Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - Pershing Gold Corp. | tv503879_ex99-1.htm |

| 8-K - 8-K - Pershing Gold Corp. | tv503879_8k.htm |

Exhibit 99.2

Business Combination Americas Silver Corporation and Pershing Gold Corporation Leading Low - Cost Precious Metal Growth Company in the Americas October 1, 2018 TSX: USA NYSE American: USAS NASDAQ: PGLC TSX: PGLC

TSX: USA NYSE American: USAS FORWARD - LOOKING STATEMENTS Safe Harbour and Other Disclosures Certain information in this presentation may contain forward - looking statements. This information is based on current expectatio ns that are subject to significant risks, assumptions and uncertainties that are difficult to predict. Actual results might differ materially from results suggested in an y forward - looking statements. All statements, other than statements of historical fact, included in the presentation, including, without limitation, statements regarding product ion and operational results, exploration results, and future plans and objectives of Americas Silver, are forward - looking statements. Words such as “expect”, “anticipate”, “estimate” , “may”, “will”, “should”, “intend”, “believe” and other similar expressions are forward - looking statements. Forward - looking statements are not guarantees of future results and co nditions but rather reflect our current views with respect to future events and are subject to risks, uncertainties, assumptions and other factors, and actual results and futur e e vents could differ materially from those anticipated in such statements. There can be no assurance that such forward - looking statements will prove to be accurate. Americas Silver as sumes no obligation to update the forward - looking statements, or to update the reasons why actual results could differ from those reflected in the forward looking - stateme nts unless and until required by securities laws applicable to the Americas Silver . Additional information identifying risks and uncertainties is contained in filings by Ame ric as Silver with the Canadian securities regulators, which filings are available at www.sedar.com . Please note that unless otherwise indicated, all figures are in US dollars. Some of the potential quantities and grades disclosed are conceptual in nature, there has been insufficient exploration to de fin e a mineral resource on all of the mineralization at the Galena Complex and Cosalá Operations and it is uncertain if further exploration will result in certain targets being deli nea ted as a mineral resource. No Offer or Solicitation This presentation is for informational purposes only and does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval with respect to the proposed transaction between Americas Silver and Pershing or otherwise, nor shall there be any s ale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such ju ris diction. No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended. Participants in Solicitation . Pershing, Americas Silver and certain of their respective directors, executive officers and other members of management an d e mployees may be deemed to be participants in the solicitation of proxies from the stockholders of Pershing and Americas Silver in connection wit h the proposed transaction. Information about the directors and executive officers of Pershing is set forth in its proxy statement for its 2018 annual meeting of stockholders, wh ich was filed with the SEC on April 30, 2018. Information about the directors and executive officers of Americas Silver is set forth in its management information circular fo r its 2018 annual meeting of shareholders filed on Form 6 - K with the SEC on April 13, 2018. These documents can be obtained free of charge from the sources indicated below. Other information regarding those persons who are, under the rules of the SEC, participants in the proxy solicitation and a description of their direct and indirect intere sts , by security holdings or otherwise, will be contained in the joint proxy statement/prospectus and other relevant materials to be filed with the SEC when they become available. Additional Information about the Proposed Transaction. The proposed transaction between Americas Silver and Pershing will be submitted to the respective stockholders of Americas Silver and Pershing for their consideration. Americas Silver will file with the SEC a registration statement on For m F - 4 that will include a joint proxy statement of Americas Silver and Pershing that also constitutes a prospectus of Americas Silver. Americas Silver and Pershing will deliver th e joint proxy statement/prospectus to their respective stockholders as required by applicable law. Americas Silver and Pershing also plan to file other documents with th e S EC regarding the proposed transaction. This press release is not a substitute for any prospectus, proxy statement or any other document which Americas Silver and Pershin g m ay file with the SEC in connection with the proposed transaction. INVESTORS AND SECURITY HOLDERS OF AMERICAS SILVER AND PERSHING ARE URGED TO READ THE JOINT PROXY STATEMENT/PROSPECTUS AND ANY OTHER RELEVANT DOCUMENTS THAT WILL BE FILED WITH THE SEC CAREFULLY AND IN THEIR ENTIRETY WHEN TH EY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT AMERICAS SILVER, PERSHING, THE PROPOSED TRANSACTION AN D RELATED MATTERS. Investors and stockholders will be able to obtain free copies of the joint proxy statement/prospectus and ot her documents containing important information about Americas Silver and Pershing, once such documents are filed with the SEC, through the website maintained by the SEC at www.sec.gov . Pershing and Americas Silver make available free of charge at www.pershinggold.com and www.americassilvercorp.com , respectively (in the “Investor Relations” and “Investors” section, as applicable), copies of materials they file with, or furnish to, the SEC. 2

TSX: USA NYSE American: USAS FORWARD - LOOKING STATEMENTS Safe Harbour and Other Disclosures Cautionary Note to United States Investors Regarding Estimates of Resources and Reserves: This presentation uses the terms "Measured," "Indicated" and "Inferred" mineral resources, which are defined in Canadian Institute of Metallurgy guidelines, the guidelines widely followed to comply wi th Canadian National Instrument 43 - 101 -- Standards of Disclosure for Mineral Projects ("NI 43 - 101"). We advise U.S. investors that these terms are not recognized by the SEC. The estimation of measured and indicated resources involves greater uncertainty as to their existence and economic feasibility than the estimation of proven and proba ble reserves. Mineral resources are not mineral reserves. Mineral resources that are not mineral reserves do not have demonstrated economic viability. U.S. investors are cau tio ned not to assume that measured or indicated mineral resources will be converted into reserves. Inferred mineral resources have a high degree of uncertainty as to their e xis tence and their economic and legal feasibility. It cannot be assumed that all or any part of an inferred mineral resource exists, or is economically or legally viable. Under Canadian rules, estimates of "inferred mineral resources" may not form the basis of feasibility studies, pre - feasibility s tudies or other economic studies, except in prescribed cases, such as in a preliminary economic assessment under certain circumstances. Pershing is a reporting issuer in th e United States and is required to discuss mineralization estimates in accordance with US reporting standards. The estimates of proven and probable mineral reserves use d i n this presentation are in reference to the mining terms defined in the Canadian Institute of Mining, Metallurgy and Petroleum Standards, which definitions have been ado pte d by NI 43 - 101. The definitions of proven and probable reserves used in NI 43 - 101 differ from the definitions in the United States Securities and Exchange Commission's Indust ry Guide 7. In the United States, a mineral reserve is defined as a part of a mineral deposit, which could be economically and legally extracted or produced at the time the reserve determination is made. Accordingly, information contained in this presentation containing descriptions of Pershing’s or Americas Silver’s mineral deposits in acc ord ance with NI 43 - 101 may not be comparable to similar information made public by other U.S. companies under the United States federal securities laws and the rules and reg ula tions thereunder. Moreover, the SEC normally only permits issuers to report mineralization that does not constitute "reserves" as in - place tonnage and grade without referenc e to unit measures. US investors are urged to consider closely the disclosure in Pershing’s Form 10 - K for the year ended December 31, 2017 and other SEC filings. You can revi ew and obtain copies of these filings from the SEC's website at http://www.sec.gov/edgar.shtml . Mr. Daren Dell, Chief Operating Officer and a Qualified Person under Canadian Securities Administrators guidelines has approved the applicable contents of this presentation. All scientific and technical information related to drill and surface samples, resource estimate, mineral processing, metallu rgy and recovery methods, and mining for the Relief Canyon project is based on information prepared by either Paul Tietz, Certified Professional Geologist #11720, Neil Prenn, P. E. #7844, Carl Defilippi, registered member SME#775870RM, or Mark Jorgensen, MMSA#01202QP who are each Qualified Persons under the definitions established by Canadian Na tio nal Instrument 43 - 101. For further information please see “Technical Report and Feasibility Study for the Relief Canyon Project, Pershing County, Nevada, U.S.A. ” w ith an effective date of May 24, 2018, which is available on Pershing’s EDGAR profile at https://www.sec.gov/ and on SEDAR at www.sedar.com. 3

TSX: USA NYSE American: USAS TRANSACTION RATIONALE Source: Company disclosure, Thomson Reuters, available broker reports RELIEF CANYON Diversified Portfolio of Precious Metal Assets in the Americas • Two producing polymetallic mines in Mexico and Idaho and an attractive shovel - ready, precious metal development project in Nevada Enhanced Growth and Scale • Near - term precious metal production growth from Relief Canyon and Zone 120 and ongoing ramp - up at the San Rafael mine will meaningfully improve production and cash flow in 2020 and beyond Proven Management Team and Board • Demonstrated experience in financing, acquiring, developing and operating open pit and underground mines Strong Financial Position • Well - positioned to build Relief Canyon with increasing cash flows at San Rafael and greater access to capital Enhanced Capital Markets Profile • Broader appeal to institutional shareholders, increased research coverage, and improved trading liquidity Compelling Value Proposition • Leading leverage among junior precious metal companies and attractive relative valuation 4

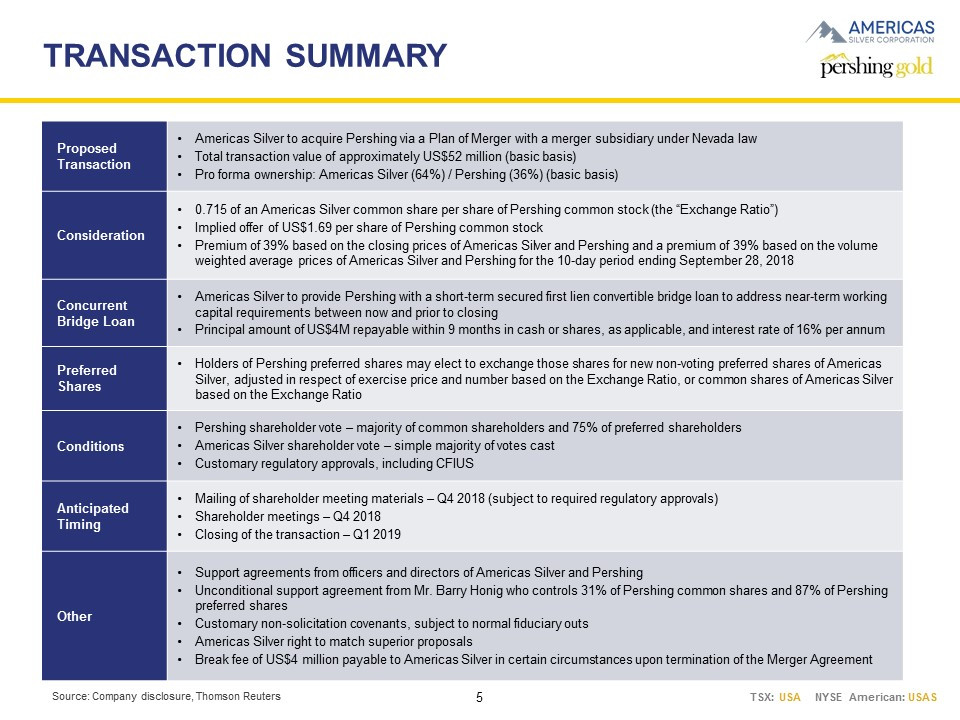

TSX: USA NYSE American: USAS TRANSACTION SUMMARY Source: Company disclosure, Thomson Reuters Proposed Transaction • Americas Silver to acquire Pershing via a Plan of Merger with a merger subsidiary under Nevada law • Total transaction value of approximately US$52 million (basic basis) • Pro forma ownership: Americas Silver (64%) / Pershing (36%) (basic basis) Consideration • 0.715 of an Americas Silver common share per share of Pershing common stock (the “Exchange Ratio”) • Implied offer of US$1.69 per share of Pershing common stock • Premium of 39% based on the closing prices of Americas Silver and Pershing and a premium of 39% based on the volume weighted average prices of Americas Silver and Pershing for the 10 - day period ending September 28, 2018 Concurrent Bridge Loan • Americas Silver to provide Pershing with a short - term secured first lien convertible bridge loan to address near - term working capital requirements between now and prior to closing • Principal amount of US$4M repayable within 9 months in cash or shares, as applicable, and interest rate of 16% per annum Preferred S hares • Holders of Pershing preferred shares may elect to exchange those shares for new non - voting preferred shares of Americas Silver, adjusted in respect of exercise price and number based on the Exchange Ratio, or common shares of Americas Silver based on the Exchange Ratio Conditions • Pershing shareholder vote – majority of common shareholders and 75% of preferred shareholders • Americas Silver shareholder vote – simple majority of votes cast • Customary regulatory approvals, including CFIUS Anticipated Timing • Mailing of shareholder meeting materials – Q4 2018 (subject to required regulatory approvals) • Shareholder meetings – Q4 2018 • Closing of the transaction – Q1 2019 Other • Support agreements from officers and directors of Americas Silver and Pershing • Unconditional support agreement from Mr. Barry Honig who controls 31% of Pershing common shares and 87% of Pershing preferred shares • Customary non - solicitation covenants, subject to normal fiduciary outs • Americas Silver right to match superior proposals • Break fee of US$4 million payable to Americas Silver in certain circumstances upon termination of the Merger Agreement 5

TSX: USA NYSE American: USAS PRO FORMA CAPITALIZATION 1. Pro forma basic shares includes Americas Silver common shares issued for 10% premium on Pershing preferred shares 2. Pershing cash balance adjusted for US$1.1M land acquisition. Pro forma cash and debt includes bridge loan Note: Balance sheet items are as at June 30, 2018, adjusted for subsequent events Source: Company disclosure, Thomson Reuters As at September 28, 2018 Americas Silver Pershing Pro Forma Share Price (US$) $2.36 $1.21 $2.36 Basic Shares O/S 1 43.1 M 33.6 M 67.5 M Basic Market Capitalization US$102 M US$41 M US$159 M Cash and Equivalents 2 US$8 M US$4 M US$16 M Total Debt 2 US$13 M US$0 M US$18 M Enterprise Value US$107 M US$36 M US$160 M 6

TSX: USA NYSE American: USAS MUTUALLY BENEFICIAL TRANSACTION Source: Company disclosure, Thomson Reuters, available broker reports Addition of a high quality shovel - ready, precious metal development project with low capital intensity and strong project economics at current gold prices Immediate upfront premium of approx. 40% Nevada operations base with a large prospective and underexplored land package Immediately accretive to precious metal reserves and resources and on all financial metrics by 2020 Feasibility study highlights ~91,000 ounces of annual gold production, a pre - tax NPV (5% discount) of US$118M and pre - tax IRR of 71% at spot prices Ongoing exposure to future value creating milestones at Relief Canyon Exposure to Americas Silver’s quality portfolio of producing, development and exploration assets Enhanced size and quality enable financing of Relief Canyon at a lower cost of capital Mitigation of single - asset risk 7 Proven mine building and operating team to develop Relief Canyon

TSX: USA NYSE American: USAS OVERVIEW OF RELIEF CANYON Note: Reserve and resource estimate based on the 2018 Relief Canyon FS. Refer to Slides 9, 16, 18, 19 and 20 for additional information on Relief Canyon Source: Company disclosure, Relief Canyon Feasibility Study (24 - May - 18) Project Description • Located in Nevada, USA – the 4 th most mining friendly jurisdiction in the world (Fraser Institute) • Situated at southern end of the Pershing Gold and Silver Trend, which hosts deposits such as Spring Valley and Rochester • Total land package of over 29,000 acres • Low cost heap leach gold project • Existing ADR plant capable of supporting 21,500 tpd • 99% of resource is oxide • Feasibility study recently completed in May 2018 • All permits in hand to start production through Phase I permit • Phase II permit submitted in June 2018 • New Secretarial Order requires BLM to complete EIS process in 1 year • Gold reserves of 635 kozs • M&I resources of 789 kozs and inferred resources of 45 kozs • Significant exploration potential – only ~20% of the property has been explored to date Office Processing Facility Overflow Ponds Historic Leach Pads Crusher Permitted Leach Pads 8 Site Plan Haul Road Future Waste Rock Dump Open Pits Low Grade Stockpile

TSX: USA NYSE American: USAS OVERVIEW OF RELIEF CANYON (CONT.) 1. Unless otherwise stated, project economics assume US$1,290/oz Au. All - in sustaining cash cost excludes salvage of mine and p rocess equipment Note: Reserve and resource estimate based on the 2018 Relief Canyon FS. Source: Company disclosure, Relief Canyon Feasibility Study (24 - May - 18) Gold Production Profile 1 Summary of Feasibility Study 1 Mine Life yrs 5.6 Avg. LOM Gold Production ozs 91,000 LOM Avg. Cash Cost (Net) US$/oz $769 LOM Avg. AISC (Net) US$/oz $801 Initial Capex US$M $28.2 Sustaining Capex US$M $14.8 Working Capital US$M $10.2 Pre - Tax NPV (5%) US$M $154 Pre - Tax IRR % 91% After - Tax NPV (5%) US$M $133 After - Tax IRR % 87% After - Tax Net Cash Flow US$M $176 Payback yrs 1.3 Pre - Tax NPV (5%) at US$1,200/oz US$M $118 Pre - Tax IRR at US$1,200/oz % 71% 9 Pre - Tax Cash Flow Profile 1 $0 $250 $500 $750 $1,000 $1,250 0 20 40 60 80 100 1 2 3 4 5 6 AISC (US$/oz Au) Gold Production (kozs) $(40) $(20) $- $20 $40 $60 $80 $100 -1 1 2 3 4 5 6 (US$M)

TSX: USA NYSE American: USAS Americas Silver Relief Canyon Pro Forma Americas Silver Relief Canyon Pro Forma PRO FORMA OPERATING PROFILE 1. Based on average annual gold production per Pershing feasibility study; 2. Including silver reserves Note: Silver equivalent calculated using the following prices: US$16/oz Ag, US$1,250/oz Au, US$2.50/ lb Cu, US$0.90/ lb Pb and US$0.90/ lb Zn Source: Company disclosure Silver Eq. Annual Production Silver Eq. Reserves 10 1.6 Mozs Ag 7.0 Mozs AgEq 91 kozs Au 1 (~7.0 Mozs AgEq ) ~14.0 Mozs AgEq 5.4x Precious Metals Exposure Silver Gold Base Metals Silver Gold Base Metals 28 Mozs Ag 67 Mozs AgEq 635 kozs Au (~51 Mozs AgEq 2 ) ~118 Mozs AgEq 2.8x Precious Metals Exposure

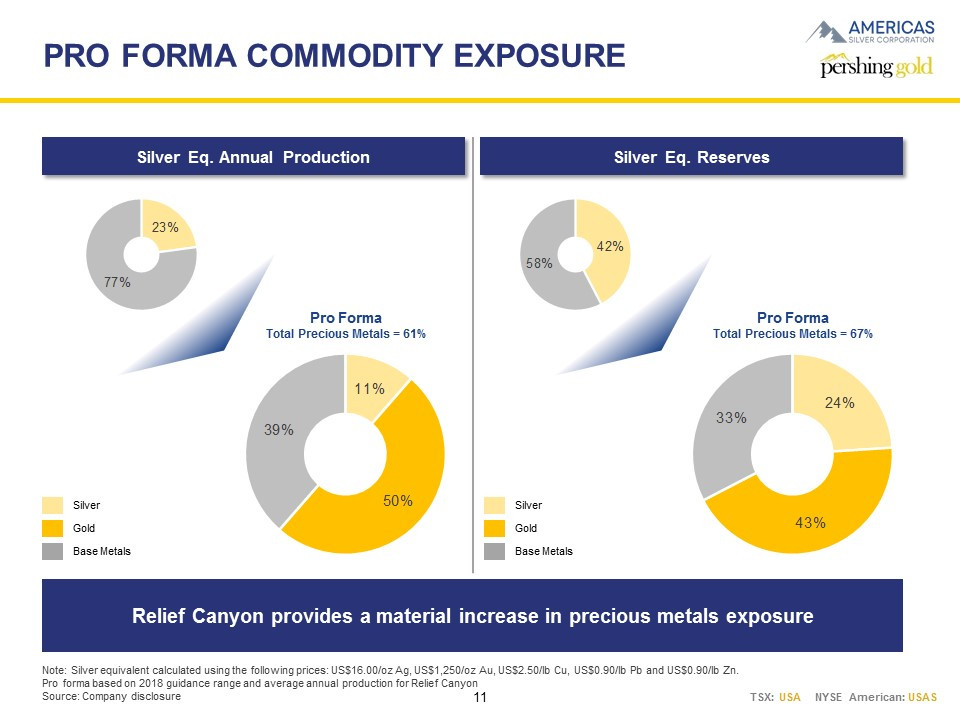

TSX: USA NYSE American: USAS PRO FORMA COMMODITY EXPOSURE Note: Silver equivalent calculated using the following prices: US$16.00/oz Ag, US$1,250/oz Au, US$2.50/ lb Cu, US$0.90/ lb Pb and US$0.90/ lb Zn . Pro forma based on 2018 guidance range and average annual production for Relief Canyon Source: Company disclosure Silver Eq. Annual Production Silver Eq. Reserves Relief Canyon provides a material increase in precious metals exposure Pro Forma Total Precious Metals = 67% 11 23% 77% 11% 50% 39% Silver Gold Base Metals Silver Gold Base Metals 42% 58% 24% 43% 33% Pro Forma Total Precious Metals = 61%

TSX: USA NYSE American: USAS A COMPELLING VALUE PROPOSITION Note: Americas Silver FDITM market capitalization includes preferred shares. Pro forma 2020 cash flow for Americas Silver includes Year 1 of Relief Canyon per the feasibility study. Great Panther is shown pro forma the acquisition of Beadell Resources. Source: Company disclosure, Thomson Reuters, available broker reports Market Capitalization (US$M) P / Consensus NAVPS (ratio) P / 2020E CFPS (ratio) 12 $84 $177 $201 $239 $276 $301 $311 $391 $410 $413 $430 $713 $730 EXN PF USA AR GPR PG EDR AGB GUY TMR LMC EQX FVI TXG 0.28x 0.31x 0.37x 0.38x 0.39x 0.41x 0.52x 0.55x 0.60x 0.62x 0.74x 1.00x 1.09x GPR AR LMC PF USA EQX GUY TMR PG EXN TXG AGB FVI EDR Peer Average: 0.57x 1.5x 2.1x 2.4x 2.6x 2.7x 2.9x 3.2x 3.8x 4.0x 5.8x 5.9x LMC AR PF USA GUY TMR GPR TXG EXN FVI EDR AGB Peer Average: 3.4x

TSX: USA NYSE American: USAS THE PATH FORWARD Source: Company disclosure Achieve full ramp - up at San Rafael in H2 2018 and realize increased cash flow generation in 2019 – 2020 Continued focus on balance sheet strength and improving cash flow generation across all assets Complete Zone 120 resource estimate and evaluation of development options by early Q4 2018 Evaluate financing alternatives to commence construction of Relief Canyon in 2019 Bring Relief Canyon and Zone 120 into production in 2020 Positioned to generate significant shareholder value in the near term 13

TSX: USA NYSE American: USAS APPENDIX

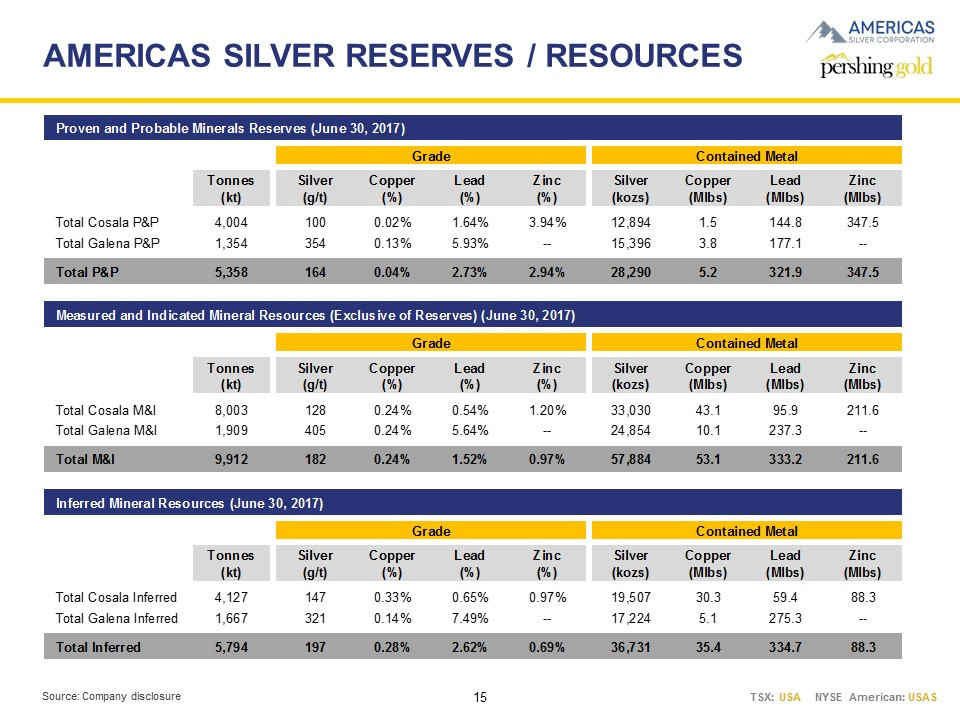

TSX: USA NYSE American: USAS AMERICAS SILVER RESERVES / RESOURCES Source: Company disclosure 15 Proven and Probable Minerals Reserves (June 30, 2017) Grade Contained Metal Tonnes (kt) Silver (g/t) Copper (%) Lead (%) Zinc (%) Silver (kozs) Copper (Mlbs) Lead (Mlbs) Zinc (Mlbs) Total Cosala P&P 4,004 100 0.02% 1.64% 3.94% 12,894 1.5 144.8 347.5 Total Galena P&P 1,354 354 0.13% 5.93% -- 15,396 3.8 177.1 -- Total P&P 5,358 164 0.04% 2.73% 2.94% 28,290 5.2 321.9 347.5 Measured and Indicated Mineral Resources (Exclusive of Reserves) (June 30, 2017) Grade Contained Metal Tonnes (kt) Silver (g/t) Copper (%) Lead (%) Zinc (%) Silver (kozs) Copper (Mlbs) Lead (Mlbs) Zinc (Mlbs) Total Cosala M&I 8,003 128 0.24% 0.54% 1.20% 33,030 43.1 95.9 211.6 Total Galena M&I 1,909 405 0.24% 5.64% -- 24,854 10.1 237.3 -- Total M&I 9,912 182 0.24% 1.52% 0.97% 57,884 53.1 333.2 211.6 Inferred Mineral Resources (June 30, 2017) Grade Contained Metal Tonnes (kt) Silver (g/t) Copper (%) Lead (%) Zinc (%) Silver (kozs) Copper (Mlbs) Lead (Mlbs) Zinc (Mlbs) Total Cosala Inferred 4,127 147 0.33% 0.65% 0.97% 19,507 30.3 59.4 88.3 Total Galena Inferred 1,667 321 0.14% 7.49% -- 17,224 5.1 275.3 -- Total Inferred 5,794 197 0.28% 2.62% 0.69% 36,731 35.4 334.7 88.3

TSX: USA NYSE American: USAS PERSHING RESERVES / RESOURCES Note: Pershing mineral reserves and resources have been converted to metric units Source: Company disclosure 16 Gold Proven and Probable Mineral Reserves Silver Proven and Probable Mineral Reserves Grade Contained Grade Contained Tonnes (kt) Gold (g/t) Gold (kozs) Tonnes (kt) Silver (g/t) Silver (kozs) Relief Canyon Proven 11,880 0.81 309 Relief Canyon Proven 3,741 3.3 391 Relief Canyon Probable 15,816 0.64 327 Relief Canyon Probable 9,316 4.1 1,241 Total P&P 27,696 0.71 635 Total P&P 13,057 3.9 1,633 Gold Measured and Indicated Mineral Resources (Inclusive) Silver Measured and Indicated Mineral Resources (Inclusive) Grade Contained Grade Contained Tonnes (kt) Gold (g/t) Gold (kozs) Tonnes (kt) Silver (g/t) Silver (kozs) Relief Canyon Measured 13,146 0.77 327 Relief Canyon Measured 9,806 4.2 1,325 Relief Canyon Indicated 24,843 0.58 462 Relief Canyon Indicated 6,139 3.7 732 Total M&I 37,989 0.65 789 Total M&I 15,945 4.0 2,057 Gold Inferred Mineral Resources Silver Inferred Mineral Resources Grade Contained Grade Contained Tonnes (kt) Gold (g/t) Gold (kozs) Tonnes (kt) Silver (g/t) Silver (kozs) Relief Canyon Inferred 4,759 0.30 45 Relief Canyon Inferred 716 2.3 54 Total Inferred 4,759 0.30 45 Total Inferred 716 2.3 54

TSX: USA NYSE American: USAS MANAGEMENT AND BOARD OF DIRECTORS * Proposed director nominee of Pershing, to be appointed in connection with closing of the transaction Source: Company disclosure 17 Management DARREN BLASUTTI DAREN DELL WARREN VARGA PETER MCRAE SHAWN WILSON President and Chief Executive Officer Chief Operating Officer Chief Financial Officer CLO and Senior Vice President, Corporate Affairs Vice President, Technical Services Board of Directors ALEX DAVIDSON DARREN BLASUTTI ALAN EDWARDS PETER HAWLEY BRADLEY R. KIPP Chairman of the Board Director Director Director Director GORDON PRIDHAM MANUEL RIVERA LORIE WAISBERG STEPHEN ALFERS* Director Director Director Director

TSX: USA NYSE American: USAS RELIEF CANYON LAND POSITION Source: Company disclosure 18 Entire deposit not situated on controlled lands at acquisition in 2011 • Expanded land position from 1,100 to over 29,000 acres Pershing now controls all lands / claims in and around the mine site and priority targets Resource geologically open to the west, east and south Significant exploration upside for new discoveries on broader land package

TSX: USA NYSE American: USAS RELIEF CANYON PERMITTING OVERVIEW Source: Company disclosure 19 All permits in hand to start production and mine through Phase I New Secretarial Order requires BLM to complete EIS process in one year • Relief Canyon Phase II expansion is ideal project for a 1 - year EIS • Recent BLM Record of Decision on EIS at McEwan’s Gold Bar project is example of Secretarial Order in action No sage grouse habitat or other sensitive environmental issues Permit modification to expand and deepen submitted June 2018 (Phase II) • Environmental baseline and engineering studies continuing Sequential permitting allows simultaneous Phase I mining while permitting Phase II Processing facility fully permitted and ready to operate

TSX: USA NYSE American: USAS RELIEF CANYON 2018 DRILLING (MAIN / WSO) Source: Company disclosure 20

TSX: USA NYSE American: USAS NOTES Mineral Reserve and Mineral Resource Estimates CIM Definitions and Standards were followed for Mineral Reserve and Mineral Resource Estimates. Mineral Reserves are estimated at a NSR cut - off value of US$40/tonne at Nuestra Señora, US$54/tonne at San Rafael and US$190/ton ne at Galena. The NSR cut - off is calculated using recent operating results for recoveries, off - site concentrate costs, and on - site operating costs. Mineral Resources are estimated at a NSR cut - off value of US$34/tonne at San Rafael, US$40/tonne at Zone 120, US$30/tonne at El Cajón and US$190/tonne at Galena. Mineral Resources at Nuestra Señora are estimated at a 90g/tonne silver equivalent cut - off grade. NSR and silver equivalent cut - offs we re calculated using recent or expected operating results for recoveries, off - site concentrate costs, and on - site operating costs. Mineral Reserves are estimated using metal prices of US$16.00/oz Ag, $2.50/lb Cu, $0.90/lb Pb and $0.90/lb Zn. Mineral Resources are estimated using metal prices of US$18.00/oz Ag, $3.00/lb Cu, $1.05/lb Pb and $1.05/lb Zn. Mineral Resources are exclusive of Mineral Reserves and as such the Mineral Resources do not have demonstrated economic viabi lit y. A minimum mining width of 4.5 feet was used for estimating Galena Reserves, with a minimum additional dilution of 0.5 feet fr om both the hanging wall and footwall. A mining recovery of 95% was used to reflect the selective nature of the mining methods used at the operation. A mining recovery of 90% was used for estimating Mineral Reserves at Nuestra Señora and San Rafael to reflect the mining meth ods used at the operations. Numbers may not add or multiply accurately due to rounding. The Mineral Resource estimate for the Cosalá Operations is based on block models prepared by independent mineral resource con sul tants. The Nuestra Señora Mineral Reserve and Resource estimate was prepared by Company personnel under the supervision of James Stonehouse, Vice President of Explorat ion , a Qualified Person for the purpose of NI 43 - 101. The San Rafael, Zone 120 and El Cajón Mineral Resource estimates were prepared by Paul Tietz, C.P.G., who is an independ ent consultant and a Qualified Person for the purpose of NI 43 - 101. The San Rafael Mineral Reserve estimate was prepared by company personnel under the supervision of Sha wn Wilson, Vice President of Technical Services, a Qualified Person for the purpose of NI 43 - 101. The Mineral Resource estimate for the Galena Complex was prepared using a combination of block modelling and the accumulation me thod. The Mineral Resource estimate was prepared by Company personnel under the supervision of Aaron Gross, C.P.G., a Qualified Person for the purpose of NI 43 - 101. The Mineral Reserve estimate was prepared by Company personnel under the supervision of Shawn Wilson, Vice President of Technical Services, a Qualified Person for the pur pos e of NI 43 - 101. All scientific and technical information related to drill and surface samples, resource estimate, mineral processing, metallurgy and recovery methods, and mining for the Relief Canyon project has been reviewed and approved by either Paul Tietz , Certified Professional Geologist #11720, Neil Prenn , P.E. #7844, Carl Defilippi , registered member SME#775870RM, or Mark Jorgensen, MMSA#01202QP who are each Qualified Persons under the definitions established by Canadian Na tio nal Instrument 43 - 101. Drill core at Relief Canyon is boxed and sealed at the drill rig and moved to the Relief Canyon logging and sample preparation facilities b y t rained personnel. The core is logged and split down the center using a typical table - fed circular rock saw. One half of the core is sent for assay while the other half is returned to the core box and stored at Relief Canyon in a secure, fenced - off, area. Pershing Gold quality assurance/quality control (QA/QC) procedures include the regular use of blanks, standard s, and duplicate samples. 21

TSX: USA NYSE American: USAS CONTACT Darren Blasutti, President and CEO dblasutti@americassilvercorp.com 416 - 848 - 9503 www.americassilvercorp.com Steve Alfers, President and CEO salfers@pershinggold.com 720 - 974 - 7254 www.pershinggold.com