Attached files

| file | filename |

|---|---|

| 8-K - 8-K - CHART INDUSTRIES INC | gtls-20181018x8kearningsre.htm |

| EX-99.1 - EXHIBIT 99.1 - CHART INDUSTRIES INC | exhibit991.htm |

Exhibit 99.2 Chart Industries Third Quarter 2018 October 18, 2018 © 2018 Chart Industries, Inc. Confidential and Proprietary © 2018 Chart Industries, Inc. Confidential and Proprietary

Forward Looking Statements Certain statements made in this news release are forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements include statements concerning the Company's plans, objectives, future orders, revenues, margins, earnings or performance, liquidity and cash flow, capital expenditures, business trends, and other information that is not historical in nature. Forward- looking statements may be identified by terminology such as "may," "will," "should," "could," "expects," "anticipates," "believes," "projects," "forecasts," “outlook,” “guidance,” "continue," or the negative of such terms or comparable terminology. Forward-looking statements contained in this presentation or in other statements made by the Company are made based on management's expectations and beliefs concerning future events impacting the Company and are subject to uncertainties and factors relating to the Company's operations and business environment, all of which are difficult to predict and many of which are beyond the Company's control, that could cause the Company's actual results to differ materially from those matters expressed or implied by forward-looking statements. Factors that could cause the Company’s actual results to differ materially from those described in the forward-looking statements include: those found in Item 1A (Risk Factors) in the Company’s most recent Annual Report on Form 10-K filed with the SEC, which should be reviewed carefully; Chart’s ability to close the VRV acquisition, successfully integrate VRV, and achieve anticipated revenue, earnings and accretion; estimated segment revenues, future revenue, earnings, cash flows, and margin targets and run rates; and Chart’s ability to close the sale of its oxygen-related products business within the BioMedical segment. The Company undertakes no obligation to update or revise any forward-looking statement. Chart is a leading diversified global manufacturer of highly engineered equipment for the industrial gas, energy, and biomedical industries. The majority of Chart's products are used throughout the liquid gas supply chain for purification, liquefaction, distribution, storage and end-use applications, a large portion of which are energy- related. Chart has domestic operations located across the United States and an international presence in Asia, Australia, Europe and Latin America. For more information, visit: http://www.chartindustries.com. 1 © 2018 Chart Industries, Inc. Confidential and Proprietary 1

Third Quarter 2018 Financial Results Q3 Highlights Sales & Revenue1 Adjusted 1 1,2 ($USD Million) Earnings Per Share Earnings Per Share • Sales increase of 34.3% over the third quarter of 2017, $272 $0.65 $0.74 16.0% excluding Hudson Products • Reported earnings per diluted share increased $272 $0.65 $0.74 $0.67 compared to the third quarter 2017, and adjusted EPS grew $0.52 in the same $203 comparative period • Orders of $264 million increased compared to $217 million in the third quarter of 2017, and increased 3.3% $0.22 organically ($0.02) Q3 2017 Q3 2018 Q3 2017 Q3 2018 Q3 2017 Q3 2018 1. All results reflect Continuing Operations 2. Adjusted earnings per share is a non-GAAP measure, see reconciliation to the comparable GAAP measure on page 5. 2 © 2018 Chart Industries, Inc. Confidential and Proprietary 2

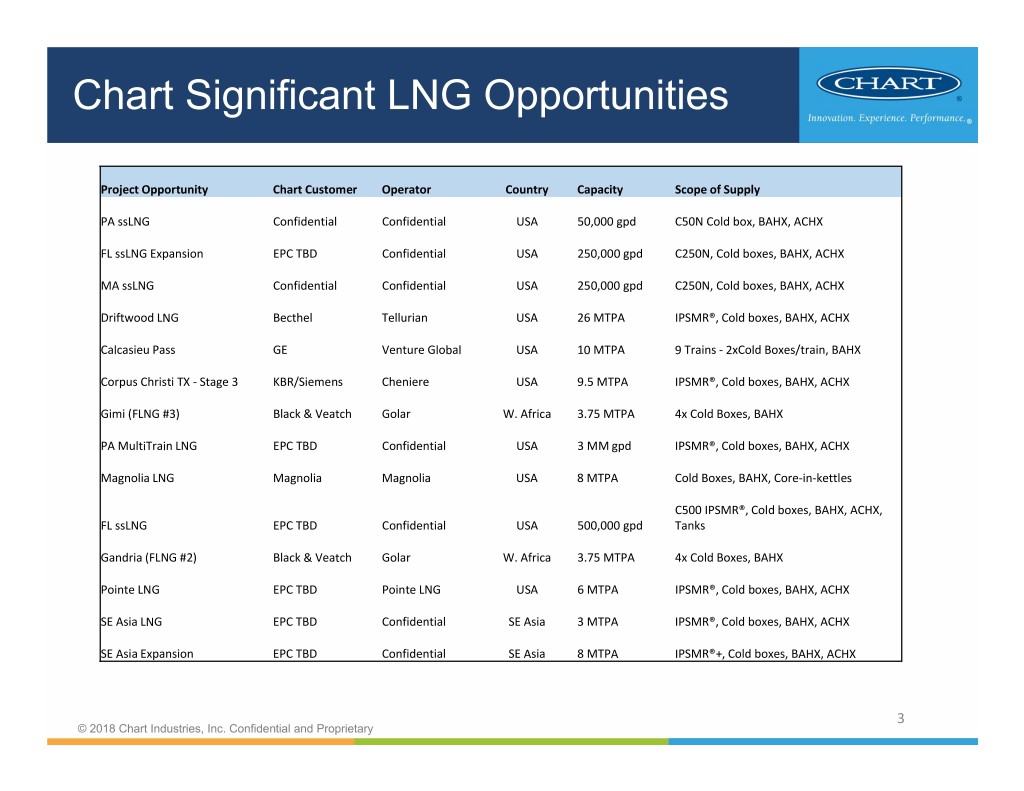

Chart Significant LNG Opportunities Project Opportunity Chart Customer Operator Country Capacity Scope of Supply PA ssLNG Confidential Confidential USA 50,000 gpd C50N Cold box, BAHX, ACHX FL ssLNG Expansion EPC TBD Confidential USA 250,000 gpd C250N, Cold boxes, BAHX, ACHX MA ssLNG Confidential Confidential USA 250,000 gpd C250N, Cold boxes, BAHX, ACHX Driftwood LNG Becthel Tellurian USA 26 MTPA IPSMR®, Cold boxes, BAHX, ACHX Calcasieu Pass GE Venture Global USA 10 MTPA 9 Trains ‐ 2xCold Boxes/train, BAHX Corpus Christi TX ‐ Stage 3 KBR/Siemens Cheniere USA 9.5 MTPA IPSMR®, Cold boxes, BAHX, ACHX Gimi (FLNG #3) Black & Veatch Golar W. Africa 3.75 MTPA 4x Cold Boxes, BAHX PA MultiTrain LNG EPC TBD Confidential USA 3 MM gpd IPSMR®, Cold boxes, BAHX, ACHX Magnolia LNG Magnolia Magnolia USA 8 MTPA Cold Boxes, BAHX, Core‐in‐kettles C500 IPSMR®, Cold boxes, BAHX, ACHX, FL ssLNG EPC TBD Confidential USA 500,000 gpd Tanks Gandria (FLNG #2) Black & Veatch Golar W. Africa 3.75 MTPA 4x Cold Boxes, BAHX Pointe LNG EPC TBD Pointe LNG USA 6 MTPA IPSMR®, Cold boxes, BAHX, ACHX SE Asia LNG EPC TBD Confidential SE Asia 3 MTPA IPSMR®, Cold boxes, BAHX, ACHX SE Asia Expansion EPC TBD Confidential SE Asia 8 MTPA IPSMR®+, Cold boxes, BAHX, ACHX 3 © 2018 Chart Industries, Inc. Confidential and Proprietary

2018 YTD Financial Results YTD Q3 2018 Highlights Sales & Revenue1 Adjusted 1 1,2 ($USD Million) Earnings Per Share Earnings Per Share • Sales increase of 38.5% over YTD third quarter of 2017, $794 $1.11 $1.41 16.2% excluding Hudson Products • Reported earnings per diluted share increased $794 $1.11 $1.41 $1.15 compared to the first three quarters of 2017, and adjusted EPS grew $1.06 in the same comparative period $574 • Orders of $869 million increased compared to $613 million in the first three quarters of 2017, and increased 14.4% organically $0.35 ($0.04) YTD 2017 YTD 2018 YTD 2017 YTD 2018 YTD 2017 YTD 2018 1. All results reflect Continuing Operations 2. Adjusted earnings per share is a non-GAAP measure, see reconciliation to the comparable GAAP measure on page 5. 4 © 2018 Chart Industries, Inc. Confidential and Proprietary 4

Adjusted Earnings Per Share Q3 Q3 Change V. YTD YTD Change V. $ millions, except per share amounts 2018 2017 PY 2018 2017 PY Net income (loss) $21.5 ($0.6) $22.1 $35.6 ($1.2) $36.8 from continuing operations EPS (1) $0.65 ($0.02) $0.67 $1.11 ($0.04) $1.15 from continuing operations Restructuring and transaction‐ $0.07 $0.24 ($0.17) $0.16 $0.39 ($0.23) related costs Aluminum cryobiological tank ‐ ‐ ‐ 0.09 ‐ 0.09 recall reserve expense CEO departure net costs ‐ ‐ ‐ 0.03 ‐ 0.03 Dilution impact of convertible 0.02 ‐ 0.02 0.02 ‐ 0.02 notes Adjusted EPS (2,3) $0.74 $0.22 $0.52 $1.41 $0.35 $1.06 from continuing operations (1) On January 1, 2018, we adopted ASC 606 which resulted in a timing related EPS impact of $0.00 Q3 2018, and $0.03 YTD 2018. (2) Adjusted EPS (a non-GAAP measure) is as reported on a historical basis. (3) Adjusted EPS normalized for FX impact would have been $0.73 and $0.26 for Q318 and Q317, or $1.42 and $0.41 YTD 2017 and 2018 respectively. (4) Tax effected adjustments are at normalized statutory quarterly rates. 5 © 2018 Chart Industries, Inc. Confidential and Proprietary 5

2018 Financial Results Recap Q3 2018 Q3 2018 Q3 2018 Q3 2018 $ millions, except per share amounts Adjustments Revenue Net Income EPS Adjusted EPS Chart Industries, Consolidated $315.2 $22.2 $0.67 $0.09 $0.76 Less: Discontinued Operations 43.0 0.7 0.02 - 0.02 Chart Industries, Continuing Operations $272.2 $21.5 $0.65 $0.09 $0.74 YTD 2018 YTD 2018 YTD 2018 $ millions, except per share amounts YTD 2018 EPS Adjustments Revenue Net Income Adjusted EPS Chart Industries, Consolidated $914.8 $40.3 $1.25 $0.30 $1.55 Less: Discontinued Operations 120.6 4.7 0.14 - 0.14 Chart Industries, Continuing Operations $794.2 $35.6 $1.11 $0.30 $1.41 6 © 2018 Chart Industries, Inc. Confidential and Proprietary

2018 Guidance Prior Guidance Prior Guidance, FY 2018 Guidance2 (Q2 2018)1 Q2 2018, Continuing Ops2 Sales Sales Sales $1.20B - $1.25B $1.04B - $1.09B $1.06B - $1.10B 7-9% organic growth Adjusted EPS $1.85 - $2.05 Adjusted EPS Adjusted EPS Inclusive of ~$0.15 impact from U.S. tax $1.64 - $1.84 $1.90 - $2.00 reform Assumes 27% full year tax rate Capital Expenditures Capital Expenditures Capital Expenditures $35M - $45M $34M - $44M $35M - $40M Inclusive of ~$11M for finalization of Inclusive of ~$11M for finalization of Inclusive of ~$11M for finalization of La Crosse, WI capacity expansion La Crosse, WI capacity expansion La Crosse, WI capacity expansion 1. The Company’s prior guidance assumed continued ownership of all assets for the entire calendar year. 2. The Company’s current guidance reflects continuing operations only, and prior guidance restated to reflect continuing operations only. 7 © 2018 Chart Industries, Inc. Confidential and Proprietary 7

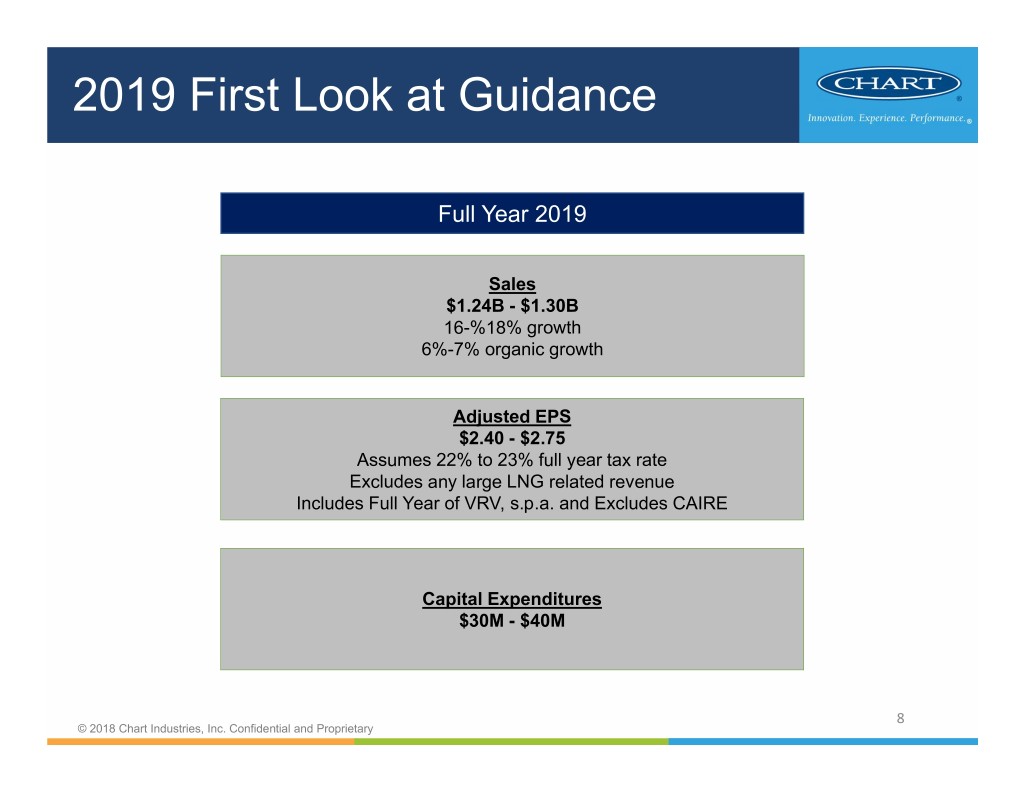

2019 First Look at Guidance Full Year 2019 Sales $1.24B - $1.30B 16-%18% growth 6%-7% organic growth Adjusted EPS $2.40 - $2.75 Assumes 22% to 23% full year tax rate Excludes any large LNG related revenue Includes Full Year of VRV, s.p.a. and Excludes CAIRE Capital Expenditures $30M - $40M 8 © 2018 Chart Industries, Inc. Confidential and Proprietary