Attached files

| file | filename |

|---|---|

| EX-99.2 - EXHIBIT 99.2 - Celanese Corp | q320188-kex992.htm |

| EX-99.1(A) - EXHIBIT 99.1(A) - Celanese Corp | q320188-kex991a.htm |

| 8-K - 8-K - Celanese Corp | q320188-kdocslidesscripts.htm |

Exhibit 99.1(b) Celanese Q3 2018 Earnings Thursday, October 18, 2018 Conference Call / Webcast Friday, October 19, 2018 10:00 a.m. Eastern Time Mark Rohr, Chairman and Chief Executive Officer Scott Richardson, SVP and Chief Financial Officer © Celanese Celanese Corporation 1

Important Information Forward-Looking Statements This presentation contains "forward-looking statements," which include information concerning the Company's plans, objectives, goals, strategies, future revenues, synergies, performance, capital expenditures, financing needs and other information that is not historical information. All forward-looking statements are based upon current expectations and beliefs and various assumptions, including the announced acquisition. There can be no assurance that the Company will realize these expectations or that these beliefs will prove correct. There are a number of risks and uncertainties that could cause actual results to differ materially from the results expressed or implied in the forward-looking statements contained in this presentation, including with respect to the acquisition. These risks and uncertainties include, among other things: changes in general economic, business, political and regulatory conditions in the countries or regions in which we operate; the length and depth of product and industry business cycles, particularly in the automotive, electrical, textiles, electronics and construction industries; changes in the price and availability of raw materials, particularly changes in the demand for, supply of, and market prices of ethylene, methanol, natural gas, wood pulp and fuel oil and the prices for electricity and other energy sources; the ability to pass increases in raw material prices on to customers or otherwise improve margins through price increases; the ability to maintain plant utilization rates and to implement planned capacity additions and expansions; the ability to reduce or maintain current levels of production costs and to improve productivity by implementing technological improvements to existing plants; the ability to identify desirable potential acquisition targets and to consummate acquisition or investment transactions consistent with the Company's strategy; increased price competition and the introduction of competing products by other companies; market acceptance of our technology; the ability to obtain governmental approvals and to construct facilities on terms and schedules acceptable to the Company; changes in tariffs, tax rates or legislation; changes in the degree of intellectual property and other legal protection afforded to our products or technologies, or the theft of such intellectual property; compliance and other costs and potential disruption or interruption of production or operations due to accidents, interruptions in sources of raw materials, cyber security incidents, terrorism or political unrest or other unforeseen events or delays in construction or operation of facilities, including as a result of geopolitical conditions, the occurrence of acts of war or terrorist incidents or as a result of weather or natural disasters; potential liability for remedial actions and increased costs under existing or future environmental regulations, including those relating to climate change; potential liability resulting from pending or future litigation, or from changes in the laws, regulations or policies of governments or other governmental activities in the countries in which we operate; changes in currency exchange rates and interest rates; our level of indebtedness, which could diminish our ability to raise additional capital to fund operations or limit our ability to react to changes in the economy or the chemicals industry; and various other factors discussed from time to time in the Company's filings with the Securities and Exchange Commission. Any forward-looking statement speaks only as of the date on which it is made, and the Company undertakes no obligation to update any forward-looking statements to reflect events or circumstances after the date on which it is made or to reflect the occurrence of anticipated or unanticipated events or circumstances. Results Unaudited The results in this document, together with the adjustments made to present the results on a comparable basis, have not been audited and are based on internal financial data furnished to management. Quarterly results should not be taken as an indication of the results of operations to be reported for any subsequent period or for the full fiscal year. Presentation This document presents the Company's four business segments Engineered Materials, Acetate Tow, Industrial Specialties and Acetyl Intermediates, with one subtotal reflecting our core, the Acetyl Chain, which is based on similarities among customers, business models and technical processes. The Acetyl Chain includes the Company's Industrial Specialties segment and Acetyl Intermediates segment. Non-GAAP Financial Measures This presentation, and statements made in connection with this presentation, refer to non-GAAP financial measures. For more information on the non-GAAP financial measures used by the Company, including the most directly comparable GAAP financial measure for each non-GAAP financial measures used, including definitions and reconciliations of the differences between such non-GAAP financial measures and the comparable GAAP financial measures, please refer to the Non-US GAAP Financial Measures and Supplemental Information document available on our website, www.celanese.com, under Investor Relations/Financial Information/Non-GAAP Financial Measures. © Celanese Celanese Corporation 2

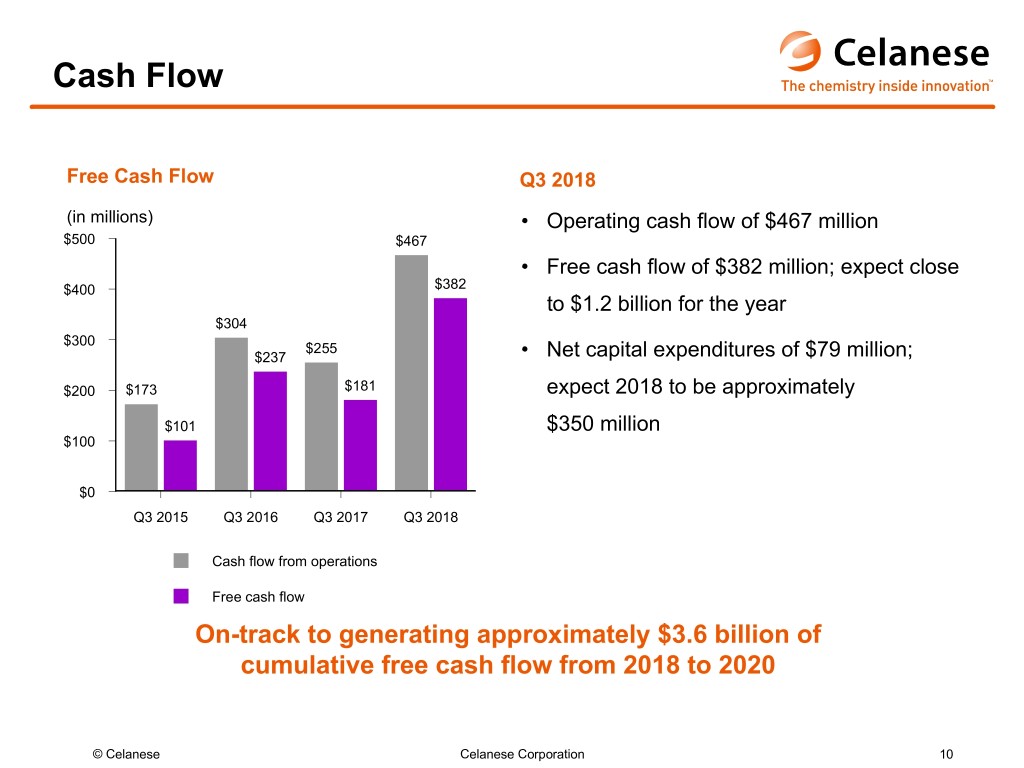

Recent Highlights • Signed a definitive agreement to acquire Next Polymers, a leading domestic engineering thermoplastics (ETP) compounder in India. The transaction is expected to close in the first quarter of 2019. • Commercialized 925 Engineered Materials projects in the third quarter of 2018, a 58 percent increase year over year. • Announced plans to expand the POM production capacity in Frankfurt, Germany by 20kt, making it the world’s largest and most efficient POM plant. • Generated free cash flow of $382 million in the third quarter from earnings growth combined with disciplined management of working capital. • Elected Kim K.W. Rucker to the Company’s Board of Directors, effective October 5. © Celanese Celanese Corporation 3

Next Polymers is a Leading Domestic ETP Compounder in India Next Polymers' Footprint Application Mix Product Portfolio ABS Industrial & Other PP Consumer Transportation PA 6 / 66 PMMA Electronics PC & Electrical 10 production lines with 5 major product families ~20kt per year capacity Provides local manufacturing and scale to capture growth in India © Celanese Celanese Corporation 4

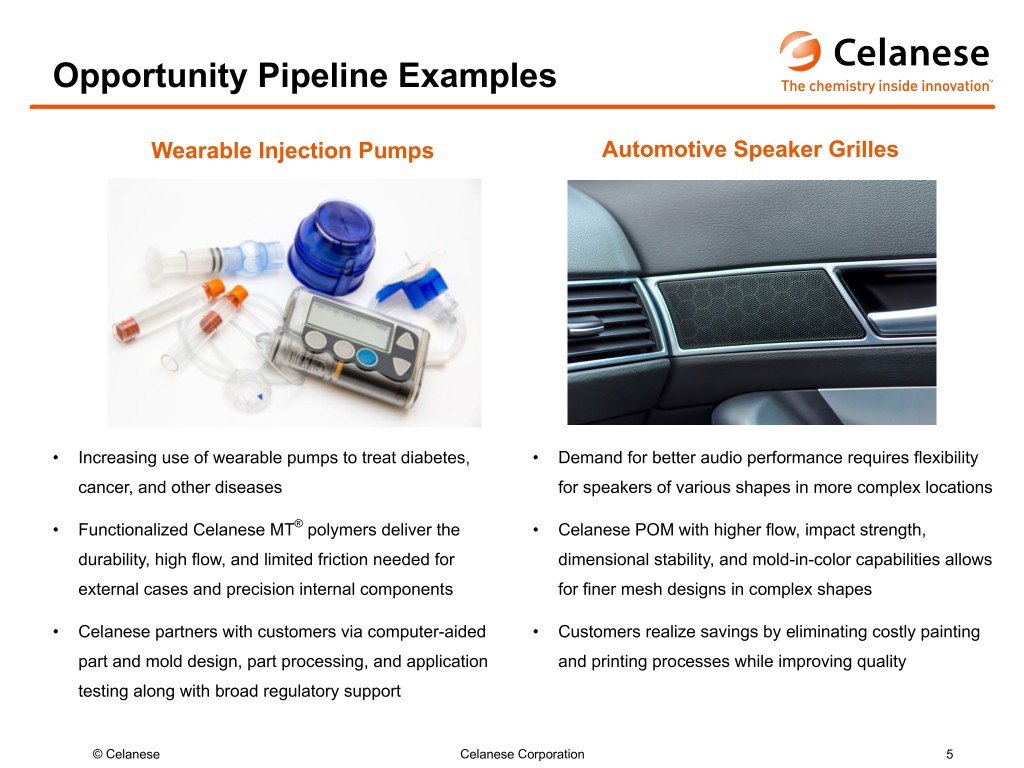

Opportunity Pipeline Examples Wearable Injection Pumps Automotive Speaker Grilles • Increasing use of wearable pumps to treat diabetes, • Demand for better audio performance requires flexibility cancer, and other diseases for speakers of various shapes in more complex locations • Functionalized Celanese MT® polymers deliver the • Celanese POM with higher flow, impact strength, durability, high flow, and limited friction needed for dimensional stability, and mold-in-color capabilities allows external cases and precision internal components for finer mesh designs in complex shapes • Celanese partners with customers via computer-aided • Customers realize savings by eliminating costly painting part and mold design, part processing, and application and printing processes while improving quality testing along with broad regulatory support © Celanese Celanese Corporation 5

Celanese Corporation Q3 2018 Highlights Q3 Performance Factors Affecting Net Sales Net sales (in millions) Total segment income margin $2,000 $1,844 $1,771 30% 16% $1,566 27.9% 12% $1,500 26.6% 8% 22.0% 20% $1,000 4% 10% 0% $500 -4% $0 0% Volume Price Currency Other Total Q3 2017 Q2 2018 Q3 2018 QoQ* YoY* GAAP Adjusted • Highest ever adjusted earnings per share of $2.96 Diluted EPS EPS • Net sales of $1,771 million, a 13% increase year over year Q3 2018 $3.00 $2.96 • Adjusted EBIT of $494 million and adjusted EBIT margin of 27.9%, Q2 2018 $2.52 $2.90 both all-time records Q3 2017 $1.68 $1.93 • Operating cash flow of $467 million • Free cash flow of $382 million *QoQ represents Q3 2018 as compared to Q2 2018; YoY represents Q3 2018 as compared to Q3 2017. © Celanese Celanese Corporation 6

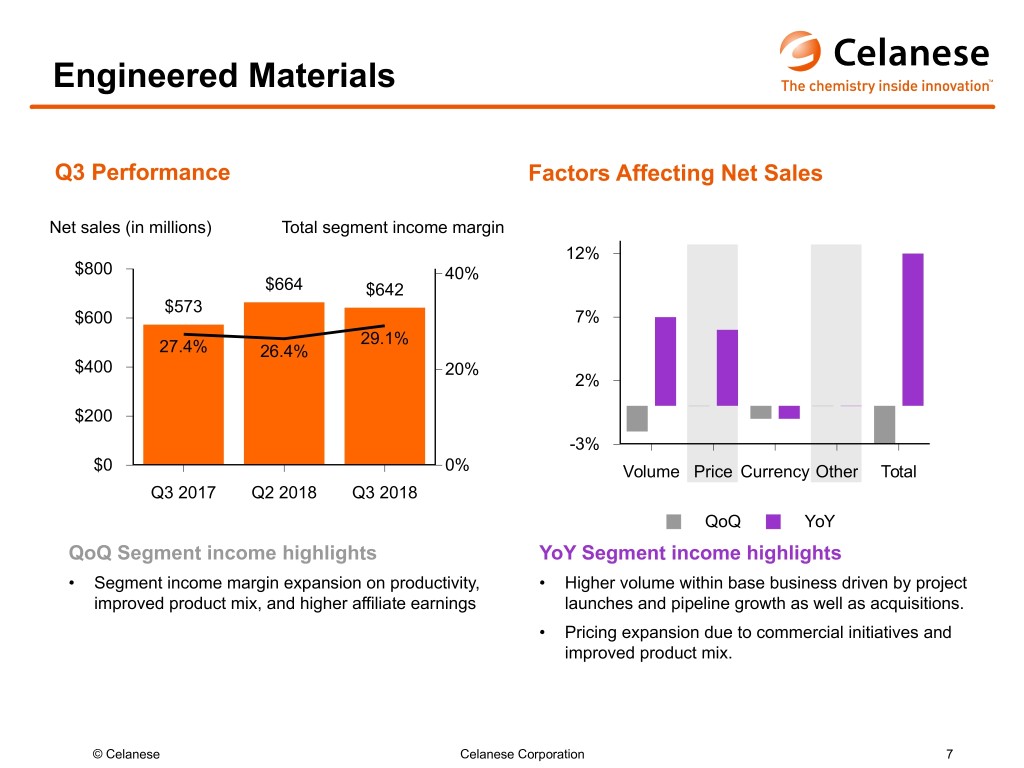

Engineered Materials Q3 Performance Factors Affecting Net Sales Net sales (in millions) Total segment income margin 12% $800 40% $664 $642 $573 $600 7% 29.1% 27.4% 26.4% $400 20% 2% $200 -3% $0 0% Volume Price Currency Other Total Q3 2017 Q2 2018 Q3 2018 QoQ YoY QoQ Segment income highlights YoY Segment income highlights • Segment income margin expansion on productivity, • Higher volume within base business driven by project improved product mix, and higher affiliate earnings launches and pipeline growth as well as acquisitions. • Pricing expansion due to commercial initiatives and improved product mix. © Celanese Celanese Corporation 7

Acetate Tow Q3 Performance Factors Affecting Net Sales Net sales (in millions) Total segment income margin 5% $200 60% $157 $162 $158 47.5% 43.9% 40% 41.1% 0% $100 20% -5% $0 0% Volume Price Currency Other Total Q3 2017 Q2 2018 Q3 2018 QoQ YoY QoQ Segment income highlights YoY Segment income highlights • Affiliate earnings declined mainly due to the timing of • Lower pricing due to lower industry utilization rates dividend payments. partially offset by productivity and product mix. • Dividends from affiliates in-line with prior year. © Celanese Celanese Corporation 8

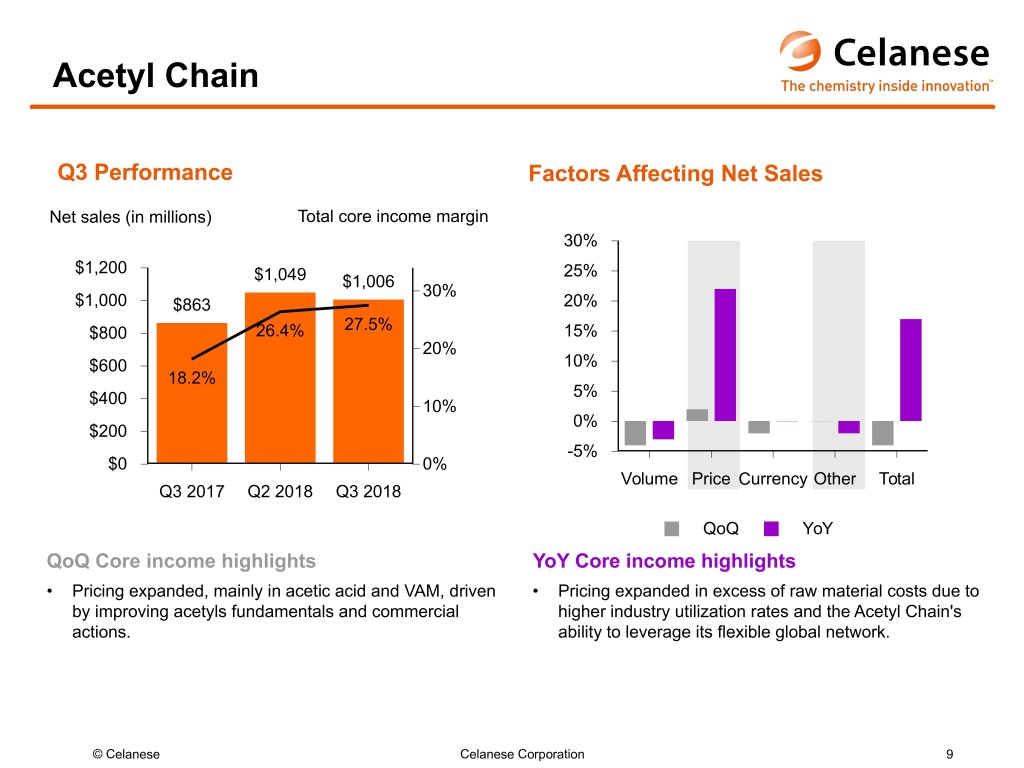

Acetyl Chain Q3 Performance Factors Affecting Net Sales Net sales (in millions) Total core income margin 30% $1,200 25% $1,049 $1,006 30% $1,000 $863 20% 27.5% $800 26.4% 15% 20% $600 10% 18.2% 5% $400 10% 0% $200 -5% $0 0% Volume Price Currency Other Total Q3 2017 Q2 2018 Q3 2018 QoQ YoY QoQ Core income highlights YoY Core income highlights • Pricing expanded, mainly in acetic acid and VAM, driven • Pricing expanded in excess of raw material costs due to by improving acetyls fundamentals and commercial higher industry utilization rates and the Acetyl Chain's actions. ability to leverage its flexible global network. © Celanese Celanese Corporation 9

Cash Flow Free Cash Flow Q3 2018 (in millions) • Operating cash flow of $467 million $500 $467 • Free cash flow of $382 million; expect close $400 $382 to $1.2 billion for the year $304 $300 $255 $237 • Net capital expenditures of $79 million; $200 $173 $181 expect 2018 to be approximately $101 $350 million $100 $0 Q3 2015 Q3 2016 Q3 2017 Q3 2018 Cash flow from operations Free cash flow On-track to generating approximately $3.6 billion of cumulative free cash flow from 2018 to 2020 © Celanese Celanese Corporation 10

Returning Cash to Shareholders Dividend Payout and Share Repurchases Share Repurchases • Deployed $150 million in Q3 2018 to $800 $741 $701 $700 repurchase ~1.3 million shares $594 $600 • Expect to complete ~$1.0 billion worth of $500 $459 shares repurchases by 2020; potential for $394 $400 accelerating $300 $247 Dividend $200 $88 $100 • Returned $73 million to shareholders in $0 dividends in Q3 2018 2012 2013 2014 2015 2016 2017 YTD 2018* Dividend Share Repurchases $3.2 billion returned to shareholders since 2012 via dividends and share repurchases *YTD Year-to-date as of September 30, 2018 © Celanese Celanese Corporation 11