Attached files

| file | filename |

|---|---|

| EX-99.2 - EXHIBIT 99.2 - HOPE BANCORP INC | hope-09x30x18ex992.htm |

| EX-99.1 - EXHIBIT 99.1 - HOPE BANCORP INC | hope-09x30x2018ex991.htm |

| 8-K - 8-K - HOPE BANCORP INC | hope09-30x20188kfinancialr.htm |

2018 Third Quarter Earnings Conference Call Wednesday, October 17, 2018 1

Forward Looking Statements & Additional Disclosures This presentation may contain statements regarding future events or the future financial performance of the Company that constitute forward‐looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. These forward‐looking statements relate to, among other things, expectations regarding the business environment in which we operate, projections of future performance, perceived opportunities in the market, and statements regarding our business strategies, objectives and vision. Forward‐ looking statements include, but are not limited to, statements preceded by, followed by or that include the words “will,” “believes,” “expects,” “anticipates,” “intends,” “plans,” “estimates” or similar expressions. With respect to any such forward‐looking statements, the Company claims the protection provided for in the Private Securities Litigation Reform Act of 1995. These statements involve risks and uncertainties. The Company’s actual results, performance or achievements may differ significantly from the results, performance or achievements expressed or implied in any forward‐looking statements. The risks and uncertainties include, but are not limited to: possible deterioration in economic conditions in our areas of operation; interest rate risk associated with volatile interest rates and related asset‐liability matching risk; liquidity risks; risk of significant non‐earning assets, and net credit losses that could occur, particularly in times of weak economic conditions or times of rising interest rates; and regulatory risks associated with current and future regulations. For additional information concerning these and other risk factors, see the Company’s most recent Annual Report on Form 10‐K. The Company does not undertake, and specifically disclaims any obligation, to update any forward‐looking statements to reflect the occurrence of events or circumstances after the date of such statements except as required by law. 2

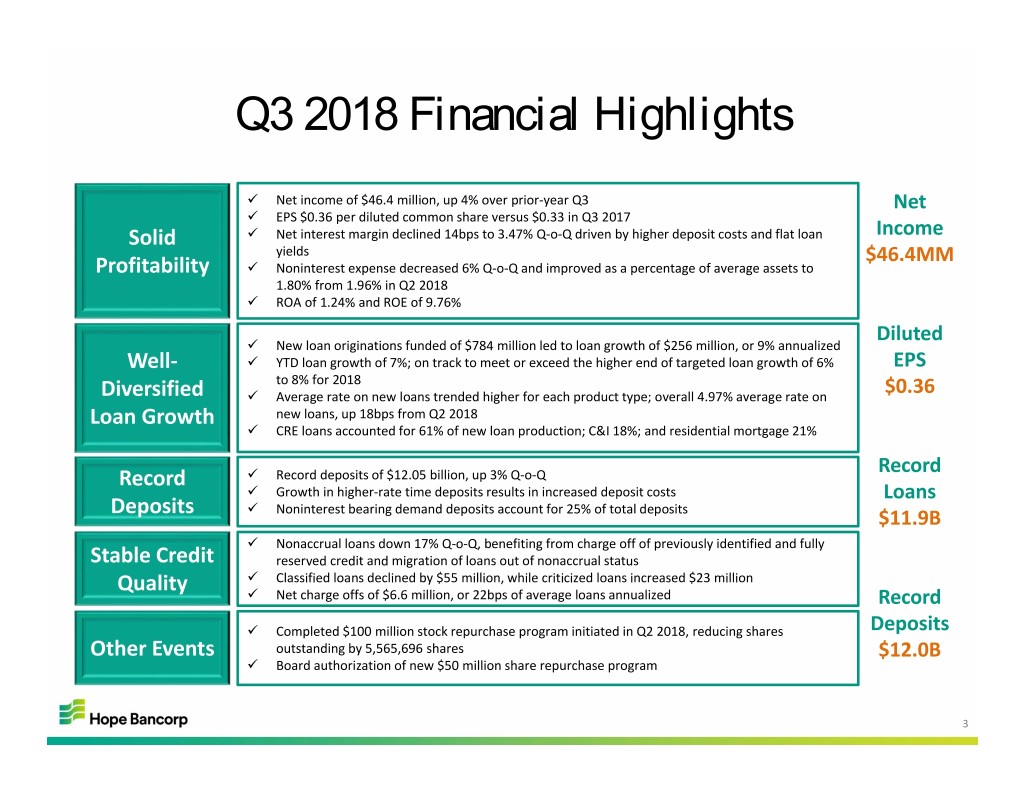

Q3 2018 Financial Highlights Net income of $46.4 million, up 4% over prior‐year Q3 Net EPS $0.36 per diluted common share versus $0.33 in Q3 2017 Solid Net interest margin declined 14bps to 3.47% Q‐o‐Q driven by higher deposit costs and flat loan Income yields $46.4MM Profitability Noninterest expense decreased 6% Q‐o‐Q and improved as a percentage of average assets to 1.80% from 1.96% in Q2 2018 ROA of 1.24% and ROE of 9.76% Diluted New loan originations funded of $784 million led to loan growth of $256 million, or 9% annualized Well‐ YTD loan growth of 7%; on track to meet or exceed the higher end of targeted loan growth of 6% EPS to 8% for 2018 Diversified Average rate on new loans trended higher for each product type; overall 4.97% average rate on $0.36 Loan Growth new loans, up 18bps from Q2 2018 CRE loans accounted for 61% of new loan production; C&I 18%; and residential mortgage 21% Record Record Record deposits of $12.05 billion, up 3% Q‐o‐Q Growth in higher‐rate time deposits results in increased deposit costs Loans Deposits Noninterest bearing demand deposits account for 25% of total deposits $11.9B Nonaccrual loans down 17% Q‐o‐Q, benefiting from charge off of previously identified and fully Stable Credit reserved credit and migration of loans out of nonaccrual status Quality Classified loans declined by $55 million, while criticized loans increased $23 million Net charge offs of $6.6 million, or 22bps of average loans annualized Record Completed $100 million stock repurchase program initiated in Q2 2018, reducing shares Deposits Other Events outstanding by 5,565,696 shares $12.0B Board authorization of new $50 million share repurchase program 3

Loan Production & Portfolio Trends New Loan Originations Funded 4.97% 4.79% Total end‐of‐period loans receivable increased $256 ($ millions) 4.56% 4.64% 4.40% 4.42% million or 2% Q‐o‐Q and 9% annualized 4.26% 4.03% 4.15% $74 $181 $182 $168 YTD loan growth of 7%; on track to meet or exceed $31 $120 $194 the higher end of targeted loan growth of 6% to 8% $80 $190 $138 $166 for 2018 $51 $236 $285 $157 $132 $85 $144 New loan originations funded of $784 million; new $450 $478 $390 $359 $385 $347 loan commitments of $819 million $321 $270 $325 Well diversified mix of loan originations with 61% 3Q16 4Q16 1Q17 2Q17 3Q17 4Q17 1Q18 2Q18 3Q18 CRE, 18% C&I and 21% Consumer CRE C&I Consumer Average Rate $2.74 billion total C&I commitments at 9/30/2018 and 54% utilization vs. 55% as of 6/30/2018 Loan Portfolio Composition SBA loan production of $71.4 million of which $52.5 4% 8% 19% million was 7(a) 20% 77% 72% Average rate on new loans increased 18bps to 4.97% and trended higher for each product type 9/30/2016 9/30/2018 (First quarter after MOE) 4

Deposit Growth Trends Deposit Composition Total end‐of‐period deposits increased 3% Q‐o‐Q to a record $12.05 billion ($ billions) $12.05 Continue to be active in deposit gathering activities $11.73 $11.51 to support robust loan growth $10.96 $10.99 $10.85 $10.70 $10.64 $10.70 Growth in higher‐rate time deposits results in increased deposit costs Deposit gathering and cost containment strategies a $5.18 $5.55 $4.10 $4.01 $4.77 $4.18 $4.04 $3.97 $4.27 top priority and being implemented 46.0% $0.24 $0.28 $0.23 $0.30 $0.30 $0.29 $0.24 $0.23 $0.23 1.9% Net Loans to Deposits $3.57 $3.69 $3.45 $3.32 $3.40 $3.48 $3.33 $3.28 $3.25 $12.5B 101.73% 27.0% 98.94% 98.70% $12.0B 98.36% 98.41% 97.88% 98.03% 97.54% 98.26% $11.5B $2.90 $2.90 $2.96 $3.02 $3.05 $3.00 $3.05 $3.04 $3.02 $11.0B 25.1% $10.5B 3Q16 4Q16 1Q17 2Q17 3Q17 4Q17 1Q18 2Q18 3Q18 $10.0B 3Q16 4Q16 1Q17 2Q17 3Q17 4Q17 1Q18 2Q18 3Q18 DDA MMA Savings Time Net Loans Deposits LTD Ratio DDA = Noninterest bearing demand deposits MMA = Money market account deposits 5

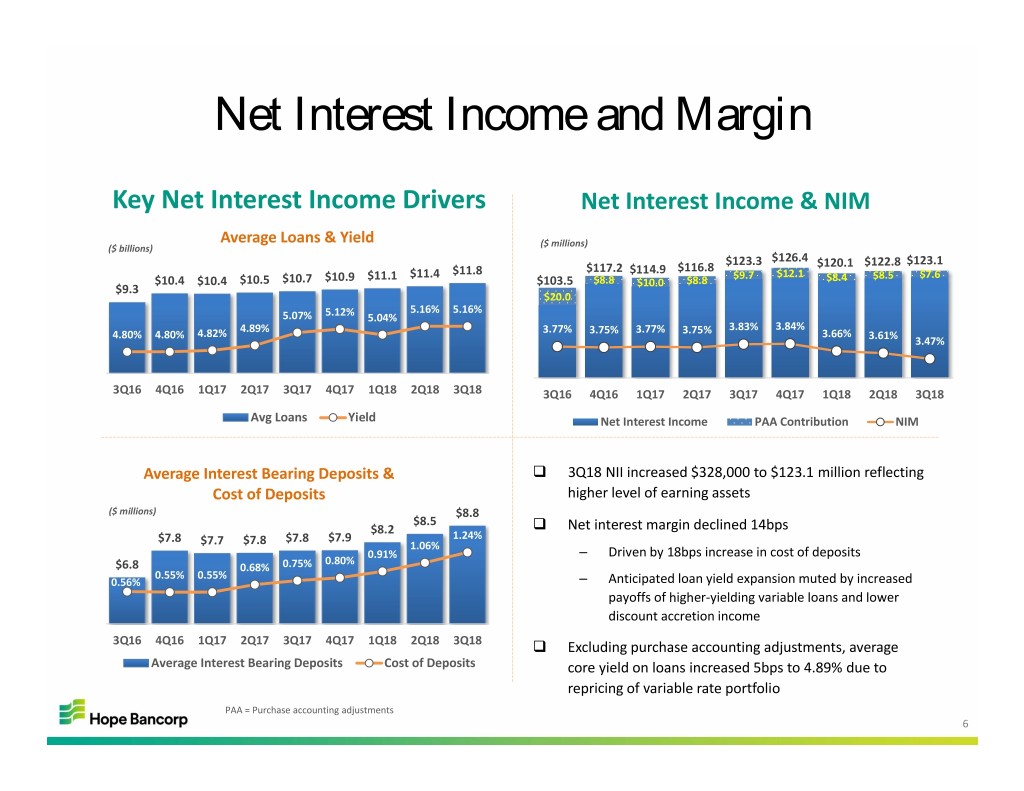

Net Interest Income and Margin Key Net Interest Income Drivers Net Interest Income & NIM Average Loans & Yield ($ millions) ($ billions) $123.3 $126.4 $123.1 $117.2 $116.8 $120.1 $122.8 $11.1 $11.4 $11.8 $114.9 $9.7 $12.1 $8.5 $7.6 $10.4 $10.4 $10.5 $10.7 $10.9 $103.5 $8.8 $10.0 $8.8 $8.4 $9.3 $20.0 5.16% 5.16% 5.07% 5.12% 5.04% 4.89% 3.77% 3.77% 3.83% 3.84% 4.80% 4.80% 4.82% 3.75% 3.75% 3.66% 3.61% 3.47% 3Q16 4Q16 1Q17 2Q17 3Q17 4Q17 1Q18 2Q18 3Q18 3Q16 4Q16 1Q17 2Q17 3Q17 4Q17 1Q18 2Q18 3Q18 Avg Loans Yield Net Interest Income PAA Contribution NIM Average Interest Bearing Deposits & 3Q18 NII increased $328,000 to $123.1 million reflecting Cost of Deposits higher level of earning assets ($ millions) $8.8 $8.5 $8.2 Net interest margin declined 14bps $7.8 $7.8 $7.9 1.24% $7.7 $7.8 1.06% 0.91% – Driven by 18bps increase in cost of deposits 0.80% $6.8 0.68% 0.75% 0.55% 0.55% 0.56% – Anticipated loan yield expansion muted by increased payoffs of higher‐yielding variable loans and lower discount accretion income 3Q16 4Q16 1Q17 2Q17 3Q17 4Q17 1Q18 2Q18 3Q18 Excluding purchase accounting adjustments, average Average Interest Bearing Deposits Cost of Deposits core yield on loans increased 5bps to 4.89% due to repricing of variable rate portfolio PAA = Purchase accounting adjustments 6

Noninterest Income Noninterest Income ($ millions) Total noninterest income decreased $1.8 million or $19.85 12% Q‐o‐Q to $13.4 million $18.19 $17.63 $16.12 $16.25 $16.45 Quarter‐over‐Quarter Difference $15.27 Gain on sale of SBA loans declined 33% due to $14.15 $10.40 $7.53 $13.45 lower amount of loans sold and decline in average $8.60 $6.62 $7.32 $7.27 $6.75 premium – $6.71 $6.07 Faster prepayment speeds reduced duration, $1.40 driving down the premiums available in the $0.42 $0.85 $0.30 $1.20 $0.35 $1.31 $0.43 secondary market $3.66 $0.95 $3.25 $3.27 $3.63 $0.48 $2.63 $3.45 $3.48 $1.48 $2.33 Other income and fees decreased 10% Q‐o‐Q $0.23 – Noninterest income reduced by $1.6 million due $5.60 to change in the fair value of equity investments $4.78 $5.34 $5.18 $5.15 $4.95 $4.80 $4.61 $4.57 3Q16 4Q16 1Q17 2Q17 3Q17 4Q17 1Q18 2Q18 3Q18 Service fees on dep accts Gain on sale of SBA loans Gain on sale of other loans Gain on sale of securities Other income and fees 7

Noninterest Expense and Efficiency Noninterest Expense and Efficiency Ratio Breakdown of Noninterest Expense and FTE ($ millions) ($ millions) $73.0 $71.6 $67.8 $66.7 $67.7 $68.4 $67.5 $33.3 $31.1 $64.0 $61.8 $37.4 $32.6 $33.5 $29.0 $30.5 $29.1 $25.9 1,502 1,463 1,470 1,491 FTE 1,512 1,400 FTE FTE FTE 57.68% 1,372 1,352 1,378 FTE FTE FTE 51.09% 51.12% 51.87% FTE 49.28% 48.17% 48.92% 49.38% 44.32% $30.5 $34.2 $34.2 $34.9 $36.0 $39.7 $39.4 $40.6 $37.0 3Q16 4Q16 1Q17 2Q17 3Q17 4Q17 1Q18 2Q18 3Q18 3Q16 4Q16 1Q17 2Q17 3Q17 4Q17 1Q18 2Q18 3Q18 Noninterest Expense Efficiency Ratio Compensation Other FTE Noninterest Expense to Average Assets ($ billions) Noninterest expense decreased by $4.2 million from $15.0 Q2 2018 $14.6 $14.0 $14.2 – $3.6 million decrease in compensation expense $13.7 2.30% $13.5 $13.3 $13.5 – $751,000 decrease in marketing/advertising expenses – $524,000 decrease in professional fees $11.8 1.98% 2.03% 2.08% 1.96% – Partially offset by $854,000 increase in other expenses 1.90% 1.80% 1.93% 1.80% related to an increase in LIHTC expenses Efficiency ratio improved to 49.38% Noninterest expense to average assets annualized 3Q16 4Q16 1Q17 2Q17 3Q17 4Q17 1Q18 2Q18 3Q18 improved to 1.80% Average Assets NIE to Avg Assets Annualized 8

Asset Quality Nonperforming Assets Provision Expense & Net Charge Offs ($ millions) ($ millions) $7.3 $8.3 $8.7 $6.5 $21.8 $17.2 $10.8 $129.6 $9.0 $5.6 $5.4 $27.5 $22.0 $120.5 $19.1 $108.5 $114.4 $109.2 0.24% $102.5 $3.6 0.22% $89.5 $89.3 $86.3 $2.8 0.90% 0.95% 0.13% $2.5 $2.3 0.87% 0.83% 0.89% 0.88% 0.87% 0.10% 0.78% 0.78% 0.05% 0.07% $0.8 0.02% 0.05% ‐0.04% 3Q16 4Q16 1Q17 2Q17 3Q17 4Q17 1Q18 2Q18 3Q18 3Q16 4Q16 1Q17 2Q17 3Q17 4Q17 1Q18 2Q18 3Q18 NPLs OREO NPAs/Total Assets Provision Expense Net Charge Offs (annualized) Criticized Loans Generally stable asset quality trends ($ millions) – Nonaccrual loans decreased 17% Q‐o‐Q – Nonperforming assets declined 8% Q‐o‐Q $348.1 $259.3 $313.1 $310.0 $315.4 $353.6 $344.6 $357.7 $302.7 – Nonperforming assets/total assets improved to 0.78% – Classified loans declined $55 million Q‐o‐Q 5.38% 5.28% 5.08% 5.24% 5.23% 5.12% 4.79% 4.26% 4.36% – Total criticized loans increased $23 million Q‐o‐Q $308.9 $243.7 $226.0 $251.1 $225.2 $214.9 $196.1 $139.5 $217.7 – Y‐o‐Y, total criticized loans decreased 9% to 4.36% of gross loans 3Q16 4Q16 1Q17 2Q17 3Q17 4Q17 1Q18 2Q18 3Q18 Net charge offs of $6.6 million includes the charge off of one Classified large relationship which was fully reserved in a prior quarter Special Mention Allowance to total loans receivable ratio as of 9/30/2018 Total Criticized Loans as a % of Gross Loans stable at 0.76% 9

Deposit Building and Asset Mix Initiatives Enhanced Treasury •New leadership recruited in Q2 2018 from larger mainstream bank Management Sales •Initial target list of commercial customers identified Program • Adding highly qualified personnel to solely focus on core deposit solicitation efforts •Revamped incentive programs in place where compensation and incentives are directly Targeted tied to core deposit production Employee • Recruiting middle market C&I lenders in existing footprint to focus on expanding sales Incentive Structure efforts beyond core Korean‐American customer base • Launching business development efforts focused on specialty industries and segments rich and Business in core deposits Development • Tapping existing warehouse mortgage line customers to attract operation and custodial Efforts deposit accounts •Enforcing mandated deposit accounts with loan approvals •Improving online banking platform to generate digital account openings from retail Rebuilding Online depositors nationwide Banking Platform •Initial CD offerings available by first quarter of 2019 • Expanded offerings of online checking and MMAs in second half of 2019 Focus on Higher‐ • Residential mortgage focus shifting to sellable mortgage loans Yielding Earnings •On‐balance sheet growth focusing on variable rate C&I and SBA loans Assets 10

Near-Term Outlook & Strategies Well positioned to meet or exceed loan growth guidance of 6‐8% for 2018 – Year‐to‐date loan growth of 7% Managing deposit costs will be key challenge and priority – Continuing to remain active in deposit gathering strategies to fund good lending opportunities that are accretive to earnings – Targeting loan‐to‐deposit ratio of 98% Implementing numerous initiatives focused on enhancing our deposit mix and higher‐yielding interest‐ earning assets Anticipate net interest margin pressure – Impact of rising deposit costs to be partially offset by higher interest‐earning assets and loan yields Noninterest expenses to average assets annualized in the 1.80% to 1.90% range Stable to improving asset quality trends supported by proactive monitoring and early detection Focused on improving market sensitivity that will lead to enhanced profitability Committed to Building on Strong Foundation for Sustained Growth and Value Creation 11

2018 First Quarter Earnings Conference Call Q&A 12