Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - Alkermes plc. | alks-ex991_37.htm |

| 8-K - 8-K - Alkermes plc. | alks-8k_20181023.htm |

Third Quarter 2018 Financial Results & Update October 23, 2018 Exhibit 99.2

Forward-Looking Statements and Non-GAAP Financial Information Certain statements set forth in this presentation constitute “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, as amended, including, but not limited to, statements concerning: the future financial and operating performance, business plans or prospects of the company; the continued growth of the long-acting injectable antipsychotic market and revenue from the company’s commercial products, including VIVITROL®, ARISTADA® and ARISTADA INITIO®; improvements to and modernization of the treatment ecosystem for opioid dependence, including related policy initiatives and the company’s engagement with policymakers; the timing, funding, results and feasibility of clinical development activities, including the timing of the phase 3 data readout for ALKS 3831, the timing of the presentation of initial phase 1 data for ALKS 4230, expansion of the phase 1 study for ALKS 4230, and initiation of a phase 1 subcutaneous dosing study for ALKS 4230, the timing of topline data from the phase 3 elective study for BIIB098, the timing of topline data from the phase 3b study evaluating ARISTADA® and INVEGA SUSTENNA®, the timing of completion of the registration packages and submission of the new drug applications (“NDAs”) for each of BIIB098 and ALKS 3831, and the timing of the company’s potential nomination of new development candidates; whether the studies conducted for ALKS 5461, ALKS 3831 and BIIB098 will meet the U.S. Food and Drug Administration’s (“FDA”) requirements for approval; the company’s expectations and timelines for regulatory interactions with the FDA, and actions by the FDA, relating to its review of the NDA submission for ALKS 5461; expectations concerning the timing, results and nature of commercial activities, including preparations for the anticipated launch of ALKS 5461, activities related to the launch of ARISTADA INITIO® and timing of the potential launch by Biogen of BIIB098; the potential financial benefits that may be achieved under the license and collaboration agreement between the company and Biogen for BIIB098; the therapeutic value and commercial potential of the company’s commercial products and development candidates; and funding for, payer coverage of, and patient access to and awareness of, the company’s commercial products and development candidates. Although the company believes that such forward-looking statements are based on reasonable assumptions within the bounds of its knowledge of its business and operations, the forward-looking statements are neither promises nor guarantees and they are necessarily subject to a high degree of uncertainty and risk. Actual performance and results may differ materially from those expressed or implied in the forward-looking statements due to various risks, assumptions and uncertainties. These risks, assumptions and uncertainties include, among others: the unfavorable outcome of litigation, including so-called “Paragraph IV” litigation and other patent litigation, related to any of our products or partnered products, which may lead to competition from generic drug manufacturers; data from clinical trials may be interpreted by the FDA in different ways than we interpret it; the FDA may not agree with our regulatory approval strategies or components of our filings for our products, including our clinical trial designs, conduct and methodologies and, for ALKS 5461, evidence of efficacy and adequacy of bridging to buprenorphine; clinical development activities may not be completed on time or at all; the results of our clinical development activities may not be positive, or predictive of real-world results or of results in subsequent clinical trials; regulatory submissions may not occur or be submitted in a timely manner; the company and its licensees may not be able to continue to successfully commercialize their products; there may be a reduction in payment rate or reimbursement for the company’s products or an increase in the company’s financial obligations to governmental payers; the FDA or regulatory authorities outside the U.S. may make adverse decisions regarding the company’s products; the company’s products may prove difficult to manufacture, be precluded from commercialization by the proprietary rights of third parties, or have unintended side effects, adverse reactions or incidents of misuse; and those risks, assumptions and uncertainties described under the heading “Risk Factors” in the company’s most recent Annual Report on Form 10-K and in subsequent filings made by the company with the U.S. Securities and Exchange Commission (“SEC”), which are available on the SEC’s website at www.sec.gov and on the company’s website at www.alkermes.com in the “Investors—SEC filings” section. Existing and prospective investors are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date hereof. Except as required by law, the company disclaims any intention or responsibility for updating or revising any forward-looking statements contained in this presentation. Non-GAAP Financial Measures: This presentation includes information about certain financial measures that are not prepared in accordance with generally accepted accounting principles in the U.S. (GAAP), including non-GAAP net income/(loss) and non-GAAP earnings per share. These non-GAAP measures are not based on any standardized methodology prescribed by GAAP and are not necessarily comparable to similar measures presented by other companies. Reconciliations of these non-GAAP financial measures to the most directly comparable GAAP financial measures can be found in the Alkermes plc Current Report on Form 8-K filed with the SEC on Oct. 23, 2018. Note Regarding Trademarks: The company is the owner of various U.S. federal trademark registrations (®) and other trademarks (TM), including ARISTADA®, VIVITROL® and ARISTADA INITIO®. Any other trademarks referred to in this presentation are the property of their respective owners. Appearances of such other trademarks herein should not be construed as any indicator that their respective owners will not assert their rights thereto.

Third Quarter Earnings Call Agenda Q3 Financial Results & 2018 Guidance Jim Frates Chief Financial Officer Commercial Update Jim Robinson President & Chief Operating Officer Business Update Richard Pops Chief Executive Officer

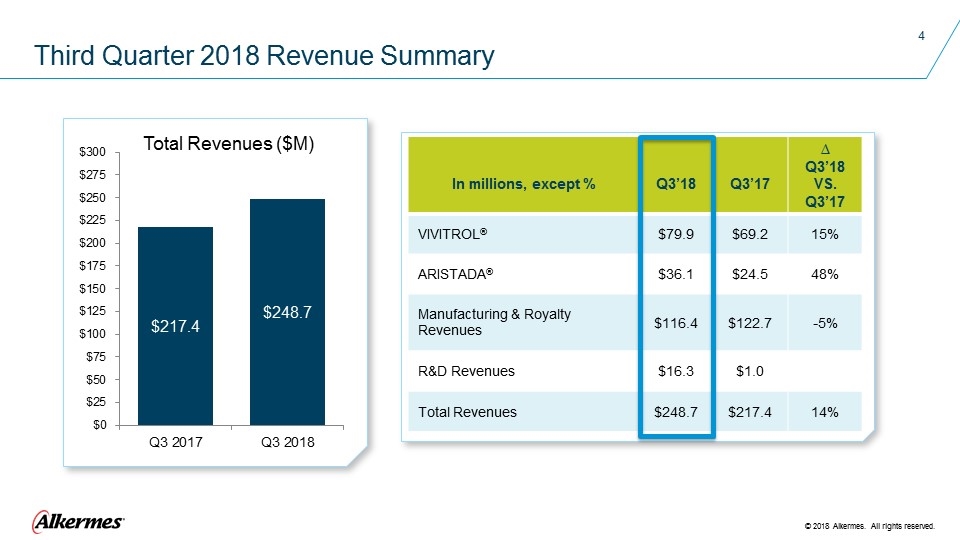

Third Quarter 2018 Revenue Summary In millions, except % Q3’18 Q3’17 ∆ Q3’18 VS. Q3’17 VIVITROL® $79.9 $69.2 15% ARISTADA® $36.1 $24.5 48% Manufacturing & Royalty Revenues $116.4 $122.7 -5% R&D Revenues $16.3 $1.0 Total Revenues $248.7 $217.4 14% Total Revenues ($M)

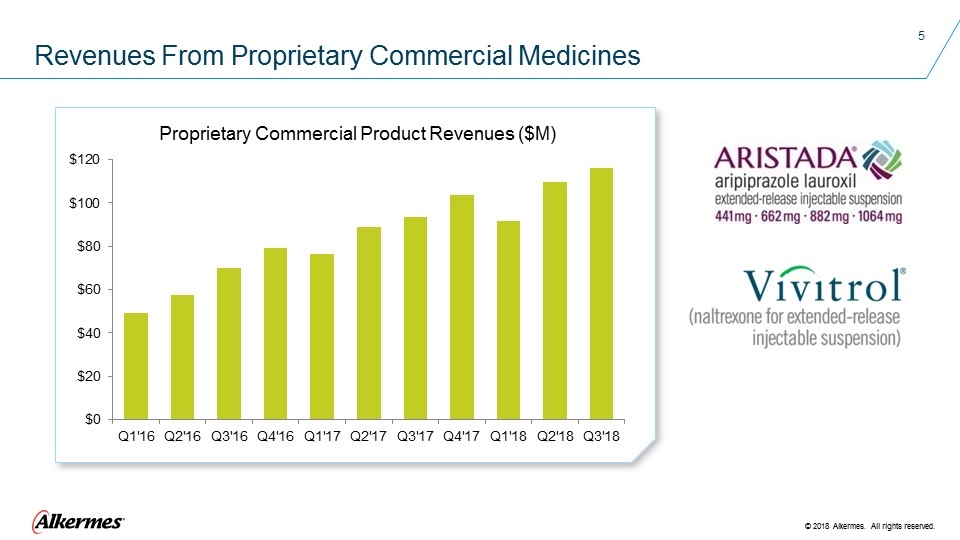

Revenues From Proprietary Commercial Medicines Proprietary Commercial Product Revenues ($M)

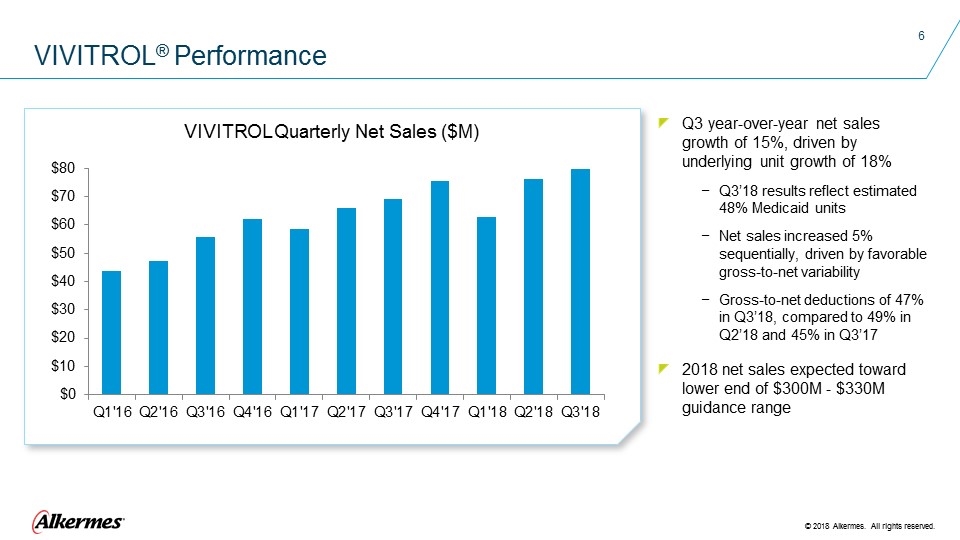

VIVITROL® Performance Q3 year-over-year net sales growth of 15%, driven by underlying unit growth of 18% Q3’18 results reflect estimated 48% Medicaid units Net sales increased 5% sequentially, driven by favorable gross-to-net variability Gross-to-net deductions of 47% in Q3’18, compared to 49% in Q2’18 and 45% in Q3’17 2018 net sales expected toward lower end of $300M - $330M guidance range VIVITROL Quarterly Net Sales ($M)

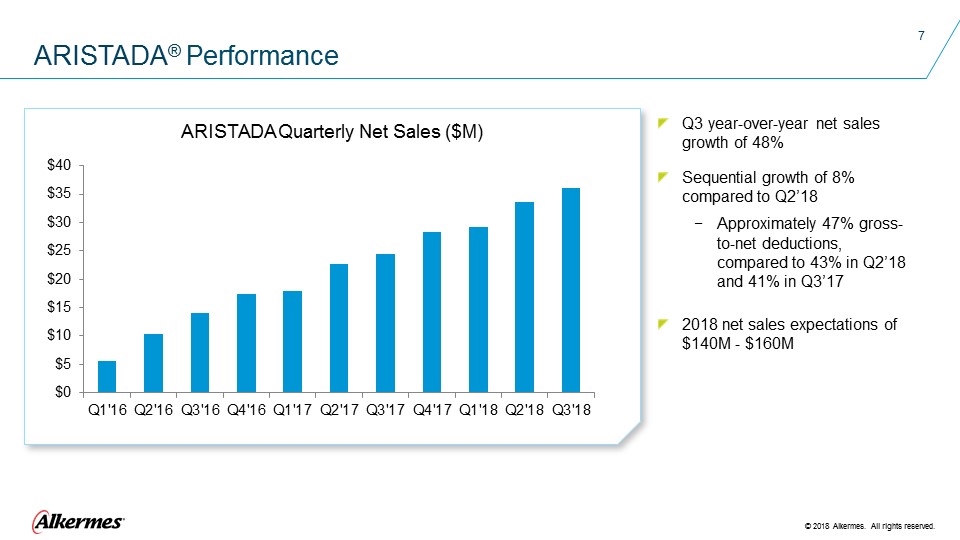

Q3 year-over-year net sales growth of 48% Sequential growth of 8% compared to Q2’18 Approximately 47% gross-to-net deductions, compared to 43% in Q2’18 and 41% in Q3’17 2018 net sales expectations of $140M - $160M ARISTADA® Performance ARISTADA Quarterly Net Sales ($M)

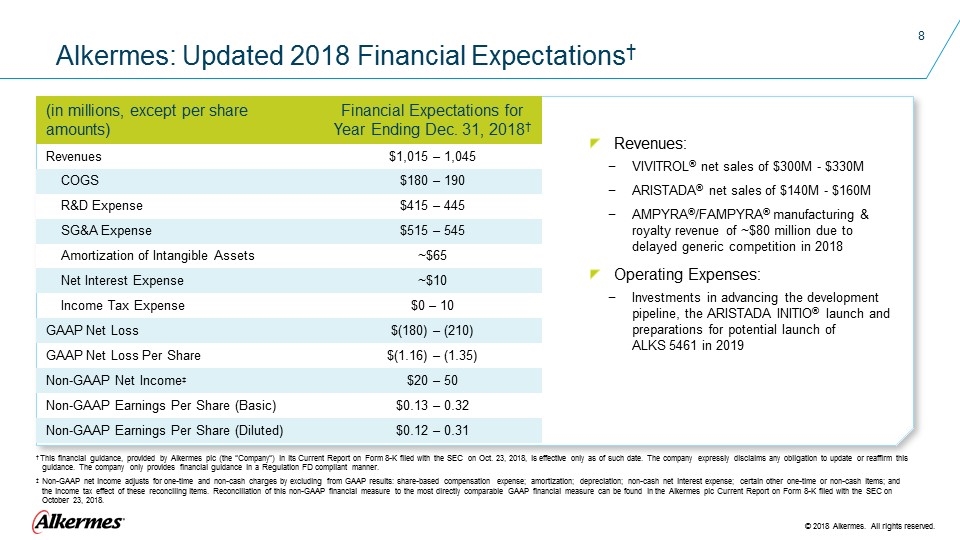

(in millions, except per share amounts) Financial Expectations for Year Ending Dec. 31, 2018† Revenues $1,015 – 1,045 COGS $180 – 190 R&D Expense $415 – 445 SG&A Expense $515 – 545 Amortization of Intangible Assets ~$65 Net Interest Expense ~$10 Income Tax Expense $0 – 10 GAAP Net Loss $(180) – (210) GAAP Net Loss Per Share $(1.16) – (1.35) Non-GAAP Net Income‡ $20 – 50 Non-GAAP Earnings Per Share (Basic) $0.13 – 0.32 Non-GAAP Earnings Per Share (Diluted) $0.12 – 0.31 Alkermes: Updated 2018 Financial Expectations† † This financial guidance, provided by Alkermes plc (the “Company”) in its Current Report on Form 8-K filed with the SEC on Oct. 23, 2018, is effective only as of such date. The company expressly disclaims any obligation to update or reaffirm this guidance. The company only provides financial guidance in a Regulation FD compliant manner. ‡ Non-GAAP net income adjusts for one-time and non-cash charges by excluding from GAAP results: share-based compensation expense; amortization; depreciation; non-cash net interest expense; certain other one-time or non-cash items; and the income tax effect of these reconciling items. Reconciliation of this non-GAAP financial measure to the most directly comparable GAAP financial measure can be found in the Alkermes plc Current Report on Form 8-K filed with the SEC on October 23, 2018. Revenues: VIVITROL® net sales of $300M - $330M ARISTADA® net sales of $140M - $160M AMPYRA®/FAMPYRA® manufacturing & royalty revenue of ~$80 million due to delayed generic competition in 2018 Operating Expenses: Investments in advancing the development pipeline, the ARISTADA INITIO® launch and preparations for potential launch of ALKS 5461 in 2019

State and federal dollars are being allocated; Funding slowly flowing into fragmented treatment system ~$2B of federal funding has been distributed to states via block grants Small percentage has flowed from the states into changing the treatment system New opioid legislation, SUPPORT for Patients and Communities Act, expected to be signed into law imminently Extends State Targeted Response Grant program for another three years: $500M per year 2019-2021 Includes provision for Comprehensive Opioid Recovery Centers, which provides funding to develop federally qualified treatment centers that utilize the full range of FDA-approved medications: $50M over five years to provide comprehensive, patient-centered treatment including detoxification and wrap-around services Improvements in accessibility of VIVITROL and implementation of public policy initiatives driving strong growth in certain states Pennsylvania, California, Florida, Michigan, Kentucky State programs expanded to ~730 at the end of Q3’18, primarily driven by criminal justice re-entry and drug court programs VIVITROL®: Opportunities to Increase Utilization and Drive Growth

ARISTADA INITIO now available ARISTADA INITIO regimen* provides an opportunity to initiate patients onto any dose of ARISTADA on day 1 ARISTADA INITIO in conjunction with two-month ARISTADA resonating with treatment providers and patients Early coverage additions to key hospital and Medicare Part D formularies Two-month ARISTADA unit growth accelerating with 26% sequential growth in Q3’18, up from 17% sequential growth in Q2’18 Two-month dose represented 15% of total ARISTADA units in Q3’18 ARISTADA market share increased to 28% among new aripiprazole long-acting atypical prescriptions (months of therapy) in Q3’181 ARISTADA®: Gaining Traction With Launch of ARISTADA INITIO® *ARISTADA INITIO regimen consists of ARISTADA INITIO + single 30 mg dose of oral aripiprazole. ARISTADA INITIO regimen plus ARISTADA on day 1 of treatment yields relevant levels of aripiprazole concentration in the body within four days. 1. IMS NPA

Investigational product for adjunctive treatment of major depressive disorder (MDD) Opioid system modulator represents a new mechanism of action for the treatment of MDD Program Status Regulatory review underway, PDUFA target action date Jan. 31, 2019 FDA Advisory Committee meeting scheduled for Nov. 1, 2018 Priorities Continued scientific exchange with medical community; Presentations at Psych Congress, Neuroscience Education Institute Congress Preparations for potential launch Investment in manufacturing, senior leadership and necessary commercial infrastructure ALKS 5461

ALKS 3831 Investigational, novel, once-daily, oral atypical antipsychotic drug candidate for the treatment of schizophrenia Designed to provide antipsychotic efficacy of olanzapine and a differentiated safety profile with favorable weight and metabolic properties Positive results from ENLIGHTEN-1 pivotal antipsychotic efficacy study announced June 2017 Presented data from phase 1 translational medicine study evaluating metabolic profile of ALKS 3831 compared to olanzapine in May 2018 Complete ENLIGHTEN-2, a six-month phase 3 study assessing weight gain with olanzapine compared to ALKS 3831; Topline data expected Q4’18 Enrollment of ENLIGHTEN-2 completed April 2018 Program Status Priorities

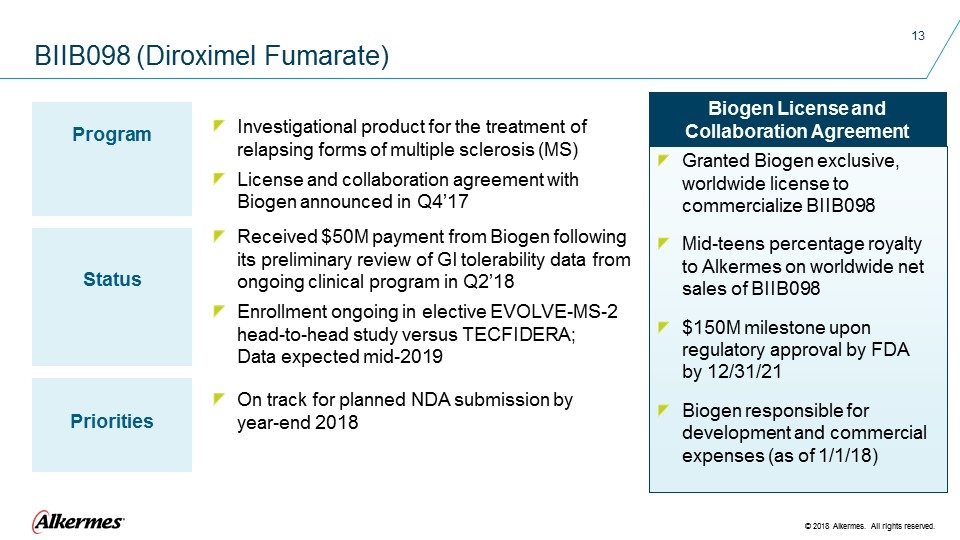

BIIB098 (Diroximel Fumarate) Investigational product for the treatment of relapsing forms of multiple sclerosis (MS) License and collaboration agreement with Biogen announced in Q4’17 Received $50M payment from Biogen following its preliminary review of GI tolerability data from ongoing clinical program in Q2’18 Enrollment ongoing in elective EVOLVE-MS-2 head-to-head study versus TECFIDERA; Data expected mid-2019 On track for planned NDA submission by year-end 2018 Granted Biogen exclusive, worldwide license to commercialize BIIB098 Mid-teens percentage royalty to Alkermes on worldwide net sales of BIIB098 $150M milestone upon regulatory approval by FDA by 12/31/21 Biogen responsible for development and commercial expenses (as of 1/1/18) Biogen License and Collaboration Agreement Program Status Priorities

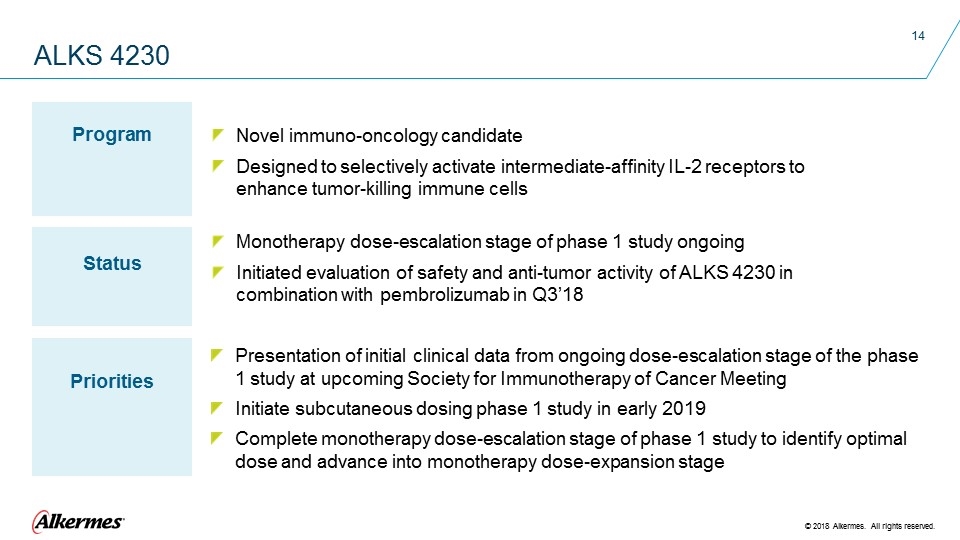

ALKS 4230 Novel immuno-oncology candidate Designed to selectively activate intermediate-affinity IL-2 receptors to enhance tumor-killing immune cells Monotherapy dose-escalation stage of phase 1 study ongoing Initiated evaluation of safety and anti-tumor activity of ALKS 4230 in combination with pembrolizumab in Q3’18 Presentation of initial clinical data from ongoing dose-escalation stage of the phase 1 study at upcoming Society for Immunotherapy of Cancer Meeting Initiate subcutaneous dosing phase 1 study in early 2019 Complete monotherapy dose-escalation stage of phase 1 study to identify optimal dose and advance into monotherapy dose-expansion stage Program Status Priorities

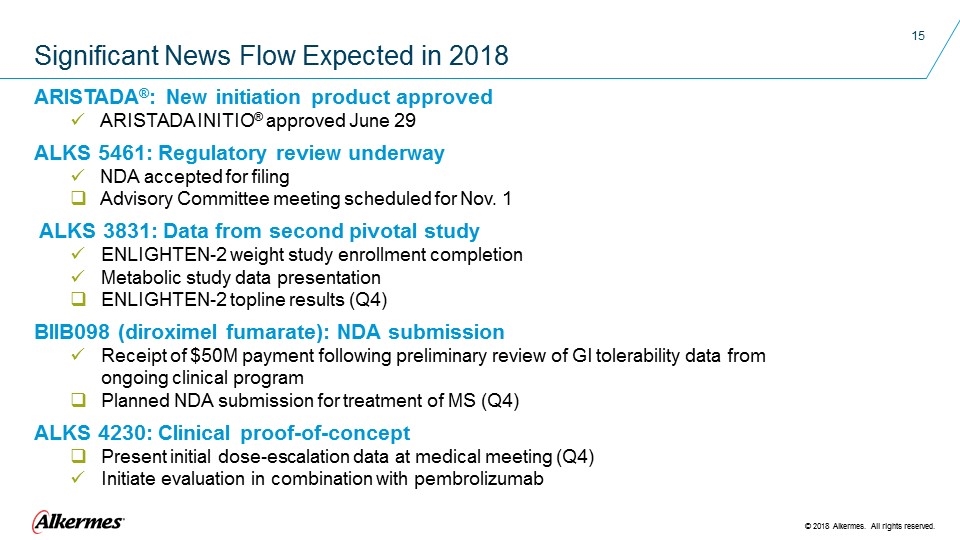

ARISTADA®: New initiation product approved ARISTADA INITIO® approved June 29 ALKS 5461: Regulatory review underway NDA accepted for filing Advisory Committee meeting scheduled for Nov. 1 ALKS 3831: Data from second pivotal study ENLIGHTEN-2 weight study enrollment completion Metabolic study data presentation ENLIGHTEN-2 topline results (Q4) BIIB098 (diroximel fumarate): NDA submission Receipt of $50M payment following preliminary review of GI tolerability data from ongoing clinical program Planned NDA submission for treatment of MS (Q4) ALKS 4230: Clinical proof-of-concept Present initial dose-escalation data at medical meeting (Q4) Initiate evaluation in combination with pembrolizumab Significant News Flow Expected in 2018

www.alkermes.com