Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - DuPont de Nemours, Inc. | exhibit991-pressrelease.htm |

| 8-K - 8-K - DuPont de Nemours, Inc. | dwdp1018188-kxcortevaform10.htm |

Form 10 October 2018 InsertAgriculture Risk Classification Division of DowDuPont

Safe Harbor and Non-GAAP Statements Forward-Looking Statements This communication contains “forward-looking statements” within the meaning of the federal securities laws, including Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. In this context, forward-looking statements often address expected future business and financial performance and financial condition, and often contain words such as “expect,” “anticipate,” “intend,” “plan,” “believe,” “seek,” “see,” “will,” “would,” “target,” and similar expressions and variations or negatives of these words. On December 11, 2015, Historical DuPont and Historical Dow entered into an Agreement and Plan of Merger, as amended on March 31, 2017, under which the companies would combine in an all-stock merger of equals transaction. Effective August 31, 2017, the merger was completed and each of Historical DuPont and Historical Dow became subsidiaries of DowDuPont. Forward-looking statements by their nature address matters that are, to varying degrees, uncertain, including the intended separation, subject to approval of DowDuPont’s Board of Directors, of DowDuPont’s agriculture, materials science and specialty products businesses in one or more tax-efficient transactions on anticipated terms (the “Intended Business Separations”). Forward-looking statements are not guarantees of future performance and are based on certain assumptions and expectations of future events which may not be realized. Forward-looking statements also involve risks and uncertainties, many of which are beyond the Company’s control. Some of the important factors that could cause DowDuPont’s, Dow’s or DuPont’s actual results, including DowDuPont’s agriculture business (either directly or as conducted by and through Dow or DuPont) to differ materially from those projected in any such forward-looking statements include, but are not limited to: (i) costs to achieve and achieving the successful integration of the respective agriculture, materials science and specialty products businesses of DowDuPont (either directly or as conducted by and through Dow or DuPont), anticipated tax treatment, unforeseen liabilities, future capital expenditures, revenues, expenses, earnings, productivity actions, economic performance, indebtedness, financial condition, losses, future prospects, business and management strategies for the management, expansion and growth of the combined operations; (ii) costs to achieve and achievement of the anticipated synergies by the combined agriculture, materials science and specialty products businesses; (iii) risks associated with the Intended Business Separations, including conditions which could delay, prevent or otherwise adversely affect the proposed transactions including associated costs, disruptions in the financial markets or other potential barriers; (iv) disruptions or business uncertainty, including from the Intended Business Separations, could adversely impact DowDuPont’s business (either directly or as conducted by and through DowDuPont), or financial performance and its ability to retain and hire key personnel; (v) uncertainty as to the long-term value of DowDuPont common stock; and (vi) risks to DowDuPont’s, Dow’s and DuPont’s business, operations and results of operations from: the availability of and fluctuations in the cost of feedstocks and energy; balance of supply and demand and the impact of balance on prices; failure to develop and market new products and optimally manage product life cycles; ability, cost and impact on business operations, including the supply chain, of responding to changes in market acceptance, rules, regulations and policies and failure to respond to such changes; outcome of significant litigation, environmental matters and other commitments and contingencies; failure to appropriately manage process safety and product stewardship issues; global economic and capital market conditions, including the continued availability of capital and financing, as well as inflation, interest and currency exchange rates; changes in political conditions, including trade disputes and retaliatory actions; business or supply disruptions; security threats, such as acts of sabotage, terrorism or war, natural disasters and weather events and patterns which could result in a significant operational event for the Company, adversely impact demand or production; ability to discover, develop and protect new technologies and to protect and enforce the Company’s intellectual property rights; failure to effectively manage acquisitions, divestitures, alliances, joint ventures and other portfolio changes; unpredictability and severity of catastrophic events, including, but not limited to, acts of terrorism or outbreak of war or hostilities, as well as management’s response to any of the aforementioned factors. Agriculture Division of DowDuPont 2

Safe Harbor and Non-GAAP Statements (cont’d) Forward-Looking Statements, Contd. These risks are and will be more fully discussed in the current, quarterly and annual reports filed with the U. S. Securities and Exchange Commission by DowDuPont, as well as the preliminary registration statement on Form 10 of Corteva, Inc. While the list of factors presented here is, considered representative, no such list should be considered to be a complete statement of all potential risks and uncertainties. Unlisted factors may present significant additional obstacles to the realization of forward-looking statements. Consequences of material differences in results as compared with those anticipated in the forward-looking statements could include, among other things, business disruption, operational problems, financial loss, legal liability to third parties and similar risks, any of which could have a material adverse effect on DowDuPont’s, Dow’s, DuPont’s or Corteva’s consolidated financial condition, results of operations, credit rating or liquidity. None of DowDuPont, Dow or DuPont assumes any obligation to publicly provide revisions or updates to any forward-looking statements whether as a result of new information, future developments or otherwise, should circumstances change, except as otherwise required by securities and other applicable laws. A detailed discussion of some of the significant risks and uncertainties which may cause results and events to differ materially from such forward-looking statements is included in the section titled “Risk Factors” (Part I, Item 1A) of the 2017 annual report on Form 10-K of each of DowDuPont and DuPont and the preliminary registration statement on Form 10 of Corteva, Inc., in each case, amended from time to time. DowDuPont Unaudited Pro Forma Financial Information This presentation contains pro forma segment net sales and segment Operating EBITDA of the DowDuPont Agriculture Division. This unaudited pro forma financial information is based on the historical consolidated financial statements of both Dow and DuPont and was prepared to illustrate the effects of the Merger, assuming the Merger had been consummated on January 1, 2016. For all periods presented prior to the three months ended December 31, 2017, adjustments have been made, (1) for the preliminary purchase accounting impact, (2) for accounting policy alignment, (3) to eliminate the effect of events that are directly attributable to the Merger Agreement (e.g., one-time transaction costs), (4) to eliminate the impact of transactions between Dow and DuPont, and (5) to eliminate the effect of divestitures agreed to with certain regulatory agencies as a condition of approval for the Merger. The unaudited pro forma financial information was based on and should be read in conjunction with the separate historical financial statements and accompanying notes contained in each of the DowDuPont, Dow and DuPont Quarterly Reports on Form 10-Q and Annual Reports on Form 10-K for the applicable periods and the historical financial statements and accompanying noted filed as exhibits to, and incorporated by reference into, Corteva’s preliminary Form 10 registration statement. The pro forma financial statements were prepared in accordance with Article 11 of Regulation S-X, are for informational purposes only and are not necessarily indicative of what DowDuPont's results of operations actually would have been had the Merger been completed as of January 1, 2016, nor are they indicative of the future operating results of DowDuPont. For further information on the unaudited pro forma financial information, please refer to DowDuPont's Current Report on Form 8-K dated October 26, 2017. Agriculture Division of DowDuPont 3

Safe Harbor and Non-GAAP Statements (cont’d) Corteva Unaudited Pro Forma Financial Information In order to provide the most meaningful comparison of results of operations and results by segment, supplemental unaudited pro forma financial information has been included in the following presentation. The following presentation presents the pro forma results of Corteva, after giving effect to events that are (1) directly attributable to the Merger, the divestiture of Historical DuPont’s specialty products and materials science businesses, the receipt of Dow AgroSciences, and the separation and distribution to DowDuPont stockholders of all the outstanding shares of Corteva common stock, (2) factually supportable and (3) with respect to the pro forma statements of income, expected to have a continuing impact on the consolidated results. Refer to Corteva’s preliminary Form 10 registration statement (and subsequent amendments thereto), which can be found on the investors section of the DowDuPont website, for further details on the above transactions. The pro forma financial statements were prepared in accordance with Article 11 of Regulation S-X, and are presented for informational purposes only, and do not purport to represent what the results of operations would have been had the above actually occurred on the dates indicated, nor do they purport to project the results of operations for any future period or as of any future date. Non-GAAP Information This presentation includes information that does not conform to U.S. generally accepted accounting principles (“GAAP”) and constitutes non-GAAP measures. These non-GAAP measures include total pro forma segment operating EBITDA and Corteva pro forma operating EBITDA. Corteva's management believes that these non-GAAP measures best reflect the ongoing performance of the Company during the periods presented and provide more relevant and meaningful information to investors as they provide insight with respect to ongoing operating results of the Company and a more useful comparison of year-over-year results. These non-GAAP measures supplement the Company's U.S. GAAP disclosures and should not be viewed as an alternative to U.S. GAAP measures of performance. Furthermore, such non-GAAP measures may not be consistent with similar measures provided or used by other companies. This data should be read in conjunction with Corteva’s preliminary Form 10 registration statement (and subsequent amendments thereto). A reconciliation between these non-GAAP measures to GAAP is included within this presentation. Corteva pro forma operating EBITDA is defined as pro forma earnings (i.e., pro forma income from continuing operations before income taxes) before interest, depreciation, amortization, non-operating costs, net and foreign exchange gains (losses), excluding the impact of adjusted significant items. Non-operating costs, net, consists of non-operating pension and other post-employment benefit (OPEB) costs, environmental remediation and legal costs associated with legacy businesses and sites of Historical DuPont. Total segment pro forma operating EBITDA is defined as Corteva pro forma operating EBITDA excluding corporate expenses. Agriculture Division of DowDuPont 4

Principal Sections of the Form 10 And What Is To Come Principal Sections Initial Filing Subsequent Filings Business section Risk factors Distribution Dividend Policy (subject to approval of Corteva Board of Directors) Material tax consequences Relationship with New DuPont and New Dow Following the Distribution Management / Executive Compensation Discussion & Analysis Description of Capital Stock / Governance Beneficial Ownership Financial Information (financial statements, pro forma financial information, and MD&A) Exhibits Agriculture Division of DowDuPont 5

Financial Information Basis of Presentation Discontinued Operations: Transfer in of Separation Historical DuPont Historical DAS Adjustments Specialty and DuPont Materials • The Form 10 includes unaudited pro forma financial information for Corteva • The presentation starts with E. I. du Pont Nemours and Company consolidated financial statements (as filed in its Form 10-K/10-Q) and is adjusted for the following: - Discontinued operations of historical DuPont Materials Science business and historical DuPont Specialty Products businesses, + the transfer in of Dow AgroSciences, +/- other pro forma adjustments related to the merger and separation Agriculture Division of DowDuPont 6

FORM 10 The pro forma information provided shows Corteva pro forma income statements and balance sheet including Dow Agrosciences and removing the historical DuPont Materials and Specialties businesses; they also reflect Corteva as if the merger occurred on 1/1/2016 and include separation adjustments to the extent they are factually supportable Supplemental pro forma information provides Crop Protection and Seed segment information on a pro forma basis No statement of cash flows or statement of shareholders equity is permitted for the pro forma financial statements The financials provided are those of historical DuPont only; they include the historical DuPont Materials and Specialties businesses and exclude the historical Dow Essential AgroSciences business US GAAP financials cannot be restated for the transfer of Dow AgroSciences and the Information discontinued operations of historical DuPont Materials Science and Specialty Products businesses until those transactions occur in 2019 Agriculture Division of DowDuPont 7

Reconciliation of AgForm Division 10 to Corteva, Inc. 2016 2017 June 30, 2018 (in millions) (6 Months) DWDP Ag Segment Pro Forma Net Sales $ 14,060 $ 14,342 $ 9,538 Excluded businesses (145) (288) (79) Other 2 68 14 Corteva Pro Forma Net Sales $ 13,917 $ 14,122 $ 9,473 Agriculture Division of DowDuPont Note: Sales are on a pro forma basis. 8

Reconciliation of Ag Division to Corteva, Inc. 2016 2017 6/30/18 1. 2016, 2017 and YTD 2Q2018 functional, leveraged and (in millions) (6 Months) corporate costs are estimated based on the total costs incurred as part of Dow and DuPont. DWDP Ag segment $ 2,322 $ 2,6112 $ 2,576 operating EBITDA 2. With a single industry focus, Agriculture functional costs such as finance, human resources, information technology and legal Functional and directly support the business and are included in segment leveraged costs (458) (441)4 (173) results. included in the segment1,2 3. Corporate costs are comprised of corporate leadership, corporate strategy, corporate insurance, board costs and audit Excluded businesses (49) (89)2 (37) fees. We expect corporate costs to be ~1% of sales post spin. Non-op pension costs 83 322 (36) 4. The 2017 corporate, functional and leveraged costs include Other 31 342 9 about ~$175-225 million in costs that are not expected to continue. Also, we expect to reduce functional and leveraged Segment operating 1,929 2,1472 2,339 costs as we align and consolidate systems across the company EBITDA* post spin. Corporate costs1,3 (175) (148)4 (84) Corteva operating $ 1,754 $ 1,9992 $ 2,255 EBITDA* Note: Operating EBITDA is on a pro forma basis. Agriculture Division of DowDuPont *See appendix for non-GAAP reconciliations. 9

On Track for June 2019 Spin SEPTEMBER 17, 2018 NOVEMBER 8, 2018 MAY 2019 OCTOBER 2018 THROUGH MAY 2019 JUNE 1, 2019(1) Management Equity Investor Day Announcements Road Show Initial Form 10 Form 10 Expected Spin Filing Amendments BOD Announcements • Pro forma financial statements • Capital structure and dividend policy (1) Subject to the approval of the DowDuPont Board of Directors. Agriculture Division of DowDuPont 10

Appendix Agriculture Division of DowDuPont 11

Corteva Selected Non-GAAP Calculation of Corteva Pro Forma Operating EBITDA In millions 2017 2016 YTD 6/30/18 YTD 6/30/17 Pro Forma Pro Forma Pro Forma Pro Forma Pro forma income from continuing operations, net of tax (GAAP) 1 $ 2,230 $ 334 $ 843 $ 1,213 (Benefit from) provision for income taxes (3,125) (375) 135 (484) Pro forma (loss) income from continuing operations before income taxes $ (895) $ (41) $ 978 $ 729 + Depreciation and Amortization 816 758 480 404 - Interest income (109) (109) (52) (56) + Interest expense 342 280 187 138 + Exchange losses, net 373 207 116 162 + / - Non-operating costs (benefits), net 265 92 (105) 258 + Significant items 1,207 567 651 678 Corteva Pro forma Operating EBITDA (non-GAAP) 2 $ 1,999 $ 1,754 $ 2,255 $ 2,313 1. Pro forma income from continuing operations, net of tax, has been prepared in accordance with Article 11 of Regulation S-X and is considered the most directly comparable GAAP measure to Pro Forma Operating EBITDA. 2. Corteva Pro forma Operating EBITDA is defined as pro forma earnings (i.e., pro forma income from continuing operations before income taxes) before interest, depreciation, amortization, non-operating costs, net and foreign exchange gains (losses), excluding the impact of adjusted significant items. Non-operating costs, net consists of non-operating pension and other post-employment benefit (OPEB) costs, environmental remediation and legal costs associated with legacy businesses and sites of Historical DuPont. Agriculture Division of DowDuPont 12

Corteva Selected Segment Information Pro forma net sales by segment In millions 2017 2016 YTD 6/30/18 YTD 6/30/17 Seed $ 8,066 $ 7,842 $ 6,169 $ 6,365 Crop Protection 6,056 6,075 3,304 3,180 Total pro forma net sales $ 14,122 $ 13,917 $ 9,473 $ 9,545 Corteva Pro forma Operating EBITDA In millions 2017 2016 YTD 6/30/18 YTD 6/30/17 Seed $ 1,204 $ 1,013 $ 1,604 $ 1,748 Crop Protection 943 916 735 630 1 2,147 1,929 2,339 2,378 Total Segment Pro forma Operating EBITDA (non-GAAP) Corporate (148) (175) (84) (65) 2 Corteva Pro forma Operating EBITDA (non-GAAP) $ 1,999 $ 1,754 $ 2,255 $ 2,313 1. Segment Pro forma Operating EBITDA is defined as pro forma EBITDA excluding the impact of non-operating pension and other post employment benefits (OPEB) costs, other non-operating costs, corporate expenses, and significant items. Pro forma EBITDA is defined as earnings (i.e., pro forma “Income from continuing operations before income taxes") before interest, depreciation, amortization and foreign exchange gains (losses). Non-operating costs, net consists of non - operating pension and other post-employment benefit (OPEB) costs, environmental remediation and legal costs associated with legacy businesses and sites of Historical DuPont. 2. Corteva Pro forma Operating EBITDA is defined as pro forma earnings (i.e., pro forma income from continuing operations before income taxes) before interest, depreciation, amortization, non-operating costs, net and foreign exchange gains (losses), excluding the impact of adjusted significant items. Agriculture Division of DowDuPont 13

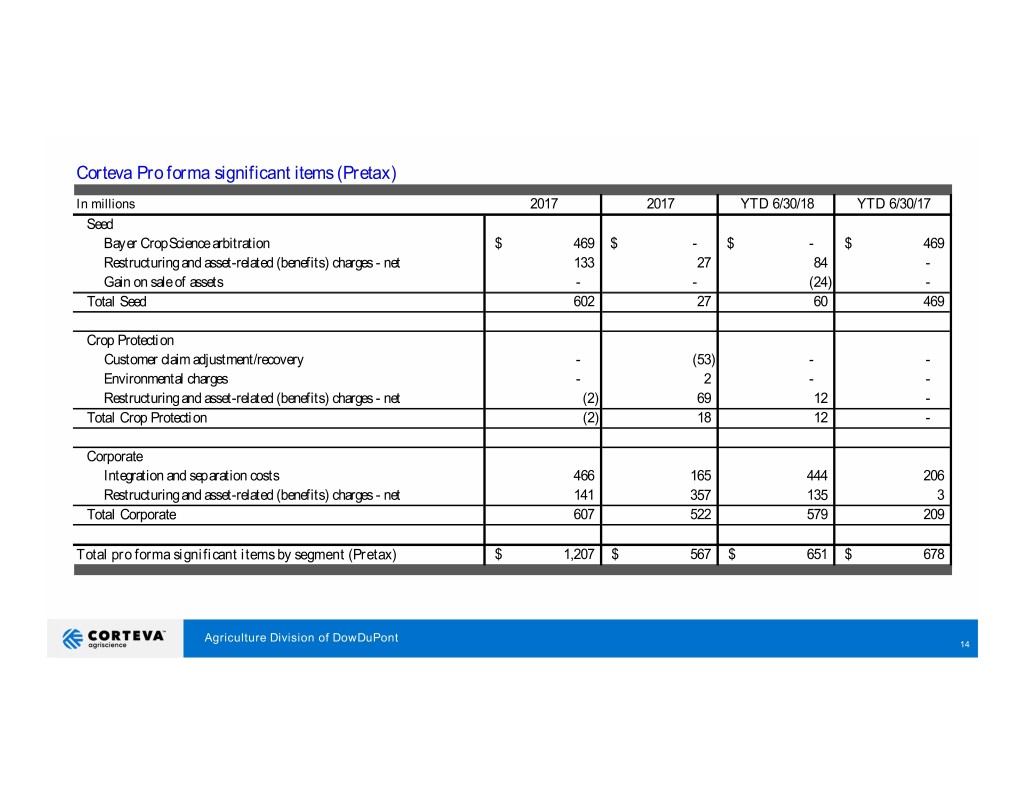

Corteva Pro forma significant items (Pretax) In millions 2017 2017 YTD 6/30/18 YTD 6/30/17 Seed Bayer CropScience arbitration$ 469 $ - $ - $ 469 Restructuring and asset-related (benefits) charges - net 133 27 84 - Gain on sale of assets - - (24) - Total Seed 602 27 60 469 Crop Protection Customer claim adjustment/recovery - (53) - - Environmental charges - 2 - - Restructuring and asset-related (benefits) charges - net (2) 69 12 - Total Crop Protection (2) 18 12 - Corporate Integration and separation costs 466 165 444 206 Restructuring and asset-related (benefits) charges - net 141 357 135 3 Total Corporate 607 522 579 209 Total pro forma significant items by segment (Pretax) $ 1,207 $ 567 $ 651 $ 678 Agriculture Division of DowDuPont 14

Agriculture Division of DowDuPont 15