Attached files

| file | filename |

|---|---|

| EX-99.2 - EXHIBIT 99.2 - MARTIN MIDSTREAM PARTNERS L.P. | a3q2018mmlpearningssumma.htm |

| EX-99.1 - EXHIBIT 99.1 - MARTIN MIDSTREAM PARTNERS L.P. | exhibit991earningspressrel.htm |

| EX-10.1 - EXHIBIT 10.1 - MARTIN MIDSTREAM PARTNERS L.P. | exhibit101stockpurchaseagr.htm |

| 8-K - 8-K - MARTIN MIDSTREAM PARTNERS L.P. | a20180930form8k-earningsre.htm |

Exhibit 99.3 ACQUISITION OF MARTIN TRANSPORT, INC. www.martinmidstream.com

Forward Looking Statements

Martin Transport, Inc. • Surface Transportation fleet consisting of 561 trucks and 1,307 trailers • Operations from 23 strategically located terminals (Gulf Coast & Midwest) • MTI operates a fleet of tank trucks that haul general chemicals such as sulfuric acid, resins and molten sulfur; petroleum products such as crude oil, lube oil, solvents and asphalt; pressurized liquids such as propane, butane, LPG and LNG; and many more

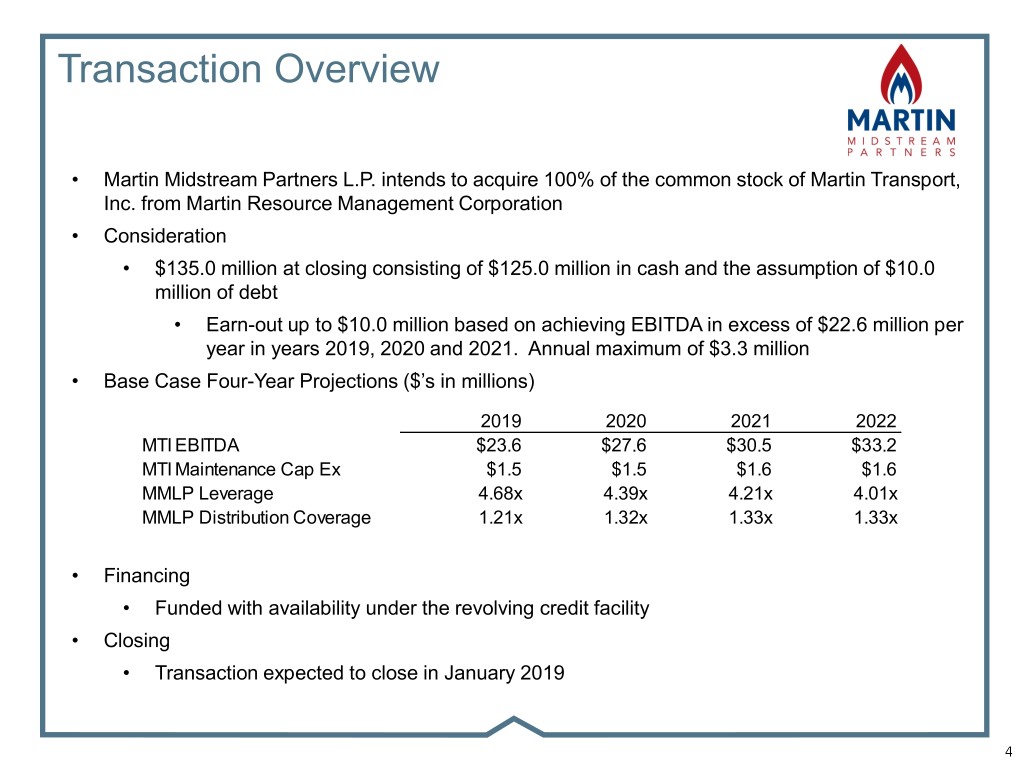

Transaction Overview • Martin Midstream Partners L.P. intends to acquire 100% of the common stock of Martin Transport, Inc. from Martin Resource Management Corporation • Consideration • $135.0 million at closing consisting of $125.0 million in cash and the assumption of $10.0 million of debt • Earn-out up to $10.0 million based on achieving EBITDA in excess of $22.6 million per year in years 2019, 2020 and 2021. Annual maximum of $3.3 million • Base Case Four-Year Projections ($’s in millions) 2019 2020 2021 2022 MTI EBITDA $23.6 $27.6 $30.5 $33.2 MTI Maintenance Cap Ex $1.5 $1.5 $1.6 $1.6 MMLP Leverage 4.68x 4.39x 4.21x 4.01x MMLP Distribution Coverage 1.21x 1.32x 1.33x 1.33x • Financing • Funded with availability under the revolving credit facility • Closing • Transaction expected to close in January 2019

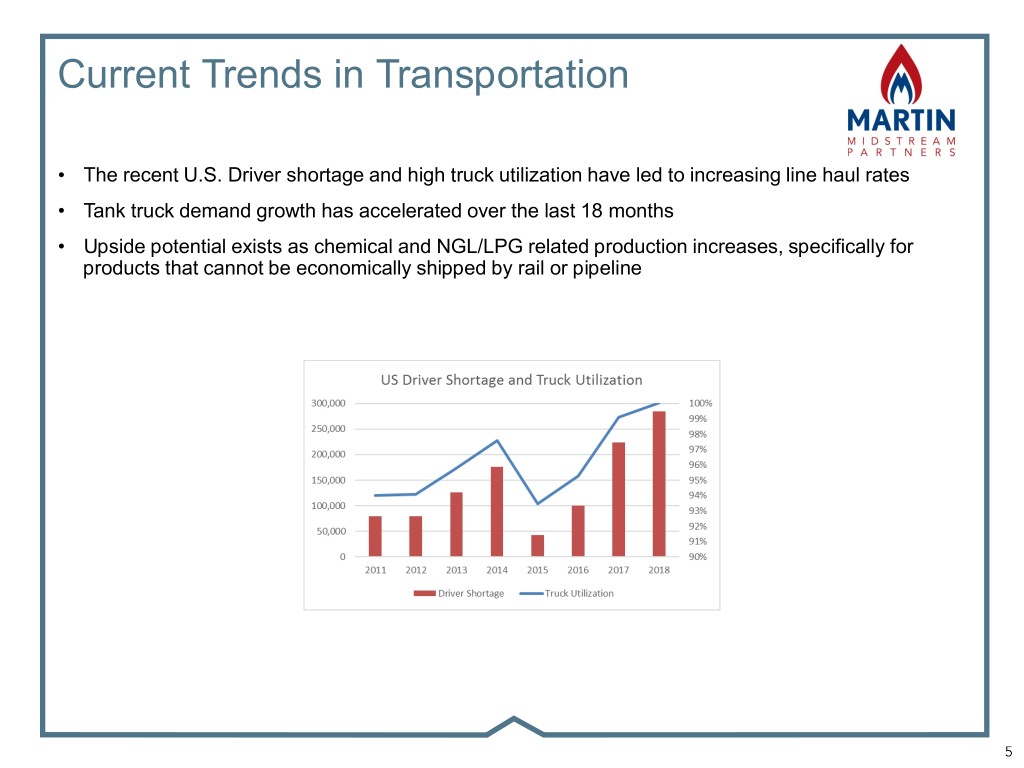

Current Trends in Transportation • The recent U.S. Driver shortage and high truck utilization have led to increasing line haul rates • Tank truck demand growth has accelerated over the last 18 months • Upside potential exists as chemical and NGL/LPG related production increases, specifically for products that cannot be economically shipped by rail or pipeline

Transaction Summary • Strategic • Integrates with core businesses to ensure we can serve our customers needs during current tightness in the transportation industry • Continued emphasis on refinery services • Strong footprint in the industries and geographic locations that are served • Knowledgeable management group with over 30 years experience in the trucking industry • Growth Opportunities • Increased trucking volumes related to: • Refining intermediate products due to the marine fuel specification decision (IMO 2020) • Startup of new ethane crackers and other chemical units for products that cannot be economically moved by pipeline or rail • Current asset base is positioned to serve increasing truck volume with minimal capital needs

4200 B STONE ROAD KILGORE, TEXAS 75662 877-256-6644 WWW.MARTINMIDSTREAM.COM IR@MARTINMLP.COM