Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - CONSOLIDATED EDISON INC | d595999dex991.htm |

| EX-2 - EX-2 - CONSOLIDATED EDISON INC | d595999dex2.htm |

| 8-K - 8-K - CONSOLIDATED EDISON INC | d595999d8k.htm |

Acquisition of Sempra Solar Holdings September 20, 2018 Exhibit 99.2

Available Information On August 2, 2018, Consolidated Edison, Inc. issued a press release reporting its second quarter 2018 earnings and filed with the Securities and Exchange Commission the company’s second quarter 2018 Form 10-Q. This presentation should be read together with, and is qualified in its entirety by reference to, the second quarter earnings press release and the second quarter 2018 Form 10-Q. Copies of the earnings press release and the Form 10-Q are available at: www.conedison.com (select "For Investors" and then select "Press Releases“ and “SEC Filings”, respectively). Forward-Looking Statements This presentation contains forward-looking statements that are intended to qualify for the safe-harbor provisions of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Forward-looking statements are statements of future expectations and not facts. Words such as "forecasts," "expects," "estimates," "anticipates," "intends," "believes," "plans," "will" and similar expressions identify forward-looking statements. The forward-looking statements reflect information available and assumptions at the time the statements are made, and speak only as of that time. Actual results or developments may differ materially from those included in the forward-looking statements because of various factors such as when the acquisition by a subsidiary of Consolidated Edison, Inc. of Sempra Solar Holdings, LLC is completed, if at all, and those factors identified in reports the company has filed with the Securities and Exchange Commission, including that the company's subsidiaries are extensively regulated and are subject to penalties; its utility subsidiaries' rate plans may not provide a reasonable return; it may be adversely affected by changes to the utility subsidiaries' rate plans; the intentional misconduct of employees or contractors could adversely affect it; the failure of, or damage to, its subsidiaries' facilities could adversely affect it; a cyber-attack could adversely affect it; it is exposed to risks from the environmental consequences of its subsidiaries' operations; a disruption in the wholesale energy markets or failure by an energy supplier could adversely affect it; it has substantial unfunded pension and other postretirement benefit liabilities; its ability to pay dividends or interest depends on dividends from its subsidiaries; it requires access to capital markets to satisfy funding requirements; changes to tax laws could adversely affect it; its strategies may not be effective to address changes in the external business environment; and it also faces other risks that are beyond its control. Non-GAAP Financial Measure This presentation also contains a financial measure, forecasted Adjusted EBITDA of Con Edison Clean Energy Businesses, Inc., a wholly-owned subsidiary of Consolidated Edison, Inc., that is not determined in accordance with generally accepted accounting principles in the United States of America (GAAP). Adjusted EBITDA refers to net income before interest, taxes, depreciation and amortization and reflects the estimated full-year impact of the acquisition of Sempra Solar Holdings, LLC, as further adjusted for estimated cash distributions to third party tax equity partners in certain assets and estimated pre-tax equivalent for 2019 federal production tax credits. Management believes this information is useful to investors for their independent evaluation and understanding of the acquisition and its impact on Con Edison Clean Energy Businesses. This information is provided only on a non-GAAP basis without a reconciliation of this measure to the mostly directly comparable GAAP measure due to the inherent difficulty in forecasting and quantifying certain amounts that are necessary for such reconciliation, including adjustments that could be made for items such as the accounting for the impact of third party tax equity investments. These items depend on variable factors, many of which may not be in our control, and which could vary significantly from future GAAP financial results. This non-GAAP financial measure is in addition to, and not meant to be considered superior to, or a substitute for, financial measures prepared in accordance with GAAP. In addition, the non-GAAP financial measure included in this presentation may not be comparable to similarly titled measures reported by other companies. For more information, contact: Jan Childress, Director, Investor Relations Olivia M. Webb, Manager, Investor Relations Tel.: 212-460-6611, Email: childressj@coned.com Tel.: 212-460-3431, Email: webbo@coned.com

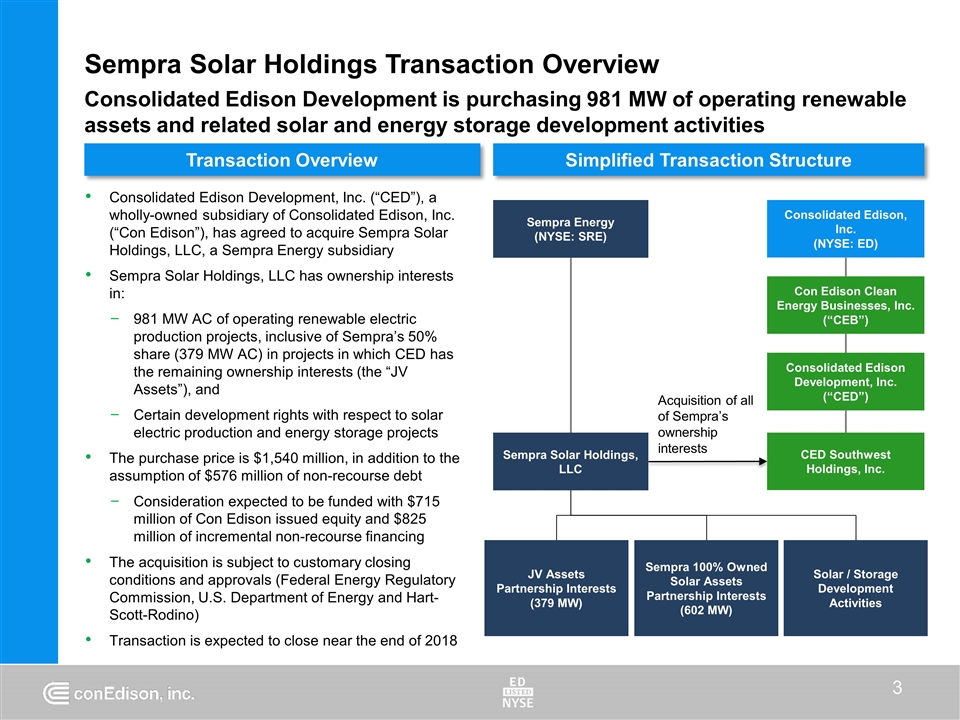

Sempra Solar Holdings Transaction Overview Consolidated Edison Development, Inc. (“CED”), a wholly-owned subsidiary of Consolidated Edison, Inc. (“Con Edison”), has agreed to acquire Sempra Solar Holdings, LLC, a Sempra Energy subsidiary Sempra Solar Holdings, LLC has ownership interests in: 981 MW AC of operating renewable electric production projects, inclusive of Sempra’s 50% share (379 MW AC) in projects in which CED has the remaining ownership interests (the “JV Assets”), and Certain development rights with respect to solar electric production and energy storage projects The purchase price is $1,540 million, in addition to the assumption of $576 million of non-recourse debt Consideration expected to be funded with $715 million of Con Edison issued equity and $825 million of incremental non-recourse financing The acquisition is subject to customary closing conditions and approvals (Federal Energy Regulatory Commission, U.S. Department of Energy and Hart-Scott-Rodino) Transaction is expected to close near the end of 2018 Consolidated Edison Development is purchasing 981 MW of operating renewable assets and related solar and energy storage development activities Transaction Overview Simplified Transaction Structure Sempra Solar Holdings, LLC Solar / Storage Development Activities Sempra 100% Owned Solar Assets Partnership Interests (602 MW) JV Assets Partnership Interests (379 MW) Consolidated Edison, Inc. (NYSE: ED) Consolidated Edison Development, Inc. (“CED”) Sempra Energy (NYSE: SRE) Con Edison Clean Energy Businesses, Inc. (“CEB”) CED Southwest Holdings, Inc. Acquisition of all of Sempra’s ownership interests

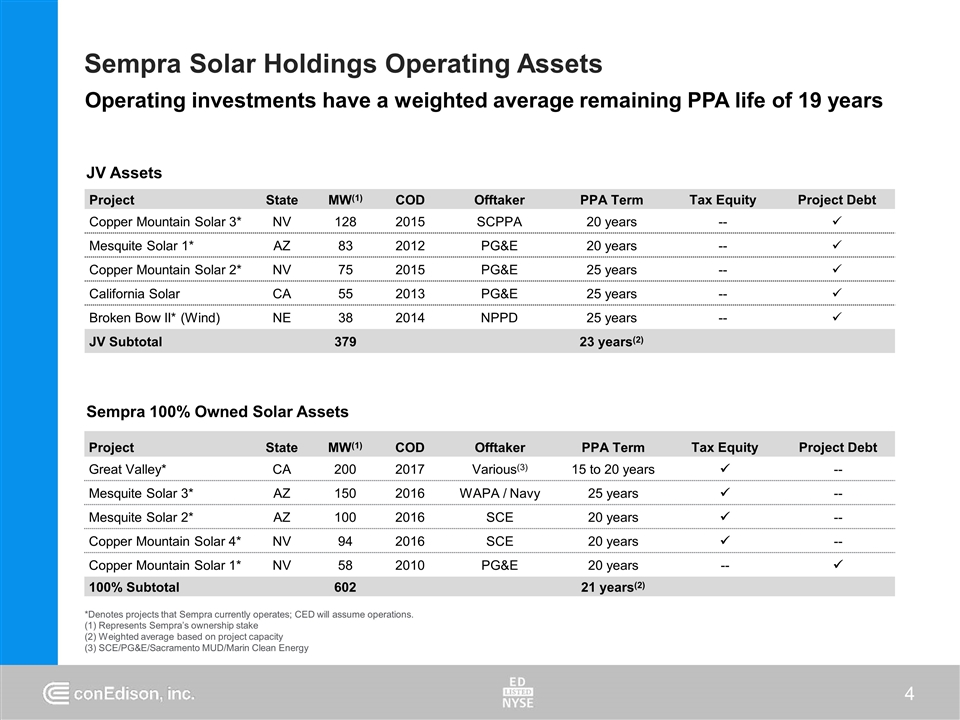

Sempra Solar Holdings Operating Assets Project State MW(1) COD Offtaker PPA Term Tax Equity Project Debt Copper Mountain Solar 3* NV 128 2015 SCPPA 20 years -- ü Mesquite Solar 1* AZ 83 2012 PG&E 20 years -- ü Copper Mountain Solar 2* NV 75 2015 PG&E 25 years -- ü California Solar CA 55 2013 PG&E 25 years -- ü Broken Bow II* (Wind) NE 38 2014 NPPD 25 years -- ü JV Subtotal 379 23 years(2) Project State MW(1) COD Offtaker PPA Term Tax Equity Project Debt Great Valley* CA 200 2017 Various(3) 15 to 20 years ü -- Mesquite Solar 3* AZ 150 2016 WAPA / Navy 25 years ü -- Mesquite Solar 2* AZ 100 2016 SCE 20 years ü -- Copper Mountain Solar 4* NV 94 2016 SCE 20 years ü -- Copper Mountain Solar 1* NV 58 2010 PG&E 20 years -- ü 100% Subtotal 602 21 years(2) JV Assets Sempra 100% Owned Solar Assets *Denotes projects that Sempra currently operates; CED will assume operations. (1) Represents Sempra’s ownership stake (2) Weighted average based on project capacity (3) SCE/PG&E/Sacramento MUD/Marin Clean Energy Operating investments have a weighted average remaining PPA life of 19 years

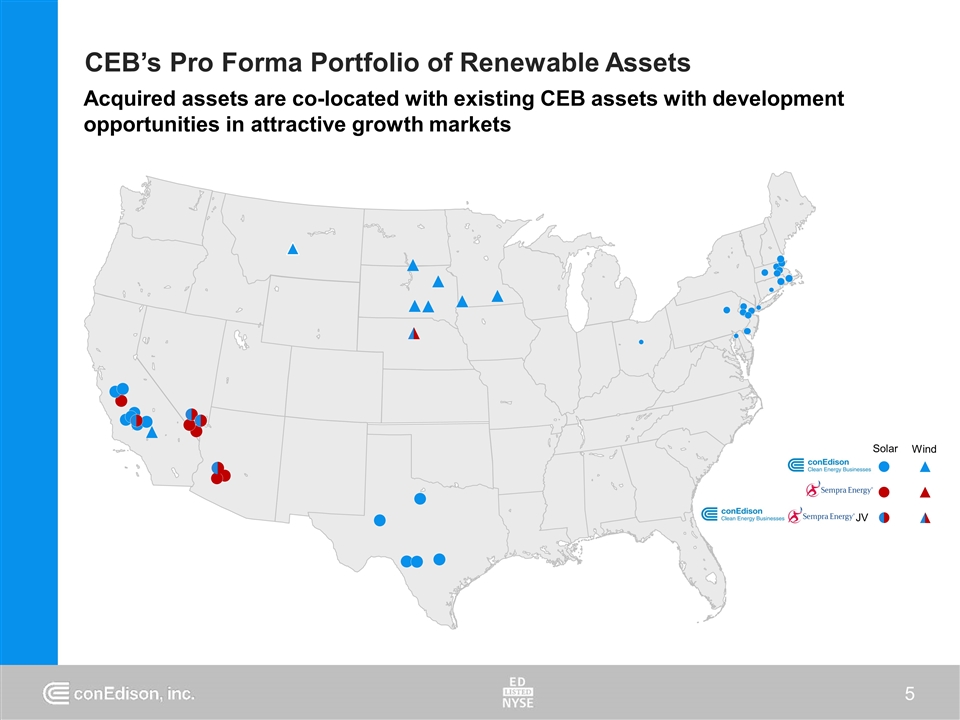

CEB’s Pro Forma Portfolio of Renewable Assets Acquired assets are co-located with existing CEB assets with development opportunities in attractive growth markets Solar Wind JV

Investment Highlights Consistent with Con Edison strategy of growing our renewables footprint Familiarity with assets and markets of operation Efficiencies from operating co-owned and co-located assets Long-term, contracted cash flows with creditworthy counterparties Further diversification of off-takers and increase in asset base Enhances our development platform to enable further growth Reinforces the corporate goal of responsible environmental stewardship

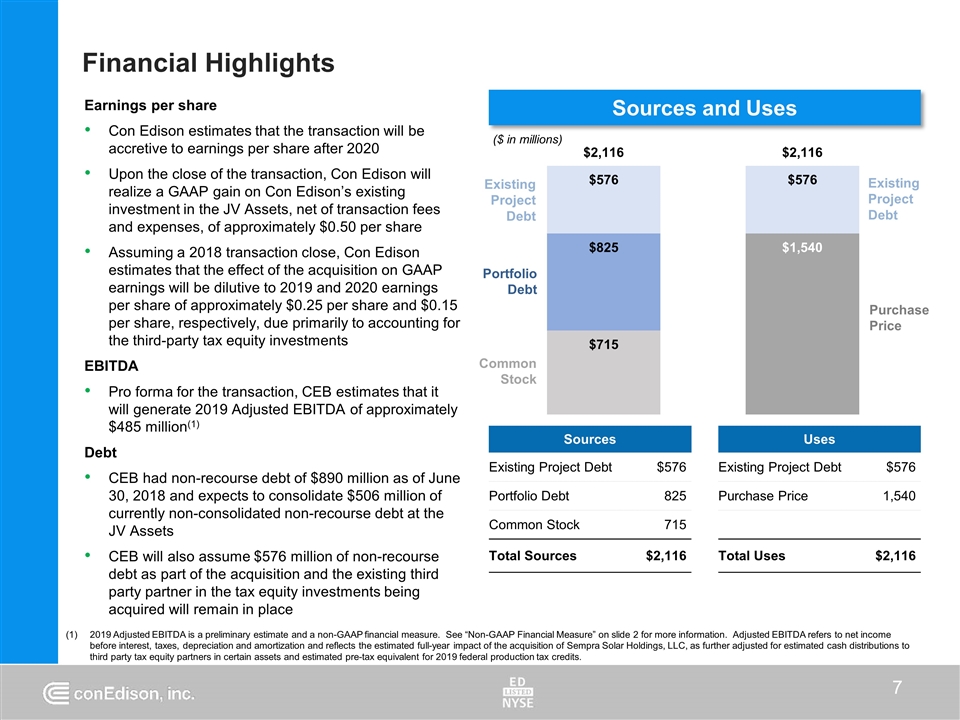

Financial Highlights Sources Uses Existing Project Debt $576 Existing Project Debt $576 Portfolio Debt 825 Purchase Price 1,540 Common Stock 715 Total Sources $2,116 Total Uses $2,116 Sources and Uses Earnings per share Con Edison estimates that the transaction will be accretive to earnings per share after 2020 Upon the close of the transaction, Con Edison will realize a GAAP gain on Con Edison’s existing investment in the JV Assets, net of transaction fees and expenses, of approximately $0.50 per share Assuming a 2018 transaction close, Con Edison estimates that the effect of the acquisition on GAAP earnings will be dilutive to 2019 and 2020 earnings per share of approximately $0.25 per share and $0.15 per share, respectively, due primarily to accounting for the third-party tax equity investments EBITDA Pro forma for the transaction, CEB estimates that it will generate 2019 Adjusted EBITDA of approximately $485 million(1) Debt CEB had non-recourse debt of $890 million as of June 30, 2018 and expects to consolidate $506 million of currently non-consolidated non-recourse debt at the JV Assets CEB will also assume $576 million of non-recourse debt as part of the acquisition and the existing third party partner in the tax equity investments being acquired will remain in place Purchase Price Existing Project Debt Portfolio Debt Existing Project Debt Common Stock ($ in millions) 2019 Adjusted EBITDA is a preliminary estimate and a non-GAAP financial measure. See “Non-GAAP Financial Measure” on slide 2 for more information. Adjusted EBITDA refers to net income before interest, taxes, depreciation and amortization and reflects the estimated full-year impact of the acquisition of Sempra Solar Holdings, LLC, as further adjusted for estimated cash distributions to third party tax equity partners in certain assets and estimated pre-tax equivalent for 2019 federal production tax credits.

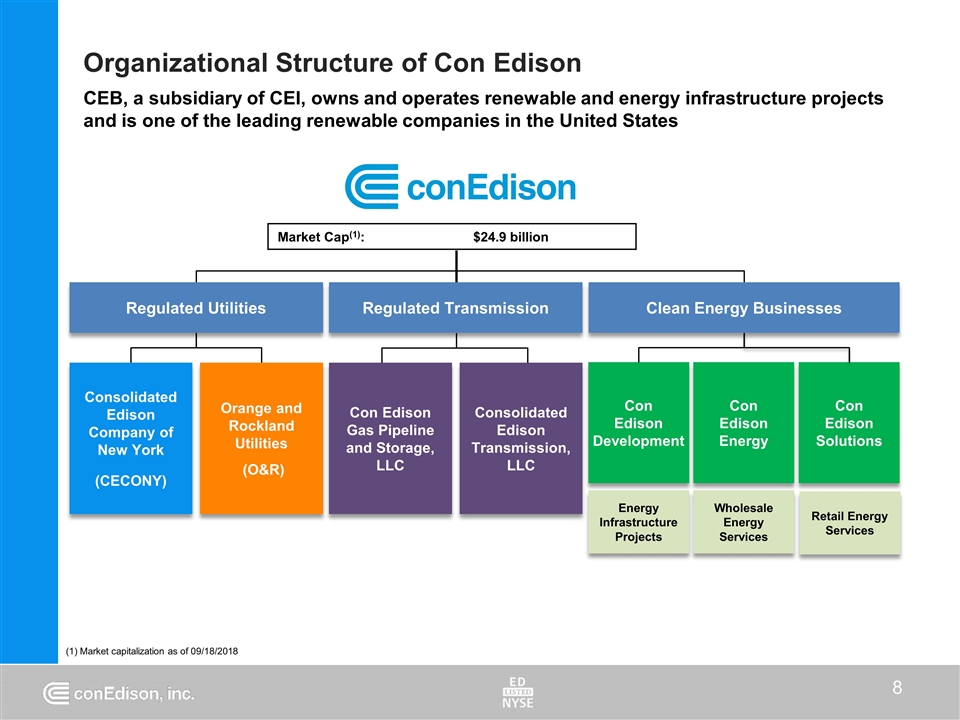

Organizational Structure of Con Edison CEB, a subsidiary of CEI, owns and operates renewable and energy infrastructure projects and is one of the leading renewable companies in the United States (1) Market capitalization as of 09/18/2018 Con Edison Solutions Con Edison Energy Con Edison Development Wholesale Energy Services Energy Infrastructure Projects Regulated Utilities Clean Energy Businesses Orange and Rockland Utilities (O&R) Consolidated Edison Company of New York (CECONY) Regulated Transmission Consolidated Edison Transmission, LLC Con Edison Gas Pipeline and Storage, LLC Retail Energy Services Market Cap(1): $24.9 billion

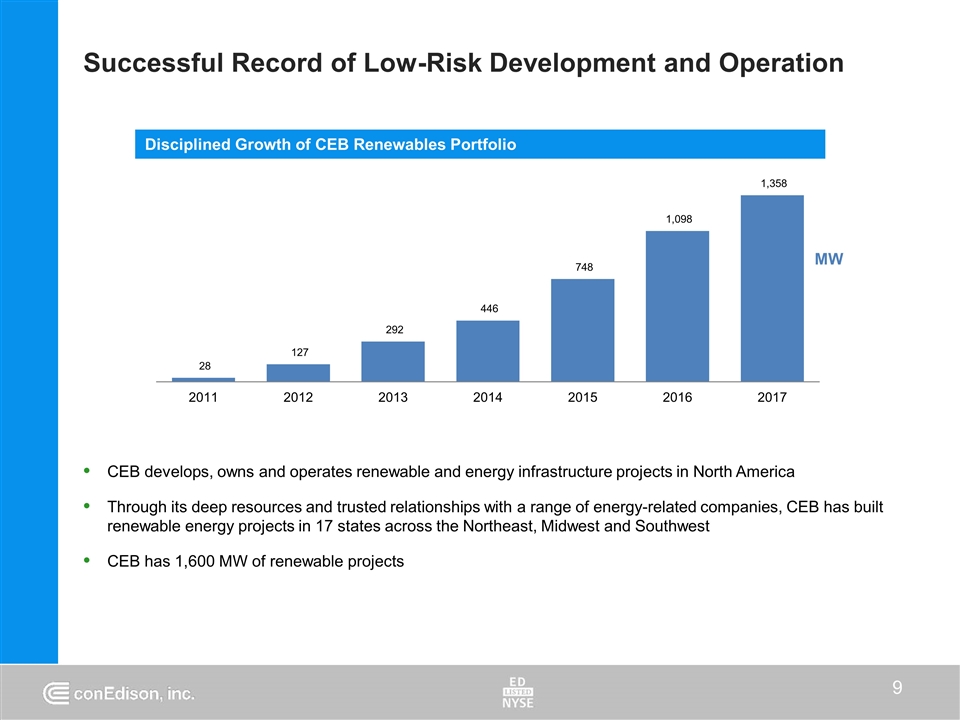

Successful Record of Low-Risk Development and Operation Disciplined Growth of CEB Renewables Portfolio MW CEB develops, owns and operates renewable and energy infrastructure projects in North America Through its deep resources and trusted relationships with a range of energy-related companies, CEB has built renewable energy projects in 17 states across the Northeast, Midwest and Southwest CEB has 1,600 MW of renewable projects

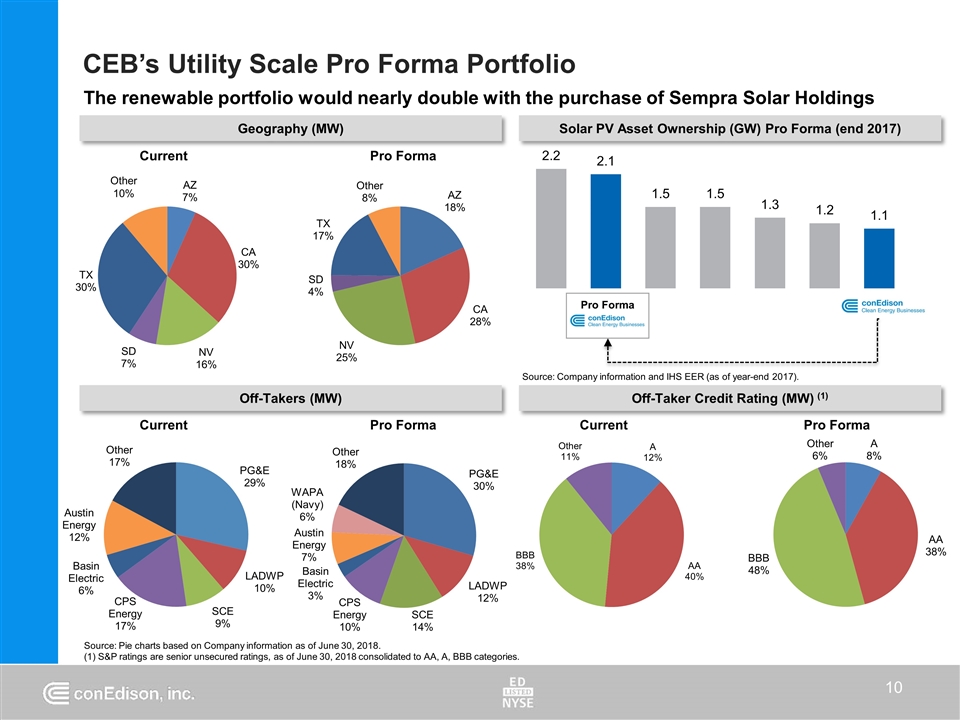

The renewable portfolio would nearly double with the purchase of Sempra Solar Holdings Solar PV Asset Ownership (GW) Pro Forma (end 2017) Geography (MW) Off-Takers (MW) Off-Taker Credit Rating (MW) (1) Source: Pie charts based on Company information as of June 30, 2018. (1) S&P ratings are senior unsecured ratings, as of June 30, 2018 consolidated to AA, A, BBB categories. Pro Forma CEB’s Utility Scale Pro Forma Portfolio Pro Forma Current Pro Forma Current Pro Forma Current Source: Company information and IHS EER (as of year-end 2017). Other 10%