Attached files

| file | filename |

|---|---|

| EX-32.2 - EXHIBIT 32.2 - BIOVIE INC. | bivi-20180630_10kex32z2.htm |

| EX-32.1 - EXHIBIT 32.1 - BIOVIE INC. | bivi-20180630_10kex32z1.htm |

| EX-31.2 - EXHIBIT 31.2 - BIOVIE INC. | bivi-20180630_10kex31z2.htm |

| EX-31.1 - EXHIBIT 31.1 - BIOVIE INC. | bivi-20180630_10kex31z1.htm |

UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

| ☒ | ANNUAL REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934. |

FOR THE FISCAL YEAR ENDED JUNE 30, 2018

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from ____________to _____________

Commission File Number: 333-190635

BIOVIE INC.

(Exact name of registrant as specified in its charter)

| Nevada | 46-2510769 | |

| (State or other jurisdiction of | (I.R.S. Empl. Ident. No.) | |

| incorporation or organization) |

| 100 Cummings Center, Suite 247-C | ||

| Beverly, MA 01915 | ||

| (Address of principal executive offices, Zip Code) | ||

| (312)-283-5793 | ||

| (Registrant’s telephone number, including area code) |

Securities registered pursuant to Section 12(g) of the Act:

| $.0001 par value common stock | Over the Counter Bulletin Board |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act during the past 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of "large accelerated filer," "accelerated filer," "smaller reporting company" and "emerging growth company" in Rule 12b-2 of the Exchange Act.

| Large Accelerated Filer | ☐ | Accelerated Filer | ☐ |

| Non-Accelerated Filer | ☐ | Smaller reporting company | ☒ |

| (Do not check if a smaller reporting company) | Emerging growth company | ☐ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes ☐ No ☒

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act

Yes ☐ No ☒

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ☒

The Aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was last sold, or the average bid and asked price of such common equity, as of the last business day of the registrant’s most recently completed fourth fiscal quarter, June 30, 2018 was $5,319,173.

There were 315,053,673 shares of the Registrant’s $0.0001 par value common stock outstanding as of September 28, 2018.

BIOVIE INC.

PART I

| Item 1. | Description of Business | 1 |

| Item 1A. | Risk Factors | 8 |

| Item 1B. | Unresolved Staff Comments | 19 |

| Item 2. | Description of Property | 19 |

| Item 3. | Legal Proceedings | 19 |

| Item 4. | Mine Safety Disclosure | 19 |

PART II

| Item 5. | Market for Common Equity and Related Stockholder Matters | 19 |

| Item 6. | Selected Financial Data | 20 |

| Item 7. | Management’s Discussion and Analysis of Financial Condition and Results of Operations | 20 |

| Item 7A. | Quantitative and Qualitative Disclosures About Market Risk | 25 |

| Item 8. | Financial Statements and Supplementary Data | 26 |

| Item 9. | Changes in and Disagreements with Accountants on Accounting and Financial Disclosure | 27 |

| Item 9A(T). | Controls and Procedures | 27 |

| Item 9B. | Other information | 27 |

PART III

| Item 10. | Directors, Executive Officers and Corporate Governance | 28 |

| Item 11. | Executive Compensation | 31 |

| Item 12. | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | 32 |

| Item 13. | Certain Relationships and Related Transactions, and Director Independence | 34 |

| Item 14. | Principal Accountant Fees and Services | 34 |

PART IV

| Item 15. | Exhibits and Financial Statement Schedules | 35 |

| Signatures | 35 | |

| Certifications |

BIOVIE INC.

This Annual Report on Form 10-K and the documents incorporated herein by reference contain forward-looking statements that have been made pursuant to the provisions of the Private Securities Litigation Reform Act of 1995. Such forward-looking statements are based on current expectations, estimates and projections about BioVie Inc.’s industry, management beliefs, and assumptions made by management. Words such as “anticipates,” “expects,” “intends,” “plans,” “believes,” “seeks,” “estimates,” variations of such words and similar expressions are intended to identify such forward-looking statements. These statements are not guarantees of future performance and are subject to certain risks, uncertainties and assumptions that are difficult to predict; therefore, actual results and outcomes may differ materially from what is expressed or forecasted in any such forward-looking statements.

PART I

| ITEM 1. | DESCRIPTION OF BUSINESS |

Introduction

BioVie Inc. (the “Company”) is a clinical-stage company pursuing the discovery, development, and commercialization of innovative drug therapies. The Company is currently focused on developing and commercializing BIV201, a novel approach to the treatment of ascites due to chronic liver cirrhosis. In March 2017, the Company received notification from the FDA that it could initiate a Phase 2a US clinical trial. In April 2017, the Company signed a Cooperative Research and Development Agreement (CRADA) with the McGuire Research Institute Inc. in Richmond, VA, and began dosing patients with BIV201 in September 2017. As of June 2018, three patients had been treated with BIV201 therapy in this ongoing Phase 2a clinical trial.

BIV201 has the potential to improve the health of thousands of patients suffering from life-threatening complications of liver cirrhosis due to hepatitis, NASH, and alcoholism. It has FDA Fast-Track status and Orphan Drug designation for the most common of these complications, ascites, which represents a significant unmet medical need. The FDA has never approved any drug specifically for treating ascites.

The BIV201 development program began at LAT Pharma LLC. On April 11, 2016, the Company acquired LAT Pharma LLC and the rights to its BIV201 development program. The Company currently owns all development and marketing rights to its drug candidate. The Company and PharmaIN, Corp. (“PharmaIN”), LAT Pharma’s former partner focused on the development of new modified drug candidates in the same therapeutic field but not including BIV201, have agreed to pay royalties equal to less than 1% of future net sales of each company's ascites drug development programs, or if such program is licensed to a third party, less than 5% of each company's net license revenues. The Company’s relationship with PharmaIN could advance into a collaboration or be terminated. The Company has an issued US Patent covering the use of BIV201 for the treatment of ascites patients in the outpatient setting using ambulatory pump infusion, and has filed patent applications for its drug candidate in Japan, and Europe, and China.

The Company’s activities are subject to significant risks and uncertainties including failure to secure additional funding to properly execute the Company’s business plan.

About Ascites and Liver Cirrhosis

About 600,000 Americans and millions worldwide suffer from liver cirrhosis. Cirrhosis is the 12th leading cause of death due to disease in the US, killing more than 30,000 people each year. The condition results primarily from hepatitis, alcoholism, and fatty liver disease linked to obesity. Ascites is a common complication of advanced liver cirrhosis, involving kidney dysfunction and the accumulation of large amounts of fluid in the abdominal cavity.

The Need for an Ascites Therapy

With no medications approved by the FDA specifically for treating ascites, an estimated 40% of patients die within two years of diagnosis. Certain drugs approved for other uses such as diuretics may provide initial relief, but patients may fail to respond to treatment as ascites worsens. This represents a critical unmet medical need. US treatment costs for liver cirrhosis, including ascites and other complications, are estimated at more than $4 billion annually.

-1-

The Ascites Development Pathway

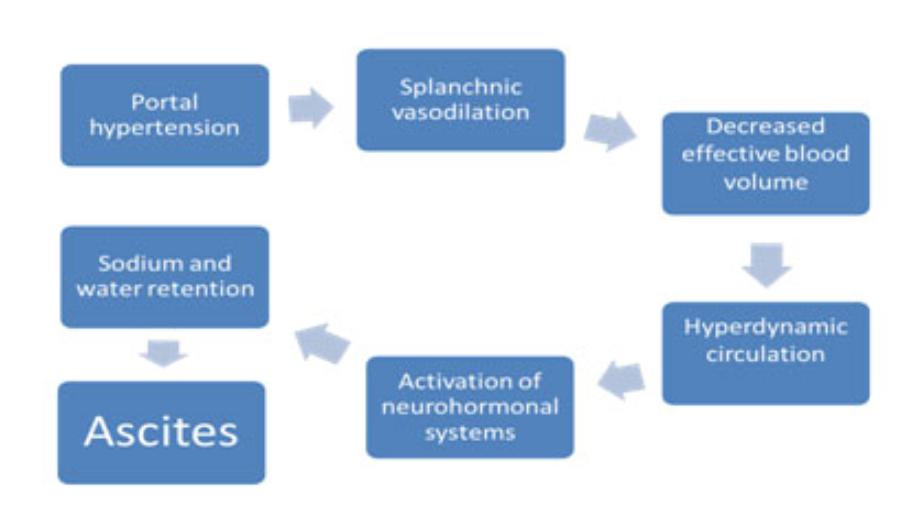

Most experts agree that ascites develops through a sequence of events illustrated by the above diagram. High blood pressure in the vein that supplies blood to the liver, called “portal hypertension,” occurs as increasing liver damage (fibrosis) impedes blood flow through the liver. This causes vasodilation and blood pooling in the central or “splanchnic” region of the body and low blood volume in the arteries. The decrease in effective blood volume activates a signaling pathway (“neurohormonal systems”) which tells the kidneys to retain large amounts of salt and water in an effort to increase blood volume. Ultimately the retention of excess sodium and water leads to the formation of ascites as these substances “weep” from the liver and lymph system and collect in the patient’s abdomen.

The BIV201 Mechanism of Action

BIV201 is being developed by BioVie with the goal of alleviating the portal hypertension and correcting splanchnic vasodilation, thereby increasing effective blood volume and reducing the signals to the kidneys to retain excess salt and water. If successful, BIV201 could halt the cycle of accelerating fluid generation in ascites patients and reduce the need for the frequent and painful paracentesis procedures many of these patients currently require.

Future Possible BIV201 Indications

Based on investigative studies around the world of the active agent in BIV201, terlipressin, our new drug candidate has potential future applications in other life-threatening conditions due to liver cirrhosis, such as those listed below. Securing marketing approvals for any of these new uses will require well-controlled clinical trials to satisfy the FDA and/or other countries’ regulatory requirements, none of which have commenced at this time. The Company may be unable to, or chose not to, pursue the development BIV201 for these indications.

| · | Bleeding Esophageal Varices (BEV): The bursting of blood vessels lining the esophagus due to high blood pressure (“portal hypertension”) in the vein which supplies blood to the liver resulting as a result of advanced liver cirrhosis. This situation requires emergency treatment to avoid blood loss and death. |

| · | Hepatorenal syndrome (HRS): As their disease progresses liver cirrhosis patients’ kidneys may begin to fail, and this deadly condition may set in. It often occurs once a patient no longer responds to (off-label) drugs used to control ascites. The second stage is called “type 1 HRS” and requires hospitalization as multiple organ failure and death may occur. |

-2-

Joint Venture and Possible Access to Early-Stage Compounds

The Company has an Agreement with PharmaIN providing certain limited rights and information on their program to develop novel modified terlipressin compounds. Although at an early stage, these compounds hold the promise of simpler and potentially safer dosing for patients outside the hospital. If this program makes significant advances, BioVie may contact PharmaIN to explore a licensing opportunity.

Efflux Pump Antibiotics Program

Prior to the Merger of Lat Pharma LLC and NanoAntibiotics Inc. in April 2016, the Company was exclusively developing novel nanotechnology anti-infective drugs to combat multi-drug resistant bacteria. We are at an early stage of discovery and development of broad spectrum antibiotics for gram-negative and gram-positive bacterial infections. Developing this technology in-house is resource-intensive with respect to time, personnel and capital necessary for scientific discovery. For further development of our nanoantibiotic technology we will need to find and license additional nanotechnology to complete our planned products. Presently this program is inactive as we are focusing our efforts on BIV201.

Intellectual Property

BioVie relies on a combination of trade secrecy and patent strategy to protect our confidential information and seek market exclusivity for our products. In May 2017 the Company announced issuance of a US patent covering the use of BIV201 in the treatment of ascites due to liver cirrhosis with administration via ambulatory pump. In July 2017 the Company announced filing an application for similar patent coverage in Japan, and subsequently filed for patent protection in Europe and China. BioVie has secured Orphan Drug designation for BIV201 in the treatment of ascites from the US Food and Drug Administration (FDA). The Company has applied for two additional Orphan Drug designations which could be granted in late 2018 or early 2019.

Research and Development

For the year ended June 30, 2018, the Company spent $370,853 in research and development activities.

Government Regulation

Government authorities in the United States, at the federal, state and local level, and in other countries extensively regulate, among other things, the research, development, testing, manufacture, quality control, approval, labeling, packaging, storage, record-keeping, promotion, advertising, distribution, post-approval monitoring and reporting, marketing and export and import of products such as those we are developing. Any pharmaceutical candidate that we develop must be approved by the FDA before it may be legally marketed in the United States and by the appropriate foreign regulatory agency before it may be legally marketed in foreign countries.

United States Drug Development Process

In the United States, the FDA regulates drugs under the Federal Food, Drug and Cosmetic Act, or FDCA, and implementing regulations. Drugs are also subject to other federal, state and local statutes and regulations. Biologics are subject to regulation by the FDA under the FDCA, the Public Health Service Act, or the PHSA, and related regulations, and other federal, state and local statutes and regulations. Biological products include, among other things, viruses, therapeutic serums, vaccines and most protein products. The process of obtaining regulatory approvals and the subsequent compliance with appropriate federal, state, local and foreign statutes and regulations require the expenditure of substantial time and financial resources. Failure to comply with the applicable United States requirements at any time during the product development process, approval process or after approval, may subject an applicant to administrative or judicial sanctions. FDA sanctions could include refusal to approve pending applications, withdrawal of an approval, a clinical hold, warning letters, product recalls, product seizures, total or partial suspension of production or distribution, injunctions, fines, refusals of government contracts, restitution, disgorgement or civil or criminal penalties. Any agency or judicial enforcement action could have a material adverse effect on us.

-3-

The process required by the FDA before a drug or biological product may be marketed in the United States generally involves the following:

• Completion of preclinical laboratory tests, animal studies and formulation studies according to Good Laboratory Practices or other applicable regulations;

• Submission to the FDA of an Investigational New Drug Application, or an IND, which must become effective before human clinical trials may begin;

• Performance of adequate and well-controlled human clinical trials according to the FDA's current good clinical practices, or GCPs, to establish the safety and efficacy of the proposed drug or biologic for its intended use;

•Submission to the FDA of a New Drug Application, or an NDA, for a new drug product, or a Biologics License Application, or a BLA, for a new biological product;

•Satisfactory completion of an FDA inspection of the manufacturing facility or facilities where the drug or biologic is to be produced to assess compliance with the FDA's current good manufacturing practice standards, or cGMP, to assure that the facilities, methods and controls are adequate to preserve the drug's or biologic's identity, strength, quality and purity;

• Potential FDA audit of the nonclinical and clinical trial sites that generated the data in support of the NDA or BLA; and

• FDA review and approval of the NDA or BLA.

The lengthy process of seeking required approvals and the continuing need for compliance with applicable statutes and regulations require the expenditure of substantial resources. There can be no certainty that approvals will be granted.

Clinical trials involve the administration of the drug or biological candidate to healthy volunteers or patients having the disease being studied under the supervision of qualified investigators, generally physicians not employed by or under the trial sponsor's control. Clinical trials are conducted under protocols detailing, among other things, the objectives of the clinical trial, dosing procedures, subject selection and exclusion criteria, and the parameters to be used to monitor subject safety. Each protocol must be submitted to the FDA as part of the IND. Clinical trials must be conducted in accordance with the FDA's good clinical practices requirements. Further, each clinical trial must be reviewed and approved by an independent institutional review board, or IRB, at or servicing each institution at which the clinical trial will be conducted. An IRB is charged with protecting the welfare and rights of trial participants and considers such items as whether the risks to individuals participating in the clinical trials are minimized and are reasonable in relation to anticipated benefits. The IRB also approves the informed consent form that must be provided to each clinical trial subject or his or her legal representative and must monitor the clinical trial until it is completed.

Human clinical trials prior to approval are typically conducted in three sequential Phases that may overlap or be combined:

• Phase 1. The drug or biologic is initially introduced into healthy human subjects and tested for safety, dosage tolerance, absorption, metabolism, distribution and excretion. In the case of some products for severe or life-threatening diseases, especially when the product may be too inherently toxic to ethically administer to healthy volunteers, the initial human testing is often conducted in patients having the specific disease.

• Phase 2. The drug or biologic is evaluated in a limited patient population to identify possible adverse effects and safety risks, to preliminarily evaluate the efficacy of the product for specific targeted diseases and to determine dosage tolerance, optimal dosage and dosing schedule for patients having the specific disease.

• Phase 3. Clinical trials are undertaken to further evaluate dosage, clinical efficacy and safety in an expanded patient population at geographically dispersed clinical trial sites. These clinical trials, which usually involve more subjects than earlier trials, are intended to establish the overall risk/benefit ratio of the product and provide an adequate basis for product labeling. Generally, at least two adequate and well-controlled Phase 3 clinical trials are required by the FDA for approval of an NDA or BLA.

-4-

Post-approval studies, or Phase 4 clinical trials, may be conducted after initial marketing approval. These studies are used to gain additional experience from the treatment of patients in the intended therapeutic indication and may be required by the FDA as part of the approval process.

Progress reports detailing the results of the clinical trials must be submitted at least annually to the FDA and written IND safety reports must be submitted to the FDA by the investigators for serious and unexpected adverse events or any finding from tests in laboratory animals that suggests a significant risk for human subjects. Phase 1, Phase 2 and Phase 3 clinical trials may not be completed successfully within any specified period, if at all. The FDA or the sponsor or its data safety monitoring board may suspend a clinical trial at any time on various grounds, including a finding that the research subjects or patients are being exposed to an unacceptable health risk. Similarly, an IRB can suspend or terminate approval of a clinical trial at its institution if the clinical trial is not being conducted in accordance with the IRB's requirements or if the drug or biologic has been associated with unexpected serious harm to patients.

Concurrent with clinical trials, companies usually complete additional animal studies and develop additional information about the chemistry and physical characteristics of the drug or biologic as well as finalize a process for manufacturing the product in commercial quantities in accordance with cGMP requirements. The manufacturing process must be capable of consistently producing quality batches of the drug or biological candidate and, among other things, must include methods for testing the identity, strength, quality and purity of the final drug or biologic. Additionally, appropriate packaging must be selected and tested and stability studies must be conducted to demonstrate that the drug or biological candidate does not undergo unacceptable deterioration over its shelf life.

U.S. Review and Approval Processes

The results of product development, preclinical studies and clinical trials, along with descriptions of the manufacturing process, analytical tests conducted on the chemistry of the drug or biologic, proposed labeling and other relevant information are submitted to the FDA as part of an NDA or BLA requesting approval to market the product. The submission of an NDA or BLA is subject to the payment of substantial user fees; a waiver of such fees may be obtained under certain limited circumstances.

The FDA reviews all NDAs and BLAs submitted before it accepts them for filing and may request additional information rather than accepting an NDA or BLA for filing. Once the submission is accepted for filing, the FDA begins an in-depth review of the NDA or BLA.

After the NDA or BLA submission is accepted for filing, the FDA reviews the NDA to determine, among other things, whether the proposed product is safe and effective for its intended use, and whether the product is being manufactured in accordance with cGMP to assure and preserve the product's identity, strength, quality and purity. The FDA reviews a BLA to determine, among other things, whether the product is safe, pure and potent and the facility in which it is manufactured, processed, packaged or held meets standards designed to assure the product's continued safety, purity and potency. In addition to its own review, the FDA may refer applications for novel drug or biological products or drug or biological products which present difficult questions of safety or efficacy to an advisory committee, typically a panel that includes clinicians and other experts, for review, evaluation and a recommendation as to whether the application should be approved and under what conditions. The FDA is not bound by the recommendations of an advisory committee, but it considers such recommendations carefully when making decisions. During the approval process, the FDA also will determine whether a risk evaluation and mitigation strategy, or REMS, is necessary to assure the safe use of the drug or biologic. If the FDA concludes that a REMS is needed, the sponsor of the NDA or BLA must submit a proposed REMS; the FDA will not approve the NDA or BLA without a REMS, if required.

Before approving an NDA or BLA, the FDA will inspect the facilities at which the product is to be manufactured. The FDA will not approve the product unless it determines that the manufacturing processes and facilities are in compliance with cGMP requirements and adequate to assure consistent production of the product within required specifications. Additionally, before approving an NDA or BLA, the FDA will typically inspect one or more clinical sites to assure compliance with cGMP. If the FDA determines the application, manufacturing process or manufacturing facilities are not acceptable it will outline the deficiencies in the submission and often will request additional testing or information.

-5-

The NDA or BLA review and approval process is lengthy and difficult and the FDA may refuse to approve an NDA or BLA if the applicable regulatory criteria are not satisfied or may require additional clinical data or other data and information. Even if such data and information is submitted, the FDA may ultimately decide that the NDA or BLA does not satisfy the criteria for approval. Data obtained from clinical trials are not always conclusive and may be susceptible to varying interpretations, which could delay, limit or prevent regulatory approval. The FDA will issue a "complete response" letter if the agency decides not to approve the NDA or BLA. The complete response letter usually describes all of the specific deficiencies in the NDA or BLA identified by the FDA. The deficiencies identified may be minor, for example, requiring labeling changes, or major, for example, requiring additional clinical trials. Additionally, the complete response letter may include recommended actions that the applicant might take to place the application in a condition for approval. If a complete response letter is issued, the applicant may either resubmit the NDA or BLA, addressing all of the deficiencies identified in the letter, or withdraw the application.

If a product receives regulatory approval, the approval may be limited to specific diseases and dosages or the indications for use may otherwise be limited, which could restrict the commercial value of the product. Further, the FDA may require that certain contraindications, warnings or precautions be included in the product labeling. In addition, the FDA may require Phase 4 testing which involves clinical trials designed to further assess a product's safety and effectiveness and may require testing and surveillance programs to monitor the safety of approved products that have been commercialized.

Orphan Drug Designation

Under the Orphan Drug Act, the FDA may grant orphan designation to a drug or biological product intended to treat a rare disease or condition, which is generally a disease or condition that affects fewer than 200,000 individuals in the United States, or more than 200,000 individuals in the United States and for which there is no reasonable expectation that the cost of developing and making a drug or biological product available in the United States for this type of disease or condition will be recovered from sales of the product. Orphan product designation must be requested before submitting an NDA or BLA. After the FDA grants orphan product designation, the identity of the therapeutic agent and its potential orphan use are disclosed publicly by the FDA. Orphan product designation does not convey any advantage in or shorten the duration of the regulatory review and approval process.

If a product that has Orphan designation subsequently receives the first FDA approval for the disease or condition for which it has such designation, the product is entitled to orphan product exclusivity, which means that the FDA may not approve any other applications to market the same drug or biological product for the same indication for seven years, except in limited circumstances, such as a showing of clinical superiority to the product with orphan exclusivity. Competitors, however, may receive approval of different products for the indication for which the Orphan product has exclusivity or obtain approval for the same product but for a different indication for which the Orphan product has exclusivity. Orphan product exclusivity also could block the approval of one of our products for seven years if a competitor obtains approval of the same drug or biological product as defined by the FDA or if our drug or biological candidate is determined to be contained within the competitor's product for the same indication or disease. If a drug or biological product designated as an orphan product receives marketing approval for an indication broader than what is designated, it may not be entitled to orphan product exclusivity. Orphan drug status in the European Union has similar but not identical benefits in the European Union.

Expedited Development and Review Programs

The FDA has a Fast Track program that is intended to expedite or facilitate the process for reviewing new drug and biological products that meet certain criteria. Specifically, new drug and biological products are eligible for Fast Track designation if they are intended to treat a serious or life-threatening condition and demonstrate the potential to address unmet medical needs for the condition. Fast Track designation applies to the combination of the product and the specific indication for which it is being studied. Unique to a Fast Track product, the FDA may consider for review sections of the NDA or BLA on a rolling basis before the complete application is submitted, if the sponsor provides a schedule for the submission of the sections of the NDA or BLA, the FDA agrees to accept sections of the NDA or BLA and determines that the schedule is acceptable, and the sponsor pays any required user fees upon submission of the first section of the NDA or BLA.

-6-

Any product submitted to the FDA for marketing approval, including those submitted to a Fast Track program, may also be eligible for other types of FDA programs intended to expedite development and review, such as priority review and accelerated approval. Any product is eligible for priority review if it has the potential to provide safe and effective therapy where no satisfactory alternative therapy exists or a significant improvement in the treatment, diagnosis or prevention of a disease compared with marketed products. The FDA will attempt to direct additional resources to the evaluation of an application for a new drug or biological product designated for priority review in an effort to facilitate the review. Additionally, a product may be eligible for accelerated approval. Drug or biological products studied for their safety and effectiveness in treating serious or life-threatening illnesses and that provide meaningful therapeutic benefit over existing treatments may receive accelerated approval, which means that they may be approved on the basis of adequate and well-controlled clinical studies establishing that the product has an effect on a surrogate endpoint that is reasonably likely to predict a clinical benefit, or on the basis of an effect on a clinical endpoint other than survival or irreversible morbidity. As a condition of approval, the FDA generally requires that a sponsor of a drug or biological product receiving accelerated approval perform adequate and well-controlled post-marketing clinical studies to establish safety and efficacy for the approved indication. Failure to conduct such studies or conducting such studies that do not establish the required safety and efficacy may result in revocation of the original approval. In addition, the FDA currently requires as a condition for accelerated approval pre-approval of promotional materials, which could adversely impact the timing of the commercial launch or subsequent marketing of the product. Fast Track designation, priority review and accelerated approval do not change the standards for approval but may expedite the development or approval process.

Post-Approval Requirements

Any drug or biological products for which we receive FDA approvals are subject to continuing regulation by the FDA, including, among other things, record-keeping requirements, reporting of adverse experiences with the product, providing the FDA with updated safety and efficacy information on an annual basis or as required more frequently for specific events, product sampling and distribution requirements, complying with certain electronic records and signature requirements and complying with FDA promotion and advertising requirements, which include, among others, standards for direct-to-consumer advertising, prohibitions against promoting drugs and biologics for uses or in patient populations that are not described in the drug's or biologic's approved labeling (known as "off-label use"), rules for conducting industry-sponsored scientific and educational activities, and promotional activities involving the internet. Failure to comply with FDA requirements can have negative consequences, including the immediate discontinuation of noncomplying materials, adverse publicity, enforcement letters from the FDA, mandated corrective advertising or communications with doctors, and civil or criminal penalties. Although physicians may prescribe legally available drugs and biologics for off-label uses, manufacturers may not market or promote such off-label uses.

We will need to rely, on third parties for the production of our product candidates. Manufacturers of our product candidates are required to comply with applicable FDA manufacturing requirements contained in the FDA's cGMP regulations. cGMP regulations require among other things, quality control and quality assurance as well as the corresponding maintenance of comprehensive records and documentation. Drug and biologic manufacturers and other entities involved in the manufacture and distribution of approved drugs and biologics are also required to register their establishments and list any products made there with the FDA and comply with related requirements in certain states, and are subject to periodic unannounced inspections by the FDA and certain state agencies for compliance with cGMP and other laws. Accordingly, manufacturers must continue to expend time, money and effort in the area of production and quality control to maintain cGMP compliance. Discovery of problems with a product after approval may result in serious and extensive restrictions on a product, manufacturer, or holder of an approved NDA or BLA, including suspension of a product until the FDA is assured that quality standards can be met, continuing oversight of manufacturing by the FDA under a "consent decree," which frequently includes the imposition of costs and continuing inspections over a period of many years, and possible withdrawal of the product from the market. In addition, changes to the manufacturing process generally require prior FDA approval before being implemented and other types of changes to the approved product, such as adding new indications and additional labeling claims, are also subject to further FDA review and approval.

The FDA also may require post-marketing testing, known as Phase 4 testing, risk minimization action plans and surveillance to monitor the effects of an approved product or place conditions on an approval that could otherwise restrict the distribution or use of the product.

-7-

Employees

Our business is managed by our officers. Our Chief Operating Officer, Jonathan Adams, began devoting full-time efforts to the Company on July 1st, 2017. Our Corporate Secretary, Julie Anderson, devote part time efforts to the Company’s activities. There are no additional employees. The Company relies on a team of highly experienced scientific, medical, and regulatory consultants to conduct its drug development activities.

| ITEM 1A. | RISK FACTORS |

THE SECURITIES BEING OFFERED INVOLVE A HIGH DEGREE OF RISK AND, THEREFORE, SHOULD BE CONSIDERED EXTREMELY SPECULATIVE. THEY SHOULD NOT BE PURCHASED BY PERSONS WHO CANNOT AFFORD THE POSSIBILITY OF THE LOSS OF THE ENTIRE INVESTMENT. PROSPECTIVE INVESTORS SHOULD READ THE ENTIRE PROSPECTUS, INCLUDING ALL EXHIBITS, AND CAREFULLY CONSIDER, AMONG OTHER FACTORS THE FOLLOWING RISK FACTORS.

Risks Relating to Our Business and Industry

We are a development stage company with a limited operating history, making it difficult for you to evaluate our business and your investment.

BioVie Inc. was incorporated on April 10, 2013. We are a development stage biopharmaceutical company with a potential therapy that we have not evaluated in clinical trials, and our operations are subject to all of the risks inherent in the establishment of a new business enterprise, including but not limited to the absence of an operating history, the lack of commercialized products, insufficient capital, expected substantial and continual losses for the foreseeable future, limited experience in dealing with regulatory issues, the lack of manufacturing experience and limited marketing experience, possible reliance on third parties for the development and commercialization of our proposed products, a competitive environment characterized by numerous, well-established and well capitalized competitors and reliance on key personnel.

Since inception, we have not established any revenues or operations that shall provide financial stability in the long term, and there can be no assurance that the Company will realize its plans on its projected timetable in order to reach sustainable or profitable operations.

Investors are subject to all the risks incident to the creation and development of a new business and each Investor should be prepared to withstand a complete loss of his, her or its investment. Furthermore, the accompanying financial statements have been prepared assuming that the Company will continue as a going concern. The Company has not emerged from the development stage, and may be unable to raise further equity. These factors raise substantial doubt about its ability to continue as a going concern. The financial statements do not include any adjustments that might result from the outcome of this uncertainty.

Because we are subject to these risks, you may have a difficult time evaluating our business and your investment in our Company. Our ability to become profitable depends primarily on our ability to develop drugs, to obtain approval for such drugs, and if approved, to successfully commercialize our drugs, our R&D efforts, including the timing and cost of clinical trials; and our ability to enter into favorable alliances with third-parties who can provide substantial capabilities in clinical development, regulatory affairs, sales, marketing and distribution.

Even if we successfully develop and market our drug candidates, we may not generate sufficient or sustainable revenue to achieve or sustain profitability, which could cause us to cease operations and cause you to lose all of your investment

-8-

If the Company fails to maintain an effective system of internal controls, it may not be able to accurately report its financial results or detect fraud. Consequently, investors could lose confidence in the Company’s financial reporting and this may decrease the trading price of its stock.

The Company must maintain effective internal controls to provide reliable financial reports and detect fraud. The Company has concluded that its disclosure controls and procedures internal controls, as well as internal controls over financial reporting, are ineffective. Failure to implement changes to the Company’s internal controls or any others that it identifies as necessary to establish an effective system of internal controls could harm its operating results and cause investors to lose confidence in the Company’s reported financial information. Any such loss of confidence would have a negative effect on the trading price of the Company’s stock.

We have no products approved for commercial sale, have never generated any revenues and may never achieve revenues or profitability, which could cause us to cease operations.

We have no products approved for commercial sale and, to date, we have not generated any revenues. Our ability to generate revenue depends heavily on (a) successful development program and thereafter demonstration in human clinical trials that BIV201, our drug candidate, is safe and effective; (b) our ability to seek and obtain regulatory approvals, including, without limitation, with respect to the indications we are seeking; (c) successful commercialization of our product candidates; and (d) market acceptance of our products. There are no assurances that we will achieve any of the forgoing objectives. Furthermore, our drug candidate is in the development stage, and we have not evaluated it in human clinical trials. If we do not successfully develop and commercialize our drug candidate we will not achieve revenues or profitability in the foreseeable future, if at all. If we are unable to generate revenues or achieve profitability, we may be unable to continue our operations.

We will need to raise substantial additional capital in the future to fund our operations and we may be unable to raise such funds when needed and on acceptable terms, which could have a materially adverse effect on our business.

Developing biopharmaceutical products, including conducting pre-clinical studies and clinical trials and establishing manufacturing capabilities, requires substantial funding. As of June 30, 2018, we had cash and cash equivalents totaling $45,800. Additional financing will be required to fund the research and development of our product candidates. We have not generated any product revenues, and do not expect to generate any revenues until, and only if, we develop, and receive approval to sell our drug candidates from the FDA and other regulatory authorities for our product candidates.

We may not have the resources to complete the development and commercialization of any of our proposed drug candidate. We will require additional financing to further the clinical development of our drug candidate. In the event that we cannot obtain the required financing, we will be unable to complete the development necessary to file an investigational new drug application with the FDA for BIV201, our drug candidate. This will delay research and development programs, preclinical studies and clinical trials, material characterization studies, regulatory processes, the establishment of our own laboratory or a search for third party marketing partners to market our products for us, which could have a materially adverse effect on our business.

The amount of capital we may need will depend on many factors, including the progress, timing and scope of our research and development programs, the progress, timing and scope of our preclinical studies and clinical trials, the time and cost necessary to obtain regulatory approvals, the time and cost necessary to establish our own marketing capabilities or to seek marketing partners, the time and cost necessary to respond to technological and market developments, changes made or new developments in our existing collaborative, licensing and other commercial relationships, and new collaborative, licensing and other commercial relationships that we may establish.

Until we can generate a sufficient amount of product revenue, if ever, we expect to finance future cash needs, through public or private equity offerings, debt financings, or corporate collaboration and licensing arrangements. Additional funds may not be available when we need them on terms that are acceptable to us, or at all. If adequate funds are not available, we may be required to delay, reduce the scope of, or eliminate one or more of our research or development programs or our commercialization efforts. In addition, we could be forced to discontinue product development and reduce or forego attractive business opportunities. To the extent that we raise additional funds by issuing equity securities, our stockholders may experience additional significant dilution, and debt financing, if available, may involve restrictive covenants. To the extent that we raise additional funds through collaboration and licensing arrangements, it may be necessary to relinquish some rights to our technologies or our product candidates, or grant licenses on terms that may not be favorable to us. We may seek to access the public or private capital markets whenever conditions are favorable, even if we do not have an immediate need for additional capital at that time.

-9-

Our fixed expenses, such as rent and other contractual commitments, will likely increase in the future, as we may enter into leases for new facilities and capital equipment; enter into additional licenses and collaborative agreements. Therefore, if we fail to raise substantial additional capital to fund these expenses, we could be forced to cease operations, which could cause you to lose all of your investment.

We have limited experience in drug development and may not be able to successfully develop any drugs, which would cause us to cease operations.

The Company has never successfully developed a new drug and brought it to market. Our management and clinical teams have experience in drug development but they may not be able to successfully develop any drugs. Our ability to achieve revenues and profitability in our business will depend on, among other things, our ability to develop products internally or to obtain rights to them from others on favorable terms; complete laboratory testing and human studies; obtain and maintain necessary intellectual property rights to our products; successfully complete regulatory review to obtain requisite governmental agency approvals; enter into arrangements with third parties to manufacture our products on our behalf; and enter into arrangements with third parties to provide sales and marketing functions. If we are unable to achieve these objectives we will be forced to cease operations and you will lose all of your investment.

Development of pharmaceutical products is a time-consuming process, subject to a number of factors, many of which are outside of our control. Consequently, if we are unsuccessful or fail to timely develop new drugs, we could be forced to discontinue our operations.

Our lead drug candidate, BIV201, has been cleared by the US Food and Drug Administration (FDA) to begin a mid-stage (Phase 2a) clinical trial. Further development and extensive testing will be required to determine its technical feasibility and commercial viability. Our success will depend on our ability to achieve scientific and technological advances and to translate such advances into reliable, commercially competitive drugs on a timely basis. Drugs that we may develop are not likely to be commercially available for a few years, if ever. The proposed development schedules for our drug candidate may be affected by a variety of factors, including technological difficulties, proprietary technology of others, and changes in government regulation, many of which will not be within our control. Any delay in the development, introduction or marketing of our drug candidates could result either in such drugs being marketed at a time when their cost and performance characteristics would not be competitive in the marketplace or in the shortening of their commercial lives. In light of the long-term nature of our projects and other risk factors described elsewhere in this document, we may not be able to successfully complete the development or marketing of any drugs which could cause us to cease operations.

We may fail to successfully develop and commercialize our drug candidate(s) if it is found to be unsafe or ineffective in clinical trials; does not receive necessary approval from the FDA or foreign regulatory agencies; fails to conform to a changing standard of care for the disease it seeks to treat; or is less effective or more expensive than current or alternative treatment methods.

Drug development failure can occur at any stage of clinical trials and as a result of many factors and there can be no assurance that we or our collaborators will reach our anticipated clinical targets. Even if we or our collaborators complete our clinical trials, we do not know what the long-term effects of exposure to our drug candidate will be. Furthermore, our drug candidate may be used in combination with other treatments and there can be no assurance that such use will not lead to unique safety issues. Failure to complete clinical trials or to prove that our drug candidate is safe and effective would have a material adverse effect on our ability to generate revenue and could require us to reduce the scope of or discontinue our operations, which could cause you to lose all of your investment.

-10-

We have no manufacturing experience, and the failure to comply with all applicable manufacturing regulations and requirements could have a materially adverse effect on our business.

The Company has never manufactured products in the highly regulated environment of pharmaceutical manufacturing, and our team has limited experience in the manufacture of drug therapies. There are numerous regulations and requirements that must be maintained to obtain licensure and permitting required prior to the commencement of manufacturing, as well as additional requirements to continue manufacturing pharmaceutical products. We do not own or lease facilities currently that could be used to manufacture any products that might be developed by the Company, nor do we have the resources at this time to acquire or lease suitable facilities. If we fail to comply with regulations, to obtain the necessary licenses and knowhow or to obtain the requisite financing in order to comply with all applicable regulations and to own or lease the required facilities in order to manufacture our products, we could be forced to cease operations, which would cause you to lose all of your investment.

We do not currently have the sales and marketing personnel necessary to sell products, and the failure to hire and retain such staff could have a materially adverse effect on our business.

We are an early stage development Company with limited resources. Even if we had products available for sale, which we currently do not, we have not secured sales and marketing staff at this early stage of operations to sell products. We cannot generate sales without sales or marketing staff and must rely on officers to provide any sales or marketing services until such personnel are secured, if ever. If we fail to hire and retain the requisite expertise in order to market and sell our products or fail to raise sufficient capital in order to afford to pay such sales or marketing staff, then we could be forced to cease operations and you could lose all of your investment.

Even if we were to successfully develop approvable drugs, we will not be able to sell these drugs if we or our third-party manufacturers fail to comply with manufacturing regulations, which could have a materially adverse effect on our business.

If we were to successfully develop approvable drugs, before we can begin selling these drugs, we must obtain regulatory approval of our manufacturing facility and process or the manufacturing facility and process of the third party or parties with whom we may outsource our manufacturing activities. In addition, the manufacture of our products must comply with the FDA's current Good Manufacturing Practices regulations, commonly known as GMP regulations. The GMP regulations govern quality control and documentation policies and procedures. Our manufacturing facilities, if any in the future, and the manufacturing facilities of our third-party manufacturers will be continually subject to inspection by the FDA and other state, local and foreign regulatory authorities, before and after product approval. We cannot guarantee that we, or any potential third-party manufacturer of our products, will be able to comply with the GMP regulations or other applicable manufacturing regulations. The failure to comply with all necessary regulations would have a materially adverse effect on our business and could force us to cease operations and you could lose all of your investment.

We must comply with significant and complex government regulations, compliance with which may delay or prevent the commercialization of our drug candidate, which could have a materially adverse effect on our business.

The R&D, manufacture and marketing of drug candidates are subject to regulation, primarily by the FDA in the United States and by comparable authorities in other countries. These national agencies and other federal, state, local and foreign entities regulate, among other things, R&D activities (including testing in animals and in humans) and the testing, manufacturing, handling, labeling, storage, record keeping, approval, advertising and promotion of the product that we are developing. Noncompliance with applicable requirements can result in various adverse consequences, including approval delays or refusals to approve drug licenses or other applications, suspension or termination of clinical investigations, revocation of approvals previously granted, fines, criminal prosecution, recalls or seizures of products, injunctions against shipping drugs and total or partial suspension of production and/or refusal to allow a company to enter into governmental supply contracts.

The process of obtaining FDA approval has historically been costly and time consuming. Current FDA requirements for a new human drug or biological product to be marketed in the United States include: (a) the successful conclusion of pre-clinical laboratory and animal tests, if appropriate, to gain preliminary information on the product's safety; (b) filing with the FDA of an IND application to conduct human clinical trials for drugs or biologics; (c) the successful completion of adequate and well-controlled human clinical investigations to establish the safety and efficacy of the product for its recommended use; and (d) filing by a company and acceptance and approval by the FDA of a New Drug Application (NDA) for a drug product or a biological license application (BLA) for a biological product to allow commercial distribution of the drug or biologic. A delay in one or more of the procedural steps outlined above could be harmful to us in terms of getting our drug candidates through clinical testing and to market, which could have a materially adverse effect on our business.

-11-

The FDA reviews the results of the clinical trials and may order the temporary or permanent discontinuation of clinical trials at any time if it believes the drug candidate exposes clinical subjects to an unacceptable health risk. Investigational drugs used in clinical studies must be produced in compliance with current good manufacturing practice (GMP) rules pursuant to FDA regulations.

Sales outside the United States of products that we develop will also be subject to regulatory requirements governing human clinical trials and marketing for drugs and biological products and devices. The requirements vary widely from country to country, but typically the registration and approval process takes several years and requires significant resources.

If we experience delays or discontinuations of our clinical trials by the FDA or comparable authorities in other countries, or if we fail to obtain registration or other approvals of our products or devices then we could be forced to cease our operations and you will lose all of your investment.

Even if we are successful in developing BIV201, our drug candidate, we have limited experience in conducting or supervising clinical trials that must be performed to obtain data to submit in concert with applications for approval by the FDA. The regulatory process to obtain approval for drugs for commercial sale involves numerous steps. Drugs are subjected to clinical trials that allow development of case studies to examine safety, efficacy, and other issues to ensure that sale of drugs meets the requirements set forth by various governmental agencies, including the FDA. In the event that our protocols do not meet standards set forth by the FDA, or that our data is not sufficient to allow such trials to validate our drugs in the face of such examination, we might not be able to meet the requirements that allow our drugs to be approved for sale which could have a materially adverse effect on our business.

We can provide no assurance that our drug candidates will obtain regulatory approval or that the results of clinical studies will be favorable.

The business plan we have developed for the next twelve months is to complete the work necessary to commence the Phase 2 clinical development program for our lead new drug candidate BIV201 and to pursue other key milestones such as additional US Orphan Drug designations. Due to our financial constraints, we may not have the resources necessary to complete our application. If the results of our planned initial Phase 2a clinical trial are satisfactory to the FDA, we will aim to proceed to a larger Phase 2b clinical trials in the US. There is no guarantee the FDA will approve a Phase 2b trial, and even if they do our financial constraints may prevent us from undertaking clinical trials.

The testing, marketing and manufacturing of any product for use in the United States will require approval from the FDA. We cannot predict with any certainty the amount of time necessary to obtain such FDA approval and whether any such approval will ultimately be granted. Preclinical and clinical trials may reveal that one or more products are ineffective or unsafe, in which event further development of such products could be seriously delayed or terminated. Moreover, obtaining approval for certain products may require testing on human subjects of substances whose effects on humans are not fully understood or documented. Delays in obtaining FDA or any other necessary regulatory approvals of any proposed drug and failure to receive such approvals would have an adverse effect on the drug's potential commercial success and on our business, prospects, financial condition and results of operations. In addition, it is possible that a proposed drug may be found to be ineffective or unsafe due to conditions or facts that arise after development has been completed and regulatory approvals have been obtained. In this event, we may be required to withdraw such proposed drug from the market. To the extent that our success will depend on any regulatory approvals from government authorities outside of the United States that perform roles similar to that of the FDA, uncertainties similar to those stated above will also exist and should it result in our drug candidates failing to receive regulatory approval you could lose all of your investment.

-12-

Confidentiality agreements with employees and others may not adequately prevent disclosure of trade secrets and other proprietary information and disclosure of our trade secrets or proprietary information could compromise any competitive advantage that we have, which could have a materially adverse effect on our business.

We depend heavily upon confidentiality agreements with our officers, employees, consultants and subcontractors to maintain the proprietary nature of our technology. These measures may not afford us complete or even sufficient protection, and may not afford an adequate remedy in the event of an unauthorized disclosure of confidential information. In addition, others may independently develop technology similar to ours, otherwise avoiding the confidentiality agreements, or produce patents that would materially and adversely affect our business, prospects, financial condition and results of operations in which event and you could lose all of your investment.

We may be unable to obtain or protect intellectual property rights relating to our products, and we may be liable for infringing upon the intellectual property rights of others, which could have a materially adverse effect on our business.

Our ability to compete effectively will depend on our ability to maintain the proprietary nature of our technologies. In 2017 the US Patent and Trademark Office issued a patent covering the Company’s lead drug candidate BIV201 for use in ascites patients administered by an ambulatory pump. There can be no assurance that any future patent applications we have filed will ultimately result in the issuance of a patent with respect to the technology owned by us or licensed to us. The patent position of pharmaceutical or biotechnology companies, including ours, is generally uncertain and involves complex legal and factual considerations. The standards that the United States Patent and Trademark Office use to grant patents are not always applied predictably or uniformly and can change. There is also no uniform, worldwide policy regarding the subject matter and scope of claims granted or allowable in pharmaceutical or biotechnology patents. Accordingly, we do not know the degree of future protection for our proprietary rights or the breadth of claims that will be allowed in any patents issued to us or to others. Further, we rely on a combination of trade secrets, know-how, technology and nondisclosure, and other contractual agreements and technical measures to protect our rights in the technology. If any trade secret, know-how or other technology not protected by a patent were to be disclosed to or independently developed by a competitor, our business and financial condition could be materially adversely affected.

We do not believe that BIV201, the drug candidate we are currently developing, infringes upon the rights of any third parties nor are they infringed upon by third parties. However, there can be no assurance that our technology will not be found in the future to infringe upon the rights of others or be infringed upon by others. In such a case, others may assert infringement claims against us, and should we be found to infringe upon their patents, or otherwise impermissibly utilize their intellectual property, we might be forced to pay damages, potentially including treble damages, if we are found to have willfully infringed on such parties' patent rights. In addition to any damages we might have to pay, we may be required to obtain licenses from the holders of this intellectual property, enter into royalty agreements, or redesign our drug candidates so as not to utilize this intellectual property, each of which may prove to be uneconomical or otherwise impossible. Conversely, we may not always be able to successfully pursue our claims against others that infringe upon our technology. Thus, the proprietary nature of our technology or technology licensed by us may not provide adequate protection against competitors.

Moreover, the cost to us of any litigation or other proceeding relating to our patents and other intellectual property rights, even if resolved in our favor, could be substantial, and the litigation would divert our management's efforts. Uncertainties resulting from the initiation and continuation of any litigation could limit our ability to continue our operations and you could lose all of your investment.

We depend upon our management and their loss or unavailability could put us at a competitive disadvantage which could have a material adverse effect on our business.

We currently depend upon the efforts and abilities of our management team of Jonathan Adams, our Chief Operating Officer, and Julie Anderson, our Company Secretary. Mr. Adams serves the Company full-time and Ms. Anderson serves the Company part-time. The loss or unavailability of the services of either of these individuals for any significant period of time could have a material adverse effect on our business, prospects, financial condition and results of operations which may cause you to lose all of your investment. We have not obtained, do not own, nor are we the beneficiary of key-person life insurance.

-13-

We may not be able to attract and retain highly skilled personnel, which could have a materially adverse effect on our business.

Our ability to attract and retain highly skilled personnel is critical to our operations and expansion. We face competition for these types of personnel from other pharmaceutical companies and more established organizations, many of which have significantly larger operations and greater financial, technical, human and other resources than us. We may not be successful in attracting and retaining qualified personnel on a timely basis, on competitive terms, or at all. If we are not successful in attracting and retaining these personnel, our business, prospects, financial condition and results of operations will be materially and adversely affected.

The biotechnology and biopharmaceutical industries are characterized by rapid technological developments and a high degree of competition. We may be unable to compete with enterprises equipped with more substantial resources than us, which could cause us to curtail or cease operations.

The biotechnology and biopharmaceutical industries are characterized by rapid technological developments and a high degree of competition based primarily on scientific and technological factors. These factors include the availability of patent and other protection for technology and products, the ability to commercialize technological developments and the ability to obtain government approval for testing, manufacturing and marketing.

We compete with biopharmaceutical firms in the United States, Europe and elsewhere, as well as a growing number of large pharmaceutical companies that are applying biotechnology to their operations. Many biopharmaceutical companies have focused their development efforts in the human therapeutics area. Many major pharmaceutical companies have developed or acquired internal biotechnology capabilities or made commercial arrangements with other biopharmaceutical companies. These companies, as well as academic institutions, government agencies and private research organizations, also compete with us in recruiting and retaining highly qualified scientific personnel and consultants. Our ability to compete successfully with other companies in the pharmaceutical field will also depend to a considerable degree on the continuing availability of capital to us.

Although there are not currently any therapies approved by the FDA specifically for the treatment of ascites due to liver cirrhosis, the Company still faces significant competitive and market risk. Other companies, such as Mallinckrodt Inc., are developing therapies for severe complications of advanced liver cirrhosis, which may in future be developed for the treatment of ascites, and these therapies could compete indirectly or directly with our drug candidate. There may be other competitive development programs of which we are unaware. Even if our drug candidate is ultimately approved by the FDA, there is no guarantee that once it is on the market doctors will adopt it in favor of current ascites treatment procedures such as diuretics and paracentesis. These competitive and market risks could have a material adverse effect on our business, prospects, financial condition and results of operations which may cause you to lose all of your investment.

Our competition will be determined in part by the potential indications for which drugs are developed and ultimately approved by regulatory authorities. Additionally, the timing of the market introduction of some of our potential drug candidate or of competitors' products may be an important competitive factor. Accordingly, the relative speed with which we can develop drugs, complete pre-clinical testing, clinical trials, approval processes and supply commercial quantities to market are important competitive factors. We expect that competition among drugs approved for sale will be based on various factors, including product efficacy, safety, reliability, availability, price and patent protection.

The successful development of biopharmaceuticals is highly uncertain. A variety of factors including, pre-clinical study results or regulatory approvals, could cause us to abandon the development of our drug candidates.

Successful development of biopharmaceuticals is highly uncertain and is dependent on numerous factors, many of which are beyond our control.

Products that appear promising in the early phases of development may fail to reach the market for several reasons. Pre-clinical study results may show the product to be less effective than desired (e.g., the study failed to meet its primary objectives) or to have harmful or problematic side effects. Products may fail to receive the necessary regulatory approvals or may be delayed in receiving such approvals. Among other things, such delays may be caused by slow enrollment in clinical studies, length of time to achieve study endpoints, additional time requirements for data analysis or a IND and later NDA, preparation, discussions with the FDA, an FDA request for additional pre-clinical or clinical data or unexpected safety or manufacturing issues; manufacturing costs, pricing or reimbursement issues, or other factors that make the product not economical. Proprietary rights of others and their competing products and technologies may also prevent the product from being commercialized.

-14-

Success in pre-clinical and early clinical studies does not ensure that large-scale clinical studies will be successful. Clinical results are frequently susceptible to varying interpretations that may delay, limit or prevent regulatory approvals. The length of time necessary to complete clinical studies and to submit an application for marketing approval for a final decision by a regulatory authority varies significantly from one product to the next, and may be difficult to predict. There can be no assurance that any of our products will develop successfully, and the failure to develop our products will have a materially adverse effect on our business and will cause you to lose all of your investment.

There may be conflicts of interest among our officers, directors and stockholders.

Certain of our executive officers and directors and their affiliates are engaged in other activities and have interests in other entities on their own behalf or on behalf of other persons. Neither we nor any of our shareholders will have any rights in these ventures or their income or profits. In particular, our executive officers or directors or their affiliates may have an economic interest in or other business relationship with partner companies that invest in us or are engaged in competing drug development. Our executive officers or directors may have conflicting fiduciary duties to us and third parties. The terms of transactions with third parties may not be subject to arm's length negotiations and therefore may be on terms less favorable to us than those that could be procured through arm's length negotiations. Although the Company is not aware of any conflict that has arisen to date, we do not have any policy in place to deal with such should such a conflict arise.

We may enter into employment agreements with our executive officers and compensation payable thereunder may not be based on arms-length negotiations.

The Company’s current executive officers also serve as directors of the Company, and the Company does not have an independent compensation committee to determine compensation and to approve employment agreements. Therefore, compensation which may be paid by the Company to its management may not be determined based on arms-length negotiations. The Company may grant stock options and other equity incentives to its executive officers and directors that are consistent with the nature of the pharmaceutical industry. There can be no assurance made that the consideration which may be payable to management will reflect the true market value of services provided to the Company.

RISKS RELATING TO OUR COMMON STOCK

There is a risk of dilution of your percentage ownership of Common Stock in the Company.

The Company has the right to raise additional capital or incur borrowings from third parties to finance its business. The Company may also implement public or private mergers, business combinations, business acquisitions and similar transactions pursuant to which it would issue substantial additional capital stock to outside parties, causing substantial dilution in the ownership of the Company by its existing stockholders. Our Board of Directors has the authority, without the consent of any of the stockholders, to cause the Company to issue more shares of Common Stock and/or preferred stock at such price and on such terms and conditions as are determined by the Board in its sole discretion. The issuance of additional shares of capital stock by the Company will dilute your ownership percentage in the Company and could impair our ability to raise capital in the future through the sale of equity securities.

Certain stockholders who are also officers and directors of the Company may have significant control over our management.

The directors and executive officers of the Company currently own an aggregate 440,181,137 shares, which currently constitutes 83.6% of the Common Stock of the Company. As a result, directors and executive officers may have a significant influence on the affairs and management of the Company, as well as on all matters requiring member approval, including electing and removing members of the Company’s Board of Directors, causing the Company to engage in transactions with affiliated entities, causing or restricting the sale or merger of the Company, and certain other matters. Such concentration of ownership and control could have the effect of delaying, deferring or preventing a change in control of the Company even when such a change of control would be in the best interests of the Company’s stockholders.

-15-

There is very little liquidity in our Common Stock and we may not be successful at obtaining a quotation on a recognized quotation service. In such event it may be difficult for you to sell your shares.

The OTC Bulletin Board and similar quotation services are often characterized by low trading volumes, and price volatility, which may make it difficult for an investor to sell our Common Stock on acceptable terms. If trades in our Common Stock are not quoted on a quotation facility, it may be very difficult for an investor to find a buyer for their shares in our Company.

Our Common Stock is subject to the “penny stock” rules of the SEC and the trading market in our securities is limited, which makes transactions in our stock cumbersome and may reduce the value of an investment in our stock.

Under U.S. federal securities legislation, our Common Stock will constitute “penny stock”. Penny stock is any equity security that has a market price of less than $5.00 per share, subject to certain exceptions. For any transaction involving a penny stock, unless exempt, the rules require that a broker or dealer approve a potential investor’s account for transactions in penny stocks, and the broker or dealer receive from the investor a written agreement to the transaction, setting forth the identity and quantity of the penny stock to be purchased. In order to approve an investor’s account for transactions in penny stocks, the broker or dealer must obtain financial information and investment experience objectives of the person, and make a reasonable determination that the transactions in penny stocks are suitable for that person and the person has sufficient knowledge and experience in financial matters to be capable of evaluating the risks of transactions in penny stocks. The broker or dealer must also deliver, prior to any transaction in a penny stock, a disclosure schedule prepared by the Securities and Exchange Commission relating to the penny stock market, which, in highlight form sets forth the basis on which the broker or dealer made the suitability determination. Brokers may be less willing to execute transactions in securities subject to the “penny stock” rules. This may make it more difficult for investors to dispose of our common stock and cause a decline in the market value of our stock. Disclosure also has to be made about the risks of investing in penny stocks in both public offerings and in secondary trading and about the commissions payable to both the broker-dealer and the registered representative, current quotations for the securities and the rights and remedies available to an investor in cases of fraud in penny stock transactions. Finally, monthly statements have to be sent disclosing recent price information for the penny stock held in the account and information on the limited market in penny stocks.

We may, in the future, issue additional common stock, which would reduce investors’ percent of ownership and may dilute our share value.