Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - Nexeo Solutions, Inc. | d593316dex991.htm |

| 8-K - FORM 8-K - Nexeo Solutions, Inc. | d593316d8k.htm |

Creating Value by Accelerating Transformation & Growth September 17, 2018 Univar Announces Agreement to Acquire Nexeo Exhibit 99.2

Forward-Looking Statements This communication contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 codified in Section 27A of the Securities Act, and Section 21E of the Exchange Act, as amended. Some forward-looking statements may be identified, without limitation, by the use of forward-looking terminology such as “anticipate,” “assume,” “believe,” “estimate,” “expect,” “intend,” “plan,” “project,” “may,” “will,” “could,” “would” and similar expressions. These forward-looking statements include all matters that are not historical facts. They appear in a number of places throughout this communication and include statements regarding, among other things, the expected timetable for closing of the proposed transaction between Univar Inc. (“Univar”) and Nexeo Solutions, Inc. (“Nexeo”), the expected benefits and synergies of the proposed transaction and the operating results, performance and capital structure of the combined company. Forward-looking statements are based on Univar’s and Nexeo’s current expectations and beliefs concerning future developments and their potential effect on Univar, Nexeo and the combined company. While Univar and Nexeo believe that forward-looking statements are reasonable as and when made, there can be no assurance that future developments affecting Univar, Nexeo and the combined company will be those anticipated. A number of important factors, risks and uncertainties could cause actual results to differ materially from those contained in or implied by the forward-looking statements, many of which are beyond Univar’s or Nexeo’s control. Factors, risks and uncertainties that could cause actual results to differ from those reflected in forward-looking statements include: changes in general economic, business and political conditions, including changes in the financial markets; the ability to satisfy the conditions to closing of the proposed transaction on the expected timing or at all and other risks related to the completion of the proposed transaction; the ability to obtain required shareholder and regulatory approvals for the proposed transaction on the expected timing or at all; the ability to complete the proposed transaction on the expected terms and timing or at all; higher than expected or unexpected costs associated with or relating to the proposed transaction; the risk that expected benefits, synergies and growth prospects of the proposed transaction and combined company may not be achieved in a timely manner or at all; results of the strategic review of Nexeo’s plastics distribution business in connection with the consummation of the proposed transaction and the outcome and impact of a resulting strategic transaction, if any; the ability to successfully integrate Nexeo’s business with Univar following the closing; the risk that Univar and Nexeo will be unable to retain and hire key personnel; the risk that disruption from the proposed transaction may adversely affect Univar’s and Nexeo’s business and their respective relationships with customers, suppliers, distributors or employees; and other risks detailed in the risk factors discussed in “Item 1.A. Risk Factors” in each of Univar’s and Nexeo’s most recent Annual Reports on Form 10-K, as updated by any Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and future filings with the SEC. Unless otherwise indicated or the context otherwise requires, comments concerning our expectations for future revenues and operating results are based on our forecasts for our existing operations and do not include the potential impact of any future acquisitions, divestitures or other potential strategic transactions. Readers are cautioned not to place undue reliance on forward-looking statements, which speak only as of the date hereof. Neither Univar nor Nexeo undertake any obligation to update or revise any forward-looking statements after the date they are made, whether as a result of new information, future events or otherwise. Disclaimer This communication shall neither constitute an offer to sell or the solicitation of an offer to buy any securities, nor shall there be any sale of securities in any jurisdiction in which the offer, solicitation, or sale would be unlawful prior to the registration or qualification under the securities laws of any such jurisdiction. No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended. Additional Information and Where to Find it In connection with the proposed transaction between Univar and Nexeo, Univar intends to file a registration statement on Form S-4, which will contain a prospectus and a proxy statement for Univar and consent solicitation statement for Nexeo (the “prospectus/joint proxy and consent solicitation statement”). INVESTORS AND SECURITY HOLDERS OF UNIVAR AND NEXEO ARE URGED TO READ ALL RELEVANT DOCUMENTS FILED WITH THE SEC WHEN THEY BECOME AVAILABLE, INCLUDING THE PROSPECTUS/JOINT PROXY AND CONSENT SOLICITATION STATEMENT, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION. A definitive prospectus/joint proxy and consent solicitation statement will be sent to the shareholders of Univar and Nexeo. Investors and security holders will be able to obtain copies of the prospectus/joint proxy and consent solicitation statement as well as other filings containing information about Univar and Nexeo, without charge, at the SEC’s website, http://www.sec.gov. Copies of the documents filed with the SEC by Univar will be available free of charge within the investor relations section of Univar’s website at www.univar.com. Copies of the documents filed with the SEC by Nexeo will be available free of charge within the investor relations section of Nexeo’s website at www.nexeosolutions.com. Participants in the Solicitation Univar, Nexeo and each of their directors, executive officers and certain other employees may be deemed to be participants in the solicitation of proxies from Univar’s shareholders and consents from Nexeo’s shareholders in respect of the proposed transaction between Univar and Nexeo. Information regarding Univar’s directors and executive officers is contained in Univar’s proxy statement for its 2018 annual meeting, which was filed with the SEC on March 20, 2018. Information regarding Nexeo’s directors and executive officers is contained in Nexeo’s proxy statement for its 2018 annual meeting, which was filed with the SEC on December 14, 2017. Investors and security holders may obtain additional information regarding the interests of such participants by reading the prospectus/joint proxy and consent solicitation statement when it becomes available, which may be obtained as described in the paragraphs above.

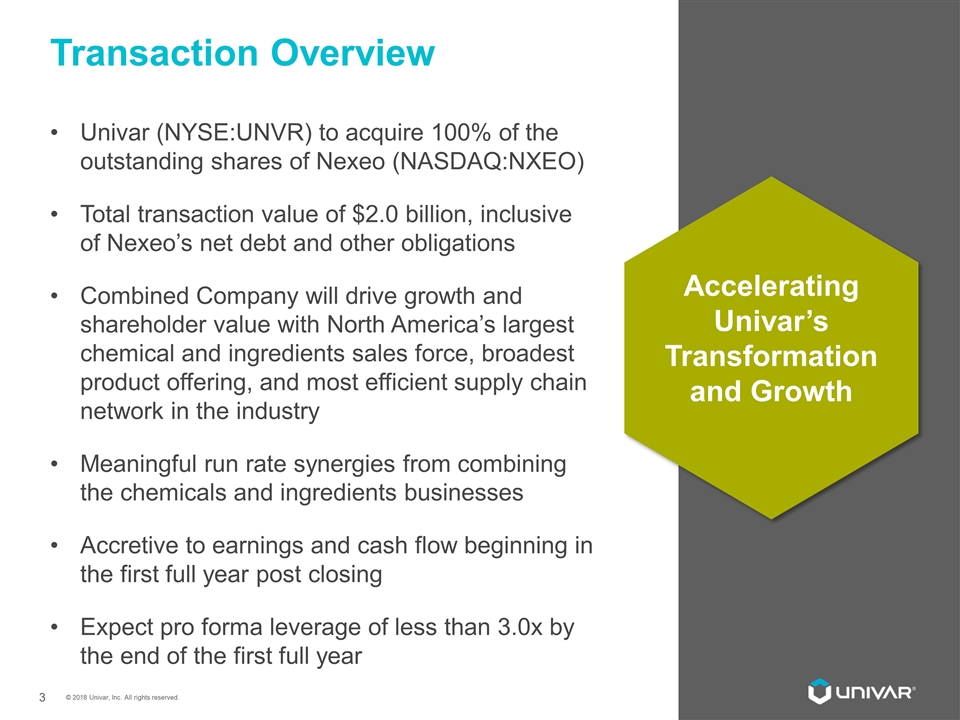

Univar (NYSE:UNVR) to acquire 100% of the outstanding shares of Nexeo (NASDAQ:NXEO) Total transaction value of $2.0 billion, inclusive of Nexeo’s net debt and other obligations Combined Company will drive growth and shareholder value with North America’s largest chemical and ingredients sales force, broadest product offering, and most efficient supply chain network in the industry Meaningful run rate synergies from combining the chemicals and ingredients businesses Accretive to earnings and cash flow beginning in the first full year post closing Expect pro forma leverage of less than 3.0x by the end of the first full year Transaction Overview Accelerating Univar’s Transformation and Growth

OUR VISION To be the most valued chemical and ingredient distributor in the world through Commercial Greatness, Operational Excellence, and One Univar. COMMERCIAL GREATNESS OPERATIONAL EXCELLENCE ONE UNIVAR

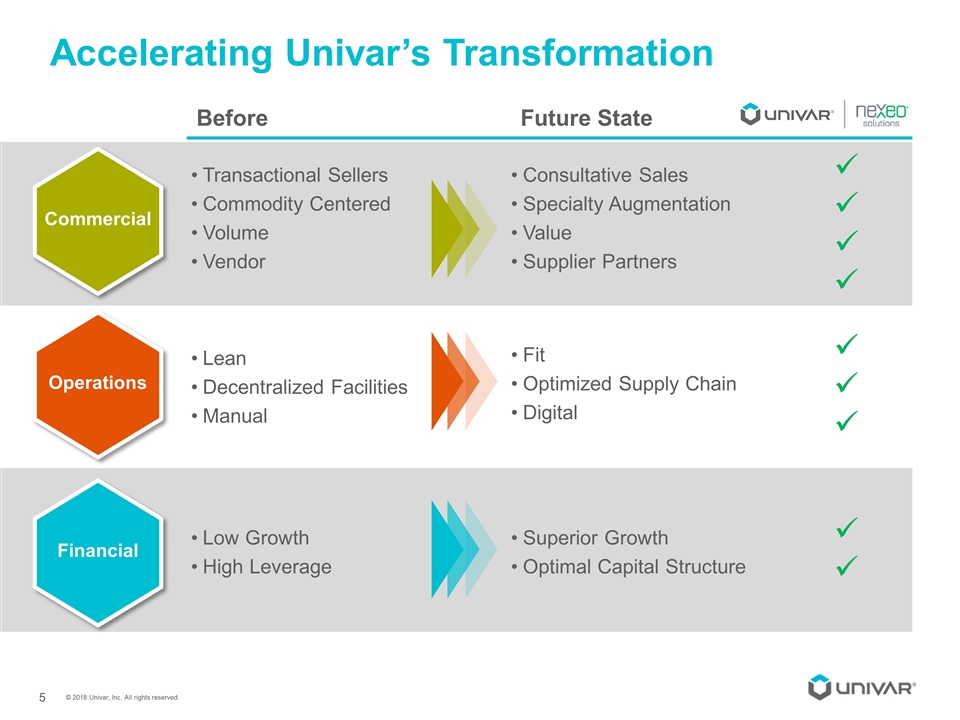

Accelerating Univar’s Transformation Before Future State Low Growth High Leverage Financial Superior Growth Optimal Capital Structure Lean Decentralized Facilities Manual Operations Fit Optimized Supply Chain Digital Transactional Sellers Commodity Centered Volume Vendor Commercial Consultative Sales Specialty Augmentation Value Supplier Partners

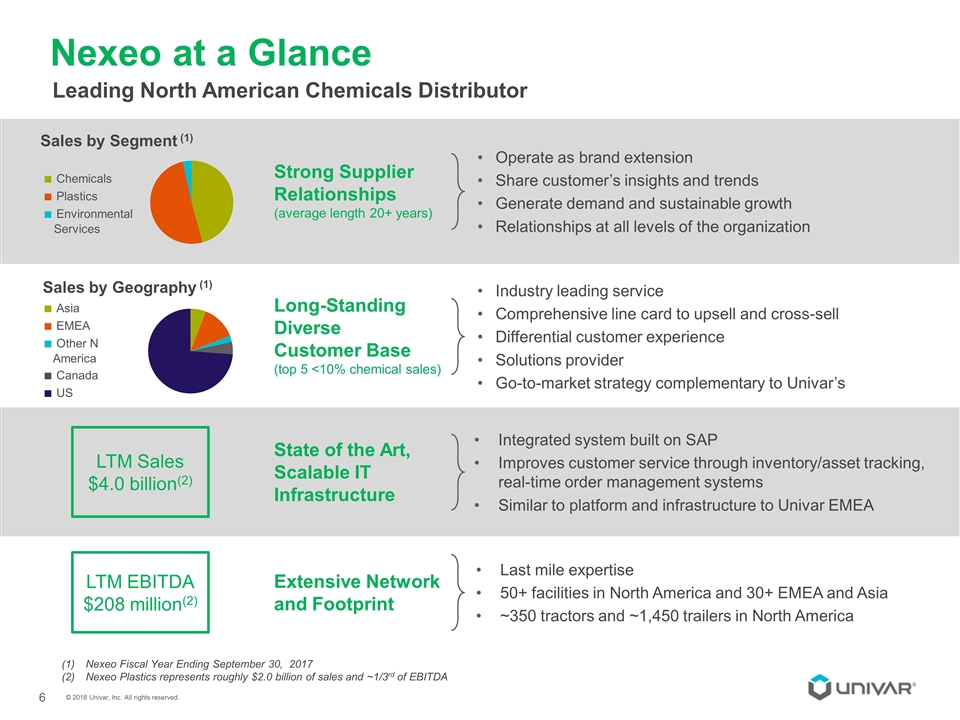

Nexeo at a Glance Leading North American Chemicals Distributor Operate as brand extension Share customer’s insights and trends Generate demand and sustainable growth Relationships at all levels of the organization Strong Supplier Relationships (average length 20+ years) Industry leading service Comprehensive line card to upsell and cross-sell Differential customer experience Solutions provider Go-to-market strategy complementary to Univar’s Long-Standing Diverse Customer Base (top 5 <10% chemical sales) Integrated system built on SAP Improves customer service through inventory/asset tracking, real-time order management systems Similar to platform and infrastructure to Univar EMEA State of the Art, Scalable IT Infrastructure Last mile expertise 50+ facilities in North America and 30+ EMEA and Asia ~350 tractors and ~1,450 trailers in North America Extensive Network and Footprint LTM EBITDA $208 million(2) LTM Sales $4.0 billion(2) Sales by Segment (1) Sales by Geography (1) Nexeo Fiscal Year Ending September 30, 2017 Nexeo Plastics represents roughly $2.0 billion of sales and ~1/3rd of EBITDA ■ Asia ■ EMEA ■ Other N America ■ Canada ■ US ■ Chemicals ■ Plastics ■ Environmental Services

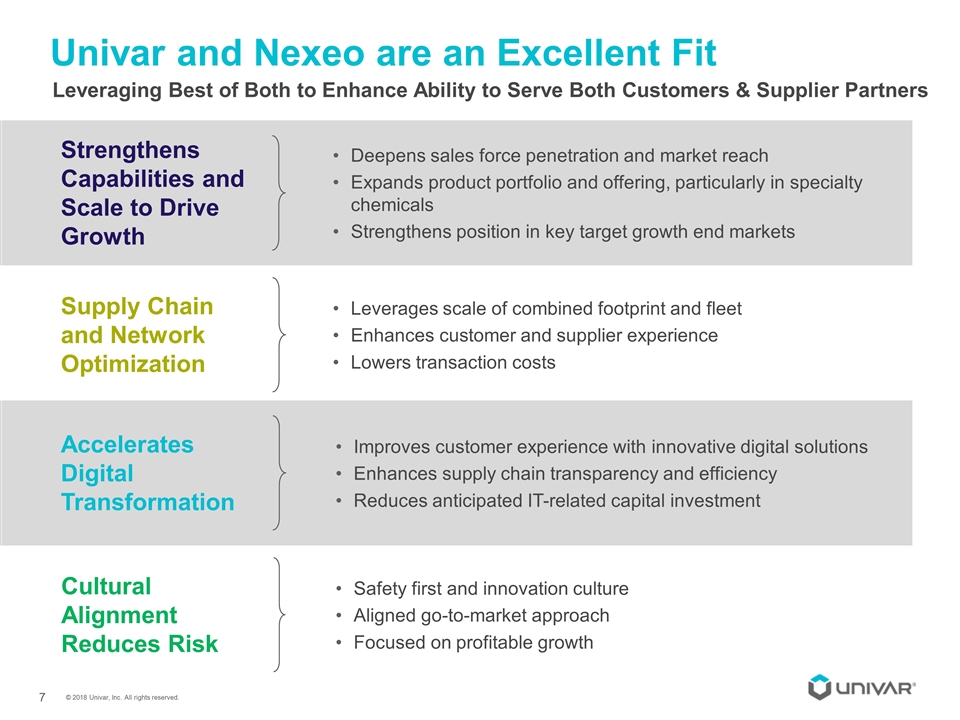

Leverages scale of combined footprint and fleet Enhances customer and supplier experience Lowers transaction costs Supply Chain and Network Optimization Univar and Nexeo are an Excellent Fit Deepens sales force penetration and market reach Expands product portfolio and offering, particularly in specialty chemicals Strengthens position in key target growth end markets Strengthens Capabilities and Scale to Drive Growth Improves customer experience with innovative digital solutions Enhances supply chain transparency and efficiency Reduces anticipated IT-related capital investment Accelerates Digital Transformation Safety first and innovation culture Aligned go-to-market approach Focused on profitable growth Cultural Alignment Reduces Risk Leveraging Best of Both to Enhance Ability to Serve Both Customers & Supplier Partners

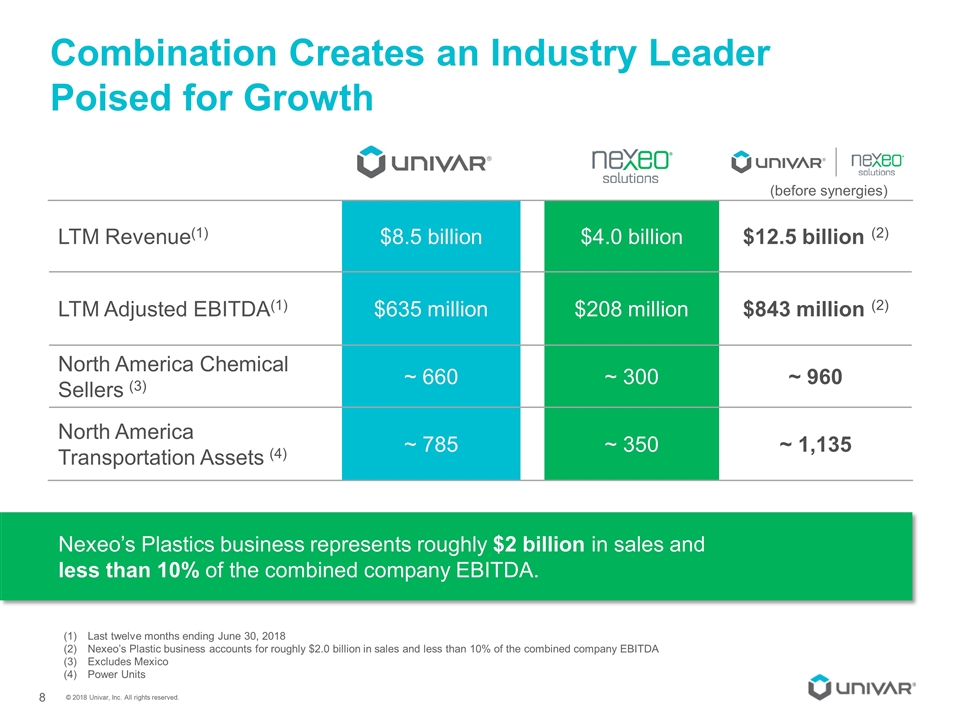

LTM Revenue(1) $8.5 billion $4.0 billion $12.5 billion (2) LTM Adjusted EBITDA(1) $635 million $208 million $843 million (2) North America Chemical Sellers (3) ~ 660 ~ 300 ~ 960 North America Transportation Assets (4) ~ 785 ~ 350 ~ 1,135 Combination Creates an Industry Leader Poised for Growth Last twelve months ending June 30, 2018 Nexeo’s Plastic business accounts for roughly $2.0 billion in sales and less than 10% of the combined company EBITDA Excludes Mexico Power Units Nexeo’s Plastics business represents roughly $2 billion in sales and less than 10% of the combined company EBITDA. (before synergies)

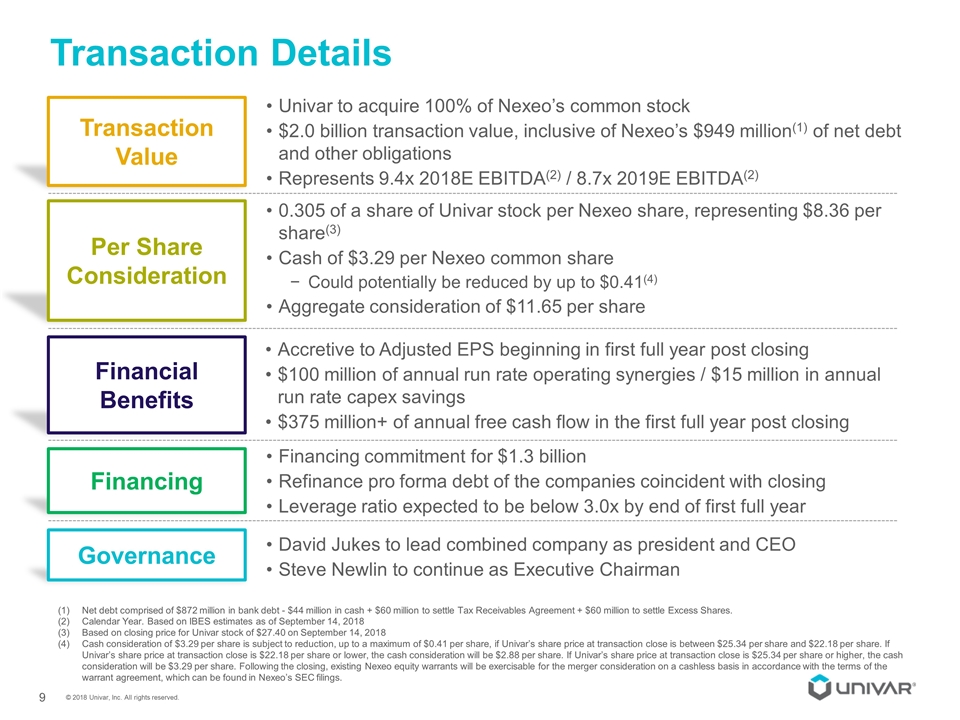

Transaction Details Transaction Value Univar to acquire 100% of Nexeo’s common stock $2.0 billion transaction value, inclusive of Nexeo’s $949 million(1) of net debt and other obligations Represents 9.4x 2018E EBITDA(2) / 8.7x 2019E EBITDA(2) Financing Financing commitment for $1.3 billion Refinance pro forma debt of the companies coincident with closing Leverage ratio expected to be below 3.0x by end of first full year Governance David Jukes to lead combined company as president and CEO Steve Newlin to continue as Executive Chairman Per Share Consideration 0.305 of a share of Univar stock per Nexeo share, representing $8.36 per share(3) Cash of $3.29 per Nexeo common share Could potentially be reduced by up to $0.41(4) Aggregate consideration of $11.65 per share Net debt comprised of $872 million in bank debt - $44 million in cash + $60 million to settle Tax Receivables Agreement + $60 million to settle Excess Shares. Calendar Year. Based on IBES estimates as of September 14, 2018 Based on closing price for Univar stock of $27.40 on September 14, 2018 Cash consideration of $3.29 per share is subject to reduction, up to a maximum of $0.41 per share, if Univar’s share price at transaction close is between $25.34 per share and $22.18 per share. If Univar’s share price at transaction close is $22.18 per share or lower, the cash consideration will be $2.88 per share. If Univar’s share price at transaction close is $25.34 per share or higher, the cash consideration will be $3.29 per share. Following the closing, existing Nexeo equity warrants will be exercisable for the merger consideration on a cashless basis in accordance with the terms of the warrant agreement, which can be found in Nexeo’s SEC filings. Financial Benefits Accretive to Adjusted EPS beginning in first full year post closing $100 million of annual run rate operating synergies / $15 million in annual run rate capex savings $375 million+ of annual free cash flow in the first full year post closing

Annual Run Rate Operating Expense Synergies ~$100 million ($0.43 per share after-tax) Optimize supply chain network and assets Leverage Nexeo’s IT infrastructure and operating processes Consolidate and leverage business support functions Annual Capital Expenditure Synergies ~$15 million Reduction in maintenance capex Leverage digital investments Integration Costs Mitigated One time integration costs ~$150 million Largely offset by surplus real estate sales and working capital improvements Meaningful, Achievable Synergies

Path to Closing Subject to both Univar and Nexeo shareholder approval Nexeo’s key stockholders, TPG and First Pacific, have agreed to provide their consent for proposed transaction Creation of Integration Management Office – Univar leaders named Subject to regulatory approval and other customary closing conditions. Transaction expected to close in the first half of 2019

Strategic Review of Plastics Business Univar has retained an outside advisor to evaluate strategic alternatives, including a potential divestiture, to maximize shareholder value Plastics business will continue to operate as an industry leader by delivering superior products and technical capabilities to suppliers and customers Business will continue to be led by Shawn Williams, Executive Vice President Nexeo Plastics

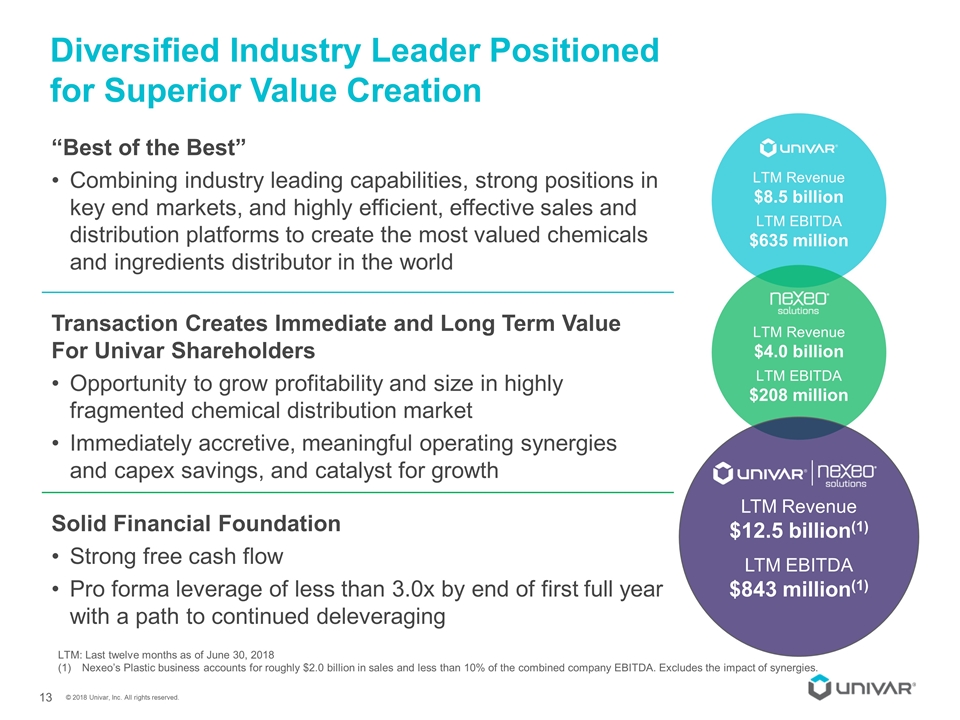

“Best of the Best” Combining industry leading capabilities, strong positions in key end markets, and highly efficient, effective sales and distribution platforms to create the most valued chemicals and ingredients distributor in the world Diversified Industry Leader Positioned for Superior Value Creation LTM Revenue $8.5 billion LTM EBITDA $635 million LTM: Last twelve months as of June 30, 2018 Nexeo’s Plastic business accounts for roughly $2.0 billion in sales and less than 10% of the combined company EBITDA. Excludes the impact of synergies. LTM Revenue $4.0 billion LTM EBITDA $208 million Solid Financial Foundation Strong free cash flow Pro forma leverage of less than 3.0x by end of first full year with a path to continued deleveraging Transaction Creates Immediate and Long Term Value For Univar Shareholders Opportunity to grow profitability and size in highly fragmented chemical distribution market Immediately accretive, meaningful operating synergies and capex savings, and catalyst for growth | LTM Revenue $12.5 billion(1) LTM EBITDA $843 million(1)