Attached files

| file | filename |

|---|---|

| EX-99.3 - EX-99.3 - ORRSTOWN FINANCIAL SERVICES INC | d608644dex993.htm |

| EX-99.2 - EX-99.2 - ORRSTOWN FINANCIAL SERVICES INC | d608644dex992.htm |

| EX-10.3 - EX-10.3 - ORRSTOWN FINANCIAL SERVICES INC | d608644dex103.htm |

| EX-10.2 - EX-10.2 - ORRSTOWN FINANCIAL SERVICES INC | d608644dex102.htm |

| EX-10.1 - EX-10.1 - ORRSTOWN FINANCIAL SERVICES INC | d608644dex101.htm |

| EX-2.1 - EX-2.1 - ORRSTOWN FINANCIAL SERVICES INC | d608644dex21.htm |

| 8-K - FORM 8-K - ORRSTOWN FINANCIAL SERVICES INC | d608644d8k.htm |

Community Banking Franchise October 23, 2018 Creating a Premier Community Banking Franchise + Exhibit 99.1

Cautionary Note Regarding Forward-Looking Statements This document contains “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. These forward-looking statements include statements regarding the anticipated closing date of the transaction, estimated cost savings, tangible book value dilution and expected earn-back, the amount of accretion of the transaction to Orrstown’s earnings, internal rate of return, return on average assets and return on tangible common equity, and reflect the current views of Orrstown’s management with respect to, among other things, future events and Orrstown’s financial performance. These statements are often, but not always, made through the use of words or phrases such as “may,” “should,” “could,” “predict,” “potential,” “believe,” “will likely result,” “expect,” “continue,” “will,” “anticipate,” “seek,” “estimate,” “intend,” “plan,” “project,” “forecast,” “goal,” “target,” “would,” and “outlook,” or the negative variations of those words or other comparable words of a future or forward-looking nature. These forward-looking statements are not historical facts, and are based on current expectations, estimates and projections about Orrstown’s industry, management’s beliefs and certain assumptions made by management, many of which, by their nature, are inherently uncertain and beyond Orrstown’s control. Accordingly, Orrstown cautions you that any such forward-looking statements are not guarantees of future performance and are subject to risks, assumptions and uncertainties that are difficult to predict. Although Orrstown believes that the expectations reflected in these forward-looking statements are reasonable as of the date made, actual results may prove to be materially different from the results expressed or implied by the forward-looking statements. The following factors, among others listed in Orrstown’s Annual Report on Form 10-K and Quarterly Reports on Form 10-Q, could cause the actual results of Orrstown’s operations to differ materially from expectations: failure to obtain the approval of the shareholders of Hamilton in connection with the proposed acquisition; the timing to consummate the proposed acquisition; the risk that a condition to closing of the proposed acquisition may not be satisfied; the risk that a regulatory approval that may be required for the proposed acquisition is not obtained or is obtained subject to conditions that are not anticipated; the parties’ ability to achieve the synergies and value creation contemplated by the proposed acquisition; the parties’ ability to successfully integrate operations in the proposed acquisition; the effect of the announcement of the proposed acquisition on the ability of Hamilton to maintain relationships with its key partners, customers and employees, and on its operating results and business generally; competition; changes in economic conditions, interest rates and financial markets; and changes in legislation or regulatory requirements. The foregoing list of factors is not exhaustive. If one or more events related to these or other risks or uncertainties materialize, or if Orrstown’s underlying assumptions prove to be incorrect, actual results may differ materially from what Orrstown anticipates. Accordingly, you should not place undue reliance on any such forward-looking statements. Any forward-looking statement speaks only as of the date on which it is made, and Orrstown does not undertake any obligation to publicly update or review any forward-looking statement, whether as a result of new information, future developments, or otherwise. New risks and uncertainties arise from time to time, and it is not possible for Orrstown to predict those events or how they may affect it. In addition, Orrstown cannot assess the impact of each factor on Orrstown’s business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements. All forward-looking statements, expressed or implied, included in this document are expressly qualified in their entirety by this cautionary statement. This cautionary statement should also be considered in connection with any subsequent written or oral forward-looking statements that Orrstown or persons acting on Orrstown’s behalf may issue. Annualized, pro forma, projected, and estimated numbers are used for illustrative purposes only, are not forecasts and may not reflect actual results. In addition, please refer to the Risk Factors listed in Orrstown’s Annual Report on Form 10-K and Quarterly Reports on Form 10-Q.

Additional Information and Where to Find It In connection with the proposed acquisition, Orrstown will file with the Securities and Exchange Commission (the “SEC”) a Registration Statement on Form S-4 that will include a Proxy Statement of Hamilton and a Prospectus of Orrstown as well as other relevant documents concerning the proposed acquisition. Investors and stockholders are encouraged to read the Registration Statement and Proxy Statement/Prospectus regarding the proposed acquisition when it becomes available and any other relevant documents filed with the SEC, as well as any amendments or supplements to those documents. A free copy of the Registration Statement and Proxy Statement/Prospectus, as well as other filings containing information about Orrstown and Hamilton, may be obtained from the SEC’s website, www.sec.gov as they become available. Copies of the Registration Statement and Proxy Statement/Prospectus (when available) and the filings that will be incorporated therein by reference may also be obtained, free of charge, from Orrstown’s website, www.orrstown.com, or by contacting Orrstown’s Executive Vice President and Chief Financial Officer, David P. Boyle, at (717) 530-2294. Orrstown Investor Relations Contacts: Hamilton Investor Relations Contact: Thomas R. Quinn, Jr. President and Chief Executive Officer Phone: (717) 530-2602 Email: tquinn@orrstown.com David P. Boyle Executive Vice President and Chief Financial Officer Phone: (717) 530-2294 Email: dboyle@orrstown.com Bob DeAlmeida President and Chief Executive Officer Phone: (410) 823-4510 Email: rdealmeida@hamilton-bank.com

Transaction Overview and Impact

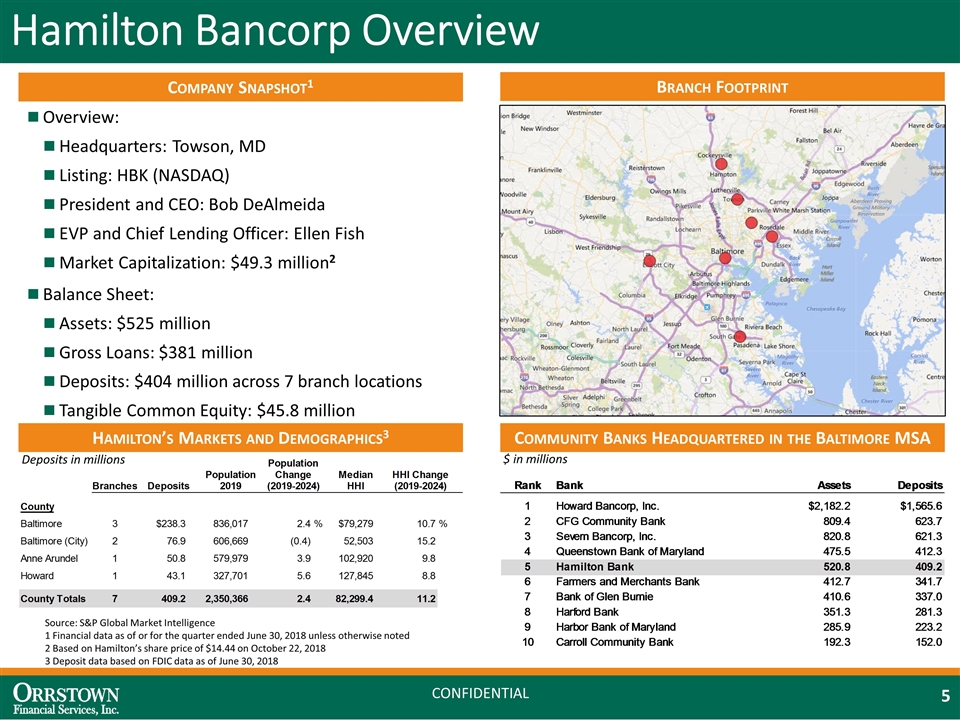

Overview: Headquarters: Towson, MD Listing: HBK (NASDAQ) President and CEO: Bob DeAlmeida EVP and Chief Lending Officer: Ellen Fish Market Capitalization: $49.3 million2 Balance Sheet: Assets: $525 million Gross Loans: $381 million Deposits: $404 million across 7 branch locations Tangible Common Equity: $45.8 million Company Snapshot1 Branch Footprint Hamilton Bancorp Overview Community Banks Headquartered in the Baltimore MSA Source: S&P Global Market Intelligence 1 Financial data as of or for the quarter ended June 30, 2018 unless otherwise noted 2 Based on Hamilton’s share price of $14.44 on October 22, 2018 3 Deposit data based on FDIC data as of June 30, 2018 $ in millions Hamilton’s Markets and Demographics3 Deposits in millions

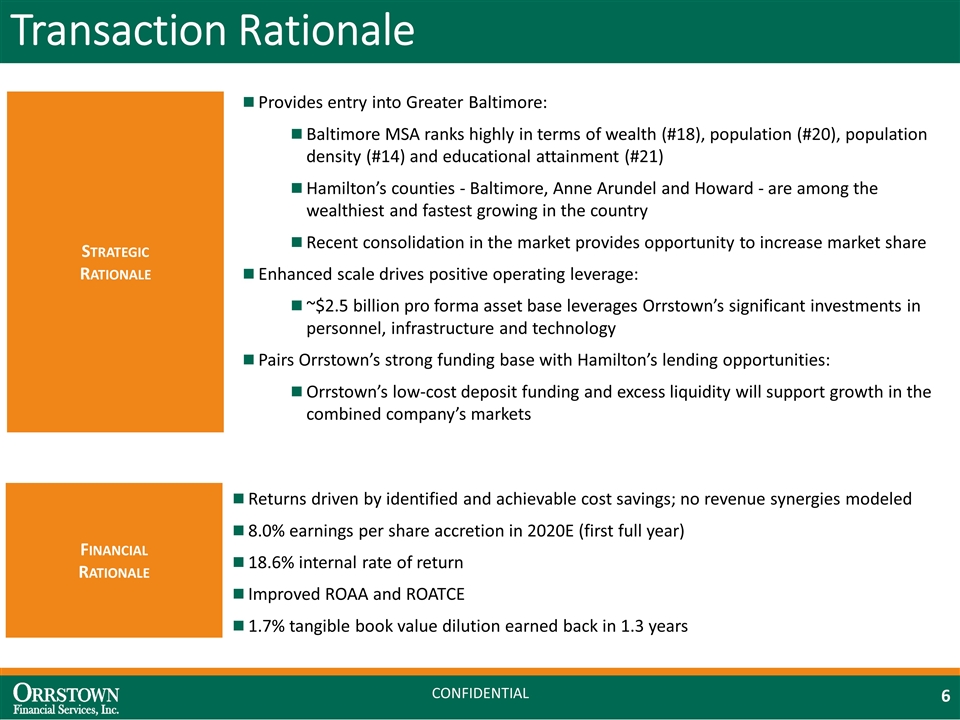

Transaction Rationale Strategic Rationale Provides entry into Greater Baltimore: Baltimore MSA ranks highly in terms of wealth (#18), population (#20), population density (#14) and educational attainment (#21) Hamilton’s counties - Baltimore, Anne Arundel and Howard - are among the wealthiest and fastest growing in the country Recent consolidation in the market provides opportunity to increase market share Enhanced scale drives positive operating leverage: ~$2.5 billion pro forma asset base leverages Orrstown’s significant investments in personnel, infrastructure and technology Pairs Orrstown’s strong funding base with Hamilton’s lending opportunities: Orrstown’s low-cost deposit funding and excess liquidity will support growth in the combined company’s markets Financial Rationale Returns driven by identified and achievable cost savings; no revenue synergies modeled 8.0% earnings per share accretion in 2020E (first full year) 18.6% internal rate of return Improved ROAA and ROATCE 1.7% tangible book value dilution earned back in 1.3 years

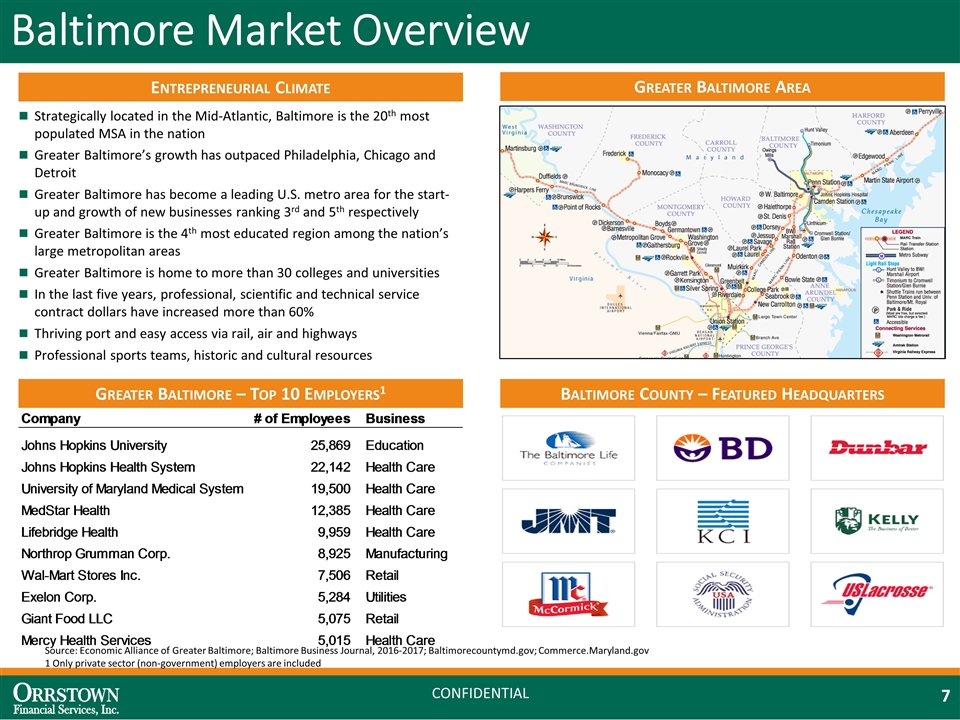

Baltimore Market Overview Entrepreneurial Climate Greater Baltimore Area Baltimore County – Featured Headquarters Greater Baltimore – Top 10 Employers1 Strategically located in the Mid-Atlantic, Baltimore is the 20th most populated MSA in the nation Greater Baltimore’s growth has outpaced Philadelphia, Chicago and Detroit Greater Baltimore has become a leading U.S. metro area for the start-up and growth of new businesses ranking 3rd and 5th respectively Greater Baltimore is the 4th most educated region among the nation’s large metropolitan areas Greater Baltimore is home to more than 30 colleges and universities In the last five years, professional, scientific and technical service contract dollars have increased more than 60% Thriving port and easy access via rail, air and highways Professional sports teams, historic and cultural resources Source: Economic Alliance of Greater Baltimore; Baltimore Business Journal, 2016-2017; Baltimorecountymd.gov; Commerce.Maryland.gov 1 Only private sector (non-government) employers are included

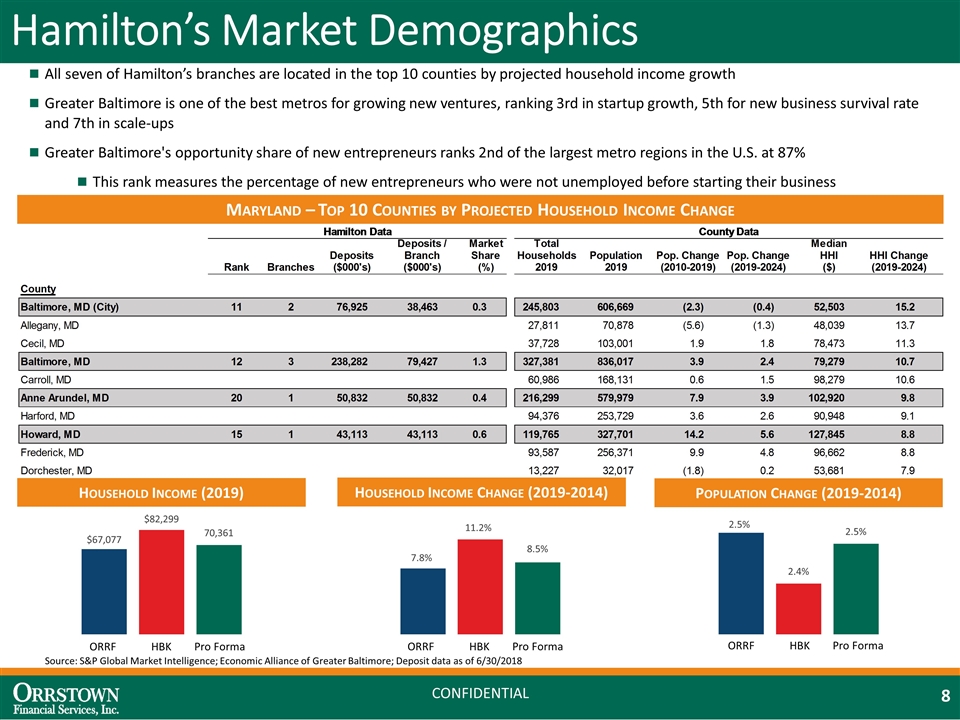

Hamilton’s Market Demographics All seven of Hamilton’s branches are located in the top 10 counties by projected household income growth Greater Baltimore is one of the best metros for growing new ventures, ranking 3rd in startup growth, 5th for new business survival rate and 7th in scale-ups Greater Baltimore's opportunity share of new entrepreneurs ranks 2nd of the largest metro regions in the U.S. at 87% This rank measures the percentage of new entrepreneurs who were not unemployed before starting their business Maryland – Top 10 Counties by Projected Household Income Change Source: S&P Global Market Intelligence; Economic Alliance of Greater Baltimore; Deposit data as of 6/30/2018 Household Income (2019) Household Income Change (2019-2014) Population Change (2019-2014) ORRF HBK Pro Forma ORRF HBK Pro Forma ORRF HBK Pro Forma

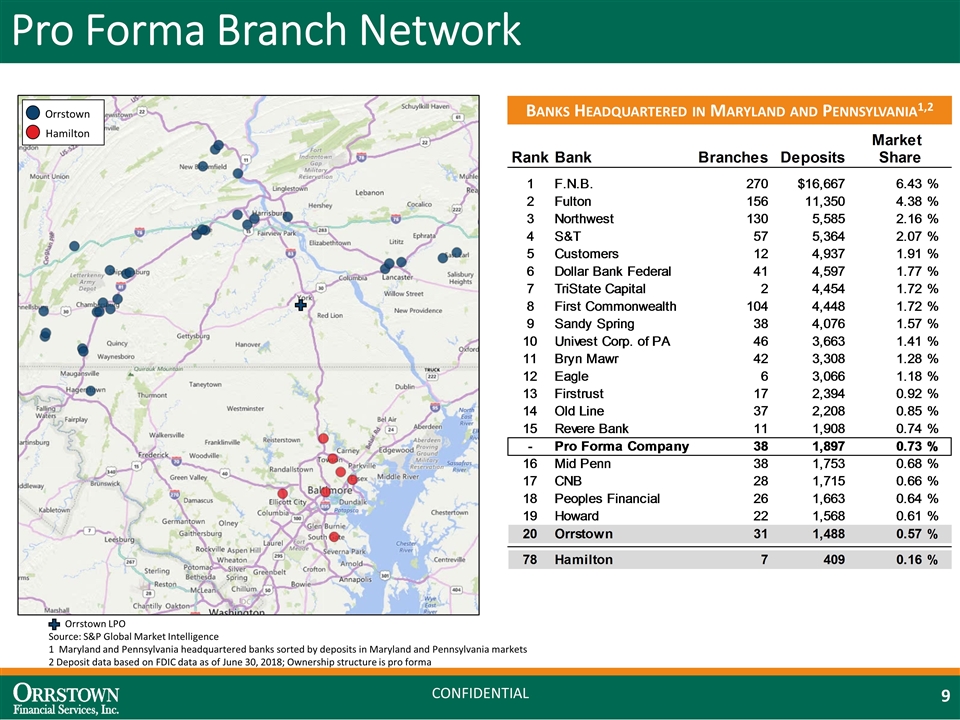

Hamilton Orrstown Pro Forma Branch Network Orrstown LPO Source: S&P Global Market Intelligence 1 Maryland and Pennsylvania headquartered banks sorted by deposits in Maryland and Pennsylvania markets 2 Deposit data based on FDIC data as of June 30, 2018; Ownership structure is pro forma Banks Headquartered in Maryland and Pennsylvania1,2

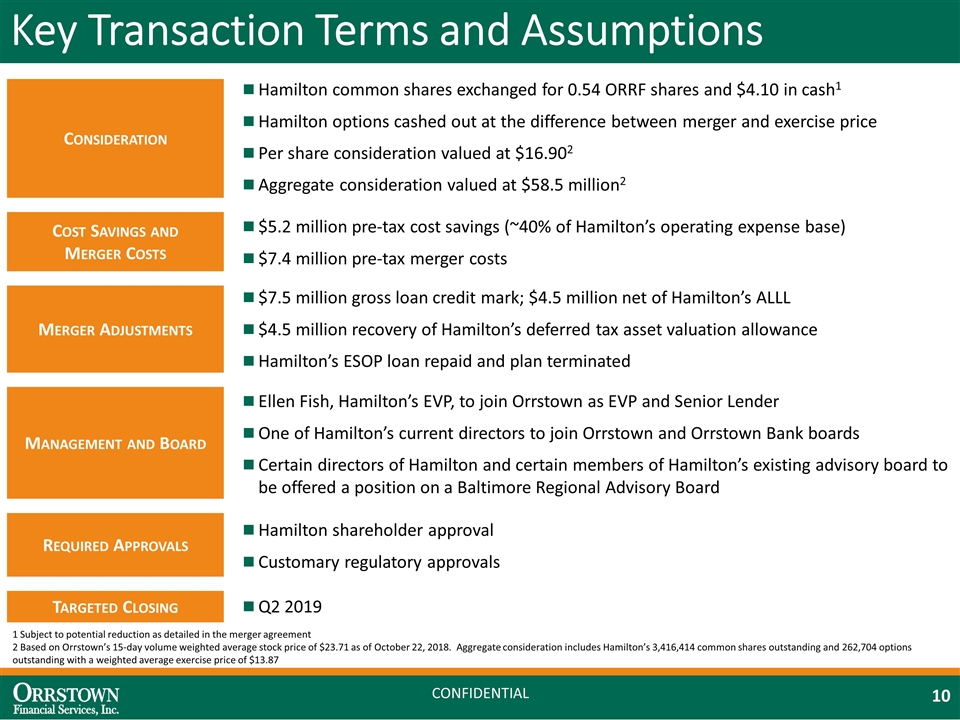

Key Transaction Terms and Assumptions Consideration Hamilton common shares exchanged for 0.54 ORRF shares and $4.10 in cash1 Hamilton options cashed out at the difference between merger and exercise price Per share consideration valued at $16.902 Aggregate consideration valued at $58.5 million2 1 Subject to potential reduction as detailed in the merger agreement 2 Based on Orrstown’s 15-day volume weighted average stock price of $23.71 as of October 22, 2018. Aggregate consideration includes Hamilton’s 3,416,414 common shares outstanding and 262,704 options outstanding with a weighted average exercise price of $13.87 Cost Savings and Merger Costs $5.2 million pre-tax cost savings (~40% of Hamilton’s operating expense base) $7.4 million pre-tax merger costs Merger Adjustments $7.5 million gross loan credit mark; $4.5 million net of Hamilton’s ALLL $4.5 million recovery of Hamilton’s deferred tax asset valuation allowance Hamilton’s ESOP loan repaid and plan terminated Management and Board Ellen Fish, Hamilton’s EVP, to join Orrstown as EVP and Senior Lender One of Hamilton’s current directors to join Orrstown and Orrstown Bank boards Certain directors of Hamilton and certain members of Hamilton’s existing advisory board to be offered a position on a Baltimore Regional Advisory Board Required Approvals Hamilton shareholder approval Customary regulatory approvals Targeted Closing Q2 2019

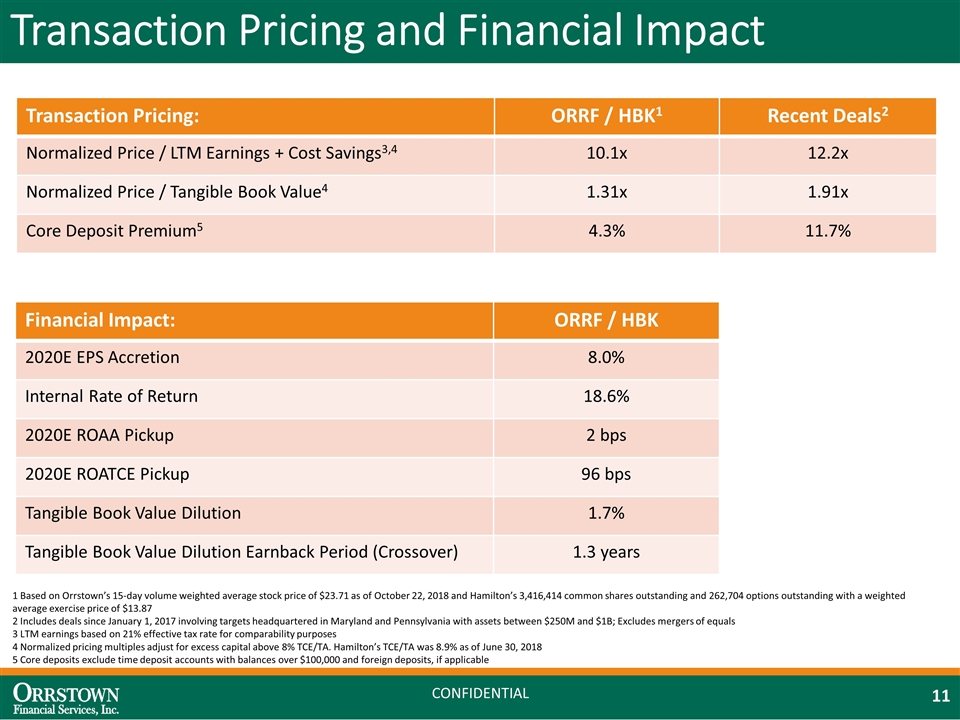

Transaction Pricing and Financial Impact Transaction Pricing: ORRF / HBK1 Recent Deals2 Normalized Price / LTM Earnings + Cost Savings3,4 10.1x 12.2x Normalized Price / Tangible Book Value4 1.31x 1.91x Core Deposit Premium5 4.3% 11.7% 1 Based on Orrstown’s 15-day volume weighted average stock price of $23.71 as of October 22, 2018 and Hamilton’s 3,416,414 common shares outstanding and 262,704 options outstanding with a weighted average exercise price of $13.87 2 Includes deals since January 1, 2017 involving targets headquartered in Maryland and Pennsylvania with assets between $250M and $1B; Excludes mergers of equals 3 LTM earnings based on 21% effective tax rate for comparability purposes 4 Normalized pricing multiples adjust for excess capital above 8% TCE/TA. Hamilton’s TCE/TA was 8.9% as of June 30, 2018 5 Core deposits exclude time deposit accounts with balances over $100,000 and foreign deposits, if applicable Financial Impact: ORRF / HBK 2020E EPS Accretion 8.0% Internal Rate of Return 18.6% 2020E ROAA Pickup 2 bps 2020E ROATCE Pickup 96 bps Tangible Book Value Dilution 1.7% Tangible Book Value Dilution Earnback Period (Crossover) 1.3 years

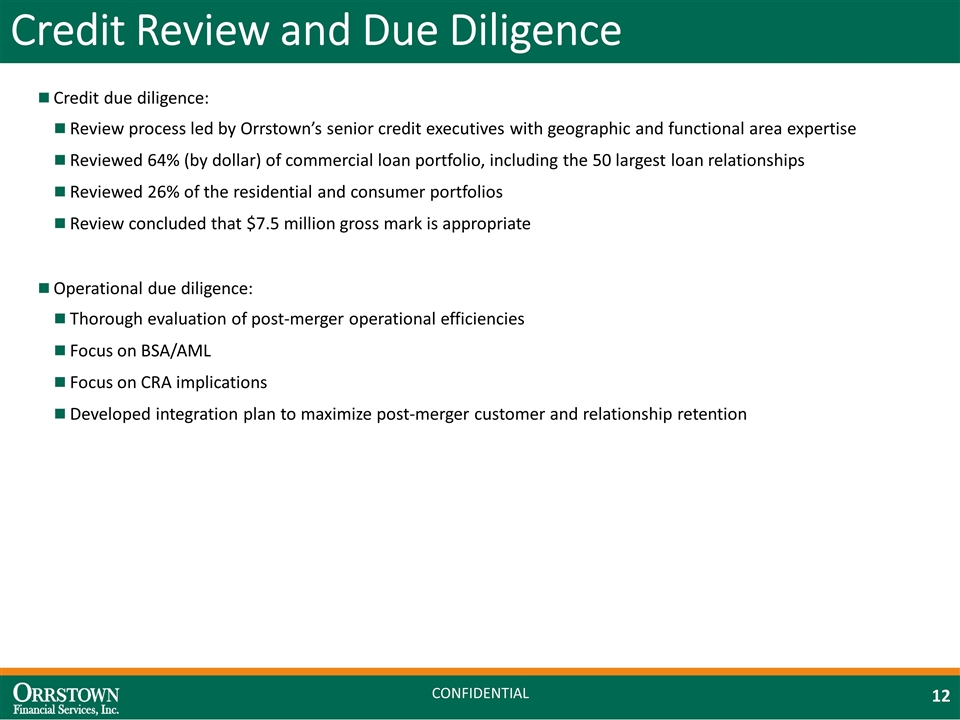

Credit Review and Due Diligence Credit due diligence: Review process led by Orrstown’s senior credit executives with geographic and functional area expertise Reviewed 64% (by dollar) of commercial loan portfolio, including the 50 largest loan relationships Reviewed 26% of the residential and consumer portfolios Review concluded that $7.5 million gross mark is appropriate Operational due diligence: Thorough evaluation of post-merger operational efficiencies Focus on BSA/AML Focus on CRA implications Developed integration plan to maximize post-merger customer and relationship retention

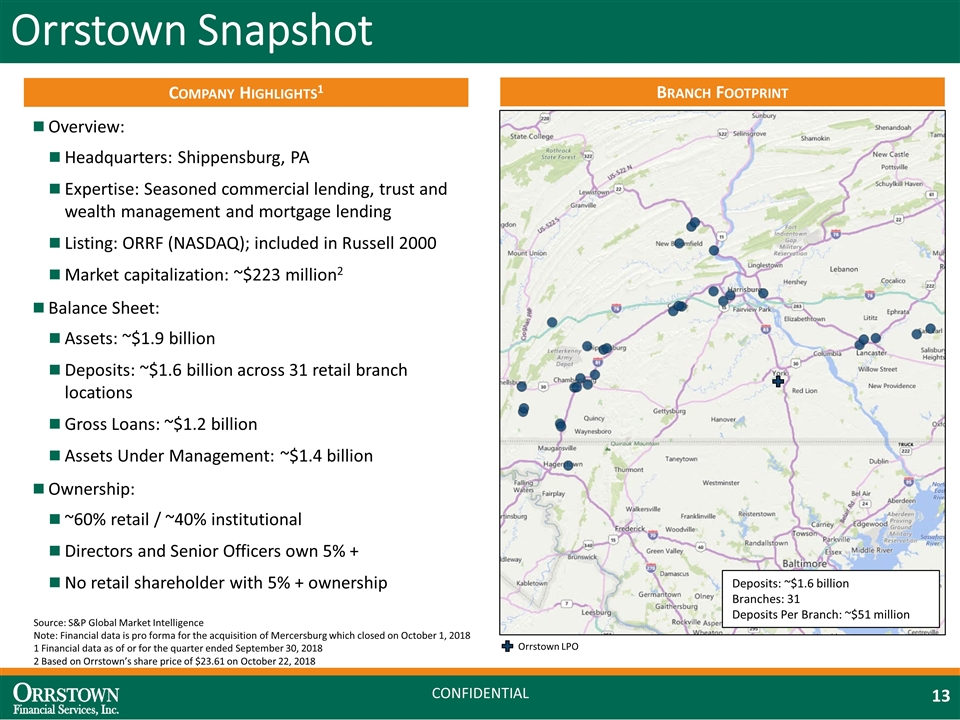

Overview: Headquarters: Shippensburg, PA Expertise: Seasoned commercial lending, trust and wealth management and mortgage lending Listing: ORRF (NASDAQ); included in Russell 2000 Market capitalization: ~$223 million2 Balance Sheet: Assets: ~$1.9 billion Deposits: ~$1.6 billion across 31 retail branch locations Gross Loans: ~$1.2 billion Assets Under Management: ~$1.4 billion Ownership: ~60% retail / ~40% institutional Directors and Senior Officers own 5% + No retail shareholder with 5% + ownership Company Highlights1 Branch Footprint Deposits: ~$1.6 billion Branches: 31 Deposits Per Branch: ~$51 million Orrstown Snapshot Source: S&P Global Market Intelligence Note: Financial data is pro forma for the acquisition of Mercersburg which closed on October 1, 2018 1 Financial data as of or for the quarter ended September 30, 2018 2 Based on Orrstown’s share price of $23.61 on October 22, 2018 Orrstown LPO

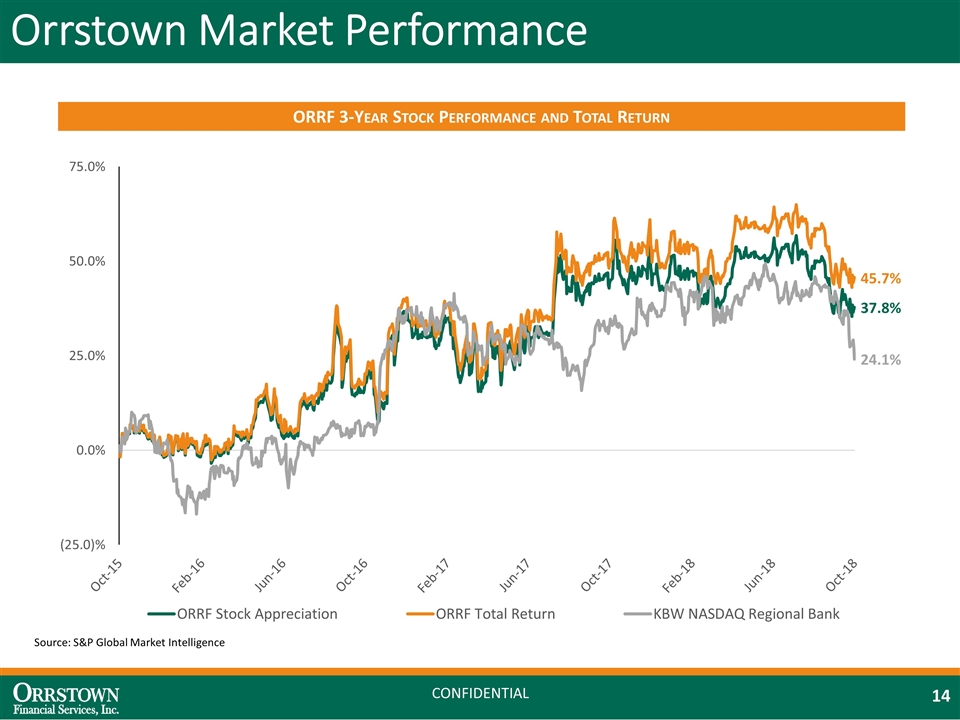

ORRF 3-Year Stock Performance and Total Return Orrstown Market Performance Source: S&P Global Market Intelligence

Appendix

Glossary of Terms AML: Anti-Money Laundering Bps: Basis Points BSA: Bank Secrecy Act CRA: Community Reinvestment Act EPS: Earnings Per Share ESOP: Employee Stock Ownership Plan HHI: Household Income LTM: Last Twelve Months MSA: Metropolitan Statistical Area ROAA: Return on Average Assets ROATCE: Return on Average Tangible Common Equity

Building A Premier Community Banking Franchise October 23, 2018 + Future Success