Attached files

| file | filename |

|---|---|

| 8-K - 8-K - RAYMOND JAMES FINANCIAL INC | a8-k_3q18shareholdersletter.htm |

CLIENT FIRST. INTEGRITY. INDEPENDENCE. CONSERVATISM. 2018 THIRD QUARTER

Dear Fellow Shareholders, Raymond James generated record quarterly net revenues of year’s fiscal third quarter but increased 5% compared to the $1.84 billion and net income of $232.3 million, or $1.55 per preceding quarter. The segment’s pre-tax income of $21.8 million diluted share, for the fiscal third quarter ended June 30, 2018. declined 37% compared to the prior year’s fiscal third quarter but Quarterly net revenues increased 13% over the prior year’s increased 34% over the preceding quarter. The sequential fiscal third quarter, lifted by growth of Private Client Group improvement in the segment’s revenues and pre-tax income was assets in fee-based accounts, strong investment banking predominantly driven by M&A revenues of $84.7 million, which revenues, higher net loans at Raymond James Bank, and improved 35% over the prior year’s fiscal third quarter and 17% higher short-term interest rates, which benefited both net over the preceding quarter. The year-over-year declines in the interest income and fees earned on balances in the Raymond segment’s revenues and pre-tax income were largely attributable James Bank Deposit Program (RJBDP). Quarterly net income to an extremely challenging market environment for fixed income, improved a substantial 27% over the prior year’s fiscal third which caused institutional fixed income commissions and trading quarter, helped by higher revenues and a lower corporate tax profits to decline during the quarter. While the M&A pipeline rate, but declined 4% sequentially due to elevated business remains robust, we expect continued headwinds for fixed income development and other expenses during the quarter. The given the flattening yield curve and low interest rate volatility. increase in business development expenses reflected the The Asset Management segment produced record quarterly net timing of conferences for financial advisors as well as revenues of $168.2 million, up 34% over the prior year’s fiscal significant recruiting and onboarding-related expenses during third quarter and 3% over the preceding quarter. Record the quarter. The increase in other expenses was largely quarterly pre-tax income of $58.3 million improved 35% attributable to legal and regulatory reserves. For the first nine compared to the prior year’s fiscal third quarter and 4% from months of fiscal 2018, record net revenues of $5.38 billion the preceding quarter. Financial assets under management increased 15% and record net income of $593.9 million ended June at a quarter-end record of $135.5 billion, which was increased 34% over the first nine months of fiscal 2017. up 49% over last year’s June and 2% over the preceding quarter. The Private Client Group (PCG), Asset Management and Results were helped by the growth of financial assets under Raymond James Bank segments generated record quarterly management, which reflected equity market appreciation, net net revenues, and the Asset Management segment and inflows, and the addition of $27 billion of assets from the Scout Raymond James Bank generated record quarterly pre-tax and Reams acquisition in November 2017. income during the quarter. PCG’s quarterly net revenues of Raymond James Bank generated record quarterly net revenues $1.28 billion improved 13% over the prior year’s fiscal third of $187.8 million and record pre-tax income of $129.2 million. The quarter and 1% over the preceding quarter. Quarterly pre-tax bank’s results were lifted by broad-based loan growth and income of $132.3 million increased 3% over the prior year’s expansion of its net interest margin (NIM) resulting from increases fiscal third quarter and declined 16% from the preceding in short-term interest rates and a higher-yielding asset mix as quarter. PCG’s record quarterly net revenues were largely cash balances were deployed into loans and securities. The attributable to growth of assets in fee-based accounts, which bank’s NIM increased to 3.30% for the quarter, up 16 basis points represented 48% of the segment’s total client assets under over the prior year’s fiscal third quarter. Net loans at Raymond administration. Results also were aided by increased fees James Bank ended the quarter at a record $19.0 billion, which earned on balances in the RJBDP, as higher short-term interest was up 14% over last year’s June and 5% over the preceding rates more than offset the decline in balances that was largely quarter, reflecting broad-based growth across all major loan due to a shift to other investments. The sequential decline in categories. The bank’s credit metrics continue to improve with PCG’s pre-tax income was primarily driven by the criticized loans as a percent of total loans of 1.24% declining from aforementioned increases in business development and other 1.61% at June 2017 and 1.30% at March 2018. expenses. Financial advisor retention and recruiting continue to be strong across all of our affiliation options. We announced several key senior leadership changes including naming current Raymond James Financial Services (RJFS) The Capital Markets segment generated quarterly net revenues President Scott Curtis as head of our Private Client Group, and of $241.7 million, which declined 7% compared to the prior

naming current Raymond James & Associates (RJA) president We are well-prepared for changing market environments, as Tash Elwyn as president and CEO of the RJA broker/dealer, evidenced by our strong capital ratios and liquidity position. following the April announcement of COO Dennis Zank’s We continue to evaluate a number of ways to deploy our retirement. RJFS National Director Jodi Perry is now president growing capital. Our primary focus is to continue investing in of RJFS’s Independent Contractors Division. I want to thank growth across all of our businesses, which is reflected in our Dennis for 40 years of service and the invaluable contributions best-in-class financial advisor recruiting results and the he has made throughout the organization, not the least of which significant investments we have made to expand and was developing the next generation of leaders such as Scott and strengthen our businesses both organically and through Tash. As evidenced with these changes, we have excellent selective acquisitions. In May, our Board of Directors successors identified across the organization to facilitate our increased the quarterly dividend 20% to $0.30 per share and firm’s long-term success and, most importantly, to sustain and increased our securities repurchase authorization to $250 strengthen our unique client-focused culture. million, which we intend to use primarily to help offset compensation-related dilution going forward. Consistent We also earned several notable awards, recognitions and with our longstanding approach, we remain disciplined and accolades during the fiscal third quarter. Raymond James opportunistic with any additional share repurchases. moved up 38 spots – from 469 to 431 – on the FORTUNE 500 list. We also ranked 58th on Forbes’ list of America’s Best Employers. We are confident that our long-term focus will continue to produce superior returns for clients, advisors, associates In PCG, three advisors with Alex. Brown, a division of Raymond and shareholders. James, were named to the Barron’s list of Top 100 Financial Advisors. In May 2018, Raymond James was named a finalist in Sincerely, Wealth Management’s Industry Awards for the firm’s Advisor Mastery Program as well as its Longevity Planning initiative. Also in May, seven Raymond James-affiliated managers were named Paul C. Reilly to Bank Investment Consultant’s list of the Top 25 Program Chairman, CEO Managers, and eight Raymond James-affiliated advisors were August 28, 2018 named to Forbes’ list of America’s Top Women Wealth Advisors. Certain statements made in this letter may constitute “forward-looking In June, four professionals affiliated with Raymond James were statements” under the Private Securities Litigation Reform Act of 1995. named to InvestmentNews’ annual 40 Under 40 list and three Forward-looking statements include information concerning future Raymond James-affiliated advisors were named to the Barron’s strategic objectives, business prospects, anticipated savings, financial results (including expenses, earnings, liquidity, cash flow and capital list of Top 100 Women Financial Advisors. expenditures), industry or market conditions, demand for and pricing Raymond James Investment Banking was recognized with five of our products, acquisitions and divestitures, anticipated results of litigation and regulatory developments or general economic conditions. International Deal of the Year awards from The M&A Advisor for In addition, words such as “expects,” and future or conditional verbs its role in four advisory transactions. The Investment Banking such as “will” and “should,” as well as any other statement that group was also recognized with two Deal of the Year awards at necessarily depends on future events, are intended to identify forward- looking statements. Forward-looking statements are not guarantees, The M&A Advisor annual Turnaround Awards: “Professional and they involve risks, uncertainties and assumptions. Although we Services (B-To-B) Deal of the Year” and “Restructuring make such statements based on assumptions that we believe to be Community Impact Deal of the Year.” reasonable, there can be no assurance that actual results will not differ materially from those expressed in the forward-looking statements. We In summary, we are pleased with our record results during the caution investors not to rely unduly on any forward-looking statements first nine months of the fiscal year, and are entering the fourth and urge you to carefully consider the risks described in our filings with the Securities and Exchange Commission (the “SEC”) from time quarter of the fiscal year with several tailwinds, including to time, including our most recent Annual Report on Form 10-K and records for the number of PCG financial advisors of 7,719, client subsequent Quarterly Reports on Form 10-Q, which are available at assets under administration of $754.3 billion, financial assets www.raymondjames.com and the SEC’s website at www.sec.gov. We expressly disclaim any obligation to update any forward-looking under management of $135.5 billion and net loans at Raymond statement in the event it later turns out to be inaccurate, whether as a James Bank of $19.0 billion. result of new information, future events, or otherwise.

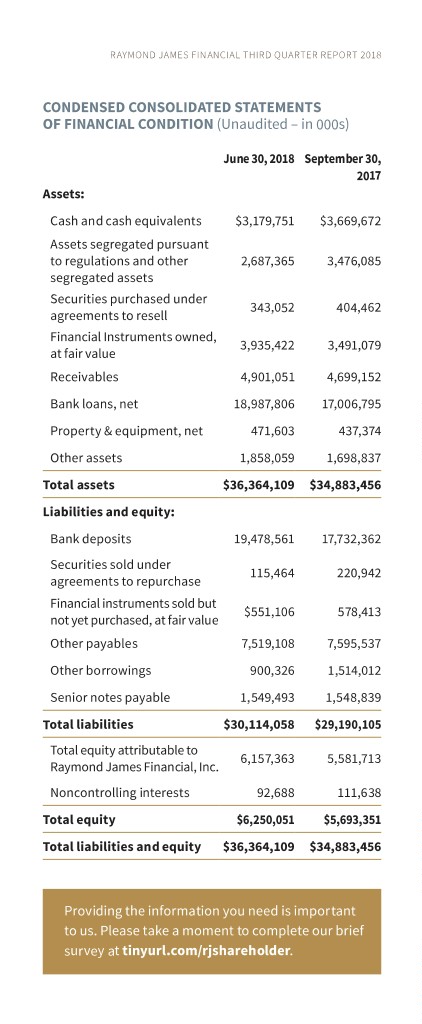

RAYMOND JAMES FINANCIAL THIRD QUARTER REPORT 2018 CONDENSED CONSOLIDATED STATEMENTS OF FINANCIAL CONDITION (Unaudited – in 000s) June 30, 2018 September 30, 2017 Assets: Cash and cash equivalents $3,179,751 $3,669,672 Assets segregated pursuant to regulations and other 2,687,365 3,476,085 segregated assets Securities purchased under 343,052 404,462 agreements to resell Financial Instruments owned, 3,935,422 3,491,079 at fair value Receivables 4,901,051 4,699,152 Bank loans, net 18,987,806 17,006,795 Property & equipment, net 471,603 437,374 Other assets 1,858,059 1,698,837 Total assets $36,364,109 $34,883,456 Liabilities and equity: Bank deposits 19,478,561 17,732,362 Securities sold under 115,464 220,942 agreements to repurchase Financial instruments sold but $551,106 578,413 not yet purchased, at fair value Other payables 7,519,108 7,595,537 Other borrowings 900,326 1,514,012 Senior notes payable 1,549,493 1,548,839 Total liabilities $30,114,058 $29,190,105 Total equity attributable to 6,157,363 5,581,713 Raymond James Financial, Inc. Noncontrolling interests 92,688 111,638 Total equity $6,250,051 $5,693,351 Total liabilities and equity $36,364,109 $34,883,456 Providing the information you need is important to us. Please take a moment to complete our brief survey at tinyurl.com/rjshareholder.

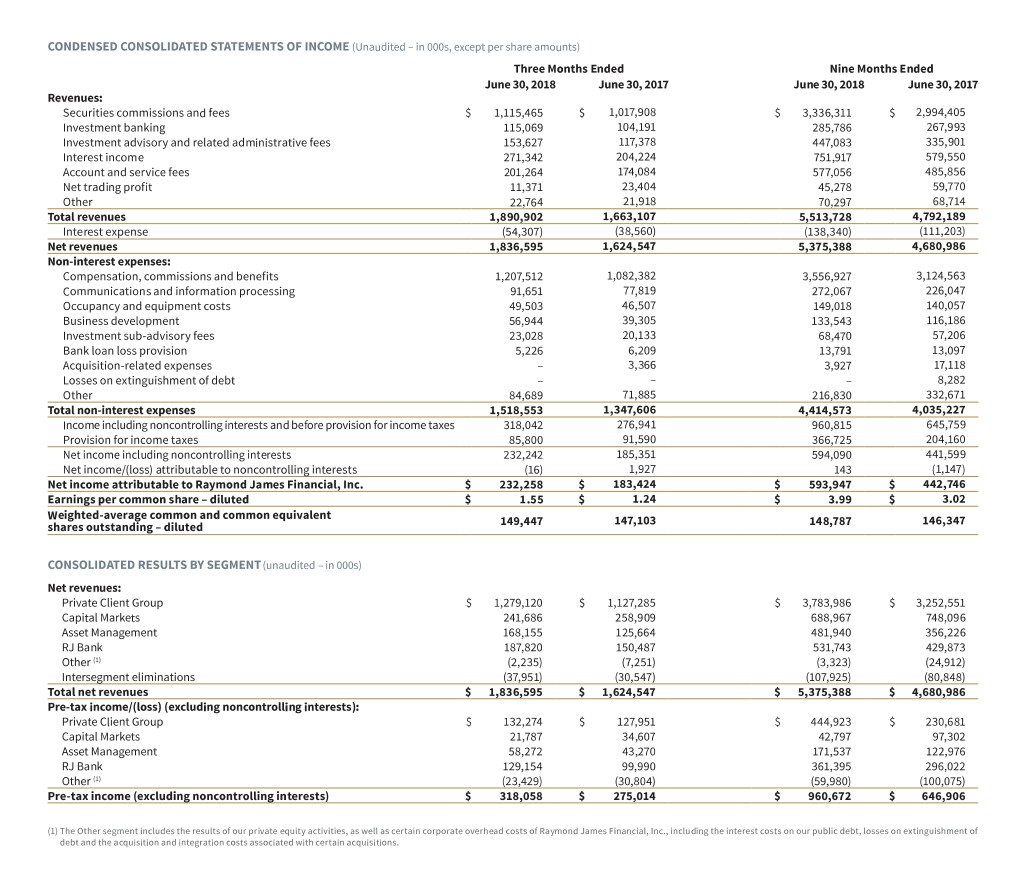

CONDENSED CONSOLIDATED STATEMENTS OF INCOME (Unaudited – in 000s, except per share amounts) Three Months Ended Nine Months Ended June 30, 2018 June 30, 2017 June 30, 2018 June 30, 2017 Revenues: Securities commissions and fees $ 1,115,465 $ 1,017,908 $ 3,336,311 $ 2,994,405 Investment banking 115,069 104,191 285,786 267,993 Investment advisory and related administrative fees 153,627 117,378 447,083 335,901 Interest income 271,342 204,224 751,917 579,550 Account and service fees 201,264 174,084 577,056 485,856 Net trading profit 11,371 23,404 45,278 59,770 Other 22,764 21,918 70,297 68,714 Total revenues 1,890,902 1,663,107 5,513,728 4,792,189 Interest expense (54,307) (38,560) (138,340) (111,203) Net revenues 1,836,595 1,624,547 5,375,388 4,680,986 Non-interest expenses: Compensation, commissions and benefits 1,207,512 1,082,382 3,556,927 3,124,563 Communications and information processing 91,651 77,819 272,067 226,047 Occupancy and equipment costs 49,503 46,507 149,018 140,057 Business development 56,944 39,305 133,543 116,186 Investment sub-advisory fees 23,028 20,133 68,470 57,206 Bank loan loss provision 5,226 6,209 13,791 13,097 Acquisition-related expenses – 3,366 3,927 17,118 Losses on extinguishment of debt – – – 8,282 Other 84,689 71,885 216,830 332,671 Total non-interest expenses 1,518,553 1,347,606 4,414,573 4,035,227 Income including noncontrolling interests and before provision for income taxes 318,042 276,941 960,815 645,759 Provision for income taxes 85,800 91,590 366,725 204,160 Net income including noncontrolling interests 232,242 185,351 594,090 441,599 Net income/(loss) attributable to noncontrolling interests (16) 1,927 143 (1,147) Net income attributable to Raymond James Financial, Inc. $ 232,258 $ 183,424 $ 593,947 $ 442,746 Earnings per common share – diluted $ 1.55 $ 1.24 $ 3.99 $ 3.02 Weighted-average common and common equivalent 147,103 146,347 shares outstanding – diluted 149,447 148,787 CONSOLIDATED RESULTS BY SEGMENT (unaudited – in 000s) Net revenues: Private Client Group $ 1,279,120 $ 1,127,285 $ 3,783,986 $ 3,252,551 Capital Markets 241,686 258,909 688,967 748,096 Asset Management 168,155 125,664 481,940 356,226 RJ Bank 187,820 150,487 531,743 429,873 Other (1) (2,235) (7,251) (3,323) (24,912) Intersegment eliminations (37,951) (30,547) (107,925) (80,848) Total net revenues $ 1,836,595 $ 1,624,547 $ 5,375,388 $ 4,680,986 Pre-tax income/(loss) (excluding noncontrolling interests): Private Client Group $ 132,274 $ 127,951 $ 444,923 $ 230,681 Capital Markets 21,787 34,607 42,797 97,302 Asset Management 58,272 43,270 171,537 122,976 RJ Bank 129,154 99,990 361,395 296,022 Other (1) (23,429) (30,804) (59,980) (100,075) Pre-tax income (excluding noncontrolling interests) $ 318,058 $ 275,014 $ 960,672 $ 646,906 (1) The Other segment includes the results of our private equity activities, as well as certain corporate overhead costs of Raymond James Financial, Inc., including the interest costs on our public debt, losses on extinguishment of debt and the acquisition and integration costs associated with certain acquisitions.

corporate profile Raymond James Financial, Inc. (NYSE: RJF) is a leading diversified financial services company providing private client group, capital markets, asset management, banking and other services to individuals, corporations and municipalities. The company has approximately 7,700 financial advisors in 3,000 locations throughout the United States, Canada and overseas. Total client assets are $754 billion. Public since 1983, the firm is listed on the New York Stock Exchange under the symbol RJF. Additional information is available at www.raymondjames.com. Stock Traded: NEW YORK STOCK EXCHANGE Stock Symbol: RJF International Headquarters: The Raymond James Financial Center 880 Carillon Parkway // St. Petersburg, FL 33716 800.248.8863 // raymondjames.com © 2018 Raymond James Financial Raymond James® is a registered trademark of Raymond James Financial, Inc. 18-Fin-Rep-0075 KM 9/18