Attached files

Exhibit 10.5

200 STATE STREET

BOSTON, MASSACHUSETTS

OFFICE LEASE AGREEMENT

BETWEEN

GLL 200 STATE STREET, L.P.,

a Delaware limited partnership

(“LANDLORD”)

AND

CENTREXION THERAPEUTICS CORPORATION

a Delaware corporation

(“TENANT”)

TABLE OF CONTENTS

| 1. |

Basic Lease Information | 1 | ||||

| 2. |

Lease Grant | 4 | ||||

| 3. |

Possession | 5 | ||||

| 4. |

Rent | 5 | ||||

| 5. |

Compliance with Laws; Use | 12 | ||||

| 6. |

Security Deposit | 12 | ||||

| 7. |

Services to be Furnished by Landlord | 14 | ||||

| 8. |

Leasehold Improvements | 15 | ||||

| 9. |

Repairs and Alterations | 15 | ||||

| 10. |

Use of Electrical Services by Tenant | 17 | ||||

| 11. |

Entry by Landlord | 18 | ||||

| 12. |

Assignment and Subletting | 18 | ||||

| 13. |

Liens | 20 | ||||

| 14. |

Indemnity and Waiver of Claims | 21 | ||||

| 15. |

Insurance | 22 | ||||

| 16. |

Subrogation | 22 | ||||

| 17. |

Casualty Damage | 22 | ||||

| 18. |

Condemnation | 23 | ||||

| 19. |

Events of Default | 24 | ||||

| 20. |

Remedies | 25 | ||||

| 21. |

Limitation Of Liability | 27 | ||||

| 22. |

No Waiver | 27 | ||||

| 23. |

Quiet Enjoyment | 27 | ||||

| 24. |

[Intentionally Omitted] | 27 | ||||

| 25. |

Holding Over | 27 | ||||

| 26. |

Subordination to Mortgages; Estoppel Certificate | 28 | ||||

| 27. |

Attorneys’ Fees | 28 | ||||

| 28. |

Notice | 29 | ||||

| 29. |

Excepted Rights | 29 | ||||

| 30. |

Surrender of Premises | 29 | ||||

| 31. |

Miscellaneous | 30 | ||||

| 32. |

Entire Agreement | 33 |

i

OFFICE LEASE AGREEMENT

THIS OFFICE LEASE AGREEMENT (the “Lease”) is made and entered into as of the 24th day of October 2016, by and between GLL 200 STATE STREET, L.P., a Delaware limited partnership (“Landlord”), and CENTREXION THERAPEUTICS CORPORATION, a Delaware corporation (“Tenant”).

| 1. | Basic Lease Information. |

| A. | “Building” shall mean the Office Unit in the commercial condominium located at and known as 200 State Street, Boston, Massachusetts; and as further defined in Section 2 hereof. |

| B. | The “Rentable Square Footage of the Building” is the rentable square footage of the Office Unit and is deemed to be 301,896 square feet. |

| C. | The “Condominium” is that certain commercial condominium known as 200 State Street Condominium, created by that certain Master Deed dated June 30, 2005, recorded with the Suffolk County Registry of Deeds at Book 37481, Page 1, as amended and restated by that certain Amended and Restated Master Deed dated April 28, 2006, recorded with the Suffolk County Registry of Deeds at Book 39523, Page 221, as the same may be amended and in effect from time to time. The Office Unit is defined in the Master Deed of the Condominium. |

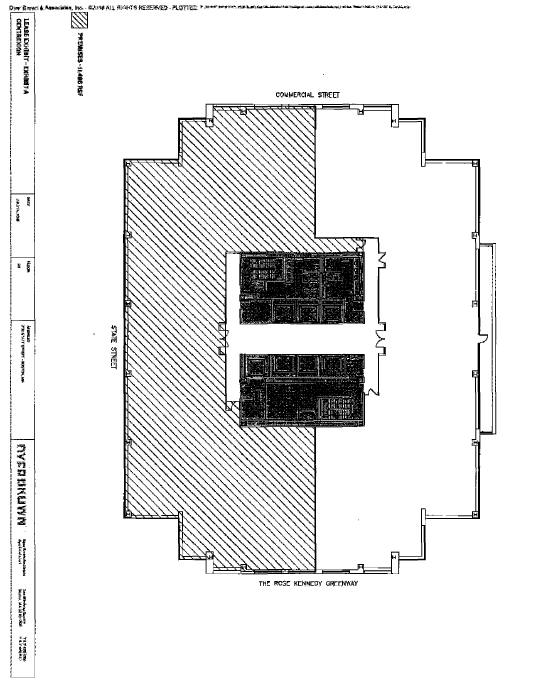

| D. | “Premises” shall mean the area shown on Exhibit A to this Lease. The Premises are located on the 6th floor of the Building. The “Rentable Square Footage of the Premises” is deemed to be 11,486 square feet on the 6th floor. If the Premises include one or more floors in their entirety, all corridors and restroom facilities located on such full floor(s) shall be considered part of the Premises. Landlord and Tenant stipulate and agree that the Rentable Square Footage of the Building and the Rentable Square Footage of the Premises are correct and shall not be remeasured. |

| E. | “Base Rent”: |

| Period |

Annual Rate Per Square Foot |

Annual Base Rent |

Monthly Base Rent |

|||||||||

| Commencement Date to the day prior to Rent Commencement Date |

$ | 0 | $ | 0 | $ | 0 | ||||||

| Lease Year 1 |

$ | 49.75 | $ | 571,428.50 | $ | 47,619.04 | ||||||

| Lease Year 2 |

$ | 50.75 | $ | 582,914.50 | $ | 48,576.21 | ||||||

| Lease Year 3 |

$ | 51.75 | $ | 594,400.50 | $ | 49,533.38 | ||||||

| Lease Year 4 |

$ | 52.75 | $ | 605,886.50 | $ | 50,490.54 | ||||||

| Lease Year 5 |

$ | 53.75 | $ | 617,372.50 | $ | 51,447.71 | ||||||

| Lease Year 6 |

$ | 54.75 | $ | 628,858.50 | $ | 52,404.88 | ||||||

| Lease Year 7 |

$ | 55.75 | $ | 640,344.50 | $ | 53,362.04 | ||||||

1

| F. | “Tenant’s Pro Rata Share”: Tenant’s Pro Rata Share shall mean the percentage derived by dividing the rentable square feet in the Premises by the total rentable square feet of the Building; in the event that either the rentable square feet of the Premises or the rentable square feet of the Building changes,Tenant’s Pro Rata Share will be appropriately adjusted and, as to the calendar year (or Fiscal Year, with respect to Taxes) in which such change occurs,Tenant’s Pro Rata Share shall be determined on the basis of the number of days during such calendar year or Fiscal Year at each such percentage. As of the date hereof, Tenant’s Pro Rata Share shall be deemed to be 3.80% |

| G. | “Base Year” for Taxes: Fiscal Year (defined below) 2017 (i.e., July 1, 2016 to June 30, 2017). |

| “Base Year” for Expenses: calendar year 2017. |

| For purposes hereof, “Fiscal Year” shall mean (with respect to the Base Year for Taxes) the period of July 1, 2016 to June 30, 2017 and each period of July 1 to June 30 thereafter. |

| H. | “Term”: The Term shall commence on the date that Landlord delivers possession of the Premises to Tenant free of all occupants and tenants in accordance with Article 3 of this Lease (the “Commencement Date”) and, unless terminated early in accordance with this Lease, end seven (7) years following the Rent Commencement Date, subject to extension as provided in this Lease (the” Termination Date”). The “Rent Commencement Date” shall be the earlier of (i)seven (7) months following the date on which Tenant has completed Tenant’sWork (described in Exhibit C) and commences to occupy the Premises for its Permitted Use (the “Business Occupancy Date”) or (ii) June 1, 2017. If the Rent Commencement Date is not the first day of a calendar month, then the first “Lease Year” (consisting of the first 12 calendar months following the Rent Commencement Date) and the Term shall be expanded to include the partial month following the Rent Commencement Date so that the first Lease Year shall expire at the end of the 12th full calendar month following the month in which the Rent Commencement Date occurs. The second and succeeding “LeaseYear(s)” shall be periods of twelve (12) full calendar months following the end of the first Lease Year. Promptly after the determination of the Business Occupancy Date, Landlord and Tenant shall enter into a commencement date letter agreement in the form of Exhibit C-1 attached hereto |

| I. | Tenant allowances: An amount equal to $574,300.00, as further described in the attached Exhibit C. |

| J. | “Security Deposit”: $300,000.00 (which amount shall be reduced as set forth in Article 6) in the form of a letter of credit in accordance with Article 6. |

2

| K. | “Guarantor”: None |

| L. | “Brokers”: Landmark Real Estate Advisors (Tenant’s broker) and Newmark Grubb Knight Frank (Landlord’s broker) |

| M. | “Permitted Use”: general office use, and uses incidental thereto consistent with general business offices in first-class office buildings in downtown Boston, Massachusetts, and for no other purpose.. |

| N. | “Notice Addresses”: |

Tenant:

On and after the Business Occupancy Date, notices shall be sent to Tenant at the Premises with a copy in like manner to Hinckley, Allen & Snyder LLP, 28 State Street, Boston, Massachusetts 02109 (Attention: Thomas Bhisitkul, Esquire) (“Tenant’s Attorney”). Prior to the Business Occupancy Date, notices shall be sent to Tenant at the following address:

| Centrexion Therapeutics Corporation | With a copy to:

Tenant’s Attorney | |||

| 509 South Exeter Street, Suite 202 | ||||

| Baltimore, MD 21202 | ||||

| Attention: Mr. Gregg Beloff |

| Landlord: | With a copy to: | |||

| GLL Real Estate Partners | Colliers International | |||

| 200 South Orange Avenue | 200 State Street, Suite 105 | |||

| Suite 1375 | Boston, Massachusetts 02109 | |||

| Orlando, Florida 32801 | Attention: Building Manager | |||

| Attention: Mr. Edward Rime | ||||

| And | ||||

| Sherin and Lodgen LLP | ||||

| 101 Federal Street | ||||

| Boston, Massachusetts 02110 | ||||

| Attention: Edward M. Bloom, Esquire | ||||

Rent (defined in Section 4.A) is payable as follows:

| By US Mail |

By Overnight Courier | |||

| Wells Fargo Lockbox | Wells Fargo Lockbox—E2001-049 | |||

| GLL 200 State Street, L.P.—Rent | Ref: GLL 200 State Street, L,P.-79677 | |||

| P.O. Box 79677 | 3440 Flair Drive | |||

| City of Industry, CA 91716-9677 | El Monte, CA 91731 | |||

3

| By Wire | ||||

| Wells Fargo Bank | ||||

| 420 Montgomery Street, 9th Floor | ||||

| San Francisco, CA 94104 | ||||

| ABA #: 121-000-248 | ||||

| Account Name: GLL 200 State Street LP.—Rent | ||||

| Account # 20000-42922526 | ||||

| Contact: Michelle Broussard | ||||

| 415-243-7596 | ||||

| O. | “Business Day(s)” are Monday through Friday of each week, exclusive of New Year’s Day, Memorial Day, Independence Day, Labor Day, Thanksgiving Day and Christmas Day (“Holidays”). Landlord may designate up to 3 additional Holidays, provided that the additional Holidays are commonly recognized by other office buildings in the area where the Building is located. |

| P. | [Intentionally Omitted] |

| Q. | “Law(s)” means all applicable statutes, codes, ordinances, orders, rules and regulations of any municipal or governmental entity. |

| R. | “Normal Business Hours” for the Building are 8:00 A.M. to 6:00 P.M. on Business Days and 8:00 A.M. to 1:00 P.M. on Saturdays. |

| 2. | Lease Grant. |

Landlord leases the Premises to Tenant and Tenant leases the Premises from Landlord, together with the right in common with others to use any portions of the Building that are designated by Landlord for the common use of tenants and others. The term “Building” as used in this Lease shall mean: (i) the Office Unit; (ii) the Building Common Areas (as hereinafter defined); and (iii) at Landlord’s discretion, any additional real property, areas, land, buildings or other improvements added thereto.

Tenant shall have the non-exclusive right to use in common with other tenants and occupants in the Building, and subject to the Rules and Regulations referred to in Article 5 of this Lease, those portions of the Building which are provided, from time to time, for use in common by Landlord, Tenant and any other tenants or occupants of the Building which shall include, notwithstanding anything to the contrary in this Lease, the Building lobby and entrances, passenger and freight elevators, common bathrooms, common parking areas, and all common hallways necessary for Tenant’s access to the Building and the Premises (such areas, together with such other portions of the Building designated by Landlord, in its discretion, including certain areas designated for the exclusive use of certain tenants, or to be shared by Landlord and certain tenants or occupants, referred to herein as the “Building Common Areas”). Tenant shall have the non-exclusive right to use in common with other tenants and occupants in the Condominium, and subject to: (i) the Rules and Regulations referred to in Article 5 of this Lease; (ii) any other rules or regulations of the Condominium in effect from time to time; and (iii) the condominium documents of the Condominium, as the same may be amended and in effect from time to time, including, without limitation, the Master Deed, the Declaration of Trust, the

4

bylaws and any other document concerning the relationship between the unit owners of Condominium and the operation and maintenance of the Condominium (the “Condominium Documents”), those portions of the Condominium which are provided, from time to time, for use in common by Landlord, Tenant and any other tenants or occupants of the Condominium (such areas, together with such other portions of the Condominium designated by Landlord, in its discretion, including certain areas designated for the exclusive use of certain tenants, or to be shared by Landlord and certain tenants or occupants, referred to herein as the “Condominium Common Areas”). The “Common Areas” as used in this Lease shall mean the Condominium Common Areas and the Building Common Areas.

| 3. | Possession. |

| A. | Subject to Landlord’s obligations under Section 9.B., and subject to satisfaction of all Delivery Conditions (as hereinafter defined) the Premises will be delivered by Landlord in “as is” condition. |

| B. | If Tenant takes possession of the Premises before the Commencement Date, such possession shall be subject to the terms and conditions of this Lease. However, except for the cost of services requested by Tenant (e.g. freight elevator usage after Normal Business Hours, electricity and fire alarm/smoke detector disconnects), Tenant shall not be required to pay Rent for any days of possession before the Rent Commencement Date during which Tenant is in possession of the Premises whether for the purpose of performing improvements or installing furniture, equipment or other personal property or, after the Business Occupancy Date, occupying the Premises for its Permitted Use. |

| C. | “Delivery Conditions” shall mean and include the following terms and conditions: (i) the Premises are vacant, broom clean, with all personal property of any prior tenant (other than the Retained FF&E, as defined in Exhibit F) and otherwise in condition such that Tenant can immediately occupy the Premises and perform Tenant’s Work; (ii) all Building systems, utilities and facilities serving the Premises, including, without limitation, heating, ventilation and air conditioning, electricity, water, plumbing and sewerage systems shall be in good working order, condition and repair and adequate in all respects for Tenant’s use; and (iii) all means of access to the Premises, including, without limitation, the Building elevators and other facilities reasonably necessary for Tenant to undertake the Tenant Work, shall be free of obstruction, intact and in good working order. |

| 4. | Rent. |

| A. | Payments. As consideration for this Lease, Tenant shall pay Landlord, without any setoff or deduction except to the extent otherwise provided in this Lease, the total amount of Base Rent and Additional Rent due for the Term. “Additional Rent” means all sums (exclusive of Base Rent) that Tenant is required to pay Landlord pursuant to the terms of this Lease. Additional Rent and Base Rent are sometimes collectively referred to as “Rent”. Tenant shall pay and be liable for all rental, sales and use taxes (but excluding income taxes), if any, imposed upon or measured by Rent under applicable Law. Monthly installments of Base Rent and recurring monthly charges of Additional Rent shall be due and payable in advance on the first day of each calendar month without notice or demand. All |

5

| other items of Rent shall be due and payable by Tenant on or before 30 days after billing by Landlord. All payments of Rent shall be by good and sufficient check or by other means (such as automatic debit or electronic transfer) acceptable to Landlord. If Tenant fails to pay any item or installment of Rent when due, Tenant shall pay Landlord an administration fee equal to 5% of the past due Rent, provided that Tenant shall be entitled to a grace period of 5 Business Days for the first 2 late payments of Rent in a given calendar year. If the Term terminates on a day other than the last day of a calendar month, the monthly Base Rent and Tenant’s Pro Rata Share of any Tax Excess (defined in Section 4.B.) or Expense Excess (defined in Section 4.B.) for the month shall be prorated based on the number of days in such calendar month. Landlord’s acceptance of less than the correct amount of Rent shall be considered a payment on account of the earliest Rent due. No endorsement or statement on a check or letter accompanying a check or payment shall be considered an accord and satisfaction, and either party may accept the check or payment without prejudice to that party’s right to recover the balance or pursue other available remedies. Tenant’s covenant to pay Rent is independent of every other covenant in this Lease. |

| B. | Expense Excess and Tax Excess. Tenant shall pay Tenant’s Pro Rata Share of the amount, if any, by which Expenses (defined in Section 4.C.) for each calendar year during the Term (commencing with calendar year 2018) exceed Expenses for the Base Year (the “Expense Excess”) and also the amount, if any, by which Taxes (defined in Section 4.D.) for each Fiscal Year during the Term (commencing with Fiscal Year 2018) exceed Taxes for the Base Year (the “Tax Excess”). If Expenses and/or Taxes in any calendar year or Fiscal Year decrease below the amount of Expenses and/or Taxes for the Base Year, Tenant’s Pro Rata Share of Expenses and/or Taxes, as the case may be, for that calendar year or Fiscal Year shall be $0. Landlord shall provide Tenant with a good faith estimate of the Expense Excess and of the Tax Excess for each calendar year or Fiscal Year during the Term. On or before the first day of each month following the conclusion of the applicable Base Year, Tenant shall pay to Landlord a monthly installment equal to one-twelfth of Tenant’s Pro Rata Share of Landlord’s estimate of the Expense Excess and one-twelfth of Tenant’s Pro Rata Share of Landlord’s estimate of the Tax Excess. If Landlord determines that its good faith estimate of the Expense Excess or of the Tax Excess was incorrect by a material amount, Landlord may provide (but not more than once in any calendar year) Tenant with a revised estimate, as the case may be. After its receipt of the revised estimate, Tenant’s monthly payments shall be based upon the revised estimate. If Landlord does not provide Tenant with an estimate of the Expense Excess by January 1 of a calendar year, or the Tax Excess by the start of each new Fiscal Year, Tenant shall continue to pay monthly installments based on the previous calendar year’s or Fiscal Year’s estimate(s), as the case may be, until Landlord provides Tenant with the new estimate. Upon delivery of the new estimate, an adjustment shall be made for any month for which Tenant paid monthly installments based on the previous calendar or Fiscal Year’s estimate(s). Tenant shall pay Landlord the amount of any underpayment within 30 days after receipt of the new estimate. Any overpayment shall be refunded to Tenant within 30 days or, at Tenant’s election, credited against the next due future installment(s) of Additional Rent. |

6

| As soon as is practical following the end of each calendar year or Fiscal Year, as the case may be, but in no event more than 120 days thereafter, Landlord shall furnish Tenant with a statement of the actual Expenses and Expense Excess and the actual Taxes and Tax Excess for the prior calendar year or Fiscal Year, as the case may be. The failure of Landlord to timely furnish any statement shall not prejudice Landlord from enforcing its rights under this Section 4. Any statement of actual Expenses will be furnished in reasonable detail, prepared on an accrual basis of accounting consistently applied from year to year. If the estimated Expense Excess and/or estimated Tax Excess for the prior calendar year or Fiscal Year, as the case may be, is more than the actual Expense Excess and/or actual Tax Excess for the prior calendar year or Fiscal Year, as the case may be, Landlord shall apply any overpayment by Tenant against Additional Rent due or next becoming due, provided if the Lease terminates before the determination of the overpayment, Landlord shall refund any overpayment to Tenant after first deducting the amount of Rent due within 30 days of its delivery of the statement of Expenses and/or Taxes. If the estimated Expense Excess and/or estimated Tax Excess for the prior calendar year or Fiscal Year, as the case may be, is less than the actual Expense Excess and/or actual Tax Excess for such prior calendar year or Fiscal Year, as the case may be, Tenant shall pay Landlord, within 30 days after its receipt of the statement of Expenses and/or Taxes, any underpayment for the prior calendar year. |

| C. | Expenses Defined. “Expenses” means all reasonable and customary costs and expenses incurred in each calendar year in connection with operating, maintaining, repairing, and managing the Building, which shall be calculated in a commercially reasonable manner consistently applied from year to year, including, but not limited to: |

| 1. | Labor costs, including, wages, salaries, social security and employment taxes, medical and other types of insurance, uniforms, training, and retirement and pension plans, but excluding such labor costs for personnel above the grade of building manager and other supervisors. |

| 2. | Management fees paid to a third party manager (provided the same are comparable to management fees generally charged for first class office buildings in Boston), the cost of equipping and maintaining a management office (including the fair rental value of said management office), accounting and bookkeeping services, legal fees not attributable to leasing or collection activity, and other administrative costs. Landlord, by itself or through an affiliate, shall have the right to directly perform or provide any services under this Lease (including management services if a third party has not been hired or paid to provide management services), provided that the cost of any such services shall not exceed the cost that would have been incurred had Landlord entered into an arms-length contract for such services with an unaffiliated entity of comparable skill and experience. |

| 3. | The cost of services, including amounts paid to service providers and the rental and purchase cost of parts, supplies, tools and equipment. |

7

| 4. | Premiums and deductibles paid by Landlord for insurance, including workers compensation, fire and extended coverage, earthquake, general liability, rental loss, elevator, boiler and other insurance customarily carried from time to time by owners of comparable office buildings. |

| 5. | The costs to operate, repair and maintain and replace all systems and equipment and components of the Building, including the structural portions of the Building, the roof and roof coverings of the Building, the exterior walls and windows and the mechanical, gas, steam, electrical, sanitary, HVAC, elevator, plumbing and life-safety systems of the Building and the costs incurred in connection with the parking garage servicing the Building, provided that none of the foregoing costs are capital expenses or costs for capital improvements, repairs, or replacements under generally accepted accounting principles. |

| 6. | Electrical Costs (defined below) and charges for water, gas, steam and sewer, but excluding those charges for which Landlord is reimbursed by tenants. “Electrical Costs” means: (a) charges paid by Landlord for electricity provided to the Building Common Areas; and (b) costs incurred in connection with an energy management program for the Building. Electrical Costs shall be adjusted as follows: (i) amounts received by Landlord as reimbursement for above standard electrical consumption shall be deducted from Electrical Costs; (ii) the cost of electricity incurred to provide overtime HVAC to specific tenants (as reasonably estimated by Landlord) shall be deducted from Electrical Costs; and (iii) the cost of electricity to individual tenant spaces in the Building shall be deducted from Electrical Costs. |

| 7. | The amortized cost of capital improvements (as distinguished from replacement parts or components installed in the ordinary course of business that are not in themselves capital improvements, repairs or replacements under generally accepted accounting principles) made to the Building which are: (a) performed primarily to reduce operating expense costs of the Building; or (b) required to comply with any Laws that are enacted, or first interpreted to apply to the Building, after the date of this Lease. The cost of any such capital improvements shall be amortized by Landlord over the improvement’s useful life, as reasonably determined by Landlord in accordance with generally accepted accounting principles consistently applied. The amortized cost of capital improvements may, at Landlord’s option, include actual or imputed interest at the rate that Landlord would reasonably be required to pay to finance the cost of the capital improvement. |

| 8. | Payments, fees or charges assessed to the owner of the Office Unit under the Condominium Documents (including, without limitation, any Condominium Charges, as hereinafter defined) and/or under any easement, license, operating agreement, declaration, restrictive covenant or any instrument pertaining to the sharing of costs by the Office Unit. Whereas the Office Unit is part of the Condominium, Condominium |

8

| Charges include, without limitation, the Office Unit’s proportionate share of the following costs: all charges and rates connected with water supplied to the Building and related sewer use charges; all charges connected with security and HVAC supplied to the Building, the cost of labor and material for cleaning the grounds and paved areas of the Building, fire, casualty, liability, and such other insurance as may be required under any mortgage on the Condominium or any ground lease to which the Condominium is subject. Notwithstanding the foregoing, Condominium Charges shall not include: (i) costs, assessments or charges for capital improvements, repairs or replacements; or (ii) any costs or expenses that are separately included in Expenses or Taxes. |

If Landlord incurs Expenses for the Building together with one or more other buildings or properties, or one or more other units of the Condominium, whether pursuant to a reciprocal easement agreement, the Condominium Documents, common area agreement or otherwise, the shared costs and expenses shall be equitably prorated and apportioned between the Building and the other buildings, units or properties. Notwithstanding anything to the contrary in this Lease, Expenses shall not include: (i) costs, including permit, license and inspection costs, incurred with respect to the installation of tenants’ or other occupants’ improvements in the Building or incurred in renovating or otherwise improving, decorating, painting or redecorating vacant space in the Building; (ii) the cost of capital improvements, including, without limitation, capital repairs or replacements (except as set forth in clause 7 above); (iii) depreciation, interest or amortizations (except as provided above for the amortization of capital improvements), or ground lease rents or charges; (iv) principal and interest payments, points or fees of mortgage and other debts encumbering the Building or the property of which the Building is part; (v) the cost of repairs or other work, or any other cost or expenditure, to the extent Landlord is reimbursed by insurance or condemnation proceeds or by any third party; (vi) costs in connection with marketing and leasing space in the Building, including without limitation, brokerage commissions, space planning costs, legal fees relating to the review or negotiation of leases and related agreements or relating to tenant disputes, construction costs, advertising and promotional expenses, lease concessions, including rental abatements and construction allowances, granted to specific tenants; (vii) costs incurred in connection with the sale, financing or refinancing of the Building; (viii) fines, interest and penalties incurred due to the late payment of Taxes (defined in Section 4.D) or Expenses, and any penalties or damages that Landlord pays to Tenant under this Lease or to other tenants in the Building under their respective leases; (ix) organizational expenses associated with the creation and operation of the entity which constitutes Landlord; (x) costs of services or other benefits which are not provided to Tenant or for which Tenant is charged for directly but which are provided to another tenant or occupant of the Building; (xi) overhead and profit increment paid to Landlord or to subsidiaries or affiliates of Landlord for goods and/or services to the extent the same exceeds the costs of such goods and/or services rendered by unaffiliated third parties on a competitive basis; (xii) costs arising from the presence of hazardous materials or substances or asbestos in or about the Premises, the Building or the Condominium; and (xiii) any Expenses not billed to Tenant within 18 months after the expiration of the calendar year in which such Expenses were incurred.

9

If the Building is not at least 95% leased during any calendar year, those Expenses that are Variable Expenses (defined below), shall, at Landlord’s option, be determined as if the Building had been 95% leased during that calendar year. If Tenant pays for its Pro Rata Share of Expenses based on increases over a “Base Year” and Expenses for a calendar year are determined as provided in the prior sentence, Variable Expenses for the Base Year shall also be determined as if the Building had been 95% leased during the Base Year. The extrapolation of Expenses under this Section shall be performed by appropriately adjusting the cost of those components of Expenses that vary materially based on changes in the occupancy of the Building including, without limitation, expenses for electricity, water, sewage and janitorial services (collectively, “Variable Expenses”); the foregoing extrapolation of Variable Expenses is intended to enable Landlord (where the Building is less than 95% leased) to distribute a portion of the Variable Expenses otherwise attributable to the vacant space to the remaining tenants in the Building; however, in no event shall the extrapolation of Variable Expenses herein result in the Landlord recovering more than the Variable Expenses actually incurred by Landlord. If any amounts comprising Expenses are incurred not just with respect to the office area of the Building, but also with respect to the retail area of the Building, then Landlord shall reasonably allocate such amounts between the office and retail areas and such allocation shall be made on a fair and equitable basis, based on the usage of and benefits received from the Expense amounts involved.

| D. | Taxes Defined. “Taxes” shall mean: (1) all real estate taxes and other assessments on the Building including, but not limited to, assessments for special improvement districts and building improvement districts, taxes and assessments levied in substitution or supplementation in whole or in part of any such taxes and assessments and the Building’s share of any real estate taxes and assessments under any reciprocal easement agreement, common area agreement or similar agreement as to the Building; (2) all personal property taxes for property that is owned by Landlord and used in connection with the operation, maintenance and repair of the Building; and (3) all reasonable costs and fees incurred in connection with seeking reductions in any tax liabilities described in (1) and (2), including, without limitation, any costs incurred by Landlord for compliance, review and appeal of tax liabilities. Without limitation, Taxes shall not include any income, capital levy, franchise, capital stock, gift, estate or inheritance tax. If a betterment assessment is payable in installments, Taxes for the year shall include the amount of the installment and any interest due and payable during that year. For all other real estate taxes, Taxes for that year shall, at Landlord’s election, include either the amount accrued, assessed or otherwise imposed for the year or the amount due and payable for that year, provided that Landlord’s election shall be applied consistently throughout the Term. If a change in Taxes is obtained for any year of the Term during which Tenant paid Tenant’s Pro Rata Share of any Tax Excess, then Taxes for that year will be retroactively adjusted and Landlord shall provide Tenant with a credit, if any, based on the adjustment. Likewise, if a change is obtained for Taxes for the Base Year, Taxes for the Base Year shall be restated and the Tax Excess for all subsequent years shall be recomputed. Tenant shall pay Landlord the amount of Tenant’s Pro Rata Share of any such increase in the Tax Excess within 30 days after Tenant’s receipt of a statement from Landlord. |

10

| E. | Audit Rights. Tenant may, within 90 days after receiving Landlord’s statement of Expenses, give Landlord written notice (“Review Notice”) that Tenant intends to review Landlord’s records of the Expenses for that calendar year. Within a reasonable time after receipt of the Review Notice, Landlord shall make all pertinent records available for inspection that are reasonably necessary for Tenant to conduct its review. If any records are maintained at a location other than the office of the Building, Tenant may either inspect the records at such other location or pay for the reasonable cost of copying and shipping the records. If Tenant retains an agent to review Landlord’s records, the agent must be with a licensed CPA firm, or other reasonably qualified third party with expertise in and familiarity with general industry practice with respect to the operation of and accounting for a first class office building, provided said third party’s compensation shall in no way be contingent upon or correspond to the financial savings to Tenant resulting from such review. Tenant shall be solely responsible for all costs, expenses and fees incurred for the audit, provided, however, that if said audit determines that Expenses for the Building for the year in question were overstated by 5% or more, then Landlord shall reimburse Tenant, within 30 days after receipt of paid invoices from Tenant, for reasonable amounts paid by Tenant to its auditing agent for such audit. Within 60 days after the records are made available to Tenant, Tenant shall have the right to give Landlord written notice (an “Objection Notice”) stating in reasonable detail any objection to Landlord’s statement of Expenses for that year. If Tenant fails to give Landlord an Objection Notice within the 60 day period or fails to provide Landlord with a Review Notice within the 90 day period described above, Tenant shall be deemed to have approved Landlord’s statement of Expenses and shall be barred from raising any claims regarding the Expenses for that year. Tenant, however, shall always have the right to audit and examine the Expenses for the Base Year. If Tenant provides Landlord with a timely Objection Notice, Landlord and Tenant shall work together in good faith to resolve any issues raised in Tenant’s Objection Notice. If Landlord and Tenant determine that Expenses for the calendar year are less than reported, Landlord shall provide Tenant with a credit against the next installment of Rent in the amount of the overpayment by Tenant, provided that if the Term expires before such determination, Landlord shall promptly refund any overpayment to Tenant. Likewise, if Landlord and Tenant determine that Expenses for the calendar year are greater than reported, Tenant shall pay Landlord the amount of any underpayment within 30 days. The records obtained by Tenant shall be treated as confidential and, as a condition to Tenant’s audit rights, Tenant and its examiners shall be required to execute and deliver to Landlord a confidentiality agreement in form reasonably acceptable to Landlord and Tenant. In no event shall Tenant be permitted to examine Landlord’s records or to dispute any statement of Expenses unless Tenant has paid and continues to pay all Rent when due. |

11

| 5. | Compliance with Laws; Use. |

The Premises shall be used only for the Permitted Use and for no other use whatsoever. Tenant shall not use or permit the use of the Premises for any purpose which is illegal, dangerous to persons or property or which, in Landlord’s reasonable opinion, unreasonably disturbs any other tenants of the Building or interferes with the operation of the Building. Tenant shall comply with all Laws, including the Americans with Disabilities Act, regarding the operation of Tenant’s business and the use, condition, configuration and occupancy of the Premises. Notwithstanding the foregoing, Tenant shall not be obligated to make any structural alterations or capital improvements to the Premises to comply with any Laws unless such compliance is required as the result of the specific nature of Tenant’s business in the Premises (other than general office use) or is the result of the acts or omissions of Tenant or its agents, employees or contractors or any design or configuration of the Premises specifically installed by Tenant. Tenant, within 10 days after receipt, shall provide Landlord with copies of any notices it receives regarding a violation or alleged violation of any Laws. Tenant shall reimburse and compensate Landlord for all expenditures made by, or damages or fines sustained or incurred by, Landlord due to any violations of Laws by Tenant or any Tenant Related Parties (as defined in Section 14.B hereof) with respect to the Premises. Tenant shall comply with the rules and regulations of the Building attached as Exhibit B and such other reasonable rules and regulations adopted by Landlord from time to time. Tenant shall also cause its agents, contractors, subcontractors, employees and subtenants to comply with all rules and regulations. Landlord shall not knowingly discriminate against Tenant in Landlord’s enforcement of the rules and regulations.

| 6. | Security Deposit. |

The Security Deposit, in the form of an unconditional irrevocable standby commercial letter of credit (the “Letter of Credit”) in the amount of $300,000.00 (the “Letter of Credit Amount”) shall be delivered to Landlord upon the execution of this Lease by Tenant and shall be held by Landlord without liability for interest (unless required by Law) as security for the performance of Tenant’s obligations. The Security Deposit is not an advance payment of Rent or a measure of Tenant’s liability for damages. Landlord may, from time to time, after any applicable notice and grace periods have expired, and without prejudice to any other remedy, use all or a portion of the Security Deposit to satisfy past due Rent or to cure any uncured Event of Default by Tenant. The Letter of Credit shall terminate and Landlord shall return the Letter of Credit within 45 days after the earlier to occur of: (1) the Termination Date and Tenant’s surrender of possession of the Premises to Landlord in accordance with this Lease; or (2) the earlier termination of this Lease and Tenant’s surrender of possession of the Premises to Landlord in accordance with this Lease. If the Letter of Credit is returned pursuant to this Article 6 prior to the determination of Tenant’s Pro Rata Share of any Tax Excess and Expense Excess for the final year of the Term, then Tenant shall deliver to the Landlord a cash deposit, to be held in a segregated, non-interest-bearing account as security for the performance of Tenant’s obligations, in the amount of 50% of Tenant’s Pro Rata Share of any Tax Excess and Expense Excess that Landlord reasonably estimates remains unpaid by Tenant on the Termination Date for (i) any prior calendar or fiscal year for which final adjustments have not been made and (ii) the period commencing on the first day of the then calendar or fiscal year, as applicable, and ending on the Termination Date. Such cash deposit, without interest, shall be returned to Tenant within 45 days after the determination of Tenant’s Pro Rata Share of any Tax Excess and Expense Excess for the periods set forth in (i) and (ii) in the foregoing sentence, and payment is made by Tenant for any unpaid amount. If Landlord transfers its interest in the Premises, Landlord may assign the Security Deposit to the transferee and, following the assignment, Landlord shall have no further liability for the return of the Security Deposit.

12

The Letter of Credit shall be issued by a reputable domestic commercial bank or other domestic financial institution (i) which accepts deposits, maintains accounts and whose deposits are insured by the FDIC (ii) whose long term debt is rated at least A or the equivalent thereof by Standard & Poors Ratings Group or A or the equivalent thereof by Moody’s Investors Services, Inc. and (iii) whose capital and surplus is in excess of $500,000,000.00 (the “Bank”). The Letter of Credit shall be in a form and content as set forth in Exhibit D or any form substantially similar thereto. Tenant shall pay all expenses, points and/or fees incurred by Tenant in obtaining the Letter of Credit. The Letter of Credit shall be maintained in effect throughout the Term.

If, as a result of any drawing by Landlord on the Letter or Credit, the amount of the Letter of Credit shall be less than the Letter of Credit Amount, Tenant shall, within 10 Business Days after receipt of notice from Landlord, provide Landlord with additional letter(s) of credit in an amount equal to the deficiency, and any such additional letter(s) of credit shall comply with all of the provisions of this Article. Without limiting the generality of the foregoing, if the Letter of Credit expires earlier than the expiration of the Term, Landlord will accept a renewal thereof (such renewal letter of credit to be in effect and delivered to Landlord, as applicable, not later than 30 days prior to the expiration of the Letter of Credit), which shall be upon the same terms as the expiring Letter of Credit or such other terms as may be reasonably acceptable to Landlord.

Notwithstanding the foregoing, if (a) there has been no Event of Default by Tenant during the preceding twelve (12) months and (b) Landlord has not had to draw on the Letter of Credit at all to satisfy past due Rent or to cure any uncured Event of Default by Tenant, then the Letter of Credit may be reduced to $100,000.00 as of the first day of the Fourth Lease Year. The foregoing reductions may be implemented either by replacing the original Letter of Credit with a new Letter of Credit in each instance or by amendments to the original Letter of Credit in such form and substance as are acceptable to Landlord.

It is specifically agreed and understood that if at any time during the Term of this Lease Landlord shall consider the Bank issuing the Letter of Credit to be in an unsatisfactory financial condition because it does not meet the financial criteria set forth above, or in the event the Bank shall be the subject of an insolvency proceeding or be placed under management of a controller, Tenant shall, upon Landlord’s demand, replace said Letter of Credit within ten (10) Business Days with a substitute Letter of Credit from a bank or financial institution then approved by Landlord or, at Landlord’s election, replace said Letter of Credit with a cash security deposit in the amount of the Letter of Credit, in which event, Landlord may draw down on said cash security deposit for the same purposes and to the same extent as it could have drawn down the Letter of Credit upon any Event of Default by Tenant. Tenant’s failure to so replace the Letter of Credit within ten (10) Business Days of Landlord’s demand shall be an Event of Default under this Lease.

13

| 7. | Services to be Furnished by Landlord. |

| A. | Landlord agrees to furnish Tenant with the following services: (1) Water service for use in the lavatories on each floor on which the Premises are located and for use in any kitchenette area approved by Landlord (but Tenant shall be responsible for providing hot water service to any such kitchenette area); (2) Heat and air conditioning (HVAC) in season during Normal Business Hours, at such temperatures and in such amounts as are standard for comparable Class A buildings in downtown Boston or at such higher standards as required by governmental authority; (3) Maintenance and repair of the Building as described in Section 9.B.; (4) Janitor service on Business Days in accordance with the cleaning specifications attached hereto as Exhibit E, or such other reasonably comparable specifications designated by Landlord from time to time. If Tenant’s use, floor covering or other improvements require special services in excess of the standard services for the Building, Tenant shall pay the additional cost attributable to the special services; (5) Elevator service; (6) Electricity to the Premises for general office use, in accordance with and subject to the terms and conditions in Article 10; (7) access to the Building and the Premises (by elevator) for Tenant and its employees 24 hours per day, 7 days per week every day of the year; subject to the terms of the Lease; (8) Security for the Building, including the stationing of security guards in the Building lobby 24 hours per day, 7 days a week; and (9) such other services as Landlord reasonably determines are necessary or appropriate for the Building and that are typical with first class office buildings. Tenant, upon such advance notice as is reasonably required by Landlord (which in no event shall be greater than 24 hour advance notice), shall have the right to receive HVAC service during hours other than Normal Business Hours. Landlord represents that the current charge for after-hours HVAC is $75.00 per hour per floor. Landlord agrees that any increases in such after-hours HVAC service charge shall be limited to increases in Landlord’s actual, reasonable costs of supplying the after-hours HVAC services. Tenant shall pay Landlord the standard charge for the additional service as reasonably determined by Landlord from time to time. |

| B. | Landlord’s failure to furnish, or any interruption or termination of, services due to governmental action, the failure of any equipment, or the occurrence of any event or cause beyond the reasonable control of Landlord (a “Service Failure”) shall not render Landlord liable to Tenant, constitute a constructive eviction of Tenant, give rise to an abatement of Rent, nor relieve Tenant from the obligation to fulfill any covenant or agreement and Landlord shall use commercially reasonable efforts to correct such Service Failure. However, if the Premises, or a material portion of the Premises, is made untenantable for a period in excess of 4 consecutive Business Days as a result of the Service Failure, then Tenant, as its sole remedy, shall be entitled to receive an abatement of Rent payable hereunder during the period beginning on the 5th consecutive Business Day of the Service Failure and ending on the day the service has been restored. If the entire Premises has not been rendered untenantable by the Service Failure, the amount of abatement that Tenant is entitled to receive shall be prorated based upon the percentage of the Premises rendered untenantable and not used by Tenant. In no event, however, shall Landlord be liable to Tenant for any loss or damage, including the theft of Tenant’s Property (defined in Article 15), arising out of or in connection with the failure of any security services, personnel or equipment. |

14

| 8. | Leasehold Improvements. |

All improvements to the Premises (collectively, “Leasehold Improvements”) shall be owned by Landlord and shall remain upon the Premises without compensation to Tenant. Notwithstanding the foregoing, all Tenant’s Property (as defined in Article 15) shall remain the property of Tenant and shall not remain upon the Premises. It is understood and agreed that any Tenant’s Property which is minimally attached to the walls or floor of the Premises may be removed by Tenant, provided Tenant repairs any damage caused by such removal. However, Landlord, by written notice to Tenant not later than 30 days prior to the Termination Date, may require Tenant to remove, at Tenant’s expense: (1) Cable (defined in Section 9.A) installed by or for the exclusive benefit of Tenant and located in the Premises or other portions of the Building; and (2) any Leasehold Improvements that are performed by or for the benefit of Tenant and, in Landlord’s reasonable judgment, are of a nature that would require removal and repair costs that are materially in excess of the removal and repair costs associated with standard office improvements (collectively referred to as “Required Removables”). Without limitation, it is agreed that Required Removables include internal stairways, raised floors, personal baths and showers, vaults, rolling file systems and structural alterations and modifications of any type. The Required Removables designated by Landlord shall be removed by Tenant before the Termination Date, provided that upon prior written notice to Landlord, Tenant may remain in the Premises for up to 5 days after the Termination Date for the sole purpose of removing the Required Removables. Tenant’s possession of the Premises shall be subject to all of the terms and conditions of this Lease, including the obligation to pay Rent on a per diem basis at the rate in effect for the last month of the Term. Tenant shall repair damage caused by the installation or removal of Required Removables. If Tenant fails to remove any Required Removables or perform related repairs in a timely manner, Landlord, at Tenant’s expense, may remove and dispose of the Required Removables and perform the required repairs. Tenant, within 30 days after receipt of an invoice, shall reimburse Landlord for the reasonable costs incurred by Landlord. Notwithstanding the foregoing, Tenant, at the time it requests approval for a proposed Alteration (defined in Section 9.C), may request in writing that Landlord advise Tenant whether the Alteration or any portion of the Alteration will be designated as a Required Removable. Within 10 days after receipt of Tenant’s request, Landlord shall advise Tenant in writing as to which portions of the Alterations, if any, will be considered to be a Required Removable. Any Required Removable identified by Landlord at the time Tenant requests approval for a proposed Alteration must be removed by Tenant whether or not Landlord provides the written notice (to be sent not later than 30 days prior to the Termination Date) to Tenant as set forth above, and all other Alterations not so designated by Landlord as a Required Removable need not be removed by Tenant.

| 9. | Repairs and Alterations. |

| A. | Tenant’s Repair Obligations. Tenant shall, at its sole cost and expense, promptly perform all maintenance and repairs to the Premises that are not Landlord’s express responsibility under this Lease, and shall keep the Premises in good order, condition and repair, damage due to fire, casualty, taking and reasonable wear and tear excepted. For purposes of this Lease, the term “reasonable wear and tear” constitutes that normal, gradual deterioration which occurs due to aging and ordinary use of the Premises despite reasonable and timely maintenance and repair, but in no event shall “reasonable wear and tear” excuse Tenant from its duty to keep the Premises in good maintenance and repair or otherwise usable, serviceable and tenantable. Tenant’s repair |

15

| obligations include, without limitation, repairs to: (1) floor covering; (2) interior partitions; (3) doors; (4) the interior side of demising walls; (5) electronic, phone, telecommunications and data cabling and related equipment (collectively, “Cable”) that is installed by or for the exclusive benefit of Tenant and located in the Premises or other portions of the Building (and Tenant’s contractor shall have access to the Building electrical and telephone closets for connection and maintenance without any charge from Landlord); (6) supplemental air conditioning units, private showers and kitchens, including hot water heaters, plumbing, and similar facilities serving Tenant exclusively; and (7) Alterations performed by contractors retained by Tenant, including related HVAC balancing. All work shall be performed in accordance with the rules and procedures described in Section 9.C. below. If Tenant fails to make any repairs to the Premises for more than 15 days after notice from Landlord (although notice shall not be required if there is an emergency involving risk of imminent injury to persons or imminent and significant property damage), Landlord may make the repairs, and Tenant shall pay the reasonable cost of the repairs to Landlord within 30 days after receipt of an invoice, together with an administrative charge in an amount equal to 10% of the cost of the repairs. Notwithstanding the foregoing, if the repair required of Tenant cannot be completed within 15 days after Landlord’s notice to Tenant, Landlord shall not exercise its right to make such repair on Tenant’s behalf so long as Tenant has commenced such repair within said 15 day period and is diligently pursuing the same to completion. |

| B. | Landlord’s Repair Obligations. Landlord shall, consistent with the standards of a first class office building, keep and maintain in good repair and working order and make repairs to and perform maintenance upon: (1) structural elements of the Building; (2) mechanical (including HVAC), electrical, plumbing and fire/life safety systems serving the Building in general; (3) Common Areas; (4) the roof of the Building; (5) exterior windows of the Building; and (6) elevators serving the Building. Landlord shall promptly make repairs (considering the nature and urgency of the repair) for which Landlord is responsible. Landlord shall use commercially reasonable efforts to minimize any disruption to Tenant’s business in performing its repair obligations. |

| C. | Alterations. Tenant shall not make alterations, additions or improvements to the Premises or install any Cable in the Premises or other portions of the Building (collectively referred to as “Alterations”) without first obtaining the written consent of Landlord in each instance, which consent shall not be unreasonably withheld or delayed. However, Landlord’s consent shall not be required for any Alteration that satisfies all of the following criteria (a “Cosmetic Alteration”): (1) it is of a cosmetic nature such as painting, wallpapering, hanging pictures and installing carpeting; (2) it is not visible from the exterior of the Premises or Building; (3) it will not affect the systems or structure of the Building; and (4) it does not require work to be performed inside the walls or above the ceiling of the Premises (other than Cable). However, even though consent is not required, the performance of Cosmetic Alterations shall be subject to all the other provisions of this Section 9.C unless otherwise provided. Prior to starting work (other than for Cosmetic Alterations), Tenant shall furnish Landlord with plans and specifications (if and to the extent necessary for the issuance of building permits) reasonably acceptable to Landlord; names of contractors reasonably acceptable to Landlord (provided |

16

| that Landlord may designate specific contractors with respect to Building systems); copies of contracts; necessary permits and approvals; and evidence of contractor’s and subcontractor’s insurance in amounts reasonably required by Landlord. Material changes to the plans and specifications must also be submitted to Landlord for its approval. Landlord agrees to respond to Tenant with respect to plans and specifications and to material changes thereof within fifteen (15) Business Days (except with respect to plans and specifications, and material changes thereto, for the initial Tenant’s Work under Exhibit C, to which Landlord hereby agrees to respond within fifteen (15) calendar days). Alterations shall be constructed in a good and workmanlike manner using materials of a quality that is at least equal to the quality designated by Landlord as the minimum standard for the Building. Landlord may designate reasonable rules, regulations and procedures for the performance of work in the Building and, to the extent reasonably necessary to avoid unreasonable disruption to the occupants of the Building, shall have the right to reasonably designate the time when Alterations may be performed. Tenant shall reimburse Landlord within 30 days after receipt of an invoice for sums paid by Landlord for third party examination of Tenant’s plans for Non-Cosmetic Alterations. In addition, within 30 days after receipt of an invoice from Landlord, Tenant shall pay Landlord a fee for Landlord’s oversight and coordination of any Non-Cosmetic Alterations equal to 2% of the cost of the Non-Cosmetic Alterations. Upon completion of Non-Cosmetic Alterations that involve the relocation or construction of walls, Tenant shall furnish Landlord “as-built” plans, completion affidavits, full and final waivers of lien and receipted bills covering all labor and materials. Tenant shall assure that the Alterations comply with all insurance requirements and Laws. Landlord’s approval of an Alteration shall not be a representation by Landlord that the Alteration complies with applicable Laws or will be adequate for Tenant’s use. In addition, Landlord’s consent and approval in connection with an Alteration is given solely for the benefit of Landlord and neither Tenant nor any third party shall have the right to rely upon such approval for any purpose whatsoever. Without limiting the foregoing, in no event shall such consent or approval be deemed to be the consent of the Landlord within the meaning of Section 2 of Chapter 254 of the General Laws of Massachusetts. |

| 10. | Use of Electrical Services by Tenant. |

| A. | Electricity used by Tenant in the Premises shall be paid for by Tenant by separate charge billed by the applicable utility company and payable directly by Tenant. Electrical service to the Premises (and separately for both suites constituting the Premises) shall be separately metered at Landlord’s expense and may be furnished by one or more companies providing electrical generation, transmission and distribution services, and the cost of electricity may consist of several different components or separate charges for such services, such as generation, distribution and stranded cost charges. |

| B. | Tenant’s use of electrical service shall not exceed, either in voltage, rated capacity or overall load, that which Landlord deems to be standard for the Building. If Tenant requests permission to consume excess electrical service, Landlord may refuse to consent or may condition consent upon conditions that Landlord reasonably elects (including, without limitation, the installation of utility |

17

| service upgrades, meters, submeters, air handlers or cooling units), and the additional usage (to the extent permitted by Law), installation and maintenance costs shall be paid by Tenant. Landlord shall have the right to separately meter electrical usage for the Premises and to measure electrical usage by survey or other commonly accepted methods. |

| C. | In order to assist Landlord in complying with any governmental energy reporting requirements for the Building, Tenant, if requested by Landlord, shall provide Landlord with information that relates to Tenant’s separately metered energy use, use of space and operating hours for the Premises and other information reasonably required by Landlord for compliance with said governmental energy reporting requirements, which requests by Landlord Tenant shall endeavor to respond to within thirty (30) days thereafter. |

| 11. | Entry by Landlord. |

Landlord, its agents, contractors and representatives may enter the Premises to inspect or show the Premises (with respect to showing to prospective tenants, only within the last 12 months of the Term unless Tenant has exercised the Extension Option, in which case only within the last 12 months of the Extension Term), to clean and make repairs (or alterations involving Building services or utility lines referred to in Article 29 hereof or as otherwise permitted in the Lease), alterations or additions to the Premises, and to conduct or facilitate repairs, alterations or additions to any portion of the Building, including other tenants’ premises. Except in emergencies (involving risk of imminent personal injury or imminent significant property damage) or to provide janitorial and other Building services after Normal Business Hours, Landlord shall provide Tenant with reasonable prior notice of entry into the Premises, which may be given orally or by email. If reasonably necessary for the protection and safety of Tenant and its employees, Landlord shall have the right to temporarily close all or a portion of the Premises to perform repairs, alterations and additions. However, except in such emergencies, Landlord will not close the Premises if the work can reasonably be completed on weekends and after Normal Business Hours. Entry by Landlord shall not constitute constructive eviction or entitle Tenant to an abatement or reduction of Rent, but Landlord shall use commercially reasonable efforts to minimize interference with the operation of Tenant’s business in the Premises.

| 12. | Assignment and Subletting. |

| A. | Except in connection with a Permitted Transfer (defined in Section 12.E. below), Tenant shall not assign, sublease, transfer or encumber any interest in this Lease or allow any third party to use any portion of the Premises (collectively or individually, a “Transfer”) without the prior written consent of Landlord, which consent shall not be unreasonably withheld or delayed if Landlord does not elect to exercise its termination rights under Section 12.B below. Without limitation, it is agreed that Landlord’s consent shall not be considered unreasonably withheld if: (1) in the case of an assignment of this Lease, the proposed transferee’s financial condition does not meet the criteria Landlord uses to select Building tenants having similar leasehold obligations; (2) the proposed transferee’s business is not, in Landlord’s reasonable determination, suitable for the Building considering the business of the other tenants and the Building’s prestige, or would result in a violation of another tenant’s rights; (3) the proposed transferee |

18

| is a governmental agency or occupant of the Building; (4) Tenant is in default after the expiration of the notice and cure periods in this Lease; (5) any portion of the Building or Premises would likely become subject to additional or different Laws as a consequence of the proposed Transfer; or (6) Landlord has, within the three (3) months prior to the request for consent, commenced negotiations with the proposed transferee for other space in the Building. Notwithstanding subsection (3) above, Landlord will not withhold its consent solely because a proposed subtenant or assignee is an occupant of the Building if Landlord does not have (or will not have within 6 months of the commencement date of the proposed sublease or assignment) space available for lease in the Building that is comparable to the space Tenant desires to sublet or assign. Tenant shall not be entitled to receive monetary damages based upon a claim that Landlord unreasonably withheld its consent to a proposed Transfer and Tenant’s sole remedy shall be an action to enforce any such provision through specific performance or declaratory judgment. Any attempted Transfer in violation of this Article shall, at Landlord’s option, be void. Consent by Landlord to one or more Transfer(s) shall not operate as a waiver of Landlord’s rights to approve any subsequent Transfers. In no event shall any Transfer or Permitted Transfer release or relieve Tenant from any obligation under this Lease. |

| B. | As part of its request for Landlord’s consent to a Transfer, Tenant shall provide Landlord with financial statements for the proposed transferee (in the case of an assignment of this Lease), a complete copy of the letter of intent, term sheet or proposed assignment, sublease and other contractual documents and such other information as Landlord may reasonably request. Landlord shall, by written notice to Tenant within 15 days of its receipt (or 7 Business Days for a sublease of less than 50% of the Premises) of the required information and documentation, either: (1) consent to the Transfer by the execution of a consent agreement in a form reasonably designated by Landlord or reasonably refuse to consent to the Transfer in writing; or (2) exercise its right to terminate this Lease with respect to (a) an assignment of this Lease or (b) a sublease of the entire Premises for the then remaining Term of the Lease. Any such termination shall be effective on the proposed effective date of the Transfer for which Tenant requested consent. Tenant shall pay Landlord a review fee of $750.00 for Landlord’s review of any Permitted Transfer or requested Transfer, provided however, that if Landlord’s actual reasonable costs and expenses (including reasonable attorney’s fees) exceed $750.00, Tenant shall reimburse Landlord for its actual reasonable costs and expenses in lieu of a fixed review fee (not to exceed $5,000.00). |

| C. | Tenant shall pay Landlord 50% of all rent and other consideration which Tenant receives as a result of a Transfer that is in excess of the Rent (or Attributed Rent, if applicable as provided below) payable to Landlord for the portion of the Premises and Term covered by the Transfer. Tenant shall pay Landlord for Landlord’s share of any excess within 30 days after Tenant’s receipt of such excess consideration. Tenant may deduct from the excess all reasonable and customary expenses directly incurred by Tenant attributable to the Transfer (other than Landlord’s review fee), including marketing costs, brokerage fees, legal fees, tenant improvement allowances, other reasonable and customary concessions and construction costs, all of which shall be amortized over the term of the Transfer, |

19

| and the costs of any services which Tenant shall supply to a subtenant, such as electricity, which are not being supplied by Landlord to Tenant under the Lease. If Tenant is in Monetary Default (defined in Section 19.A. below), Landlord may require that all sublease payments be made directly to Landlord, in which case Tenant shall receive a credit against Rent in the amount of any payments received (less Landlord’s share of any excess). For the period from the Commencement Date to the Rent Commencement Date, during which Tenant is not obligated to pay Rent, the excess rent and other consideration which Tenant receives as a result of a transfer shall be calculated as the amount of such rents and other consideration in excess of $47,619.04 per month (the “Attributed Rent”). |

| D. | Except as provided below with respect to a Permitted Transfer, if Tenant is a corporation, limited liability company, partnership, or similar entity, and if the entity which owns or controls a majority of the voting shares/rights at any time changes for any reason (including but not limited to a merger, consolidation or reorganization), such change of ownership or control shall constitute a Transfer. The foregoing shall not apply so long as Tenant is an entity whose outstanding stock is listed on a recognized security exchange, or if at least 80% of its voting stock is owned by another entity, the voting stock of which is so listed. |

| E. | Tenant may (i) assign its entire interest under this Lease to a successor to Tenant by purchase, merger, consolidation or reorganization without the consent of Landlord or (ii) assign this Lease or sublet any portion of the Premises to any entity which controls Tenant or is controlled by Tenant or is under common control with Tenant without the consent of Landlord and without Landlord having any right to recapture all or any portion of the Premises or share in any Excess Rent, provided that all of the following conditions in either case are satisfied (a “Permitted Transfer”): (1) Tenant is not in default under this Lease beyond applicable notice and grace periods; (2) Tenant’s successor under subpart (i) shall own all or substantially all of the assets of Tenant; (3) Tenant’s successor under subpart (i) shall have a net worth which is at least equal to the greater of Tenant’s net worth at the date of this Lease or Tenant’s net worth as of the day prior to the proposed purchase, merger, consolidation or reorganization; (4) the Permitted Use does not allow the Premises to be used for retail purposes; and (5) Tenant shall give Landlord written notice at least 20 days prior to the effective date of the proposed purchase, merger, consolidation or reorganization under subpart (i) or any Transfer under subpart (ii) (provided, however, that, if prohibited by confidentiality requirements in connection with such purchase, merger, consolidation or reorganization, then Tenant shall give Landlord written notice within 10 days after the effective date of such transaction). Tenant’s notice to Landlord shall include information and documentation showing that each of the above conditions has been satisfied. If requested by Landlord, Tenant’s successor shall sign a commercially reasonable form of assumption agreement. |

| 13. | Liens. |

Tenant shall not permit mechanic’s or other liens to be placed upon the Building, Premises or Tenant’s leasehold interest in connection with any work or service done or purportedly done by or at the direction of Tenant. If a lien is so placed, Tenant shall, within 20 days of notice from Landlord of the filing of the lien, fully discharge the lien by settling the claim

20

which resulted in the lien or by bonding or insuring over the lien in the manner prescribed by the applicable lien Law. If Tenant fails to discharge the lien, then, in addition to any other right or remedy of Landlord, Landlord may bond or insure over the lien or otherwise discharge the lien. Tenant shall reimburse Landlord for any amount paid by Landlord to bond or insure over the lien or discharge the lien, including, without limitation, reasonable attorneys’ fees (if and to the extent permitted by Law) within 30 days after receipt of an invoice from Landlord.

| 14. | Indemnity and Waiver of Claims. |

| A. | Except to the extent caused by the negligence or willful misconduct of Landlord or any Landlord Related Parties (defined below), Tenant shall indemnify, defend and hold Landlord, its trustees, members, principals, beneficiaries, partners, officers, directors, employees, Mortgagee(s) (defined in Article 26) and agents (“Landlord Related Parties”) harmless against and from all liabilities, obligations, damages, penalties, claims, actions, costs, charges and expenses, including, without limitation, reasonable attorneys’ fees and other professional fees (if and to the extent permitted by Law), which may be imposed upon, incurred by or asserted by third parties against Landlord or any of the Landlord Related Parties and arising out of or in connection with (i) any damage or injury occurring in the Premises or (ii) any acts or omissions (including violations of Law) of Tenant, the Tenant Related Parties (defined below) or any of Tenant’s subtenants, contractors or licensees. |

| B. | Except to the extent caused by the negligence or willful misconduct of Tenant or any Tenant Related Parties (defined below), Landlord shall indemnify, defend and hold Tenant, its trustees, members, principals, beneficiaries, partners, officers, directors, employees and agents (“Tenant Related Parties”) harmless against and from all liabilities, obligations, damages, penalties, claims, actions, costs, charges and expenses, including, without limitation, reasonable attorneys’ fees and other professional fees (if and to the extent permitted by Law), which may be imposed upon, incurred by or asserted by third parties against Tenant or any of the Tenant Related Parties and arising out of or in connection with the acts or omissions (including violations of Law) of Landlord, the Landlord Related Parties or any of Landlord’s contractors or licensees. |

| C. | To the extent permitted by Law and except to the extent caused by the negligence or willful misconduct of Landlord or any Landlord Related Parties, Landlord and the Landlord Related Parties shall not be liable for, and Tenant waives, all claims for loss or damage to Tenant’s business or loss, theft or damage to Tenant’s Property (defined in Article 15) or the property of any person claiming by, through or under Tenant resulting from: (1) wind or weather; (2) the failure of any sprinkler, heating or air-conditioning equipment, any electric wiring or any gas, water or steam pipes; (3) the backing up of any sewer pipe or downspout; (4) the bursting, leaking or running of any tank, water closet, drain or other pipe; (5) water, snow or ice upon or coming through the roof, skylight, stairs, doorways, windows, walks or any other place upon or near the Building; (6) any act or omission of any party other than Landlord or Landlord Related Parties; and (7) any causes not reasonably within the control of Landlord. Tenant shall insure itself against such losses under Article 15 below. |

21

| 15. | Insurance. |

Tenant shall carry and maintain the following insurance (“Tenant’s Insurance”), at its sole cost and expense: (1) Commercial General Liability Insurance applicable to the Premises and its appurtenances providing, on an occurrence basis, a minimum combined single limit of $3,000,000.00; (2) All Risk Property/Business Interruption Insurance, including flood and earthquake, written at replacement cost value and with a replacement cost endorsement covering all of Tenant’s trade fixtures, equipment, furniture and other personal property within the Premises (“Tenant’s Property”); (3) Workers’ Compensation Insurance as required by the state in which the Premises is located and in amounts as may be required by applicable statute; and (4) Employers Liability Coverage of at least $1,000,000.00 per occurrence. Any company writing any of Tenant’s Insurance shall have an A.M. Best rating of not less than A-VIII. All Commercial General Liability Insurance policies shall name Tenant as a named insured and Landlord (or any successor), and its respective members, principals, beneficiaries, partners, officers, directors, employees, and agents, and other designees of Landlord as the interest of such designees shall appear, as additional insureds. Tenant shall use commercially reasonable efforts to require that the insurer(s) give Landlord and its designees at least 30 days’ advance written notice of any change, cancellation, termination or lapse of insurance. Tenant shall provide Landlord with a certificate of insurance evidencing Tenant’s Insurance prior to the earlier to occur of the Commencement Date or the date Tenant is provided with possession of the Premises for any reason, and upon renewals at least 15 days prior to the expiration of the insurance coverage. Landlord shall maintain so called All Risk or Special Form property insurance on the Building at not less than 95% of replacement cost value, as reasonably estimated by Landlord, and Commercial General Liability Insurance applicable to the Building and Common Areas, providing, on an occurrence basis, a minimum combined single limit of at least $3,000,000.00. Except as specifically provided to the contrary, the limits of either party’s’ insurance shall not limit such party’s liability under this Lease.

| 16. | Subrogation. |

Notwithstanding anything in this Lease to the contrary, Landlord and Tenant hereby waive and shall cause their respective insurance carriers to waive any and all rights of recovery, claim, action or causes of action against the other and their respective trustees, principals, beneficiaries, partners, officers, directors, agents, and employees, for any loss or damage that may occur to Landlord or Tenant or any party claiming by, through or under Landlord or Tenant, as the case may be, with respect to Tenant’s Property, the Building, the Premises, any additions or improvements to the Building or Premises, or any contents thereof, including all rights of recovery, claims, actions or causes of action arising out of the negligence of Landlord or any Landlord Related Parties or the negligence of Tenant or any Tenant Related Parties, which loss or damage is (or would have been, had the insurance required by this Lease been carried) covered by insurance.

| 17. | Casualty Damage. |

| A. | If all or any part of the Premises is damaged by fire or other casualty, Tenant shall immediately notify Landlord in writing. During any period of time that all or a material portion of the Premises is rendered untenantable as a result of a fire or other casualty (whether to the Premises or to the Building), the Rent shall abate for the portion of the Premises that is untenantable and not used by Tenant. Landlord shall have the right to terminate this Lease if: (1) the Building |

22