Attached files

| file | filename |

|---|---|

| 8-K - 8-K - ZAGG Inc | a201809248kcoverletter.htm |

ZAGG INC INVESTOR PRESENTATION © 2017 ZAGG IP Holding Co., Inc. TML-0066-B CONFIDENTIAL: Information contained herein is subject to non-disclosure agreement or other confidentiality requirements.

Cautionary note regarding forward-looking statements Forward-Looking Statements This presentation of ZAGG Inc (“ZAGG,” the “Company,” “we” or “us”) contains (and oral communications made by us may contain) “forward-looking statements” within the meaning of the safe harbor provisions of the U.S. Private Securities Litigation Reform Act of 1995. Forward-looking statements can be identified by words such as "anticipate," "believe," "estimate," "expect," "intend," "plan," "predict," "project," "target," “future,” “seek,” “likely,” “strategy,” “may,” “should,” “will” and similar references to future periods. Examples of forward-looking statements include, among others, statements we make regarding our guidance for the Company and statements that estimate or project future results of operations or the performance of the Company. Forward-looking statements are neither historical facts nor assurances of future performance. Instead, they are based only on our current beliefs, expectations and assumptions regarding the future of our business, future plans and strategies, projections, anticipated events and trends, the economy and other future conditions. Because forward-looking statements relate to the future, they are subject to inherent uncertainties, risks and changes in circumstances that are difficult to predict and many of which are outside of our control. Our actual results and financial condition may differ materially from those indicated in the forward-looking statements. Therefore, you should not rely on any of these forward-looking statements. Important factors that could cause our actual results and financial condition to differ materially from those indicated in the forward-looking statements include, among others, the following: (a) the ability to design, produce, and distribute the creative product solutions required to retain existing customers and to attract new customers; (b) building and maintaining marketing and distribution functions sufficient to gain meaningful international market share for our products; (c) the ability to respond quickly with appropriate products after the adoption and introduction of new mobile devices by major manufacturers like Apple, Samsung, and Google; (d) changes or delays in announced launch schedules for (or recalls or withdrawals of) new mobile devices by major manufacturers like Apple, Samsung, and Google; (e) the ability to successfully integrate new operations or acquisitions, (f) the impact of inconsistent quality or reliability of new product offerings; (g) the impact of lower profit margins in certain new and existing product categories, including certain mophie products; (h) the impacts of changes in economic conditions, including on customer demand; (i) managing inventory in light of constantly shifting consumer demand; (j) the failure of information systems or technology solutions or the failure to secure information system data, failure to comply with privacy laws, security breaches, or the effect on the company from cyber-attacks, terrorist incidents, or the threat of terrorist incidents; (k) adoption of or changes in accounting policies, principles, or estimates; (l) changes in law, economic and financial conditions, including the effect of enactment of US tax reform or other tax law changes; and (m) changes in US and international trade policy and tariffs, including the possible effect of recent US tariff proposals on selected materials used in the manufacture of products sold by the Company which are sourced from China. New factors emerge from time to time and it is not possible for management to predict all such factors, nor can it assess the impact of any such factor on the business or the extent to which any factor, or combination of factors, may cause results to differ materially from those contained in any forward-looking statement. Readers should also review the risks and uncertainties listed in our most recent Annual Report on Form 10-K and other reports we file with the U.S. Securities and Exchange Commission, including (but not limited to) Item 1A - "Risk Factors" in the Form 10-K and Management's Discussion and Analysis of Financial Condition and Results of Operations and the risks described therein from time to time. We undertake no obligation to publicly update any forward-looking statement, whether written or oral, that may be made from time to time, whether as a result of new information, future developments or otherwise. The forward-looking statements contained in this presentation are intended to qualify for the safe harbor provisions of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. This presentation also contains estimates and other statistical data made by independent parties and by ZAGG relating to market share, growth and other industry data. This data involves a number of assumptions and limitations, and you are cautioned not to give undue weight to such estimates. We have not independently verified the statistical and other industry data generated by independent parties and contained in this presentation and, accordingly, cannot guarantee their accuracy or completeness. In addition, projections, assumptions and estimates of our future performance and the future performance of the markets in which we compete are necessarily subject to a high degree of uncertainty and risk due to a variety of factors. These and other factors could cause results or outcomes to differ materially from those expressed in the estimates made by the independent parties and by ZAGG. Non-GAAP Financial Measures This presentation also includes certain non-GAAP financial measures, Adjusted EBITDA and Adjusted EBITDA Margin. Readers are cautioned that Adjusted EBITDA (earnings before interest, taxes, depreciation, amortization, stock-based compensation expense, other income (expense), mophie transaction expenses, mophie fair value inventory write-up related to acquisition, mophie restructuring charges, mophie employee retention bonus, loss on disputed mophie purchase price (2016 only), and impairment of intangible asset) and Adjusted EBITDA Margin (Adjusted EBITDA stated as a percentage of revenue) are not financial measures under US generally accepted accounting principles (“GAAP”). In addition, this financial information should not be construed as an alternative to any other measure of performance determined in accordance with GAAP, or as an indicator of operating performance, liquidity or cash flows generated by operating, investing and financing activities, as there may be significant factors or trends that it fails to address. As such, it should be read only in conjunction with our consolidated financial statements prepared in accordance with GAAP. We present Adjusted EBITDA and Adjusted EBITDA Margin because we believe that they are helpful to some investors as measures of performance. We caution readers that non-GAAP financial information, by its nature, departs from traditional accounting conventions. Accordingly, its use can make it difficult to compare current results with results from other reporting periods and with the financial results of other companies. We have provided a reconciliation of Adjusted EBITDA and Adjusted EBITDA Margin to the most directly comparable GAAP measures, which is available in the appendix. © 2017 ZAGG IP Holding Co., Inc. TML-0066-B CONFIDENTIAL: Information contained herein is subject to non-disclosure agreement or other confidentiality requirements.

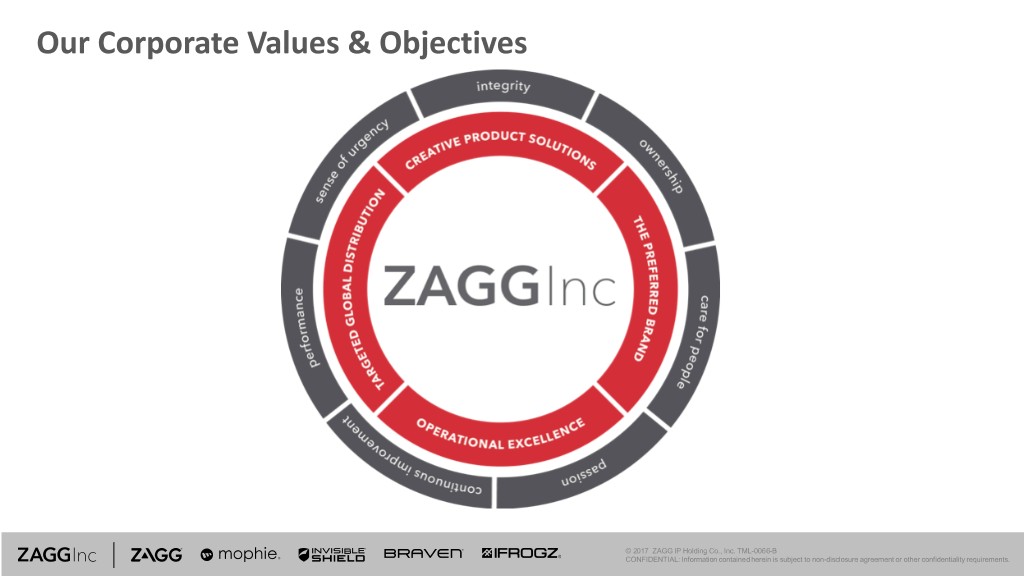

Our Corporate Values & Objectives © 2017 ZAGG IP Holding Co., Inc. TML-0066-B CONFIDENTIAL: Information contained herein is subject to non-disclosure agreement or other confidentiality requirements.

Our story…thus far A History of Innovation © 2017 ZAGG IP Holding Co., Inc. TML-0066-B CONFIDENTIAL: Information contained herein is subject to non-disclosure agreement or other confidentiality requirements.

A History of Innovation Category Pioneer & Creators . Screen Protection . Battery Phone Cases . Portable Batteries . Wireless Charging . Tablet Keyboards . Phone Cases . Rugged Bluetooth Speakers . Waterproof Bluetooth Speakers Patent Portfolio . 10X growth since 2013 2018 Best Wireless Bluetooth Speaker © 2017 ZAGG IP Holding Co., Inc. TML-0066-B CONFIDENTIAL: Information contained herein is subject to non-disclosure agreement or other confidentiality requirements.

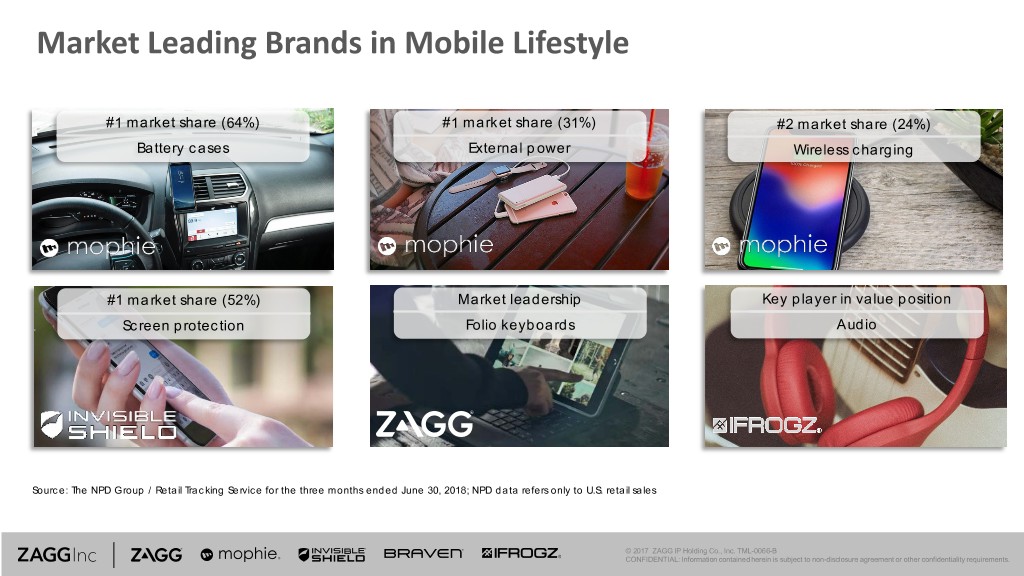

Market Leading Brands in Mobile Lifestyle #1 market share (64%) #1 market share (31%) #2 market share (24%) Battery cases External power Wireless charging #1 market share (52%) Market leadership Key player in value position Screen protection Folio keyboards Audio Source: The NPD Group / Retail Tracking Service for the three months ended June 30, 2018; NPD data refers only to U.S. retail sales © 2017 ZAGG IP Holding Co., Inc. TML-0066-B CONFIDENTIAL: Information contained herein is subject to non-disclosure agreement or other confidentiality requirements.

Product Portfolio Aligns With Consumer Needs 48% $300M Investment protection Handset costs continue to rise $519M Protecting trade-in value of device net sales Brittleness vs. scratch resistance screens $250M 2017 1.5 billion smartphones sold in 2017 $200M Extended power 26% Larger screens and thinner devices are gaining popularity Apps5% & increased phone usage drain battery at an alarming rate $150M 5%“Our One Wish? Longer Battery Life” – Wall Street Journal 15% $100M Mobile audio lifestyle 5% 5% People are consuming increasing amounts of content – 1% wireless options allow for more flexibility Mobile music listening has increased weekly headphone usage Screen Power Power Audio Keyboards Cases/ from 3 hours in 1980 to over 20 hours in 2016 Protection Management Cases Other Connectivity & productivity Mobile traffic outpacing desktop traffic Increasing frequency of working remotely Tablets being used for more than just consumption – content creation % of sales figures from 2017 year-end results © 2017 ZAGG IP Holding Co., Inc. TML-0066-B CONFIDENTIAL: Information contained herein is subject to non-disclosure agreement or other confidentiality requirements.

Aligned With Top OEMs © 2017 ZAGG IP Holding Co., Inc. TML-0066-B CONFIDENTIAL: Information contained herein is subject to non-disclosure agreement or other confidentiality requirements.

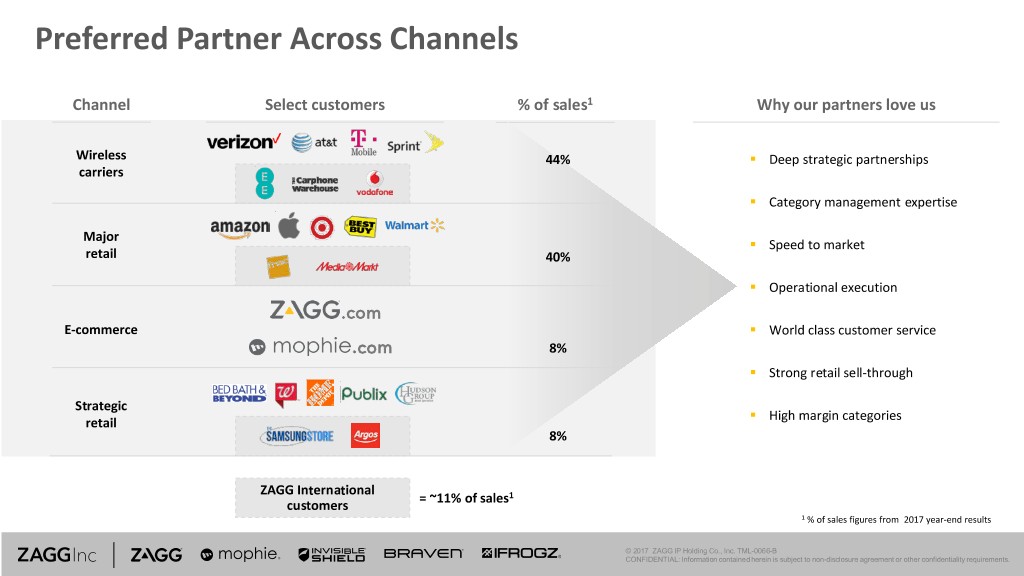

Preferred Partner Across Channels Channel Select customers % of sales1 Why our partners love us Wireless 44% . Deep strategic partnerships carriers . Category management expertise Major . Speed to market retail 40% . Operational execution .com E-commerce . World class customer service .com 8% . Strong retail sell-through Strategic . High margin categories retail 8% ZAGG International = ~11% of sales1 customers 1 % of sales figures from 2017 year-end results © 2017 ZAGG IP Holding Co., Inc. TML-0066-B CONFIDENTIAL: Information contained herein is subject to non-disclosure agreement or other confidentiality requirements.

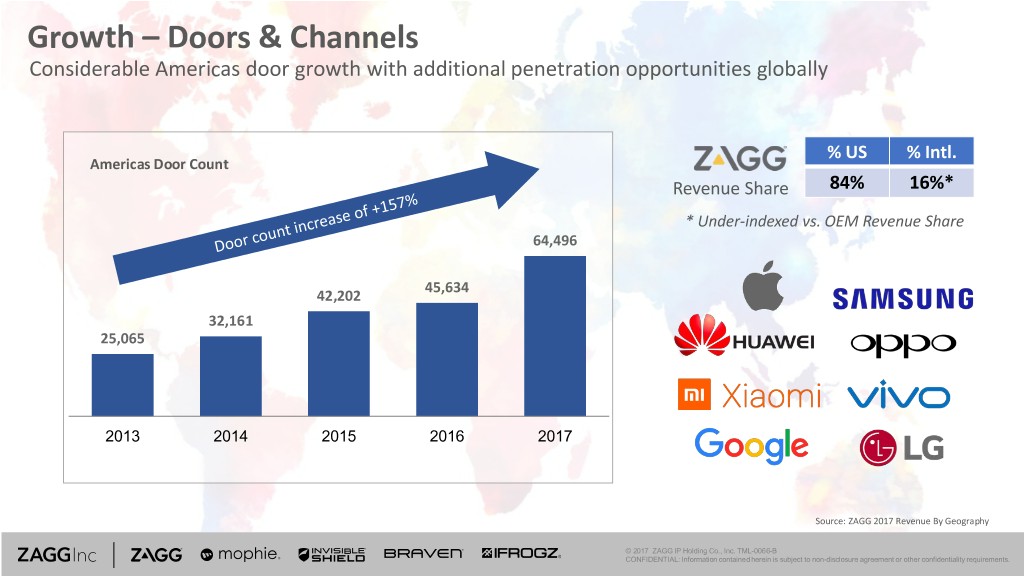

Growth – Doors & Channels Considerable Americas door growth with additional penetration opportunities globally % US % Intl. Americas Door Count Revenue Share 84% 16%* * Under-indexed vs. OEM Revenue Share 64,496 45,634 42,202 32,161 25,065 2013 2014 2015 2016 2017 Source: ZAGG 2017 Revenue By Geography © 2017 ZAGG IP Holding Co., Inc. TML-0066-B CONFIDENTIAL: Information contained herein is subject to non-disclosure agreement or other confidentiality requirements.

Growth – Categories Significant organic and inorganic expansion opportunities available M&A • Power Cases • Tablet Keyboards • Screen Protection • BT Earbuds • BT Speakers • TBD • Portable Power • Tablet/Laptop Cases • Insurance • BT Headphones • BT Earbuds • Wireless Charging • Hubs • Services • BT Speakers • BT Headphones • Cables & Adapters • Docks • Protective Cases • Home Audio • Car & Wall Chargers • Computer Keyboards • External protection • Alexa Enabled • Docks & Stands • Mice • Google Home Enabled • Protective Cases • Presenters • Cortana Enabled • Smartwatch Accys • BT Speakerphones • B2B Charging • Computer Headsets © 2017 ZAGG IP Holding Co., Inc. TML-0066-B CONFIDENTIAL: Information contained herein is subject to non-disclosure agreement or other confidentiality requirements.

InvisibleShield © 2017 ZAGG IP Holding Co., Inc. TML-0066-B CONFIDENTIAL: Information contained herein is subject to non-disclosure agreement or other confidentiality requirements.

InvisibleShield Brand #1 selling mobile screen protector More than 165 million sold worldwide 550+ Authorized InvisibleShield warranty retail locations in the U.S. & Canada © 2017 ZAGG IP Holding Co., Inc. TML-0066-B CONFIDENTIAL: Information contained herein is subject to non-disclosure agreement or other confidentiality requirements.

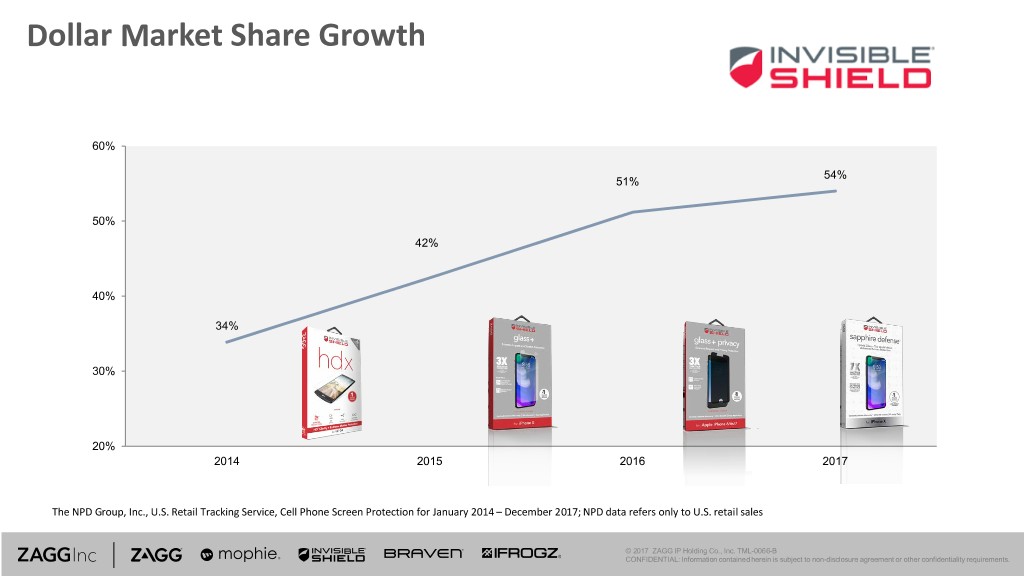

Dollar Market Share Growth 60% 54% 51% 50% 42% 40% 34% 30% 20% 2014 2015 2016 2017 The NPD Group, Inc., U.S. Retail Tracking Service, Cell Phone Screen Protection for January 2014 – December 2017; NPD data refers only to U.S. retail sales © 2017 ZAGG IP Holding Co., Inc. TML-0066-B CONFIDENTIAL: Information contained herein is subject to non-disclosure agreement or other confidentiality requirements.

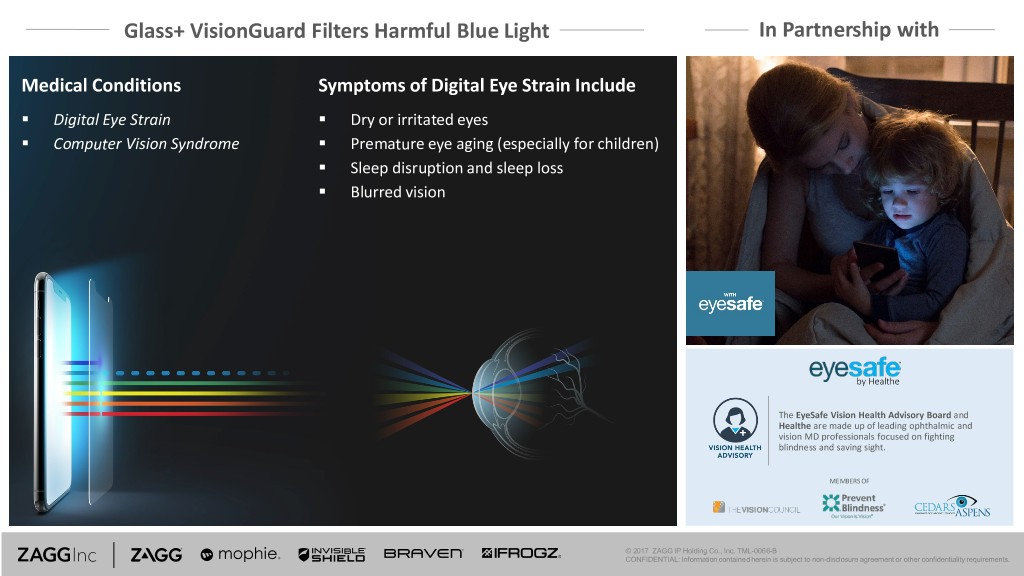

Glass+ VisionGuard Filters Harmful Blue Light In Partnership with Medical Conditions Symptoms of Digital Eye Strain Include . Digital Eye Strain . Dry or irritated eyes . Computer Vision Syndrome . Premature eye aging (especially for children) . Sleep disruption and sleep loss . Blurred vision by Healthe The EyeSafe Vision Health Advisory Board and Healthe are made up of leading ophthalmic and vision MD professionals focused on fighting blindness and saving sight. MEMBERS OF © 2017 ZAGG IP Holding Co., Inc. TML-0066-B CONFIDENTIAL: Information contained herein is subject to non-disclosure agreement or other confidentiality requirements.

InvisibleShield On-Demand . 7,500 device designs . 550 US locations . 3,500+ global locations . Push technology for same-day service Need modified ISOD graphic © 2017 ZAGG IP Holding Co., Inc. TML-0066-B CONFIDENTIAL: Information contained herein is subject to non-disclosure agreement or other confidentiality requirements.

CPR – Cell Phone Repair 2 times when consumers need screen protection: . when they buy their phone . when they break their phone 450+ locations © 2017 ZAGG IP Holding Co., Inc. TML-0066-B CONFIDENTIAL: Information contained herein is subject to non-disclosure agreement or other confidentiality requirements.

mophie © 2017 ZAGG IP Holding Co., Inc. TML-0066-B CONFIDENTIAL: Information contained herein is subject to non-disclosure agreement or other confidentiality requirements.

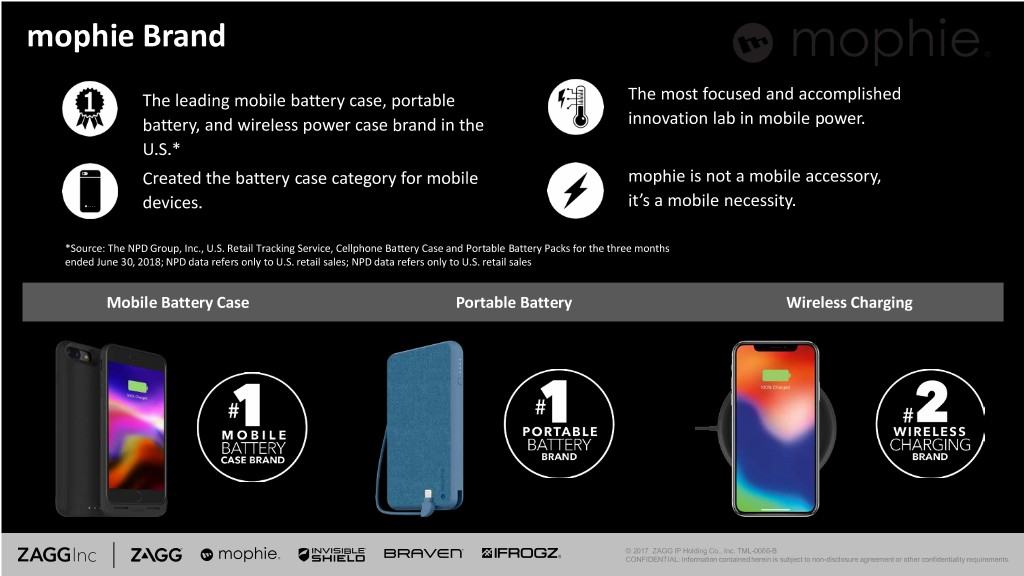

mophie Brand The leading mobile battery case, portable The most focused and accomplished battery, and wireless power case brand in the innovation lab in mobile power. U.S.* Created the battery case category for mobile mophie is not a mobile accessory, devices. it’s a mobile necessity. *Source: The NPD Group, Inc., U.S. Retail Tracking Service, Cellphone Battery Case and Portable Battery Packs for the three months ended June 30, 2018; NPD data refers only to U.S. retail sales; NPD data refers only to U.S. retail sales Mobile Battery Case Portable Battery Wireless Charging © 2017 ZAGG IP Holding Co., Inc. TML-0066-B CONFIDENTIAL: Information contained herein is subject to non-disclosure agreement or other confidentiality requirements.

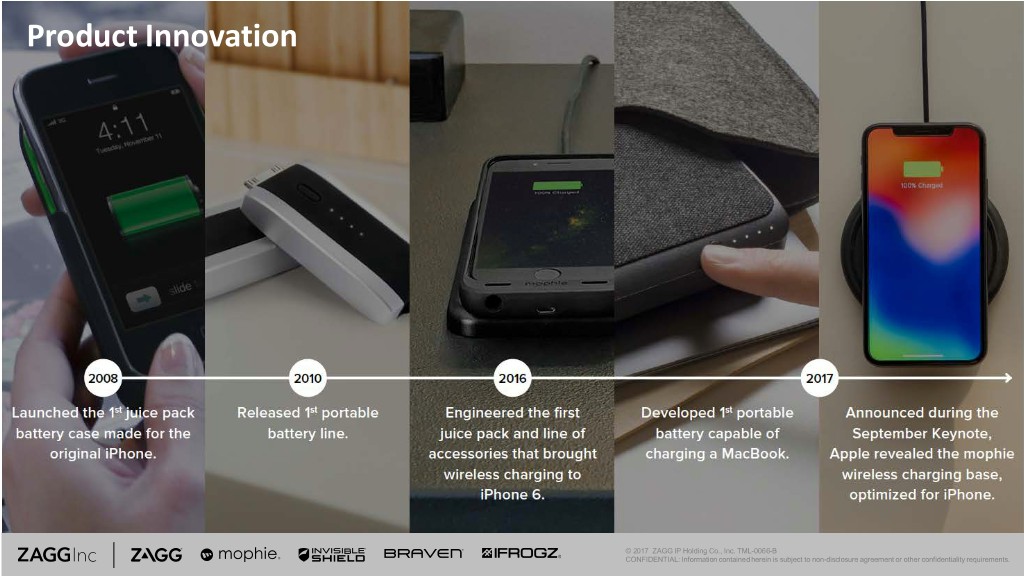

Product Innovation © 2017 ZAGG IP Holding Co., Inc. TML-0066-B CONFIDENTIAL: Information contained herein is subject to non-disclosure agreement or other confidentiality requirements.

Wireless Adoption World-Class Brands Part of Our Lives © 2017 ZAGG IP Holding Co., Inc. TML-0066-B CONFIDENTIAL: Information contained herein is subject to non-disclosure agreement or other confidentiality requirements.

Wireless Product Innovation © 2017 ZAGG IP Holding Co., Inc. TML-0066-B CONFIDENTIAL: Information contained herein is subject to non-disclosure agreement or other confidentiality requirements.

Financial Overview © 2017 ZAGG IP Holding Co., Inc. TML-0066-B CONFIDENTIAL: Information contained herein is subject to non-disclosure agreement or other confidentiality requirements.

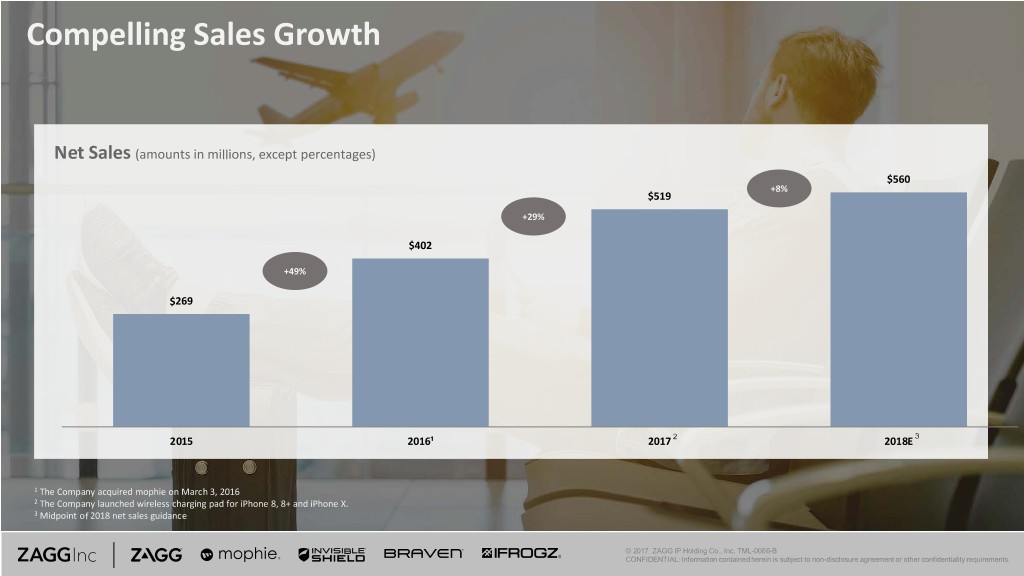

Compelling Sales Growth Net Sales (amounts in millions, except percentages) $560 +8% $519 +29% $402 +49% $269 2015 2016¹ 2017 2 2018E 3 1 The Company acquired mophie on March 3, 2016 2 The Company launched wireless charging pad for iPhone 8, 8+ and iPhone X. 3 Midpoint of 2018 net sales guidance © 2017 ZAGG IP Holding Co., Inc. TML-0066-B CONFIDENTIAL: Information contained herein is subject to non-disclosure agreement or other confidentiality requirements.

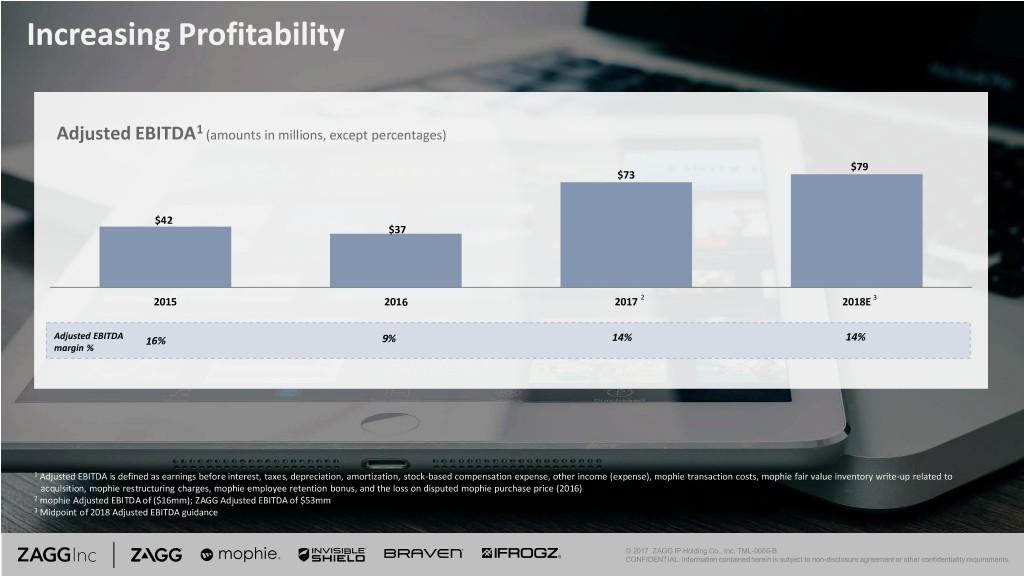

Increasing Profitability Adjusted EBITDA1 (amounts in millions, except percentages) $79 $73 $42 $37 2015 2016 2017 2 2018E 3 Adjusted EBITDA 16% 9% 14% 14% margin % 1 Adjusted EBITDA is defined as earnings before interest, taxes, depreciation, amortization, stock-based compensation expense, other income (expense), mophie transaction costs, mophie fair value inventory write-up related to acquisition, mophie restructuring charges, mophie employee retention bonus, and the loss on disputed mophie purchase price (2016) 2 mophie Adjusted EBITDA of ($16mm); ZAGG Adjusted EBITDA of $53mm 3 Midpoint of 2018 Adjusted EBITDA guidance © 2017 ZAGG IP Holding Co., Inc. TML-0066-B CONFIDENTIAL: Information contained herein is subject to non-disclosure agreement or other confidentiality requirements.

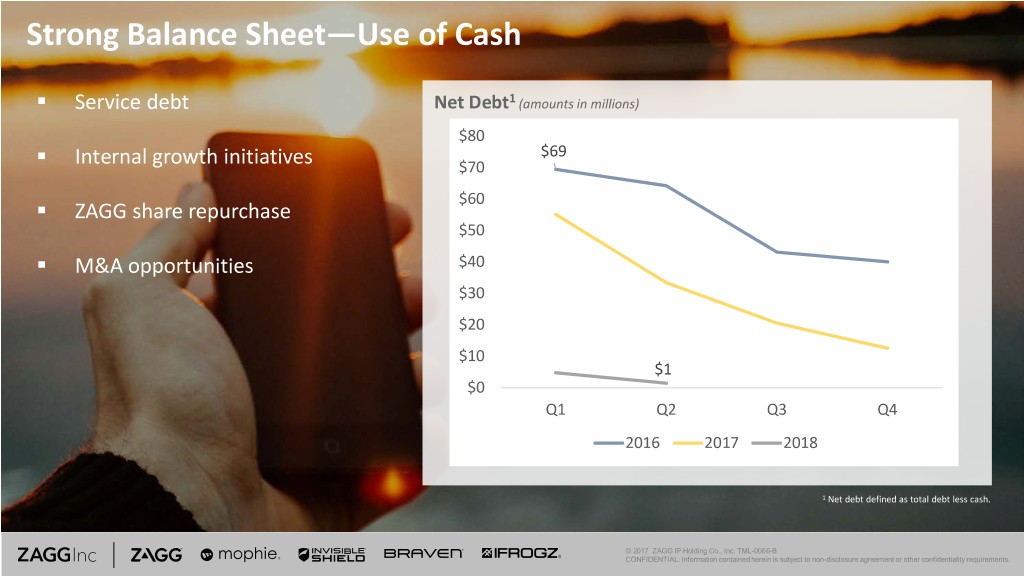

Strong Balance Sheet—Use of Cash . Service debt Net Debt1 (amounts in millions) $80 . $69 Internal growth initiatives $70 $60 . ZAGG share repurchase $50 . M&A opportunities $40 $30 $20 $10 $1 $0 Q1 Q2 Q3 Q4 2016 2017 2018 1 Net debt defined as total debt less cash. © 2017 ZAGG IP Holding Co., Inc. TML-0066-B CONFIDENTIAL: Information contained herein is subject to non-disclosure agreement or other confidentiality requirements.

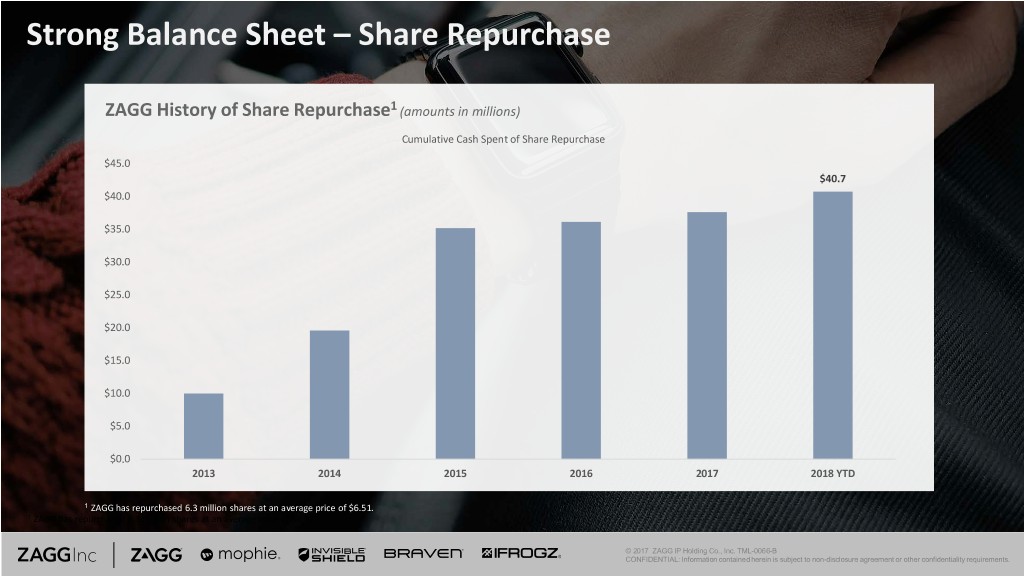

Strong Balance Sheet – Share Repurchase ZAGG History of Share Repurchase1 (amounts in millions) Cumulative Cash Spent of Share Repurchase $45.0 $40.7 $40.0 $35.0 $30.0 $25.0 $20.0 $15.0 $10.0 $5.0 $0.0 2013 2014 2015 2016 2017 2018 YTD 1 ZAGG has repurchased 6.3 million shares at an average price of $6.51. 1 ZAGG has repurchased 6.3 million shares at an average price of $6.51. © 2017 ZAGG IP Holding Co., Inc. TML-0066-B CONFIDENTIAL: Information contained herein is subject to non-disclosure agreement or other confidentiality requirements.

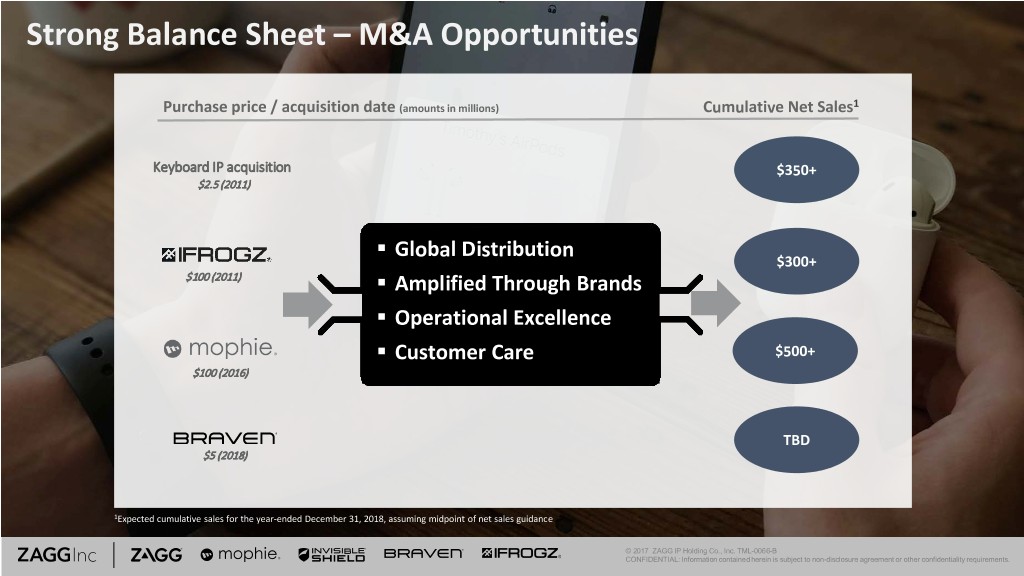

Strong Balance Sheet – M&A Opportunities Purchase price / acquisition date (amounts in millions) Cumulative Net Sales1 Keyboard IP acquisition $350+ $2.5 (2011) . Global Distribution $300+ $100 (2011) . Amplified Through Brands . Operational Excellence . Customer Care $500+ $100 (2016) TBD $5 (2018) 1Expected cumulative sales for the year-ended December 31, 2018, assuming midpoint of net sales guidance © 2017 ZAGG IP Holding Co., Inc. TML-0066-B CONFIDENTIAL: Information contained herein is subject to non-disclosure agreement or other confidentiality requirements.

Appendix © 2017 ZAGG IP Holding Co., Inc. TML-0066-B CONFIDENTIAL: Information contained herein is subject to non-disclosure agreement or other confidentiality requirements.

Experienced senior management team Prior experience: Prior experience: Prior experience: Prior experience: Prior experience: Chris Ahern, CEO Brad J. Holiday, CFO Brian Stech, President Jim Kearns, COO Abby Barraclough, General Counsel Years at ZAGG: 4 Years at ZAGG: 3 Years at ZAGG: 4 Years at ZAGG: 1 month Years at ZAGG: 7 Years of experience: 21 Years of experience: 41 Years of experience: 21 Years of experience: 30 Years of experience: 18 Prior experience: Prior experience: Prior experience: Prior experience: Prior experience: Taylor Smith, Steve Bain, Robert Johnson, Gavin Slevin, Matt Smith, VP of VP of Finance & Accounting GM of ZAGG, GM of mophie GM of International Corporate Development InvisibleShield, IFROGZ Years at ZAGG: 7 Years at ZAGG: 1.5 Years at ZAGG: 6 months Years at ZAGG: 3 Years at ZAGG: 1 Years of experience: 16 Years of experience: 26 Years of experience: 25 Years of experience: 19 Years of experience:16 Senior leadership has assembled a talented and dedicated management team which has transformed ZAGG and positioned the company for continued growth © 2017 ZAGG IP Holding Co., Inc. TML-0066-B CONFIDENTIAL: Information contained herein is subject to non-disclosure agreement or other confidentiality requirements.

Projected 2018 Guidance 2018 Guidance1 (amounts in millions, except per share data and percentages) . Net sales in a range of $550 - $570 . Gross profit as a percentage of net sales in the low to mid 30’s range . Adjusted EBITDA of $77 - $80 . Diluted earnings per share of $1.30 - $1.50 . Annual effective tax rate of approximately 25% 1 Midpoint of 2018 guidance © 2017 ZAGG IP Holding Co., Inc. TML-0066-B CONFIDENTIAL: Information contained herein is subject to non-disclosure agreement or other confidentiality requirements.

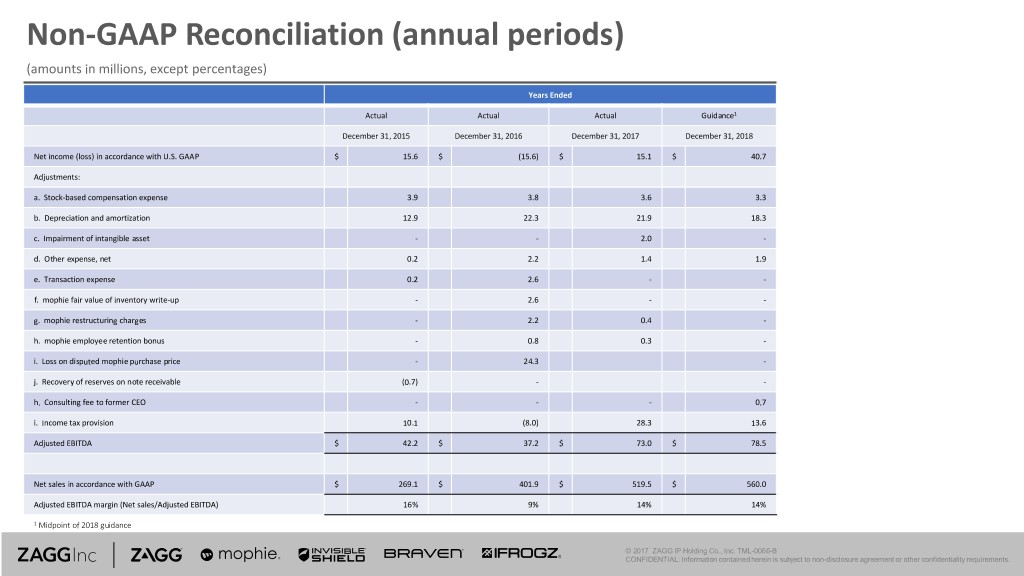

Non-GAAP Reconciliation (annual periods) (amounts in millions, except percentages) Years Ended Actual Actual Actual Guidance1 December 31, 2015 December 31, 2016 December 31, 2017 December 31, 2018 Net income (loss) in accordance with U.S. GAAP $ 15.6 $ (15.6) $ 15.1 $ 40.7 Adjustments: a. Stock-based compensation expense 3.9 3.8 3.6 3.3 b. Depreciation and amortization 12.9 22.3 21.9 18.3 c. Impairment of intangible asset - - 2.0 - d. Other expense, net 0.2 2.2 1.4 1.9 e. Transaction expense 0.2 2.6 - - f. mophie fair value of inventory write-up - 2.6 - - g. mophie restructuring charges - 2.2 0.4 - h. mophie employee retention bonus - 0.8 0.3 - i. Loss on disputed mophie purchase price - 24.3 - j. Recovery of reserves on note receivable (0.7) - - h. Consulting fee to former CEO - - - 0.7 i. Income tax provision 10.1 (8.0) 28.3 13.6 Adjusted EBITDA $ 42.2 $ 37.2 $ 73.0 $ 78.5 Net sales in accordance with GAAP $ 269.1 $ 401.9 $ 519.5 $ 560.0 Adjusted EBITDA margin (Net sales/Adjusted EBITDA) 16% 9% 14% 14% 1 Midpoint of 2018 guidance © 2017 ZAGG IP Holding Co., Inc. TML-0066-B CONFIDENTIAL: Information contained herein is subject to non-disclosure agreement or other confidentiality requirements.