Attached files

| file | filename |

|---|---|

| 8-K - CURRENT REPORT - XYNOMIC PHARMACEUTICALS HOLDINGS, INC. | f8k091918_bisoncapitalacq.htm |

Exhibit 99.1

Bison Capital Acquisition Corp. & Xynomic Pharmaceuticals, Inc. Investor Presentation September 2018

Disclosure Disclaimer This investor presentation is not a proxy statement or a solicitation of a proxy, consent or authorization with respect to an y s ecurities or in respect of the proposed transaction. This investor presentation shall also not constitute an offer to sell or the solicitation of an offer to buy any securities, nor shall there be any sale of securities in any states or jurisdictions in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No registered offering of securities shall be made except by means of a prospec tus meeting the requirements of section 10 of the Securities Act of 1933, as amended. Additional Information about the Transaction and Where to Find it The proposed transaction has been approved by the board of directors of both companies and the shareholders of Xynomic Pharma ceu ticals, Inc. (“Xynomic”), and will be submitted to shareholders of Bison Capital Acquisition Corp. (“BCAC”) for their approval. In connection with that approval, BCAC intends to file with the SEC a proxy statement containing in formation about the proposed transaction and the respective businesses of Xynomic and BCAC. BCAC will mail a definitive proxy statement and other relevant documents to its shareholders. BCAC shareholders are urged to read the p rel iminary proxy statement and any amendments thereto and the definitive proxy statement in connection with BCAC’s solicitation of proxies for the special meeting to be held to approve the proposed transaction, becaus e t hese documents will contain important information about BCAC, Xynomic and the proposed transaction. The definitive proxy statement will be mailed to shareholders of BCAC as of a record date to be established for voting on the pr oposed transaction. Shareholders will also be able to obtain a free copy of the proxy statement, as well as other filings containing information about BCAC, without charge, at the SEC’s website (www.sec.gov) or by calling 1 - 800 - SEC - 0330 . Participants in the Solicitation BCAC and its directors and executive officers and other persons may be deemed to be participants in the solicitation of proxi es from BCAC’s shareholders with respect to the proposed transaction. Information regarding BCAC’s directors and executive officers is available in its annual report on Form 10 - K for the fiscal year ended December 31, 2017, fil ed with the SEC on February 21, 2018. Additional information regarding the participants in the proxy solicitation relating to the proposed transaction and a description of their direct and indirect interests will be contained in the proxy statement when it becomes available. Xynomic and its directors and executive officers may also be deemed to be participants in the solicitation of proxies from the shareh ol ders of BCAC in connection with the proposed transaction. A list of the names of such directors and executive officers and information regarding their interests in the proposed transaction will be included in the proxy st ate ment for the proposed transaction when available. Forward - Looking Statements This investor presentation includes “forward - looking statements” within the meaning of the safe harbor provisions of the U.S. Pr ivate Securities Litigation Reform Act of 1995 and within the meaning of Section 27a of the Securities Act of 1933, as amended, and Section 21e of the Securities Exchange Act of 1934, as amended. Any actual results may differ from e xpe ctations, estimates and projections presented or implied and, consequently, you should not rely on these forward - looking statements as predictions of future events. Words such as “expect,” “estimate,” “project,” “budget,” “fore cast,” “anticipate,” “intend,” “plan,” “may,” “will,” “could,” “should,” “believes,” “predicts,” “potential,” “continue,” and similar expressions are intended to identify such forward - looking statements. These forward - looking statements i nclude, without limitation, BCAC’s expectations with respect to future performance, anticipated financial impacts of the proposed business combination, approval of the business combination transactions by security holders , t he satisfaction of the closing conditions to such transactions and the timing of the completion of such transactions. Such forward - looking statements relate to future events or future performance, but reflect the parties’ current beliefs, based o n information currently available. Most of these factors are outside the parties’ control and are difficult to predict. A number of factors could cause actual events, performance or results to differ materially from the events, performa nce and results discussed in the forward - looking statements. Factors that may cause such differences include, among other things: the possibility that the business combination does not close or that the closing may be delayed bec ause conditions to the closing may not be satisfied, including the receipt of requisite shareholder and other approvals, the performances of BCAC and Xynomic, and the ability of BCAC or, after the closing of the transactions, the co mbined company, to continue to meet The Nasdaq Capital Market’s listing standards; the reaction of Xynomic’s licensors, collaborators, service providers or suppliers to the business combination; unexpected costs, liabilities or delays in the business combination transaction; the outcome of any legal proceedings related to the transaction; the occurrence of any event, change or other circumstances that could give rise to the termination of the busine ss combination transaction agreement; and general economic conditions. The foregoing list of factors is not exclusive. Additional information concerning these and other risk factors are contained in BCAC’s most recent filings with the SEC. All subsequent written and oral forward - looking statements concerning BCAC and Xynomic, the business combination transactions described herein or other matters and attributable to BCAC , X ynomic, Xynomic’s shareholders or any person acting on behalf of any of them are expressly qualified in their entirety by the cautionary statements above. Readers are cautioned not to place undue reliance upon any fo rwa rd - looking statements, which speak only as of the date made. Neither BCAC, Xynomic, nor Xynomic’s shareholders undertake or accept any obligation or undertaking to release publicly any updates or revisions to any forward - looki ng statement to reflect any change in their expectations or any change in events, conditions or circumstances on which any such statement is based. 2

Transaction Overview - 1 3 • On September 12, 2018, Bison Capital Acquisition Corp. (“BCAC”) signed a definitive merger agreement with Xynomic Pharmaceuticals, Inc. (“Xynomic”) • The merger consideration, entirely payable in BCAC shares at $10.15 per share, consists of » $350 million, subject to certain closing adjustments, and » Potentially additional $100 million if Xynomic achieves certain earnout criteria • 3% of the merger consideration will be held in escrow for 18 months, to serve as, among others, security for and exclusive source of BCAC’s indemnity rights under the Merger Agreement • Closing conditions include, but are not limited to » Approval of the Merger Agreement and the transactions by BCAC’s existing shareholders » Approval of listing on Nasdaq of the merger consideration shares » BCAC having at least $7,500,001 of net tangible assets at the closing

• BCAC will re - domesticate as a Delaware corporation prior to closing • Upon closing, BCAC will change its name to “Xynomic Pharmaceuticals Holdings, Inc.” • The board of BCAC will consist of nine directors » 4 current directors of BCAC including 3 current independent directors » 3 current directors of Xynomic » 2 independent directors mutually agreed upon by BCAC and Xynomic • The executives of Xynomic are expected to be appointed as executives of BCAC Transaction Overview - 2 4

Why Healthcare? » Strong, persistent and growing global market demand bolstered by aging population, technological advancement and scientific breakthroughs Why Oncology Biotech? » Cancer remains one of the leading causes of natural deaths worldwide » There are a high degree of unmet medical needs in the field of oncology » Oncology drugs that have obtained regulatory approval have been commercially successful for numerous pharma companies Why Healthcare? Why Oncology Biotech? 5

Why Xynomic? 6 A pipeline of late stage and early stage innovative small molecule programs Focusing on potentially best - in - class or first - in - class oncology therapeutics Abexinostat (Abex), the lead program, in - licensed from Pharmacyclics/AbbVie » A Phase 3 HDAC inhibitor being investigated for use against lymphomas and renal cancer » Potential efficacy (objective response rate (ORR) & progression free survival (PFS)) in follicular lymphoma (FL), diffuse large B - cell lymphoma (DLBCL) and renal cell carcinoma (RCC) 3 on - going trials (including 2 pivotal trials) plus potentially 5 additional trials by Q2’2019 Demonstrated ability to obtain exclusive licenses on assets, including clinical stage assets » Licensed global rights from Pharmacyclics/AbbVie and Boehringer Ingelheim » Collaborating with Janssen in a trial on combination therapy Operations in both the U.S. and China allowing for leveraging global resources Management team composed of industry veterans and supported by world - class scientific/medical advisors

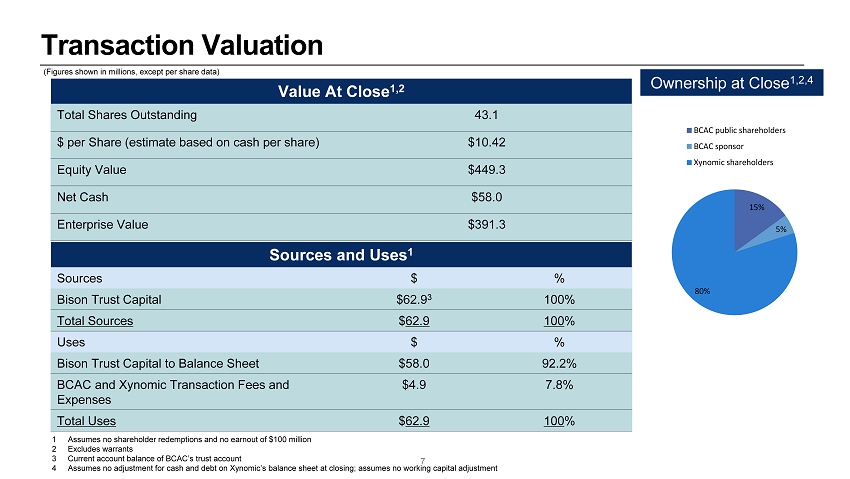

Value At Close 1,2 Total Shares Outstanding 43.1 $ per Share (estimate based on cash per share) $10.42 Equity Value $449.3 Net Cash $58.0 Enterprise Value $391.3 Transaction Valuation Sources and Uses 1 Sources $ % Bison Trust Capital $62.9 3 100% Total Sources $ 62.9 100 % Uses $ % Bison Trust Capital to Balance Sheet $58.0 92.2% BCAC and Xynomic Transaction Fees and Expenses $4.9 7.8% Total Uses $ 62.9 100 % Ownership at Close 1,2,4 1 Assumes no shareholder redemptions and no earnout of $100 million 2 Excludes warrants 3 Current account balance of BCAC’s trust account 4 Assumes no adjustment for cash and debt on Xynomic’s balance sheet at closing; assumes no working capital adjustment 7 15% 5% 80% BCAC public shareholders BCAC sponsor Xynomic shareholders (Figures shown in millions, except per share data)

Experienced Management Team 8 Y. Mark Xu, Chairman, CEO & President Successful serial entrepreneur Pharmacyclics (General Manager, Greater China), Schering (research & development), McKesson (marketing), Bridge Lab (cofounder, China CFO) W. Jason Wu, PhD, COO More than 20 years drug development experience in both US and China Lilly (late stage clinical trial), Merck (marketing), Hutchison China MediTech (business development) Yong Cui, PhD, VP of CMC Leading expert in drug manufacturing Lead pharmaceutical scientist of 2 successful NDA filings in the US (one an oncology drug and the other an anti - viral drug) Expert consultant to the China FDA Genentech, Vertex, Pfizer - Hisun, Qilu Yong Cui, PhD, VP of CMC S. Murray Yule, PhD, CMO More than 17 years experience in the biopharma industry Eisai ( led the team that successfully achieved global market approval of eribulin for breast cancer ) Astex/ Supergen/Otsuka (Medical Director) Board certified medical oncologist

World Class Scientific Advisory Board (SAB) Dr. Pamela Munster • Professor of Medicine and Director of the Early Phase Clinical Trials Unit, University of California San Francisco • Renowned expert in solid tumor • Led cancer clinical trials for numerous big pharma and emerging biotech companies Dr. Anas Younes • Chief of Lymphoma Service, Memorial Sloan Kettering Cancer Center (MSKCC) • Before joining MSKCC, 20 years at MD Anderson in lymphoma practice • L ed the efforts to develop the first FDA - approved targeted drug treating Hodgkin lymphoma in three decades (Adcetris®) and the approval of the first immune checkpoint inhibitor for lymphoma (Opdivo®) Dr. Jun Guo • Vice President, Beijing Cancer Hospital • Head of Department of Kidney Cancer and Melanoma • Led numerous clinical trials for multinational pharmaceutical companies in China 9

Innovative Oncology Pipeline (Global Rights) Preclinical Phase 1 Phase 2 Phase 3 Abexinostat (Abex): HDAC i nhibitor (licensor: Pharmacyclics/AbbVie) Follicular Lymphoma (2 trials) Diffuse Large B - Cell Lymphoma & Mantel Cell Lymphoma (with Janssen’s Imbruvica) Kidney Cancer (with Novartis’ Pazopanib) Breast Cancer (with Novartis’ Kisqali) Multiple Solid Tumors (with Merck’s Keytruda) Diffuse Large B - Cell Lymphoma XP - 102 (BI 882370): Pan - RAF inhibitor (licensor: Boehringer Ingelheim ) Colorectal Cancer Melanoma XP - 103 (TRK/Fra - 1 inhibitor ) XP - 104 (RET inhibitor) Pivotal Pivotal Pivotal 10

Abex: In - Licensed from Pharmacyclics/AbbVie 11 1. AbbVie 2015 annual report 2. Pharmacyclics December 2014 Investor Presentation 3. imbruvica.com 4. AbbVie and Johnson & Johnson 2017 annual reports Abex was previously jointly developed by Pharmacyclics’ world class, proven R&D team and its ex - US partner Servier AbbVie paid $21 billion (in a combination of cash and stock) to acquire Pharmacyclics in 2015 1 » Pharmacyclics had 2 oncology drugs (Imbruvica and Abex) in its pipeline with overlapping indications at the time of the acquisition 2 » Imbruvica was approved for 6 indications 3 to date and generated $4.3 billion in sales in 2017 4 Xynomic in - licensed the exclusive global rights to Abex from Pharmacyclics/AbbVie in February 2017

Abex: Overview of Clinical Development 12 Already tested on approximately 600 patients worldwide Unique PK profile HDAC inhibitor Monotherapy against » Follicular lymphoma (FL): 56 - 64% ORR, 625 days medium PFS » Diffuse large B - cell lymphoma (DLBCL): 34% ORR, 2.8 months medium PFS Combo: potentially first drug treating solid tumor to be approved based on epigenetic modification » Heavily pre - treated renal cell carcinoma (RCC) x 27% ORR vs. standard - of - care (SOC)’s 10% ORR in treatment naive patients x Median duration of response 10.5 months vs. SOC’s 8 months in treatment naive patients » ER+ breast cancer x In combination with Novartis’ CDK4/6 inhibitor Kisqali

Abex’ Mechanism of Action 13 Diverse functions of HDACs and HDAC inhibitors regulating different stages of cancer through multiple different mechanisms and changing different biological processes. Far right, ↑ indicates promotion or upregulation, ↓ indicates repression or downregulation. Source: Li and Seto, Cold Spring Harb Perspect Med. Author manuscript; available in PMC 2017 August 15

Abex – Completed Clinical Trials * Monotherapy In Combination Protocol # # of Patients TA Protocol # # of Patients TA PCYC - 0401 15 Solid tumors or hematological cancers CL1 - 005 35 Solid tumors PCYC - 0405 7 Hematological tumors CL1 - 006 32 Digestive cancer CL1 - 010 1 NHL CL1 - 008 19 Late stage s olid tumors PCYC - 0402 3 9 Solid tumors CL1 - 009 8 Nasopharyngeal carcinoma PCYC - 0403 55 Lymphoma PCYC - 1 4 11 16 Breast cancer CL1 - 002 3 9 Solid tumors PCYC - 14 03 31 Epithelial ovarian, fallopian tube or primary peritoneal carcinoma PCYC - 1407 17 Leukemia NCT01543763 51 Late stage s olid tumors PCYC - 1417 12 Solid tumors NCT01027910 22 Metastatic sarcoma PCYC - 1401 135 Hodgkin’s disease, non - Hodgkin lymphoma and chronic lymphocytic leukemia PCYC - 1404 62 Late stage s olid tumors (including brain tumor) 14 * The following clinical trials were completed by or on behalf of Pharmacyclics/AbbVie or Servier

Convenient Oral Administration 15 Source: Joseph J. et al. CRA - 024781: a novel synthetic inhibitor of histone deacetylase enzymes with antitumor activity in vitro and in vivo. Mol Cancer Ther; 2006: 1309 - 1317.

Safety Abex * Farydak ® ( pabinostat )** Beleodaq ® ( belinostat ) Istodax ® (romidespin) ^ Zolinza ® (vorinostat) hematological Neutropenia 14 67 1 4 27 3.5 Anemia 7 18 11 3 16 2.3 Thrombocytopenia 17 34 7 0 14 5.8 GI Diarrhea 3 † 25 2 <1 1 0 Nausea 2 † 6 1 3 6 3.5 Vomiting 0 † 7 1 <1 10 1.2 other Fatigue 3 25 5 8 14 3.5 Arthralgia 7 na na na na 2.3 Abex and Approved HDACs † - Grade 3 & 4 AE’s (%) 16 * From Abex trial PCYC - 0403 ** From Abex trial PCYC - 1401 in salvage lymphoma Other data from approved HDAC inhibitors’ pivotal trials results

Abex: Objective Response Rate FL DLBCL PTCL Assumption Phase 1 Phase 2 Assumption Phase 1 Phase 2 Assumption Phase 1 Phase 2 40% 60% 44% 56% (n=16) 20% 40% 25% 50% 23% 31% 22% 40% (n=24) Target ORR Actual 0% 100% Source: Andrew M. Evens, et al. A Phase I/II Multicenter, Open - Label Study of the Oral Histone Deacetylase Inhibitor Abexinostat in Relapsed/Refractory Lymphoma. Clin Cancer Res. 2016; 22(5): 1059 - 1066. 17

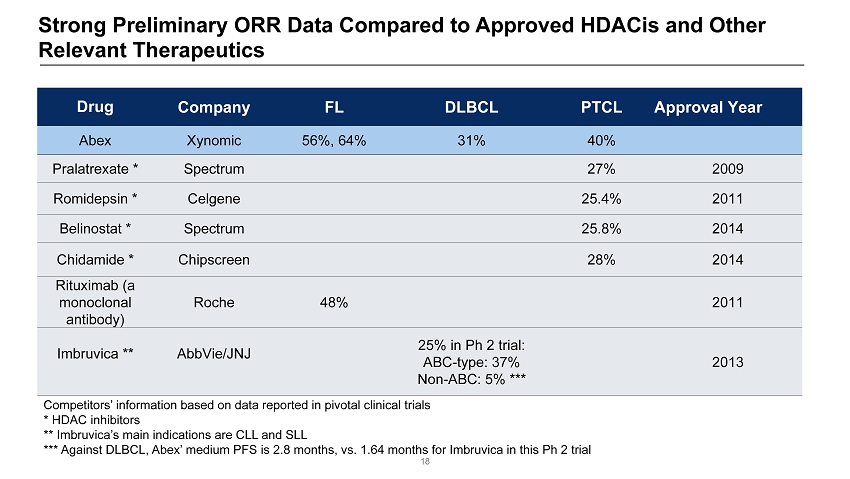

Strong Preliminary ORR Data Compared to Approved HDACis and Other Relevant Therapeutics 18 Drug Company FL DLBCL PTCL Approval Year Abex Xynomic 56%, 64% 31% 40% Pralatrexate * Spectrum 27% 2009 Romidepsin * Celgene 25.4% 2011 Belinostat * Spectrum 25.8% 2014 Chidamide * Chipscreen 28% 2014 Rituximab (a monoclonal antibody) Roche 48% 2011 Imbruvica ** AbbVie/JNJ 25% in Ph 2 trial: ABC - type: 37% Non - ABC: 5% *** 2013 Competitors’ information based on data reported in pivotal clinical trials * HDAC inhibitors ** Imbruvica’s main indications are CLL and SLL *** Against DLBCL, Abex’ medium PFS is 2.8 months, vs. 1.64 months for Imbruvica in this Ph 2 trial

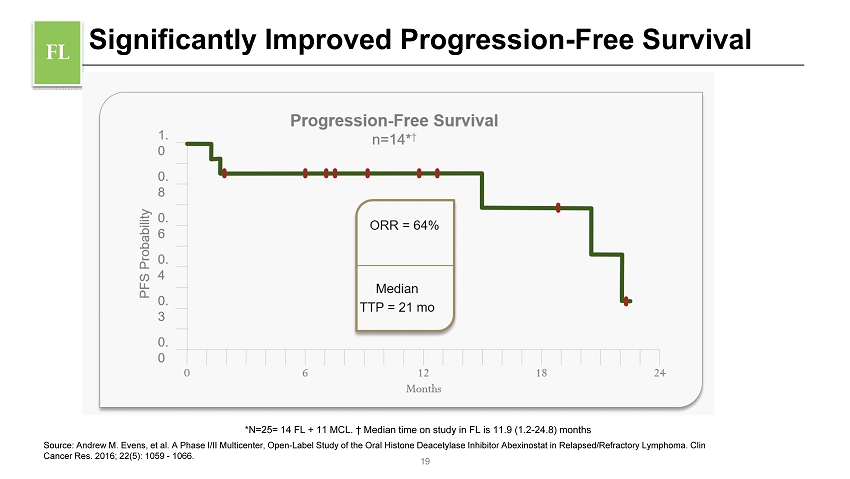

Significantly Improved Progression - Free Survival FL *N=25= 14 FL + 11 MCL. † Median time on study in FL is 11.9 (1.2 - 24.8) months 19 Source: Andrew M. Evens, et al. A Phase I/II Multicenter, Open - Label Study of the Oral Histone Deacetylase Inhibitor Abexinostat in Relapsed/Refractory Lymphoma. Clin Cancer Res. 2016; 22(5): 1059 - 1066.

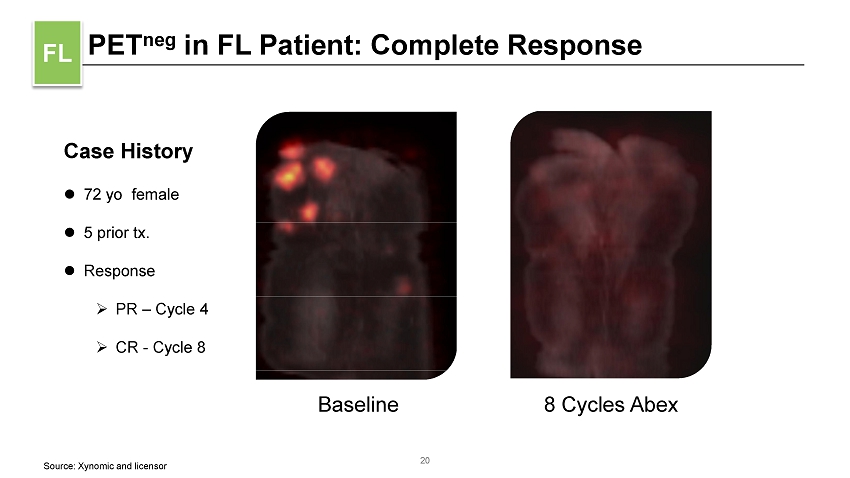

PET neg in FL Patient: Complete Response FL Case History 72 yo female 5 prior tx. Response » PR – Cycle 4 » CR - Cycle 8 Baseline 8 Cycles Abex 20 Source: Xynomic and licensor

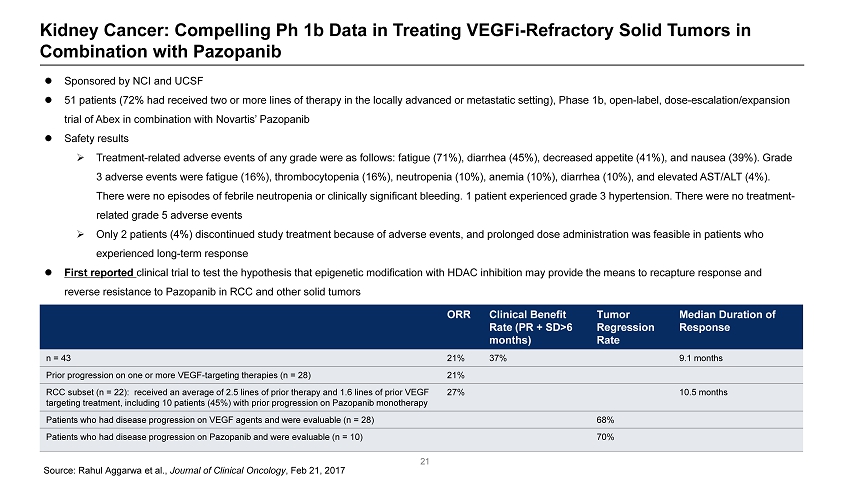

Kidney Cancer: Compelling Ph 1b Data in Treating VEGFi - Refractory Solid Tumors in Combination with Pazopanib Sponsored by NCI and UCSF 51 patients (72% had received two or more lines of therapy in the locally advanced or metastatic setting), Phase 1b, open - label, dose - escalation/expansion trial of Abex in combination with Novartis’ Pazopanib Safety results » Treatment - related adverse events of any grade were as follows: fatigue (71%), diarrhea (45%), decreased appetite (41%), and naus ea (39%). Grade 3 adverse events were fatigue (16%), thrombocytopenia (16%), neutropenia (10%), anemia (10%), diarrhea (10%), and elevated AS T/A LT (4%). There were no episodes of febrile neutropenia or clinically significant bleeding. 1 patient experienced grade 3 hypertension. Th ere were no treatment - related grade 5 adverse events » Only 2 patients (4%) discontinued study treatment because of adverse events, and prolonged dose administration was feasible i n p atients who experienced long - term response First reported clinical trial to test the hypothesis that epigenetic modification with HDAC inhibition may provide the means to recapture res pon se and reverse resistance to Pazopanib in RCC and other solid tumors ORR Clinical Benefit Rate (PR + SD>6 months) Tumor Regression Rate Median Duration of Response n = 43 21% 37% 9.1 months Prior progression on one or more VEGF - targeting therapies (n = 28) 21% RCC subset (n = 22): received an average of 2.5 lines of prior therapy and 1.6 lines of prior VEGF targeting treatment, including 10 patients (45%) with prior progression on Pazopanib monotherapy 27% 10.5 months Patients who had disease progression on VEGF agents and were evaluable (n = 28) 68% Patients who had disease progression on Pazopanib and were evaluable (n = 10) 70% Source: Rahul Aggarwa et al., Journal of Clinical Oncology , Feb 21, 2017 21

Abex’ Commercial Opportunities Indication Global Market Size in 2023, $ Follicular Lymphoma 4.1 billion Renal Cell Carcinoma (Kidney Cancer) 4.7 billion Breast Cancer 20 billion Solid Tumors (with K eytruda) 8 billion Diffuse Large B - Cell Lymphoma 14.4 billion Sources: Decision Resources, EvaluatePharma, Datamonitor, IMS, WM Foundation and Kantar Health’s CancerMpact 22

On - going and Planned Trials Drug Indications Phase # of Patients Key Partners Location FPI Date Abex/Keytruda Multiple solid tumors 1b 42 UCSF U.S. 7/25/2018 Abex 4L FL Pivotal Ph 2 120 MSK U.S. and EU7 8/ 9 /2018 Abex/Pazopanib 1L and 2L RCC Pivotal Ph 3 390 UCSF U.S., EU 6 , China and South Korea 9/5/2018 Abex/Imbruvica r/r DLBCL and r/r MCL 1/2 40 Janssen, MSK U.S. September 20 18 (estimate) Abex/Kisqali ER+ breast cancer 1/2 50 UCSF U.S. 10/15/18 (estimate) Abex 3L FL Pivotal Ph 2 66 Cancer Hospital Chinese Academy of Medical Sciences China Q1’2019 ( estimate ) Abex r/r DLCBL Pivotal Ph 2 88 Cancer Hospital Chinese Academy of Medical Sciences China Q1’2019 ( estimate ) XP - 102 CRC, Melanoma 1 40 N/A U.S. and China Q1’2019 (estimate) 23 On - going Planned

Renal Cell Carcinoma (RCC) Successful FDA meeting on 3/16/2018 » Authorized to start pivotal Ph 3 » Priority Review designation Ph 3 design: 1L and 2L, PFS as primary end point, Abex + Pazopanib vs. Pazopanib Well positioned to become the new SOC in 1st line RCC Sites: U.S., EU 6 , China and South Korea FPI 9/5/2018 US investigator’s kickoff meeting: 11/5/2018 Managed by Parexel 24

Follicular Lymphoma r/r FL: 56 - 64% ORR and 625 days of medium PFS in two Ph 1/2 trials FDA has authorized to start pivotal trial (9/21/2017 meeting) Accelerated Approval designation 4L: 120 subjects, single arm, ORR as primary end point Sites: U.S. and EU7 FPI: 8/ 9 /2018 U.S. investigator’s kickoff meeting: 10/20/2018 Managed by PPD 25

China 3L FL pivotal (independent of U.S./EU trials) » ~ 66 subjects, single arm, ORR as primary end point » FPI expected in Q1’2019 r/r DLBCL » ~ 88 subjects, single arm, ORR as primary end point » FPI expected in Q1’2019 1L RCC » ~150 patients led by Prof. Jun Guo at Beijing Cancer Hospital » Part of global multi - center trial 26

Updated Clinical Development Timeline Indication Regions 2H’2018 2019 2020 2021 2022 3L FL (Abex as monotherapy) China Enroll ~66 patients (complete recruitment) NDA submission 4L FL (Abex as monotherapy) U.S. EU7 Enroll ~30 patients Enroll ~90 patients (complete recruitment) NDA submission 1L & 2L RCC (Abex combined with Pazopanib) U.S. EU 6 China S Korea Enroll ~30 patients Enroll ~120 patients; first 25 - patients safety data readout Enroll ~120 patients; first 25% futility data readout Enroll ~120 patients (complete recruitment) NDA submission r/r DLBCL (Abex as monotherapy) China Enroll ~60 patients Enroll ~28 patients (complete recruitment) NDA submission 27

XP - 102: A 2nd - Generation Pan - RAF Inhibitor with Best - in - Class Potential RAF is a popular molecular target in oncology and represents a significant commercial opportunity Two big pharma (Roche and Novartis) have already launched 1st generation oncology drugs that target RAF kinases, with peak annual sales forecast of ~$3.6 billion (including combo therapies with MEK inhibitors) * XP - 102 is a 2nd generation, Pan - RAF inhibitor for RAF mutant cancers, e.g. colorectal cancer (CRC), NSCLC and malignant melanoma XP - 102 potentially offers improved therapeutic window compared with first - generation BRAF inhibitors, thus potentially more pronounced and long - lasting pathway suppression and improved efficacy Exclusive global rights, in - licensed from Boehringer Ingelheim Pan - RAF inhibitor, unique DFG - out binding, best - in - class animal data Ph 1 in U.S. by Q1’2019, in China by Q2’2019 CRC and melanoma 28 * Source: Analyst reports

XP - 102: Pre - Clinical Pharmacology Summary Demonstrated potency and selectivity in cellular and kinase assays » B - RAF V600 cell lines EC 50 <10 nM » B - RAF wild - type cell lines EC 50 >1,000 nM High efficacy in CRC and melanoma animal models Showed no significant sign of toxicity in exploratory toxicology studies at exposure levels that delivered superior efficacy in xenograft models Most promising when used in combination with chemotherapy and other targeted agents 29 Source: Irene C.Waizenegger, et al. A Novel RAF Kinase Inhibitor with DFG - Out Binding Mode: High Efficacy in BRAF - Mutant Tumor X enograft Models in the Absence of Normal Tissue Hyperproliferation. Mol Cancer Ther; 2016; 15(3): 354 - 365.

XP - 102: Current Status 30 API GLP toxicity batch completed Toxicology studies on - going, expected to be completed by 2018 Formulation work in progress and expected to be finished by January 2019 Xynomic’s goal is to submit US - IND application in Q1’2019

Research Stage Programs: XP - 103 & XP - 104 (Small Molecule Kinase Inhibitors) XP - 103 » TRK/Fra - 1 inhibitor » A competitor’s TRK inhibitor Larotrectinib’s recent Ph 1 data show ORR of over 90% against multiple tumors, yet drug resistance might be an issue * » Our XP - 103, with dual targets (TRK and Fra - 1), has the potential to maintain excellent efficacy while minimizing drug resistance XP - 104 » Highly selective RET inhibitor » Being investigated for use against multiple tumors, especially tumors that have developed resistance against other targeted therapies » Patent filing expected in September 2018 » Animal studies: under preparation and in discussion with contract research organization s; expected to be launched in September 2018 31 * Sources: Loxo Oncology’s presentations at ASCO Annual Meeting 2017 and AACR Pediatric Cancer Research Meeting (12/4/2017)

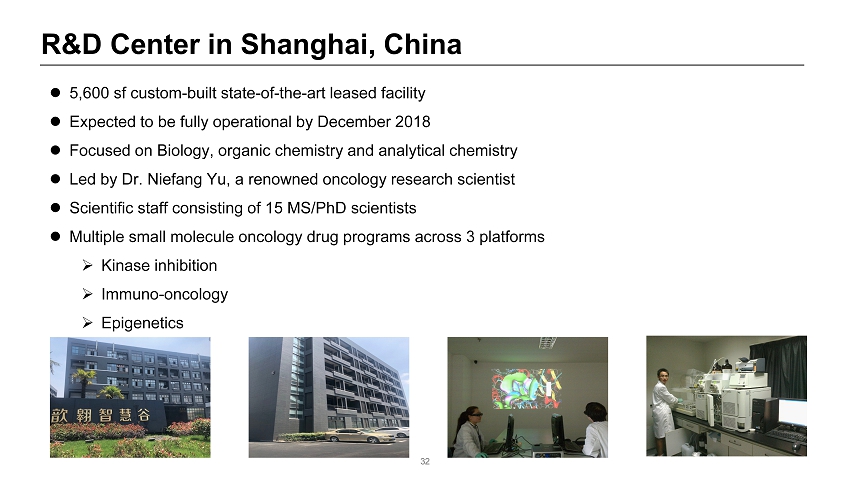

R&D Center in Shanghai, China 5,600 sf custom - built state - of - the - art leased facility Expected to be fully operational by December 2018 Focused on Biology, organic chemistry and analytical chemistry Led by Dr. Niefang Yu, a renowned oncology research scientist Scientific staff consisting of 15 MS/PhD scientists Multiple small molecule oncology drug programs across 3 platforms » Kinase inhibition » Immuno - oncology » Epigenetics 32

Pipeline Summary Abex: currently being evaluated in 3 therapeutic areas XP - 102 (BI 882370): CRC and melanoma » Animal data from initial studies suggest promising potential » Unique binding mode XP - 103 and XP - 104: research stage assets with newer mechanisms of action Breast & Other Solid Tumors Ph 1/2 33 Hematological Cancer Pivotal Ph 2 Kidney Cancer Pivotal Ph 3

Summary – Xynomic Pharma A U.S. oncology company founded by industry veterans Pure play oncology company: oral, proven molecular targets Drug candidates originated from global top - 20 pharma companies: high - quality U.S./EU data integrity, exclusive global rights, strong IP estate Collaboration with global big pharma companies (e.g., Janssen) Leverages resources in both China and U.S./EU to cost - effectively and time - efficiently develop these assets Multiple catalysts in the next 12 months 34