Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - CONNECTICUT WATER SERVICE INC / CT | d642963d8k.htm |

Exhibit 99.1 An Ideal Combination CTWS + SJW Group October 2018Exhibit 99.1 An Ideal Combination CTWS + SJW Group October 2018

Forward Looking Statements This document contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, as amended. Some of these forward-looking statements can be identified by the use of forward-looking words such as “believes,” “expects,” “may,” “will,” “should,” “seeks,” “approximately,” “intends,” “plans,” “estimates,” “projects,” “strategy,” or “anticipates,” or the negative of those words or other comparable terminology. The accuracy of such statements is subject to a number of risks, uncertainties and assumptions including, but not limited to, the following factors: (1) the risk that the conditions to the closing of the transaction are not satisfied, including the risk that required approval from the shareholders of Connecticut Water (“CTWS”) for the transaction is not obtained; (2) the risk that the regulatory approvals required for the transaction are not obtained, on the terms expected or on the anticipated schedule; (3) the effect of water, utility, environmental and other governmental policies and regulations; (4) litigation relating to the transaction; (5) the ability of the parties to the transaction to meet expectations regarding the timing, completion and accounting and tax treatments of the proposed transaction; (6) the occurrence of any event, change or other circumstance that could give rise to the termination of the transaction agreement between the parties to the proposed transaction; (7) changes in demand for water and other products and services of Connecticut Water; (8) unanticipated weather conditions; (9) catastrophic events such as fires, earthquakes, explosions, floods, ice storms, tornadoes, terrorist acts, physical attacks, cyber-attacks, or other similar occurrences that could adversely affect Connecticut Water’s facilities, operations, financial condition, results of operations, and reputation; (10) risks that the proposed transaction disrupts the current plans and operations of Connecticut Water; (11) potential difficulties in employee retention as a result of the proposed transaction; (12) unexpected costs, charges or expenses resulting from the transaction; (13) the effect of the announcement or pendency of the proposed transaction on Connecticut Water’s business relationships, operating results, and business generally, including, without limitation, competitive responses to the proposed transaction; (14) risks related to diverting management’s attention from ongoing business operations of Connecticut Water; (15) the trading price of Connecticut Water’s common stock; and (16) legislative and economic developments. In addition, actual results are subject to other risks and uncertainties that relate more broadly to Connecticut Water’s overall business and financial condition, including those more fully described in Connecticut Water’s filings with the U.S. Securities and Exchange Commission (the “SEC”), including, without limitation, its annual report on Form 10-K for the fiscal year ended December 31, 2017 and its quarterly report on Form 10-Q for the period ended June 30, 2018. Forward-looking statements are not guarantees of performance, and speak only as of the date made, and none of SJW Group, its management, Connecticut Water or its management undertakes any obligation to update or revise any forward-looking statements except as required by law. 2Forward Looking Statements This document contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, as amended. Some of these forward-looking statements can be identified by the use of forward-looking words such as “believes,” “expects,” “may,” “will,” “should,” “seeks,” “approximately,” “intends,” “plans,” “estimates,” “projects,” “strategy,” or “anticipates,” or the negative of those words or other comparable terminology. The accuracy of such statements is subject to a number of risks, uncertainties and assumptions including, but not limited to, the following factors: (1) the risk that the conditions to the closing of the transaction are not satisfied, including the risk that required approval from the shareholders of Connecticut Water (“CTWS”) for the transaction is not obtained; (2) the risk that the regulatory approvals required for the transaction are not obtained, on the terms expected or on the anticipated schedule; (3) the effect of water, utility, environmental and other governmental policies and regulations; (4) litigation relating to the transaction; (5) the ability of the parties to the transaction to meet expectations regarding the timing, completion and accounting and tax treatments of the proposed transaction; (6) the occurrence of any event, change or other circumstance that could give rise to the termination of the transaction agreement between the parties to the proposed transaction; (7) changes in demand for water and other products and services of Connecticut Water; (8) unanticipated weather conditions; (9) catastrophic events such as fires, earthquakes, explosions, floods, ice storms, tornadoes, terrorist acts, physical attacks, cyber-attacks, or other similar occurrences that could adversely affect Connecticut Water’s facilities, operations, financial condition, results of operations, and reputation; (10) risks that the proposed transaction disrupts the current plans and operations of Connecticut Water; (11) potential difficulties in employee retention as a result of the proposed transaction; (12) unexpected costs, charges or expenses resulting from the transaction; (13) the effect of the announcement or pendency of the proposed transaction on Connecticut Water’s business relationships, operating results, and business generally, including, without limitation, competitive responses to the proposed transaction; (14) risks related to diverting management’s attention from ongoing business operations of Connecticut Water; (15) the trading price of Connecticut Water’s common stock; and (16) legislative and economic developments. In addition, actual results are subject to other risks and uncertainties that relate more broadly to Connecticut Water’s overall business and financial condition, including those more fully described in Connecticut Water’s filings with the U.S. Securities and Exchange Commission (the “SEC”), including, without limitation, its annual report on Form 10-K for the fiscal year ended December 31, 2017 and its quarterly report on Form 10-Q for the period ended June 30, 2018. Forward-looking statements are not guarantees of performance, and speak only as of the date made, and none of SJW Group, its management, Connecticut Water or its management undertakes any obligation to update or revise any forward-looking statements except as required by law. 2

CTWS Board Unanimously Recommends Shareholders Vote the GREEN Proxy Card “FOR” the SJW Group Combination Combination with SJW Group delivers a significant, certain premium of 33% to the unaffected 1 CTWS stock price , with the all-cash $70.00/share price exceeding CTWS’ unaffected all-time 1 2 high share price Represents a highly attractive Price-to-Earnings (P/E) multiple of 30.1x CTWS’ 2018E earnings 2 3 per share, the highest of any utility transaction announced since 2016 Transaction is the result of an independent, thorough Board-led process designed to deliver 3 superior value to CTWS shareholders, while also delivering significant stakeholder benefits as a regulated public utility To provide assurance that every viable alternative had been considered, CTWS conducted a robust 45-day go-shop process with the assistance of independent financial advisors and also 4 engaged with Eversource – no indications of interest or superior proposals were received 1 CTWS unaffected closing stock price on March 14, 2018 (the last trading day before the original merger transaction with SJW Group was announced) 2 CTWS highest all-time closing stock price prior to March 15, 2018 (the day the original merger transaction with SJW Group was announced) 3 Selected public-to-public electric, gas and water utility transactions announced since January 1, 2016 Source: Source: CapitalIQ, FactSet, public filings, investor presentations 3CTWS Board Unanimously Recommends Shareholders Vote the GREEN Proxy Card “FOR” the SJW Group Combination Combination with SJW Group delivers a significant, certain premium of 33% to the unaffected 1 CTWS stock price , with the all-cash $70.00/share price exceeding CTWS’ unaffected all-time 1 2 high share price Represents a highly attractive Price-to-Earnings (P/E) multiple of 30.1x CTWS’ 2018E earnings 2 3 per share, the highest of any utility transaction announced since 2016 Transaction is the result of an independent, thorough Board-led process designed to deliver 3 superior value to CTWS shareholders, while also delivering significant stakeholder benefits as a regulated public utility To provide assurance that every viable alternative had been considered, CTWS conducted a robust 45-day go-shop process with the assistance of independent financial advisors and also 4 engaged with Eversource – no indications of interest or superior proposals were received 1 CTWS unaffected closing stock price on March 14, 2018 (the last trading day before the original merger transaction with SJW Group was announced) 2 CTWS highest all-time closing stock price prior to March 15, 2018 (the day the original merger transaction with SJW Group was announced) 3 Selected public-to-public electric, gas and water utility transactions announced since January 1, 2016 Source: Source: CapitalIQ, FactSet, public filings, investor presentations 3

Agenda I. CTWS + SJW Group: An Ideal Combination II. Background to the Combination: Independent, Board-Led Process III. Conclusion 4Agenda I. CTWS + SJW Group: An Ideal Combination II. Background to the Combination: Independent, Board-Led Process III. Conclusion 4

CTWS + SJW GROUP: AN IDEAL COMBINATIONCTWS + SJW GROUP: AN IDEAL COMBINATION

Substantial Value Creation for CTWS Shareholders Significant, • $70.00 per share price delivers significant, certain value Certain, • All-cash consideration allows shareholders to realize immediate value and avoid market Immediate risk and share price volatility post-transaction Value 1 • $70.00 per share price represents a 33% premium to unaffected CTWS share price Compelling 2 Transaction • Consistent with the average premium paid in recent utility acquisitions Premium and • Exceeds CTWS’ unaffected all-time high of $63.55 prior to the announced merger with Valuation SJW Group on March 15, 2018 Highly • Implied 2018E P/E multiple of 30.1x represents the highest of any utility transaction Attractive 3 announced since 2016 Transaction 3 • 15% above the next highest forward P/E transaction multiple Multiple 1 Based on SJW Group’s revised offer of $70.00/share and CTWS’ unaffected, pre-announcement closing price of $52.57/share as of March 14, 2018 2 Average premium paid in closed or currently pending utility acquisition transactions since 2015 3 Selected public-to-public electric, gas and water utility transactions announced since January 1, 2016 6Substantial Value Creation for CTWS Shareholders Significant, • $70.00 per share price delivers significant, certain value Certain, • All-cash consideration allows shareholders to realize immediate value and avoid market Immediate risk and share price volatility post-transaction Value 1 • $70.00 per share price represents a 33% premium to unaffected CTWS share price Compelling 2 Transaction • Consistent with the average premium paid in recent utility acquisitions Premium and • Exceeds CTWS’ unaffected all-time high of $63.55 prior to the announced merger with Valuation SJW Group on March 15, 2018 Highly • Implied 2018E P/E multiple of 30.1x represents the highest of any utility transaction Attractive 3 announced since 2016 Transaction 3 • 15% above the next highest forward P/E transaction multiple Multiple 1 Based on SJW Group’s revised offer of $70.00/share and CTWS’ unaffected, pre-announcement closing price of $52.57/share as of March 14, 2018 2 Average premium paid in closed or currently pending utility acquisition transactions since 2015 3 Selected public-to-public electric, gas and water utility transactions announced since January 1, 2016 6

SJW Group Combination Consistent with Our Obligations and Responsibilities as a Regulated Utility Company — No changes in customer rates as a result of the combination — Commitment to make $200MM in annual capital investments across combined operations Customer — Existing superior customer service further enhanced by sharing of best practices, operational expertise and Benefits resources focused on delivering safe, reliable water service to all our communities — Experienced local employees and leadership will continue to serve customers under existing brands — No layoffs or job cuts as a result of transaction — No changes in compensation or benefit packages planned Commitment to — Company will retain passionate, dedicated team of locally-based leaders and employees Employees — New England headquarters remain in Clinton, CT with local leadership team — Improves opportunities for career development and geographic mobility — Company to maintain strong community ties and participation in local events and organizations — Continued support of local economic development and investments in growth, safety and reliability in the Dedication to communities served Communities — No use of Connecticut sources or supplies for the out-of-state sister companies — Funding for CTWS’ H O customer assistance program at the same or higher levels than the past three years 2 — Continued environmental stewardship and industry leadership on water conservation initiatives with an annual budget for customer oriented conservation programs — CTWS and SJW Group maintain position as industry leaders promoting water conservation and protection of Continued land and water resources Environmental — Additional notification and prioritization for open space and conservation for certain company-owned lands Focus — The combined company’s shared environmental ethics enables continual improvement across sustainable business practices — Continued responsible water resource management programs 7SJW Group Combination Consistent with Our Obligations and Responsibilities as a Regulated Utility Company — No changes in customer rates as a result of the combination — Commitment to make $200MM in annual capital investments across combined operations Customer — Existing superior customer service further enhanced by sharing of best practices, operational expertise and Benefits resources focused on delivering safe, reliable water service to all our communities — Experienced local employees and leadership will continue to serve customers under existing brands — No layoffs or job cuts as a result of transaction — No changes in compensation or benefit packages planned Commitment to — Company will retain passionate, dedicated team of locally-based leaders and employees Employees — New England headquarters remain in Clinton, CT with local leadership team — Improves opportunities for career development and geographic mobility — Company to maintain strong community ties and participation in local events and organizations — Continued support of local economic development and investments in growth, safety and reliability in the Dedication to communities served Communities — No use of Connecticut sources or supplies for the out-of-state sister companies — Funding for CTWS’ H O customer assistance program at the same or higher levels than the past three years 2 — Continued environmental stewardship and industry leadership on water conservation initiatives with an annual budget for customer oriented conservation programs — CTWS and SJW Group maintain position as industry leaders promoting water conservation and protection of Continued land and water resources Environmental — Additional notification and prioritization for open space and conservation for certain company-owned lands Focus — The combined company’s shared environmental ethics enables continual improvement across sustainable business practices — Continued responsible water resource management programs 7

SJW Group’s Offer Price Represents Unprecedented Value for CTWS Shareholders 1 CTWS Historical Share Price SJW Group Transaction: $70.00 $70.00 CTWS close price on $60.00 August 3, 2018: $62.85 $50.00 CTWS close price on March 14, 2018: $52.57 Last trading day prior to announcement of $40.00 original CTWS + SJW Group merger transaction $30.00 2015 2016 2017 2018 1 Three-year historical stock price prior to SJW Group acquisition announcement date of August 3, 2018 | Source: CapitalIQ 8SJW Group’s Offer Price Represents Unprecedented Value for CTWS Shareholders 1 CTWS Historical Share Price SJW Group Transaction: $70.00 $70.00 CTWS close price on $60.00 August 3, 2018: $62.85 $50.00 CTWS close price on March 14, 2018: $52.57 Last trading day prior to announcement of $40.00 original CTWS + SJW Group merger transaction $30.00 2015 2016 2017 2018 1 Three-year historical stock price prior to SJW Group acquisition announcement date of August 3, 2018 | Source: CapitalIQ 8

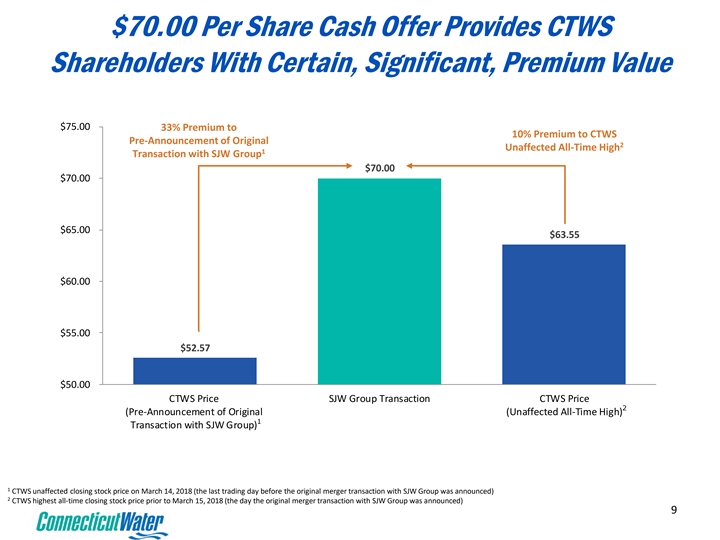

$70.00 Per Share Cash Offer Provides CTWS Shareholders With Certain, Significant, Premium Value $75.00 33% Premium to 10% Premium to CTWS Pre-Announcement of Original 2 Unaffected All-Time High 1 Transaction with SJW Group $70.00 $70.00 $65.00 $63.55 $60.00 $55.00 $52.57 $50.00 CTWS Price SJW Group Transaction CTWS Price 2 (Pre-Announcement of Original (Unaffected All-Time High) 1 Transaction with SJW Group) 1 CTWS unaffected closing stock price on March 14, 2018 (the last trading day before the original merger transaction with SJW Group was announced) 2 CTWS highest all-time closing stock price prior to March 15, 2018 (the day the original merger transaction with SJW Group was announced) 9$70.00 Per Share Cash Offer Provides CTWS Shareholders With Certain, Significant, Premium Value $75.00 33% Premium to 10% Premium to CTWS Pre-Announcement of Original 2 Unaffected All-Time High 1 Transaction with SJW Group $70.00 $70.00 $65.00 $63.55 $60.00 $55.00 $52.57 $50.00 CTWS Price SJW Group Transaction CTWS Price 2 (Pre-Announcement of Original (Unaffected All-Time High) 1 Transaction with SJW Group) 1 CTWS unaffected closing stock price on March 14, 2018 (the last trading day before the original merger transaction with SJW Group was announced) 2 CTWS highest all-time closing stock price prior to March 15, 2018 (the day the original merger transaction with SJW Group was announced) 9

SJW Group Transaction Would Represent Highest Forward 1 P/E Multiple for Any Public Utility Transaction Since 2016 32.0x 30.1x 28.0x 24.0x 2 Average: 23.4x 20.0x 16.0x SJW Group WGL / Avista / Vectren / Empire District / ITC / SCANA / Transaction AltaGas Hydro One CenterPoint Algonquin Fortis Dominion 1 Selected electric, gas and water utility transactions announced since January 1, 2016 2 Average forward P/E multiple for selected transactions, excluding SJW Group transaction Source: Public filings, equity research, SNL, Capital IQ 10SJW Group Transaction Would Represent Highest Forward 1 P/E Multiple for Any Public Utility Transaction Since 2016 32.0x 30.1x 28.0x 24.0x 2 Average: 23.4x 20.0x 16.0x SJW Group WGL / Avista / Vectren / Empire District / ITC / SCANA / Transaction AltaGas Hydro One CenterPoint Algonquin Fortis Dominion 1 Selected electric, gas and water utility transactions announced since January 1, 2016 2 Average forward P/E multiple for selected transactions, excluding SJW Group transaction Source: Public filings, equity research, SNL, Capital IQ 10

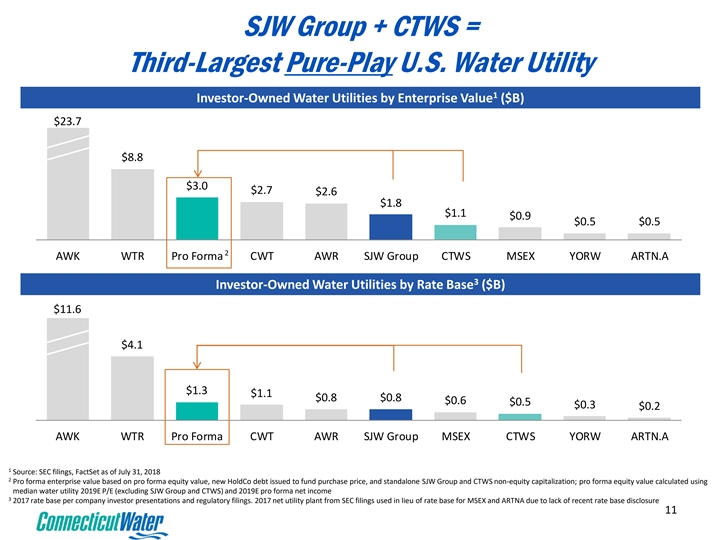

SJW Group + CTWS = Third-Largest Pure-Play U.S. Water Utility 1 Investor-Owned Water Utilities by Enterprise Value ($B) $23.7 $8.8 $3.0 $2.7 $2.6 $1.8 $1.1 $0.9 $0.5 $0.5 2 AWK WTR Pro Forma CWT AWR SJW Group CTWS MSEX YORW ARTN.A 3 Investor-Owned Water Utilities by Rate Base ($B) $11.6 $4.1 $1.3 $1.1 $0.8 $0.8 $0.6 $0.5 $0.3 $0.2 AWK WTR Pro Forma CWT AWR SJW Group MSEX CTWS YORW ARTN.A 1 Source: SEC filings, FactSet as of July 31, 2018 2 Pro forma enterprise value based on pro forma equity value, new HoldCo debt issued to fund purchase price, and standalone SJW Group and CTWS non-equity capitalization; pro forma equity value calculated using median water utility 2019E P/E (excluding SJW Group and CTWS) and 2019E pro forma net income 3 2017 rate base per company investor presentations and regulatory filings. 2017 net utility plant from SEC filings used in lieu of rate base for MSEX and ARTNA due to lack of recent rate base disclosure 11SJW Group + CTWS = Third-Largest Pure-Play U.S. Water Utility 1 Investor-Owned Water Utilities by Enterprise Value ($B) $23.7 $8.8 $3.0 $2.7 $2.6 $1.8 $1.1 $0.9 $0.5 $0.5 2 AWK WTR Pro Forma CWT AWR SJW Group CTWS MSEX YORW ARTN.A 3 Investor-Owned Water Utilities by Rate Base ($B) $11.6 $4.1 $1.3 $1.1 $0.8 $0.8 $0.6 $0.5 $0.3 $0.2 AWK WTR Pro Forma CWT AWR SJW Group MSEX CTWS YORW ARTN.A 1 Source: SEC filings, FactSet as of July 31, 2018 2 Pro forma enterprise value based on pro forma equity value, new HoldCo debt issued to fund purchase price, and standalone SJW Group and CTWS non-equity capitalization; pro forma equity value calculated using median water utility 2019E P/E (excluding SJW Group and CTWS) and 2019E pro forma net income 3 2017 rate base per company investor presentations and regulatory filings. 2017 net utility plant from SEC filings used in lieu of rate base for MSEX and ARTNA due to lack of recent rate base disclosure 11

BACKGROUND TO THE COMBINATION: INDEPENDENT, BOARD-LED PROCESSBACKGROUND TO THE COMBINATION: INDEPENDENT, BOARD-LED PROCESS

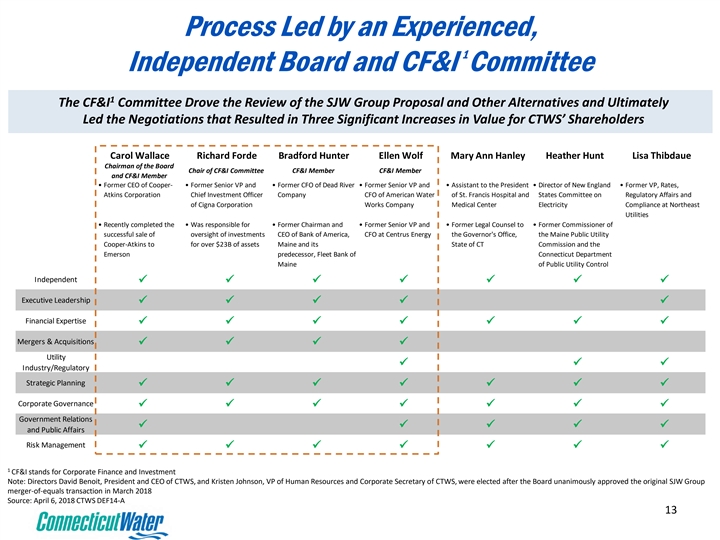

Process Led by an Experienced, 1 Independent Board and CF&I Committee 1 The CF&I Committee Drove the Review of the SJW Group Proposal and Other Alternatives and Ultimately Led the Negotiations that Resulted in Three Significant Increases in Value for CTWS’ Shareholders Carol Wallace Richard Forde Bradford Hunter Ellen Wolf Mary Ann Hanley Heather Hunt Lisa Thibdaue Chairman of the Board Chair of CF&I Committee CF&I Member CF&I Member and CF&I Member • Former CEO of Cooper- • Former Senior VP and • Former CFO of Dead River • Former Senior VP and • Assistant to the President • Director of New England • Former VP, Rates, Atkins Corporation Chief Investment Officer Company CFO of American Water of St. Francis Hospital and States Committee on Regulatory Affairs and of Cigna Corporation Works Company Medical Center Electricity Compliance at Northeast Utilities • Recently completed the • Was responsible for • Former Chairman and • Former Senior VP and • Former Legal Counsel to • Former Commissioner of successful sale of oversight of investments CEO of Bank of America, CFO at Centrus Energy the Governor's Office, the Maine Public Utility Cooper-Atkins to for over $23B of assets Maine and its State of CT Commission and the Emerson predecessor, Fleet Bank of Connecticut Department Maine of Public Utility Control Independent üüüüüüü Executive Leadership üüüüü Financial Expertise üüüüüüü Mergers & Acquisitions üüüü Utility üüü Industry/Regulatory Strategic Planning üüüüüüü Corporate Governance üüüüüüü Government Relations üüüüü and Public Affairs Risk Management üüüüüüü 1 CF&I stands for Corporate Finance and Investment Note: Directors David Benoit, President and CEO of CTWS, and Kristen Johnson, VP of Human Resources and Corporate Secretary of CTWS, were elected after the Board unanimously approved the original SJW Group merger-of-equals transaction in March 2018 Source: April 6, 2018 CTWS DEF14-A 13Process Led by an Experienced, 1 Independent Board and CF&I Committee 1 The CF&I Committee Drove the Review of the SJW Group Proposal and Other Alternatives and Ultimately Led the Negotiations that Resulted in Three Significant Increases in Value for CTWS’ Shareholders Carol Wallace Richard Forde Bradford Hunter Ellen Wolf Mary Ann Hanley Heather Hunt Lisa Thibdaue Chairman of the Board Chair of CF&I Committee CF&I Member CF&I Member and CF&I Member • Former CEO of Cooper- • Former Senior VP and • Former CFO of Dead River • Former Senior VP and • Assistant to the President • Director of New England • Former VP, Rates, Atkins Corporation Chief Investment Officer Company CFO of American Water of St. Francis Hospital and States Committee on Regulatory Affairs and of Cigna Corporation Works Company Medical Center Electricity Compliance at Northeast Utilities • Recently completed the • Was responsible for • Former Chairman and • Former Senior VP and • Former Legal Counsel to • Former Commissioner of successful sale of oversight of investments CEO of Bank of America, CFO at Centrus Energy the Governor's Office, the Maine Public Utility Cooper-Atkins to for over $23B of assets Maine and its State of CT Commission and the Emerson predecessor, Fleet Bank of Connecticut Department Maine of Public Utility Control Independent üüüüüüü Executive Leadership üüüüü Financial Expertise üüüüüüü Mergers & Acquisitions üüüü Utility üüü Industry/Regulatory Strategic Planning üüüüüüü Corporate Governance üüüüüüü Government Relations üüüüü and Public Affairs Risk Management üüüüüüü 1 CF&I stands for Corporate Finance and Investment Note: Directors David Benoit, President and CEO of CTWS, and Kristen Johnson, VP of Human Resources and Corporate Secretary of CTWS, were elected after the Board unanimously approved the original SJW Group merger-of-equals transaction in March 2018 Source: April 6, 2018 CTWS DEF14-A 13

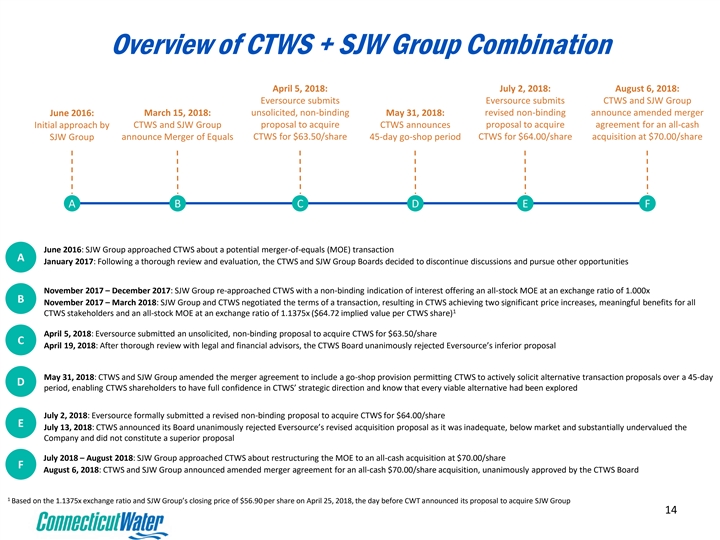

Overview of CTWS + SJW Group Combination April 5, 2018: July 2, 2018: August 6, 2018: Eversource submits Eversource submits CTWS and SJW Group June 2016: March 15, 2018: unsolicited, non-binding May 31, 2018: revised non-binding announce amended merger Initial approach by CTWS and SJW Group proposal to acquire CTWS announces proposal to acquire agreement for an all-cash SJW Group announce Merger of Equals CTWS for $63.50/share 45-day go-shop period CTWS for $64.00/share acquisition at $70.00/share A B C D E F June 2016: SJW Group approached CTWS about a potential merger-of-equals (MOE) transaction A January 2017: Following a thorough review and evaluation, the CTWS and SJW Group Boards decided to discontinue discussions and pursue other opportunities November 2017 – December 2017: SJW Group re-approached CTWS with a non-binding indication of interest offering an all-stock MOE at an exchange ratio of 1.000x B November 2017 – March 2018: SJW Group and CTWS negotiated the terms of a transaction, resulting in CTWS achieving two significant price increases, meaningful benefits for all 1 CTWS stakeholders and an all-stock MOE at an exchange ratio of 1.1375x ($64.72 implied value per CTWS share) April 5, 2018: Eversource submitted an unsolicited, non-binding proposal to acquire CTWS for $63.50/share C April 19, 2018: After thorough review with legal and financial advisors, the CTWS Board unanimously rejected Eversource’s inferior proposal May 31, 2018: CTWS and SJW Group amended the merger agreement to include a go-shop provision permitting CTWS to actively solicit alternative transaction proposals over a 45-day D period, enabling CTWS shareholders to have full confidence in CTWS’ strategic direction and know that every viable alternative had been explored July 2, 2018: Eversource formally submitted a revised non-binding proposal to acquire CTWS for $64.00/share E July 13, 2018: CTWS announced its Board unanimously rejected Eversource’s revised acquisition proposal as it was inadequate, below market and substantially undervalued the Company and did not constitute a superior proposal July 2018 – August 2018: SJW Group approached CTWS about restructuring the MOE to an all-cash acquisition at $70.00/share F August 6, 2018: CTWS and SJW Group announced amended merger agreement for an all-cash $70.00/share acquisition, unanimously approved by the CTWS Board 1 Based on the 1.1375x exchange ratio and SJW Group’s closing price of $56.90 per share on April 25, 2018, the day before CWT announced its proposal to acquire SJW Group 14Overview of CTWS + SJW Group Combination April 5, 2018: July 2, 2018: August 6, 2018: Eversource submits Eversource submits CTWS and SJW Group June 2016: March 15, 2018: unsolicited, non-binding May 31, 2018: revised non-binding announce amended merger Initial approach by CTWS and SJW Group proposal to acquire CTWS announces proposal to acquire agreement for an all-cash SJW Group announce Merger of Equals CTWS for $63.50/share 45-day go-shop period CTWS for $64.00/share acquisition at $70.00/share A B C D E F June 2016: SJW Group approached CTWS about a potential merger-of-equals (MOE) transaction A January 2017: Following a thorough review and evaluation, the CTWS and SJW Group Boards decided to discontinue discussions and pursue other opportunities November 2017 – December 2017: SJW Group re-approached CTWS with a non-binding indication of interest offering an all-stock MOE at an exchange ratio of 1.000x B November 2017 – March 2018: SJW Group and CTWS negotiated the terms of a transaction, resulting in CTWS achieving two significant price increases, meaningful benefits for all 1 CTWS stakeholders and an all-stock MOE at an exchange ratio of 1.1375x ($64.72 implied value per CTWS share) April 5, 2018: Eversource submitted an unsolicited, non-binding proposal to acquire CTWS for $63.50/share C April 19, 2018: After thorough review with legal and financial advisors, the CTWS Board unanimously rejected Eversource’s inferior proposal May 31, 2018: CTWS and SJW Group amended the merger agreement to include a go-shop provision permitting CTWS to actively solicit alternative transaction proposals over a 45-day D period, enabling CTWS shareholders to have full confidence in CTWS’ strategic direction and know that every viable alternative had been explored July 2, 2018: Eversource formally submitted a revised non-binding proposal to acquire CTWS for $64.00/share E July 13, 2018: CTWS announced its Board unanimously rejected Eversource’s revised acquisition proposal as it was inadequate, below market and substantially undervalued the Company and did not constitute a superior proposal July 2018 – August 2018: SJW Group approached CTWS about restructuring the MOE to an all-cash acquisition at $70.00/share F August 6, 2018: CTWS and SJW Group announced amended merger agreement for an all-cash $70.00/share acquisition, unanimously approved by the CTWS Board 1 Based on the 1.1375x exchange ratio and SJW Group’s closing price of $56.90 per share on April 25, 2018, the day before CWT announced its proposal to acquire SJW Group 14

SJW Group Combination Results from a Comprehensive Process Designed to Deliver Superior Value to CTWS Shareholders Thorough, Disciplined Negotiations Resulted in Three Significant Price Increases for CTWS — June 2016: SJW Group approached CTWS about a potential merger-of-equals transaction — August 2016 – January 2017: CTWS and SJW Group conducted mutual due diligence and held preliminary discussions regarding a potential transaction ◦ At the time, SJW Group verbally proposed a zero-premium transaction Review of Initial — January 2017: Following a thorough review and evaluation, the CTWS and SJW Group Boards discontinued SJW Group Approach discussions ◦ At this time, the CTWS Board elected to continue to pursue growth opportunities independently and build upon CTWS’ strong track record of outperformance and robust shareholder returns — November 2016 – May 2017: CTWS explored another transaction involving the possible acquisition of a large water utility, which did not occur ◦ Notwithstanding the unsuccessful acquisition process, the Board recognized it should consider other opportunities to increase scale and geographic diversity as a potential path for expanding its investor Review of Strategic base, increasing capital markets access and enhancing shareholder value Opportunities, — February 2017 – July 2017: Consistent with its independent growth strategy, CTWS completed the SJW Group acquisitions of Heritage Village and Avon Water to add nearly 10,000 new water customers across Connecticut Re-Approach and — September 2017: SJW Group hired former CTWS CEO, Eric Thornburg, as CEO and President First Price Increase — November 2017 – December 2017: SJW Group re-approached CTWS with a non-binding indication of interest offering an all-stock MOE at an exchange ratio of 1.000x (i.e., one SJW Group share received for each CTWS share held) ◦ Recognizing a combination with SJW Group continued to offer potential value creation opportunities and maintained strong industrial logic, the Board elected to re-engage with SJW Group 15SJW Group Combination Results from a Comprehensive Process Designed to Deliver Superior Value to CTWS Shareholders Thorough, Disciplined Negotiations Resulted in Three Significant Price Increases for CTWS — June 2016: SJW Group approached CTWS about a potential merger-of-equals transaction — August 2016 – January 2017: CTWS and SJW Group conducted mutual due diligence and held preliminary discussions regarding a potential transaction ◦ At the time, SJW Group verbally proposed a zero-premium transaction Review of Initial — January 2017: Following a thorough review and evaluation, the CTWS and SJW Group Boards discontinued SJW Group Approach discussions ◦ At this time, the CTWS Board elected to continue to pursue growth opportunities independently and build upon CTWS’ strong track record of outperformance and robust shareholder returns — November 2016 – May 2017: CTWS explored another transaction involving the possible acquisition of a large water utility, which did not occur ◦ Notwithstanding the unsuccessful acquisition process, the Board recognized it should consider other opportunities to increase scale and geographic diversity as a potential path for expanding its investor Review of Strategic base, increasing capital markets access and enhancing shareholder value Opportunities, — February 2017 – July 2017: Consistent with its independent growth strategy, CTWS completed the SJW Group acquisitions of Heritage Village and Avon Water to add nearly 10,000 new water customers across Connecticut Re-Approach and — September 2017: SJW Group hired former CTWS CEO, Eric Thornburg, as CEO and President First Price Increase — November 2017 – December 2017: SJW Group re-approached CTWS with a non-binding indication of interest offering an all-stock MOE at an exchange ratio of 1.000x (i.e., one SJW Group share received for each CTWS share held) ◦ Recognizing a combination with SJW Group continued to offer potential value creation opportunities and maintained strong industrial logic, the Board elected to re-engage with SJW Group 15

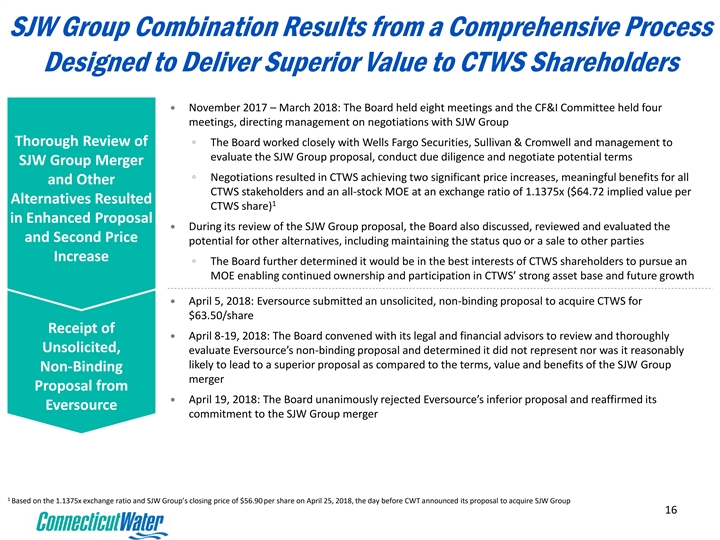

SJW Group Combination Results from a Comprehensive Process Designed to Deliver Superior Value to CTWS Shareholders — November 2017 – March 2018: The Board held eight meetings and the CF&I Committee held four meetings, directing management on negotiations with SJW Group Thorough Review of ◦ The Board worked closely with Wells Fargo Securities, Sullivan & Cromwell and management to evaluate the SJW Group proposal, conduct due diligence and negotiate potential terms SJW Group Merger ◦ Negotiations resulted in CTWS achieving two significant price increases, meaningful benefits for all and Other CTWS stakeholders and an all-stock MOE at an exchange ratio of 1.1375x ($64.72 implied value per Alternatives Resulted 1 CTWS share) in Enhanced Proposal — During its review of the SJW Group proposal, the Board also discussed, reviewed and evaluated the and Second Price potential for other alternatives, including maintaining the status quo or a sale to other parties Increase ◦ The Board further determined it would be in the best interests of CTWS shareholders to pursue an MOE enabling continued ownership and participation in CTWS’ strong asset base and future growth — April 5, 2018: Eversource submitted an unsolicited, non-binding proposal to acquire CTWS for $63.50/share Receipt of — April 8-19, 2018: The Board convened with its legal and financial advisors to review and thoroughly Unsolicited, evaluate Eversource’s non-binding proposal and determined it did not represent nor was it reasonably likely to lead to a superior proposal as compared to the terms, value and benefits of the SJW Group Non-Binding merger Proposal from — April 19, 2018: The Board unanimously rejected Eversource’s inferior proposal and reaffirmed its Eversource commitment to the SJW Group merger 1 Based on the 1.1375x exchange ratio and SJW Group’s closing price of $56.90 per share on April 25, 2018, the day before CWT announced its proposal to acquire SJW Group 16SJW Group Combination Results from a Comprehensive Process Designed to Deliver Superior Value to CTWS Shareholders — November 2017 – March 2018: The Board held eight meetings and the CF&I Committee held four meetings, directing management on negotiations with SJW Group Thorough Review of ◦ The Board worked closely with Wells Fargo Securities, Sullivan & Cromwell and management to evaluate the SJW Group proposal, conduct due diligence and negotiate potential terms SJW Group Merger ◦ Negotiations resulted in CTWS achieving two significant price increases, meaningful benefits for all and Other CTWS stakeholders and an all-stock MOE at an exchange ratio of 1.1375x ($64.72 implied value per Alternatives Resulted 1 CTWS share) in Enhanced Proposal — During its review of the SJW Group proposal, the Board also discussed, reviewed and evaluated the and Second Price potential for other alternatives, including maintaining the status quo or a sale to other parties Increase ◦ The Board further determined it would be in the best interests of CTWS shareholders to pursue an MOE enabling continued ownership and participation in CTWS’ strong asset base and future growth — April 5, 2018: Eversource submitted an unsolicited, non-binding proposal to acquire CTWS for $63.50/share Receipt of — April 8-19, 2018: The Board convened with its legal and financial advisors to review and thoroughly Unsolicited, evaluate Eversource’s non-binding proposal and determined it did not represent nor was it reasonably likely to lead to a superior proposal as compared to the terms, value and benefits of the SJW Group Non-Binding merger Proposal from — April 19, 2018: The Board unanimously rejected Eversource’s inferior proposal and reaffirmed its Eversource commitment to the SJW Group merger 1 Based on the 1.1375x exchange ratio and SJW Group’s closing price of $56.90 per share on April 25, 2018, the day before CWT announced its proposal to acquire SJW Group 16

SJW Group Combination Results from a Comprehensive Process Designed to Deliver Superior Value to CTWS Shareholders — May 31, 2018: CTWS and SJW Group amended the merger agreement to include a go-shop provision permitting CTWS to actively solicit alternative transaction proposals over a 45-day period, enabling CTWS shareholders to have full confidence in CTWS’ strategic direction and to know that every viable alternative has been explored — CTWS’ financial advisors contacted 50+ parties, including 20+ water and regulated utilities and 30+ financial sponsors, to solicit interest in exploring a potential alternative transaction with CTWS Board’s Decision to ◦ Approximately 25 parties requested and received additional details regarding CTWS Solicit Alternative — All parties were informed that June 13, 2018, was the deadline for submitting preliminary, non-binding Transaction Proposals indications of interest, after which selected parties would be provided additional information and access to (“Go-Shop” Process) CTWS management before the July 14, 2018, deadline for submitting binding proposals ◦ No indications of interest or superior proposals were received — Eversource was among those contacted and invited to participate in the go-shop process — However, Eversource declined to participate and did not submit a proposal for the Board’s consideration 17SJW Group Combination Results from a Comprehensive Process Designed to Deliver Superior Value to CTWS Shareholders — May 31, 2018: CTWS and SJW Group amended the merger agreement to include a go-shop provision permitting CTWS to actively solicit alternative transaction proposals over a 45-day period, enabling CTWS shareholders to have full confidence in CTWS’ strategic direction and to know that every viable alternative has been explored — CTWS’ financial advisors contacted 50+ parties, including 20+ water and regulated utilities and 30+ financial sponsors, to solicit interest in exploring a potential alternative transaction with CTWS Board’s Decision to ◦ Approximately 25 parties requested and received additional details regarding CTWS Solicit Alternative — All parties were informed that June 13, 2018, was the deadline for submitting preliminary, non-binding Transaction Proposals indications of interest, after which selected parties would be provided additional information and access to (“Go-Shop” Process) CTWS management before the July 14, 2018, deadline for submitting binding proposals ◦ No indications of interest or superior proposals were received — Eversource was among those contacted and invited to participate in the go-shop process — However, Eversource declined to participate and did not submit a proposal for the Board’s consideration 17

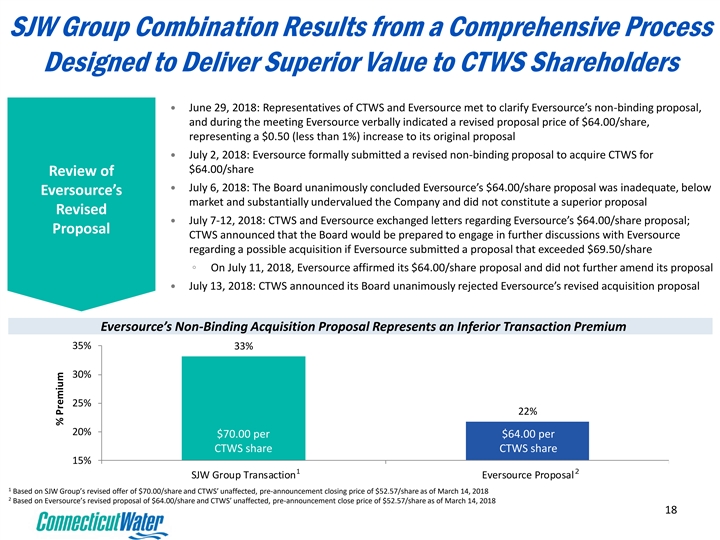

SJW Group Combination Results from a Comprehensive Process Designed to Deliver Superior Value to CTWS Shareholders — June 29, 2018: Representatives of CTWS and Eversource met to clarify Eversource’s non-binding proposal, and during the meeting Eversource verbally indicated a revised proposal price of $64.00/share, representing a $0.50 (less than 1%) increase to its original proposal — July 2, 2018: Eversource formally submitted a revised non-binding proposal to acquire CTWS for $64.00/share Review of — July 6, 2018: The Board unanimously concluded Eversource’s $64.00/share proposal was inadequate, below Eversource’s market and substantially undervalued the Company and did not constitute a superior proposal Revised — July 7-12, 2018: CTWS and Eversource exchanged letters regarding Eversource’s $64.00/share proposal; Proposal CTWS announced that the Board would be prepared to engage in further discussions with Eversource regarding a possible acquisition if Eversource submitted a proposal that exceeded $69.50/share ◦ On July 11, 2018, Eversource affirmed its $64.00/share proposal and did not further amend its proposal — July 13, 2018: CTWS announced its Board unanimously rejected Eversource’s revised acquisition proposal Eversource’s Non-Binding Acquisition Proposal Represents an Inferior Transaction Premium 35% 33% 30% 25% 22% 20% $70.00 per $64.00 per CTWS share CTWS share 15% 1 2 SJW Group Transaction Eversource Proposal 1 Based on SJW Group’s revised offer of $70.00/share and CTWS’ unaffected, pre-announcement closing price of $52.57/share as of March 14, 2018 2 Based on Eversource’s revised proposal of $64.00/share and CTWS’ unaffected, pre-announcement close price of $52.57/share as of March 14, 2018 18 % PremiumSJW Group Combination Results from a Comprehensive Process Designed to Deliver Superior Value to CTWS Shareholders — June 29, 2018: Representatives of CTWS and Eversource met to clarify Eversource’s non-binding proposal, and during the meeting Eversource verbally indicated a revised proposal price of $64.00/share, representing a $0.50 (less than 1%) increase to its original proposal — July 2, 2018: Eversource formally submitted a revised non-binding proposal to acquire CTWS for $64.00/share Review of — July 6, 2018: The Board unanimously concluded Eversource’s $64.00/share proposal was inadequate, below Eversource’s market and substantially undervalued the Company and did not constitute a superior proposal Revised — July 7-12, 2018: CTWS and Eversource exchanged letters regarding Eversource’s $64.00/share proposal; Proposal CTWS announced that the Board would be prepared to engage in further discussions with Eversource regarding a possible acquisition if Eversource submitted a proposal that exceeded $69.50/share ◦ On July 11, 2018, Eversource affirmed its $64.00/share proposal and did not further amend its proposal — July 13, 2018: CTWS announced its Board unanimously rejected Eversource’s revised acquisition proposal Eversource’s Non-Binding Acquisition Proposal Represents an Inferior Transaction Premium 35% 33% 30% 25% 22% 20% $70.00 per $64.00 per CTWS share CTWS share 15% 1 2 SJW Group Transaction Eversource Proposal 1 Based on SJW Group’s revised offer of $70.00/share and CTWS’ unaffected, pre-announcement closing price of $52.57/share as of March 14, 2018 2 Based on Eversource’s revised proposal of $64.00/share and CTWS’ unaffected, pre-announcement close price of $52.57/share as of March 14, 2018 18 % Premium

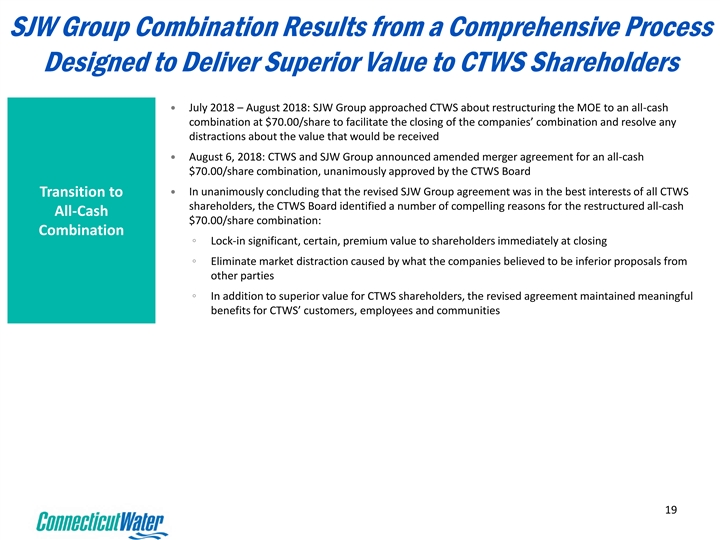

SJW Group Combination Results from a Comprehensive Process Designed to Deliver Superior Value to CTWS Shareholders — July 2018 – August 2018: SJW Group approached CTWS about restructuring the MOE to an all-cash combination at $70.00/share to facilitate the closing of the companies’ combination and resolve any distractions about the value that would be received — August 6, 2018: CTWS and SJW Group announced amended merger agreement for an all-cash $70.00/share combination, unanimously approved by the CTWS Board — In unanimously concluding that the revised SJW Group agreement was in the best interests of all CTWS Transition to shareholders, the CTWS Board identified a number of compelling reasons for the restructured all-cash All-Cash $70.00/share combination: Combination ◦ Lock-in significant, certain, premium value to shareholders immediately at closing ◦ Eliminate market distraction caused by what the companies believed to be inferior proposals from other parties ◦ In addition to superior value for CTWS shareholders, the revised agreement maintained meaningful benefits for CTWS’ customers, employees and communities 19SJW Group Combination Results from a Comprehensive Process Designed to Deliver Superior Value to CTWS Shareholders — July 2018 – August 2018: SJW Group approached CTWS about restructuring the MOE to an all-cash combination at $70.00/share to facilitate the closing of the companies’ combination and resolve any distractions about the value that would be received — August 6, 2018: CTWS and SJW Group announced amended merger agreement for an all-cash $70.00/share combination, unanimously approved by the CTWS Board — In unanimously concluding that the revised SJW Group agreement was in the best interests of all CTWS Transition to shareholders, the CTWS Board identified a number of compelling reasons for the restructured all-cash All-Cash $70.00/share combination: Combination ◦ Lock-in significant, certain, premium value to shareholders immediately at closing ◦ Eliminate market distraction caused by what the companies believed to be inferior proposals from other parties ◦ In addition to superior value for CTWS shareholders, the revised agreement maintained meaningful benefits for CTWS’ customers, employees and communities 19

CONCLUSIONCONCLUSION

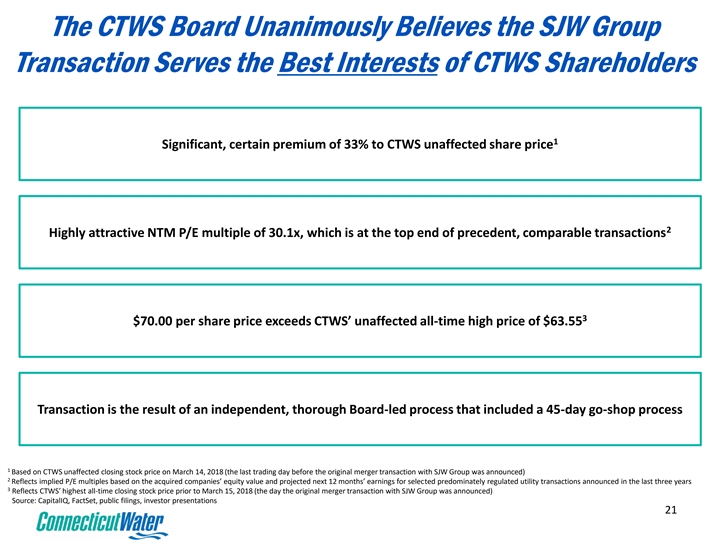

The CTWS Board Unanimously Believes the SJW Group Transaction Serves the Best Interests of CTWS Shareholders 1 Significant, certain premium of 33% to CTWS unaffected share price 2 Highly attractive NTM P/E multiple of 30.1x, which is at the top end of precedent, comparable transactions 3 $70.00 per share price exceeds CTWS’ unaffected all-time high price of $63.55 Transaction is the result of an independent, thorough Board-led process that included a 45-day go-shop process 1 Based on CTWS unaffected closing stock price on March 14, 2018 (the last trading day before the original merger transaction with SJW Group was announced) 2 Reflects implied P/E multiples based on the acquired companies’ equity value and projected next 12 months’ earnings for selected predominately regulated utility transactions announced in the last three years 3 Reflects CTWS’ highest all-time closing stock price prior to March 15, 2018 (the day the original merger transaction with SJW Group was announced) Source: CapitalIQ, FactSet, public filings, investor presentations 21The CTWS Board Unanimously Believes the SJW Group Transaction Serves the Best Interests of CTWS Shareholders 1 Significant, certain premium of 33% to CTWS unaffected share price 2 Highly attractive NTM P/E multiple of 30.1x, which is at the top end of precedent, comparable transactions 3 $70.00 per share price exceeds CTWS’ unaffected all-time high price of $63.55 Transaction is the result of an independent, thorough Board-led process that included a 45-day go-shop process 1 Based on CTWS unaffected closing stock price on March 14, 2018 (the last trading day before the original merger transaction with SJW Group was announced) 2 Reflects implied P/E multiples based on the acquired companies’ equity value and projected next 12 months’ earnings for selected predominately regulated utility transactions announced in the last three years 3 Reflects CTWS’ highest all-time closing stock price prior to March 15, 2018 (the day the original merger transaction with SJW Group was announced) Source: CapitalIQ, FactSet, public filings, investor presentations 21

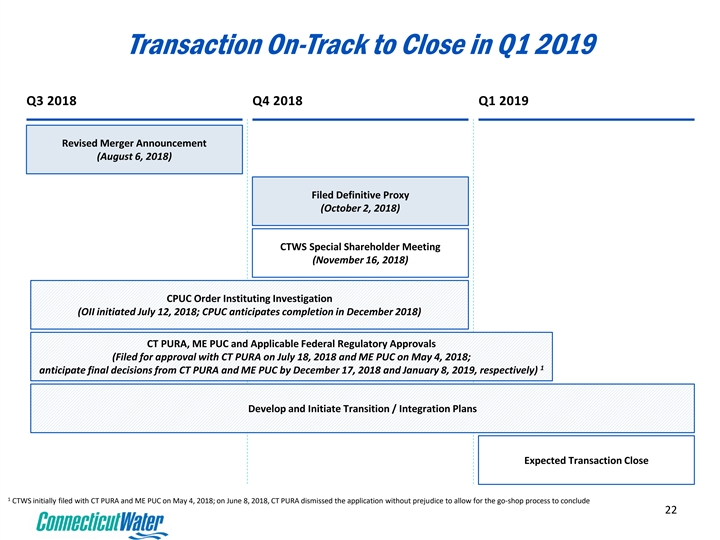

Transaction On-Track to Close in Q1 2019 Q3 2018 Q4 2018 Q1 2019 Revised Merger Announcement (August 6, 2018) Filed Definitive Proxy (October 2, 2018) CTWS Special Shareholder Meeting (November 16, 2018) CPUC Order Instituting Investigation (OII initiated July 12, 2018; CPUC anticipates completion in December 2018) CT PURA, ME PUC and Applicable Federal Regulatory Approvals (Filed for approval with CT PURA on July 18, 2018 and ME PUC on May 4, 2018; 1 anticipate final decisions from CT PURA and ME PUC by December 17, 2018 and January 8, 2019, respectively) Develop and Initiate Transition / Integration Plans Expected Transaction Close 1 CTWS initially filed with CT PURA and ME PUC on May 4, 2018; on June 8, 2018, CT PURA dismissed the application without prejudice to allow for the go-shop process to conclude 22Transaction On-Track to Close in Q1 2019 Q3 2018 Q4 2018 Q1 2019 Revised Merger Announcement (August 6, 2018) Filed Definitive Proxy (October 2, 2018) CTWS Special Shareholder Meeting (November 16, 2018) CPUC Order Instituting Investigation (OII initiated July 12, 2018; CPUC anticipates completion in December 2018) CT PURA, ME PUC and Applicable Federal Regulatory Approvals (Filed for approval with CT PURA on July 18, 2018 and ME PUC on May 4, 2018; 1 anticipate final decisions from CT PURA and ME PUC by December 17, 2018 and January 8, 2019, respectively) Develop and Initiate Transition / Integration Plans Expected Transaction Close 1 CTWS initially filed with CT PURA and ME PUC on May 4, 2018; on June 8, 2018, CT PURA dismissed the application without prejudice to allow for the go-shop process to conclude 22

Additional Information About the SJW Group Combination and Where to Find It Additional Information and Where to Find It This communication relates to the proposed acquisition of Connecticut Water by SJW Group. In connection with the proposed transaction, on October 2, 2018, Connecticut Water filed a definitive proxy statement on Schedule 14A and the accompanying GREEN proxy card with the SEC. SHAREHOLDERS OF CONNECTICUT WATER ARE URGED TO READ THE DEFINITIVE PROXY STATEMENT AND ALL OTHER RELEVANT DOCUMENTS FILED OR TO BE FILED WITH THE SEC BECAUSE THEY CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION. Investors and security holders will be able to obtain a copy of the definitive proxy statement and the other documents filed by Connecticut Water with the SEC free of charge at the SEC’s web site, http://www.sec.gov, and shareholders of Connecticut Water will also be able to obtain transaction-related documents free of charge by directing a request to Connecticut Water’s Corporate Secretary, Kristen A. Johnson, at Connecticut Water Service, Inc., 93 West Main Street, Clinton, Connecticut 06413, or by telephone at 1-800-428-3985. Participants in Solicitation SJW Group and its directors and executive officers, and Connecticut Water and its directors and executive officers, may be deemed to be participants in the solicitation of proxies from the holders of Connecticut Water’s common stock in respect of the proposed transaction. Information about the directors and executive officers of SJW Group is set forth in the proxy statement for SJW Group’s 2018 Annual Meeting of Stockholders, which was filed with the SEC on March 6, 2018. Information about the directors and executive officers of Connecticut Water is set forth in the proxy statement for Connecticut Water’s 2018 Annual Meeting of Shareholders, which was filed with the SEC on April 6, 2018. Investors may obtain additional information regarding the interest of such participants by reading the definitive proxy statement regarding the proposed transaction, which was filed on October 2, 2018, and other relevant materials filed with the SEC regarding the proposed transaction. 23Additional Information About the SJW Group Combination and Where to Find It Additional Information and Where to Find It This communication relates to the proposed acquisition of Connecticut Water by SJW Group. In connection with the proposed transaction, on October 2, 2018, Connecticut Water filed a definitive proxy statement on Schedule 14A and the accompanying GREEN proxy card with the SEC. SHAREHOLDERS OF CONNECTICUT WATER ARE URGED TO READ THE DEFINITIVE PROXY STATEMENT AND ALL OTHER RELEVANT DOCUMENTS FILED OR TO BE FILED WITH THE SEC BECAUSE THEY CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION. Investors and security holders will be able to obtain a copy of the definitive proxy statement and the other documents filed by Connecticut Water with the SEC free of charge at the SEC’s web site, http://www.sec.gov, and shareholders of Connecticut Water will also be able to obtain transaction-related documents free of charge by directing a request to Connecticut Water’s Corporate Secretary, Kristen A. Johnson, at Connecticut Water Service, Inc., 93 West Main Street, Clinton, Connecticut 06413, or by telephone at 1-800-428-3985. Participants in Solicitation SJW Group and its directors and executive officers, and Connecticut Water and its directors and executive officers, may be deemed to be participants in the solicitation of proxies from the holders of Connecticut Water’s common stock in respect of the proposed transaction. Information about the directors and executive officers of SJW Group is set forth in the proxy statement for SJW Group’s 2018 Annual Meeting of Stockholders, which was filed with the SEC on March 6, 2018. Information about the directors and executive officers of Connecticut Water is set forth in the proxy statement for Connecticut Water’s 2018 Annual Meeting of Shareholders, which was filed with the SEC on April 6, 2018. Investors may obtain additional information regarding the interest of such participants by reading the definitive proxy statement regarding the proposed transaction, which was filed on October 2, 2018, and other relevant materials filed with the SEC regarding the proposed transaction. 23