Attached files

| file | filename |

|---|---|

| EX-99.2 - EXHIBIT 99.2 - ACCESS NATIONAL CORP | tv504321_ex99-2.htm |

| 8-K - FORM 8-K - ACCESS NATIONAL CORP | tv504321_8k.htm |

Exhibit 99.1

Merger Investor Presentation October 5, 2018

Certain statements in this presentation may constitute “forward - looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Forward - looking statements include, without limitation, projections, predictions, expectations, or beliefs about future events or results and are not statements of historical fact. Such statements also include statements as to the anticipated impact of the Union Bankshares Corporation (“Union” or “UBSH”) acquisition of Access National Corporation (“Access” or “ANCX”), including future financial and operating results, ability to successfully integrate the combined businesses, the amount of cost savings, overall operational efficiencies and enhanced revenues as well as other statements regarding the acquisition. Such forward - looking statements are based on various assumptions as of the time they are made, and are inherently subject to known and unknown risks, uncertainties and other factors that may cause actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by such forward - looking statements. Forward - looking statements are often accompanied by words that convey projected future events or outcomes such as “expect,” “believe,” “estimate,” “plan,” “project,” “anticipate,” “intend,” “will,” “may,” “view,” “opportunity,” “potential,” or words of similar meaning or other statements concerning opinions or judgment of Union or Access or their management about future events. Although each of Union and Access believes that its expectations with respect to forward - looking statements are based upon reasonable assumptions within the bounds of its existing knowledge of its business and operations, there can be no assurance that actual results, performance, or achievements of Union or Access will not differ materially from any projected future results, performance, or achievements expressed or implied by such forward - looking statements. Actual future results, performance, or achievements may differ materially from historical results or those anticipated depending on a variety of factors, including but not limited to, the businesses of Union and Access may not be integrated successfully or such integration may be more difficult, time - consuming or costly than expected, expected revenue synergies and cost savings from the proposed acquisition may not be fully realized or realized within the expected time frame, revenues following the proposed acquisition may be lower than expected, customer and employee relationships and business operations may be disrupted by the proposed acquisition, the diversion of management time on acquisition - related issues, changes in Union’s share price before closing, risks relating to the potential dilutive effect of shares of Union common stock to be issued in the proposed transaction , the ability to obtain regulatory, shareholder or other approvals or other conditions to closing on a timely basis or at all, the ability to close the proposed acquisition on the expected timeframe, or at all, and that closing may be more difficult, time - consuming or costly than expected, the reaction to the proposed acquisition of the companies’ customers, employees and counterparties, and other risk factors, many of which are beyond the control of Union and Access. We refer you to the “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” sections of Union’s Annual Report on Form 10 - K for the year ended December 31, 2017, and Access’s Annual Report on Form 10 - K for the year ended December 31, 2017 and comparable “risk factors” sections of Union’s and Access’s Quarterly Reports on Form 10 - Q and other filings, which have been filed with the Securities and Exchange Commission (the “SEC”) and are available on the SEC’s website at www.sec.gov. All of the forward - looking statements made in this presentation are expressly qualified by the cautionary statements contained or referred to herein. The actual results or developments anticipated may not be realized or, even if substantially realized, they may not have the expected consequences to or effects on Union, Access or their respective businesses or operations. Readers are cautioned not to rely too heavily on the forward - looking statements contained in this presentation. Forward - looking statements speak only as of the date they are made and neither Union nor Access undertakes any obligation to update, revise or clarify these forward - looking statements, whether as a result of new information, future events or otherwise. Forward Looking Statements 1

Important Additional Information will be Filed with the SEC This presentation does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval with respect to the proposed acquisition by Union of Access. No offer of securities shall be made except by means of a prospectus meeting the requirements of the Securities Act of 1933, as amended, and no offer to sell or solicitation of an offer to buy shall be made in any jurisdiction in which such offer, solicitation or sale would be unlawful . In connection with the proposed acquisition, Union will file with the SEC a Registration Statement on Form S - 4 that will include a joint proxy statement of Union and Access and a prospectus of Union (the “Joint Proxy/Prospectus”), and each of Union and Access may file with the SEC other relevant documents concerning the proposed transaction. A definitive Joint Proxy/Prospectus will be sent to the shareholders of Union and Access. Investors and shareholders of Union and Access are urged to read carefully and in their entirety the Registration Statement and Joint Proxy/Prospectus when they become available and any other relevant documents filed with the SEC by Union and Access, as well as any amendments or supplements to those documents, because they will contain important information about the proposed transaction. Investors and shareholders may obtain free copies of the Registration Statement and the Joint Proxy/Prospectus (when available) and other documents filed with the SEC by Union and Access through the website maintained by the SEC at www.sec.gov. Free copies of the Registration Statement and the Joint Proxy/Prospectus and other documents filed with the SEC also may be obtained by directing a request by telephone or mail to Union Bankshares Corporation, 1051 East Cary Street, Suite 1200, Richmond , Virginia 23219, Attention: Investor Relations (telephone: (804) 633 - 5031), or Access National Corporation, 1800 Robert Fulton Drive, Suite 300, Reston, VA 20191. Attention: Sheila Linton (telephone : (703) 871 - 2100), or by accessing Union’s website at www.bankatunion.com under “ Investor Relations” or Access’s website at www.accessnationalbank.com under “Investor Relations.” The information on Union’s and Access’s websites is not, and shall not be deemed to be, a part of this presentation or incorporated into other filings either company makes with the SEC . Participants in the Solicitation Union , Access and their respective directors and certain of their executive officers and employees may be deemed to be participants in the solicitation of proxies from the shareholders of Union or Access in connection with the proposed transaction. Information about the directors and executive officers of Union and their ownership of Union common stock is set forth in the proxy statement for Union’s 2018 annual meeting of shareholders, which was filed with the SEC on March 21, 2018. Information about the directors and executive officers of Access and their ownership of Access common stock is set forth in the proxy statement for Access’s 2018 annual meeting of shareholders, which was filed with the SEC on April 12, 2018. Information regarding the persons who may, under the rules of the SEC, be deemed participants in the proxy solicitation and a description of their direct and indirect interests, by security holdings or otherwise, will be contained in the Joint Proxy/Prospectus and other relevant materials to be filed with the SEC when they become available. Free copies of these documents may be obtained as described above . Non - GAAP Information This presentation contains certain financial information determined by methods other than in accordance with generally accepted accounting policies in the United States (“GAAP”). The non - GAAP financial measure is return on average tangible common equity (“ROTCE”). This non - GAAP disclosure has limitations as an analytical tool and should not be considered in isolation or as a substitute for analysis of ANCX’s results as reported under GAAP, nor is it necessarily comparable to non - GAAP performance measures that may be presented by other companies. ANCX management uses this non - GAAP measure in its analysis of ANCX performance, respectively, because it believes the measure is material and will be used as a measure of ANCX performance by investors. For a reconciliation of this non - GAAP measure to its comparable GAAP measure, see the Appendix. Additional Information 2

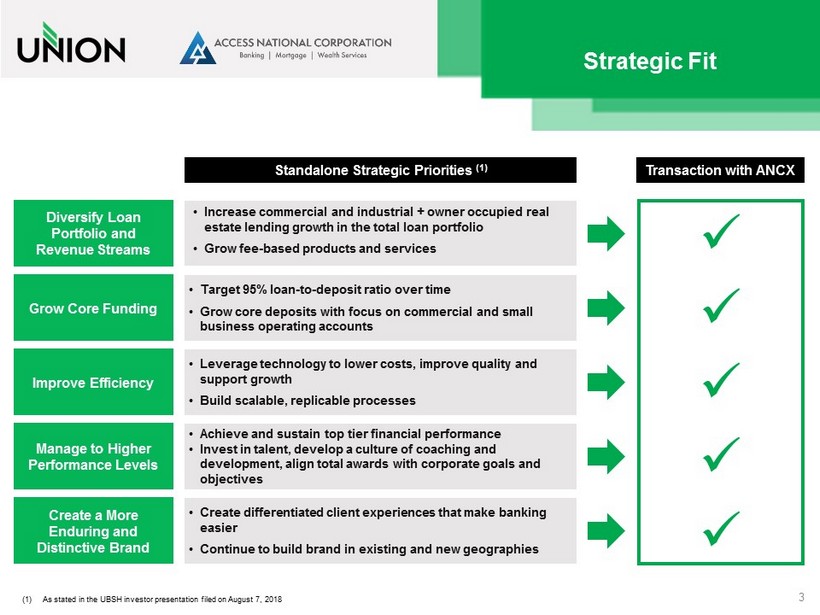

Strategic Fit Diversify Loan Portfolio and Revenue Streams Grow Core Funding Improve Efficiency Manage to Higher Performance Levels • Target 95% loan - to - deposit ratio over time • Grow core deposits with focus on commercial and small business operating accounts • Leverage technology to lower costs, improve quality and support growth • Build scalable, replicable processes Create a More Enduring and Distinctive Brand • Create differentiated client experiences that make banking easier • Continue to build brand in existing and new geographies x (1) As stated in the UBSH investor presentation filed on August 7, 2018 Standalone Strategic Priorities (1) Transaction with ANCX 3 • Achieve and sustain top tier financial performance • Invest in talent, develop a culture of coaching and development, align total awards with corporate goals and objectives x x x x • Increase commercial and industrial + owner occupied real estate lending growth in the total loan portfolio • Grow fee - based products and services

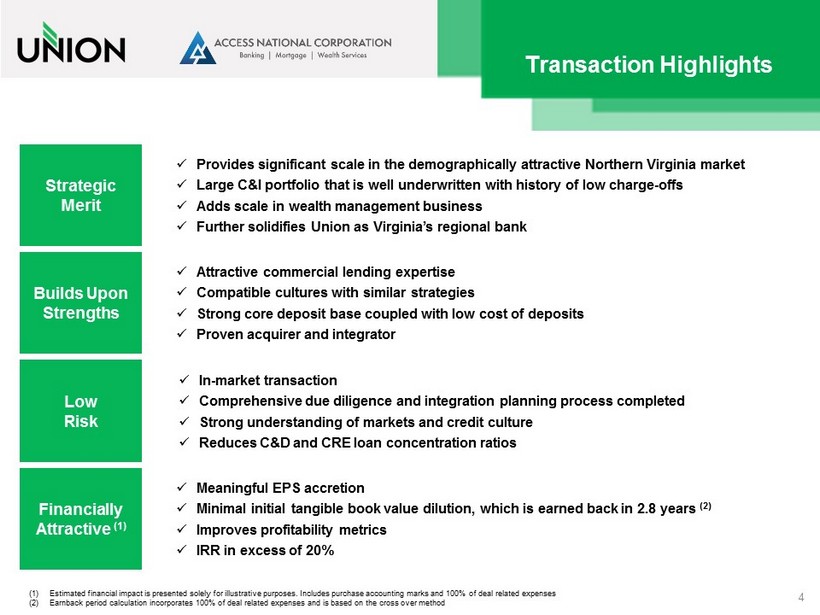

Transaction Highlights x Meaningful EPS accretion x Minimal initial tangible book value dilution, which is earned back in 2.8 years (2) x Improves profitability metrics x IRR in excess of 20% x In - market transaction x Comprehensive due diligence and integration planning process completed x Strong understanding of markets and credit culture x Reduces C&D and CRE loan concentration ratios Strategic Merit Low Risk Financially Attractive (1) x Provides significant scale in the demographically attractive Northern Virginia market x Large C&I portfolio that is well underwritten with history of low charge - offs x Adds scale in wealth management business x Further solidifies Union as Virginia’s regional bank 4 (1) Estimated financial impact is presented solely for illustrative purposes. Includes purchase accounting marks and 100% of deal related expenses (2) Earnback period calculation incorporates 100% of deal related expenses and is based on the cross over method Builds Upon Strengths x Attractive commercial lending expertise x Compatible cultures with similar strategies x Strong core deposit base coupled with low cost of deposits x Proven acquirer and integrator

Overview of Access National Corporation Standalone Access Footprint ▪ Headquartered in Reston, Virginia with 15 branches across Northern Virginia and Richmond ▪ Completed merger with Middleburg Financial Corporation (“Middleburg”) in April 2017 ▪ Wealth and Trust assets under management of approximately $2.0 billion ▪ ~$400 million of annual mortgage production Franchise Highlights Q2 ’18 Financials Dollars in millions Source: S&P Global Market Intelligence Data as of or for the three months ended 6/30/18 (1) ROTCE is a non - GAAP measure that divides (i) net income determined in accordance with GAAP and adjusting it by non - recurring items by (ii) average common equity and adjusting it by subtracting average goodwill and intangible assets; see Appendix for non - GAAP reconciliation 5 ANCX (15) Headquarters Reston, VA Year Established 1999 Branches 15 Total Assets $2,921 Total Loans 2,036 Check for TARP, Deposits 2,127 SBLF, Preferred Etc. ROAA 1.26 % ROTCE 15.8 Net Interest Margin 3.62 ON CAMELS TAB Efficiency Ratio 61.0 Cost of Deposits 0.56 NPAs / Assets 0.25 % Reserves / Loans 0.81 CET1 Ratio 12.10 % Tier 1 Capital Ratio 12.10 Total Capital Ratio 12.90 C&D Loans / Total Bank Capital 35 % Manually Update CRE Loans / Total Bank Capital 197 CRE Tab (1)

l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l ll l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l l North Carolina Maryland Virginia Raleigh Raleigh Raleigh Raleigh Raleigh Raleigh Raleigh Raleigh Raleigh Raleigh Raleigh Raleigh Raleigh Raleigh Raleigh Raleigh Raleigh Raleigh Raleigh Raleigh Raleigh Raleigh Raleigh Raleigh Raleigh Raleigh Raleigh Raleigh Raleigh Raleigh Raleigh Raleigh Raleigh Raleigh Raleigh Raleigh Raleigh Raleigh Raleigh Raleigh Raleigh Raleigh Raleigh Raleigh Raleigh Raleigh Raleigh Raleigh Raleigh Charlotte Charlotte Charlotte Charlotte Charlotte Charlotte Charlotte Charlotte Charlotte Charlotte Charlotte Charlotte Charlotte Charlotte Charlotte Charlotte Charlotte Charlotte Charlotte Charlotte Charlotte Charlotte Charlotte Charlotte Charlotte Charlotte Charlotte Charlotte Charlotte Charlotte Charlotte Charlotte Charlotte Charlotte Charlotte Charlotte Charlotte Charlotte Charlotte Charlotte Charlotte Charlotte Charlotte Charlotte Charlotte Charlotte Charlotte Charlotte Charlotte Greensboro Greensboro Greensboro Greensboro Greensboro Greensboro Greensboro Greensboro Greensboro Greensboro Greensboro Greensboro Greensboro Greensboro Greensboro Greensboro Greensboro Greensboro Greensboro Greensboro Greensboro Greensboro Greensboro Greensboro Greensboro Greensboro Greensboro Greensboro Greensboro Greensboro Greensboro Greensboro Greensboro Greensboro Greensboro Greensboro Greensboro Greensboro Greensboro Greensboro Greensboro Greensboro Greensboro Greensboro Greensboro Greensboro Greensboro Greensboro Greensboro Virginia Beach Virginia Beach Virginia Beach Virginia Beach Virginia Beach Virginia Beach Virginia Beach Virginia Beach Virginia Beach Virginia Beach Virginia Beach Virginia Beach Virginia Beach Virginia Beach Virginia Beach Virginia Beach Virginia Beach Virginia Beach Virginia Beach Virginia Beach Virginia Beach Virginia Beach Virginia Beach Virginia Beach Virginia Beach Virginia Beach Virginia Beach Virginia Beach Virginia Beach Virginia Beach Virginia Beach Virginia Beach Virginia Beach Virginia Beach Virginia Beach Virginia Beach Virginia Beach Virginia Beach Virginia Beach Virginia Beach Virginia Beach Virginia Beach Virginia Beach Virginia Beach Virginia Beach Virginia Beach Virginia Beach Virginia Beach Virginia Beach Norfolk Norfolk Norfolk Norfolk Norfolk Norfolk Norfolk Norfolk Norfolk Norfolk Norfolk Norfolk Norfolk Norfolk Norfolk Norfolk Norfolk Norfolk Norfolk Norfolk Norfolk Norfolk Norfolk Norfolk Norfolk Norfolk Norfolk Norfolk Norfolk Norfolk Norfolk Norfolk Norfolk Norfolk Norfolk Norfolk Norfolk Norfolk Norfolk Norfolk Norfolk Norfolk Norfolk Norfolk Norfolk Norfolk Norfolk Norfolk Norfolk Baltimore Baltimore Baltimore Baltimore Baltimore Baltimore Baltimore Baltimore Baltimore Baltimore Baltimore Baltimore Baltimore Baltimore Baltimore Baltimore Baltimore Baltimore Baltimore Baltimore Baltimore Baltimore Baltimore Baltimore Baltimore Baltimore Baltimore Baltimore Baltimore Baltimore Baltimore Baltimore Baltimore Baltimore Baltimore Baltimore Baltimore Baltimore Baltimore Baltimore Baltimore Baltimore Baltimore Baltimore Baltimore Baltimore Baltimore Baltimore Baltimore Washington Washington Washington Washington Washington Washington Washington Washington Washington Washington Washington Washington Washington Washington Washington Washington Washington Washington Washington Washington Washington Washington Washington Washington Washington Washington Washington Washington Washington Washington Washington Washington Washington Washington Washington Washington Washington Washington Washington Washington Washington Washington Washington Washington Washington Washington Washington Washington Washington Richmond Richmond Richmond Richmond Richmond Richmond Richmond Richmond Richmond Richmond Richmond Richmond Richmond Richmond Richmond Richmond Richmond Richmond Richmond Richmond Richmond Richmond Richmond Richmond Richmond Richmond Richmond Richmond Richmond Richmond Richmond Richmond Richmond Richmond Richmond Richmond Richmond Richmond Richmond Richmond Richmond Richmond Richmond Richmond Richmond Richmond Richmond Richmond Richmond Roanoke Roanoke Roanoke Roanoke Roanoke Roanoke Roanoke Roanoke Roanoke Roanoke Roanoke Roanoke Roanoke Roanoke Roanoke Roanoke Roanoke Roanoke Roanoke Roanoke Roanoke Roanoke Roanoke Roanoke Roanoke Roanoke Roanoke Roanoke Roanoke Roanoke Roanoke Roanoke Roanoke Roanoke Roanoke Roanoke Roanoke Roanoke Roanoke Roanoke Roanoke Roanoke Roanoke Roanoke Roanoke Roanoke Roanoke Roanoke Roanoke Asheville Asheville Asheville Asheville Asheville Asheville Asheville Asheville Asheville Asheville Asheville Asheville Asheville Asheville Asheville Asheville Asheville Asheville Asheville Asheville Asheville Asheville Asheville Asheville Asheville Asheville Asheville Asheville Asheville Asheville Asheville Asheville Asheville Asheville Asheville Asheville Asheville Asheville Asheville Asheville Asheville Asheville Asheville Asheville Asheville Asheville Asheville Asheville Asheville Fredericksburg Fredericksburg Fredericksburg Fredericksburg Fredericksburg Fredericksburg Fredericksburg Fredericksburg Fredericksburg Fredericksburg Fredericksburg Fredericksburg Fredericksburg Fredericksburg Fredericksburg Fredericksburg Fredericksburg Fredericksburg Fredericksburg Fredericksburg Fredericksburg Fredericksburg Fredericksburg Fredericksburg Fredericksburg Fredericksburg Fredericksburg Fredericksburg Fredericksburg Fredericksburg Fredericksburg Fredericksburg Fredericksburg Fredericksburg Fredericksburg Fredericksburg Fredericksburg Fredericksburg Fredericksburg Fredericksburg Fredericksburg Fredericksburg Fredericksburg Fredericksburg Fredericksburg Fredericksburg Fredericksburg Fredericksburg Fredericksburg Charlottesville Charlottesville Charlottesville Charlottesville Charlottesville Charlottesville Charlottesville Charlottesville Charlottesville Charlottesville Charlottesville Charlottesville Charlottesville Charlottesville Charlottesville Charlottesville Charlottesville Charlottesville Charlottesville Charlottesville Charlottesville Charlottesville Charlottesville Charlottesville Charlottesville Charlottesville Charlottesville Charlottesville Charlottesville Charlottesville Charlottesville Charlottesville Charlottesville Charlottesville Charlottesville Charlottesville Charlottesville Charlottesville Charlottesville Charlottesville Charlottesville Charlottesville Charlottesville Charlottesville Charlottesville Charlottesville Charlottesville Charlottesville Charlottesville Staunton Staunton Staunton Staunton Staunton Staunton Staunton Staunton Staunton Staunton Staunton Staunton Staunton Staunton Staunton Staunton Staunton Staunton Staunton Staunton Staunton Staunton Staunton Staunton Staunton Staunton Staunton Staunton Staunton Staunton Staunton Staunton Staunton Staunton Staunton Staunton Staunton Staunton Staunton Staunton Staunton Staunton Staunton Staunton Staunton Staunton Staunton Staunton Staunton Reston Reston Reston Reston Reston Reston Reston Reston Reston Reston Reston Reston Reston Reston Reston Reston Reston Reston Reston Reston Reston Reston Reston Reston Reston Reston Reston Reston Reston Reston Reston Reston Reston Reston Reston Reston Reston Reston Reston Reston Reston Reston Reston Reston Reston Reston Reston Reston Reston Assets $16.0 Loans $11.4 Deposits $11.9 Branches 155 Our Combined Company x Enhances Union’s position as the #1 regional bank headquartered in Virginia (2) x Increases footprint in Northern Virginia − ~25% of our pro forma company will operate in Northern Virginia (3) x Leverages Access’s C&I expertise x Increased scale – serving a larger, diversified client base x Added convenience and wider product service offerings for customers Pro Forma Highlights ($bn) ( 1) Pro Forma Branch Footprint 6 Data as of 6/30/18 (1) Excludes purchase accounting adjustments (2) Regional bank defined as having less than $50 billion in assets; rank determined by asset size (3) Based upon branch level deposit market share data as of 6/30/18; Northern Virginia is defined as the counties of Arlington, Fairfax, Fauquier, Loudoun and Prince William, and the independent cities of Alexandria, Falls Church, Fairfax, Manassas and Manassas Park UBSH (140) ANCX (15) UBSH LPO (2)

Northern Virginia (1) Enhancing Our Presence in Key Markets Washington - Arlington - Alexandria, DC - VA - MD - WV MSA 7 Source : S&P Global Market Intelligence Note: Deposit data excludes branches with deposits greater than $1 billion Deposit data as of 6/30/18; pro forma for announced transactions (1) Includes the following counties: Alexandria (City), Arlington, Fairfax, Fairfax (City), Falls Church (City), Fauquier, Loudon, Manassas Park (City), Manassas (City) and Prince William Virginia Deposits Market Rank Institution ($mm) Share Branches 1 Wells Fargo & Co. $24,074 15.12% 261 2 BB&T Corp. 23,464 14.74 300 3 Bank of America Corp. 17,676 11.10 126 4 SunTrust Banks Inc. 15,637 9.82 177 Pro Forma 11,567 7.27 146 5 Union Bankshares Corp. 9,419 5.92 131 6 TowneBank 6,334 3.98 32 7 United Bankshares Inc. 5,413 3.40 69 8 Capital One Financial Corp. 4,916 3.09 49 9 PNC Financial Services Group Inc. 3,984 2.50 94 10 Carter Bank & Trust 3,254 2.04 78 12 Access National Corp. 2,147 1.35 15 Deposits Market Rank Institution ($mm) Share Branches 1 Bank of America Corp. $10,383 16.16% 57 2 Wells Fargo & Co. 9,094 14.15 77 3 BB&T Corp. 8,772 13.65 84 4 SunTrust Banks Inc. 5,999 9.33 62 5 Capital One Financial Corp. 4,856 7.56 43 6 United Bankshares Inc. 4,541 7.07 44 7 PNC Financial Services Group Inc. 2,973 4.63 69 Pro Forma 2,819 4.39 18 8 Burke & Herbert Bank & Trust Co. 2,330 3.62 25 9 Access National Corp. 2,088 3.25 14 10 Toronto-Dominion Bank 1,739 2.71 24 17 Union Bankshares Corp. 731 1.14 4 Deposits Market Rank Institution ($mm) Share Branches 1 Bank of America Corp. $23,403 16.23% 149 2 Wells Fargo & Co. 16,156 11.21 154 3 Capital One Financial Corp. 15,438 10.71 122 4 BB&T Corp. 13,972 9.69 164 5 SunTrust Banks Inc. 13,124 9.10 149 6 PNC Financial Services Group Inc. 10,286 7.14 176 7 United Bankshares Inc. 6,771 4.70 66 8 Citigroup Inc. 5,809 4.03 30 9 Sandy Spring Bancorp Inc. 4,865 3.37 47 10 M&T Bank Corp. 4,345 3.01 75 12 Pro Forma 3,924 2.72 33 13 Access National Corp. 2,088 1.45 14 14 Union Bankshares Corp. 1,836 1.27 19

Northern Virginia Market Highlights ▪ Most populated region in Virginia with more than 2 million residents ▪ Among the most highly educated regions of the country, supported by world - class school systems and higher education institutions ▪ Home to premier healthcare facilities with more than 5,000 practicing physicians ▪ High quality transportation and infrastructure to support leading businesses, including two major international airports ▪ 10 Fortune 500 Companies headquartered throughout the region ▪ Nation’s Capital provides federal government employment and contracting base Northern Virginia Market Overview Demographics Comparison ’19 − ’24 Projected Population Growth (%) 2019 Projected Median HHI ($) 8 Source : S&P Global Market Intelligence , GMU Center for Regional Analysis, Northern Virginia Chamber of Commerce Note: Northern Virginia is defined as the counties of Arlington, Fairfax, Fauquier , Loudoun and Prince William, and the independent cities of Alexandria, Falls Church, Fairfax, Manassas and Manassas Park Demographic data deposit weighted by county; deposit data as of 6/30/18 3.7% 5.9% 4.1% 5.2% 3.7% 3.6% UBSH ANCX Pro Forma Northern Virginia Virginia USA $67,527 $126,792 $79,052 $102,260 $73,579 $63,174 UBSH ANCX Pro Forma Northern Virginia Virginia USA

8.5% 7.4% 7.4% 6.8% 6.7% 6.6% 6.6% 6.4% 6.4% 6.0% 0.0% 2.5% 5.0% 7.5% 10.0% Loudoun, VA Falls Church, VA (City) New Kent, VA Manassas Park, VA (City) Fredericksburg, VA (City) Alexandria, VA (City) Prince William, VA Stafford, VA Arlington, VA James City, VA Northern Virginia Demographics Opportunity in Fast - Growing , Affluent Markets $141 $128 $124 $123 $123 $123 $120 $119 $116 $116 $0 $40 $80 $120 $160 Loudoun, VA Howard, MD Fairfax, VA Falls Church, VA (City) San Mateo, CA Santa Clara, CA Hunterdon, NJ Arlington, VA Williamson, TN Morris, NJ Top 10 Counties in the U.S. – Median HH Income ($000s) (1) Top 10 Counties in Virginia – Projected 5 - Yr Pop. Growth 9 Source : S&P Global Market Intelligence Dashed line denotes ANCX county of operation (1) Median HH Income projected for 2019

Multifamily 2% 1 - 4 Family 25% C&D 5% Non Owner - Occupied CRE 20% Owner - Occupied CRE 24% C&I 23% Consumer & Other 1% Commercial Loans 47% Access’s Loans 6/30/18 Access Loan and Deposit Portfolios Access’s Deposits 6/30/18 10 Source: S&P Global Market Intelligence Dollars in millions Demand Deposits 34% NOW Accounts 22% Money Market & Savings 29% Retail Time Deposits 7% Jumbo Time Deposits 7% Transaction Accounts 56% Deposit Composition Amount % of Total Demand Deposits $720 33.8 % NOW Accounts 477 22.4 Money Market & Savings 625 29.4 Retail Time Deposits 158 7.4 Jumbo Time Deposits 146 6.9 Total Deposits $2,127 100.0 % Loan Portfolio Amount % of Total Multifamily $46 2.2 % 1-4 Family 512 25.1 C&D 99 4.9 Non Owner-Occupied CRE 412 20.3 Owner-Occupied CRE 479 23.5 C&I 464 22.8 Consumer & Other 24 1.2 Gross Loans & Leases $2,036 100.0 %

Demand Deposits 22% NOW Accounts 22% Money Market & Savings 34% Retail Time Deposits 18% Jumbo Time Deposits 3% Transaction Accounts 44% C&D 12% 1 - 4 Family 22% Multifamily 5% Non Owner - Occupied CRE 24% Owner - Occupied CRE 16% C&I 14% Consumer & Other 7% Commercial Loans 30% Demand Deposits 24% NOW Accounts 22% Money Market & Savings 34% Retail Time Deposits 16% Jumbo Time Deposits 4% Transaction Accounts 46% Demand Deposits 34% NOW Accounts 22% Money Market & Savings 29% Retail Time Deposits 7% Jumbo Time Deposits 7% Transaction Accounts 56% Multifamily 2% 1 - 4 Family 25% C&D 5% Non Owner - Occupied CRE 20% Owner - Occupied CRE 24% C&I 23% Consumer & Other 1% Commercial Loans 47% ANCX Pro Forma Loan & Deposit Portfolio UBSH Pro Forma ( 1 ) Yield on Loans and Leases: 4.91% Yield on Loans and Leases : 4.88% Cost of Total Deposits: 0.54% Cost of Total Deposits : 0.57% Loans Deposits 11 Source : S&P Global Market Intelligence Data as of or for the three months ended 6/30/18 (1) Excludes purchase accounting adjustments Multifamily 6% 1 - 4 Family 22% C&D 13% Non Owner - Occupied CRE 25% Owner - Occupied CRE 14% C&I 12% Consumer & Other 8% Commercial Loans 26%

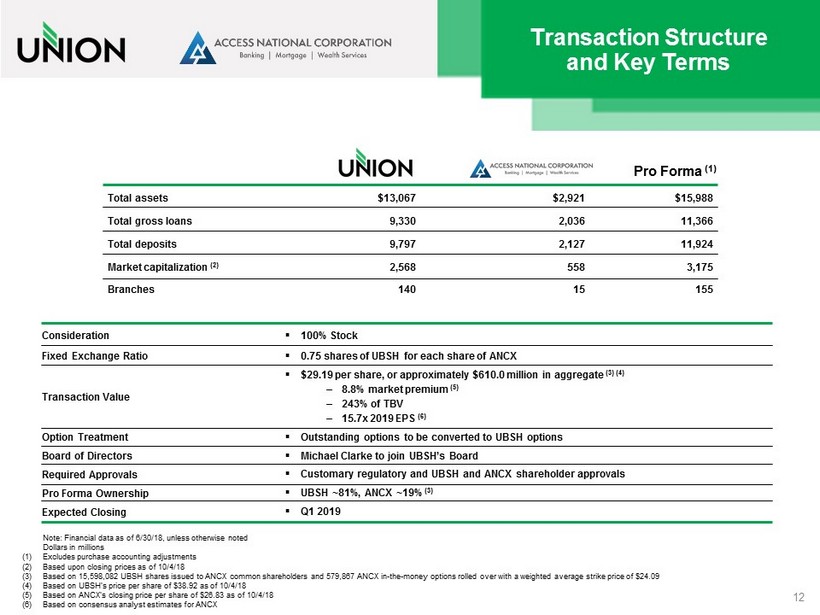

▪ $29.19 per share, or approximately $610.0 million in aggregate (3) (4) – 8.8% market premium (5) – 243% of TBV – 15.7x 2019 EPS (6) Transaction Structure and Key Terms ▪ 0.75 shares of UBSH for each share of ANCX ▪ Outstanding options to be converted to UBSH options ▪ Michael Clarke to join UBSH’s Board ▪ Q1 2019 Consideration Fixed Exchange Ratio Transaction Value Option Treatment Board of Directors Required Approvals Expected Closing ▪ Customary regulatory and UBSH and ANCX shareholder approvals ▪ 100% Stock ▪ UBSH ~81%, ANCX ~19% (3) Pro Forma Ownership 12 Note: Financial data as of 6/30/18, unless otherwise noted Dollars in millions (1) Excludes purchase accounting adjustments (2) Based upon closing prices as of 10/4/18 (3) Based on 15,598,082 UBSH shares issued to ANCX common shareholders and 579,867 ANCX in - the - money options rolled over with a weig hted average strike price of $24.09 (4) Based on UBSH’s price per share of $ 38.92 as of 10/4 /18 (5) Based on ANCX’s closing price per share of $26.83 as of 10 /4/18 (6) Based on consensus analyst estimates for ANCX Total assets Total gross loans Total deposits Branches Market capitalization (2) Pro Forma (1) $15,988 $2,921 140 15 155 2,036 2,127 11,924 9,797 9,330 $13,067 558 3,175 2,568 11,366

Comprehensive Due Diligence x Engaged third party resources for Credit, Tax and Legal diligence of Access x Credit diligence of Access ‒ Reviewed 51% of all outstanding commercial loan balances ‒ Reviewed 95% of all commercial loans risk - graded special mention or worse ‒ Reviewed 98% of all commercial classified loan balances x Additional diligence of Access: ‒ Retail / marketing strategy ‒ Commercial ‒ Finance / accounting ‒ Consumer lending ‒ Mortgage 13 ‒ Risk management ‒ IT / bank operations / facilities ‒ Human resources ‒ Wealth management

Key Assumptions Expense Savings Credit Mark ▪ Gross loan credit mark of ($24.5) million, or 1.2% ▪ Expected to be approximately $25 million pre - tax (fully phased - in) − ~30% of ANCX’s consensus 2019 non - interest expense − 60% realized in 2019 and 100% thereafter Merger & Integration Costs ▪ Approximately $32 million, after - tax Core Deposit Intangible ▪ Core deposit intangible of 2.5% ($45 million) assumed on non - time deposits − A mortized sum - of - years’ - digits over 10 years Regulatory Capital Impact ▪ Assumes pro forma trust preferred securities transfer from Tier 1 Capital to Tier 2 Capital, as pro forma company exceeds $15 billion in assets 14 Other Purchase Accounting Adjustments (1) ▪ Net other pre - tax write - ups of $6 million (1) Excludes the gross credit mark, ANCX’s allowance for loan losses and the transaction - created core deposit intangible

x Union M&A Financial Criteria EPS Impact Tangible Book Value Earnback IRR Immediate earnings accretion < 3 years >18% UBSH Criteria Transaction with ANCX Financial Impact 15 x x

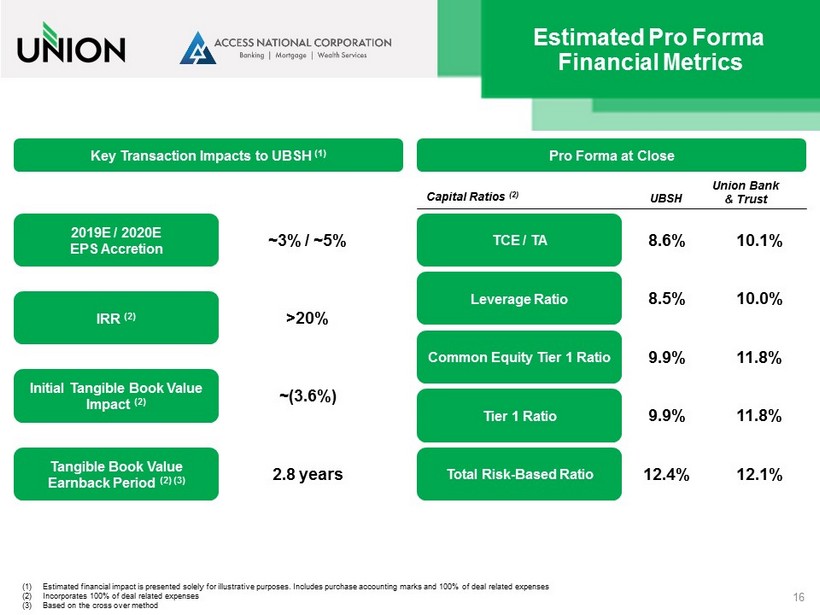

Estimated Pro Forma Financial Metrics Key Transaction Impacts to UBSH (1) 2019E / 2020E EPS Accretion IRR (2) Initial Tangible Book Value Impact (2) Tangible Book Value Earnback Period (2) (3) ~3% / ~5% >20% ~(3.6%) 2.8 years (1) Estimated financial impact is presented solely for illustrative purposes. Includes purchase accounting marks and 100% of deal related expenses (2) Incorporates 100% of deal related expenses (3) Based on the cross over method 16 Capital Ratios (2) TCE / TA Leverage Ratio Common Equity Tier 1 Ratio Tier 1 Ratio Total Risk - Based Ratio 8.6% 8.5% 9.9% 9.9% 12.4% Pro Forma at Close UBSH Union Bank & Trust 10.1% 10.0% 11.8% 11.8% 12.1%

Summary x Solidifies Union’s position as Virginia’s preeminent regional bank x Enhances presence in key Northern Virginia market x Delivers improvements to top tier financial performance x Financially attractive transaction for shareholders x Proven track record of successful conversions and integrations 17

Appendix

Access Fee Income: Mortgage and Wealth Management ▪ Originate s ~ $4 00 million of loans annually for resale, not loan portfolio ▪ Stable, experienced and tenured leadership ▪ All production is sold service - released ▪ Mandatory + best efforts delivery drives margins ▪ Purchase d loans are 72 % of YTD volume ▪ Priorities : − Offer attractive products to enhance client value proposition − Manage for measured risk and profit − Earnings contribution that support long - term shareholder value − YTD Revenue: $9.3 Million (1) Mortgage Banking Wealth Management ▪ $1 .4 billion Middleburg Trust Company AUM (1) − Separately c hartered V i rginia t rust company − Fee paid money management drives majority of revenue − Trust and Fiduciary Services differentiate and reduce account turnover − Experienced in complex estates and generational wealth transfer ▪ $350 million Middleburg Investment Group AUM (1) − Retail advisor program, FINRA regulated − Brokerage services, insurance for smaller accounts − Business retirement plans with a primary focus on 401(k) − YTD Revenue: $4.5 Million (1) 19 Source: ANCX public filings (1) Data as of or for the six months ended 6/30/18

Source : S&P Global Market Intelligence Data as of the three months ended 6/30/18 Non - GAAP Reconciliation 20 Access ROTCE Reconciliation ($000) Q2 ’18 Net Income $8,962 Amortization of Intangibles & Goodwill Impairment 802 Less: Effect of Taxes on Amortization & Impairment (168) Adjusted Net Income $9,596 Average Common Equity $428,590 Less: Average Intangibles (185,242) Average Tangible Common Equity $243, 348 Adjusted Net Income $9,596 Divided by: Average Tangible Common Equity 243,348 Unadjusted ROTCE 3.9% Multiplied by: Annualization Factor 4.0x Annualized ROTCE 15.8%