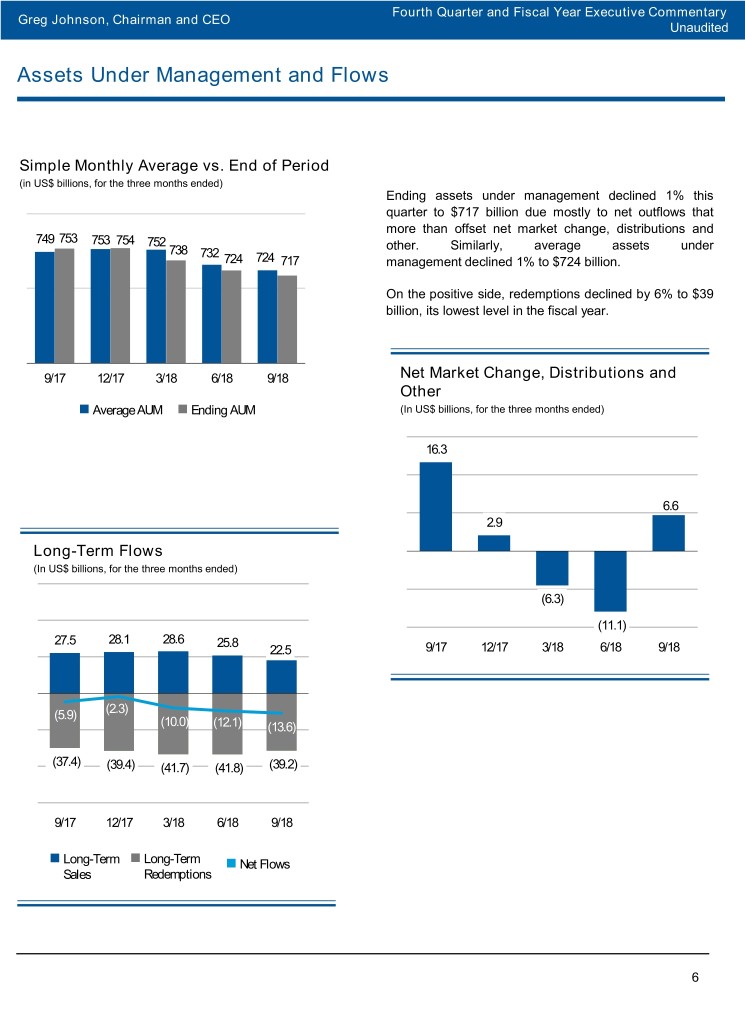

Fourth Quarter and Fiscal Year Executive Commentary Greg Johnson, Chairman and CEO Unaudited Assets Under Management and Flows Simple Monthly Average vs. End of Period (in US$ billions, for the three months ended) Ending assets under management declined 1% this quarter to $717 billion due mostly to net outflows that more than offset net market change, distributions and 749 753 753 754 752 other. Similarly, average assets under 738 732 724 724 717 management declined 1% to $724 billion. On the positive side, redemptions declined by 6% to $39 billion, its lowest level in the fiscal year. 9/17 12/17 3/18 6/18 9/18 Net Market Change, Distributions and Other Average AUM Ending AUM (In US$ billions, for the three months ended) 16.3 6.6 2.9 Long-Term Flows (In US$ billions, for the three months ended) (6.3) (11.1) 27.5 28.1 28.6 25.8 22.5 9/17 12/17 3/18 6/18 9/18 (5.9) (2.3) (10.0) (12.1) (13.6) (37.4) (39.4) (41.7) (41.8) (39.2) 9/17 12/17 3/18 6/18 9/18 Long-Term Long-Term Net Flows Sales Redemptions 6

Fourth Quarter and Fiscal Year Executive Commentary Greg Johnson, Chairman and CEO Unaudited Long-Term Flows: Retail¹ (In US$ billions, for the three months ended) International United States 12.4 11.6 11.6 9.6 8.9 10.3 8.9 9.1 9.2 8.4 2.0 0.6 (3.2) (0.6) (0.9) (0.7) (1.2) (6.2) (5.5) (5.7) (9.7) (11.2) (11.8) (10.8) (16.0) (17.1) (13.4) (17.4) (18.4) (17.7) 9/17 12/17 3/18 6/18 9/18 9/17 12/17 3/18 6/18 9/18 Long-Term Long-Term Net Flows Long-Term Long-Term Net Flows Sales Redemptions Sales Redemptions Retail flow trends have remained fairly steady for Additionally, we built our LibertyShares suite of ETF several quarters now with international retail flows right products, a Portfolio Construction Team, and added a around break even, while U.S. retail sales increased private wealth channel. slightly. In fact, this year alone we invested an enormous Improved redemptions on the international front amount into our business. We added significant contributed to the slight improvement in flows in this resources to our strategic relationship and ETF sales channel, more than offsetting lower sales following a teams and channelized the team structures to focus decrease in demand for several global fixed income their efforts. Furthermore, we expanded several funds (most notably, lower sales from Greater China teams including our internal sales, DCIO and client where demand for Emerging Markets Bond slowed over analytics teams, and have provided more training to concerns of rising U.S. interest rates, U.S. dollar employees on the front lines of our distribution efforts. strengthening and rising trade tension). We believe we have the right leadership and structure in place to become a leader in the fee-based world. In the U.S., we continue to see demand for our growth strategies and several funds generated strong inflows Additionally, there has been solid demand for our again this quarter. Additionally, some international funds ETF products and alternative funds under the K2 returned to modest inflows. brand as well as continued traction in our collective investment trust vehicles. Redemptions also declined in the U.S. retail channel, although net outflows increased due to higher reinvested distribution activity in the prior quarter. As an organization, we’ve taken steps to address the changes in the distribution landscape in the U.S. to position ourselves as a top asset manager for our clients in the current environment. We expanded our product line up and product support beyond the scope of our traditional capabilities. 1. Graphs do not include high net-worth client flows. 7

Fourth Quarter and Fiscal Year Executive Commentary Greg Johnson, Chairman and CEO Unaudited Long-Term Flows: Institutional¹ (In US$ billions, for the three months ended) International United States 4.6 4.9 3.2 3.4 2.5 2.8 2.5 2.3 2.0 2.2 (0.3) (0.3) (0.6) (2.1) (2.1) (2.2) (2.7) (3.5) (3.6) (4.3) (4.3) (3.9) (5.0) (4.8) (4.5) (5.0) (5.4) (6.6) (5.9) (8.5) 9/17 12/17 3/18 6/18 9/18 9/17 12/17 3/18 6/18 9/18 Long-Term Long-Term Net Flows Sales Redemptions Long-Term Long-Term Net Flows Sales Redemptions Institutional outflows increased this quarter due mostly to a drop in international sales and an $820 million global equity redemption coming from a U.S. client. However, overall sales in the U.S. did improve a bit with help from a K2 strategy win. Sales in this channel can fluctuate significantly from quarter to quarter, but the overall pipeline remains healthy and we currently see particularly strong interest in our alternatives offerings. 1. Graphs do not include high net-worth client flows. 8

Fourth Quarter and Fiscal Year Executive Commentary Greg Johnson, Chairman and CEO Unaudited Flows by Investment Objective Global/International Equity Global/International Fixed Income (in US$ billions, for the three months ended) (in US$ billions, for the three months ended) 11.9 11.1 10.3 8.3 5.4 5.9 6.6 6.0 7.2 4.3 3.8 1.8 0.1 (1.9) (3.6) (2.0) (5.0) (4.5) (7.3) (7.3) (9.0) (10.0) (11.0) (11.6) (11.6) (11.5) (10.2) (11.0) (11.0) (13.3) 9/17 12/17 3/18 6/18 9/18 9/17 12/17 3/18 6/18 9/18 Long-Term Long-Term Net Flows Long-Term Long-Term Net Flows Sales Redemptions Sales Redemptions % of Beg. Prior 4 Quarters Current % of Beg. Prior 4 Quarters Current AUM1 Avg Quarter AUM1 Avg Quarter Sales 11% 9% Sales 25% 19% Redemptions 23% 23% Redemptions 25% 26% Global equity net flows were essentially unchanged Global international fixed income net outflows this quarter, but sales and redemptions both were $2 billion and did not change materially decreased due mostly to institutional activity. On over the prior quarter. There was a significant the retail side, we did see some improvement in net drop in demand for several strategies in the flows for several funds including Mutual Global category due in part to emerging market volatility Discovery, Templeton Growth, and Templeton in the quarter, which was offset by a similar drop Asian Growth due to strengthening performance. in redemption activity. Mutual Global Discovery fund was in the 2nd quartile year-to-date, and Templeton Growth was in Global Macro experienced some performance the top quartile for the month of September, and volatility, which impacted sales; however, performance through October remains strong. performance rebounded into quarter end and has continued to be strong through October. 1. Sales and redemptions as a percentage of beginning assets under management are annualized. 9

Fourth Quarter and Fiscal Year Executive Commentary Greg Johnson, Chairman and CEO Unaudited U.S. Equity Multi-Asset/Balanced (in US$ billions, for the three months ended) (In US$ billions, for the three months ended) 4.1 4.4 4.5 4.0 4.0 3.1 3.6 3.5 4.0 3.8 1.5 (0.2) (0.4) (0.2) (0.9) (1.1) (0.5) (1.1) (1.8) (2.5) (5.6) (5.5) (5.5) (5.9) (5.8) (5.7) (5.4) (6.7) (6.2) (6.3) 9/17 12/17 3/18 6/18 9/18 9/17 12/17 3/18 6/18 9/18 Long-Term Long-Term Net Flows Long-Term Long-Term Net Flows Sales Redemptions Sales Redemptions % of Beg. Prior 4 Quarters Current % of Beg. Prior 4 Quarters Current 1 AUM Avg Quarter AUM1 Avg Quarter Sales 14% 16% Sales 11% 11% Redemptions 22% 22% Redemptions 17% 16% U.S. equity continues to be a bright spot for us with There have been several success stories in the continued success in a number of growth multi-asset/balanced investment objective, notably in strategies. In fact, sales have trended upward for the Franklin Convertible Securities fund, which has four consecutive quarters. However, the category generated over $500 million of net inflows this remains in outflows this quarter due in part to quarter, and continued flow traction into our K2 redemption activity in some value strategies. strategies. However, these stories were overshadowed by over $1 billion of net outflows from the Franklin Income fund in the quarter. The fund was recently upgraded to 5 stars by Morningstar, which bodes well for future sales, but relative performance does remain challenged over the 1- and 5-year periods. Additionally, an integrated sales and marketing campaign associated with the fund’s 70th anniversary launched at the end of August and is expected to run through the end of the calendar year. 1. Sales and redemptions as a percentage of beginning assets under management are annualized. 10

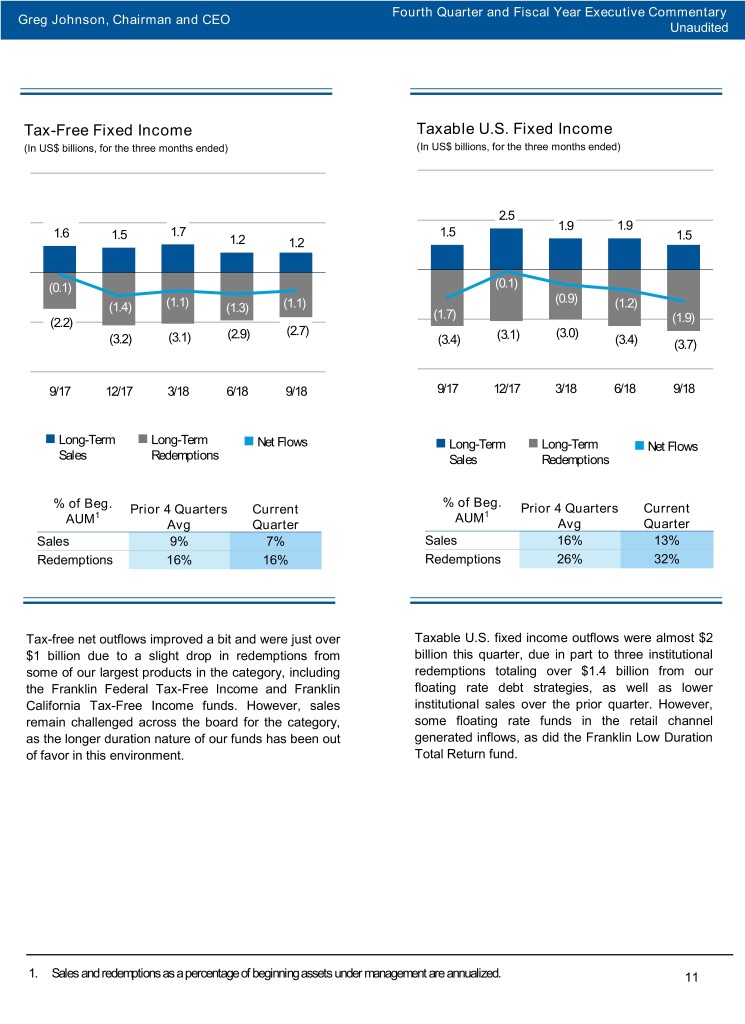

Fourth Quarter and Fiscal Year Executive Commentary Greg Johnson, Chairman and CEO Unaudited Tax-Free Fixed Income Taxable U.S. Fixed Income (In US$ billions, for the three months ended) (In US$ billions, for the three months ended) 2.5 1.9 1.9 1.6 1.5 1.7 1.5 1.5 1.2 1.2 (0.1) (0.1) (0.9) (1.4) (1.1) (1.1) (1.2) (1.3) (1.7) (2.2) (1.9) (2.7) (3.1) (2.9) (3.1) (3.0) (3.2) (3.4) (3.4) (3.7) 9/17 12/17 3/18 6/18 9/18 9/17 12/17 3/18 6/18 9/18 Long-Term Long-Term Net Flows Long-Term Long-Term Net Flows Sales Redemptions Sales Redemptions % of Beg. % of Beg. Prior 4 Quarters Current Prior 4 Quarters Current 1 AUM1 AUM Avg Quarter Avg Quarter Sales 9% 7% Sales 16% 13% Redemptions 16% 16% Redemptions 26% 32% Tax-free net outflows improved a bit and were just over Taxable U.S. fixed income outflows were almost $2 $1 billion due to a slight drop in redemptions from billion this quarter, due in part to three institutional some of our largest products in the category, including redemptions totaling over $1.4 billion from our the Franklin Federal Tax-Free Income and Franklin floating rate debt strategies, as well as lower California Tax-Free Income funds. However, sales institutional sales over the prior quarter. However, remain challenged across the board for the category, some floating rate funds in the retail channel as the longer duration nature of our funds has been out generated inflows, as did the Franklin Low Duration of favor in this environment. Total Return fund. 1. Sales and redemptions as a percentage of beginning assets under management are annualized. 11

Fourth Quarter and Fiscal Year Executive Commentary Ken Lewis, CFO Unaudited Financial Results (in US$ millions except per share data, for the twelve months ended) Annual Operating and Net Income1 Annual Diluted Earnings Per Share $3.79 3,221 3,028 $3.29 $2.94 $3.01 2,366 2,264 2,119 2,384 2,035 1,727 1,697 $1.39 764 9/14 9/15 9/16 9/17 9/18 9/14 9/15 9/16 9/17 9/18 Operating Income Net Income 1 Fiscal year operating results were in line with our expectations as we made several strategic investments in the business that contributed to lower operating income. However, at more than $2 billion, operating income remains strong, while net income decreased more significantly to $764 million due to the impact of the Tax Cuts and Jobs Act. After refining our calculations, we adjusted our estimated income tax charge from the Tax Act to $969 million, which brought the fiscal year effective tax rate to 66.5%. These adjustments included a $90 million tax reduction to the transition tax estimate recorded in the current quarter, which may be reduced or eliminated by future regulation or legislation. Earnings per share declined, primarily for the same reason, to $1.39, but this was partially offset by the 4% decrease in diluted average shares outstanding versus the prior year. 1. Net income attributable to Franklin Resources, Inc. 12

Fourth Quarter and Fiscal Year Executive Commentary Ken Lewis, CFO Unaudited (in US$ millions except per share data, for the three months ended) Quarterly Operating and Net Income (Loss)1 Quarterly Diluted Earnings (Loss) Per Share 558 581 556 503 479 $0.96 $0.76 $0.78 $0.75 503 443 425 402 (583) $(1.06) 9/17 12/17 3/18 6/18 9/18 9/17 12/17 3/18 6/18 9/18 Operating Income Net Income (Loss) 1 For the quarter, operating income declined 5% to $478 million as revenues dropped slightly more than expenses. Net income increased to $503 million, due largely to the transition tax adjustments as well as lower state income tax in the quarter leading to a tax rate of just 1% percent. Diluted earnings per share once again increased more than net income, to $0.96. Operating Revenues and Expenses (In US$ millions, for the three months ended) Sep-18 vs. Sep-18 vs. Sep-18 Jun-18 Mar-18 Dec-17 Sep-17 Jun-18 Sep-17 Investment management fees $ 1,058.9 $ 1,077.9 (2%) $ 1,117.1 $ 1,113.6 $ 1,109.8 (5%) Sales and distribution fees 380.8 391.4 (3%) 409.8 417.8 421.8 (10%) Shareholder servicing fees 51.8 53.9 (4%) 61.3 54.9 56.0 (8%) Other 35.7 35.4 1% 29.6 29.2 29.3 22% Total Operating Revenues $ 1,527.2 $ 1,558.6 (2%) $ 1,617.8 $ 1,615.5 $ 1,616.9 (6%) Investment management fee revenue declined modestly this quarter, reflecting lower average assets under management and partially offset by the benefit of an additional day in the quarter, and includes about $7 million of performance fees. Sales and distribution fee revenue was $381 million, a decrease of 3% due to a combination of lower asset-based fees and commissionable sales. Shareholder servicing fees decreased to $52 million this quarter due to lower transaction-based fees. Other revenue was about $36 million, essentially flat over the prior quarter. The vast majority of this line is from consolidated investment products that is partially offset by noncontrolling interest. 1. Net income (loss) attributable to Franklin Resources, Inc. 13

Fourth Quarter and Fiscal Year Executive Commentary Ken Lewis, CFO Unaudited Sep-18 vs. Sep-18 vs. Sep-18 Jun-18 Mar-18 Dec-17 Sep-17 Jun-18 Sep-17 Sales, distribution and marketing $ 489.7 $ 499.8 (2%) $ 521.5 $ 528.7 $ 534.9 (8%) Compensation and benefits 345.1 357.5 (3%) 355.5 332.5 336.1 3% Information systems and 68.3 62.5 9% 58.1 55.0 60.0 14% technology Occupancy 34.6 30.5 13% 34.1 29.4 33.0 5% General, administrative and other 110.8 105.2 5% 92.9 88.8 95.2 16% Total Operating Expenses $ 1,048.5 $ 1,055.5 (1%) $ 1,062.1 $ 1,034.4 $ 1,059.2 (1%) Sales distribution and marketing expense was $490 million this quarter and decreased at a lesser rate than sales and distribution revenue due to a regulatory commission structure change in India, and a slight impact of the class A pricing structure change that we discussed last quarter. Compensation and benefits expense decreased by about $12 million this quarter due to lower vacation accrual over the summer months, as well as lower severance expense and payroll taxes in the U.S. Information, systems and technology expense continues to be seasonally higher in the 4th quarter and was $68 million Occupancy expense increased 13% to over $34 million this quarter due to a mix of higher rent, maintenance and utilities as well as an asset impairment. General, administrative and other expense was $111 million, an increase over the prior quarter due to a number of items, including higher advertising and consolidated investment products expenses. Expenses from consolidated investment products are partially offset in noncontrolling interests. Next quarter, we expect a drop in expenses due to information systems and technology and general, administrative and other expenses, which experience some seasonality. Typically, these expenses are lowest in the 1st quarter and increase throughout the fiscal year. Operating Margin (%) vs. Average AUM (in US$ billions, for the fiscal year ended) 37.9% 38.1% 37.3% 36.6% 35.4% 35.7% 35.4% 34.8% 33.5% 33.5% 888 870 28.7% 808 Average AUM: 749 737 741 1 694 706 2.0% CAGR 605 571 442 9/08 9/09 9/10 9/11 9/12 9/13 9/14 9/15 9/16 9/17 9/18 Operating Fiscal Year Income: Operating Income 1 2,099 1,203 1,959 2,660 2,515 2,921 3,221 3,028 2,366 2,264 2,119 0.1% CAGR (in US$ millions) ━ Operating Margin Average AUM Profitability for the fiscal year declined a bit due to the strategic investments previously discussed; however, remains very strong. 14 1. CAGR is the compound average annual growth rate over the trailing 10-year period.

Fourth Quarter and Fiscal Year Executive Commentary Ken Lewis, CFO Unaudited Other Income and Taxes Other Income (In US$ millions, for the three months ended September 30, 2018) 1.0 2.6 1.1 12.7 (5.8) (39.7) 34.1 29.5 32.7 4.6 Interest and Equity method Available-for- Trading Interest Foreign Consolidated Total other Noncontrolling Other income, dividend investments sale investments expense exchange and Investment income interests¹ net of income investments other Products (CIPs) noncontrolling interests Other income, net of noncontrolling interests was $34.1 million this quarter. Lower interest expense drove most of the increase due to the extinguishment charge in the prior quarter and a lower debt balance. Higher dividend and interest income and gains on equity method investments also had an impact. Looking ahead to fiscal year 2019, we currently expect the tax rate to be in the range of 22% to 23% as we fully realize the benefit from lower U.S. corporate tax rates. Capital Management Change in Ending Shares Outstanding 20% U.S. Asset 15% Managers (ex- BEN)2: 2.1% 10% Compound 5% Annual Dilution 0% -5% BEN: 3.8% -10% Compound -15% Annual Accretion -20% 9/13 3/14 9/14 3/15 9/15 3/16 9/16 3/17 9/17 3/18 9/18 BEN U.S. Asset Managers Average (ex-BEN)2 1. Reflects the portion of noncontrolling interests, attributable to third-party investors, related to CIPs included in Other income. 2. U.S. asset managers include AB, AMG, APAM, APO, ARES, BLK, BSIG, BX, CG, CNS, EV, FII, GBL, HLNE, IVZ, KKR, LM, MN, OAK, OZM, PZN, TROW, VCTR, VRTS, WDR and WETF. Source: Thomson Reuters and company reports. 15

Fourth Quarter and Fiscal Year Executive Commentary Ken Lewis, CFO Unaudited Share Repurchases (US$ millions) vs. Average BEN Price $60 500 $50 433 446 404 Special Cash 337 $40 327 348 Dividends per Share Declared: $30 265 256 262 218 190 175 200 179 178 167 Feb-18: $3.00 $20 137 129 151 168 Dec-14: $0.50 $10 $0 9/13 3/14 9/14 3/15 9/15 3/16 9/16 3/17 9/17 3/18 9/18 Share Repurchase Amount BEN Average Price for the Period Special Cash Dividend Declared Capital management remains an area of focus for the company and the board. During the quarter we repurchased an additional 10.8 million shares, bringing the total for the full fiscal year to 39.9 million shares at a cost of more than $1.4 billion. Shares outstanding ended the year at 519.1 million, a net decrease of 6.5% from a year ago, and an average annual decrease of 3.6% over the trailing five years. Trailing 12 Months Share Repurchases and Dividends1 (US$ millions and percentage of net income) 3,552 3,364 3,085 NM NM NM 1,220 1,173 NM NM NM 45% NM 26% NM NM 9/17 12/17 3/18 6/18 9/18 Dividends Share Repurchases Dividends for the full year totaled $3.92 per share, yielding a combined total return of capital of over $3.5 billion. This is in addition to the strategic investments we made into the business, including multiple acquisitions aimed to strengthen our capabilities for clients. As of September 30, cash and investments, net of debt, the tax liability for repatriation and initial consideration to acquire Benefit Partners, LLC was $6.8 billion, a 35% decrease from $10.4 billion at September 30, 2017. 1. The chart above illustrates the amount of share repurchases and dividends over the trailing 12 months, for the period ended. Dividend payout is calculated as dividend amount declared divided by net income attributable to Franklin Resources, Inc. for the trailing 12-month period. Repurchase payout is calculated as stock repurchase amount divided by net income attributable to Franklin Resources, Inc. for the trailing 12-month period. Note: The payout ratio for the 12/17, 3/18, 6/18 and 9/18 period is not meaningful due to the 12/17 reported loss that was 16 attributable to tax reform.

Fourth Quarter and Fiscal Year Executive Commentary Ken Lewis, CFO Unaudited Appendix Mix of Ending Assets Under Management (as of September 30, 2018) Investment Objective (US$ billions) Sep-18 Equity $ 309.6 1% 43% Multi Asset/Balanced 138.9 Fixed Income 259.3 2% Cash Management 9.3 4% 67% Total $ 717.1 13% 36% 14% Sales Region (US$ billions) Sep-18 United States $ 482.0 20% Europe, Middle East 98.3 and Africa Asia-Pacific 91.4 Canada 29.8 Latin America 15.6 Total $ 717.1 Sales and Distribution Summary (in US$ millions, for the three months ended) Sep-18 Jun-18 Change % Change Asset-based fees $ 318.0 $ 324.0 $ (6.0) (2%) Asset-based expenses (411.7) (420.4) 8.7 (2%) Asset-based fees, net $ (93.7) $ (96.4) $ 2.7 (3%) Sales-based fees 59.2 63.3 (4.1) (6%) Contingent sales charges 3.6 4.1 (0.5) (12%) Sales-based expenses (57.8) (59.4) 1.6 (3%) Sales-based fees, net $ 5.0 $ 8.0 $ (3.0) (38%) Amortization of deferred sales commissions (20.2) (20.0) (0.2) 1% Sales and Distribution Fees, Net $ (108.9) $ (108.4) $ (0.5) 0% 17

Fourth Quarter and Fiscal Year Executive Commentary Ken Lewis, CFO Unaudited Appendix (continued) CIPs Related Adjustments (in US$ millions, for the three and twelve months ended) FY Sep-18 Sep-18 Operating Revenues $ 24.1 $ 79.4 Operating Expenses 8.5 24.2 This table summarizes the Operating Income $ 15.6 $ 55.2 impact of CIPs on the Investment Income 9.1 (14.4) Company’s reported U.S. GAAP financial results. Interest Expense (0.6) (2.4) CIPs (39.7) (55.0) Other Income $ (31.2) $ (71.8) Net Income $ (15.6) $ (16.6) Less: net income attributable to noncontrolling (24.8) (22.4) interests Net Income Attributable to Franklin $ 9.2 $ 5.8 Resources, Inc. 18

Forward-Looking Statements The financial results in this commentary are preliminary. Statements in this commentary regarding Franklin Resources, Inc. (“Franklin”) and its subsidiaries, which are not historical facts, are "forward-looking statements" within the meaning of the U.S. Private Securities Litigation Reform Act of 1995. When used in this commentary, words or phrases generally written in the future tense and/or preceded by words such as “will,” “may,” “could,” “expect,” “believe,” “anticipate,” “intend,” “plan,” “seek,” “estimate,” “preliminary” or other similar words are forward-looking statements. Forward-looking statements involve a number of known and unknown risks, uncertainties and other important factors, some of which are listed below, that could cause actual results and outcomes to differ materially from any future results or outcomes expressed or implied by such forward-looking statements. While forward-looking statements are our best prediction at the time that they are made, you should not rely on them and are cautioned against doing so. Forward-looking statements are based on our current expectations and assumptions regarding our business, the economy and other future conditions. Because forward-looking statements relate to the future, they are subject to inherent uncertainties, risks and changes in circumstances that are difficult to predict. They are neither statements of historical fact nor guarantees or assurances of future performance. These and other risks, uncertainties and other important factors are described in more detail in Franklin’s recent filings with the U.S. Securities and Exchange Commission, including, without limitation, in Risk Factors and Management’s Discussion and Analysis of Financial Condition and Results of Operations in Franklin’s Annual Report on Form 10-K for the fiscal year ended September 30, 2017 and Franklin’s subsequent Quarterly Reports on Form 10-Q: • Volatility and disruption of the capital and credit markets, and adverse changes in the global economy, may significantly affect our results of operations and may put pressure on our financial results. • The amount and mix of our assets under management (“AUM”) are subject to significant fluctuations. • We are subject to extensive, complex, overlapping and frequently changing rules, regulations, policies, and legal interpretations. • Global regulatory and legislative actions and reforms have made the regulatory environment in which we operate more costly and future actions and reforms could adversely impact our financial condition and results of operations. • Failure to comply with the laws, rules or regulations in any of the jurisdictions in which we operate could result in substantial harm to our reputation and results of operations. • Changes in tax laws or exposure to additional income tax liabilities could have a material impact on our financial condition, results of operations and liquidity. • Any significant limitation, failure or security breach of our information and cyber security infrastructure, software applications, technology or other systems that are critical to our operations could disrupt our business and harm our operations and reputation. • Our business operations are complex and a failure to properly perform operational tasks or the misrepresentation of our products and services, or the termination of investment management agreements representing a significant portion of our AUM, could have an adverse effect on our revenues and income. • We face risks, and corresponding potential costs and expenses, associated with conducting operations and growing our business in numerous countries. • We depend on key personnel and our financial performance could be negatively affected by the loss of their services. • Strong competition from numerous and sometimes larger companies with competing offerings and products could limit or reduce sales of our products, potentially resulting in a decline in our market share, revenues and income. • Changes in the third-party distribution and sales channels on which we depend could reduce our income and hinder our growth. • Our increasing focus on international markets as a source of investments and sales of our products subjects us to increased exchange rate and market-specific political, economic or other risks that may adversely impact our revenues and income generated overseas. • Harm to our reputation or poor investment performance of our products could reduce the level of our AUM or affect our sales, and negatively impact our revenues and income. • Our future results are dependent upon maintaining an appropriate level of expenses, which is subject to fluctuation. • Our ability to successfully manage and grow our business can be impeded by systems and other technological limitations. • Our inability to successfully recover should we experience a disaster or other business continuity problem could cause material financial loss, loss of human capital, regulatory actions, reputational harm, or legal liability. 19

Forward-Looking Statements (continued) • Regulatory and governmental examinations and/or investigations, litigation and the legal risks associated with our business, could adversely impact our AUM, increase costs and negatively impact our profitability and/or our future financial results. • Our ability to meet cash needs depends upon certain factors, including the market value of our assets, operating cash flows and our perceived creditworthiness. • We are dependent on the earnings of our subsidiaries. Any forward-looking statement made by us in this commentary speaks only as of the date on which it is made. Factors or events that could cause our actual results to differ may emerge from time to time, and it is not possible for us to predict all of them. We undertake no obligation to publicly update any forward-looking statement, whether as a result of new information, future developments or otherwise, except as may be required by law. The information in this commentary is provided solely in connection with this commentary, and is not directed toward existing or potential investment advisory clients or fund shareholders. Investor Relations Contacts Brian Sevilla +1 (650) 312-3326 20