Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - BYLINE BANCORP, INC. | by-ex991_6.htm |

| 8-K - 8-K - BYLINE BANCORP, INC. | by-8k_20181017.htm |

Acquisition of Oak Park River Forest Bankshares, Inc. October 17, 2018 Exhibit 99.2

Forward-Looking Statements The information included herein may contain “forward-looking statements” within the meaning of the U.S. Private Securities Litigation Reform Act of 1995. Any statements about Byline’s expectations, beliefs, plans, strategies, predictions, forecasts, objectives or assumptions of future events or performance are not historical facts and may be forward-looking. These statements include, but are not limited to, the expected completion date, financial benefits and other effects of the proposed merger of Byline and Oak Park River Forest Bankshares, Inc. (“Bankshares”). These statements are often, but not always, made through the use of words or phrases such as “anticipates,” “believes,” “expects,” “can,” “could,” “may,” “predicts,” “potential,” “opportunity,” “should,” “will,” “estimate,” “plans,” “projects,” “continuing,” “ongoing,” “expects,” “seeks,” “intends” and similar words or phrases. Accordingly, these statements involve estimates, known and unknown risks, assumptions and uncertainties that could cause actual strategies, actions or results to differ materially from those expressed in them, and are not guarantees of timing, future results or other events or performance. Because forward-looking statements are necessarily only estimates of future strategies, actions or results, based on management’s current expectations, assumptions and estimates on the date hereof, and there can be no assurance that actual strategies, actions or results will not differ materially from expectations, readers are cautioned not to place undue reliance on such statements. Factors that may cause such a difference include, but are not limited to, the reaction to the transaction of the companies’ customers, employees and counterparties; customer disintermediation; inflation; expected synergies, cost savings and other financial benefits of the proposed transaction might not be realized within the expected timeframes or might be less than projected; the requisite stockholder and regulatory approvals for the proposed transaction might not be obtained; credit and interest rate risks associated with Byline’s and Bankshares’ respective businesses, customers, borrowings, repayment, investment, and deposit practices; general economic conditions, either nationally or in the market areas in which Byline and Bankshares operate or anticipate doing business, are less favorable than expected; new regulatory or legal requirements or obligations; and other risks. Certain risks and important factors that could affect Byline’s future results are identified in its Annual Report on Form 10-K for the year ended December 31, 2017 and other reports filed with the Securities and Exchange Commission, including among other things under the heading “Risk Factors” in such Annual Report on Form 10-K. Any forward-looking statement speaks only as of the date on which it is made, and Byline undertakes no obligation to update any forward-looking statement, whether to reflect events or circumstances after the date on which the statement is made, to reflect new information or the occurrence of unanticipated events, or otherwise. Important Additional Information and Where to Find It This communication is being made in respect of the proposed merger transaction involving Byline and Bankshares. Byline intends to file a registration statement on Form S-4 with the SEC, which will include a proxy statement of Bankshares and a prospectus of Byline, and Byline will file other documents regarding the proposed transaction with the SEC. A definitive proxy statement/prospectus will also be sent to Bankshares stockholders seeking the required stockholder approval of the proposed transaction. Before making any voting or investment decision, investors and security holders of Bankshares are urged to carefully read the entire registration statement and proxy statement/prospectus, when they become available, as well as any amendments or supplements to these documents, because they will contain important information about the proposed transaction. The documents filed by Byline with the SEC may be obtained free of charge at the SEC’s website at www.sec.gov. In addition, the documents filed by Byline may be obtained free of charge at its website at http://www.bylinebancorp.com/Docs. Alternatively, these documents, when available, can be obtained free of charge from Byline upon written request to Byline Bancorp, Inc., Attn: Corporate Secretary, 180 North LaSalle Street, 3rd Floor, Chicago, Illinois 60601, or by calling (773)-475-2979. Information regarding the interests of certain of Bankshares’ directors and executive officers and a description of their direct and indirect interests, by security holdings or otherwise, will be included in the registration statement on Form S-4 regarding the proposed transaction when it becomes available. Participants in the Solicitation Byline, Bankshares, their respective directors and executive officers and certain of their other members of management and employees may be deemed to be participants in the solicitation of proxies from Bankshares’ stockholders in connection with the proposed transaction. Information about the directors and executive officers of Byline may be found in Byline’s Annual Report on Form 10-K for the year ended December 31, 2017, as amended by its Form 10-K/A filed with the SEC on April 30, 2018, a copy of which can be obtained free of charge from Byline or from the SEC’s website as indicated above. In addition, information about the directors and executive officers of Byline and Bankshares and other persons who may be deemed participants in the transaction will be included in the proxy statement/prospectus and other relevant materials when filed with the SEC.

Acquisition of Oak Park River Forest Bankshares, Inc. Strategically enhancing our deposit franchise

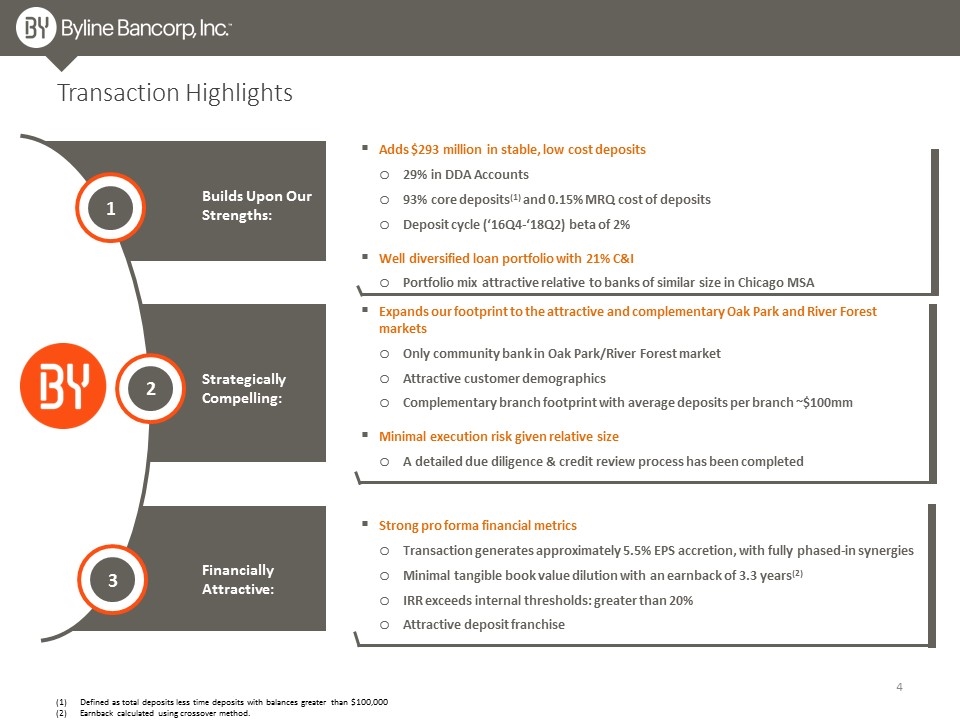

Builds Upon Our Strengths: Transaction Highlights 1 2 3 Expands our footprint to the attractive and complementary Oak Park and River Forest markets Only community bank in Oak Park/River Forest market Attractive customer demographics Complementary branch footprint with average deposits per branch ~$100mm Minimal execution risk given relative size A detailed due diligence & credit review process has been completed Strong pro forma financial metrics Transaction generates approximately 5.5% EPS accretion, with fully phased-in synergies Minimal tangible book value dilution with an earnback of 3.3 years(2) IRR exceeds internal thresholds: greater than 20% Attractive deposit franchise Defined as total deposits less time deposits with balances greater than $100,000 Earnback calculated using crossover method. Adds $293 million in stable, low cost deposits 29% in DDA Accounts 93% core deposits(1) and 0.15% MRQ cost of deposits Deposit cycle (‘16Q4-‘18Q2) beta of 2% Well diversified loan portfolio with 21% C&I Portfolio mix attractive relative to banks of similar size in Chicago MSA Strategically Compelling: Financially Attractive:

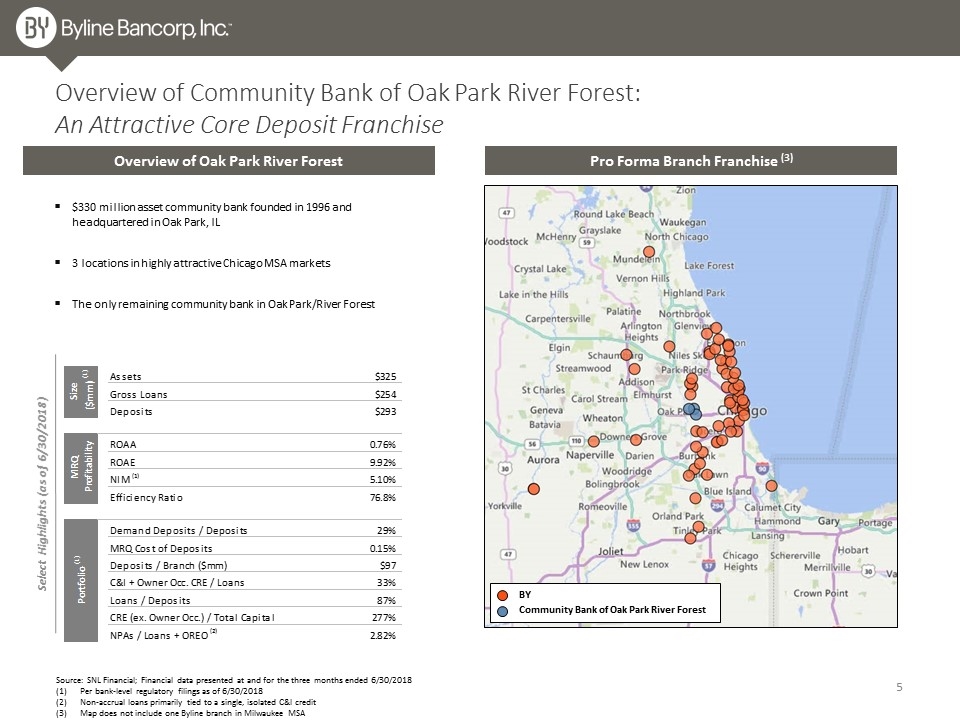

Source: SNL Financial; Financial data presented at and for the three months ended 6/30/2018 Per bank-level regulatory filings as of 6/30/2018 Non-accrual loans primarily tied to a single, isolated C&I credit Map does not include one Byline branch in Milwaukee MSA Overview of Community Bank of Oak Park River Forest: An Attractive Core Deposit Franchise $330 million asset community bank founded in 1996 and headquartered in Oak Park, IL 3 locations in highly attractive Chicago MSA markets The only remaining community bank in Oak Park/River Forest BY Community Bank of Oak Park River Forest Pro Forma Branch Franchise (3) Overview of Oak Park River Forest Select Highlights (as of 6/30/2018)

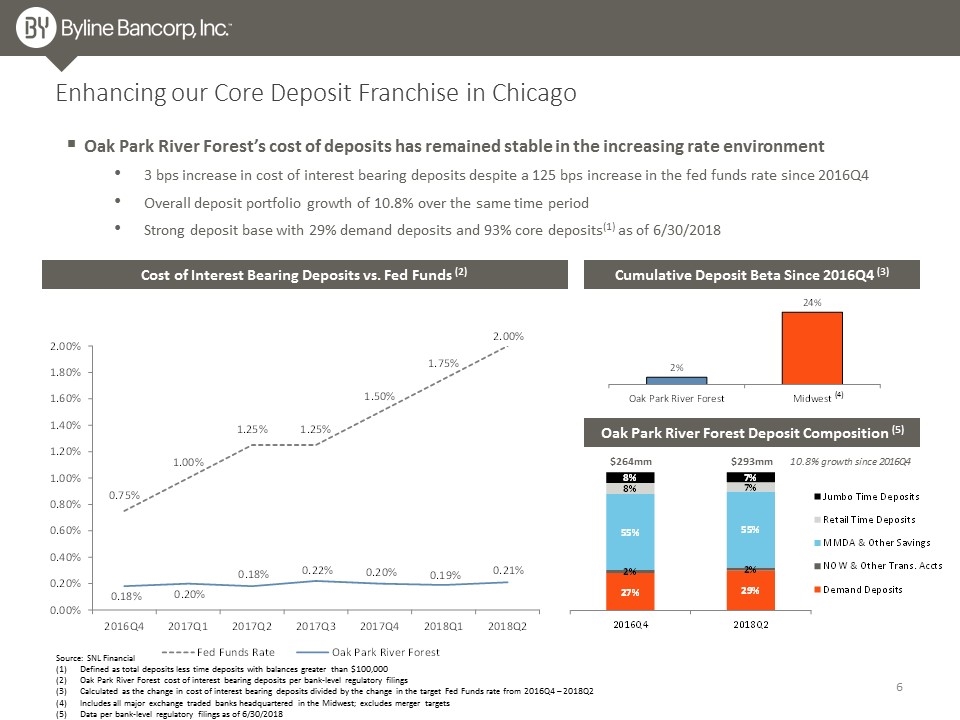

Source: SNL Financial Defined as total deposits less time deposits with balances greater than $100,000 Oak Park River Forest cost of interest bearing deposits per bank-level regulatory filings Calculated as the change in cost of interest bearing deposits divided by the change in the target Fed Funds rate from 2016Q4 – 2018Q2 Includes all major exchange traded banks headquartered in the Midwest; excludes merger targets Data per bank-level regulatory filings as of 6/30/2018 Enhancing our Core Deposit Franchise in Chicago Cost of Interest Bearing Deposits vs. Fed Funds (2) Cumulative Deposit Beta Since 2016Q4 (3) Oak Park River Forest Deposit Composition (5) Oak Park River Forest’s cost of deposits has remained stable in the increasing rate environment 3 bps increase in cost of interest bearing deposits despite a 125 bps increase in the fed funds rate since 2016Q4 Overall deposit portfolio growth of 10.8% over the same time period Strong deposit base with 29% demand deposits and 93% core deposits(1) as of 6/30/2018 (4) 10.8% growth since 2016Q4 $264mm $293mm

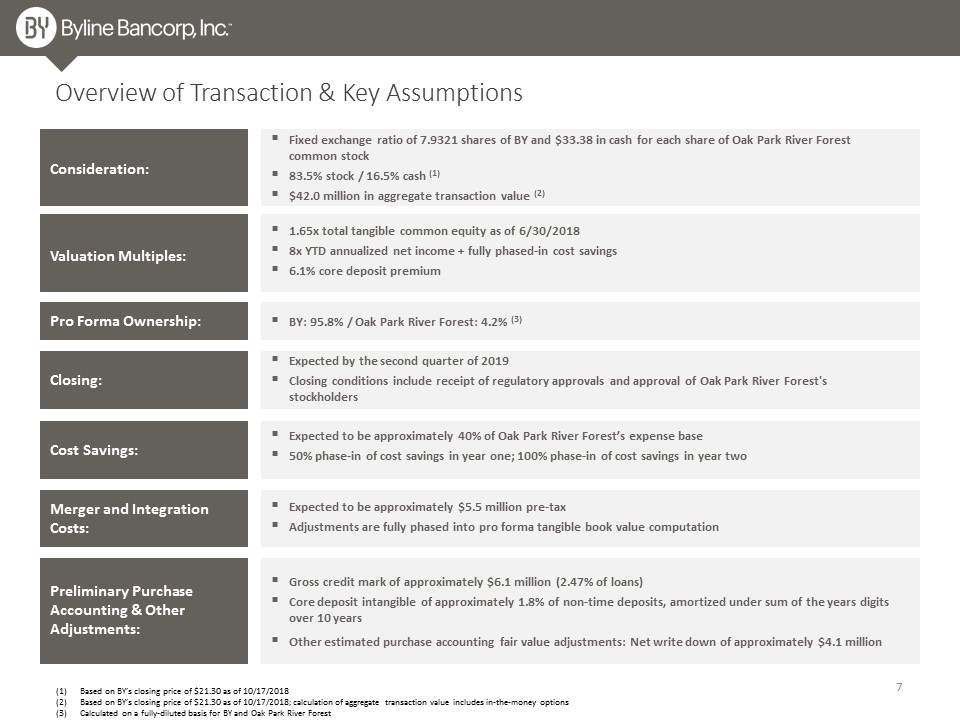

Based on BY’s closing price of $21.30 as of 10/17/2018 Based on BY’s closing price of $21.30 as of 10/17/2018; calculation of aggregate transaction value includes in-the-money options Calculated on a fully-diluted basis for BY and Oak Park River Forest Overview of Transaction & Key Assumptions Consideration: Fixed exchange ratio of 7.9321 shares of BY and $33.38 in cash for each share of Oak Park River Forest common stock 83.5% stock / 16.5% cash (1) $42.0 million in aggregate transaction value (2) Closing: Expected by the second quarter of 2019 Closing conditions include receipt of regulatory approvals and approval of Oak Park River Forest's stockholders Valuation Multiples: 1.65x total tangible common equity as of 6/30/2018 8x YTD annualized net income + fully phased-in cost savings 6.1% core deposit premium Pro Forma Ownership: BY: 95.8% / Oak Park River Forest: 4.2% (3) Expected to be approximately 40% of Oak Park River Forest’s expense base 50% phase-in of cost savings in year one; 100% phase-in of cost savings in year two Cost Savings: Merger and Integration Costs: Expected to be approximately $5.5 million pre-tax Adjustments are fully phased into pro forma tangible book value computation Preliminary Purchase Accounting & Other Adjustments: Gross credit mark of approximately $6.1 million (2.47% of loans) Core deposit intangible of approximately 1.8% of non-time deposits, amortized under sum of the years digits over 10 years Other estimated purchase accounting fair value adjustments: Net write down of approximately $4.1 million

Appendix

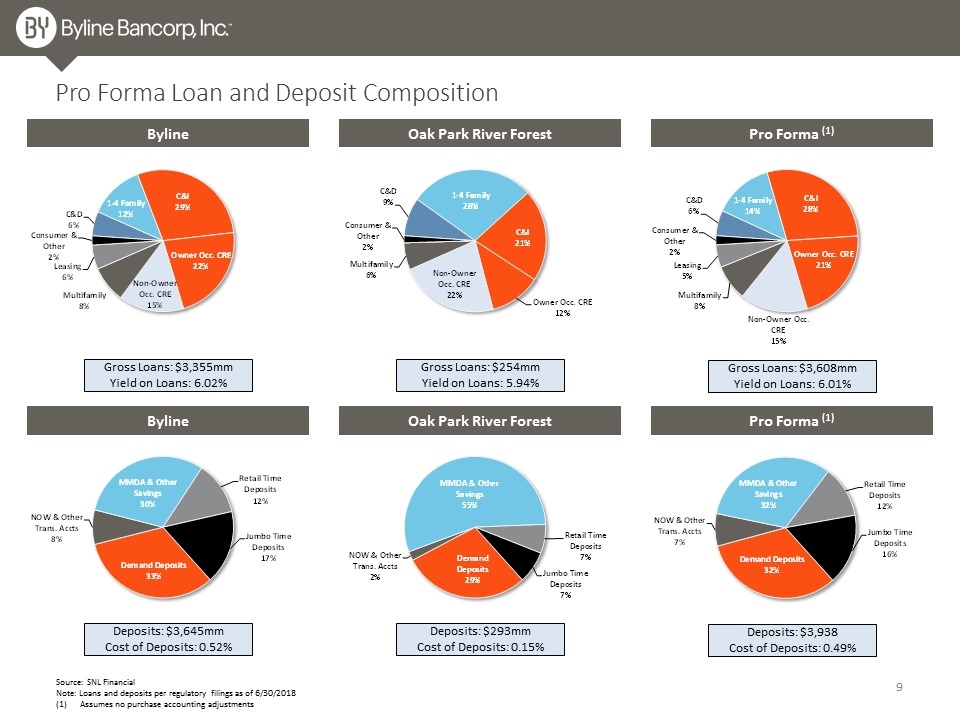

Source: SNL Financial Note: Loans and deposits per regulatory filings as of 6/30/2018 Assumes no purchase accounting adjustments Pro Forma Loan and Deposit Composition Byline Oak Park River Forest Pro Forma (1) Byline Oak Park River Forest Pro Forma (1) Gross Loans: $3,355mm Yield on Loans: 6.02% Gross Loans: $254mm Yield on Loans: 5.94% Gross Loans: $3,608mm Yield on Loans: 6.01% Deposits: $3,645mm Cost of Deposits: 0.52% Deposits: $293mm Cost of Deposits: 0.15% Deposits: $3,938 Cost of Deposits: 0.49%