Attached files

| file | filename |

|---|---|

| EX-99.3 - EXHIBIT 99.3 - KEYCORP /NEW/ | a3q18erex993.htm |

| EX-99.1 - EXHIBIT 99.1 - KEYCORP /NEW/ | a3q18earningsrelease.htm |

| 8-K - 8-K - KEYCORP /NEW/ | a3q18er8-k.htm |

KeyCorp Third Quarter 2018 Earnings Review October 18, 2018 Beth E. Mooney Don Kimble Chairman and Chief Financial Officer Chief Executive Officer

FORWARD-LOOKING STATEMENTS AND ADDITIONAL INFORMATION This communication contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 including, but not limited to, KeyCorp’s expectations or predictions of future financial or business performance or conditions. Forward-looking statements are typically identified by words such as “believe,” “seek,” “expect,” “anticipate,” “intend,” “target,” “estimate,” “continue,” “positions,” “plan,” “predict,” “project,” “forecast,” “guidance,” “goal,” “objective,” “prospects,” “possible,” “potential,” “strategy,” “opportunities,” or “trends,” by future conditional verbs such as “assume,” “will,” “would,” “should,” “could” or “may”, or by variations of such words or by similar expressions. These forward-looking statements are based on assumptions that involve risks and uncertainties, which are subject to change based on various important factors (some of which are beyond KeyCorp’s control). Actual results may differ materially from current projections. Actual outcomes may differ materially from those expressed or implied as a result of the factors described under “Forward-looking Statements” and “Risk Factors” in KeyCorp’s Annual Report on Form 10-K for the year ended December 31, 2017 (“Form 10-K”) and in other filings of KeyCorp with the Securities and Exchange Commission (the “SEC”). Such forward-looking statements speak only as of the date they are made, and we undertake no obligation to update any forward-looking statement to reflect events or circumstances after that date or to reflect the occurrence of unanticipated events. For additional information regarding KeyCorp, please refer to our SEC filings available at www.key.com/ir. Annualized, pro forma, projected and estimated numbers are used for illustrative purpose only, are not forecasts and may not reflect actual results. This presentation also includes certain non-GAAP financial measures related to “tangible common equity,” “pre-provision net revenue,” “cash efficiency ratio,” and certain financial measures excluding notable items, including merger-related charges. Notable items include certain revenue or expense items that may occur in a reporting period which management does not consider indicative of ongoing financial performance. Management believes it is useful for the investment community to consider financial metrics with and without notable items in order to enable a better understanding of company results, facilitate comparability of period-to-period financial results, and to evaluate and forecast those results. Although Key has procedures in place to ensure that these measures are calculated using the appropriate GAAP or regulatory components, they have limitations as analytical tools and should not be considered in isolation, or as a substitute for analysis of results under GAAP. For more information on these calculations and to view the reconciliations to the most comparable GAAP measures, please refer to the appendix of this presentation or Figure 2 of our Form 10-Q dated June 30, 2018. GAAP: Generally Accepted Accounting Principles 2

3Q18 Investor Highlights $.45 58.7% 16.8% earnings per common share cash efficiency ratio (a) return on avg. tangible common equity (a) ° EPS growth with positive operating leverage ° Net interest income growth reflects benefit from rising interest rates and higher earning asset balances − Avg. loan balances reflect continued levels of lower utilization and higher paydowns; end of period loan growth reflects late-quarter momentum Driving − Deposit growth driven by retail and commercial relationships, as well as seasonal inflows Returns ° Continued momentum in fee-based businesses − Investment banking & debt placement fees reached a record level of $664 MM (TTM) ° Expense levels reflect continued discipline and strategic investments ° Cash efficiency ratio and ROTCE both improved >300 bps YoY Strong Risk ° Strong asset quality while maintaining credit discipline Management − Net charge-offs to average loans of .27%; portfolios continue to perform well ° Increased common share dividend by 42% in 3Q18, from $.12 to $.17 Disciplined Capital ° Repurchased $542 MM (b) in common shares Management ° Maintained strong capital position – CET1 ratio of 9.93% (c) (a) Non-GAAP measure; See Appendix for reconciliation (b) Common share repurchase amount includes repurchases to offset issuances of common shares under our employee compensation plans (c) 9/30/18 ratio is estimated 3

Financial Review 4

Financial Highlights Continuing operations, unless otherwise noted 3Q18 2Q18 3Q17 LQ ∆ Y/Y ∆ EPS – assuming dilution $ .45 $ .44 $ .32 2 % 41 % Cash efficiency ratio (a) 58.7 % 58.8 % 62.2 % (3) bps (349) bps (a) Profitability Return on average tangible common equity 16.8 16.7 12.2 8 460 Return on average total assets 1.40 1.41 1.07 (1) 33 Net interest margin 3.18 3.19 3.15 (1) 3 Common Equity Tier 1 (c) 9.93 % 10.13 % 10.26 % (20) bps (33) bps Capital (b) Tier 1 risk-based capital (c) 11.09 10.95 11.11 14 (2) Tangible common equity to tangible assets (a) 8.05 8.32 8.49 (27) (44) NCOs to average loans .27 % .27 % .15 % - bps 12 bps Asset NPLs to EOP portfolio loans (d) .72 .62 .60 10 12 Quality Allowance for loan and lease losses to EOP .99 1.01 1.02 (2) (3) loans EOP = End of Period (a) Non-GAAP measure: see Appendix for reconciliation (b) From consolidated operations (c) 9/30/18 ratios are estimated (d) Nonperforming loan balances exclude $606 million, $629 million, and $783 million of purchased credit impaired loans at September 30, 2018, June 30, 2018, and 5 September 30, 2017, respectively

Loans Total Average Loans Highlights $ in billions vs. Prior Year $90 $88 $87 ° Average loans up 2% from 3Q17 – C&I balances up 8% driven by broad-based growth with middle-market clients $80 – Home equity continue to be impacted by market trends vs. Prior Quarter $70 4Q16 1Q17 2Q17 3Q17 4Q17 1Q18 2Q18 3Q18 ° Average loans relatively stable with 2Q18 (down 0.2%) Average C&I Loans – Continued levels of lower utilization and elevated paydowns $ in billions ° Period-end loans reflect commercial loan growth in $50 the second half of the quarter $45 $41 $40 $30 4Q16 1Q17 2Q17 3Q17 4Q17 1Q18 2Q18 3Q18 6

Deposits Average Deposits Highlights $ in billions ° Deposit cost up 10 bps from 2Q18, reflecting: $110 1.00% $106 – Higher interest rates and beta $103 .80% – Continued migration of portfolio into higher- $100 yielding products .60% ° Strong and stable deposit base .53% .40% – 29% noninterest-bearing $90 – ~65% stable retail and low-cost escrow .28% .20% $80 .00% vs. Prior Year 4Q16 1Q17 2Q17 3Q17 4Q17 1Q18 2Q18 3Q18 ° Average deposit up 2% from 3Q17 Total average deposits Cost of total deposits ° Continued mix shift to higher-yielding deposit products 3Q18 Average Deposit Mix ° Strength in retail banking franchise and growth $ in billions from commercial relationships $13.2 $5.4 $30.6 vs. Prior Quarter 39% 61% ° Average deposit balances up 2% from 2Q18 $56.4 ° Growth from retail and commercial relationships ° Short-term and seasonal deposit inflows Noninterest-bearing Consumer (a) NOW and MMDA Commercial and corporate Savings CDs and other time deposits 7 (a) Consumer includes retail banking, small business, and private banking

Net Interest Income and Margin Net Interest Income & Net Interest Margin Trend (TE) Highlights $ in millions; continuing operations ° Excluding PAA, 3Q18 net interest income was $967 MM $962 $26 $993 $1,000 4.0% and net interest margin was 3.09% $48 $800 vs. Prior Year 3.5% $600 ° Net interest income up $53 MM, or 6%, from 3Q17, 3.18% 3.15% excl. PAA $400 3.09% 3.0% – Largely driven by higher interest rates and $200 2.99% earning asset growth $0 2.5% vs. Prior Quarter 4Q16 1Q17 2Q17 3Q17 4Q17 1Q18 2Q18 3Q18 Net interest income (TE), excl. PAA Reported NIM (TE) ° Net interest income up $8 MM, or 1%, from 2Q18, Purchase accounting accretion (PAA) x NIM (TE); excl. PAA excl. PAA – Reflects benefit from higher interest rates and day count 3Q17 4Q17 1Q18 2Q18 3Q18 NIM – reported 3.15% 3.09% 3.15% 3.19% 3.18% – Partially offset by lower loan fees PAA .16 .12 .11 .09 .09 NIM – excl. PAA 2.99% 2.97% 3.04% 3.10% 3.09% NIM Change vs. Prior Quarter 2Q18: 3.19% NII – reported ($MM) $ 962 $ 952 $ 952 $ 987 $993 Elevated liquidity levels (.02) PAA 48 38 33 28 26 Loan fees (.01) NII – excl. PAA $914 $914 $919 $959 $967 (a) Higher interest rates .02 Total change (.01) 3Q18: 3.18% TE = Taxable equivalent PAA = Purchase accounting accretion 8 (a) 3Q18 purchase accounting accretion of $26 MM is made up of $18 MM related to contractual maturities and $8 MM related to prepayments

Noninterest Income Noninterest Income Highlights $ in millions up / (down) 3Q18 vs. 3Q17 vs. 2Q18 vs. Prior Year Trust and investment services income $ 117 $ (18) $ (11) ° Noninterest income up $17 MM (+3%) from 3Q17 Investment banking and debt 166 25 11 placement fees ° Strength in investment banking and debt placement Service charges on deposit accounts 85 (6) (6) fees (+$25 MM) from the Cain Brothers acquisition and organic growth Operating lease income and other 35 19 41 leasing gains ° Operating lease income up $19 MM, primarily driven Corporate services income 52 (2) (9) by higher volume and $13 MM of lease residual Cards and payments income 69 (6) (2) losses in 3Q17 Corporate-owned life insurance 34 3 2 ° Trust and investment services income down, primarily Consumer mortgage income 9 2 2 due to the sale of Key’s insurance business Mortgage servicing fees 19 (2) (3) ° Lower deposit service charges and cards and payments Other income 23 2 (76) income reflects revenue recognition changes Total noninterest income $ 609 $ 17 $ (51) vs. Prior Quarter Other income included a $78 MM gain on the sale of Key’s insurance business in 2Q18 ° Noninterest income down $51 MM (-8%) from 2Q18 ° Other income down $76 MM reflecting the 2Q18 gain of Operating lease income and other leasing gains included $42 MM of lease $78 MM from the KIBS sale residual losses in 2Q18 and $13 MM in 3Q17 ° Trust and investment services income $11 MM lower, primarily reflecting the sale of Key’s insurance business ° Growth in operating lease income due to $42 MM lease residual loss in 2Q18 ° Investment banking and debt placement fees up $11 MM 9

Noninterest Expense Noninterest Expense vs. Prior Year $ in millions up / (down) 3Q18 vs. 3Q17 vs. 2Q18 Personnel $ 553 $ (6) $ (33) ° Noninterest expense down $28 MM, or (3)% Net occupancy 76 2 (3) ° Prior year included merger-related charges of Computer processing 52 (4) 1 $36 MM ($25 MM personnel; $11 MM non- Business services, 43 (6) (8) personnel) professional fees ° Recent acquisitions and investments (incl. Cain Equipment 27 (2) 1 Brothers) contributed to YoY growth, offsetting Operating lease expense 31 7 1 benefit from continued cost savings Marketing 26 (8) - FDIC assessment 21 - - Intangible asset amortization 23 (2) (2) vs. Prior Quarter OREO expense, net 3 - 3 Other expense 109 (9) 11 ° Noninterest expense down $29 MM, or (3)% Total noninterest expense $ 964 $ (28) $ (29) ° Lower personnel expense, including lower salaries and incentive compensation ° Business services and professional fees declined $8 MM offset by an increase in other expense 10

Credit Quality Net Charge-offs & Provision for Credit Losses Allowance for Loan and Lease Losses $ in millions 3Q18 allowance for loan losses to period-end loans of .99% $100 1.00% $887 $900 $880 250% .80% $75 $60 $62 200% .60% $51 $800 $50 170% 150% .40% $32 138% 100% $700 $25 .27% .20% 50% .15% $0 .00% $600 0% 4Q16 1Q17 2Q17 3Q17 4Q17 1Q18 2Q18 3Q18 4Q16 1Q17 2Q17 3Q17 4Q17 1Q18 2Q18 3Q18 NCOs Provision for credit NCOs to average loans Allowance for loan Allowance for loan and losses and lease losses lease losses to NPLs Nonperforming Loans (a) Acquired Loans $ in millions $ in millions $800 2.00% $100 1.00% $645 1.60% $600 $517 $80 .80% $80 1.20% $72 $72 $73 $71 $400 .72% .60% .60% .80% $60 $200 .50% .52% .40% .40% .48% .40% .45% $0 .00% $40 .20% 4Q16 1Q17 2Q17 3Q17 4Q17 1Q18 2Q18 3Q18 3Q17 4Q17 1Q18 2Q18 3Q18 NPLs NPLs to period-end loans Allowance for Acquired loan allowance to acquired loans period-end acquired loans NCO = Net charge-off (a) Nonperforming loan balances exclude $606 million and $783 million of purchased credit impaired loans at September 30, 2018, and 11 September 30, 2017, respectively

Capital Common Equity Tier 1 (a) Highlights 12.00% ° Strong capital position with Common Equity Tier 1 ratio of 9.93% (a) at 9/30/18 10.26% 9.93% 10.00% ° Increased common share dividend by 42% (from $0.12 to $0.17 per quarter) 8.00% ° Repurchased $542 MM (c) in common shares during 3Q18 6.00% 4Q16 1Q17 2Q17 3Q17 4Q17 1Q18 2Q18 3Q18 Tangible Common Equity to Tangible Assets (b) Quarterly Common Share Dividend • Third increase in the last 12 months 10.00% $0.20 • 42% increase from the prior quarter 8.49% 8.05% $.17 7.50% $0.16 5.00% $0.12 $.095 2.50% $0.08 0.00% $0.04 4Q16 1Q17 2Q17 3Q17 4Q17 1Q18 2Q18 3Q18 4Q16 1Q17 2Q17 3Q17 4Q17 1Q18 2Q18 3Q18 (a) 9/30/18 ratios are estimated (b) Non-GAAP measure: see Appendix for reconciliation 12 (c) Common share repurchase amount includes repurchases to offset issuances of common shares under our employee compensation plans

4Q Outlook and Long-term Targets 4Q18 (vs. 3Q18) Long-term Targets Average Loans: Up low single digit Positive operating leverage Average Deposits: Relatively stable Net Interest Income (TE): Up low single digit Cash efficiency ratio: 54%-56% Noninterest Income: Up mid-single digit Moderate risk profile: Net charge-offs to avg. loans targeted Noninterest Expense: Relatively stable range of 40-60 bps Net Charge-offs / Provision: Relatively stable ROTCE: 15%-18% GAAP Tax Rate: 16-17% 13 Guidance ranges: relatively stable: +/- 2%; low single digit: <3%; mid-single digit: 4% - 6%

Appendix 14

Loan Portfolio Detail, at 9/30/18 Total Loans Commercial Loans $ in billions 9/30/18 % of total Diversified Portfolio by Industry loans Total commercial loans: Utilities Agriculture Commercial and industrial $ 45.0 50 Transportation Automotive Business Products Commercial real estate 16.5 18 Technology Media Business Services C&I CRE And Telecom Chemicals Commercial lease financing 4.5 5 $40 $18 Construction Total Commercial $ 66.0 74 Consumer Discretionary Residential mortgage $ 5.5 6 Real Estate Home equity 11.3 13 Consumer Services Consumer direct 1.8 2 Equipment Credit card 1.1 1 Consumer indirect 3.6 4 Public Sector Finance Other Total Consumer $ 23.3 26 Oil And Gas Materials/ Metals And Mining Extraction Home Equity Commercial Real Estate 2008/ Outstanding Average Average prior Balances Loan Size FICO Construction vintage ° Focused on relationships with CRE owners First lien $ 6,743 59 % $ 71,423 772 17 % Second lien 4,595 41 46,451 771 30 ° Aligned with targeted industry verticals Total home equity $ 11,339 ° Primarily commercial mortgage; selective approach to construction ° Combined weighted-average LTV at Commercial mortgage origination: 70% Fixed ° Criticized non-accruals: 0.7% of period- 58% 89% Variable 46% end balances (a) 54% ° $561 million in lines outstanding (7.5% of the home equity lines) come to end of draw period by 3Q20 9/30/2008 9/30/2018 Tables may not foot due to rounding 15 (a) Loan and lease outstandings; excludes purchase credit impaired loans from the First Niagara acquisition

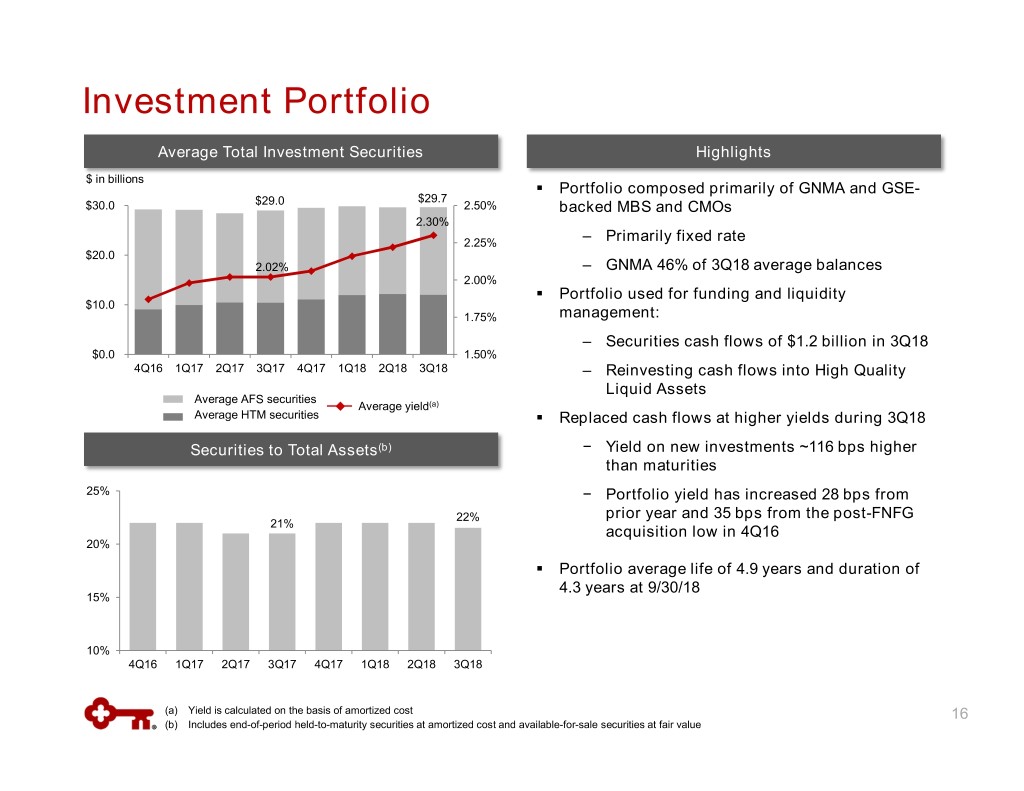

Investment Portfolio Average Total Investment Securities Highlights $ in billions ° Portfolio composed primarily of GNMA and GSE- $29.7 $30.0 $29.0 2.50% backed MBS and CMOs 2.30% 2.25% ‒ Primarily fixed rate $20.0 2.02% ‒ GNMA 46% of 3Q18 average balances 2.00% ° Portfolio used for funding and liquidity $10.0 1.75% management: ‒ Securities cash flows of $1.2 billion in 3Q18 $0.0 1.50% 4Q16 1Q17 2Q17 3Q17 4Q17 1Q18 2Q18 3Q18 – Reinvesting cash flows into High Quality Liquid Assets Average AFS securities Average yield (a) Average HTM securities ° Replaced cash flows at higher yields during 3Q18 Securities to Total Assets (b) − Yield on new investments ~116 bps higher than maturities 25% − Portfolio yield has increased 28 bps from 22% prior year and 35 bps from the post-FNFG 21% acquisition low in 4Q16 20% ° Portfolio average life of 4.9 years and duration of 4.3 years at 9/30/18 15% 10% 4Q16 1Q17 2Q17 3Q17 4Q17 1Q18 2Q18 3Q18 (a) Yield is calculated on the basis of amortized cost 16 (b) Includes end-of-period held-to-maturity securities at amortized cost and available-for-sale securities at fair value

Asset & Liability Management Positioning Better positioned to benefit from economic growth and rising interest rates Business and Balance Sheet Highlights 3Q18 Positioning • Strong, low-cost deposit base • Target retaining asset sensitive position – $75 B interest-bearing deposits at 74 bps – Higher deposit betas modestly reduced our benefit to rising rates – $31 B noninterest-bearing deposits – Flatness in forward curve reinforced this strategy – ~65% stable retail and low-cost escrow – >85% from markets where Key maintains top-5 deposit or • Terminated $5.2 B notional of discretionary hedges branch share due to mature in 2019 – Creates upside to higher short-term rates ‰ Key’s benefit to • Relationship-oriented lending franchise ramped rise in interest rates increases to 3% – Distinctive commercial capabilities drive C&I loan growth and – Maintained down-rate protection through the purchase of interest ~70% floating-rate loan mix rate floors at a nominal cost of $330 K – Recent investments in residential mortgage and auto lending enhance Key’s growth trajectory and balance our ALM position • Aligns balance sheet positioning with outlook for continued economic growth – Little incremental cost for this year – increased upside for 2019 • Disciplined balance sheet management with recurring re-investment opportunities – Rate curve has moved up 15-20 bps post termination, benefitting our new position – $31 B securities portfolio is >99% government-guaranteed and generates ~$400 MM cash flows per month – Discretionary hedge activities (~$12.3B) help moderate Modest asset sensitive position: interest rate risk exposure while providing near-term earnings NII impact of +3% for a 200 bps increase over 12 months upside ($1.6B swaps mature through 4Q18 at weighted- average receive rate of 1.22%) Each 25 bps increase in the Fed Funds rate results in NII benefit of ~$4-8 MM per quarter 17 (a) Simulation analysis for net interest income is described in Figure 31 of Key’s 2017 Form 10-K

Credit Quality Trends Delinquencies to Period-end Total Loans Criticized Outstandings (a) to Period-end Total Loans Continuing operations Continuing operations .80% 6.0% .60% 4.0% 0.41% 3.3% 3.3% 0.38% .40% 2.0% .20% 0.10% 0.10% .00% .0% 4Q16 1Q17 2Q17 3Q17 4Q17 1Q18 2Q18 3Q18 4Q16 1Q17 2Q17 3Q17 4Q17 1Q18 2Q18 3Q18 30 – 89 days delinquent 90+ days delinquent Metric (b) 3Q18 2Q18 1Q18 4Q17 3Q17 Delinquencies to EOP total loans: 30-89 days .41 .49 .35 .42 .38 % Delinquencies to EOP total loans: 90+ days .10 .12 .09 .10 .10 NPLs to EOP portfolio loans (c) .72 .62 .61 .58 .60 NPAs to EOP portfolio loans + OREO + Other NPAs (c) .75 .65 .65 .62 .64 Allowance for loan losses to period-end loans .99 1.01 1.00 1.01 1.02 Allowance for loan losses to NPLs 137.5 162.8 162.8 174.4 170.2 (a) Loan and lease outstandings; excludes purchase credit impaired loans from the First Niagara acquisition (b) From continuing operations (c) Nonperforming loan balances exclude $606 million, $629 million, $690 million, $738 million, and $783 million of purchased credit impaired loans at 18 September 30, 2018, June 30, 2018, March 31, 2018, December 31, 2017, and September 30, 2017, respectively

Credit Quality Credit Quality by Portfolio Net loan Net loan Allowance / Allowance / Period- Average charge-offs (b) / Nonperforming Ending charge- period-end NPLs end loans loans average loans loans (c) allowance (d) offs loans (d) (%) (%) $ in millions (%) 9/30/18 3Q18 3Q18 3Q18 9/30/18 9/30/18 9/30/18 9/30/18 Commercial and industrial (a) $ 45,023 $ 44,749 $ 33 0.29% $ 227 $ 543 1.21% 239.21% Commercial real estate: Commercial Mortgage 14,716 14,268 5 .14 98 143 .97 145.92 Construction 1,763 1,759 - - 2 31 1.76 N/M Commercial lease financing (e) 4,470 4,444 1 .09 10 37 .83 370.00 Real estate – residential mortgage 5,497 5,466 - - 62 9 .16 14.52 Home equity 11,339 11,415 1 .03 221 34 .30 15.38 Credit cards 1,098 1,095 8 2.90 2 45 4.10 N/M Consumer direct loans 1,807 1,789 9 2.00 4 26 1.44 650.00 Consumer indirect loans 3,555 3,482 3 .34 19 19 .53 100.00 Continuing total $ 89,296 $ 88,467 $ 60 .27% $ 645 $ 887 .99% 137.52% Discontinued operations 1,130 1,160 3 1.03 6 14 1.24 233.33 Consolidated total $ 90,426 $ 89,627 $ 63 .28% $ 651 $ 901 1.00% 138.40% N/M = Not meaningful (a) 9/30/18 ending loan balance includes $129 million of commercial credit card balances; average loan balance includes $128 million of assets from commercial credit cards (b) Net loan charge-off amounts are annualized in calculation (c) 9/30/18 NPL amount excludes $606 million of purchased credit impaired loans (d) 9/30/18 allowance by portfolio is estimated (e) Commercial lease financing includes receivables held as collateral for a secured borrowing of $12 million at September 30, 2018. Principal reductions are based on 19 the cash payments received from these related receivables

GAAP to Non-GAAP Reconciliation Three months ended $ in millions 9/30/2018 6/30/2018 9/30/2017 Average tangible common equity Average Key shareholders' equity (GAAP) $ 15,210 $ 15,032 $ 15,241 Less: Intangible assets (average) (a) 2,848 2,883 2,878 Preferred Stock (average) 1,316 1,025 1,025 Average tangible common equity (non-GAAP) $ 11,046 $ 11,124 $ 11,338 Return on average tangible common equity from continuing operations Net income (loss) from continuing operations attributable to Key common shareholders (GAAP) $ 468 $ 464 $ 349 Average tangible common equity (non-GAAP) 11,046 11,124 11,338 Return on average tangible common equity from continuing operations (non- GAAP) 16.81% 16.73% 12.21% Tangible common equity to tangible assets at period end Key shareholders' equity (GAAP) $ 15,208 $ 15,100 $ 15,249 Less: Intangible assets (a) 2,838 2,858 2,870 Preferred Stock (b) 1,421 1,009 1,009 Tangible common equity (non-GAAP) $ 10,949 $ 11,233 $ 11,370 Total assets (GAAP) $ 138,805 $ 137,792 $ 136,733 Less: Intangible assets (a) 2,838 2,858 2,870 Tangible common equity to tangible assets ratio (non-GAAP) $ 135,967 $ 134,194 $ 133,863 Tangible common equity to tangible assets ratio (non-GAAP) 8.05% 8.32% 8.49% Cash efficiency ratio Noninterest expense (GAAP) $ 964 $ 993 $ 992 Less: Intangible asset amortization 23 25 25 Adjusted noninterest expense (non-GAAP) $ 941 $ 968 $ 967 Net interest income (GAAP) $ 986 $ 979 $ 948 Plus: Taxable-equivalent adjustment 7 8 14 Noninterest income 609 660 592 Adjusted total taxable-equivalent revenue (non-GAAP) $ 1,602 $ 1,647 $ 1,554 Cash efficiency ratio (non-GAAP) 58.7% 58.8% 62.2% (a) For the three months ended September 30, 2018, June 30, 2018, and September 30, 2017, intangible assets exclude $17 million, $20 million, and $30 million, respectively, of period-end purchased credit card receivables 20 (b) Net of capital surplus