Attached files

| file | filename |

|---|---|

| 8-K - 8-K Q3 INVESTOR PRESENTATION - CTS CORP | q32018investorpresentation.htm |

April 2018 October 2018

Safe Harbor Statement This presentation contains statements that are, or may be deemed to be, forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements include, but are not limited to, any financial or other guidance, statements that reflect our current expectations concerning future results and events, and any other statements that are not based solely on historical fact. Forward-looking statements are based on management's expectations, certain assumptions and currently available information. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date hereof and are based on various assumptions as to future events, the occurrence of which necessarily are subject to uncertainties. These forward-looking statements are made subject to certain risks, uncertainties and other factors, which could cause our actual results, performance or achievements to differ materially from those presented in the forward-looking statements. Examples of factors that may affect future operating results and financial condition include, but are not limited to: changes in the economy generally and in respect to the businesses in which CTS operates; unanticipated issues in integrating acquisitions; the results of actions to reposition our businesses; rapid technological change; general market conditions in the automotive, communications, and computer industries, as well as conditions in the industrial, defense and aerospace, and medical markets; reliance on key customers; unanticipated natural disasters or other events; the ability to protect our intellectual property; pricing pressures and demand for our products; unanticipated developments that could occur with respect to contingencies such as litigation and environmental matters as well as any product liability claims; and risks associated with our international operations, including trade and tariff barriers, exchange rates and political and geopolitical risks. Many of these, and other, risks and uncertainties are discussed in further detail in Item 1A. of CTS’ Annual Report on Form 10-K. We undertake no obligation to publicly update our forward- looking statements to reflect new information or events or circumstances that arise after the date hereof, including market or industry changes. 2

Our Company Ticker: CTS (NYSE) 2017 Sales: $423 Million Founded: 1896 Sales by Market: ▪ Transportation – 64% Business: CTS is a leading designer ▪ Industrial – 18% and manufacturer of sensors, ▪ Medical – 9% actuators and electronic components. ▪ Aero & Defense – 5% ▪ Telecom & IT – 4% Locations: 15 manufacturing locations throughout North America, Asia and Sales by Region: Europe. ▪ Americas – 54% ▪ Asia – 31% Number of Employees: ~3,200 ▪ Europe – 15% Globally Note: Sales by market and region based on trailing twelve months sales as of September 30, 2018 3

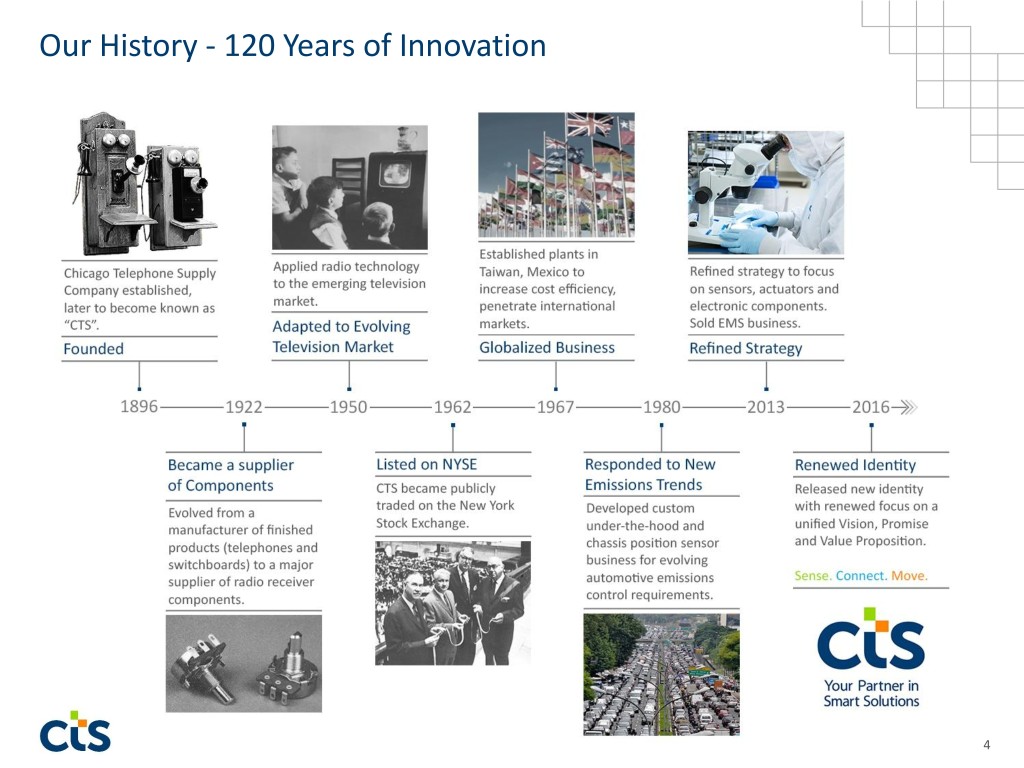

Our History - 120 Years of Innovation 4

Our Vision and Value Proposition We aim to be a leading provider of sensing and motion devices as well as connectivity components, enabling an intelligent and seamless world. 5

Product Applications in Transportation Engine Efficiency Occupant Safety Fuel Handling ▪ Accelerator Pedal Module ▪ Seat Belt Buckle Switch ▪ Contacting Fuel Level Card ▪ Current Sensor ▪ Seat Belt Tension Sensor ▪ Gear Position Sensor ▪ Seat Track Position Sensor ▪ Throttle Position Sensor ▪ Turbo Actuator ▪ Turbo Position Sensor ▪ Exhaust Management / Variable Valve Lift Sensor Aftertreatment ▪ EGR Position Sensor Autonomous Drive ▪ DPF RF Sensor ▪ PLL Module Chassis / Driveline ▪ Brake Pedal Sensor ▪ Chassis Height Sensor ▪ Transmission Speed Sensor ▪ Transmission Range Sensor ▪ Wheel Speed Sensor Key Customers 6

Product Applications in Industrial Industrial Printers, HVAC, Automation and Safety Products ▪ Piezo Micro-Actuators ▪ Switches ▪ Encoders ▪ Frequency Control ▪ EMI Filters ▪ Flow Meter Transducers ▪ Thermal Solution For LED High Bay Lighting Industrial HVAC Industrial Inkjet Printers Key Customers 7

Product Applications in Medical Ultrasound / IVUS, Infusion Pumps, CPAPs and other medical devices ▪ Single Crystal Piezo ▪ Bulk Piezo ▪ Encoders ▪ Frequency Control ▪ Piezo micro-valves ▪ Switches ▪ Joysticks CPAP Machines Infusion Pumps Ultrasound Equipment Dental Equipment Wireless Pacing Key Customers 8

Product Applications in Aero & Defense Military Sonar and Communication Products ▪ Piezo Hydrophones ▪ Piezo Sonar Arrays ▪ Frequency Control ▪ EMI Filters Unmanned Aerial Vehicles (UAV) Maritime Applications Key Customers 9

Product Applications in Telecom & IT Communications Products ▪ RF Filters ▪ EMI/RFI Filters ▪ Frequency Control ▪ Timing Modules ▪ Thermal Products ▪ Multilayer Piezo ▪ Bulk Piezo Mobile Devices Wireline Infrastructure Small Cell Base Stations Macro Cell Base Stations Wireless Infrastructure Backhaul Communications Key Customers 10

Positioning for Growth with Fundamental Market Trends Smart Home/ IndustryIndustry 4.04.0 Green Buildings Building Unmanned Autonomous Energy Aerial Vehicles Vehicle Harvesting EFFICIENT (Drones) Medical Information Industrial Technology Fuel Efficiency/ Improved Remote SMART Vehicle CONNECTED Medical SMART Monitoring CONNECTED Electrification Diagnosis Electrification Communications Diagnosis InternetInternet ofof 5G & Small Miniaturization Things Cells Defense & Transportation Aerospace 11

CTS Addressable Markets Expected to Grow Mid-Single Digits Market SAM in $ Billions Organic Growth Drivers Transportation ▪ Actuators for harsh environments $3.4 ▪ RF Sensing for particulate filters ▪ Autonomous drive Industrial ▪ $1.2 3D and textile printing ▪ New products for industrial controls Medical ▪ Medical 3D/4D ultrasound $0.2 ▪ HMI control for medical devices ▪ Wireless pacing Aero & Defense ▪ Hydrophones for sonar applications $0.7 ▪ Military communication Telecom & IT ▪ 100GB & 400GB wireline networks $1.3 ▪ Small cell deployment ▪ Security and haptics for mobile devices 12

Organic Growth Total Booked Business Investments to Grow ($ Millions) Technologies and Products that Sense, Connect and Move $1,832 $1,737 $116 $351 ▪ Improve Customer Intimacy ▪ R&D Investments at ~6% of Sales ▪ Enhance Sales Force Capabilities ▪ Improvements to Cost Structure ▪ Continuous Improvement Dec 2017 Sep 2018 Expected to ship in 2018 Note: Total Booked Business represents open purchase orders, contractual commitments, and the total expected lifetime revenue from business awarded to CTS in multi-year platform awards. 13

Targeted Acquisitions Expand Broaden Product Geographic Range Reach Enhance Strengthen Technology Customer Portfolio Relationships Disciplined approach to acquisitions: ▪ Returns in excess of cost of capital ▪ Accretive to earnings ▪ Maintain balance sheet strength ▪ Synergy opportunities ▪ Targeting 10% growth (both inorganic and organic) 14

The Road Ahead of Us AD Targeted End Markets T&IT LV Light Vehicles 30-50% CV Industrial 20-30% Medical 10-20% O M Telecom & IT 10-20% M Commercial Vehicles 10-20% I LV/CV AD Aero & Defense 5-15% T I AD T&IT Organic Growth CV Innovation M&A M LV EMS Divestiture M AD IT/O I Front End Refocus Legend: T AD: Aero & Defense CV: Commercial Vehicles I New Customers I: Industrial LV/CV IT: Information Technology Regional Expansion LV: Light Vehicles Organic Projects M: Medical O: Others M&A T: Telecom 15

Annual Financial Performance Trend Sales Adjusted Earnings Per Share ($ Millions) $470 $1.56 $465 $1.49 $116 $423 Booked $397 Business $382 $350 $1.23 $1.08 Q3 YTD $0.93 Actual 2015 2016 2017 2018E 2015 2016 2017 2018E Note: 2018E represents updated guidance provided on October 25, 2018. Prior guidance provided on July 26, 2018: Sales $450-$465, Adjusted EPS $1.40-$1.55 16

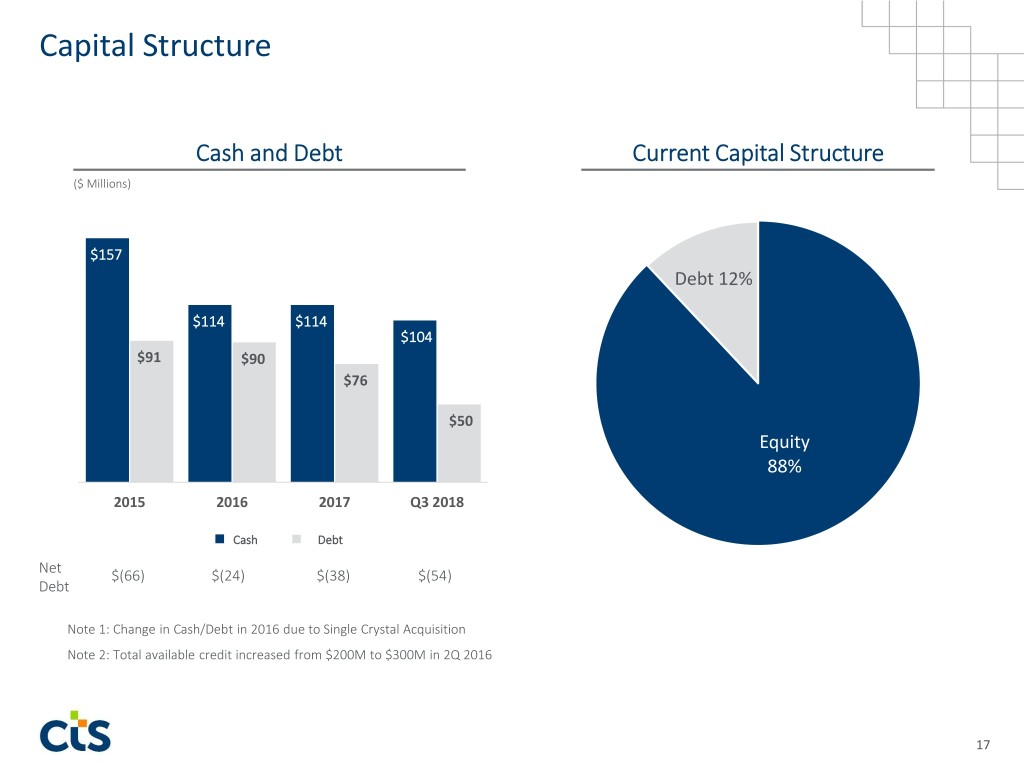

Capital Structure Cash and Debt Current Capital Structure ($ Millions) $157 Debt 12% $114 $114 $104 $91 $90 $76 $50 Equity 88% 2015 2016 2017 Q3 2018 Cash Debt Net $(66) $(24) $(38) $(54) Debt Note 1: Change in Cash/Debt in 2016 due to Single Crystal Acquisition Note 2: Total available credit increased from $200M to $300M in 2Q 2016 17

Target Capital Deployment – Disciplined Approach Operating Cash Flow 12-14% of Sales Growth Return Capital to Investment Acquisitions Shareholders ~4% of Sales* 60-80% of Dividends & Buybacks Free Cash Flow 20-40% of Free Cash Flow *6-7% in 2018 Capital Structure Leverage = 1.0x - 2.5x EBITDA 18

Financial Framework Long-Term 2012 2017 Target Range 1 Gross Margin 30.0% 34.3% 34-37% 1 SG&A Expense 20.7% 15.5% 13-15% 1 R&D Expense 6.9% 5.4% 5-7% CapEx 2.6% 4.3% ~4%* 1 Excludes the impact of the pension settlement charge recorded in Q4 2017 which reduced gross margin *6-7% in 2018 by $4.8M or 1.1%, increased SG&A by $6.5M or 1.5%, and increased R&D by $2.1M or 0.5%. Targeting 10% Annual Growth (Organic + Inorganic) 19

Appendix 20

CTS Core Values 21

Financial Summary ($ Millions, except percentages and Adjusted Diluted EPS) Q3 YTD 2018 2017 2016 2015 Net Sales $350.4 $423.0 $396.7 $382.3 Adjusted Gross Margin $122.3 $145.2 $140.4 $127.1 Adjusted Gross Margin % of Sales 34.9% 34.3% 35.4% 33.2% Depreciation and Amortization $16.3 $20.7 $19.0 $16.3 Adjusted EBITDA $67.2 $80.0 $77.4 $60.9 Adjusted EBITDA % of Sales 19.2% 18.9% 19.5% 15.9% Adjusted Diluted EPS $1.12 $1.23 $1.08 $0.93 Operating Cash Flow $42.6 $58.0 $47.2 $39.2 Total Debt / Capitalization 11.7% 18.2% 22.1% 24.4% Note: See Regulation G reconciliations from GAAP to Non-GAAP measures and adjustments. 22

Regulation G Schedules Adjusted Gross Margin ($ Millions, except percentages) Q3 Year-to-Date Full Year 2018 2017 2018 2017 2017 2016 2015 Gross margin $ 42.1 $ 37.5 $ 122.3 $ 107.6 $ 140.4 $ 140.4 $ 127.1 Adjustments to reported gross margin: Pension settlement charge - - - - 4.8 - - Adjusted gross margin $ 42.1 $ 37.5 $ 122.3 $ 107.6 $ 145.2 $ 140.4 $ 127.1 Sales $ 118.9 $ 106.2 $ 350.4 $ 312.1 $ 423.0 $ 396.7 $ 382.3 Adjusted gross margin as a % of sales 35.4% 35.3% 34.9% 34.5% 34.3% 35.4% 33.2% 23

Regulation G Schedules Adjusted EBITDA ($ Millions, except percentages) Q3 Year-to-Date Full Year 2018 2017 2018 2017 2017 2016 2015 Net earnings $ 10.2 $ 9.6 $ 29.0 $ 28.1 $ 14.4 $ 34.4 $ 7.0 Depreciation and amortization expense 5.4 5.4 16.3 15.1 20.7 19.0 16.3 Interest expense 0.5 0.8 1.6 2.2 3.3 3.7 2.6 Tax expense 4.1 4.3 12.3 12.0 25.8 22.9 5.3 EBITDA 20.2 20.1 59.2 57.4 64.2 80.0 31.2 Adjustments to EBITDA: Restructuring charges 1.0 1.4 3.4 2.9 4.1 3.0 15.2 Loss on sale-leaseback - - - - - 0.1 - Loss (gain) on sale of facilities, net of expenses - 0.7 - 0.7 0.7 (11.1) - Non-recurring environmental charge - 1.0 - - - 14.5 Pension settlement charge - - - 13.4 - - Transaction costs and other one-time costs - - - 0.3 0.5 0.8 - Lease termination charge - - - - 0.1 0.8 - Foreign currency loss (gain) 1.7 (1.0) 2.6 (2.5) (3.0) 3.8 - Non-recurring costs of tax improvement initiatives 0.2 - 1.0 - - - - Total adjustments to reported operating earnings 3.0 1.1 8.0 1.4 15.8 (2.6) 29.7 Adjusted EBITDA $ 23.2 $ 21.2 $ 67.2 $ 58.8 $ 80.0 $ 77.4 $ 60.9 Sales $ 118.9 $ 106.2 $ 350.4 $ 312.1 $ 423.0 $ 396.7 $ 382.3 Adjusted EBITDA as a % of sales 19.5% 20.0% 19.2% 18.8% 18.9% 19.5% 15.9% 24

Regulation G Schedules Adjusted Diluted EPS Q3 Year-to-Date Full Year 2018 2017 2018 2017 2017 2016 2015 Diluted earnings per share $ 0.30 $ 0.29 $ 0.86 $ 0.84 $ 0.43 $ 1.03 $ 0.21 Tax affected adjustments to reported diluted earnings per share: Restructuring charges 0.02 0.03 0.08 0.05 0.08 0.06 0.40 Increase in valuation allowance and revaluation of deferred taxes as a result of restructuring activities - - - - - 0.07 - Loss (gain) on sale of facilities, net of expenses - 0.01 - 0.01 0.01 (0.22) - Non-recurring environmental charge - 0.02 - - - 0.27 Pension settlement charge - - - - 0.26 - - Transaction costs and other one-time costs - - - 0.01 0.01 0.02 - Lease termination charge - - - - - 0.02 - Foreign currency loss (gain) 0.04 (0.02) 0.06 (0.06) (0.07) 0.09 - Tax impact of cash repatriation - - - - - 0.26 (Decrease) increase in recognition of valuation allowances - - - (0.01) (0.05) 0.03 0.10 Tax impact of non-recurring stock compensation charge - - - - - (0.02) - Increase in reserve on uncertain tax benefits - - - - - - 0.17 Tax impact of U.S. tax reform - - - - 0.54 - - Tax impact of other foreign taxes - - - - 0.02 - (0.48) Discrete tax items 0.02 - 0.07 - - - - Non-recurring costs of tax improvement initiatives 0.01 - 0.03 - - - - Adjusted diluted earnings per share $ 0.39 $ 0.31 $ 1.12 $ 0.84 $ 1.23 $ 1.08 $ 0.93 Total Debt to Capitalization Q3 As of December 31 ($ Millions, except percentages) 2018 2017 2017 2016 2015 Total debt (A) $ 50.0 $ 82.3 $ 76.3 $ 90.1 $ 90.7 Total shareholders' equity(B) $ 376.2 $ 346.6 $ 343.8 $ 317.9 $ 281.7 Total capitalization (A+B) $ 426.2 $ 428.9 $ 420.1 $ 408.0 $ 372.4 Total debt to capitalization 11.7% 19.2% 18.2% 22.1% 24.4% 25