Attached files

| file | filename |

|---|---|

| 8-K - 8-K INVESTOR PRESENTATION-SEPTEMBER 2018 2 - FARMER BROTHERS CO | a8-kinvestorpresentationxs.htm |

UNDERSTANDING, LEADING, BUILDING & WINNING IN THE BUSINESS OF COFFEE FARMER BROTHERS 1

WE ARE A COFFEE COMPANY DESIGNED TO DELIVER THE COFFEE PEOPLE WANT, THE WAY THEY WANT IT. 2

We have transformed from a 100-year-old coffee company to a growing and profitable forward-thinking industry leader, championing coffee culture. 3

20151 20181,2 CAGR3 COFFEE VOLUME 87,685,000 107,429,000 7.0% (In Pounds) NET SALES $545.9 $606.5 3.6% (In Millions) 4,5 ADJUSTED EBITDA $30.9 $47.6 15.5% (In Millions) STOCK PRICE 6 $23.50 $30.55 9.1% NOTES 1. Fiscal year ending June 30. 2. Includes Boyd’s, newly acquired in fiscal 2018. 3. Represents the compound annual growth rate over the entire period from June 30, 2015 to June 30, 2018. 4. Adjusted EBITDA is a non-GAAP financial measure and is unaudited; a reconciliation of this non-GAAP measure to its corresponding GAAP measure is included in the appendix. 5. Prior year financial information has been retrospectively adjusted to reflect the impact of certain changes in accounting principles and corrections to previously issued financial statements. 6. As of the last business day of the respective fiscal year. 4

INVESTMENT HIGHLIGHTS MARKET INDUSTRY COMPREHENSIVE CAPACITY OPPORTUNITY LEADERSHIP CAPABILITIES TO GROW A significant opportunity Purposeful leadership in A business model Recent SQF certification, to expand market share in sustainability, ethical sourcing designed to effectively and and focus on leveraging the $76B coffee industry and waste elimination creates efficiently deliver across all investment in state-of-the- growing at 3-5% annually superior customer offerings stages of the coffee art Northlake facility,create business significant opportunities for customer acquisitionand sustainable long-term growth STRONG DSD BOYD’S M&A CASH FLOW NETWORK INTEGRATION GROWTH Balancing top-line DSD sales channel Boyd’s integration on Well-positioned to pursue growth with increased better positions the track to deliver growth through additional operating leverage company to capture forecasted synergies opportunistic M&A generates strong free national accounts and cash flow reduce customer churn NOTE Please see appendix for sources. 5

UNDERSTANDING THE BUSINESS OF COFFEE 6

UNDERSTANDING The days of a The days of a single-origin cup of joe in pour-over the morning anytime, are over. everywhere are here. 7

UNDERSTANDING COFFEE IS A DYNAMIC CATEGORY DRIVEN BY INNOVATION AND CHANGING CONSUMER DEMANDS. VOLUME QUALITY INNOVATION Specialty coffee currently Product, technology and A $76B industry with an accounts for 25% of the experience innovation are driving annual growth rate of 3-5%. market. It is growing and consumption. Cold Brew and Nitro commands a highest price point. didn't exist in a meaningful way just three years ago. NOTE Please see appendix for sources. 8

UNDERSTANDING TRENDS IMPORTANT TRENDS IMPORTANT TO US RIGHT NOW TO OUR FUTURE Sourcing Sourcing Sustainability and origin stories are 100% sustainably sourced coffee will be expected. influencing purchasing decisions. Drinking Drinking Understanding of the health benefits of coffee Coffee is now consumed across wider dayparts. continue to expand. Product Innovation Product Innovation Millennials and Gen Xers now prefer gourmet, Cold and frozen-format coffee is forecasted to grow specialty and espresso-based coffee and in 12.5% between 2016-2021. different formats. NOTE Please see appendix for sources. 9

UNDERSTANDING MARKET SHARE OVERVIEW By revenue, Farmer Brothers accounts for less than 1% of the U.S. coffee market MARKET CONSOLIDATION IS UNDERWAY "Significant consolidation lies ahead in the coffee industry." - James Watson, Rabobank NOTE Please see appendix for sources. 10

UNDERSTANDING COFFEE ROASTERS WE COMPETE AGAINST NOTE Company logos not owned by Farmer Brothers. 11

LEADING IN THE BUSINESS OF COFFEE 12

LEADING We are …in all facets experts in of coffee coffee... 13

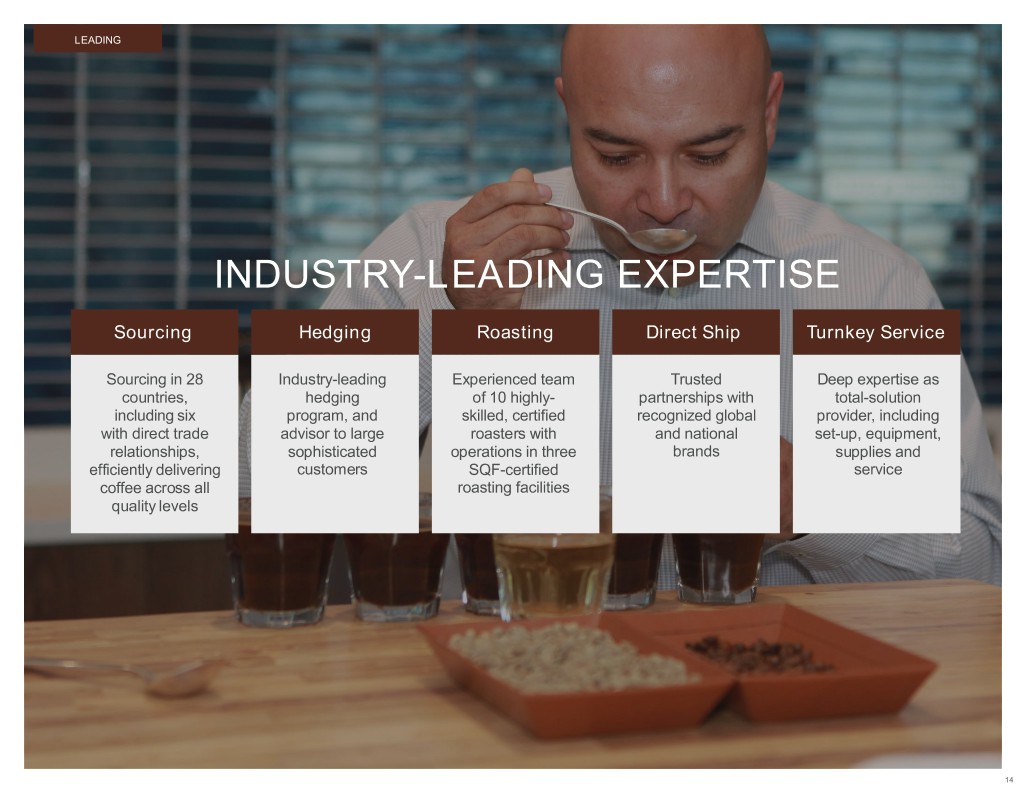

LEADING INDUSTRY-LEADING EXPERTISE Sourcing Hedging Roasting Direct Ship Turnkey Service Sourcing in 28 Industry-leading Experienced team Trusted Deep expertise as countries, hedging of 10 highly- partnerships with total-solution including six program, and skilled, certified recognized global provider, including with direct trade advisor to large roasters with and national set-up, equipment, relationships, sophisticated operations in three brands supplies and efficiently delivering customers SQF-certified service coffee across all roasting facilities quality levels 14

LEADING PURPOSEFUL LEADERSHIP Industry Ethical Sourcing Sustainability Eliminating Waste Founding member of Longstanding direct trade Award-winning sustainability Driving towards zero- World Coffee Research relationships and innovative program with science-based waste status in roasting partnerships reduction goals and distribution facilities 15

BUILDING IN THE BUSINESS OF COFFEE 16

BUILDING We are built …and prepared for growth... for change. 17

BUILDING Farmer Brothers' transformation and modernization journey Capacity & Roasting Portfolio Customers Commerce Logistics Organization 18

BUILDING CAPACITY & ROASTING THEN NOW NEXT Three facilities with limited ability to Three facilities, including our new Ramp up production at flagship meet the changing needs of coffee flagship Safe Quality Food plant beginning FY2019 consumers Certified, Zero-Waste facility, with total potential capacity across the system of 200+ million lbs. of coffee per year 19

BUILDING PORTFOLIO THEN NOW NEXT Primarily traditional coffee products Full and focused portfolio with Greater traction for premium and with limited premium products growth in premium and specialty specialty brands and high-growth categories along with a presence innovative segments in select adjacent beverage categories 20

BUILDING CUSTOMERS THEN NOW NEXT Customer profile heavily weighted Profitable legacy customers Deliver increased ROI and towards offices, truck stops and demanding premium coffee profitability through winning large restaurants demanding traditional customer accounts and quality coffee opportunistic M&A Partnerships with sophisticated global and national brands 21

BUILDING COMMERCE THEN NOW NEXT Legacy local sales network with Realign professional, national Drive sales growth through limited focus on national relationships account sales operation E-commerce and third-party distributors Modernize DSD sales capabilities 22

BUILDING LOGISTICS THEN NOW NEXT Owned fleet of long-haul and delivery Outsourced long-haul to 3PL and Deliver efficiency through trucks moving product along the implemented fleet management technology network one step at a time for a more efficient distribution network 23

BUILDING ORGANIZATION THEN NOW NEXT Legacy management steeped in Experienced senior leadership team Optimize M&A integration traditional coffee business capabilities across all functional teams In-house sustainability and M&A expertise Elevate E-commerce talent Infused culture with vibrant talent resulting from move of headquarters 24

WINNING IN THE BUSINESS OF COFFEE 25

WINNING We are positioned to WIN AND GROW 26

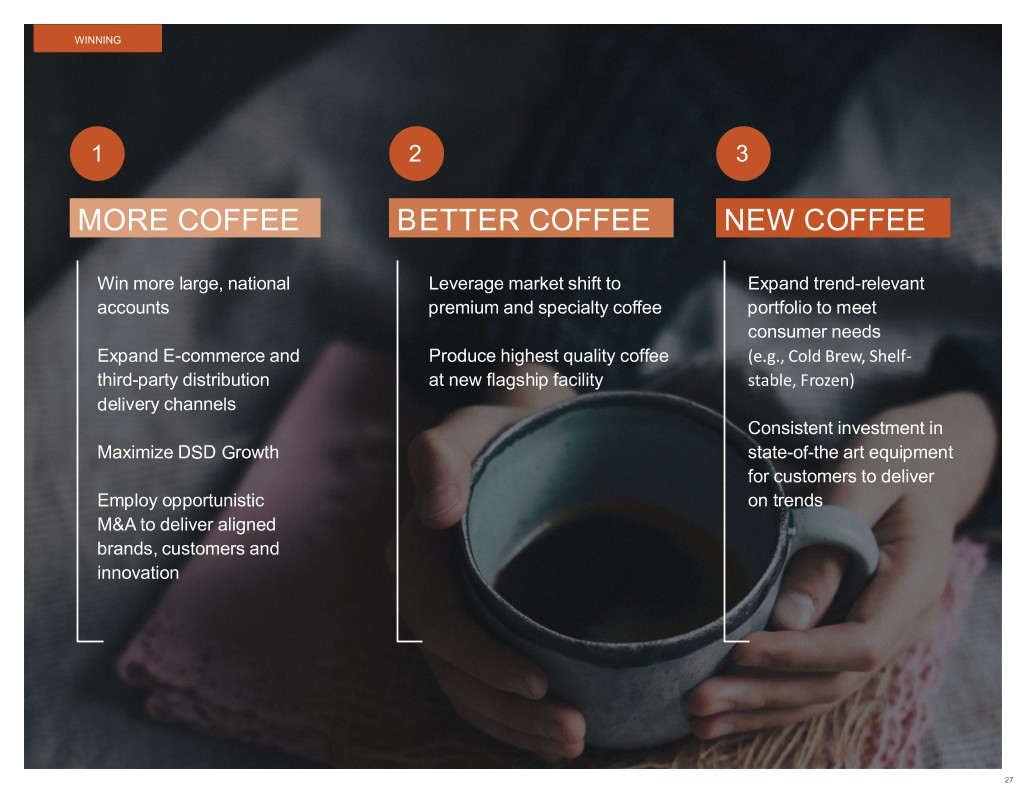

WINNING 1 2 3 MORE COFFEE BETTER COFFEE NEW COFFEE Win more large, national Leverage market shift to Expand trend-relevant accounts premium and specialty coffee portfolio to meet consumer needs Expand E-commerce and Produce highest quality coffee (e.g., Cold Brew, Shelf- third-party distribution at new flagship facility stable, Frozen) delivery channels Consistent investment in Maximize DSD Growth state-of-the art equipment for customers to deliver Employ opportunistic on trends M&A to deliver aligned brands, customers and innovation 27

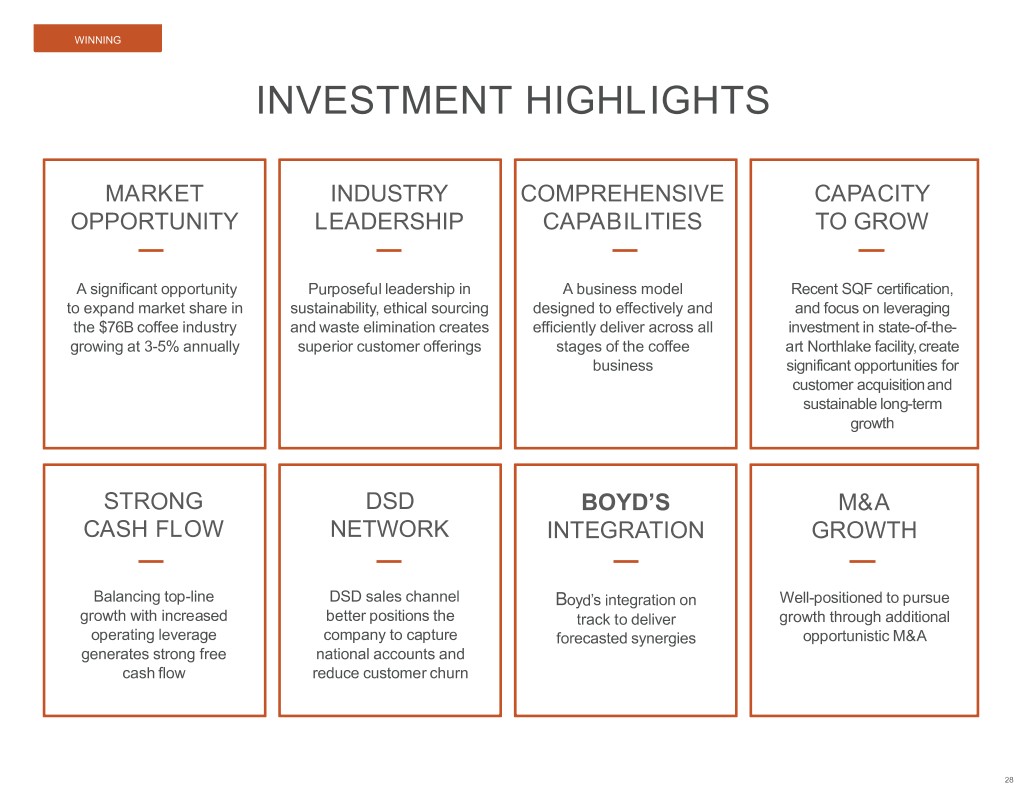

WINNING INVESTMENT HIGHLIGHTS MARKET INDUSTRY COMPREHENSIVE CAPACITY OPPORTUNITY LEADERSHIP CAPABILITIES TO GROW A significant opportunity Purposeful leadership in A business model Recent SQF certification, to expand market share in sustainability, ethical sourcing designed to effectively and and focus on leveraging the $76B coffee industry and waste elimination creates efficiently deliver across all investment in state-of-the- growing at 3-5% annually superior customer offerings stages of the coffee art Northlake facility,create business significant opportunities for customer acquisitionand sustainable long-term growth STRONG DSD BOYD’S M&A CASH FLOW NETWORK INTEGRATION GROWTH Balancing top-line DSD sales channel Boyd’s integration on Well-positioned to pursue growth with increased better positions the track to deliver growth through additional operating leverage company to capture forecasted synergies opportunistic M&A generates strong free national accounts and cash flow reduce customer churn 28

RETROSPECTIVELY ADJUSTED HISTORICAL FINANCIAL RESULTS 29

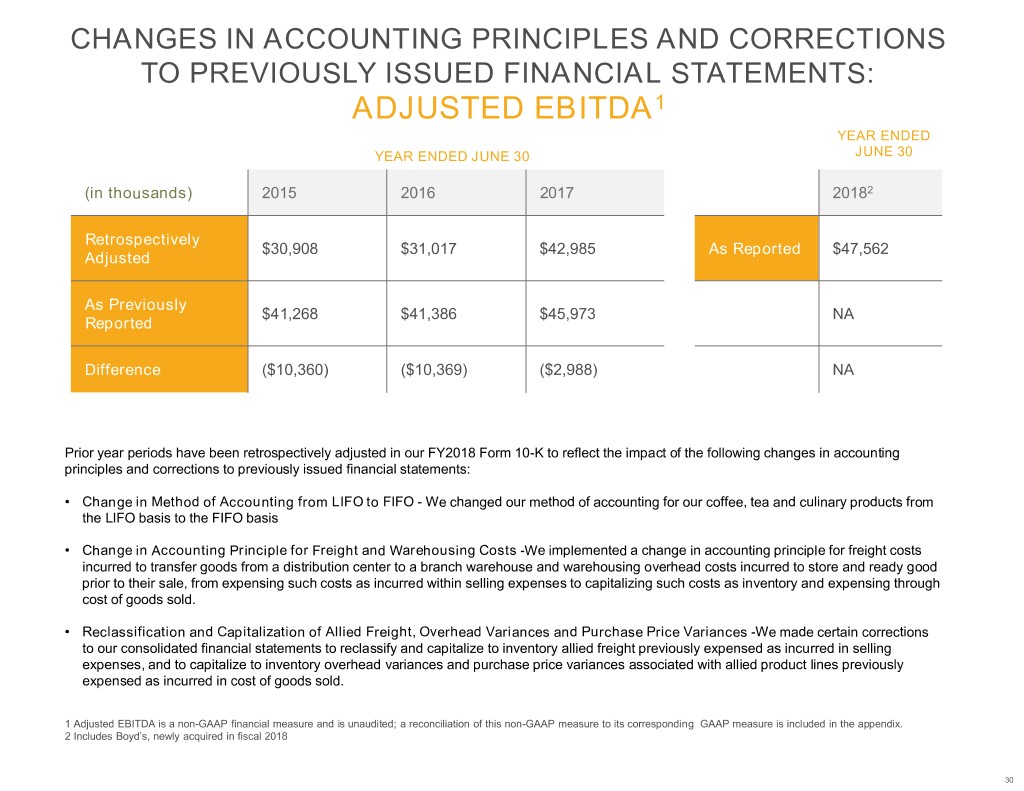

CHANGES IN ACCOUNTING PRINCIPLES AND CORRECTIONS TO PREVIOUSLY ISSUED FINANCIAL STATEMENTS: ADJUSTED EBITDA1 YEAR ENDED YEAR ENDED JUNE 30 JUNE 30 (in thousands) 2015 2016 2017 20182 Retrospectively $30,908 $31,017 $42,985 As Reported $47,562 Adjusted As Previously $41,268 $41,386 $45,973 NA Reported Difference ($10,360) ($10,369) ($2,988) NA Prior year periods have been retrospectively adjusted in our FY2018 Form 10-K to reflect the impact of the following changes in accounting principles and corrections to previously issued financial statements: • Change in Method of Accounting from LIFO to FIFO - We changed our method of accounting for our coffee, tea and culinary products from the LIFO basis to the FIFO basis • Change in Accounting Principle for Freight and Warehousing Costs -We implemented a change in accounting principle for freight costs incurred to transfer goods from a distribution center to a branch warehouse and warehousing overhead costs incurred to store and ready good prior to their sale, from expensing such costs as incurred within selling expenses to capitalizing such costs as inventory and expensing through cost of goods sold. • Reclassification and Capitalization of Allied Freight, Overhead Variances and Purchase Price Variances -We made certain corrections to our consolidated financial statements to reclassify and capitalize to inventory allied freight previously expensed as incurred in selling expenses, and to capitalize to inventory overhead variances and purchase price variances associated with allied product lines previously expensed as incurred in cost of goods sold. 1 Adjusted EBITDA is a non-GAAP financial measure and is unaudited; a reconciliation of this non-GAAP measure to its corresponding GAAP measure is included in the appendix. 2 Includes Boyd’s, newly acquired in fiscal 2018 30

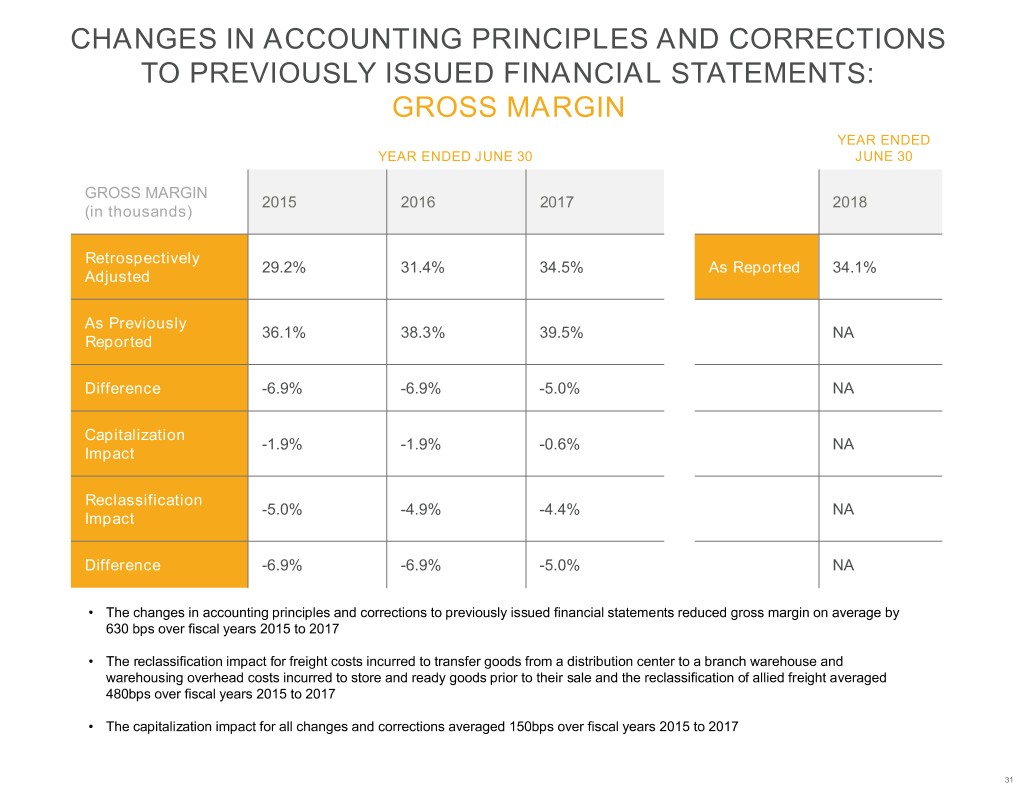

CHANGES IN ACCOUNTING PRINCIPLES AND CORRECTIONS TO PREVIOUSLY ISSUED FINANCIAL STATEMENTS: GROSS MARGIN YEAR ENDED YEAR ENDED JUNE 30 JUNE 30 GROSS MARGIN 2015 2016 2017 2018 (in thousands) Retrospectively 29.2% 31.4% 34.5% As Reported 34.1% Adjusted As Previously 36.1% 38.3% 39.5% NA Reported Difference -6.9% -6.9% -5.0% NA Capitalization -1.9% -1.9% -0.6% NA Impact Reclassification -5.0% -4.9% -4.4% NA Impact Difference -6.9% -6.9% -5.0% NA • The changes in accounting principles and corrections to previously issued financial statements reduced gross margin on average by 630 bps over fiscal years 2015 to 2017 • The reclassification impact for freight costs incurred to transfer goods from a distribution center to a branch warehouse and warehousing overhead costs incurred to store and ready goods prior to their sale and the reclassification of allied freight averaged 480bps over fiscal years 2015 to 2017 • The capitalization impact for all changes and corrections averaged 150bps over fiscal years 2015 to 2017 31

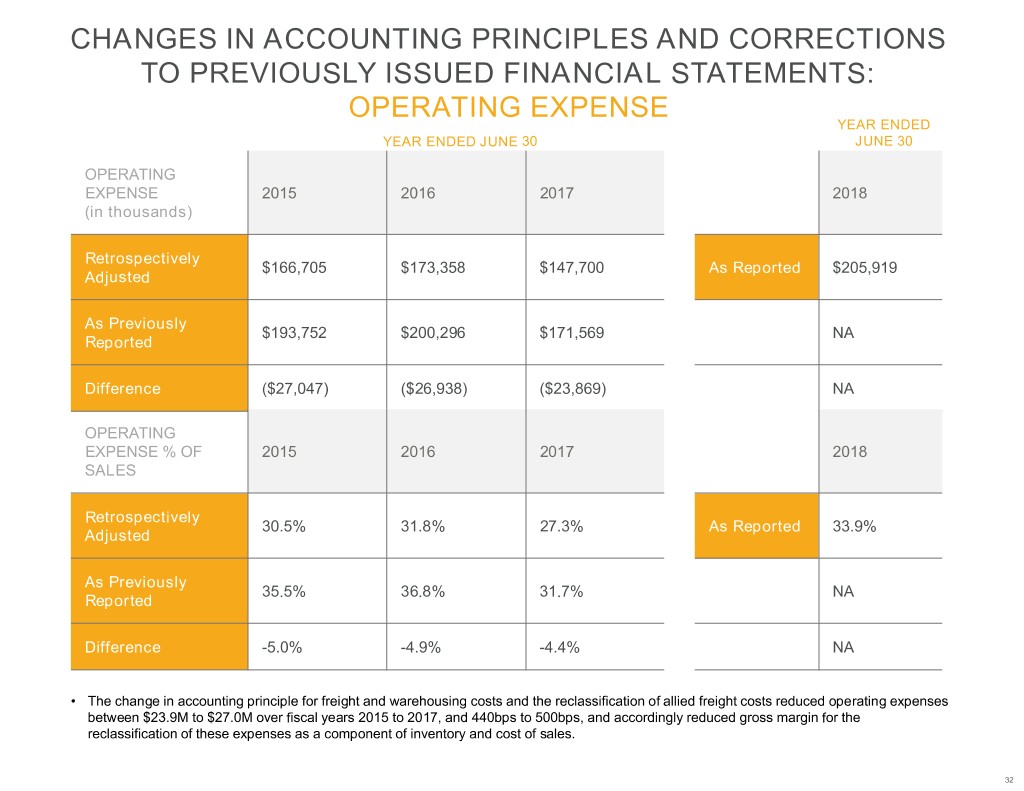

CHANGES IN ACCOUNTING PRINCIPLES AND CORRECTIONS TO PREVIOUSLY ISSUED FINANCIAL STATEMENTS: OPERATING EXPENSE YEAR ENDED YEAR ENDED JUNE 30 JUNE 30 OPERATING EXPENSE 2015 2016 2017 2018 (in thousands) Retrospectively $166,705 $173,358 $147,700 As Reported $205,919 Adjusted As Previously $193,752 $200,296 $171,569 NA Reported Difference ($27,047) ($26,938) ($23,869) NA OPERATING EXPENSE % OF 2015 2016 2017 2018 SALES Retrospectively 30.5% 31.8% 27.3% As Reported 33.9% Adjusted As Previously 35.5% 36.8% 31.7% NA Reported Difference -5.0% -4.9% -4.4% NA • The change in accounting principle for freight and warehousing costs and the reclassification of allied freight costs reduced operating expenses between $23.9M to $27.0M over fiscal years 2015 to 2017, and 440bps to 500bps, and accordingly reduced gross margin for the reclassification of these expenses as a component of inventory and cost of sales. 32

APPENDIX 33

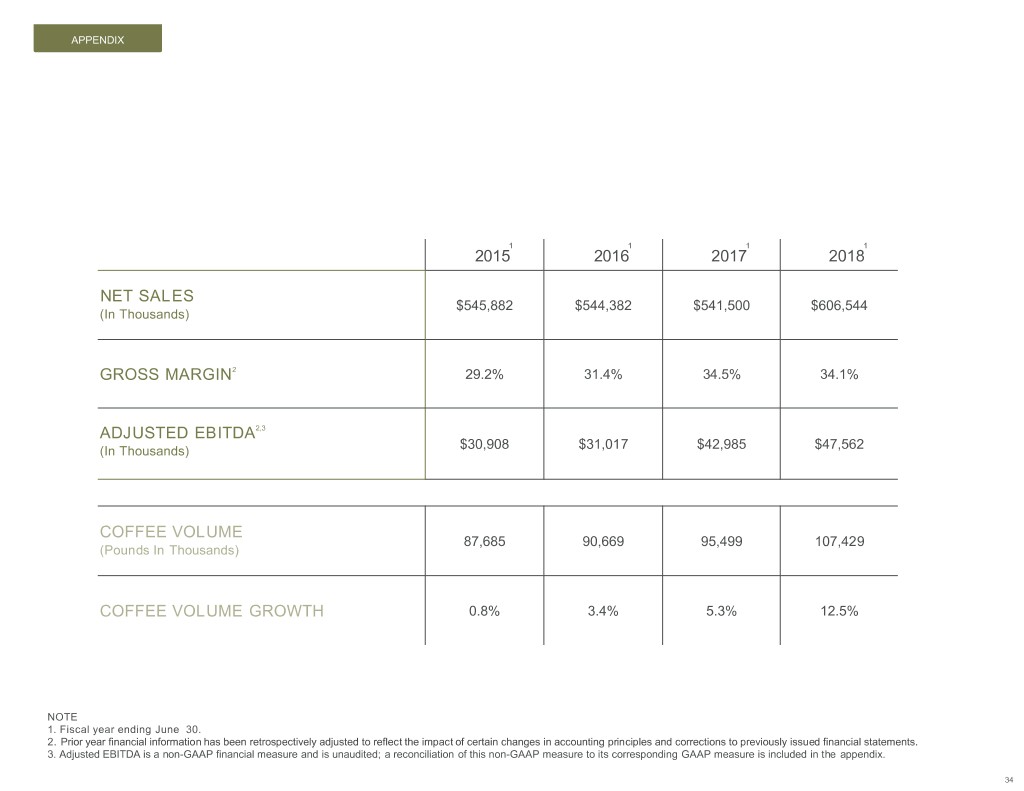

APPENDIX 1 1 1 1 2015 2016 2017 2018 NET SALES $545,882 $544,382 $541,500 $606,544 (In Thousands) GROSS MARGIN2 29.2% 31.4% 34.5% 34.1% ADJUSTED EBITDA2,3 (In Thousands) $30,908 $31,017 $42,985 $47,562 COFFEE VOLUME 87,685 90,669 95,499 107,429 (Pounds In Thousands) COFFEE VOLUME GROWTH 0.8% 3.4% 5.3% 12.5% NOTE 1. Fiscal year ending June 30. 2. Prior year financial information has been retrospectively adjusted to reflect the impact of certain changes in accounting principles and corrections to previously issued financial statements. 3. Adjusted EBITDA is a non-GAAP financial measure and is unaudited; a reconciliation of this non-GAAP measure to its corresponding GAAP measure is included in the appendix. 34

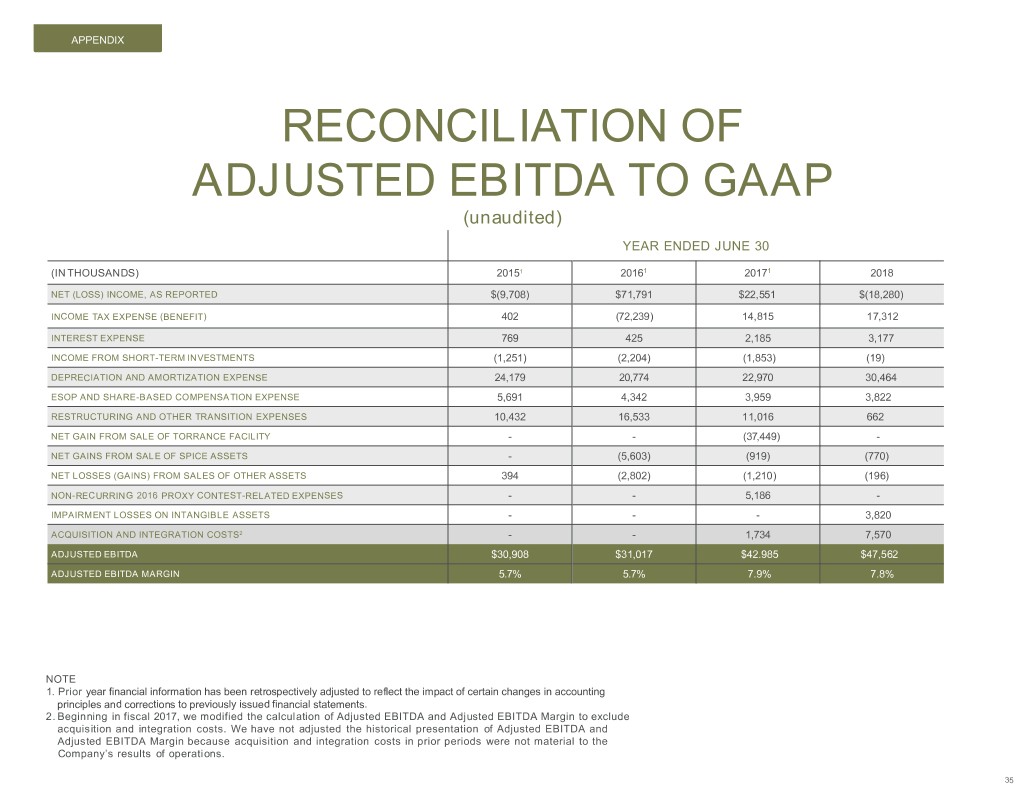

APPENDIXAPENDIX RECONCILIATION OF ADJUSTED EBITDA TO GAAP (unaudited) YEAR ENDED JUNE 30 (IN THOUSANDS) 20151 20161 20171 2018 NET (LOSS) INCOME, AS REPORTED $(9,708) $71,791 $22,551 $(18,280) INCOME TAX EXPENSE (BENEFIT) 402 (72,239) 14,815 17,312 INTEREST EXPENSE 769 425 2,185 3,177 INCOME FROM SHORT-TERM INVESTMENTS (1,251) (2,204) (1,853) (19) DEPRECIATION AND AMORTIZATION EXPENSE 24,179 20,774 22,970 30,464 ESOP AND SHARE-BASED COMPENSATION EXPENSE 5,691 4,342 3,959 3,822 RESTRUCTURING AND OTHER TRANSITION EXPENSES 10,432 16,533 11,016 662 NET GAIN FROM SALE OF TORRANCE FACILITY - - (37,449) - NET GAINS FROM SALE OF SPICE ASSETS - (5,603) (919) (770) NET LOSSES (GAINS) FROM SALES OF OTHER ASSETS 394 (2,802) (1,210) (196) NON-RECURRING 2016 PROXY CONTEST-RELATED EXPENSES - - 5,186 - IMPAIRMENT LOSSES ON INTANGIBLE ASSETS - - - 3,820 ACQUISITION AND INTEGRATION COSTS2 - - 1,734 7,570 ADJUSTED EBITDA $30,908 $31,017 $42.985 $47,562 ADJUSTED EBITDA MARGIN 5.7% 5.7% 7.9% 7.8% NOTE 1. Prior year financial information has been retrospectively adjusted to reflect the impact of certain changes in accounting principles and corrections to previously issued financial statements. 2. Beginning in fiscal 2017, we modified the calculation of Adjusted EBITDA and Adjusted EBITDA Margin to exclude acquisition and integration costs. We have not adjusted the historical presentation of Adjusted EBITDA and Adjusted EBITDA Margin because acquisition and integration costs in prior periods were not material to the Company’s results of operations. 35

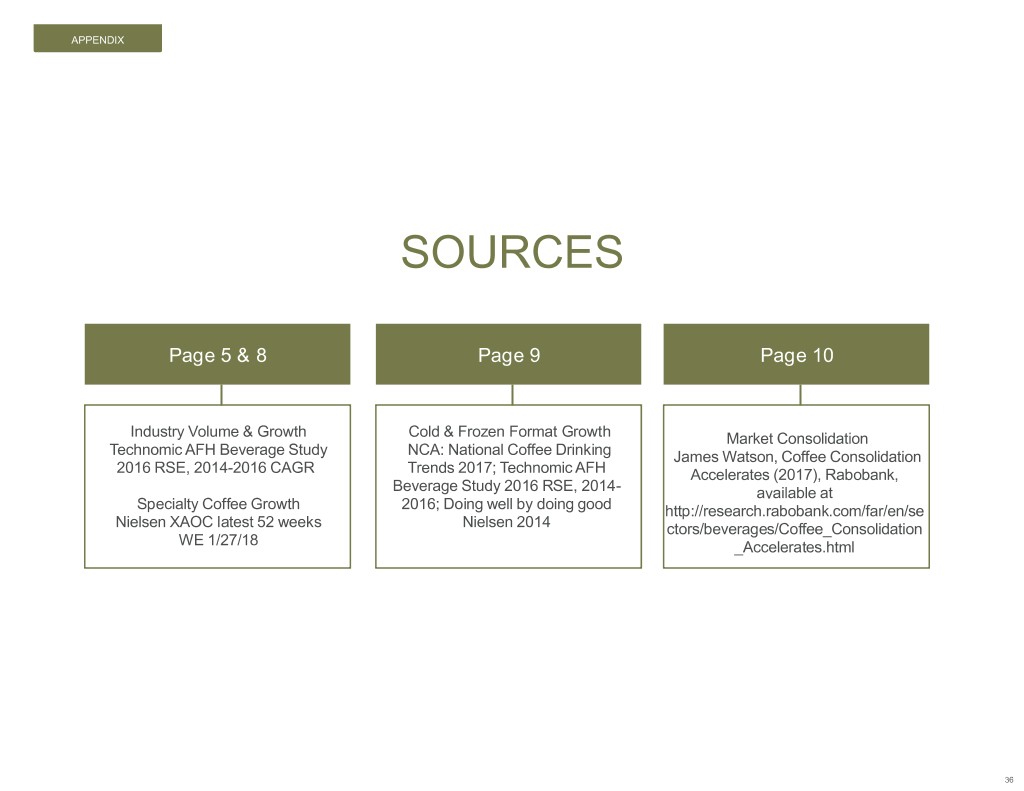

APPENDIX SOURCES Page 5 & 8 Page 9 Page 10 Industry Volume & Growth Cold & Frozen Format Growth Market Consolidation Technomic AFH Beverage Study NCA: National Coffee Drinking James Watson, Coffee Consolidation 2016 RSE, 2014-2016 CAGR Trends 2017; Technomic AFH Accelerates (2017), Rabobank, Beverage Study 2016 RSE, 2014- available at Specialty Coffee Growth 2016; Doing well by doing good http://research.rabobank.com/far/en/se Nielsen XAOC latest 52 weeks Nielsen 2014 ctors/beverages/Coffee_Consolidation WE 1/27/18 _Accelerates.html 36

APPENDIX FORWARD-LOOKING STATEMENTS Certain statements contained in this presentation are not based on historical fact and are forward-looking statements within the meaning of federal securities laws and regulations. These statements are based on management’s current expectations, assumptions, estimates and observations of future events and include any statements that do not directly relate to any historical or current fact; actual results may differ materially due in part to the risk factors set forth in our most recent 10-K and 10-Q filings. These forward- looking statements can be identified by the use of words like “anticipates,” “estimates,” “projects,” “expects,” “plans,” “believes,” “intends,” “will,” “assumes” and other words of similar meaning. Owing to the uncertainties inherent in forward-looking statements, actual results could differ materially from those set forth in forward-looking statements. We intend these forward-looking statements to speak only at the time of this presentation and do not undertake to update or revise these statements as more information becomes available except as required under federal securities laws and the rules and regulations of the SEC. Factors that could cause actual results to differ materially from those in forward looking statements include, but are not limited to, the success of our corporate relocation plan, the timing and success of our DSD restructuring plan, the Company’s success in consummating acquisitions and integrating acquired businesses, the impact of capital improvement projects, the adequacy and availability of capital resources to fund the Company’s existing and planned business operations and the Company’s capital expenditure requirements, the relative effectiveness of compensation-based employee incentives in causing improvements in Company performance, the capacity to meet the demands of our large national account customers, the extent of execution of plans for the growth of Company business and achievement of financial metrics related to those plans, the ability of the Company to retain and/or attract qualified employees, the success of the Company’s adaptation to technology and new commerce channels, the effect of the capital markets as well as other external factors on stockholder value, fluctuations in availability and cost of green coffee, competition, organizational changes, the effectiveness of our hedging strategies in reducing price risk, changes in consumer preferences, our ability to provide sustainability in ways that do not materially impair profitability, changes in the strength of the economy, business conditions in the coffee industry and food industry in general, our continued success in attracting new customers, variances from budgeted sales mix and growth rates, weather and special or unusual events, as well as other risks described in this presentation and other factors described from time to time in our filings with the SEC. 37

38