Attached files

| file | filename |

|---|---|

| 8-K - 8-K - VICI PROPERTIES INC. | a8-kxupdatedinvestorpresen.htm |

Exhibit 99.1 INVESTOR PRESENTATION

hetcs\Discussion Materials\2017-09 VICI Refi RFP\07. RAP\VICI RAP v126.pptx DISCLAIMERS Forward Looking Statements Certain statements in this presentation and that may be made in meetings are forward‐looking statements. Forward‐looking statements are based on the Company’s current plans, expectations and projections about future events and are not guarantees of future performance. These statements can be identified by the fact that they do not relate to strictly historical and current facts and by the use of the words such as "expects", "plans" "opportunities" and similar words and variations thereof. Although the Company believes that the expectations reflected in such forward‐looking statements are based on reasonable assumptions, its results, performance and achievements could differ materially from those expressed in or by the forward‐looking statements and may be affected by a variety of risks and other factors including, among others: risks that the acquisition of the Margaritaville Resort Casino and Harrah’s Philadelphia may not be consummated on the terms or timeframe described herein, or at all; the ability of the parties to satisfy the conditions set forth in the definitive transaction documents for the acquisition of the Margaritaville Resort Casino and Harrah’s Philadelphia, including the ability to receive, or delays in obtaining, the regulatory and other approvals and/or consents required to consummate the transactions; the risk that the call right to reacquire the Octavius Property, in the event that the Harrah’s Philadelphia Purchase Agreement is terminated, may be exercised; the terms on which the Company finances the Margaritaville Resort Casino and Harrah’s Philadelphia transactions, including the source of funds used to finance such transactions; disruptions to the real property and operations of the Margaritaville Resort Casino and Harrah’s Philadelphia during the pendency of the closings; risks that the Company may not achieve the benefits contemplated by our pending and recently completed acquisitions of real estate assets (including any expected accretion or the amount of any future rent payments); risks that not all potential risks and liabilities have been identified in the due diligence for our pending and recently completed transactions; the Company's dependence on subsidiaries of Caesars Entertainment Corporation ("Caesars") as tenant of all of its properties and Caesars or its subsidiaries as guarantor of the lease payments and the consequences of any material adverse effect on their business could have on the Company; the Company's dependence on the gaming industry; the Company's ability to pursue its business and growth strategies may be limited by its substantial debt service requirements and by the requirement that the Company distribute 90% of its real estate investment trust ("REIT") taxable income in order to qualify for taxation as a REIT and that the Company distribute 100% of its REIT taxable income in order to avoid current entity level U.S. Federal income taxes; the impact of extensive regulation from gaming and other regulatory authorities; the ability of the Company's tenants to obtain and maintain regulatory approvals in connection with the operation of the Company's properties; the possibility that our tenants may choose not to renew their lease agreements with the Company following the initial or subsequent terms of the leases; restrictions on the Company's ability to sell its properties subject to the lease agreements; the Company's substantial amount of indebtedness and ability to service and refinance such indebtedness; the Company's historical and pro forma financial information may not be reliable indicators of its future results of operations and financial condition; the Company's inability to achieve the expected benefits from operating as a company independent of Caesars; limits on the Company's operational and financial flexibility imposed by its debt agreements; the possibility the Company's separation from Caesars Entertainment Operating Company, Inc. ("CEOC") fails to qualify as a tax‐free spin‐off, which could subject the Company to significant tax liabilities. Additional important factors that may affect the Company’s business, results of operations and financial position are described from time to time in the Company’s Annual Report on Form 10‐K for the year ended December 31, 2017, Quarterly Reports on Form 10‐Q and the Company’s other filings with the Securities and Exchange Commission. The Company does not undertake any obligation to update or revise any forward‐looking statement, whether as a result of new information, future events, or otherwise, except as may be required by applicable law. Caesars Information The Company makes no representation as to the accuracy or completeness of the information regarding Caesars included in this presentation. The historical audited and unaudited financial statements of Caesars, as the parent and guarantor of CEOC, the Company's significant lessee, have been filed with the SEC. Certain financial and other information for Caesars and CEOC included in this presentation have been derived from Caesars' public filings and other publicly available presentations and press releases. Market and Industry Data This presentation contains estimates and information concerning the Company's industry, including market position, rent growth and rent coverage of the Company's peers, that are based on industry publications, reports and peer company public filings. This information involves a number of assumptions and limitations, and you are cautioned not to rely on or give undue weight to this information. This Company has not independently verified the accuracy or completeness of the data contained in these industry publications, reports or filings. This industry in which the Company operates is subject to a high degree of uncertainty and risk due to variety of factors, including those described in the "Risk Factors" section of the Company's public filings with the SEC. Non‐GAAP Financial Measures This presentation includes reference to Funds From Operations (“FFO”), FFO per share, Adjusted Funds From Operations (“AFFO”), AFFO per share, and Adjusted EBITDA, which are not required by, or presented in accordance with, generally accepted accounting principles in the United States (“GAAP”). These are non‐GAAP financial measures and should not be construed as alternatives to net income or as an indicator of operating performance (as determined in accordance with GAAP). We believe FFO, FFO per share, AFFO, AFFO per share, and Adjusted EBITDA provide a meaningful perspective of the underlying operating performance of our business. For additional information regarding these non-GAAP financial measures, as well as certain non-GAAP financial measures of Caesars and CEOC, see “Definitions of Non-GAAP Financial Measures” included in the Appendix at the end of this presentation. Financial Data Financial information provided herein is as of June 30, 2018 unless otherwise noted. Published September 25, 2018. 2

hetcs\Discussion Materials\2017-09 VICI Refi RFP\07. RAP\VICI RAP v126.pptx VICI IS THE NEXT GENERATION EXPERIENTIAL REAL ESTATE COMPANY MISSION TO BE AMERICA’S MOST DYNAMIC LEISURE & HOSPITALITY EXPERIENTIAL REAL ESTATE COMPANY VISION WE SEEK TO BE THE REAL ESTATE PARTNER OF CHOICE FOR THE LEADING CREATORS & OPERATORS OF PLACE -BASED, SCALED LEISURE & HOSPITALITY EXPERIENCES WE SEEK TO LEASE PROPERTIES TO TENANTS WITH MARKET - LEADING RELATIONSHIPS WITH HIGH VALUE CONSUMERS OF LEISURE & HOSPITALITY 3

hetcs\Discussion Materials\2017-09 VICI Refi RFP\07. RAP\VICI RAP v126.pptx VICI PROVIDES THE OPTIMAL COMBINATION OF: ✓ Sector Revenue Stability Across All Cycles ✓ Long-term Leases Backed by 3.6x Rent Coverage ✓ In-Place Acquisition Opportunities ✓ Potential & Credibility for Substantial Non-gaming Growth ✓ +$7Bn of Activity in First 10 Months ✓ Fully Internalized Governance & Management 4

1Portfolio Income: Character & Quality 5

hetcs\Discussion Materials\2017-09 VICI Refi RFP\07. RAP\VICI RAP v126.pptx FUNDAMENTAL ADVANTAGES OF OUR EXPERIENTIAL AND GAMING REAL ESTATE PORTFOLIO Diversified High Barriers to State & Local Triple Net REIT Revenue Streams Entry Given 1 2 3 4 Incentives to with 100% from Gaming, Legislative & Ensure Casinos Occupancy F&B, Retail and Regulatory Thrive Entertainment Controls Regional Gaming Lack of Near Cash Flows Show 5 Tenant Financial 7 Term Supply 8 6 Transparent Low Volatility Transparency & Growth in Highly Growth Pipeline Through All Strength Desirable Las Cycles, Including Vegas Market Financial Crisis 6

hetcs\Discussion Materials\2017-09 VICI Refi RFP\07. RAP\VICI RAP v126.pptx INCOME FOUNDATION: STRENGTH OF OUR TENANT Tenant’s Underlying Revenue Diversity 1 Broad Array of Revenue Streams Other2 12% 1.3MM Casino Sq.Ft. 120+ Restaurants ~14,500 Hotel Food and Rooms Beverage Gaming 19% 51% Rooms 18% 50+ Retail Outlets 780K Sq.Ft Meeting ~1,600 Annual Space Ticketed Shows …A Well Capitalized Tenant with Total Rewards System Drives… Strong Rent Coverage Total Rewards is the Gaming Industry’s First, Largest, Enterprise EBITDAR & Margin, Corporate Level Rent Coverage 3,4 and Most Preferred Loyalty Program 27% 28% 26% $2,245 $2,270 25% $2,204 $2,120 3.6x 3.6x 3.5x >60% ~40 >50mm 3.4x Members view it as Casinos accept Total Members from all their preferred Rewards across 23 50 states and 125 loyalty program different markets countries 2015 2016 2017 LTM 6/30/18 Source: Caesars public filings, Caesars Form 10-K for the year ended December 31, 2017 and Form 10-Q for the quarter ended June 30, 2018 1. Represents 12 months ended June 30, 2018 revenue by vertical for Caesars based on Caesars’ Form 10-Q for the quarter ended June 30, 2018 and Same-Store supplemental information in Caesars’ “Effect of Revenue Recognition Restatement”, which are publicly available. 2. Includes entertainment revenues, rental income, and parking revenues. 3. See Appendix to this presentation for additional information, including the definition and reconciliation to the most comparable GAAP financial measure. Caesars Enterprise Wide Adjusted EBITDAR does not give pro forma effect to the merger with Caesars Acquisition Corporation, but includes the operations of Caesars Entertainment Operating Company. 7 4. Caesars provides corporate level guarantee of the rent obligations for all VICI owned properties except Harrah’s Las Vegas, which is guaranteed by CRC. $ in millions; Caesars EBITDAR / VICI Rent x

hetcs\Discussion Materials\2017-09 VICI Refi RFP\07. RAP\VICI RAP v126.pptx INCOME DURABILITY THROUGHOUT ECONOMIC CYCLES Gaming Revenue: 50% Less Volatile than S&P 500 Revenue… 300% Peak-to-trough: 250% Gambling -9% Retail -11% S&P Sales -18% 200% 150% 100% Casino Gambling PCE1 Retail & Food Service Sales S&P 500 Revenue/Share 50% Q498 Q400 Q402 Q404 Q406 Q408 Q410 Q412 Q414 Q416 …With Demonstrated Durability in Regional Markets Core “Same Store” Commercial Gaming Revenues (US$bn, annual)2 18.5 2007 peak: $18.0 2017: $18.3bn 18.0 17.5 Peak to Trough: -3.9% 2009-17 Change in: 2017 vs Peak: +1.9% 17.0 2009 trough: $17.3bn Revenues: +$1.0bn 2017 vs Trough: +6.0% Investment: +$1.7bn 2009-17 CAGR: +0.7% 16.5 2007 2009 2011 2013 2015 2017 Source: Haver Analytics, Goldman Sachs Global Investment Research, Published February 26, 2018. Source: State Gaming Boards, UNLV, Credit Suisse. Credit Suisse Research, Published September 11, 2018. 1. Refers to the Personal Consumption Expenditures as defined and reported by the U.S. Bureau of Economic Analysis. 2. Core “same store” regional markets and focus on more mature and representative commercial regional gaming markets, adjusted for adjacent new supply, cannibalization between 8 markets; and excluding genuinely additive supply and destination markets.

hetcs\Discussion Materials\2017-09 VICI Refi RFP\07. RAP\VICI RAP v126.pptx INCOME MAGNITUDE AND VALUE 2015 – 2018 Single-Asset Real Estate Transactions with NOI > $70 Million NOI ($MM) 120 245 Park Ave, NYC 1 100 Fashion Show, LV 1095 Sixth Ave, NYC 1 MGM National Harbor, MD 787 Seventh Ave, NYC Worldwide Plaza, NYC1 Harrah’s Las Vegas 1 80 10 Hudson Yards, NYC 1285 Sixth Ave, NYC 1515 Broadway, NYC1 1 1211 Sixth Ave, NYC 50 Northern Ave, Boston 60 0% 3% 6% 9% Cap Rate (%) Circle sizes represent relative asset value Source: Real Capital Analytics (RCA). 1. Transaction was for a stake in the property; bubble represents the implied price of 100% interest. 9

hetcs\Discussion Materials\2017-09 VICI Refi RFP\07. RAP\VICI RAP v126.pptx INCOME FLOW THROUGH & TRANSPARENCY Q2 2018 LTM Unlevered Cash Flow1 as % of Revenues 93% 90% Other REIT Sections Median = 53% 64% 63% 62% 62% 58% 53% 50% 48% 47% 45% 28% Mall VICI² Hotel Office Single Home Family Manuf Storage Student Housing Industrial NetLease Apartment Healthcare Strip Center Strip Transparency & Integrity of VICI AFFO Multiple & Payout Ratio3 18E AFFOx 18E Payout 18E AFFOx Delta 18E Payout Ratio Delta Incl. Redev Ratio Incl. Redev VICI4 14.4x 14.4x 0% 80% 80% 0% Subsector Triple Net 16.2x 16.3x 0% 83% 83% 0% Single Family 29.0x 30.0x 4% 43% 45% 2% Apartment 21.9x 23.5x 7% 70% 75% 5% Healthcare 16.4x 18.4x 12% 75% 83% 8% Malls 16.7x 18.8x 12% 93% 104% 10% Strip Center 13.8x 16.0x 16% 88% 102% 14% Office 29.4x 37.8x 29% 80% 104% 24% Simple Average 19.9x 24.5x 23% 78.7% 95.5% 16.8% Mkt Cap Wtd. 20.4x 22.7x 11% 77.9% 86.2% 8.3% Source: Company Filings; Goldman Sachs Global Investment Research 1. Calculated as EBITDA less capex. 2. Based on Q2 2018 LQA figures. Excludes tenant reimbursements and direct financing lease adjustments. Unlevered free cash flow reflects Adj. EBITDA less capex. 3. Redevelopment categorized as capex that does not lead to incremental portfolio square footage. 10 4. VICI information per midpoint of Company guidance issued September 2, 2018. AFFOx based on June 30, 2018 VICI share price of $20.64; Payout ratio based on an annualized quarterly announced dividend of $0.2875 per share.

2Growth Opportunities

hetcs\Discussion Materials\2017-09 VICI Refi RFP\07. RAP\VICI RAP v126.pptx CLEARLY IDENTIFIED AND ACTIONABLE GROWTH Broad Opportunities Across Identified and Other Experiential Real Estate Assets # of Properties As Well as ROFR on Any +84% Increase in Caesars Real Estate Number of Purchased Outside Clark Properties County, NV 7 35 3 3 2 19 1 Caesars Forum Convention Center Caesars Octavius Tower1 Initial Portfolio Recent Pending Call Option ROFR Assets Caesars Owned Total Identified Potential Third- Potential Other Acquisitions Acquisitions2 Properties (Centaur), Put-Call Assets 3 Portfolio Party Leisure, (Convention Gaming Assets Hospitality, and Center) Entertainment Assets Clear Pipeline for Growth + Other Gaming Assets + Other Leisure, Hospitality, and Entertainment Assets 1. The Company announced on July 12, 2018 that it completed the acquisition of the real estate assets related to Octavius Tower. This acquisition represents the consolidation of the portion of the remaining real estate of Caesars Palace Las Vegas not already owned by the Company. 2. On June 19, 2018, the Company announced that it entered into definitive agreements pursuant to which VICI will acquire the land and real estate assets of the Margaritaville Resort Casino. On July 12, 2018, the Company announced that it entered into definitive agreements pursuant to which VICI will acquire the land and real estate assets associated with Harrah’s Philadelphia. Both acquisitions are subject to customary closing conditions. 12 3. Caesars does not have a contractual obligation to sell these properties to VICI and will make an independent financial decision in any potential transaction.

hetcs\Discussion Materials\2017-09 VICI Refi RFP\07. RAP\VICI RAP v126.pptx SUBSTANTIAL ORGANIC RENT & AFFO GROWTH 5-Year Call Option From Emergence1 to Acquire Three Properties at a 10% Cap Rate2 with $130 Million of Total Rent as of June 20163 H A R R A H ’ S AT L A N T I C C I T Y H A R R A H ’ S L A U G H L I N H A R R A H ’ S N E W O R L E A N S Ability to Generate Highly Attractive Internal AFFO Growth Reinvested Same-Store Lease Internal Free Cash Flow4 Escalation5 AFFO Growth ~2-3% ~2.5% ~5% 1. Term extends until October 6, 2022. 2. Under the Call Right Agreements, rent equates to 60% of the trailing Property EBITDAR at the time of exercise. The Purchase Price is set at 10.0x rent. 3. Source: Caesars Entertainment Operating Company Disclosure Statement for the Debtors’ Second Amended Joint Plan of Reorganization filed in the United States Bankruptcy Court, Northern District of Illinois, Eastern Division on June 28, 2016. In conjunction with the Plan of Reorganization, the Debtors’ investment banker performed a valuation analysis. Such valuation assumed annual rent associated with the option properties of $130.0 million. These estimates were prepared by the Debtors. There can be no assurance that the Company will acquire any or all of the option properties, and the acquisition of the option properties is subject to various risks and uncertainties, including business, regulatory and others. 4. Assumes AFFO payout ratio of ~70-80%, AFFO/share per midpoint of Company guidance issued September 2, 2018, acquisitions at an 8.5% cap rate on an assumed 5.5x leverage neutral basis and illustrative debt costs of 5.0%. 13 5. Same-store lease escalation is pro forma for the pending closing of the Harrah’s Philadelphia (and associated lease modifications) and Margaritaville Bossier acquisitions and completed closing of Octavius Tower acquisition. Assumes illustrative debt / TEV of 50%.

hetcs\Discussion Materials\2017-09 VICI Refi RFP\07. RAP\VICI RAP v126.pptx LAS VEGAS LAND PROVIDES OPPORTUNITY FOR FURTHER GROWTH Unrivaled Opportunity to Deepen the Strip at its Center VICI has a Put-Call Rights Agreement on 18 acres for Caesars’ The Mirage expected Caesars Forum Venetian Convention Center Caesars Harrah’s Caesars-owned 41 acres Palace The LINQ VICI-owned 27 acres of land that is part of the Non-CPLV lease Bellagio strategically located adjacent Paris to the LINQ and behind Planet Hollywood The Cosmopolitan Planet Hollywood VICI-owned 7 acres of Strip frontage property at Caesars Palace part of the CPLV lease and available for redevelopment Note: Map is illustrative and may not be shown exactly to scale. 14

hetcs\Discussion Materials\2017-09 VICI Refi RFP\07. RAP\VICI RAP v126.pptx POTENTIAL NON-GAMING EXTERNAL GROWTH OPPORTUNITIES Recreation / Hospitality ($78Bn)1 Fitness Centers ($34Bn) Concert Venues ($32Bn) Theme Parks ($18Bn) Movie Theatres ($17Bn) Spa / Wellness ($17bn) Cultural ($15Bn) Size of Market (Revenues) of Market Size Sports Arenas ($9bn)² Ski Resorts ($3bn) How do you get there? Walk Mass Transit Car Airplane How long do you stay there? Minutes Hour Hours Day Days Disciplined M&A Approach 1. Market Quality Other Leisure & Hospitality 2. Asset Real Estate Quality Non-Gaming Resorts International Gaming Opportunities 3. Asset Income Quality Casino Acquisitions w/ other Gaming Cos. Acquisition & Development Partnerships with Caesars EconomicStrategic & Risk 4. Accretion Time Opportunities Growth Source: IBISWorld. ¹ Reflects Bars and Nightclubs ($26bn), Golf Courses ($24bn), Golf Driving Ranges & Family Fun Centers ($13.5bn), Marinas ($5bn), Bowling ($4bn), Arcade & Entertainment Centers ($2bn), Pool Halls ($2bn), and Ice Skating Rinks ($0.9bn). ² Reflects sports franchise ticket sales and concession revenues. 15

hetcs\Discussion Materials\2017-09 VICI Refi RFP\07. RAP\VICI RAP v126.pptx THE ADVANTAGE OF EXPERIENTIAL REAL ESTATE Consumer Spending on “Experiences” Has Greatly Outpaced “Things” During the Past 15 Years 2,000 5.3% 1,500 Shift in Spending 2.8% Behavior 1,000 2.3% Indexed PCE Performance PCE Indexed 500 1.5% 0 0% 1% 2% 3% 4% 5% 6% CAGR Since 2000 Motor Vehicles Clothing Home Furnishings Consumer Experiences Source: Bureau of Economic Analysis, William Blair Equity Research, Published July 20, 2017. 16

3Capability & Governance

hetcs\Discussion Materials\2017-09 VICI Refi RFP\07. RAP\VICI RAP v126.pptx RESULTS DRIVEN MANAGEMENT WITH OVER $7BN OF ACTIVITY VICI Has Accomplished More Since Emergence Than Many REITs Do in Their Entire History… DEBT CAPITAL EQUITY CAPITAL ACQUISITIONS / GROWTH ✓ Refinanced and Eliminated Purchase Acquisitions Rent ~$3.7Bn of Debt, Greatly ✓ Completed $1Bn Equity Price Reducing Interest Expense Private Placement to Fund Harrah’s Las $ 1,136____ $ 87 HLV Acquisition Vegas ✓ Reduced Leverage from Harrah’s 1 ✓ 8.4x at Emergence to 4.6x Completed $1.4Bn Upsized Philadelphia / $ 590 3___ $ 56 While Growing Enterprise IPO With Overallotment in Octavius Tower th Value from $8.3Bn to 4 Largest REIT IPO Margaritaville $ 261 ____ $ 23 $10.8Bn2 Total $ 1,987 ___ $ 167 …And With a Defined, In-Place Growth Plan, We are Just Beginning 1. Represents $3.2 billion Net Debt as of June 30, 2018, divided by the annualized 2Q’18 Adjusted EBITDA of $702 million. 2. TEV based on 2Q share count of 370.2 million and 6/30/18 share price of $20.64. 18 3. Net purchase price includes the impact of a $159 million reduction to the $241.5 million purchase price of Harrah’s Philadelphia, reflecting the aggregate net present value of the contemplated lease modifications with Caesars, resulting in net cash consideration for Harrah’s Philadelphia of $82.5 million.

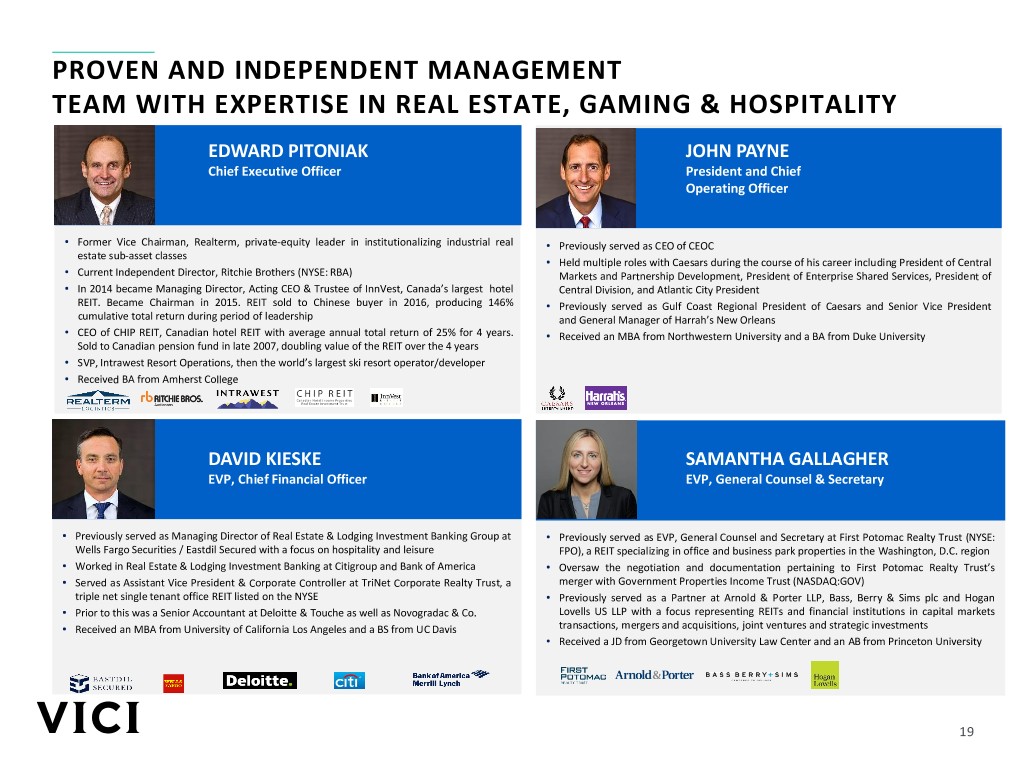

hetcs\Discussion Materials\2017-09 VICI Refi RFP\07. RAP\VICI RAP v126.pptx PROVEN AND INDEPENDENT MANAGEMENT TEAM WITH EXPERTISE IN REAL ESTATE, GAMING & HOSPITALITY EDWARD PITONIAK JOHN PAYNE Chief Executive Officer President and Chief Operating Officer • Former Vice Chairman, Realterm, private-equity leader in institutionalizing industrial real • Previously served as CEO of CEOC estate sub-asset classes • Held multiple roles with Caesars during the course of his career including President of Central • Current Independent Director, Ritchie Brothers (NYSE: RBA) Markets and Partnership Development, President of Enterprise Shared Services, President of • In 2014 became Managing Director, Acting CEO & Trustee of InnVest, Canada’s largest hotel Central Division, and Atlantic City President REIT. Became Chairman in 2015. REIT sold to Chinese buyer in 2016, producing 146% • Previously served as Gulf Coast Regional President of Caesars and Senior Vice President cumulative total return during period of leadership and General Manager of Harrah’s New Orleans • CEO of CHIP REIT, Canadian hotel REIT with average annual total return of 25% for 4 years. • Received an MBA from Northwestern University and a BA from Duke University Sold to Canadian pension fund in late 2007, doubling value of the REIT over the 4 years • SVP, Intrawest Resort Operations, then the world’s largest ski resort operator/developer • Received BA from Amherst College DAVID KIESKE SAMANTHA GALLAGHER EVP, Chief Financial Officer EVP, General Counsel & Secretary • Previously served as Managing Director of Real Estate & Lodging Investment Banking Group at • Previously served as EVP, General Counsel and Secretary at First Potomac Realty Trust (NYSE: Wells Fargo Securities / Eastdil Secured with a focus on hospitality and leisure FPO), a REIT specializing in office and business park properties in the Washington, D.C. region • Worked in Real Estate & Lodging Investment Banking at Citigroup and Bank of America • Oversaw the negotiation and documentation pertaining to First Potomac Realty Trust’s • Served as Assistant Vice President & Corporate Controller at TriNet Corporate Realty Trust, a merger with Government Properties Income Trust (NASDAQ:GOV) triple net single tenant office REIT listed on the NYSE • Previously served as a Partner at Arnold & Porter LLP, Bass, Berry & Sims plc and Hogan • Prior to this was a Senior Accountant at Deloitte & Touche as well as Novogradac & Co. Lovells US LLP with a focus representing REITs and financial institutions in capital markets • Received an MBA from University of California Los Angeles and a BS from UC Davis transactions, mergers and acquisitions, joint ventures and strategic investments • Received a JD from Georgetown University Law Center and an AB from Princeton University 19

hetcs\Discussion Materials\2017-09 VICI Refi RFP\07. RAP\VICI RAP v126.pptx INDEPENDENT AND EXPERIENCED BOARD OF DIRECTORS ✓ N O T E N A N T / D I R E C T O R O V E R L A P ✓ S E P A R A T I O N O F C H A I R M A N & C E O R O L E ✓ 0 % P A R E N T / T E N A N T C O M P A N Y O W N E R S H I P ✓ A N N U A L L Y E L E C T E D B O A R D 1 ✓ I N D E P E N D E N T C H A I R M A N James Abrahamson* Diana Cantor Eugene Davis Eric Hausler AFFILIATIONS AFFILIATIONS AFFILIATIONS AFFILIATIONS BIOGRAPHY BIOGRAPHY BIOGRAPHY BIOGRAPHY • Chairman of Interstate Hotels & Resorts • Partner with Alternative Investment • Founder and CEO of PIRINATE Consulting Group, LLC • Previously served as CEO of Isle of Capri • Previously served as Interstate’s CEO from Management, LLC • Serves as Chairman of the Board of Atlas Casinos 2011 to March 2017 • Vice Chairman of the Virginia Retirement System Iron Limited and WMIH Corporation • Previously served as ISLE’s CFO from • Serves as a director of Verso Corporation and Titan • Serves as an independent director at • Served as an MD with New York Private Bank 2014 to 2016 and Trust Energy CorePoint Lodging and at BrightView • Previously a director at Planet Hollywood, Delta • Served as an MD in Fixed Income Research, • Serves as a director at Domino’s Pizza, Inc. and Corporation Airlines, Windstar Cruise Line, Genco Shipping and covering the gaming, lodging and leisure Universal Corporation Trading, and Aliante industries for Bear Stearns Elizabeth Holland Craig Macnab Edward Pitoniak Michael Rumbolz AFFILIATIONS AFFILIATIONS AFFILIATIONS AFFILIATIONS BIOGRAPHY BIOGRAPHY BIOGRAPHY BIOGRAPHY • CEO of Abbell Associates, LLC • Held the position of Chairman and CEO of • CEO of VICI Properties Inc. • President and CEO of Everi Holdings, Inc. • Currently serves as an independent director National Retail Properties, Inc. from 2008 to • Previously served as Vice Chairman of • Serves as an independent director of of Federal Realty Investment Trust April 2017 Realterm Seminole Hard Rock Entertainment, LLC. • Serves the Executive Board and the Board • Serves as an independent director of Forest • Serves as an independent director of Ritchie • Previously served as Chairman and CEO of of Trustees of International Council of City and American Tower Corporation Brother Auctioneers Cash Systems, Inc. from 2005 – 2008 Shopping Centers • Previously served as director of Eclipsys • Served as Chairman of InnVest from Corporation from 2008 – 2014 and DDR 2015 – 2016 from 2013 – 2015 * Denotes Chair of Board of Directors 1. Opted out of the Maryland Unsolicited Takeover Act. 20

hetcs\Discussion Materials\2017-09 VICI Refi RFP\07. RAP\VICI RAP v126.pptx STRONG CORPORATE GOVERNANCE HIGHLIGHTED BY INDEPENDENCE FROM TENANT O v e r l a p p i n g P D i r e c t o r s w i t h Te n a n t 0 4 2 P a r e n t / Te n a n t P C o m p a n y 1 2 O w n e r s h i p 0% 75% 10% P I n d e p e n d e n t C h a i r m a n Yes No No S e p a r a t i o n o f P P C h a i r m a n & C E O R o l e Yes Yes No P P S t a g g e r e d B o a r d ? No3 No Yes Source: Company filings 1. MGM ownership PF for May 2018 Empire City Casino acquisition in which MGP issued ~12.9 million OP units to MGM ($380 million issued at 5/25/18 close price of $29.38). 2. Includes 9.9% overlapping insiders for GLPI and tenant. 21 3. Opted out of MUTA.

Appendix

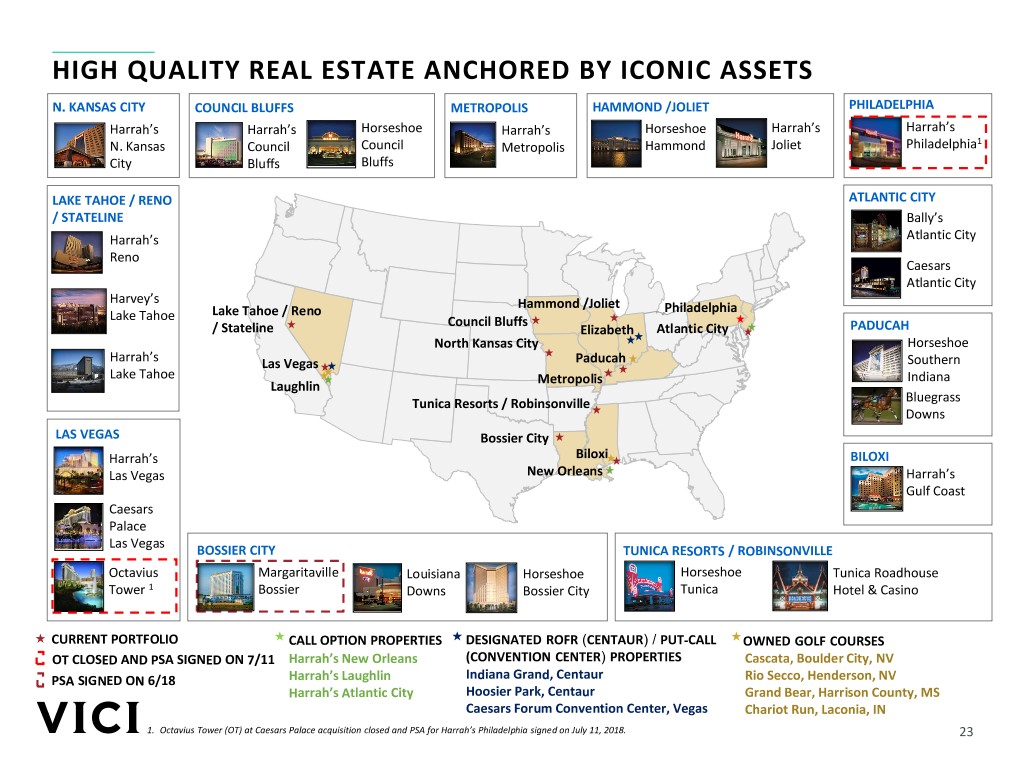

hetcs\Discussion Materials\2017-09 VICI Refi RFP\07. RAP\VICI RAP v126.pptx HIGH QUALITY REAL ESTATE ANCHORED BY ICONIC ASSETS N. KANSAS CITY COUNCIL BLUFFS METROPOLIS HAMMOND /JOLIET PHILADELPHIA Harrah’s Harrah’s Horseshoe Harrah’s Horseshoe Harrah’s Harrah’s N. Kansas Council Council Metropolis Hammond Joliet Philadelphia1 City Bluffs Bluffs LAKE TAHOE / RENO ATLANTIC CITY / STATELINE Bally’s Harrah’s Atlantic City Reno Caesars Atlantic City Harvey’s Hammond /Joliet Lake Tahoe / Reno Philadelphia Lake Tahoe Council Bluffs / Stateline Elizabeth Atlantic City PADUCAH North Kansas City Horseshoe Harrah’s Las Vegas Paducah Southern Lake Tahoe Metropolis Indiana Laughlin Tunica Resorts / Robinsonville Bluegrass Downs LAS VEGAS Bossier City Harrah’s Biloxi BILOXI Las Vegas New Orleans Harrah’s Gulf Coast Caesars Palace Las Vegas BOSSIER CITY TUNICA RESORTS / ROBINSONVILLE Octavius Margaritaville Louisiana Horseshoe Horseshoe Tunica Roadhouse Tower 1 Bossier Downs Bossier City Tunica Hotel & Casino CURRENT PORTFOLIO CALL OPTION PROPERTIES DESIGNATED ROFR (CENTAUR) / PUT-CALL OWNED GOLF COURSES OT CLOSED AND PSA SIGNED ON 7/11 Harrah’s New Orleans (CONVENTION CENTER) PROPERTIES Cascata, Boulder City, NV PSA SIGNED ON 6/18 Harrah’s Laughlin Indiana Grand, Centaur Rio Secco, Henderson, NV Harrah’s Atlantic City Hoosier Park, Centaur Grand Bear, Harrison County, MS Caesars Forum Convention Center, Vegas Chariot Run, Laconia, IN 1. Octavius Tower (OT) at Caesars Palace acquisition closed and PSA for Harrah’s Philadelphia signed on July 11, 2018. 23

hetcs\Discussion Materials\2017-09 VICI Refi RFP\07. RAP\VICI RAP v126.pptx BALANCE SHEET POSITIONED FOR GROWTH Capitalization Summary Disciplined Balance Sheet Management2 (Data as of June 30, 2018) Net Leverage Ratio progression $ and shares in millions 2Q’18 8.4x Revolving Credit Facility ($400 million capacity) $0 6.5x 4.7x Term Loan B Facility 2,100 4.6x Second Lien Notes 498 Emergence Initial HLV Post-IPO 6/30/2018 Total Non-CPLV 2,598 Acquisition 3.8x Interest CPLV CMBS Debt 1,550 Coverage Ratio3 Total Debt 4,148 Fixed / Floating Composition4 Cash (941) Variable Rate, 14% Net Debt $3,207 Total Common Shares Outstanding 370.1 Fixed Annualized 2Q’18 Adjusted EBITDA1 702 Rate, 86% Total Leverage Ratio 5.9x Net Leverage Ratio 4.6x 1. $175 million Adjusted EBITDA annualized. 2. Net Leverage Ratio calculated as Net Debt divided by Adjusted EBITDA. Emergence Net Leverage Ratio calculated based on $5.2 billion Net Debt and $618 million Adjusted EBITDA ($631 million 2016 PF Adj. EBITDA at Formation further adjusted for incremental estimated independent company G&A of $13 million). Initial HLV Acquisition Net Leverage Ratio calculated based on $4.8 billion Net Debt and $711 million Adjusted EBITDA ($724 million 2016 PF Adj. EBITDA further adjusted for incremental estimated independent company G&A of $13 million). See Appendix to this presentation for the definition and reconciliation to the most comparable GAAP financial measure. 3. Calculated as $702 million annualized 2Q’18 Adjusted EBITDA divided by $185 million annualized 2Q’18 interest expense, net. See Appendix to this presentation for additional information, 24 including the definition and reconciliation to the most comparable GAAP financial measure. 4. Reflects interest rate swap transactions entered into on April 24, 2018.

hetcs\Discussion Materials\2017-09 VICI Refi RFP\07. RAP\VICI RAP v126.pptx MASTER LEASE AGREEMENTS: TRIPLE NET STRUCTURE PROVIDES SECURITY & EARNINGS PREDICTABILITY Non-CPLV & Joliet (2 Leases)1 Caesars Palace Las Vegas2 Harrah’s Las Vegas Initial Rent $465 Million $165 Million $87 Million Annual >2% / change in CPI beginning >2% / change in CPI beginning 1% per year for years 2 – 5 and >2% / Escalator in year 6 in year 2 change in CPI thereafter Year 8: 70% Base / 30% Variable Year 8 & 11: 80% Base / 20% Variable Year 8 & 11: 80% Base / 20% Variable Rent Resets Year 11: 80% Base / 20% Variable HLV revenue 4% of revenue increase Annual Non‐CPLV Facility Net Revenue Annual Non‐CPLV Facility Net in year 8 (less year 1); additional Rental Reset of 19.5% (year 8) and 13% (year 11) Revenue of 13% in years 8 & 11 resets indexed to prior 3 years Term 15-year initial term with four 5-year renewal options Guarantee Caesars (CEC) Caesars Resorts Collection (CRC) Capex $350 Million Capex spending required over rolling 3 year $171 Million between 2017 and 20214 Requirement period at $100 Million minimum per year 3 1. Contemplated lease modifications, which are not reflected in the chart above, will modify annual escalators to start in year 2 and variable rent resets are reduced from 19.5% and 13% to 4% and based on a three‐year rolling average. Additionally, the contemplated lease modifications provide for a 1.7x EBITDAR coverage ratio. The contemplated lease modifications are subject to the closing of Harrah's Philadelphia, as well as obtaining requisite lender and holder consents under our debt documents. 2. Initial Base Rent does not include the $35 million base rent added with the acquisition of Octavius Tower, which closed on July 12, 2018. The Octavius Tower lease will be consolidated into the CPLV lease agreement upon the close of Harrah’s Philadelphia and the execution of the related lease modifications, which will modify the variable rent resets from 13% to 4% and provided for a 1.2x EBITDAR coverage ratio. 3. Over the three years, the $350 million minimum is allocated $84 million to CPLV, $255 million to Non‐CPLV (total $339 million) and the rest to CPLV/Non‐CPLV as tenant may elect. 4. Maintenance capex at 1% of net revenue thereafter. 5. Includes $10 million attributable to annual golf course fees. 25 6. Corporate Rent Coverage represents Caesars corporate level guarantee of the rent obligations for all VICI owned properties except Harrah’s Las Vegas, which is guaranteed by CRC. See later pages of the Appendix to this presentation for additional information, including the definition and reconciliation to the most comparable GAAP financial measure.

hetcs\Discussion Materials\2017-09 VICI Refi RFP\07. RAP\VICI RAP v126.pptx LEASE MODIFICATIONS PROVIDE STABILITY AND NEAR TERM GROWTH Lease Modifications Entered Into With Caesars In Connection With Octavius Tower and Pending Harrah’s Philadelphia1 Acquisitions Provide Long-Term Stability Anticipated Term Strategic Rationale Non-CPLV Master Lease Annual • 1.5% rent escalators beginning in year 2 ✓ Annual escalators enhance VICI’s current same store growth profile Escalators ✓ Previous magnitude of the rent reset discouraged Caesars to invest in properties • Variable rent resets in years 8 and 11 adjusted to be 4% and grow net property revenue Rent Resets of property net revenue change (vs. 19.5% / 13%) ✓ Removes potential volatility associated with property revenue EBITDAR • 1.2x EBITDAR coverage floor, beginning in out years ✓ Coverage floors are market standard, protects against business downturns Coverage Floor CPLV Master Lease ✓ Previous magnitude of the rent reset discouraged Caesars to invest in the • Variable rent resets in years 8 and 11 adjusted to be 4% property and grow net property revenue Rent Resets of property net revenue change (vs. 13%) ✓ Removes potential volatility associated with property revenue EBITDAR • 1.7x EBITDAR coverage floor, beginning in out years ✓ Coverage floors are market standard, protects against business downturns Coverage Floor 1. The contemplated lease modifications are subject to the closing of Harrah's Philadelphia, as well as obtaining requisite lender and holder consents under our debt documents. There can be no assurances that the transactions 26 contemplated here will close on the timeframes contemplated, or at all, and as such are subject to customary closing conditions including the receipt of regulatory approvals and other consents.

hetcs\Discussion Materials\2017-09 VICI Refi RFP\07. RAP\VICI RAP v126.pptx RECONCILIATION FROM GAAP TO NON-GAAP FINANCIAL MEASURES The following table reconciles net income to FFO, AFFO and Adjusted EBITDA, and Net Debt to Adjusted EBITDA less incremental G&A for the periods presented. At Formation1 – YE Post-HLV – YE Post-IPO – YE Three Months Ended ($ in millions) December 31, 2016 December 31, 20171 December 31, 20171 June 30, 2018 Net Income $421 $583 $583 $139 Real Estate Depreciation – – – – FFO $421 $583 $583 $139 Direct Financing Lease Adjustments2 (52) (57) (57) (13) Non-cash stock compensation – – – 1 Amortization of debt issuance costs and original issue discount – 6 6 1 Other Depreciation3 2 2 2 1 Capital Expenditures – – – (0) AFFO $372 $534 $534 $129 Interest Expense, Net 257 189 189 46 Provision for Income Taxes 2 2 2 0 Adjusted EBITDA $631 $724 $724 $175 Incremental G&A4 13 13 13 – Annualized Adjusted EBITDA less incremental G&A5 $618 $711 $711 $702 Total Debt (Including Preferred Equity6) 5,217 4,817 4,148 4,148 Cash and Cash Equivalents7 56 184 801 941 Net Debt $5,161 $4,633 $3,347 $3,208 Net Debt to Adjusted EBITDA less incremental G&A 8.4x 6.5x 4.7x 4.6x 1. Pro forma for Formation Transactions following Emergence as described in the Prospectus dated January 31, 2018 relating to the Company’s initial public offering. For further information, see “Unaudited Pro Forma Combined Condensed Financial Information” in “Selected Historical and Pro Forma Financial Data” starting on page 61. 2. Represents the non-cash adjustment to recognize fixed amounts due under the Lease Agreements on an effective interest basis at a constant rate of return over the terms of the leases. 3. Represents depreciation related to our golf course operations. 4. Represents midpoint of $12 million to $14 million estimate of general and administrative costs on a consolidated basis, including costs of operating as an independent company, incremental to the $11 million of general and administrative expenses reflected in unaudited pro forma combined statement of operations for the year ended December 31, 2016. 5. Annualized Adjusted EBITDA calculated by taking the quarterly EBITDA value less incremental G&A multiplied by 4. 6. Includes 12 million shares of Series A Preferred Equity with an aggregate liquidation preference of $300.0 million held by certain of CEOC’s creditors and backstop investors. 7. Cash and Cash Equivalents for the Post-IPO period includes $184 million of cash available on December 31, 2017, per the Form 10-K filed on March 28, 2018, plus $617 million of remaining cash proceeds generated from the completion of the Company’s initial public offering. 27

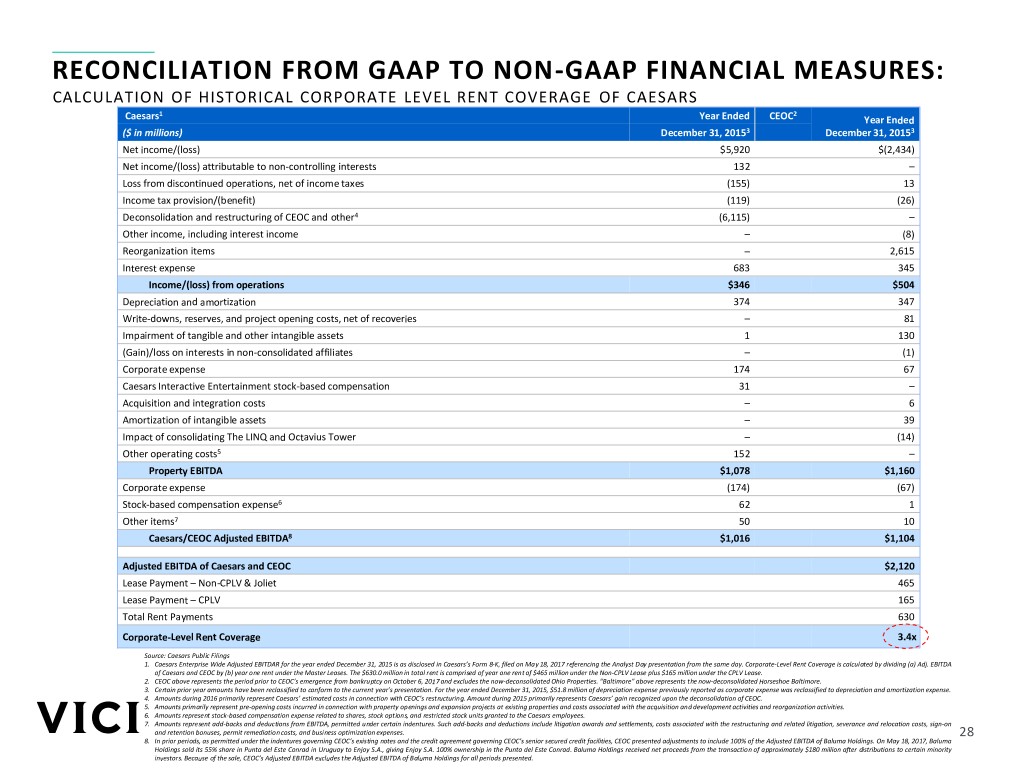

hetcs\Discussion Materials\2017-09 VICI Refi RFP\07. RAP\VICI RAP v126.pptx RECONCILIATION FROM GAAP TO NON-GAAP FINANCIAL MEASURES: CALCULATION OF HISTORICAL CORPORATE LEVEL RENT COVERAGE OF CAESARS 1 2 Caesars Year Ended CEOC Year Ended ($ in millions) December 31, 20153 December 31, 20153 Net income/(loss) $5,920 $(2,434) Net income/(loss) attributable to non-controlling interests 132 – Loss from discontinued operations, net of income taxes (155) 13 Income tax provision/(benefit) (119) (26) Deconsolidation and restructuring of CEOC and other4 (6,115) – Other income, including interest income – (8) Reorganization items – 2,615 Interest expense 683 345 Income/(loss) from operations $346 $504 Depreciation and amortization 374 347 Write-downs, reserves, and project opening costs, net of recoveries – 81 Impairment of tangible and other intangible assets 1 130 (Gain)/loss on interests in non-consolidated affiliates – (1) Corporate expense 174 67 Caesars Interactive Entertainment stock-based compensation 31 – Acquisition and integration costs – 6 Amortization of intangible assets – 39 Impact of consolidating The LINQ and Octavius Tower – (14) Other operating costs5 152 – Property EBITDA $1,078 $1,160 Corporate expense (174) (67) Stock-based compensation expense6 62 1 Other items7 50 10 Caesars/CEOC Adjusted EBITDA8 $1,016 $1,104 Adjusted EBITDA of Caesars and CEOC $2,120 Lease Payment – Non-CPLV & Joliet 465 Lease Payment – CPLV 165 Total Rent Payments 630 Corporate-Level Rent Coverage 3.4x Source: Caesars Public Filings 1. Caesars Enterprise Wide Adjusted EBITDAR for the year ended December 31, 2015 is as disclosed in Caesars’s Form 8-K, filed on May 18, 2017 referencing the Analyst Day presentation from the same day. Corporate-Level Rent Coverage is calculated by dividing (a) Adj. EBITDA of Caesars and CEOC by (b) year one rent under the Master Leases. The $630.0 million in total rent is comprised of year one rent of $465 million under the Non-CPLV Lease plus $165 million under the CPLV Lease. 2. CEOC above represents the period prior to CEOC’s emergence from bankruptcy on October 6, 2017 and excludes the now-deconsolidated Ohio Properties. “Baltimore” above represents the now-deconsolidated Horseshoe Baltimore. 3. Certain prior year amounts have been reclassified to conform to the current year’s presentation. For the year ended December 31, 2015, $51.8 million of depreciation expense previously reported as corporate expense was reclassified to depreciation and amortization expense. 4. Amounts during 2016 primarily represent Caesars’ estimated costs in connection with CEOC’s restructuring. Amount during 2015 primarily represents Caesars’ gain recognized upon the deconsolidation of CEOC. 5. Amounts primarily represent pre-opening costs incurred in connection with property openings and expansion projects at existing properties and costs associated with the acquisition and development activities and reorganization activities. 6. Amounts represent stock-based compensation expense related to shares, stock options, and restricted stock units granted to the Caesars employees. 7. Amounts represent add-backs and deductions from EBITDA, permitted under certain indentures. Such add-backs and deductions include litigation awards and settlements, costs associated with the restructuring and related litigation, severance and relocation costs, sign-on and retention bonuses, permit remediation costs, and business optimization expenses. 28 8. In prior periods, as permitted under the indentures governing CEOC’s existing notes and the credit agreement governing CEOC’s senior secured credit facilities, CEOC presented adjustments to include 100% of the Adjusted EBITDA of Baluma Holdings. On May 18, 2017, Baluma Holdings sold its 55% share in Punta del Este Conrad in Uruguay to Enjoy S.A., giving Enjoy S.A. 100% ownership in the Punta del Este Conrad. Baluma Holdings received net proceeds from the transaction of approximately $180 million after distributions to certain minority investors. Because of the sale, CEOC’s Adjusted EBITDA excludes the Adjusted EBITDA of Baluma Holdings for all periods presented.

hetcs\Discussion Materials\2017-09 VICI Refi RFP\07. RAP\VICI RAP v126.pptx RECONCILIATION FROM GAAP TO NON-GAAP FINANCIAL MEASURES: CALCULATION OF HISTORICAL CORPORATE LEVEL RENT COVERAGE OF CAESARS (CONT’D) Caesars adopted ASU 2014-09 effective January 1, 2018, using the full retrospective method, which requires the recasting of each prior reporting period presented consistent with the new standard. The most significant effects of adopting the new standard related to the accounting for Caesars’ Total Rewards customer loyalty program and casino promotional allowances. The following recast reconciliation is derived from the supplemental information in “Effect of Revenue Recognition Restatement” and the investor presentation “2Q 2018 Earnings” dated August 1, 2018 of Caesars Entertainment Corporation, which is publicly available. Three Months Ended Year-Ended December 31, March 31, June 30, March 31, June 30, ($ in millions) Twelve Months Ended 2016 2017 2017 2017 2018 2018 June 30, 2018 Net income/(loss) attributable to company $(2,681) $9,842 $(403) $(1,291) $(34) $29 $11,531 Net income/(loss) attributable to non-controlling interests (24) (13) 2 2 - - (17) Discontinued operations, net of income taxes (3,379) (26) - - - - (26) Income tax (benefit)/provision 338 (1,983) 61 40 13 (36) (2,107) Gain on deconsolidation of subsidiary - (31) - - - - (31) Restructuring of CEOC and other1 5,932 (7,837) 464 1,432 (184) (45) (9,962) Loss on extinguishment of debt - 220 - - - - 220 Interest expense 798 941 197 191 330 334 1,218 Depreciation and amortization 788 873 189 175 280 268 1,057 Corporate expense 264 282 56 74 82 76 310 Other operating costs2 102 48 (1) (34) 66 33 182 Property EBITDAR $2,138 $2,316 $565 $589 $553 $659 $2,375 Corporate expense (264) (282) (56) (74) (82) (76) (310) Stock-based compensation expense3 233 43 9 9 18 20 63 Other items4 28 129 18 27 29 20 132 Adjusted EBITDAR (Same-Store5) $2,135 $2,206 $536 $551 $518 $623 $2,260 Baltimore Adjusted EBITDAR5 69 39 14 15 - - 10 Adjusted EBITDAR $2,204 $2,245 $550 $566 $518 $623 $2,270 Lease Payment – Non-CPLV & Joliet 465 465 465 Lease Payment – CPLV 165 165 165 Total Rent Payments 630 630 630 Corporate-Level Rent Coverage 3.5x 3.6x 3.6x Source: Caesars Public Filings 1. 2018 amount primarily represents a change in fair value of our derivative liability related to the conversion option of the CEC Convertible Notes; 2017 amount primarily represents CEC’s costs in connection with the restructuring of CEOC. 2. Amounts primarily represent costs incurred in connection with the development activities and reorganization activities, and/or recoveries associated with such items. 3. Amounts represent stock-based compensation expense related to shares, stock options, and restricted stock units granted to the Company’s employees. 4. Amounts represent add-backs and deductions from adjusted EBITDAR permitted under certain indentures. Such add-backs and deductions include litigation awards and settlements, costs associated with CEOC’s restructuring and related litigation, severance and relocation costs, sign-on and retention bonuses, permit remediation costs, and business optimization expenses. 5. Same-store results include CEOC and certain of its U.S. subsidiaries as if they consolidated in all periods, and exclude the results of the Horseshoe Baltimore property in periods of its consolidation (dates prior to August 31, 2017). 29

hetcs\Discussion Materials\2017-09 VICI Refi RFP\07. RAP\VICI RAP v126.pptx DEFINITIONS OF NON-GAAP FINANCIAL MEASURES FFO is a non‐GAAP financial measure that is considered a supplemental measure for the real estate industry and a supplement to GAAP measures. Consistent with the definition used by The National Association of Real Estate Investment Trusts (“NAREIT”), we define FFO as net income (or loss) (computed in accordance with GAAP) excluding gains (or losses) from sales of property plus real estate depreciation. AFFO is a non‐GAAP measure that is used as a supplemental operating measure to evaluate our performance. We calculate AFFO by adding or subtracting from FFO direct financing lease adjustments, transaction costs incurred in connection with the acquisition of real estate investments, non‐cash stock‐based compensation expense, amortization of debt issuance costs and original issue discount, non‐cash interest expense, non‐real estate depreciation (which is comprised of the depreciation related to our golf course operations), capital expenditures (which are comprised of additions to property, plant and equipment related to our golf course operations), impairment charges on non‐real estate assets, amortization of capitalized leasing costs and gains (or losses) on debt extinguishment. Adjusted EBITDA is a non‐GAAP financial measure, which we define as net income as adjusted for gains (or losses) from sales of property, real estate depreciation, direct financing lease adjustments, transaction costs incurred in connection with the acquisition of real estate investments, non‐cash stock‐based compensation expense, amortization of debt issuance costs and original issue discount, other non‐cash interest expense, non‐real estate depreciation (which is comprised of the depreciation related to our golf course operations), capital expenditures (which are comprised of additions to property, plant and equipment related to our golf course operations), impairment charges on non‐real estate assets, amortization of capitalized leasing costs, gains (or losses) on debt extinguishment, interest expense, net and income tax expense. These non‐GAAP financial measures (i) do not represent cash flow from operations as defined by GAAP; (ii) should not be considered as an alternative to net income as a measure of operating performance or to cash flows from operating, investing and financing activities; and (iii) are not alternatives to cash flow as a measure of liquidity. In addition, these measures should not be viewed as measures of liquidity, our ability to make cash distributions, or our ability to make interest payments on our indebtedness. Investors are also cautioned that FFO, FFO per share, AFFO, AFFO per share and Adjusted EBITDA, as presented, may not be comparable to similarly titled measures reported by other REITs due to the fact that not all real estate companies use the same definitions. Our presentation of these measures does not replace the presentation of our financial results in accordance with GAAP Certain Non-GAAP Financial Measures of Caesars and CEOC In this presentation, we include Adjusted EBITDA of Caesars (which is the guarantor of the lease payment obligations under the Formation Lease Agreements) and CEOC (subsidiaries of which are tenants under the Formation Lease Agreements) and Adjusted EBITDAR of CEOC, all as reported by Caesars in its publicly available filings with the SEC. Each of Adjusted EBITDA and Adjusted EBITDAR is a non-GAAP financial measure and should not be construed as an alternative to net income/(loss) as an indicator of operating performance or as an alternative to cash flow provided by operating activities as a measure of liquidity (as determined in accordance with GAAP) of Caesars or CEOC Adjusted EBITDA of Caesars and CEOC is defined as net income/(loss) before (i) interest expense, net of interest capitalized and interest income, (ii) income tax provision, (iii) depreciation and amortization, (iv) corporate expenses, and (v) certain items that are not considered indicative of ongoing operating performance at an operating property level, further adjusted to exclude certain non-cash and other items Adjusted EBITDA of Caesars and CEOC may not be comparable to similarly titled measures reported by other companies within the industry. Caesars has indicated in its publicly available filings with the SEC that management of Caesars uses Adjusted EBITDA of Caesars and CEOC to measure performance and allocate resources and believes that Adjusted EBITDA provides investors with additional information consistent with that used by management and allows a better understanding of the results of operational activities separate from the financial impact of decisions made for the long-term benefit of the Caesars and CEOC. We, in turn, use Adjusted EBITDA of Caesars and CEOC to evaluate the capacity of Caesars and CEOC to meet their respective obligations under the Formation Lease Agreements. Such information is not publicly available for the applicable tenant under the HLV Lease Agreement or its guarantor Property EBITDAR of Caesars and CEOC is defined as revenues less property operating expenses and is comprised of net income/(loss) before (i) interest expense, net of interest capitalized and interest income, (ii) income tax provision, (iii) depreciation and amortization, (iv) corporate expenses, and (v) certain items that Caesars does not consider indicative of its ongoing operating performance at an operating property level. Adjusted EBITDAR is defined as EBITDAR further adjusted to exclude certain non-cash and other items as exhibited in the following reconciliation, and is presented as a supplemental measure of Caesars’ performance. Caesars has indicated that its management believes that Adjusted EBITDAR provides its investors with additional information and allows a better understanding of the results of operational activities separate from the financial impact of decisions made for the long-term benefit of Caesars. We, in turn, use Property EBITDAR and Adjusted EBITDAR of Caesars and CEOC to evaluate the ability of Caesars and CEOC to meet their respective obligations under the Formation Lease Agreements. 30