Attached files

| file | filename |

|---|---|

| 8-K - 8-K - BOK FINANCIAL CORP | a20180930bokfconferencecal.htm |

Third Quarter 2018 Earnings Conference Call October 24, 2018 1

Legal Disclaimers Forward-Looking Statements: This presentation contains statements that are based on management’s beliefs, assumptions, current expectations, estimates, and projections about BOK Financial Corporation, the financial services industry, and the economy generally. These remarks constitute forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Words such as “anticipates”, “believes”, “estimates”, “expects”, “forecasts”, “plans”, “projects”, variations of such words, and similar expressions are intended to identify such forward-looking statements. Management judgments relating to, and discussion of the provision and allowance for credit losses involve judgments as to future events and are inherently forward-looking statements. Assessments that BOK Financial’s acquisitions, including its latest acquisition of CoBiz Financial, Inc., and other growth endeavors will be profitable are necessary statements of belief as to the outcome of future events, based in part on information provided by others which BOKF has not independently verified. These statements are not guarantees of future performance and involve certain risks, uncertainties, and assumptions which are difficult to predict with regard to timing, extent, likelihood and degree of occurrence. Therefore, actual results and outcomes may materially differ from what is expressed, implied or forecasted in such forward-looking statements. Internal and external factors that might cause such a difference include, but are not limited to, changes in interest rates and interest rate relationships, inflation, demand for products and services, the degree of competition by traditional and non-traditional competitors, changes in banking regulations, tax laws, prices, levies, and assessments, the impact of technological advances, and trends in customer behavior as well as their ability to repay loans. There may also be difficulties and delays in integrating CoBiz Financial Inc.’s business or fully realizing cost savings and other benefits including, but not limited to, business disruption and customer acceptance of BOK Financial Corporation’s products and services. For a discussion of risk factors that may cause actual results to differ from expectations, please refer to BOK Financial Corporation’s most recent annual and quarterly reports. BOK Financial Corporation and its affiliates undertake no obligation to update, amend, or clarify forward-looking statements, whether as a result of new information, future events, or otherwise. Non-GAAP Financial Measures: This presentation may refer to non-GAAP financial measures. Additional information on these financial measures is available in BOK Financial’s 10-Q and 10-K filings with the Securities and Exchange Commission which can be accessed at www.BOKF.com. All data is presented as of September 30, 2018 unless otherwise noted. 2

Steven G. Bradshaw Chief Executive Officer 3

Third Quarter Summary Q3 2018 Q2 2018 Q3 2017 Diluted EPS $1.79 $1.75 $1.31 Net income before taxes $152.2 $148.5 $128.2 Net income attributable to $117.3 $114.4 $85.6 BOKF shareholders Noteworthy items impacting Q3 profitability: • Loan growth remains strong coming off a record-breaking quarter. • Net interest income continues to grow on a pre-provision basis. • Fees and commission revenue increased 6% sequentially, enhanced by a large advisory fee for a client. • Small increase in expenses. • Provision for loan losses recorded due to loan growth. 4

Additional Details Annualized Quarterly Quarterly Year over $billions Q3 2018 Growth Growth Year Growth Period-End Loans $18.3 1.9% 7.7% 6.6% Average Loans $18.2 2.5% 10.2% 5.5% Period-End Deposits $21.6 (2.4)% (9.6)% (1.0)% Average Deposits $21.9 (0.5)% (2.2)% (0.8)% Fiduciary Assets $45.6 (2.1)% (8.4)% 0.8% Assets Under Management or in Custody $77.6 (1.6)% (6.4)% —% • Strong loan growth across all major categories and most regional markets. • Average deposits are relatively flat for the quarter with period end balances down in wealth management due to customer migration to off balance sheet alternatives. • Strong liquidity position with average loan/deposit ratio of 83 percent. • Assets under management down largely due to timing of inflows and seasonality of disbursements. 5

Steven Nell Chief Financial Officer Financial Overview 6

Net Interest Revenue and Margin ($millions) Q3 2018 Q2 2018 Q1 2018 Q4 2017 Q3 2017 Net interest revenue $240.9 $238.6 $219.7 $216.9 $218.5 Provision for credit losses $4.0 $— $(5.0) $(7.0) $— NIR after provision $236.9 $238.6 $224.7 $223.9 $218.5 Net interest margin 3.21% 3.17% 2.99% 2.97% 3.01% • Net interest revenue continues to climb due to strong loan growth. ◦ Yield on available for sale securities was 2.37%, an increase of 7 basis points sequentially, and up 20 basis points year over year. ◦ Loan yields were 4.80 percent, up 12 basis point sequentially excluding the impact of interest recoveries. ◦ Interest-bearing deposits increased 11 basis points sequentially. • Net interest margin continues to expand but at a decreasing rate as deposit betas increase. • A small provision of $4 million was taken this quarter due to large growth in our loan portfolio the past few quarters. 7

Fees and Commissions Revenue, $mil Growth: Quarterly, Quarterly, Trailing 12 Q3 2018 Sequential Year over Year Months Brokerage and Trading $23.1 (12.8)% (30.4)% (10.9)% Transaction Card 21.4 2.0% (6.7)% 2.9% Fiduciary and Asset Management 57.5 37.9% 41.4% 17.4% Deposit Service Charges and Fees 27.8 (0.2)% (1.5)% 2.5% Mortgage Banking 23.5 (10.7)% (5.4)% (7.8)% Other Revenue 14.2 (2.1)% 4.0% (0.5)% Total Fees and Commissions $167.5 6.1% (3.4)% 1.5% • Brokerage and Trading: Down largely due to mortgage production environment – lower mortgage backed trading activity. • Transaction Card: Continued growth on a quarterly basis, but year over year comparison impacted by heavy contract buyout revenue in 3Q17. • Fiduciary and Asset Management: A large $15 million fee earned on the sale of client assets. • Mortgage Banking: The rising rate environment has impacted origination volume and margins. 8

Expenses %Incr. %Incr. ($mil) Q3 2018 Q2 2018 Q3 2017 Seq. YOY Personnel expense $143.5 $138.9 $147.9 3.3% (3.0)% Other operating expense $109.1 $107.5 $118.0 1.4% (7.6)% Total operating expense $252.6 $246.5 $265.9 2.5% (5.0)% Efficiency Ratio 61.41% 61.68% 65.92% • Personnel expense up in Q3 from equity compensation expense. • Non personnel expense up slightly due to an impairment of a software license coupled with an OREO writedown on a healthcare property. • $1 million of merger-related expenses in both Q3 and Q2. • Mortgage-related cost actions in Q3 – approximately $1.6 million in expense saves. 9

Forecast and Assumptions ▪ Continued loan growth as we integrate CoBiz portfolios into our lines of business. ▪ Slowing growth in net interest margin with continued Fed rate increases. ▪ Revenue from fee-generating businesses down due to continued mortgage headwinds. ▪ Controlled expense growth excluding CoBiz integration costs. ▪ Provision levels moving forward will be influenced by loan growth. Loan loss reserve levels could drop below 1 percent after CoBiz consolidation. ▪ Blended federal and state effective tax rate 22-23% going forward. ▪ CoBiz integration and closing charges expected to be $45 million going forward with approximately 75 percent in the fourth quarter of 2018 and 25 percent in the first quarter of 2019. ▪ We are still comfortable with the 6 percent accretion in 2019 as previously quoted with an expected conversion late in the first quarter of 2019. ▪ Hold on specific 2019 guidance until the budget process is completed. 10

Stacy Kymes EVP-Corporate Banking 11

Loan Portfolio Seq. YOY Sep 30, Jun 30, Sep 30, Loan Loan ($mil) 2018 2018 2017 Growth Growth Energy $ 3,294.9 $ 3,147.2 $ 2,868.0 4.7% 14.9% Services 3,017.3 2,944.5 2,967.5 2.5% 1.7% Healthcare 2,437.3 2,353.7 2,239.5 3.6% 8.8% Wholesale/retail 1,650.7 1,699.6 1,658.1 (2.9)% (0.4)% Manufacturing 660.6 647.8 519.4 2.0% 27.2% Other 515.3 556.2 543.4 (7.4)% (5.2)% Total C&I $ 11,576.1 $ 11,349.0 $ 10,795.9 2.0% 7.2% Commercial Real Estate 3,804.7 3,712.2 3,518.1 2.5% 8.1% Residential Mortgage 1,971.7 1,942.3 1,945.8 1.5% 1.3% Personal 996.9 1,000.2 947.0 (0.3)% 5.3% Total Loans $ 18,349.5 $ 18,003.7 $ 17,206.8 1.9% 6.2% • Added to the loan portfolio coming off a record-breaking quarter, posting 6.2% year-over-year growth. • Strong growth in energy, healthcare, manufacturing, and commercial real estate. 12

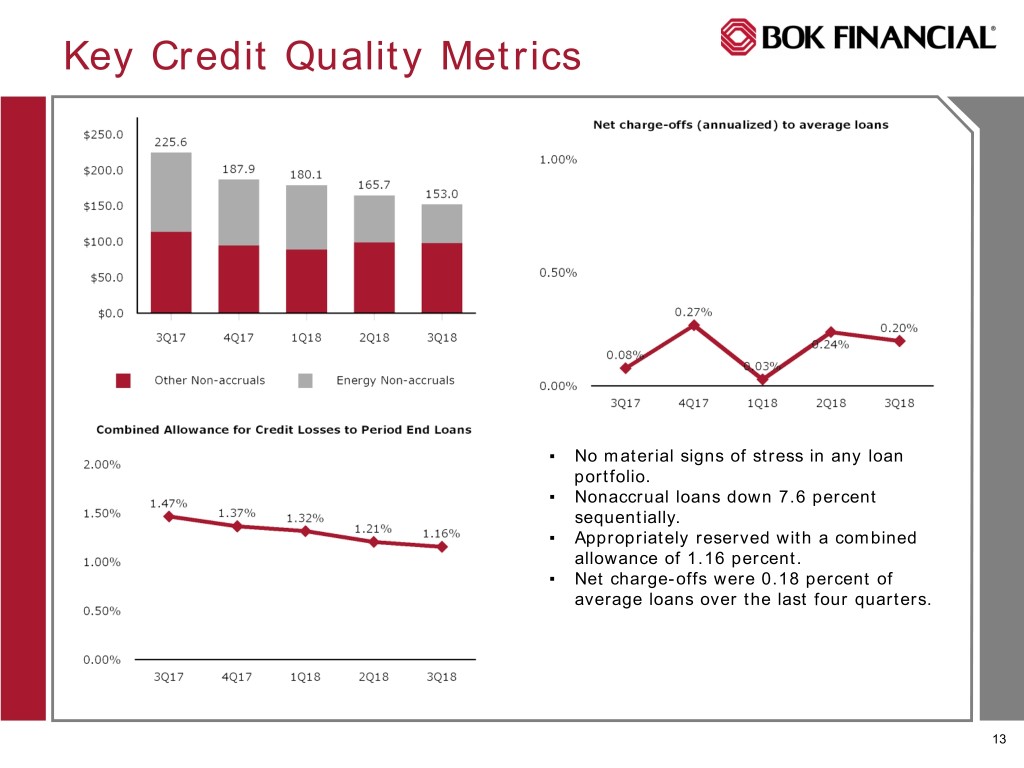

Key Credit Quality Metrics ▪ No material signs of stress in any loan portfolio. ▪ Nonaccrual loans down 7.6 percent sequentially. ▪ Appropriately reserved with a combined allowance of 1.16 percent. ▪ Net charge-offs were 0.18 percent of average loans over the last four quarters. 13

Steven G. Bradshaw Chief Executive Officer Closing Remarks 14

Question and Answer Session 15