Attached files

| file | filename |

|---|---|

| 8-K - THE BANCORP INC. FORM 8-K - Bancorp, Inc. | bancorp8k.htm |

Exhibit 99.1

Payments Franchise OverviewOctober 9, 2018

Forward Looking Statements and Other Disclosures

1 2 THE BANCORP BUSINESSOur business model and strategy overviewPAYMENTS FRANCHISE OVERVIEWThe Bancorp’s key role in an evolving marketplace

The Bancorp Strategy 16/30/2018 vs. 6/30/2017 net interest income plus non interest income excluding change in value of unconsolidated entity and gain/loss on sale of securities The Bancorp has developed a client-driven business strategy which leverages our strategic assets and has significantly improved our financial performance BUSINESS STRATEGY ELEMENTS:Leverage Payments PlatformValue-added solutionsLow cost fundingSignificant fee incomeBuild out our historically low credit loss lines of businessesFocus on execution Key Financial Metrics Q2 2018 YTD Near term Objective Multi-year Objective Core Revenue Growth1 16% >10% >10% Efficiency Ratio1 70% <69% <60% Return on Equity % 12.5% 14.0% 20.0% Return on Assets % 0.94% 1.20% 1.75% Tier 1/Avg Assets (consolidated) 8.1% >8.5% >9.0% 1

The Bancorp has a unique deposit gathering platform linked to our payments franchise …creates a stable, low cost deposit base… Deposits ($M)1 Other Payments Prepaid cards HIGHLIGHTS:Average deposit cost of 0.59% for the quarter ended 6/30/2018Payments represent the largest and fastest growing source of deposits (13% compounded annual growth rate since 2013)Decline in Other reflects the exit of our Health Savings Account business and other non-strategic deposit relationships 1 Based on average annual or YTD balances through 6/30/2018 1

…which we are utilizing to build our lending franchise We will continue to grow our historically low losslending activities within our key business lines Loan balances ($M)1 Institutional Banking Real Estate Capital Markets Small Business Leasing 1 End of period balances Niche vehicle fleet leasing and management SBA and other small business lending Banking and lending solutions for wealth managers Commercial real estate loan origination and securitization 2018 Compound Annual Growth Rates for period 2013 – Q2 2018: Institutional Banking 24%, Small Business 30%, Leasing 19% 2 Securities-Backed Lines of Credit 2 1

Key differentiators for The Bancorp Leading payments franchise, driving fee income growth Commencing Phase #3 re-engineering of platform to enable innovative growth Low cost payments deposits will only partially adjust to increases in market interest rates Asset sensitive balance sheet with majority of loans and investments that will quickly reprice to higher interest rates Low credit-loss history lending products have grown rapidly and receive lower risk-based capital treatment IMPACT OF DURBIN ADMENDMENTDisadvantages for banks over 10- billion in assets REGULATORY CAPABILITIESSignificant investment in BSA/AML1 technology processes, and expansion of staff OPERATING PLATFORMEnhanced operational infrastructure supports product and client growth CLIENT RELATIONSHIPSDeep historical ties to leading fin-tech players and entrepreneurial start-ups COMPETITIVE EDGE FOR PAYMENTS 1 1Bank Secrecy Act/Anti-Money Laundering FINTECH LEADERSHIPUnique non-branch platform which leverages technology and strategic partners

1 2 THE BANCORP BUSINESSOur business model and strategy overviewPAYMENTS FRANCHISE OVERVIEWThe Bancorp’s key role in an evolving marketplace

Our Payments franchise is comprised of the Payments Solutions Group (Issuance) and Payment Acceptance Group (Acceptance) Payment Solutions Group Issuing bank for leading prepaid card and debit programs Payment Acceptance Group Merchant acquiring, ACH services, and Rapid Funds BUSINESS OVERVIEW Sponsorship of products and services across the payments spaceSponsorship of private label banking (e.g., checking account with a debit card) PARTNERS ACH sponsorship of large-scale payment processors (payroll, online billpay, etc.)VISA/MasterCard sponsorship of large credit card acquiring ISOs1 and their merchantsSponsorship of OCT/AFT transactions 1 Independent Sales Organization (ISO) Payments Franchise Overview 2

Serving the world’s most successful companies >110,000,000 Prepaid Cards in U.S. Distribution 1.1+ BillionMerchant Card Transactions Processed in 2017 $560 BillionCombined Annual Payments Processing Volume in 2017 LARGEST #1 Prepaid Card Issuer in U.S.1 8th LARGESTDebit Card Issuer1 TOP 15Automated Clearing House (ACH) Originating Bank >200kACH Originators Sponsored Note: Information as of Q2 2018, unless noted as 20171Nilson Report, April 2018 Issue #1129 $4.2 Billion Total Assets 2

Payments Financial Performance Sources: National Automated Clearing House Association (NACHA); Nilson Report Our growing Payments business is the primary driver of non-interest income and the largest source of the Bank’s deposits Compound Annual Growth 10% Compound Annual Growth 9% Million $ Billion Gross dollar volume represents total annual amount spent ACH transactional volume represents total annual number of ACH transfers processed Financial HighlightsLargest source of deposits (~$3.0B in 2017, 75% of total)Key driver of non-interest income (2017 non-interest income ~$60M, 5% growth YoY, 65% of total 2017 non-interest income)Key Market MetricsLargest U.S. issuer of prepaid cards (>100M)8th largest U.S. debit issuer15th largest U.S. originator of ACH transactions 2

Market Sources of Demand The Bancorp delivers the ability to access funds across a wide spectrum of markets General Purpose Reloadable (GPR)TravelTax RefundGift CardsDebitRapid Funds Consumer Corporate Government Payroll CardsIncentives and RebatesHealthcare (FSA, HSA, HRA)Insurance CasualtyCorporate ExpenseTransitACHRapid Funds Public Benefit and Welfare ProgramsUnemployment InsuranceEmergency Assistance and Disaster ReliefPension, Social SecurityChild Support Sources of Funds 2

Payments Ecosystem The Bancorp plays a key role within a highly developed marketplace ISSUANCE ACCEPTANCE Payment Network BIN1 Sponsor“Issuer” ProgramManager ISO3/ Third Party Sender Merchant/ Originator BIN Sponsor“Acquirer”/ODFI2 The BancorpWells FargoFifth Third Global PaymentsFiservBill.com Retail and ecommerce (7-Eleven, Uber) The BancorpMeta FinancialBank of the Internet PaypalInCommNetspend GalileoFIS GreenDotWestern Union Walgreens, CVS, Walmart CardholderServices Retail DistributionPartners Card Production & Fulfillment ReloadNetworks Processor MasterCardVisa Typically Program Managers or 3rd Parties Typically Program Managers or 3rd Parties 1 Bank Identification Number (BIN) 2 Originating Depository Financial Institution (ODFI)3 Independent Sales Organization (ISO) 2

Payments Business Model The Bancorp is a leading issuer for debit and prepaid cards and maintains partnerships with many of the sector leaders AssociationVISA/MasterCard Merchant Issuing Banks Consumer Acquiring Banks 1 7 2 3 6 5 4 9 8 Program Manager ISO Processor Processor 2

Issuing – Key Roles The Bancorp works in a highly integrated manner with our Program Managers and Processors Principal Member and conduit to card networksPrincipal oversight and control of program Facilitates the flow of and assumes fiduciary responsibility for fundsEnsures compliance with applicable law and regulatory guidanceSettles with the card networks for all transactions Issuing Bank Program Manager Processor Key Product Management roleIdentifies target client marketDesigns fee plansExecutes on implementation planKey Marketing roleDevelops marketing plansForms relationships with vendors and distributorsManages day to day product/program management functionsCustomer service and customer experienceWorks with Issuing Bank to manage processors Key FunctionsCreates card accounts, facilitates card production and package deliveryMaintains account of record (card balances, transactions, customer interaction history)Interfaces with card networksKey Risk ControlsAdministers program parameters, thresholds and rulesFacilitates transaction risk scoring “We provide the bank platform…” “…while they manage the client relationship” “…and they provide accounting and administration” 2

ACH Services – Business Model The Bancorp generates significant transaction volume and revenue from its ACH payments activities Payments CompanyThird Party Sender Receiver ODFI – The Bancorp Originator RDFI 2

ACH Services – Key Roles 2 The Bancorp works in a highly integrated manner with our Third Party Senders Principal Member and conduit to Federal ReservePrincipal oversight and control OFDI Third Party Sender Originator Payments expertiseFed/State/Local Payroll Tax management Employers needing to pay employeesResponsible to taxing authorities “We provide the bank platform…” “…while we manage every element of the payroll process…” “…so our employees payrolls are delivered on time” “We provide the bank platform…” “…while we manage all payments processes for our utility biller clients…” “…so our customers have convenient payment options and our accounts payable is received on time” PAYROLL BILL PAY Fortune 500 Motor Car Company Fortune 500 Telecomm Company

Rapid Funds – Business Model The U.S. Payments Ecosystem has been searching for a solution to “faster” payments for over a decade VISA and MasterCard developed their own solutions utilizing existing card network rails and the ubiquity of debit cards Deposit $ to cardOriginal Credit Transaction (OCT) Purchase using a cardPurchase Transaction Traditional “pull” from card New “push” to card 2

Rapid Funds – Payment Flows Real-time payments that are secure, simple and scalable 2 Company/Organization Receiver BIN Sponsor PayPal/Venmo AssociationVISA/MasterCard BIN Sponsor AssociationVISA/MasterCard P2P – Person to Person CorporateDisbursements Customer, Partner or Employee of Company

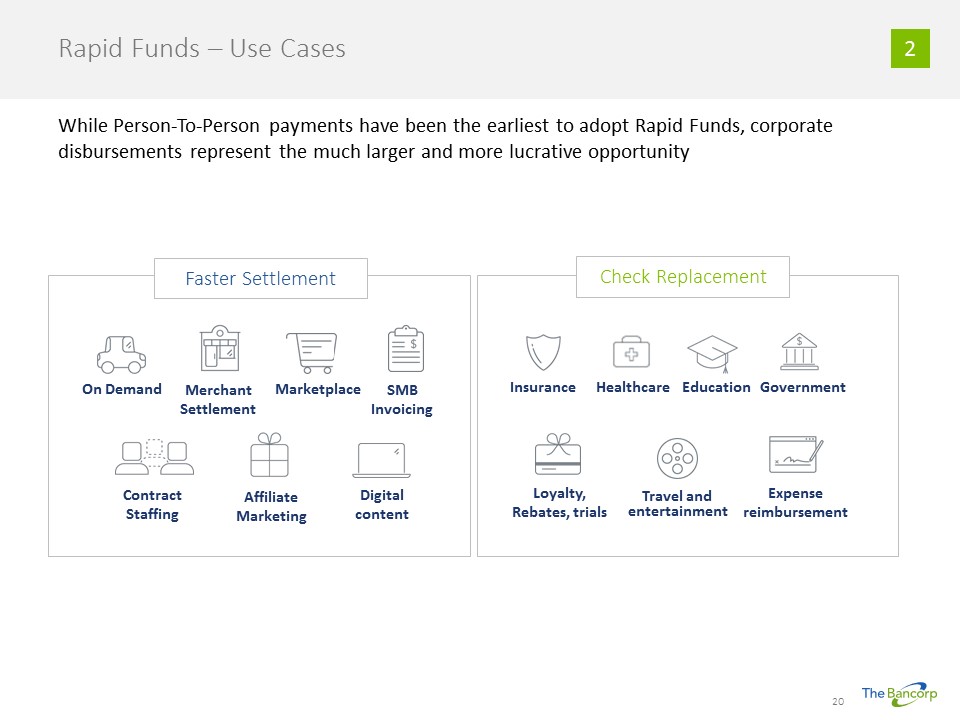

Rapid Funds – Use Cases While Person-To-Person payments have been the earliest to adopt Rapid Funds, corporate disbursements represent the much larger and more lucrative opportunity Check Replacement On Demand Marketplace MerchantSettlement SMB Invoicing ContractStaffing AffiliateMarketing Digitalcontent Insurance Government Healthcare Loyalty,Rebates, trials Travel and entertainment Expensereimbursement Education Faster Settlement 2

Payments High Level Growth Opportunities The Bancorp has significant opportunities to continue to grow our core Payments business and expand into related markets Expanding relationships with long-term strategic clients in a consolidating marketEnhancing payment solutions offering across market segmentsDevelop new programs and partnerships as the market evolves Payment Issuance (PSG) Payment Acceptance (PAG) Credit Linkage Built and launched a direct Rapid Funds Transfer channel. Rapid Funds is a new to market Visa/MC card-based transaction type for real-time corporate disbursements and P2P paymentsAllows The Bancorp to sell a turn-key solutionGenerates incremental revenue with little incremental expenseDeepening relationships with long-term strategic clients through cross selling of supplemental payment products Pursuing opportunities to provide credit to payments partners in the business to business arenaEvaluating opportunities to expand credit sponsorship in late 2018 2