Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - CITIZENS & NORTHERN CORP | tv503665_ex99-1.htm |

| EX-2.1 - EXHIBIT 2.1 - CITIZENS & NORTHERN CORP | tv503665_ex2-1.htm |

| 8-K - FORM 8-K - CITIZENS & NORTHERN CORP | tv503665_8k.htm |

Exhibit 99.2

September 28, 2018 Expansion Into Bucks County with Acquisition of Monument Bancorp, Inc.

Legal Information Forward Looking Statements : This presentation contains statements which, to the extent that they are not recitations of historical fact may constitute forward - looking statements for purposes of the Securities Act of 1933 , as amended, and the Securities Exchange Act of 1934 , as amended . Such forward - looking statements may include financial and other projections as well as statements regarding Citizens & Northern Corporation (the “Corporation”) that may include future plans, objectives, performance, revenues, growth, profits, operating expenses or the Corporation’s underlying assumptions . The words “may”, “would”, “should”, “could”, “will”, “likely”, “possibly”, “expect,” “anticipate,” “intend”, “estimate”, “target”, “potentially”, “probably”, “outlook”, “predict”, “contemplate”, “continue”, “strategic”, “objective”, “plan”, “forecast”, “project” and “believe” or other similar words, phrases or concepts may identify forward - looking statements . Persons reading or present at this presentation are cautioned that such statements are only predictions, and that the Corporation’s actual future results or performance may be materially different . Such forward - looking statements involve known and unknown risks and uncertainties . A number of factors, many of which are beyond the Corporation’s control, could cause our actual results, events or developments, or industry results, to be materially different from any future results, events or developments expressed, implied or anticipated by such forward - looking statements, and so our business and financial condition and results of operations could be materially and adversely affected . In the context of the proposed transaction with Monument, such factors include, among others : that the execution of the transaction may take longer than anticipated or be more costly to complete and that the anticipated benefits, including any anticipated cost savings or strategic gains, may be significantly harder to achieve or take longer than anticipated or may not be achieved ; that the banking agency approvals we require for the transaction will not be obtained in a timely manner or at all or will be conditioned in a manner that would impair our ability to implement our business plans ; integration efforts between the Corporation and Monument may divert the attention of the management teams of the Corporation and Monument and cause a loss in the momentum of their ongoing businesses ; and success of the Corporation in Monument’s geographic market area will require the Corporation to attract and retain key personnel in the market and to differentiate the Corporation from its competitors in the market . All forward - looking statements and information made herein are based on management’s current beliefs and assumptions as of September 27 , 2018 and speak only as of that date . The Corporation does not undertake to update forward - looking statements . For a complete discussion of the assumptions, risks and uncertainties related to our business generally, you are encouraged to review our filings with the Securities and Exchange Commission, including our most recent annual report on Form 10 - K, as well as any changes in risk factors that we may identify in our quarterly or other reports subsequently filed with the SEC . Non - GAAP Financial Measures : In this presentation, we may use certain non - GAAP (generally accepted accounting principles) financial measures . Reconciliations of the differences between each non - GAAP financial measure with the most comparable financial measure calculated and presented in accordance with GAAP are included on the slides entitled “Reconciliation of non - GAAP Financial Measures to Comparable GAAP Financial Measures” at the end of this presentation . Additional Information About The Transaction and Where to Find It : The proposed transaction will be submitted to the shareholders of Monument for their consideration and approval . In connection with the proposed transaction, C&N will be filing with the Securities and Exchange Commission (the “SEC”) a registration statement on Form S - 4 which will contain a proxy statement/prospectus to be distributed to the shareholders of Monument . Investors are urged to read the registration statement and the proxy statement/prospectus regarding the proposed transaction when it becomes available and any other relevant documents filed with the SEC, as well as any amendments or supplements to those documents, because they will contain important information . Once filed, investors will be able to obtain a free copy of the proxy statement/prospectus, as well as other filings containing information about C&N and Monument, free of charge from the SEC’s Internet site (www . sec . gov), by contacting C&N at 570 - 724 - 3411 or by contacting Monument at 215 - 340 - 1020 . Investors should read the proxy statement/prospectus and other documents to be filed with the SEC carefully before making a decision concerning the transaction . 2

Legal Information Participants in The Transaction : The directors, executive officers, and certain other members of management and employees of Monument are participants in the solicitation of proxies in favor of the merger from the shareholders of Monument . Information regarding the directors and executive officers of C&N and Monument, and the interests of such participants, will be included in the proxy statement/prospectus and the other relevant documents filed with the SEC if and when they become available . This document is not an offer to sell shares of C&N’s securities which may be issued in the proposed transaction . Such securities are offered only by means of the proxy statement/prospectus referred to above . 3

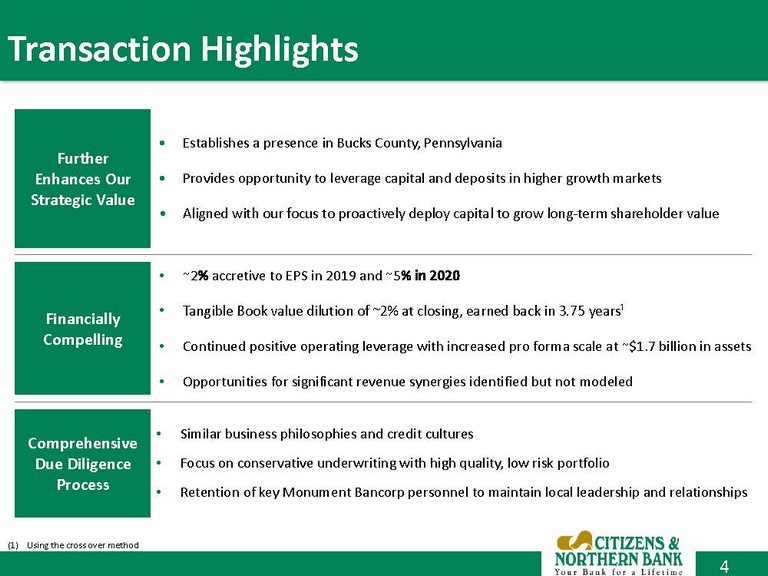

Transaction Highlights 4 Further Enhances Our Strategic Value Financially Compelling • ~ 2 % accretive to EPS in 2019 and ~ 5 % in 2020 • Tangible Book value dilution of ~2% at closing, earned back in 3.75 years¹ • Continued positive operating leverage with increased pro forma scale at ~$1.7 billion in assets • Opportunities for significant revenue synergies identified but not modeled Comprehensive Due Diligence Process • Similar business philosophies and credit cultures • Focus on conservative underwriting with high quality, low risk portfolio • Retention of key Monument Bancorp personnel to maintain local leadership and relationships • Establishes a presence in Bucks County, Pennsylvania • Provides opportunity to leverage capital and deposits in higher growth markets • Aligned with our focus to proactively deploy capital to grow long - term shareholder value (1) Using the cross over method

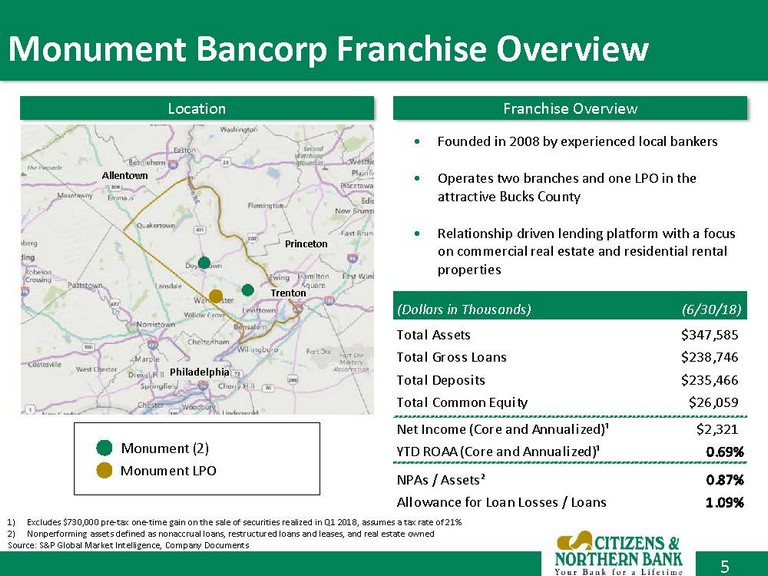

Monument Bancorp Franchise Overview 5 1) Excludes $730,000 pre - tax one - time gain on the sale of securities realized in Q1 2018, assumes a tax rate of 21% 2) Nonperforming assets defined as nonaccrual loans, restructured loans and leases, and real estate owned Source : S&P Global Market Intelligence, Company Documents • Founded in 2008 by experienced local bankers • Operates two branches and one LPO in the attractive Bucks County • Relationship driven lending platform with a focus on commercial real estate and residential rental properties Location Franchise Overview Monument (2) Monument LPO (Dollars in Thousands) (6/30/18) Total Assets $347,585 Total Gross Loans $238,746 Total Deposits $235,466 Total Common Equity $26,059 Net Income (Core and Annualized)¹ $2,321 YTD ROAA (Core and Annualized)¹ 0.69% NPAs / Assets² 0.87% Allowance for Loan Losses / Loans 1.09% Trenton Princeton Allentown Philadelphia

$62,370 $68,659 $87,059 $90,695 $83,541 8.79% 8.65% 7.43% 6.99% 7.16% Pennsylvania New York Bucks Montgomery Mercer, NJ Proj. 5- Year Median HHI Growth Entrance Into a Vibrant Market: Bucks County 6 Source : S&P Global Market Intelligence, Fortune, U.S. Census, FDIC Summary of Deposits as of June 30, 2018 • The local economy is anchored by large employers and industries, including health services, biotechnology, financial services, and tourism • Situated squarely in between Philadelphia, Princeton, and Allentown, Bucks County is supported by strong local economies with attractive demographics • As a result, Bucks County has seen a net inflow of its population of 31,827 people since 2000 • With $236 million in total deposits, Monument’s market share of 1.27% offers significant opportunity to capture deposits from the $18.5 billion in Bucks County deposits 2019 Estimated Median HH Income Population Top Employers Current Franchise New Markets 281,447 95,460 629,559 831,796 376,021 Pennsylvania New York Bucks Montgomery Mercer, NJ

Transaction Overview 7 Deal Value¹ Attractively Priced Governance & Pro Forma Ownership • Second quarter of 2019 Required Approvals Anticipated Closing • Key management of Monument to be retained by CZNC • One Monument Board member to be added to CZNC’s Board of Directors • Pro forma ownership of 91% CZNC / 9% Monument Bancorp, Inc. • Customary regulatory approvals • Monument shareholder approval • Implied deal value of $26.74 per share¹ or $42.7 million in aggregate¹ • Monument shareholders can elect to receive 1.0144 shares of CZNC common stock or $28.10 in cash • Subject to 80% stock and 20% cash consideration • 161% of tangible book value • 18.0x 2Q18 Adjusted YTD Annualized Earnings² (1) Based on CZNC stock price of $26.02 as of September 27, 2018; 1,564,599 Monument common shares outstanding and 60,085 options outstanding with a weighted average exercise price of $13.88. Options holders will be cashed out at $28.10 less the exercise pri ce (2) Adjusted YTD Annualized Earnings exclude $730,000 pre - tax one - time gain on the sale of securities realized in Q1 2018, assumes a tax rate of 21%

Review of Pro Forma Financial Impact 8 Cost Savings One - time Deal Costs Pre - tax Purchase Accounting Adjustments ³ Financial Impact • ~2% accretive to EPS in 2019 and ~5% in 2020 • ~ 2 % Tangible Book Value dilution per share¹ • Tangible Book Value earned back in 3.75 years ¹ , ² 1 • CZNC capital metrics to be in excess of “well capitalized” at closing Key Transaction Assumptions • 20% of Monument’s non - interest expense base, or approximately $1.5 million pre - tax • 75% phased - in in 2019 and 100% thereafter • One - time deal costs of ~$3.9 million pre - tax • Credit Mark: $3.2 million gross mark • OREO mark: $0.6 million • Liability fair value mark: $0.6 million (positive to equity) • CDI: $1.8 million amortized using straight line over 10 years (1) Assumes one - time deal costs are 100% recognized prior to closing for modeling purposes (2) Using the cross over method (3) Based on June 30, 2018 balance sheet

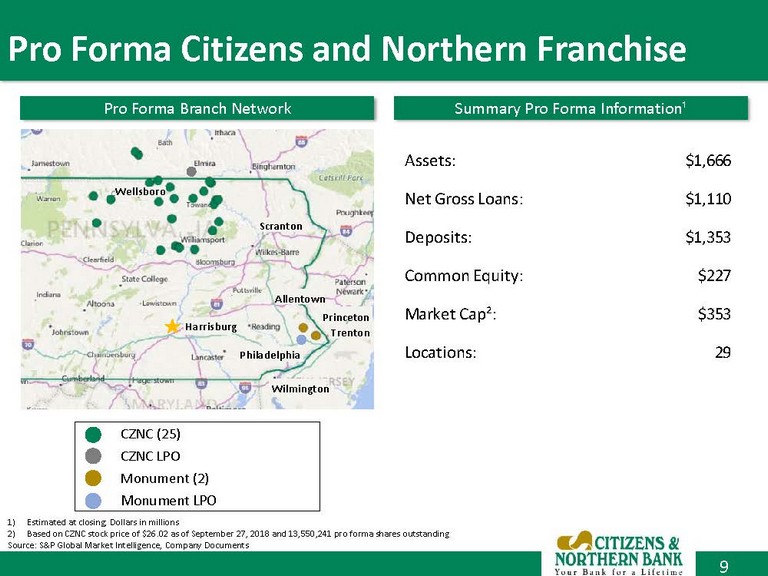

Summary Pro Forma Information¹ Pro Forma Branch Network Assets: $1,666 Net Gross Loans: $1,110 Deposits: $1,353 Common Equity: $227 Market Cap²: $353 Locations: 29 Pro Forma Citizens and Northern Franchise 9 1) Estimated at closing; Dollars in millions 2) Based on CZNC stock price of $26.02 as of September 27, 2018 and 13,550,241 pro forma shares outstanding Source : S&P Global Market Intelligence, Company Documents Harrisburg Wilmington Philadelphia Allentown Trenton Princeton Scranton Wellsboro CZNC (25) CZNC LPO Monument ( 2) Monument LPO

Contact Information President and CEO Brad Scovill BradleyS@cnbankpa.com 570 - 723 - 2102 Treasurer and CFO Mark Hughes MarkH@cnbankpa.com 570 - 724 - 8533 10 Online www.cnbankpa.com

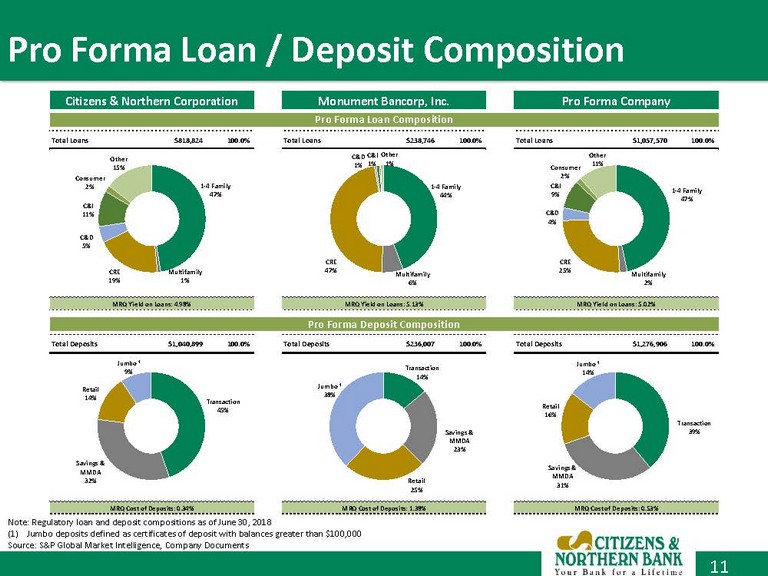

Pro Forma Loan / Deposit Composition 11 Citizens & Northern Corporation Monument Bancorp, Inc. Pro Forma Company Pro Forma Loan Composition Total Loans $818,824 100.0% Total Loans $238,746 100.0% Total Loans $1,057,570 100.0% MRQ Yield on Loans: 4.98% MRQ Yield on Loans: 5.13% MRQ Yield on Loans: 5.02% Pro Forma Deposit Composition Total Deposits $1,040,899 100.0% Total Deposits $236,007 100.0% Total Deposits $1,276,906 100.0% MRQ Cost of Deposits: 0.34% MRQ Cost of Deposits: 1.38% MRQ Cost of Deposits: 0.53% 1 - 4 Family 47% Multifamily 1% CRE 19% C&D 5% C&I 11% Consumer 2% Other 15% 1 - 4 Family 44% Multifamily 6% CRE 47% C&D 1% C&I 1% Other 1% 1 - 4 Family 47% Multifamily 2% CRE 25% C&D 4% C&I 9% Consumer 2% Other 11% Transaction 45% Savings & MMDA 32% Retail 14% Jumbo ¹ 9% Transaction 14% Savings & MMDA 23% Retail 25% Jumbo ¹ 38% Transaction 39% Savings & MMDA 31% Retail 16% Jumbo ¹ 14% Note: Regulatory loan and deposit compositions as of June 30, 2018 (1) Jumbo deposits defined as certificates of deposit with balances greater than $100,000 Source: S&P Global Market Intelligence, Company Documents

Reconciliation of non - GAAP Financial Measures to Comparable GAAP Financial Measures 12 Note: Dollars in thousands except per share amounts Tangible Book Value Dilution Aggregate Per Share CZNC Estimated Tangible Book Value at March 31, 2019 $182,917 $14.89 Plus: Equity Consideration $33,038 Less: Estimated After-tax Buyer One-time Deal Costs ($625) Less: Estimated Intangible Assets Created ($18,352) Pro Forma Tangible Book Value $196,978 $14.54 Tangible Book Value Dilution (2.4%)

Reconciliation of non - GAAP Financial Measures to Comparable GAAP Financial Measures 13 Note: Dollars in thousands Year-to-Date June 30, 2018 Core and Annualized Net Income Pre-Tax Income (GAAP) $2,199 Less: One-time Gain on Sale of Investment Securities (Non-GAAP) $730 Core Pre-tax Income (Non-GAAP) $1,469 Core Tax Rate (Non-GAAP) 21.0% Less: Core Tax Expense (Non-GAAP) $308 Core Net Income (Non-GAAP) $1,161 Core and Annualized Net Income (Non-GAAP) $2,321 Average Assets $336,744 YTD ROAA (Core and Annualized) 0.69%